PIMCO

Total Return ESG Fund

Summary Prospectus

August 1, 2022

| Share Class: |

Inst |

I-2 |

I-3 |

Admin |

Class A |

Class C |

| Ticker: |

PTSAX |

PRAPX |

PTRSX |

PRFAX |

PTGAX |

PTGCX |

Before you invest, you may want to review the Fund’s prospectus, which, as supplemented, contains more information about the Fund and its risks. You can find the Fund’s prospectus, reports to shareholders (once available) and other information about the Fund online at http:// investments.pimco.com/prospectuses. You can also get this information at no cost by calling 888.87.PIMCO or by sending an email request to piprocess@dstsystems.com. The Fund’s prospectus and Statement of Additional Information, both dated August 1, 2022, as supplemented, are incorporated by reference into this Summary Prospectus.

Investment Objective

The Fund seeks maximum total return, consistent with preservation of capital and prudent investment management.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You

may pay other fees, such as commissions and other fees to financial intermediaries, which are not

reflected in the table and example below. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in Class A shares of eligible funds offered by PIMCO Equity Series and PIMCO Funds. More information about these and other discounts is available in the “Classes of Shares” section on page 80 of the Fund’s prospectus, Appendix B to the Fund’s prospectus (Financial Firm-Specific Sales Charge Waivers and Discounts) or from your financial professional.

Shareholder Fees (fees paid directly from your investment):

| |

Inst

Class |

I-2 |

I-3 |

Admin

Class |

Class A |

Class C |

| Maximum Sales

Charge (Load)

Imposed on

Purchases (as a

percentage of

offering price) |

None |

None |

None |

None |

2.25% |

None |

| Maximum Deferred

Sales Charge (Load)

(as a percentage of

the lower of the

original purchase

price or redemption

price) |

None |

None |

None |

None |

1.00% |

1.00% |

Annual

Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment):

| |

Inst

Class |

I-2 |

I-3 |

Admin

Class |

Class A |

Class C |

| Management Fees |

0.50% |

0.60% |

0.70% |

0.50% |

0.65% |

0.65% |

| Distribution and/or

Service (12b-1) Fees |

N/A |

N/A |

N/A |

0.25% |

0.25% |

1.00% |

| Other Expenses(1) |

0.01% |

0.01% |

0.01% |

0.01% |

0.01% |

0.01% |

| Total Annual

Fund Operating

Expenses |

0.51% |

0.61% |

0.71% |

0.76% |

0.91% |

1.66% |

| Fee Waiver and/or

Expense

Reimbursement(2) |

N/A |

N/A |

(0.05%) |

N/A |

N/A |

N/A |

| Total Annual

Fund Operating

Expenses After

Fee Waiver

and/or Expense

Reimbursement |

0.51% |

0.61% |

0.66% |

0.76% |

0.91% |

1.66% |

1

“Other Expenses” include interest expense of 0.01%. Interest expense is

borne by the Fund separately from the management fees paid to Pacific Investment Management Company

LLC (“PIMCO”). Excluding interest expense, Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement are 0.50%, 0.60%, 0.65%, 0.75%, 0.90% and 1.65% for Institutional Class, I-2, I-3, Administrative Class, Class A and Class C shares,

respectively.

2

PIMCO has contractually agreed, through July 31, 2023, to reduce its supervisory and administrative fee for the Fund’s I-3 shares by 0.05% of the average daily

net assets attributable to I-3 shares of the Fund. This Fee Waiver Agreement renews annually unless

terminated by PIMCO upon at least 30 days’ prior notice to the end of the contract term.

Example.

The Example is intended to help you compare the cost of investing in Institutional Class, I-2,

I-3, Administrative Class, Class A or Class C shares of the Fund with the costs of investing in other mutual funds. The Example assumes that you invest $10,000 in the noted class of shares for the time periods

indicated, and then redeem all your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although

your actual costs may be higher or lower, based on these assumptions your costs would be:

If you redeem your shares at the end of each period:

| |

1 Year |

3 Years |

5 Years |

10 Years |

| Institutional Class |

$52 |

$164 |

$285 |

$640 |

| I-2 |

$62 |

$195 |

$340 |

$762 |

| I-3 |

$67 |

$222 |

$390 |

$878 |

| Administrative Class |

$78 |

$243 |

$422 |

$942 |

| Class A |

$316 |

$509 |

$718 |

$1,319 |

| Class C |

$269 |

$523 |

$902 |

$1,965 |

If you do not redeem your shares:

| |

1 Year |

3 Years |

5 Years |

10 Years |

| Class A |

$316 |

$509 |

$718 |

$1,319 |

| Class C |

$169 |

$523 |

$902 |

$1,965 |

PIMCO Funds | Summary Prospectus

PIMCO Total Return ESG Fund

Portfolio

Turnover

The Fund pays transaction costs when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction

costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the Annual Fund Operating Expenses or in the Example tables, affect the Fund’s performance.

During the most recent fiscal year, the Fund’s portfolio turnover rate was 184% of the average value of its portfolio.

Principal Investment Strategies

The Fund seeks to achieve its investment objective by investing under normal circumstances at least 65% of its total assets in a diversified portfolio of Fixed Income Instruments

of varying maturities, which may be represented by forwards or derivatives such as options, futures

contracts, or swap agreements. “Fixed Income Instruments” include bonds, debt

securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. The average portfolio duration of this Fund normally varies within two years (plus or minus) of the portfolio duration of the

securities comprising the Bloomberg U.S. Aggregate Index, as calculated by PIMCO, which as of May 31, 2022 was 6.54 years. Duration is a measure used to determine the sensitivity of a security’s price to

changes in interest rates. The longer a security’s duration, the more sensitive it will be to changes in interest rates. The Fund will not invest in the securities of any non-governmental issuer determined by PIMCO to be

engaged principally in the manufacture of alcoholic beverages, tobacco products or military

equipment, the operation of gambling casinos, the production or trade of pornographic materials,

or in the oil industry, including extraction, production, and refining or the production, distribution of coal and coal fired generation. The Fund can invest in the securities of any issuer determined by PIMCO to be engaged

principally in biofuel production, natural gas generation and sales and trading activities. However, green/sustainable bonds from issuers involved in fossil fuel-related sectors may be permitted. Labeled green

bonds are those issues with proceeds specifically earmarked to be used for climate and

environmental projects. Labeled green bonds are often verified by a third party, which certifies

that the bond will fund projects that include environmental benefits. In addition, the Fund will not invest in the securities of any non-governmental issuer determined by PIMCO to be engaged principally in the provision of

healthcare services or the manufacture of pharmaceuticals, unless the issuer derives 100% of its

gross revenues from products or services designed to protect and improve the quality of human

life, as determined on the basis of information available to PIMCO. This generally prohibits investments in healthcare service and/or pharmaceutical manufacturing issuers that derive gross revenue from products or

services related to abortion, abortifacients, contraceptives or stem cell research. To the extent

possible on the basis of information available to PIMCO, an issuer will be deemed to be

principally engaged in an activity if it derives more than 10% of its gross revenues from such activities.

In analyzing whether an

issuer meets any of the criteria described above, PIMCO may rely upon, among other things, information provided by an independent third party.

The Fund

may avoid investment in the securities of issuers whose business practices with respect to the environment, social responsibility, and governance (“ESG practices”) are not to PIMCO’s satisfaction. In determining the

efficacy of an issuer’s ESG practices, PIMCO will use its own proprietary assessments of material ESG issues and may also reference standards as set forth by recognized global organizations such as entities sponsored by the United

Nations. Additionally, PIMCO may engage proactively with issuers to encourage them to improve their ESG practices. PIMCO’s activities in this respect may include, but are not limited to, direct dialogue with

company management, such as through in-person meetings, phone calls, electronic communications, and letters. Through these engagement activities, PIMCO seeks to identify opportunities for a company to improve its ESG

practices, and will endeavor to work collaboratively with company management to establish

concrete objectives and to develop a plan for meeting these objectives. The Fund may invest in securities of issuers whose ESG practices are currently suboptimal, with the expectation that these practices may improve over time either as

a result of PIMCO’s engagement efforts or through the company’s own initiatives. It may

also exclude those issuers that are not receptive to PIMCO’s engagement efforts, as

determined in PIMCO’s sole discretion.

The Fund invests primarily in investment grade securities,

but may invest up to 20% of its total assets in high yield securities (“junk bonds”), as rated by Moody’s Investors Service, Inc. (“Moody’s”), Standard & Poor’s

Ratings Services (“S&P”) or Fitch, Inc. (“Fitch”), or, if unrated, as

determined by PIMCO. In the event that ratings services assign different ratings to the same

security, PIMCO will use the highest rating as the credit rating for that security. The Fund may invest up to 30% of its total assets in securities denominated in foreign currencies, and may invest beyond this limit in U.S.

dollar-denominated securities of foreign issuers. The Fund may invest up to 15% of its total assets in securities and instruments that are economically tied to emerging market countries (this limitation does not apply to

investment grade sovereign debt denominated in the local currency with less than 1 year remaining to maturity, which means the Fund may invest, together with any other investments denominated in foreign

currencies, up to 30% of its total assets in such instruments). The Fund will normally limit its foreign currency exposure (from non-U.S. dollar-denominated securities or currencies) to 20% of its total

assets.

The Fund may invest, without limitation, in derivative instruments, such as options, futures contracts or swap agreements, or in mortgage- or asset-backed securities, subject to

applicable law and any other restrictions described in the Fund’s prospectus or Statement of

Additional Information. The Fund may purchase or sell securities on a when-issued, delayed

delivery or forward commitment basis and may engage in short sales. The Fund may, without limitation, seek to obtain market exposure to the securities in which it primarily invests by entering into a series of purchase and sale

contracts or by using other investment techniques (such as buy backs or dollar rolls). The “total

2 Summary Prospectus | PIMCO Funds

Summary Prospectus

return” sought by the Fund consists of income earned on the Fund’s investments, plus capital

appreciation, if any, which generally arises from decreases in interest rates, foreign currency appreciation, or improving credit fundamentals for a particular sector or security. The Fund may also invest up to 10% of its

total assets in preferred securities.

Principal Risks

It is

possible to lose money on an investment in the Fund. The principal risks of investing in the

Fund, which could adversely affect its net asset value, yield and total return, are listed below.

Interest Rate Risk: the risk that fixed income securities will decline in value because of an increase in interest rates; a fund with a longer average portfolio duration will be more

sensitive to changes in interest rates than a fund with a shorter average portfolio duration

Call Risk: the risk that an issuer may exercise its right to redeem a fixed income security earlier than expected (a

call). Issuers may call outstanding securities prior to their maturity for a number of reasons

(e.g.,

declining interest rates, changes in credit spreads and improvements in the issuer’s credit quality). If an issuer calls a security that the Fund has invested in, the Fund may not recoup the full amount of its initial investment and may be

forced to reinvest in lower-yielding securities, securities with greater credit risks or securities with other, less favorable features

Credit Risk: the risk that the Fund could lose money if the issuer or guarantor of a fixed income security, or the counterparty to a derivative contract, is unable or unwilling, or

is perceived (whether by market participants, rating agencies, pricing services or otherwise) as unable or unwilling, to meet its financial obligations

High Yield Risk: the risk that high yield securities and unrated securities of similar credit quality (commonly known as

“junk bonds”) are subject to greater levels of credit, call and liquidity risks. High yield securities are considered primarily speculative with respect to the issuer’s continuing ability to make

principal and interest payments, and may be more volatile than higher-rated securities of similar maturity

Market Risk: the risk that the value of securities owned by the Fund may go up or down, sometimes rapidly or unpredictably, due to factors affecting securities markets generally

or particular industries

Issuer Risk: the risk that the value of a security may decline for a reason directly related to the issuer, such as management performance, financial leverage and reduced demand

for the issuer’s goods or services

Liquidity Risk: the risk that a particular investment may be difficult to purchase or sell and that the Fund may be unable to sell illiquid investments at an advantageous time or price

or achieve its desired level of exposure to a certain sector. Liquidity risk may result from the

lack of an active market, reduced number and capacity of traditional market participants to make

a market in fixed income securities, and may be magnified in a rising interest rate environment or other circumstances where investor redemptions from fixed income funds may

be higher than normal, causing increased supply in the market due to selling activity

Derivatives Risk: the risk of investing in derivative instruments (such as futures, swaps and structured securities), including leverage, liquidity, interest rate, market, credit and

management risks, and valuation complexity. Changes in the value of a derivative may not correlate

perfectly with, and may be more sensitive to market events than, the underlying asset, rate or

index, and the Fund could lose more than the initial amount invested. The Fund’s use of derivatives may result in losses to the Fund, a reduction in the Fund’s returns and/or increased volatility. Over-the-counter

(“OTC”) derivatives are also subject to the risk that a counterparty to the transaction will not fulfill its contractual obligations to the other party, as many of the protections afforded to centrally-cleared derivative

transactions might not be available for OTC derivatives. The primary credit risk on derivatives that are exchange-traded or traded through a central clearing counterparty resides with the Fund's clearing broker or

the clearinghouse. Changes in regulation relating to a mutual fund’s use of derivatives and related instruments could potentially limit or impact the Fund’s ability to invest in derivatives, limit the

Fund’s ability to employ certain strategies that use derivatives and/or adversely affect the value of derivatives and the Fund’s performance

Equity Risk: the risk that the value of equity securities, such as common stocks and preferred securities, may decline due to general market conditions which are not

specifically related to a particular company or to factors affecting a particular industry or industries. Equity securities generally have greater price volatility than fixed income securities

Mortgage-Related and Other Asset-Backed Securities Risk: the risks

of investing in mortgage-related and other asset-backed securities, including interest rate risk, extension risk, prepayment risk and credit risk

Foreign (Non-U.S.)

Investment Risk: the risk that investing in foreign (non-U.S.) securities may result in the Fund experiencing more rapid and extreme changes in value than

a fund that invests exclusively in securities of U.S. companies, due to smaller markets, differing

reporting, accounting and auditing standards, increased risk of delayed settlement of portfolio

transactions or loss of certificates of portfolio securities, and the risk of unfavorable foreign government actions, including nationalization, expropriation or confiscatory taxation, currency blockage, or political

changes or diplomatic developments or the imposition of sanctions and other similar measures. Foreign securities may also be less liquid and more difficult to value than securities of U.S. issuers

Emerging Markets Risk: the risk of investing in emerging market securities, primarily increased foreign (non-U.S.) investment risk

Sovereign Debt Risk: the risk that investments in fixed income instruments issued by sovereign entities may decline in value as a

result of default or other adverse credit event resulting from an issuer’s

August 1, 2022 | SUMMARY PROSPECTUS 3

PIMCO Total Return ESG

Fund

inability or unwillingness to

make principal or interest payments in a timely fashion

Currency Risk: the risk that foreign (non-U.S.) currencies will change in value relative to the U.S. dollar and affect the

Fund’s investments in foreign (non-U.S.) currencies or in securities that trade in, and receive revenues in, or in derivatives that provide exposure to, foreign (non-U.S.) currencies

Leveraging Risk: the risk that certain transactions of the Fund, such as reverse repurchase agreements, loans of portfolio securities, and the use of when-issued, delayed delivery

or forward commitment transactions, or derivative instruments, may give rise to leverage,

magnifying gains and losses and causing the Fund to be more volatile than if it had not been

leveraged. This means that leverage entails a heightened risk of loss

Management Risk: the risk that the investment techniques and risk analyses applied by PIMCO will not produce the desired

results and that actual or potential conflicts of interest, legislative, regulatory, or tax

restrictions, policies or developments may affect the investment techniques available to PIMCO

and the individual portfolio managers in connection with managing the Fund and may cause PIMCO to restrict or prohibit participation in certain investments. There is no guarantee that the investment objective of the Fund

will be achieved

Short Exposure Risk: the risk of entering into short sales, including the potential loss of more money than the actual cost of the investment, and the risk that the third party to

the short sale will not fulfill its contractual obligations, causing a loss to the Fund

Environmental, Social and Governance Investing Risk: the risk that, because the Fund’s ESG strategy may select or exclude securities of certain issuers for reasons in addition to performance, the Fund’s performance will differ from funds

that do not utilize an ESG investing strategy. ESG investing is qualitative and subjective by nature, and there is no guarantee that the factors utilized by PIMCO or any judgment exercised by PIMCO will reflect the

opinions of any particular investor

LIBOR Transition Risk: the risk related to the anticipated discontinuation of the London Interbank Offered Rate (“LIBOR”). Certain instruments held by the

Fund rely in some fashion upon LIBOR. Although the transition process away from LIBOR has become

increasingly well-defined in advance of the anticipated discontinuation date, there remains

uncertainty regarding the nature of any replacement rate, and any potential effects of the transition away from LIBOR on the Fund or on certain instruments in which the Fund invests can be difficult to ascertain. The transition process

may involve, among other things, increased volatility or illiquidity in markets for instruments that currently rely on LIBOR and may result in a reduction in the value of certain instruments held by the Fund

Please see “Description of Principal Risks” in the Fund's prospectus for a more detailed description of the risks of investing in the Fund. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit

Insurance Corporation or any other government agency.

Performance Information

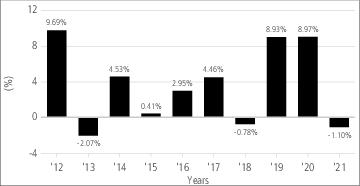

The performance information shows summary performance information for the Fund in a bar chart and an Average Annual Total Returns table. The information provides some

indication of the risks of investing in the Fund by showing changes in its performance from year to year and by showing how the Fund’s average annual returns compare with the returns of a broad-based securities

market index and an index of similar funds. Absent any applicable fee waivers and/or expense

limitations, performance would have been lower. The bar chart shows performance of the

Fund’s Institutional Class shares. For periods prior to the inception date of the Class A shares (February 3, 2020) and Class C shares (February 3, 2020), performance information shown in the table for those classes is based on the performance

of the Fund's Institutional Class shares, adjusted to reflect the fees and expenses paid by those

classes of shares. Performance for Class A and Class C shares in the Average Annual Total Returns table reflects the impact of sales charges.Because I-3 shares of the Fund had not commenced operations as of December 31, 2021, no performance for I-3

shares is provided.The Fund’s past performance, before

and after taxes, is not necessarily an indication of how the Fund will perform in the future.

The Bloomberg U.S. Aggregate Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond

market, with index components for government and corporate securities, mortgage pass-through

securities, and asset-backed securities. These major sectors are subdivided into more specific

indices that are calculated and reported on a regular basis. Lipper Core Plus Bond Funds Average is a total return performance average of Funds tracked by Lipper, Inc. that invest at least 65% in domestic investment-grade

debt issues (rated in the top four grades) with any remaining investment in non-benchmark sectors such as high-yield, global and emerging market debt. These funds maintain dollar-weighted average maturities of

five to ten years.

Performance for the Fund is updated daily and quarterly and may be obtained as follows: daily and quarterly updates on the net asset value and performance page at https://www.pimco.com/en-us/product-finder.

Calendar Year Total Returns — Institutional Class

| Best Quarter |

June 30, 2020 |

4.13% |

| Worst Quarter |

June 30, 2013 |

-3.31% |

| Year-to-Date |

June 30, 2022 |

-12.72% |

4 Summary Prospectus | PIMCO Funds

Summary Prospectus

Average

Annual Total Returns (for periods ended 12/31/21)

| |

1 Year |

5 Years |

10 Years |

| Institutional Class Return Before Taxes |

-1.10% |

4.00% |

3.51% |

| Institutional Class Return After Taxes on Distributions(1) |

-2.15% |

2.73% |

2.05% |

| Institutional Class Return After Taxes on Distributions

and Sales of Fund Shares(1) |

-0.54% |

2.56% |

2.11% |

| I-2 Return Before Taxes |

-1.20% |

3.90% |

3.41% |

| Administrative Class Return Before Taxes |

-1.35% |

3.74% |

3.25% |

| Class A Return Before Taxes |

-3.68% |

3.11% |

2.87% |

| Class C Return Before Taxes |

-3.19% |

2.82% |

2.33% |

| Bloomberg U.S. Aggregate Index (reflects no deductions

for fees, expenses or taxes) |

-1.54% |

3.57% |

2.90% |

| Lipper Core Plus Bond Funds Average (reflects no

deductions for taxes) |

-0.81% |

4.10% |

3.59% |

1

After-tax returns are calculated using the highest historical individual federal

marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax

returns depend on an investor’s tax situation and may differ from those shown, and the

after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases the return after taxes may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period. After-tax returns are for Institutional Class shares only. After-tax returns for other classes will

vary.

Investment

Adviser/Portfolio Managers

PIMCO serves as the investment adviser for the Fund. The Fund’s portfolio is jointly and primarily

managed by Scott Mather, Mark Kiesel, Mohit Mittal and Jelle Brons. Mr. Mather is CIO U.S. Core Strategies. Mr. Kiesel is CIO Global Credit. Messrs. Mather, Kiesel and Mittal are Managing Directors of PIMCO, and Mr. Brons

is an Executive Vice President of PIMCO. Messrs. Mather and Kiesel have jointly and primarily

managed the Fund since September 2014, Mr. Mittal has jointly and primarily managed the Fund since December 2019 and Mr. Brons has jointly and primarily managed the Fund since April 2019.

Purchase and Sale of Fund Shares

Fund shares may be purchased or sold (redeemed) on any business day (normally any day when the New York Stock

Exchange (“NYSE”) is open). Generally, purchase and redemption orders for Fund shares are processed at the net asset value next calculated after an order is received by the Fund.

Institutional Class, I-2, I-3 and Administrative Class

The minimum initial investment for Institutional Class, I-2, I-3 and Administrative Class shares of the Fund is $1 million, except that the minimum initial investment may be

modified for certain financial firms that submit orders on behalf of their customers.

You may sell (redeem) all or

part of your Institutional Class, I-2, I-3 and Administrative Class shares of the Fund on any business day. If you are the registered owner of the shares on the books of the Fund, depending on the elections made on the Account

Application, you may sell by:

◾

Sending a written request by regular mail to:

PIMCO Funds

P.O. Box 219024, Kansas City, MO 64121-9024

or by overnight mail to:

PIMCO Funds c/o DST Asset Manager Solutions, Inc.

430 W 7th Street, STE 219024, Kansas City, MO 64105-1407

P.O. Box 219024, Kansas City, MO 64121-9024

or by overnight mail to:

PIMCO Funds c/o DST Asset Manager Solutions, Inc.

430 W 7th Street, STE 219024, Kansas City, MO 64105-1407

◾

Calling us at 888.87.PIMCO and a Shareholder Services associate will assist you

◾

Sending a fax to our Shareholder Services department at 816.421.2861

◾

Sending an e-mail to piprocess@dstsystems.com

Class A and Class C

The minimum initial investment for Class A and Class C shares of the Fund is $1,000. The minimum subsequent investment for Class A and Class C shares is $50. The minimum initial

investment may be modified for certain financial firms that submit orders on behalf of their

customers. You may purchase or sell (redeem) all or part of your Class A and Class C shares

through a broker-dealer, or other financial firm, or, if you are the registered owner of the shares on the books of the Fund, by regular mail to PIMCO Funds, P.O. Box 219294, Kansas City, MO 64121-9294 or overnight mail to PIMCO Funds, c/o

DST Asset Manager Solutions, Inc., 430 W. 7th Street, STE 219294, Kansas City, MO 64105-1407. The

Fund reserves the right to require payment by wire or U.S. Bank check in connection with accounts opened directly with the Fund by Account Application.

Tax Information

The

Fund’s distributions are generally taxable to you as ordinary income, capital gains, or a combination of the two, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account, in which case

distributions may be taxable upon withdrawal.

Payments to Broker-Dealers and Other Financial Firms

If you purchase

shares of the Fund through a broker-dealer or other financial firm (such as a bank), the Fund and/or its related companies (including PIMCO) may pay the financial firm for the sale of those shares of the Fund and/or related services.

These payments may create a conflict of interest by influencing the broker-dealer or other financial firm and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your

financial firm’s website for more information.

August 1, 2022 | SUMMARY PROSPECTUS 5