CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Core Equity Fund

March 31, 2020

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Common Stocks: | ||||||||

| Communication Services: | ||||||||

| 18,471 | ACTIVISION BLIZZARD, INC. | $462,604 | 1,098,655 | |||||

| 5,787 | ALPHABET, INC., CLASS A(b) | 2,477,356 | 6,724,205 | |||||

| 4,279 | ALPHABET, INC., CLASS C(b) | 1,763,252 | 4,975,664 | |||||

| 2,000 | ALTICE U.S.A., INC., CLASS A(b) | 43,775 | 44,580 | |||||

| 10,315 | AMC NETWORKS, INC., CLASS A(b) | 390,292 | 250,758 | |||||

| 152,447 | AT&T, INC. | 4,129,526 | 4,443,830 | |||||

| 300 | CABLE ONE, INC. | 113,966 | 493,203 | |||||

| 66,413 | CENTURYLINK, INC. | 652,342 | 628,267 | |||||

| 690 | CHARTER COMMUNICATIONS, INC., CLASS A(b) | 138,385 | 301,054 | |||||

| 3,700 | CINEMARK HOLDINGS, INC. | 43,054 | 37,703 | |||||

| 57,795 | COMCAST CORP., CLASS A | 632,884 | 1,986,992 | |||||

| 99,420 | DISCOVERY, INC., CLASS A(b) | 2,523,687 | 1,932,725 | |||||

| 385 | DISH NETWORK CORP., CLASS A(b) | 4,926 | 7,696 | |||||

| 11,266 | ELECTRONIC ARTS, INC.(b) | 280,102 | 1,128,515 | |||||

| 31,804 | FACEBOOK, INC., CLASS A(b) | 1,885,863 | 5,304,907 | |||||

| 1,360 | GCI LIBERTY, INC., CLASS A(b) | 51,149 | 77,479 | |||||

| 300 | IAC/INTERACTIVECORP(b) | 37,278 | 53,769 | |||||

| 15,600 | INTERPUBLIC GROUP OF (THE) COS., INC. | 40,950 | 252,564 | |||||

| 5,832 | LIBERTY GLOBAL PLC, CLASS A(b)(c) | 42,377 | 96,286 | |||||

| 7,374 | LIBERTY GLOBAL PLC, CLASS C(b)(c) | 51,974 | 115,845 | |||||

| 1,800 | LIBERTY MEDIA CORP.-LIBERTY FORMULA ONE, CLASS C(b) | 45,464 | 49,014 | |||||

| 1,100 | MATCH GROUP, INC.(b) | 31,366 | 72,644 | |||||

| 4,111 | NETFLIX, INC.(b) | 1,369,837 | 1,543,680 | |||||

| 2,375 | NEWS CORP., CLASS A | 7,170 | 21,316 | |||||

| 700 | NEXSTAR MEDIA GROUP, INC., CLASS A | 44,492 | 40,411 | |||||

| 5,434 | OMNICOM GROUP, INC. | 271,408 | 298,327 | |||||

| 1,200 | SPOTIFY TECHNOLOGY S.A.(b)(c) | 149,087 | 145,728 | |||||

| 9,840 | SPRINT CORP.(b) | 21,187 | 84,821 | |||||

| 1,544 | TEGNA, INC. | 7,743 | 16,768 | |||||

| 26,727 | T-MOBILE U.S., INC.(b) | 1,937,915 | 2,242,395 | |||||

| 8,700 | TWITTER, INC.(b) | 197,336 | 213,672 | |||||

| 51,083 | VERIZON COMMUNICATIONS, INC. | 2,028,534 | 2,744,690 | |||||

| 1 | VIACOMCBS, INC., CLASS B | 49 | 14 | |||||

| 27,007 | WALT DISNEY (THE) CO. | 679,844 | 2,608,876 | |||||

| 22,557,174 | 40,037,053 | 9.54% | ||||||

| Consumer Discretionary: | ||||||||

| 1,500 | ADVANCE AUTO PARTS, INC. | 53,557 | 139,980 | |||||

| 5,281 | AMAZON.COM, INC.(b) | 4,484,503 | 10,296,471 | |||||

| 2,400 | ARAMARK | 47,393 | 47,928 | |||||

| 1,100 | AUTOLIV, INC.(c) | 13,982 | 50,611 | |||||

| 13,006 | AUTONATION, INC.(b) | 343,345 | 364,948 | |||||

| 1,662 | AUTOZONE, INC.(b) | 1,304,598 | 1,406,052 | |||||

| 53,291 | BEST BUY CO., INC. | 2,951,617 | 3,037,587 | |||||

| 1,400 | BIG LOTS, INC. | 15,477 | 19,908 | |||||

| 555 | BOOKING HOLDINGS, INC.(b) | 661,638 | 746,653 | |||||

| 4,400 | BORGWARNER, INC. | 51,799 | 107,228 | |||||

| 831 | BURLINGTON STORES, INC.(b) | 85,265 | 131,680 | |||||

| 3,068 | CARMAX, INC.(b) | 33,093 | 165,150 | |||||

| 3,800 | CARNIVAL CORP. | 59,114 | 50,046 | |||||

| 4,600 | D.R. HORTON, INC. | 22,057 | 156,400 | |||||

| 2,326 | DARDEN RESTAURANTS, INC. | 108,803 | 126,674 | |||||

| 5,977 | DICK'S SPORTING GOODS, INC. | 173,600 | 127,071 | |||||

| 3,389 | DOLLAR GENERAL CORP. | 248,398 | 511,773 | |||||

| 5,224 | DOLLAR TREE, INC.(b) | 52,773 | 383,807 | |||||

| 1,100 | DOMINO'S PIZZA, INC. | 154,333 | 356,477 | |||||

| 72,891 | EBAY, INC. | 2,246,259 | 2,191,104 | |||||

| 1,200 | ETSY, INC.(b) | 49,559 | 46,128 | |||||

| 922 | EXPEDIA GROUP, INC. | 23,373 | 51,881 | |||||

| 1,391 | FLOOR & DECOR HOLDINGS, INC., CLASS A(b) | 42,485 | 44,637 | |||||

| 20,696 | FOOT LOCKER, INC. | 738,397 | 456,347 | |||||

| 22,163 | FORD MOTOR CO. | 72,511 | 107,047 | |||||

| 1,300 | FRONTDOOR, INC.(b) | 30,171 | 45,214 | |||||

| 18,795 | GAP (THE), INC. | 316,742 | 132,317 | |||||

| 5,273 | GARMIN LTD.(c) | 188,068 | 395,264 | |||||

| 3,833 | GENERAL MOTORS CO. | 117,673 | 79,650 | |||||

| 1 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Core Equity Fund

March 31, 2020

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Consumer Discretionary (Cont'd): | ||||||||

| 15,000 | GENTEX CORP. | $106,860 | 332,400 | |||||

| 3,450 | GENUINE PARTS CO. | 102,424 | 232,289 | |||||

| 2,000 | HANESBRANDS, INC. | 10,096 | 15,740 | |||||

| 400 | HASBRO, INC. | 10,206 | 28,620 | |||||

| 1,600 | HILTON WORLDWIDE HOLDINGS, INC. | 115,613 | 109,184 | |||||

| 13,972 | HOME DEPOT (THE), INC. | 2,047,064 | 2,608,712 | |||||

| 7,200 | INTERNATIONAL GAME TECHNOLOGY PLC | 51,017 | 42,840 | |||||

| 9,297 | KOHL'S CORP. | 120,812 | 135,643 | |||||

| 971 | KONTOOR BRANDS, INC. | 5,113 | 18,614 | |||||

| 3,290 | L BRANDS, INC. | 38,158 | 38,032 | |||||

| 2,338 | LAS VEGAS SANDS CORP. | 14,654 | 99,295 | |||||

| 19,688 | LENNAR CORP., CLASS A | 826,491 | 752,082 | |||||

| 58 | LENNAR CORP., CLASS B | 652 | 1,677 | |||||

| 1,200 | LKQ CORP.(b) | 14,970 | 24,612 | |||||

| 4,767 | LULULEMON ATHLETICA, INC.(b)(c) | 606,562 | 903,585 | |||||

| 12,078 | MACY'S, INC. | 181,820 | 59,303 | |||||

| 3,038 | MARRIOTT INTERNATIONAL, INC., CLASS A | 63,603 | 227,273 | |||||

| 294 | MARRIOTT VACATIONS WORLDWIDE CORP. | 4,103 | 16,341 | |||||

| 10,620 | MCDONALD'S CORP. | 433,348 | 1,756,017 | |||||

| 6,600 | MGM RESORTS INTERNATIONAL | 54,921 | 77,880 | |||||

| 600 | MOHAWK INDUSTRIES, INC.(b) | 26,796 | 45,744 | |||||

| 600 | MURPHY U.S.A., INC.(b) | 4,392 | 50,616 | |||||

| 4,915 | NEWELL BRANDS, INC. | 52,223 | 65,271 | |||||

| 17,800 | NIKE, INC., CLASS B | 268,854 | 1,472,772 | |||||

| 4,300 | NORDSTROM, INC. | 45,233 | 65,962 | |||||

| 7,189 | NORWEGIAN CRUISE LINE HOLDINGS LTD.(b) | 354,599 | 78,791 | |||||

| 103 | NVR, INC.(b) | 133,164 | 264,618 | |||||

| 900 | O'REILLY AUTOMOTIVE, INC.(b) | 27,058 | 270,945 | |||||

| 900 | PLANET FITNESS, INC., CLASS A(b) | 45,306 | 43,830 | |||||

| 370 | POOL CORP. | 34,226 | 72,805 | |||||

| 22,302 | PULTEGROUP, INC. | 322,088 | 497,781 | |||||

| 20,045 | QURATE RETAIL, INC., CLASS A(b) | 77,825 | 122,375 | |||||

| 1,500 | RALPH LAUREN CORP. | 31,320 | 100,245 | |||||

| 4,543 | ROSS STORES, INC. | 175,795 | 395,105 | |||||

| 4,560 | ROYAL CARIBBEAN CRUISES LTD. | 97,679 | 146,695 | |||||

| 3,200 | SIX FLAGS ENTERTAINMENT CORP. | 48,149 | 40,128 | |||||

| 8,454 | SKECHERS U.S.A., INC., CLASS A(b) | 276,155 | 200,698 | |||||

| 36,969 | STARBUCKS CORP. | 1,239,447 | 2,430,342 | |||||

| 4,800 | TAPESTRY, INC. | 14,970 | 62,160 | |||||

| 22,005 | TARGET CORP. | 2,265,472 | 2,045,805 | |||||

| 1,203 | TESLA, INC.(b) | 484,298 | 630,372 | |||||

| 1,900 | THOR INDUSTRIES, INC. | 22,316 | 80,142 | |||||

| 1,400 | TIFFANY & CO. | 35,210 | 181,300 | |||||

| 20,188 | TJX (THE) COS., INC. | 86,033 | 965,188 | |||||

| 1,466 | TOPBUILD CORP.(b) | 11,809 | 105,024 | |||||

| 553 | ULTA BEAUTY, INC.(b) | 73,007 | 97,162 | |||||

| 8,340 | URBAN OUTFITTERS, INC.(b) | 174,368 | 118,762 | |||||

| 1,100 | VEONEER, INC.(b)(c) | 5,428 | 8,052 | |||||

| 6,800 | VF CORP. | 81,950 | 367,744 | |||||

| 3,000 | WENDY'S (THE) CO. | 43,280 | 44,640 | |||||

| 2,559 | WHIRLPOOL CORP. | 147,290 | 219,562 | |||||

| 2,107 | WILLIAMS-SONOMA, INC. | 92,334 | 89,590 | |||||

| 1,400 | WYNDHAM HOTELS & RESORTS, INC. | 46,408 | 44,114 | |||||

| 1,600 | WYNN RESORTS LTD. | 32,322 | 96,304 | |||||

| 900 | YUM CHINA HOLDINGS, INC.(c) | 40,023 | 38,367 | |||||

| 26,415,897 | 40,815,183 | 9.73% | ||||||

| Consumer Staples: | ||||||||

| 8,800 | ALTRIA GROUP, INC. | 564,326 | 340,296 | |||||

| 10,300 | ARCHER-DANIELS-MIDLAND CO. | 188,618 | 362,354 | |||||

| 700 | BEYOND MEAT, INC.(b) | 51,107 | 46,620 | |||||

| 7,290 | BROWN-FORMAN CORP., CLASS B | 57,343 | 404,668 | |||||

| 10,068 | CHURCH & DWIGHT CO., INC. | 241,887 | 646,164 | |||||

| 3,772 | CLOROX (THE) CO. | 567,267 | 653,499 | |||||

| 56,139 | COCA-COLA (THE) CO. | 844,179 | 2,484,151 | |||||

| 1,280 | COLGATE-PALMOLIVE CO. | 36,019 | 84,941 | |||||

| 1,900 | CONAGRA BRANDS, INC. | 26,152 | 55,746 | |||||

| 1,600 | CONSTELLATION BRANDS, INC., CLASS A | 202,589 | 229,376 | |||||

| 2 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Core Equity Fund

March 31, 2020

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Consumer Staples (Cont'd): | ||||||||

| 7,712 | COSTCO WHOLESALE CORP. | $631,991 | 2,198,923 | |||||

| 6,448 | ESTEE LAUDER (THE) COS., INC., CLASS A | 538,773 | 1,027,424 | |||||

| 2,796 | FLOWERS FOODS, INC. | 59,994 | 57,374 | |||||

| 22,764 | GENERAL MILLS, INC. | 832,581 | 1,201,256 | |||||

| 5,300 | HERBALIFE NUTRITION LTD.(b) | 36,401 | 154,548 | |||||

| 12,516 | HERSHEY (THE) CO. | 1,672,186 | 1,658,370 | |||||

| 4,800 | HORMEL FOODS CORP. | 43,206 | 223,872 | |||||

| 16,650 | INGREDION, INC. | 1,224,758 | 1,257,075 | |||||

| 13,592 | JM SMUCKER (THE) CO. | 1,399,653 | 1,508,712 | |||||

| 1,643 | KEURIG DR. PEPPER, INC. | - | 39,876 | |||||

| 3,533 | KIMBERLY-CLARK CORP. | 343,818 | 451,765 | |||||

| 3,714 | KRAFT HEINZ (THE) CO. | 26,692 | 91,884 | |||||

| 67,822 | KROGER (THE) CO. | 1,281,471 | 2,042,799 | |||||

| 633 | LAMB WESTON HOLDINGS, INC. | 7,452 | 36,144 | |||||

| 700 | MCCORMICK & CO., INC. (NON VOTING) | 21,613 | 98,847 | |||||

| 1,300 | MOLSON COORS BEVERAGE CO., CLASS B | 37,841 | 50,713 | |||||

| 6,969 | MONDELEZ INTERNATIONAL, INC., CLASS A | 94,887 | 349,007 | |||||

| 7,364 | MONSTER BEVERAGE CORP.(b) | 206,981 | 414,299 | |||||

| 232 | NU SKIN ENTERPRISES, INC., CLASS A | 8,194 | 5,069 | |||||

| 29,337 | PEPSICO, INC. | 2,522,685 | 3,523,374 | |||||

| 8,329 | PHILIP MORRIS INTERNATIONAL, INC. | 456,643 | 607,684 | |||||

| 29,290 | PILGRIM'S PRIDE CORP.(b) | 489,068 | 530,735 | |||||

| 700 | POST HOLDINGS, INC.(b) | 43,421 | 58,079 | |||||

| 37,696 | PROCTER & GAMBLE (THE) CO. | 1,193,744 | 4,146,560 | |||||

| 7,700 | SYSCO CORP. | 117,906 | 351,351 | |||||

| 23,537 | TYSON FOODS, INC., CLASS A | 1,394,110 | 1,362,086 | |||||

| 2,700 | US FOODS HOLDING CORP.(b) | 45,757 | 47,817 | |||||

| 27,978 | WALGREENS BOOTS ALLIANCE, INC. | 906,255 | 1,279,993 | |||||

| 15,004 | WALMART, INC. | 1,236,594 | 1,704,754 | |||||

| 19,654,162 | 31,788,205 | 7.58% | ||||||

| Energy: | ||||||||

| 17,200 | ANTERO MIDSTREAM CORP. | 38,791 | 36,120 | |||||

| 7,500 | APACHE CORP. | 44,218 | 31,350 | |||||

| 6,200 | BAKER HUGHES CO. | 72,080 | 65,100 | |||||

| 20,075 | CABOT OIL & GAS CORP. | 334,981 | 345,089 | |||||

| 2,200 | CHENIERE ENERGY, INC.(b) | 73,298 | 73,700 | |||||

| 28,175 | CHEVRON CORP. | 1,278,870 | 2,041,561 | |||||

| 2,700 | CIMAREX ENERGY CO. | 45,271 | 45,441 | |||||

| 1,700 | CONCHO RESOURCES, INC. | 49,631 | 72,845 | |||||

| 23,044 | CONOCOPHILLIPS | 383,142 | 709,755 | |||||

| 2,000 | CONTINENTAL RESOURCES, INC. | 20,765 | 15,280 | |||||

| 9,794 | ENBRIDGE, INC.(c) | 137,797 | 284,907 | |||||

| 4,500 | EOG RESOURCES, INC. | 174,791 | 161,640 | |||||

| 16,551 | EXXON MOBIL CORP. | 628,157 | 628,441 | |||||

| 3,100 | HELMERICH & PAYNE, INC. | 39,003 | 48,515 | |||||

| 2,600 | HESS CORP. | 90,342 | 86,580 | |||||

| 18,112 | KINDER MORGAN, INC. | 209,947 | 252,119 | |||||

| 7,200 | NOBLE ENERGY, INC. | 44,105 | 43,488 | |||||

| 5,994 | OCCIDENTAL PETROLEUM CORP. | 53,941 | 69,411 | |||||

| 3,900 | ONEOK, INC. | 59,690 | 85,059 | |||||

| 6,900 | PBF ENERGY, INC., CLASS A | 45,787 | 48,852 | |||||

| 1,000 | PHILLIPS 66 | 50,510 | 53,650 | |||||

| 2,230 | PIONEER NATURAL RESOURCES CO. | 225,620 | 156,435 | |||||

| 9,633 | SCHLUMBERGER LTD. | 108,848 | 129,949 | |||||

| 23,559 | VALERO ENERGY CORP. | 1,036,930 | 1,068,636 | |||||

| 11,500 | WILLIAMS (THE) COS., INC. | 154,047 | 162,725 | |||||

| 5,400,562 | 6,716,648 | 1.60% | ||||||

| Financials: | ||||||||

| 6,805 | AFLAC, INC. | 218,918 | 233,003 | |||||

| 500 | ALLEGHANY CORP. | 140,685 | 276,175 | |||||

| 16,433 | ALLSTATE (THE) CORP. | 920,850 | 1,507,399 | |||||

| 19,826 | ALLY FINANCIAL, INC. | 404,611 | 286,089 | |||||

| 3,633 | AMERICAN EXPRESS CO. | 111,938 | 311,021 | |||||

| 3,100 | AMERICAN FINANCIAL GROUP, INC. | 190,545 | 217,248 | |||||

| 5,500 | AMERICAN INTERNATIONAL GROUP, INC. | 129,086 | 133,375 | |||||

| 17,714 | AMERIPRISE FINANCIAL, INC. | 1,850,664 | 1,815,331 | |||||

| 13,600 | ANNALY CAPITAL MANAGEMENT, INC. | 80,993 | 68,952 | |||||

| 3 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Core Equity Fund

March 31, 2020

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Financials (Cont'd): | ||||||||

| 848 | AON PLC(c) | $32,575 | 139,954 | |||||

| 22,433 | ARCH CAPITAL GROUP LTD.(b)(c) | 513,989 | 638,443 | |||||

| 2,300 | ARTHUR J. GALLAGHER & CO. | 80,002 | 187,473 | |||||

| 4,900 | ASSURANT, INC. | 218,575 | 510,041 | |||||

| 23,567 | ASSURED GUARANTY LTD.(c) | 785,244 | 607,793 | |||||

| 11,289 | ATHENE HOLDING LTD., CLASS A(b)(c) | 434,631 | 280,193 | |||||

| 1,000 | AXIS CAPITAL HOLDINGS LTD.(c) | 28,371 | 38,650 | |||||

| 160,639 | BANK OF AMERICA CORP. | 2,274,054 | 3,410,366 | |||||

| 10,000 | BANK OF NEW YORK MELLON (THE) CORP. | 206,454 | 336,800 | |||||

| 23,506 | BERKSHIRE HATHAWAY, INC., CLASS B(b) | 2,744,558 | 4,297,602 | |||||

| 7,031 | BRIGHTHOUSE FINANCIAL, INC.(b) | 235,812 | 169,939 | |||||

| 620 | CANNAE HOLDINGS, INC.(b) | 2,893 | 20,764 | |||||

| 8,416 | CAPITAL ONE FINANCIAL CORP. | 280,817 | 424,335 | |||||

| 17,900 | CHARLES SCHWAB (THE) CORP. | 156,088 | 601,798 | |||||

| 6,250 | CHUBB LTD.(c) | 587,621 | 698,063 | |||||

| 102,035 | CITIGROUP, INC. | 5,578,377 | 4,297,714 | |||||

| 1,965 | CME GROUP, INC. | 203,851 | 339,768 | |||||

| 500 | CREDIT ACCEPTANCE CORP.(b) | 86,421 | 127,845 | |||||

| 11,776 | DISCOVER FINANCIAL SERVICES | 330,143 | 420,050 | |||||

| 3,601 | E*TRADE FINANCIAL CORP. | 49,884 | 123,586 | |||||

| 978 | EVERCORE, INC., CLASS A | 74,397 | 45,047 | |||||

| 869 | EVEREST RE GROUP LTD.(c) | 250,643 | 167,213 | |||||

| 469 | FAIRFAX FINANCIAL HOLDINGS LTD.(c) | 86,576 | 143,964 | |||||

| 1,863 | FIDELITY NATIONAL FINANCIAL, INC. | 15,560 | 46,351 | |||||

| 10,565 | FIFTH THIRD BANCORP | 109,297 | 156,890 | |||||

| 1,108 | FIRST AMERICAN FINANCIAL CORP. | 53,359 | 46,990 | |||||

| 400 | FIRST CITIZENS BANCSHARES, INC., CLASS A | 57,523 | 133,148 | |||||

| 30,500 | FIRST HORIZON NATIONAL CORP. | 193,065 | 245,830 | |||||

| 2,468 | GLOBE LIFE, INC. | 145,321 | 177,622 | |||||

| 12,368 | GOLDMAN SACHS GROUP (THE), INC. | 1,432,986 | 1,911,969 | |||||

| 3,000 | HANOVER INSURANCE GROUP (THE), INC. | 215,948 | 271,740 | |||||

| 13,312 | HARTFORD FINANCIAL SERVICES GROUP (THE), INC. | 484,859 | 469,115 | |||||

| 35,000 | HUNTINGTON BANCSHARES, INC. | 169,771 | 287,350 | |||||

| 505 | INTERCONTINENTAL EXCHANGE, INC. | 12,819 | 40,779 | |||||

| 18,668 | JANUS HENDERSON GROUP PLC(c) | 277,820 | 285,994 | |||||

| 59,862 | JPMORGAN CHASE & CO. | 2,584,346 | 5,389,376 | |||||

| 5,904 | KEYCORP | 30,107 | 61,225 | |||||

| 1,852 | LEGG MASON, INC. | 25,956 | 90,470 | |||||

| 200 | MARKEL CORP.(b) | 67,789 | 185,578 | |||||

| 5,684 | MARSH & MCLENNAN COS., INC. | 240,120 | 491,439 | |||||

| 1,300 | MERCURY GENERAL CORP. | 38,019 | 52,936 | |||||

| 1,800 | METLIFE, INC. | 42,684 | 55,026 | |||||

| 1,474 | MGIC INVESTMENT CORP. | 18,102 | 9,360 | |||||

| 2,000 | MOODY'S CORP. | 70,550 | 423,000 | |||||

| 84,073 | MORGAN STANLEY | 2,840,624 | 2,858,482 | |||||

| 1,600 | MSCI, INC. | 51,168 | 462,336 | |||||

| 5,900 | NASDAQ, INC. | 240,309 | 560,205 | |||||

| 2,485 | PACWEST BANCORP | 28,898 | 44,531 | |||||

| 8,825 | PNC FINANCIAL SERVICES GROUP (THE), INC. | 325,194 | 844,729 | |||||

| 14,827 | POPULAR, INC. | 741,766 | 518,945 | |||||

| 4,747 | PRINCIPAL FINANCIAL GROUP, INC. | 143,565 | 148,771 | |||||

| 21,894 | PROGRESSIVE (THE) CORP. | 1,246,564 | 1,616,653 | |||||

| 5,900 | PRUDENTIAL FINANCIAL, INC. | 182,565 | 307,626 | |||||

| 16,006 | RAYMOND JAMES FINANCIAL, INC. | 1,016,976 | 1,011,579 | |||||

| 17,302 | REGIONS FINANCIAL CORP. | 116,601 | 155,199 | |||||

| 3,371 | REINSURANCE GROUP OF AMERICA, INC. | 296,860 | 283,636 | |||||

| 800 | RENAISSANCERE HOLDINGS LTD.(c) | 81,779 | 119,456 | |||||

| 3,151 | ROYAL BANK OF CANADA(c) | 75,539 | 193,944 | |||||

| 735 | S&P GLOBAL, INC. | 24,183 | 180,112 | |||||

| 7,500 | SEI INVESTMENTS CO. | 108,537 | 347,550 | |||||

| 10,100 | SLM CORP. | 36,679 | 72,619 | |||||

| 20,278 | STATE STREET CORP. | 1,042,261 | 1,080,209 | |||||

| 4,737 | SYNCHRONY FINANCIAL | 128,601 | 76,218 | |||||

| 3,657 | SYNOVUS FINANCIAL CORP. | 49,372 | 64,217 | |||||

| 3,549 | T. ROWE PRICE GROUP, INC. | 106,978 | 346,560 | |||||

| 2,946 | TCF FINANCIAL CORP. | 51,834 | 66,756 | |||||

| 1,300 | TD AMERITRADE HOLDING CORP. | 45,798 | 45,058 | |||||

| 4 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Core Equity Fund

March 31, 2020

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Financials (Cont'd): | ||||||||

| 19,022 | TRAVELERS (THE) COS., INC. | $1,767,703 | 1,889,836 | |||||

| 15,442 | TRUIST FINANCIAL CORP. | 315,841 | 476,231 | |||||

| 16,200 | TWO HARBORS INVESTMENT CORP. | 75,902 | 61,722 | |||||

| 17,585 | US BANCORP | 318,503 | 605,803 | |||||

| 9,900 | VOYA FINANCIAL, INC. | 521,505 | 401,445 | |||||

| 9,159 | W.R. BERKLEY CORP. | 273,043 | 477,825 | |||||

| 1,800 | WASHINGTON FEDERAL, INC. | 23,535 | 46,728 | |||||

| 47,427 | WELLS FARGO & CO. | 593,148 | 1,361,155 | |||||

| 2,568 | WESTERN ALLIANCE BANCORP | 59,789 | 78,607 | |||||

| 2,600 | ZIONS BANCORP N.A. | 49,361 | 69,576 | |||||

| 38,557,248 | 50,582,501 | 12.06% | ||||||

| Health Care: | ||||||||

| 12,487 | ABBOTT LABORATORIES | 246,035 | 985,349 | |||||

| 28,373 | ABBVIE, INC. | 1,407,552 | 2,161,739 | |||||

| 300 | ABIOMED, INC.(b) | 44,070 | 43,548 | |||||

| 1,800 | ADAPTIVE BIOTECHNOLOGIES CORP.(b) | 45,536 | 50,004 | |||||

| 1,457 | AGILENT TECHNOLOGIES, INC. | 63,335 | 104,350 | |||||

| 1,200 | AGIOS PHARMACEUTICALS, INC.(b) | 44,843 | 42,576 | |||||

| 6,964 | ALEXION PHARMACEUTICALS, INC.(b) | 537,224 | 625,298 | |||||

| 2,191 | ALIGN TECHNOLOGY, INC.(b) | 327,961 | 381,124 | |||||

| 2,233 | ALLERGAN PLC | 259,023 | 395,464 | |||||

| 34,100 | AMERISOURCEBERGEN CORP. | 2,402,692 | 3,017,850 | |||||

| 18,814 | AMGEN, INC. | 3,435,339 | 3,814,162 | |||||

| 7,050 | ANTHEM, INC. | 381,518 | 1,600,632 | |||||

| 193 | AVANOS MEDICAL, INC.(b) | 3,014 | 5,197 | |||||

| 3,700 | AVANTOR, INC.(b) | 41,168 | 46,213 | |||||

| 9,039 | BAXTER INTERNATIONAL, INC. | 441,749 | 733,876 | |||||

| 2,765 | BECTON DICKINSON AND CO. | 227,292 | 635,314 | |||||

| 6,792 | BIOGEN, INC.(b) | 1,848,819 | 2,148,853 | |||||

| 32,800 | BOSTON SCIENTIFIC CORP.(b) | 182,160 | 1,070,264 | |||||

| 47,070 | BRISTOL-MYERS SQUIBB CO. | 2,055,080 | 2,623,682 | |||||

| 2,145 | BRUKER CORP. | 43,219 | 76,920 | |||||

| 20,122 | CARDINAL HEALTH, INC. | 921,069 | 964,649 | |||||

| 1,500 | CATALENT, INC.(b) | 72,507 | 77,925 | |||||

| 2,772 | CENTENE CORP.(b) | 79,676 | 164,684 | |||||

| 3,600 | CERNER CORP. | 40,604 | 226,764 | |||||

| 6,542 | CIGNA CORP. | 228,194 | 1,159,112 | |||||

| 200 | COOPER (THE) COS., INC. | 50,902 | 55,134 | |||||

| 12,401 | CVS HEALTH CORP. | 507,356 | 735,751 | |||||

| 9,229 | DANAHER CORP. | 272,153 | 1,277,386 | |||||

| 22,007 | DAVITA, INC.(b) | 1,626,845 | 1,673,852 | |||||

| 5,332 | DENTSPLY SIRONA, INC. | 141,306 | 207,042 | |||||

| 1,500 | DEXCOM, INC.(b) | 87,311 | 403,905 | |||||

| 8,226 | EDWARDS LIFESCIENCES CORP.(b) | 228,593 | 1,551,588 | |||||

| 3,800 | ELANCO ANIMAL HEALTH, INC.(b) | 74,580 | 85,082 | |||||

| 25,679 | ELI LILLY & CO. | 2,508,504 | 3,562,191 | |||||

| 44,036 | EXELIXIS, INC.(b) | 786,642 | 758,300 | |||||

| 20,487 | GILEAD SCIENCES, INC. | 381,470 | 1,531,608 | |||||

| 3,800 | HENRY SCHEIN, INC.(b) | 67,547 | 191,976 | |||||

| 6,608 | HOLOGIC, INC.(b) | 92,603 | 231,941 | |||||

| 5,942 | HORIZON THERAPEUTICS PLC(b) | 137,546 | 176,002 | |||||

| 2,378 | HUMANA, INC. | 820,169 | 746,740 | |||||

| 2,299 | IDEXX LABORATORIES, INC.(b) | 98,745 | 556,910 | |||||

| 2,300 | ILLUMINA, INC.(b) | 98,233 | 628,176 | |||||

| 1,900 | INCYTE CORP.(b) | 120,835 | 139,137 | |||||

| 1,462 | INTUITIVE SURGICAL, INC.(b) | 560,949 | 723,997 | |||||

| 5,634 | IQVIA HOLDINGS, INC.(b) | 560,732 | 607,683 | |||||

| 6,984 | JAZZ PHARMACEUTICALS PLC(b)(c) | 915,001 | 696,584 | |||||

| 24,558 | JOHNSON & JOHNSON | 1,573,363 | 3,220,290 | |||||

| 842 | LABORATORY CORP. OF AMERICA HOLDINGS(b) | 53,269 | 106,420 | |||||

| 7,292 | MCKESSON CORP. | 421,610 | 986,316 | |||||

| 12,348 | MEDTRONIC PLC(c) | 1,077,575 | 1,113,543 | |||||

| 43,496 | MERCK & CO., INC. | 1,385,905 | 3,346,582 | |||||

| 1,317 | METTLER-TOLEDO INTERNATIONAL, INC.(b) | 123,051 | 909,402 | |||||

| 2,100 | MODERNA, INC.(b) | 56,988 | 62,895 | |||||

| 939 | MOLINA HEALTHCARE, INC.(b) | 122,169 | 131,188 | |||||

| 44,680 | MYLAN N.V.(b) | 841,743 | 666,179 | |||||

| 5 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Core Equity Fund

March 31, 2020

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Health Care (Cont'd): | ||||||||

| 800 | NEUROCRINE BIOSCIENCES, INC.(b) | $72,192 | 69,240 | |||||

| 300 | PENUMBRA, INC.(b) | 36,663 | 48,399 | |||||

| 1,200 | PERRIGO CO. PLC(c) | 53,711 | 57,708 | |||||

| 116,885 | PFIZER, INC. | 3,131,597 | 3,815,126 | |||||

| 2,600 | PPD, INC.(b) | 45,518 | 46,306 | |||||

| 1,000 | QIAGEN N.V.(b)(c) | 39,870 | 41,600 | |||||

| 292 | REGENERON PHARMACEUTICALS, INC.(b) | 144,299 | 142,581 | |||||

| 8,022 | RESMED, INC. | 644,542 | 1,181,560 | |||||

| 700 | SAREPTA THERAPEUTICS, INC.(b) | 66,178 | 68,474 | |||||

| 10,110 | STERIS PLC | 1,183,076 | 1,415,097 | |||||

| 1,800 | TELEFLEX, INC. | 195,858 | 527,148 | |||||

| 6,072 | THERMO FISHER SCIENTIFIC, INC. | 1,007,478 | 1,722,019 | |||||

| 830 | UNITED THERAPEUTICS CORP.(b) | 72,357 | 78,705 | |||||

| 14,091 | UNITEDHEALTH GROUP, INC. | 1,941,198 | 3,514,014 | |||||

| 3,477 | UNIVERSAL HEALTH SERVICES, INC., CLASS B | 211,964 | 344,501 | |||||

| 1,880 | VAREX IMAGING CORP.(b) | 19,829 | 42,695 | |||||

| 5,199 | VARIAN MEDICAL SYSTEMS, INC.(b) | 193,000 | 533,729 | |||||

| 699 | VEEVA SYSTEMS, INC., CLASS A(b) | 45,879 | 109,303 | |||||

| 2,400 | VERTEX PHARMACEUTICALS, INC.(b) | 337,589 | 571,080 | |||||

| 8,978 | WATERS CORP.(b) | 1,428,708 | 1,634,445 | |||||

| 4,304 | ZIMMER BIOMET HOLDINGS, INC. | 233,961 | 435,048 | |||||

| 559 | ZOETIS, INC. | 40,258 | 65,789 | |||||

| 42,319,099 | 66,703,916 | 15.90% | ||||||

| Industrials: | ||||||||

| 6,987 | 3M CO. | 417,187 | 953,795 | |||||

| 923 | ACCO BRANDS CORP. | 3,137 | 4,661 | |||||

| 11,607 | ADT, INC. | 45,143 | 50,142 | |||||

| 4,642 | AGCO CORP. | 225,963 | 219,334 | |||||

| 900 | AIR LEASE CORP. | 17,685 | 19,926 | |||||

| 1,533 | ALLEGION PLC(c) | 40,913 | 141,067 | |||||

| 300 | AMERCO | 88,798 | 87,165 | |||||

| 3,100 | AMERICAN AIRLINES GROUP, INC. | 47,729 | 37,789 | |||||

| 5,175 | AMETEK, INC. | 73,220 | 372,703 | |||||

| 5,100 | BOEING (THE) CO. | 215,200 | 760,614 | |||||

| 1,200 | BWX TECHNOLOGIES, INC. | 54,215 | 58,452 | |||||

| 5,604 | CARLISLE COS., INC. | 470,886 | 702,069 | |||||

| 10,504 | CATERPILLAR, INC. | 272,491 | 1,218,884 | |||||

| 3,200 | CINTAS CORP. | 258,101 | 554,304 | |||||

| 2,000 | COPART, INC.(b) | 143,195 | 137,040 | |||||

| 6,700 | CORELOGIC, INC. | 76,313 | 204,618 | |||||

| 5,739 | CRANE CO. | 189,222 | 282,244 | |||||

| 4,524 | CSX CORP. | 181,824 | 259,225 | |||||

| 14,665 | CUMMINS, INC. | 2,331,857 | 1,984,468 | |||||

| 7,300 | DEERE & CO. | 199,160 | 1,008,568 | |||||

| 10,100 | DELTA AIR LINES, INC. | 100,965 | 288,153 | |||||

| 1,525 | DOVER CORP. | 32,899 | 128,009 | |||||

| 19,882 | EATON CORP. PLC | 752,240 | 1,544,633 | |||||

| 2,280 | EXPEDITORS INTERNATIONAL OF WASHINGTON, INC. | 112,692 | 152,122 | |||||

| 5,753 | FEDEX CORP. | 113,466 | 697,609 | |||||

| 3,325 | FORTIVE CORP. | 43,068 | 183,507 | |||||

| 39,301 | FORTUNE BRANDS HOME & SECURITY, INC. | 1,900,757 | 1,699,768 | |||||

| 1,400 | GATX CORP. | 24,276 | 87,584 | |||||

| 2,128 | GENERAL DYNAMICS CORP. | 296,250 | 281,556 | |||||

| 875 | HEICO CORP. | 61,334 | 65,284 | |||||

| 2,156 | HEICO CORP., CLASS A | 109,365 | 137,768 | |||||

| 360 | HERC HOLDINGS, INC.(b) | 5,808 | 7,366 | |||||

| 9,188 | HONEYWELL INTERNATIONAL, INC. | 265,803 | 1,229,263 | |||||

| 1,200 | HUBBELL, INC. | 43,310 | 137,688 | |||||

| 1,423 | HUNTINGTON INGALLS INDUSTRIES, INC. | 192,370 | 259,285 | |||||

| 1,500 | IAA, INC.(b) | 45,883 | 44,940 | |||||

| 2,271 | IDEX CORP. | 140,770 | 313,648 | |||||

| 4,865 | IHS MARKIT LTD.(c) | 341,988 | 291,900 | |||||

| 4,824 | ILLINOIS TOOL WORKS, INC. | 155,812 | 685,587 | |||||

| 2,382 | INGERSOLL RAND, INC.(b) | 18,866 | 59,074 | |||||

| 1,468 | JACOBS ENGINEERING GROUP, INC. | 29,713 | 116,368 | |||||

| 2,100 | JB HUNT TRANSPORT SERVICES, INC. | 40,530 | 193,683 | |||||

| 13,203 | JETBLUE AIRWAYS CORP.(b) | 81,151 | 118,167 | |||||

| 6 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Core Equity Fund

March 31, 2020

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Industrials (Cont'd): | ||||||||

| 13,073 | JOHNSON CONTROLS INTERNATIONAL PLC | $341,983 | 352,448 | |||||

| 4,274 | L3HARRIS TECHNOLOGIES, INC. | 274,846 | 769,833 | |||||

| 600 | LENNOX INTERNATIONAL, INC. | 17,874 | 109,074 | |||||

| 1,400 | LINCOLN ELECTRIC HOLDINGS, INC. | 28,970 | 96,600 | |||||

| 2,538 | LOCKHEED MARTIN CORP. | 689,956 | 860,255 | |||||

| 1,800 | LYFT, INC., CLASS A(b) | 50,324 | 48,330 | |||||

| 1,200 | MANITOWOC (THE) CO., INC.(b) | 10,053 | 10,200 | |||||

| 3,509 | MANPOWERGROUP, INC. | 170,600 | 185,942 | |||||

| 15,263 | MASCO CORP. | 139,724 | 527,642 | |||||

| 577 | NORDSON CORP. | 57,299 | 77,935 | |||||

| 760 | NORFOLK SOUTHERN CORP. | 14,546 | 110,960 | |||||

| 4,673 | NORTHROP GRUMMAN CORP. | 480,108 | 1,413,816 | |||||

| 2,519 | NVENT ELECTRIC PLC(c) | 24,113 | 42,496 | |||||

| 3,666 | OLD DOMINION FREIGHT LINE, INC. | 488,884 | 481,199 | |||||

| 7,480 | OSHKOSH CORP. | 303,782 | 481,188 | |||||

| 1,100 | OWENS CORNING | 22,578 | 42,691 | |||||

| 1,067 | PACCAR, INC. | 47,468 | 65,226 | |||||

| 4,628 | PARKER-HANNIFIN CORP. | 350,966 | 600,390 | |||||

| 2,519 | PENTAIR PLC(c) | 49,295 | 74,965 | |||||

| 5,225 | QUANTA SERVICES, INC. | 97,933 | 165,789 | |||||

| 1,157 | RAYTHEON CO. | 32,516 | 151,741 | |||||

| 12,257 | REPUBLIC SERVICES, INC. | 732,074 | 920,010 | |||||

| 5,250 | ROCKWELL AUTOMATION, INC. | 73,987 | 792,277 | |||||

| 2,580 | ROLLINS, INC. | 67,194 | 93,241 | |||||

| 700 | ROPER TECHNOLOGIES, INC. | 94,317 | 218,267 | |||||

| 2,015 | SNAP-ON, INC. | 191,097 | 219,272 | |||||

| 16,780 | SOUTHWEST AIRLINES CO. | 560,041 | 597,536 | |||||

| 5,900 | SPIRIT AEROSYSTEMS HOLDINGS, INC., CLASS A | 238,478 | 141,187 | |||||

| 2,557 | STANLEY BLACK & DECKER, INC. | 72,048 | 255,700 | |||||

| 600 | STERICYCLE, INC.(b) | 18,858 | 29,148 | |||||

| 5,162 | TIMKEN (THE) CO. | 171,352 | 166,939 | |||||

| 1,596 | TORO (THE) CO. | 76,510 | 103,884 | |||||

| 10,505 | TRANE TECHNOLOGIES PLC(c) | 490,333 | 867,608 | |||||

| 200 | TRANSDIGM GROUP, INC. | 60,439 | 64,038 | |||||

| 12,944 | UBER TECHNOLOGIES, INC.(b) | 398,810 | 361,396 | |||||

| 7,843 | UNION PACIFIC CORP. | 124,750 | 1,106,177 | |||||

| 1,928 | UNITED AIRLINES HOLDINGS, INC.(b) | 38,137 | 60,828 | |||||

| 3,540 | UNITED PARCEL SERVICE, INC., CLASS B | 166,527 | 330,707 | |||||

| 11,099 | UNITED RENTALS, INC.(b) | 1,158,398 | 1,142,087 | |||||

| 10,640 | UNITED TECHNOLOGIES CORP. | 359,144 | 1,003,671 | |||||

| 3,634 | VERISK ANALYTICS, INC. | 459,914 | 506,507 | |||||

| 180 | VERITIV CORP.(b) | 1,653 | 1,415 | |||||

| 700 | W.W. GRAINGER, INC. | 30,601 | 173,950 | |||||

| 975 | WASTE CONNECTIONS, INC. | 42,575 | 75,563 | |||||

| 17,554 | WASTE MANAGEMENT, INC. | 879,219 | 1,624,798 | |||||

| 1,200 | WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORP. | 21,945 | 57,756 | |||||

| 1,600 | XYLEM, INC. | 30,618 | 104,208 | |||||

| 20,514,392 | 35,466,920 | 8.45% | ||||||

| Information Technology: | ||||||||

| 2,200 | 2U, INC.(b) | 40,782 | 46,684 | |||||

| 4,949 | ACCENTURE PLC, CLASS A(c) | 304,426 | 807,974 | |||||

| 6,754 | ADOBE, INC.(b) | 802,976 | 2,149,393 | |||||

| 10,700 | ADVANCED MICRO DEVICES, INC.(b) | 115,242 | 486,636 | |||||

| 12,626 | AKAMAI TECHNOLOGIES, INC.(b) | 715,662 | 1,155,153 | |||||

| 1,100 | ALLIANCE DATA SYSTEMS CORP. | 47,178 | 37,015 | |||||

| 1,236 | ALTERYX, INC., CLASS A(b) | 140,231 | 117,630 | |||||

| 4,065 | AMDOCS LTD. | 200,086 | 223,453 | |||||

| 8,600 | ANALOG DEVICES, INC. | 120,368 | 770,990 | |||||

| 1,400 | ANAPLAN, INC.(b) | 47,612 | 42,364 | |||||

| 1,200 | ANSYS, INC.(b) | 30,630 | 278,964 | |||||

| 70,583 | APPLE, INC. | 6,404,827 | 17,948,551 | |||||

| 7,400 | APPLIED MATERIALS, INC. | 134,145 | 339,068 | |||||

| 4,877 | ARROW ELECTRONICS, INC.(b) | 267,343 | 252,970 | |||||

| 1,300 | ATLASSIAN CORP. PLC, CLASS A(b)(c) | 116,368 | 178,438 | |||||

| 2,586 | AUTODESK, INC.(b) | 163,995 | 403,675 | |||||

| 6,766 | AUTOMATIC DATA PROCESSING, INC. | 361,211 | 924,777 | |||||

| 7,371 | BLACK KNIGHT, INC.(b) | 272,636 | 427,960 | |||||

| 7 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Core Equity Fund

March 31, 2020

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Information Technology (Cont'd): | ||||||||

| 9,493 | BOOZ ALLEN HAMILTON HOLDING CORP. | $296,190 | 651,599 | |||||

| 3,991 | BROADCOM, INC. | 183,141 | 946,266 | |||||

| 3,413 | BROADRIDGE FINANCIAL SOLUTIONS, INC. | 106,898 | 323,655 | |||||

| 1,209 | CACI INTERNATIONAL, INC., CLASS A(b) | 249,365 | 255,280 | |||||

| 33,619 | CADENCE DESIGN SYSTEMS, INC.(b) | 1,583,883 | 2,220,199 | |||||

| 1,522 | CDK GLOBAL, INC. | 19,712 | 49,998 | |||||

| 7,000 | CDW CORP. | 292,424 | 652,890 | |||||

| 27,277 | CERENCE, INC.(b) | 633,070 | 420,066 | |||||

| 84,983 | CISCO SYSTEMS, INC. | 1,929,611 | 3,340,682 | |||||

| 18,076 | CITRIX SYSTEMS, INC. | 2,088,263 | 2,558,658 | |||||

| 1,000 | COGNEX CORP. | 44,753 | 42,220 | |||||

| 2,700 | COGNIZANT TECHNOLOGY SOLUTIONS CORP., CLASS A | 25,751 | 125,469 | |||||

| 4,600 | COMMSCOPE HOLDING CO., INC.(b) | 41,842 | 41,906 | |||||

| 15,600 | CORNING, INC. | 85,176 | 320,424 | |||||

| 900 | COUPA SOFTWARE, INC.(b) | 111,897 | 125,757 | |||||

| 923 | DELL TECHNOLOGIES, INC., CLASS C(b) | 21,056 | 36,505 | |||||

| 1,600 | DOCUSIGN, INC.(b) | 101,517 | 147,840 | |||||

| 2,000 | DOLBY LABORATORIES, INC., CLASS A | 43,420 | 108,420 | |||||

| 2,300 | DROPBOX, INC., CLASS A(b) | 42,360 | 41,630 | |||||

| 4,992 | DXC TECHNOLOGY CO. | 158,627 | 65,146 | |||||

| 1,640 | ECHOSTAR CORP., CLASS A(b) | 21,050 | 52,431 | |||||

| 954 | EPAM SYSTEMS, INC.(b) | 163,143 | 177,120 | |||||

| 300 | EURONET WORLDWIDE, INC.(b) | 25,458 | 25,716 | |||||

| 1,300 | F5 NETWORKS, INC.(b) | 30,063 | 138,619 | |||||

| 300 | FAIR ISAAC CORP.(b) | 80,682 | 92,307 | |||||

| 12,959 | FIDELITY NATIONAL INFORMATION SERVICES, INC. | 538,426 | 1,576,333 | |||||

| 3,900 | FIREEYE, INC.(b) | 44,602 | 41,262 | |||||

| 9,784 | FISERV, INC.(b) | 172,685 | 929,382 | |||||

| 200 | FLEETCOR TECHNOLOGIES, INC.(b) | 33,618 | 37,308 | |||||

| 5,523 | FORTINET, INC.(b) | 393,491 | 558,762 | |||||

| 5,708 | GLOBAL PAYMENTS, INC. | 297,530 | 823,265 | |||||

| 800 | GODADDY, INC., CLASS A(b) | 39,006 | 45,688 | |||||

| 18,800 | HEWLETT PACKARD ENTERPRISE CO. | 102,062 | 182,548 | |||||

| 11,910 | HP, INC. | 179,763 | 206,758 | |||||

| 400 | HUBSPOT, INC.(b) | 54,548 | 53,276 | |||||

| 68,231 | INTEL CORP. | 1,023,945 | 3,692,662 | |||||

| 11,178 | INTERNATIONAL BUSINESS MACHINES CORP. | 1,160,467 | 1,239,975 | |||||

| 5,000 | INTUIT, INC. | 103,285 | 1,150,000 | |||||

| 13,175 | JABIL, INC. | 259,881 | 323,841 | |||||

| 400 | KEYSIGHT TECHNOLOGIES, INC.(b) | 32,788 | 33,472 | |||||

| 9,185 | LAM RESEARCH CORP. | 803,602 | 2,204,400 | |||||

| 27,189 | LEIDOS HOLDINGS, INC. | 2,191,927 | 2,491,872 | |||||

| 827 | LOGMEIN, INC. | 17,893 | 68,873 | |||||

| 1,721 | MANHATTAN ASSOCIATES, INC.(b) | 112,154 | 85,740 | |||||

| 3,770 | MARVELL TECHNOLOGY GROUP LTD. | 20,234 | 85,315 | |||||

| 8,053 | MASTERCARD, INC., CLASS A | 1,701,115 | 1,945,283 | |||||

| 1,900 | MEDALLIA, INC.(b) | 44,418 | 38,076 | |||||

| 4,200 | MICROCHIP TECHNOLOGY, INC. | 38,962 | 284,760 | |||||

| 46,725 | MICRON TECHNOLOGY, INC.(b) | 1,063,489 | 1,965,253 | |||||

| 113,888 | MICROSOFT CORP. | 4,940,620 | 17,961,276 | |||||

| 500 | MKS INSTRUMENTS, INC. | 32,310 | 40,725 | |||||

| 900 | MONGODB, INC.(b) | 115,074 | 122,886 | |||||

| 900 | NEW RELIC, INC.(b) | 42,264 | 41,616 | |||||

| 36,573 | NORTONLIFELOCK, INC. | 432,755 | 684,281 | |||||

| 8,184 | NVIDIA CORP. | 1,200,803 | 2,157,302 | |||||

| 18,025 | NXP SEMICONDUCTORS N.V.(c) | 1,630,731 | 1,494,813 | |||||

| 1,597 | OKTA, INC.(b) | 180,600 | 195,249 | |||||

| 64,269 | ORACLE CORP. | 3,416,256 | 3,106,121 | |||||

| 2,800 | PALO ALTO NETWORKS, INC.(b) | 116,508 | 459,088 | |||||

| 466 | PAYCHEX, INC. | 27,642 | 29,321 | |||||

| 1,553 | PAYCOM SOFTWARE, INC.(b) | 217,948 | 313,721 | |||||

| 7,600 | PAYPAL HOLDINGS, INC.(b) | 595,521 | 727,624 | |||||

| 907 | PERSPECTA, INC. | 8,504 | 16,544 | |||||

| 3,800 | PLURALSIGHT, INC., CLASS A(b) | 42,888 | 41,724 | |||||

| 600 | PROOFPOINT, INC.(b) | 56,232 | 61,554 | |||||

| 2,400 | PTC, INC.(b) | 82,674 | 146,904 | |||||

| 3,588 | QORVO, INC.(b) | 317,244 | 289,300 | |||||

| 8 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Core Equity Fund

March 31, 2020

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Information Technology (Cont'd): | ||||||||

| 7,921 | QUALCOMM, INC. | $619,767 | 535,856 | |||||

| 3,800 | RINGCENTRAL, INC., CLASS A(b) | 432,566 | 805,258 | |||||

| 8,372 | SALESFORCE.COM, INC.(b) | 147,727 | 1,205,400 | |||||

| 65,456 | SEAGATE TECHNOLOGY PLC | 2,607,966 | 3,194,253 | |||||

| 2,100 | SERVICENOW, INC.(b) | 273,110 | 601,818 | |||||

| 6,675 | SKYWORKS SOLUTIONS, INC. | 640,777 | 596,611 | |||||

| 900 | SMARTSHEET, INC., CLASS A(b) | 39,015 | 37,359 | |||||

| 1,400 | SPLUNK, INC.(b) | 162,032 | 176,722 | |||||

| 3,000 | SQUARE, INC., CLASS A(b) | 111,050 | 157,140 | |||||

| 1,938 | SS&C TECHNOLOGIES HOLDINGS, INC. | 86,602 | 84,923 | |||||

| 10,981 | SYNNEX CORP. | 1,048,564 | 802,711 | |||||

| 10,032 | SYNOPSYS, INC.(b) | 913,224 | 1,292,021 | |||||

| 4,600 | TERADYNE, INC. | 82,730 | 249,182 | |||||

| 27,940 | TEXAS INSTRUMENTS, INC. | 943,662 | 2,792,044 | |||||

| 7,720 | TRIMBLE, INC.(b) | 113,413 | 245,728 | |||||

| 200 | VERISIGN, INC.(b) | 23,200 | 36,018 | |||||

| 18,278 | VISA, INC., CLASS A | 562,267 | 2,944,951 | |||||

| 7,800 | VISHAY INTERTECHNOLOGY, INC. | 48,931 | 112,398 | |||||

| 3,772 | VMWARE, INC., CLASS A(b) | 190,784 | 456,789 | |||||

| 5,845 | WESTERN DIGITAL CORP. | 90,457 | 243,269 | |||||

| 208,267 | WESTERN UNION (THE) CO. | 4,265,673 | 3,775,881 | |||||

| 1,000 | WORKDAY, INC., CLASS A(b) | 137,260 | 130,220 | |||||

| 6,688 | XEROX HOLDINGS CORP. | 243,629 | 126,671 | |||||

| 6,750 | XILINX, INC. | 47,180 | 526,095 | |||||

| 2,685 | ZEBRA TECHNOLOGIES CORP., CLASS A(b) | 397,763 | 492,966 | |||||

| 1,300 | ZENDESK, INC.(b) | 79,215 | 83,213 | |||||

| 700 | ZSCALER, INC.(b) | 41,398 | 42,602 | |||||

| 56,901,497 | 109,254,750 | 26.05% | ||||||

| Materials: | ||||||||

| 1,075 | AIR PRODUCTS & CHEMICALS, INC. | 43,205 | 214,581 | |||||

| 1,300 | ALBEMARLE CORP. | 29,152 | 73,281 | |||||

| 13,770 | AMCOR PLC(c) | 60,200 | 111,812 | |||||

| 700 | ASHLAND GLOBAL HOLDINGS, INC. | 12,006 | 35,049 | |||||

| 3,165 | AVERY DENNISON CORP. | 207,899 | 322,419 | |||||

| 25,813 | CELANESE CORP. | 2,239,726 | 1,894,416 | |||||

| 4,500 | CHEMOURS (THE) CO. | 49,032 | 39,915 | |||||

| 7,262 | CORTEVA, INC. | 88,857 | 170,657 | |||||

| 1,800 | CROWN HOLDINGS, INC.(b) | 57,831 | 104,472 | |||||

| 7,262 | DOW, INC. | 147,036 | 212,341 | |||||

| 10,454 | DUPONT DE NEMOURS, INC. | 408,910 | 356,481 | |||||

| 7,160 | EASTMAN CHEMICAL CO. | 255,445 | 333,513 | |||||

| 3,891 | ECOLAB, INC. | 133,579 | 606,335 | |||||

| 15,800 | FREEPORT-MCMORAN, INC. | 103,648 | 106,650 | |||||

| 238 | INTERNATIONAL FLAVORS & FRAGRANCES, INC. | 5,120 | 24,295 | |||||

| 19,791 | INTERNATIONAL PAPER CO. | 619,259 | 616,094 | |||||

| 4,450 | LINDE PLC(c) | 723,931 | 769,850 | |||||

| 4,476 | LYONDELLBASELL INDUSTRIES N.V., CLASS A | 176,907 | 222,144 | |||||

| 700 | MARTIN MARIETTA MATERIALS, INC. | 27,965 | 132,461 | |||||

| 24,755 | NEWMONT CORP. | 929,653 | 1,120,906 | |||||

| 5,844 | NUCOR CORP. | 99,313 | 210,501 | |||||

| 4,000 | OLIN CORP. | 47,145 | 46,680 | |||||

| 10,294 | PACKAGING CORP. OF AMERICA | 771,550 | 893,828 | |||||

| 5,172 | PPG INDUSTRIES, INC. | 123,888 | 432,379 | |||||

| 6,625 | RELIANCE STEEL & ALUMINUM CO. | 325,929 | 580,284 | |||||

| 600 | ROYAL GOLD, INC. | 22,314 | 52,626 | |||||

| 2,400 | RPM INTERNATIONAL, INC. | 24,657 | 142,800 | |||||

| 500 | SCOTTS MIRACLE-GRO (THE) CO. | 37,765 | 51,200 | |||||

| 1,400 | SEALED AIR CORP. | 24,528 | 34,594 | |||||

| 257 | SHERWIN-WILLIAMS (THE) CO. | 12,489 | 118,097 | |||||

| 3,600 | SONOCO PRODUCTS CO. | 74,519 | 166,860 | |||||

| 3,234 | SOUTHERN COPPER CORP.(c) | 38,445 | 91,069 | |||||

| 8,200 | STEEL DYNAMICS, INC. | 89,708 | 184,828 | |||||

| 4,392 | VALVOLINE, INC. | 24,184 | 57,491 | |||||

| 2,100 | VULCAN MATERIALS CO. | 63,441 | 226,947 | |||||

| 2,242 | WESTROCK CO. | 24,357 | 63,359 | |||||

| 8,123,593 | 10,821,215 | 2.58% | ||||||

| 9 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Core Equity Fund

March 31, 2020

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Real Estate: | ||||||||

| 2,100 | ALEXANDRIA REAL ESTATE EQUITIES, INC. | $106,066 | 287,826 | |||||

| 9,773 | AMERICAN TOWER CORP. | 1,576,410 | 2,128,071 | |||||

| 3,529 | APARTMENT INVESTMENT & MANAGEMENT CO., CLASS A | 39,963 | 124,044 | |||||

| 734 | AVALONBAY COMMUNITIES, INC. | 31,138 | 108,023 | |||||

| 3,388 | BOSTON PROPERTIES, INC. | 171,468 | 312,475 | |||||

| 900 | CAMDEN PROPERTY TRUST | 24,065 | 71,316 | |||||

| 24,200 | COLONY CAPITAL, INC. | 47,800 | 42,350 | |||||

| 500 | CORESITE REALTY CORP. | 43,021 | 57,950 | |||||

| 4,700 | CROWN CASTLE INTERNATIONAL CORP. | 190,955 | 678,680 | |||||

| 900 | CYRUSONE, INC. | 45,900 | 55,575 | |||||

| 2,500 | DIGITAL REALTY TRUST, INC. | 269,780 | 347,275 | |||||

| 5,200 | DOUGLAS EMMETT, INC. | 44,883 | 158,652 | |||||

| 1,700 | DUKE REALTY CORP. | 28,435 | 55,046 | |||||

| 2,140 | EQUINIX, INC. | 817,154 | 1,336,580 | |||||

| 10,892 | EQUITY LIFESTYLE PROPERTIES, INC. | 502,076 | 626,072 | |||||

| 5,416 | EQUITY RESIDENTIAL | 174,162 | 334,221 | |||||

| 675 | ESSEX PROPERTY TRUST, INC. | 73,174 | 148,662 | |||||

| 900 | FEDERAL REALTY INVESTMENT TRUST | 48,326 | 67,149 | |||||

| 1,046 | FOUR CORNERS PROPERTY TRUST, INC. | 8,684 | 19,571 | |||||

| 2,000 | GAMING AND LEISURE PROPERTIES, INC. | 53,895 | 55,420 | |||||

| 7,000 | HEALTHPEAK PROPERTIES, INC. | 72,217 | 166,950 | |||||

| 41,198 | HOST HOTELS & RESORTS, INC. | 501,809 | 454,826 | |||||

| 678 | HOWARD HUGHES (THE) CORP.(b) | 20,502 | 34,252 | |||||

| 700 | JBG SMITH PROPERTIES | 17,888 | 22,281 | |||||

| 700 | JONES LANG LASALLE, INC. | 39,951 | 70,686 | |||||

| 4,001 | KIMCO REALTY CORP. | 33,139 | 38,690 | |||||

| 3,900 | LAMAR ADVERTISING CO., CLASS A | 43,876 | 199,992 | |||||

| 1,800 | MID-AMERICA APARTMENT COMMUNITIES, INC. | 132,698 | 185,454 | |||||

| 3,700 | OUTFRONT MEDIA, INC. | 47,754 | 49,876 | |||||

| 10,911 | PROLOGIS, INC. | 282,240 | 876,917 | |||||

| 1,424 | PUBLIC STORAGE | 135,843 | 282,821 | |||||

| 6,972 | RAYONIER, INC. | 74,591 | 164,191 | |||||

| 2,600 | REALTY INCOME CORP. | 49,031 | 129,636 | |||||

| 3,900 | REGENCY CENTERS CORP. | 85,344 | 149,877 | |||||

| 6,422 | SBA COMMUNICATIONS CORP. | 1,163,408 | 1,733,747 | |||||

| 1,594 | SIMON PROPERTY GROUP, INC. | 75,050 | 87,447 | |||||

| 1,100 | SUN COMMUNITIES, INC. | 83,011 | 137,335 | |||||

| 2,100 | TAUBMAN CENTERS, INC. | 53,754 | 87,948 | |||||

| 4,100 | UDR, INC. | 63,318 | 149,814 | |||||

| 1,727 | VENTAS, INC. | 83,361 | 46,284 | |||||

| 10,100 | VEREIT, INC. | 51,263 | 49,389 | |||||

| 4,300 | VICI PROPERTIES, INC. | 66,375 | 71,552 | |||||

| 2,100 | WEINGARTEN REALTY INVESTORS | 29,916 | 30,303 | |||||

| 4,916 | WEYERHAEUSER CO. | 64,713 | 83,326 | |||||

| 7,568,407 | 12,318,552 | 2.94% | ||||||

| Utilities: | ||||||||

| 3,000 | AES CORP. | 32,870 | 40,800 | |||||

| 2,000 | ALLIANT ENERGY CORP. | 24,835 | 96,580 | |||||

| 1,600 | AMEREN CORP. | 40,872 | 116,528 | |||||

| 8,554 | AMERICAN ELECTRIC POWER CO., INC. | 477,380 | 684,149 | |||||

| 13,200 | AVANGRID, INC. | 502,113 | 577,896 | |||||

| 5,800 | CENTERPOINT ENERGY, INC. | 66,308 | 89,610 | |||||

| 13,300 | CMS ENERGY CORP. | 259,708 | 781,375 | |||||

| 4,989 | CONSOLIDATED EDISON, INC. | 319,712 | 389,142 | |||||

| 12,073 | DOMINION ENERGY, INC. | 450,978 | 871,550 | |||||

| 5,743 | DTE ENERGY CO. | 462,041 | 545,413 | |||||

| 12,117 | DUKE ENERGY CORP. | 582,142 | 980,023 | |||||

| 8,325 | EDISON INTERNATIONAL | 179,967 | 456,127 | |||||

| 3,164 | ENTERGY CORP. | 68,368 | 297,321 | |||||

| 1,735 | ESSENTIAL UTILITIES, INC. | 22,973 | 70,615 | |||||

| 2,974 | EVERGY, INC. | 67,407 | 163,719 | |||||

| 4,961 | EVERSOURCE ENERGY | 125,492 | 388,000 | |||||

| 36,566 | EXELON CORP. | 1,375,912 | 1,345,994 | |||||

| 5,500 | FIRSTENERGY CORP. | 176,693 | 220,385 | |||||

| 900 | NATIONAL FUEL GAS CO. | 20,790 | 33,561 | |||||

| 4,400 | NEXTERA ENERGY, INC. | 204,691 | 1,058,728 | |||||

| 6,900 | NISOURCE, INC. | 43,973 | 172,293 | |||||

| 10 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Core Equity Fund

March 31, 2020

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Utilities (Cont'd): | ||||||||

| 10,933 | OGE ENERGY CORP. | $282,750 | 335,971 | |||||

| 5,000 | PG&E CORP.(b) | 46,280 | 44,950 | |||||

| 12,903 | PINNACLE WEST CAPITAL CORP. | 1,006,821 | 977,918 | |||||

| 700 | PPL CORP. | 10,384 | 17,276 | |||||

| 1,200 | PUBLIC SERVICE ENTERPRISE GROUP, INC. | 51,552 | 53,892 | |||||

| 3,200 | SEMPRA ENERGY | 174,758 | 361,568 | |||||

| 8,600 | SOUTHERN (THE) CO. | 176,010 | 465,604 | |||||

| 5,426 | UGI CORP. | 80,112 | 144,711 | |||||

| 1,600 | WEC ENERGY GROUP, INC. | 91,440 | 141,008 | |||||

| 968 | XCEL ENERGY, INC. | 36,241 | 58,370 | |||||

| 7,461,573 | 11,981,077 | 2.86% | ||||||

| Sub-total Common Stocks: | 255,473,604 | 416,486,020 | 99.29% | |||||

| Short-Term Investments: | ||||||||

| 2,538,487 | NORTHERN INSTITUTIONAL FUNDS - U.S. GOVERNMENT SELECT PORTFOLIO, 0.37%(d) | 2,538,487 | 2,538,487 | |||||

| Sub-total Short-Term Investments: | 2,538,487 | 2,538,487 | 0.60% | |||||

| Grand total | $258,012,091 | 419,024,507 | 99.89% | |||||

| Notes to Schedule of Investments: | |

| (a) | Investments in U.S. and foreign equity securities are valued at the last sales price or the regular trading session closing price on the principal exchange or market where the securities are traded. Foreign security values are stated in U.S. dollars. |

| (b) | Non-income producing assets. |

| (c) | Foreign security values are stated in U.S. dollars. As of March 31, 2020, the value of foreign stocks or depositary receipts of companies based outside of the United States represented 2.89% of net assets. |

| (d) | The short-term investment is a money market portfolio of the investment company, Northern Institutional Funds. At December 31, 2019, the value of the Clearwater Core Equity Fund's investment in the U.S. Government Select Portfolio of the Northern Institutional Funds was $2,916,876 with net sales of $378,389 during the three months ended March 31, 2020. |

| 11 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Core Equity Fund

March 31, 2020

(unaudited)

Fair value is an estimate of the price

the Clearwater Core Equity Fund would receive upon selling a security in a timely transaction to an independent buyer in the principal or most advantageous market for the security. This guidance establishes a

three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Various inputs are

used in determining the value of the Clearwater Core Equity Fund's investments, as described below. These inputs are summarized in the three broad levels listed below.

| • | Level 1 – Unadjusted quoted market prices in active markets for identical securities on the measurement date. |

| • | Level 2 – Other significant observable inputs including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc. or quoted prices for identical or similar assets in markets that are not active. Inputs that are derived principally from or corroborated by observable market data are also considered Level 2 measurements. An adjustment to any observable input that is significant to the fair value may render the measurement a Level 3 measurement. |

| • | Level 3 – Valuations based on unobservable inputs, which may include the Adviser’s own assumptions in determining the fair value of an investment. |

Investments in U.S. and

foreign equity securities are valued at the last sales price or the regular trading session closing price on the principal exchange or market in which such securities are traded, with foreign security values stated in

U.S. dollars. Equity securities which have not traded on the date of valuation or securities for which sales prices are not generally reported are valued at the mean between the last bid and asked prices. Security

transactions are accounted for as of trade date. Wherever possible, the Clearwater Core Equity Fund uses independent pricing services approved by the Board of Trustees of Clearwater Investment Trust to value its

investments. When prices are not readily available (including those for which trading has been suspended), are determined not to reflect fair value, or when the Adviser becomes aware that a significant event impacting

the value of a security or group of securities has occurred after the closing of the exchange on which the security or securities principally trade, but before the calculation of the daily net asset value, the

Clearwater Core Equity Fund may value these securities at fair value as determined in good faith using procedures established by the Board of Trustees.

The inputs or methodology

used for valuing securities are not necessarily an indication of the risk associated with investing in those securities and other financial instruments, if any. The following is a summary of the inputs used in valuing

the Clearwater Core Equity Fund’s investments and other financial instruments, if any, which are carried at fair value, as of March 31, 2020.

| Level 1 | Level 2 | Level 3 | Total | ||||

| Common Stocks | $416,486,020 | $— | $— | $416,486,020 | |||

| Short-Term Investments | 2,538,487 | — | — | 2,538,487 | |||

| Total | $419,024,507 | $— | $— | $419,024,507 |

For the Clearwater Core

Equity Fund, the investment value is comprised of equity securities and short-term investments. See the Clearwater Core Equity Fund’s Schedule of Investments for industry classification. Investments in equity

and short-term securities generally are valued at the last sales price or the regular trading session closing price on the principal exchange or market where they are traded.

| 12 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Core Equity Fund

March 31, 2020

(unaudited)

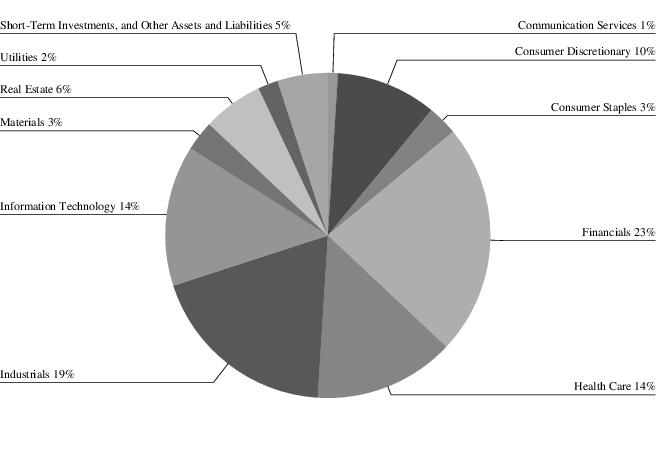

Clearwater Core Equity Fund Portfolio

Diversification

(as a percentage of net assets)

| 13 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Small Companies Fund

March 31, 2020

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Common Stocks: | ||||||||

| Communication Services: | ||||||||

| 149,248 | ALASKA COMMUNICATIONS SYSTEMS GROUP, INC.(b) | $269,931 | 259,692 | |||||

| 66,393 | ENTERCOM COMMUNICATIONS CORP., CLASS A | 280,982 | 113,532 | |||||

| 64,340 | ENTRAVISION COMMUNICATIONS CORP., CLASS A | 186,398 | 130,610 | |||||

| 50,229 | EW SCRIPPS (THE) CO., CLASS A | 684,682 | 378,727 | |||||

| 1,669 | GRAY TELEVISION, INC.(b) | 18,266 | 17,925 | |||||

| 37,351 | READING INTERNATIONAL, INC., CLASS A(b) | 550,188 | 145,295 | |||||

| 34,648 | SAGA COMMUNICATIONS, INC., CLASS A | 1,052,124 | 953,166 | |||||

| 17,851 | TOWNSQUARE MEDIA, INC., CLASS A | 139,834 | 82,293 | |||||

| 3,182,405 | 2,081,240 | 0.85% | ||||||

| Consumer Discretionary: | ||||||||

| 189,700 | AMERICAN EAGLE OUTFITTERS, INC. | 3,387,557 | 1,508,115 | |||||

| 301,914 | BBX CAPITAL CORP. | 1,546,173 | 697,421 | |||||

| 121,936 | BLUEGREEN VACATIONS CORP.(c) | 1,147,451 | 704,790 | |||||

| 110,975 | CALLAWAY GOLF CO. | 1,850,286 | 1,134,165 | |||||

| 47,443 | CARRIAGE SERVICES, INC. | 916,790 | 766,205 | |||||

| 213,435 | CLARUS CORP. | 1,204,054 | 2,091,663 | |||||

| 7,935 | CROWN CRAFTS, INC. | 37,850 | 37,929 | |||||

| 160,862 | DANA, INC. | 1,858,997 | 1,256,332 | |||||

| 71,600 | EXTENDED STAY AMERICA, INC. | 1,391,461 | 523,396 | |||||

| 145,674 | FIESTA RESTAURANT GROUP, INC.(b) | 1,769,880 | 587,066 | |||||

| 281,942 | FULL HOUSE RESORTS, INC.(b) | 661,760 | 352,428 | |||||

| 111,300 | GILDAN ACTIVEWEAR, INC.(d) | 2,967,612 | 1,420,188 | |||||

| 67,200 | HANESBRANDS, INC. | 921,601 | 528,864 | |||||

| 21,340 | HELEN OF TROY LTD.(b) | 2,251,674 | 3,073,600 | |||||

| 60,338 | HOOKER FURNITURE CORP. | 1,390,880 | 941,876 | |||||

| 12,797 | INSTALLED BUILDING PRODUCTS, INC.(b) | 893,009 | 510,217 | |||||

| 26,692 | J ALEXANDER'S HOLDINGS, INC.(b) | 289,196 | 102,230 | |||||

| 230,067 | LIFETIME BRANDS, INC. | 2,211,304 | 1,299,879 | |||||

| 31,900 | MALIBU BOATS, INC., CLASS A(b) | 1,009,960 | 918,401 | |||||

| 54,781 | MASTERCRAFT BOAT HOLDINGS, INC.(b) | 1,238,281 | 399,901 | |||||

| 68,618 | MOTORCAR PARTS OF AMERICA, INC.(b) | 1,293,852 | 863,215 | |||||

| 389,261 | OFFICE DEPOT, INC. | 725,691 | 638,388 | |||||

| 192,936 | POTBELLY CORP.(b) | 1,515,946 | 596,172 | |||||

| 66,843 | SKYLINE CHAMPION CORP.(b) | 1,536,580 | 1,048,098 | |||||

| 40,940 | STONERIDGE, INC.(b) | 933,730 | 685,745 | |||||

| 20,633 | UNIFI, INC.(b) | 432,745 | 238,311 | |||||

| 9,365 | VISTA OUTDOOR, INC.(b) | 69,108 | 82,412 | |||||

| 71,310 | WINNEBAGO INDUSTRIES, INC. | 2,148,506 | 1,983,131 | |||||

| 27,837 | WYNDHAM DESTINATIONS, INC. | 1,356,040 | 604,063 | |||||

| 38,957,974 | 25,594,201 | 10.48% | ||||||

| Consumer Staples: | ||||||||

| 73,766 | BJ'S WHOLESALE CLUB HOLDINGS, INC.(b) | 1,834,460 | 1,878,820 | |||||

| 8,076 | MEDIFAST, INC.(c) | 457,836 | 504,750 | |||||

| 42,128 | PERFORMANCE FOOD GROUP CO.(b) | 1,448,301 | 1,041,404 | |||||

| 1,076 | SENECA FOODS CORP., CLASS A(b) | 39,193 | 42,803 | |||||

| 34,863 | SPECTRUM BRANDS HOLDINGS, INC. | 1,846,251 | 1,267,968 | |||||

| 566,028 | SUNOPTA, INC.(b)(c)(d) | 2,187,557 | 973,568 | |||||

| 26,365 | UNIVERSAL CORP. | 1,424,310 | 1,165,597 | |||||

| 9,237,908 | 6,874,910 | 2.81% | ||||||

| Energy: | ||||||||

| 124,386 | MURPHY OIL CORP.(c) | 2,248,376 | 762,486 | |||||

| 35,601 | NATIONAL OILWELL VARCO, INC. | 327,308 | 349,958 | |||||

| 420,962 | NEXTIER OILFIELD SOLUTIONS, INC.(b) | 2,237,589 | 492,526 | |||||

| 4,813,273 | 1,604,970 | 0.66% | ||||||

| Financials: | ||||||||

| 9,628 | 1ST CONSTITUTION BANCORP | 183,798 | 127,571 | |||||

| 13,239 | AMALGAMATED BANK, CLASS A | 226,695 | 143,246 | |||||

| 36,821 | AMBAC FINANCIAL GROUP, INC.(b) | 697,268 | 454,371 | |||||

| 100,492 | AMERICAN EQUITY INVESTMENT LIFE HOLDING CO. | 2,577,857 | 1,889,250 | |||||

| 10,167 | AMERICAN NATIONAL BANKSHARES, INC. | 367,944 | 242,991 | |||||

| 34,353 | AMERIS BANCORP | 1,077,159 | 816,227 | |||||

| 13,813 | ARGO GROUP INTERNATIONAL HOLDINGS LTD.(d) | 723,465 | 511,910 | |||||

| 107,251 | ASSOCIATED BANC-CORP | 2,470,813 | 1,371,740 | |||||

| 46,550 | AXIS CAPITAL HOLDINGS LTD.(d) | 2,492,373 | 1,799,158 | |||||

| 47,860 | BANCORP (THE), INC.(b) | 434,951 | 290,510 | |||||

| 14 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Small Companies Fund

March 31, 2020

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Financials (Cont'd): | ||||||||

| 13,321 | BANKWELL FINANCIAL GROUP, INC. | $368,487 | 203,278 | |||||

| 18,492 | BCB BANCORP, INC. | 226,527 | 196,940 | |||||

| 55,672 | BLACKROCK TCP CAPITAL CORP. | 765,630 | 347,950 | |||||

| 11,659 | BRIDGE BANCORP, INC. | 377,193 | 246,704 | |||||

| 4,166 | BRYN MAWR BANK CORP. | 155,490 | 118,231 | |||||

| 48,383 | CANNAE HOLDINGS, INC.(b) | 946,363 | 1,620,347 | |||||

| 25,487 | CAROLINA FINANCIAL CORP. | 904,017 | 659,349 | |||||

| 9,422 | CB FINANCIAL SERVICES, INC. | 253,743 | 181,939 | |||||

| 8,950 | CITIZENS HOLDING CO. | 184,838 | 180,074 | |||||

| 252,772 | CNO FINANCIAL GROUP, INC. | 4,426,849 | 3,131,845 | |||||

| 21,041 | COMMERCE BANCSHARES, INC. | 1,001,678 | 1,059,414 | |||||

| 14,606 | COMMUNITY BANKERS TRUST CORP. | 130,349 | 70,839 | |||||

| 69,074 | CRAWFORD & CO., CLASS A | 619,458 | 497,333 | |||||

| 22,696 | CRAWFORD & CO., CLASS B | 185,565 | 145,027 | |||||

| 101,211 | DONEGAL GROUP, INC., CLASS A | 1,520,565 | 1,538,407 | |||||

| 14,965 | EAGLE BANCORP MONTANA, INC. | 263,774 | 242,583 | |||||

| 33,111 | EMPIRE BANCORP, INC.(b) | 447,702 | 324,488 | |||||

| 27,247 | ENTERPRISE FINANCIAL SERVICES CORP. | 1,135,339 | 760,464 | |||||

| 84,144 | ESSENT GROUP LTD. | 3,453,322 | 2,216,353 | |||||

| 126,661 | EXANTAS CAPITAL CORP. | 1,119,731 | 349,584 | |||||

| 68,410 | FIDUS INVESTMENT CORP. | 951,978 | 452,874 | |||||

| 6,483 | FIRST BANCSHARES (THE), INC. | 217,375 | 123,631 | |||||

| 2,892 | FIRST BANK/HAMILTON NJ | 31,447 | 20,071 | |||||

| 10,051 | FIRST HAWAIIAN, INC. | 257,790 | 166,143 | |||||

| 30,410 | FIRST MERCHANTS CORP. | 1,250,782 | 805,561 | |||||

| 9,800 | FIRST MID BANCSHARES, INC. | 335,103 | 232,652 | |||||

| 77,252 | FIRST MIDWEST BANCORP, INC. | 1,720,204 | 1,022,430 | |||||

| 7,289 | FIRST NORTHWEST BANCORP | 122,410 | 79,231 | |||||

| 24,300 | FIRSTCASH, INC. | 1,737,314 | 1,743,282 | |||||

| 42,444 | FLUSHING FINANCIAL CORP. | 873,797 | 567,052 | |||||

| 53,400 | GLACIER BANCORP, INC. | 2,184,309 | 1,815,867 | |||||

| 28,584 | HANCOCK WHITNEY CORP. | 1,332,312 | 557,960 | |||||

| 16,511 | HARBORONE BANCORP, INC.(b) | 176,523 | 124,328 | |||||

| 25,460 | HOMESTREET, INC. | 590,299 | 565,976 | |||||

| 129,059 | HOPE BANCORP, INC. | 2,110,460 | 1,060,865 | |||||

| 100,551 | INVESTCORP CREDIT MANAGEMENT BDC, INC. | 712,315 | 246,350 | |||||

| 56,532 | LAKELAND BANCORP, INC. | 948,354 | 611,111 | |||||

| 30,705 | LANDMARK BANCORP, INC. | 719,534 | 626,382 | |||||

| 15,917 | LCNB CORP. | 282,661 | 200,554 | |||||

| 6,871 | LENDINGTREE, INC.(b) | 1,868,484 | 1,260,073 | |||||

| 34,906 | LUTHER BURBANK CORP. | 376,044 | 320,088 | |||||

| 54,205 | MACKINAC FINANCIAL CORP. | 802,885 | 566,442 | |||||

| 8,240 | MAINSTREET BANCSHARES, INC.(b) | 174,029 | 138,102 | |||||

| 57,317 | MVC CAPITAL, INC. | 498,739 | 250,475 | |||||

| 4,559 | NATIONAL WESTERN LIFE GROUP, INC., CLASS A | 1,450,448 | 784,148 | |||||

| 73,058 | NEW MOUNTAIN FINANCE CORP. | 958,968 | 496,794 | |||||

| 347,973 | OAKTREE SPECIALTY LENDING CORP. | 1,540,182 | 1,127,433 | |||||

| 157,730 | OAKTREE STRATEGIC INCOME CORP. | 1,338,491 | 873,824 | |||||

| 6,913 | OCEANFIRST FINANCIAL CORP. | 147,731 | 109,986 | |||||

| 1,581 | OCONEE FEDERAL FINANCIAL CORP. | 36,347 | 28,869 | |||||

| 2,239 | ORRSTOWN FINANCIAL SERVICES, INC. | 50,483 | 30,831 | |||||

| 14,538 | PENNANTPARK FLOATING RATE CAPITAL LTD. | 168,950 | 70,655 | |||||

| 118,720 | PENNANTPARK INVESTMENT CORP. | 766,165 | 307,485 | |||||

| 6,478 | PENNS WOODS BANCORP, INC. | 181,444 | 157,415 | |||||

| 12,936 | PEOPLES BANCORP OF NORTH CAROLINA, INC. | 293,270 | 263,377 | |||||

| 34,724 | PIONEER BANCORP, INC.(b) | 469,703 | 360,435 | |||||

| 18,500 | PRA GROUP, INC.(b) | 497,957 | 512,820 | |||||

| 3,881 | SALISBURY BANCORP, INC. | 147,544 | 120,311 | |||||

| 920 | SB FINANCIAL GROUP, INC. | 15,179 | 10,230 | |||||

| 28,956 | SHORE BANCSHARES, INC. | 437,007 | 314,173 | |||||

| 2,336 | SIERRA BANCORP | 40,971 | 41,067 | |||||

| 24,283 | SIMMONS FIRST NATIONAL CORP., CLASS A | 687,172 | 446,807 | |||||

| 53,648 | SOLAR CAPITAL LTD. | 1,098,683 | 624,463 | |||||

| 72,294 | SOUTHERN NATIONAL BANCORP OF VIRGINIA, INC. | 1,136,364 | 711,373 | |||||

| 3,671 | SOUTHWEST GEORGIA FINANCIAL CORP. | 75,193 | 67,039 | |||||

| 25,567 | STIFEL FINANCIAL CORP. | 1,248,890 | 1,055,406 | |||||

| 28,558 | SUMMIT STATE BANK | 363,303 | 228,178 | |||||

| 15 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Small Companies Fund

March 31, 2020

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Financials (Cont'd): | ||||||||

| 24,400 | SYNOVUS FINANCIAL CORP. | $596,222 | 428,464 | |||||

| 123,290 | TCF FINANCIAL CORP. | 3,931,347 | 2,793,751 | |||||

| 216,518 | UMPQUA HOLDINGS CORP. | 3,322,747 | 2,360,046 | |||||

| 16,486 | UNITED BANCORP, INC. | 204,353 | 181,676 | |||||

| 5,970 | UNITED BANCSHARES, INC.(b) | 129,860 | 97,013 | |||||

| 39,315 | UNITED SECURITY BANCSHARES | 403,597 | 251,616 | |||||

| 50,770 | UNITY BANCORP, INC. | 993,903 | 594,009 | |||||

| 56,456 | UNIVEST FINANCIAL CORP. | 1,418,854 | 921,362 | |||||

| 28,400 | WALKER & DUNLOP, INC. | 485,825 | 1,143,668 | |||||

| 41,496 | WEBSTER FINANCIAL CORP. | 2,008,379 | 950,258 | |||||

| 18,716 | WEST BANCORPORATION, INC. | 392,649 | 306,007 | |||||

| 32,236 | WSFS FINANCIAL CORP. | 1,348,832 | 803,321 | |||||

| 78,401,104 | 54,869,933 | 22.47% | ||||||

| Health Care: | ||||||||

| 2,252 | ADDUS HOMECARE CORP.(b) | 149,121 | 152,235 | |||||

| 37,001 | AMN HEALTHCARE SERVICES, INC.(b) | 1,905,074 | 2,139,028 | |||||

| 174,179 | AVID BIOSERVICES, INC.(b) | 888,967 | 890,055 | |||||

| 35,981 | BIODELIVERY SCIENCES INTERNATIONAL, INC.(b) | 180,891 | 136,368 | |||||

| 54,445 | BIOTELEMETRY, INC.(b) | 2,092,647 | 2,096,677 | |||||

| 19,457 | BRUKER CORP. | 541,848 | 697,728 | |||||

| 17,924 | CROSS COUNTRY HEALTHCARE, INC.(b) | 120,486 | 120,808 | |||||

| 891 | CRYOLIFE, INC.(b) | 14,481 | 15,076 | |||||

| 21,949 | CUTERA, INC.(b) | 379,237 | 286,654 | |||||

| 22,421 | EMERGENT BIOSOLUTIONS, INC.(b) | 742,329 | 1,297,279 | |||||

| 18,632 | GLOBUS MEDICAL, INC., CLASS A(b) | 863,940 | 792,419 | |||||

| 149,202 | HARVARD BIOSCIENCE, INC.(b) | 277,134 | 329,736 | |||||

| 20,300 | HILL-ROM HOLDINGS, INC. | 1,669,613 | 2,042,180 | |||||

| 66,027 | INFUSYSTEM HOLDINGS, INC.(b) | 316,477 | 560,569 | |||||

| 52,241 | INTEGRA LIFESCIENCES HOLDINGS CORP.(b) | 3,029,139 | 2,333,605 | |||||

| 16,233 | INVACARE CORP. | 146,450 | 120,611 | |||||

| 2,558 | LEMAITRE VASCULAR, INC. | 58,604 | 63,745 | |||||

| 16,268 | LHC GROUP, INC.(b) | 1,144,737 | 2,280,774 | |||||

| 16,059 | LIGAND PHARMACEUTICALS, INC.(b)(c) | 1,259,328 | 1,167,810 | |||||

| 20,612 | LIVANOVA PLC(b)(d) | 1,881,932 | 932,693 | |||||

| 15,465 | MAGELLAN HEALTH, INC.(b) | 806,238 | 744,021 | |||||

| 52,420 | MERIDIAN BIOSCIENCE, INC.(b) | 393,523 | 440,328 | |||||

| 27,231 | NANOVIBRONIX, INC.(b) | 132,728 | 56,368 | |||||

| 110,956 | NEXTGEN HEALTHCARE, INC.(b) | 815,485 | 1,158,381 | |||||

| 31,887 | OMNICELL, INC.(b) | 1,583,959 | 2,091,149 | |||||

| 3,846 | OPTIMIZERX CORP.(b) | 27,303 | 34,845 | |||||

| 14,484 | ORTHOFIX MEDICAL, INC.(b) | 509,751 | 405,697 | |||||

| 17,948 | OWENS & MINOR, INC. | 102,910 | 164,224 | |||||

| 55,593 | PREMIER, INC., CLASS A(b) | 1,669,811 | 1,819,003 | |||||

| 30,685 | PROVIDENCE SERVICE (THE) CORP.(b) | 1,882,753 | 1,683,993 | |||||

| 55,204 | PSYCHEMEDICS CORP. | 705,029 | 333,984 | |||||

| 4,124 | SURMODICS, INC.(b) | 166,759 | 137,412 | |||||

| 32,640 | SYNEOS HEALTH, INC.(b) | 1,406,402 | 1,286,669 | |||||

| 93,545 | TRIPLE-S MANAGEMENT CORP., CLASS B(b) | 2,136,298 | 1,318,985 | |||||

| 131,119 | VAREX IMAGING CORP.(b) | 3,673,190 | 2,977,713 | |||||

| 33,674,574 | 33,108,822 | 13.56% | ||||||

| Industrials: | ||||||||

| 13,900 | ACUITY BRANDS, INC. | 1,580,104 | 1,190,674 | |||||

| 6,784 | AEROVIRONMENT, INC.(b) | 362,472 | 413,553 | |||||

| 53,320 | AIR LEASE CORP. | 1,690,020 | 1,180,505 | |||||

| 16,978 | AIR TRANSPORT SERVICES GROUP, INC.(b) | 328,342 | 310,358 | |||||

| 18,408 | ALBANY INTERNATIONAL CORP., CLASS A | 829,810 | 871,251 | |||||

| 18,840 | AMERICAN WOODMARK CORP.(b) | 1,456,760 | 858,539 | |||||

| 17,080 | APOGEE ENTERPRISES, INC. | 626,050 | 355,606 | |||||

| 44,580 | ASGN, INC.(b) | 2,140,756 | 1,574,566 | |||||

| 14,775 | ASTRONICS CORP.(b) | 239,051 | 135,635 | |||||

| 56,081 | AVIS BUDGET GROUP, INC.(b) | 1,813,050 | 779,526 | |||||

| 25,909 | BRINK'S (THE) CO. | 1,708,809 | 1,348,563 | |||||

| 29,750 | BWX TECHNOLOGIES, INC. | 1,584,869 | 1,449,122 | |||||

| 18,842 | CECO ENVIRONMENTAL CORP.(b) | 140,183 | 87,992 | |||||

| 28,028 | CIRCOR INTERNATIONAL, INC.(b) | 999,140 | 325,966 | |||||

| 101,200 | COLFAX CORP.(b) | 2,609,049 | 2,003,760 | |||||

| 7,511 | COLUMBUS MCKINNON CORP. | 202,004 | 187,775 | |||||

| 16 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Small Companies Fund

March 31, 2020

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Industrials (Cont'd): | ||||||||

| 18,300 | DONALDSON CO., INC. | $820,016 | 706,929 | |||||

| 2,648 | ECHO GLOBAL LOGISTICS, INC.(b) | 57,248 | 45,228 | |||||

| 114,095 | ENERPAC TOOL GROUP CORP. | 2,866,437 | 1,888,272 | |||||

| 6,949 | FTI CONSULTING, INC.(b) | 793,122 | 832,282 | |||||

| 103,900 | GATES INDUSTRIAL CORP. PLC(b) | 1,479,172 | 766,782 | |||||

| 8,420 | GORMAN-RUPP (THE) CO. | 253,712 | 262,788 | |||||

| 103,975 | GRAFTECH INTERNATIONAL LTD. | 1,268,775 | 844,277 | |||||

| 20,028 | GRAHAM CORP. | 381,418 | 258,361 | |||||

| 54,152 | HARSCO CORP.(b) | 1,089,203 | 377,439 | |||||

| 35,742 | HERC HOLDINGS, INC.(b) | 1,666,880 | 731,281 | |||||

| 28,700 | HEXCEL CORP. | 1,854,128 | 1,067,353 | |||||

| 35,593 | HILLENBRAND, INC. | 846,473 | 680,182 | |||||

| 88,425 | INTERFACE, INC. | 1,562,056 | 668,493 | |||||

| 155,976 | JELD-WEN HOLDING, INC.(b) | 3,543,064 | 1,517,646 | |||||

| 15,450 | KADANT, INC. | 1,308,339 | 1,153,342 | |||||

| 22,475 | KENNAMETAL, INC. | 766,618 | 418,485 | |||||

| 13,943 | KRATOS DEFENSE & SECURITY SOLUTIONS, INC.(b) | 148,985 | 192,971 | |||||

| 239,178 | LSI INDUSTRIES, INC. | 1,296,441 | 904,093 | |||||

| 21,308 | MASONITE INTERNATIONAL CORP.(b) | 1,386,488 | 1,011,065 | |||||

| 32,963 | MERCURY SYSTEMS, INC.(b) | 1,570,847 | 2,351,580 | |||||

| 4,039 | MSA SAFETY, INC. | 368,240 | 408,747 | |||||

| 183,300 | NOW, INC.(b) | 2,005,233 | 945,828 | |||||

| 15,500 | NV5 GLOBAL, INC.(b) | 708,179 | 639,995 | |||||

| 192,000 | PGT INNOVATIONS, INC.(b) | 2,936,615 | 1,610,880 | |||||

| 110,865 | PIONEER POWER SOLUTIONS, INC.(b) | 640,160 | 171,841 | |||||

| 173,867 | REV GROUP, INC. | 1,963,728 | 725,025 | |||||

| 20,700 | RUSH ENTERPRISES, INC., CLASS A | 836,685 | 660,744 | |||||

| 51,493 | RYDER SYSTEM, INC. | 2,974,569 | 1,361,475 | |||||

| 28,558 | SKYWEST, INC. | 1,256,073 | 747,934 | |||||

| 143,744 | STEELCASE, INC., CLASS A | 2,071,806 | 1,418,753 | |||||

| 87,936 | TEREX CORP. | 3,115,428 | 1,262,761 | |||||

| 72,638 | TITAN MACHINERY, INC.(b) | 1,019,946 | 631,224 | |||||

| 46,280 | TRIMAS CORP.(b) | 1,203,803 | 1,069,068 | |||||

| 3,685 | TRIUMPH GROUP, INC. | 27,658 | 24,911 | |||||

| 8,628 | VALMONT INDUSTRIES, INC. | 1,190,710 | 914,395 | |||||

| 31,878 | WOODWARD, INC. | 1,940,747 | 1,894,828 | |||||

| 67,529,471 | 44,240,649 | 18.11% | ||||||

| Information Technology: | ||||||||

| 24,286 | ASURE SOFTWARE, INC.(b)(c) | 200,316 | 144,745 | |||||

| 69,627 | AVIAT NETWORKS, INC.(b) | 1,229,827 | 591,829 | |||||

| 34,488 | AVNET, INC. | 1,429,758 | 865,649 | |||||

| 17,332 | AXT, INC.(b) | 66,632 | 55,636 | |||||

| 36,281 | BELDEN, INC. | 1,399,520 | 1,309,018 | |||||

| 304,521 | CELESTICA, INC.(b)(d) | 2,814,905 | 1,065,823 | |||||

| 66,820 | COHU, INC. | 996,412 | 827,232 | |||||

| 98,463 | DSP GROUP, INC.(b) | 1,254,137 | 1,319,404 | |||||

| 7,400 | ENTEGRIS, INC. | 184,440 | 331,298 | |||||

| 8,732 | EURONET WORLDWIDE, INC.(b) | 421,875 | 748,507 | |||||

| 7,474 | EVERBRIDGE, INC.(b) | 652,130 | 794,935 | |||||

| 42,849 | EVO PAYMENTS, INC., CLASS A(b) | 1,023,972 | 655,590 | |||||

| 19,058 | FARO TECHNOLOGIES, INC.(b) | 919,749 | 848,081 | |||||

| 73,424 | FIREEYE, INC.(b) | 1,150,430 | 776,826 | |||||

| 133,620 | FRANKLIN WIRELESS CORP.(b) | 287,454 | 545,170 | |||||

| 117,743 | FREQUENCY ELECTRONICS, INC.(b) | 1,084,285 | 1,076,171 | |||||

| 58,372 | HARMONIC, INC.(b) | 409,900 | 336,223 | |||||

| 51,237 | IDENTIV, INC.(b) | 253,058 | 173,181 | |||||

| 72,197 | IMMERSION CORP.(b) | 535,499 | 386,976 | |||||

| 254,547 | INFINERA CORP.(b) | 1,409,410 | 1,349,099 | |||||

| 48,243 | INSEEGO CORP.(b) | 295,569 | 300,554 | |||||

| 5,384 | INSIGHT ENTERPRISES, INC.(b) | 213,013 | 226,828 | |||||

| 20,401 | JABIL, INC. | 346,167 | 501,457 | |||||

| 14,682 | KBR, INC. | 250,070 | 303,624 | |||||

| 63,064 | LIMELIGHT NETWORKS, INC.(b) | 275,188 | 359,465 | |||||

| 17,202 | LUMENTUM HOLDINGS, INC.(b) | 871,654 | 1,267,787 | |||||

| 6,478 | MAXLINEAR, INC.(b) | 67,883 | 75,598 | |||||

| 6,510 | MKS INSTRUMENTS, INC. | 480,406 | 530,239 | |||||

| 27,081 | NETGEAR, INC.(b) | 488,048 | 618,530 | |||||

| 17 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Small Companies Fund

March 31, 2020

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Information Technology (Cont'd): | ||||||||

| 19,379 | NOVANTA, INC.(b) | $673,609 | 1,547,994 | |||||

| 1,819 | OSI SYSTEMS, INC.(b) | 123,758 | 125,365 | |||||

| 42,909 | PERFICIENT, INC.(b) | 814,428 | 1,162,405 | |||||

| 13,564 | PFSWEB, INC.(b) | 29,217 | 40,692 | |||||

| 7,283 | PHOTRONICS, INC.(b) | 74,325 | 74,724 | |||||

| 59,321 | PLANTRONICS, INC.(c) | 1,023,170 | 596,769 | |||||

| 19,880 | PLEXUS CORP.(b) | 1,070,588 | 1,084,653 | |||||

| 22,265 | PROS HOLDINGS, INC.(b) | 876,551 | 690,883 | |||||

| 65,846 | SCANSOURCE, INC.(b) | 2,514,326 | 1,408,446 | |||||

| 395,351 | SERVICESOURCE INTERNATIONAL, INC.(b) | 382,565 | 346,683 | |||||

| 325,211 | STEEL CONNECT, INC.(b) | 527,819 | 243,908 | |||||

| 65,575 | SUPER MICRO COMPUTER, INC.(b) | 1,361,339 | 1,395,436 | |||||

| 25,672 | SYKES ENTERPRISES, INC.(b) | 731,452 | 696,225 | |||||

| 38,529 | SYNCHRONOSS TECHNOLOGIES, INC.(b)(c) | 181,083 | 117,513 | |||||

| 14,555 | SYNNEX CORP. | 1,111,062 | 1,063,970 | |||||

| 161,416 | TIVO CORP. | 1,213,191 | 1,142,825 | |||||

| 63,816 | UNISYS CORP.(b) | 501,962 | 788,128 | |||||

| 1,094 | UPLAND SOFTWARE, INC.(b) | 27,205 | 29,341 | |||||

| 155,266 | VERRA MOBILITY CORP.(b) | 2,114,398 | 1,108,599 | |||||

| 14,757 | VIRTUSA CORP.(b) | 660,422 | 419,099 | |||||

| 8,792 | WNS HOLDINGS LTD. ADR(b)(d)(e) | 472,830 | 377,880 | |||||

| 41,460 | XPERI CORP. | 773,001 | 576,709 | |||||

| 38,270,008 | 33,423,722 | 13.68% | ||||||

| Materials: | ||||||||

| 12,052 | AMERICAN VANGUARD CORP. | 212,462 | 174,272 | |||||

| 46,800 | AXALTA COATING SYSTEMS LTD.(b) | 715,685 | 808,236 | |||||

| 43,920 | H.B. FULLER CO. | 2,345,404 | 1,226,686 | |||||

| 33,645 | INGEVITY CORP.(b) | 2,063,322 | 1,184,304 | |||||

| 30,157 | KOPPERS HOLDINGS, INC.(b) | 567,057 | 373,042 | |||||

| 89,193 | OLIN CORP. | 1,542,645 | 1,040,882 | |||||

| 13,600 | RELIANCE STEEL & ALUMINUM CO. | 981,254 | 1,191,224 | |||||

| 55,800 | SCHWEITZER-MAUDUIT INTERNATIONAL, INC. | 2,185,718 | 1,552,356 | |||||

| 10,613,547 | 7,551,002 | 3.09% | ||||||

| Real Estate: | ||||||||

| 43,309 | ALPINE INCOME PROPERTY TRUST, INC. | 779,567 | 533,134 | |||||

| 62,807 | BLUEROCK RESIDENTIAL GROWTH REIT, INC. | 531,539 | 349,835 | |||||

| 84,460 | CITY OFFICE REIT, INC.(d) | 1,080,022 | 610,646 | |||||

| 6,410 | COMMUNITY HEALTHCARE TRUST, INC. | 178,399 | 245,375 | |||||

| 19,249 | CONDOR HOSPITALITY TRUST, INC. | 137,767 | 79,113 | |||||

| 67,067 | DIAMONDROCK HOSPITALITY CO. | 728,909 | 340,700 | |||||

| 38,623 | EMPIRE STATE REALTY TRUST, INC., CLASS A | 570,007 | 346,062 | |||||

| 48,040 | ESSENTIAL PROPERTIES REALTY TRUST, INC. | 981,936 | 627,403 | |||||

| 154,248 | INDEPENDENCE REALTY TRUST, INC. | 1,873,094 | 1,378,977 | |||||

| 13,742 | INNOVATIVE INDUSTRIAL PROPERTIES, INC.(c) | 1,284,912 | 1,043,430 | |||||

| 1,335 | INVESTORS REAL ESTATE TRUST | 86,033 | 73,425 | |||||

| 24,794 | ISTAR, INC. | 255,670 | 263,064 | |||||

| 36,844 | MARCUS & MILLICHAP, INC.(b) | 1,011,318 | 998,473 | |||||

| 11,568 | MONMOUTH REAL ESTATE INVESTMENT CORP. | 137,703 | 139,394 | |||||

| 18,413 | NEXPOINT RESIDENTIAL TRUST, INC. | 501,531 | 464,192 | |||||

| 20,697 | ONE LIBERTY PROPERTIES, INC. | 528,182 | 288,309 | |||||

| 73,581 | PHYSICIANS REALTY TRUST | 1,213,857 | 1,025,719 | |||||

| 89,118 | PLYMOUTH INDUSTRIAL REIT, INC. | 1,471,789 | 994,557 | |||||

| 28,138 | QTS REALTY TRUST, INC., CLASS A | 1,340,491 | 1,632,285 | |||||

| 48,644 | RAFAEL HOLDINGS, INC., CLASS B(b) | 964,235 | 623,130 | |||||

| 69,283 | REALOGY HOLDINGS CORP.(c) | 1,827,617 | 208,542 | |||||

| 72,929 | STRATUS PROPERTIES, INC.(b) | 2,010,048 | 1,290,114 | |||||

| 43,355 | UMH PROPERTIES, INC. | 533,404 | 470,835 | |||||

| 18,076 | XENIA HOTELS & RESORTS, INC. | 368,750 | 186,183 | |||||

| 20,396,780 | 14,212,897 | 5.82% | ||||||

| Utilities: | ||||||||

| 15,530 | ALLETE, INC. | 773,168 | 942,361 | |||||

| 960 | MIDDLESEX WATER CO. | 52,791 | 57,715 | |||||

| 140,645 | PURE CYCLE CORP.(b) | 960,159 | 1,568,192 | |||||

| 24,152 | SJW GROUP | 1,508,208 | 1,395,261 | |||||

| 16,023 | SPIRE, INC. | 907,028 | 1,193,393 | |||||

| 1,923 | UNITIL CORP. | 80,410 | 100,611 | |||||

| 18 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Small Companies Fund

March 31, 2020

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Utilities (Cont'd): | ||||||||

| 805 | YORK WATER (THE) CO. | $30,127 | 34,985 | |||||

| 4,311,891 | 5,292,518 | 2.17% | ||||||

| Sub-total Common Stocks: | 309,388,935 | 228,854,864 | 93.70% | |||||

| Convertible Bonds: | ||||||||

| Health Care: | ||||||||

| 340,000 | INVACARE CORP., 4.50%, 6/1/22 | 296,098 | 305,845 | |||||

| 296,098 | 305,845 | 0.12% | ||||||

| Sub-total Convertible Bonds: | 296,098 | 305,845 | 0.12% | |||||

| Convertible Preferred Stocks: | ||||||||

| Real Estate: | ||||||||

| 6,041 | WHEELER REAL ESTATE INVESTMENT TRUST, INC.(b) | 61,499 | 40,475 | |||||

| 14,090 | WHEELER REAL ESTATE INVESTMENT TRUST, INC. (Step to 10.75% on 9/21/2023), 8.75%(b)(f) | 179,449 | 123,287 | |||||

| 240,948 | 163,762 | 0.07% | ||||||

| Sub-total Convertible Preferred Stocks: | 240,948 | 163,762 | 0.07% | |||||

| Investment Companies: | ||||||||

| Financials: | ||||||||

| 5,400 | ISHARES RUSSELL 2000 ETF | 530,051 | 618,084 | |||||

| 530,051 | 618,084 | 0.25% | ||||||

| Sub-total Investment Companies: | 530,051 | 618,084 | 0.25% | |||||

| Master Limited Partnerships: | ||||||||

| Industrials: | ||||||||

| 49,874 | STEEL PARTNERS HOLDINGS L.P.(b) | 613,881 | 270,487 | |||||

| 613,881 | 270,487 | 0.11% | ||||||

| Sub-total Master Limited Partnerships: | 613,881 | 270,487 | 0.11% | |||||

| Preferred Stocks: | ||||||||

| Industrials: | ||||||||

| 145,341 | STEEL PARTNERS HOLDINGS L.P., 6.00% | 2,356,403 | 2,460,623 | |||||

| 2,356,403 | 2,460,623 | 1.01% | ||||||

| Sub-total Preferred Stocks: | 2,356,403 | 2,460,623 | 1.01% | |||||

| Rights: | ||||||||

| Consumer Discretionary: | ||||||||

| 55,700 | MEDIA GENERAL, INC. (CONTINGENT VALUE RIGHTS)(b)(g) | - | - | |||||

| - | - | 0.00% | ||||||

| Sub-total Rights: | - | - | 0.00% | |||||

| Warrants: | ||||||||

| Health Care: | ||||||||

| 19,977 | NANOVIBRONIX, INC.(b)(g) | 200 | - | |||||