Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05009

COLORADO BONDSHARES —

A TAX-EXEMPT FUND

(Exact name of registrant as specified in its charter)

1200 17TH STREET, SUITE 850

DENVER, COLORADO 80202-5808

(Address of principal executive offices) (Zip code)

FRED R. KELLY, JR.

1200 17TH STREET, SUITE 850

DENVER, COLORADO 80202-5808

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-572-6990

Date of fiscal year end: 09/30

Date of reporting period: 09/30/2018

Table of Contents

Table of Contents

ITEM 1. REPORTS TO STOCKHOLDERS.

Table of Contents

November 20, 2018

Dear Shareholders:

Gridlock is good for the system. After digesting the results of the mid-term election, I am of the opinion that what happened may be ok; for bonds at least. Many have been fighting back the gut-aching feeling that if the economy got too healthy, this might conceivably lead to inflation pressures. This could, in turn, prompt the Federal Reserve to increase rates even more than the current projections of one more this year and up to four in 2019. This was not a particularly rosy prognosis for fixed income instruments but maybe that analysis has changed. For now, it appears that a more likely scenario is that the next two years will be spent in mortal combat and political dissidence involving all three branches of government, giving the Federal Reserve a reason to moderate. In addition, it appears that other economies around the world are decelerating rather than accelerating, as previously predicted.

With a main event like political bickering, it appears quite unlikely that anything else of major consequence gets done. How is that so bad if we understand the rules as they stand and are not left guessing about what may be on the horizon? Maybe the country maintains the status quo for at least a couple more years. And the status quo is not all that bad. Colorado is doing very well. Virtually everyone who wants a job, has one. Some may well be under-employed but at least they can put food on the table. The U.S. is by far the most vibrant economy on the globe and the dollar, though strong, may be peaking. This should lead to greater demand for U.S. products, particularly if trade talks prove successful.

It appears unlikely, now, that an additional tax measure will pass so no new additions to the deficit. Healthcare and immigration legislation are doomed so unemployment remains low and premiums are hopefully predictable. Any compromise infrastructure bill that passes will likely be watered down from what was originally conceived. Fewer bonds being issued at the federal level, probably puts less downward pressure on the bond market and might even spark a rally.

Given these observations, I feel more comfortable about committing some, not all, of your funds to new projects thereby garnering more income in an attempt to raise the dividend. Halleluiah! We will also be distributing a capital gain dividend to you in December which will amount to approximately $0.06/share. This amount is already reflected in the share price so do your tax planning accordingly and do not be surprised when the shares go down in price by the exact amount of the capital gain distribution. This happens automatically as a balance sheet adjustment when the already accrued distributions are paid.

Table of Contents

Last year, I facetiously promised to try and do better to improve on our #1 rating (as computed by Thomson Reuters Lipper) among our peer group. Given that, once again, we were ranked #1 by the same service, I failed to top it but we will settle for a tie with last year.

Please review the accompanying information for a detailed view of the 2018 fiscal year. No matter how the coming year turns out, one thing is true. Our shareholders always come first with us. So, look for us to keep endeavoring on your behalf to make the most of what we have. What we have is a portfolio of strong earning assets with above average liquidity located in a dynamic state and an incomparable group of investors. Thank you all!

Sincerely,

Fred R. Kelly, Jr.

Portfolio Manager

Table of Contents

Table of Contents

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

The US economy has continued to strengthen on the heels of strong labor force participation, rising incomes and consumer spending (partly fueled by the Tax Cuts and Jobs Act). GDP beat forecasts in third quarter 2018 at 3.5%, down slightly from 4.2% in second quarter. All of this promises to record one of the longest economic expansions in US history. This is all somewhat tempered by inflation concerns and rising trade tensions amid current trade war negotiations. It is our belief that there will be resolution around the trade issues before too long.

The Colorado economy remains one of the strongest in the country and continues to show positive markers for continued expansion, albeit at a slower pace than prior years, suggesting we are coming to a more mature stage of the business cycle. In past years, Colorado’s strong labor market has been a significant component of our robust economy. This remains true in 2018 and the near future. Partnered with consumer spending and new job opportunities, the state has one of the lowest unemployment rates in the nation. The Colorado Legislative Council September 2018 Economic and Review Forecast presented an interesting observation where the strong labor force counteracts “structural shifts” such as the increasing number of annual retirements. This aging generation, better known as the “Baby Boomers”, are estimated to be around 70 million nationwide.

Earlier this year, the FOMC (Federal Open Market Committee) stated that the labor market had continued to strengthen as had economic activity and, in keeping with that observation, they raised the target rate for federal funds twice in the first half of the year and once again in September. The Federal Reserve commented that economic activity “has been rising at a solid rate,” an upgrade from May of this year. They announced that they would likely raise rates one more time in 2018, bringing the total number of increases for the calendar year to four. Should those indicators maintain a consistent expansion into 2019, the Committee would expect to make further increases for calendar year 2019.

The municipal bond market is multifaceted in nature, lending complexity to an already challenging task of analyzing credit quality while weighing the risks that inevitably crop up in an economy such as ours. Municipal bonds persisted in strength again this year with issuances north of $280 billion year over year at the national level and roughly $10 billion for the state of Colorado. Prices generally trended higher punctuated by occasional corrective pressure from the Federal Reserve, seeking to temper the strong economy. During the 1st and 2nd quarter 2018, the Fund garnered additional capital gains and tax-exempt income through select refunding where original cost basis was low enough to effect substantial gains and interest income. Throughout the fiscal year period, the Fund experienced strong net cash inflows, as shareholders sought both tax-exempt income and relative safety when compared with other, more uncertain investments. Depending on their respective tax bracket, investors could capture appealing tax-equivalent yields, especially when compared to U.S. Treasuries or low yielding bank CDs. Given that the top marginal tax rate only went down to 40.8%, tax-exempt income becomes a fairly meaningful contribution to an individual’s portfolio. Additionally, individual state and local tax deductions from federal taxes are now limited to $10,000.

Experts estimate the state population to be around 5.68 million. Different sources estimate the growth rate over the next couple of years to somewhere in the vicinity of 1.37%. Assuming that growth rate, one could expect the population in the Denver Metro area to grow to around 6 million by 2020 and possibly 7.8 million by 2040. Over 80% of Colorado’s population reside in the 12 counties that make up the Front

1

Table of Contents

Range. Given those statistics and the fact that the majority of our special district bonds are located within the Front Range, Management is confident that our investments in these districts will continue to prosper.

The Denver housing market has experienced a slight dip in home sales over recent months, giving rise to speculation as to whether these are signs of a pervasive slower growth in the industry or a seasonal downshift. The more widely held perception is that this is more of a “normalizing” in stark contrast to the buying frenzy of the last several years. Much of the regional rhetoric being published on the subject points to several factors that have been the impetus behind the deceleration. The most obvious are the persistence of high home prices coupled with rising interest rates which, simply put, raise concerns among cautious buyers of how to cash flow their investment without significantly compromising their lifestyle. So, with higher home prices and more potential interest rate hikes, new home buyers and existing home owners looking to “move up” are at the mercy of two factors: price and borrowing costs, both of which can put pressure on potential future sales. The pushback has become evident recently in price reductions by sellers who no longer appear to be in the driver’s seat as in years past.

The housing industry plays a key role in the Colorado municipal bond industry because of its dramatic effect on taxable land. Therefore, it is encouraging to note that the state continues to experience net in-migration, strong wage and employment growth which subsequently creates demand for more housing. Third quarter 2018 data revealed existing home sales were “down 20% to 3,983 homes, the largest decline since 2010, for any month but year to date annual sales…still up from 2017” (Metrostudy, Denver Executive Summary, Third Quarter 2018). The median price for existing detached homes was $428,000.

Home prices, in general, are still high with the average price for new single family detached over $500,000, again contributing to the noticeably cooler attitude from prospective buyers. This has caused many builders to rethink their strategies and examine the challenge of committing to their upcoming building season in 2019, taking into account trade labor shortages and vacant lot availability and weighing those against their convictions that economists have correctly called the near future for Colorado. This has galvanized a number of them to shift their focus back to more affordable options within the $350,000 to $400,000 price range. This sector increased 5% in annual starts over last year. Supply for existing homes, as measured in months on the market, has remained below two months while lot supply is around 14.8 months, the lowest in over 18 years. New single family detached homes, townhomes and condominiums are around 10.6 months in aggregate. This is down from last quarter but unchanged from last year (Metrostudy, Denver Executive Summary, Third Quarter 2018).

To date, the positive still appears to outweigh the negative. However, this slowing trend has prompted some to believe that these factors are changing the way we view family formations. Forbes published an article (Forbes, August 27, 2018 “Are Millennials Killing The U.S. Housing Market” by Neil Howe) where Mr. Howe made some interesting observations. He remarked that in 1972, “America built twice as many houses even though our adult population back then was only 57% as large as it is today.” Mr. Howe pointed out that millennials have a more “group lifestyle” mentality, meaning they are more comfortable living at home with their parent or with their peers than pursuing the conventional paths of marriage and a home in suburbia. Some Baby Boomers, on the other hand, are electing to remain in their existing homes instead of opting for a downsized version. This could be in part because many are choosing to remain in the workforce longer and some have millennial children that are delaying moving out. This would explain part of the changing dynamic in the housing industry nationwide, as well as Colorado. Many would-be buyers are gravitating toward the townhome/duplex market while still others are remodeling their existing homes, which offers a more affordable option. Rents have continued to trend upward with one source citing an average of

2

Table of Contents

$1,610/month in the Denver metro area, an increase of 1.86% over last year (Rent Jungle). Going forward, we believe, rentals in the condo and townhome sector will continue to fill a need for those unable or unwilling to step into a hefty mortgage.

Charter schools have been great performers for the Fund over the years. Currently, there are over 7,000 charter schools in the United States with an enrollment of around 3.2 million students. Charter schools exist in 43 states plus the District of Columbia. Colorado’s charter school law was passed in 1993. Schools opened quickly and by fall of 2017 there were 250 schools with 120,700 students enrolled. At fiscal year-end, charter schools constituted 20% of the bonds in the portfolio.

The combination of relatively low interest rates and tight underwriting spreads have continued to put pressure on municipal bond funds to produce net positive returns for the year. Municipal bond mutual funds typically experience net cash inflows correlative with strong total return performance. Every month throughout the fiscal year, the Fund had net positive cash inflows. The Fund’s total return (principal appreciation plus income) performance record for fiscal year period ended 09/30/2018 was ranked #1 by Lipper when compared to peers in the single-state intermediate municipal bond fund category. This year’s results were highlighted by a number of positive events, some being the retirement of several bonds purchased in prior years at a deep discount with unpaid interest owed. The bonds were all paid off in full plus all accrued interest. For the fiscal year ended September 30, 2018, the Fund recorded a total return of 5.29% at net asset value; the return was comprised of an investment income component of 4.171% and principal depreciation of 1.009%. Some funds use leverage to enhance yields. The Fund did not use leverage. According to Thomson Reuters, the Fund has ranked #1 in the 1-year, 3-year and 5-year category. The average annual total returns at the maximum offering price (including sales charges and reinvestment of all dividends and distributions) are 0.28%, 3.11%, 3.96%, 4.01% for the one, three, five and ten-year periods ended September 30, 2018, respectively.

A key factor that has contributed to the Fund’s stability in the past and continues going forward is management’s determination to maintain a shorter average duration (time period that securities are likely to be held by the portfolio) which remains very competitive within our peer group. Throughout the year, the Fund carried a disproportionately high weighting of short-term bonds and cash in the portfolio, designed to lessen the exposure to market risk in a time when it appeared likely for interest rates to rise and spreads to widen. In the first part of the year, several Colorado issuers refinanced their higher coupon debt for bonds with significantly lower rates. This effectively reduced their annual debt service payments and simultaneously improved the financial health of their districts. Additionally, some issuers, again taking advantage of the lower borrowing costs, made the decision to embark on new projects that had been delayed during the credit crisis years earlier. Both scenarios resulted in more new deals that came to our Colorado market in 2018. While the strategy of buying short maturities helped to protect principal, it did not maximize the current income stream. Distributions of $0.38/share in fiscal year 2018 compared less favorably to $0.48/share in 2017 and $0.41/share in 2016. It is management’s philosophy that it is easier to recoup lost income than it is to recover principal losses. Until the risks posed by rising interest rates have abated, management will continue to exercise this methodology. Much of this year’s income may be attributed to longer term holdings being principally invested in not-rated tax-exempt bonds, with coupon rates that exceed average coupons currently available in the market. Not-rated securities are generally subject to greater credit risk than rated issues; but proper analysis by management may effectively mitigate these risks. It should be stated that past performance is not necessarily indicative of future performance, but it is one of many important factors to consider when evaluating a potential investment.

3

Table of Contents

PERFORMANCE SUMMARY (Unaudited)

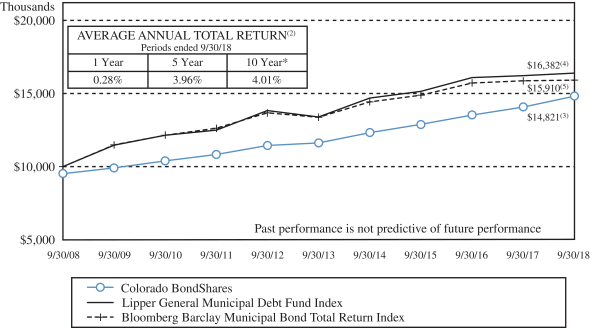

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN

COLORADO BONDSHARES(1)

THE LIPPER GENERAL MUNICIPAL DEBT FUND INDEX(4)

AND THE BLOOMBERG BARCLAY MUNICIPAL BOND TOTAL RETURN INDEX(5)

| (1) | Total return is the percentage change in the value of a hypothetical investment that has occurred in the indicated period of time, taking into account the imposition of the sales charge and other fees and assuming the reinvestment of all dividends and distributions. Past performance is not indicative of future performance. The graph does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares of the Fund. |

| * | Fiscal year ended September 30, 2016 includes a principal write down of approximately $14.5 million due to an adverse decision by the Colorado State Court of Appeal on the Marin Metropolitan District bonds that is a non-recurring event outside of the control of the Fund. |

| (2) | Average annual total return reflects the hypothetical annually compounded return that would have produced the same cumulative total return if the Fund’s performance had been constant over the entire period. Average annual total returns for the one-year, five-year and ten-year periods ended September 30, 2018 are 0.28%, 3.96%, and 4.01%, respectively. Average annual total includes the imposition of the sales charge and assumes the reinvestment of all dividends and distributions. Past |

4

Table of Contents

| performance is not indicative of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares of the Fund. |

| (3) | Includes reinvestment of dividends and adjustment for the maximum sales charge of 4.75%. |

| (4) | The Lipper General Municipal Debt Fund Index is a non-weighted index of the 30 largest funds that invest at least 65% of assets in municipal debt issues in the top four credit ratings. The Lipper General Municipal Debt Fund Index reflects no deductions for fees, expenses or taxes, includes reinvestment of dividends but does not reflect any adjustment for sales charge. |

| (5) | The Bloomberg Barclay Municipal Bond Total Return Index which replaced the Barclays Capital Municipal Bond Total Return Index (the “Barclay Index”) is considered representative of the broad market for investment grade, tax-exempt and fixed-rate bonds with long-term maturities (greater than two years) selected from issues larger than $50 million. You cannot invest directly in this index. This index is not professionally managed and does not pay any commissions, expenses or taxes. If this index did pay commissions, expenses or taxes, its returns would be lower. The Fund selected the Bloomberg Barclay Index to compare the returns of the Fund to an appropriate broad-based securities market index. You should note, however, that there are some fundamental differences between the portfolio of securities invested in by the Fund and the securities represented by the Bloomberg Barclay Index. Unlike the Fund which invests primarily in not rated securities on issues of any size, the Bloomberg Barclay Index only includes securities with a rating of at least “Baa” by Moody’s Investor Services, Inc. from an issue size of no less than $50 million. Some of these differences between the portfolio of the Fund and the securities represented by the Bloomberg Barclay Index may cause the performance of the Fund to differ from the performance of the Bloomberg Barclay Index. |

5

Table of Contents

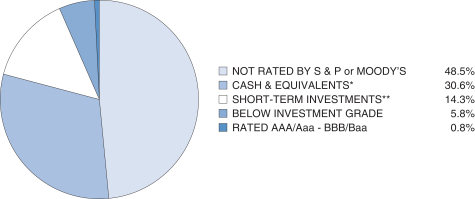

CREDIT QUALITY (unaudited)

Colorado BondShares — A Tax-Exempt Fund

Based on a Percentage of Total Net Assets as of September 30, 2018

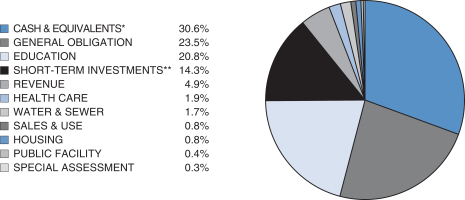

SECTOR BREAKDOWN (unaudited)

Colorado BondShares — A Tax-Exempt Fund

Based on a Percentage of Total Net Assets as of September 30, 2018

* Cash & equivalents include cash and receivables less liabilities.

** Short-term investments include securities with a maturity date or redemption feature of one year or less, as identified in the Schedule of Investments.

6

Table of Contents

Officers and Trustees of the Fund

The following tables list the trustees and officers of the Fund, together with their address, age, positions held with the Fund, the term of each office held and the length of time served in each office, principal business occupations during the past five years and other directorships, if any, held by each trustee and officer. Each trustee and officer has served in that capacity for the Fund continuously since originally elected or appointed. The Board of Trustees supervises the business activities of the Fund. Each trustee serves as a trustee until termination of the Fund unless the trustee dies, resigns, retires, or is removed. The Statement of Additional Information of the Fund includes additional information about Fund trustees and is available, without charge, upon request. Shareholders may call (800) 572-0069 to request the Statement of Additional Information.

| Name, Address and Age |

Position held with the Fund and Length of Time Served |

Principal Occupation During the Past Five Years: |

Other Directorships | |||

| Non-Interested Trustees | ||||||

| Bruce G. Ely 1200 17th Street, Suite 850 Denver CO 80202 Age: 67 |

Trustee since July 2002 | Mr. Ely was a Regional Director for Cutwater Asset Management, a wholly owned subsidiary of MBIA, Inc., until his retirement in September 2013. | None | |||

| James R. Madden 1200 17th Street, Suite 850 Denver CO 80202 Age: 74 |

Trustee since September 2004 | Mr. Madden has owned Madden Enterprises, a real estate company that owns and leases commercial buildings and real estate, for the past thirty years. He is also a stockholder and director of The Community Bank in western Kansas. He has been a bank director for 25 years. | None | |||

| Interested Trustees* | ||||||

| George N. Donnelly 1200 17th Street, Suite 850 Denver CO 80202 Age: 71 |

Chairman of the Board of Trustees, Trustee since inception of the Fund in 1987 and Interim President, Secretary and Treasurer of the Fund since September 26, 2008 | Mr. Donnelly was a Senior Regional Vice President for Phoenix Life Insurance Company until his retirement in January 2010. | None | |||

*George N. Donnelly is an “interested person” of the Fund as defined in the Investment Company Act of 1940 (the “1940 Act”) by virtue of his position as both an officer and a trustee of the Fund as described in the table above. None of the trustees nor the officers of the Fund have any position with the Investment Adviser, the principal underwriter of the Fund, the distribution agent of the Fund, the service agent of the Fund or the custodian of the Fund, or any affiliates thereof. There is no family relationship between any officers and trustees of the Fund.

7

Table of Contents

Compensation

The Board met four times during the fiscal year ended September 30, 2018. The following tables show the compensation paid by the Fund to each of the trustees during that year:

| Name of Person, Position(s) with the Fund |

Aggregate Compensation from Fund |

Pension or Retirement Benefits Accrued As Part of Fund Expenses |

Total Compensation from Fund Paid to Such Person |

|||||||||

| Non-Interested Trustees |

||||||||||||

| Bruce G. Ely, Trustee |

$ | 3,600 | N/A | $ | 3,600 | |||||||

| James R. Madden, Trustee |

3,600 | N/A | 3,600 | |||||||||

| Interested Trustees |

||||||||||||

| George N. Donnelly, Trustee, Interim President, Secretary and Treasurer |

3,600 | N/A | 3,600 | |||||||||

No officer or trustee of the Fund received remuneration from the Fund in excess of $60,000 for services to the Fund during the fiscal year ended September 30, 2018. The officers and trustees of the Fund, as a group, received $10,800 in compensation from the Fund for services to the Fund during the 2018 fiscal year.

Other Information

Proxy Voting Record

The Fund does not invest in equity securities. Accordingly, there were no matters relating to a portfolio security considered during the 12 months ended June 30, 2018 with respect to which the Fund was entitled to vote. Applicable regulations require us to inform you that the foregoing proxy voting information is available on the SEC website at http://www.sec.gov or you may call us at 1-800-572-0069.

Quarterly Statement of Investments

The Fund files a complete statement of investments with the Securities and Exchange Commission for the first and third quarters for each fiscal year on Form N-Q. Shareholders may view the filed Form N-Q by visiting the Commission’s website at http://www.sec.gov. The filed form may also be viewed and copied at the Commission’s Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by calling 1-800-732-0330 or you may call us at 1-800-572-0069.

8

Table of Contents

Trustees Approve Advisory Agreement

The Board of Trustees (the “Trustees”) of Colorado BondShares — A Tax-Exempt Fund unanimously approved the continuance of the Fund’s Investment Advisory and Service Agreement with Freedom Funds Management Company (“Freedom Funds”) at a meeting held on September 28, 2018. In approving the Advisory Agreement, the Trustees, including the disinterested trustees, considered the reasonableness of the advisory fee in light of the extent and quality of the advisory services provided and any additional benefits received by Freedom Funds or its affiliates in connection with providing services to the Fund, compared the fees charged by Freedom Funds to those paid by similar funds, and analyzed the expenses incurred by Freedom Funds with respect to the Fund. The Trustees also considered the Fund’s performance relative to a selected peer group, the expense ratio of the Fund in comparison to other funds of comparable size, and other factors. The Trustees determined that the Fund’s advisory fee structure was fair and reasonable in relation to the services provided and that approving the agreement was in the best interests of the Fund and its shareholders. Matters considered by the Trustees in connection with its consideration of the Advisory Agreement included, among other things, the following:

1. Investment Adviser Services

Freedom Funds manages the assets of the Fund, including making purchases and sales of portfolio securities consistent with the Fund’s investment objectives and policies. In addition, Freedom Funds administers the Fund’s daily business affairs such as providing accurate accounting records, computing accrued income and expenses of the Fund, computing the daily net asset value of the Fund, assuring proper dividend disbursements, proper financial information to investors, and notices of all shareholders’ meetings, and providing sufficient office space, storage, telephone services, and personnel to accomplish these responsibilities. In considering the nature, extent and quality of the services provided by Freedom Funds, the Trustees believe that the services provided by Freedom Funds have provided the Fund with superior results. At the same time, Freedom Fund’s fee structure is equal to or lower than the comparable funds. The Trustees noted the Fund’s focus is inherently more labor intensive. Under the circumstances, the Trustees found the fee structure to be justified.

2. Investment Performance

The Trustees reviewed the performance of the Fund compared to other similar funds, and reported that the current (as of September 27, 2018) net asset value was $9.138 per share and the current distribution yield (based on net asset value) was 3.43% (also as of September 27, 2018). Since the overall structure of the portfolio was satisfactory and the performance of the Fund, measured in terms of distribution yield and total return, was ahead of the other members of its peer group of Colorado funds (higher than the distribution yield of six comparable Colorado municipal bond funds), no changes to either the type of assets or manner of operations were recommended.

3. Expense Ratios

The Trustees reviewed the performance (measured by distribution yield), fees and expense ratios of six Colorado municipal bond funds (such six being the only such funds known to the Trustees at the time). The Fund was at the top of the list in terms of current yield and total performance; it had one of the lower expense ratios. The Trustees considered the fact that the Fund’s unique focus on not rated bonds, while

9

Table of Contents

geared toward producing superior investment results, often required additional expenses. While expenses can vary with not rated bonds (principally as a result of litigation with respect to defaulted issues and higher monitoring costs occasioned by less readily available information), the Trustees noted the Fund’s performance for the current year.

4. Management Fees and Expenses

The Trustees reviewed the investment advisory fee rates payable by the Fund to Freedom Funds. As part of its review, the Trustees considered the estimated advisory fees and the Fund’s estimated total expense ratio for the one-year period as of September 27, 2018 as compared to a group of six comparable Colorado municipal bond funds identified by Freedom Funds. After reviewing the foregoing information, and in light of the nature, extent and quality of the services provided by Freedom Funds, the Trustees concluded that the advisory fees charged by Freedom Funds for the advisory and related services to the Fund and the Fund’s total expense ratio are reasonable. The management fee is one half of one percent of total net assets managed. Such fee is payable to Freedom Funds on a monthly basis. This fee is comparable to the group of six competing Colorado municipal bond funds identified by Freedom Funds and is consistent with national funds many times the Fund’s size.

5. Profitability

The Trustees reviewed the level of profits realized by Freedom Funds and relevant affiliates thereof in providing investment and administrative services to the Fund. The Trustees considered the level of profits realized without regard to revenue sharing or other payments by Freedom Funds and its affiliates to third parties in respect to distribution of the Fund’s securities. The Trustees also considered other direct or indirect benefits received by Freedom Funds and its affiliates in connection with its relationship with the Fund and found that there were none. The Trustees concluded that, in light of the foregoing factors and the nature, extent and quality of the services provided by Freedom Funds, the profits realized by Freedom Funds are reasonable.

6. Economies of Scale

In reviewing advisory fees and profitability, the Trustees also considered the extent to which Freedom Funds and its affiliates, on the one hand, and the Fund, on the other hand, can expect to realize benefits from economies of scale as the assets of the Fund increase. The Trustees acknowledged the difficulty in accurately measuring the benefits resulting from the economies of scale with respect to the management of any specific fund or group of funds, particularly in an environment where costs are rising due to changing regulations. The Trustees reviewed data summarizing the increases and decreases in the assets of the Fund over various time periods, and evaluated the extent to which the total expense ratio of the Fund and Freedom Fund’s profitability may have been affected by such increases or decreases. Between October 2017 and September 27, 2018, total net assets of the Fund under management by Freedom Funds increased from $1,137.8 billion to 1,265.9 billion. The number of shares of the Fund that have been redeemed has been less than the number of new shares issued by the Fund, and as a result the Fund continues to grow at what the Trustees determined was a healthy level and the fund is near its all-time high in terms of total assets.

Based upon the foregoing, the Trustees concluded that the benefits from the economies of scale are currently being shared equitably by Freedom Funds and the Fund. The Trustees also concluded that the

10

Table of Contents

structure of the advisory fee can be expected to cause Freedom Funds, its affiliates and the Fund to continue to share such benefits equitably and that breakpoints need not be instituted at this time.

After requesting and reviewing these and other factors that they deemed relevant, the Trustees concluded that the continuation of the Advisory Agreement was in the best interest of the Fund and its shareholders.

Freedom Funds also serves as the transfer agent, shareholder servicing agent and dividend disbursing agent for the Fund, pursuant to a Transfer Agency and Service Agreement (the “Service Agreement”).

Freedom Funds’ duties under the Service Agreement include processing purchase and redemption transactions, establishing and maintaining shareholder accounts and records, disbursing dividends declared by the Fund and all other customary services of a transfer agent, shareholder servicing agent and dividend disbursing agent. As compensation for these services, the Fund may pay Freedom Funds at a rate intended to represent Freedom Funds’ cost of providing such services. This fee would be in addition to the investment advisory fee payable to Freedom Funds under the Advisory Agreement.

11

Table of Contents

FUND EXPENSES (unaudited)

The following examples are intended to help you understand the ongoing costs (in dollars) of investing in the Fund and compare these costs with those of other mutual funds. The examples (actual and hypothetical 5% return) are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

As a shareholder of Colorado BondShares — A Tax-Exempt Fund (the “Fund’) you can incur two types of costs:

| • | Sales charges (front loads) on fund purchases and |

| • | Ongoing fund costs, including management fees, administrative services, and other fund expenses. All mutual funds have operating expenses. Operating expenses, which are deducted from the Fund’s gross income, directly reduce the investment return of the Fund. |

Actual Fund Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in shareholder reports of other funds.

Six Months Ended September 30, 2018

| Colorado BondShares — A Tax- Exempt Fund |

Beginning Account Value 04/01/18 |

Ending Account Value 09/30/18 |

Expenses Paid During Period(1) | ||||||||||||

| Based on Actual Fund Return |

$ | 1,000.00 | $ | 1,027.47 | $ | 2.85 | |||||||||

| Based on Hypothetical 5% Annual Return Before Expenses |

$ | 1,000.00 | $ | 1,022.20 | $ | 2.84 | |||||||||

| (1) | The expenses shown in this table are equal to the Fund’s annualized expense ratio of 0.56% for fiscal year ended September 30, 2018, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

Please note that expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if transactional costs were included, your costs would have been higher. You can find more information about the Fund’s expenses in the Financial Statements section of this report. For additional information on operating costs please see the Fund’s prospectus.

12

Table of Contents

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Trustees of

Colorado BondShares — A Tax-Exempt Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Colorado BondShares — A Tax-Exempt Fund (the “Fund”) as of September 30, 2018, and the related statements of operations and changes in net assets for the year then ended, and the financial highlights for the year then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Colorado BondShares — A Tax-Exempt Fund as of September 30, 2018, and the results of its operations and changes in net assets for the year then ended, and the financial highlights for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

The Fund’s management is responsible for these financial statements. Our responsibility is to express an opinion on the Fund’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Plante & Moran, PLLC

We have served as the Fund’s auditor since 2014.

Denver, Colorado

November 16, 2018

13

Table of Contents

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Trustees of

Colorado BondShares — A Tax-Exempt Fund

We have audited the accompanying statement of assets and liabilities of Colorado BondShares — A Tax-Exempt Fund (the “Fund”), including the schedule of investments, as of September 30, 2017, and the related statements of operations and changes in net assets for the year then ended, the financial highlights for each of the four years ended September 30, 2017, 2016, 2015, and 2014, and the related notes. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of September 30, 2017, by correspondence with the custodian. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Colorado BondShares — A Tax-Exempt Fund as of September 30, 2017, and the results of its operations and changes in its net assets for the year then ended, and the financial highlights for each of the four years ended September 30, 2017, 2016, 2015, and 2014, in conformity with accounting principles generally accepted in the United States of America.

EKS&H LLLP

We have served as the Fund’s auditor since 2014.

November 21, 2017

Denver, Colorado

14

Table of Contents

Colorado BondShares

A Tax-Exempt Fund

Schedule of Investments

September 30, 2018

| Colorado Municipal Bonds 42.5% | Maturity |

Coupon |

Principal |

Value |

||||||||||||||

| Colorado 100.0% | ||||||||||||||||||

| ABERDEEN METROPOLITAN DISTRICT #1 |

12/1/2035 | 7.50% | $ | 1,600,000 | $ | 476,000 | ||||||||||||

| ANTHOLOGY WEST METROPOLITAN DISTRICT #4(g) |

12/15/2037 | 6.00% | 6,440,000 | 6,263,029 | ||||||||||||||

| BANNING LEWIS RANCH METROPOLITAN DISTRICT #3 – SENIOR 2015A |

12/1/2045 | 6.13% | 1,775,000 | 1,686,090 | ||||||||||||||

| BOULDER COUNTY – BOULDER COLLEGE OF MASSAGE(a)(j) |

10/15/2031 | 0.00% | 4,315,000 | 4,315,000 | ||||||||||||||

| BRAMMING FARM METROPOLITAN DISTRICT #1(d) |

12/1/2044 | 6.00% | 2,025,000 | 2,039,661 | ||||||||||||||

| BRENNAN METROPOLITIAN DISTRICT – SENIOR 2016A |

12/1/2046 | 5.25% | 1,185,000 | 1,219,448 | ||||||||||||||

| BRENNAN METROPOLITAN DISTRICT – SUBORDINATE 2016b(g) |

12/15/2046 | 7.50% | 516,000 | 501,217 | ||||||||||||||

| BRIGHTON CROSSING METROPOLITAN DISTRICT #4 – SENIOR 2017A |

12/1/2037 | 5.00% | 525,000 | 535,411 | ||||||||||||||

| BRIGHTON CROSSING METROPOLITAN DISTRICT #4 – SUBORDINATE 2017B(g) |

12/1/2047 | 7.00% | 670,000 | 650,409 | ||||||||||||||

| CASTLE OAKS METROPOLITAN DISTRICT #3 |

12/1/2044 | 6.25% | 2,860,000 | 3,191,045 | ||||||||||||||

| CASTLE OAKS METROPOLITAN DISTRICT #3 – SERIES 2016 |

12/1/2045 | 5.50% | 2,345,000 | 2,579,453 | ||||||||||||||

| CASTLE OAKS METROPOLITAN DISTRICT #3 – SERIES 2017 |

12/1/2037 | 5.00% | 3,275,000 | 3,270,775 | ||||||||||||||

| COLLIERS HILL METROPOLITAN DISTRICT #2 – SUBORDINATE 2017B(g) |

12/15/2047 | 8.50% | 3,501,000 | 3,293,286 | ||||||||||||||

| COLORADO CENTRE METROPOLITAN DISTRICT – SERIES B(g)(i)(j) |

1/1/2032 | 0.00% | 6,490,174 | 3,407,341 | ||||||||||||||

| COLORADO CENTRE METROPOLITAN DISTRICT – SERIES 1992 P/O(e)(i) |

1/1/2027 | 0.00% | 2,016,986 | 1,606,267 | ||||||||||||||

| COLORADO CENTRE METROPOLITAN DISTRICT – SERIES 1992 I/O(f)(i)(j) |

1/1/2027 | 9.00% | 2,015,949 | 1,612,759 | ||||||||||||||

| COLORADO CROSSING METROPOLITAN DISTRICT #2 |

12/1/2047 | 7.50% | 7,391,000 | 7,268,531 | ||||||||||||||

| CECFA – PROSPECT RIDGE ACADEMY CHARTER SCHOOL |

3/15/2023 | 5.00% | 13,500,000 | 13,473,000 | ||||||||||||||

| CECFA – THOMAS MACLAREN CHARTER SCHOOL |

6/1/2024 | 5.00% | 15,350,000 | 15,133,412 | ||||||||||||||

| CECFA – APEX CMNTY CHARTER SCHOOL |

7/1/2022 | 5.25% | 11,635,000 | 11,469,550 | ||||||||||||||

| CECFA – SWALLOW ACADEMY CHARTER SCHOOL |

11/15/2027 | 5.35% | 3,515,000 | 3,514,789 | ||||||||||||||

| CECFA-NEW VISION CHARTER SCHOOL |

6/1/2025 | 5.38% | 23,135,000 | 22,992,720 | ||||||||||||||

15

Table of Contents

Colorado BondShares

A Tax-Exempt Fund

Schedule of Investments — (Continued)

| Colorado Municipal Bonds (Continued) | Maturity |

Coupon |

Principal |

Value |

||||||||||||||

| Colorado (Continued) | ||||||||||||||||||

| CECFA – GRAND PEAK ACADEMY CHARTER SCHOOL |

7/1/2025 | 5.60% | $ | 20,975,000 | $ | 20,787,484 | ||||||||||||

| CECFA – UNIVERSITY LAB CHARTER SCHOOL #6 |

12/15/2019 | 2.50% | 500,000 | 499,285 | ||||||||||||||

| CECFA – AMERICAN ACADEMY CHARTER SCHOOL |

12/1/2025 | 4.20% | 37,355,000 | 37,437,555 | ||||||||||||||

| CECFA – MONARCH MONTESSORI CHARTER SCHOOL |

5/15/2020 | 5.50% | 8,620,000 | 8,616,811 | ||||||||||||||

| CECFA – PROSPECT RIDGE ACADEMY CHARTER SCHOOL |

3/15/2023 | 4.85% | 21,330,000 | 21,111,154 | ||||||||||||||

| CECFA – AMERICAN ACADEMY CHARTER SCHOOL |

12/1/2026 | 4.05% | 27,570,000 | 26,346,995 | ||||||||||||||

| CECFA – ADDENBROOKE CLASSICAL ACADEMY CHARTER SCHOOL |

6/1/2021 | 4.50% | 18,045,000 | 17,740,942 | ||||||||||||||

| COLORADO HOUSING & FINANCE AUTHORITY(a)(j) |

12/1/2013 | 0.00% | 3,755,000 | 3,755,000 | ||||||||||||||

| CHFA – CASEY’S POND SENIOR LIVING(l) |

6/1/2032 | 0.00% | 8,110,000 | 5,431,429 | ||||||||||||||

| CHFA – CASEY’S POND SENIOR LIVING(l) |

6/1/2042 | 0.00% | 10,665,000 | 7,124,860 | ||||||||||||||

| CHFA – CASEY’S POND SENIOR LIVING(l) |

6/1/2047 | 0.00% | 8,600,000 | 5,743,338 | ||||||||||||||

| COLORADO INTERNATIONAL CENTER METROPOLITAN DISTRICT #3 |

12/1/2031 | 4.63% | 635,000 | 607,466 | ||||||||||||||

| COLORADO SPRINGS URBAN RENEWAL AUTHORITY |

12/15/2030 | 6.75% | 2,224,000 | 2,069,521 | ||||||||||||||

| CONIFER METROPOLITAN DISTRICT(a) |

12/1/2030 | 0.00% | 10,000,000 | 4,000,000 | ||||||||||||||

| CONIFER METROPOLITAN DISTRICT(a) |

12/1/2032 | 0.00% | 1,450,000 | 580,000 | ||||||||||||||

| CONIFER METROPOLITAN DISTRICT(a) |

12/1/2033 | 0.00% | 1,550,000 | 620,000 | ||||||||||||||

| COPPERLEAF METROPOLITAN DISTRICT #3 |

12/1/2037 | 5.00% | 500,000 | 499,355 | ||||||||||||||

| COUNTRY CLUB HIGHLANDS METROPOLITAN DISTRICT |

12/1/2037 | 7.25% | 1,030,000 | 875,500 | ||||||||||||||

| CUCHARES RANCH METROPOLITAN DISTRICT |

12/1/2045 | 5.00% | 2,100,000 | 2,051,049 | ||||||||||||||

| DENVER WEST PROMENADE METROPOLITAN DISTRICT |

12/1/2031 | 5.13% | 500,000 | 501,095 | ||||||||||||||

| DENVER WEST PROMENADE METROPOLITAN DISTRICT |

12/15/2046 | 6.00% | 500,000 | 448,505 | ||||||||||||||

| UNITED W & S – EAST CHERRY CREEK(c) |

11/15/2023 | 5.00% | 4,949,000 | 4,951,920 | ||||||||||||||

| ELBERT & HWY 86 COML METROPOLITAN DISTRICT |

12/1/2032 | 7.50% | 4,500,000 | 3,375,000 | ||||||||||||||

| ERIE FARM METROPOLITAN DISTRICT – SERIES 2016A |

12/1/2045 | 5.50% | 2,000,000 | 2,016,460 | ||||||||||||||

| ERIE HIGHLANDS METROPOLITAN DISTRICT #1 – SENIOR 2015A |

12/1/2045 | 5.75% | 2,620,000 | 2,643,030 | ||||||||||||||

| ERIE HIGHLANDS METROPOLITAN DISTRICT #1 – SUBORDINATE 2015B |

12/15/2045 | 7.75% | 708,000 | 697,465 | ||||||||||||||

16

Table of Contents

Colorado BondShares

A Tax-Exempt Fund

Schedule of Investments — (Continued)

| Colorado Municipal Bonds (Continued) | Maturity |

Coupon |

Principal |

Value |

||||||||||||||

| Colorado (Continued) | ||||||||||||||||||

| ERIE HIGHLANDS METROPOLITAN DISTRICT NO2, SER 2018A |

12/1/2048 | 5.25% | $ | 6,000,000 | $ | 6,015,360 | ||||||||||||

| ERIE HIGHLANDS METROPOLITAN DISTRICT NO 2, SER 2018B SUBORDINATES(g) |

12/15/2048 | 7.63% | 1,819,000 | 1,819,000 | ||||||||||||||

| FLATIRON MEADOWS METROPOLITAN DISTRICT |

12/1/2046 | 5.13% | 2,000,000 | 1,920,700 | ||||||||||||||

| FOREST TRACE METROPOLITAN DISTRICT #3 – SUBORDINATE 2016B(g) |

12/15/2046 | 7.25% | 683,000 | 625,150 | ||||||||||||||

| FORT LUPTON GOLF COURSE(a) |

12/15/2037 | 0.00% | 620,000 | 15,500 | ||||||||||||||

| FRONTERRA VLG METROPOLITAN DISTRICT #2 |

12/1/2034 | 5.00% | 3,685,000 | 3,686,099 | ||||||||||||||

| GREAT WESTERN PARK METROPOLITAN DISTRICT #2 – SENIOR 2016A |

12/1/2026 | 4.00% | 585,000 | 567,117 | ||||||||||||||

| GREAT WESTERN PARK METROPOLITAN DISTRICT #2 – SUBORDINATE 2016B |

12/15/2046 | 7.25% | 775,000 | 729,911 | ||||||||||||||

| GREEN GABLES METROPOLITAN DISTRICT #1 – SENIOR 2016A |

12/1/2046 | 5.30% | 1,250,000 | 1,248,088 | ||||||||||||||

| GREEN GABLES METROPOLITAN DISTRICT #1 – SUBORDINATE 2016B(g) |

12/15/2046 | 7.75% | 740,000 | 732,992 | ||||||||||||||

| HIGHLANDS METROPOLITAN DISTRICT #2 – SENIOR 2016A |

12/1/2046 | 5.13% | 1,960,000 | 1,975,817 | ||||||||||||||

| HIGHLANDS METROPOLITAN DISTRICT #2 – SUBORDINATE 2016B |

12/15/2046 | 7.50% | 1,269,000 | 1,251,221 | ||||||||||||||

| HYLAND VILLAGE METROPOLITAN DISTRICT |

12/1/2027 | 7.25% | 4,293,000 | 1,674,270 | ||||||||||||||

| JEFFCO BUSINESS CENTER METROPOLITAN DISTRICT #1(j) |

5/1/2020 | 8.00% | 1,006,000 | 1,006,000 | ||||||||||||||

| JEFFERSON CENTER METROPOLITAN DISTRICT #1 |

12/1/2026 | 4.75% | 2,269,000 | 2,267,344 | ||||||||||||||

| LEWIS POINTE METROPOLITAN DISTRICT – SENIOR 2015A |

12/1/2044 | 6.00% | 2,590,000 | 2,595,983 | ||||||||||||||

| LEWIS POINTE METROPOLITAN DISTRICT – JUNIOR LIEN 2017C(g) |

12/15/2047 | 9.00% | 536,000 | 329,586 | ||||||||||||||

| LEYDEN ROCK METROPOLITAN DISTRICT – SENIOR 2016A |

12/1/2025 | 4.00% | 500,000 | 506,130 | ||||||||||||||

| LEYDEN ROCK METROPOLITAN DISTRICT – SENIOR 2016A |

12/1/2033 | 4.38% | 905,000 | 900,484 | ||||||||||||||

| LEYDEN ROCK METROPOLITAN DISTRICT – SENIOR 2016A |

12/1/2045 | 5.00% | 1,525,000 | 1,551,596 | ||||||||||||||

| LEYDEN ROCK METROPOLITAN DISTRICT – SUBORDINATE 2016B(g) |

12/15/2045 | 7.25% | 1,195,000 | 1,168,304 | ||||||||||||||

17

Table of Contents

Colorado BondShares

A Tax-Exempt Fund

Schedule of Investments — (Continued)

| Colorado Municipal Bonds (Continued) | Maturity |

Coupon |

Principal |

Value |

||||||||||||||

| Colorado (Continued) | ||||||||||||||||||

| LEYDEN ROCK METROPOLITAN DISTRICT #10 – JUNIOR LIEN 2017C(g) |

12/15/2049 | 10.75% | $ | 1,025,000 | $ | 998,155 | ||||||||||||

| LITTLETON VILLAGE METROPOLITAN DISTRICT #2 |

12/1/2045 | 5.38% | 1,700,000 | 1,716,252 | ||||||||||||||

| LITTLETON VILLAGE METROPOLITAN DISTRICT NO 2, SERIES 2018B SUBORDINATES(g) |

12/15/2028 | 7.63% | 1,140,000 | 1,129,979 | ||||||||||||||

| MARIN METROPOLITAN DISTRICT(a)(j) |

12/1/2028 | 0.00% | 17,485,000 | 3,000,076 | ||||||||||||||

| MARVELLA METROPOLITAN DISTRICT – SENIOR 2016A |

12/1/2046 | 5.13% | 1,405,000 | 1,438,804 | ||||||||||||||

| MEADOWS METROPOLITAN DISTRICT #1(k) |

6/1/2029 | 8.00% | 11,580,000 | 11,709,464 | ||||||||||||||

| MEADOWS METROPOLITAN DISTRICT #2(k) |

6/1/2029 | 8.00% | 11,565,000 | 11,694,297 | ||||||||||||||

| MEADOWS METROPOLITAN DISTRICT #7(k) |

6/1/2029 | 8.00% | 11,515,000 | 11,643,738 | ||||||||||||||

| MIDCITIES METROPOLITAN DISTRICT #2 – SUBORDINATE 2016B(g) |

12/15/2046 | 7.75% | 1,945,000 | 1,905,050 | ||||||||||||||

| MOUNT CARBON METROPOLITAN DISTRICT – SERIES 2004A(g) |

6/1/2043 | 7.00% | 197,916 | 178,125 | ||||||||||||||

| MOUNT CARBON METROPOLITAN DISTRICT – SERIES 2004B(g) |

6/1/2043 | 7.00% | 1,540,000 | 1,386,000 | ||||||||||||||

| MOUNT CARBON METROPOLITAN DISTRICT – SERIES 2004C(g) |

6/1/2043 | 0.00% | 565,000 | 124,300 | ||||||||||||||

| MOUNTAIN SHADOWS METROPOLITAN DISTRICT – SUBORDINATE |

12/15/2046 | 7.50% | 1,800,000 | 1,788,804 | ||||||||||||||

| MOUNTAIN SHADOWS METROPOLITAN DISTRICT – SUBORDINATE |

12/15/2040 | 10.00% | 1,994,000 | 1,971,568 | ||||||||||||||

| MURPHY CREEK METROPOLITAN DISTRICT #3 |

12/1/2026 | 6.00% | 2,540,000 | 2,082,800 | ||||||||||||||

| MURPHY CREEK METROPOLITAN DISTRICT #3 |

12/1/2035 | 6.13% | 1,880,000 | 1,541,600 | ||||||||||||||

| NORTH PINE VISTAS METROPOLITAN DISTRICT #2 – SENIOR 2016A |

12/1/2046 | 6.75% | 6,735,000 | 6,734,192 | ||||||||||||||

| NORTH PINE VISTAS METROPOLITAN DISTRICT #2 – SUBORDINATE |

12/15/2046 | 8.50% | 1,810,000 | 1,809,620 | ||||||||||||||

| NORTH PINE VISTAS METROPOLITAN DISTRICT #3 – SENIOR 2016A |

12/1/2036 | 6.00% | 4,345,000 | 4,330,314 | ||||||||||||||

| NORTH PINE VISTAS METROPOLITAN DISTRICT #3 – SUBORDINATE |

12/15/2046 | 8.25% | 1,203,000 | 1,199,571 | ||||||||||||||

| OVERLOOK METROPOLITAN DISTRICT – SENIOR 2016A |

12/1/2046 | 5.50% | 1,500,000 | 1,421,880 | ||||||||||||||

| PALISADE METROPOLITAN DISTRICT #2 |

12/1/2031 | 4.38% | 2,650,000 | 2,545,882 | ||||||||||||||

| PALISADE PARK NORTH METROPOLITAN DISTRICT #1 – SENIOR 2016A |

12/1/2046 | 5.88% | 2,075,000 | 1,920,765 | ||||||||||||||

18

Table of Contents

Colorado BondShares

A Tax-Exempt Fund

Schedule of Investments — (Continued)

| Colorado Municipal Bonds (Continued) | Maturity |

Coupon |

Principal |

Value |

||||||||||||||

| Colorado (Continued) | ||||||||||||||||||

| PALISADE PARK NORTH METROPOLITAN DISTRICT #1 – SUBORDINATE 2016B |

12/15/2046 | 8.00% | $ | 525,000 | $ | 493,248 | ||||||||||||

| PALISADE PARK NORTH METROPOLITAN DISTRICT #2 – SENIOR 2018A |

12/1/2047 | 5.63% | 1,745,000 | 1,711,758 | ||||||||||||||

| PARKER AUTOMOTIVE METROPOLITAN DISTRICT |

12/1/2045 | 5.00% | 2,088,000 | 1,924,948 | ||||||||||||||

| PARKER AUTOMOTIVE METROPOLITAN DISTRICT SUB SERIES |

12/15/2032 | 8.00% | 3,785,000 | 3,746,393 | ||||||||||||||

| PIONEER METROPOLITAN DISTRICT #3(g) |

12/1/2046 | 6.50% | 5,236,000 | 4,766,540 | ||||||||||||||

| THE PLAZA METROPOLITAN DISTRICT #1 |

12/1/2040 | 5.00% | 5,350,000 | 5,482,894 | ||||||||||||||

| POTOMAC FARMS METROPOLITAN DISTRICT – SERIES 2007A |

12/1/2037 | 7.25% | 2,340,000 | 2,191,691 | ||||||||||||||

| POTOMAC FARMS METROPOLITAN DISTRICT – SERIES 2007B |

12/1/2023 | 7.63% | 311,000 | 295,170 | ||||||||||||||

| PROMENADE AT CASTLE ROCK METROPOLITAN DISTRICT #1 – SERIES A |

12/1/2025 | 5.13% | 1,040,000 | 1,097,522 | ||||||||||||||

| PUBLIC FINANCE AUTHORITY COLO EARLY COLLEGES CHARTER SCHOOL – SERIES 2016A |

7/1/2023 | 4.25% | 33,695,000 | 33,096,577 | ||||||||||||||

| PUBLIC FINANCE AUTHORITY WEST RIDGE ACADEMY CHARTER SCHOOL – SERIES 2017A |

12/1/2021 | 5.50% | 9,345,000 | 9,322,852 | ||||||||||||||

| RAVENNA METROPOLITAN DISTRICT CONV CABS – SUBORDINATE SERIES 2017B(d) |

12/15/2026 | 7.50% | 8,000,000 | 7,753,200 | ||||||||||||||

| RENDEZVOUS METROPOLITAN DISTRICT NO 4 – SUBORDINATE, SERIES 2018B(g) |

10/15/2048 | 8.00% | 1,189,000 | 1,136,708 | ||||||||||||||

| REX RANCH METROPOLITAN DISTRICT – SUBORDINATE 2018B(g) |

12/15/2047 | 7.88% | 445,000 | 438,561 | ||||||||||||||

| RICHARDS FARM METROPOLITAN DISTRICT #2 – SENIOR SERIES 2015A |

12/1/2045 | 5.75% | 1,400,000 | 1,321,096 | ||||||||||||||

| RIVERDALE PEAKS II METROPOLITAN DISTRICT |

12/1/2025 | 6.40% | 930,000 | 465,000 | ||||||||||||||

| RIVERDALE PEAKS II METROPOLITAN DISTRICT |

12/1/2035 | 6.50% | 1,135,000 | 567,500 | ||||||||||||||

| ROUTT CNTY LID – SERIES 2004A |

8/1/2024 | 6.50% | 273,000 | 275,402 | ||||||||||||||

| ROXBOROUGH VILLAGE METROPOLITAN DISTRICT – SERIES |

12/31/2021 | 0.00% | 169,939 | 97,800 | ||||||||||||||

| ROXBOROUGH VILLAGE METROPOLITAN DISTRICT – SERIES |

12/31/2042 | 0.00% | 242,645 | 26,691 | ||||||||||||||

| SIERRA RIDGE METROPOLITAN DISTRICT #2 – SENIOR SERIES 2016A |

12/1/2031 | 4.50% | 1,000,000 | 967,120 | ||||||||||||||

| SIERRA RIDGE METROPOLITAN DISTRICT #2 – SUBORDINATE SERIES 2016B(g) |

12/15/2046 | 7.63% | 1,500,000 | 1,449,930 | ||||||||||||||

19

Table of Contents

Colorado BondShares

A Tax-Exempt Fund

Schedule of Investments — (Continued)

| Colorado Municipal Bonds (Continued) | Maturity |

Coupon |

Principal |

Value |

||||||||||||||

| Colorado (Continued) | ||||||||||||||||||

| SILVER PEAKS METROPOLITAN DISTRICT #2 |

12/1/2036 | 5.75% | $ | 500,000 | $ | 447,095 | ||||||||||||

| SOLARIS METROPOLITIAN DISTRICT #3 – SUBORDINATE SERIES |

12/15/2046 | 7.00% | 1,000,000 | 971,070 | ||||||||||||||

| SOLITUDE METROPOLITAN DISTRICT(j) |

12/1/2026 | 7.00% | 3,520,000 | 2,464,000 | ||||||||||||||

| SORREL RANCH METROPOLITAN DISTRICT |

12/1/2036 | 5.75% | 5,977,000 | 5,304,647 | ||||||||||||||

| SOUTHGLENN METROPOLITAN DISTRICT |

12/1/2021 | 3.00% | 1,433,000 | 1,419,945 | ||||||||||||||

| SOUTHSHORE METROPOLITAN DISTRICT #2 CONV CABS(d) |

12/1/2042 | 6.50% | 7,205,000 | 7,058,162 | ||||||||||||||

| SOUTHSHORE METROPOLITAN DISTRICT #2 – SUBORDINATE SERIES |

12/15/2042 | 7.75% | 5,202,000 | 5,116,427 | ||||||||||||||

| ST VRAIN LAKES METROPOLITAN DISTRICT #2 – SENIOR SERIES 2017A |

12/1/2037 | 5.00% | 1,500,000 | 1,465,545 | ||||||||||||||

| ST VRAIN LAKES METROPOLITAN DISTRICT #2 – SUBORDINATE SERIES 2017B(g) |

12/15/2047 | 7.63% | 1,083,000 | 1,044,131 | ||||||||||||||

| STC METROPOLITAN DISTRICT #2 – SENIOR SERIES 2015A |

12/1/2038 | 6.00% | 1,000,000 | 1,021,650 | ||||||||||||||

| STC METROPOLITAN DISTRICT #2 – SUBORDINATE SERIES 2015B(g) |

12/15/2038 | 7.75% | 3,500,000 | 3,528,280 | ||||||||||||||

| STERLING RANCH COMMUNITY AUTHORITY BOARD – SENIOR SERIES 2015A |

12/1/2035 | 5.50% | 2,195,000 | 2,231,261 | ||||||||||||||

| STERLING RANCH COMMUNITY AUTHORITY BOARD – SENIOR SERIES 2015A |

12/1/2045 | 5.75% | 3,000,000 | 3,060,060 | ||||||||||||||

| STERLING RANCH COMMUNITY AUTHORITY BOARD – SUBORDINATE SERIES 2015B(g) |

12/15/2045 | 7.75% | 1,045,000 | 1,054,123 | ||||||||||||||

| STONE RIDGE METROPOLITAN DISTRICT #2 |

12/1/2031 | 0.00% | 11,896,000 | 1,903,360 | ||||||||||||||

| TABLE MOUNTAIN METROPOLITAN DISTRICT – SENIOR SERIES 2016A |

12/1/2045 | 5.25% | 1,615,000 | 1,667,181 | ||||||||||||||

| TABLE MOUNTAIN METROPOLITAN DISTRICT – SUBORDINATE SERIES 2016B(g) |

12/15/2045 | 7.75% | 570,000 | 582,466 | ||||||||||||||

| TALLYN’S REACH METROPOLITAN DISTRICT #3 |

11/1/2038 | 5.13% | 2,070,000 | 2,166,752 | ||||||||||||||

| TALLYN’S REACH METROPOLITIAN DISTRICT #3 – SUBORDINATE SERIES 2016A(g) |

11/1/2038 | 6.75% | 1,220,000 | 1,205,397 | ||||||||||||||

| UNITED WATER & SAN DISTRICT LUPTON LAKES |

3/1/2021 | 6.00% | 7,775,000 | 7,776,400 | ||||||||||||||

| UNITED WATER & SAN DISTRICT ELBERT COUNTY(g) |

12/1/2023 | 6.00% | 5,342,000 | 5,287,779 | ||||||||||||||

| VDW METROPOLITAN DISTRICT #2 – SUBORDINATE SERIES 2016B(g) |

12/15/2045 | 7.25% | 1,934,000 | 1,808,309 | ||||||||||||||

| VILLAS EASTLAKE RESERVOIR METROPOLITAN DISTRICT – SUBORDINATE SERIES 2016B(g) |

12/15/2046 | 8.00% | 355,000 | 357,510 | ||||||||||||||

20

Table of Contents

Colorado BondShares

A Tax-Exempt Fund

Schedule of Investments — (Continued)

| Colorado Municipal Bonds (Continued) | Maturity |

Coupon |

Principal |

Value |

||||||||||||||

| Colorado (Continued) | ||||||||||||||||||

| WESTOWN METROPOLITAN DISTRICT – SENIOR SERIES 2017A |

12/1/2047 | 5.00% | $ | 1,400,000 | $ | 1,351,994 | ||||||||||||

| WHISPERING PINES METROPOLITAN DISTRICT #1 – SENIOR SERIES 2017A |

12/1/2037 | 5.00% | 1,000,000 | 1,002,320 | ||||||||||||||

|

|

|

|

|

|||||||||||||||

| Colorado (amortized cost $554,446,852) |

598,353,609 | 537,812,762 | ||||||||||||||||

|

|

|

|

|

|||||||||||||||

| Colorado Municipal Bonds |

$ | 598,353,609 | $ | 537,812,762 | ||||||||||||||

|

|

|

|

|

|||||||||||||||

| Short-Term Municipal Bonds 14.3% | ||||||||||||||||||

| Multi-State 64.1% | ||||||||||||||||||

| FREDDIE MAC VR AMT TAX (LOC 6) |

5/15/2046 | 1.62% | $ | 15,350,000 | $ | 15,350,000 | ||||||||||||

| FREDDIE MAC VR AMT (LOC 6) |

6/15/2036 | 1.61% | 27,385,000 | 27,385,000 | ||||||||||||||

| FREDDIE MAC VR AMT TAX (LOC 6) |

7/15/2050 | 1.62% | 9,660,000 | 9,660,000 | ||||||||||||||

| FREDDIE MAC VR (LOC 6) |

12/15/2045 | 1.59% | 18,805,000 | 18,805,000 | ||||||||||||||

| FREDDIE MAC VR (LOC 6) |

3/15/2049 | 1.59% | 34,840,000 | 34,840,000 | ||||||||||||||

| SUNAMERICA TRUST CLASS A – SERIES 2001-2 AMT TAX (LOC 6) |

7/1/2041 | 1.62% | 10,200,000 | 10,200,000 | ||||||||||||||

|

|

|

|

|

|||||||||||||||

| Multi-State (amortized cost $116,240,000) |

116,240,000 | 116,240,000 | ||||||||||||||||

|

|

|

|

|

|||||||||||||||

| Colorado 35.9% | ||||||||||||||||||

| BROOMFIELD URBAN RENEWAL AUTHORITY (LOC 1) |

12/1/2030 | 1.61% | 9,745,000 | 9,745,000 | ||||||||||||||

| CECFA – ABILITIES CONNECTION CHARTER SCHOOL |

4/1/2019 | 5.85% | 30,825,000 | 30,833,939 | ||||||||||||||

| COLORADO HOUSING & FINANCE AUTHORITY (LOC 2) |

10/1/2038 | 1.60% | 2,975,000 | 2,975,000 | ||||||||||||||

| COLORADO HOUSING & FINANCE AUTHORITY (LOC 2) |

11/1/2034 | 1.60% | 865,000 | 865,000 | ||||||||||||||

| COLORADO HOUSING & FINANCE AUTHORITY (LOC 4) |

11/1/2036 | 1.56% | 10,140,000 | 10,140,000 | ||||||||||||||

| COLORADO HOUSING & FINANCE AUTHORITY – SERIES 2007A (LOC 3) |

1/1/2032 | 1.63% | 2,700,000 | 2,700,000 | ||||||||||||||

| COLORADO SPRINGS UTILITIES (LOC 3) |

11/1/2041 | 1.55% | 1,300,000 | 1,300,000 | ||||||||||||||

| LAFAYETTE CITY CTR GENERAL IMPROVEMENT DISTRICT |

12/1/2018 | 5.75% | 70,000 | 70,265 | ||||||||||||||

21

Table of Contents

Colorado BondShares

A Tax-Exempt Fund

Schedule of Investments — (Continued)

| Short-Term Municipal Bonds (Continued) | Maturity |

Coupon |

Principal |

Value |

||||||||||||||

| Colorado (Continued) | ||||||||||||||||||

| SHERIDAN REDEVLOPMENT AGENCY – SERIES 2011A-1 (LOC 5) |

12/1/2029 | 1.65% | $ | 6,400,000 | $ | 6,400,000 | ||||||||||||

|

|

|

|

|

|||||||||||||||

| Colorado (amortized cost $65,012,672) |

65,020,000 | 65,029,204 | ||||||||||||||||

|

|

|

|

|

|||||||||||||||

| Short-Term Municipal Bonds |

$ | 181,260,000 | $ | 181,269,204 | ||||||||||||||

|

|

|

|

|

|||||||||||||||

| Other Municipal Bonds 7.3% | ||||||||||||||||||

| South Dakota 61.4% | ||||||||||||||||||

| FLANDREAU SANTEE SIOUX TRIBE |

1/1/2036 | 5.75% | $ | 6,055,000 | $ | 5,419,831 | ||||||||||||

| FLANDREAU SANTEE SIOUX TRIBE |

1/1/2026 | 5.00% | 4,125,000 | 3,843,428 | ||||||||||||||

| FLANDREAU SANTEE SIOUX TRIBE |

1/1/2031 | 5.50% | 3,565,000 | 3,224,614 | ||||||||||||||

| FLANDREAU SANTEE SIOUX TRIBE TE SERIES 2018B |

1/1/2038 | 6.00% | 6,120,000 | 6,023,304 | ||||||||||||||

| FLANDREAU SANTEE SIOUX TRIBE TE SERIES 2018C |

1/1/2038 | 6.00% | 5,450,000 | 5,363,890 | ||||||||||||||

| FLANDREAU SANTEE SIOUX TRIBE TAXABLE SERIES 2018A |

1/1/2023 | 8.28% | 875,000 | 870,030 | ||||||||||||||

| FLANDREAU SANTEE SIOUX TRIBE TAXABLE SERIES 2018A |

1/1/2024 | 8.28% | 950,000 | 943,198 | ||||||||||||||

| FLANDREAU SANTEE SIOUX TRIBE TAXABLE SERIES 2018A |

1/1/2025 | 8.28% | 1,030,000 | 1,022,543 | ||||||||||||||

| FLANDREAU SANTEE SIOUX TRIBE TAXABLE SERIES 2018A |

1/1/2026 | 8.28% | 1,115,000 | 1,105,991 | ||||||||||||||

| FLANDREAU SANTEE SIOUX TRIBE TAXABLE SERIES 2018A |

1/1/2027 | 8.28% | 1,205,000 | 1,195,035 | ||||||||||||||

| FLANDREAU SANTEE SIOUX TRIBE TAXABLE SERIES 2018A |

1/1/2028 | 8.28% | 1,305,000 | 1,291,689 | ||||||||||||||

| FLANDREAU SANTEE SIOUX TRIBE TAXABLE SERIES 2018A |

1/1/2033 | 8.28% | 8,670,000 | 8,545,672 | ||||||||||||||

| LOWER BRULE SIOUX TRIBE |

3/1/2025 | 5.88% | 1,345,000 | 1,309,613 | ||||||||||||||

| OGLALA SIOUX TRIBE OF PINE RIDGE |

10/1/2022 | 5.00% | 1,560,000 | 1,553,885 | ||||||||||||||

| OGLALA SIOUX TRIBE, SERIES 2018 |

7/1/2028 | 5.50% | 4,000,000 | 3,943,360 | ||||||||||||||

| OGLALA SIOUX TRIBE, SERIES 2018 |

7/1/2037 | 6.00% | 9,270,000 | 9,085,249 | ||||||||||||||

| OGLALA SIOUX TRIBE OF PINE RIDGE |

10/1/2024 | 5.50% | 1,985,000 | 1,989,367 | ||||||||||||||

|

|

|

|

|

|||||||||||||||

| South Dakota (amortized cost $58,604,970) |

58,625,000 | 56,730,697 | ||||||||||||||||

|

|

|

|

|

|||||||||||||||

22

Table of Contents

Colorado BondShares

A Tax-Exempt Fund

Schedule of Investments — (Continued)

| Other Municipal Bonds (Continued) | Maturity |

Coupon |

Principal |

Value |

||||||||||||||

| Puerto Rico 10.6% | ||||||||||||||||||

| COMMONWEALTH OF PUERTO RICO(a) |

7/1/2035 | 8.00% | $ | 2,500,000 | $ | 1,446,875 | ||||||||||||

| PUERTO RICO SALES TAX FINANCING CORP(d) |

8/1/2045 | 0.00% | 7,100,000 | 1,790,904 | ||||||||||||||

| PUERTO RICO SALES TAX FINANCING CORP(d) |

8/1/2038 | 0.00% | 20,000,000 | 4,442,600 | ||||||||||||||

| PUERTO RICO SALES TAX FINANCING CORP(d) |

8/1/2039 | 0.00% | 10,000,000 | 2,080,100 | ||||||||||||||

|

|

|

|

|

|||||||||||||||

| Puerto Rico (amortized cost $9,408,000) |

39,600,000 | 9,760,479 | ||||||||||||||||

|

|

|

|

|

|||||||||||||||

| South Carolina 6.1% | ||||||||||||||||||

| GREEN MIDLANDS CHARTER SCHOOL – SENIOR SERIES 2016A |

12/1/2021 | 5.25% | 5,655,000 | 5,654,152 | ||||||||||||||

|

|

|

|

|

|||||||||||||||

| South Carolina (amortized cost $5,655,000) |

5,655,000 | 5,654,152 | ||||||||||||||||

|

|

|

|

|

|||||||||||||||

| Oregon 6.0% | ||||||||||||||||||

| MULTNOMAH CITY HOSPITAL FACILITY ODD FELLOWS |

9/15/2020 | 5.45% | 6,085,000 | 5,502,361 | ||||||||||||||

|

|

|

|

|

|||||||||||||||

| Oregon (amortized cost $6,085,000) |

6,085,000 | 5,502,361 | ||||||||||||||||

|

|

|

|

|

|||||||||||||||

| Arizona 5.4% | ||||||||||||||||||

| HERITAGE ACADEMY CHARTER SCHOOL MARICOPA COUNTY |

7/1/2027 | 5.25% | 5,000,000 | 4,951,250 | ||||||||||||||

|

|

|

|

|

|||||||||||||||

| Arizona (amortized cost $5,000,000) |

5,000,000 | 4,951,250 | ||||||||||||||||

|

|

|

|

|

|||||||||||||||

| Multi-State 5.3% | ||||||||||||||||||

| FREDDIE MAC(g)(j) |

1/1/2037 | 9.75% | 4,904,915 | 4,904,915 | ||||||||||||||

|

|

|

|

|

|||||||||||||||

| Multi-State (amortized cost $4,904,915) |

4,904,915 | 4,904,915 | ||||||||||||||||

|

|

|

|

|

|||||||||||||||

| Washington 3.3% | ||||||||||||||||||

| TACOMA CONSOLIDATED LID |

4/1/2043 | 5.75% | 3,055,000 | 3,057,108 | ||||||||||||||

|

|

|

|

|

|||||||||||||||

| Washington (amortized cost $2,895,900) |

3,055,000 | 3,057,108 | ||||||||||||||||

|

|

|

|

|

|||||||||||||||

| Missouri 1.5% | ||||||||||||||||||

| KANSAS CITY INDL DEV AUTH |

1/1/2028 | 6.75% | 508,000 | 509,600 | ||||||||||||||

| ST LOUIS INDL DEV AUTH SR HSG – SENIOR SERIES 2005A |

5/1/2027 | 6.75% | 884,000 | 836,087 | ||||||||||||||

|

|

|

|

|

|||||||||||||||

| Missouri (amortized cost $1,392,000) |

1,392,000 | 1,345,687 | ||||||||||||||||

|

|

|

|

|

|||||||||||||||

| Oklahoma 0.5% | ||||||||||||||||||

| HASKELL CNTY PUBLIC FAC. |

4/1/2024 | 5.25% | 450,000 | 457,727 | ||||||||||||||

|

|

|

|

|

|||||||||||||||

| Oklahoma (amortized cost $450,000) |

450,000 | 457,727 | ||||||||||||||||

|

|

|

|

|

|||||||||||||||

| Other Municipal Bonds |

$ | 124,766,915 | $ | 92,364,376 | ||||||||||||||

|

|

|

|

|

|||||||||||||||

23

Table of Contents

Colorado BondShares

A Tax-Exempt Fund

Schedule of Investments — (Continued)

| Colorado Capital Appreciation and Zero Coupon Bonds 4.8% | Maturity |

Coupon |

Principal |

Value |

||||||||||||||||

| Colorado 100.0% | ||||||||||||||||||||

| COLORADO HEALTH FACILITIES AUTHORITY(b)(d) |

|

7/15/2020 | 0.00% | $ | 520,000 | $ | 499,543 | |||||||||||||

| CONIFER METROPOLITAN DISTRICT(a)(d)(j) |

|

12/1/2031 | 0.00% | 7,470,000 | 3,352,312 | |||||||||||||||

| FLYINGHORSE METROPOLITAN DISTRICT #2(d) |

|

12/15/2042 | 8.00% | 15,725,000 | 13,719,748 | |||||||||||||||

| PV WATER & SAN METROPOLITAN DISTRICT(a)(d) |

|

12/15/2037 | 0.00% | 14,000,000 | 2,940,000 | |||||||||||||||

| RAVENNA METROPOLITAN DISTRICT CONV CABS – SERIES 2017A(d) |

|

12/1/2046 | 0.00% | 33,685,000 | 32,036,456 | |||||||||||||||

| RAVENNA METROPOLITAN DISTRICT CONV CABS – SERIES 2017 SUPPLEMENTAL B(d) |

|

12/1/2021 | 0.00% | 15,000 | 12,771 | |||||||||||||||

| RAVENNA METROPOLITAN DISTRICT CONV CABS – SERIES 2017 SUPPLEMENTAL B(d) |

|

12/1/2022 | 0.00% | 170,000 | 137,450 | |||||||||||||||

| RAVENNA METROPOLITAN DISTRICT CONV CABS – SERIES 2017 SUPPLEMENTAL B(d) |

|

12/1/2023 | 0.00% | 325,000 | 249,948 | |||||||||||||||

| RAVENNA METROPOLITAN DISTRICT CONV CABS – SERIES 2017 SUPPLEMENTAL B(d) |

|

12/1/2024 | 0.00% | 490,000 | 357,514 | |||||||||||||||

| RAVENNA METROPOLITAN DISTRICT CONV CABS – SERIES 2017 SUPPLEMENTAL B(d) |

|

12/1/2025 | 0.00% | 585,000 | 404,136 | |||||||||||||||

| STERLING RANCH METROPOLITAN DISTRICT #2 CONV CAB(d) |

|

12/1/2045 | 0.00% | 6,685,000 | 5,437,044 | |||||||||||||||

| WILDWING METROPOLITAN DISTRICT #1(d) |

|

12/1/2023 | 0.00% | 2,150,000 | 1,470,342 | |||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Colorado (amortized cost $71,665,781) |

|

81,820,000 | 60,617,264 | |||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Colorado Capital Appreciation and Zero Coupon Bonds |

|

$ | 81,820,000 | $ | 60,617,264 | |||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Colorado Taxable Certificates/Notes/Bonds 0.5% | ||||||||||||||||||||

| Colorado 100.0% | ||||||||||||||||||||

| PUBLIC FINANCE AUTHORITY COLO EARLY COLLEGES CHARTER SCHOOL – SERIES 2016B TAX |

|

7/1/2023 | 5.75% | 6,970,000 | 6,787,804 | |||||||||||||||

| TABERNASH POLE CREEK NOTE(a)(j) |

|

12/31/2018 | 0.00% | 227,347 | 127,601 | |||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Colorado (amortized cost $7,197,347) |

|

7,197,347 | 6,915,405 | |||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Colorado Taxable Certificates/Notes/Bonds |

|

$ | 7,197,347 | $ | 6,915,405 | |||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Total investments, at value |

69.4 | % | $ | 878,979,011 | ||||||||||||||||

| Other assets net of liabilities |

30.6 | % | 386,979,007 | |||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Net Assets |

100.0 | % | $ | 1,265,958,018 | ||||||||||||||||

|

|

|

|

|

|||||||||||||||||

24

Table of Contents

Colorado BondShares

A Tax-Exempt Fund

Schedule of Investments — (Continued)

| (a) | Defaulted or non-income producing based upon the financial condition of the issuer (see note 2 in notes to financial statements). |

| (b) | Originally issued as general obligation bonds but are now pre-refunded and are secured by an escrow fund consisting entirely of direct U.S. Government obligations. |

| (c) | Represents securities whose blended characteristics are reflective of a zero coupon bond and a step rate bond. Interest rate shown represents effective yield at acquisition. |

| (d) | Interest rate shown for capital appreciation and zero coupon bonds represents the effective yield at the date of acquisition. |

| (e) | Principal-only certificate represents the right to receive the principal payments on the underlying debt security upon maturity. The price of this security is typically more volatile than that of coupon-bearing bonds of the same maturity. |

| (f) | Interest-only certificate represents the right to receive semi-annual interest payments on the underlying debt security. The principal amount of the underlying security represents the notional amount on which current interest is calculated. The interest rate shown represents the effective yield at the date of acquisition. |

| (g) | Interest rate disclosed for cash flow bond represents the effective yield at September 30, 2018. Income on this security is derived from the cash flow of the issuer. |

| (h) | Represents current interest rate for a step rate bond. No step rate bonds were owned by the Fund at September 30, 2018. |

| (i) | Terms of security have been restructured since the original issuance. The total face amount of all such restructured securities approximates $10,935,693 and a value of $6,750,859 or less than 1.0% of net assets, as of September 30, 2018. |

| (j) | Securities valued at fair value (see note 2 in notes to financial statements). |

| (k) | See note 7 in notes to financial statements for further information on purchase accrued interest related to these bonds. |

| (l) | The Fund has entered into a forbearance agreement under which it agrees that the issuer may pay a reduced rate of interest in lieu of the contract rate for a period of time (see note 2 in notes to financial statements). |

| (m) | Tax lien receipt certificates. |

See accompanying notes to financial statements.

25

Table of Contents

Colorado BondShares

A Tax-Exempt Fund

Schedule of Investments — (Continued)

| (LOC) | These securities are Variable Rate Demand Obligations (“VRDO”) with scheduled principal and interest payments that have a guaranteed liquidity provider in the form of a letter of credit. These obligations bear interest at a rate that resets daily or weekly (see note 2 in notes to financial statements). The numbered list below corresponds to the liquidity provider associated with the respective LOC. |

1. BNP Paribas

2. FHLB Topeka

3. US Bank, N. A.

4. Royal Bank of Canada

5. JPMorgan Chase Bank, N.A.

6. Freddie Mac