As filed with the Securities and Exchange Commission

on

Registration No. 333-273324

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________

Amendment No. 5 to

FORM

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

| 8011 | ||

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

____________________________

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

____________________________

Alex Cunningham

Chief Executive Officer

Cardiff Lexington Corporation

3753 Howard Hughes Parkway, Suite 200

Las Vegas, NV 89169

(844) 628-2100

(Names, address, including zip code, and telephone number, including area code, of agent for service)

____________________________

| Copies to: | |

|

Louis A. Bevilacqua, Esq. Bevilacqua PLLC 1050 Connecticut Avenue, NW Suite 500 Washington, DC 20036 (202) 869-0888 |

Lance Brunson, Esq. Callie Tempest Jones, Esq. Brunson Chandler & Jones, PLLC Walker Center 175 S. Main Street, Suite 1410 Salt Lake City, UT 84111 (801) 303-5737 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated Filer ☐ | Accelerated Filer ☐ |

| Smaller reporting company | |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ¨

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED JUNE 12, 2024 |

Cardiff Lexington Corporation

1,600,000 Shares of Common Stock

____________________________

We are offering 1,600,000 shares of common stock, assuming a public offering price of $5.00 per share (which is the midpoint of the estimated range of the public offering price). We currently estimate that the public offering price will be between $4.00 and $6.00 per share.

Our common stock is currently quoted on the OTC Pink Market operated by OTC Markets Group Inc. under the symbol “CDIX.” On June 10, 2024, the closing price of our common stock on the OTC Pink Market was $7.00. In connection with this offering, we have applied for the listing of our common stock on The Nasdaq Capital Market under the symbol “CDIX.” The closing of this offering is contingent upon our uplisting to The Nasdaq Capital Market.

Upon the completion of this offering, we anticipate that our executive officers and directors will collectively be able to exercise approximately 72.54% of our total voting power (or approximately 72.32% if the underwriters exercise the over-allotment option in full). As a result, they will possess significant influence and will be able to elect a majority of our board of directors and authorize or prevent proposed significant corporate transactions without the votes of any other stockholders. Notwithstanding the foregoing, since no individual, company or persons acting as a group (as described in Section 13(d) of the Securities Exchange Act of 1934, as amended) will own a majority of our voting power, we will not be a “controlled company” under the corporate governance standards for companies listed on The Nasdaq Stock Market, or Nasdaq, although it is possible that we may become a “controlled company” in the future if our executive officers and directors decide to form a group. See also “Risk Factors—Risks Related to this Offering and Ownership of Our Common Stock.”

Investing in our securities involves a high degree of risk. Before buying any securities, you should carefully read the discussion of the material risks of investing in our securities under the heading “Risk Factors” beginning on page 12 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price | $ | 5.00 | $ | 8,000,000 | ||||

| Underwriting discounts and commissions(1) | $ | 0.38 | $ | 600,000 | ||||

| Proceeds to us, before expenses(2) | $ | 4.62 | $ | 7,400,000 | ||||

| (1) | Does not include a non-accountable expense allowance equal to 1% of the gross proceeds of this offering payable to Craft Capital Management LLC and R.F. Lafferty & Co., Inc., the representatives of the underwriters. We have also agreed to issue to the representatives or their designees warrants to purchase up to a number of shares of common stock equal to 5% of the number of shares sold in this offering at an exercise price equal to 125% of the public offering price. The registration statement of which this prospectus forms a part also registers the representatives’ warrants and the shares of common stock issuable upon exercise of the representatives’ warrants. See “Underwriting” for a complete description of the compensation arrangements. |

| (2) | We estimate the total expenses payable by us, excluding the underwriting discount and non-accountable expense allowance, will be approximately $650,000. |

We have granted the underwriters an option for a period of 45 days after the closing of this offering to purchase up to 15% of the total number of shares to be offered by us pursuant to this offering (excluding shares subject to this option), solely for the purpose of covering over-allotments, at the public offering price less the underwriting discounts and commissions.

The underwriters expect to deliver the shares against payment as set forth under “Underwriting” on or about , 2024.

| Craft Capital Management LLC | R.F. Lafferty & Co., Inc. |

The date of this prospectus is , 2024

TABLE OF CONTENTS

| i |

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus or in any free writing prospectuses prepared by us or on our behalf or to which we have referred you. We and the underwriters have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses prepared by us or on our behalf or to which we have referred you. We take no responsibility for and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares of common stock offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. We are not making an offer to sell these shares of common stock in any jurisdiction where the offer or sale is not permitted or where the person making the offer or sale is not qualified to do so or to any person to whom it is not permitted to make such offer or sale. The information contained in this prospectus is current only as of the date on the front cover of the prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

Persons who come into possession of this prospectus and any applicable free writing prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus and any such free writing prospectus applicable to that jurisdiction. See “Underwriting” for additional information on these restrictions.

INDUSTRY AND MARKET DATA

We are responsible for the disclosure in this prospectus. However, this prospectus includes industry data that we obtained from market research, publicly available information and industry publications. We did not fund and are not otherwise affiliated with any of the sources cited in this prospectus. The market research, publicly available information and industry publications that we use generally state that the information contained therein has been obtained from sources believed to be reliable. The information therein represents the most recently available data from the relevant sources and publications and we believe remains reliable. However, this data involves a number of assumptions and limitations regarding our industry which are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section titled “Risk Factors.” Forward-looking information obtained from these sources is also subject to the same qualifications and additional uncertainties regarding the other forward-looking statements in this prospectus.

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks and trade names or products in this prospectus is not intended to, and does not imply a relationship with, or endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but the omission of such references is not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable owner of these trademarks, service marks and trade names.

| ii |

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in our securities. You should carefully read the entire prospectus, including the risks associated with an investment in our company discussed in the “Risk Factors” section of this prospectus, before making an investment decision. Some of the statements in this prospectus are forward-looking statements. See the section titled “Cautionary Statement Regarding Forward-Looking Statements.”

Unless otherwise indicated by the context, reference in this prospectus to “we,” “us,” “our,” “our company” and similar references are to Cardiff Lexington Corporation and its consolidated subsidiaries.

Our Company

Overview

We are an acquisition holding company focused on locating undervalued and undercapitalized companies, primarily in the healthcare industry, and providing them capitalization and leadership to maximize the value and potential of their private enterprises while also providing diversification and risk mitigation for our stockholders. Specifically, our primary focus will continue to be to maximize organic growth by deploying increased working capital to expand utilization at our eleven current healthcare facilities. We additionally expect to open additional locations and may look at select synergistic acquisitions in the healthcare sector. In terms of growth stages and capital structures, we intend to focus our portfolio of subsidiaries approximately as follows: 80% will be targeted to established profitable niche small to mid-sized healthcare companies and 20% will be targeted to second stage startups in healthcare (emerging businesses with a strong organic growth plan that is materially cash generative).

On May 31, 2021, we acquired Nova Ortho and Spine, LLC, or Nova, which operates a group of regional primary specialty and ancillary care facilities throughout Florida that provide traumatic injury victims with primary care evaluations, interventional pain management, and specialty consultation services. We focus on plaintiff related care and are a highly efficient provider of emergency medical condition, or EMC, assessments. We provide a full range of diagnostic and surgical services for injuries and disorders of the skeletal system and associated bones, joints, tendons, muscles, ligaments, and nerves. From sports injuries, to sprains, strains, and fractures, our doctors are dedicated to helping patients return to active lifestyles.

We also own a real estate company, Edge View Properties, Inc., or Edge View, which we acquired on July 16, 2014. Edge View owns five (5) acres zoned medium density residential (MDR) with 12 lots already platted, six (6) acres zoned high-density residential (HDR) that can be platted in various configurations to meet current housing needs, and twelve (12) acres zoned in Lemhi County as Agriculture that is available for further annexation into the City of Salmon for development, as well as a common area for landowners to view wildlife, provide access to the Salmon River and fishing in a two (2) acre pond. Salmon is known as Idaho’s premier whitewater destination as well as one of the easier accesses to the Frank Church Wilderness Area - the largest wilderness in the lower 48 states. Management has invested years working to develop a new and exciting housing development in Salmon, Idaho, and plans to enter into a joint venture agreement with a developer for this planned concept development.

All of our revenue is generated by our healthcare business, which generated revenue of $11,853,266 and $10,693,196 for the years ended December 31, 2023 and 2022, respectively, and $2,661,966 and $2,706,399 for the three months ended March 31, 2024 and 2023, respectively. For the year ended December 31, 2023, we had a net income of $3,028,394, as compared to a net loss of $5,429,521 for the year ended December 31, 2022. For the three months ended March 31, 2024 and 2023, we had a net loss of $283,104 and $15,991, respectively.

| 1 |

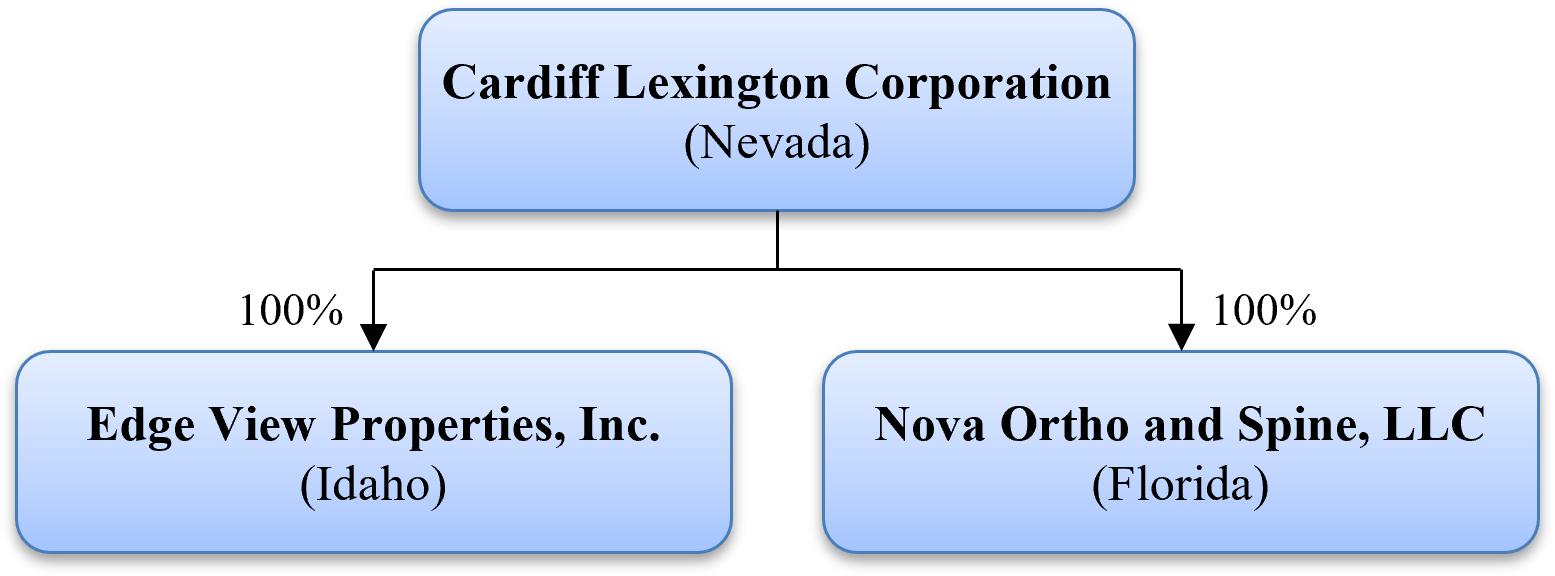

Our Corporate History and Structure

We were incorporated on September 3, 1986, in Colorado as Cardiff International Inc. On November 10, 2005, we merged with Legacy Card Company and became Cardiff Lexington Corporation. On August 27, 2014, we redomiciled and became a corporation under the laws of Florida. On April 13, 2021, we redomiciled and became a corporation under the laws of Nevada.

All of our operations are conducted through our operating subsidiaries, Nova and Edge View. Nova was organized in the State of Florida on December 3, 2018, and Edge View was incorporated in the State of Idaho on February 9, 2005.

During the year ended December 31, 2023, we sold our financial services (tax resolution) business, Platinum Tax Defenders, or Platinum Tax, that we acquired on July 31, 2018, which was a full-service tax resolution firm located in Los Angeles, California. Through this subsidiary, we provided fee-based tax resolution services to individuals and companies that had federal and state tax liabilities by assisting clients to settle outstanding tax debts.

We also previously owned all of the equity interests of We Three, LLC, d/b/a Affordable Housing Initiative, or AHI, an affordable home acquirer located in Maryville, Tennessee. On October 31, 2022, we entered into a buyback agreement to sell AHI back to the original owners in exchange for the return of 175,045 shares of series F preferred stock by the original owners and our issuance of 67,500 shares of series B preferred stock to the original owners.

Our Business Strategy

We employ an acquisition and value creation strategy, with the goal of locating undervalued and undercapitalized healthcare companies and providing them capitalization and leadership in order to maximize the value and potential of their private, often family run, enterprises while also providing diversification and risk mitigation for our stockholders. Our primary focus is on the healthcare sector and real estate, where we utilize our management team’s relationship networks, industry experiences and deal sourcing capabilities to target companies we believe have an experienced management team and compelling assets which we believe are well positioned for growth. Our culture emphasizes core values, teamwork, accountability, and performance. Specifically, our primary focus will continue to be to maximize organic growth by deploying increased working capital to expand utilization at current locations. We additionally expect to open additional locations and may look at select synergistic acquisitions in the healthcare sector. In terms of growth stages and capital structures, we intend to focus our portfolio of subsidiaries approximately as follows: 80% will be targeted to established profitable niche small to mid-sized healthcare companies and 20% will be targeted to second stage startups in healthcare (emerging businesses with a strong organic growth plan that is materially cash generative). Our acquisition strategy is driven by structure, transaction value, alignment, resources and return on investment. As we identify potential targets, it is also our strategy and goal to identify and recruit the right operating executive partners that have the requisite tools and experience to manage and grow our existing and newly acquired subsidiaries. Based on our management’s long history and experience in building relationships with a vast number of executives and their teams, we are confident that we have placed or left successful executives in charge of our current subsidiaries and will be able to identify appropriate executives to add long term value to any future acquisitions.

After our acquisitions, the entities become wholly owned subsidiaries and the target company’s management team either maintains responsibility for the day-to-day operations or we locate suitable executives to overtake responsibility for the entities. We believe that we can then provide these entities with some of the benefits of being a publicly traded company, including but not limited to, providing them with increased access to funding that we can obtain on their behalf in the capital markets for operations or expansion and our management team’s experience operating businesses. Our combined acquisition and value creation strategy drives our goal to deliver our public stockholders an opportunity to own a long term, stable, durable compounding equity investment that can produce strong returns.

Our Market Opportunity

Utilizing our management teams and principals’ expansive network of relationships, we believe there to be a significant opportunity for organic growth and expanded utilization of our current locations and an opportunity to open additional locations within new markets. Additionally, there are a substantial number of small to mid-sized healthcare companies, second stage startups – emerging businesses with a strong organic growth plan that is materially cash generative and income producing real estate holdings that we may seek to acquire that can potentially generate attractive returns for our stockholders. We further believe the economic and market dislocation resulting from the COVID-19 pandemic enhanced our opportunity to obtain potentially profitable businesses, which are facing lingering working capital challenges post pandemic, but have rebounded and returned to or near previous levels of profitability. In this environment, we believe the expertise and relationships of our management team represent a compelling value proposition for potential business targets looking for additional working capital infusion, a pathway to exit some equity, and leadership to assist them to grow and expand

| 2 |

Our Competitive Strengths

We believe that we have several competitive advantages that differentiate us from other holding companies. Our competitive strengths include:

| · | Management operating and investing experience. Our directors and executive officers have significant executive, investment and operational experience in the management and growth of small and middle market companies. We believe that this breadth of experience provides us with a competitive advantage in evaluating businesses and acquisition opportunities. | |

| · | Extensive network of small to middle market companies. As a result of their experience with acquisitions and in providing services to small to middle market companies around the United States, our management team members have developed a broad array of contacts at private and closely held companies. We believe that these contacts will be important in generating potential acquisition opportunities for us. | |

| · | Public company benefits. We believe our structure will make us an attractive business transaction partner to prospective acquisition targets. As an existing public company, we will be able to raise capital to deploy to our acquired businesses for their business operations. Additionally, we will be able to offer to the employees of our subsidiaries equity in our company as an additional means of creating management incentives that are better aligned with stockholder’s interests. | |

| · | Maintaining of day-to-day control of operations. As part of our acquisition criteria for a target company, we search for companies with what we believe are strong management teams, which allows us to have the management team maintain control of the day-to-day operations of the companies. We believe this model is attractive to target companies with management desiring to obtain the benefits of being a public company while maintaining control over the operations of their company. |

Our Healthcare Business

Services

We provide a full range of diagnostic and surgical services for injuries and disorders of the skeletal system and associated bones, joints, tendons, muscles, ligaments, and nerves. Orthopedic and pain procedure services include hip and knee replacement, shoulder reconstruction, fracture care and hand surgery, as well as spinal surgery.

Our service model is designed to promote referral relationships, facilitate patient access, and coordinate administration among medical providers, personal injury attorneys, and chiropractors. This “referral relationship” approach to case management results in increased revenue as attorneys consider the value of our patient management process when brokering settlements. As EMC and early stage continued care providers, we believe that we have superior access to patient information to determine the validity of each case and manage cases appropriately.

Revenue is primarily provided by bodily injury insurance policies, general liability policies, and personal injury protection policies, which partially insulates our business from the declining reimbursement programs paid from or correlated to Medicare/Medicaid and traditional health insurance companies.

Healthcare Facilities

We currently operate eleven facilities, most of which were opened in the last twenty-four months. As of March 31, 2024, we operated eleven facilities, and management estimates that those eleven facilities were operating at 35% capacity. We believe that the most important factors relating to the overall utilization of a facility include adequate working capital, the quality and market position of the facility and the number, quality and specialties of physicians providing patient care within the facility. Other factors that affect utilization include general and local economic conditions, market penetration, the degree of outpatient use, the availability of reimbursement programs such as Medicare and Medicaid, and demographic changes such as the growth in local populations. Utilization across the industry is also being affected by improvements in clinical practice, medical technology and pharmacology. Current industry trends in utilization and occupancy have been significantly affected by changes in reimbursement policies of third party payers. We are also unable to predict the extent to which these industry trends will continue or accelerate.

| 3 |

Competitive Strengths

We believe that our healthcare business has several competitive advantages, including the following:

| · | Broad array of services focusing on plaintiff related care. We provide a full range of diagnostic and surgical services for injuries and disorders of the skeletal system and associated bones, joints, tendons, muscles, ligaments, and nerves with a focus on plaintiff related care. From sports injuries, to sprains, strains, and fractures, orthopedic and pain procedure services include hip and knee replacement, shoulder reconstruction, fracture care and hand surgery, as well as spinal surgery. Our service model is designed to promote referral relationships, facilitate patient access, and coordinate administration among medical providers, personal injury attorneys, and chiropractors. As a result, our revenue is primarily provided by bodily injury insurance policies, general liability policies, and personal injury protection policies, which partially insulates our business from the declining reimbursement programs paid from or correlated to Medicare/ Medicaid and traditional health insurance companies. |

| · | Opportunities for accelerated growth. We have a track record of delivering strong growth through a combination of organic growth, new contract additions and selective acquisitions. Organic growth has historically been supported by consistent underlying market volume trends, stable pricing and a diversified payor mix. We believe that our networks of high-quality providers position us to take advantage of these trends. We have successfully executed on new contract growth by providing a set of differentiated services and delivering integrated, efficient, high-quality care, which has helped us expand our relationships with our existing customers and compete effectively in the bidding process for new contracts. Additionally, we believe we will have opportunities to expand our services through acquisitions, as discussed in more detail below. |

| · | Focus on clinical excellence. We are focused on achieving the best clinical outcomes for our patients through the application of rigorous recruiting and credentialing standards, the promotion of a physician-led leadership culture and the monitoring of our clinical quality measures. Through extensive clinical and leadership development programs, we train our healthcare professionals to continually enhance their skills and deliver innovative and patient-focused experiences and outcomes. We provide internally developed continuing medical education accredited courses to our healthcare professionals, including instructor-led and on-line education sessions. We have developed and implemented quality measurement systems that track multiple key indicators, which assist our professionals in systematically monitoring, examining and analyzing outcomes and processes. These quality measurement systems are supplemented by our active peer review infrastructure designed to ensure the development and implementation of actionable items that will improve patient outcomes. Our ability to deliver high levels of customer service and patient care is a direct result of this focus, which helps us to differentiate our services, and to attract and retain providers. |

| · | Ability to attract and retain high-quality providers. Through our processes, we are able to identify and target high-quality providers to match the needs of our customers. We believe that our operating infrastructure enables us to provide attractive opportunities for our providers to enhance their skills through extensive clinical and leadership development programs. We believe that our differentiated recruiting, training and development programs strengthen our customer and provider relationships, enhance our contract and clinician retention rates and allow us to efficiently recruit providers to support our new contract pipeline. |

| 4 |

Growth Strategies

The key elements of our strategy to grow our healthcare business include:

| · | Capitalize on organic growth opportunities. As noted above, management estimates that our eleven facilities operating as of March 31, 2024, were operating at 35% capacity as of such date. Accordingly, we believe that we have an opportunity for organic growth at our existing facilities. We also believe our physician-led, patient-focused culture and approach to clinical solutions will allow us to continue to successfully recruit and retain clinical professionals. |

| · | Supplement organic growth with strategic acquisitions. The market in which we compete is highly fragmented, presenting significant opportunities for additional acquisitions. We will continue to follow a disciplined strategy in exploring future acquisitions by analyzing the strategic rationale, financial impact and organic growth profile of each potential opportunity. Our current focus for future acquisitions is Orthopedic Surgery Centers followed by MRI imaging, medical billing, and outpatient surgery centers. We have been in discussions with several privately owned MRI facilities. Key targets are strategically located within our market territory. We believe that the addition of these profitable businesses would be immediately enhanced by significant additional new business that we would direct to them while positively augmenting cash flow. |

| · | Enhance operational efficiencies and productivity. We believe there are significant opportunities to continue to build upon our success in improving our productivity and profitability. We continue to focus on initiatives to improve productivity, including more efficient scheduling, continued use of mid-level providers, enhancing our leadership training programs, improving and realigning compensation programs. We believe that our processes related to managed care contracting, billing, coding, collection and compliance have driven a strong track record of efficient revenue cycle management. We have made significant investments in infrastructure, including management information systems that we believe will continue to enable us to improve clinical results and key client metrics while reducing the cost of providing patient care. We have dedicated teams with business and clinical expertise that are responsible for implementing best practices. Furthermore, we will continue to utilize risk mitigation programs for loss prevention and early intervention. We believe that our significant investments in scalable technology systems will facilitate additional cost reductions and efficiencies. |

Our Risks and Challenges

An investment in our securities involves a high degree of risk. You should carefully consider the risks summarized below. These risks are discussed more fully in the “Risk Factors” section immediately following this Prospectus Summary. These risks include, but are not limited to, the following:

Risks Related to Our Business and Structure

| · | The report of our independent registered public accounting firm included a “going concern” explanatory paragraph. | |

| · | Our acquisition strategy exposes us to substantial risk. | |

| · | We may not be able to effectively integrate the businesses that we acquire. | |

| · | Failure to manage our growing and changing business could have a material adverse effect on our business, prospects, financial condition, and results of operations. | |

| · | We face competition for businesses that fit our acquisition strategy and, therefore, we may have to acquire targets at sub-optimal prices or, alternatively, forego certain acquisition opportunities. | |

| · | We may not be able to successfully fund acquisitions due to the unavailability of equity or debt financing on acceptable terms, which could impede the implementation of our acquisition strategy. | |

| · | Our future success is dependent on the management teams of our businesses, the loss of any of whom could materially adversely affect our financial condition, business and results of operations. | |

| · | We may engage in a business transaction with one or more target businesses that have relationships with our executive officers, our directors, or any of their respective affiliates, which may create or present conflicts of interest. |

| 5 |

Risks Related to our Healthcare Business

| · | Our ability to grow our business through organic expansion either by developing new facilities or by modifying existing facilities is dependent upon many factors. | |

| · | Changes to payment rates or methods of third-party payors, including government healthcare programs, changes to the laws and regulations that regulate payments for medical services, the failure of payment rates to increase as our costs increase, or changes to our payor mix, could adversely affect our operating margins and revenues. | |

| · | An increase in uninsured or underinsured patients or the deterioration in the collectability of the accounts of such patients could harm our results of operations. | |

| · | Failure to timely or accurately bill for services could have a negative impact on our net revenue, bad debt expense and cash flow. | |

| · | Our facilities face competition for patients from other healthcare providers. | |

| · | Our performance depends on our ability to recruit and retain quality physicians. | |

| · | Our performance depends on our ability to attract and retain qualified nurses and medical support staff and we face competition for staffing that may increase our labor costs and harm our results of operations. | |

| · | If we fail to comply with extensive laws and government regulations, we could suffer civil or criminal penalties or be required to make significant changes to our operations that could reduce our revenue and profitability. | |

| · | If any of our existing healthcare facilities lose their accreditation or any of our new facilities fail to receive accreditation, such facilities could become ineligible to receive reimbursement under Medicare or Medicaid. | |

| · | We could be subject to lawsuits which could harm the value of our business, including litigation for which we are not fully reserved. |

Risks Related to our Real Estate Business

| · | We are subject to demand fluctuations in the real estate industry and any reduction in demand could adversely affect our business, results of operations, and financial condition. | |

| · | Adverse weather conditions, natural disasters, and other unforeseen and/or unplanned conditions could disrupt our real estate developments. | |

| · | If the market value of our real estate investments decreases, our results of operations will also likely decrease. | |

| · | The real estate industry is highly competitive and if other property developers are more successful or offer better value to customers, our business could suffer. | |

| · | We may incur environmental liabilities with respect to our real estate assets. |

| 6 |

Risks Related to This Offering and Ownership of Our Common Stock

| · | We may not be able to satisfy Nasdaq’s listing requirements or maintain a listing of our common stock on Nasdaq. | |

| · | The market price of our common stock may be highly volatile, and you could lose all or part of your investment. | |

| · | Our officers and directors own a significant percentage of our outstanding voting securities which could reduce the ability of minority stockholders to effect certain corporate actions. |

Corporate Information

Our principal executive office is located at 3753 Howard Hughes Parkway, Suite 200, Las Vegas, NV 89169. Our telephone number is (844) 628-2100. We maintain a website at www.cardifflexington.com. The reference to our website is intended to be an inactive textual reference only. The information contained on, or that can be accessed through, our website is not part of this prospectus and investors should not rely on such information in deciding whether to purchase shares of our common stock.

| 7 |

The Offering

| Shares offered: | 1,600,000 shares of common stock (or 41,336,061 shares if the underwriters exercise the over-allotment in full), based on the assumed public offering price of $5.00, the midpoint of the anticipated price range. | |

| Offering price: | We currently estimate that the public offering price will be between $4.00 and $6.00 per share. For purposes of this prospectus, the assumed public offering price per share is $5.00, the midpoint of the anticipated price range. The actual offering price per share will be as determined between the underwriters and us based on market conditions at the time of pricing. Therefore, the assumed offering price used throughout this prospectus may not be indicative of the final offering price. | |

| Shares to be outstanding after this offering(1): | 41,096,061 shares of common stock (or 41,336,061 shares if the underwriters exercise the over-allotment option in full), based on an assumed public offering price of $5.00 per share, which is the midpoint of the estimated range of the public offering price shown on the cover page of this prospectus.

The number of shares of common stock outstanding after this offering includes (i) the conversion of all shares of our outstanding series B preferred stock, series C preferred stock, series E preferred stock, series F-1 preferred stock, series I preferred stock and series L preferred stock into an aggregate of approximately 26,092,594 shares of common stock, effective automatically on the date on which our common stock begins trading on Nasdaq, and (ii) the issuance of approximately 12,000 shares of common stock to Bevilacqua PLLC, our outside counsel, upon completion of this offering, which is an estimate based on the assumed public offering price of $5.00. See “Description of Capital Stock” for more information regarding the automatic conversion of our preferred stock. | |

| Over-allotment option: | We have granted to the underwriters a 45-day option to purchase from us up to an additional 15% of the shares sold in the offering (240,000 additional shares) at the public offering price, less the underwriting discounts and commissions. | |

| Representatives’ warrants: | We have agreed to issue to Craft Capital Management LLC and R.F. Lafferty & Co., Inc., as representatives of the underwriters, or their designees, warrants to purchase up to a total number of shares of common stock equal to 5% of the total number of shares sold in this offering at an exercise price equal to 125% of the public offering price of the shares sold in this offering (subject to adjustments). The warrants will be exercisable at any time and from time to time, in whole or in part, during the four-and-a-half-year period commencing six months after the date of the commencement of the sales of the public securities. The representatives’ warrants will have a cashless exercise provision and will provide for immediate “piggyback” registration rights with respect to the registration of the shares underlying the warrants for a period of seven years from commencement of sales of this offering. The registration statement of which this prospectus forms a part also registers the representatives’ warrants and the shares of common stock issuable upon exercise of the representatives’ warrants. See the “Underwriting” section for more information. | |

| Use of proceeds: |

We expect to receive net proceeds of approximately $6.7 million from this offering (or $7.8 million if the underwriters exercise the over-allotment option in full), based on an assumed public offering price of $5.00 per share, which is the midpoint of the estimated range of the public offering price shown on the cover page of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

We intend to use the net proceeds from this offering for the repayment of certain debt in the amount of $535,000 and for working capital and general corporate purposes. See “Use of Proceeds.” |

| 8 |

| Risk factors: | Investing in our common stock involves a high degree of risk. As an investor, you should be able to bear a complete loss of your investment. You should carefully consider the information set forth in the “Risk Factors” section beginning on page 12. |

| Lock-up: | We and our directors, officers, and stockholders holding more than 5% of our common stock as of the effective date of this prospectus have agreed not to sell, transfer or dispose of any common stock for a period of six months from the date of this prospectus, subject to certain exceptions. See “Underwriting” for more information. | |

| Trading market and symbol: | Our common stock is currently quoted on the OTC Pink Market under the symbol “CDIX.” In connection with this offering, we have applied for the listing of our common stock on The Nasdaq Capital Market under the symbol “CDIX.” The closing of this offering is contingent upon our uplisting to The Nasdaq Capital Market. |

| (1) | The number of shares of common stock outstanding immediately following this offering is based on 13,391,467 shares outstanding as of June 10, 2024 and excludes: |

| · | 2 shares of common stock issuable upon the conversion of our series A preferred stock upon a transfer thereof; | |

| · | shares of common stock issuable upon the conversion of 868,056 shares of our series N senior convertible preferred stock, which are convertible into a number of shares of common stock determined by dividing the stated value ($4.00 per share), plus accrued, but unpaid, dividends thereon, by a conversion price equal to $900 (subject to adjustments); | |

| · | shares of common stock issuable upon the conversion of 375,000 shares of our series X senior convertible preferred stock, which are convertible into a number of shares of common stock determined by dividing the stated value ($4.00 per share), plus accrued, but unpaid, dividends thereon, by a conversion price equal to the lower of (i) the lowest volume weighted average price of our common stock on our principal trading market during the five (5) trading days immediately prior to the applicable conversion date and (ii) the price per share paid in any subsequent financing, including this offering; | |

| · | shares of common stock issuable upon the conversion of 938,908 shares of our series Y senior convertible preferred stock, which are convertible commencing on the first anniversary of the date on which our common stock begins trading on Nasdaq into a number of shares of common stock determined by dividing the stated value ($4.00 per share), plus accrued, but unpaid, dividends thereon, by a conversion price equal to the lowest volume weighted average price of our common stock on our principal trading market during the five (5) trading days immediately prior to the applicable conversion date; | |

| · | 3,150 shares of common stock issuable upon the exercise of outstanding warrants at a weighted average exercise price of $1,163 per share; | |

| · | shares of common stock that may be issued upon the exercise of outstanding warrants issued to Leonite Capital LLC, or Leonite, in connection with convertible promissory notes, which such warrants are for a number of shares of common stock equal to two hundred percent (200%) of the number of shares of common stock that would be issued upon full conversion of such notes, at exercise prices ranging from $150 to $3,000; | |

| · | up to 80,000 shares of common stock issuable upon exercise of the representatives’ warrants issued in connection with this offering (or 92,000 shares if the underwriters exercise the over-allotment option in full); |

| 9 |

| · | shares of common stock issuable upon the conversion of a convertible promissory note in the principal amount of $105,000 issued to Greentree Financial Group, Inc., which is convertible into shares of common stock at a conversion price equal to the lower of $0.25 or 50% of the lowest closing price of our common stock for the ten (10) trading days immediately prior to the conversion date; | |

| · | shares of common stock issuable upon the conversion of a convertible promissory note in the principal amount of $5,000 issued to Alex Cunningham, our Chief Executive Officer, which is convertible into shares of common stock at a conversion price equal to 80% of the lowest closing price of our common stock for the five (5) trading days immediately prior to the conversion date; and | |

| · | 2,000,000 shares of common stock that are reserved for issuance under our 2024 Equity Incentive Plan. |

Please see “Description of Capital Stock” for additional details regarding our outstanding convertible securities.

| 10 |

Summary Financial Information

The following tables summarize certain financial data regarding our business and should be read in conjunction with our financial statements and related notes contained elsewhere in this prospectus and the information under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Our summary consolidated financial data as of December 31, 2023 and 2022 and for the years then ended are derived from our audited consolidated financial statements included elsewhere in this prospectus. We derived our summary consolidated financial data as of March 31, 2024 and for the three months ended March 31, 2024 and 2023 from our unaudited condensed consolidated financial statements included elsewhere in this prospectus.

All financial statements included in this prospectus are prepared and presented in accordance with generally accepted accounting principles in the United States, or GAAP. The summary financial information is only a summary and should be read in conjunction with the historical financial statements and related notes contained elsewhere herein. The financial statements contained elsewhere fully represent our financial condition and operations; however, they are not indicative of our future performance.

| Three Months Ended March 31, | Years Ended December 31, | |||||||||||||||

| Statements of Operations Data | 2024 | 2023 | 2023 | 2022 | ||||||||||||

| Total revenue | $ | 2,661,966 | $ | 2,706,399 | $ | 11,853,266 | $ | 10,693,196 | ||||||||

| Total cost of sales | 948,154 | 956,295 | 3,560,624 | 4,060,034 | ||||||||||||

| Gross profit | 1,713,812 | 1,750,104 | 8,292,642 | 6,633,162 | ||||||||||||

| Total operating expenses | 1,494,820 | 992,556 | 3,097,597 | 2,726,273 | ||||||||||||

| Income from continuing operations | 218,992 | 757,548 | 5,195,045 | 3,906,889 | ||||||||||||

| Total other expense, net | (390,784 | ) | (728,049 | ) | (2,080,131 | ) | (7,157,527 | ) | ||||||||

| Net income (loss) before discontinued operations | (171,792 | ) | 29,499 | 3,114,914 | (3,250,638 | ) | ||||||||||

| Loss from discontinued operations | (111,312 | ) | (45,490 | ) | – | (2,178,883 | ) | |||||||||

| Loss from disposal of discontinued operations | – | – | (86,520 | ) | – | |||||||||||

| Net income (loss) | $ | (283,104 | ) | $ | (15,991 | ) | $ | 3,028,394 | $ | (5,429,521 | ) | |||||

| Preferred stock dividends | (151,634 | ) | (344,947 | ) | (780,074 | ) | (384,170 | ) | ||||||||

| Net income (loss) attributable to common stockholders | $ | (434,738 | ) | $ | (360,938 | ) | $ | 2,248,320 | $ | (5,813,691 | ) | |||||

| Basic earnings (loss) per share – continuing operations | $ | (0.11 | ) | $ | (31.04 | ) | $ | 156 | $ | (999 | ) | |||||

| Diluted earnings (loss) per share – continuing operations | $ | (0.11 | ) | $ | (31.04 | ) | $ | 232 | $ | (999 | ) | |||||

| Balance Sheet Data | As of March 31, 2023 | As of December 31, 2023 | As of December 31, 2022 | |||||||||

| Cash | $ | 1,253,552 | $ | 866,943 | $ | 219,085 | ||||||

| Total current assets | 15,910,582 | 14,177,197 | 6,828,005 | |||||||||

| Total assets | 22,605,310 | 20,745,811 | 13,344,780 | |||||||||

| Total current liabilities | 14,995,206 | 13,860,567 | 9,964,927 | |||||||||

| Total liabilities | 15,353,675 | 14,124,289 | 10,189,587 | |||||||||

| Total mezzanine equity | 6,041,738 | 5,890,104 | 4,899,984 | |||||||||

| Total stockholders’ equity (deficit) | 1,209,897 | 731,418 | (1,744,791 | ) | ||||||||

| Total liabilities, mezzanine equity and stockholders’ equity | $ | 22,605,310 | $ | 20,745,811 | $ | 13,344,780 | ||||||

| 11 |

RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider the following risk factors, together with the other information contained in this prospectus, before purchasing our securities. We have listed below (not necessarily in order of importance or probability of occurrence) what we believe to be the most significant risk factors applicable to us, but they do not constitute all of the risks that may be applicable to us. Any of the following factors could harm our business, financial condition, results of operations or prospects, and could result in a partial or complete loss of your investment. Some statements in this prospectus, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section titled “Cautionary Statement Regarding Forward-Looking Statements”.

Risks Related to Our Business and Structure

The report of our independent registered public accounting firm included a “going concern” explanatory paragraph.

The report of our independent registered public accounting firm that accompanies our financial statements for the year ended December 31, 2023 contains an explanatory paragraph relating to our ability to continue as a going concern. We had previously sustained operating losses since our inception, have an accumulated deficit of $68,684,115 and $70,932,435 as of December 31, 2023 and 2022, respectively, and had negative cash flow from operating activities of $1,807,987 and $1,099,461 during the years ended December 31, 2023 and 2022, respectively. These factors raise a substantial doubt about our ability to continue as a going concern.

However, management believes, based on our operating plan, that current working capital and current and expected additional financing should be sufficient to fund operations and satisfy our obligations as they come due for at least one year from the financial statement issuance date. However, additional funds from new financing and/or future equity raises are required for continued operations and to execute our business plan and our strategy of acquiring additional businesses. The funds required to execute our business plan will depend on the size, capital structure and purchase price consideration that the seller of a target business deems acceptable in a given transaction. The amount of funds needed to execute our business plan also depends on what portion of the purchase price of a target business the seller of that business is willing to take in the form of seller notes or our equity or equity in one of our subsidiaries. Given these factors, we believe that the amount of outside additional capital necessary to execute our business plan on the low end (assuming target company sellers accept a significant portion of the purchase price in the form of seller notes or our equity or equity in one of our subsidiaries) ranges between $4 million to $8 million. If, and to the extent, that sellers are unwilling to accept a significant portion of the purchase price in seller notes and equity, then the cash required to execute our business plan could be as much as $10 million.

Although we do not believe that we will require additional cash to continue our operations over the next twelve months, there are no assurances that we will be able to raise our revenues to a level which supports profitable operations and provides sufficient funds to pay obligations in the future. Our prior losses have had an adverse effect on our financial condition. In addition, continued operations and our ability to acquire additional businesses may be dependent on our ability to obtain additional financing in the future, and there are no assurances that such financing will be available to us at all or will be available in sufficient amounts or on reasonable terms. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty. If we are unable to generate additional funds in the future through our operations, financings or from other sources or transactions, we will exhaust our resources and will be unable to continue operations. If we cannot continue as a going concern, our stockholders would likely lose most or all of their investment in our company.

Our acquisition strategy exposes us to substantial risk.

Our acquisition of companies is subject to substantial risk, including but not limited to the failure to identify material problems during due diligence (for which we may not be indemnified post-closing), the risk of over-paying for assets (or not making acquisitions on an accretive basis), the ability to obtain or retain customers and the risks of entering markets where we have limited experience. While we perform due diligence on prospective acquisitions, we may not be able to discover all potential operational deficiencies in such entities.

Our prior and future businesses may not perform as expected or the returns from such businesses may not support the financing utilized to acquire them or maintain them. Furthermore, integration and consolidation of acquired businesses requires substantial human, financial and other resources and may divert management’s attention from our existing business concerns, disrupt our ongoing business or not be successfully integrated. Even if we consummate businesses that we believe will be accretive, those businesses may in fact result in a decrease in revenues as a result of incorrect assumptions in our evaluation of such businesses, unforeseen consequences, or other external events beyond our control. Furthermore, if we consummate any future acquisitions, our capitalization and results of operations may change significantly, and stockholders will generally not have the opportunity to evaluate the economic, financial, and other relevant information that we will consider in determining the application of these funds and other resources. As a result, the consummation of acquisitions may have a material adverse effect on our business, financial condition, results of operations and cash flows.

| 12 |

We may experience difficulty as we evaluate, acquire and integrate businesses that we may acquire, which could result in drains on our resources, including the attention of our management, and disruptions of our on-going business.

We acquire small to mid-sized businesses in various industries. Generally, because such businesses are privately held, we may experience difficulty in evaluating potential target businesses as much of the information concerning these businesses is not publicly available. Therefore, our estimates and assumptions used to evaluate the operations, management and market risks with respect to potential target businesses may be subject to various risks and uncertainties. Further, the time and costs associated with identifying and evaluating potential target businesses may cause a substantial drain on our resources and may divert our management team’s attention away from the operations of our businesses for significant periods of time.

In addition, we may have difficulty effectively integrating and managing acquisitions. The management or improvement of businesses we acquire may be hindered by a number of factors, including limitations in the standards, controls, procedures and policies implemented in connection with such acquisitions. Further, the management of an acquired business may involve a substantial reorganization of the business’ operations resulting in the loss of employees and customers or the disruption of our ongoing businesses. We may experience greater than expected costs or difficulties relating to an acquisition, in which case, we might not achieve the anticipated returns from any particular acquisition.

We may not be able to effectively integrate the businesses that we acquire.

Our ability to realize the anticipated benefits of acquisitions will depend on our ability to integrate those businesses with our own. The combination of multiple independent businesses is a complex, costly and time-consuming process and there can be no assurance that we will be able to successfully integrate businesses into our business, or if such integration is successfully accomplished, that such integration will not be costlier or take longer than presently contemplated. Integration of future acquisitions may include various risks and uncertainties, including the factors discussed in the paragraph below. If we cannot successfully integrate and manage the businesses within a reasonable time, we may not be able to realize the potential and anticipated benefits of such acquisitions, which could have a material adverse effect on our stock price, business, cash flows, results of operations and financial position.

We will consider acquisitions that we believe will complement, strengthen and enhance our growth. We evaluate opportunities on a preliminary basis from time to time, but these transactions may not advance beyond the preliminary stages or be completed. Such acquisitions are subject to various risks and uncertainties, including:

| · | the inability to effectively integrate the operations, products, technologies, and personnel of the acquired companies (some of which are in diverse geographic regions) and achieve expected synergies; | |

| · | the potential disruption of existing business and diversion of management’s attention from day-to-day operations; | |

| · | the inability to maintain uniform standards, controls, procedures, and policies; | |

| · | the need or obligation to divest portions of the acquired companies; | |

| · | the potential failure to identify material problems and liabilities during due diligence review of acquisition targets; | |

| · | the potential failure to obtain sufficient indemnification rights to fully offset possible liabilities associated with acquired businesses; and | |

| · | the challenges associated with operating in new geographic regions. |

| 13 |

Failure to manage our growing and changing business could have a material adverse effect on our business, prospects, financial condition, and results of operations.

As we grow, we expect to encounter additional challenges to our internal processes, capital commitment process, and acquisition funding and financing capabilities. Our existing operations, personnel, systems, and internal control may not be adequate to support our growth and expansion and may require us to make additional unanticipated investments in our infrastructure. To manage the future growth of our operations, we will be required to improve our administrative, operational, and financial systems, procedures, and controls, and maintain, expand, train, and manage our growing employee base. If we are unable to manage our growth effectively, we may not be able to take advantage of market opportunities, execute our business strategies successfully or respond to competitive pressures. As a result, our business, prospects, financial condition, and results of operations could be materially and adversely affected.

We face competition for businesses that fit our acquisition strategy and, therefore, we may have to acquire targets at sub-optimal prices or, alternatively, forego certain acquisition opportunities.

We have been formed to acquire and manage small to mid-sized businesses. In pursuing such acquisitions, we expect to face strong competition from a wide range of other potential purchasers. Although the pool of potential purchasers for such businesses is typically smaller than for larger businesses, those potential purchasers can be aggressive in their approach to acquiring such businesses. Furthermore, we expect that we may need to use third-party financing in order to fund some or all of these potential acquisitions, thereby increasing our acquisition costs. To the extent that other potential purchasers do not need to obtain third-party financing or are able to obtain such financing on more favorable terms, they may be in a position to be more aggressive with their acquisition proposals. As a result, in order to be competitive, our acquisition proposals may need to be aggressively priced, including at price levels that exceed what we originally determined to be fair or appropriate. Alternatively, we may determine that we cannot pursue on a cost-effective basis what would otherwise be an attractive acquisition opportunity.

We may not be able to successfully fund acquisitions due to the unavailability of equity or debt financing on acceptable terms, which could impede the implementation of our acquisition strategy.

We finance acquisitions primarily through additional equity and debt financings. Because the timing and size of acquisitions cannot be readily predicted, we may need to be able to obtain funding on short notice to benefit fully from attractive acquisition opportunities. The sale of additional shares of any class of equity will be subject to market conditions and investor demand for such shares at prices that may not be in the best interest of our stockholders. The sale of additional equity securities could also result in dilution to our stockholders. The incurrence of indebtedness would result in increased debt service obligations and could require us to agree to operating and financial covenants that would restrict our operations. Financing may not be available in amounts or on terms acceptable to us, if at all. These risks may materially adversely affect our ability to pursue our acquisition strategy.

We may change our management and acquisition strategies without the consent of our stockholders, which may result in a determination by us to pursue riskier business activities.

We may change our strategy at any time without the consent of our stockholders, which may result in our acquiring businesses or assets that are different from, and possibly riskier than, the strategy described in this prospectus. A change in our strategy may increase our exposure to interest rate and currency fluctuations, subject us to regulation under the Investment Company Act of 1940, as amended, or the Investment Company Act, or subject us to other risks and uncertainties that affect our operations and profitability.

We are a holding company and rely on distributions and other payments, advances, and transfers of funds from our subsidiaries to meet our obligations.

Our primary business is the holding and managing of controlling interests our operating businesses. Therefore, we will be dependent upon the ability of our businesses to generate cash flows and, in turn, distribute cash to us in the form of distributions, advances and other transfers of funds to enable us to satisfy our financial obligations. The ability of our businesses to make payments to us may also be subject to limitations under laws of the jurisdictions in which they are incorporated or organized.

| 14 |

In the future, we may seek to enter into credit facilities to help fund our acquisition capital and working capital needs. These credit facilities may expose us to additional risks associated with leverage and may inhibit our operating flexibility.

We may seek to enter into credit facilities with third-party lenders to help fund our acquisitions. Such credit facilities will likely require us to pay a commitment fee on the undrawn amount and will likely contain a number of affirmative and restrictive covenants. If we violate any such covenants, our lenders could accelerate the maturity of any debt outstanding. Such debt may be secured by our assets, including the stock we may own in businesses that we acquire and the rights we have under intercompany loan agreements that we may enter into with our businesses. Our ability to meet our debt service obligations may be affected by events beyond our control and will depend primarily upon cash produced by businesses that we currently manage and may acquire in the future and distributed or paid to us. Any failure to comply with the terms of our indebtedness may have a material adverse effect on our financial condition.

In addition, we expect that such credit facilities will bear interest at floating rates which will generally change as interest rates change. We will bear the risk that the rates that we are charged by our lenders will increase faster than we can grow the cash flow from our businesses or businesses that we may acquire in the future, which could reduce profitability, materially adversely affect our ability to service our debt, cause us to breach covenants contained in our third-party credit facilities and reduce cash flow available for distribution.

The loss of the services of the current officers and directors could severely impact our business operations and future development, which could result in a loss of revenues and one’s ability to ever sell any shares.

Our performance is substantially dependent upon the professional expertise of the current officers and board of directors. Each has extensive expertise in business development and acquisitions, and we are dependent on their abilities. If they are unable to perform their duties, this could have an adverse effect on business operations, financial condition, and operating results if we are unable to replace them with other individuals qualified to develop and market our business. The loss of their services could result in a loss of revenues, which could result in a reduction of the value of any shares you hold as well as the complete loss of your investment.

Our future success is dependent on the management teams of our businesses, the loss of any of whom could materially adversely affect our financial condition, business, and results of operations.

The future success of our existing and future businesses depends on the respective management teams of those businesses because we intend to operate our businesses on a stand-alone basis, primarily relying on their existing management teams for day-to-day operations. Consequently, their operational success, as well as the success of any organic growth strategy, will be dependent on the continuing efforts of the management teams of our businesses. We will seek to provide these individuals with equity incentives and to have employment agreements with certain persons we have identified as key to their businesses. However, these measures may not prevent these individuals from leaving their employment. The loss of services of one or more of these individuals may materially adversely affect our financial condition, business, and results of operations.

We may engage in a business transaction with one or more target businesses that have relationships with our executive officers, our directors, or any of their respective affiliates, which may create or present conflicts of interest.

We may decide to engage in a business transaction with one or more target businesses with which our executive officers, our directors, or any of their respective affiliates, have a relationship, which may create or present conflicts of interest. Regardless of whether we obtain a fairness opinion from an independent investment banking firm with respect to such a transaction, conflicts of interest may still exist with respect to a particular acquisition and, as a result, the terms of the acquisition of a target business may not be as advantageous to our shareholders as it would have been absent any conflicts of interest.

| 15 |

The operational objectives and business plans of our businesses may conflict with our operational and business objectives or with the plans and objective of another business we own and operate.

Our businesses operate in different industries and face different risks and opportunities depending on market and economic conditions in their respective industries and regions. A business’ operational objectives and business plans may not be similar to our objectives and plans or the objectives and plans of another business that we own and operate. This could create competing demands for resources, such as management attention and funding needed for operations or acquisitions, in the future.

If, in the future, we cease to control and operate our businesses or other businesses that we acquire in the future or engage in certain other activities, we may be deemed to be an investment company under the Investment Company Act.

We have the ability to make investments in businesses that we will not operate or control. If we make significant investments in businesses that we do not operate or control, or that we cease to operate or control, or if we commence certain investment-related activities, we may be deemed to be an investment company under the Investment Company Act. Our decision to sell a business will be based upon financial, operating, and other considerations rather than a plan to complete a sale of a business within any specific time frame. If we were deemed to be an investment company, we would either have to register as an investment company under the Investment Company Act, obtain exemptive relief from the Securities and Exchange Commission, or the SEC, or modify our investments or organizational structure or our contract rights to fall outside the definition of an investment company. Registering as an investment company could, among other things, materially adversely affect our financial condition, business, and results of operations, materially limit our ability to borrow funds or engage in other transactions involving leverage and require us to add directors who are independent of us and otherwise will subject us to additional regulation that will be costly and time-consuming.

We have identified material weaknesses in our internal control over financial reporting. If we fail to develop or maintain an effective system of internal controls, we may not be able to accurately report our financial results and prevent fraud. As a result, current and potential shareholders could lose confidence in our financial statements, which would harm the trading price of our common shares.

Companies that file reports with the SEC, including us, are subject to the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or SOX 404. SOX 404 requires management to establish and maintain a system of internal control over financial reporting and annual reports on Form 10-K filed under the Securities Exchange Act of 1934, as amended, or the Exchange Act, to contain a report from management assessing the effectiveness of a company’s internal control over financial reporting. Separately, under SOX 404, as amended by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, public companies that are large, accelerated filers or accelerated filers must include in their annual reports on Form 10-K an attestation report of their regular auditors attesting to and reporting on management’s assessment of internal control over financial reporting. Non-accelerated filers and smaller reporting companies, like us, are not required to include an attestation report of their auditors in annual reports.

A report of our management is included under Item 9A “Controls and Procedures” of our annual report on Form 10-K for the year ended December 31, 2023. We are a smaller reporting company and, consequently, are not required to include an attestation report of our auditor in our annual report. However, if and when we become subject to the auditor attestation requirements under SOX 404, we can provide no assurance that we will receive a positive attestation from our independent auditors.

During its evaluation of the effectiveness of internal control over financial reporting as of December 31, 2023, management identified material weaknesses. These material weaknesses were associated with our lack of (i) formal documentation over internal control procedures and environment, (ii) proper segregation of duties and multiple level of reviews and (iii) sufficient process, systems and access to technical accounting resources to enable appropriate accounting for and reporting on complex and/or non-routine debt and equity financing transactions including accounting for derivatives, convertible debt, preferred stock. We also have not developed and effectively communicated our accounting policies and procedures to our employees, which has resulted in inconsistent practices. We are undertaking remedial measures, which measures will take time to implement and test, to address these material weaknesses. There can be no assurance that such measures will be sufficient to remedy the material weaknesses identified or that additional material weaknesses or other control or significant deficiencies will not be identified in the future. If we continue to experience material weaknesses in our internal controls or fail to maintain or implement required new or improved controls, such circumstances could cause us to fail to meet our periodic reporting obligations or result in material misstatements in our financial statements, or adversely affect the results of periodic management evaluations and, if required, annual auditor attestation reports. Each of the foregoing results could cause investors to lose confidence in our reported financial information and lead to a decline in our stock price.

| 16 |

Risks Related to our Healthcare Business

Our ability to grow our business through organic expansion either by developing new facilities or by modifying existing facilities is dependent upon many factors.

Our ability to grow our business through organic expansion is dependent on capacity and occupancy at our facilities. Should our facilities reach maximum occupancy, we may need to implement other growth strategies either by developing new facilities or by modifying existing facilities.

Our facilities typically need to be purpose-designed in order to enable the type and quality of service that we provide. Consequently, we must either develop sites to create facilities or purchase or lease existing facilities, which may require substantial modification. We must be able to identify suitable sites and there is no guarantee that such sites will be available at all, or at an economically viable cost or in areas of sufficient demand for our services. The subsequent successful development and construction of a new facility is contingent upon, among other things, negotiation of construction contracts, regulatory permits and planning consents and satisfactory completion of construction. Similarly, our ability to expand existing facilities is also dependent upon various factors, including identification of appropriate expansion projects, permitting, licensure, financing, integration into our relationships with payors and referral sources, and margin pressure as new facilities are filled with patients.

Delays caused by difficulties in respect of any of the above factors may lead to cost overruns and longer periods before a return is generated on an investment, if at all. We may incur significant capital expenditure but due to a regulatory, planning, or other reason, may find that we are prevented from opening a new facility or modifying an existing facility. Moreover, even when incurring such development capital expenditure, there is no guarantee that we can fill beds when they become available. Upon operational commencement of a new facility, we typically expect that it will take approximately 12-18 months to reach our targeted occupancy level. Any delays or stoppages in our projects, the unsatisfactory completion or construction of such projects or the failure of such projects to increase our occupancy levels could have a material adverse effect on our business, results of operations and financial condition.

Changes to payment rates or methods of third-party payors, including government healthcare programs, changes to the laws and regulations that regulate payments for medical services, the failure of payment rates to increase as our costs increase, or changes to our payor mix, could adversely affect our operating margins and revenues.