CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Core Equity Fund

September 30, 2019

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Common Stocks: | ||||||||

| Communication Services: | ||||||||

| 18,873 | ACTIVISION BLIZZARD, INC. | $289,106 | 998,759 | |||||

| 6,317 | ALPHABET, INC., CLASS A(b) | 2,474,009 | 7,713,941 | |||||

| 4,479 | ALPHABET, INC., CLASS C(b) | 1,782,514 | 5,459,901 | |||||

| 5,717 | ALTICE U.S.A, INC., CLASS A(b) | 167,165 | 163,964 | |||||

| 12,933 | AMC NETWORKS, INC., CLASS A(b) | 697,233 | 635,786 | |||||

| 81,851 | AT&T, INC. | 1,588,090 | 3,097,242 | |||||

| 300 | CABLE ONE, INC. | 113,966 | 376,410 | |||||

| 1,900 | CARS.COM, INC.(b) | 14,708 | 17,062 | |||||

| 2,214 | CENTURYLINK, INC. | 32,921 | 27,631 | |||||

| 1,929 | CHARTER COMMUNICATIONS, INC., CLASS A(b) | 79,053 | 794,979 | |||||

| 100 | CLEAR CHANNEL OUTDOOR HOLDINGS, INC.(b) | 101 | 252 | |||||

| 78,722 | COMCAST CORP., CLASS A | 1,370,904 | 3,548,788 | |||||

| 1,000 | DISCOVERY, INC., CLASS A(b) | 28,210 | 26,630 | |||||

| 5,823 | DISH NETWORK CORP., CLASS A(b) | 226,086 | 198,390 | |||||

| 11,266 | ELECTRONIC ARTS, INC.(b) | 280,102 | 1,102,040 | |||||

| 31,804 | FACEBOOK, INC., CLASS A(b) | 1,885,863 | 5,663,656 | |||||

| 2,257 | FOX CORP., CLASS A | 93,778 | 71,175 | |||||

| 1,360 | GCI LIBERTY, INC., CLASS A(b) | 51,149 | 84,415 | |||||

| 1,972 | IAC/INTERACTIVECORP(b) | 156,820 | 429,837 | |||||

| 15,600 | INTERPUBLIC GROUP OF (THE) COS., INC. | 40,950 | 336,336 | |||||

| 5,832 | LIBERTY GLOBAL PLC, CLASS A(b)(c) | 42,377 | 144,342 | |||||

| 7,374 | LIBERTY GLOBAL PLC, CLASS C(b)(c) | 51,974 | 175,427 | |||||

| 1,500 | LIONS GATE ENTERTAINMENT CORP., CLASS A(b) | 27,387 | 13,875 | |||||

| 1,600 | LIVE NATION ENTERTAINMENT, INC.(b) | 88,717 | 106,144 | |||||

| 1,100 | MATCH GROUP, INC. | 30,570 | 78,584 | |||||

| 2,211 | NETFLIX, INC.(b) | 713,130 | 591,708 | |||||

| 2,375 | NEWS CORP., CLASS A | 7,170 | 33,060 | |||||

| 27,391 | OMNICOM GROUP, INC. | 1,946,173 | 2,144,715 | |||||

| 25,971 | SINCLAIR BROADCAST GROUP, INC., CLASS A | 1,197,731 | 1,110,001 | |||||

| 14,300 | SIRIUS XM HOLDINGS, INC. | 90,452 | 89,446 | |||||

| 9,840 | SPRINT CORP.(b) | 21,187 | 60,713 | |||||

| 724 | TAKE-TWO INTERACTIVE SOFTWARE, INC.(b) | 88,784 | 90,746 | |||||

| 1,544 | TEGNA, INC. | 7,743 | 23,978 | |||||

| 1,900 | TELEPHONE & DATA SYSTEMS, INC. | 50,350 | 49,020 | |||||

| 11,308 | T-MOBILE U.S., INC.(b) | 563,139 | 890,731 | |||||

| 11,575 | TRIPADVISOR, INC.(b) | 475,048 | 447,721 | |||||

| 19,514 | TWITTER, INC.(b) | 658,803 | 803,977 | |||||

| 79,188 | VERIZON COMMUNICATIONS, INC. | 3,698,307 | 4,779,788 | |||||

| 99,994 | VIACOM, INC., CLASS B | 3,128,008 | 2,402,856 | |||||

| 32,662 | WALT DISNEY (THE) CO. | 1,126,786 | 4,256,512 | |||||

| 800 | YELP, INC.(b) | 26,800 | 27,800 | |||||

| 1,000 | ZAYO GROUP HOLDINGS, INC.(b) | 26,680 | 33,900 | |||||

| 25,440,044 | 49,102,238 | 9.61% | ||||||

| Consumer Discretionary: | ||||||||

| 1,800 | ADIENT PLC | 38,861 | 41,328 | |||||

| 1,500 | ADVANCE AUTO PARTS, INC. | 53,558 | 248,100 | |||||

| 4,880 | AMAZON.COM, INC.(b) | 1,645,127 | 8,471,241 | |||||

| 500 | APTIV PLC(c) | 30,790 | 43,710 | |||||

| 5,751 | ARAMARK | 246,182 | 250,629 | |||||

| 1,100 | AUTOLIV, INC.(c) | 13,982 | 86,768 | |||||

| 2,539 | AUTOZONE, INC.(b) | 2,185,068 | 2,753,850 | |||||

| 48,711 | BEST BUY CO., INC. | 1,665,845 | 3,360,572 | |||||

| 1,400 | BIG LOTS, INC. | 15,477 | 34,300 | |||||

| 279 | BOOKING HOLDINGS, INC.(b) | 188,278 | 547,568 | |||||

| 28,006 | BORGWARNER, INC. | 1,000,054 | 1,027,260 | |||||

| 831 | BURLINGTON STORES, INC.(b) | 85,265 | 166,050 | |||||

| 8,300 | CAESARS ENTERTAINMENT CORP.(b) | 66,994 | 96,778 | |||||

| 3,068 | CARMAX, INC.(b) | 33,093 | 269,984 | |||||

| 2,100 | CARVANA CO.(b) | 130,236 | 138,600 | |||||

| 126 | CHIPOTLE MEXICAN GRILL, INC.(b) | 100,702 | 105,899 | |||||

| 4,600 | D.R. HORTON, INC. | 22,057 | 242,466 | |||||

| 4,874 | DARDEN RESTAURANTS, INC. | 434,713 | 576,204 | |||||

| 5,977 | DICK'S SPORTING GOODS, INC. | 173,600 | 243,921 | |||||

| 3,089 | DOLLAR GENERAL CORP. | 207,226 | 490,966 | |||||

| 5,224 | DOLLAR TREE, INC.(b) | 52,773 | 596,372 | |||||

| 900 | DOMINO'S PIZZA, INC. | 90,041 | 220,131 | |||||

| 1 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Core Equity Fund

September 30, 2019

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Consumer Discretionary (Cont'd): | ||||||||

| 51,633 | EBAY, INC. | $1,643,431 | 2,012,654 | |||||

| 3,267 | EXPEDIA GROUP, INC. | 232,465 | 439,118 | |||||

| 791 | FLOOR & DECOR HOLDINGS, INC., CLASS A(b) | 22,319 | 40,460 | |||||

| 19,421 | FOOT LOCKER, INC. | 725,543 | 838,210 | |||||

| 38,163 | FORD MOTOR CO. | 164,117 | 349,573 | |||||

| 1,300 | FRONTDOOR, INC.(b) | 30,172 | 63,141 | |||||

| 1,336 | GAMESTOP CORP., CLASS A | 5,383 | 7,375 | |||||

| 5,579 | GARMIN LTD.(c) | 202,757 | 472,486 | |||||

| 2,018 | GARRETT MOTION, INC.(b)(c) | 16,668 | 20,099 | |||||

| 6,433 | GENERAL MOTORS CO. | 211,146 | 241,109 | |||||

| 15,000 | GENTEX CORP. | 106,860 | 413,025 | |||||

| 4,856 | GENUINE PARTS CO. | 261,724 | 483,609 | |||||

| 322 | GRAHAM HOLDINGS CO., CLASS B | 215,889 | 213,631 | |||||

| 2,000 | HANESBRANDS, INC. | 10,095 | 30,640 | |||||

| 400 | HASBRO, INC. | 10,206 | 47,476 | |||||

| 900 | HILTON GRAND VACATIONS, INC.(b) | 23,760 | 28,800 | |||||

| 13,767 | HOME DEPOT (THE), INC. | 1,998,411 | 3,194,219 | |||||

| 27,540 | KOHL'S CORP. | 1,190,199 | 1,367,636 | |||||

| 971 | KONTOOR BRANDS, INC. | 5,113 | 34,082 | |||||

| 2,790 | L BRANDS, INC. | 31,188 | 54,656 | |||||

| 2,538 | LAS VEGAS SANDS CORP. | 25,413 | 146,595 | |||||

| 2,900 | LENNAR CORP., CLASS A | 37,613 | 161,965 | |||||

| 58 | LENNAR CORP., CLASS B | 652 | 2,574 | |||||

| 1,200 | LKQ CORP.(b) | 14,970 | 37,740 | |||||

| 400 | LOWE'S COS., INC. | 34,236 | 43,984 | |||||

| 10,317 | LULULEMON ATHLETICA, INC.(b)(c) | 1,402,521 | 1,986,332 | |||||

| 3,800 | MACY'S, INC. | 47,081 | 59,052 | |||||

| 3,038 | MARRIOTT INTERNATIONAL, INC., CLASS A | 63,603 | 377,836 | |||||

| 294 | MARRIOTT VACATIONS WORLDWIDE CORP. | 4,103 | 30,461 | |||||

| 10,620 | MCDONALD'S CORP. | 433,348 | 2,280,220 | |||||

| 7,000 | MGM RESORTS INTERNATIONAL | 64,629 | 194,040 | |||||

| 600 | MOHAWK INDUSTRIES, INC.(b) | 26,796 | 74,442 | |||||

| 600 | MURPHY USA, INC.(b) | 4,392 | 51,180 | |||||

| 5,915 | NEWELL BRANDS, INC. | 73,613 | 110,729 | |||||

| 17,800 | NIKE, INC., CLASS B | 268,854 | 1,671,776 | |||||

| 4,300 | NORDSTROM, INC. | 45,233 | 144,781 | |||||

| 17,903 | NORWEGIAN CRUISE LINE HOLDINGS LTD.(b) | 945,659 | 926,838 | |||||

| 503 | NVR, INC.(b) | 1,170,386 | 1,869,827 | |||||

| 2,300 | O'REILLY AUTOMOTIVE, INC.(b) | 511,946 | 916,573 | |||||

| 800 | PENSKE AUTOMOTIVE GROUP, INC. | 32,264 | 37,824 | |||||

| 300 | POLARIS, INC. | 23,007 | 26,403 | |||||

| 370 | POOL CORP. | 34,226 | 74,629 | |||||

| 40,115 | PULTEGROUP, INC. | 934,810 | 1,466,203 | |||||

| 600 | PVH CORP. | 22,503 | 52,938 | |||||

| 11,545 | QURATE RETAIL, INC.(b) | 86,458 | 119,087 | |||||

| 1,500 | RALPH LAUREN CORP. | 31,320 | 143,205 | |||||

| 625 | ROKU, INC.(b) | 93,606 | 63,600 | |||||

| 4,743 | ROSS STORES, INC. | 176,855 | 521,019 | |||||

| 3,870 | ROYAL CARIBBEAN CRUISES LTD. | 82,045 | 419,237 | |||||

| 24,469 | SKECHERS U.S.A., INC., CLASS A(b) | 854,529 | 913,917 | |||||

| 50,692 | STARBUCKS CORP. | 2,326,639 | 4,482,187 | |||||

| 5,000 | TAPESTRY, INC. | 19,161 | 130,250 | |||||

| 5,646 | TARGET CORP. | 539,608 | 603,614 | |||||

| 1,260 | TESLA, INC.(b) | 165,777 | 303,496 | |||||

| 1,900 | THOR INDUSTRIES, INC. | 22,316 | 107,616 | |||||

| 1,400 | TIFFANY & CO. | 35,210 | 129,682 | |||||

| 20,188 | TJX (THE) COS., INC. | 86,033 | 1,125,279 | |||||

| 12,618 | TOLL BROTHERS, INC. | 506,759 | 517,969 | |||||

| 1,466 | TOPBUILD CORP.(b) | 11,809 | 141,366 | |||||

| 753 | ULTA BEAUTY, INC.(b) | 117,541 | 188,740 | |||||

| 8,340 | URBAN OUTFITTERS, INC.(b) | 174,368 | 234,271 | |||||

| 200 | VAIL RESORTS, INC. | 42,166 | 45,512 | |||||

| 1,100 | VEONEER, INC.(b)(c) | 5,428 | 16,489 | |||||

| 6,800 | VF CORP. | 81,950 | 605,132 | |||||

| 400 | VISTEON CORP.(b) | 24,116 | 33,016 | |||||

| 600 | WAYFAIR, INC., CLASS A(b) | 49,325 | 67,272 | |||||

| 2,695 | WHIRLPOOL CORP. | 178,025 | 426,780 | |||||

| 2 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Core Equity Fund

September 30, 2019

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Consumer Discretionary (Cont'd): | ||||||||

| 637 | WILLIAMS-SONOMA, INC. | $36,201 | 43,303 | |||||

| 1,800 | WYNN RESORTS LTD. | 52,106 | 195,696 | |||||

| 2,716 | YUM CHINA HOLDINGS, INC.(c) | 5,770 | 123,388 | |||||

| 12,654 | YUM! BRANDS, INC. | 1,086,679 | 1,435,343 | |||||

| 28,701,026 | 56,246,104 | 11.01% | ||||||

| Consumer Staples: | ||||||||

| 8,800 | ALTRIA GROUP, INC. | 564,326 | 359,920 | |||||

| 10,300 | ARCHER-DANIELS-MIDLAND CO. | 188,618 | 423,021 | |||||

| 7,290 | BROWN-FORMAN CORP., CLASS B | 57,343 | 457,666 | |||||

| 17,733 | BUNGE LTD. | 984,741 | 1,004,042 | |||||

| 28,466 | CHURCH & DWIGHT CO., INC. | 1,479,914 | 2,141,782 | |||||

| 1,125 | CLOROX (THE) CO. | 173,791 | 170,854 | |||||

| 57,881 | COCA-COLA (THE) CO. | 869,464 | 3,151,042 | |||||

| 1,380 | COLGATE-PALMOLIVE CO. | 43,344 | 101,444 | |||||

| 1,900 | CONAGRA BRANDS, INC. | 26,152 | 58,292 | |||||

| 7,649 | COSTCO WHOLESALE CORP. | 612,726 | 2,203,753 | |||||

| 7,270 | ESTEE LAUDER (THE) COS., INC., CLASS A | 694,476 | 1,446,367 | |||||

| 12,400 | GENERAL MILLS, INC. | 277,055 | 683,488 | |||||

| 5,300 | HERBALIFE NUTRITION LTD.(b) | 36,401 | 200,658 | |||||

| 4,963 | HERSHEY (THE) CO. | 575,856 | 769,215 | |||||

| 4,800 | HORMEL FOODS CORP. | 43,206 | 209,904 | |||||

| 7,814 | INGREDION, INC. | 510,701 | 638,716 | |||||

| 1,300 | JM SMUCKER (THE) CO. | 60,305 | 143,026 | |||||

| 7,643 | KEURIG DR. PEPPER, INC. | 7,519 | 208,807 | |||||

| 3,336 | KIMBERLY-CLARK CORP. | 278,758 | 473,879 | |||||

| 3,714 | KRAFT HEINZ (THE) CO. | 26,692 | 103,751 | |||||

| 76,366 | KROGER (THE) CO. | 1,477,481 | 1,968,715 | |||||

| 633 | LAMB WESTON HOLDINGS, INC. | 7,452 | 46,032 | |||||

| 700 | MCCORMICK & CO., INC. (NON VOTING) | 21,613 | 109,410 | |||||

| 4,160 | MOLSON COORS BREWING CO., CLASS B | 192,976 | 239,200 | |||||

| 6,969 | MONDELEZ INTERNATIONAL, INC., CLASS A | 94,887 | 385,525 | |||||

| 8,354 | MONSTER BEVERAGE CORP.(b) | 258,761 | 485,033 | |||||

| 232 | NU SKIN ENTERPRISES, INC., CLASS A | 8,194 | 9,867 | |||||

| 32,023 | PEPSICO, INC. | 2,796,981 | 4,390,353 | |||||

| 14,929 | PHILIP MORRIS INTERNATIONAL, INC. | 519,854 | 1,133,559 | |||||

| 14,998 | PILGRIM'S PRIDE CORP.(b) | 464,732 | 480,611 | |||||

| 700 | POST HOLDINGS, INC.(b) | 43,421 | 74,088 | |||||

| 54,829 | PROCTER & GAMBLE (THE) CO. | 2,533,075 | 6,819,631 | |||||

| 500 | SPECTRUM BRANDS HOLDINGS, INC. | 24,845 | 26,360 | |||||

| 7,700 | SYSCO CORP. | 117,906 | 611,380 | |||||

| 36,014 | TYSON FOODS, INC., CLASS A | 1,913,693 | 3,102,246 | |||||

| 35,638 | WALGREENS BOOTS ALLIANCE, INC. | 1,324,826 | 1,971,138 | |||||

| 12,104 | WALMART, INC. | 905,704 | 1,436,503 | |||||

| 20,217,789 | 38,239,278 | 7.49% | ||||||

| Energy: | ||||||||

| 1,162 | APERGY CORP.(b) | 18,689 | 31,432 | |||||

| 43,402 | CABOT OIL & GAS CORP. | 1,166,001 | 762,573 | |||||

| 32,927 | CHEVRON CORP. | 1,590,066 | 3,905,142 | |||||

| 500 | CIMAREX ENERGY CO. | 32,151 | 23,970 | |||||

| 3,600 | CNX RESOURCES CORP.(b) | 25,763 | 26,136 | |||||

| 2,200 | CONCHO RESOURCES, INC. | 101,031 | 149,380 | |||||

| 58,840 | CONOCOPHILLIPS | 2,758,298 | 3,352,703 | |||||

| 450 | CONSOL ENERGY, INC.(b) | 5,125 | 7,034 | |||||

| 2,000 | CONTINENTAL RESOURCES, INC.(b) | 20,765 | 61,580 | |||||

| 1,337 | DIAMONDBACK ENERGY, INC. | 80,335 | 120,210 | |||||

| 9,794 | ENBRIDGE, INC.(c) | 137,797 | 343,574 | |||||

| 1,400 | EOG RESOURCES, INC. | 89,751 | 103,908 | |||||

| 4,000 | EQT CORP. | 72,343 | 42,560 | |||||

| 40,851 | EXXON MOBIL CORP. | 1,591,403 | 2,884,489 | |||||

| 10,158 | HALLIBURTON CO. | 138,080 | 191,478 | |||||

| 3,100 | HELMERICH & PAYNE, INC. | 39,003 | 124,217 | |||||

| 29,864 | HOLLYFRONTIER CORP. | 1,828,955 | 1,601,905 | |||||

| 6,912 | KINDER MORGAN, INC. | 55,532 | 142,456 | |||||

| 3,652 | MARATHON PETROLEUM CORP. | 134,026 | 221,859 | |||||

| 3,000 | MURPHY OIL CORP. | 39,255 | 66,330 | |||||

| 4,022 | NATIONAL OILWELL VARCO, INC. | 51,730 | 85,266 | |||||

| 6,101 | OCCIDENTAL PETROLEUM CORP. | 58,993 | 271,311 | |||||

| 3 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Core Equity Fund

September 30, 2019

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Energy (Cont'd): | ||||||||

| 2,000 | ONEOK, INC. | $19,065 | 147,380 | |||||

| 31,900 | PARSLEY ENERGY, INC., CLASS A | 509,926 | 535,920 | |||||

| 2,400 | PATTERSON-UTI ENERGY, INC. | 24,857 | 20,520 | |||||

| 8,722 | PHILLIPS 66 | 458,328 | 893,133 | |||||

| 1,960 | PIONEER NATURAL RESOURCES CO. | 135,788 | 246,509 | |||||

| 2,600 | RANGE RESOURCES CORP. | 24,900 | 9,932 | |||||

| 2,500 | RPC, INC. | 24,681 | 14,025 | |||||

| 13,336 | SCHLUMBERGER LTD. | 222,256 | 455,691 | |||||

| 1,000 | TARGA RESOURCES CORP. | 18,740 | 40,170 | |||||

| 17,219 | VALERO ENERGY CORP. | 752,442 | 1,467,748 | |||||

| 6,100 | WPX ENERGY, INC.(b) | 60,768 | 64,599 | |||||

| 12,286,843 | 18,415,140 | 3.61% | ||||||

| Financials: | ||||||||

| 15,982 | AFLAC, INC. | 520,002 | 836,178 | |||||

| 500 | ALLEGHANY CORP.(b) | 140,685 | 398,880 | |||||

| 9,753 | ALLSTATE (THE) CORP. | 296,804 | 1,059,956 | |||||

| 19,826 | ALLY FINANCIAL, INC. | 404,611 | 657,430 | |||||

| 3,633 | AMERICAN EXPRESS CO. | 111,938 | 429,711 | |||||

| 3,400 | AMERICAN FINANCIAL GROUP, INC. | 210,306 | 366,690 | |||||

| 5,500 | AMERICAN INTERNATIONAL GROUP, INC. | 129,086 | 306,350 | |||||

| 26,690 | AMERIPRISE FINANCIAL, INC. | 2,655,512 | 3,926,099 | |||||

| 848 | AON PLC(c) | 32,575 | 164,147 | |||||

| 35,638 | ARCH CAPITAL GROUP LTD.(b)(c) | 916,635 | 1,496,083 | |||||

| 2,300 | ARTHUR J. GALLAGHER & CO. | 80,002 | 206,011 | |||||

| 4,900 | ASSURANT, INC. | 218,575 | 616,518 | |||||

| 30,441 | ASSURED GUARANTY LTD.(c) | 1,106,313 | 1,353,407 | |||||

| 4,149 | ATHENE HOLDING LTD., CLASS A(b)(c) | 181,572 | 174,507 | |||||

| 1,300 | AXIS CAPITAL HOLDINGS LTD.(c) | 43,361 | 86,736 | |||||

| 191,021 | BANK OF AMERICA CORP. | 3,039,174 | 5,572,083 | |||||

| 10,000 | BANK OF NEW YORK MELLON (THE) CORP. | 206,454 | 452,100 | |||||

| 7,900 | BB&T CORP. | 173,879 | 421,623 | |||||

| 27,906 | BERKSHIRE HATHAWAY, INC., CLASS B(b) | 3,620,611 | 5,805,006 | |||||

| 11,926 | BRIGHTHOUSE FINANCIAL, INC.(b) | 443,135 | 482,645 | |||||

| 620 | CANNAE HOLDINGS, INC.(b) | 2,893 | 17,031 | |||||

| 22,243 | CAPITAL ONE FINANCIAL CORP. | 1,525,515 | 2,023,668 | |||||

| 17,900 | CHARLES SCHWAB (THE) CORP. | 156,088 | 748,757 | |||||

| 6,250 | CHUBB LTD.(c) | 587,621 | 1,009,000 | |||||

| 50,559 | CITIGROUP, INC. | 2,887,173 | 3,492,616 | |||||

| 865 | CME GROUP, INC. | 31,878 | 182,809 | |||||

| 4,871 | COMERICA, INC. | 409,337 | 321,437 | |||||

| 500 | CREDIT ACCEPTANCE CORP.(b) | 86,421 | 230,655 | |||||

| 18,084 | DISCOVER FINANCIAL SERVICES | 813,653 | 1,466,432 | |||||

| 10,182 | E*TRADE FINANCIAL CORP. | 276,402 | 444,852 | |||||

| 469 | FAIRFAX FINANCIAL HOLDINGS LTD.(c) | 86,576 | 206,820 | |||||

| 1,863 | FIDELITY NATIONAL FINANCIAL, INC. | 15,560 | 82,736 | |||||

| 66,803 | FIFTH THIRD BANCORP | 1,622,842 | 1,829,066 | |||||

| 400 | FIRST CITIZENS BANCSHARES, INC., CLASS A | 57,523 | 188,620 | |||||

| 30,500 | FIRST HORIZON NATIONAL CORP. | 193,065 | 494,100 | |||||

| 47,824 | FRANKLIN RESOURCES, INC. | 1,452,675 | 1,380,201 | |||||

| 2,468 | GLOBE LIFE, INC. | 145,321 | 236,336 | |||||

| 8,500 | GOLDMAN SACHS GROUP (THE), INC. | 723,237 | 1,761,455 | |||||

| 3,000 | HANOVER INSURANCE GROUP (THE), INC. | 215,948 | 406,620 | |||||

| 34,960 | HARTFORD FINANCIAL SERVICES GROUP (THE), INC. | 1,663,573 | 2,118,926 | |||||

| 35,000 | HUNTINGTON BANCSHARES, INC. | 169,770 | 499,450 | |||||

| 505 | INTERCONTINENTAL EXCHANGE, INC. | 12,819 | 46,596 | |||||

| 2,700 | INVESCO LTD. | 32,171 | 45,738 | |||||

| 15,903 | JANUS HENDERSON GROUP PLC(c) | 222,792 | 357,181 | |||||

| 69,357 | JPMORGAN CHASE & CO. | 2,918,450 | 8,162,625 | |||||

| 5,904 | KEYCORP | 30,107 | 105,327 | |||||

| 1,852 | LEGG MASON, INC. | 25,956 | 70,728 | |||||

| 200 | MARKEL CORP.(b) | 67,789 | 236,380 | |||||

| 5,684 | MARSH & MCLENNAN COS., INC. | 240,120 | 568,684 | |||||

| 1,300 | MERCURY GENERAL CORP. | 38,018 | 72,644 | |||||

| 11,412 | METLIFE, INC. | 482,154 | 538,190 | |||||

| 40,278 | MGIC INVESTMENT CORP. | 530,550 | 506,697 | |||||

| 2,000 | MOODY'S CORP. | 70,550 | 409,660 | |||||

| 16,800 | MORGAN STANLEY | 240,305 | 716,856 | |||||

| 4 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Core Equity Fund

September 30, 2019

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Financials (Cont'd): | ||||||||

| 3,900 | MSCI, INC. | $124,722 | 849,225 | |||||

| 5,900 | NASDAQ, INC. | 240,309 | 586,165 | |||||

| 1,700 | NEW RESIDENTIAL INVESTMENT CORP. | 23,886 | 26,656 | |||||

| 4,539 | PACWEST BANCORP | 65,912 | 164,947 | |||||

| 8,925 | PNC FINANCIAL SERVICES GROUP (THE), INC. | 328,223 | 1,250,928 | |||||

| 23,112 | POPULAR, INC. | 1,233,526 | 1,249,897 | |||||

| 5,628 | PRINCIPAL FINANCIAL GROUP, INC. | 175,248 | 321,584 | |||||

| 9,491 | PROGRESSIVE (THE) CORP. | 285,859 | 733,180 | |||||

| 5,900 | PRUDENTIAL FINANCIAL, INC. | 182,565 | 530,705 | |||||

| 17,302 | REGIONS FINANCIAL CORP. | 116,601 | 273,718 | |||||

| 3,371 | REINSURANCE GROUP OF AMERICA, INC. | 296,860 | 538,955 | |||||

| 800 | RENAISSANCERE HOLDINGS LTD.(c) | 81,779 | 154,760 | |||||

| 3,151 | ROYAL BANK OF CANADA(c) | 75,538 | 255,735 | |||||

| 735 | S&P GLOBAL, INC. | 24,183 | 180,060 | |||||

| 7,500 | SEI INVESTMENTS CO. | 108,537 | 444,413 | |||||

| 10,100 | SLM CORP. | 36,679 | 89,133 | |||||

| 5,825 | SUNTRUST BANKS, INC. | 141,999 | 400,760 | |||||

| 9,432 | SYNCHRONY FINANCIAL | 285,461 | 321,537 | |||||

| 3,657 | SYNOVUS FINANCIAL CORP. | 49,372 | 130,774 | |||||

| 3,549 | T. ROWE PRICE GROUP, INC. | 106,978 | 405,473 | |||||

| 2,946 | TCF FINANCIAL CORP. | 51,834 | 112,154 | |||||

| 2,600 | TFS FINANCIAL CORP. | 25,038 | 46,852 | |||||

| 8,514 | TRAVELERS (THE) COS., INC. | 814,739 | 1,265,947 | |||||

| 17,585 | US BANCORP | 318,503 | 973,154 | |||||

| 26,345 | VOYA FINANCIAL, INC. | 1,415,896 | 1,434,222 | |||||

| 9,159 | W.R. BERKLEY CORP. | 273,043 | 661,555 | |||||

| 1,800 | WASHINGTON FEDERAL, INC. | 23,535 | 66,582 | |||||

| 64,102 | WELLS FARGO & CO. | 1,227,804 | 3,233,305 | |||||

| 2,604 | WILLIS TOWERS WATSON PLC(c) | 454,330 | 502,494 | |||||

| 2,600 | ZIONS BANCORP N.A. | 49,361 | 115,752 | |||||

| 41,204,402 | 73,111,675 | 14.32% | ||||||

| Health Care: | ||||||||

| 17,530 | ABBOTT LABORATORIES | 620,869 | 1,466,735 | |||||

| 21,711 | ABBVIE, INC. | 939,598 | 1,643,957 | |||||

| 1,000 | ACADIA HEALTHCARE CO., INC.(b) | 25,720 | 31,080 | |||||

| 4,120 | AGILENT TECHNOLOGIES, INC. | 181,587 | 315,716 | |||||

| 2,402 | ALEXION PHARMACEUTICALS, INC.(b) | 163,012 | 235,252 | |||||

| 1,391 | ALIGN TECHNOLOGY, INC.(b) | 181,009 | 251,660 | |||||

| 800 | ALKERMES PLC(b)(c) | 23,616 | 15,608 | |||||

| 2,233 | ALLERGAN PLC | 259,023 | 375,791 | |||||

| 34,879 | AMERISOURCEBERGEN CORP. | 2,476,727 | 2,871,588 | |||||

| 22,317 | AMGEN, INC. | 4,138,952 | 4,318,563 | |||||

| 7,050 | ANTHEM, INC. | 381,518 | 1,692,705 | |||||

| 193 | AVANOS MEDICAL, INC.(b) | 3,014 | 7,230 | |||||

| 11,819 | BAXTER INTERNATIONAL, INC. | 695,717 | 1,033,808 | |||||

| 3,965 | BECTON DICKINSON AND CO. | 492,312 | 1,002,986 | |||||

| 7,465 | BIOGEN, INC.(b) | 1,876,095 | 1,738,001 | |||||

| 400 | BIOMARIN PHARMACEUTICAL, INC.(b) | 34,064 | 26,960 | |||||

| 3,200 | BLUEBIRD BIO, INC.(b) | 414,307 | 293,824 | |||||

| 32,800 | BOSTON SCIENTIFIC CORP.(b) | 182,160 | 1,334,632 | |||||

| 26,348 | BRISTOL-MYERS SQUIBB CO. | 785,333 | 1,336,107 | |||||

| 2,145 | BRUKER CORP. | 43,219 | 94,230 | |||||

| 500 | CANTEL MEDICAL CORP. | 37,230 | 37,400 | |||||

| 39,916 | CARDINAL HEALTH, INC. | 1,824,313 | 1,883,636 | |||||

| 5,880 | CELGENE CORP.(b) | 324,200 | 583,884 | |||||

| 3,704 | CENTENE CORP.(b) | 106,465 | 160,235 | |||||

| 3,600 | CERNER CORP. | 40,604 | 245,412 | |||||

| 2,249 | CHARLES RIVER LABORATORIES INTERNATIONAL, INC.(b) | 312,774 | 297,700 | |||||

| 7,042 | CIGNA CORP. | 236,060 | 1,068,905 | |||||

| 200 | COOPER (THE) COS., INC. | 50,902 | 59,400 | |||||

| 1,520 | COVETRUS, INC.(b) | 18,619 | 18,073 | |||||

| 7,625 | CVS HEALTH CORP. | 236,748 | 480,909 | |||||

| 10,529 | DANAHER CORP. | 287,475 | 1,520,703 | |||||

| 5,632 | DENTSPLY SIRONA, INC. | 152,472 | 300,242 | |||||

| 1,500 | DEXCOM, INC.(b) | 87,312 | 223,860 | |||||

| 9,526 | EDWARDS LIFESCIENCES CORP.(b) | 248,804 | 2,094,863 | |||||

| 15,281 | ELI LILLY & CO. | 1,083,845 | 1,708,874 | |||||

| 5 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Core Equity Fund

September 30, 2019

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Health Care (Cont'd): | ||||||||

| 1,400 | EXACT SCIENCES CORP.(b) | $111,825 | 126,518 | |||||

| 80,061 | EXELIXIS, INC.(b) | 1,655,671 | 1,415,879 | |||||

| 19,320 | GILEAD SCIENCES, INC. | 160,676 | 1,224,502 | |||||

| 2,237 | HCA HEALTHCARE, INC. | 238,333 | 269,379 | |||||

| 3,800 | HENRY SCHEIN, INC.(b) | 67,547 | 241,300 | |||||

| 6,608 | HOLOGIC, INC.(b) | 92,603 | 333,638 | |||||

| 5,942 | HORIZON THERAPEUTICS PLC(b) | 137,546 | 161,801 | |||||

| 200 | ICU MEDICAL, INC.(b) | 45,928 | 31,920 | |||||

| 2,299 | IDEXX LABORATORIES, INC.(b) | 98,745 | 625,167 | |||||

| 2,300 | ILLUMINA, INC.(b) | 98,233 | 699,706 | |||||

| 1,900 | INCYTE CORP.(b) | 120,836 | 141,037 | |||||

| 900 | INSULET CORP.(b) | 71,397 | 148,437 | |||||

| 6,500 | INTERCEPT PHARMACEUTICALS, INC.(b) | 416,369 | 431,340 | |||||

| 462 | INTUITIVE SURGICAL, INC.(b) | 100,629 | 249,448 | |||||

| 268 | IONIS PHARMACEUTICALS, INC.(b) | 12,689 | 16,056 | |||||

| 4,358 | IQVIA HOLDINGS, INC.(b) | 434,765 | 650,998 | |||||

| 2,501 | JAZZ PHARMACEUTICALS PLC(b)(c) | 318,044 | 320,478 | |||||

| 22,372 | JOHNSON & JOHNSON | 1,280,869 | 2,894,489 | |||||

| 842 | LABORATORY CORP. OF AMERICA HOLDINGS(b) | 53,269 | 141,456 | |||||

| 9,174 | MCKESSON CORP. | 696,055 | 1,253,719 | |||||

| 9,400 | MEDTRONIC PLC(c) | 790,465 | 1,021,028 | |||||

| 75,140 | MERCK & CO., INC. | 3,469,125 | 6,325,285 | |||||

| 1,317 | METTLER-TOLEDO INTERNATIONAL, INC.(b) | 123,051 | 927,695 | |||||

| 200 | MOLINA HEALTHCARE, INC.(b) | 23,246 | 21,944 | |||||

| 28,896 | MYLAN N.V.(b) | 548,148 | 571,563 | |||||

| 1,700 | NEKTAR THERAPEUTICS(b) | 55,893 | 30,965 | |||||

| 300 | PENUMBRA, INC.(b) | 36,663 | 40,347 | |||||

| 91,655 | PFIZER, INC. | 2,533,196 | 3,293,164 | |||||

| 4,791 | RESMED, INC. | 129,046 | 647,312 | |||||

| 200 | SAGE THERAPEUTICS, INC.(b) | 19,160 | 28,058 | |||||

| 12,763 | STERIS PLC | 1,598,760 | 1,844,126 | |||||

| 1,800 | TELEFLEX, INC. | 195,858 | 611,550 | |||||

| 11,147 | THERMO FISHER SCIENTIFIC, INC. | 1,195,862 | 3,246,787 | |||||

| 13,546 | UNITEDHEALTH GROUP, INC. | 1,342,430 | 2,943,817 | |||||

| 3,772 | UNIVERSAL HEALTH SERVICES, INC., CLASS B | 251,140 | 561,085 | |||||

| 1,880 | VAREX IMAGING CORP.(b) | 19,829 | 53,655 | |||||

| 5,199 | VARIAN MEDICAL SYSTEMS, INC.(b) | 193,000 | 619,149 | |||||

| 499 | VEEVA SYSTEMS, INC., CLASS A(b) | 19,015 | 76,192 | |||||

| 900 | VERTEX PHARMACEUTICALS, INC.(b) | 22,442 | 152,478 | |||||

| 2,600 | WATERS CORP.(b) | 60,997 | 580,398 | |||||

| 294 | WELLCARE HEALTH PLANS, INC.(b) | 80,065 | 76,196 | |||||

| 4,304 | ZIMMER BIOMET HOLDINGS, INC. | 233,961 | 590,810 | |||||

| 1,159 | ZOETIS, INC. | 110,713 | 144,400 | |||||

| 38,229,769 | 66,555,801 | 13.03% | ||||||

| Industrials: | ||||||||

| 6,987 | 3M CO. | 417,187 | 1,148,663 | |||||

| 923 | ACCO BRANDS CORP. | 3,137 | 9,110 | |||||

| 300 | ACUITY BRANDS, INC. | 34,488 | 40,437 | |||||

| 4,642 | AGCO CORP. | 225,963 | 351,399 | |||||

| 900 | AIR LEASE CORP. | 17,685 | 37,638 | |||||

| 1,533 | ALLEGION PLC(c) | 40,913 | 158,895 | |||||

| 400 | AMERCO | 120,202 | 156,016 | |||||

| 1,700 | AMERICAN AIRLINES GROUP, INC. | 67,418 | 45,849 | |||||

| 5,175 | AMETEK, INC. | 73,220 | 475,168 | |||||

| 6,036 | BOEING (THE) CO. | 284,621 | 2,296,517 | |||||

| 1,200 | BWX TECHNOLOGIES, INC. | 54,215 | 68,652 | |||||

| 5,604 | CARLISLE COS., INC. | 470,886 | 815,606 | |||||

| 10,504 | CATERPILLAR, INC. | 272,491 | 1,326,760 | |||||

| 3,200 | CINTAS CORP. | 258,101 | 857,920 | |||||

| 5,739 | CRANE CO. | 189,222 | 462,736 | |||||

| 3,724 | CSX CORP. | 136,592 | 257,961 | |||||

| 11,778 | CUMMINS, INC. | 1,836,703 | 1,915,927 | |||||

| 7,300 | DEERE & CO. | 199,160 | 1,231,364 | |||||

| 10,100 | DELTA AIR LINES, INC. | 100,965 | 581,760 | |||||

| 16,994 | DOVER CORP. | 1,336,522 | 1,691,923 | |||||

| 16,254 | EATON CORP. PLC | 495,276 | 1,351,520 | |||||

| 2,280 | EXPEDITORS INTERNATIONAL OF WASHINGTON, INC. | 112,692 | 169,381 | |||||

| 6 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Core Equity Fund

September 30, 2019

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Industrials (Cont'd): | ||||||||

| 5,753 | FEDEX CORP. | $113,466 | 837,464 | |||||

| 782 | FLUOR CORP. | 10,432 | 14,960 | |||||

| 3,953 | FORTIVE CORP. | 71,279 | 271,018 | |||||

| 4,300 | FORTUNE BRANDS HOME & SECURITY, INC. | 33,889 | 235,210 | |||||

| 1,400 | GATX CORP. | 24,276 | 108,542 | |||||

| 2,828 | GENERAL DYNAMICS CORP. | 423,356 | 516,760 | |||||

| 94,400 | GENERAL ELECTRIC CO. | 715,085 | 843,936 | |||||

| 2,836 | HEICO CORP. | 339,739 | 354,160 | |||||

| 2,156 | HEICO CORP., CLASS A | 109,365 | 209,800 | |||||

| 360 | HERC HOLDINGS, INC.(b) | 5,808 | 16,744 | |||||

| 9,188 | HONEYWELL INTERNATIONAL, INC. | 265,803 | 1,554,610 | |||||

| 1,200 | HUBBELL, INC. | 43,310 | 157,680 | |||||

| 1,423 | HUNTINGTON INGALLS INDUSTRIES, INC. | 192,370 | 301,377 | |||||

| 2,271 | IDEX CORP. | 140,770 | 372,171 | |||||

| 4,824 | ILLINOIS TOOL WORKS, INC. | 155,812 | 754,908 | |||||

| 10,505 | INGERSOLL-RAND PLC | 631,190 | 1,294,321 | |||||

| 1,468 | JACOBS ENGINEERING GROUP, INC. | 29,713 | 134,322 | |||||

| 2,100 | JB HUNT TRANSPORT SERVICES, INC. | 40,530 | 232,365 | |||||

| 13,203 | JETBLUE AIRWAYS CORP.(b) | 81,151 | 221,150 | |||||

| 859 | JOHNSON CONTROLS INTERNATIONAL PLC | 16,341 | 37,701 | |||||

| 1,200 | KANSAS CITY SOUTHERN | 19,170 | 159,612 | |||||

| 4,274 | L3HARRIS TECHNOLOGIES, INC. | 274,846 | 891,727 | |||||

| 5,697 | LENNOX INTERNATIONAL, INC. | 1,235,207 | 1,384,200 | |||||

| 1,400 | LINCOLN ELECTRIC HOLDINGS, INC. | 28,970 | 121,464 | |||||

| 1,990 | LOCKHEED MARTIN CORP. | 352,779 | 776,219 | |||||

| 1,200 | MANITOWOC (THE) CO., INC.(b) | 10,053 | 15,000 | |||||

| 3,458 | MANPOWERGROUP, INC. | 175,281 | 291,302 | |||||

| 15,263 | MASCO CORP. | 139,724 | 636,162 | |||||

| 200 | MIDDLEBY (THE) CORP.(b) | 20,548 | 23,380 | |||||

| 1,100 | NIELSEN HOLDINGS PLC | 29,762 | 23,375 | |||||

| 577 | NORDSON CORP. | 57,299 | 84,392 | |||||

| 1,702 | NORFOLK SOUTHERN CORP. | 117,419 | 305,781 | |||||

| 5,973 | NORTHROP GRUMMAN CORP. | 516,333 | 2,238,621 | |||||

| 2,519 | NVENT ELECTRIC PLC(c) | 24,113 | 55,519 | |||||

| 7,480 | OSHKOSH CORP. | 303,782 | 566,984 | |||||

| 1,100 | OWENS CORNING | 22,578 | 69,520 | |||||

| 1,067 | PACCAR, INC. | 47,468 | 74,701 | |||||

| 4,628 | PARKER-HANNIFIN CORP. | 350,966 | 835,863 | |||||

| 2,519 | PENTAIR PLC(c) | 49,295 | 95,218 | |||||

| 4,100 | QUANTA SERVICES, INC. | 52,131 | 154,980 | |||||

| 1,157 | RAYTHEON CO. | 32,516 | 226,992 | |||||

| 14,185 | REPUBLIC SERVICES, INC. | 880,819 | 1,227,712 | |||||

| 1,531 | RESIDEO TECHNOLOGIES, INC.(b) | 8,723 | 21,970 | |||||

| 9,210 | ROCKWELL AUTOMATION, INC. | 692,444 | 1,517,808 | |||||

| 2,580 | ROLLINS, INC. | 67,194 | 87,901 | |||||

| 700 | ROPER TECHNOLOGIES, INC. | 94,317 | 249,620 | |||||

| 2,015 | SNAP-ON, INC. | 191,097 | 315,428 | |||||

| 36,059 | SOUTHWEST AIRLINES CO. | 1,509,573 | 1,947,547 | |||||

| 10,578 | SPIRIT AEROSYSTEMS HOLDINGS, INC., CLASS A | 617,169 | 869,935 | |||||

| 2,557 | STANLEY BLACK & DECKER, INC. | 72,048 | 369,256 | |||||

| 600 | STERICYCLE, INC.(b) | 18,858 | 30,558 | |||||

| 47,961 | TEXTRON, INC. | 2,638,281 | 2,348,171 | |||||

| 5,162 | TIMKEN (THE) CO. | 171,352 | 224,599 | |||||

| 1,596 | TORO (THE) CO. | 76,510 | 116,987 | |||||

| 500 | TRANSDIGM GROUP, INC. | 176,409 | 260,335 | |||||

| 8,643 | UNION PACIFIC CORP. | 137,416 | 1,399,993 | |||||

| 7,361 | UNITED AIRLINES HOLDINGS, INC.(b) | 505,701 | 650,786 | |||||

| 3,540 | UNITED PARCEL SERVICE, INC., CLASS B | 166,527 | 424,163 | |||||

| 2,565 | UNITED RENTALS, INC.(b) | 196,251 | 319,702 | |||||

| 11,340 | UNITED TECHNOLOGIES CORP. | 444,920 | 1,548,137 | |||||

| 3,634 | VERISK ANALYTICS, INC. | 459,914 | 574,681 | |||||

| 180 | VERITIV CORP.(b) | 1,653 | 3,254 | |||||

| 700 | W.W. GRAINGER, INC. | 30,601 | 208,005 | |||||

| 1,707 | WABTEC CORP. | 60,644 | 122,665 | |||||

| 975 | WASTE CONNECTIONS, INC. | 42,575 | 89,700 | |||||

| 26,746 | WASTE MANAGEMENT, INC. | 1,728,843 | 3,075,790 | |||||

| 4,800 | WELBILT, INC.(b) | 37,515 | 80,928 | |||||

| 7 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Core Equity Fund

September 30, 2019

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Industrials (Cont'd): | ||||||||

| 1,600 | XYLEM, INC. | $30,618 | 127,392 | |||||

| 25,109,556 | 51,164,436 | 10.02% | ||||||

| Information Technology: | ||||||||

| 6,512 | 2U, INC.(b) | 99,017 | 106,015 | |||||

| 4,949 | ACCENTURE PLC, CLASS A(c) | 304,426 | 951,940 | |||||

| 8,492 | ADOBE, INC.(b) | 643,139 | 2,345,915 | |||||

| 10,700 | ADVANCED MICRO DEVICES, INC.(b) | 115,242 | 310,193 | |||||

| 14,739 | AKAMAI TECHNOLOGIES, INC.(b) | 844,826 | 1,346,850 | |||||

| 1,600 | ALLIANCE DATA SYSTEMS CORP. | 75,650 | 205,008 | |||||

| 836 | ALTERYX, INC., CLASS A(b) | 96,023 | 89,811 | |||||

| 4,065 | AMDOCS LTD. | 200,086 | 268,737 | |||||

| 400 | AMPHENOL CORP., CLASS A | 35,916 | 38,600 | |||||

| 8,600 | ANALOG DEVICES, INC. | 120,368 | 960,878 | |||||

| 1,200 | ANSYS, INC.(b) | 30,630 | 265,632 | |||||

| 64,552 | APPLE, INC. | 3,135,046 | 14,457,711 | |||||

| 7,400 | APPLIED MATERIALS, INC. | 134,145 | 369,260 | |||||

| 1,109 | ARISTA NETWORKS, INC.(b) | 215,910 | 264,962 | |||||

| 4,877 | ARROW ELECTRONICS, INC.(b) | 267,343 | 363,727 | |||||

| 1,300 | ATLASSIAN CORP. PLC, CLASS A(b)(c) | 116,369 | 163,072 | |||||

| 2,586 | AUTODESK, INC.(b) | 163,995 | 381,952 | |||||

| 8,749 | AUTOMATIC DATA PROCESSING, INC. | 687,276 | 1,412,264 | |||||

| 7,371 | BLACK KNIGHT, INC.(b) | 272,636 | 450,073 | |||||

| 9,493 | BOOZ ALLEN HAMILTON HOLDING CORP. | 296,190 | 674,193 | |||||

| 5,291 | BROADCOM, INC. | 497,844 | 1,460,686 | |||||

| 3,413 | BROADRIDGE FINANCIAL SOLUTIONS, INC. | 106,898 | 424,680 | |||||

| 1,062 | CACI INTERNATIONAL, INC., CLASS A(b) | 224,187 | 245,598 | |||||

| 45,475 | CADENCE DESIGN SYSTEMS, INC.(b) | 2,416,925 | 3,004,988 | |||||

| 1,522 | CDK GLOBAL, INC. | 19,712 | 73,193 | |||||

| 7,000 | CDW CORP. | 292,424 | 862,680 | |||||

| 3,204 | CIENA CORP.(b) | 135,352 | 125,693 | |||||

| 95,434 | CISCO SYSTEMS, INC. | 2,057,712 | 4,715,394 | |||||

| 26,947 | CITRIX SYSTEMS, INC. | 2,745,411 | 2,600,924 | |||||

| 10,090 | COGNEX CORP. | 458,211 | 495,722 | |||||

| 6,073 | COGNIZANT TECHNOLOGY SOLUTIONS CORP., CLASS A | 232,761 | 365,989 | |||||

| 400 | COHERENT, INC.(b) | 51,825 | 61,488 | |||||

| 6,700 | CORELOGIC, INC.(b) | 76,313 | 310,009 | |||||

| 21,889 | CORNING, INC. | 229,346 | 624,274 | |||||

| 2,700 | CYPRESS SEMICONDUCTOR CORP. | 3,261 | 63,018 | |||||

| 1,635 | DELL TECHNOLOGIES, INC., CLASS C(b) | 75,203 | 84,791 | |||||

| 700 | DOCUSIGN, INC.(b) | 29,771 | 43,344 | |||||

| 2,000 | DOLBY LABORATORIES, INC., CLASS A | 43,420 | 129,280 | |||||

| 5,511 | DXC TECHNOLOGY CO. | 164,609 | 162,575 | |||||

| 1,640 | ECHOSTAR CORP., CLASS A(b) | 21,050 | 64,977 | |||||

| 400 | ELASTIC N.V.(b) | 28,596 | 32,936 | |||||

| 454 | EPAM SYSTEMS, INC.(b) | 75,613 | 82,773 | |||||

| 300 | EURONET WORLDWIDE, INC.(b) | 25,458 | 43,890 | |||||

| 1,706 | F5 NETWORKS, INC.(b) | 87,537 | 239,557 | |||||

| 15,038 | FIDELITY NATIONAL INFORMATION SERVICES, INC. | 811,732 | 1,996,445 | |||||

| 1,000 | FIRST SOLAR, INC.(b) | 46,410 | 58,010 | |||||

| 9,784 | FISERV, INC.(b) | 172,685 | 1,013,525 | |||||

| 2,135 | FLEETCOR TECHNOLOGIES, INC.(b) | 508,464 | 612,275 | |||||

| 5,523 | FORTINET, INC.(b) | 393,491 | 423,945 | |||||

| 200 | GARTNER, INC.(b) | 25,570 | 28,598 | |||||

| 5,709 | GLOBAL PAYMENTS, INC. | 297,587 | 907,667 | |||||

| 1,700 | GODADDY, INC., CLASS A(b) | 98,073 | 112,166 | |||||

| 18,800 | HEWLETT PACKARD ENTERPRISE CO. | 102,062 | 285,196 | |||||

| 27,110 | HP, INC. | 537,314 | 512,921 | |||||

| 78,531 | INTEL CORP. | 1,044,485 | 4,046,702 | |||||

| 4,878 | INTERNATIONAL BUSINESS MACHINES CORP. | 495,522 | 709,359 | |||||

| 8,888 | INTUIT, INC. | 740,106 | 2,363,675 | |||||

| 500 | IPG PHOTONICS CORP.(b) | 74,090 | 67,800 | |||||

| 8,167 | KEYSIGHT TECHNOLOGIES, INC.(b) | 500,288 | 794,241 | |||||

| 9,185 | LAM RESEARCH CORP. | 803,602 | 2,122,745 | |||||

| 25,718 | LEIDOS HOLDINGS, INC. | 2,073,203 | 2,208,662 | |||||

| 827 | LOGMEIN, INC. | 17,893 | 58,684 | |||||

| 2,240 | MANHATTAN ASSOCIATES, INC.(b) | 148,410 | 180,701 | |||||

| 3,770 | MARVELL TECHNOLOGY GROUP LTD. | 20,234 | 94,137 | |||||

| 8 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Core Equity Fund

September 30, 2019

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Information Technology (Cont'd): | ||||||||

| 6,976 | MASTERCARD, INC., CLASS A | $1,370,547 | 1,894,472 | |||||

| 2,141 | MICRO FOCUS INTERNATIONAL PLC ADR(c)(d) | 76,184 | 30,295 | |||||

| 4,200 | MICROCHIP TECHNOLOGY, INC. | 38,962 | 390,222 | |||||

| 57,318 | MICRON TECHNOLOGY, INC.(b) | 1,429,930 | 2,456,076 | |||||

| 111,008 | MICROSOFT CORP. | 3,664,650 | 15,433,442 | |||||

| 500 | MKS INSTRUMENTS, INC. | 32,310 | 46,140 | |||||

| 3,000 | NETAPP, INC. | 209,810 | 157,530 | |||||

| 1,500 | NUTANIX, INC., CLASS A(b) | 63,843 | 39,375 | |||||

| 3,491 | NVIDIA CORP. | 68,182 | 607,678 | |||||

| 38,526 | NXP SEMICONDUCTORS N.V.(c) | 3,533,140 | 4,203,957 | |||||

| 597 | OKTA, INC.(b) | 55,185 | 58,781 | |||||

| 50,841 | ON SEMICONDUCTOR CORP.(b) | 1,131,101 | 976,656 | |||||

| 42,624 | ORACLE CORP. | 2,250,952 | 2,345,599 | |||||

| 2,800 | PALO ALTO NETWORKS, INC.(b) | 116,508 | 570,724 | |||||

| 1,952 | PAYCHEX, INC. | 139,107 | 161,567 | |||||

| 1,553 | PAYCOM SOFTWARE, INC.(b) | 217,948 | 325,338 | |||||

| 7,600 | PAYPAL HOLDINGS, INC.(b) | 595,521 | 787,284 | |||||

| 907 | PERSPECTA, INC. | 8,504 | 23,691 | |||||

| 600 | PROOFPOINT, INC.(b) | 56,232 | 77,430 | |||||

| 2,700 | PTC, INC.(b) | 107,547 | 184,086 | |||||

| 2,400 | PURE STORAGE, INC., CLASS A(b) | 43,850 | 40,656 | |||||

| 2,403 | QORVO, INC.(b) | 185,625 | 178,158 | |||||

| 5,641 | QUALCOMM, INC. | 437,723 | 430,296 | |||||

| 3,800 | RINGCENTRAL, INC., CLASS A(b) | 432,566 | 477,508 | |||||

| 3,100 | SABRE CORP. | 62,820 | 69,425 | |||||

| 8,372 | SALESFORCE.COM, INC.(b) | 147,727 | 1,242,740 | |||||

| 51,085 | SEAGATE TECHNOLOGY PLC | 1,775,211 | 2,747,862 | |||||

| 2,100 | SERVICENOW, INC.(b) | 273,110 | 533,085 | |||||

| 2,258 | SKYWORKS SOLUTIONS, INC. | 182,369 | 178,947 | |||||

| 500 | SPLUNK, INC.(b) | 40,835 | 58,930 | |||||

| 5,200 | SQUARE, INC., CLASS A(b) | 284,188 | 322,140 | |||||

| 1,938 | SS&C TECHNOLOGIES HOLDINGS, INC. | 86,602 | 99,943 | |||||

| 14,419 | SYMANTEC CORP. | 71,242 | 340,721 | |||||

| 7,159 | SYNOPSYS, INC.(b) | 532,601 | 982,573 | |||||

| 4,600 | TERADYNE, INC. | 82,730 | 266,386 | |||||

| 28,440 | TEXAS INSTRUMENTS, INC. | 952,040 | 3,675,586 | |||||

| 7,720 | TRIMBLE, INC.(b) | 113,413 | 299,613 | |||||

| 200 | VERISIGN, INC.(b) | 23,200 | 37,726 | |||||

| 787 | VERSUM MATERIALS, INC. | 4,722 | 41,656 | |||||

| 25,078 | VISA, INC., CLASS A | 657,962 | 4,313,667 | |||||

| 7,800 | VISHAY INTERTECHNOLOGY, INC. | 48,931 | 132,054 | |||||

| 3,772 | VMWARE, INC., CLASS A | 185,543 | 566,026 | |||||

| 6,045 | WESTERN DIGITAL CORP. | 99,733 | 360,524 | |||||

| 129,026 | WESTERN UNION (THE) CO. | 2,606,278 | 2,989,532 | |||||

| 300 | WEX, INC.(b) | 41,025 | 60,621 | |||||

| 1,700 | WORKDAY, INC., CLASS A(b) | 254,727 | 288,932 | |||||

| 1,184 | XEROX HOLDINGS CORP. | 33,188 | 35,413 | |||||

| 6,750 | XILINX, INC. | 47,180 | 647,325 | |||||

| 2,795 | ZEBRA TECHNOLOGIES CORP., CLASS A(b) | 414,834 | 576,804 | |||||

| 1,300 | ZENDESK, INC.(b) | 79,216 | 94,744 | |||||

| 52,232,247 | 113,202,642 | 22.17% | ||||||

| Materials: | ||||||||

| 1,075 | AIR PRODUCTS & CHEMICALS, INC. | 43,205 | 238,499 | |||||

| 1,300 | ALBEMARLE CORP. | 29,152 | 90,376 | |||||

| 13,770 | AMCOR PLC(c) | 60,200 | 134,258 | |||||

| 700 | ASHLAND GLOBAL HOLDINGS, INC. | 12,006 | 53,935 | |||||

| 3,165 | AVERY DENNISON CORP. | 207,899 | 359,449 | |||||

| 2,592 | BALL CORP. | 140,020 | 188,724 | |||||

| 8,171 | CELANESE CORP. | 742,734 | 999,232 | |||||

| 23,053 | CF INDUSTRIES HOLDINGS, INC. | 1,111,919 | 1,134,208 | |||||

| 2,400 | CHEMOURS (THE) CO. | 69,007 | 35,856 | |||||

| 7,262 | CORTEVA, INC. | 88,857 | 203,336 | |||||

| 1,800 | CROWN HOLDINGS, INC.(b) | 57,831 | 118,908 | |||||

| 7,262 | DOW, INC. | 147,036 | 346,034 | |||||

| 7,262 | DUPONT DE NEMOURS, INC. | 212,802 | 517,853 | |||||

| 3,000 | EASTMAN CHEMICAL CO. | 58,011 | 221,490 | |||||

| 3,891 | ECOLAB, INC. | 133,579 | 770,574 | |||||

| 9 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Core Equity Fund

September 30, 2019

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Materials (Cont'd): | ||||||||

| 4,400 | ELEMENT SOLUTIONS, INC.(b) | $42,294 | 44,792 | |||||

| 15,800 | FREEPORT-MCMORAN, INC. | 103,648 | 151,206 | |||||

| 238 | INTERNATIONAL FLAVORS & FRAGRANCES, INC. | 5,120 | 29,200 | |||||

| 30,628 | INTERNATIONAL PAPER CO. | 1,087,636 | 1,280,863 | |||||

| 4,450 | LINDE PLC(c) | 723,931 | 862,054 | |||||

| 2,601 | LYONDELLBASELL INDUSTRIES N.V., CLASS A | 218,118 | 232,711 | |||||

| 700 | MARTIN MARIETTA MATERIALS, INC. | 27,965 | 191,870 | |||||

| 3,200 | MOSAIC (THE) CO. | 54,200 | 65,600 | |||||

| 7,400 | NEWMONT GOLDCORP CORP. | 136,530 | 280,608 | |||||

| 5,844 | NUCOR CORP. | 99,312 | 297,518 | |||||

| 3,100 | OLIN CORP. | 65,390 | 58,032 | |||||

| 3,245 | PACKAGING CORP. OF AMERICA | 133,051 | 344,294 | |||||

| 5,172 | PPG INDUSTRIES, INC. | 123,888 | 612,934 | |||||

| 6,625 | RELIANCE STEEL & ALUMINUM CO. | 325,929 | 660,247 | |||||

| 600 | ROYAL GOLD, INC. | 22,314 | 73,926 | |||||

| 2,400 | RPM INTERNATIONAL, INC. | 24,657 | 165,144 | |||||

| 500 | SCOTTS MIRACLE-GRO (THE) CO. | 37,765 | 50,910 | |||||

| 1,400 | SEALED AIR CORP. | 24,528 | 58,114 | |||||

| 857 | SHERWIN-WILLIAMS (THE) CO. | 41,646 | 471,239 | |||||

| 3,600 | SONOCO PRODUCTS CO. | 74,519 | 209,556 | |||||

| 3,234 | SOUTHERN COPPER CORP.(c) | 38,445 | 110,376 | |||||

| 23,039 | STEEL DYNAMICS, INC. | 589,156 | 686,562 | |||||

| 4,392 | VALVOLINE, INC. | 24,184 | 96,756 | |||||

| 2,100 | VULCAN MATERIALS CO. | 63,441 | 317,604 | |||||

| 2,242 | WESTROCK CO. | 24,357 | 81,721 | |||||

| 7,226,282 | 12,846,569 | 2.52% | ||||||

| Real Estate: | ||||||||

| 2,100 | ALEXANDRIA REAL ESTATE EQUITIES, INC. | 106,143 | 323,484 | |||||

| 9,673 | AMERICAN TOWER CORP. | 1,556,483 | 2,138,990 | |||||

| 3,629 | APARTMENT INVESTMENT & MANAGEMENT CO., CLASS A | 44,956 | 189,216 | |||||

| 1,734 | AVALONBAY COMMUNITIES, INC. | 193,548 | 373,382 | |||||

| 3,388 | BOSTON PROPERTIES, INC. | 171,468 | 439,288 | |||||

| 2,600 | BRANDYWINE REALTY TRUST | 27,832 | 39,390 | |||||

| 900 | CAMDEN PROPERTY TRUST | 24,065 | 99,909 | |||||

| 5,500 | COLONY CAPITAL, INC. | 29,068 | 33,110 | |||||

| 1,545 | CORECIVIC, INC. | 22,130 | 26,698 | |||||

| 500 | CORESITE REALTY CORP. | 43,409 | 60,925 | |||||

| 4,700 | CROWN CASTLE INTERNATIONAL CORP. | 193,063 | 653,347 | |||||

| 500 | DIGITAL REALTY TRUST, INC. | 26,734 | 64,905 | |||||

| 5,200 | DOUGLAS EMMETT, INC. | 45,222 | 222,716 | |||||

| 1,700 | DUKE REALTY CORP. | 28,435 | 57,749 | |||||

| 1,701 | EQUINIX, INC. | 563,657 | 981,137 | |||||

| 5,446 | EQUITY LIFESTYLE PROPERTIES, INC. | 574,160 | 727,586 | |||||

| 5,416 | EQUITY RESIDENTIAL | 174,162 | 467,184 | |||||

| 875 | ESSEX PROPERTY TRUST, INC. | 116,032 | 285,819 | |||||

| 1,500 | EXTRA SPACE STORAGE, INC. | 130,992 | 175,230 | |||||

| 900 | FEDERAL REALTY INVESTMENT TRUST | 48,326 | 122,526 | |||||

| 1,046 | FOUR CORNERS PROPERTY TRUST, INC. | 8,807 | 29,581 | |||||

| 7,000 | HCP, INC. | 75,334 | 249,410 | |||||

| 12,222 | HOST HOTELS & RESORTS, INC. | 93,479 | 211,318 | |||||

| 678 | HOWARD HUGHES (THE) CORP.(b) | 20,502 | 87,869 | |||||

| 700 | JBG SMITH PROPERTIES | 17,888 | 27,447 | |||||

| 700 | JONES LANG LASALLE, INC. | 39,951 | 97,342 | |||||

| 6,601 | KIMCO REALTY CORP. | 67,254 | 137,829 | |||||

| 3,900 | LAMAR ADVERTISING CO., CLASS A | 41,016 | 319,527 | |||||

| 1,100 | LIBERTY PROPERTY TRUST | 23,353 | 56,463 | |||||

| 600 | LIFE STORAGE, INC. | 48,946 | 63,246 | |||||

| 5,123 | MACERICH (THE) CO. | 111,630 | 161,836 | |||||

| 1,800 | MID-AMERICA APARTMENT COMMUNITIES, INC. | 132,698 | 234,018 | |||||

| 800 | OMEGA HEALTHCARE INVESTORS, INC. | 25,945 | 33,432 | |||||

| 10,169 | PROLOGIS, INC. | 257,893 | 866,602 | |||||

| 1,424 | PUBLIC STORAGE | 135,843 | 349,264 | |||||

| 6,972 | RAYONIER, INC. | 74,591 | 196,610 | |||||

| 2,700 | REALTY INCOME CORP. | 55,485 | 207,036 | |||||

| 3,900 | REGENCY CENTERS CORP. | 85,344 | 271,011 | |||||

| 9,800 | RETAIL PROPERTIES OF AMERICA, INC., CLASS A | 80,756 | 120,736 | |||||

| 1,224 | RETAIL VALUE, INC. | 33,005 | 45,337 | |||||

| 10 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Core Equity Fund

September 30, 2019

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Real Estate (Cont'd): | ||||||||

| 5,372 | SBA COMMUNICATIONS CORP. | $903,150 | 1,295,458 | |||||

| 1,800 | SERVICE PROPERTIES TRUST | 23,967 | 46,422 | |||||

| 4,598 | SIMON PROPERTY GROUP, INC. | 555,000 | 715,679 | |||||

| 589 | SL GREEN REALTY CORP. | 29,460 | 48,151 | |||||

| 2,800 | STORE CAPITAL CORP. | 73,380 | 104,748 | |||||

| 1,100 | SUN COMMUNITIES, INC. | 83,590 | 163,295 | |||||

| 2,100 | TAUBMAN CENTERS, INC. | 52,545 | 85,743 | |||||

| 4,100 | UDR, INC. | 64,026 | 198,768 | |||||

| 1,300 | URBAN EDGE PROPERTIES | 18,730 | 25,727 | |||||

| 3,527 | VENTAS, INC. | 150,097 | 257,577 | |||||

| 800 | VORNADO REALTY TRUST | 29,237 | 50,936 | |||||

| 1,715 | WASHINGTON PRIME GROUP, INC. | 8,005 | 7,100 | |||||

| 2,100 | WEINGARTEN REALTY INVESTORS | 29,916 | 61,173 | |||||

| 4,600 | WELLTOWER, INC. | 273,029 | 416,990 | |||||

| 5,416 | WEYERHAEUSER CO. | 75,648 | 150,023 | |||||

| 7,919,385 | 14,876,295 | 2.91% | ||||||

| Utilities: | ||||||||

| 3,000 | AES CORP. | 32,870 | 49,020 | |||||

| 2,000 | ALLIANT ENERGY CORP. | 24,835 | 107,860 | |||||

| 1,600 | AMEREN CORP. | 40,872 | 128,080 | |||||

| 8,554 | AMERICAN ELECTRIC POWER CO., INC. | 477,380 | 801,424 | |||||

| 1,735 | AQUA AMERICA, INC. | 22,973 | 77,780 | |||||

| 13,200 | AVANGRID, INC. | 502,113 | 689,700 | |||||

| 5,800 | CENTERPOINT ENERGY, INC. | 66,308 | 175,044 | |||||

| 13,300 | CMS ENERGY CORP. | 259,708 | 850,535 | |||||

| 4,989 | CONSOLIDATED EDISON, INC. | 319,712 | 471,311 | |||||

| 12,073 | DOMINION ENERGY, INC. | 450,978 | 978,396 | |||||

| 6,243 | DTE ENERGY CO. | 510,391 | 830,069 | |||||

| 12,617 | DUKE ENERGY CORP. | 620,162 | 1,209,466 | |||||

| 8,325 | EDISON INTERNATIONAL | 179,967 | 627,871 | |||||

| 3,164 | ENTERGY CORP. | 68,368 | 371,327 | |||||

| 2,974 | EVERGY, INC. | 67,407 | 197,949 | |||||

| 4,961 | EVERSOURCE ENERGY | 125,492 | 424,017 | |||||

| 38,749 | EXELON CORP. | 1,463,785 | 1,871,964 | |||||

| 5,500 | FIRSTENERGY CORP. | 176,693 | 265,265 | |||||

| 900 | NATIONAL FUEL GAS CO. | 20,790 | 42,228 | |||||

| 4,400 | NEXTERA ENERGY, INC. | 204,691 | 1,025,156 | |||||

| 6,900 | NISOURCE, INC. | 43,973 | 206,448 | |||||

| 1,200 | NRG ENERGY, INC. | 33,011 | 47,520 | |||||

| 10,933 | OGE ENERGY CORP. | 282,750 | 496,140 | |||||

| 12,719 | PINNACLE WEST CAPITAL CORP. | 1,016,510 | 1,234,633 | |||||

| 700 | PPL CORP. | 10,384 | 22,043 | |||||

| 1,200 | PUBLIC SERVICE ENTERPRISE GROUP, INC. | 51,552 | 74,496 | |||||

| 3,200 | SEMPRA ENERGY | 174,758 | 472,352 | |||||

| 8,600 | SOUTHERN (THE) CO. | 176,010 | 531,222 | |||||

| 5,426 | UGI CORP. | 80,112 | 272,765 | |||||

| 1,600 | WEC ENERGY GROUP, INC. | 91,440 | 152,160 | |||||

| 968 | XCEL ENERGY, INC. | 36,241 | 62,814 | |||||

| 7,632,236 | 14,767,055 | 2.89% | ||||||

| Sub-total Common Stocks: | 266,199,579 | 508,527,233 | 99.58% | |||||

| Short-Term Investments: | ||||||||

| 2,255,651 | NORTHERN INSTITUTIONAL FUNDS - U.S. GOVERNMENT SELECT PORTFOLIO, 1.85%(e) | 2,255,651 | 2,255,651 | |||||

| Sub-total Short-Term Investments: | 2,255,651 | 2,255,651 | 0.44% | |||||

| Grand total | $268,455,230 | 510,782,884 | 100.02% | |||||

| Notes to Schedule of Investments: | |

| (a) | Investments in U.S. and foreign equity securities are valued at the last sales price or the regular trading session closing price on the principal exchange or market where the securities are traded. Foreign security values are stated in U.S. dollars. |

| (b) | Non-income producing assets. |

| (c) | Foreign security values are stated in U.S. dollars. As of September 30, 2019, the value of foreign stocks or depositary receipts of companies based outside of the United States represented 3.39% of net assets. |

| 11 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Core Equity Fund

September 30, 2019

(unaudited)

| (d) | Securities are American Depositary Receipts of companies based outside of the United States representing 0.01% of net assets as of September 30, 2019. |

| (e) | The short-term investment is a money market portfolio of the investment company, Northern Institutional Funds. At December 31, 2018, the value of the Clearwater Core Equity Fund’s investment in the U.S. Government Select Portfolio of the Northern Institutional Funds was $4,473,835 with net sales of $2,218,184 during the nine months ended September 30, 2019. |

| 12 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Core Equity Fund

September 30, 2019

(unaudited)

Fair value is an estimate of the price

the Clearwater Core Equity Fund would receive upon selling a security in a timely transaction to an independent buyer in the principal or most advantageous market for the security. This guidance establishes a

three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Various inputs are

used in determining the value of the Clearwater Core Equity Fund's investments, as described below. These inputs are summarized in the three broad levels listed below.

| • | Level 1 – Unadjusted quoted market prices in active markets for identical securities on the measurement date. |

| • | Level 2 – Other significant observable inputs including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc. or quoted prices for identical or similar assets in markets that are not active. Inputs that are derived principally from or corroborated by observable market data are also considered Level 2 measurements. An adjustment to any observable input that is significant to the fair value may render the measurement a Level 3 measurement. |

| • | Level 3 – Valuations based on unobservable inputs, which may include the Adviser’s own assumptions in determining the fair value of an investment. |

Investments in U.S. and

foreign equity securities are valued at the last sales price or the regular trading session closing price on the principal exchange or market in which such securities are traded, with foreign security values stated in

U.S. dollars. Equity securities which have not traded on the date of valuation or securities for which sales prices are not generally reported are valued at the mean between the last bid and asked prices. Security

transactions are accounted for as of trade date. Wherever possible, the Clearwater Core Equity Fund uses independent pricing services approved by the Board of Trustees of Clearwater Investment Trust to value its

investments. When prices are not readily available (including those for which trading has been suspended), are determined not to reflect fair value, or when the Adviser becomes aware that a significant event impacting

the value of a security or group of securities has occurred after the closing of the exchange on which the security or securities principally trade, but before the calculation of the daily net asset value, the

Clearwater Core Equity Fund may value these securities at fair value as determined in good faith using procedures established by the Board of Trustees.

The inputs or methodology

used for valuing securities are not necessarily an indication of the risk associated with investing in those securities and other financial instruments, if any. The following is a summary of the inputs used in valuing

the Clearwater Core Equity Fund’s investments and other financial instruments, if any, which are carried at fair value, as of September 30, 2019.

On August 28, 2018, the

FASB issued Accounting Standards Update ("ASU") 2018-13, “Disclosure Framework -- Changes to the Disclosure Requirements for Fair Value Measurement,” which amends the fair value measurement disclosure

requirements of ASC 820. The amendments of ASU 2018-13 include new, eliminated, and modified disclosure requirements of ASC 820. In addition, the amendments clarify that materiality is an appropriate consideration of

entities when evaluating disclosure requirements. The ASU is effective for all entities for fiscal years beginning after December 15, 2019, including interim periods therein. Early adoption is permitted for any

eliminated or modified disclosures upon issuance of this ASU. The Fund has early adopted ASU 2018-13 for the period ended September 30, 2019.

| Level 1 | Level 2 | Level 3 | Total | ||||

| Common Stocks | $508,527,233 | $— | $— | $508,527,233 | |||

| Short-Term Investments | 2,255,651 | — | — | 2,255,651 | |||

| Total | $510,782,884 | $— | $— | $510,782,884 |

For the Clearwater Core

Equity Fund, 100% of the investment value is comprised of equity securities and short-term investments. See the Clearwater Core Equity Fund’s Schedule of Investments for industry classification. Investments in

equity and short-term securities generally are valued at the last sales price or the regular trading session closing price on the principal exchange or market where they are traded.

| 13 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Core Equity Fund

September 30, 2019

(unaudited)

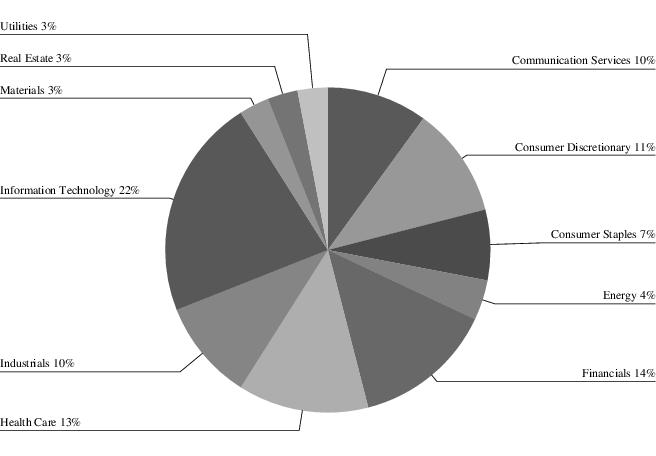

Clearwater Core Equity Fund Portfolio

Diversification

(as a percentage of net assets)

| 14 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Small Companies Fund

September 30, 2019

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Common Stocks: | ||||||||

| Communication Services: | ||||||||

| 138,581 | ALASKA COMMUNICATIONS SYSTEMS GROUP, INC.(b) | $251,984 | 238,359 | |||||

| 30,343 | BEASLEY BROADCAST GROUP, INC., CLASS A | 98,075 | 94,063 | |||||

| 15,700 | CONSOLIDATED COMMUNICATIONS HOLDINGS, INC. | 67,461 | 74,732 | |||||

| 7,014 | CUMULUS MEDIA, INC., CLASS A(b) | 96,996 | 101,984 | |||||

| 75,249 | ENTERCOM COMMUNICATIONS CORP., CLASS A | 385,280 | 251,332 | |||||

| 32,156 | ENTRAVISION COMMUNICATIONS CORP., CLASS A | 106,704 | 102,256 | |||||

| 13,890 | EW SCRIPPS (THE) CO., CLASS A | 166,737 | 184,459 | |||||

| 17,474 | HEMISPHERE MEDIA GROUP, INC.(b) | 219,115 | 213,532 | |||||

| 29,286 | IMAX CORP.(b)(c) | 580,138 | 642,828 | |||||

| 135,556 | MARCHEX, INC., CLASS B(b) | 348,474 | 425,646 | |||||

| 24,716 | MEET GROUP (THE), INC.(b) | 85,076 | 80,945 | |||||

| 66,100 | READING INTERNATIONAL, INC., CLASS A(b) | 946,229 | 790,556 | |||||

| 25,266 | SAGA COMMUNICATIONS, INC., CLASS A | 777,440 | 751,664 | |||||

| 67,470 | VONAGE HOLDINGS CORP.(b) | 850,196 | 762,411 | |||||

| 11,765 | WIDEOPENWEST, INC.(b) | 67,184 | 72,472 | |||||

| 5,047,089 | 4,787,239 | 1.41% | ||||||

| Consumer Discretionary: | ||||||||

| 120,500 | AMERICAN EAGLE OUTFITTERS, INC. | 2,323,314 | 1,954,510 | |||||

| 242,010 | BBX CAPITAL CORP. | 1,302,559 | 1,130,187 | |||||

| 47,685 | BED BATH & BEYOND, INC.(d) | 464,241 | 507,369 | |||||

| 75,451 | BLUEGREEN VACATIONS CORP. | 735,218 | 703,203 | |||||

| 84,990 | CALLAWAY GOLF CO. | 1,377,798 | 1,649,656 | |||||

| 49,624 | CARRIAGE SERVICES, INC. | 993,606 | 1,014,315 | |||||

| 10,942 | CHILDREN'S PLACE (THE), INC.(d) | 1,255,234 | 842,425 | |||||

| 232,506 | CLARUS CORP. | 1,303,697 | 2,726,133 | |||||

| 13,553 | CROWN CRAFTS, INC. | 64,648 | 84,706 | |||||

| 86,843 | CSS INDUSTRIES, INC. | 1,163,408 | 344,767 | |||||

| 13,952 | DRIVE SHACK, INC.(b) | 54,978 | 60,133 | |||||

| 68,800 | EXTENDED STAY AMERICA, INC. | 1,351,173 | 1,007,232 | |||||

| 106,209 | FIESTA RESTAURANT GROUP, INC.(b) | 1,475,322 | 1,106,698 | |||||

| 175,902 | FULL HOUSE RESORTS, INC.(b) | 396,501 | 379,948 | |||||

| 33,782 | G-III APPAREL GROUP LTD.(b) | 918,237 | 870,562 | |||||

| 60,300 | GILDAN ACTIVEWEAR, INC.(c) | 1,821,573 | 2,140,650 | |||||

| 12,801 | GROWGENERATION CORP.(b) | 61,268 | 54,404 | |||||

| 67,200 | HANESBRANDS, INC. | 921,601 | 1,029,504 | |||||

| 19,000 | HELEN OF TROY LTD.(b) | 1,922,619 | 2,995,540 | |||||

| 1,125 | HOOKER FURNITURE CORP. | 23,912 | 24,120 | |||||

| 11,036 | IROBOT CORP.(b)(d) | 821,346 | 680,590 | |||||

| 29,188 | J. ALEXANDER'S HOLDINGS, INC.(b) | 337,351 | 342,083 | |||||

| 26,032 | LAKELAND INDUSTRIES, INC.(b) | 293,501 | 316,549 | |||||

| 186,265 | LIFETIME BRANDS, INC. | 1,893,454 | 1,648,445 | |||||

| 5,871 | LITHIA MOTORS, INC., CLASS A | 316,256 | 777,203 | |||||

| 36,860 | MALIBU BOATS, INC., CLASS A(b) | 1,192,330 | 1,130,865 | |||||

| 8,267 | MARINEMAX, INC.(b) | 132,976 | 127,973 | |||||

| 18,490 | MARRIOTT VACATIONS WORLDWIDE CORP. | 1,534,212 | 1,915,749 | |||||

| 53,623 | MASTERCRAFT BOAT HOLDINGS, INC.(b) | 1,269,346 | 800,323 | |||||

| 56,991 | MOTORCAR PARTS OF AMERICA, INC.(b) | 1,032,026 | 963,148 | |||||

| 586,077 | OFFICE DEPOT, INC. | 1,236,286 | 1,028,565 | |||||

| 40,527 | PARTY CITY HOLDCO, INC.(b)(d) | 605,939 | 231,409 | |||||

| 105,569 | PENN NATIONAL GAMING, INC.(b) | 2,282,694 | 1,966,223 | |||||

| 136,676 | POTBELLY CORP.(b) | 1,245,912 | 595,907 | |||||

| 53,109 | RED LION HOTELS CORP.(b) | 378,257 | 344,146 | |||||

| 48,812 | SKYLINE CHAMPION CORP.(b) | 987,649 | 1,468,753 | |||||

| 90,878 | TWIN RIVER WORLDWIDE HOLDINGS, INC.(d) | 2,768,185 | 2,074,740 | |||||

| 4,382 | UNIFI, INC.(b) | 87,293 | 96,054 | |||||

| 16,700 | WILLIAMS-SONOMA, INC. | 825,821 | 1,135,266 | |||||

| 91,400 | WINNEBAGO INDUSTRIES, INC. | 2,935,774 | 3,505,190 | |||||

| 42,107,515 | 41,775,243 | 12.33% | ||||||

| Consumer Staples: | ||||||||

| 32,059 | BJ'S WHOLESALE CLUB HOLDINGS, INC.(b) | 841,009 | 829,366 | |||||

| 14,333 | CALAVO GROWERS, INC. | 1,183,861 | 1,364,215 | |||||

| 67,962 | CENTRAL GARDEN & PET CO., CLASS A(b) | 2,126,426 | 1,884,247 | |||||

| 2,787 | COFFEE HOLDING CO., INC.(b) | 12,265 | 11,037 | |||||

| 39,441 | PERFORMANCE FOOD GROUP CO.(b) | 1,353,979 | 1,814,680 | |||||

| 47,575 | PRIMO WATER CORP.(b) | 575,026 | 584,221 | |||||

| 33,000 | SPECTRUM BRANDS HOLDINGS, INC. | 1,820,601 | 1,739,760 | |||||

| 15 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Small Companies Fund

September 30, 2019

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Consumer Staples (Cont'd): | ||||||||

| 446,429 | SUNOPTA, INC.(b)(c) | $2,186,785 | 803,572 | |||||

| 39,757 | UNIVERSAL CORP. | 2,167,649 | 2,179,081 | |||||

| 12,267,601 | 11,210,179 | 3.31% | ||||||

| Energy: | ||||||||

| 27,780 | BERRY PETROLEUM CORP. | 313,554 | 260,021 | |||||

| 178,135 | C&J ENERGY SERVICES, INC.(b) | 2,528,234 | 1,911,389 | |||||

| 81,486 | MURPHY OIL CORP. | 1,942,122 | 1,801,655 | |||||

| 45,544 | OIL STATES INTERNATIONAL, INC.(b) | 1,138,368 | 605,735 | |||||

| 15,090 | PROFIRE ENERGY, INC.(b) | 25,398 | 28,520 | |||||

| 31,728 | SOLARIS OILFIELD INFRASTRUCTURE, INC., CLASS A(d) | 568,859 | 425,790 | |||||

| 6,516,535 | 5,033,110 | 1.49% | ||||||

| Financials: | ||||||||

| 12,257 | AMBAC FINANCIAL GROUP, INC.(b) | 211,027 | 239,624 | |||||

| 105,399 | AMERICAN EQUITY INVESTMENT LIFE HOLDING CO. | 2,735,795 | 2,550,656 | |||||

| 28,078 | AMERIS BANCORP | 855,284 | 1,129,859 | |||||

| 13,813 | ARGO GROUP INTERNATIONAL HOLDINGS LTD.(c) | 723,465 | 970,225 | |||||

| 107,251 | ASSOCIATED BANC-CORP | 2,470,813 | 2,171,833 | |||||

| 38,929 | AXIS CAPITAL HOLDINGS LTD.(c) | 2,042,958 | 2,597,343 | |||||

| 47,860 | BANCORP (THE), INC.(b) | 434,951 | 473,814 | |||||

| 7,086 | BANKWELL FINANCIAL GROUP, INC. | 192,580 | 194,865 | |||||

| 24,775 | BCB BANCORP, INC. | 303,494 | 318,111 | |||||

| 102,637 | BLACKROCK TCP CAPITAL CORP. | 1,453,475 | 1,391,245 | |||||

| 46,597 | CANNAE HOLDINGS, INC.(b) | 883,141 | 1,280,020 | |||||

| 22,437 | CAROLINA FINANCIAL CORP. | 795,621 | 797,411 | |||||

| 9,471 | CB FINANCIAL SERVICES, INC. | 255,287 | 262,915 | |||||

| 36,233 | CENTERSTATE BANK CORP. | 891,755 | 869,048 | |||||

| 1,879 | CENTRAL VALLEY COMMUNITY BANCORP | 37,299 | 38,238 | |||||

| 5,885 | CITIZENS HOLDING CO. | 123,675 | 119,171 | |||||

| 207,174 | CNO FINANCIAL GROUP, INC. | 3,755,220 | 3,279,564 | |||||

| 27,893 | COMMERCE BANCSHARES, INC. | 1,395,407 | 1,691,710 | |||||

| 65,883 | CRAWFORD & CO., CLASS A | 590,276 | 716,807 | |||||

| 6,782 | CRAWFORD & CO., CLASS B | 52,628 | 68,430 | |||||

| 101,211 | DONEGAL GROUP, INC., CLASS A | 1,520,565 | 1,483,753 | |||||

| 14,965 | EAGLE BANCORP MONTANA, INC. | 263,774 | 261,887 | |||||

| 19,339 | ENTERPRISE FINANCIAL SERVICES CORP. | 786,061 | 788,064 | |||||

| 39,665 | ESSENT GROUP LTD. | 1,683,937 | 1,890,831 | |||||

| 137,437 | EXANTAS CAPITAL CORP. | 1,191,984 | 1,562,659 | |||||

| 6,964 | FARMERS NATIONAL BANC CORP. | 73,057 | 100,839 | |||||

| 65,373 | FIDUS INVESTMENT CORP. | 918,492 | 969,482 | |||||

| 21,355 | FIRST HAWAIIAN, INC. | 547,717 | 570,178 | |||||

| 31,785 | FIRST MERCHANTS CORP. | 1,309,231 | 1,196,228 | |||||

| 77,252 | FIRST MIDWEST BANCORP, INC. | 1,720,204 | 1,504,869 | |||||

| 2,480 | FIRST NORTHWEST BANCORP | 39,736 | 42,954 | |||||

| 10,700 | FIRSTCASH, INC. | 636,540 | 980,869 | |||||

| 47,600 | GLACIER BANCORP, INC. | 2,014,105 | 1,925,896 | |||||

| 28,092 | HANCOCK WHITNEY CORP. | 1,360,465 | 1,075,783 | |||||

| 31,646 | HERITAGE COMMERCE CORP. | 351,821 | 371,999 | |||||

| 147,427 | HOPE BANCORP, INC. | 2,439,921 | 2,114,103 | |||||

| 52,522 | HUNT COS. FINANCE TRUST, INC. | 179,449 | 176,474 | |||||

| 73,744 | INVESTCORP CREDIT MANAGEMENT BDC, INC. | 534,879 | 490,398 | |||||

| 24,906 | LANDMARK BANCORP, INC. | 621,673 | 579,812 | |||||

| 2,621 | LCNB CORP. | 39,802 | 46,497 | |||||

| 5,280 | LENDINGTREE, INC.(b)(d) | 1,390,835 | 1,639,070 | |||||

| 23,292 | LUTHER BURBANK CORP. | 244,943 | 263,898 | |||||

| 24,167 | MACKINAC FINANCIAL CORP. | 339,858 | 373,622 | |||||

| 19,758 | MR COOPER GROUP, INC.(b) | 202,322 | 209,830 | |||||

| 31,662 | MVC CAPITAL, INC. | 286,618 | 281,792 | |||||

| 3,500 | NATIONAL WESTERN LIFE GROUP, INC., CLASS A | 1,164,873 | 939,295 | |||||

| 60,476 | NEW MOUNTAIN FINANCE CORP. | 823,750 | 824,288 | |||||

| 331,544 | OAKTREE SPECIALTY LENDING CORP. | 1,520,026 | 1,717,398 | |||||

| 163,263 | OAKTREE STRATEGIC INCOME CORP. | 1,373,924 | 1,346,920 | |||||

| 6,913 | OCEANFIRST FINANCIAL CORP. | 147,731 | 163,147 | |||||

| 1,581 | OCONEE FEDERAL FINANCIAL CORP. | 36,347 | 37,391 | |||||

| 20,619 | PENNANTPARK FLOATING RATE CAPITAL LTD. | 239,812 | 239,180 | |||||

| 157,608 | PENNANTPARK INVESTMENT CORP. | 1,058,307 | 988,202 | |||||

| 4,319 | PENNS WOODS BANCORP, INC. | 181,459 | 199,754 | |||||

| 14,779 | PEOPLES BANCORP OF NORTH CAROLINA, INC. | 339,412 | 439,084 | |||||

| 16 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Small Companies Fund

September 30, 2019

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Financials (Cont'd): | ||||||||

| 29,331 | PIONEER BANCORP, INC.(b) | $400,762 | 366,344 | |||||

| 52,800 | PRA GROUP, INC.(b) | 1,491,319 | 1,784,112 | |||||

| 4,110 | RENAISSANCERE HOLDINGS LTD.(c) | 516,890 | 795,079 | |||||

| 3,636 | SALISBURY BANCORP, INC. | 137,808 | 142,568 | |||||

| 10,191 | SHORE BANCSHARES, INC. | 146,185 | 157,043 | |||||

| 2,336 | SIERRA BANCORP | 40,971 | 62,044 | |||||

| 48,816 | SIMMONS FIRST NATIONAL CORP., CLASS A | 1,470,729 | 1,215,518 | |||||

| 38,567 | SOLAR CAPITAL LTD. | 790,861 | 796,409 | |||||

| 20,344 | SOUTHERN NATIONAL BANCORP OF VIRGINIA, INC. | 322,319 | 313,094 | |||||

| 3,268 | SOUTHWEST GEORGIA FINANCIAL CORP. | 67,091 | 65,523 | |||||

| 27,690 | STIFEL FINANCIAL CORP. | 1,354,417 | 1,588,852 | |||||

| 27,147 | SUMMIT STATE BANK | 345,644 | 319,520 | |||||

| 48,613 | SYNOVUS FINANCIAL CORP. | 1,568,049 | 1,738,401 | |||||

| 90,160 | TCF FINANCIAL CORP. | 2,979,708 | 3,432,391 | |||||

| 125,700 | UMPQUA HOLDINGS CORP. | 2,227,631 | 2,069,022 | |||||

| 14,864 | UNITED BANCORP, INC. | 185,616 | 165,734 | |||||

| 5,918 | UNITED BANCSHARES, INC. | 128,716 | 118,478 | |||||

| 15,665 | UNITY BANCORP, INC. | 226,203 | 346,980 | |||||

| 43,503 | WALKER & DUNLOP, INC. | 984,090 | 2,433,123 | |||||

| 36,189 | WEBSTER FINANCIAL CORP. | 1,749,739 | 1,696,178 | |||||

| 18,716 | WEST BANCORPORATION, INC. | 392,649 | 406,886 | |||||

| 32,236 | WSFS FINANCIAL CORP. | 1,348,832 | 1,421,608 | |||||

| 66,664,010 | 70,392,242 | 20.78% | ||||||

| Health Care: | ||||||||

| 31,480 | AMN HEALTHCARE SERVICES, INC.(b) | 1,588,056 | 1,811,989 | |||||

| 34,000 | BIOTELEMETRY, INC.(b) | 1,375,275 | 1,384,820 | |||||

| 22,377 | BRUKER CORP. | 619,164 | 983,021 | |||||

| 37,081 | CUTERA, INC.(b) | 778,093 | 1,083,878 | |||||

| 21,843 | EMERGENT BIOSOLUTIONS, INC.(b) | 695,870 | 1,141,952 | |||||

| 28,897 | GLOBUS MEDICAL, INC., CLASS A(b) | 1,395,919 | 1,477,215 | |||||

| 6,586 | HARROW HEALTH, INC.(b) | 31,441 | 37,013 | |||||

| 149,190 | HARVARD BIOSCIENCE, INC.(b) | 276,606 | 458,759 | |||||

| 16,080 | HILL-ROM HOLDINGS, INC. | 1,239,261 | 1,692,098 | |||||

| 4,485 | ICU MEDICAL, INC.(b) | 598,774 | 715,806 | |||||

| 56,996 | INFUSYSTEM HOLDINGS, INC.(b) | 248,414 | 301,509 | |||||

| 13,731 | INTEGRA LIFESCIENCES HOLDINGS CORP.(b) | 793,219 | 824,821 | |||||

| 15,708 | INVACARE CORP. | 88,213 | 117,810 | |||||

| 20,045 | LHC GROUP, INC.(b) | 1,314,827 | 2,276,310 | |||||

| 2,478 | LIGAND PHARMACEUTICALS, INC.(b) | 271,751 | 246,660 | |||||

| 17,287 | LIVANOVA PLC(b)(c) | 1,690,596 | 1,275,608 | |||||

| 8,181 | MAGELLAN HEALTH, INC.(b) | 502,977 | 508,040 | |||||

| 68,000 | MEDNAX, INC.(b) | 2,604,302 | 1,538,160 | |||||

| 27,231 | NANOVIBRONIX, INC.(b) | 132,728 | 73,524 | |||||

| 33,739 | OMNICELL, INC.(b) | 1,731,977 | 2,438,317 | |||||

| 11,666 | ORTHOFIX MEDICAL, INC.(b) | 593,050 | 618,531 | |||||

| 36,928 | PREMIER, INC., CLASS A(b) | 1,098,689 | 1,067,958 | |||||

| 33,683 | PROVIDENCE SERVICE (THE) CORP.(b) | 2,142,323 | 2,002,791 | |||||

| 49,116 | PSYCHEMEDICS CORP. | 693,751 | 447,447 | |||||

| 76,419 | STREAMLINE HEALTH SOLUTIONS, INC.(b) | 88,634 | 84,061 | |||||

| 37,600 | SYNEOS HEALTH, INC.(b) | 1,732,066 | 2,000,696 | |||||

| 43,209 | TIVITY HEALTH, INC.(b) | 1,223,896 | 718,566 | |||||

| 93,545 | TRIPLE-S MANAGEMENT CORP., CLASS B(b) | 2,136,298 | 1,253,503 | |||||

| 125,983 | VAREX IMAGING CORP.(b) | 3,562,696 | 3,595,555 | |||||

| 31,248,866 | 32,176,418 | 9.50% | ||||||

| Industrials: | ||||||||

| 168,622 | ACTUANT CORP., CLASS A | 4,249,447 | 3,699,567 | |||||

| 5,969 | AEROVIRONMENT, INC.(b) | 319,576 | 319,700 | |||||

| 54,500 | AIR LEASE CORP. | 2,027,222 | 2,279,190 | |||||

| 7,235 | AIR TRANSPORT SERVICES GROUP, INC.(b) | 139,801 | 152,080 | |||||

| 15,008 | ALBANY INTERNATIONAL CORP., CLASS A | 579,755 | 1,353,121 | |||||

| 17,100 | AMERICAN WOODMARK CORP.(b) | 1,409,848 | 1,520,361 | |||||

| 5,989 | APOGEE ENTERPRISES, INC. | 218,344 | 233,511 | |||||

| 92,183 | ARC DOCUMENT SOLUTIONS, INC.(b) | 363,444 | 125,369 | |||||

| 66,313 | ARMSTRONG FLOORING, INC.(b) | 881,076 | 423,740 | |||||

| 33,838 | ASGN, INC.(b) | 1,487,593 | 2,127,057 | |||||

| 8,088 | ASTRONICS CORP.(b) | 194,326 | 237,625 | |||||

| 83,571 | AVIS BUDGET GROUP, INC.(b) | 2,864,798 | 2,361,716 | |||||

| 17 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Small Companies Fund

September 30, 2019

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Industrials (Cont'd): | ||||||||

| 25,026 | BRINK'S (THE) CO. | $1,673,767 | 2,075,907 | |||||

| 25,400 | BWX TECHNOLOGIES, INC. | 1,349,630 | 1,453,134 | |||||

| 4,415 | CBIZ, INC.(b) | 87,034 | 103,753 | |||||

| 18,023 | CECO ENVIRONMENTAL CORP.(b) | 134,702 | 125,891 | |||||

| 26,324 | CIRCOR INTERNATIONAL, INC.(b) | 947,316 | 988,466 | |||||

| 83,900 | COLFAX CORP.(b) | 2,455,343 | 2,438,134 | |||||

| 28,681 | COLUMBUS MCKINNON CORP. | 765,537 | 1,044,849 | |||||

| 4,771 | COVENANT TRANSPORTATION GROUP, INC., CLASS A(b) | 68,921 | 78,435 | |||||

| 27,600 | DONALDSON CO., INC. | 1,249,708 | 1,437,408 | |||||

| 1,746 | DUCOMMUN, INC.(b) | 62,048 | 74,030 | |||||

| 137,200 | GATES INDUSTRIAL CORP. PLC(b) | 2,001,472 | 1,381,604 | |||||

| 37,759 | GIBRALTAR INDUSTRIES, INC.(b) | 1,087,815 | 1,734,648 | |||||

| 11,900 | GORMAN-RUPP (THE) CO. | 360,214 | 414,001 | |||||

| 16,379 | GRAHAM CORP. | 317,881 | 325,287 | |||||

| 70,544 | HARSCO CORP.(b) | 1,303,697 | 1,337,514 | |||||

| 21,000 | HEXCEL CORP. | 1,276,724 | 1,724,730 | |||||

| 73,806 | INTERFACE, INC. | 1,409,300 | 1,065,759 | |||||

| 125,028 | JELD-WEN HOLDING, INC.(b) | 3,484,070 | 2,411,790 | |||||

| 16,945 | KADANT, INC. | 1,406,484 | 1,487,602 | |||||

| 22,249 | KENNAMETAL, INC. | 781,139 | 683,934 | |||||

| 204,796 | LSI INDUSTRIES, INC. | 1,099,213 | 1,069,035 | |||||

| 43,109 | MASONITE INTERNATIONAL CORP.(b) | 2,828,344 | 2,500,322 | |||||

| 25,888 | MERCURY SYSTEMS, INC.(b) | 1,057,167 | 2,101,329 | |||||

| 5,524 | MSA SAFETY, INC. | 493,438 | 602,724 | |||||

| 50,366 | NAVIGANT CONSULTING, INC. | 1,337,435 | 1,407,730 | |||||

| 126,200 | NOW, INC.(b) | 1,421,099 | 1,447,514 | |||||

| 171,760 | PGT INNOVATIONS, INC.(b) | 2,679,714 | 2,966,295 | |||||

| 106,190 | PIONEER POWER SOLUTIONS, INC.(b) | 627,210 | 573,426 | |||||

| 69,870 | QUANEX BUILDING PRODUCTS CORP. | 1,467,474 | 1,263,250 | |||||

| 154,047 | REV GROUP, INC. | 1,757,550 | 1,760,757 | |||||

| 33,000 | RUSH ENTERPRISES, INC., CLASS A | 1,376,111 | 1,273,140 | |||||

| 46,101 | RYDER SYSTEM, INC. | 2,779,246 | 2,386,649 | |||||

| 19,190 | SKYWEST, INC. | 742,469 | 1,101,506 | |||||

| 5,908 | SPX CORP.(b) | 118,270 | 236,379 | |||||

| 181,239 | STEELCASE, INC., CLASS A | 2,589,944 | 3,334,798 | |||||

| 87,936 | TEREX CORP. | 3,115,428 | 2,283,698 | |||||

| 22,527 | THERMON GROUP HOLDINGS, INC.(b) | 499,907 | 517,670 | |||||

| 51,329 | TITAN MACHINERY, INC.(b) | 777,589 | 736,058 | |||||

| 68,793 | TRIMAS CORP.(b) | 1,808,640 | 2,108,505 | |||||

| 2,180 | UNIVERSAL FOREST PRODUCTS, INC. | 87,180 | 86,938 | |||||

| 10,386 | VALMONT INDUSTRIES, INC. | 1,523,166 | 1,437,838 | |||||

| 32,741 | VIAD CORP. | 1,672,890 | 2,198,558 | |||||

| 28,427 | WOODWARD, INC. | 1,429,240 | 3,065,283 | |||||

| 70,246,756 | 73,679,315 | 21.75% | ||||||

| Information Technology: | ||||||||

| 41,834 | ANIXTER INTERNATIONAL, INC.(b) | 2,898,060 | 2,891,566 | |||||

| 69,627 | AVIAT NETWORKS, INC.(b) | 1,229,827 | 950,409 | |||||

| 11,693 | AXT, INC.(b) | 50,256 | 41,627 | |||||

| 234,090 | CELESTICA, INC.(b)(c) | 2,491,392 | 1,678,425 | |||||

| 94,200 | COHU, INC. | 1,510,462 | 1,272,171 | |||||

| 11,247 | CYPRESS SEMICONDUCTOR CORP. | 148,711 | 262,505 | |||||

| 102,385 | DSP GROUP, INC.(b) | 1,306,291 | 1,442,093 | |||||

| 17,700 | ENTEGRIS, INC. | 475,456 | 832,962 | |||||

| 8,425 | EURONET WORLDWIDE, INC.(b) | 379,541 | 1,232,578 | |||||

| 8,993 | EVERBRIDGE, INC.(b) | 845,327 | 554,958 | |||||

| 35,311 | EVO PAYMENTS, INC., CLASS A(b) | 842,266 | 992,945 | |||||

| 19,414 | FARO TECHNOLOGIES, INC.(b) | 946,431 | 938,667 | |||||

| 77,753 | FIREEYE, INC.(b) | 1,265,004 | 1,037,225 | |||||

| 133,620 | FRANKLIN WIRELESS CORP.(b) | 287,454 | 297,973 | |||||

| 110,306 | FREQUENCY ELECTRONICS, INC.(b) | 1,011,141 | 1,340,218 | |||||

| 32,546 | IDENTIV, INC.(b) | 161,968 | 171,192 | |||||

| 68,828 | IMMERSION CORP.(b) | 531,048 | 526,534 | |||||

| 153,079 | INFINERA CORP.(b) | 830,211 | 834,281 | |||||

| 12,362 | INSIGHT ENTERPRISES, INC.(b) | 496,249 | 688,440 | |||||

| 66,624 | JABIL, INC. | 1,382,705 | 2,383,140 | |||||

| 50,964 | KBR, INC. | 941,817 | 1,250,657 | |||||

| 13,539 | KEMET CORP. | 230,805 | 246,139 | |||||

| 18 | (Continued) |

CLEARWATER INVESTMENT TRUST

Schedule of Investments -

Clearwater Small Companies Fund

September 30, 2019

(unaudited)

| Shares | Security | Cost | Fair value (a) | Percent of net assets | ||||

| Information Technology (Cont'd): | ||||||||

| 19,181 | LUMENTUM HOLDINGS, INC.(b) | $1,039,951 | 1,027,334 | |||||

| 6,190 | MKS INSTRUMENTS, INC. | 444,669 | 571,213 | |||||

| 96,977 | MONOTYPE IMAGING HOLDINGS, INC. | 1,733,769 | 1,921,114 | |||||

| 16,889 | NOVANTA, INC.(b) | 471,353 | 1,380,169 | |||||

| 35,581 | PERFICIENT, INC.(b) | 562,867 | 1,372,715 | |||||

| 13,805 | PFSWEB, INC.(b) | 29,740 | 34,927 | |||||

| 42,920 | PLEXUS CORP.(b) | 2,401,659 | 2,682,929 | |||||

| 13,046 | PROS HOLDINGS, INC.(b) | 404,440 | 777,542 | |||||

| 86,656 | RIBBON COMMUNICATIONS, INC.(b) | 441,824 | 506,071 | |||||

| 3,444 | ROGERS CORP.(b) | 398,157 | 470,829 | |||||

| 65,846 | SCANSOURCE, INC.(b) | 2,514,326 | 2,011,595 | |||||

| 382,242 | SERVICESOURCE INTERNATIONAL, INC.(b) | 372,988 | 336,373 | |||||

| 258,208 | STEEL CONNECT, INC.(b) | 431,614 | 446,700 | |||||

| 33,900 | SUPER MICRO COMPUTER, INC.(b) | 708,973 | 650,880 | |||||

| 39,830 | SYKES ENTERPRISES, INC.(b) | 1,171,334 | 1,220,391 | |||||

| 22,511 | SYNNEX CORP. | 1,274,077 | 2,541,492 | |||||

| 286,837 | TIVO CORP. | 2,743,009 | 2,184,264 | |||||

| 63,759 | UNISYS CORP.(b) | 605,659 | 473,729 | |||||

| 111,480 | VERRA MOBILITY CORP.(b) | 1,512,770 | 1,599,738 | |||||

| 25,167 | VIRTUSA CORP.(b) | 1,188,166 | 906,515 | |||||

| 40,713,767 | 44,983,225 | 13.28% | ||||||

| Materials: | ||||||||

| 12,352 | AMERICAN VANGUARD CORP. | 218,973 | 193,926 | |||||

| 40,000 | H.B. FULLER CO. | 2,190,810 | 1,862,400 | |||||

| 38,377 | INGEVITY CORP.(b) | 2,577,278 | 3,255,905 | |||||

| 7,487 | INNOPHOS HOLDINGS, INC. | 212,843 | 243,028 | |||||

| 29,795 | KOPPERS HOLDINGS, INC.(b) | 579,129 | 870,312 | |||||

| 6,778 | MATERION CORP. | 344,347 | 415,898 | |||||

| 3,564 | MERCER INTERNATIONAL, INC.(c) | 48,243 | 44,693 | |||||

| 1,667 | NORTHERN TECHNOLOGIES INTERNATIONAL CORP. | 18,495 | 21,071 | |||||

| 37,614 | PQ GROUP HOLDINGS, INC.(b) | 584,924 | 599,567 | |||||

| 24,300 | RELIANCE STEEL & ALUMINUM CO. | 1,847,591 | 2,421,738 | |||||

| 76,000 | SCHWEITZER-MAUDUIT INTERNATIONAL, INC. | 3,021,050 | 2,845,440 | |||||

| 11,643,683 | 12,773,978 | 3.77% | ||||||

| Real Estate: | ||||||||

| 54,922 | BLUEROCK RESIDENTIAL GROWTH REIT, INC. | 471,193 | 646,432 | |||||

| 21,833 | CATCHMARK TIMBER TRUST, INC., CLASS A | 206,352 | 232,958 | |||||

| 8,057 | CITY OFFICE REIT, INC.(c) | 76,191 | 115,940 | |||||

| 70,348 | CONDOR HOSPITALITY TRUST, INC. | 772,926 | 777,345 | |||||

| 67,067 | DIAMONDROCK HOSPITALITY CO. | 728,909 | 687,437 | |||||