| January 28, 2019 | Baron Asset Fund Baron Growth Fund Baron Small Cap Fund Baron Opportunity Fund Baron Fifth Avenue Growth Fund Baron Discovery Fund Baron Durable Advantage Fund 767 Fifth Avenue New York, New York 10153 1-800-99BARON 212-583-2100 |

| Table of Contents | Baron Funds® |

| Baron Funds® | 3 | |||||

| 10 | ||||||

| 17 | ||||||

| 24 | ||||||

| 31 | ||||||

| 39 | ||||||

| 46 | ||||||

| Information about the Funds | 52 | |||||

| Additional Investment Strategies | 52 | |||||

| 55 | ||||||

| 56 | ||||||

| 62 | ||||||

| 63 | ||||||

| Information about your Investment | 67 | |||||

| How to Purchase Shares | 68 | |||||

| 71 | ||||||

| 73 | ||||||

| 75 | ||||||

| Policies Regarding Frequent Purchases and Redemptions of Fund Shares |

76 | |||||

| 77 | ||||||

| 78 | ||||||

| 78 | ||||||

| 79 | ||||||

| 82 | ||||||

| 84 | ||||||

| 97 | ||||||

| Back cover | ||||||

| 1-800-99BARON | 2 | |||||

Investment Goal

The investment goal of Baron Asset Fund (the “Fund”) is capital appreciation through long-term investments primarily in securities of mid-sized companies with undervalued assets or favorable growth prospects.

Fees and Expenses of the Fund

The table below describes the fees and expenses that you would pay if you bought and held shares of the Fund.

Annual Fund Operating Expenses

(Expenses that you pay each year as a percentage of the value of your investment)

| Management Fee |

Distribution (12b-1) Fee |

Other Expenses |

Total Annual Fund Operating Expenses |

|||||||||||||

| BARON ASSET FUND |

||||||||||||||||

| Retail Shares |

1.00% | 0.25% | 0.05% | 1.30% | ||||||||||||

| Institutional Shares |

1.00% | 0.00% | 0.04% | 1.04% | ||||||||||||

| R6 Shares |

1.00% | 0.00% | 0.04% | 1.04% | ||||||||||||

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year, and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| YEAR | 1 | 3 | 5 | 10 | ||||||||||||

| BARON ASSET FUND |

||||||||||||||||

| Retail Shares |

$ | 132 | $ | 412 | $ | 713 | $ | 1,568 | ||||||||

| Institutional Shares |

$ | 106 | $ | 331 | $ | 574 | $ | 1,271 | ||||||||

| R6 Shares |

$ | 106 | $ | 331 | $ | 574 | $ | 1,271 | ||||||||

| 3 | www.BaronFunds.com | |||||

Baron Asset Fund

Portfolio Turnover. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes for Fund shareholders. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the example, affect the Fund’s performance. During the most recent fiscal year ended September 30, 2018, the Fund’s portfolio turnover rate was 9.87% of the average value of its portfolio.

Investments, Risks, and Performance

Principal Investment Strategies of the Fund

The Fund invests for the long term primarily in equity securities in the form of common stock of U.S. mid-sized growth companies. BAMCO, Inc. (“BAMCO” or the “Adviser”) defines mid-sized companies as those, at the time of purchase, with market capitalizations above $2.5 billion or the smallest market cap stock in the Russell Midcap Growth Index at reconstitution, whichever is larger, and below the largest market cap stock in the Russell Midcap Growth Index at reconstitution. The Adviser seeks to invest in businesses it believes have significant opportunities for growth, sustainable competitive advantages, exceptional management, and an attractive valuation. Because of its long-term approach, the Fund could have a significant percentage of its assets invested in securities that have appreciated beyond their market capitalizations at the time of the Fund’s investment.

Principal Risks of Investing in the Fund

General Stock Market. Investing in the stock market is risky because securities fluctuate in value. These fluctuations may be due to political, economic or general market circumstances. Other factors may affect a single company or industry but not the broader market. Because the values of securities fluctuate, when you sell your investment in the Fund, you may lose money. Current and future portfolio holdings in the Fund are subject to risk.

Growth Investing. Growth stocks can react differently to issuer, political, market and economic developments than the market as a whole and other types of stocks. Growth stocks tend to be more expensive relative to their earnings or assets compared to other types of stocks. As a result, growth stocks tend to be sensitive to changes in their earnings and more volatile than other types of stocks.

Mid-Sized Companies. The Adviser believes there is more potential for capital appreciation in mid-sized companies, but there also may be more risk. Securities of mid-sized companies may not be well known to most investors, and the securities may be less actively traded than those of large businesses. The securities of mid-sized

| 1-800-99BARON | 4 | |||||

Baron Asset Fund

companies may fluctuate in price more widely than the stock market generally, and they may be more difficult to sell during market downturns. Mid-sized companies rely more on the skills of management and on their continued tenure. Investing in mid-sized companies requires a long-term outlook and may require shareholders to assume more risk and to have more patience than investing in the securities of larger, more established companies.

Technology. Technology companies, including internet-related and information technology companies, as well as companies propelled by new technologies, may present the risk of rapid change and product obsolescence, and their successes may be difficult to predict for the long term. Some technology companies may be newly formed and have limited operating history and experience. Technology companies may also be adversely affected by changes in governmental policies, competitive pressures and changing demand. The securities of these companies may also experience significant price movements caused by disproportionate investor optimism or pessimism, with little or no basis in the companies’ fundamentals or economic conditions.

Performance

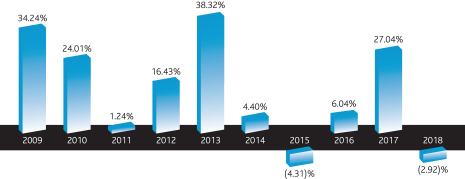

The following bar chart and table provide some indication of the risks of investing in the Fund (Retail Shares) by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual returns for 1, 5 and 10 years compare with those of a broad measure of market performance. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available online at www.BaronFunds.com/performance or by calling 1-800-99BARON (1-800-992-2766).

Year by Year Total Return (%) as of December 31 of Each Year (Retail Shares)

| Best Quarter: | 06/30/09: 20.73% |

| Worst Quarter: | 09/30/11: (17.84)% |

| 5 | www.BaronFunds.com | |||||

Baron Asset Fund

Average Annual Total Returns (for periods ended 12/31/18)

The following table shows the Fund’s Retail Shares’ annual returns and long-term performance (before and after taxes) and the change in value of broad-based market indexes over various periods ended December 31, 2018. The table also shows the average annual returns of the Fund’s Institutional Shares and R6 Shares, but it does not show after-tax returns.

After-tax returns are calculated using the highest individual federal marginal income tax rate in effect at the time of each distribution and assumed sale, but they do not include the impact of state and local taxes.

Your actual after-tax returns depend on your own tax situation and may differ from those shown. After-tax returns reflect past tax effects and are not predictive of future tax effects. After-tax returns are not relevant to investors who hold their Fund’s shares in a tax-deferred account (including a 401(k) or IRA or Coverdell account), or to investors that are tax-exempt.

Average Annual Total Returns for the periods ended December 31, 2018

| 1 year | 5 years | 10 years | Since Inception |

|||||||||||||

| BARON ASSET FUND |

||||||||||||||||

| Retail Shares |

||||||||||||||||

| Return before taxes |

(0.14)% | 7.92% | 13.77% | 11.05% | ||||||||||||

| Return after taxes on distributions |

(1.63)% | 6.17% | 12.19% | 10.01% | ||||||||||||

| Return after taxes on distributions and sale of Fund shares |

1.20% | 6.06% | 11.38% | 9.66% | ||||||||||||

| Institutional

Shares* |

||||||||||||||||

| Return before taxes |

0.14% | 8.21% | 14.07% | 11.14% | ||||||||||||

| R6 Shares* |

||||||||||||||||

| Return before taxes |

0.12% | 8.21% | 14.06% | 11.14% | ||||||||||||

| Russell Midcap® Growth Index (reflects no deduction for fees, expenses or taxes) |

(4.75)% | 7.42% | 15.12% | 9.64% | † | |||||||||||

| S&P 500 Index (reflects no deduction for fees, expenses or taxes) |

(4.38)% | 8.49% | 13.12% | 9.36% | ||||||||||||

| * | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Stares. Performance for the R6 Shares prior to January 29, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

| † | For the period June 30, 1987 to December 31, 2018. |

The Russell Midcap® Growth Index is an unmanaged index of mid-cap growth companies. The S&P 500 Index is an unmanaged index of larger-cap companies.

| 1-800-99BARON | 6 | |||||

Baron Asset Fund

Management

Investment Adviser. BAMCO is the investment adviser of the Fund.

Portfolio Manager. Andrew Peck has been the sole portfolio manager of the Fund since January 23, 2008. He had been a co-portfolio manager of the Fund with Ronald Baron since July 23, 2003. Mr. Peck has worked at the Adviser as an analyst since February of 1998.

Purchase and Sale of Fund Shares

Shares may be purchased only on days that the New York Stock Exchange is open for trading.

| Minimum Initial Investment |

Minimum Subsequent Investment |

Maximum Subsequent Investment | ||||

| Retail Shares |

$2,000 | No Minimum | No Maximum | |||

| Baron Automatic Investment Plan |

$500 (with subsequent minimum investments of $50 per month until your investment has reached $2,000.) | No Minimum | No Maximum | |||

| Baron Funds® website purchases |

$2,000 | $10 | $6,500 for retirement accounts and $250,000 for non-retirement accounts. | |||

| Institutional Shares |

$1,000,000 (Employees of the Adviser and its affiliates and Trustees of the Baron Funds® and employer sponsored retirement plans (qualified and nonqualified) are not subject to the eligibility requirements for Institutional Shares.) | No Minimum | No Maximum | |||

| 7 | www.BaronFunds.com | |||||

Baron Asset Fund

| Minimum Initial Investment |

Minimum Subsequent Investment |

Maximum Subsequent Investment | ||||

| Baron Funds® website purchases |

You may not make an initial purchase through the Baron Funds® website. | $10 | $6,500 for retirement accounts and $250,000 for non-retirement accounts. | |||

| R6 Shares |

$5,000,000 (There is no minimum initial investment for qualified retirement plans; however, the shares must be held through plan-level or omnibus accounts held on the books of the Fund.) | No Minimum | No Maximum | |||

| Baron Funds® website purchases |

You may not make an initial purchase through the Baron Funds® website. | $10 | $6,500 for retirement accounts and $250,000 for non-retirement accounts. | |||

You Can Purchase or Redeem Shares By:

| 1. | Mailing a request to Baron Funds®, P.O. Box 219946, Kansas City, MO 64121-9946 or by overnight mail to: Baron Funds®, 430 West 7th Street, Kansas City, MO 64105-1514; |

| 2. | Wire (Purchase Only); |

| 3. | Calling 1-800-442-3814; |

| 4. | Visiting the Baron Funds® website www.BaronFunds.com; or |

| 5. | Through a broker, dealer or other financial intermediary that may charge you a fee. |

The Fund is not for short-term traders who intend to purchase and then sell their Fund shares within a 90 day period. If the Adviser reasonably believes that a person is not a long-term investor, it will attempt to prohibit that person from making additional investments in the Fund.

| 1-800-99BARON | 8 | |||||

Baron Asset Fund

Tax Information

Distributions of the Fund’s net investment income (other than “qualified dividend income”) and distributions of net short-term capital gains will be taxable to you as ordinary income. Distributions of the Fund’s net capital gains reported as capital gain dividends by the Fund will be taxable to you as long-term capital gains, regardless of the length of time you have held shares of the Fund. If you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account, you may be subject to federal income tax on withdrawals from tax-deferred arrangement at a later date.

Financial Intermediary Compensation

If you purchase Retail or Institutional Shares of the Fund through a broker, dealer or other financial intermediary (such as a bank or financial adviser), the Fund, Baron Capital, Inc., the Fund’s distributor, BAMCO or their affiliates may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker, dealer or other financial intermediary, including your salesperson, to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

| 9 | www.BaronFunds.com | |||||

Investment Goal

The investment goal of Baron Growth Fund (the “Fund”) is capital appreciation through long-term investments primarily in securities of small-sized growth companies.

Fees and Expenses of the Fund

The table below describes the fees and expenses that you would pay if you bought and held shares of the Fund.

Annual Fund Operating Expenses

(Expenses that you pay each year as a percentage of the value of your investment)

| Management Fee |

Distribution (12b-1) Fee |

Other Expenses |

Total Annual Fund Operating Expenses |

|||||||||||||

| BARON GROWTH FUND |

||||||||||||||||

| Retail Shares |

1.00% | 0.25% | 0.04% | 1.29% | ||||||||||||

| Institutional Shares |

1.00% | 0.00% | 0.03% | 1.03% | ||||||||||||

| R6 Shares |

1.00% | 0.00% | 0.04% | 1.04% | ||||||||||||

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| YEAR | 1 | 3 | 5 | 10 | ||||||||||||

| BARON GROWTH FUND |

||||||||||||||||

| Retail Shares |

$ | 131 | $ | 409 | $ | 708 | $ | 1,556 | ||||||||

| Institutional Shares |

$ | 105 | $ | 328 | $ | 569 | $ | 1,259 | ||||||||

| R6 Shares |

$ | 106 | $ | 331 | $ | 574 | $ | 1,271 | ||||||||

| 1-800-99BARON | 10 | |||||

Baron Growth Fund

Portfolio Turnover. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes for Fund shareholders. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the example, affect the Fund’s performance. During the most recent fiscal year ended September 30, 2018, the Fund’s portfolio turnover rate was 2.92% of the average value of its portfolio.

Investments, Risks, and Performance

Principal Investment Strategies of the Fund

The Fund invests for the long term primarily in equity securities in the form of common stock of U.S. small-sized growth companies. BAMCO, Inc. (“BAMCO” or the “Adviser”) defines small-sized companies as those, at the time of purchase, with market capitalizations up to the largest market cap stock in the Russell 2000 Growth Index at reconstitution, or companies with market capitalizations up to $2.5 billion, whichever is larger. The Adviser seeks to invest in businesses it believes have significant opportunities for growth, sustainable competitive advantages, exceptional management, and an attractive valuation. Because of its long-term approach, the Fund could have a significant percentage of its assets invested in securities that have appreciated beyond their market capitalizations at the time of the Fund’s investment.

Principal Risks of Investing in the Fund

General Stock Market. Investing in the stock market is risky because securities fluctuate in value. These fluctuations may be due to political, economic or general market circumstances. Other factors may affect a single company or industry but not the broader market. Because the values of securities fluctuate, when you sell your investment in the Fund, you may lose money. Current and future portfolio holdings in the Fund are subject to risk.

Growth Investing. Growth stocks can react differently to issuer, political, market and economic developments than the market as a whole and other types of stocks. Growth stocks tend to be more expensive relative to their earnings or assets compared to other types of stocks. As a result, growth stocks tend to be sensitive to changes in their earnings and more volatile than other types of stocks.

Small-Sized Companies. The Adviser believes there is more potential for capital appreciation in small-sized companies, but there also may be more risk. Securities of small-sized companies may not be well known to most investors, and the securities may be less actively traded than those of large businesses. The securities of small-sized companies may fluctuate in price more widely than the stock market generally,

| 11 | www.BaronFunds.com | |||||

Baron Growth Fund

and they may be more difficult to sell during market downturns. Small-sized companies rely more on the skills of management and on their continued tenure. Investing in small-sized companies requires a long-term outlook and may require shareholders to assume more risk and to have more patience than investing in the securities of larger, more established companies.

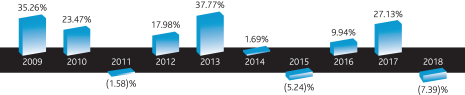

Performance

The following bar chart and table provide some indication of the risks of investing in the Fund (Retail Shares) by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual returns for 1, 5 and 10 years compare with those of a broad measure of market performance. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available online at www.BaronFunds.com/performance or by calling 1-800-99BARON (1-800-992-2766).

Year by Year Total Return (%) as of December 31 of Each Year (Retail Shares)

| Best Quarter: | 06/30/09: 20.76% |

| Worst Quarter: | 12/31/18: (18.58)% |

Average Annual Total Returns (for periods ended 12/31/18)

The following table shows the Fund’s Retail Shares’ annual returns and long-term performance (before and after taxes) and the change in value of broad-based market indexes over various periods ended December 31, 2018. The table also shows the average annual returns of the Fund’s Institutional Shares and R6 Shares, but it does not show after-tax returns.

After-tax returns are calculated using the highest individual federal marginal income tax rate in effect at the time of each distribution and assumed sale, but they do not include the impact of state and local taxes.

| 1-800-99BARON | 12 | |||||

Baron Growth Fund

Your actual after-tax returns depend on your own tax situation and may differ from those shown. After-tax returns reflect past tax effects and are not predictive of future tax effects. After-tax returns are not relevant to investors who hold their Fund’s shares in a tax-deferred account (including a 401(k) or IRA or Coverdell account), or to investors that are tax-exempt.

Average Annual Total Returns for the periods ended December 31, 2018

| 1 year | 5 years | 10 years | Since Inception |

|||||||||||||

| BARON GROWTH FUND |

||||||||||||||||

| Retail Shares |

||||||||||||||||

| Return before taxes |

(2.92)% | 5.49% | 13.49% | 12.34% | ||||||||||||

| Return after taxes on distributions |

(4.51)% | 3.40% | 12.11% | 11.40% | ||||||||||||

| Return after taxes on distributions and sale of Fund shares |

(0.32)% | 4.16% | 11.28% | 10.89% | ||||||||||||

| Institutional Shares* |

||||||||||||||||

| Return before taxes |

(2.67)% | 5.76% | 13.77% | 12.46% | ||||||||||||

| R6 Shares* |

||||||||||||||||

| Return before taxes |

(2.67)% | 5.76% | 13.78% | 12.46% | ||||||||||||

| Russell 2000® Growth Index (reflects no deduction for fees, expenses or taxes) |

(9.31)% | 5.13% | 13.52% | 7.35% | ||||||||||||

| S&P 500 Index (reflects no deduction for fees, expenses or taxes) |

(4.38)% | 8.49% | 13.12% | 9.41% | ||||||||||||

| * | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Stares. Performance for the R6 Shares prior to January 29, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

The Russell 2000® Growth Index is an unmanaged index of U.S. small-cap growth companies. The S&P 500 Index is an unmanaged index of larger-cap companies.

Management

Investment Adviser. BAMCO is the investment adviser of the Fund.

Portfolio Managers. Ronald Baron serves as the Lead Portfolio Manager of the Fund and has been the portfolio manager of the Fund since its inception on December 31, 1994. Neal Rosenberg has been co-manager of the Fund since August 28, 2018. From January 27, 2017 to August 28, 2018, Mr. Baron served as the Lead Portfolio Manager of the Fund and Mr. Rosenberg served as the Assistant Portfolio Manager of the Fund. Mr. Baron founded the Adviser in 1987. Mr. Rosenberg joined the Adviser as a research analyst in May of 2006.

| 13 | www.BaronFunds.com | |||||

Baron Growth Fund

Purchase and Sale of Fund Shares

Shares may be purchased only on days that the New York Stock Exchange is open for trading.

| Minimum Initial Investment |

Minimum Subsequent Investment |

Maximum Subsequent Investment | ||||

| Retail Shares |

$2,000 | No Minimum | No Maximum | |||

| Baron Automatic Investment Plan |

$500 (with subsequent minimum investments of $50 per month until your investment has reached $2,000.) | No Minimum | No Maximum | |||

| Baron Funds® website purchases |

$2,000 | $10 | $6,500 for retirement accounts and $250,000 for non-retirement accounts. | |||

| Institutional Shares |

$1,000,000 (Employees of the Adviser and its affiliates and Trustees of the Baron Funds® and employer sponsored retirement plans (qualified and nonqualified) are not subject to the eligibility requirements for Institutional Shares.) | No Minimum | No Maximum | |||

| Baron Funds® website purchases |

You may not make an initial purchase through the Baron Funds® website. | $10 | $6,500 for retirement accounts and $250,000 for non-retirement accounts. | |||

| 1-800-99BARON | 14 | |||||

Baron Growth Fund

| Minimum Initial Investment |

Minimum Subsequent Investment |

Maximum Subsequent Investment | ||||

| R6 Shares |

$5,000,000 (There is no minimum initial investment for qualified retirement plans; however, the shares must be held through plan-level or omnibus accounts held on the books of the Fund.) | No Minimum | No Maximum | |||

| Baron Funds® website purchases |

You may not make an initial purchase through the Baron Funds® website. | $10 | $6,500 for retirement accounts and $250,000 for non-retirement accounts. | |||

You Can Purchase or Redeem Shares By:

| 1. | Mailing a request to Baron Funds®, P.O. Box 219946, Kansas City, MO 64121-9946 or by overnight mail to: Baron Funds®, 430 West 7th Street, Kansas City, MO 64105-1514; |

| 2. | Wire (Purchase Only); |

| 3. | Calling 1-800-442-3814; |

| 4. | Visiting the Baron Funds® website www.BaronFunds.com; or |

| 5. | Through a broker, dealer or other financial intermediary that may charge you a fee. |

The Fund is not for short-term traders who intend to purchase and then sell their Fund shares within a 90 day period. If the Adviser reasonably believes that a person is not a long-term investor, it will attempt to prohibit that person from making additional investments in the Fund.

Tax Information

Distributions of the Fund’s net investment income (other than “qualified dividend income”) and distributions of net short-term capital gains will be taxable to you as ordinary income. Distributions of the Fund’s net capital gains reported as capital gain dividends by the Fund will be taxable to you as long-term capital gains, regardless of the length of time you have held shares of the Fund. If you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account, you may be subject to federal income tax on withdrawals from tax-deferred arrangement at a later date.

| 15 | www.BaronFunds.com | |||||

Baron Growth Fund

Financial Intermediary Compensation

If you purchase Retail or Institutional Shares of the Fund through a broker, dealer or other financial intermediary (such as a bank or financial adviser), the Fund, Baron Capital, Inc., the Fund’s distributor, BAMCO or their affiliates may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker, dealer or other financial intermediary, including your salesperson, to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

| 1-800-99BARON | 16 | |||||

Investment Goal

The investment goal of Baron Small Cap Fund (the “Fund”) is capital appreciation through investments primarily in securities of small-sized growth companies.

Fees and Expenses of the Fund

The table below describes the fees and expenses that you would pay if you bought and held shares of the Fund.

Annual Fund Operating Expenses

(Expenses that you pay each year as a percentage of the value of your investment)

| Management Fee |

Distribution (12b-1) Fee |

Other Expenses |

Total Annual Fund Operating Expenses |

|||||||||||||

| BARON SMALL CAP FUND |

||||||||||||||||

| Retail Shares |

1.00% | 0.25% | 0.05% | 1.30% | ||||||||||||

| Institutional Shares |

1.00% | 0.00% | 0.04% | 1.04% | ||||||||||||

| R6 Shares |

1.00% | 0.00% | 0.05% | 1.05% | ||||||||||||

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| YEAR | 1 | 3 | 5 | 10 | ||||||||||||

| BARON SMALL CAP FUND |

||||||||||||||||

| Retail Shares |

$ | 132 | $ | 412 | $ | 713 | $ | 1,568 | ||||||||

| Institutional Shares |

$ | 106 | $ | 331 | $ | 574 | $ | 1,271 | ||||||||

| R6 Shares |

$ | 107 | $ | 334 | $ | 579 | $ | 1,283 | ||||||||

| 17 | www.BaronFunds.com | |||||

Baron Small Cap Fund

Portfolio Turnover. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes for Fund shareholders. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the example, affect the Fund’s performance. During the most recent fiscal year ended September 30, 2018, the Fund’s portfolio turnover rate was 14.19% of the average value of its portfolio.

Investments, Risks, and Performance

Principal Investment Strategies of the Fund

The Fund invests 80% of its net assets in equity securities in the form of common stock of U.S. small-sized growth companies. BAMCO, Inc. (“BAMCO” or the “Adviser”) defines small-sized companies as those, at the time of purchase, with market capitalizations up to the largest market cap stock in the Russell 2000 Growth Index at reconstitution, or companies with market capitalizations up to $2.5 billion, whichever is larger. The Adviser seeks to invest in businesses it believes have significant opportunities for growth, sustainable competitive advantages, exceptional management, and an attractive valuation. Because of its long-term approach, the Fund could have a significant percentage of its assets invested in securities that have appreciated beyond their market capitalizations at the time of the Fund’s investment.

Principal Risks of Investing in the Fund

General Stock Market. Investing in the stock market is risky because securities fluctuate in value. These fluctuations may be due to political, economic or general market circumstances. Other factors may affect a single company or industry but not the broader market. Because the values of securities fluctuate, when you sell your investment in the Fund, you may lose money. Current and future portfolio holdings in the Fund are subject to risk.

Growth Investing. Growth stocks can react differently to issuer, political, market and economic developments than the market as a whole and other types of stocks. Growth stocks tend to be more expensive relative to their earnings or assets compared to other types of stocks. As a result, growth stocks tend to be sensitive to changes in their earnings and more volatile than other types of stocks.

Small-Sized Companies. The Adviser believes there is more potential for capital appreciation in small-sized companies, but there also may be more risk. Securities of small-sized companies may not be well known to most investors, and the securities may be less actively traded than those of large businesses. The securities of

| 1-800-99BARON | 18 | |||||

Baron Small Cap Fund

small-sized companies may fluctuate in price more widely than the stock market generally, and they may be more difficult to sell during market downturns. Small-sized companies rely more on the skills of management and on their continued tenure. Investing in small-sized companies requires a long-term outlook and may require shareholders to assume more risk and to have more patience than investing in the securities of larger, more established companies.

Special Situations. The Funds may invest in “special situations.” A special situation arises when, in the opinion of the Adviser, the securities of a company will be recognized and appreciate in value due to a specific anticipated development at that company. Such developments might include a new product, a management change, an acquisition or a technological advancement. The risk of investing in special situations is that the anticipated development does not occur or its impact is not what the Adviser expected.

Technology. Technology companies, including internet-related and information technology companies, as well as companies propelled by new technologies, may present the risk of rapid change and product obsolescence, and their successes may be difficult to predict for the long term. Some technology companies may be newly formed and have limited operating history and experience. Technology companies may also be adversely affected by changes in governmental policies, competitive pressures and changing demand. The securities of these companies may also experience significant price movements caused by disproportionate investor optimism or pessimism, with little or no basis in the companies’ fundamentals or economic conditions.

Performance

The following bar chart and table provide some indication of the risks of investing in the Fund (Retail Shares) by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual returns for 1, 5 and 10 years compare with those of a broad measure of market performance. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available online at www.BaronFunds.com/performance or by calling 1-800-99BARON (1-800-992-2766).

| 19 | www.BaronFunds.com | |||||

Baron Small Cap Fund

Year by Year Total Return (%) as of December 31 of Each Year (Retail Shares)

| Best Quarter: | 06/30/09: 20.31% |

| Worst Quarter: | 12/31/18: (22.07)% |

Average Annual Total Returns (for periods ended 12/31/18)

The following table shows the Fund’s Retail Shares’ annual returns and long-term performance (before and after taxes) and the change in value of broad-based market indexes over various periods ended December 31, 2018. The table also shows the average annual returns of the Fund’s Institutional Shares and R6 Shares, but it does not show after-tax returns.

After-tax returns are calculated using the highest individual federal marginal income tax rate in effect at the time of each distribution and assumed sale, but they do not include the impact of state and local taxes.

Your actual after-tax returns depend on your own tax situation and may differ from those shown. After-tax returns reflect past tax effects and are not predictive of future tax effects. After-tax returns are not relevant to investors who hold their Fund’s shares in a tax-deferred account (including a 401(k) or IRA or Coverdell account), or to investors that are tax-exempt.

Average Annual Total Returns for the periods ended December 31, 2018

| 1 year | 5 years | 10 years | Since Inception |

|||||||||||||

| BARON SMALL CAP FUND |

||||||||||||||||

| Retail Shares |

||||||||||||||||

| Return before taxes |

(7.39)% | 4.52% | 12.79% | 9.16% | ||||||||||||

| Return after taxes on distributions |

(9.32)% | 1.75% | 11.10% | 8.15% | ||||||||||||

| Return after taxes on distributions and sale of Fund shares |

(2.65)% | 3.38% | 10.63% | 7.88% | ||||||||||||

| Institutional Shares* |

||||||||||||||||

| Return before taxes |

(7.13)% | 4.79% | 13.07% | 9.29% | ||||||||||||

| 1-800-99BARON | 20 | |||||

Baron Small Cap Fund

| 1 year | 5 years | 10 years | Since Inception |

|||||||||||||

| R6 Shares* |

||||||||||||||||

| Return before taxes |

(7.13 | )% | 4.79% | 13.07% | 9.29% | |||||||||||

| Russell 2000® Growth Index (reflects no deduction for fees, expenses or taxes) |

(9.31 | )% | 5.13% | 13.52% | 5.41% | |||||||||||

| S&P 500 Index (reflects no deduction for fees, expenses or taxes) |

(4.38 | )% | 8.49% | 13.12% | 6.68% | |||||||||||

| * | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Stares. Performance for the R6 Shares prior to January 29, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

The Russell 2000® Growth Index is an unmanaged index of U.S. small-cap growth companies. The S&P 500 Index is an unmanaged index of larger-cap companies.

Management

Investment Adviser. BAMCO is the investment adviser of the Fund.

Portfolio Manager. Cliff Greenberg has been the portfolio manager of the Fund since its inception on September 30, 1997. Mr. Greenberg has worked at the Adviser as an analyst since January of 1997.

Purchase and Sale of Fund Shares

Shares may be purchased only on days that the New York Stock Exchange is open for trading.

| Minimum Initial Investment |

Minimum Subsequent Investment |

Maximum Subsequent Investment | ||||

| Retail Shares |

$2,000 | No Minimum | No Maximum | |||

| Baron Automatic Investment Plan |

$500 (with subsequent minimum investments of $50 per month until your investment has reached $2,000.) | No Minimum | No Maximum | |||

| Baron Funds® website purchases |

$2,000 | $10 | $6,500 for retirement accounts and $250,000 for non-retirement accounts. | |||

| 21 | www.BaronFunds.com | |||||

Baron Small Cap Fund

| Minimum Initial Investment |

Minimum Subsequent Investment |

Maximum Subsequent Investment | ||||

| Institutional Shares |

$1,000,000 (Employees of the Adviser and its affiliates and Trustees of the Baron Funds® and employer sponsored retirement plans (qualified and nonqualified) are not subject to the eligibility requirements for Institutional Shares.) | No Minimum | No Maximum | |||

| Baron Funds® website purchases |

You may not make an initial purchase through the Baron Funds® website. | $10 | $6,500 for retirement accounts and $250,000 for non-retirement accounts. | |||

| R6 Shares |

$5,000,000 (There is no minimum initial investment for qualified retirement plans; however, the shares must be held through plan-level or omnibus accounts held on the books of the Fund.) | No Minimum | No Maximum | |||

| Baron Funds® website purchases |

You may not make an initial purchase through the Baron Funds® website. | $10 | $6,500 for retirement accounts and $250,000 for non-retirement accounts. | |||

| 1-800-99BARON | 22 | |||||

Baron Small Cap Fund

You Can Purchase or Redeem Shares By:

| 1. | Mailing a request to Baron Funds®, P.O. Box 219946, Kansas City, MO 64121-9946 or by overnight mail to: Baron Funds®, 430 West 7th Street, Kansas City, MO 64105-1514; |

| 2. | Wire (Purchase Only); |

| 3. | Calling 1-800-442-3814; |

| 4. | Visiting the Baron Funds® website www.BaronFunds.com; or |

| 5. | Through a broker, dealer or other financial intermediary that may charge you a fee. |

The Fund is not for short-term traders who intend to purchase and then sell their Fund shares within a 90 day period. If the Adviser reasonably believes that a person is not a long-term investor, it will attempt to prohibit that person from making additional investments in the Fund.

Tax Information

Distributions of the Fund’s net investment income (other than “qualified dividend income”) and distributions of net short-term capital gains will be taxable to you as ordinary income. Distributions of the Fund’s net capital gains reported as capital gain dividends by the Fund will be taxable to you as long-term capital gains, regardless of the length of time you have held shares of the Fund. If you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account, you may be subject to federal income tax on withdrawals from tax-deferred arrangement at a later date.

Financial Intermediary Compensation

If you purchase Retail or Institutional Shares of the Fund through a broker, dealer or other financial intermediary (such as a bank or financial adviser), the Fund, Baron Capital, Inc., the Fund’s distributor, BAMCO or their affiliates may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker, dealer or other financial intermediary, including your salesperson, to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

| 23 | www.BaronFunds.com | |||||

Investment Goal

The investment goal of Baron Opportunity Fund (the “Fund”) is capital appreciation through investments primarily in growth companies that benefit from technology advances.

Fees and Expenses of the Fund

The table below describes the fees and expenses that you would pay if you bought and held shares of the Fund.

Annual Fund Operating Expenses

(Expenses that you pay each year as a percentage of the value of your investment)

| Management Fee |

Distribution Fee |

Other Expenses |

Total Annual Fund Operating Expenses |

|||||||||||||

| BARON OPPORTUNITY FUND |

||||||||||||||||

| Retail Shares |

1.00% | 0.25% | 0.12% | 1.37% | ||||||||||||

| Institutional Shares |

1.00% | 0.00% | 0.11% | 1.11% | ||||||||||||

| R6 Shares |

1.00% | 0.00% | 0.09% | 1.09% | ||||||||||||

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| YEAR | 1 | 3 | 5 | 10 | ||||||||||||

| BARON OPPORTUNITY FUND |

||||||||||||||||

| Retail Shares |

$ | 139 | $ | 434 | $ | 750 | $ | 1,646 | ||||||||

| Institutional Shares |

$ | 113 | $ | 353 | $ | 612 | $ | 1,352 | ||||||||

| R6 Shares |

$ | 111 | $ | 347 | $ | 601 | $ | 1,329 | ||||||||

| 1-800-99BARON | 24 | |||||

Baron Opportunity Fund

Portfolio Turnover. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes for Fund shareholders. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the example, affect the Fund’s performance. During the most recent fiscal year ended September 30, 2018, the Fund’s portfolio turnover rate was 23.97% of the average value of its portfolio.

Investments, Risks, and Performance

Principal Investment Strategies of the Fund

The Fund invests primarily in equity securities in the form of common stock of U.S. high growth businesses of any market capitalization selected for their capital appreciation potential. BAMCO, Inc. (“BAMCO” or the “Adviser”) may invest in companies in any sector or industry that it believes will benefit from innovations and advances in technology. The Adviser seeks to invest in businesses it believes have significant opportunities for growth, sustainable competitive advantages, exceptional management, and an attractive valuation.

Principal Risks of Investing in the Fund

General Stock Market. Investing in the stock market is risky because securities fluctuate in value. These fluctuations may be due to political, economic or general market circumstances. Other factors may affect a single company or industry but not the broader market. Because the values of securities fluctuate, when you sell your investment in the Fund, you may lose money. Current and future portfolio holdings in the Fund are subject to risk.

Growth Investing. Growth stocks can react differently to issuer, political, market and economic developments than the market as a whole and other types of stocks. Growth stocks tend to be more expensive relative to their earnings or assets compared to other types of stocks. As a result, growth stocks tend to be sensitive to changes in their earnings and more volatile than other types of stocks.

Small- and Mid-Sized Companies. The Adviser believes there is more potential for capital appreciation in small- and mid-sized companies, but there also may be more risk. Securities of small- and mid-sized companies may not be well known to most investors, and the securities may be less actively traded than those of large businesses. The securities of small- and mid-sized companies may fluctuate in price more widely than the stock market generally, and they may be more difficult to sell during market downturns. Small- and mid-sized companies rely more on the skills of

| 25 | www.BaronFunds.com | |||||

Baron Opportunity Fund

management and on their continued tenure. Investing in small- and mid-sized companies requires a long-term outlook and may require shareholders to assume more risk and to have more patience than investing in the securities of larger, more established companies.

Technology. Technology companies, including internet-related and information technology companies, as well as companies propelled by new technologies, may present the risk of rapid change and product obsolescence, and their successes may be difficult to predict for the long term. Some technology companies may be newly formed and have limited operating history and experience. Technology companies may also be adversely affected by changes in governmental policies, competitive pressures and changing demand. The securities of these companies may also experience significant price movements caused by disproportionate investor optimism or pessimism, with little or no basis in the companies’ fundamentals or economic conditions.

Performance

The following bar chart and table provide some indication of the risks of investing in the Fund (Retail Shares) by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual returns for 1, 5 and 10 years compare with those of a broad measure of market performance. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available online at www.BaronFunds.com/performance or by calling 1-800-99BARON (1-800-992-2766).

Year by Year Total Return (%) as of December 31 of Each Year (Retail Shares)

| Best Quarter: | 06/30/09: 23.97% |

| Worst Quarter: | 09/30/11: (17.97)% |

| 1-800-99BARON | 26 | |||||

Baron Opportunity Fund

Average Annual Total Returns (for periods ended 12/31/18)

The following table shows the Fund’s Retail Shares’ annual returns and long-term performance (before and after taxes) and the change in value of broad-based market indexes over various periods ended December 31, 2018. The table also shows the average annual returns of the Fund’s Institutional Shares and R6 Shares, but it does not show after-tax returns.

After-tax returns are calculated using the highest individual federal marginal income tax rate in effect at the time of each distribution and assumed sale, but they do not include the impact of state and local taxes.

Your actual after-tax returns depend on your own tax situation and may differ from those shown. After-tax returns reflect past tax effects and are not predictive of future tax effects. After-tax returns are not relevant to investors who hold their Fund’s shares in a tax-deferred account (including a 401(k) or IRA or Coverdell account), or to investors that are tax-exempt.

Average Annual Total Returns for the periods ended December 31, 2018

| 1 year | 5 years | 10 years | Since Inception |

|||||||||||||

| BARON OPPORTUNITY FUND |

||||||||||||||||

| Retail Shares |

||||||||||||||||

| Return before taxes |

8.05% | 7.53% | 15.65% | 6.12% | ||||||||||||

| Return after taxes on distributions |

6.87% | 5.22% | 14.15% | 5.37% | ||||||||||||

| Return after taxes on distributions and sale of Fund shares |

5.76% | 5.56% | 13.00% | 4.96% | ||||||||||||

| Institutional Shares* |

||||||||||||||||

| Return before taxes |

8.35% | 7.82% | 15.95% | 6.26% | ||||||||||||

| R6 Shares* |

||||||||||||||||

| Return before taxes |

8.34% | 7.83% | 15.96% | 6.27% | ||||||||||||

| Russell 3000® Growth Index (reflects no deduction for fees, expenses or taxes) |

(2.12)% | 9.99% | 15.15% | 3.76% | ||||||||||||

| S&P 500 Index (reflects no deduction for fees, expenses or taxes) |

(4.38)% | 8.49% | 13.12% | 5.30% | ||||||||||||

| * | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Stares. Performance for the R6 Shares prior to August 31, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

The Russell 3000® Growth Index is an unmanaged index of companies classified as growth among the largest 3,000 U.S. companies. The S&P 500 Index is an unmanaged index of larger-cap companies.

| 27 | www.BaronFunds.com | |||||

Baron Opportunity Fund

Management

Investment Adviser. BAMCO is the investment adviser of the Fund.

Portfolio Manager. Michael Lippert has been the portfolio manager of the Fund since March 3, 2006. Mr. Lippert has worked at the Adviser as an analyst since December of 2001.

Purchase and Sale of Fund Shares

Shares may be purchased only on days that the New York Stock Exchange is open for trading.

| Minimum Initial Investment |

Minimum Subsequent Investment |

Maximum Subsequent Investment | ||||

| Retail Shares |

$2,000 | No Minimum | No Maximum | |||

| Baron Automatic Investment Plan |

$500 (with subsequent minimum investments of $50 per month until your investment has reached $2,000.) | No Minimum | No Maximum | |||

| Baron Funds® website purchases |

$2,000 | $10 | $6,500 for retirement accounts and $250,000 for non-retirement accounts. | |||

| Institutional Shares |

$1,000,000 (Employees of the Adviser and its affiliates and Trustees of the Baron Funds® and employer sponsored retirement plans (qualified and nonqualified) are not subject to the eligibility requirements for Institutional Shares.) | No Minimum | No Maximum | |||

| 1-800-99BARON | 28 | |||||

Baron Opportunity Fund

| Minimum Initial Investment |

Minimum Subsequent Investment |

Maximum Subsequent Investment | ||||

| Baron Funds® website purchases |

You may not make an initial purchase through the Baron Funds® website. | $10 | $6,500 for retirement accounts and $250,000 for non-retirement accounts. | |||

| R6 Shares |

$5,000,000 (There is no minimum initial investment for qualified retirement plans; however, the shares must be held through plan-level or omnibus accounts held on the books of the Fund.) | No Minimum | No Maximum | |||

| Baron Funds® website purchases |

You may not make an initial purchase through the Baron Funds® website. | $10 | $6,500 for retirement accounts and $250,000 for non-retirement accounts. | |||

You Can Purchase or Redeem Shares By:

| 1. | Mailing a request to Baron Funds®, P.O. Box 219946, Kansas City, MO 64121-9946 or by overnight mail to: Baron Funds®, 430 West 7th Street, Kansas City, MO 64105-1514; |

| 2. | Wire (Purchase Only); |

| 3. | Calling 1-800-442-3814; |

| 4. | Visiting the Baron Funds® website www.BaronFunds.com; or |

| 5. | Through a broker, dealer or other financial intermediary that may charge you a fee. |

The Fund is not for short-term traders who intend to purchase and then sell their Fund shares within a 90 day period. If the Adviser reasonably believes that a person is not a long-term investor, it will attempt to prohibit that person from making additional investments in the Fund.

| 29 | www.BaronFunds.com | |||||

Baron Opportunity Fund

Tax Information

Distributions of the Fund’s net investment income (other than “qualified dividend income”) and distributions of net short-term capital gains will be taxable to you as ordinary income. Distributions of the Fund’s net capital gains reported as capital gain dividends by the Fund will be taxable to you as long-term capital gains, regardless of the length of time you have held shares of the Fund. If you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account, you may be subject to federal income tax on withdrawals from tax-deferred arrangement at a later date.

Financial Intermediary Compensation

If you purchase Retail or Institutional Shares of the Fund through a broker, dealer or other financial intermediary (such as a bank or financial adviser), the Fund, Baron Capital, Inc., the Fund’s distributor, BAMCO or their affiliates may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker, dealer or other financial intermediary, including and your salesperson, to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

| 1-800-99BARON | 30 | |||||

Baron Fifth Avenue Growth Fund

Investment Goal

The investment goal of Baron Fifth Avenue Growth Fund (the “Fund”) is capital appreciation through investments primarily in securities of large-sized growth companies.

Fees and Expenses of the Fund

The table below describes the fees and expenses that you would pay if you bought and held shares of the Fund.

Annual Fund Operating Expenses

(Expenses that you pay each year as a percentage of the value of your investment)

| Management Fee |

Distribution (12b-1) Fee |

Other Expenses |

Total Annual Fund Operating Expenses |

Expense Reimbursements |

Total Annual Fund Operating Expenses After Expense Reimbursements2 |

|||||||||||||||||||

| BARON FIFTH AVENUE GROWTH FUND |

||||||||||||||||||||||||

| Retail Shares1 |

0.70% | 0.25% | 0.14% | 1.09% | (0.09% | ) | 1.00% | |||||||||||||||||

| Institutional Shares1 |

0.70% | 0.00% | 0.12% | 0.82% | (0.07% | ) | 0.75% | |||||||||||||||||

| R6 Shares1 |

0.70% | 0.00% | 0.10% | 0.80% | (0.05% | ) | 0.75% | |||||||||||||||||

| 1 | Based on the fiscal year ended September 30, 2018 (restated to reflect current expense waivers). |

| 2 | BAMCO, Inc. (“BAMCO” or the “Adviser”) has agreed that for so long as it serves as the adviser to the Fund, it will reimburse certain expenses of the Fund, limiting net annual operating expenses (portfolio transaction costs, interest, dividend and extraordinary expenses are not subject to the operating expense limitation) to 1.00% of average daily net assets of Retail Shares, 0.75% of average daily net assets of Institutional Shares and 0.75% of average daily net assets of R6 shares. |

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same.

| 31 | www.BaronFunds.com | |||||

Baron Fifth Avenue Growth Fund

Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| YEAR | 1 | 3 | 5 | 10 | ||||||||||||

| BARON FIFTH AVENUE GROWTH FUND |

||||||||||||||||

| Retail Shares |

$ | 102 | $ | 318 | $ | 552 | $ | 1,225 | ||||||||

| Institutional Shares |

$ | 77 | $ | 240 | $ | 417 | $ | 930 | ||||||||

| R6 Shares |

$ | 77 | $ | 240 | $ | 417 | $ | 930 | ||||||||

Portfolio Turnover. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes for Fund shareholders. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the example, affect the Fund’s performance. During the most recent fiscal year ended September 30, 2018, the Fund’s portfolio turnover rate was 8.81% of the average value of its portfolio.

Investments, Risks, and Performance

Principal Investment Strategies of the Fund

The Fund invests primarily in equity securities in the form of common stock of U.S. large-sized growth companies. The Adviser defines large-sized companies as those, at the time of purchase, with market capitalizations no smaller than the top 85th percentile by total market capitalization of the Russell 1000 Growth Index at June 30, or companies with market capitalizations above $10 billion, whichever is smaller. The Adviser seeks to invest in businesses it believes have significant opportunities for growth, sustainable competitive advantages, exceptional management, and an attractive valuation.

Principal Risks of Investing in the Fund

General Stock Market. Investing in the stock market is risky because securities fluctuate in value. These fluctuations may be due to political, economic or general market circumstances. Other factors may affect a single company or industry but not the broader market. Because the values of securities fluctuate, when you sell your investment in the Fund, you may lose money. Current and future portfolio holdings in the Fund are subject to risk.

| 1-800-99BARON | 32 | |||||

Baron Fifth Avenue Growth Fund

Growth Investing. Growth stocks can react differently to issuer, political, market and economic developments than the market as a whole and other types of stocks. Growth stocks tend to be more expensive relative to their earnings or assets compared to other types of stocks. As a result, growth stocks tend to be sensitive to changes in their earnings and more volatile than other types of stocks.

Large-Cap Companies. Because the Fund invests primarily in large-cap company securities, it may underperform other funds during periods when the Fund’s securities are out of favor.

Technology. Technology companies, including internet-related and information technology companies, as well as companies propelled by new technologies, may present the risk of rapid change and product obsolescence, and their successes may be difficult to predict for the long term. Some technology companies may be newly formed and have limited operating history and experience. Technology companies may also be adversely affected by changes in governmental policies, competitive pressures and changing demand. The securities of these companies may also experience significant price movements caused by disproportionate investor optimism or pessimism, with little or no basis in the companies’ fundamentals or economic conditions.

Consumer Discretionary Sector Risk. The consumer discretionary sector may be affected by changes in domestic and international economies, exchange and interest rates, competition, consumers’ disposable income, consumer preferences, social trends and marketing campaigns.

Performance

The following bar chart and table provide some indication of the risks of investing in the Fund (Retail Shares) by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual returns for 1, 5 and 10 years compare with those of a broad measure of market performance. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available online at www.BaronFunds.com/performance or by calling 1-800-99BARON (1-800-992-2766).

| 33 | www.BaronFunds.com | |||||

Baron Fifth Avenue Growth Fund

Year by Year Total Return (%) as of December 31 of Each Year (Retail Shares)

| Best Quarter: | 03/31/12: 22.69% |

| Worst Quarter: | 12/31/18: (16.99)% |

Average Annual Total Returns (for periods ended 12/31/18)

The following table shows the Fund’s Retail Shares’ annual returns and long-term performance (before and after taxes) and the change in value of broad-based market indexes over various periods ended December 31, 2018. The table also shows the average annual returns of the Fund’s Institutional Shares and R6 Shares, but it does not show after-tax returns.

After-tax returns are calculated using the highest individual federal marginal income tax rate in effect at the time of each distribution and assumed sale, but they do not include the impact of state and local taxes.

Your actual after-tax returns depend on your own tax situation and may differ from those shown. After-tax returns reflect past tax effects and are not predictive of future tax effects. After-tax returns are not relevant to investors who hold their Fund’s shares in a tax-deferred account (including a 401(k) or IRA or Coverdell account), or to investors that are tax-exempt.

| 1-800-99BARON | 34 | |||||

Baron Fifth Avenue Growth Fund

Average Annual Total Returns for the periods ended December 31, 2018

| 1 year | 5 years | 10 years | Since Inception |

|||||||||||||

| BARON FIFTH AVENUE GROWTH FUND |

||||||||||||||||

| Retail Shares |

||||||||||||||||

| Return before taxes |

1.10% | 9.86% | 13.98% | 8.09% | ||||||||||||

| Return after taxes on distributions |

1.10% | 9.86% | 13.93% | 7.88% | ||||||||||||

| Return after taxes on distributions and sale of Fund shares |

0.65% | 7.83% | 11.81% | 6.72% | ||||||||||||

| Institutional Shares* |

||||||||||||||||

| Return before taxes |

1.39% | 10.15% | 14.26% | 8.27% | ||||||||||||

| R6 Shares* |

||||||||||||||||

| Return before taxes |

1.39% | 10.16% | 14.26% | 8.27% | ||||||||||||

| Russell 1000® Growth Index (reflects no deduction for fees, expenses or taxes) |

(1.51)% | 10.40% | 15.29% | 8.91% | ||||||||||||

| S&P 500 Index (reflects no deduction for fees, expenses or taxes) |

(4.38)% | 8.49% | 13.12% | 7.94% | ||||||||||||

| * | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Stares. Performance for the R6 Shares prior to January 29, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

The Russell 1000® Growth Index is an unmanaged index of larger-cap growth companies. The S&P 500 Index is an unmanaged index of larger-cap companies.

Management

Investment Adviser. BAMCO is the investment adviser of the Fund.

Portfolio Manager. Alex Umansky has been the portfolio manager of the Fund since November 1, 2011.

| 35 | www.BaronFunds.com | |||||

Baron Fifth Avenue Growth Fund

Purchase and Sale of Fund Shares

Shares may be purchased only on days that the New York Stock Exchange is open for trading.

| Minimum Initial Investment |

Minimum Subsequent Investment |

Maximum Subsequent Investment | ||||

| Retail Shares |

$2,000 | No Minimum | No Maximum | |||

| Baron Automatic Investment Plan |

$500 (with subsequent minimum investments of $50 per month until your investment has reached $2,000.) | No Minimum | No Maximum | |||

| Baron Funds® website purchases |

$2,000 | $10 | $6,500 for retirement accounts and $250,000 for non-retirement accounts. | |||

| Institutional Shares |

$1,000,000 (Employees of the Adviser and its affiliates and Trustees of the Baron Funds® and employer sponsored retirement plans (qualified and nonqualified) are not subject to the eligibility requirements for Institutional Shares.) | No Minimum | No Maximum | |||

| Baron Funds® website purchases |

You may not make an initial purchase through the Baron Funds® website. | $10 | $6,500 for retirement accounts and $250,000 for non-retirement accounts. | |||

| 1-800-99BARON | 36 | |||||

Baron Fifth Avenue Growth Fund

| Minimum Initial Investment |

Minimum Subsequent Investment |

Maximum Subsequent Investment | ||||

| R6 Shares |

$5,000,000 (There is no minimum initial investment for qualified retirement plans; however, the shares must be held through plan-level or omnibus accounts held on the books of the Fund.) | No Minimum | No Maximum | |||

| Baron Funds® website purchases |

You may not make an initial purchase through the Baron Funds® website. | $10 | $6,500 for retirement accounts and $250,000 for non-retirement accounts. | |||

You Can Purchase or Redeem Shares By:

| 1. | Mailing a request to Baron Funds®, P.O. Box 219946, Kansas City, MO 64121-9946 or by overnight mail to: Baron Funds®, 430 West 7th Street, Kansas City, MO 64105-1514; |

| 2. | Wire (Purchase Only); |

| 3. | Calling 1-800-442-3814; |

| 4. | Visiting the Baron Funds® website www.BaronFunds.com; or |

| 5. | Through a broker, dealer or other financial intermediary that may charge you a fee. |

The Fund is not for short-term traders who intend to purchase and then sell their Fund shares within a 90 day period. If the Adviser reasonably believes that a person is not a long-term investor, it will attempt to prohibit that person from making additional investments in the Fund.

Tax Information

Distributions of the Fund’s net investment income (other than “qualified dividend income”) and distributions of net short-term capital gains will be taxable to you as ordinary income. Distributions of the Fund’s net capital gains reported as capital gain dividends by the Fund will be taxable to you as long-term capital gains, regardless of the length of time you have held shares of the Fund. If you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account, you may be subject to federal income tax on withdrawals from tax-deferred arrangement at a later date.

| 37 | www.BaronFunds.com | |||||

Baron Fifth Avenue Growth Fund

Financial Intermediary Compensation

If you purchase Retail or Institutional Shares of the Fund through a broker, dealer or other financial intermediary (such as a bank or financial adviser), the Fund, Baron Capital, Inc., the Fund’s distributor, BAMCO or their affiliates may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker, dealer or other financial intermediary, including and your salesperson, to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

| 1-800-99BARON | 38 | |||||

Investment Goal

The investment goal of Baron Discovery Fund (the “Fund”) is capital appreciation through investments primarily in securities of small-sized growth companies.

Fees and Expenses of the Fund

The table below describes the fees and expenses that you would pay if you bought and held shares of the Fund.

Annual Fund Operating Expenses

(Expenses that you pay each year as a percentage of the value of your investment)

| Management Fee |

Distribution (12b-1) Fee |

Other Expenses |

Total Annual Fund Operating Expenses |

Expense Reimbursements |

Total Annual Fund Operating Expenses after Expense Reimbursements1 |

|||||||||||||||||||

| BARON DISCOVERY FUND |

||||||||||||||||||||||||

| Retail Shares |

1.00% | 0.25% | 0.15% | 1.40% | (0.05% | ) | 1.35% | |||||||||||||||||

| Institutional Shares |

1.00% | 0.00% | 0.12% | 1.12% | (0.02% | ) | 1.10% | |||||||||||||||||

| R6 Shares |

1.00% | 0.00% | 0.10% | 1.10% | (0.01% | ) | 1.09% | |||||||||||||||||

| 1 | BAMCO, Inc. (“BAMCO” or the “Adviser”) has agreed that, for so long as it serves as the adviser to the Fund, it will reimburse certain expenses of the Fund, limiting net annual operating expenses (portfolio transaction costs, interest, dividend and extraordinary expenses are not subject to the operating expense limitation) to 1.35% of average daily net assets of Retail Shares, 1.10% of average daily net assets of Institutional Shares, and 1.09% of average daily net assets of R6 Shares. |

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although

| 39 | www.BaronFunds.com | |||||

Baron Discovery Fund

your actual costs may be higher or lower, based on these assumptions your costs would be:

| YEAR | 1 | 3 | 5 | 10 | ||||||||||||

| BARON DISCOVERY FUND |

||||||||||||||||

| Retail Shares |

$ | 137 | $ | 428 | $ | 739 | $ | 1,624 | ||||||||

| Institutional Shares |

$ | 112 | $ | 350 | $ | 606 | $ | 1,340 | ||||||||

| R6 Shares |

$ | 111 | $ | 347 | $ | 601 | $ | 1,329 | ||||||||

Portfolio Turnover. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes for Fund shareholders. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the example, affect the Fund’s performance. During the most recent fiscal year ended September 30, 2018, the Fund’s portfolio turnover rate was 72.25% of the average value of its portfolio.

Investments, Risks, and Performance

Principal Investment Strategies of the Fund

The Fund invests primarily in equity securities in the form of common stock of U.S. small-sized growth companies. The Adviser defines small-sized companies as those, at the time of purchase, with market capitalizations up to the largest market cap stock in the Russell 2000 Growth Index at June 30, or companies with market capitalizations up to $2.5 billion, whichever is larger, so long as the purchase of those securities would not cause the Fund’s weighted average market capitalization to exceed that of the Russell 2000 Growth Index. If at any time, the Fund’s weighted average market capitalization exceeds that of the Russell 2000 Growth Index, the Fund may only purchase securities with market capitalizations up to the weighted average market capitalization of the Russell 2000 Growth Index. The Adviser seeks to invest in businesses it believes have significant opportunities for growth, sustainable competitive advantages, exceptional management, and an attractive valuation.

Principal Risks of Investing in the Fund

General Stock Market. Investing in the stock market is risky because securities fluctuate in value. These fluctuations may be due to political, economic or general market circumstances. Other factors may affect a single company or industry but not the broader market. Because the values of securities fluctuate, when you sell your investment in the Fund, you may lose money. Current and future portfolio holdings in the Fund are subject to risk.

| 1-800-99BARON | 40 | |||||

Baron Discovery Fund

Growth Investing. Growth stocks can react differently to issuer, political, market and economic developments than the market as a whole and other types of stocks. Growth stocks tend to be more expensive relative to their earnings or assets compared to other types of stocks. As a result, growth stocks tend to be sensitive to changes in their earnings and more volatile than other types of stocks.

Small-Sized Companies. The Adviser believes there is more potential for capital appreciation in small-sized companies, but there also may be more risk. Securities of small-sized companies may not be well known to most investors, and the securities may be less actively traded than those of large businesses. The securities of small-sized companies may fluctuate in price more widely than the stock market generally, and they may be more difficult to sell during market downturns. Small-sized companies rely more on the skills of management and on their continued tenure. Investing in small-sized companies requires a long-term outlook and may require shareholders to assume more risk and to have more patience than investing in the securities of larger, more established companies.

Special Situations. The Funds may invest in “special situations.” A special situation arises when, in the opinion of the Adviser, the securities of a company will be recognized and appreciate in value due to a specific anticipated development at that company. Such developments might include a new product, a management change, an acquisition or a technological advancement. The risk of investing in special situations is that the anticipated development does not occur or its impact is not what the Adviser expected.

Health Care Sector Risk. Investments in health care companies are subject to a number of risks, including the adverse impact of legislative actions and government regulations. These actions and regulations can affect the approval process for patents, medical devices and drugs, the funding of research and medical care programs, and the operation and licensing of facilities and personnel. Biotechnology and related companies are affected by patent considerations, intense competition, rapid technology change and obsolescence, and regulatory requirements of various federal and state agencies. In addition, some of these companies are relatively small and have thinly traded securities, may not yet offer products or may offer a single product, and may have persistent losses during a new product’s transition from development to production, or erratic revenue patterns. The stock prices of these companies are very volatile, particularly when their products are up for regulatory approval and/or under regulatory scrutiny.

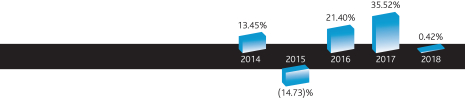

Performance

The following bar chart and table provide some indication of the risks of investing in the Fund (Retail Shares) by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual returns compare with those of a broad measure of market performance. The Fund’s past performance (before and after taxes) is

| 41 | www.BaronFunds.com | |||||

Baron Discovery Fund

not necessarily an indication of how the Fund will perform in the future. Updated performance information is available online at www.BaronFunds.com/performance or by calling 1-800-99BARON (1-800-992-2766).

Year by Year Total Return (%) as of December 31 of Each Year (Retail Shares)

| Best Quarter: | 06/30/18: 16.76% |

| Worst Quarter: | 12/31/18: (23.39)% |

Average Annual Total Returns (for periods ended 12/31/18)

The following table shows the Fund’s Retail Shares’ annual returns and long-term performance (before and after taxes) and the change in value of broad-based market indexes over various periods ended December 31, 2018. The table also shows the average annual returns of the Fund’s Institutional Shares and R6 Shares, but it does not show after-tax returns.

After-tax returns are calculated using the highest individual federal marginal income tax rate in effect at the time of each distribution and assumed sale, but they do not include the impact of state and local taxes.

Your actual after-tax returns depend on your own tax situation and may differ from those shown. After-tax returns reflect past tax effects and are not predictive of future tax effects. After-tax returns are not relevant to investors who hold their Fund’s shares in a tax-deferred account (including a 401(k) or IRA or Coverdell account), or to investors that are tax-exempt.

Average Annual Total Returns for the periods ended December 31, 2018

| 1 year | 5 years | 10 years | Since Inception |

|||||||||||||

| BARON DISCOVERY FUND |

||||||||||||||||

| Retail Shares |

||||||||||||||||

| Return before taxes |

0.42% | 9.83% | N/A | 12.61% | ||||||||||||

| Return after taxes on distributions |

(1.32)% | 9.33% | N/A | 12.11% | ||||||||||||