Table of Contents

|

Prospectus | |

| PIMCO Funds |

| *I-2 was formerly called Class P. |

| Asset Allocation Funds |

July 28, 2017 (as supplemented June 1, 2018) |

| Inst |

I-2* |

I-3 |

Admin |

A |

C |

R | |

| PIMCO All Asset Fund |

PAAIX |

PALPX |

PAANX |

PAALX |

PASAX |

PASCX |

PATRX |

| PIMCO All Asset All Authority Fund |

PAUIX |

PAUPX |

PAUNX |

— |

PAUAX |

PAUCX |

— |

| PIMCO Global Multi-Asset Fund |

PGAIX |

PGAPX |

— |

— |

PGMAX |

PGMCX |

PGMRX |

| PIMCO Multi-Strategy Alternative Fund |

PXAIX |

PXAPX |

— |

— |

PXAAX |

— |

— |

| PIMCO REALPATH® Income Fund |

PRIEX |

— |

— |

PRNAX |

PTNAX |

— |

— |

| PIMCO REALPATH® 2020 Fund |

PRWIX |

— |

— |

PFNAX |

PTYAX |

— |

— |

| PIMCO REALPATH® 2025 Fund |

PENTX |

— |

— |

PENMX |

PENZX |

— |

— |

| PIMCO REALPATH® 2030 Fund |

PRLIX |

— |

— |

PNLAX |

PEHAX |

— |

— |

| PIMCO REALPATH® 2035 Fund |

PIVIX |

— |

— |

PIVNX |

PIVAX |

— |

— |

| PIMCO REALPATH® 2040 Fund |

PROIX |

— |

— |

PEOAX |

POFAX |

— |

— |

| PIMCO REALPATH® 2045 Fund |

PFZIX |

— |

— |

PFZMX |

PFZAX |

— |

— |

| PIMCO REALPATH® 2050 Fund |

PRMIX |

— |

— |

POTAX |

PFYAX |

— |

— |

| PIMCO REALPATH® 2055 Fund |

PRQIX |

— |

— |

PQRZX |

PQRAX |

— |

— |

|

||

| Page | ||

| 1 | ||

| 1 | ||

| 6 | ||

| 12 | ||

| 17 | ||

| 22 | ||

| 28 | ||

| 34 | ||

| 40 | ||

| 46 | ||

| 52 | ||

| 58 | ||

| 64 | ||

| 70 | ||

| Summary of Other Important Information Regarding Fund Shares |

76 | |

| 77 | ||

| 91 | ||

| 92 | ||

| 101 | ||

| 106 | ||

| 113 | ||

| 114 | ||

| 115 | ||

| Characteristics and Risks of Securities and Investment Techniques |

117 | |

| 133 | ||

| 138 | ||

| A-1 | ||

| Appendix B - Financial Firm-Specific Sales Charge Waivers and Discounts |

B-1 |

|

|

PIMCO All Asset Fund | |

|

|

|

|

Investment Objective

The Fund seeks maximum real return, consistent with preservation of real capital and prudent investment management.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in Class A shares of eligible funds offered by PIMCO Equity Series and PIMCO Funds. More information about these and other discounts is available in the "Classes of Shares" section on page 101 of the Fund's prospectus, Appendix B to the Fund's prospectus (Financial Firm-Specific Sales Charge Waivers and Discounts) or from your financial advisor.

Shareholder Fees (fees paid directly from your investment):

|

|

Inst |

I-2 |

I-3 |

Admin |

Class A |

Class C |

Class R |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

None |

None |

None |

None |

3.75% |

None |

None |

| Maximum Deferred Sales Charge (Load) (as a percentage of the lower of the original purchase price or redemption price) |

None |

None |

None |

None |

1.00% |

1.00% |

None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment):

|

|

Inst |

I-2 |

I-3 |

Admin |

Class A |

Class C |

Class R |

| Management Fees(1) |

0.225% |

0.325% |

0.425% |

0.225% |

0.425% |

0.425% |

0.425% |

| Distribution and/or Service (12b-1) Fees |

N/A |

N/A |

N/A |

0.25% |

0.25% |

1.00% |

0.50% |

| Acquired Fund Fees and Expenses(2) |

0.84% |

0.84% |

0.84% |

0.84% |

0.84% |

0.84% |

0.84% |

| Total Annual Fund Operating Expenses(3) |

1.065% |

1.165% |

1.265% |

1.315% |

1.515% |

2.265% |

1.765% |

| Fee Waiver and/or Expense Reimbursement(4)(5) |

(0.14%) |

(0.14%) |

(0.19%) |

(0.14%) |

(0.14%) |

(0.14%) |

(0.14%) |

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement |

0.925% |

1.025% |

1.075% |

1.175% |

1.375% |

2.125% |

1.625% |

1 Expense information in the table has been restated to reflect current Management Fees.

2 Acquired Fund Fees and Expenses include interest expense of the Underlying PIMCO Funds of 0.06%. Interest expense can result from certain transactions within the Underlying PIMCO Funds and is separate from the management fees paid to PIMCO. Excluding interest expense of the Underlying PIMCO Funds, Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement are 0.865%, 0.965%, 1.015%, 1.115%, 1.315%, 2.065% and 1.565% for Institutional Class, I-2, I-3, Administrative Class, Class A, Class C and Class R shares, respectively.

3 Total Annual Fund Operating Expenses do not match the Ratio of Expenses to Average Net Assets Excluding Waivers of the Fund, as set forth in the Financial Highlights table of the Fund's prospectus, because the Ratio of Expenses to Average Net Assets Excluding Waivers reflects the operating expenses of the Fund and does not include Acquired Fund Fees and Expenses.

4 PIMCO has contractually agreed, through July 31, 2018, to reduce its advisory fee to the extent that the Underlying PIMCO Fund Expenses attributable to advisory and supervisory and administrative fees exceed 0.64% of the total assets invested in Underlying PIMCO Funds. PIMCO may recoup these waivers in future periods, not exceeding three years, provided total expenses, including such recoupment, do not exceed the annual expense limit. The fee reduction is implemented based on a calculation of Underlying PIMCO Fund Expenses attributable to advisory and supervisory and administrative fees that is different from the calculation of Acquired Fund Fees and Expenses listed in the table above.

5 PIMCO has contractually agreed, through July 31, 2019, to reduce its supervisory and administrative fee for the Fund's I-3 shares by 0.05% of the average daily net assets attributable to I-3 shares of the Fund. This Fee Waiver Agreement renews annually unless terminated by PIMCO upon at least 30 days' prior notice to the end of the contract term.

Example. The Example is intended to help you compare the cost of investing in Institutional Class, I-2, I-3, Administrative Class, Class A, Class C or Class R shares of the Fund with the costs of investing in other mutual funds. The Example assumes that you invest $10,000 in the noted class of shares for the time periods indicated, and then redeem all your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. Investors may pay brokerage commissions on their purchases and sales of Institutional Class, I-2 or I-3 shares of the Fund, which are not reflected in the Example. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

If you redeem your shares at the end of each period:

|

|

1 Year |

3 Years |

5 Years |

10 Years |

| Institutional Class |

$94 |

$325 |

$574 |

$1,287 |

| I-2 |

$105 |

$356 |

$627 |

$1,402 |

| I-3 |

$110 |

$382 |

$676 |

$1,512 |

| Administrative Class |

$120 |

$403 |

$707 |

$1,572 |

| Class A |

$510 |

$823 |

$1,158 |

$2,103 |

| Class C |

$316 |

$694 |

$1,200 |

$2,589 |

| Class R |

$165 |

$542 |

$944 |

$2,067 |

If you do not redeem your shares:

|

|

1 Year |

3 Years |

5 Years |

10 Years |

| Class A |

$510 |

$823 |

$1,158 |

$2,103 |

| Class C |

$216 |

$694 |

$1,200 |

$2,589 |

Portfolio Turnover

The Fund pays transaction costs when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the Annual Fund Operating Expenses or in the Example tables, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 54% of the average value of its portfolio.

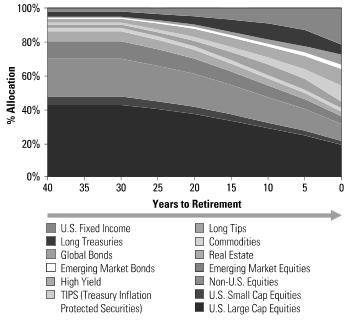

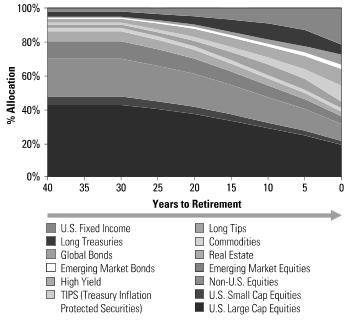

Principal Investment Strategies

The Fund is a "fund of funds," which is a term used to describe mutual funds that pursue their investment objective by investing in other funds. The Fund seeks to achieve its investment objective by investing under normal circumstances substantially all of its assets in the least expensive class of

|

|

PIMCO FUNDS | PROSPECTUS |

1 |

| PIMCO All Asset Fund | ||

|

|

|

|

shares of any actively managed or smart beta funds (including mutual funds or exchange-traded funds) of the Trust, or PIMCO ETF Trust or PIMCO Equity Series, each an affiliated open-end investment company, except other funds of funds (collectively, "Underlying PIMCO Funds"). As used in the investment objective, "real return" equals total return less the estimated cost of inflation, which is typically measured by the change in an official inflation measure, and "real capital" equals capital less the estimated cost of inflation measured by the change in an official inflation measure. In addition to investing in Underlying PIMCO Funds, at the discretion of Pacific Investment Management Company LLC ("PIMCO") and without shareholder approval, the Fund may invest in additional Underlying PIMCO Funds created in the future.

The Fund invests its assets in shares of the Underlying PIMCO Funds and does not invest directly in stocks or bonds of other issuers. Research Affiliates, LLC, the Fund's asset allocation sub-adviser, determines how the Fund allocates and reallocates its assets among the Underlying PIMCO Funds. In doing so, the asset allocation sub-adviser seeks concurrent exposure to a broad spectrum of asset classes.

Investments in Underlying PIMCO Funds.The Fund may invest in any or all of the Underlying PIMCO Funds, but will not normally invest in every Underlying PIMCO Fund at any particular time. The Fund's investment in a particular Underlying PIMCO Fund normally will not exceed 50% of its total assets. The Fund will not invest in the Short Strategy Underlying PIMCO Funds, which seek to gain a negative exposure to an asset class such as equities. The Fund's combined investments in the Equity-Related Underlying PIMCO Funds will not exceed 50% of its total assets. In addition, the Fund's combined investments in Inflation-Related Underlying PIMCO Funds, which seek to gain exposure to an asset class such as U.S. Treasury Inflation-Protected Securities ("TIPS"), commodities, or real estate, normally will not exceed 75% of its total assets.

Asset Allocation Investment Process. The Fund's assets are not allocated according to a predetermined blend of shares of the Underlying PIMCO Funds. Instead, when making allocation decisions among the Underlying PIMCO Funds, the Fund's asset allocation sub-adviser considers various quantitative and qualitative data relating to the U.S. and foreign economies and securities markets. Such data includes projected growth trends in the U.S. and foreign economies, forecasts for interest rates and the relationship between short- and long-term interest rates (yield curve), current and projected trends in inflation, relative valuation levels in the equity and fixed income markets and various segments within those markets, the outlook and projected growth of various industrial sectors, information relating to business cycles, borrowing needs and the cost of capital, political trends, data relating to trade balances and labor information. The Fund's asset allocation sub-adviser has the flexibility to reallocate the Fund's assets among any or all of the asset class exposures represented by the Underlying PIMCO Funds based on its ongoing analyses of the equity, fixed income and commodity markets. While these analyses are performed daily, material shifts in asset class exposures typically take place over longer periods of time.

Principal Risks

It is possible to lose money on an investment in the Fund. The principal risks of investing in the Fund, which could adversely affect its net asset value, yield and total return are listed below.

Principal Risks of the Fund

Allocation Risk: the risk that a Fund could lose money as a result of less than optimal or poor asset allocation decisions. The Fund could miss attractive investment opportunities by underweighting markets that subsequently experience significant returns and could lose value by overweighting markets that subsequently experience significant declines

Fund of Funds Risk: the risk that a Fund's performance is closely related to the risks associated with the securities and other investments held by the Underlying PIMCO Funds and that the ability of a Fund to achieve its investment objective will depend upon the ability of the Underlying PIMCO Funds to achieve their investment objectives

Certain principal risks of investing in the Underlying PIMCO Funds, and consequently the Fund, which could adversely affect its net asset value, yield and total return, are listed below.

Certain Principal Risks of Underlying PIMCO Funds

As used in the risk disclosures below, the term "Fund" refers to one or more Underlying PIMCO Funds.

Market Trading Risk: the risk that an active secondary trading market for shares of a Fund that is an exchange-traded fund does not continue once developed, that such Fund may not continue to meet a listing exchange's trading or listing requirements, or that such Fund's shares trade at prices other than the Fund's net asset value

Municipal Project-Specific Risk: the risk that a Fund may be more sensitive to adverse economic, business or political developments if it invests a substantial portion of its assets in the bonds of specific projects (such as those relating to education, health care, housing, transportation, and utilities), industrial development bonds, or in bonds from issuers in a single state

Municipal Bond Risk: the risk that an Underlying PIMCO Fund may be affected significantly by the economic, regulatory or political developments affecting the ability of issuers of debt securities whose interest is, in the opinion of bond counsel for the issuer at the time of issuance, exempt from federal income tax ("Municipal Bonds") to pay interest or repay principal

Interest Rate Risk: the risk that fixed income securities will decline in value because of an increase in interest rates; a fund with a longer average portfolio duration will be more sensitive to changes in interest rates than a fund with a shorter average portfolio duration

Call Risk: the risk that an issuer may exercise its right to redeem a fixed income security earlier than expected (a call). Issuers may call outstanding securities prior to their maturity for a number of reasons (e.g., declining interest rates, changes in credit spreads and improvements in the issuer's credit quality). If an issuer calls a security that the Fund has invested in, the Fund may not recoup the full amount of its initial investment and may be

| 2 |

PROSPECTUS | PIMCO FUNDS | |

| Prospectus | ||

|

|

|

|

forced to reinvest in lower-yielding securities, securities with greater credit risks or securities with other, less favorable features

Credit Risk: the risk that the Fund could lose money if the issuer or guarantor of a fixed income security, or the counterparty to a derivative contract, is unable or unwilling to meet its financial obligations

High Yield Risk: the risk that high yield securities and unrated securities of similar credit quality (commonly known as "junk bonds") are subject to greater levels of credit, call and liquidity risks. High yield securities are considered primarily speculative with respect to the issuer's continuing ability to make principal and interest payments, and may be more volatile than higher-rated securities of similar maturity

Distressed Company Risk: the risk that securities of distressed companies may be subject to greater levels of credit, issuer and liquidity risk than a portfolio that does not invest in such securities. Securities of distressed companies include both debt and equity securities. Debt securities of distressed companies are considered predominantly speculative with respect to the issuers' continuing ability to make principal and interest payments

Market Risk: the risk that the value of securities owned by the Fund may go up or down, sometimes rapidly or unpredictably, due to factors affecting securities markets generally or particular industries

Issuer Risk: the risk that the value of a security may decline for a reason directly related to the issuer, such as management performance, financial leverage and reduced demand for the issuer's goods or services

Liquidity Risk: the risk that a particular investment may be difficult to purchase or sell and that the Fund may be unable to sell illiquid securities at an advantageous time or price or achieve its desired level of exposure to a certain sector. Liquidity risk may result from the lack of an active market, reduced number and capacity of traditional market participants to make a market in fixed income securities, and may be magnified in a rising interest rate environment or other circumstances where investor redemptions from fixed income mutual funds may be higher than normal, causing increased supply in the market due to selling activity

Derivatives Risk: the risk of investing in derivative instruments (such as futures, swaps and structured securities), including leverage, liquidity, interest rate, market, credit and management risks, mispricing or valuation complexity. Changes in the value of the derivative may not correlate perfectly with, and may be more sensitive to market events than, the underlying asset, rate or index, and the Fund could lose more than the initial amount invested. The Fund's use of derivatives may result in losses to the Fund, a reduction in the Fund's returns and/or increased volatility. Over-the-counter ("OTC") derivatives are also subject to the risk that a counterparty to the transaction will not fulfill its contractual obligations to the other party, as many of the protections afforded to centrally-cleared derivative transactions might not be available for OTC derivatives. For derivatives traded on an exchange or through a central counterparty, credit risk resides with the Fund's clearing broker, or the clearinghouse itself, rather than with a counterparty in an OTC derivative transaction. Changes in regulation relating to a mutual fund's use of derivatives and related instruments could potentially limit or impact the Fund's ability to invest in derivatives, limit the Fund's ability to employ certain strategies that use derivatives and/or adversely affect the value of derivatives and the Fund's performance

Futures Contract Risk: the risk that, while the value of a futures contract tends to correlate with the value of the underlying asset that it represents, differences between the futures market and the market for the underlying asset may result in an imperfect correlation. Futures contracts may involve risks different from, and possibly greater than, the risks associated with investing directly in the underlying assets. The purchase or sale of a futures contract may result in losses in excess of the amount invested in the futures contract

Model Risk: the risk that the Fund's investment models used in making investment allocation decisions, and the indexation methodologies used in constructing an underlying index for a Fund that seeks to track the investment results of such underlying index, may not adequately take into account certain factors and may result in a decline in the value of an investment in the Fund

Commodity Risk: the risk that investing in commodity-linked derivative instruments may subject the Fund to greater volatility than investments in traditional securities. The value of commodity-linked derivative instruments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments

Equity Risk: the risk that the value of equity securities, such as common stocks and preferred securities, may decline due to general market conditions which are not specifically related to a particular company or to factors affecting a particular industry or industries. Equity securities generally have greater price volatility than fixed income securities

Mortgage-Related and Other Asset-Backed Securities Risk: the risks of investing in mortgage-related and other asset-backed securities, including interest rate risk, extension risk, prepayment risk and credit risk

Foreign (Non-U.S.) Investment Risk: the risk that investing in foreign (non-U.S.) securities may result in the Fund experiencing more rapid and extreme changes in value than a fund that invests exclusively in securities of U.S. companies, due to smaller markets, differing reporting, accounting and auditing standards, increased risk of delayed settlement of portfolio transactions or loss of certificates of portfolio securities, and the risk of unfavorable foreign government actions, including nationalization, expropriation or confiscatory taxation, currency blockage, or political changes or diplomatic developments. Foreign securities may also be less liquid and more difficult to value than securities of U.S. issuers

Real Estate Risk: the risk that the Fund's investments in Real Estate Investment Trusts ("REITs") or real estate-linked derivative instruments will subject the Fund to risks similar to those associated with direct ownership of real estate, including losses from casualty or condemnation, and changes in local and general economic conditions, supply and demand, interest rates, zoning laws, regulatory limitations on rents, property taxes and operating expenses. The Fund's investments in REITs or real estate-linked derivative instruments subject it to management and tax risks. In addition, privately traded REITs subject the Fund to liquidity and valuation risk

| July 28, 2017 (as supplemented June 1, 2018) | PROSPECTUS |

3 | |

| PIMCO All Asset Fund | ||

|

|

|

|

Emerging Markets Risk: the risk of investing in emerging market securities, primarily increased foreign (non-U.S.) investment risk

Sovereign Debt Risk: the risk that investments in fixed income instruments issued by sovereign entities may decline in value as a result of default or other adverse credit event resulting from an issuer's inability or unwillingness to make principal or interest payments in a timely fashion

Currency Risk: the risk that foreign (non-U.S.) currencies will decline in value relative to the U.S. dollar and affect the Fund's investments in foreign (non-U.S.) currencies or in securities that trade in, and receive revenues in, or in derivatives that provide exposure to, foreign (non-U.S.) currencies

Leveraging Risk: the risk that certain transactions of the Fund, such as reverse repurchase agreements, loans of portfolio securities, and the use of when-issued, delayed delivery or forward commitment transactions, or derivative instruments, may give rise to leverage, magnifying gains and losses and causing the Fund to be more volatile than if it had not been leveraged. This means that leverage entails a heightened risk of loss

Smaller Company Risk: the risk that the value of securities issued by a smaller company may go up or down, sometimes rapidly and unpredictably as compared to more widely held securities, due to narrow markets and limited resources of smaller companies. A Fund's investments in smaller companies subject it to greater levels of credit, market and issuer risk

Issuer Non-Diversification Risk: the risk of focusing investments in a small number of issuers, including being more susceptible to risks associated with a single economic, political or regulatory occurrence than a more diversified portfolio might be. Funds that are "non-diversified" may invest a greater percentage of their assets in the securities of a single issuer (such as bonds issued by a particular state) than funds that are "diversified"

Management Risk: the risk that the investment techniques and risk analyses applied by PIMCO will not produce the desired results and that legislative, regulatory, or tax restrictions, policies or developments may affect the investment techniques available to PIMCO and the individual portfolio manager in connection with managing the Fund. There is no guarantee that the investment objective of the Fund will be achieved

Short Exposure Risk: the risk of entering into short sales, including the potential loss of more money than the actual cost of the investment, and the risk that the third party to the short sale will not fulfill its contractual obligations, causing a loss to the Fund

Tax Risk: the risk that the tax treatment of swap agreements and other derivative instruments, such as commodity-linked derivative instruments, including commodity index-linked notes, swap agreements, commodity options, futures, and options on futures, may be affected by future regulatory or legislative changes that could affect whether income from such investments is "qualifying income" under Subchapter M of the Internal Revenue Code, or otherwise affect the character, timing and/or amount of the Fund's taxable income or gains and distributions

Subsidiary Risk: the risk that, by investing in certain Underlying PIMCO Funds that invest in a subsidiary (each a "Subsidiary"), the Fund is indirectly exposed to the risks associated with a Subsidiary's investments. The Subsidiaries are not registered under the 1940 Act and may not be subject to all the investor protections of the 1940 Act. There is no guarantee that the investment objective of a Subsidiary will be achieved

Value Investing Risk: a value stock may decrease in price or may not increase in price as anticipated by PIMCO if it continues to be undervalued by the market or the factors that the portfolio manager believes will cause the stock price to increase do not occur

Arbitrage Risk: the risk that securities purchased pursuant to an arbitrage strategy intended to take advantage of a perceived relationship between the value of two securities may not perform as expected

Convertible Securities Risk: as convertible securities share both fixed income and equity characteristics, they are subject to risks to which fixed income and equity investments are subject. These risks include equity risk, interest rate risk and credit risk

Exchange-Traded Fund Risk: the risk that an exchange-traded fund may not track the performance of the index it is designed to track, market prices of shares of an exchange-traded fund may fluctuate rapidly and materially, or shares of an exchange-traded fund may trade significantly above or below net asset value, any of which may cause losses to the Fund invested in the exchange-traded fund

Tracking Error Risk: the risk that the portfolio of a Fund that seeks to track the investment results of an underlying index may not closely track the underlying index for a number of reasons. The Fund incurs operating expenses, which are not applicable to the underlying index, and the costs of buying and selling securities, especially when rebalancing the Fund's portfolio to reflect changes in the composition of the underlying index. Performance of the Fund and the underlying index may vary due to asset valuation differences and differences between the Fund's portfolio and the underlying index due to legal restrictions, cost or liquidity restraints. The risk that performance of the Fund and the underlying index may vary may be heightened during periods of increased market volatility or other unusual market conditions. In addition, a Fund's use of a representative sampling approach may cause the Fund to be less correlated to the return of the underlying index than if the Fund held all of the securities in the underlying index

Indexing Risk: the risk that a Fund that seeks to track the investment results of an underlying index is negatively affected by general declines in the asset classes represented by the underlying index

Please see "Description of Principal Risks" in the Fund's prospectus for a more detailed description of the risks of investing in the Fund. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

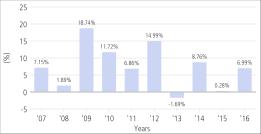

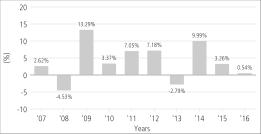

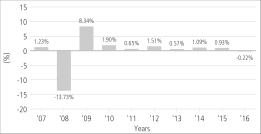

Performance Information

The performance information shows summary performance information for the Fund in a bar chart and an Average Annual Total Returns table. The information provides some indication of the risks of investing in the Fund by showing changes in its performance from year to year and by showing how the Fund's average annual returns compare with the returns of a primary and a secondary broad-based securities market index and an index of similar funds. Absent any applicable fee waivers and/or expense limitations, performance would have been lower. The bar chart shows performance of

| 4 |

PROSPECTUS | PIMCO FUNDS | |

| Prospectus | ||

|

|

|

|

the Fund's Institutional Class shares. For periods prior to the inception date of I-2 shares (April 30, 2008) and Class R shares (January 31, 2006), performance information shown in the table for these classes is based on the performance of the Fund's Institutional Class shares, adjusted to reflect the actual distribution and/or service (12b-1) fees and other expenses paid by these classes of shares. Performance in the Average Annual Total Returns table reflects the impact of sales charges. The I-3 shares of the Fund have not commenced operations as of the date of this prospectus. The Fund's past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

The Fund measures its performance against a primary benchmark and a secondary benchmark. The Fund's primary benchmark is the Bloomberg Barclays U.S. TIPS 1-10 Year Index.

The Bloomberg Barclays U.S. TIPS: 1-10 Year Index is an unmanaged market index comprised of U.S. Treasury Inflation Protected securities having a maturity of at least 1 year and less than 10 years. The CPI + 500 Basis Points benchmark is created by adding 5% to the annual percentage change in the CPI. The CPI is an unmanaged index representing the rate of inflation of the U.S. consumer prices as determined by the US Bureau of Labor Statistics. Lipper Alternative Global Macro Funds Average is a total return performance average of Funds tracked by Lipper, Inc. that, by prospectus language, invest around the world using economic theory to justify the decision-making process. The strategy is typically based on forecasts and analysis about interest rate trends, the general flow of funds, political changes, government policies, intergovernmental relations, and other broad systemic factors. These funds generally trade a wide range of markets and geographic regions, employing a broad range of trading ideas and instruments.

Performance for the Fund is updated daily and quarterly and may be obtained as follows: daily updates on the net asset value and performance page at http://investments.pimco.com/DailyPerformance and quarterly updates at http://investments.pimco.com/QuarterlyPerformance.

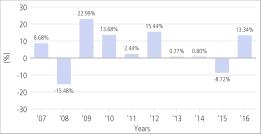

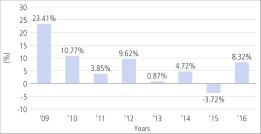

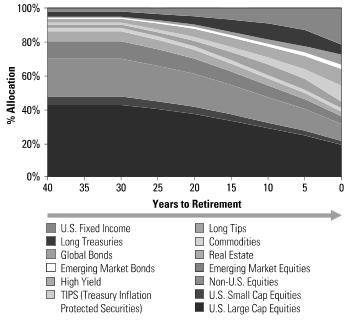

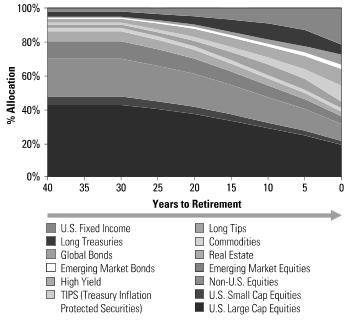

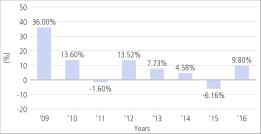

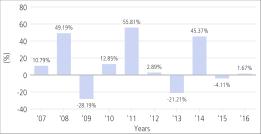

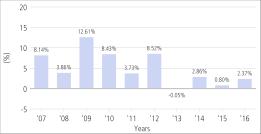

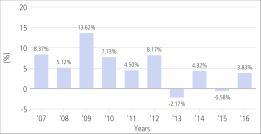

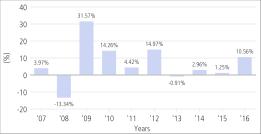

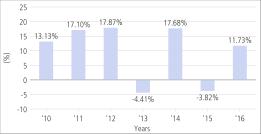

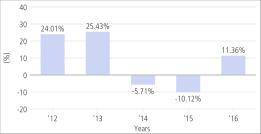

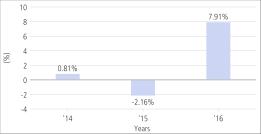

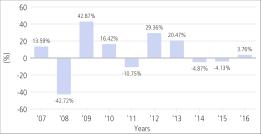

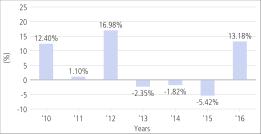

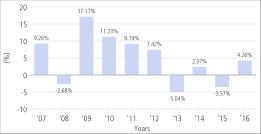

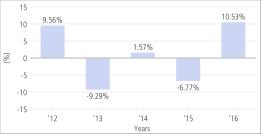

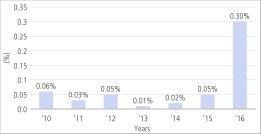

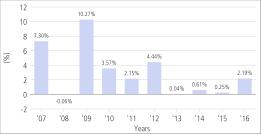

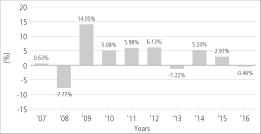

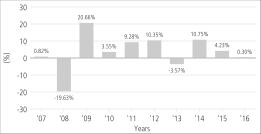

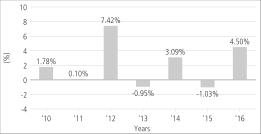

Calendar Year Total Returns — Institutional Class*

*The year-to-date return as of June 30, 2017 is 7.04%. For the periods shown in the bar chart, the highest quarterly return was 12.61% in the Q2 2009, and the lowest quarterly return was -8.57% in the Q3 2015.

Average Annual Total Returns (for periods ended 12/31/16)

|

|

1 Year |

5 Years |

10 Years | |||

| Institutional Class Return Before Taxes |

13.34 |

% |

3.94 |

% |

4.79 |

% |

| Institutional Class Return After Taxes on Distributions(1) |

11.60 |

% |

2.02 |

% |

2.53 |

% |

| Institutional Class Return After Taxes on Distributions and Sales of Fund Shares(1) |

7.54 |

% |

2.21 |

% |

2.79 |

% |

| I-2 Return Before Taxes |

13.30 |

% |

3.85 |

% |

4.70 |

% |

| Administrative Class Return Before Taxes |

13.13 |

% |

3.70 |

% |

4.53 |

% |

| Class A Return Before Taxes |

8.65 |

% |

2.64 |

% |

3.82 |

% |

| Class C Return Before Taxes |

11.00 |

% |

2.65 |

% |

3.44 |

% |

| Class R Return Before Taxes |

12.59 |

% |

3.18 |

% |

3.94 |

% |

| Bloomberg Barclays U.S. TIPS: 1-10 Year Index (reflects no deductions for fees, expenses or taxes) |

4.01 |

% |

0.70 |

% |

3.75 |

% |

| Consumer Price Index + 500 Basis Points (reflects no deductions for fees, expenses or taxes) |

7.09 |

% |

6.34 |

% |

6.80 |

% |

| Lipper Alternative Global Macro Funds Average (reflects no deductions for taxes) |

4.57 |

% |

2.95 |

% |

3.04 |

% |

(1) After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and the after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases the return after taxes may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period. After-tax returns are for Institutional Class shares only. After-tax returns for other classes will vary.

Investment Adviser/Portfolio Manager

PIMCO serves as the investment adviser for the Fund. Research Affiliates, LLC serves as the asset allocation sub-adviser to the Fund. The Fund's portfolio is jointly managed by Robert D. Arnott and Christopher

J. Brightman. Mr. Arnott is the Chairman and Founder of Research Affiliates, LLC and he has managed the Fund since its inception in July 2002. Mr. Brightman is Chief Investment Officer of Research Affiliates, LLC and he has managed the

Fund since November 2016.

PIMCO serves as the investment adviser for the Fund. Research Affiliates, LLC serves as the asset allocation sub-adviser to the Fund. The Fund's portfolio is jointly managed by Robert D. Arnott and Christopher

J. Brightman. Mr. Arnott is the Chairman and Founder of Research Affiliates, LLC and he has managed the Fund since its inception in July 2002. Mr. Brightman is Chief Investment Officer of Research Affiliates, LLC and he has managed the

Fund since November 2016.

Other Important Information Regarding Fund Shares

For important information about purchase and sale of Fund shares, tax information, and payments to broker-dealers and other financial intermediaries, please turn to the "Summary of Other Important Information Regarding Fund Shares" section on page 76 of this prospectus.

| July 28, 2017 (as supplemented June 1, 2018) | PROSPECTUS |

5 | |

|

|

PIMCO All Asset All Authority Fund | |

|

|

|

|

Investment Objective

The Fund seeks maximum real return, consistent with preservation of real capital and prudent investment management.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in Class A shares of eligible funds offered by PIMCO Equity Series and PIMCO Funds. More information about these and other discounts is available in the "Classes of Shares" section on page 101 of the Fund's prospectus, Appendix B to the Fund's prospectus (Financial Firm-Specific Sales Charge Waivers and Discounts) or from your financial advisor.

Shareholder Fees (fees paid directly from your investment):

|

|

Inst |

I-2 |

I-3 |

Admin |

Class A |

Class C |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

None |

None |

None |

None |

5.50% |

None |

| Maximum Deferred Sales Charge (Load) (as a percentage of the lower of the original purchase price or redemption price) |

None |

None |

None |

None |

1.00% |

1.00% |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment):

|

|

Inst |

I-2 |

I-3 |

Admin |

Class A |

Class C |

| Management Fees |

0.25% |

0.35% |

0.45% |

0.25% |

0.45% |

0.45% |

| Distribution and/or Service (12b-1) Fees |

N/A |

N/A |

N/A |

0.25% |

0.25% |

1.00% |

| Other Expenses(1) |

0.62% |

0.62% |

0.62% |

0.62% |

0.62% |

0.62% |

| Acquired Fund Fees and Expenses |

1.12% |

1.12% |

1.12% |

1.12% |

1.12% |

1.12% |

| Total Annual Fund Operating Expenses(2) |

1.99% |

2.09% |

2.19% |

2.24% |

2.44% |

3.19% |

| Fee Waiver and/or Expense Reimbursement(3)(4) |

(0.10%) |

(0.10%) |

(0.15%) |

(0.10%) |

(0.10%) |

(0.10%) |

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement(5) |

1.89% |

1.99% |

2.04% |

2.14% |

2.34% |

3.09% |

1 Interest expense of 0.62% results from the Fund's ability to borrow money for investment purposes from a committed line of credit. Such expense is required to be treated as a Fund expense for accounting purposes and is not payable to PIMCO. Any interest expense amount will vary based on the Fund's use of those investments as an investment strategy best suited to seek the objective of the Fund.

2 Total Annual Fund Operating Expenses do not match the Ratio of Expenses to Average Net Assets Excluding Waivers of the Fund, as set forth in the Financial Highlights table of the Fund's prospectus, because the Ratio of Expenses to Average Net Assets Excluding Waivers reflects the operating expenses of the Fund and does not include Acquired Fund Fees and Expenses.

3 PIMCO has contractually agreed, through July 31, 2018, to reduce its advisory fee to the extent that the Underlying PIMCO Fund Expenses attributable to advisory and supervisory and administrative fees exceed 0.69% of the total assets invested in Underlying PIMCO Funds. PIMCO may recoup these waivers in future periods, not exceeding three years, provided total expenses, including such recoupment, do not exceed the annual expense limit. The fee reduction is implemented based on a calculation of Underlying PIMCO Fund Expenses attributable to advisory and supervisory and administrative fees that is different from the calculation of Acquired Fund Fees and Expenses listed in the table above.

4 PIMCO has contractually agreed, through July 31, 2019, to reduce its supervisory and administrative fee for the Fund's I-3 shares by 0.05% of the average daily net assets attributable to I-3 shares of the Fund. This Fee Waiver Agreement renews annually unless terminated by PIMCO upon at least 30 days' prior notice to the end of the contract term.

5 "Other Expenses" and Acquired Fund Fees and Expenses include interest expense of the Fund and of the Underlying PIMCO Funds of 0.62% and 0.07%, respectively. Interest expense is borne by the Fund and the Underlying PIMCO Funds separately from the management fees paid to PIMCO. Excluding interest expense of the Fund and of the Underlying PIMCO Funds, Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement are 1.20%, 1.30%, 1.35%, 1.45%, 1.65% and 2.40% for Institutional Class, I-2, I-3, Administrative Class, Class A and Class C shares, respectively.

Example. The Example is intended to help you compare the cost of investing in Institutional Class, I-2, I-3, Administrative Class, Class A or Class C shares of the Fund with the costs of investing in other mutual funds. The Example assumes that you invest $10,000 in the noted class of shares for the time periods indicated, and then redeem all your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. Investors may pay brokerage commissions on their purchases and sales of Institutional Class, I-2 or I-3 shares of the Fund, which are not reflected in the Example. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

If you redeem your shares at the end of each period:

|

|

1 Year |

3 Years |

5 Years |

10 Years |

| Institutional Class |

$192 |

$615 |

$1,063 |

$2,309 |

| I-2 |

$202 |

$645 |

$1,115 |

$2,413 |

| I-3 |

$207 |

$671 |

$1,161 |

$2,512 |

| Administrative Class |

$217 |

$691 |

$1,191 |

$2,567 |

| Class A |

$774 |

$1,260 |

$1,771 |

$3,166 |

| Class C |

$412 |

$974 |

$1,660 |

$3,487 |

If you do not redeem your shares:

|

|

1 Year |

3 Years |

5 Years |

10 Years |

| Class A |

$774 |

$1,260 |

$1,771 |

$3,166 |

| Class C |

$312 |

$974 |

$1,660 |

$3,487 |

Portfolio Turnover

The Fund pays transaction costs when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the Annual Fund Operating Expenses or in the Example tables, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 51% of the average value of its portfolio.

Principal Investment Strategies

The Fund is a "fund of funds," which is a term used to describe mutual funds that pursue their investment objective by investing in other funds. The Fund seeks to achieve its investment objective by investing under normal circumstances substantially all of its assets in the least expensive class of shares of any actively managed or smart beta funds (including mutual funds

|

|

PIMCO FUNDS | PROSPECTUS |

6 |

| Prospectus | ||

|

|

|

|

or exchange-traded funds) of the Trust, or PIMCO ETF Trust or PIMCO Equity Series, each an affiliated open-end investment company, except other funds of funds (collectively, "Underlying PIMCO Funds"). As used in the investment objective, "real return" equals total return less the estimated cost of inflation, which is typically measured by the change in an official inflation measure, and "real capital" equals capital less the estimated cost of inflation measured by the change in an official inflation measure. In addition to investing in Underlying PIMCO Funds, at the discretion of Pacific Investment Management Company LLC ("PIMCO") and without shareholder approval, the Fund may invest in additional Underlying PIMCO Funds created in the future.

The Fund invests its assets in shares of the Underlying PIMCO Funds and does not invest directly in stocks or bonds of other issuers. Research Affiliates, LLC, the Fund's asset allocation sub-adviser, determines how the Fund allocates and reallocates its assets among the Underlying PIMCO Funds. In doing so, the asset allocation sub-adviser seeks concurrent exposure to a broad spectrum of asset classes.

Investments in Underlying PIMCO Funds. The Fund may invest in any or all of the Underlying PIMCO Funds, but will not normally invest in every Underlying PIMCO Fund at any particular time. The Fund's investment in any particular Underlying PIMCO Fund normally will not exceed 50% of its total assets. The Fund's investments in the Short Strategy Underlying PIMCO Funds, which seek to gain a negative exposure to an asset class such as equities, normally will not exceed 20% of its total assets. The Fund's combined investments in the Domestic Equity-Related Underlying PIMCO Funds normally will not exceed 50% of its total assets. The Fund's combined investments in the International Equity-Related Underlying PIMCO Funds normally will not exceed 50% of its total assets. The Fund's combined investments in the Equity-Related Underlying PIMCO Funds (less any investment in the PIMCO StocksPLUS® Short Fund) normally will not exceed 66⅔% of its total assets. In addition, the Fund's combined investments in Inflation-Related Underlying PIMCO Funds, which seek to gain exposure to an asset class such as U.S. Treasury Inflation-Protected Securities ("TIPS"), commodities, or real estate, normally will not exceed 75% of its total assets.

Asset Allocation Investment Process. The Fund's assets are not allocated according to a predetermined blend of shares of the Underlying PIMCO Funds. Instead, when making allocation decisions among the Underlying PIMCO Funds, the Fund's asset allocation sub-adviser considers various quantitative and qualitative data relating to the U.S. and foreign economies and securities markets. Such data includes projected growth trends in the U.S. and foreign economies, forecasts for interest rates and the relationship between short- and long-term interest rates (yield curve), current and projected trends in inflation, relative valuation levels in the equity and fixed income markets and various segments within those markets, the outlook and projected growth of various industrial sectors, information relating to business cycles, borrowing needs and the cost of capital, political trends, data relating to trade balances and labor information. The Fund's asset allocation sub-adviser has the flexibility to reallocate the Fund's assets among any or all of the asset class exposures represented by the Underlying PIMCO Funds based on its ongoing analyses of the equity, fixed income and commodity markets. While these analyses are performed daily, material shifts in asset class exposures typically take place over longer periods of time.

Borrowing for Investment Purposes. The Fund may use leverage by borrowing for investment purposes to purchase additional shares of Underlying PIMCO Funds. The Fund can borrow from banks up to a maximum of 33⅓% of total assets. If at any time the Fund's borrowings exceed this 33⅓% maximum limitation, the Fund will, within three business days, decrease its borrowings to the extent required. Borrowing requires the payment of interest and other loan costs. To make such payments, the Fund may be forced to sell portfolio securities when it is not otherwise advantageous to do so. At times when the Fund's borrowings are substantial, the interest expense to the Fund may result in the Fund having little or no investment income. The use of leverage by borrowing creates the potential for greater gains to shareholders of the Fund during favorable market conditions and the risk of magnified losses during adverse market conditions. In addition, the Underlying PIMCO Funds may engage in certain transactions that give rise to a form of leverage.

Principal Risks

It is possible to lose money on an investment in the Fund. The principal risks of investing in the Fund, which could adversely affect its net asset value, yield and total return are listed below.

Principal Risks of the Fund

Allocation Risk: the risk that a Fund could lose money as a result of less than optimal or poor asset allocation decisions. The Fund could miss attractive investment opportunities by underweighting markets that subsequently experience significant returns and could lose value by overweighting markets that subsequently experience significant declines

Fund of Funds Risk: the risk that a Fund's performance is closely related to the risks associated with the securities and other investments held by the Underlying PIMCO Funds and that the ability of a Fund to achieve its investment objective will depend upon the ability of the Underlying PIMCO Funds to achieve their investment objectives

Leveraging Risk: the risk that certain transactions of the Fund, such as direct borrowing from banks, reverse repurchase agreements, loans of portfolio securities, and the use of when-issued, delayed delivery or forward commitment transactions, or derivative instruments, may give rise to leverage, magnifying gains and losses and causing the Fund to be more volatile than if it had not been leveraged. This means that leverage entails a heightened risk of loss

Certain principal risks of investing in the Underlying PIMCO Funds, and consequently the Fund, which could adversely affect its net asset value, yield and total return, are listed below.

| July 28, 2017 (as supplemented June 1, 2018) | PROSPECTUS |

7 | |

| PIMCO All Asset All Authority Fund | ||

|

|

|

|

Certain Principal Risks of Underlying PIMCO Funds

As used in the risk disclosures below, the term "Fund" refers to one or more Underlying PIMCO Funds.

Market Trading Risk: the risk that an active secondary trading market for shares of a Fund that is an exchange-traded fund does not continue once developed, that such Fund may not continue to meet a listing exchange's trading or listing requirements, or that such Fund's shares trade at prices other than the Fund's net asset value

Municipal Project-Specific Risk: the risk that a Fund may be more sensitive to adverse economic, business or political developments if it invests a substantial portion of its assets in the bonds of specific projects (such as those relating to education, health care, housing, transportation, and utilities), industrial development bonds, or in bonds from issuers in a single state

Municipal Bond Risk: the risk that an Underlying PIMCO Fund may be affected significantly by the economic, regulatory or political developments affecting the ability of issuers of debt securities whose interest is, in the opinion of bond counsel for the issuer at the time of issuance, exempt from federal income tax ("Municipal Bonds") to pay interest or repay principal

Interest Rate Risk: the risk that fixed income securities will decline in value because of an increase in interest rates; a fund with a longer average portfolio duration will be more sensitive to changes in interest rates than a fund with a shorter average portfolio duration

Call Risk: the risk that an issuer may exercise its right to redeem a fixed income security earlier than expected (a call). Issuers may call outstanding securities prior to their maturity for a number of reasons (e.g., declining interest rates, changes in credit spreads and improvements in the issuer's credit quality). If an issuer calls a security that the Fund has invested in, the Fund may not recoup the full amount of its initial investment and may be forced to reinvest in lower-yielding securities, securities with greater credit risks or securities with other, less favorable features

Credit Risk: the risk that the Fund could lose money if the issuer or guarantor of a fixed income security, or the counterparty to a derivative contract, is unable or unwilling to meet its financial obligations

High Yield Risk: the risk that high yield securities and unrated securities of similar credit quality (commonly known as "junk bonds") are subject to greater levels of credit, call and liquidity risks. High yield securities are considered primarily speculative with respect to the issuer's continuing ability to make principal and interest payments, and may be more volatile than higher-rated securities of similar maturity

Distressed Company Risk: the risk that securities of distressed companies may be subject to greater levels of credit, issuer and liquidity risk than a portfolio that does not invest in such securities. Securities of distressed companies include both debt and equity securities. Debt securities of distressed companies are considered predominantly speculative with respect to the issuers' continuing ability to make principal and interest payments

Market Risk: the risk that the value of securities owned by the Fund may go up or down, sometimes rapidly or unpredictably, due to factors affecting securities markets generally or particular industries

Issuer Risk: the risk that the value of a security may decline for a reason directly related to the issuer, such as management performance, financial leverage and reduced demand for the issuer's goods or services

Liquidity Risk: the risk that a particular investment may be difficult to purchase or sell and that the Fund may be unable to sell illiquid securities at an advantageous time or price or achieve its desired level of exposure to a certain sector. Liquidity risk may result from the lack of an active market, reduced number and capacity of traditional market participants to make a market in fixed income securities, and may be magnified in a rising interest rate environment or other circumstances where investor redemptions from fixed income mutual funds may be higher than normal, causing increased supply in the market due to selling activity

Derivatives Risk: the risk of investing in derivative instruments (such as futures, swaps and structured securities), including leverage, liquidity, interest rate, market, credit and management risks, mispricing or valuation complexity. Changes in the value of the derivative may not correlate perfectly with, and may be more sensitive to market events than, the underlying asset, rate or index, and the Fund could lose more than the initial amount invested. The Fund's use of derivatives may result in losses to the Fund, a reduction in the Fund's returns and/or increased volatility. Over-the-counter ("OTC") derivatives are also subject to the risk that a counterparty to the transaction will not fulfill its contractual obligations to the other party, as many of the protections afforded to centrally-cleared derivative transactions might not be available for OTC derivatives. For derivatives traded on an exchange or through a central counterparty, credit risk resides with the Fund's clearing broker, or the clearinghouse itself, rather than with a counterparty in an OTC derivative transaction. Changes in regulation relating to a mutual fund's use of derivatives and related instruments could potentially limit or impact the Fund's ability to invest in derivatives, limit the Fund's ability to employ certain strategies that use derivatives and/or adversely affect the value of derivatives and the Fund's performance

Futures Contract Risk: the risk that, while the value of a futures contract tends to correlate with the value of the underlying asset that it represents, differences between the futures market and the market for the underlying asset may result in an imperfect correlation. Futures contracts may involve risks different from, and possibly greater than, the risks associated with investing directly in the underlying assets. The purchase or sale of a futures contract may result in losses in excess of the amount invested in the futures contract

Model Risk: the risk that the Fund's investment models used in making investment allocation decisions, and the indexation methodologies used in constructing an underlying index for a Fund that seeks to track the investment results of such underlying index, may not adequately take into account certain factors and may result in a decline in the value of an investment in the Fund

Commodity Risk: the risk that investing in commodity-linked derivative instruments may subject the Fund to greater volatility than investments in traditional securities. The value of commodity-linked derivative instruments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or factors affecting a particular industry

| 8 |

PROSPECTUS | PIMCO FUNDS | |

| Prospectus | ||

|

|

|

|

or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments

Equity Risk: the risk that the value of equity securities, such as common stocks and preferred securities, may decline due to general market conditions which are not specifically related to a particular company or to factors affecting a particular industry or industries. Equity securities generally have greater price volatility than fixed income securities

Mortgage-Related and Other Asset-Backed Securities Risk: the risks of investing in mortgage-related and other asset-backed securities, including interest rate risk, extension risk, prepayment risk and credit risk

Foreign (Non-U.S.) Investment Risk: the risk that investing in foreign (non-U.S.) securities may result in the Fund experiencing more rapid and extreme changes in value than a fund that invests exclusively in securities of U.S. companies, due to smaller markets, differing reporting, accounting and auditing standards, increased risk of delayed settlement of portfolio transactions or loss of certificates of portfolio securities, and the risk of unfavorable foreign government actions, including nationalization, expropriation or confiscatory taxation, currency blockage, or political changes or diplomatic developments. Foreign securities may also be less liquid and more difficult to value than securities of U.S. issuers

Real Estate Risk: the risk that the Fund's investments in Real Estate Investment Trusts ("REITs") or real estate-linked derivative instruments will subject the Fund to risks similar to those associated with direct ownership of real estate, including losses from casualty or condemnation, and changes in local and general economic conditions, supply and demand, interest rates, zoning laws, regulatory limitations on rents, property taxes and operating expenses. The Fund's investments in REITs or real estate-linked derivative instruments subject it to management and tax risks. In addition, privately traded REITs subject the Fund to liquidity and valuation risk

Emerging Markets Risk: the risk of investing in emerging market securities, primarily increased foreign (non-U.S.) investment risk

Sovereign Debt Risk: the risk that investments in fixed income instruments issued by sovereign entities may decline in value as a result of default or other adverse credit event resulting from an issuer's inability or unwillingness to make principal or interest payments in a timely fashion

Currency Risk: the risk that foreign (non-U.S.) currencies will decline in value relative to the U.S. dollar and affect the Fund's investments in foreign (non-U.S.) currencies or in securities that trade in, and receive revenues in, or in derivatives that provide exposure to, foreign (non-U.S.) currencies

Leveraging Risk: the risk that certain transactions of the Fund, such as reverse repurchase agreements, loans of portfolio securities, and the use of when-issued, delayed delivery or forward commitment transactions, or derivative instruments, may give rise to leverage, magnifying gains and losses and causing the Fund to be more volatile than if it had not been leveraged. This means that leverage entails a heightened risk of loss

Smaller Company Risk: the risk that the value of securities issued by a smaller company may go up or down, sometimes rapidly and unpredictably as compared to more widely held securities, due to narrow markets and limited resources of smaller companies. A Fund's investments in smaller companies subject it to greater levels of credit, market and issuer risk

Issuer Non-Diversification Risk: the risk of focusing investments in a small number of issuers, including being more susceptible to risks associated with a single economic, political or regulatory occurrence than a more diversified portfolio might be. Funds that are "non-diversified" may invest a greater percentage of their assets in the securities of a single issuer (such as bonds issued by a particular state) than funds that are "diversified"

Management Risk: the risk that the investment techniques and risk analyses applied by PIMCO will not produce the desired results and that legislative, regulatory, or tax restrictions, policies or developments may affect the investment techniques available to PIMCO and the individual portfolio manager in connection with managing the Fund. There is no guarantee that the investment objective of the Fund will be achieved

Short Exposure Risk: the risk of entering into short sales, including the potential loss of more money than the actual cost of the investment, and the risk that the third party to the short sale will not fulfill its contractual obligations, causing a loss to the Fund. Also, to the extent the Fund seeks to gain negative exposure to an asset class such as equities, such exposure may create the potential for losses should those asset classes deliver positive returns

Tax Risk: the risk that the tax treatment of swap agreements and other derivative instruments, such as commodity-linked derivative instruments, including commodity index-linked notes, swap agreements, commodity options, futures, and options on futures, may be affected by future regulatory or legislative changes that could affect whether income from such investments is "qualifying income" under Subchapter M of the Internal Revenue Code, or otherwise affect the character, timing and/or amount of the Fund's taxable income or gains and distributions

Subsidiary Risk: the risk that, by investing in certain Underlying PIMCO Funds that invest in a subsidiary (each a "Subsidiary"), the Fund is indirectly exposed to the risks associated with a Subsidiary's investments. The Subsidiaries are not registered under the 1940 Act and may not be subject to all the investor protections of the 1940 Act. There is no guarantee that the investment objective of a Subsidiary will be achieved

Value Investing Risk: a value stock may decrease in price or may not increase in price as anticipated by PIMCO if it continues to be undervalued by the market or the factors that the portfolio manager believes will cause the stock price to increase do not occur

Arbitrage Risk: the risk that securities purchased pursuant to an arbitrage strategy intended to take advantage of a perceived relationship between the value of two securities may not perform as expected

Convertible Securities Risk: as convertible securities share both fixed income and equity characteristics, they are subject to risks to which fixed income and equity investments are subject. These risks include equity risk, interest rate risk and credit risk

Exchange-Traded Fund Risk: the risk that an exchange-traded fund may not track the performance of the index it is designed to track, market prices of shares of an exchange-traded fund may fluctuate rapidly and materially, or shares of an exchange-traded fund may trade significantly above or below net asset value, any of which may cause losses to the Fund invested in the exchange-traded fund

| July 28, 2017 (as supplemented June 1, 2018) | PROSPECTUS |

9 | |

| PIMCO All Asset All Authority Fund | ||

|

|

|

|

Tracking Error Risk: the risk that the portfolio of a Fund that seeks to track the investment results of an underlying index may not closely track the underlying index for a number of reasons. The Fund incurs operating expenses, which are not applicable to the underlying index, and the costs of buying and selling securities, especially when rebalancing the Fund's portfolio to reflect changes in the composition of the underlying index. Performance of the Fund and the underlying index may vary due to asset valuation differences and differences between the Fund's portfolio and the underlying index due to legal restrictions, cost or liquidity restraints. The risk that performance of the Fund and the underlying index may vary may be heightened during periods of increased market volatility or other unusual market conditions. In addition, a Fund's use of a representative sampling approach may cause the Fund to be less correlated to the return of the underlying index than if the Fund held all of the securities in the underlying index

Indexing Risk: the risk that a Fund that seeks to track the investment results of an underlying index is negatively affected by general declines in the asset classes represented by the underlying index

Please see "Description of Principal Risks" in the Fund's prospectus for a more detailed description of the risks of investing in the Fund. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Performance Information

The performance information shows summary performance information for the Fund in a bar chart and an Average Annual Total Returns table. The information provides some indication of the risks of investing in the Fund by showing changes in its performance from year to year and by showing how the Fund's average annual returns compare with the returns of a primary and a secondary broad-based securities market index and an index of similar funds. Absent any applicable fee waivers and/or expense limitations, performance would have been lower. The bar chart shows performance of the Fund's Institutional Class shares. For periods prior to the inception date of I-2 shares (July 10, 2008), performance information shown in the table for that class is based on the performance of the Fund's Institutional Class shares, adjusted to reflect the actual distribution and/or service (12b-1) fees and other expenses paid by I-2 shares. The Administrative Class of the Fund has not commenced operations as of the date of this prospectus. Performance in the Average Annual Total Returns table reflects the impact of sales charges. The I-3 shares of the Fund have not commenced operations as of the date of this prospectus. The Fund's past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

The Fund measures its performance against a primary benchmark and a secondary benchmark. The Fund's primary benchmark is the Standard & Poor's 500 Composite Stock Price Index ("S&P 500 Index").

The S&P 500 Index is an unmanaged market index generally considered representative of the stock market as a whole. The Index focuses on the large-cap segment of the U.S. equities market. The CPI + 650 Basis Points benchmark is created by adding 6.5% to the annual percentage change in the CPI. The CPI is an unmanaged index representing the rate of inflation of the U.S. consumer prices as determined by the US Bureau of Labor Statistics. Lipper Alternative Global Macro Funds Average is a total return performance average of Funds tracked by Lipper, Inc. that, by prospectus language, invest around the world using economic theory to justify the decision-making process. The strategy is typically based on forecasts and analysis about interest rate trends, the general flow of funds, political changes, government policies, intergovernmental relations, and other broad systemic factors. These funds generally trade a wide range of markets and geographic regions, employing a broad range of trading ideas and instruments.

Performance for the Fund is updated daily and quarterly and may be obtained as follows: daily updates on the net asset value and performance page at http://investments.pimco.com/DailyPerformance and quarterly updates at http://investments.pimco.com/QuarterlyPerformance.

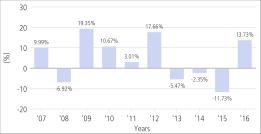

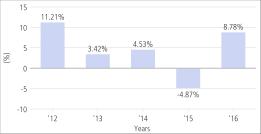

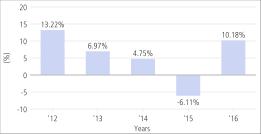

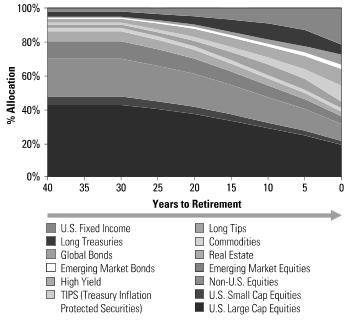

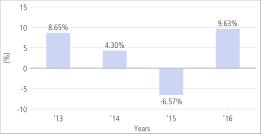

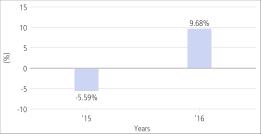

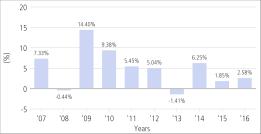

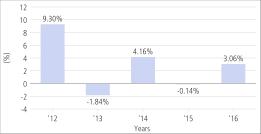

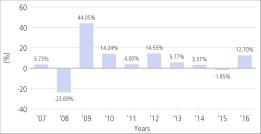

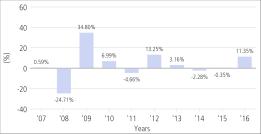

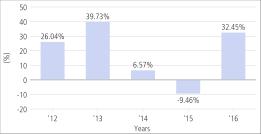

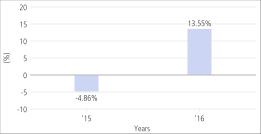

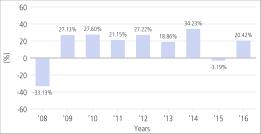

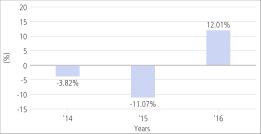

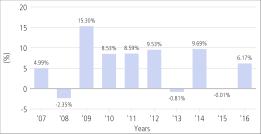

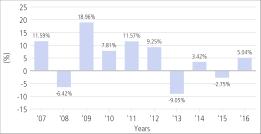

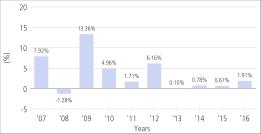

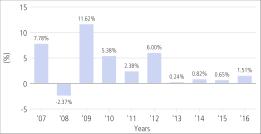

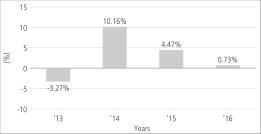

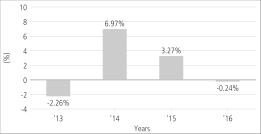

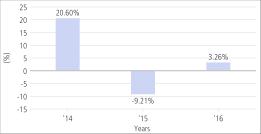

Calendar Year Total Returns — Institutional Class*

*The year-to-date return as of June 30, 2017 is 6.38%. For the periods shown in the bar chart, the highest quarterly return was 11.93% in the Q2 2009, and the lowest quarterly return was -10.03% in the Q3 2015.

Average Annual Total Returns (for periods ended 12/31/16)

|

|

1 Year |

5 Years |

10 Years | |||

| Institutional Class Return Before Taxes |

13.73 |

% |

1.75 |

% |

4.27 |

% |

| Institutional Class Return After Taxes on Distributions(1) |

11.98 |

% |

-0.44 |

% |

1.86 |

% |

| Institutional Class Return After Taxes on Distributions and Sales of Fund Shares(1) |

7.77 |

% |

0.43 |

% |

2.39 |

% |

| I-2 Return Before Taxes |

13.47 |

% |

1.63 |

% |

4.14 |

% |

| Class A Return Before Taxes |

6.98 |

% |

0.14 |

% |

3.33 |

% |

| Class C Return Before Taxes |

11.22 |

% |

0.52 |

% |

2.95 |

% |

| S&P 500 Index (reflects no deductions for fees, expenses or taxes) |

11.96 |

% |

14.66 |

% |

6.95 |

% |

| Consumer Price Index + 650 Basis Points (reflects no deductions for fees, expenses or taxes) |

8.59 |

% |

7.84 |

% |

8.30 |

% |

| Lipper Alternative Global Macro Funds Average (reflects no deductions for taxes) |

4.57 |

% |

2.95 |

% |

3.04 |

% |

(1) After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and the after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases the return after taxes may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period. After-tax returns are for Institutional Class shares only. After-tax returns for other classes will vary.

| 10 |

PROSPECTUS | PIMCO FUNDS | |

| Prospectus | ||

|

|

|

|

Investment Adviser/Portfolio Manager

PIMCO serves as the investment adviser for the Fund. Research Affiliates, LLC serves as the asset allocation sub-adviser to the Fund. The Fund's portfolio is jointly managed by Robert D. Arnott and Christopher

J. Brightman. Mr. Arnott is the Chairman and Founder of Research Affiliates, LLC and he has managed the Fund since its inception in October 2003. Mr. Brightman is Chief Investment Officer of Research Affiliates, LLC and he has managed the

Fund since November 2016.

PIMCO serves as the investment adviser for the Fund. Research Affiliates, LLC serves as the asset allocation sub-adviser to the Fund. The Fund's portfolio is jointly managed by Robert D. Arnott and Christopher

J. Brightman. Mr. Arnott is the Chairman and Founder of Research Affiliates, LLC and he has managed the Fund since its inception in October 2003. Mr. Brightman is Chief Investment Officer of Research Affiliates, LLC and he has managed the

Fund since November 2016.

Other Important Information Regarding Fund Shares

For important information about purchase and sale of Fund shares, tax information, and payments to broker-dealers and other financial intermediaries, please turn to the "Summary of Other Important Information Regarding Fund Shares" section on page 76 of this prospectus.

| July 28, 2017 (as supplemented June 1, 2018) | PROSPECTUS |

11 | |

|

|

PIMCO Global Multi-Asset Fund | |

|

|

|

|

Investment Objective

The Fund seeks total return which exceeds that of a blend of 60% MSCI All Country World Index/40% Bloomberg Barclays Global Aggregate Index (USD Hedged).

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in Class A shares of eligible funds offered by PIMCO Equity Series and PIMCO Funds. More information about these and other discounts is available in the "Classes of Shares" section on page 101 of the Fund's prospectus, Appendix B to the Fund's prospectus (Financial Firm-Specific Sales Charge Waivers and Discounts) or from your financial advisor.

Shareholder Fees (fees paid directly from your investment):

|

|

Inst |

I-2 |

Class A |

Class C |

Class R |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

None |

None |

5.50% |

None |

None |

| Maximum Deferred Sales Charge (Load) (as a percentage of the lower of the original purchase price or redemption price) |

None |

None |

1.00% |

1.00% |

None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment):

|

|

Inst |

I-2 |

Class A |

Class C |

Class R |

| Management Fees(1) |

0.95% |

1.05% |

1.15% |

1.15% |

1.15% |

| Distribution and/or Service (12b-1) Fees |

N/A |

N/A |

0.25% |

1.00% |

0.50% |

| Other Expenses |

0.10% |

0.10% |

0.10% |

0.10% |

0.10% |

| Acquired Fund Fees and Expenses |

0.27% |

0.27% |

0.27% |

0.27% |

0.27% |

| Total Annual Fund Operating Expenses(2) |

1.32% |

1.42% |

1.77% |

2.52% |

2.02% |

| Fee Waiver and/or Expense Reimbursement(3)(4) |

(0.24%) |

(0.24%) |

(0.24%) |

(0.24%) |

(0.24%) |

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement(5) |

1.08% |

1.18% |

1.53% |

2.28% |

1.78% |

1 Expense information in the table has been restated to reflect current Management Fees.

2 Total Annual Fund Operating Expenses do not match the Ratio of Expenses to Average Net Assets Excluding Waivers of the Fund, as set forth in the Financial Highlights table of the Fund's prospectus, because the Ratio of Expenses to Average Net Assets Excluding Waivers reflects the operating expenses of the Fund and does not include Acquired Fund Fees and Expenses.

3 PIMCO has contractually agreed to waive the Fund's advisory fee and the supervisory and administrative fee in an amount equal to the management fee and administrative services fee, respectively, paid by the PIMCO Cayman Commodity Fund II Ltd. (the "Subsidiary") to PIMCO. The Subsidiary pays PIMCO a management fee and an administrative services fee at the annual rate of 0.49% and 0.20%, respectively, of its net assets. This waiver may not be terminated by PIMCO and will remain in effect for as long as PIMCO's contract with the Subsidiary is in place.

4 PIMCO has contractually agreed, through July 31, 2018, to waive, first, the advisory fee and, second, the supervisory and administrative fee it receives from the Fund in an amount equal to the expenses attributable to the Management Fees of Underlying PIMCO Funds indirectly incurred by the Fund in connection with its investments in Underlying PIMCO Funds, to the extent the Fund's Management Fees are greater than or equal to the Management Fees of the Underlying PIMCO Funds. This waiver renews annually for a full year unless terminated by PIMCO upon at least 30 days' notice prior to the end of the contract term.

5 "Other Expenses" and Acquired Fund Fees and Expenses include interest expense of the Fund and of the Underlying PIMCO Funds of 0.10% and 0.02%, respectively. Interest expense is borne by the Fund and the Underlying PIMCO Funds separately from the management fees paid to PIMCO. Excluding interest expense of the Fund and of the Underlying PIMCO Funds, Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement are 0.96%, 1.06%, 1.41%, 2.16% and 1.66% for Institutional Class, I-2, Class A, Class C and Class R shares, respectively.

Example. The Example is intended to help you compare the cost of investing in Institutional Class, I-2, Class A, Class C or Class R shares of the Fund with the costs of investing in other mutual funds. The Example assumes that you invest $10,000 in the noted class of shares for the time periods indicated, and then redeem all your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. Investors may pay brokerage commissions on their purchases and sales of Institutional Class shares or I-2 shares of the Fund, which are not reflected in the Example. Although your actual costs may be higher or lower, based on these assumptions your costs would be: