SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended: June 30, 2013

Commission File Number: 000-16375

ThermoGenesis Corp.

(Exact name of registrant as specified in its charter)

|

Delaware

(State of incorporation)

|

94-3018487

(I.R.S. Employer Identification No.)

|

2711 Citrus Road

Rancho Cordova, California 95742

(Address of principal executive offices) (Zip Code)

(916) 858-5100

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act: Common Stock, $0.001 par value Nasdaq Stock Market, LLC Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding twelve months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K, is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment of this Form 10-K. o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.) x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

Non-accelerated filer* o

|

Smaller reporting company x

|

|

*(Do not check if a smaller reporting company)

|

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) o Yes x No

The aggregate market value of the common stock held by non-affiliates as of December 31, 2012 (the last trading day of the second quarter) was $13,762,000 based on the closing sale price on such day.

As of August 28, 2013, 16,660,962 shares of the registrant’s Common Stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: Portions of the registrant’s proxy statement for its 2013 Annual Meeting of Stockholders are incorporated by reference into Part III hereof.

|

Part I

|

|

|

|

|

|

Page Number

|

|

ITEM 1.

|

|

2

|

|

ITEM 1A.

|

|

16

|

|

ITEM 1B.

|

|

24

|

|

ITEM 2.

|

|

25

|

|

ITEM 3.

|

|

25

|

|

ITEM 4.

|

|

25

|

|

|

|

|

|

Part II

|

|

|

|

|

|

|

|

ITEM 5.

|

|

26

|

|

ITEM 6.

|

|

26

|

|

ITEM 7.

|

|

28

|

|

|

|

29

|

|

|

|

31

|

|

|

|

34

|

|

|

|

35

|

|

ITEM 7A.

|

|

35

|

|

ITEM 8.

|

|

36

|

|

ITEM 9.

|

|

59

|

|

ITEM 9A.

|

|

59

|

|

ITEM 9B.

|

|

59

|

|

|

|

|

|

Part III

|

|

|

|

|

|

|

|

ITEM 10.

|

|

60

|

|

ITEM 11.

|

|

60

|

|

ITEM 12.

|

|

60

|

|

ITEM 13.

|

|

60

|

|

ITEM 14.

|

|

60

|

|

|

|

|

|

Part IV

|

|

|

|

|

|

|

|

ITEM 15.

|

|

61

|

|

|

|

66

|

PART I

Business Overview

ThermoGenesis Corp. (the “Company”, “we”, “our”) is a leading designer and supplier of clinical technologies for processing, storage and administration of stem cells used in the practice of regenerative medicine. Regenerative medicine is an emerging field using cell-based therapies to treat a number of clinical indications, including the repair or restoration of diseased or damaged tissue and cell function. Our products automate the volume reduction and cryopreservation of adult stem cell concentrates from cord blood, peripheral blood, and bone marrow for use in laboratory and point-of-care settings. Our primary business model is based on the sale of medical devices and the recurring revenues generated from their companion single-use, sterile disposable products. We currently sell our products in approximately 30 countries throughout the world to customers that include private and public cord blood banks, surgeons, hospitals and research institutions. Our worldwide commercialization strategy relies primarily on the utilization of distributors. The Company was founded in 1986 and is located in Rancho Cordova, California.

Our growth strategy is to expand our offerings in regenerative medicine while partnering with other pioneers in the stem cell arena to accelerate our worldwide penetration of this growing market.

Regenerative medicine represents a new paradigm in human health and the treatment of disease and injury. It is uniquely capable of altering the fundamental mechanisms of disease and through translational medicine, we are better understanding our body’s ability to heal itself. Harnessing, concentrating and directing that ability for the treatment of acute and chronic conditions has demonstrated curative potential never before seen.

We believe our enabling tools and technologies are foundational to the automation and commercialization of regenerative medicine practiced at the point-of-care. However, global regulatory bodies are increasing their oversight and placing a greater burden of proof on device manufacturers to demonstrate the safety, consistency, predictability and effectiveness of in-vivo use from the cells produced by our devices. In a laboratory or manufacturing setting the consistency and predictability are controlled by the rigorous validated procedures and test methods around their Good Manufacturing Practices (“cGMP”). A point-of-care product is used by and in a physician managed environment where the safety and well-being of the patient is the key principle. Therefore enabling the physician to ensure a point-of-care product delivers a clinically effective cell therapy meeting current cGMP quality standards requires rigorous precision and consistent control mechanisms of all variables at the patient bed side during a procedure, including but not limited to cell temperatures, dosing, cell viability, and viscosity. All of these control processes must be simple, rapid, and cost effective to become a routine treatment modality.

To capture the true potential of our technological assets and know-how across the entire value stream of regenerative medicine, we believe we must broaden our clinical capabilities and extend our presence into point-of-care to ensure a level of consistency and control across multiple indications and delivery settings. In doing so, we will evolve into a fully integrated regenerative medicine company capable of developing and delivering safe and consistently efficacious, commercially viable autologous cell therapies physicians can deliver with ease, in less than 60 minutes, at the patient’s bed-side. We believe this transformation will substantially expand the company’s addressable markets to include billion dollar patient populations within the vascular and orthopedic markets.

Consistent with this strategy, on July 15, 2013, we entered into an Agreement and Plan of Merger and Reorganization with TotipotentRX Corporation (“TotipotentRX”), a privately held California Corporation, and its principle shareholders. TotipotentRX specializes in developing cell-based therapies in the field of regenerative medicine and is the exclusive provider of cell-based product and services to the Fortis Healthcare System. The combined company, which will be called Cesca Therapeutics, is expected to become one of the first fully integrated regenerative medicine companies in the world, developing clinically validated, commercially scalable, point-of-care cell therapies for major therapeutic markets, including orthopedic, cardiovascular and neurologic indications. Our consummation of the merger with TotipotentRX is subject to, among other things, approval by our stockholders and TotipotentRX shareholders.

Our Solutions

We believe our automated products significantly enhance the safety, reproducibility and viability of regenerative medical procedures and expand the use and success of those products in clinical treatment through their ease of use and high cell recovery rates. Our competitive advantage is achieved through applying our advanced research and engineering capabilities to the development of a comprehensive line of products for healthcare providers to utilize in regenerative medicine. Our solutions enable our customers to automate their processes, comply with quality regulations, improve their efficiency and produce therapeutic doses of high quality stem cell concentrates.

Key Events and Accomplishments

The following are key events and accomplishments that occurred in fiscal 2013:

|

· |

Received Registration Approval for AXP in China |

Our AXP received registration approval from China’s State Food & Drug Administration enabling the Company to initiate commercial distribution in China.

|

· |

Signed Golden Meditech Holdings Limited (“Golden Meditech”) AXP Distribution Agreement |

We signed an exclusive, subject to existing distributors and customers, agreement to distribute the AXP Disposable Blood Processing Set in China and several southeast Asian countries.

|

· |

AXP System Selected by New Customers in United Kingdom and Portugal |

Our AXP system was selected by United Kingdom’s NHS Blood and Transplant (“NHSBT”) which manages six cord blood collection facilities and operates a cord blood bank laboratory under a five-year exclusive agreement and Crioestaminal, a leading cord blood stem cell bank in Portugal.

|

· |

Sold ThermoLine Product Line to Helmer Scientific |

The sale of our ThermoLine plasma freezer and thawer product line was part of our growth strategy to focus our core business on developing enabling technologies for the stem cell regenerative medicine market.

|

· |

Signed New Cord Blood Products Distribution Agreements |

We signed three integrated distribution agreements with Concessus, HVD Biotech Vertriebs GmbH and Comercia Exportacao e Importacao de Materials Medicos to provide a customer-centric focus that incorporates sales, service and support for our cord blood product portfolio.

Market Overview

Regenerative Medicine Market

The regenerative medicine market continues to experience meaningful advances in clinical efficacy, the number of FDA therapeutic product approvals and product commercialization of cell based therapies. The vast majority of this progress has been achieved through the broader application of adult stem cells, reflecting a greater awareness and appreciation of their therapeutic potential.

Positive results generated from the application of adult stem cells have resulted in greater government and private sector investment in the research and development of new cell therapies, including the continued advancement of existing treatments.

The regenerative medicine market is comprised of companies that harvest, process, purify, expand, modify, cryopreserve, store or administer cells as the therapeutic agent. These cells can be stem cells, modified autologous cells, i.e. cell vaccines, and cell carrier packages for therapeutic cytokines and growth factors, i.e. platelets. Key success factors include:

|

· |

Target or purified cell recovery rates |

|

· |

Efficiency of cell processing, including time |

|

· |

Product quality and efficacy |

|

· |

Purity, viability and potency of stem cells |

|

· |

Obtaining regulatory approval / U.S. Food and Drug Administration (“FDA”) clearance |

Cells are processed in the laboratory as well as in the operating room or point-of-care setting. Point-of-care applications involve the processing of patient cells in conjunction with a surgical procedure in an operating room or in an outpatient clinical setting. The laboratory market requirements include, but are not limited to, current cGMP, objective quality assurance and the ability to process multiple samples at one time. Requirements for the point-of-care include sterile field packaging, portability, minimal processing steps, predictable recovery rates, and speed of processing. These market requirements must be considered and translated into product features and benefits for successful market adoption.

The availability of therapeutic cells, including stem cells, at the point-of-care enables physicians to apply cells across an array of applications. In the United States the regulations governing the use of tissue and cells are defined in the Public Health Services Act under Sections 351 and 361. Cells intended to treat patients which are autologous, minimally manipulated, homologous and not combined with another regulated article are categorized as 361 agents and may be prescribed by physicians without a PreMarket Approval (“PMA”) or Biological License Approval (“BLA”). All other cell products are therefore regulated as 351 tissue or cell treatments and can only be used within an approved clinical trial or as defined in the PMA/BLA license. Therefore, many physicians are now choosing to study patient outcomes to understand the benefits of the therapeutic cells under their own independently-sponsored and regulated studies. Such research efforts are growing and already include studies using cells derived from bone marrow, peripheral blood, cord blood, adipose, and placenta sources in diverse areas such as spinal fusion, non-healing fractures, wound healing, radiation injury, breast reconstruction and augmentation, cardiovascular applications, peripheral vascular disease and liver disease among many others.

In terms of the largest market opportunities, the current forecast is that commercial products will come first in orthopedics, cardiology, skin and wound healing, diabetes and central nervous system disorders. With initiatives like the Armed Forces Institute for Regenerative Medicine (“AFIRM”), the acceleration of therapy development for the treatment of wounded warriors could create more rapid adoption for general patient populations due to the significant clinical research dollars and highly-collaborative nature of the AFIRM program.1

Market Size

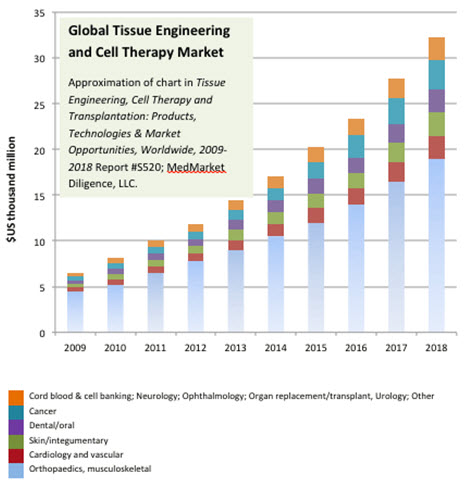

Market estimates for regenerative medicine include pathologies that affect vast numbers of people of all age groups.

Below is illustrated the 2009 to 2018 forecast for the global markets in tissue engineering, cell therapy and transplantation, by clinical area.

1Excerpts from Oct. 2012 white paper: A Private Investor Guide to Regenerative Medicine Unique Opportunities in an Emerging Field- www.regenerativemedicinefoundation.org.

Regenerative medicine can capitalize on the trends surrounding cost containment. As healthcare costs rise, there has been a similar boost in efforts to limit expenses by employers, payers and the government. If regenerative medicine therapies can provide a cost-effective alternative to current treatments, physicians and hospitals might have an incentive to more readily adopt them. Again, the need for baseline clinical and cost data, and more comprehensive studies, is as critical as funding the research itself.

Overall demographics make a compelling case for examination of regenerative medicine as a field of the future. The demands of an aging population places ever increasing demands on healthcare delivery requirements and cost, and most prominently shows up as in the dramatic percentage of gross domestic product (“GDP”) spending on healthcare. The U.S. alone spent an estimated $2.2 trillion, or 16% of GDP, on healthcare in 2006, a figure that is expected to reach $4.1 trillion by 2016. By 2040, the senior citizen population will double in the U.S. to about 70 million and about 25% of GDP could be devoted to healthcare by that time.1

Cord Blood Market

Since the first cord blood transplant was carried out in 1988, stem cells derived from umbilical cord blood have been used in more than 30,000 transplants worldwide to treat a wide range of blood diseases, genetic and metabolic disorders, immunodeficiencies and various forms of cancer. Today over 4,000 cord blood transplantations are performed annually and that number is expected to grow.

Cord blood banks now exist in nearly every developed country, as well as several developing nations.

Cord blood banking can be divided into 3 segments; private, public and public/private (hybrid) with private companies serving individual families and public banks serving the broader public. The hybrid private/public banks use revenue generated from patrons from their private sector to fund a public bank.

The number of units a cord bank receives is somewhat related to how many sites from which they receive units. Some cord blood banks may receive units only from nearby hospitals and birthing centers, while others allow mail-in units from a wide geographic region via courier services.

Product Overview

We provide products and technologies to enable highly-effective cell separation, processing and cryopreservation for storage of biological fluids including umbilical cord blood and bone marrow in a proprietary format. These proprietary products and technologies are designed for use in the laboratory as well as point-of-care.

Cord Blood

|

· |

The AXP System is a medical device with an accompanying disposable bag set that isolates and retrieves stem cells from umbilical cord blood. The AXP System provides cord blood banks with an automated method to concentrate adult stem cells which reduces the overall processing and labor costs with a reduced risk of contamination under cGMP conditions. The AXP System retains over 97% of the mononuclear cells (“MNCs”). High MNC recovery has significant clinical importance to patient transplant survival rates. Self-powered and microprocessor-controlled, the AXP device contains flow control optical sensors that achieve precise separation. |

Our market for the AXP System includes both private and public cord blood banks. In private banks, parents pay to preserve the cord blood cells from their offspring for family use, while a public bank owns cord blood stem cells donated by individuals, which are then available to the public for transplantation. Also, there are banks we consider “public/private” that offer both services. Some public sites are evaluating the inclusion of a private bank within their facility. Since the infrastructure to process and store cord blood is already in place, they see it as a way of funding their public side.

The AXP System has been commercially available since 2006, marketed under a Master File with the FDA. In 2007, we received 510(k) clearance from the FDA for use in the processing of cord blood for cryopreservation.

|

· |

The BioArchive System is a robotic cryogenic medical device used to cryopreserve and archive stem cells for future transplant and treatment. Launched in fiscal 1998, our BioArchive Systems have now been purchased by over 110 umbilical cord blood banks in over 35 countries for the archiving, cryopreservation and storage of stem cell preparations extracted from human placentas and umbilical cords for future use. |

The BioArchive System is designed to store over 3,600 stem cell samples. It is the only fully-automated, commercially available system on the market that integrates controlled-rate freezing, sample management and long term cryogenic storage in liquid nitrogen. The robotic storage and retrieval of these stem cell units improves cell viability, provides precise inventory management and minimizes the possibility of human error.

Bone Marrow

|

· |

The Res-Q 60 BMC, is a rapid, reliable, and easy to use product for cell processing at the point-of-care. The product is a centrifuge-based disposable device designed for the isolation and extraction of specific stem cell populations from bone marrow. The product was launched in 2009. The key advantages of the Res-Q 60 BMC include (a) delivering a high number of target cells from a small sample of bone marrow, and (b) providing a disposable that is highly portable and packaged for the sterile field. These features allow the physician to process bone marrow and return the cells to the patient in 15 minutes. |

|

· |

The MarrowXpress® or MXP System, a derivative product of the AXP and its accompanying disposable bag set, isolates and concentrates stem cells from bone marrow aspirate and its initial application is for the preparation of cells for regeneration of bone in spinal fusion procedures. The product is an automated, closed, sterile system that volume-reduces blood from bone marrow to a user-defined volume in 30 minutes, while retaining over 90% of the MNCs, a clinically important cell fraction. Self-powered and microprocessor-controlled, the MXP System contains flow control optical sensors that achieve precise separation. In June 2008, we received the CE-Mark, enabling commercial sales in Europe. In July 2008, we received authorization from the FDA to begin marketing the MXP in the U.S. for the preparation of cell concentrate from bone marrow. |

PRP

|

· |

The Res-Q 60 PRP, is designed to be used for the safe and rapid preparation of autologous PRP from a small sample of blood at the point-of-care. The product allows PRP to be mixed with autograft and/or allograft bone prior to application to a bony defect in the body. The Res-Q 60 PRP received FDA 510(k) clearance in June of 2011. |

Sales and Distribution Channels

We market and sell our products primarily through independent distributors. During fiscal 2013, we employed new integrated distribution arrangements whereby our suite of cord blood products are distributed into specific territories by a single distributor. The new arrangements have improved the customer experience by streamlining their product, service and support needs through a single point of contact.

Business Development

We continue to have encouraging discussions with multiple potential partners aimed at identifying and developing growth opportunities beyond our current product offerings and geographies. These include leveraging our technology platforms to create new products for our existing markets, cord blood and bone marrow processing and adjacent markets such as adipose tissue processing. In addition, we seek to develop products that serve more of the cell processing work flow continuum from cell sourcing and preparation through to preservation and patient administration.

We maintain a rigorous flow of discussions with numerous organizations having complementary products, services or other relevant assets. We are optimistic that our business development efforts will generate increased sales and stockholder value through the advancement of existing products into new applications and through the development and commercialization of new products. See Item 1A “Risk Factors”.

Competition

The regenerative medicine and medical device industries are characterized by rapidly evolving technology and intense competition from medical device companies, pharmaceutical companies and stem cell companies operating in the field of cardiac, vascular, orthopedics and neural medicine. The primary competitors for our current product mix include automated cell processing systems from BioSafe, TerumoBCT (formerly COBE), non automated processing from Terumo Cardiovascular Systems, Biomet, CytoMedix and cell cryopreservation storage systems from Chart Industries and Taylor-Wharton.

Clinical Evaluations

We believe that increasing the amount of available clinical data demonstrating the safety and efficacy of our products is a competitive differentiator and will continue to be a major element of our growth strategy. As such, indication-specific clinical data will be essential for broad market acceptance and regulatory approval.

Below are examples of third party clinical evaluations we are supporting:

|

Sponsor/Site

|

Product

|

Indication

|

Purpose

|

Status

|

|

TotipotentSC/ Fortis Hospital,

New Delhi, India

|

Res-Q

|

Critical Limb Ischemia (“CLI”) /Peripheral Artery Disease (“PAD”)

|

Purpose is to establish Res-Q 60 BMC safety/efficacy for CLI (Ph1b study)

|

Underway – Follow up observations

|

|

Celling Technologies, LLC “Celling”/ UC Davis

|

Res-Q

|

Non-union bone fractures

|

Purpose is to establish Res-Q 60 BMC safety/efficacy for non-union bone fractures.

|

Enrollment complete – Follow up observations and assessment

|

|

Second University of Naples, Italy

|

MXP

|

CLI /PAD

|

Purpose is to establish MXP BMC safety/efficacy for CLI

|

Complete: Data analysis and assessment

|

Research and Development

Our research and development activities in fiscal 2013 focused on developing or expanding contract manufacturing capabilities for low cost disposables and building on our product quality leadership position. Significant investments were also made to support product registration in China, Taiwan, India and South Korea. In fiscal 2014, the Company plans to introduce new features and enhancements to the AXP and MXP platforms. Research and development expenses were $2,991,000, $3,729,000 and $3,003,000 for the years ended June 30, 2013, 2012 and 2011, respectively. These totals include expenses related to engineering, regulatory, scientific and clinical affairs.

Manufacturing

Our long-term manufacturing strategy continues to be utilizing high quality, low cost contract manufacturers for production of routine products while maintaining in-house manufacturing capabilities for complex, low volume devices that depend upon core technologies. The Company has completed virtually all of its major outsourcing programs.

Quality System

Our quality system has been created to be harmonized with domestic and international standards and is focused to ensure it is appropriate for the specific devices we manufacture. Our corporate quality policies govern the methods used in, and the facilities and controls used for, the design, manufacture, packaging, labeling, storage, installation, and servicing of all finished devices intended for human use. These requirements are intended to ensure that finished devices will be safe and effective and otherwise in compliance with the FDA Quality System Regulation (“QSR”) (21 CFR 820) administered by the FDA and the applicable rules of other governmental agencies.

We, as well as any contract manufacturers of our products, are subject to inspections by the FDA and other regulatory agencies for compliance with applicable regulations, codified in the QSR which include requirements relating to manufacturing processes, extensive testing, control documentation and other quality assurance procedures. Our facilities have undergone International Organization of Standards (“ISO”) 13485:2012 and EU Medical Device Directive (“MDD”) (93/42/EEC) inspections and we have obtained approval to CE-Mark our products. Failure to obtain or maintain necessary regulatory approvals to market our products would have a material adverse impact on our business.

Regulatory Strategy

Our regulatory strategy is to be involved in selective clinical programs that generate data to help fuel adoption of our product offerings. We have a quality and regulatory compliance management system that complies with the requirements of the ISO 13485: 2012 standard, the FDA’s QSR, the European Union MDD, the Canadian Medical Device Regulations (“SOR 98-282”), and other applicable local, state, national and international regulations.

Our medical devices are subject to regulation by numerous government agencies, including the FDA and comparable state and foreign agencies. To varying degrees, each of these agencies requires us to comply with laws and regulations governing the development, testing, manufacturing, labeling, marketing, distribution, installation and servicing, clinical testing, post-market surveillance and approval of our products, including investigational, and commercially-distributed medical devices. These international, national, state, and local agencies set the legal requirements for ensuring our products are safe and effective, as well as manufactured, packaged and labeled in conformity with cGMP established by the FDA, as well as comparable regulations under the MDD of the EU. Virtually every activity associated with the manufacture and sale of our products and services are scrutinized on a defined basis and failure to implement and maintain a Quality Management System could subject the Company to civil and criminal penalties.

Class III Devices

Before certain medical devices may be marketed in the U.S., they must be approved by the FDA. FDA approval depends on the classification of the device. If the product is a Class III device, the FDA approval process includes the following:

| · |

Extensive pre-clinical laboratory and animal testing, |

| · |

Submission and approval of an Investigational Device Exemption (“IDE”) application, |

| · |

Human clinical trials to establish the safety and efficacy of the medical device for the intended indication, and |

| · |

Submission and approval of a PMA application to the FDA. |

Pre-clinical trials include laboratory evaluation, through in vitro and in vivo animal studies, to obtain safety and dosage information about the product to justify future clinical trials in human subjects. Safety testing is performed to demonstrate the biocompatibility of the device, particularly if the device is intended to come into contact with blood or other body tissues. Pre-clinical studies must be performed by laboratories which comply with the FDA’s Good Laboratory Practices regulations. The results of the pre-clinical studies are submitted to the FDA as part of an IDE application and are reviewed by the FDA before human clinical trials can begin.

Clinical trials involve the application of the medical device or biologic produced by the medical device to patients by a qualified medical investigator, after approval from an Institutional Review Board (“IRB”), and in certain jurisdictions having authorization for the trial under investigational use. Medical device trials which are conducted inside the U.S. are subject to FDA preapproval under either 21 C.F.R. Part 812, known as IDE application, or 21 C.F.R. Part 312, known as Investigation New Drug (“IND”) application. Clinical trials conducted outside the U.S., and the data collected therefrom, are allowed per the requirements outlined in 21 C.F.R. Part 312.120.

Medical device clinical trials are typically conducted as a Phase III clinical trial. A Phase II or combined Phase I/II safety pilot trial may be performed prior to initiating the Phase III clinical trial to determine the safety of the product for specific targeted indications or dosage optimization studies. The FDA, the clinical trial sponsor, the investigators or the IRB may suspend clinical trials at any time if any one of them believes that study participants are being exposed to an unacceptable health risk.

The combined results of product development, pre-clinical studies, and Phase III clinical studies are submitted to the FDA as a PMA application for approval of the marketing and commercialization of the medical device in the U.S. The FDA may deny the approval of a PMA application if applicable regulatory criteria are not satisfied or it may require additional clinical testing. Even if the appropriate data is submitted, the FDA may ultimately decide the PMA application does not satisfy the criteria for approval. Product approvals, once obtained, may be withdrawn if compliance with regulatory standards is not maintained or if safety concerns arise after the product reaches the market. The FDA may require post-marketing testing and surveillance programs to monitor the effect of the medical devices that have been commercialized and has the power to prevent or limit future marketing of the product based on the results of such programs.

Class II Devices

Several of our medical devices, such as the BioArchive, Res-Q 60 PRP and AXP are categorized as Class II. These devices have a lower potential safety risk to the patient, user, or caregiver. A PMA submission is not a requirement for these devices. A similar (but simpler and shorter) process of premarket notification, known as a 510(k) submission, is required to demonstrate substantial equivalence to another legally U.S. marketed device. Substantial equivalence means that the new device is at least as safe and effective as the predicate. Once the FDA has notified the Company that the product file has been cleared, the medical device may be marketed and distributed in the U.S.

Class I Devices

Some of our products, such as MXP and Res-Q 60 BMC that have minimal risk to the intended user have been deemed by the FDA as being exempt from FDA approval or clearance processes. While submissions to the FDA are not a requirement for these Class I (low risk) devices, compliance with the QSR is still mandated.

Other U.S. Regulatory Information

Failure to comply with applicable FDA requirements can result in fines, injunctions, civil penalties, recall or seizure of products, total or partial suspension of production or loss of distribution rights. It may also include the refusal of the FDA to grant approval of a PMA or clearance of a 510(k). Actions by the FDA may also include withdrawal of marketing clearances and possibly criminal prosecution. Such actions, if taken by the FDA, could have a material adverse effect on the Company’s business, financial condition, and results of operation.

Each manufacturing establishment must be registered with the FDA and is subject to a biennial inspection for compliance with the Federal Food, Drug, and Cosmetic Act and the QSRs. In addition, each manufacturing establishment in California must be registered with the California State Food and Drug Branch of the California Department of Public Health and be subject to an annual inspection by the State of California for compliance with the applicable state regulations. Companies are also subject to various environmental laws and regulations, both within and outside the U.S. Our operations involve the use of substances regulated under environmental laws, primarily manufacturing and sterilization processes. Workplace safety, hazardous material, and controlled substances regulations also govern our activities. The Company has a California Environmental Protection Agency Identification number for the disposal of biohazardous waste from its research and development biological lab. Our cost associated with environmental law compliance is immaterial. The California State Food and Drug Branch of the California Department of Public Health completed a quality system compliance audit resulting with zero observations in fiscal 2011. The FDA audited ThermoGenesis in fiscal 2012 resulting in two minor non-conformances that were resolved before the end of the audit.

International Regulatory Requirements

Internationally, we are required to comply with a multitude of other regulatory requirements. These regulations may differ from the FDA regulatory scheme. In the EU, a single regulatory approval process has been created and approval is represented by the CE-Mark. To be able to affix the CE-Mark to our medical devices and distribute them in the EU, we must meet minimum standards for safety and quality (known as the essential requirements) and comply with one or more conformity rules. A notified body assesses our quality management system and compliance to the MDD. Marketing authorization for our products is subject to revocation by the applicable governmental agency or notified body under the EU which are subject to annual audit confirmations with respect to our quality system.

Patents and Proprietary Rights

The Company believes that patent protection is important for its products and potential segments of its current and proposed business. In the U.S., the Company currently holds 11 patents, and has 4 patents pending to protect the designs of products that the Company intends to market. The Company has received notices of issuance for three of the pending U.S. applications. It is Company policy to seek foreign patent protection in relevant markets around the world.

Patent positions of medical device companies, including our company, are uncertain and involve complex and evolving legal and factual questions. The coverage sought in a patent application can be denied or significantly reduced either before or after the patent is issued. Consequently, there can be no assurance that any of our pending patent applications will result in an issued patent. There is also no assurance that any existing or future patent will provide significant protection or commercial advantage, or whether any existing or future patent will be circumvented by a more basic patent, thus requiring us to obtain a license to produce and sell the product. Generally, patent applications can be maintained in secrecy for at least 18 months after their earliest priority date. In addition, publication of discoveries in the scientific or patent literature often lags behind actual discoveries. Therefore, we cannot be certain that we were the first to invent the subject matter covered by each of our pending U.S. patent applications or that we were the first to file non-U.S. patent applications for such subject matter.

If a third party files a patent application relating to an invention claimed in our patent application, we may be required to participate in an interference proceeding declared by the U.S. Patent and Trademark Office to determine who owns the patent. Such proceeding could involve substantial uncertainties and cost, even if the eventual outcome is favorable to us. There can be no assurance that our patents, if issued, would be upheld as valid in court.

Licenses and Distribution Rights

Cord Blood Registry Systems, Inc. (“CBR”)

On July 26, 2013, we entered into an extension addendum to the License and Escrow Agreement to amend and reduce the minimum cash and short-term investments balance to $3,500,000 at any month end through October 31, 2013. Thereafter, it reverts back to $6,000,000 at any month end.

On February 6, 2013, we entered into an amendment to the License and Escrow Agreement to amend and reduce the financial covenants that we must meet in order to avoid an event of default. The modified covenants include a minimum cash and short-term investments balance of not less than $4,000,000 at any month end through June 30, 2013, which reverts back to $6,000,000 at any month end, and a quick ratio of 1.75 to 1 at the end of any month.

The Company is in compliance with the covenants at June 30, 2013.

In June 2010, the Company and CBR entered into a License and Escrow Agreement as a method to provide assurances to CBR of continuity of product delivery and manufacturing for CBR’s business, and to alleviate concerns about long term supply risk. We are the sole provider to CBR of devices and disposables used in the processing of cord blood samples in CBR’s operations. Under the agreement, the Company granted CBR a non-exclusive, royalty-free license to certain intellectual property necessary for the potential manufacture and supply of AXP devices and certain AXP disposables. The license is for the sole and limited purpose of manufacturing and supplying the AXP and related disposables for use by CBR. The licensed intellectual property will be maintained in escrow and will be released to and used by CBR if and only if the Company defaults under the Agreement. Originally, default occurred if the Company (1) fails to meet certain positive cash flow metrics for each rolling quarterly measurement period beginning December 31, 2010, except where the following two measures are met, (2) failure to meet cash balance and short-term investments of at least $6 million at the end of any given month, or (3) failure to meet a quick ratio of 2 to 1 at the end of any given month.

On August 22, 2006, the Company announced that GE Healthcare (“GEHC”) and CBR, the world’s largest family cord blood bank, signed a multi-year contract to supply CBR with the Company’s AXP System. In conjunction with this agreement, the Company signed a Product Development and Supply Assurance Agreement with CBR which assures the supply of AXP products for a 15-year period.

Golden Meditech

In August 2012, the Company entered into a Product Purchase and International Distributor Agreement with Golden Meditech. Under the terms of the agreement, Golden Meditech obtained the exclusive, subject to existing distributors and customers, rights to develop an installed base for the Company’s AXP System in specified countries. This right includes the right to distribute AXP Disposable Blood Processing Sets and use rights to the AXP System, and other accessories used for the processing of stem cells from cord blood. Golden Meditech has rights in the People’s Republic of China (excluding Hong Kong and Taiwan), India, Singapore, Indonesia, and the Philippines and may begin selling once relevant approval has been obtained in each respective country. Additionally, Golden Meditech is subject to certain annual minimum purchase commitments. The term of the agreement is for 5 years with one year renewal options by mutual agreement.

Asahi

Effective June 30, 2012 Asahi exercised its option to purchase certain intellectual property rights of the Company for the CryoSeal System, including, but not limited to, patents and patent applications, trademarks and any and all commercial and technical know-how. The intellectual property rights were sold for $2,000,000 which was received in August 2012.

In June 2010, the Company and Asahi entered into an amendment of their Distribution and License Agreement, originally effective March 28, 2005. Under the terms of the amendment, Asahi obtained exclusive rights to distribute the CryoSeal System in South Korea, North Korea, Taiwan, the People’s Republic of China, the Philippines, Thailand, Singapore, India and Malaysia. These rights included the exclusive right to market, distribute and sell the processing disposables and thrombin reagent for production of thrombin in a stand-alone product. The Company will provide support to Asahi in the form of maintaining manufacturing capabilities of the CryoSeal System until the earlier of when Asahi receives regulatory approval from the Ministry of Health, Labour and Welfare (“MHLW”) or December 31, 2012, upon which the Company shall have no further obligation to manufacture. Asahi received regulatory approval on August 31, 2011. Asahi shall continue to have the right to manufacture such products in Japan and shall additionally have a non-exclusive right to manufacture such products outside of Japan and would make royalty payments to the Company for products it manufactures and sells. The Amendment extends the agreement eight years with automatic one year renewals. Asahi paid us a $1,000,000 license fee, which was fully earned and non-refundable as of June 30, 2012. Concurrent with exercising the purchase option, the terms and conditions of the Amendment terminated.

Arthrex

In January 2012, the Company entered into an agreement with Arthrex. Under the terms of the agreement, Arthrex obtained exclusive rights in certain territories to sell, distribute and service the Company’s Res-Q 60 System technology for use in the preparation of autologous PRP and BMC for sports medicine applications and orthopedic procedures. The Company granted Arthrex a limited license to use the Company’s intellectual property as part of enabling Arthrex to sell the products. Arthrex will purchase products from the Company to distribute and service at certain purchase prices, which may be changed after an initial period. The agreement contains purchase minimums that must be met on a yearly basis for Arthrex to maintain its exclusivity. Arthrex also pays a certain royalty rate based upon volume of products sold. The term of the agreement is for five years, subject to an extension right of an additional three years.

Nanshan

In November 2010, the Company and Nanshan entered into an International Distributor Agreement. Under the terms of the agreement, Nanshan obtained rights to sell, distribute, and service the Company’s MXP and Res-Q product lines in the People’s Republic of China and Hong Kong (not including Taiwan). The term of the agreement is for four years, subject to extension rights. Nanshan was granted restricted common stock upon execution of the agreement in the amount of 0.5% of the total outstanding common stock of the Company which equaled 70,117 shares. Nanshan has the right to additional grants of restricted common stock of the Company over the term of the agreement in an amount up to 806,000 shares upon the achievement of certain milestones up to $43 million in cumulative sales. Effective December 25, 2012, the agreement was terminated. As the distribution agreement has terminated, Nanshan is no longer eligible to earn additional shares of common stock.

BioParadox LLC (“BioParadox”)

In October 2010, the Company and BioParadox entered into a License and Distribution Agreement. Under the terms of the agreement BioParadox obtained exclusive world-wide rights for the use, research and commercialization of the Res-Q technology in the production of PRP in the diagnosis, treatment and prevention of cardiovascular disease. The term of the agreement will depend on the satisfaction by BioParadox of certain milestones, or the payment of extension fees. If certain delivery or financial metrics are not maintained, the agreement requires the Company to place in escrow the detailed instructions for manufacturing the products. BioParadox will have the right to manufacture the product for the cardiac field for the term of the agreement in the event of a default by the Company or if certain on-time delivery metrics or supply requirements are not met.

GEHC

In January 2012, the Company and GEHC signed an amendment, effective August 1, 2012. Under the terms of the amendment, GEHC will continue to distribute the AXP product line in the United States and Canada. The purchase prices for the products are fixed. The amendment will automatically renew for one year terms unless terminated by either party with 90 days notice. On August 26, 2013, the Company sent GEHC a 90 day notice of termination, which terminates the agreement effective November 24, 2013.

In January 2010, the Company and GEHC also signed an amendment to extend their Amended and Restated International Distribution Agreement, effective February 1, 2010. Under the terms of the amendment, the contract ran through July 31, 2012, GEHC continued to distribute the AXP product line in the United States, Canada and approximately 25 countries throughout the world, excluding certain countries in Latin America, Asia, CIS, Eastern Europe and the Middle East. The amendment provided incentives for both parties related to sales success, product quality and delivery. Under the original agreement, signed October 13, 2005, the Company received fees for the rights granted under the agreement. The amounts received are being recognized as revenue on the straight-line method over the initial five year term of the contract.

In May 2010, the Company and GEHC signed a non-exclusive distribution agreement for the Res-Q 60 BMC System. Under the agreement, GEHC had the right to distribute the Res-Q 60 BMC in the U.S., excluding orthopedic indications, Canada and 19 European countries. The agreement has a two and a half year term, with automatic one year renewals, unless terminated by either party with six months advance notice. The Agreement provides for a price reduction mechanism should the Company fail to meet certain product quality and delivery metrics. The parties mutually agreed to terminate effective December 31, 2011.

Fenwal, Inc. (“Fenwal”)

In March 2010, the Company and Fenwal signed a five-year distribution agreement. Under the agreement, Fenwal will have exclusive rights to market and distribute the AXP System and BioArchive System for use in cord blood processing and storage in China, India and Japan. The Company and Fenwal are in discussions to terminate the agreement

Celling

In September 2008, the Company and Celling signed a distribution agreement for the Company’s MXP and Res-Q 60 BMC product lines. The distribution rights are for the field of use in orthopedic intraoperative or point-of-care applications. The five-year agreement provides Celling with an initial two-year period of exclusive distribution rights in the U.S. and non-exclusive distribution rights throughout the rest of the world, excluding Central and South America, Russia and certain Eastern European countries. The exclusivity period and field of use may be extended under certain circumstances. The parties amended the agreement in July 2009 to provide shared funding for clinical studies to demonstrate the clinical effectiveness of the products in orthopedic applications. The parties amended the agreement in January 2012. The revised distribution rights are world-wide, non-exclusive within field of use for the MXP and exclusive within field of use in the United States and non-exclusive in Mexico for the Res-Q.

New York Blood Center (“NYBC”)/Pall Medical

In March 1997, the Company and NYBC, as licensors, entered into a license agreement with Pall Medical, a subsidiary of Pall Corporation, as a Licensee through which Pall Medical became the exclusive worldwide manufacturer (excluding Japan) for a system of sterile, disposable containers developed by the Company and NYBC for the processing of hematopoietic stem cells sourced from placental cord blood (“PCB”). The system is designed to simplify and streamline the harvesting of stem cells from umbilical cord blood and the manual concentration, cryopreservation (freezing) and transfusion of the PCB stem cells while maintaining the highest stem cell population and viability from each PCB donation. In May 1999, the Company and Pall Medical amended the original agreement, and the Company regained the rights to distribute the bag sets outside North America and Europe under the Company’s name. In fiscal 2012, the Company and NYBC signed an agreement which provides for the equal sharing of royalties between the two parties effective July 1, 2011, except for calendar 2012, in which NYBC received 75% and the Company 25%.

Backlog

Our backlog was $319,000 and $1,528,000 as of June 30, 2013 and 2012, respectively. Our backlog consists of product orders for which a customer purchase order has been received and is scheduled for shipment within the next twelve months. Orders are subject to cancellation or rescheduling by the customer, sometimes with a cancellation charge. Due to timing of order placement, product lead times, changes in product delivery schedules and cancellations, and because sales will often reflect orders shipped in the same quarter received, our backlog at any particular date is not necessarily indicative of sales for any succeeding period.

Employees

As of June 30, 2013, the Company had 66 employees, 30 of whom were engaged in manufacturing operations and quality control, 13 in research and new product development, regulatory affairs, clinical and scientific affairs, 13 in administration and 10 in sales, marketing and customer service. The Company also utilizes temporary employees throughout the year to address business needs and significant fluctuations in orders and product manufacturing. None of our employees are represented by a collective bargaining agreement, nor have we experienced any work stoppage.

Foreign Sales and Operations

For fiscal 2013, foreign sales were $9,934,000 or 55% of net revenues. For fiscal 2012, foreign sales were $8,240,000 or 43% of net revenues. For fiscal 2011, foreign sales were $9,655,000 or 41% of net revenues.

Our AXP and MXP bag sets are manufactured by a contract supplier in Costa Rica and our manual cord blood disposable bag set that can be used with the BioArchive System is manufactured by a contract supplier in Mexico.

Where you can Find More Information

The Company is required to file annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and other information with the Securities and Exchange Commission (“SEC”). The public can obtain copies of these materials by visiting the SEC’s Public Reference Room at 100 F Street, NE, Room 1580, Washington, DC 20549, by calling the SEC at 1-800-732-0330, or by accessing the SEC’s website at http://www.sec.gov. In addition, as soon as reasonably practicable after these materials are filed with or furnished to the SEC, the Company will make copies available to the public free of charge through its website, www.thermogenesis.com. The information on the Company’s website is not incorporated into, and is not part of, this annual report.

An investment in ThermoGenesis’ common stock is subject to risks inherent to our business. The material risks and uncertainties that management believes affect us are described below. Before making an investment decision, you should carefully consider the risks and uncertainties described below together with all of the other information included or incorporated by reference in this report. The risks and uncertainties described below are not the only ones facing ThermoGenesis. Additional risks and uncertainties that we are not aware of or focused on or that we currently deem immaterial may also impair ThermoGenesis’ business operations. This report is qualified in its entirety by these risk factors.

If any of the following risks actually occur, our financial condition and results of operations could be materially and adversely affected. If this were to happen, the value of our common stock could decline significantly, and you could lose all or part of your investment.

Risks Related to Our Business

Our Proposed Merger with TotipotentRX is Subject to Various Closing Conditions, and the Failure to Complete the Merger with TotipotentRX could Negatively Impact Us. The TotipotentRX Merger is subject to the satisfaction of a number of conditions, including, but not limited to approval by our stockholders and TotipotentRX’s shareholders. No assurance can be given that the TotipotentRX Merger will occur on the terms and timeline currently contemplated or at all. If the proposed TotipotentRX Merger is not completed, the share price of our common stock may decline to the extent that the current market price of our common stock reflects an assumption that the TotipotentRX Merger will be completed. Further, a failed TotipotentRX Merger may result in negative publicity and a negative impression of us in the investment community since we have spent a substantial amount of effort, time and money to explain the benefits of the TotipotentRX Merger.

Our Future Revenue Growth is Dependent on our New Products being Accepted and our Existing Products being Accepted for New Indications or into New Markets and we are not sure they will be Accepted. The acceptance of our products into new markets or for new indications will depend upon the medical community and third-party payers accepting the products as clinically useful, reliable, accurate, and cost effective compared to existing and future products or procedures. Acceptance will also depend on our ability to adequately train technicians on how to use our existing and future products. Even if our products are released for sale, their use may not be recommended by the medical profession or hospitals unless acceptable reimbursement from healthcare and third party payers is available. Failure of these products to achieve significant market share could have material adverse effects on our long term business, financial condition, and results of operation.

Outcomes of Pending or Future Clinical Trials or Evaluations may be Negative and the Regenerative Medicine Market may not Expand, or may not Expand in the Areas Targeted by our Products. The marketing and sales of new products may depend on successful clinical trial or evaluation outcomes in the regenerative medicine areas targeted by our products and the approval of regulators. Clinical trials also represent a significant expenditure of resources. Negative clinical trial results in connection with our products or in the areas targeted by the Company could negatively impact regulatory approval or market acceptance of our products. Unfavorable clinical trials or failure of study results to obtain regulatory approval or target areas with successful clinical trials, could have material adverse effects on our long term business, financial condition, and results of operations.

A Significant Portion of our Revenue is Derived from Customers in Foreign Countries. We may Lose Revenues, Market Share, and Profits due to Exchange Rate Fluctuations, Political and Economic Changes Related to our Foreign Business. In the year ended June 30, 2013, sales to customers in foreign countries comprised approximately 55% of our revenues. This compares to 43% in fiscal 2012. Our foreign business is subject to economic, political and regulatory uncertainties and risks that are unique to each area of the world. Fluctuations in exchange rates may also affect the prices that our foreign customers are willing to pay, and may put us at a price disadvantage compared to other competitors. Potentially volatile shifts in exchange rates may negatively affect our financial position and results.

The Loss of a Significant Distributor or End User Customer may Adversely Affect our Financial Condition and Results of Operations. Revenues from four significant distributors comprised 56% of our revenues for the year ended June 30, 2013 and a significant portion of our largest distributor’s revenue came from one customer. The loss of a large end user customer or distributor may decrease our revenues.

We are Heavily Reliant on a Single Distributor to Market and Sell our MXP and Res-Q Systems. We have limited control over our distributor’s sales and marketing efforts. Although we have added distributors in other territories and other indications, we must manage our distribution network effectively to gain additional revenue and gross profit. Since the Res-Q products are a significant portion of our projected revenue growth, a delay or failure by our distributors to successfully market these products may decrease our future revenues and competitive advantage.

Our Inability to Successfully Identify and Complete Acquisitions or Successfully Integrate any New Products could have a Material Adverse Effect on our Business. Our current business strategy includes the acquisition of other companies, technologies and products that position us to move into greater markets and larger revenue streams. Promising acquisitions are difficult to identify and complete for a number of reasons, including competition among prospective buyers and the need for regulatory, including antitrust, approvals. We would seek to acquire based on time and risks associated with moving towards our strategic markets, as opposed to the risks and costs associated with trying to organically grow or develop those components. We may not be able to identify and successfully complete transactions. Any acquisitions we may complete may be made at a substantial premium over the fair value of the net identifiable assets. Further, we may not be able to integrate any acquired businesses successfully into our existing businesses, make such businesses profitable, or realize anticipated cost savings or synergies, if any, from these acquisitions, which could adversely affect our business.

We may be Exposed to Liabilities under the Foreign Corrupt Practices Act and any Determination that we Violated these Laws could have a Material Adverse Effect on our Business. We are subject to the Foreign Corrupt Practices Act (“FCPA”), and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by U.S. persons and issuers as defined by the statute, for the purpose of obtaining or retaining business. It is our policy to implement safeguards to discourage these practices by our employees. However, our existing safeguards and any future improvements may prove to be less than effective and the employees, consultants, sales agents or distributors of our Company may engage in conduct for which we might be held responsible. Violations of the FCPA may result in severe criminal or civil sanctions and we may be subject to other liabilities, which could negatively affect our business, operating results and financial condition.

Adverse Results of Legal Proceedings could have a Material Adverse Effect on Us. We are subject to, and may in the future be subject to, a variety of legal proceedings and claims that arise out of the ordinary conduct of our business. Results of legal proceedings cannot be predicted with certainty. Irrespective of their merits, legal proceedings may be both lengthy and disruptive to our operations and may cause significant expenditure and diversion of management attention. We may be faced with significant monetary damages or injunctive relief against us that could have a material adverse effect on a portion of our business operations or a material adverse effect on our financial condition and results of operations.

Risks Related to Our Operations

Our Inability to Protect our Patents, Trademarks, Trade Secrets and other Proprietary Rights could Adversely Impact our Competitive Position. We believe that our patents, trademarks, trade secrets and other proprietary rights are important to our success and our competitive position. Accordingly, we devote substantial resources to the establishment and protection of our patents, trademarks, trade secrets and proprietary rights. We use various methods, including confidentiality agreements with employees, vendors, and customers, to protect our trade secrets and proprietary know-how for our products. We currently hold patents for products, and have patents pending in certain countries for additional products that we market or intend to market. However, our actions to establish and protect our patents, trademarks, and other proprietary rights may be inadequate to prevent imitation of our products by others or to prevent others from claiming violations of their trademarks and proprietary rights by us. If our products are challenged as infringing upon patents of other parties, we may be required to modify the design of the product, obtain a license, or litigate the issues, all of which may have an adverse business effect on us.

We may be Subject to Claims that our Products or Processes Infringe the Intellectual Property Rights of Others, which may Cause us to Pay Unexpected Litigation Costs or Damages, Modify our Products or Processes or Prevent us from Selling our Products. Although it is our intention to avoid infringing or otherwise violating the intellectual property rights of others, third parties may nevertheless claim that our processes and products infringe their intellectual property and other rights. Our strategies of capitalizing on growing international demand as well as developing new innovative products across multiple business lines present similar infringement claim risks both internationally and in the United States as we expand the scope of our product offerings and markets. We compete with other companies for contracts in some small or specialized industries, which increases the risk that the other companies will develop overlapping technologies leading to an increased possibility that infringement claims will arise. Whether or not these claims have merit, we may be subject to costly and time-consuming legal proceedings, and this could divert our management’s attention from operating our business. In order to resolve such proceedings, we may need to obtain licenses from these third parties or substantially re-engineer or rename our products in order to avoid infringement. In addition, we might not be able to obtain the necessary licenses on acceptable terms, or at all, or be able to re-engineer or rename our products successfully.

We may not be able to Protect our Intellectual Property in Countries Outside the United States. Intellectual property law outside the United States is uncertain and in many countries is currently undergoing review and revisions. The laws of some countries do not protect our patent and other intellectual property rights to the same extent as United States laws. This is particularly relevant to us as a significant amount of our current and projected future sales are outside of the United States. Third parties may attempt to oppose the issuance of patents to us in foreign countries by initiating opposition proceedings. Opposition proceedings against any of our patent filings in a foreign country could have an adverse effect on our corresponding patents that are issued or pending in the United States. It may be necessary or useful for us to participate in proceedings to determine the validity of our patents or our competitors’ patents that have been issued in countries other than the U.S. This could result in substantial costs, divert our efforts and attention from other aspects of our business, and could have a material adverse effect on our results of operations and financial condition.

Any Failure to Achieve and Maintain the High Design and Manufacturing Standards that our Products Require may Seriously Harm our Business. Our products require precise, high-quality manufacturing. Achieving precision and quality control requires skill and diligence by our personnel as well as our vendors. Our failure to achieve and maintain these high manufacturing standards, including the incidence of manufacturing errors, design defects or component failures could result in patient injury or death, product recalls or withdrawals, delays or failures in product testing or delivery, cost overruns or other problems that could seriously hurt our business. Additionally, the large amount of AXP disposable inventory certain distributors and end-users maintain may delay the identification of a manufacturing error and expand the financial impact. A manufacturing error or defect, or previously undetected design defect, or uncorrected impurity or variation in a raw material component, either unknown or undetected, could affect the product. Despite our very high manufacturing standards, we cannot completely eliminate the risk of errors, defects or failures. If we or our vendors are unable to manufacture our products in accordance with necessary quality standards, our business and results of operations may be negatively affected.

Our Revenues and Operating Results may be Adversely Affected as a Result of our Required Compliance with the Adopted European Union Directive on the Restriction of the Use of Hazardous Substances in Electrical and Electronic Equipment, as well as other Standards Around the World. A number of domestic and foreign jurisdictions seek to restrict the use of various substances, a number of which have been or are currently used in our products or processes. For example, the European Union Restriction of Hazardous Substances in Electrical and Electronic Equipment (“RoHS”) Directive now requires that certain substances, which may be found in certain products we have manufactured in the past, be removed from all electronics components. Eliminating such substances from our manufacturing processes requires the expenditure of additional research and development funds to seek alternative substances for our products, as well as increased testing by third parties to ensure the quality of our products and compliance with the RoHS Directive. Other countries, such as China, have enacted or may enact laws or regulations similar to RoHS. While we have implemented a compliance program to ensure our product offerings meet these regulations, there may be instances where alternative substances will not be available or commercially feasible, or may only be available from a single source, or may be significantly more expensive than their restricted counterparts. Additionally, if we were found to be non-compliant with any such rule or regulation, we could be subject to fines, penalties and/or restrictions imposed by government agencies that could adversely affect our operating results.

Compliance with Government Regulations Regarding the Use of “Conflict Minerals” may Result in Additional Expense and Affect our Operations. The SEC recently adopted a final rule to implement Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, which imposes new disclosure requirements regarding the use of “conflict minerals” mined from the Democratic Republic of Congo and adjoining countries. These minerals include tantalum, tin, gold and tungsten. The new requirements will require due diligence efforts on our part in fiscal 2014 and thereafter, and we will also be required to comply with the initial disclosure requirements that become effective in May 2014. We may incur significant costs associated with complying with the new disclosure requirements, including but not limited to costs related to determining which of our products may be subject to the new rules and source of any “conflict minerals” used in those products. Additionally, implementing the new requirements could adversely affect the sourcing, supply and pricing of materials used in the manufacture of our products. We may also face reputational challenges if we are unable to verify through our compliance procedures the origins for all metals used in our products.

Our Products may be Subject to Product Recalls which may Harm our Reputation and Divert our Managerial and Financial Resources. The FDA and similar governmental authorities in other countries have the authority to order the mandatory recall of our products or order their removal from the market if the governmental entity finds our products might cause adverse health consequences or death. The FDA may also seize product or prevent further distribution. A government-mandated or voluntary recall by us could occur as a result of component failures, manufacturing errors or design defects (including labeling defects). In the past we have initiated voluntary recalls of some of our products and we could do so in the future. Any recall of our products may harm our reputation with customers, divert managerial and financial resources and negatively impact our profitability.

We are Dependent on our Suppliers and Manufacturers to Meet Existing Regulations. Certain of our suppliers and manufacturers are subject to heavy government regulations, including FDA QSR compliance, in the operation of their facilities, products and manufacturing processes. Any adverse action by the FDA against our suppliers or manufacturers could delay supply or manufacture of component products required to be integrated or sold with our products. There are no assurances we will be successful in locating an alternative supplier or manufacturer to meet product shipment or launch deadlines. As a result, our sales, contractual commitments and financial forecasts may be significantly affected by any such delays.

Dependence on Suppliers for Disposable Products and Custom Components may Impact the Production Schedule. The Company obtains certain disposable products and custom components from a limited number of suppliers. If the supplier raises the price or discontinues production, the Company may have to find another qualified supplier to provide the item or re-engineer the item. In the event that it becomes necessary for us to find another supplier, we would first be required to qualify the quality assurance systems and product quality of that alternative supplier. Any operational issues with re-engineering or the alternative qualified supplier may impact the production schedule, therefore delaying revenues, and this may cause the cost of disposables or key components to increase.

Failure to Meet Certain Financial Covenants could Decrease our AXP Revenues. Under certain license and escrow agreements, if we fail to meet certain financial covenants, other companies may take possession of the escrowed intellectual property and initiate manufacturing of the applicable device and disposables. If this were to occur, our revenues would be negatively impacted.

Failure to Retain or Hire Key Personnel may Adversely Affect our Ability to Sustain or Grow our Business. Our ability to operate successfully and manage our potential future growth depends significantly upon retaining key research, technical, clinical, regulatory, sales, marketing and managerial personnel. Our future success partially depends upon the continued services of key technical and senior management personnel. Our future success also depends on our continuing ability to attract, retain and motivate highly qualified managerial and technical personnel. The inability to retain or attract qualified personnel could have a significant negative effect upon our efforts and thereby materially harm our business and future financial condition.

All of our Operations are Conducted at a Single Location. Any Disruption at our Facility could Delay Revenues or Increase our Expenses. All of our operations are conducted at a single location although we contract the manufacturing of certain devices, disposables and components. We take precautions to safeguard our facility, through insurance, health and safety protocols, and off-site storage of computer data. However, a natural disaster, such as a fire, flood or earthquake, could cause substantial delays in our operations, damage or destroy our manufacturing equipment or inventory, and cause us to incur additional expenses. The insurance we maintain against fires, floods, and other natural disasters may not be adequate to cover our losses in any particular case.

Risks Related to Our Industry

Our Business is Heavily Regulated, Resulting in Increased Costs of Operations and Delays in Product Sales. Many of our products require FDA approval or clearance to sell in the U.S. and will require approvals from comparable agencies to sell in foreign countries. These authorizations may limit the U.S. or foreign markets in which our products may be sold. Further, our products must be manufactured under requirements of our quality system for continued CE-Marking so they can continue to be marketed and sold in Europe. These requirements are similar to the QSR of both the FDA and California Department of Public Health. Failure to comply with or inappropriately interpret these quality system requirements and regulations may subject the Company to delays in production while it corrects deficiencies found by the FDA, the State of California, or the Company’s notifying body as a result of any audit of our quality system. If we are found to be out of compliance, we could receive a Warning Letter or an untitled letter from the FDA or even be temporarily shut down in manufacturing and product sales while the non-conformances are rectified. Also, we may have to recall products and temporarily cease their manufacture and distribution, which would increase our costs and reduce our revenues. The FDA may also invalidate our PMA or 510(k) if appropriate regulations relative to the PMA or 510(k) product are not met. The notified bodies may elect to not renew CE-Mark certification. Any of these events would negatively impact our revenues and costs of operations.

Changes in Governmental Regulations may Reduce Demand for our Products or Increase our Expenses. We compete in many markets in which we and our customers must comply with federal, state, local and international regulations, such as environmental, health and safety and food and drug regulations. We develop, configure and market our products to meet customer needs created by those regulations. Any significant change in regulations could reduce demand for our products or increase our expenses. For example, many of our instruments are marketed to the industry for enabling new regenerative therapies. Changes in the U.S. FDA’s regulation of the devices and products directed at regenerative medicine, and development process for new therapeutic applications could have an adverse effect on the demand for these products.