UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-05037)

Professionally Managed Portfolios

(Exact name of registrant as specified in charter)

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

(Address of principal executive offices) (Zip code)

Elaine E. Richards

Professionally Managed Portfolios

c/o U.S. Bank Global Fund Services

2020 E. Financial Way, Ste. 100

Glendora, CA 91741

(Name and address of agent for service)

2020 E. Financial Way, Ste. 100

Glendora, CA 91741

(Name and address of agent for service)

(626) 914-7363

Registrant's telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: December 31, 2020

Item 1. Report to Stockholders.

Muzinich & Co.

Muzinich Credit Opportunities Fund

Muzinich U.S. High Yield

Corporate Bond Fund

Muzinich Low Duration Fund

Muzinich High Income

Floating Rate Fund

ANNUAL REPORT

December 31, 2020

Important Notice: The U.S. Securities and Exchange Commission will permit funds to make shareholder reports available electronically beginning January 1, 2021. Accordingly, paper

copies will no longer be mailed. Instead, at that time, the Muzinich Funds will send a notice, either by mail or e-mail, each time your fund’s updated report is available on our website at www.muzinichusfunds.com/literature. Investors enrolled in

electronic delivery will receive the notice by e-mail, with links to the updated report and don’t need to take any action. Investors who are not enrolled in electronic delivery by January 1, 2021 will receive the notice in the mail. All investors who

prefer to receive shareholder reports in a printed format may, at any time, choose that option free of charge by calling 1-855-MUZINICH (1-855-689-4642).

Muzinich Funds

|

TABLE OF CONTENTS

|

|

A Message to our Shareholders

|

1

|

||

|

Sector Allocations

|

6

|

||

|

Historical Performance

|

10

|

||

|

Schedules of Investments

|

17

|

||

|

Statements of Assets and Liabilities

|

48

|

||

|

Statements of Operations

|

51

|

||

|

Statements of Changes in Net Assets

|

52

|

||

|

Financial Highlights

|

57

|

||

|

Notes to Financial Statements

|

64

|

||

|

Report of Independent Registered Public Accounting Firm

|

77

|

||

|

Expense Examples

|

78

|

||

|

Approval of Investment Advisory Agreement

|

80

|

||

|

Trustees and Executive Officers

|

83

|

||

|

Additional Information

|

86

|

||

|

Privacy Notice

|

88

|

(This Page Intentionally Left Blank.)

Muzinich Funds

Dear Investors:

The Muzinich Credit Opportunities Fund (“Credit Opportunities Fund”) finished the year with asset growth from $417,324,951 to $541,125,839, reflecting net

inflows and a strong net investment return of +6.30% for the Supra Institutional Class and +6.24% for the Institutional Class. The Fund underperformed the broad global corporate credit markets as reflected in the +7.99% return of the ICE BofAML

Global Corporate and High Yield Index (GI00) hedged to USD, which is the Fund’s primary benchmark. Since inception from January 3, 2013, the Fund’s Supra Institutional Class have gained an annualized net return of +5.10%, while the benchmark has

also returned +5.10% annualized.

|

Since Inception

|

||||

|

Performance as of December 31, 2020

|

1 Year

|

3 Year

|

5 Year

|

(1/3/2013)

|

|

Credit Opportunities Fund – Supra Institutional

|

6.30%

|

5.67%

|

5.61%

|

5.10%

|

|

ICE BofAML Global Corporate & High Yield Index (GI00)

|

7.56%

|

5.74%

|

6.07%

|

4.74%

|

|

ICE BofAML Global Corporate & High Yield Index (USD 100% Hedged)

|

7.99%

|

6.45%

|

6.67%

|

5.10%

|

Periods greater than one year are average annual returns.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an

investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data currency to the most

recent month end may be obtained by calling (1-855-689-4642). The Fund imposes a 1.00% redemption fee on shares held for less than 90 days. Performance data quoted does not reflect the redemption fee. If reflected, total returns would be less.

Expense Ratios1

Gross Expense Ratio: 0.77%

Net Expense Ratio: 0.60%2

|

1

|

Expense ratios are from the Fund’s most recent prospectus dated April 30, 2020 (Supra Institutional Class). See the Financial Highlights in this report for the most current expense ratios.

|

|

2

|

The Advisor has contractually agreed to waive its fees and reimburse certain expenses through April 30, 2021.

|

The Muzinich U.S. High Yield Corporate Bond Fund (“U.S. High Yield Fund”) began the year with assets of $45,105,476 and grew to $68,764,402, on net inflows

and investment performance. The Fund’s Supra Institutional Class gained +6.82% net over this year, outperforming the +6.32% return of the benchmark, the ICE BofAML BB-B U.S. Cash Pay High Yield Constrained Index (JUC4). Institutional Class gained

+6.81%.

The Muzinich Low Duration Fund (“Low Duration Fund”) declined from its year end-starting balance of $732,102,499 to $596,418,893, reflecting large net

outflows, but positive investment performance. The Supra Institutional Class produced a net gain of +2.64%, vs. +3.34% for the index, ICE BofAML 1-3 Year U.S. Corporate & Government Index (B1A0), which serves as this Fund’s primary benchmark.

The Institutional Class gained 2.70%. Since inception on June 30, 2016, the Institutional Class has produced an annualized net return of +3.69% vs. the benchmark’s annualized return of +2.11%.

|

Since Inception

|

|||

|

Performance as of December 31, 2020

|

1 Year

|

3 Year

|

(6/30/2016)

|

|

Low Duration Fund – Supra Institutional

|

2.64%

|

3.72%

|

3.69%

|

|

ICE BofA ML 1-3 Year U.S. Corporate & Government Index (B1A0)

|

3.34%

|

3.01%

|

2.11%

|

Periods greater than one year are average annual returns.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an

investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data currency to the most

recent month end may be obtained by calling (1-855-689-4642). The Fund imposes a 1.00% redemption fee on shares held for less than 90 days. Performance data quoted does not reflect the redemption fee. If reflected, total returns would be less.

Expense Ratios1

Gross Expense Ratio: 0.60%

Net Expense Ratio: 0.50%2

|

1

|

Expense ratios are from the Fund’s most recent prospectus dated April 30, 2020 (Supra Institutional Class). See the Financial Highlights in this report for the most current expense ratios.

|

|

2

|

The Advisor has contractually agreed to waive its fees and reimburse certain expenses through April 30, 2021.

|

1

Muzinich Funds

The Muzinich High Income Floating Rate Fund (“Floating Rate Fund”) finished the year with strong asset growth from $11,438,262 to $17,708,055, reflecting

net inflows and a positive investment gain over the period. The Fund returned +4.83% over the period and outperformed the +2.78% gain for its benchmark, the Credit Suisse Leveraged Loan Index.

Market

The first quarter of 2020 was completely overshadowed by a collapse in the price of oil, occurring simultaneously with March’s COVID-19 global sell-off.

As people across the globe were quarantined and global economies largely shuttered, global fixed income — with the exception of safe-haven Treasuries — and equities alike declined precipitously. However, hugely supportive measures from various

central banks (led by the U.S. Federal Reserve, the European Central Bank, Bank of England, and various emerging markets (EM) central banks), were able to help the markets digest economic uncertainties. Aggressive global fiscal stimulus measures by

governments, including those in the U.S. and EU, additionally eased investor nerves, facilitating a global credit market rally following the COVID-19 induced panic. Globally, broad government policies designed to support the unemployed and small

businesses were enormously helpful in keeping the financial spigots as open as possible in a world that was largely closed to all but the most essential activity. Awash with new liquidity and buoyed by stabilization efforts, investment grade and

high yield corporates started rebounding, with surging new issuance across both developed and emerging markets, as companies looked to lock in record cheap financing. Massive new issuance did not, however, dampen investor enthusiasm for fixed income

that was being fully supported by monetary and fiscal policy. On the contrary, demand stayed high and prices recovered attractively, first in investment grade credit, followed later in the period by a strong high yield surge. The U.S. bounced back

faster than Europe, in general. Loans took longer to recover in both markets amidst unprecedented low rates but presented the market with notable value by the period’s end. Overall, global corporate credit continued to rally for the remainder of

the reporting period with some intermittent volatility, driven forward by continued technical support offered widely by central banks and the impending resolution of geopolitical uncertainties that had long weighed on investor sentiment, including,

notably, the U.S. election and the U.K.’s successful departure from the European Union, (Brexit). We ended the year as a world with stimulus and light at the end of the COVID-19 tunnel; investors demonstrated confidence by adding credit to their

portfolios despite rising COVID-19 cases and death counts. Looking ahead, we see bullish growth outlooks for both commodities and energy as balance sheets continue to be repaired, and for COVID-19 recovery sectors reliant on continued economic

reopening.

Performance Factors

Muzinich Credit Opportunities Fund

In 2020, the Credit Opportunities Fund generated positive performance demonstrating its ability to preserve capital when the markets were most strained

before recovering quickly and rebounding on good credit selection and full investment. While the Fund generated an attractive positive return, it underperformed its indicative benchmark, the ICE BofA ML Global Corporate and High Yield Index (GI00).

The Fund benefitted from defensive positioning at the beginning of Q1. In March, when even high quality assets everywhere came under significant pressure in the rush by investors to sell anything to raise cash and liquidity, the Fund’s defensive

U.S. high yield allocations (and conservative positioning more broadly), protected the portfolio during the worst of the drawdown. Specifically, the Fund benefitted from its emphasis on non-cyclical sectors and limited energy exposure. Following

the March selloff, the investment team strategically added longer-duration, high quality paper which effectively bolstered returns. By late summer, we started a repositioning program in anticipation of short-term volatility, reallocating from longer

duration/higher quality credit to shorter duration/credit focused sectors that offered increased yield and more exposure to opportunities presented by an anticipated reopening of the global economies. As a result of these diligent tactical moves,

the Fund was well positioned when U.S. Treasury rates rose in Q3. While the Fund’s longer duration and higher quality U.S. investment grade holdings were negatively impacted, the Fund’s U.S. and emerging market high yield sleeves more than

compensated. During the year the Fund also started a small position in global syndicated loans and has continued to benefit from the relative value we have found therein. In Q4, we focused on positioning in anticipation of a positive market

response following the U.S. election by reserving 5% cash for “dip buying” opportunities. This decision served the Fund well since we were well-placed to deploy our cash prudently; we also began rotating steadily from “stay-at-home” sectors to

“reopening” sectors that saw improvement from the anticipated resumption of normalized economic activities. Throughout the reporting period, we continued to move away from more duration sensitive exposure as we believed interest rates would be

increasing for bonds with 10-year maturities and longer; to this effect we have reduced duration primarily in U.S. investment grade holdings and some emerging markets investment grade positions.

2

Muzinich Funds

Muzinich U.S. High Yield Corporate Bond Fund

In this environment, the Muzinich U.S. High Yield Corporate Bond delivered strong positive returns, outperforming its benchmark. Fund performance exceeded

the benchmark both when the market was most stressed in March and when the market rallied, showing both strength in risk control and nimbleness around market momentum. At the time of the global sell-off, the Fund’s capital preservation came from

underweighting energy and aerospace, and from strong telecom credit selection, though our higher quality energy selections lagged the subsequent market rebound in Q2. For the year, outperformance was driven by credit selection in services, telecom,

and capital goods. Strong selection across the 3-5 years duration range bolstered performance. By ratings, the Fund benefitted on a relative basis from superior credit selection of CCC+ rated credits versus the benchmark, while on an absolute

basis, the largest contributions came from the BB rated cohort. At the end of the reporting period, we remained focused on fallen angel Exploration and Production (E&P) and pipelines within the energy sector. Additionally, we spent most of the

year underweight COVID-19 impacted sectors; preferring to invest in these spaces via secured bonds or short-term paper within the liquidity window. Looking ahead, we see value in staying fully invested since we believe carry will be the largest

source of return in the year to come.

Low Duration Fund

In 2020, the Fund generated strong performance and outperformed its benchmark, more than recovering the ground lost in the March sell-off earlier in the

year. While the Fund’s European and credit-biased portfolio was perhaps slower to rebound than portfolios led by a stronger Treasury movement, the Fund benefitted over the year as a whole from careful management of its exposure to some of the

sectors most impacted by COVID-19 and from taking steps to reduce the beta of the portfolio ahead of expected volatility later in the year. Longer duration EUR names performed well in light of falling rates, with overall portfolio duration remaining

within the Fund’s mandate. We maintained a bias towards BBB rated credits with a healthy allocation as well to select high yield bonds as we expect further recovery in credit spreads. The U.S. remained the strongest performing region on an absolute

and relative basis, due to the aforementioned strong rally in Treasuries over the reporting period. By industry, our superior credit selection of automotive & auto parts and super retail bolstered relative performance, while on an absolute basis,

contributions were led by banking, diversified financial services, and automotive & auto parts. Lower quality credit underperformed higher quality credit while the market was recovering from the pandemic, however the Fund’s bias to BBBs was a net

positive during the period. At the end of the year, we focused on names where we saw what we believed to be good liquidity and a demonstrated ability to weather a pandemic-induced storm. We found that the primary market remained one of the most

efficient places to deploy cash, and we participated in new issues. As yields globally have fallen back to very low levels in a post-pandemic rally, we view investors’ need for yield as a likely powerful future driver.

Floating Rate Fund

In 2020, the Fund generated a positive return and strongly outperformed its benchmark, the Credit Suisse Leveraged Loan Index (CSLLI). Positive

performance was driven by credit selection within the lower rated exposures as investors sought discounts wherever they were still available. On a sector basis, Fund performance was bolstered by superior credit selection in healthcare and technology.

Looking forward, we believe that loan valuations coupled with what we see as likely strong technicals, could make for a strong 2021 for the asset class. We believe that the loan market still offers attractive opportunities and that it is likely that

retail will begin to return to the market as rate expectations rise. Consequently, we are expecting a total return for the year ahead which exceeds the interest return. Risks to this view could include more defaults than we currently expect, or

another exogenous shock to markets generally, but all things being equal, we believe loans could provide attractive returns in 2021.

Outlook

Where do we go from here? At this point, we see fundamentals improving (with the assumption of a successful recovery from COVID-19) and the potential for

solid economic numbers in 2H 2021. One of our longer-term concerns with this scenario is a steepening of the yield curve, although we believe that this will likely be manageable given Fed support. Companies have done a great job cutting costs,

creating substantial cash flow leverage to an upside scenario. Technicals remain encouraging as corporate credit, particularly leveraged finance including high yield and term loans, remains the only game in town as fixed income investors are likely

to look for spread product to mitigate a potential steepening of the Treasury curve. We believe supply should remain elevated from historic norms in 2021, but the absolute amount of debt issued will decline as the challenges posed by COVID-19

recede. As Treasury yields have fallen to low levels in a formidable post-pandemic rally, we view the need for spread as a powerful future driver of fund flows as low yield cash deposits are channeled into higher yielding credit assets in 2021.

3

Muzinich Funds

We appreciate the confidence and trust you have placed in Muzinich.

Sincerely,

|

|

|

|

Anthony DeMeo

|

Stuart Fuller

|

Joe Galzerano

|

|

|

|

|

Tatjana Greil-Castro

|

Warren Hyland

|

Ian Horn

|

|

|

|

|

Michael McEachern

|

Sam McGairl

|

Bryan Petermann

|

|

|

|

|

Torben Ronberg

|

Thomas Samson

|

Kevin Ziets

|

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Past performance does not guarantee future results. Short-term performance, in particular, is not a good indication of the Funds’ future performance, and

an investment should not be made solely on returns.

References to other funds should not be interpreted as an offer of these securities.

Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Please see the Schedules

of Investments for a complete list of holdings.

Mutual fund investing involves risk. Principal loss is possible. Investments in debt securities typically decrease in value when interest rates rise. This

risk is usually greater for longer-term debt securities. Investment by the Funds in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. Investments in foreign securities involve

greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for emerging markets. Derivatives involve risks different from, and in certain cases, greater than the risks presented by

more traditional investments. These risks are fully disclosed in the prospectus. Floating rate loans may not be fully collateralized and therefore may decline significantly in value. Each Fund will bear its share of the fees and expenses of

investments in underlying funds or exchange-traded funds (ETFs). Shareholders will pay higher expenses than would be the case if making direct investments in underlying funds or ETFs. Because the Funds invest in ETFs, they are subject to additional

risks that do not apply to conventional mutual funds, including the risks that the market price of an ETF’s shares may trade at a discount to its net asset value (“NAV”), an active secondary trading market may not develop or be maintained, or trading

may be halted by the exchange in which they trade, which may impact a Fund’s ability to sell its shares. The Funds invest in high yield debt instruments which tend to be less liquid than higher quality debt instruments. The Funds may make short sales

of securities, which involves the risk that losses may exceed the original amount invested. Please note that while the Funds’ prospectus states that the Funds may use leverage, and that they may make short sales of securities, which involve the risk

that losses may exceed the original amount invested, the Funds’ portfolio managers do not anticipate engaging in either practice. The Funds will endeavor to limit price fluctuations caused by the changing relative value of currencies in which the

Funds invest, but hedging involves costs and there can be no guarantee that the Funds will be perfectly hedged or that the hedging will work as anticipated. Diversification does not assure a profit, nor does it protect against a loss in a declining

market.

Must be preceded or accompanied by a prospectus.

4

Muzinich Funds

Bond ratings are grades given to bonds that indicate their credit quality as determined by a private independent rating service. The firm evaluates a bond issuer’s financial

strength, or its ability to pay a bond’s principal and interest in a timely fashion. Ratings are expressed as letters ranging from ‘AAA’ which is the highest grade to ‘D,’ which is the lowest grade. In limited situations when the rating agency has

not issued a formal rating, the Advisor will classify the security as non-rated.

Index Definitions:

The ICE BofA Merrill Lynch Global Corporate & High Yield Index (GI00) is an unmanaged index tracking the performance of fixed-rate investment grade and below investment

grade corporate debt publicly issued in the major domestic and Eurobond markets. Qualifying currencies include AUD, CAD, EUR, JPY, GBP, and USD. Qualifying issues must meet minimum size requirements denominated in the currency of issue, and must have

a remaining term of at least one year to maturity.

The ICE BofA Merrill Lynch BB-B US Cash Pay High Yield Constrained Index (JUC4) contains all securities in The BofA Merrill Lynch US Cash Pay High Yield Index rated BB1

through B3, based on an average of Moody’s, S&P and Fitch, but caps issuer exposure at 2%. Index constituents are capitalization-weighted, based on their current amount outstanding, provided the total allocation to an individual issuer does not

exceed 2%.

The ICE BofA Merrill Lynch 1-3 Year US Corporate & Government Index (B1A0) is a subset of The BofA Merrill Lynch US Corporate & Government Index including all

securities with a remaining term to final maturity less than 3 years.

The ICE BofA ML Global High Yield Index (HW00) tracks the performance of USD, CAD, GBP and EUR denominated below investment grade corporate debt publicly issued in the major

domestic or eurobond markets. Qualifying securities must have a below investment grade rating (based on an average of Moody’s, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one year remaining term to final

maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of USD 250 million, EUR 250 million, GBP 100 million, or CAD 100 million.

CS Leveraged Loan Index – The CS Leveraged Loan Index is designed to mirror the investable universe of US dollar denominated leveraged loan market. The index is rebalanced

monthly on the last business day of the month instead of daily. Qualifying loans must have a minimum outstanding balance of $100 million for all facilities except TL A facilities (TL A facilities need a minimum outstanding balance of $1 billion),

issuers domiciled in developed countries, at least one year long tenor, be rated “5B” or lower, fully funded and priced by a third party vendor at month-end.

Glossary:

U.S. Treasury is a fixed-interest U.S. government debt security with a maturity of more than 10 years.

Duration is a measure of the expected life of a fixed income security that is used to determine the sensitivity of a security’s price to changes in interest rates.

Spreads are the difference between the interest rate received on a bond and the interest rate that would be received at the same time on a similar-duration U.S. government

debt security.

Beta is a measure of volatility of a security or portfolio compared to the market as a whole.

Muzinich & Co. is a registered investment adviser. The Muzinich Funds are distributed by Quasar Distributors, LLC.

5

Credit Opportunities Fund

|

SECTOR ALLOCATIONS at December 31, 2020 (Unaudited)

|

|

Sector

|

% of Net Assets

|

|||

|

|

||||

|

Healthcare

|

10.9

|

%

|

||

|

Banking

|

10.1

|

%

|

||

|

Telecommunications

|

8.6

|

%

|

||

|

Automotive & Auto Parts

|

7.6

|

%

|

||

|

Energy

|

7.5

|

%

|

||

|

Diversified Financial Services

|

5.8

|

%

|

||

|

Food/Beverage/Tobacco

|

5.7

|

%

|

||

|

Cable/Satellite TV

|

3.5

|

%

|

||

|

Broadcasting

|

3.2

|

%

|

||

|

Technology

|

3.1

|

%

|

||

|

Quasi & Foreign Government

|

3.0

|

%

|

||

|

Homebuilders/Real Estate

|

2.8

|

%

|

||

|

Utilities

|

2.3

|

%

|

||

|

Chemicals

|

2.0

|

%

|

||

|

Containers

|

2.0

|

%

|

||

|

Metals/Mining

|

2.0

|

%

|

||

|

Building Materials

|

1.8

|

%

|

||

|

Transportation Excluding Air/Rail

|

1.7

|

%

|

||

|

Services

|

1.5

|

%

|

||

|

Airlines

|

1.4

|

%

|

||

|

Capital Goods

|

1.3

|

%

|

||

|

Diversified Media

|

1.3

|

%

|

||

|

Affiliated Mutual Funds

|

1.1

|

%

|

||

|

Super Retail

|

0.8

|

%

|

||

|

Insurance

|

0.7

|

%

|

||

|

Restaurants

|

0.7

|

%

|

||

|

Steel

|

0.7

|

%

|

||

|

Consumer-Products

|

0.6

|

%

|

||

|

Paper

|

0.6

|

%

|

||

|

Leisure

|

0.5

|

%

|

||

|

Aerospace/Defense

|

0.4

|

%

|

||

|

Food & Drug Retail

|

0.4

|

%

|

||

|

Gaming

|

0.4

|

%

|

||

|

Environmental

|

0.2

|

%

|

||

|

Publishing/Printing

|

0.2

|

%

|

||

|

Hotels

|

0.1

|

%

|

||

|

Cash & Equivalents1

|

3.5

|

%

|

||

|

Total

|

100.0

|

%

|

||

|

1

|

Represents cash and other assets in excess of liabilities.

|

6

U.S. High Yield Fund

|

SECTOR ALLOCATIONS at December 31, 2020 (Unaudited)

|

|

Sector

|

% of Net Assets

|

|||

|

|

||||

|

Energy

|

13.7

|

%

|

||

|

Healthcare

|

10.2

|

%

|

||

|

Telecommunications

|

7.6

|

%

|

||

|

Cable/Satellite TV

|

5.6

|

%

|

||

|

Homebuilders/Real Estate

|

5.6

|

%

|

||

|

Automotive & Auto Parts

|

5.4

|

%

|

||

|

Broadcasting

|

5.1

|

%

|

||

|

Diversified Financial Services

|

3.6

|

%

|

||

|

Metals/Mining

|

3.3

|

%

|

||

|

Food/Beverage/Tobacco

|

3.2

|

%

|

||

|

Building Materials

|

3.1

|

%

|

||

|

Chemicals

|

3.1

|

%

|

||

|

Gaming

|

2.7

|

%

|

||

|

Capital Goods

|

2.5

|

%

|

||

|

Banking

|

2.4

|

%

|

||

|

Technology

|

2.4

|

%

|

||

|

Services

|

2.3

|

%

|

||

|

Super Retail

|

2.1

|

%

|

||

|

Utilities

|

1.8

|

%

|

||

|

Airlines

|

1.6

|

%

|

||

|

Restaurants

|

1.5

|

%

|

||

|

Leisure

|

1.4

|

%

|

||

|

Aerospace/Defense

|

1.2

|

%

|

||

|

Diversified Media

|

1.1

|

%

|

||

|

Food & Drug Retail

|

1.0

|

%

|

||

|

Steel

|

0.9

|

%

|

||

|

Containers

|

0.7

|

%

|

||

|

Paper

|

0.6

|

%

|

||

|

Consumer Products

|

0.5

|

%

|

||

|

Publishing/Printing

|

0.5

|

%

|

||

|

Insurance

|

0.4

|

%

|

||

|

Hotels

|

0.1

|

%

|

||

|

Transportation Excluding Air/Rail

|

0.1

|

%

|

||

|

Cash & Equivalents1

|

2.7

|

%

|

||

|

Total

|

100.0

|

%

|

||

|

1

|

Represents cash and other assets in excess of liabilities.

|

7

Low Duration Fund

|

SECTOR ALLOCATIONS at December 31, 2020 (Unaudited)

|

|

Sector

|

% of Net Assets

|

|||

|

|

||||

|

Banking

|

20.6

|

%

|

||

|

Diversified Financial Services

|

16.4

|

%

|

||

|

Automotive & Auto Parts

|

9.4

|

%

|

||

|

Homebuilders/Real Estate

|

7.6

|

%

|

||

|

Telecommunications

|

5.4

|

%

|

||

|

Energy

|

5.1

|

%

|

||

|

Chemicals

|

3.1

|

%

|

||

|

Technology

|

2.7

|

%

|

||

|

Healthcare

|

2.6

|

%

|

||

|

Super Retail

|

2.3

|

%

|

||

|

Utilities

|

2.3

|

%

|

||

|

Services

|

2.2

|

%

|

||

|

Airlines

|

1.8

|

%

|

||

|

Transportation Excluding Air/Rail

|

1.8

|

%

|

||

|

Aerospace/Defense

|

1.3

|

%

|

||

|

Capital Goods

|

1.3

|

%

|

||

|

Gaming

|

1.3

|

%

|

||

|

Leisure

|

1.3

|

%

|

||

|

Affiliated Mutual Funds

|

1.2

|

%

|

||

|

Food/Beverage/Tobacco

|

1.1

|

%

|

||

|

Quasi & Foreign Government

|

1.1

|

%

|

||

|

Collateralized Debt Obligation

|

0.9

|

%

|

||

|

Food & Drug Retail

|

0.8

|

%

|

||

|

Building Materials

|

0.7

|

%

|

||

|

Cable/Satellite TV

|

0.7

|

%

|

||

|

Diversified Media

|

0.7

|

%

|

||

|

Insurance

|

0.6

|

%

|

||

|

Broadcasting

|

0.5

|

%

|

||

|

Metals/Mining

|

0.5

|

%

|

||

|

Containers

|

0.3

|

%

|

||

|

Steel

|

0.3

|

%

|

||

|

Consumer-Products

|

0.2

|

%

|

||

|

Publishing/Printing

|

0.2

|

%

|

||

|

Cash & Equivalents1

|

1.7

|

%

|

||

|

Total

|

100.0

|

%

|

||

|

1

|

Represents cash and other assets in excess of liabilities.

|

8

Floating Rate Fund

|

SECTOR ALLOCATIONS at December 31, 2020 (Unaudited)

|

|

Sector

|

% of Net Assets

|

|||

|

|

||||

|

Technology

|

14.8

|

%

|

||

|

Healthcare

|

12.7

|

%

|

||

|

Services

|

7.8

|

%

|

||

|

Telecommunications

|

6.5

|

%

|

||

|

Utilities

|

5.7

|

%

|

||

|

Capital Goods

|

5.5

|

%

|

||

|

Automotive & Auto Parts

|

4.6

|

%

|

||

|

Diversified Financial Services

|

4.3

|

%

|

||

|

Food/Beverage/Tobacco

|

4.2

|

%

|

||

|

Diversified Media

|

4.0

|

%

|

||

|

Gaming

|

3.1

|

%

|

||

|

Broadcasting

|

2.5

|

%

|

||

|

Building Materials

|

2.4

|

%

|

||

|

Consumer Products

|

2.2

|

%

|

||

|

Insurance

|

2.2

|

%

|

||

|

Metals/Mining

|

1.9

|

%

|

||

|

Chemicals

|

1.8

|

%

|

||

|

Super Retail

|

1.8

|

%

|

||

|

Cable/Satellite TV

|

1.7

|

%

|

||

|

Environmental

|

1.4

|

%

|

||

|

Energy

|

1.3

|

%

|

||

|

Containers

|

1.1

|

%

|

||

|

Transportation Excluding Air/Rail

|

1.1

|

%

|

||

|

Leisure

|

1.0

|

%

|

||

|

Restaurants

|

0.9

|

%

|

||

|

Cash & Equivalents1

|

3.5

|

%

|

||

|

Total

|

100.0

|

%

|

||

|

1

|

Represents cash and other assets in excess of liabilities.

|

9

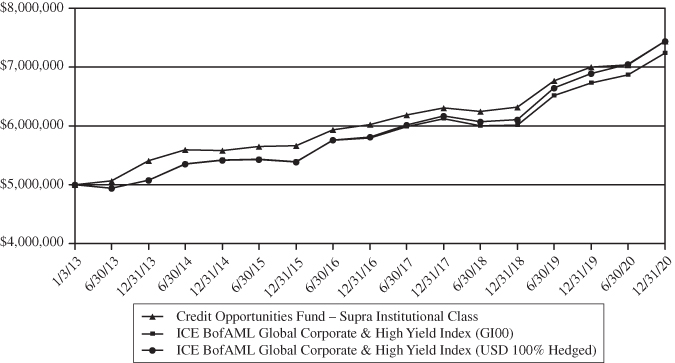

Credit Opportunities Fund

|

HISTORICAL PERFORMANCE – SUPRA INSTITUTIONAL CLASS

|

Value of $5,000,000 vs. ICE BofAML Global Corporate & High Yield Index (GI00)

and ICE BofAML Global Corporate & High Yield Index (USD 100% Hedged)

(Unaudited)

|

Average Annual

|

Since Inception

|

Ending Value

|

|||

|

Returns for the Periods Ended December 31, 2020

|

1 Year

|

3 Year

|

5 Year

|

(1/3/2013)

|

(12/31/2020)

|

|

Credit Opportunities Fund – Supra Institutional Class

|

6.30%

|

5.67%

|

5.61%

|

5.10%

|

$7,441,731

|

|

ICE BofAML Global Corporate &

|

|||||

|

High Yield Index (GI00)

|

7.56%

|

5.74%

|

6.07%

|

4.74%

|

$7,238,713

|

|

ICE BofAML Global Corporate &

|

|||||

|

High Yield Index (USD 100% Hedged)

|

7.99%

|

6.45%

|

6.67%

|

5.10%

|

$7,440,929

|

This chart illustrates the performance of a hypothetical $5,000,000 investment made on January 3, 2013, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that

a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital gains, dividends

and return of capital, if applicable, for the Fund and dividends for the index.

10

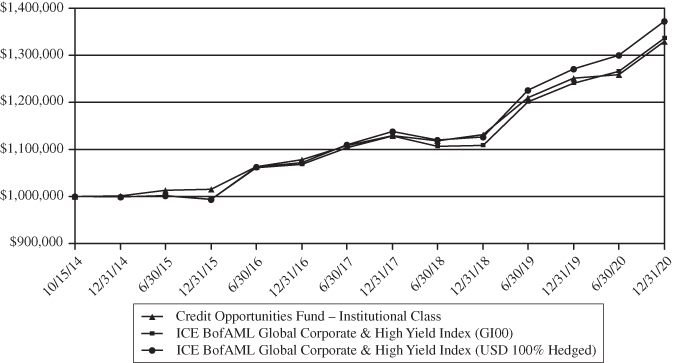

Credit Opportunities Fund

|

HISTORICAL PERFORMANCE – INSTITUTIONAL CLASS

|

Value of $1,000,000 vs. ICE BofAML Global Corporate & High Yield Index (GI00)

and ICE BofAML Global Corporate & High Yield Index (USD 100% Hedged)

(Unaudited)

|

Average Annual

|

Since Inception

|

Ending Value

|

|||

|

Returns for the Periods Ended December 31, 2020

|

1 Year

|

3 Year

|

5 Year

|

(10/15/2014)

|

(12/31/2020)

|

|

Credit Opportunities Fund – Institutional Class

|

6.24%

|

5.59%

|

5.54%

|

4.69%

|

$1,329,562

|

|

ICE BofAML Global Corporate & High Yield Index (GI00)

|

7.56%

|

5.74%

|

6.07%

|

4.75%

|

$1,336,436

|

|

ICE BofAML Global Corporate &

|

|||||

|

High Yield Index (USD 100% Hedged)

|

7.99%

|

6.45%

|

6.67%

|

5.23%

|

$1,372,621

|

This chart illustrates the performance of a hypothetical $1,000,000 investment made on October 15, 2014, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes

that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital gains,

dividends and return of capital, if applicable, for the Fund and dividends for the index.

11

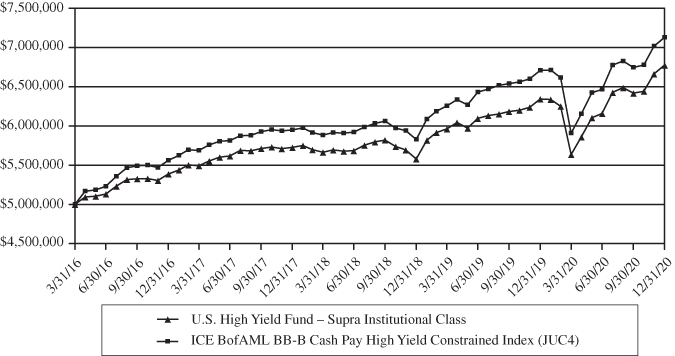

U.S. High Yield Fund

|

HISTORICAL PERFORMANCE – SUPRA INSTITUTIONAL CLASS

|

Value of $5,000,000 vs. ICE BofAML BB-B

Cash Pay High Yield Constrained Index (JUC4)

(Unaudited)

|

Average Annual

|

Since Inception

|

Ending Value

|

||

|

Returns for the Periods Ended December 31, 2020

|

1 Year

|

3 Year

|

(3/31/2016)

|

(12/31/2020)

|

|

U.S. High Yield Fund – Supra Institutional Class

|

6.82%

|

5.76%

|

6.60%

|

$6,775,401

|

|

ICE BofAML BB-B Cash Pay

|

||||

|

High Yield Constrained Index (JUC4)

|

6.32%

|

6.21%

|

7.80%

|

$7,132,344

|

This chart illustrates the performance of a hypothetical $5,000,000 investment made on March 31, 2016, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a

shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital gains, dividends and

return of capital, if applicable, for the Fund and dividends for the index.

12

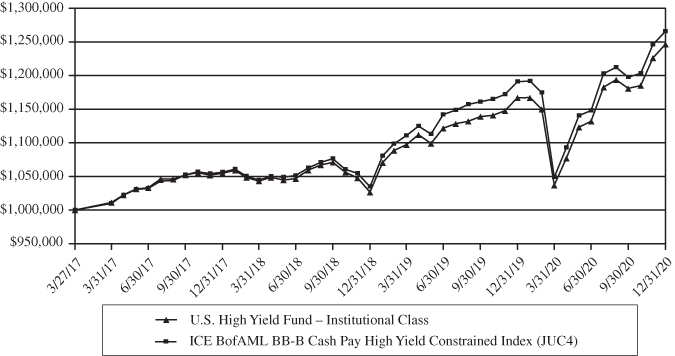

U.S. High Yield Fund

|

HISTORICAL PERFORMANCE – INSTITUTIONAL CLASS

|

Value of $1,000,000 vs. ICE BofAML BB-B

Cash Pay High Yield Constrained Index (JUC4)

(Unaudited)

|

Average Annual

|

Since Inception

|

Ending Value

|

||

|

Returns for the Periods Ended December 31, 2020

|

1 Year

|

3 Year

|

(3/27/2017)

|

(12/31/2020)

|

|

U.S. High Yield Fund – Institutional Class

|

6.81%

|

5.73%

|

6.03%

|

$1,246,464

|

|

ICE BofAML BB-B Cash Pay

|

||||

|

High Yield Constrained Index (JUC4)

|

6.32%

|

6.21%

|

6.42%

|

$1,266,264

|

This chart illustrates the performance of a hypothetical $1,000,000 investment made on March 27, 2017, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a

shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital gains, dividends and

return of capital, if applicable, for the Fund and dividends for the index.

13

Low Duration Fund

|

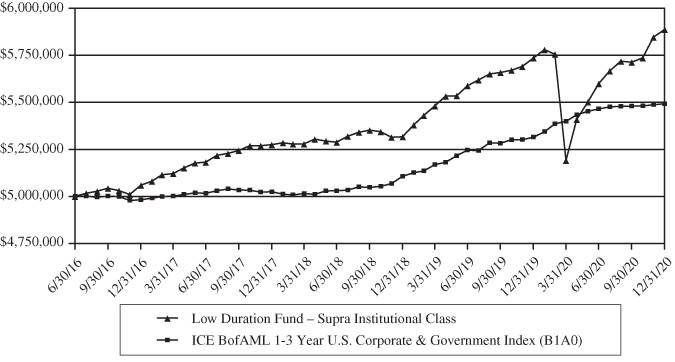

HISTORICAL PERFORMANCE – SUPRA INSTITUTIONAL CLASS

|

Value of $5,000,000 vs. ICE BofAML

1-3 Year U.S. Corporate & Government Index (B1A0)

(Unaudited)

|

Average Annual

|

Since Inception

|

Ending Value

|

||

|

Returns for the Periods Ended December 31, 2020

|

1 Year

|

3 Year

|

(6/30/2016)

|

(12/31/2020)

|

|

Low Duration Fund – Supra Institutional Class

|

2.64%

|

3.72%

|

3.69%

|

$5,885,994

|

|

ICE BofAML 1-3 Year U.S. Corporate & Government Index (B1A0)

|

3.34%

|

3.01%

|

2.11%

|

$5,492,102

|

This chart illustrates the performance of a hypothetical $5,000,000 investment made on June 30, 2016, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a

shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital gains, dividends and

return of capital, if applicable, for the Fund and dividends for the index.

14

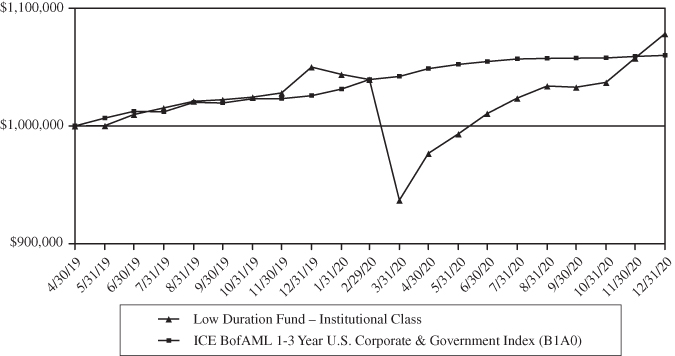

Low Duration Fund

|

HISTORICAL PERFORMANCE – INSTITUTIONAL CLASS

|

Value of $1,000,000 vs. ICE BofAML

1-3 Year U.S. Corporate & Government Index (B1A0)

(Unaudited)

|

Average Annual

|

Since Inception

|

Ending Value

|

|

|

Returns for the Periods Ended December 31, 2020

|

1 Year

|

(4/30/2019)

|

(12/31/2020)

|

|

Low Duration Fund – Institutional Class

|

2.70%

|

3.77%

|

$1,078,397

|

|

ICE BofAML 1-3 Year U.S. Corporate & Government Index (B1A0)

|

3.34%

|

3.55%

|

$1,059,974

|

This chart illustrates the performance of a hypothetical $1,000,000 investment made on April 30, 2019, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a

shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital gains, dividends and

return of capital, if applicable, for the Fund and dividends for the index.

15

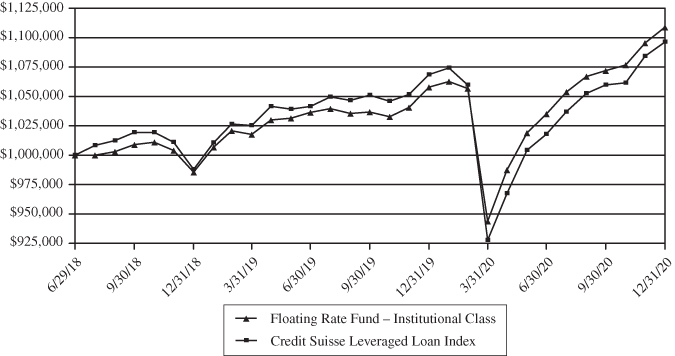

Floating Rate Fund

|

HISTORICAL PERFORMANCE – INSTITUTIONAL CLASS

|

Value of $1,000,000 vs. Credit Suisse Leveraged Loan Index

(Unaudited)

|

Average Annual

|

Since Inception

|

Ending Value

|

|

|

Returns for the Periods Ended December 31, 2020

|

1 Year

|

(6/29/2018)

|

(12/31/2020)

|

|

Floating Rate Fund – Institutional Class

|

4.83%

|

4.21%

|

$1,108,929

|

|

Credit Suisse Leveraged Loan Index

|

2.78%

|

3.82%

|

$1,096,288

|

This chart illustrates the performance of a hypothetical $1,000,000 investment made on June 29, 2018, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a

shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital gains, dividends and

return of capital, if applicable, for the Fund and dividends for the index.

16

Credit Opportunities Fund

|

SCHEDULE OF INVESTMENTS at December 31, 2020

|

|

Principal

|

|||||||||

|

Amount†

|

Value

|

||||||||

|

CORPORATE BONDS: 84.8%

|

|||||||||

|

Aerospace/Defense: 0.2%

|

|||||||||

|

Carrier Global Corp.

|

|||||||||

|

1,100,000

|

2.700%, 2/15/31

|

$

|

1,183,921

|

||||||

|

Airlines: 1.4%

|

|||||||||

|

Delta Air Lines Inc

|

|||||||||

|

1,200,000

|

3.400%, 4/19/21

|

1,207,933

|

|||||||

|

950,000

|

7.375%, 1/15/26

|

1,086,099

|

|||||||

|

Delta Air Lines Inc / SkyMiles IP Ltd

|

|||||||||

|

1,175,000

|

4.750%, 10/20/28

|

1,283,955

|

|||||||

|

Emirates Airline

|

|||||||||

|

1,825,666

|

4.500%, 2/6/25

|

1,859,660

|

|||||||

|

Mileage Plus Holdings LLC /

|

|||||||||

|

Mileage Plus Intellectual

|

|||||||||

|

Property Assets Ltd

|

|||||||||

|

1,975,000

|

6.500%, 6/20/27

|

2,126,828

|

|||||||

|

7,564,475

|

|||||||||

|

Automotive & Auto Parts: 6.9%

|

|||||||||

|

Faurecia SE

|

|||||||||

|

EUR

|

1,300,000

|

3.750%, 6/15/28

|

1,672,505

|

||||||

|

FCA Bank SPA

|

|||||||||

|

EUR

|

750,000

|

0.250%, 2/28/23

|

919,902

|

||||||

|

Fiat Chrysler Automobiles NV

|

|||||||||

|

EUR

|

1,250,000

|

3.375%, 7/7/23

|

1,629,800

|

||||||

|

Ford Motor Co

|

|||||||||

|

1,125,000

|

8.500%, 4/21/23

|

1,267,993

|

|||||||

|

Ford Motor Credit Co LLC

|

|||||||||

|

2,725,000

|

4.063%, 11/1/24

|

2,866,210

|

|||||||

|

250,000

|

4.542%, 8/1/26

|

267,188

|

|||||||

|

1,937,000

|

4.271%, 1/9/27

|

2,047,167

|

|||||||

|

750,000

|

4.125%, 8/17/27

|

786,562

|

|||||||

|

1,550,000

|

4.000%, 11/13/30

|

1,629,437

|

|||||||

|

General Motors Co

|

|||||||||

|

1,735,000

|

5.400%, 10/2/23

|

1,944,004

|

|||||||

|

1,650,000

|

6.125%, 10/1/25

|

2,003,061

|

|||||||

|

3,700,000

|

6.800%, 10/1/27

|

4,760,152

|

|||||||

|

General Motors Financial Co Inc

|

|||||||||

|

775,000

|

5.200%, 3/20/23

|

850,139

|

|||||||

|

2,550,000

|

2.700%, 8/20/27

|

2,708,438

|

|||||||

|

Kia Motors Corp

|

|||||||||

|

470,000

|

3.250%, 4/21/26

|

515,197

|

|||||||

|

570,000

|

3.500%, 10/25/27

|

621,767

|

|||||||

|

Nissan Motor Co Ltd

|

|||||||||

|

481,000

|

3.043%, 9/15/23

|

503,257

|

|||||||

|

325,000

|

3.522%, 9/17/25

|

348,283

|

|||||||

|

EUR

|

3,000,000

|

2.652%, 3/17/26

|

3,879,894

|

||||||

|

Schaeffler AG

|

|||||||||

|

EUR

|

900,000

|

2.750%, 10/12/25

|

1,166,962

|

||||||

|

Volkswagen International

|

|||||||||

|

Finance NV

|

|||||||||

|

EUR

|

1,900,000

|

3.500% (5 Year Swap Rate

|

|||||||

|

EUR + 3.746%), 6/17/25 1,2,4

|

2,454,028

|

||||||||

|

ZF Finance GmbH

|

|||||||||

|

EUR

|

700,000

|

3.000%, 9/21/25

|

887,218

|

||||||

|

ZF North America Capital Inc

|

|||||||||

|

EUR

|

1,100,000

|

2.750%, 4/27/23

|

1,381,400

|

||||||

|

37,110,564

|

|||||||||

|

Banking: 9.6%

|

|||||||||

|

ABN AMRO Bank NV

|

|||||||||

|

1,600,000

|

4.400% (5 Year Swap Rate

|

||||||||

|

USD + 2.197%), 3/27/28 1,2

|

1,707,577

|

||||||||

|

Australia & New Zealand

|

|||||||||

|

Banking Group Ltd

|

|||||||||

|

410,000

|

2.950% (5 Year CMT

|

||||||||

|

Rate + 1.288%), 7/22/30 1,2

|

432,867

|

||||||||

|

Banco Bradesco SA

|

|||||||||

|

2,319,000

|

3.200%, 1/27/25

|

2,432,075

|

|||||||

|

Banco Daycoval SA

|

|||||||||

|

850,000

|

4.250%, 12/13/24

|

886,389

|

|||||||

|

Banco do Brasil SA

|

|||||||||

|

971,000

|

4.750%, 3/20/24

|

1,046,253

|

|||||||

|

Bancolombia SA

|

|||||||||

|

500,000

|

4.875% (5 Year CMT

|

||||||||

|

Rate + 2.929%), 10/18/27 1,2

|

516,400

|

||||||||

|

Bank Leumi Le-Israel BM

|

|||||||||

|

2,180,000

|

3.275% (5 Year CMT

|

||||||||

|

Rate + 1.631%), 1/29/31 1,2

|

2,269,925

|

||||||||

|

Bank of Ireland Group PLC

|

|||||||||

|

2,075,000

|

4.125% (5 Year CMT

|

||||||||

|

Rate + 2.500%), 9/19/27 1,2

|

2,114,069

|

||||||||

|

Bank of New Zealand

|

|||||||||

|

2,050,000

|

3.500%, 2/20/24

|

2,229,585

|

|||||||

|

Barclays Bank PLC

|

|||||||||

|

EUR

|

1,305,000

|

6.000%, 1/14/21

|

1,596,627

|

||||||

|

EUR

|

1,875,000

|

6.625%, 3/30/22

|

2,480,563

|

||||||

|

BBVA Bancomer SA/Texas

|

|||||||||

|

1,282,000

|

1.875%, 9/18/25

|

1,296,423

|

|||||||

|

BPCE SA

|

|||||||||

|

2,400,000

|

4.500%, 3/15/25

|

2,716,138

|

|||||||

|

Caixa Geral de Depositos SA

|

|||||||||

|

EUR

|

900,000

|

5.750% (5 Year Swap Rate

|

|||||||

|

EUR + 5.500%), 6/28/28 1,2

|

1,210,498

|

||||||||

|

CaixaBank SA

|

|||||||||

|

EUR

|

2,400,000

|

2.750% (5 Year Swap Rate

|

|||||||

|

EUR + 2.350%), 7/14/28 1,2

|

3,068,937

|

||||||||

|

CaixaBank SA

|

|||||||||

|

EUR

|

1,000,000

|

6.750%, 12/13/69 2

|

1,353,884

|

||||||

|

Commerzbank AG

|

|||||||||

|

EUR

|

1,800,000

|

7.750%, 3/16/21

|

2,230,784

|

||||||

|

Danske Bank A/S

|

|||||||||

|

EUR

|

480,000

|

2.500% (5 Year Swap Rate

|

|||||||

|

EUR + 2.500%), 6/21/29 1,2

|

621,337

|

||||||||

The accompanying notes are an integral part of these financial statements.

17

Credit Opportunities Fund

|

SCHEDULE OF INVESTMENTS at December 31, 2020

(Continued)

|

|

Principal

|

|||||||||

|

Amount†

|

Value

|

||||||||

|

CORPORATE BONDS: 84.8% (Continued)

|

|||||||||

|

Banking: 9.6% (Continued)

|

|||||||||

|

Deutsche Bank AG

|

|||||||||

|

4,100,000

|

2.222% (SOFR + 2.159%),

|

||||||||

|

9/18/24 1,2

|

$

|

4,220,598

|

|||||||

|

1,000,000

|

2.129% (SOFR + 1.870%),

|

||||||||

|

11/24/26 1,2

|

1,023,912

|

||||||||

|

1,250,000

|

4.296% (5 Year Swap Rate

|

||||||||

|

USD + 2.248%), 5/24/28 1,2

|

1,288,732

|

||||||||

|

Emirates NBD Bank PJSC

|

|||||||||

|

860,000

|

2.625%, 2/18/25

|

907,730

|

|||||||

|

Global Bank Corp

|

|||||||||

|

800,000

|

5.250% (3 Month LIBOR

|

||||||||

|

USD + 3.300%), 4/16/29 1,2

|

875,500

|

||||||||

|

Ibercaja Banco SA

|

|||||||||

|

EUR

|

1,100,000

|

2.750% (5 Year Swap Rate

|

|||||||

|

EUR + 2.882%), 7/23/30 1,2

|

1,307,878

|

||||||||

|

ING Groep NV

|

|||||||||

|

600,000

|

4.700% (5 Year Swap Rate

|

||||||||

|

USD + 1.938%), 3/22/28 1,2

|

643,366

|

||||||||

|

Itau Unibanco Holding SA

|

|||||||||

|

450,000

|

5.125%, 5/13/23

|

481,050

|

|||||||

|

National Australia Bank Ltd

|

|||||||||

|

2,000,000

|

3.933% (5 Year CMT

|

||||||||

|

Rate + 1.880%), 8/2/34 1,2

|

2,250,177

|

||||||||

|

QNB Finance Ltd

|

|||||||||

|

970,000

|

2.625%, 5/12/25

|

1,023,479

|

|||||||

|

Shinhan Bank Co Ltd

|

|||||||||

|

1,000,000

|

4.000%, 4/23/29

|

1,138,195

|

|||||||

|

Societe Generale SA

|

|||||||||

|

EUR

|

2,200,000

|

1.375% (5 Year Swap Rate

|

|||||||

|

EUR + 0.900%), 2/23/28 1,2

|

2,734,838

|

||||||||

|

Standard Chartered Plc

|

|||||||||

|

1,300,000

|

3.516% (5 Year CMT

|

||||||||

|

Rate + 1.850%), 2/12/30 1,2

|

1,361,147

|

||||||||

|

UniCredit SpA

|

|||||||||

|

1,175,000

|

5.861% (5 Year Mid Swap

|

||||||||

|

Rate USD + 3.703%), 6/19/32 1,2

|

1,325,688

|

||||||||

|

Volksbank Wien AG

|

|||||||||

|

EUR

|

800,000

|

2.750% (5 Year Swap Rate

|

|||||||

|

EURIBOR + 2.550%), 10/6/27 1,2

|

979,728

|

||||||||

|

51,772,349

|

|||||||||

|

Broadcasting: 3.0%

|

|||||||||

|

Gray Television Inc

|

|||||||||

|

1,400,000

|

4.750%, 10/15/30

|

1,428,875

|

|||||||

|

Netflix Inc

|

|||||||||

|

1,050,000

|

5.375%, 11/15/29

|

1,239,000

|

|||||||

|

Nexstar Broadcasting Inc

|

|||||||||

|

1,975,000

|

4.750%, 11/1/28

|

2,070,047

|

|||||||

|

Scripps Escrow II, Inc.

|

|||||||||

|

1,150,000

|

3.875%, 1/15/29

|

1,197,311

|

|||||||

|

Sinclair Television Group, Inc.

|

|||||||||

|

950,000

|

4.125%, 12/1/30

|

973,850

|

|||||||

|

Sirius XM Radio Inc

|

|||||||||

|

1,425,000

|

3.875%, 8/1/22

|

1,448,156

|

|||||||

|

TEGNA Inc

|

|||||||||

|

1,400,000

|

4.750%, 3/15/26

|

1,496,670

|

|||||||

|

2,425,000

|

4.625%, 3/15/28

|

2,484,110

|

|||||||

|

3,475,000

|

5.000%, 9/15/29

|

3,674,317

|

|||||||

|

16,012,336

|

|||||||||

|

Building Materials: 1.7%

|

|||||||||

|

Cemex SAB de CV

|

|||||||||

|

EUR

|

910,000

|

2.750%, 12/5/24

|

1,125,571

|

||||||

|

900,000

|

7.375%, 6/5/27

|

1,025,325

|

|||||||

|

640,000

|

5.200%, 9/17/30

|

702,560

|

|||||||

|

500,000

|

5.200%, 9/17/30

|

548,875

|

|||||||

|

Martin Marietta Materials Inc

|

|||||||||

|

1,375,000

|

4.250%, 7/2/24

|

1,534,665

|

|||||||

|

Masco Corp

|

|||||||||

|

1,550,000

|

2.000%, 10/1/30

|

1,580,135

|

|||||||

|

Standard Industries Inc

|

|||||||||

|

800,000

|

4.375%, 7/15/30

|

857,012

|

|||||||

|

WESCO Distribution Inc

|

|||||||||

|

1,525,000

|

7.125%, 6/15/25

|

1,679,262

|

|||||||

|

9,053,405

|

|||||||||

|

Cable/Satellite TV: 2.8%

|

|||||||||

|

CCO Holdings LLC /

|

|||||||||

|

CCO Holdings Capital Corp

|

|||||||||

|

2,925,000

|

5.000%, 2/1/28

|

3,096,112

|

|||||||

|

2,050,000

|

4.750%, 3/1/30

|

2,214,513

|

|||||||

|

1,875,000

|

4.250%, 2/1/31

|

1,978,331

|

|||||||

|

1,925,000

|

4.500%, 5/1/32

|

2,057,767

|

|||||||

|

CSC Holdings LLC

|

|||||||||

|

1,575,000

|

5.750%, 1/15/30

|

1,728,570

|

|||||||

|

1,450,000

|

4.125%, 12/1/30

|

1,517,570

|

|||||||

|

2,000,000

|

4.625%, 12/1/30

|

2,090,270

|

|||||||

|

Radiate Holdco LLC /

|

|||||||||

|

Radiate Finance Inc

|

|||||||||

|

325,000

|

4.500%, 9/15/26

|

335,969

|

|||||||

|

UPCB Finance VII Ltd.

|

|||||||||

|

EUR

|

275,000

|

3.625%, 6/15/29

|

349,474

|

||||||

|

15,368,576

|

|||||||||

|

Capital Goods: 1.1%

|

|||||||||

|

Alfa SAB de CV

|

|||||||||

|

1,500,000

|

5.250%, 3/25/24

|

1,656,390

|

|||||||

|

KION Group AG

|

|||||||||

|

EUR

|

1,300,000

|

1.625%, 9/24/25

|

1,646,079

|

||||||

|

Westinghouse Air Brake

|

|||||||||

|

Technologies Corp

|

|||||||||

|

1,900,000

|

4.400%, 3/15/24 2

|

2,081,447

|

|||||||

|

Xylem Inc

|

|||||||||

|

700,000

|

1.950%, 1/30/28

|

738,575

|

|||||||

|

6,122,491

|

|||||||||

|

Chemicals: 2.0%

|

|||||||||

|

Alpek SAB de CV

|

|||||||||

|

2,800,000

|

4.250%, 9/18/29

|

3,073,770

|

|||||||

The accompanying notes are an integral part of these financial statements.

18

Credit Opportunities Fund

|

SCHEDULE OF INVESTMENTS at December 31, 2020

(Continued)

|

|

Principal

|

|||||||||

|

Amount†

|

Value

|

||||||||

|

CORPORATE BONDS: 84.8% (Continued)

|

|||||||||

|

Chemicals: 2.0% (Continued)

|

|||||||||

|

Equate Petrochemical BV

|

|||||||||

|

500,000

|

4.250%, 11/3/26

|

$

|

558,767

|

||||||

|

Ingevity Corp

|

|||||||||

|

975,000

|

3.875%, 11/1/28

|

984,141

|

|||||||

|

MEGlobal Canada ULC

|

|||||||||

|

500,000

|

5.000%, 5/18/25

|

563,835

|

|||||||

|

500,000

|

5.875%, 5/18/30

|

625,000

|

|||||||

|

Orbia Advance Corp SAB de CV

|

|||||||||

|

1,000,000

|

4.000%, 10/4/27

|

1,109,560

|

|||||||

|

Sherwin-Williams Co

|

|||||||||

|

650,000

|

3.450%, 6/1/27

|

734,947

|

|||||||

|

1,150,000

|

2.300%, 5/15/30

|

1,202,907

|

|||||||

|

UPL Corp Ltd

|

|||||||||

|

1,822,000

|

4.500%, 3/8/28

|

1,940,828

|

|||||||

|

10,793,755

|

|||||||||

|

Consumer-Products: 0.3%

|

|||||||||

|

Church & Dwight Co Inc

|

|||||||||

|

900,000

|

3.150%, 8/1/27

|

998,841

|

|||||||

|

Kimberly-Clark de

|

|||||||||

|

Mexico SAB de CV

|

|||||||||

|

720,000

|

2.431%, 7/1/31

|

745,124

|

|||||||

|

1,743,965

|

|||||||||

|

Containers: 2.0%

|

|||||||||

|

Ardagh Packaging Finance PLC /

|

|||||||||

|

Ardagh Holdings USA Inc

|

|||||||||

|

537,000

|

6.000%, 2/15/25

|

557,003

|

|||||||

|

EUR

|

1,525,000

|

2.125%, 8/15/26

|

1,870,923

|

||||||

|

Ardagh Pkg Fin/hldgs Usa

|

|||||||||

|

300,000

|

4.125%, 8/15/26

|

313,875

|

|||||||

|

Ball Corp

|

|||||||||

|

EUR

|

1,550,000

|

1.500%, 3/15/27

|

1,949,500

|

||||||

|

Berry Global Inc

|

|||||||||

|

589,000

|

5.125%, 7/15/23

|

597,099

|

|||||||

|

550,000

|

4.875%, 7/15/26

|

591,379

|

|||||||

|

Berry Global Inc

|

|||||||||

|

925,000

|

1.570%, 1/15/26

|

934,528

|

|||||||

|

Crown European Holdings SA

|

|||||||||

|

EUR

|

1,900,000

|

0.750%, 2/15/23

|

2,320,192

|

||||||

|

Klabin Austria GmbH

|

|||||||||

|

280,000

|

5.750%, 4/3/29

|

325,993

|

|||||||

|

Reynolds Group Issuer Inc /

|

|||||||||

|

Reynolds Group Issuer LLC /

|

|||||||||

|

Reynolds Group Issuer Lu

|

|||||||||

|

20,000

|

5.125%, 7/15/23

|

20,256

|

|||||||

|

Sealed Air Corp

|

|||||||||

|

EUR

|

325,000

|

4.500%, 9/15/23

|

433,648

|

||||||

|

Silgan Holdings Inc

|

|||||||||

|

EUR

|

500,000

|

2.250%, 6/1/28

|

621,492

|

||||||

|

10,535,888

|

|||||||||

|

Diversified Financial Services: 5.6%

|

|||||||||

|

Alliance Data Systems Corp

|

|||||||||

|

1,200,000

|

4.750%, 12/15/24

|

1,214,250

|

|||||||

|

CIT Group Inc

|

|||||||||

|

1,800,000

|

5.000%, 8/15/22

|

1,910,592

|

|||||||

|

Credit Suisse AG

|

|||||||||

|

700,000

|

6.500%, 8/8/23

|

790,049

|

|||||||

|

Credit Suisse Group AG

|

|||||||||

|

1,500,000

|

7.500% (5 Year Swap Rate

|

||||||||

|

USD + 4.598%), 12/11/23 1,2,4

|

1,673,699

|

||||||||

|

Grupo de Inversiones

|

|||||||||

|

Suramericana SA

|

|||||||||

|

1,500,000

|

5.500%, 4/29/26

|

1,713,248

|

|||||||

|

Icahn Enterprises LP /

|

|||||||||

|

Icahn Enterprises Finance Corp

|

|||||||||

|

1,200,000

|

4.750%, 9/15/24

|

1,248,378

|

|||||||

|

ICD Funding Ltd

|

|||||||||

|

3,000,000

|

3.223%, 4/28/26

|

3,022,950

|

|||||||

|

Intrum AB

|

|||||||||

|

EUR

|

1,175,000

|

4.875%, 8/15/25

|

1,491,053

|

||||||

|

Macquarie Bank Ltd

|

|||||||||

|

667,000

|

6.625%, 4/7/21

|

677,428

|

|||||||

|

MDGH – GMTN BV

|

|||||||||

|

EUR

|

760,000

|

3.625%, 5/30/23

|

1,016,279

|

||||||

|

790,000

|

2.500%, 5/21/26

|

840,339

|

|||||||

|

OneMain Finance Corp

|

|||||||||

|

1,000,000

|

7.750%, 10/1/21

|

1,053,750

|

|||||||

|

625,000

|

6.125%, 3/15/24

|

683,594

|

|||||||

|

Power Finance Corp Ltd

|

|||||||||

|

2,000,000

|

3.950%, 4/23/30

|

2,140,700

|

|||||||

|

Refinitiv US Holdings Inc

|

|||||||||

|

EUR

|

1,350,000

|

4.500%, 5/15/26

|

1,739,520

|

||||||

|

SoftBank Group Corp

|

|||||||||

|

300,000

|

5.375%, 7/30/22

|

312,934

|

|||||||

|

EUR

|

3,025,000

|

4.000%, 4/20/23

|

3,866,015

|

||||||

|

SPARC EM SPC Panama

|

|||||||||

|

Metro Line 2 SP

|

|||||||||

|

75,278

|

N/A%, 12/5/22 3

|

73,491

|

|||||||

|

UBS AG

|

|||||||||

|

3,400,000

|

5.125%, 5/15/24

|

3,756,150

|

|||||||

|

UBS Group AG

|

|||||||||

|

1,100,000

|

7.000% (5 Year Swap Rate

|

||||||||

|

USD + 4.866%), 12/29/49 1,2,4

|

1,254,688

|

||||||||

|

30,479,107

|

|||||||||

|

Diversified Media: 1.1%

|

|||||||||

|

Adevinta ASA

|

|||||||||

|

EUR

|

1,575,000

|

2.625%, 11/15/25

|

1,970,265

|

||||||

|

EUR

|

200,000

|

3.000%, 11/15/27

|

253,425

|

||||||

|

Cable One Inc

|

|||||||||

|

1,850,000

|

4.000%, 11/15/30

|

1,925,156

|

|||||||

|

Prosus NV

|

|||||||||

|

1,760,000

|

5.500%, 7/21/25

|

2,027,256

|

|||||||

|

6,176,102

|

|||||||||

The accompanying notes are an integral part of these financial statements.

19

Credit Opportunities Fund

|

SCHEDULE OF INVESTMENTS at December 31, 2020

(Continued)

|

|

Principal

|

|||||||||

|

Amount†

|

Value

|

||||||||

|

CORPORATE BONDS: 84.8% (Continued)

|

|||||||||

|

Energy: 7.4%

|

|||||||||

|

Apache Corp

|

|||||||||

|

700,000

|

4.875%, 11/15/27

|

$

|

743,050

|

||||||

|

Blue Racer Midstream LLC /

|

|||||||||

|

Blue Racer Finance Corp.

|

|||||||||

|

775,000

|

7.625%, 12/15/25

|

827,312

|

|||||||

|

BP Capital Markets Plc

|

|||||||||

|

EUR

|

1,250,000

|

3.250% (5 Year Swap Rate

|

|||||||

|

EUR + 3.880%), 3/22/26 1,2,4

|

1,632,038

|

||||||||

|

EUR

|

775,000

|

3.625% (5 Year Swap Rate

|

|||||||

|

EUR + 4.120%), 3/22/29 1,2,4

|

1,037,900

|

||||||||

|

Cheniere Energy Partners LP

|

|||||||||

|

300,000

|

5.625%, 10/1/26

|

312,510

|

|||||||

|

Continental Resources Inc

|

|||||||||

|

1,800,000

|

5.750%, 1/15/31

|

2,001,339

|

|||||||

|

Ecopetrol SA

|

|||||||||

|

1,000,000

|

6.875%, 4/29/30

|