UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant x | |

| Filed by a Party other than the Registrant ¨ | |

| Check the appropriate box: | |

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

CREDIT SUISSE COMMODITY STRATEGY FUNDS CREDIT SUISSE ASSET MANAGEMENT INCOME FUND, INC. CREDIT SUISSE HIGH YIELD BOND FUND

| |

| (Name of Registrant as Specified In Its Charter) | |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |

| Payment of Filing Fee (Check the appropriate box): | |

| x | No fee required. |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

CREDIT SUISSE COMMODITY STRATEGY FUNDS

Credit Suisse Commodity Return Strategy Fund

CREDIT SUISSE OPPORTUNITY FUNDS

Credit Suisse Floating Rate High Income Fund

Credit Suisse Strategic Income Fund

Credit Suisse Managed Futures Strategy Fund

Credit Suisse Multialternative Strategy Fund

CREDIT

SUISSE TRUST

Commodity Return Strategy Portfolio

CREDIT SUISSE ASSET MANAGEMENT INCOME FUND, INC.

CREDIT SUISSE HIGH YIELD BOND FUND

Eleven Madison Avenue

New York, New York 10010

June [·], 2023

Dear Shareholder:

A joint special meeting of shareholders of the funds listed above (each, a “Fund”) will be held at the offices of the Funds, Eleven Madison Avenue, [Floor 2B], New York, New York 10010, on Thursday, August 24, 2023 at 4 p.m., Eastern Time, to vote on the proposals listed in the enclosed Joint Proxy Statement.

On June 12, 2023, Credit Suisse Group AG (“CS Group”) merged with and into UBS Group AG, a global financial services company (“UBS Group”), with UBS Group remaining as the surviving company (the “Transaction”). CS Group was the ultimate parent company of the Funds’ investment adviser, Credit Suisse Asset Management, LLC (“Credit Suisse”), and sub-adviser, Credit Suisse Asset Management Limited (“Credit Suisse UK”), as applicable. Even though there will be no change in the portfolio managers or the investment strategies of your Fund, the closing of the Transaction may be deemed to have caused a technical termination of the Funds’ investment advisory agreements with Credit Suisse, as well as the sub-advisory agreement between Credit Suisse and Credit Suisse UK with respect to Credit Suisse Strategic Income Fund. As explained in more detail in the enclosed Joint Proxy Statement, it is expected that the investment advisory services that Credit Suisse and Credit Suisse UK provide to the Funds will be transitioned (through merger of entities or transfer of services) to asset management affiliates of UBS Group within one year of the closing of the Transaction, subject to any approvals deemed necessary. However, such changes have not yet been finalized.

Assuming the closing of the Transaction is deemed to result in the termination of the Funds’ investment advisory and sub-advisory agreements, in order for Credit Suisse and Credit Suisse UK to continue to manage your Fund until the Funds’ investment advisory services are transitioned, we are asking the shareholders of each Fund to approve a new investment agreement with Credit Suisse and the shareholders of the Credit Suisse Strategic Income Fund to approve a new sub-advisory agreement between Credit Suisse and Credit Suisse UK. It is important to note that your Fund’s advisory fee rate under its new agreement will remain the same, each open-end Fund’s contractual limitations on total expenses are expected to continue under its new agreement, and the Transaction is not expected to result in any immediate change in the portfolio managers or investment strategies of your Fund.

Before you vote, we encourage you to read the full text of the enclosed Joint Proxy Statement for an explanation of each of the proposals and information regarding important recent developments affecting the Funds.

1

Your vote on these matters is important. Even if you plan to attend and vote at the meeting, please promptly follow the enclosed instructions to submit voting instructions by telephone or over the Internet. Alternatively, you may submit voting instructions by signing and dating each proxy card and returning it in the accompanying postage-paid return envelope. In order to ensure that shares will be voted in accordance with your instructions, please submit your proxy promptly.

If you have any questions about the proposals to be voted on, please call AST Fund Solutions, LLC at 877-674-6273.

By Order of each Board,

| /s/ Karen Regan | |

| Karen Regan | |

| Secretary of the Funds | |

| June [·], 2023 | |

| New York, New York |

2

IMPORTANT INFORMATION

FOR FUND SHAREHOLDERS

While we encourage you to read the full text of the enclosed Joint Proxy Statement, for your convenience, we have provided a brief overview of the proposals to be voted on.

Questions and Answers

| Q. | Why am I receiving this joint proxy statement? |

| A. | A joint special meeting of the funds listed below (each, a “Fund” and collectively, the “Funds”) will be held on Thursday, August 24, 2023 at 4 p.m., Eastern Time. You have received this letter because you were a shareholder of record of one of the Funds: |

Credit Suisse Commodity Return Strategy Fund, a series of Credit Suisse Commodity Strategy Funds

Credit Suisse Floating Rate High Income Fund, a series of Credit Suisse Opportunity Funds

Credit Suisse Strategic Income Fund, a series of Credit Suisse Opportunity Funds

Credit Suisse Managed Futures Strategy Fund, a series of Credit Suisse Opportunity Funds

Credit Suisse Multialternative Strategy Fund, a series of Credit Suisse Opportunity Funds

Commodity Return Strategy Portfolio, a series of Credit Suisse Trust

Credit Suisse Asset Management Income Fund, Inc.

Credit Suisse High Yield Bond Fund

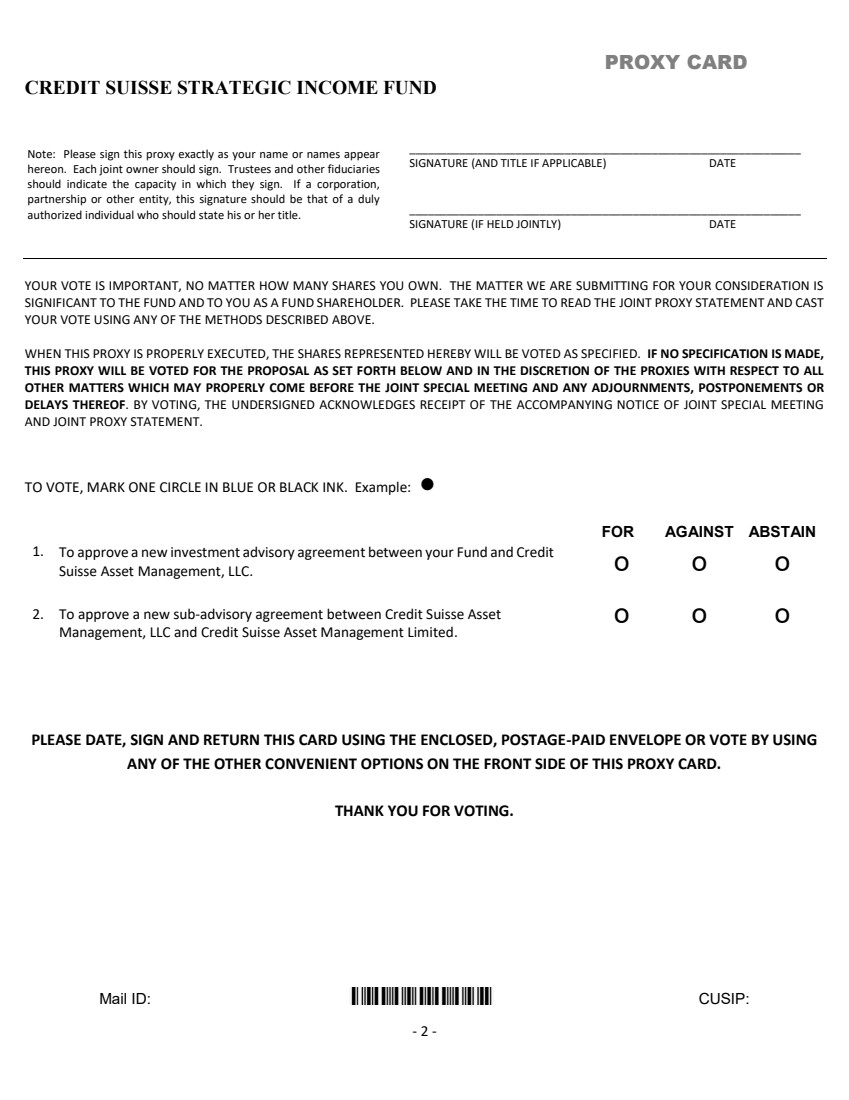

The enclosed joint proxy statement describes a proposal to approve a new investment advisory agreement between your Fund and Credit Suisse Asset Management, LLC (“Credit Suisse”) and, solely with respect Credit Suisse Strategic Income Fund (the “Strategic Income Fund”), a proposal to approve a new sub-advisory agreement between Credit Suisse and Credit Suisse Asset Management Limited (“Credit Suisse UK”) with respect to such Fund.

| Q. | Who is asking for my vote? |

| A. | The Board of Directors or Board of Trustees (each, a “Board” and collectively, the “Boards”), as applicable, of your Fund is asking you to vote at the meeting on the proposal(s) applicable to your Fund. Each Fund’s Board approved the Fund’s new investment advisory agreement and, in the case of the Strategic Income Fund, the new sub-advisory agreement with respect to such Fund. Each Fund’s Board also voted to submit each new agreement to be voted upon by shareholders of the applicable Fund. |

| Q. | What am I being asked to vote “FOR” in this proxy? |

| A. | You are being asked to vote in favor of a proposal to approve the new investment advisory agreement for your Fund. In addition, if you are a shareholder of the Strategic Income Fund, you are being asked to approve a new sub-advisory agreement between Credit Suisse and Credit Suisse UK. |

| Q. | Why am I being asked to vote on new investment advisory and new sub-advisory agreements? |

| A. | You are being asked to approve a new investment advisory agreement and, in the case of the Strategic Income Fund, a new sub-advisory agreement for your Fund as a result of recent events involving Credit Suisse Group AG (“CS Group”). On June 12, 2023 (the “Closing Date”), CS Group merged with and into UBS Group AG, a global financial services company (“UBS Group”), with UBS Group remaining as the surviving company (the “Transaction”), pursuant to a definitive merger agreement signed on March 19, 2023. Immediately prior to the Closing Date, CS Group was the ultimate parent company of Credit Suisse and Credit Suisse UK. |

i

Each Fund was party to an investment advisory agreement with Credit Suisse and Credit Suisse was party to a sub-advisory agreement with Credit Suisse UK with respect to the Strategic Income Fund, each of which may be deemed to have terminated under applicable law in connection with the closing of the Transaction. As explained in more detail below and in the enclosed Joint Proxy Statement, it is expected that the investment advisory services that Credit Suisse and Credit Suisse UK provide to the Funds will be transitioned (through merger of entities or transfer of services) to asset management affiliates of UBS Group within one year of the closing of the Transaction, subject to any approvals deemed necessary (the “UBS Transition”). However, such changes have not yet been finalized.

Assuming the closing of the Transaction is deemed to result in the termination of the Funds’ investment advisory and sub-advisory agreements, in order for Credit Suisse and Credit Suisse UK to continue to manage your Fund until the Funds’ investment advisory services are transitioned, your Fund requires your approval of a new investment advisory agreement with Credit Suisse and, in the case of the Strategic Income Fund, a new sub-advisory agreement between Credit Suisse and Credit Suisse UK.

| Q. | What else is happening with Credit Suisse and the Funds? |

| A. | On June 7, 2023, Credit Suisse, Credit Suisse UK and certain of their affiliates filed an application for a waiver from the prohibitions under Section 9(a) of the Investment Company Act of 1940, as amended (the “1940 Act”), in connection with a consent order and final judgment (“Consent Judgment”) filed in New Jersey Superior Court, which was entered against certain of Credit Suisse’s affiliates. The Consent Judgment did not involve any of the Funds or the services that Credit Suisse, Credit Suisse UK and their affiliates provided to the Funds. As further described in the enclosed Joint Proxy Statement, as a result of the Consent Judgment, Credit Suisse and Credit Suisse UK could be disqualified from providing investment advisory services to the Funds without such a waiver, even though they did not engage in the conduct underlying the Consent Judgment, due to the broad scope of Section 9 of the 1940 Act. Upon learning of the terms of the Consent Judgment and the potential consequences thereof under Section 9(a), Credit Suisse promptly contacted the Boards and the Staff of the Commission, including with respect to Credit Suisse’s view (as supported by outside counsel to the Funds) that the Consent Judgment was not disqualifying. |

The Securities and Exchange Commission (the “Commission”) granted a temporary waiver on June 7, 2023 to Credit Suisse, Credit Suisse UK and their affiliates, as well as to UBS Group and its affiliates (“UBS”), effective upon the Closing Date. Credit Suisse, Credit Suisse UK and certain of their affiliates also applied for (i) a time-limited exemption from Section 9(a) (the “Time-Limited Exemption”), which, if granted, would enable Credit Suisse and Credit Suisse UK to provide investment advisory services to the Funds until the 12-month anniversary of the Closing Date (by which point it is currently anticipated that such services will be transitioned to one or more UBS asset management affiliates), and (ii) a permanent exemption from Section 9(a) for UBS (together with the Time-Limited Exemption, the “Permanent Order”). The Commission has not yet taken final action on the application for the Permanent Order.

Following the expiration of the Time-Limited Exemption, it is expected that Credit Suisse and Credit Suisse UK will be disqualified from providing investment advisory services to the Funds; accordingly, subject to any approvals deemed to be necessary, the Funds’ investment advisory services are expected to undergo the UBS Transition prior to the expiration of the Time-Limited Exemption. However, such changes have not yet been finalized.

| Q. | How do the new investment advisory agreement and new sub-advisory agreement, as applicable, differ from my Fund’s current agreement(s)? |

| A. | The new agreements will be substantially identical to the current agreements, except for the dates of execution, effectiveness and termination and certain non-material changes. |

ii

| Q. | Will my Fund’s contractual advisory fee rates go up? |

| A. | No. Your Fund’s contractual advisory fee rates will not change as a result of the new agreements. In addition, the contractual expense limitation agreements limiting each Open-End Fund’s total net expenses are expected to continue under the new agreements. |

| Q. | Will the new investment advisory and sub-advisory agreements result in any changes in the portfolio management, investment objective or investment strategy of my Fund? |

| A. | No immediate changes to the portfolio managers of your Fund or to your Fund’s investment objective or investment strategy are currently anticipated in connection with the new agreements. |

However, it is currently anticipated that, subject to any approvals that are deemed to be required, the investment advisory services provided by Credit Suisse and, in the case of the Strategic Income Fund, Credit Suisse UK, will be transitioned in accordance with the UBS Transition. Credit Suisse and Credit Suisse UK, as applicable, expect to continue to provide investment advisory services to the Funds, subject to shareholder approval of the new agreements.

| Q. | What happens if new investment advisory and sub-advisory agreements are not approved for my Fund? |

| A. | Prior to the closing of the Transaction, the Board of your Fund approved an interim investment advisory agreement and, in the case of the Strategic Income Fund, an interim sub-advisory agreement. The interim agreements did not require shareholder approval and took effect upon the Closing Date, at which point your Fund’s prior investment advisory agreement and sub-advisory agreement, as applicable, may be deemed to have terminated. Each interim agreement will terminate upon the earlier of shareholder approval of the corresponding new agreement or 150 days following the Closing Date. The terms of the interim agreements are substantially identical to those of the prior agreements except for the term, termination and escrow provisions required by applicable law and certain non-material changes. During the period that each interim agreement is in effect, Credit Suisse’s advisory fees and Credit Suisse UK’s sub-advisory fees will be held in an escrow account, pursuant to Rule 15a-4 under the 1940 Act. |

If shareholders of your Fund do not approve a new investment advisory agreement and/or a new sub-advisory agreement, as applicable, for your Fund, Credit Suisse and Credit Suisse UK, as applicable, will not be able to provide investment advisory services to your Fund following the expiration of the 150-day period following the closing of the Transaction, which will occur on November 9, 2023. If shareholders of your Fund do not approve a new investment advisory agreement and/or new sub-advisory agreement, as applicable, for your Fund, your Fund may be forced to liquidate.

Your vote is necessary to ensure that Credit Suisse can continue to manage your Fund until the UBS Transition is completed, as discussed above.

| Q. | Will there be any changes to my Fund’s custodian or other service providers as a result of the Transaction? |

| A. | No changes are being proposed to each Fund’s custodian, administrator or co-administrator, distributor and transfer agent, as applicable, at this time; however, it is expected that, subject to Board approval, one or more service providers may change prior to the expiration of the one-year period following the closing date of the Transaction in connection with the UBS Transition. |

| Q. | Is my Fund paying for this proxy statement? |

| A. | No. All costs of the proxy and the shareholder meetings, including proxy solicitation costs, legal fees and the costs of printing and mailing the proxy statement, will be borne by Credit Suisse. |

iii

| Q. | Will my vote make a difference? |

| A. | Yes. Your vote is needed to ensure that the proposals for your Fund can be acted upon. Your Fund’s Board encourages you to participate in the governance of your Fund. |

| Q. | How do I vote my shares? |

| A. | You may vote your shares in one of four ways: |

| • | By telephone: Call the toll-free number printed on the enclosed proxy card(s) and follow the directions. |

| • | By Internet: Access the website address printed on the enclosed proxy card(s) and follow the directions on the website. |

| • | By mail: Complete, sign and date the proxy card(s) you received and return in the self-addressed, postage-paid envelope. |

| • | At the meeting: Vote your shares at the meeting scheduled to be held on August 24, 2023 at 4 p.m. (Eastern time). Please see the Question and Answer below regarding the location of the meeting. |

| Q. | When and where is the meeting scheduled to be held? |

| A. | The meeting will be held at the offices of the Funds, Eleven Madison Avenue, [Floor 2B], New York, New York 10010, on Thursday, August 24, 2023 at 4 p.m., Eastern Time. |

| Q. | Why might I receive more than one proxy card? |

| A. | If you own shares in more than one Fund on June 23, 2023, the record date for the meeting, you may receive more than one proxy card. Even if you plan to attend the meeting, please sign, date and return EACH proxy card you receive, or if you provide voting instructions by telephone or over the Internet, please vote on the proposal with respect to EACH Fund you own. |

| Q. | Whom do I call if I have question about voting my proxy? |

| A. | If you need more information, or have any questions about voting, please call the Funds’ proxy solicitor, AST Fund Solutions, LLC at 877-674-6273. |

| Q. | Will anyone contact me? |

| A. | You may receive a call to verify that you received your proxy materials, to answer any questions you may have about the proposals and to encourage you to vote. |

Please vote now. Your vote is important.

To avoid the wasteful and unnecessary expense of further solicitation, and no matter how large or small your holdings may be, we urge you to indicate your voting instructions on the proxy card, if received by mail, date and sign it and return it promptly in the postage-paid envelope provided, or record your voting instructions by telephone or via the Internet. If you submit a properly executed proxy card but do not indicate how you wish your shares to be voted, your shares will be voted “FOR” each of the applicable proposals. If your shares are held through a broker, you must provide voting instructions to your broker about how to vote your shares in order for your broker to vote your shares as you instruct at the meeting. |

iv

PRELIMINARY COPY – SUBJECT TO COMPLETION

CREDIT SUISSE COMMODITY STRATEGY FUNDS

Credit Suisse Commodity Return Strategy Fund

CREDIT SUISSE OPPORTUNITY FUNDS

Credit Suisse Floating

Rate High Income Fund

Credit Suisse Strategic Income Fund

Credit Suisse Managed Futures Strategy Fund

Credit Suisse Multialternative Strategy Fund

CREDIT

SUISSE TRUST

Commodity Return Strategy Portfolio

CREDIT SUISSE ASSET MANAGEMENT INCOME FUND, INC.

CREDIT SUISSE HIGH YIELD BOND FUND

Eleven Madison Avenue, New York, New York 10010

NOTICE OF JOINT

SPECIAL MEETING OF

SHAREHOLDERS

To be held on August 24, 2023

To the Shareholders of the funds listed below (each, a “Fund” and collectively, the “Funds”):

Credit Suisse Commodity Return Strategy Fund, a series of Credit Suisse Commodity Strategy Funds

Credit Suisse Floating Rate High Income Fund, a series of Credit Suisse Opportunity Funds

Credit Suisse Strategic Income Fund, a series of Credit Suisse Opportunity Funds

Credit Suisse Managed Futures Strategy Fund, a series of Credit Suisse Opportunity Funds

Credit Suisse Multialternative Strategy Fund, a series of Credit Suisse Opportunity Funds

Commodity Return Strategy Portfolio, a series of Credit Suisse Trust

Credit Suisse Asset Management Income Fund, Inc.

Credit Suisse High Yield Bond Fund

Notice is hereby given that a Joint Special Meeting of Shareholders of each Fund (the “Meeting”) will be held at the offices of the Funds, Eleven Madison Avenue, [Floor 2B], New York, New York 10010, on Thursday, August 24, 2023 at 4 p.m., Eastern Time for the following purposes, which are described in the accompanying Joint Proxy Statement dated June [·], 2023:

| Proposal | Shareholders Entitled to Vote | |

| Proposal 1: To consider and approve a new investment advisory agreement between each Fund and Credit Suisse Asset Management, LLC | Shareholders of each Fund, voting separately | |

| Proposal 2: To consider and approve a new sub-advisory agreement between Credit Suisse Asset Management, LLC and Credit Suisse Asset Management Limited | Shareholders of Credit Suisse Strategic Income Fund only |

i

Proposal 2, which is limited to Credit Suisse Strategic Income Fund (the “Strategic Income Fund”), is contingent upon approval of Proposal 1 by shareholders of the Strategic Income Fund. If the shareholders of the Strategic Income Fund do not approve Proposal 1, then Proposal 2 will be deemed null and the Board (as defined below) of that Fund will then consider whether other actions, if any, are warranted.

Each of Credit Suisse Commodity Strategy Funds, a Delaware statutory trust, Credit Suisse Opportunity Funds, a Delaware statutory trust, and Credit Suisse Trust, a Massachusetts business trust, is a registered open-end management investment company and is comprised of one or more series (each such series, an “Open-End Fund”). Each of Credit Suisse Asset Management Income Fund, Inc., a Maryland corporation, and Credit Suisse High Yield Bond Fund, a Delaware statutory trust, is a registered closed-end management investment company (each, a “Closed-End Fund”).

As explained in more detail in the enclosed proxy statement, on June 12, 2023, Credit Suisse Group AG (“CS Group”), merged with and into UBS Group AG, a global financial services company (“UBS Group”), with UBS Group remaining as the surviving company (the “Transaction”). Immediately prior to the Transaction, CS Group was the ultimate parent company of Credit Suisse Asset Management, LLC (“Credit Suisse” or the “Manager”), the Funds’ investment adviser, and Credit Suisse Asset Management Limited (“Credit Suisse UK”), the sub-adviser to the Strategic Income Fund. Even though there will be no change in the portfolio managers or the investment strategies of your Fund, the closing of the Transaction may be deemed to have caused a technical termination of the Funds’ investment advisory agreements with Credit Suisse and Credit Suisse UK with respect to the Strategic Income Fund. As explained in more detail in the enclosed Joint Proxy Statement, it is expected that the investment advisory services that Credit Suisse and Credit Suisse UK provide to the Funds will be transitioned (through merger of entities or transfer of services) to asset management affiliates of UBS Group within one year of the closing of the Transaction, subject to any approvals deemed necessary. However, such changes have not yet been finalized. Assuming the closing of the Transaction is deemed to result in the termination of the Funds’ investment advisory and sub-advisory agreements, in order for Credit Suisse and Credit Suisse UK to continue to manage your Fund until the Funds’ investment advisory services are transitioned, we are asking: (i) shareholders of each Fund to approve a new investment advisory agreement with Credit Suisse; and (ii) shareholders of the Strategic Income Fund to approve a new sub-advisory agreement between Credit Suisse and Credit Suisse UK. It is important to note that the investment advisory fee rates of the Funds will not change under the new agreements, and no immediate changes to the Funds’ investment strategies or portfolio managers are currently anticipated in connection with the Transaction.

The close of business on June 23, 2023 has been fixed as the record date (“Record Date”) with respect to each Fund for the determination of shareholders entitled to notice of, and to vote at, the Meeting or any postponement or adjournment thereof. The enclosed proxy is being solicited on behalf of each Fund’s Board of Directors or Board of Trustees, as applicable (each, a “Board”). Each shareholder who does not expect to attend the Meeting in person is requested to complete, date, sign and promptly return the enclosed proxy card. As a registered shareholder, you may also vote your proxy electronically by telephone or over the Internet by following the instructions included with your proxy card. Shareholders may make inquiries about this proxy card by telephone at (877 )674-6273. Shareholders who hold shares through a bank or other intermediary, shareholders who are the holders of a variable annuity contract or variable life insurance policy or shareholders who are participants in certain tax qualified pension and retirement plans (as discussed below), should consult their bank or intermediary, their participating insurance company or their participating qualified plan regarding their ability to revoke voting instructions after such instructions have been provided. A previously submitted proxy card can be revoked by mail (addressed to the Secretary of the applicable Fund, c/o Credit Suisse Asset Management, LLC, Eleven Madison Avenue, [Floor 2B], New York, New York 10010), voting again through the toll-free number or the Internet address listed in the proxy card, or at the Meeting by executing a superseding proxy card or by submitting a notice of revocation. Merely attending the Meeting, however, will not revoke any previously submitted proxy card.

ii

Important Notice Regarding the Availability of Proxy Materials for the Joint Special Meeting of Shareholders to Be Held on Thursday, August 24, 2023. The Joint Proxy Statement is available on the internet at: www.credit-suisse.com/us/funds.

By Order of each Board,

| /s/Karen Regan | |

| Karen Regan | |

| Secretary of the Funds | |

| June [·], 2023 | |

| New York, New York |

YOUR VOTE IS IMPORTANT

Please indicate your voting instructions on the enclosed proxy card, sign and date it, and return it in the envelope provided, which needs no postage if mailed in the United States. Your vote is very important no matter how many shares you own. Please mark and mail your proxy card promptly in order to save the Funds any additional cost of further proxy solicitation and in order for the Meeting to be held as scheduled.

iii

TABLE OF CONTENTS

Page

| INTRODUCTION | 1 |

| PROPOSAL 1 AND PROPOSAL 2: APPROVAL OF A NEW INVESTMENT ADVISORY AGREEMENT WITH CREDIT SUISSE AND, WITH RESPECT TO THE STRATEGIC INCOME FUND ONLY, APPROVAL OF A NEW SUB-ADVISORY AGREEMENT BETWEEN CREDIT SUISSE AND CREDIT SUISSE UK | 3 |

| Summary | 3 |

| Background | 4 |

| Comparison of the Prior Advisory Agreements and the New Advisory Agreements | 6 |

| Board Review and Approval of the New Advisory Agreements | 7 |

| ADDITIONAL INFORMATION | 11 |

| Proxy Voting and Shareholder Meeting | 11 |

| Shareholders Sharing the Same Address | 13 |

| Share and Class Information | 13 |

| Ownership Information | 13 |

| Aggregate Fees and Brokerage Commissions | 13 |

| Information About the Funds’ Investment Manager, Sub-Adviser, Co-Administrator/Administrator and Distributor | 13 |

| Delaware Statutory Trust Act — Control Share Acquisitions of DHY | 14 |

| Submission of Proposals for Next Meeting of Shareholders | 14 |

| Other Matters | 15 |

| Reports to Shareholders | 15 |

| APPENDIX A Outstanding Voting Shares | A-1 |

| APPENDIX B Shareholder Approval of the Prior Advisory Agreements | B-1 |

| APPENDIX C New Investment Advisory Agreement for the Open-End Funds | C-1 |

| APPENDIX D New Investment Advisory Agreement for CIK | D-1 |

| APPENDIX E New Investment Advisory Agreement for DHY | E-1 |

| APPENDIX F New Sub-Advisory Agreement for the Strategic Income Fund | F-1 |

| APPENDIX G Advisory and Sub-Advisory Fee Rates Under Prior Advisory Agreements | G-1 |

| APPENDIX H 5% Share Ownership | H-1 |

| APPENDIX I Equity Securities Owned by Directors/Trustees and Executive Officers | I-1 |

| APPENDIX J Fees Paid to the Manager, Credit Suisse UK and CSSU | J-1 |

| APPENDIX K Principal Executive Officers and Directors of Credit Suisse and Credit Suisse UK | K-1 |

PRELIMINARY COPY – SUBJECT TO COMPLETION

JOINT PROXY STATEMENT

CREDIT SUISSE COMMODITY STRATEGY FUNDS

Credit Suisse Commodity Return Strategy Fund

CREDIT SUISSE OPPORTUNITY FUNDS

Credit Suisse Floating

Rate High Income Fund

Credit Suisse Strategic Income Fund

Credit Suisse Managed Futures Strategy Fund

Credit Suisse Multialternative Strategy Fund

CREDIT

SUISSE TRUST

Commodity Return Strategy Portfolio

CREDIT SUISSE ASSET MANAGEMENT INCOME FUND, INC.

CREDIT SUISSE HIGH YIELD BOND FUND

Eleven Madison

Avenue

New York, New York 10010

JOINT SPECIAL MEETING OF SHAREHOLDERS

To be held on August 24, 2023

INTRODUCTION

This joint proxy statement (the “Joint Proxy Statement”) is furnished in connection with the solicitation of proxies on behalf of the Board of Trustees or Board of Directors, as applicable (each, a “Board” and collectively, the “Boards”), of each of Credit Suisse Commodity Strategy Funds, Credit Suisse Opportunity Funds, Credit Suisse Trust, Credit Suisse Asset Management Income Fund, Inc. and Credit Suisse High Yield Bond Fund in connection with the joint special meeting (the “Meeting”) of shareholders of the funds listed below (each, a “Fund” and collectively, the “Funds”), and at any and all adjournments, postponements or delays thereof:

Credit Suisse Commodity Return Strategy Fund, a series of Credit Suisse Commodity Strategy Funds

Credit Suisse Floating Rate High Income Fund, a series of Credit Suisse Opportunity Funds

Credit Suisse Strategic Income Fund, a series of Credit Suisse Opportunity Funds

Credit Suisse Managed Futures Strategy Fund, a series of Credit Suisse Opportunity Funds

Credit Suisse Multialternative Strategy Fund, a series of Credit Suisse Opportunity Funds

Commodity Return Strategy Portfolio, a series of Credit Suisse Trust

Credit Suisse Asset Management Income Fund, Inc.

Credit Suisse High Yield Bond Fund

1

The Meeting was called for the purpose of voting on the following proposals (each, a “Proposal” and collectively, the “Proposals”), each as further described in this Joint Proxy Statement:

| Proposal | Shareholders Entitled to Vote | |

| Proposal 1: To consider and approve a new investment advisory agreement between each Fund and Credit Suisse Asset Management, LLC | Shareholders of each Fund, voting separately | |

| Proposal 2: To consider and approve a new sub-advisory agreement between Credit Suisse Asset Management, LLC and Credit Suisse Asset Management Limited | Shareholders of Credit Suisse Strategic Income Fund only |

Proposal 2, which is limited to Credit Suisse Strategic Income Fund (the “Strategic Income Fund”), is contingent upon approval of Proposal 1 by shareholders of the Strategic Income Fund. If the shareholders of the Strategic Income Fund do not approve Proposal 1, then Proposal 2 will be deemed null and the Board of that Fund will then consider whether other actions, if any, are warranted. Credit Suisse Asset Management Limited (“Credit Suisse UK” or the “Sub-Advisor”), an affiliate of Credit Suisse (as defined below), acts as the sub-adviser to the Strategic Income Fund.

The Notice of Joint Special Meeting, Joint Proxy Statement and proxy card are being mailed to shareholders on or about [·], 2023.

The Meeting will be held at the offices of the Funds, Eleven Madison Avenue, [Floor 2B], New York, New York 10010, on Thursday, August 24, 2023 at 4 p.m., Eastern Time. The close of business on June 23, 2023 has been fixed as the record date (“Record Date”) with respect to each Fund for the determination of shareholders entitled to notice of, and to vote at, the Meeting and any postponement or adjournment thereof. A table of the outstanding voting shares of the Funds as of the Record Date is presented in Appendix A. Each share is entitled to one vote (a fractional share is entitled to a fractional vote).

Proxy solicitations will be made primarily by mail, but solicitations may also be made by telephone or personal interviews conducted by officers or employees of each Fund; Credit Suisse Asset Management, LLC (“Credit Suisse” or the “Manager”), the investment adviser to the Funds and co-administrator with respect to the Open-End Funds (as defined below); or AST Fund Solutions, LLC, a professional proxy solicitation firm that has been retained by the Manager to assist with the distribution of proxy materials and the solicitation and tabulation of proxies at an aggregate cost of approximately $164,000 plus all reasonable out of pocket expenses incurred on behalf of each Fund. The solicitation cost will be borne by Credit Suisse.

If the enclosed proxy card is properly executed and returned in time to be voted at the Meeting, the shares represented thereby will be voted in accordance with the instructions marked on the proxy card. If no instructions are marked on the proxy card, the proxy card will be voted “FOR” each applicable proposal presented for approval at the Meeting and will be voted on any matters that may properly come before the Meeting in accordance with the judgment of the persons named in the proxy card. A previously submitted proxy card can be revoked by mail (addressed to the Secretary of the Fund, c/o Credit Suisse Asset Management, LLC, Eleven Madison Avenue, 9th Floor, New York, New York 10010), voting again through the toll-free number or the Internet address listed in the proxy card, or at the Meeting by executing a superseding proxy card or by submitting a notice of revocation. Merely attending the Meeting, however, will not revoke any previously submitted proxy card.

Each of Credit Suisse Commodity Strategy Funds (“CS Commodity Strategy Funds”), a Delaware statutory trust, Credit Suisse Opportunity Funds (“CS Opportunity Funds”), a Delaware statutory trust, and Credit Suisse Trust (“CS Trust” and collectively with CS Commodity Strategy Funds and CS Opportunity Funds, the “Trusts”), a Massachusetts business trust, is registered as an open-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”), and comprises one or more series (each such series, an “Open-End Fund”). For purposes of this Joint Proxy Statement, the term “shareholder” (when used to refer to the beneficial holder of ownership interests in an Open-End Fund) also includes holders of variable annuity contracts and variable life insurance policies and participants in certain tax qualified pension and retirement plans.

Each of Credit Suisse Asset Management Income Fund, Inc. (“CIK”), a Maryland corporation, and Credit Suisse High Yield Bond Fund (“DHY”), a Delaware statutory trust, is registered as a closed-end management investment company under the 1940 Act (each, a “Closed-End Fund”). The shares of common stock or common shares of beneficial interest, as applicable (“Common Shares”), of each of CIK and DHY are listed on the NYSE American.

2

PROPOSAL 1 AND PROPOSAL 2:

APPROVAL OF A NEW INVESTMENT ADVISORY AGREEMENT WITH CREDIT SUISSE AND, WITH RESPECT TO THE STRATEGIC INCOME FUND ONLY, APPROVAL OF A NEW SUB-ADVISORY AGREEMENT BETWEEN CREDIT SUISSE AND CREDIT SUISSE UK

Summary

You are being asked to approve a new investment advisory agreement and, in the case of the Strategic Income Fund, a new sub-advisory agreement for your Fund as a result of recent events involving Credit Suisse Group AG (“CS Group”). On June 12, 2023 (the “Closing Date”), CS Group merged with and into UBS Group AG, a global financial services company (“UBS Group”), with UBS Group remaining as the surviving company (the “Transaction”), pursuant to a definitive merger agreement signed on March 19, 2023. The Transaction has important ramifications for your Fund. Namely, each Fund’s Prior Advisory Agreement(s) (as defined below), which the Fund’s Board last approved in November 2022, may be deemed to have terminated under applicable law in connection with the closing of the Transaction.

Prior to the Closing Date, each Board met to approve each Fund’s New Advisory Agreement(s) and Interim Advisory Agreement(s) (each as defined below). The Interim Advisory Agreements, which took effect on the Closing Date, permit the Manager and Credit Suisse UK to continue to provide investment advisory services to the Funds until the Funds obtain shareholder approval of the New Advisory Agreements, for a period of up to 150 days following the Closing Date.

In addition, on June 7, 2023, the Manager, Credit Suisse UK and certain of their affiliates filed an application for a waiver from the prohibitions under Section 9(a) of the 1940 Act in connection with the Consent Judgment (as defined below) which was entered against certain of Credit Suisse’s affiliates, but did not involve any of the Funds or the services that Credit Suisse, Credit Suisse UK and their affiliates provided to the Funds. As further described below, as a result of the Consent Judgment, the Manager and Credit Suisse UK could be disqualified from providing investment advisory services to the Funds without such a waiver, even though they did not engage in the conduct underlying the Consent Judgment, due to the broad scope of Section 9 of the 1940 Act. The Securities and Exchange Commission (the “Commission”) granted a temporary waiver on June 7, 2023 to the Manager, Credit Suisse UK and their affiliates, as well as to UBS Group and its affiliates (“UBS”), effective upon the Closing Date. The Manager, Credit Suisse UK and certain of their affiliates also applied for the Time Limited-Exemption (as defined below), which, if granted, would permit the Manager and Credit Suisse UK to provide investment advisory services to the Funds for a period of 12 months following the Closing Date. Following the expiration of the Time-Limited Exemption, it is expected that the Manager and Credit Suisse UK will be disqualified from providing investment advisory services to the Funds; accordingly, subject to any approvals deemed to be necessary, the Funds’ investment advisory services are expected to be transitioned (through merger of entities or transfer of services) to asset management affiliates of UBS Group prior to the expiration of the Time-Limited Exemption.

It is important to note that, while the Funds’ investment adviser and sub-adviser, as applicable, are expected to ultimately change as a result of the Transaction and the Time-Limited Exemption, such changes have not been finalized as of the date of this Joint Proxy Statement. Shareholder approval of Proposal 1 and Proposal 2, as applicable, is necessary for your Fund to continue to receive investment advisory services from the Manager and Credit Suisse UK, as applicable, for the entirety of the Time-Limited Exemption during which changes to the Funds’ investment adviser and sub-adviser, as applicable, as well as any changes to the Funds’ other service providers, will be finalized. The investment advisory fee rates of the Funds will not change under the New Advisory Agreements, and no immediate changes to the Funds’ investment strategies or portfolio managers are currently anticipated in connection with the Transaction.

The foregoing summary is intended to provide a brief overview of the discussion of Proposal 1 and Proposal 2 that follows and is qualified in its entirety by such discussion.

3

Background

Prior Agreements

The Trusts were party, on behalf of their respective Open-End Funds, to an Amended and Restated Investment Management Agreement, dated November 16, 2016, as further amended on May 25, 2021, with Credit Suisse (the “Prior Open-End Fund Investment Advisory Agreement”). CIK was party to an Amended and Restated Investment Management Agreement, dated November 15, 2016, as further amended on May 25, 2021, with Credit Suisse (the “Prior CIK Investment Advisory Agreement”). DHY was party to an Amended and Restated Investment Management Agreement, dated November 15, 2016, as further amended on May 25, 2021, with Credit Suisse (the “Prior DHY Investment Advisory Agreement” and collectively with the Prior Open-End Fund Investment Advisory Agreement and the Prior CIK Investment Advisory Agreement, the “Prior Investment Advisory Agreements”). Credit Suisse and Credit Suisse UK were party to a Sub-Advisory Agreement, dated August 14, 2012 with respect to the Strategic Income Fund (the “Prior Sub-Advisory Agreement” and together with the Prior Investment Advisory Agreements, the “Prior Advisory Agreements”). Each Prior Advisory Agreement was last approved by the respective Board, including a majority of the Independent Board Members, at a meeting held on November 14-15, 2022 (the “November 2022 15(c) Meeting”). The date of each Prior Advisory Agreement’s most recent shareholder approval is set out in Appendix B.

As noted above, the closing of the Transaction may be deemed to have caused the Prior Advisory Agreements to terminate.

Interim Agreements

Rule 15a-4 under the 1940 Act permits a person to act as an investment adviser to a registered investment company under an interim advisory agreement that has not been approved by the company’s shareholders for a period of 150 days following the date on which the previous agreement was deemed to terminate (in this case, the Closing Date), subject to the requirements set forth in the rule set out below. At the May 2023 Board Meeting (as defined below), each Fund’s Board, including a majority of the Directors/Trustees who are not “interested persons” (as defined in the 1940 Act) of any party to the applicable New Advisory Agreement (collectively, the “Independent Board Members”), unanimously approved an interim investment advisory agreement with the Manager (each, an “Interim Investment Advisory Agreement”), and the Board of the Strategic Income Fund unanimously approved an interim sub-advisory agreement between the Manager and Credit Suisse UK with respect to such Fund (the “Interim Sub-Advisory Agreement” and together with the Interim Investment Advisory Agreements, the “Interim Advisory Agreements”), in each case on substantially similar terms as the Prior Advisory Agreements and in accordance with Rule 15a-4. The Interim Advisory Agreements went into effect on the Closing Date. The Interim Advisory Agreements are not subject to shareholder approval, and you are not being asked to approve these agreements.

The requirements of Rule 15a-4 differ depending on the particular event that triggered the termination of the previous advisory agreement. With respect to the Transaction, the Interim Advisory Agreement(s) for each Fund must satisfy the following criteria, among others: (i) the compensation under the applicable Interim Advisory Agreement may be no greater than the Manager’s or Credit Suisse UK’s compensation under the respective Prior Advisory Agreement; (ii) the applicable Board, including a majority of the Independent Board Members, must vote in person to approve the applicable Interim Advisory Agreement and determine that the scope and quality of services to be provided to the applicable Fund under the applicable Interim Advisory Agreement will be at least equivalent to the scope and quality of services provided under the respective Prior Advisory Agreement; (iii) the applicable Board or a majority of the applicable Fund’s shareholders must be permitted to terminate the applicable Interim Advisory Agreement at any time, without the payment of any penalty, on not more than 10 days’ notice; (iv) the applicable Interim Advisory Agreement must contain substantially similar terms and conditions as the respective Prior Advisory Agreement; and (v) amounts payable under the applicable Interim Advisory Agreement must be held in escrow until the shareholders have approved the corresponding New Advisory Agreement and thereafter must be paid out in accordance with Rule 15a-4.

4

New Agreements

To ensure that Credit Suisse and Credit Suisse UK, as applicable, can continue to provide investment advisory services to the Funds and that each Fund’s operations continue uninterrupted following the expiration of the 150-day term of its Interim Advisory Agreement(s) until the changes to the Fund’s investment adviser(s) are finalized over the course of the Time-Limited Exemption, we are asking shareholders of each Fund in Proposal 1 to approve a new investment advisory agreement with the Manager (each, a “New Investment Advisory Agreement”) and, in Proposal 2, we are asking shareholders of the Strategic Income Fund to approve a new sub-advisory agreement between the Manager and Credit Suisse UK with respect to such Fund (the “New Sub-Advisory Agreement” and together with the New Investment Advisory Agreements, the “New Advisory Agreements”). Proposal 2, with respect to the Strategic Income Fund, is contingent upon approval of Proposal 1 by shareholders of the Strategic Income Fund. If the shareholders of the Strategic Income Fund do not approve Proposal 1, then Proposal 2 will be deemed null and the Board of that Fund will then consider whether other actions, if any, are warranted. Copies of the New Investment Advisory Agreement for each of the Open-End Funds, CIK and DHY are attached in Appendix C, Appendix D and Appendix E, respectively. A copy of the New Sub-Advisory Agreement with respect to the Strategic Income Fund is attached in Appendix F.

At a meeting held on May 16, 2023 (the “May 2023 Board Meeting”), in anticipation of the closing of the Transaction, each Board, including a majority of Independent Board Members, unanimously approved a New Investment Advisory Agreement between each Fund and the Manager and, with respect to the Strategic Income Fund, the New Sub-Advisory Agreement between the Manager and Credit Suisse UK. Each Fund’s New Investment Advisory Agreement and, in the case of the Strategic Income Fund, the New Sub-Advisory Agreement, as approved by the Board, is submitted for approval by the shareholders of the Fund and must be voted upon separately by shareholders of the Fund. If a Fund’s shareholders approve a New Advisory Agreement with respect to that Fund, it will go into effect upon approval.

As of the date of this Joint Proxy Statement, no immediate changes to the Funds’ investment strategies or portfolio managers are anticipated in connection with the Transaction. The composition of each Board has not changed and no changes to the members of the Board are currently contemplated as a direct result of the Transaction. Each Board will continue to make decisions regarding the Manager, Credit Suisse UK (as applicable), custodian, administrator, distributor and transfer agent of the Funds. No changes are being proposed to these existing service providers at this time; however, it is expected that, subject to Board approval, one or more service providers may change prior to the expiration of the Time-Limited Exemption in connection with the CS Fund Servicing Reorganization (as defined below). It is also expected that UBS Group’s management will assume ultimate management responsibility for Credit Suisse and Credit Suisse UK.

Expected Time-Limited Exemption from Disqualification Under Section 9(a) of the 1940 Act

In determining how to vote for the Proposals, shareholders should carefully consider the Time-Limited Exemption (as defined below) for which Credit Suisse, Credit Suisse UK and certain of their affiliates have applied to the Commission. If the Time-Limited Exemption is granted, it is anticipated that the services that Credit Suisse, Credit Suisse UK and their affiliates currently provide to the Funds will be transitioned (through merger of entities or transfer of services) to one or more asset management affiliates of UBS Group on or prior to the expiration of the Time-Limited Exemption.

On December 17, 2013, the New Jersey Bureau of Securities filed a complaint in the Superior Court of New Jersey, Mercer County Chancery Division (the “Court”) alleging that Credit Suisse Securities (USA) LLC (“CSSU”), Credit Suisse First Boston Mortgage Securities Corp. (“FBMSC”) and DLJ Mortgage Capital, Inc. (“DLJ” and, together with CSSU and FBMSC, the “Settling Entities”) violated the New Jersey Uniform Securities Law in connection with the offer, sale, or purchase of residential mortgage-backed securities prior to the global financial crisis of 2008. On October 24, 2022, the Court entered a Consent Order and Final Judgment (“Consent Judgment”) negotiated and submitted by the parties. The Consent Judgment also states that “Credit Suisse shall not violate the [New Jersey] Securities Law” or the Consent Judgment or a related administrative consent order. The Manager and Credit Suisse UK were not involved in the conduct underlying the Consent Judgment.

5

Section 9(a) of the 1940 Act automatically prohibits entities that are, or whose affiliates are, subject to, among other things, certain court ordered “injunctions,” from serving or acting as investment adviser of any investment company registered under the 1940 Act or a principal underwriter for any registered open-end investment company under the 1940 Act, or serving in various other capacities in respect of registered investment companies. The Manager and Credit Suisse UK provide investment advisory services to Funds, and CSSU serves as principal underwriter to the Open-End Funds. Because the Manager and Credit Suisse UK are affiliates of the Settling Entities, they could also be subject to disqualification under Section 9(a), despite not being involved in the conduct underlying the Consent Judgment. Upon learning of the terms of the Consent Judgment and the potential consequences thereof under Section 9(a), Credit Suisse promptly contacted the Boards and the Staff of the Commission, including with respect to Credit Suisse’s view (as supported by outside counsel to the Funds) that the Consent Judgment was not disqualifying.

On June 7, 2023, the Manager, Credit Suisse UK and the Settling Entities (the “Applicants”) submitted an application to the Commission pursuant to Section 9(c) of the 1940 Act. The application seeks:

| (1) | a temporary order (the “Temporary Order”) granting a temporary exemption from Section 9(a) of the 1940 Act to the Applicants to serve as investment adviser to the Funds and as underwriter to the Open-End Funds (collectively, “Fund Servicing Activities”) and to any company that became an “affiliated person” (as defined in the 1940 Act) of an Applicant as of the Closing Date or that becomes an “affiliated person” of an Applicant following the Closing Date (collectively, the “UBS Covered Persons”) to serve in any of the capacities referenced in Section 9(a) pending the determination of the Commission on the application for a permanent order; and |

| (2) | a permanent order (the “Permanent Order”) that would: |

| (a) | if granted prior to the 12-month anniversary of the Closing Date, provide to the Applicants a time-limited exemption from Section 9(a) of the 1940 Act (the “Time-Limited Exemption”) for 12 months from the Closing Date to provide the Manager, Credit Suisse UK and CSSU with adequate time to complete the CS Fund Servicing Reorganization (as defined below) while engaged in the Fund Servicing Activities; and |

| (b) | provide a permanent exemption to the UBS Covered Persons from Section 9(a) of the 1940 Act so as to serve in any of the capacities referenced in that Section. |

The “CS Fund Servicing Reorganization” refers to the process of (i) transitioning the Fund Servicing Activities that the Manager, Credit Suisse UK and CSSU perform on behalf of one or more of the Funds to other providers of such services, and/or (ii) restructuring the Applicants’ businesses such that the Manager, Credit Suisse UK and/or each other company that was an “affiliated person” of the Settling Entities as of the date of the Section 9(c) application may provide Fund Servicing Activities without being subject to disqualification under Section 9(a) of the 1940 Act.

On June 7, 2023 (prior to the Closing Date), the Commission granted the Temporary Order. As of the date of this Joint Proxy Statement, the Commission has not yet taken final action with respect to the Permanent Order.

If the Permanent Order is granted, the Manager, Credit Suisse UK and CSSU could be disqualified from engaging in Fund Servicing Activities for the Funds upon the expiration of the Time-Limited Exemption (i.e., on the 12-month anniversary of the Closing Date), unless the Applicants’ businesses are restructured such that the Manager and Credit Suisse UK are no longer affiliated persons of the Settling Entities. It is currently anticipated that, subject to any approvals that are deemed to be required, the Fund Servicing Activities provided by the Manager, Credit Suisse UK and CSSU will be transitioned (through merger of entities or transfer of services) to one or more asset management affiliates of UBS Group on or prior to the expiration of the Time-Limited Exemption.

Comparison of the Prior Advisory Agreements and the New Advisory Agreements

The terms of each New Advisory Agreement are substantially identical to the terms of the corresponding Prior Advisory Agreement, except for the dates of execution, effectiveness and termination and certain non-material changes. Each Prior Advisory Agreement had, and the corresponding New Advisory Agreement has, an initial period of two years and thereafter shall continue automatically for successive annual periods, provided such continuance is specifically approved at least annually by (a) the Board of the applicable Fund or (b) a vote of a “majority” (as defined in the 1940 Act) of the Fund’s outstanding voting securities, provided that in either event the continuance is also approved by a majority of the Independent Board Members, by vote cast in person at a meeting called for the purpose of voting on such approval.

6

Appendix G sets out the advisory fee rate payable by each Fund under its Prior Investment Advisory Agreement and the sub-advisory fee rate payable by the Manager to Credit Suisse UK with respect to the Strategic Income Fund under the Prior Sub-Advisory Agreement. Under each New Investment Advisory Agreement, there will be no increase in advisory fee rates payable by the respective Fund(s), and under the New Sub-Advisory Agreement, there will be no increase in sub-advisory fees payable by the Manager to Credit Suisse UK.

Each Prior Advisory Agreement and the corresponding New Advisory Agreement may be terminated with respect to a Fund at any time without the payment of any penalty, on 60 days’ written notice to the Manager by the Board or by a vote of the majority of the respective Fund’s outstanding voting securities. Each Prior Advisory Agreement and the corresponding New Advisory Agreement may be terminated by the Manager on 90 days’ written notice to the respective Fund. Each Prior Advisory Agreement and the corresponding New Advisory Agreement will also terminate automatically in the event of its “assignment” (as defined in the 1940 Act).

Board Review and Approval of the New Advisory Agreements

As noted above, each Board, including a majority of the Independent Board Members of each Board, unanimously approved the New Advisory Agreement(s) at the May 2023 Board Meeting. The factors considered by each Board in considering and approving the New Advisory Agreement are set out below.

In anticipation of the closing of the Transaction, and in response to a request from the Board, representatives of UBS attended the May 2023 Board Meeting and provided information regarding the UBS asset management business and the investment advisory and principal underwriting services currently provided to the UBS family of registered investment companies (the “UBS Presentation”).

Each Board’s evaluation of the New Advisory Agreements reflected information provided at the May 2023 Board Meeting as well as, where relevant, information relating to each Fund, the Manager and Credit Suisse UK, that was previously furnished to the Board in connection with the most recent renewal of the Prior Advisory Agreements at the November 2022 15(c) Meeting (collectively, the “November 2022 15(c) Materials”) and other Board meetings throughout the year. The November 2022 15(c) Materials included the following information: (1) performance data for each Fund for various time periods; (2) comparative performance, advisory fee, and expense ratio information for a peer group of funds in each respective Fund’s relevant performance group (“Performance Group”) and universe of funds (“Performance Universe”); (3) comparable performance information for each Fund’s relevant benchmark index or indices; (4) comparative data regarding the expense ratio of each Fund, as compared to its relevant expense group (“Expense Group”) and universe of funds (“Expense Universe”); (5) a profitability analysis for the Manager with respect to each Fund; and (6) other information regarding the nature, extent and quality of services provided by the Manager and the Sub-Advisers, as applicable. The Board considered Credit Suisse’s representation at the May 2023 Board Meeting that (i) no material changes to the information provided in the November 2022 15(c) Materials had occurred since the November 2022 15(c) Meeting and (ii) the personnel, resources and services provided to the Funds are not expected to change under the New Advisory Agreements and will be similar to those services provided under the Prior Advisory Agreements.

Each Board, including all of the Independent Board Members, were assisted by experienced independent legal counsel throughout the New Advisory Agreement review process. The Independent Board Members discussed the proposed approvals in private session with such counsel at which no representatives of management, the Manager or Credit Suisse UK were present. Each Board member, including each of the Independent Board Members, relied upon the advice of independent legal counsel and his or her own business judgment in determining the material factors to be considered in evaluating the New Advisory Agreements and the weight to be given to each such factor. The conclusions reached by the Board members were based on a comprehensive evaluation of all of the information provided and were not the result of any one factor. Moreover, each Board member may have afforded different weight to the various factors in reaching his or her conclusions with respect to the New Advisory Agreements.

7

While the application for the Section 9(c) waiver was submitted and the Temporary Order was granted after the Board approved the New Advisory Agreements at the May 2023 Board Meeting, the Boards, since shortly after the entry of the Consent Judgment, have been apprised of the Consent Judgment and the potential consequences thereof under Section 9(a) and were provided with regular updates, including Credit Suisse’s view (as supported by outside counsel to the Funds) that the Consent Judgment was not disqualifying and the possibility that the Commission could reach a different conclusion. In addition, the Boards were apprised of the filing of the Section 9(c) waiver application and the implications of the Time-Limited Exemption prior to approving the submission of the New Advisory Agreements to shareholders at a meeting of the Boards held on June 15, 2023.

Investment Advisory Fee Rates and Expenses

Each Board reviewed and considered the contractual advisory fee of each Fund set out in Appendix G, in light of the extent and quality of the management services provided by Credit Suisse, as investment adviser, and, in the case of the Strategic Income Fund, by Credit Suisse UK, as sub-adviser. Each Board reviewed each Fund’s management fee and total expense ratio. The Board also considered that Credit Suisse has entered into contractual expense limitation agreements limiting each Open-End Fund’s total net expenses and that these arrangements were expected to continue under the New Advisory Agreements. The Board of DHY also considered the voluntary fee waivers currently in place for the Fund, and the actual fee rate for the most recent fiscal year paid by DHY after taking waivers and breakpoints into account. The Board for DHY acknowledged that voluntary fee waivers could be discontinued at any time but had received assurances that such waivers would remain in place over the next year. The November 2022 15(c) Materials included funds in both the relevant Expense Group and Expense Universe provided by Broadridge, an independent provider of investment company data. Each Board noted the following with respect to its respective Fund(s) fees and expenses as presented in a report provided by Broadridge: (i) Credit Suisse Commodity Return Strategy Fund’s (“Commodity Fund”) contractual and net advisory fees and overall expenses were within the middle range of its peers; (ii) Credit Suisse Floating Rate High Income Fund’s (“Floating Rate Fund”) contractual and net advisory fees and overall expenses were within the range of its peers; (iii) Strategic Income Fund’s contractual and net advisory fees and overall expenses were in line with or above the range of its peers; (iv) Credit Suisse Managed Futures Strategy Fund’s (“Managed Futures Fund”) contractual and net advisory fees were within the middle range of its peers and its overall expenses were in line with or lower than the range of its peers; (v) Credit Suisse Multialternative Strategy Fund’s (“Multialternative Strategy Fund”) contractual and net advisory fees and overall expenses were lower than most of its peers; (vi) Commodity Return Strategy Portfolio’s (“Commodity Portfolio”) contractual and net advisory fees were within the range of its peers and overall expenses were above the range of its peers; (vii) CIK’s advisory fees and overall expenses were lower than its peers; and (viii) DHY’s advisory fees and overall expenses were generally above the range of its peers. Additionally, each Board was previously provided with a description of the methodology used to arrive at the funds included in the Expense Group and the Expense Universe.

Nature, Extent and Quality of the Services

Each Board received and considered information regarding the nature, extent and quality of services provided to its respective Fund(s) by Credit Suisse and, in the case of the Strategic Income Fund, by Credit Suisse UK. Each Board also noted information received at regular meetings throughout the year related to the services rendered by Credit Suisse which, in addition to portfolio management and investment management services, included credit analysis and research, supervising the day-to-day operations of each Fund’s non-advisory functions which include accounting, administration, custody, transfer agent and other applicable third party service providers, overseeing and facilitating audits, overseeing each applicable Fund’s credit facility and supervising and/or preparing applicable Fund filings, disclosures and shareholder reports. Each Board noted that the extensive investment management services provided by Credit Suisse included broad supervisory responsibility and oversight over other service providers to the Funds. Each Board also considered Credit Suisse’s compliance program with respect to the Funds. Each Board noted that Credit Suisse reports to the Boards about portfolio management and compliance matters on a periodic basis. Each Board also reviewed background information about Credit Suisse and, in the case of the Strategic Income Fund, Credit Suisse UK, including their respective Form ADV Part 2 – Disclosure Brochure and, with respect to Credit Suisse, Brochure Supplement and considered the background and experience of Credit Suisse’s senior management and the expertise of, and the amount of attention given to the Fund by, senior personnel of Credit Suisse. In addition, each Board reviewed the qualifications, backgrounds and responsibilities of the portfolio management team primarily responsible for the day-to-day portfolio management of the respective Fund and the extent of the resources devoted to research and analysis of actual and potential investments, as well as the resources provided to them. Each Board evaluated the ability of each of Credit Suisse and, in the case of the Strategic Income Fund, Credit Suisse UK, based on its resources, reputation and other attributes, to attract and retain qualified investment professionals including research, advisory, and supervisory personnel. Each Board also received and considered information about the nature, extent and quality of services and fee rates offered to other Credit Suisse clients for comparable services. Each Board acknowledged Credit Suisse’s representation that the services provided to the Funds are more extensive than the services provided in connection with other types of accounts, such as separate accounts, offered by Credit Suisse and the services are also more extensive from those offered and provided to a sub-advised fund. Each Board also considered that the services provided by Credit Suisse have expanded over time as a result of regulatory and other developments.

8

In approving the New Sub-Advisory Agreement, the Board of the Strategic Income Fund considered the benefits of retaining Credit Suisse’s affiliate as the Fund’s sub-adviser and Credit Suisse UK’s investment style.

Fund Performance

Each Board considered information provided in the November 2022 15(c) Materials and at each subsequent quarterly meeting to consider the performance of its respective Fund(s). That information in the November 2022 15(c) Materials included performance results of the Funds over the previous year as well as over longer time periods, along with comparisons both to the relevant Performance Group and Performance Universe for the Fund provided in the Broadridge materials. Each Board was also provided with a description of the methodology used to arrive at the funds included in the Performance Group and the Performance Universe. The Boards noted that: (i) the Commodity Fund outperformed the majority of its Performance Universe for the one-year period reported, and either performed in line with or slightly underperformed its Performance Universe over various longer investment periods reported; (ii) the Floating Rate Fund outperformed its Performance Universe for the one-year period reported, and generally outperformed its Performance Universe over various longer investment periods reported; (iii) the Strategic Income Fund outperformed its Performance Universe for the one-year period reported, and generally outperformed over various longer investment periods reported; (iv) the Managed Futures Fund outperformed its Performance Universe for the one-year period reported, and had varying performance compared to its Performance Universe over various longer investment periods reported; (v) the Multialternative Strategy Fund outperformed the majority of its Performance Universe for the one-year period reported, and performed either in line with or slightly outperformed its Performance Universe over various longer investment periods reported; (vi) the Commodity Portfolio performed in line with its Performance Universe for the one-year period reported, and had varying performance compared to its Performance Universe over various longer investment periods reported; (vii) CIK outperformed its Performance Universe for the one-year period reported, and either outperformed or performed in line with its Performance Universe over various longer investment periods reported; and (viii) DHY performed in line with its Performance Universe for the one-year period reported, and either outperformed or performed in line with its Performance Universe over various longer investment periods reported, and has continued to trade relatively well, at a discount to net asset value. Each Board also considered the investment performance of the respective Fund(s) relative to its stated objectives.

At the May 2023 Board Meeting, the Boards received information regarding each Fund’s performance relative to its benchmark and select peers for various periods ended March 31, 2023.

Credit Suisse Profitability

Each Board referred to a profitability analysis of Credit Suisse provided in the November 2022 15(c) Materials based on the fees payable under the Prior Investment Advisory Agreements and the New Investment Advisory Agreements for the Funds, including any fee waivers, as well as other relationships between the Funds on the one hand and Credit Suisse affiliates on the other. Each Board’s deliberations also reflected, in the context of Credit Suisse’s profitability, Credit Suisse’s methodology for allocating costs to the Funds, recognizing that cost allocation methodologies are inherently subjective. Each Board had also received net profitability information for all of the Funds. Each Board reviewed Credit Suisse’s profit margin as reflected in the profitability analysis, as well as reviewing profitability in light of appropriate court cases and the services rendered to the Funds.

9

Economies of Scale

Each Board considered information provided in the November 2022 15(c) Materials regarding whether there have been economies of scale with respect to the management of the Funds, whether the Funds have appropriately benefited from any economies of scale, and whether there is potential for realization of any further economies of scale for the Funds as follows:

OPEN-END FUNDS – The Board of each Open-End Fund, other than the Floating Rate Fund, noted that, if the Open-End Fund’s asset levels grow, further economies of scale potentially could be realized and also noted the contractual expense limitations currently in place between the Fund and Credit Suisse. The Board of the Floating Rate Fund noted that the Floating Rate Fund’s contractual advisory fee had breakpoints that would allow investors to benefit directly in the form of lower fees as Fund assets grow and also noted the contractual expense limitation currently in place between Floating Rate Fund and Credit Suisse. Those Boards received information regarding Credit Suisse’s profitability in connection with providing investment management services to each Open-End Fund, including Credit Suisse’s costs in providing the services.

CIK – The Board noted the current advisory fee structure and the fact that the Fund does not pay advisory fees on the Fund’s leveraged assets. Additionally, the Board noted the Fund has an effective shelf registration statement that permits it to conduct an at-the-market offering, whereby the Fund may issue additional shares when the Fund’s shares are trading at a premium to its net asset value, and that between November 17, 2021 and September 30, 2022, the Fund sold and issued approximately 277,489 new shares for a net increase in assets of approximately $823,639. The Board received information regarding Credit Suisse’s profitability in connection with providing advisory services to the Fund, including Credit Suisse’s costs in providing the services.

DHY – The Board noted that the Fund’s contractual advisory fee had breakpoints that would allow investors to benefit directly in the form of lower fees as Fund assets grow, as well as the current voluntary expense waiver. Additionally, at times when the Fund’s shares have traded at a premium to its net asset value, the Fund has endeavored to conduct at-the-market offerings to raise additional assets, most recently in 2017. The Board also noted that further economies of scale potentially could be realized once the Fund’s shares again traded at a premium to net asset value whereby an additional at-the-market offering could be conducted to increase the Fund’s assets. The Board received information regarding Credit Suisse’s profitability in connection with providing advisory services to the Fund, including Credit Suisse’s costs in providing the services.

Other Benefits to Credit Suisse

Each Board considered other benefits received by Credit Suisse and its affiliates as a result of their relationship with the Funds previously included in the November 2022 15(c) Materials. Such benefits included, among others, benefits potentially derived from an increase in Credit Suisse’s businesses and its reputation as a result of its relationship with the Funds (such as the ability to market its advisory services to other clients and investors including separate account or third party sub-advised mandates or other financial products offered by Credit Suisse and its affiliates), as well as, with respect to the Open-End Funds, the fees paid to an affiliate of Credit Suisse for distribution services.

Each Board considered the standards Credit Suisse applied in seeking best execution and Credit Suisse’s policies and practices regarding soft dollars and reviewed Credit Suisse’s method for allocating portfolio investment opportunities among its advisory clients, as provided in the November 2022 15(c) Materials.

Other Factors and Broader Review

As discussed above, each Board previously reviewed and referred to detailed materials received from Credit Suisse as part of this special approval process. Each Board also reviews and assesses the quality of the services that each Fund receives throughout the year and reviews reports of Credit Suisse at least quarterly, which include, among other things, detailed portfolio and market reviews, detailed fund performance reports, and Credit Suisse’s compliance procedures.

10

Each Board also considered the information provided by the representatives of UBS during the UBS Presentation at the May 2023 Board Meeting. In particular, each Board considered the information regarding the investment advisory and principal underwriting services currently provided to the UBS family of registered investment companies.

In addition, each Board considered representations from Credit Suisse and UBS that there were no plans to make any immediate changes to the Funds’ investment strategies or portfolio managers immediately following the closing of the Transaction.

Conclusions

After consideration of the foregoing, each Board reached the following conclusions regarding the New Investment Advisory Agreements and, as applicable, the New Sub-Advisory Agreement (in addition to the conclusions set forth above): (a) the contractual and net advisory fees for each Fund were reasonable in relation to the services provided by Credit Suisse and Credit Suisse UK, as applicable; (b) each Board was satisfied by the nature, extent and quality of the investment advisory services provided to each Fund by Credit Suisse and Credit Suisse UK, as applicable (and with respect to the Commodity Fund and Commodity Portfolio, in a challenging commodities environment), and that, based on dialogue with management and counsel, the services to be provided by Credit Suisse and Credit Suisse UK, as applicable, under the New Advisory Agreements are typical of, and consistent with, those provided to similar mutual funds by other investment advisers; (c) (x) with respect to the Open-End Funds and DHY, in light of the costs of providing investment management and other services to each Fund and Credit Suisse’s and Credit Suisse UK’s, as applicable, ongoing commitment to each Fund and willingness to waive fees, including, in the case of the Open-End Funds, by agreeing to a contractual expense limitation, Credit Suisse’s and Credit Suisse UK’s, as applicable, net profitability based on fees payable under the New Advisory Agreements, as well as other ancillary benefits that Credit Suisse and its affiliates received, were considered reasonable, and (y) with respect to CIK, in light of the costs of providing investment management and other services to the Fund and Credit Suisse’s ongoing commitment to the Fund and willingness to base the fee on an average weekly base amount which, with respect to each quarter, is the average of the lower of (i) the stock price (market value) of the Fund’s outstanding shares and (ii) the Fund’s net assets, in each case determined as of the last trading day for each week during that quarter, Credit Suisse’s net profitability based on fees payable under the Fund’s New Advisory Agreement, as well as other ancillary benefits that Credit Suisse and its affiliates received, were considered reasonable; and (d) in light of the information received and considered by the Board, each Fund’s current fee structure was considered reasonable. No single factor reviewed by each Board was identified by each Board as the principal factor in determining whether to approve the New Advisory Agreements. The Independent Board Members were advised by separate independent legal counsel throughout the process.

ADDITIONAL INFORMATION

Proxy Voting and Shareholder Meeting

All properly executed and timely received proxy cards will be voted in accordance with the instructions marked thereon or otherwise provided therein. Accordingly, unless instructions to the contrary are marked, proxy cards will be voted for the approval of each Fund’s New Investment Advisory Agreement and, in the case of the Strategic Income Fund, approval of the New Sub-Advisory Agreement. Any shareholder may revoke his or her proxy at any time prior to exercise thereof by giving written notice to the Secretary of each Fund at Eleven Madison Avenue, New York, New York 10010, by signing another proxy of a later date or by personally voting at the Meeting.