UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05009

COLORADO BONDSHARES — A TAX-EXEMPT FUND

(Exact name of registrant as specified in its charter)

1200 17TH STREET, SUITE 850

DENVER, COLORADO 80202-5808

(Address of principal executive offices) (Zip code)

FRED R. KELLY, JR.

1200 17TH STREET, SUITE 850

DENVER, COLORADO 80202-5808

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-572-6990

Date of fiscal year end: 09/30

Date of reporting period: 03/31/2014

| ITEM 1. REPORT TO STOCKHOLDERS |

| ITEM 2. CODE OF ETHICS |

| ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT |

| ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES |

| ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS |

| ITEM 6. INVESTMENTS |

| ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES |

| ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES |

| ITEM 9. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS |

| ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

| ITEM 11. CONTROLS AND PROCEDURES |

| ITEM 12. EXHIBITS |

(a)(2)(i)

(99.302) Interim President’s (Principal Executive Officer) Section 302 Certification

(a)(2)(ii)

(99.302) Interim Treasurer’s (Principal Financial Officer) Section 302 Certification

(b)

(99.906) Combined Interim President & Treasurer (Principal Executive Officer and Principal Financial Officer) Section 906 Certification

ITEM 1. REPORT TO STOCKHOLDERS.

May 27, 2014

Dear Shareholders:

As I gaze out the window of my office, I see seven cranes operating in Downtown Denver. When was the last time I could say that; 2005, 2006? Union Station held an open house recently after a three year $1 billion renovation signaling yet another boon to the downtown area. Office lease rates in the area are believed to have reached about $45 per foot for the best space. A common complaint among realtors today is that there are not enough “for sale” homes to satisfy so many eager buyers. This is after years of citing too much inventory and too few sales. The stock market is at all-time highs and yet there is said to be nearly two trillion dollars of liquidity on the sidelines. Conditions look quite positive in Colorado, from my vantage point. Still, it feels a little like past peaks.

After six years of recovery, should one now be worrying about and preparing for the next economic downturn? Or was the last cataclysm so severe and the recovery so anemic, to date, that the economy can be abnormally prolonged before reaching unsustainable levels? The indicators are at odds and even have the pros confused.

When I wrote my last shareholder letter for the September 2013 year end there was almost universal agreement that interest rates were rising and would continue to do so. It was said to be the end of the thirty year run in bonds. Instead, contrary to those expectations, the 10-year treasury peaked at 3.04% and is now down in the 2.50% vicinity, as of the writing of this report. If the economy has, indeed, run its course and it is time again for recession then rates will not be going up substantially any time soon. If on the other hand, the recovery still has some legs then the prosperity that ensues from additional building may more than offset the potential downdraft in bond prices caused by higher rates. Is it possible that we as bondholders could be so fortunate as to have our cake and eat it too? I think it is possible, at least in the short run. By mere passage of time, each day that goes by gets us closer to the return of our money at maturity. In a portfolio such as we have with a short average maturity of 6 years and an average price of 94.632, this is particularly important. Having our bonds called early only hastens that eventuality. In the interim, we are being paid a fairly handsome dividend rate of 4.46% (at NAV), to watch and see what happens. The view from here is pretty good.

For a more detailed review of the fund’s performance over the last six months please read the following pages which show among other things that we are unavoidably spending too much on litigation. We are being asked to defend municipal bond law in our state and this is something that we must do. Footnote 8 specifically outlines the current status of the pending matters. Thank you so very much for your patronage. It has been a pleasure to serve you.

Sincerely,

Fred R. Kelly, Jr.

Portfolio Manager

Colorado BondShares

FUND EXPENSES (unaudited)

The following examples are intended to help you understand the ongoing costs (in dollars) of investing in the Fund and compare these costs with those of other mutual funds. The examples (actual and hypothetical 5% return) are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

As a shareholder of Colorado BondShares — A Tax-Exempt Fund (the “Fund’) you can incur two types of costs:

| • | Sales charges (front loads) on fund purchases and |

| • | Ongoing fund costs, including management fees, administrative services, and other fund expenses. All mutual funds have operating expenses. Operating expenses, which are deducted from the Fund’s gross income, directly reduce the investment return of the Fund. |

Actual Fund Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in shareholder reports of other funds.

Six Months Ended March 31, 2014

| Colorado BondShares — A Tax-Exempt Fund |

Beginning

Account Value 10/01/13 |

Ending

Account Value 03/31/14 |

Expenses

Paid During Period(1) | ||||||||||||

| Based on Actual Fund Return |

$ | 1,000.00 | $ | 1,029.20 | $ | 3.13 | |||||||||

| Based on Hypothetical 5% Annual Return Before Expenses |

$ | 1,000.00 | $ | 1,021.90 | $ | 3.12 | |||||||||

| (1) | The expenses shown in this table are equal to the Fund’s annualized expense ratio of 0.62% for the period ended March 31, 2014, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. |

Please note that expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if transactional costs were included, your costs would have been higher. You can find more information about the Fund’s expenses in the Financial Statements section of this report. For additional information on operating costs please see the Fund’s prospectus.

1

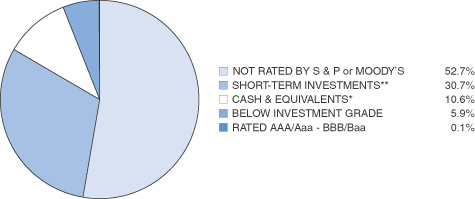

CREDIT QUALITY (unaudited)

Colorado BondShares — A Tax-Exempt Fund

Based on a Percentage of Total Net Assets as of March 31, 2014

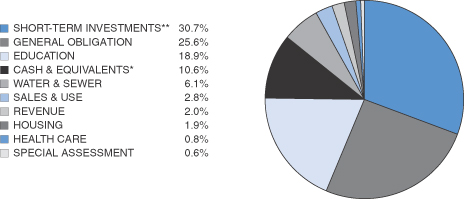

SECTOR BREAKDOWN (unaudited)

Colorado BondShares — A Tax-Exempt Fund

Based on a Percentage of Total Net Assets as of March 31, 2014

* Cash & equivalents include cash, receivables less liabilities.

** Short-term investments include securities with a maturity date or redemption feature of one year or less, as identified in the Schedule of Investments.

2

Colorado BondShares

A Tax-Exempt Fund

Schedule of Investments

March 31, 2014 (unaudited)

| Face Amount |

Value |

|||||||||

| Colorado Municipal Bonds — 50.7% | ||||||||||

| 1,600,000 | Aberdeen Metropolitan District No. 1 G.O. (LTD Tax Convertible to Unlimited Tax) Series 2005, 7.50% to yield 8.00% due 12/1/2035 |

$ | 1,524,320 | |||||||

| 745,000 | Adonea Metropolitan District No. 2 LTD Tax (Convertible to Unlimited Tax) G.O. Series 2005A, 6.125% to yield 6.25% due 12/1/2025 |

474,476 | ||||||||

| 2,000,000 | Arista Metropolitan District Special Revenue Series 2005, 6.75% due 12/1/2035 |

1,793,260 | ||||||||

| 6,000,000 | Arista Metropolitan District Subordinate (Convertible to Parity) Special Revenue Series 2008, 9.25% to yield 8.125% – 11.73% due 12/1/2037 |

3,182,100 | ||||||||

| 1,000,000 | Beacon Pointe Metropolitan District LTD Tax (Convertible to Unlimited Tax) G.O. Series 2005A, 6.125% to yield 6.25% due 12/1/2025 |

999,480 | ||||||||

| 4,315,000 | Boulder County Development Revenue (Boulder College of Massage Therapy Project) Series 2006A, 6.35% due 10/15/2031(a)(j) |

4,315,000 | ||||||||

| 2,162,000 | Bradburn Metropolitan District No. 2 G.O. (LTD Tax Convertible to Unlimited Tax) Series 2004, 8.00% due 12/15/2034 |

2,159,643 | ||||||||

| 2,025,000 | Bradburn Metropolitan District No. 3 G.O. LTD Tax Series 2010, 7.50% due 12/1/2039 |

2,039,114 | ||||||||

| 8,000,000 | Brighton Crossing Metropolitan District No. 4 G.O. (LTD Tax Convertible to Unlimited Tax) Refunding Series 2013, 7.00% 12/1/2023 |

8,045,600 | ||||||||

| 11,175,000 | Bromley Park Metropolitan District No. 2 G.O. LTD Tax Convertible Zero Coupon Series 2007B, 7.00% due 12/15/2037 |

11,178,800 | ||||||||

| 1,426,000 | Buffalo Run Mesa Metropolitan District LTD Tax G.O. Series 2004, 5.00% to yield 5.793% – 5.832% due 12/1/2034(j) |

1,283,400 | ||||||||

| 437,363 | Buffalo Run Mesa Metropolitan District LTD Tax G.O. Series 2006, 5.00% to yield 5.763% due 12/1/2037(j) |

393,626 | ||||||||

| 500,000 | Castle Oaks Metropolitan District G.O. LTD Tax Series 2005, 6.00% due 12/1/2025(b) |

544,425 | ||||||||

| 8,010,000 | Castle Oaks Metropolitan District G.O. LTD Tax Refunding and Improvement Series 2012, 5.50% due 12/1/2022 |

7,689,440 | ||||||||

| 6,500,000 | Cimarron Metropolitan District LTD Tax (Convertible to Unlimited Tax) Revenue Series 2012, 6.00% due 12/1/2022 |

6,257,420 | ||||||||

| 6,465,662 | Colorado Centre Metropolitan District LTD Tax and Special Revenue Series 1992B, 0.00% due 1/1/2032(g)(i)(j) |

3,394,473 | ||||||||

| 2,009,520 | Colorado Centre Metropolitan District LTD Tax and Special Revenue Series 1992A, principal only, due 1/1/2027(e)(i)(j) |

1,607,616 | ||||||||

| 2,008,335 | Colorado Centre Metropolitan District LTD Tax and Special Revenue Series 1992A, interest only, 9.00% due 1/1/2027(f)(i)(j) |

1,606,668 | ||||||||

| 1,630,000 | Colorado Educational and Cultural Facilities Authority Charter School Revenue (Brighton Charter School Project) Series 2006, 6.00% due 11/1/2036 |

1,294,513 | ||||||||

| 3,635,000 | Colorado Educational and Cultural Facilities Authority Charter School Revenue (Carbon Valley Academy Project) A Charter School Created by St. Vrain Valley RE-1J Series 2006, 5.625% to yield 7.394% – 8.022% due 12/1/2036 |

2,803,021 | ||||||||

3

Colorado BondShares

A Tax-Exempt Fund

Schedule of Investments (unaudited) — (Continued)

| Face Amount |

Value |

|||||||||

| Colorado Municipal Bonds — (Continued) | ||||||||||

| 5,410,000 | Colorado Educational and Cultural Facilities Authority Student Housing Revenue (Inn at Auraria LLC Project) Series 2005A, 5.875% due 7/1/2023(j)(l) |

$ | 5,410,000 | |||||||

| 1,335,000 | Colorado Educational and Cultural Facilities Authority Charter School Revenue (Knowledge Quest Academy Project) A Charter School Created by Weld County School District No. RE-5J, Series 2005 , 6.50% to yield 8.00% due 5/1/2036 |

1,147,219 | ||||||||

| 785,000 | Colorado Educational and Cultural Facilities Authority Charter School Revenue Refunding and Improvement (Elbert County Charter School Project) Series 2004, 7.375% to yield 7.45% due 3/1/2035 |

687,527 | ||||||||

| 5,385,000 | Colorado Educational and Cultural Facilities Authority Charter School Revenue (Liberty Common Middle High School Project) A Charter School Chartered Through Poudre School District R-1 Series 2011, 5.50% due 12/15/2015 |

5,386,777 | ||||||||

| 7,160,000 | Colorado Educational and Cultural Facilities Authority (Union Colony Elementary School Project) A Charter School Chartered Through Weld County School District 6 Charter School Revenue Series 2012A, 5.65% due 3/1/2016 |

7,159,642 | ||||||||

| 15,795,000 | Colorado Educational and Cultural Facilities Authority (Jefferson Academy Project) A Charter School Chartered Through Jefferson County School District No. R-1 Charter School Revenue Refunding and Improvement Series 2012, 5.65% due 6/15/2017 |

15,806,372 | ||||||||

| 9,835,000 | Colorado Educational and Cultural Facilities Authority (STEM School Project) A Charter School Chartered Through Douglas County School District Re. 1 Charter School Revenue Series 2012A, 5.70% due 6/15/2017 |

9,834,508 | ||||||||

| 25,650,000 | Colorado Educational and Cultural Facilities Authority (Skyview Academy Project) A Charter School Chartered Through Douglas County School District No. Re 1 Charter School Revenue Series 2012, 5.60% due 7/1/2017 |

25,648,974 | ||||||||

| 8,530,000 | Colorado Educational and Cultural Facilities Authority (Westgate Community School Project) A Charter School Chartered Through Adams 12 Five Star Schools Charter School Revenue Series 2012A, 5.75% due 7/1/2017 |

8,528,465 | ||||||||

| 10,980,000 | Colorado Educational and Cultural Facilities Authority Charter School Revenue (University Lab School Project) A Charter School Chartered Through Weld County School District No. 6 Series 2012, 5.40% due 12/15/2017 |

10,994,823 | ||||||||

| 20,000,000 | Colorado Educational and Cultural Facilities Authority Charter School Revenue (American Academy Parker Facilities Project) A Charter School Created by Douglas County School District Re. 1 Series 2012, 5.70% due 12/15/2017 |

19,958,600 | ||||||||

| 3,780,000 | Colorado Educational and Cultural Facilities Authority (STEM School Expansion Project) A Charter School Chartered Through Douglas County School District RE 1 Charter School Revenue Series 2013A, 5.80% due 6/15/2018 |

3,802,756 | ||||||||

| 13,275,000 | Colorado Educational and Cultural Facilities Authority Charter School Revenue, Series 2013 (Prospect Ridge Academy Project) A Charter School Authorized Through Adams 12 Five Star Schools, 5.80% due 8/15/2018 |

13,329,427 | ||||||||

| 32,365,000 | Colorado Educational and Cultural Facilities Authority (Ability Connection Colorado Project) Refunding and Improvement Revenue Series 2014, 5.85% due 4/01/2019 |

32,365,000 | ||||||||

4

Colorado BondShares

A Tax-Exempt Fund

Schedule of Investments (unaudited) — (Continued)

| Face Amount |

Value |

|||||||||

| Colorado Municipal Bonds — (Continued) | ||||||||||

| 3,755,000 | Colorado Housing and Finance Authority Economic Development Revenue (Micro Business Development Corporation Project) Series 2005, 6.75% due 12/1/2010(a)(j) |

$ | 1,938,331 | |||||||

| 22,360,000 | Colorado Springs Urban Renewal Authority Tax Increment Revenue (University Village Project) Series 2008A Senior, 7.00% to yield 7.00% – 9.00% due 12/1/2029 |

14,482,572 | ||||||||

| 7,435,000 | Colorado Springs Urban Renewal Authority Tax Increment Revenue (University Village Project) Series 2008B Subordinate (Convertible to Senior), 7.50% due 12/15/2029(j) |

5,022,045 | ||||||||

| 1,545,000 | Confluence Metropolitan District (in the town of Avon) Tax Supported Revenue Series 2007, 5.25% to yield 6.929% due 12/1/2017 |

1,478,859 | ||||||||

| 1,030,000 | Country Club Highlands Metropolitan District G.O. Limited Tax Series 2007, 7.25% due 12/1/2037 |

399,990 | ||||||||

| 220,000 | Denver Convention Center Hotel Authority Convention Center Hotel Senior Revenue Refunding Series 2006, 4.50% to yield 4.25% – 8.481% due 12/1/2022 |

225,049 | ||||||||

| 1,865,000 | Denver (City and County of) Subordinate Multifamily Housing Revenue (Capitol Heights Apartments) Series 1999C, 8.00% due 5/1/2032(j) |

1,865,000 | ||||||||

| 450,000 | Denver (City and County of) Single Family Home Mortgage Revenue (Metro Mayors Caucus Single Family Mortgage Bond Program) Series 2001A, 6.30% to yield 5.80% due 11/1/2032 |

476,829 | ||||||||

| 510,000 | Denver West Promenade Metropolitan District Limited Tax (Convertible to Unlimited Tax) G.O. Series 2013, 5.125% due 12/01/2031 |

467,471 | ||||||||

| 7,065,000 | East Cherry Creek Valley Water and Sanitation District Water Activity Enterprise, Inc. Step Rate Water Revenue Series 2004, 6.00% due 11/15/2023(c) |

7,052,424 | ||||||||

| 4,500,000 | Elbert and Highway 86 Commercial Metropolitan District Public Improvement Fee Revenue Series 2008A, 7.50% due 12/1/2032 |

2,001,600 | ||||||||

| 620,000 | Fort Lupton Golf Course Revenue Anticipation Warrants Senior Series 1996A, 8.50% due 12/15/2015(a) |

3,094 | ||||||||

| 3,830,000 | Fronterra Village Metropolitan District No. 2 G.O. (LTD Tax Convertible to Unlimited Tax) Refunding & Improvement Series 2007, 4.375% – 5.00% to yield 4.552% –7.135% due 12/1/2017-2034 |

3,637,580 | ||||||||

| 2,000,000 | Granby Ranch Metropolitan District LTD Tax G.O. Series 2006, 6.75% due 12/1/2036 |

2,002,860 | ||||||||

| 1,000,000 | High Plains Metropolitan District LTD Tax (Convertible to Unlimited Tax) G.O. Series 2005A, 6.125% to yield 6.25% due 12/1/2025 |

553,280 | ||||||||

| 4,293,000 | Hyland Village Metropolitan District LTD Tax G.O. Variable Rate Bonds Series 2008, 6.25% to yield 26.393% due 12/1/2027 |

1,129,274 | ||||||||

| 1,006,000 | Jeffco Business Center Metropolitan District No. 1 LTD Tax G.O. Series 2000, 8.00% to yield 20.907% due 5/1/2020(j) |

1,006,000 | ||||||||

| 360,000 | Lafayette City Center GID LTD Tax G.O. Series 1999, 5.75% to yield 7.60% due 12/1/2018 |

343,130 | ||||||||

| 4,215,000 | Madre Metropolitan District No. 2 G.O. (LTD Tax Convertible to Unlimited Tax) Series 2007A, 5.375% to yield 5.375% – 7.534% due 12/1/2026 |

3,334,107 | ||||||||

5

Colorado BondShares

A Tax-Exempt Fund

Schedule of Investments (unaudited) — (Continued)

| Face Amount |

Value |

|||||||||

| Colorado Municipal Bonds — (Continued) | ||||||||||

| 2,500,000 | Madre Metropolitan District No. 2 G.O. (LTD Tax Convertible to Unlimited Tax) Series 2007A, 5.50% to yield 6.95% – 9.654% due 12/1/2036 |

$ | 1,767,750 | |||||||

| 17,485,000 | Marin Metropolitan District LTD Tax G.O. Series 2008, 7.75% due 12/1/2028 |

17,286,545 | ||||||||

| 11,580,000 | Meadows Metropolitan District No. 1 G.O. LTD Tax Series 1989 A (reissued on 12/29/1993), 7.999% due 6/1/2029(k) |

11,251,244 | ||||||||

| 11,565,000 | Meadows Metropolitan District No. 2 G.O. LTD Tax Series 1989 B (reissued on 12/29/1993), 7.999% due 6/1/2029(k) |

11,236,670 | ||||||||

| 11,515,000 | Meadows Metropolitan District No. 7 G.O. LTD Tax Series 1989 C (reissued on 12/29/1993), 7.999% due 6/1/2029(k) |

11,188,089 | ||||||||

| 260,000 | Mount Carbon Metropolitan District LTD Tax and Revenue Refunding Series 2004A, 7.00% to yield 7.075% due 6/1/2043 |

151,403 | ||||||||

| 2,000,000 | Mount Carbon Metropolitan District LTD Tax and Revenue Refunding Series 2004B, 7.00% to yield 7.075% due 6/1/2043 |

1,164,640 | ||||||||

| 565,000 | Mount Carbon Metropolitan District LTD Tax and Revenue Refunding Series 2004C, due 6/1/2043(e) |

56,500 | ||||||||

| 1,000,000 | Mountain Shadows Metropolitan District G.O. (LTD Tax Convertible to Unlimited Tax) Series 2007, 5.50% due 12/1/2027 |

779,640 | ||||||||

| 2,540,000 | Murphy Creek Metropolitan District No. 3 G.O. (LTD Tax Convertible to Unlimited Tax) Refunding and Improvement Series 2006, 6.00% to yield 7.90% due 12/1/2026 |

1,251,661 | ||||||||

| 1,880,000 | Murphy Creek Metropolitan District No. 3 G.O. (LTD Tax Convertible to Unlimited Tax) Refunding and Improvement Series 2006, 6.125% to yield 7.90% – 12.568% due 12/1/2035 |

916,838 | ||||||||

| 1,500,000 | Neu Towne Metropolitan District G.O. (LTD Tax Convertible to Unlimited Tax) Series 2004, 7.20% due 12/1/2023 |

398,250 | ||||||||

| 4,585,000 | Northwest Metropolitan District No. 3 G.O. (LTD Tax Convertible to Unlimited Tax) Series 2005, 6.125% to yield 12.00% due 12/1/2025 |

4,366,295 | ||||||||

| 18,500,000 | Northwest Metropolitan District No. 3 G.O. (LTD Tax Convertible to Unlimited Tax) Series 2005, 6.25% to yield 13.00% due 12/1/2035 |

16,885,505 | ||||||||

| 3,325,000 | Pine Bluffs Metropolitan District (in the Town of Parker) G.O. LTD Tax Series 2004, 7.25% to yield 17.889% due 12/1/2024 |

1,646,208 | ||||||||

| 2,340,000 | Potomac Farms Metropolitan District G.O. Refunding and Improvement (LTD Tax Convertible to Unlimited Tax) Series 2007A, 7.25% due 12/1/2037 |

1,857,890 | ||||||||

| 423,000 | Potomac Farms Metropolitan District G.O. Refunding and Improvement (LTD Tax Convertible to Unlimited Tax) Series 2007B, 7.625% due 12/1/2023 |

387,417 | ||||||||

| 9,000,000 | Ravenna Metropolitan District G.O. LTD Tax Series 2007, 7.00% due 12/1/2037 |

8,084,340 | ||||||||

| 3,500,000 | Reata North Metropolitan District LTD TAX G.O. Series 2007, 5.50% to yield 9.00% due 12/1/2032 |

2,773,295 | ||||||||

| 13,350,000 | Reata South Metropolitan District LTD TAX G.O. Series 2007A, 7.25% due 6/1/2037 |

12,448,742 | ||||||||

6

Colorado BondShares

A Tax-Exempt Fund

Schedule of Investments (unaudited) — (Continued)

| Face Amount |

Value |

|||||||||

| Colorado Municipal Bonds — (Continued) | ||||||||||

| 935,000 | Riverdale Peaks II Metropolitan District G.O. (LTD Tax Convertible to Unlimited Tax) Series 2005, 6.40% due 12/1/2025(l) |

$ | 600,205 | |||||||

| 1,135,000 | Riverdale Peaks II Metropolitan District G.O. (LTD Tax Convertible to Unlimited Tax) Series 2005, 6.50% due 12/1/2035(l) |

678,526 | ||||||||

| 709,000 | Routt County LID No. 2002-1 Special Assessment Series 2004A, 6.50% to yield 6.59% due 8/1/2024 |

695,366 | ||||||||

| 57,638 | Roxborough Village Metropolitan District Series 1993A, 9.00% due 12/31/2016(i) |

59,094 | ||||||||

| 246,006 | Roxborough Village Metropolitan District Series 1993B, principal only, 0.00% due 12/31/2021(e)(i)(j) |

131,493 | ||||||||

| 272,957 | Roxborough Village Metropolitan District Series 1993B, interest only, 10.41% due 12/31/2042(f)(i)(j) |

42,308 | ||||||||

| 1,960,000 | Serenity Ridge Metropolitan District No. 2 Series 2004, 7.375% due 12/1/2024 |

946,602 | ||||||||

| 500,000 | Silver Peaks Metropolitan District No. 2 G.O. (LTD Tax Convertible to Unlimited Tax) Series 2006, 5.75% due 12/1/2036 |

323,015 | ||||||||

| 3,685,000 | Solitude Metropolitan District Senior G.O. LTD Tax Series 2006, 7.00% due 12/1/2026 |

3,535,463 | ||||||||

| 8,000,000 | Southglenn Metropolitan District Subordinate Convertible Capital Appreciation Special Revenue Series 2008, 8.125% due 12/15/2030 |

8,238,880 | ||||||||

| 9,000,000 | Stone Ridge Metropolitan District No. 2 G.O. (LTD Tax Convertible to Unlimited Tax) Series 2007, 7.25% due 12/1/2031 |

2,270,250 | ||||||||

| 1,186,000 | Traditions Metropolitan District No. 2 G.O. (LTD Tax Convertible to Unlimited Tax) Series 2006, 5.75% to yield 7.63% due 12/1/2036 |

1,083,885 | ||||||||

| 18,240,000 | United Water & Sanitation District (Lupton Lakes Water Storage Project and Water Activity Enterprise) Revenue Series 2006, 6.00% due 3/1/2021 |

18,266,630 | ||||||||

| 6,875,000 | United Water & Sanitation District Ravenna Project Water Activity Enterprise Convertible Capital Appreciation Series 2007, 6.125% due 12/1/2037 |

6,192,588 | ||||||||

| 10,145,000 | United Water & Sanitation District United Water Acquisition Project Water Activity Enterprise Revenue Refunding Series 2012, 6.00% due 12/1/2023 |

10,178,986 | ||||||||

| 11,500,000 | Valagua Metropolitan District G.O. LTD Tax Series 2008, 7.75% – 31.019% due 12/1/2037 |

2,892,250 | ||||||||

| 2,250,000 | Waterfront Metropolitan District LTD Tax (Convertible to Unlimited Tax) G.O. Refunding & Improvement Series 2007, 4.25% to yield 7.794% due 12/1/2032 |

1,806,210 | ||||||||

| 500,000 | Wheatlands Metropolitan District No. 2 G.O. (LTD Tax Convertible to Unlimited Tax) Series 2005, 6.00% due 12/1/2025 |

448,025 | ||||||||

| 1,245,000 | Wheatlands Metropolitan District No. 2 G.O. (LTD Tax Convertible to Unlimited Tax) Series 2008, 8.25% due 12/15/2035 |

1,245,523 | ||||||||

| 1,989,000 | Wildgrass Metropolitan District G.O. (LTD Tax Convertible to Unlimited Tax) Refunding Series 2007, 6.20% to yield 5.25% due 12/1/2034 |

1,992,560 | ||||||||

|

|

|

|||||||||

| Total Colorado Municipal Bonds (amortized cost $464,101,008) |

$ | 437,592,761 | ||||||||

|

|

|

|||||||||

7

Colorado BondShares

A Tax-Exempt Fund

Schedule of Investments (unaudited) — (Continued)

| Face Amount |

Value |

|||||||||

| Short-Term Municipal Bonds — 30.7% | ||||||||||

| 1,367,000 | BNC Metropolitan District No.1 G.O. (LTD Tax Convertible to Unlimited Tax) Series 2004, 8.00% due 6/1/2028(b) |

$ | 1,452,150 | |||||||

| 5,000,000 | Bachelor Gulch Metropolitan District G.O. Variable Rate Series 2004, 0.07% due 12/1/2023 (LOC 5) |

5,000,000 | ||||||||

| 11,455,000 | Broomfield Urban Renewal Authority Tax Increment Revenue (Broomfield Event Center Project) Series 2005, 0.14%, due 12/1/2030 (LOC 6) |

11,455,000 | ||||||||

| 7,535,000 | Castle Pines North Finance Corporation Variable Rate Certificates of Participation Series 2008, 0.08% due 12/1/2033 (LOC 1) |

7,535,000 | ||||||||

| 11,030,000 | Colorado Housing and Finance Authority Multi-Family/Project Class I Adjustable Rate 2008 Series C-3, 0.06% due 10/1/2038 (LOC 2) |

11,030,000 | ||||||||

| 8,865,000 | Colorado Housing and Finance Authority Single Family Mortgage Class I Adjustable Rate 2006 Series A-2, 0.06% due 11/1/2034 (LOC 2) |

8,865,000 | ||||||||

| 28,835,000 | Colorado Housing and Finance Authority Single Family Mortgage Class I Adjustable Rate 2005 Series B-2, 0.06% due 5/1/2034 (LOC 3) |

28,835,000 | ||||||||

| 16,135,000 | Colorado Housing and Finance Authority Multi-Family/Project Class I Adjustable Rate 2005 Series A-2, 0.06% due 4/1/2036 (LOC 3) |

16,135,000 | ||||||||

| 7,740,000 | Colorado Housing and Finance Authority Single Family Mortgage Class I Adjustable Rate 2002 Series B-3, 0.06% due 11/1/2021 (LOC 3) |

7,740,000 | ||||||||

| 19,950,000 | Colorado Housing and Finance Authority Single Family Mortgage Class II Adjustable Rate 2013 Series B, 0.06% due 11/1/2036 (LOC 8) |

19,950,000 | ||||||||

| 2,600,000 | Colorado Housing and Finance Authority Single Family Mortgage Class I Adjustable Rate 2006 Series C-2, 0.06% due 11/1/2034 (LOC 2) |

2,600,000 | ||||||||

| 8,230,000 | Colorado Springs (City of) Variable Rate Demand Utilities System Improvement Revenue Series 2010C, 0.06% due 11/1/2040 (LOC 7) |

8,230,000 | ||||||||

| 1,500,000 | Colorado Springs (City of) Variable Rate Demand Utilities System Improvement Revenue Series 2012A, 0.06% due 11/1/2041 (LOC 5) |

1,500,000 | ||||||||

| 14,355,000 | Cornerstone Metropolitan District No. 2 Subordinate Variable Rate LTD Tax G.O. Refunding Series 2010B, 0.08% due 12/1/2046 (LOC 4) |

14,355,000 | ||||||||

| 9,705,000 | EagleBend Affordable Housing Corporation Taxable Convertible Variable Rate Multifamily Housing Project Revenue Refunding Series 2006A, 0.07% due 7/1/2021 (LOC 5) |

9,705,000 | ||||||||

| 30,970,000 | Ebert Metropolitan District LTD Tax G.O. Refunding Series 2004A, 8.00% to yield 5.05% due 12/1/2034(b) |

32,455,012 | ||||||||

| 21,000,000 | Jefferson Center Metropolitan District No. 2 Special Revenue Variable Rate Series 2007A, 2.66% due 12/1/2028(j) |

21,000,000 | ||||||||

| 12,450,000 | Town of Mountain Village Housing Authority Housing Facilities Revenue (Village Court Apartments Project) Series 2000, 0.07% due 11/1/2040 (LOC 5) |

12,450,000 | ||||||||

| 900,000 | Parker Automotive Metropolitan District G.O. Variable Rate (LTD Tax Convertible to Unlimited Tax) Series 2005, 0.07% due 12/1/2034 (LOC 5) |

900,000 | ||||||||

8

Colorado BondShares

A Tax-Exempt Fund

Schedule of Investments (unaudited) — (Continued)

| Face Amount |

Value |

|||||||||

| Short-Term Municipal Bonds — (Continued) | ||||||||||

| 2,000,000 | Plaza Metropolitan District No. 1 Public Improvement Fee/Tax Increment Supported Revenue Series 2003, 7.70% to yield 7.653% due 12/1/2017(b) |

$ | 2,045,140 | |||||||

| 20,800,000 | Plaza Metropolitan District No. 1 Public Improvement Fee/Tax Increment Supported Revenue Series 2003, 8.00% to yield 7.971% – 10.00% due 12/1/2025(b) |

21,279,648 | ||||||||

| 4,425,000 | Plaza Metropolitan District No. 1 Public Improvement Fee/Tax Increment Supported Revenue Series 2003, 7.60% to yield 7.547% due 12/1/2016(b) |

4,524,120 | ||||||||

| 2,080,000 | Santee Sioux Nation Tribal Health Care Revenue (Indian Health Service Joint Venture Construction Program Project) Series 2009, 8.00% due 10/1/2014 |

2,110,326 | ||||||||

| 7,400,000 | Sheridan Redevelopment Agency Variable Rate Tax Increment Refunding Revenue (South Santa Fe Drive Corridor Redevelopment Project) Series 2011A-1, 0.09% due 12/1/2029 (LOC 7) |

7,400,000 | ||||||||

| 2,000,000 | Southlands Metropolitan District No. 1 G.O. (LTD Tax Convertible to Unlimited Tax) Series 2004, 7.125% to yield 7.18% due 12/1/2034(b) |

2,092,660 | ||||||||

| 250,000 | Southlands Metropolitan District No. 1 G.O. (LTD Tax Convertible to Unlimited Tax) Series 2004, 6.75% to yield 6.80% due 12/1/2016(b) |

260,270 | ||||||||

| 1,000,000 | Southlands Metropolitan District No. 1 G.O. (LTD Tax Convertible to Unlimited Tax) Series 2004, 7.00% to yield 7.05% due 12/1/2024(b) |

1,045,500 | ||||||||

| 3,012,007 | Sterling Hills West Metropolitan District G.O. LTD Tax Series 2004, 7.50% due 12/1/2021(b) |

3,189,143 | ||||||||

|

|

|

|||||||||

| Total Short-Term Municipal Bonds (amortized cost $262,354,155) |

$ | 265,138,969 | ||||||||

|

|

|

|||||||||

| Colorado Capital Appreciation and Zero Coupon Bonds — 4.1% | ||||||||||

| 520,000 | Colorado Health Facilities Authority Zero Coupon Retirement Housing Revenue (Liberty Heights Project) 1990 Subordinate Series B, 6.97% due 7/15/2020(b)(d) |

$ | 460,070 | |||||||

| 7,470,000 | Conifer Metropolitan District Jefferson County Supplemental Interest Coupons Series 2006, 8.00% due 12/1/2010-12/1/2031(a)(d)(j) |

3,352,312 | ||||||||

| 15,725,000 | Flying Horse Metropolitan District No. 2 Refunding and Improvement Subordinate LTD Tax G.O. Convertible Capital Appreciation Series 2013B, 8.00% due 12/15/2042(d) |

10,867,705 | ||||||||

| 14,000,000 | PV Water and Sanitation Metropolitan District Capital Appreciation Revenue Series 2006, 6.00% due 12/15/2017(a)(d) |

5,872,720 | ||||||||

| 3,415,000 | Ravenna Metropolitan District Supplemental “B” Interest Registered Coupons, 8.25% due 12/1/2013 – 12/1/2023(d) |

2,372,489 | ||||||||

| 4,390,000 | Traditions Metropolitan District No. 2 Subordinate G.O. (LTD Tax Convertible to Unlimited Tax) Convertible Capital Appreciation Series 2008, 8.50% due 12/15/2037(d) |

4,329,813 | ||||||||

| 8,920,000 | United Water & Sanitation District Ravenna Project Water Activity Enterprise Capital Appreciation Revenue Refunding Series 2009, 6.50% due 12/15/2016(a)(d)(j) |

2,973,304 | ||||||||

9

Colorado BondShares

A Tax-Exempt Fund

Schedule of Investments (unaudited) — (Continued)

| Face Amount |

Value |

|||||||||||

| Colorado Capital Appreciation and Zero Coupon Bonds — (Continued) | ||||||||||||

| 2,286,030 | United Water & Sanitation District Ravenna Project Water Activity Enterprise Capital Appreciation Subordinate Series 2006B, 7.00% due 12/15/2011(d)(j) |

|

$ | 2,171,728 | ||||||||

| 6,530,000 | Wildwing Metropolitan District No. 1 Capital Appreciation Revenue Series 2008, 7.50% due 12/1/2023(d) |

|

3,134,008 | |||||||||

|

|

|

|||||||||||

| Total Colorado Capital Appreciation and Zero Coupon Bonds (amortized cost $45,240,058) |

|

$ | 35,534,149 | |||||||||

|

|

|

|||||||||||

| Other Municipal Bonds — 3.2% | ||||||||||||

| 4,904,915 | Freddie Mac Multifamily Variable Rate Certificates Series M001 Class B, 22.02% due 4/1/2037(g)(j) |

|

$ | 4,904,915 | ||||||||

| 541,000 | The Industrial Development Authority of the City of Kansas City, Missouri Multi-family Housing Revenue (Alexandria Apartments) Series 2005A, 6.75% due 1/1/2028 |

|

544,771 | |||||||||

| 6,975,000 | The Hospital Facilities Authority of Multnomah County, Oregon Revenue Refunding (Odd Fellows Home-Friendship Health Center) Series 2013A, 5.45% due 9/15/2020 |

|

6,981,557 | |||||||||

| 1,560,000 | Oglala Sioux Tribe (Pine Ridge, South Dakota) Essential Governmental Function Revenue and Refunding Series 2012, 5.00% due 10/1/2022(j) |

|

1,560,000 | |||||||||

| 1,985,000 | Oglala Sioux Tribe (Pine Ridge, South Dakota) Essential Governmental Function Revenue Tax-Exempt Series 2014B, 5.50% to yield 5.70% due 10/1/2024 |

|

1,953,955 | |||||||||

| 942,000 | The Industrial Development Authority of the City of St. Louis, Missouri Senior Housing Revenue (Grant School Apartments) Series 2005A, 6.75% due 5/1/2027 |

|

885,527 | |||||||||

| 4,500,000 | Tacoma, Washington (City of) Consolidated LID District No.65, 5.75% to yield 5.75% – 6.22% due 4/1/2043 |

|

4,450,185 | |||||||||

| 5,000,000 | Uinta County School District Number 6 G.O. Refunding Series 2006, 7.00% to yield 4.40% due 12/1/2020 |

|

6,002,600 | |||||||||

|

|

|

|||||||||||

| Total Other Municipal Bonds (amortized cost $26,961,973) |

|

$ | 27,283,510 | |||||||||

|

|

|

|||||||||||

| Colorado Taxable Bonds/Certificates/Notes — 0.7% | ||||||||||||

| 2,100,212 | 777 F High Street LLC, Tax Lien Receipt Certificates, 9.00% due 10/15/2012(j)(m) |

|

$ | 2,100,212 | ||||||||

| 4,150,000 | Pioneer Metropolitan District No. 3 LTD Tax G.O. Taxable Series 2012, 11.00% due 12/1/2037(j) |

|

4,150,000 | |||||||||

| 227,347 | Note receivable from Tabernash Meadows, LLC, a Colorado limited liability company, 24.00% due 2/9/2002(a)(j) |

|

156,940 | |||||||||

|

|

|

|||||||||||

| Total Colorado Taxable Bonds/Certificates/Notes (amortized cost $6,477,559) |

|

$ | 6,407,152 | |||||||||

|

|

|

|||||||||||

| Total investments, at value (amortized cost 805,134,753) |

89.4% | $ | 771,956,541 | |||||||||

| Other assets net of liabilities |

10.6% | 91,030,191 | ||||||||||

|

|

|

|

|

|||||||||

| Net assets |

100.0% | $ | 862,986,732 | |||||||||

|

|

|

|

|

|||||||||

10

Colorado BondShares

A Tax-Exempt Fund

Schedule of Investments (unaudited) — (Continued)

| (a) | Defaulted or non-income producing based upon the financial condition of the issuer (see footnote 2 in notes to financial statements). |

| (b) | Originally issued as general obligation bonds but are now pre-refunded and are secured by an escrow fund consisting entirely of direct U.S. Government obligations. |

| (c) | Represents securities whose blended characteristics are reflective of a zero coupon bond and a step rate bond. Interest rate shown represents effective yield at acquisition. |

| (d) | Interest rate shown for capital appreciation and zero coupon bonds represents the effective yield at the date of acquisition. |

| (e) | Principal-only certificate represents the right to receive the principal payments on the underlying debt security upon maturity. The price of this security is typically more volatile than that of coupon-bearing bonds of the same maturity. |

| (f) | Interest-only certificate represents the right to receive semi-annual interest payments on the underlying debt security. The principal amount of the underlying security represents the notional amount on which current interest is calculated. The interest rate shown represents the effective yield at the date of acquisition. |

| (g) | Interest rate disclosed for cash flow bond represents the effective yield at March 31, 2014. Income on this security is derived from the cash flow of the issuer. |

| (h) | Represents current interest rate for a step rate bond. No step rate bonds were owned by the Fund at March 31, 2014. |

| (i) | Terms of security have been restructured since the original issuance. The total face amount of all such restructured securities approximates $11,060,118 and a value of $6,841,652 or less than 1.0% of net assets, as of March 31, 2014. |

| (j) | Securities valued at fair value (see footnote 2 in notes to financial statements). |

| (k) | See footnote 7 in notes to financial statements for further information on purchase accrued interest related to these bonds. |

| (l) | The Fund has entered into a forbearance agreement under which it agrees that the issuer may pay a reduced rate of interest in lieu of the contract rate for a period of time (see footnote 2 in notes to financial statements). |

| (m) | Tax lien receipt certificates. |

See accompanying notes to financial statements.

11

Colorado BondShares

A Tax-Exempt Fund

Schedule of Investments (unaudited) — (Continued)

| (LOC) | These securities are Variable Rate Demand Obligations (“VRDO”) with scheduled principal and interest payments that have a guaranteed liquidity provider in the form of a letter of credit. These obligations bear interest at a rate that resets daily or weekly (see footnote 2 in notes to financial statements). The numbered list below corresponds to the liquidity provider associated with the respective LOC. |

1. Wells Fargo Bank, N. A.

2. FHLB Topeka

3. Barclays Bank PLC

4. Bank of America, N.A.

5. US Bank, N. A.

6. BNP Paribas

7. JPMorgan Chase Bank, N.A.

8. Royal Bank of Canada

The following abbreviations are used in the descriptions of securities included in the Schedule of Investments:

G.O. — General Obligation

GID — General Improvement District

LID — Local Improvement District

LTD — Limited

See accompanying notes to financial statements.

12

Colorado BondShares

A Tax-Exempt Fund

Statement of Assets and Liabilities

March 31, 2014 (unaudited)

| ASSETS | ||||

| Investments, at value (amortized cost $805,134,753) |

$ | 771,956,541 | ||

| — see accompanying schedule |

||||

| Cash |

290,482 | |||

| Interest receivable |

50,641,337 | |||

| Purchase accrued interest (note 7) |

44,543,697 | |||

| Receivable for shares of beneficial interest sold |

259,350 | |||

|

|

|

|||

| TOTAL ASSETS |

867,691,407 | |||

|

|

|

|||

| LIABILITIES | ||||

| Payables and other liabilities: |

||||

| Dividends payable |

1,514,922 | |||

| Payable for shares of beneficial interest redeemed |

321,567 | |||

| Payable for investment securities purchased |

1,953,955 | |||

| Management fees payable |

366,319 | |||

| Accrued expenses payable |

547,912 | |||

|

|

|

|||

| TOTAL LIABILITIES |

4,704,675 | |||

|

|

|

|||

| NET ASSETS |

$ | 862,986,732 | ||

|

|

|

|||

| COMPOSITION OF NET ASSETS |

||||

| Paid-in capital |

$ | 895,012,693 | ||

| Accumulated net realized gain |

1,152,251 | |||

| Net unrealized depreciation of investments |

(33,178,212 | ) | ||

|

|

|

|||

| NET ASSETS |

$ | 862,986,732 | ||

|

|

|

|||

| NET ASSET PRICE AND REDEMPTION PRICE PER SHARE |

$ | 9.05 | ||

|

|

|

|||

| MAXIMUM OFFERING PRICE PER SHARE |

$ | 9.50 | ||

|

|

|

|||

See accompanying notes to financial statements.

13

Colorado BondShares

A Tax-Exempt Fund

Statement of Operations

For the Six Months Ended March 31, 2014 (unaudited)

| INVESTMENT INCOME |

||||

| Interest |

$ | 22,294,890 | ||

| EXPENSES |

||||

| Management fees (note 4) |

2,157,196 | |||

| Custodian fees (note 5) |

40,975 | |||

| Legal and auditing fees |

261,138 | |||

| Portfolio pricing fees |

19,115 | |||

| Registration fees |

5,068 | |||

| Shareholders’ reports |

68,605 | |||

| Transfer agency expenses (note 4) |

90,993 | |||

| Trustees’ fees |

3,620 | |||

| Other |

34,502 | |||

|

|

|

|||

| Total expenses |

2,681,212 | |||

| Custody credits (note 5) |

(658 | ) | ||

|

|

|

|||

| Net expenses |

2,680,554 | |||

|

|

|

|||

| NET INVESTMENT INCOME |

19,614,336 | |||

|

|

|

|||

| REALIZED AND UNREALIZED GAIN ON INVESTMENTS |

||||

| Net realized gain on investments |

1,110,434 | |||

| Net unrealized appreciation on investments |

4,085,316 | |||

|

|

|

|||

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS |

5,195,750 | |||

|

|

|

|||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS |

$ | 24,810,086 | ||

|

|

|

See accompanying notes to financial statements.

14

Colorado BondShares

A Tax-Exempt Fund

Statements of Changes in Net Assets

For the Periods Indicated

| Six Months Ended March 31, 2014 |

Year Ended September 30, 2013 |

|||||||

| (unaudited) | ||||||||

| FROM OPERATIONS: |

||||||||

| Net investment income |

$ | 19,614,336 | $ | 37,733,531 | ||||

| Net realized gain on investments |

1,110,434 | 885,869 | ||||||

| Unrealized appreciation (depreciation) on investments |

4,085,316 | (24,771,322 | ) | |||||

|

|

|

|

|

|||||

| Net increase in net assets resulting from operations |

24,810,086 | 13,848,078 | ||||||

|

|

|

|

|

|||||

| FROM DISTRIBUTIONS TO SHAREHOLDERS: (note 2) |

||||||||

| Dividends to shareholders from net investment income |

(19,614,336 | ) | (37,733,531 | ) | ||||

| Net realized gain to shareholders from investment transactions |

(885,539 | ) | (161,719 | ) | ||||

|

|

|

|

|

|||||

| Total distributions to shareholders |

(20,499,875 | ) | (37,895,250 | ) | ||||

|

|

|

|

|

|||||

| FROM BENEFICIAL INTEREST TRANSACTIONS: |

||||||||

| Proceeds from sale of shares |

34,103,623 | 117,309,816 | ||||||

| Reinvested dividends and distributions |

12,828,273 | 24,105,749 | ||||||

| Redemption of shares |

(60,841,619 | ) | (114,158,432 | ) | ||||

|

|

|

|

|

|||||

| Increase (decrease) in net assets derived from beneficial interest transactions |

(13,909,723 | ) | 27,257,133 | |||||

|

|

|

|

|

|||||

| Net increase (decrease) in net assets |

(9,599,512 | ) | 3,209,961 | |||||

| NET ASSETS: |

||||||||

| Beginning of period |

872,586,244 | 869,376,283 | ||||||

|

|

|

|

|

|||||

| End of period |

$ | 862,986,732 | $ | 872,586,244 | ||||

|

|

|

|

|

|||||

See accompanying notes to financial statements.

15

Colorado BondShares

A Tax-Exempt Fund

Financial Highlights

| Six

Months Ended 3/31/2014 |

For Fiscal Years Ended September 30 | |||||||||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||||||

| For a share outstanding throughout the period |

(unaudited) | |||||||||||||||||||||||

| Net Asset Value, beginning of period |

$ | 9.00 | $ | 9.24 | $ | 9.15 | $ | 9.19 | $ | 9.15 | $ | 9.24 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income From Investment Operations |

||||||||||||||||||||||||

| Net investment income(1) |

0.21 | 0.39 | 0.41 | 0.41 | 0.40 | 0.43 | ||||||||||||||||||

| Net gain or (loss) on investments (both realized and unrealized) |

0.05 | (0.24 | ) | 0.09 | (0.04 | ) | 0.04 | (0.07 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Increase from investment operations |

0.26 | 0.15 | 0.50 | 0.37 | 0.44 | 0.36 | ||||||||||||||||||

| Less Distributions |

||||||||||||||||||||||||

| Dividends to shareholders from net investment income |

(0.20 | ) | (0.39 | ) | (0.41 | ) | (0.41 | ) | (0.40 | ) | (0.44 | ) | ||||||||||||

| Distributions from realized capital gains |

$ | (0.01 | ) | — | — | — | — | $ | (0.01 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Distributions |

(0.21 | ) | (0.39 | ) | (0.41 | ) | (0.41 | ) | (0.40 | ) | (0.45 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net increase (decrease) in net asset value |

0.05 | (0.24 | ) | 0.09 | (0.04 | ) | 0.04 | (0.09 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net Asset Value, end of period |

$ | 9.05 | $ | 9.00 | $ | 9.24 | $ | 9.15 | $ | 9.19 | $ | 9.15 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Return, at Net Asset Value(2) |

2.92 | %+ | 1.58 | % | 5.64 | % | 4.17 | % | 4.95 | % | 4.02 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios/Supplemental Data: |

||||||||||||||||||||||||

| Ratios to average net assets: |

||||||||||||||||||||||||

| Net investment income |

4.53 | %* | 4.23 | % | 4.42 | % | 4.56 | % | 4.37 | % | 4.80 | % | ||||||||||||

| Total expenses |

0.62 | %* | 0.73 | % | 0.58 | % | 0.58 | % | 0.57 | % | 0.55 | % | ||||||||||||

| Net expenses |

0.62 | %* | 0.73 | % | 0.58 | % | 0.58 | % | 0.57 | % | 0.55 | % | ||||||||||||

| Net assets, end of period (000s) |

$ | 862,987 | $ | 872,586 | $ | 869,376 | $ | 784,345 | $ | 849,349 | $ | 794,629 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Portfolio turnover rate(3) |

5.51 | %+ | 8.21 | % | 8.66 | % | 4.67 | % | 2.73 | % | 7.39 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| + | not annualized |

| * | annualized |

| (1) | Net investment income per share was calculated using an average shares method. |

| (2) | Assumes a hypothetical initial investment on the business day before the first day of the fiscal period, with all dividends reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. |

| (3) | The portfolio turnover rate is computed by dividing the lesser of purchases or sales of portfolio securities for a period by the monthly average of the value of portfolio securities owned during the period. Sales of securities include the proceeds of securities which have been called, or for which payment has been made through redemption or maturity. Securities with a maturity date of one year or less at the time of acquisition are excluded from the calculation. Cost of purchases and proceeds from sales of investment securities (excluding short-term securities) for the period ended March 31, 2014 were $52,028,182 and $30,520,598, respectively. |

See accompanying notes to financial statements.

16

Colorado BondShares

A Tax-Exempt Fund

Notes to Financial Statements (unaudited)

| (1) | Organization |

Colorado BondShares — A Tax-Exempt Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended, as a diversified, open-end management company. The Fund’s investment objectives are to maximize income exempt from federal income taxes and from personal income taxes of the State of Colorado to the extent consistent with the preservation of capital and to seek opportunities for capital appreciation. The Fund’s investment adviser is Freedom Funds Management Company (“Freedom Funds”). The following is a summary of significant accounting policies consistently followed by the Fund.

| (2) | Summary of Significant Accounting Policies |

These financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America. This requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates. These financial statements reflect all adjustments which are, in the opinion of management, necessary to a fair statement of the results for the reporting period. The following summarizes the significant accounting policies of the Fund:

| (a) | Investment Valuation and Risk |

Securities for which there is no last sales price are valued by an independent pricing service based on evaluated prices which considers such factors as transactions in bonds, quotations from bond dealers, market transactions in comparable securities and various relationships between securities, or are fair valued by management.

Securities for which market quotations are not readily available (or management considers otherwise are no longer valid or reliable) are valued at fair value determined in accordance with procedures approved by the Board of Trustees. This can occur in the event of, among other things, natural disasters, acts of terrorism, market disruptions, intra-day trading halts, and extreme market volatility. The determination of fair value involves subjective judgments. As a result, using fair value to price a security may result in a price materially different from the prices used by other mutual funds to determine net asset value or the price that may be realized upon the actual sale of the security. Short-term holdings are valued at current market quotations or amortized cost whichever management believes best approximates fair value.

Fixed-income securities owned by the Fund are subject to interest-rate risk, credit risk, prepayment risk and market risk. The Fund invests in not rated securities which may be subject to a greater degree of credit risk and risk of loss of income and principal and may be more sensitive to economic conditions than lower yielding, higher rated fixed income securities. The Fund concentrates its investments in Colorado and, therefore, may be impacted by specific events, issuers or factors affecting Colorado. The Fund has more credit risk related to the economic conditions of Colorado than a portfolio with a broader geographical diversification.

17

Colorado BondShares

A Tax-Exempt Fund

Notes to Financial Statements (unaudited) — (Continued)

ASC 820 Fair Value Measurements and Disclosures establishes a fair value hierarchy that classifies securities based on valuation techniques used to measure fair value and distinguish between observable inputs (market data obtained from independent sources) and the reporting entities own assumptions which are not readily observable to market participants. The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3).

Level 1 Inputs: Quoted prices (unadjusted) in active markets for identical assets or liabilities that the reporting entity has the ability to access at the measurement date.

Level 2 Inputs: Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly. If the asset or liability has a specified (contractual) term, a Level 2 input must be observable for substantially the full term of the asset or liability.

Level 3 Inputs: Significant unobservable inputs for the asset or liability including management’s own assumptions. Unobservable inputs shall be used to measure fair value to the extent that observable inputs are not available.

The following table summarizes the valuation of the Fund’s investments as defined by ASC 820 hierarchy levels as of March 31, 2014:

Valuation Inputs Summary

| Colorado Municipal Bonds |

Short-Term Municipal Bonds |

Colorado Capital Appreciation and Zero Coupon Bonds |

Other Municipal Bonds |

Colorado Taxable Bonds/ Certificates/ Notes |

Total Securities March 31, 2014 |

|||||||||||||||||||

| Level 1 Securities |

— | — | — | — | — | — | ||||||||||||||||||

| Level 2 Securities |

409,576,801 | 244,138,969 | 27,036,805 | 20,818,595 | — | 701,571,170 | ||||||||||||||||||

| Level 3 Securities |

28,015,960 | 21,000,000 | 8,497,344 | 6,464,915 | 6,407,152 | 70,385,371 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Totals |

437,592,761 | 265,138,969 | 35,534,149 | 27,283,510 | 6,407,152 | 771,956,541 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

18

Colorado BondShares

A Tax-Exempt Fund

Notes to Financial Statements (unaudited) — (Continued)

| Colorado Municipal Bonds |

Short-Term Municipal Bonds |

Colorado Capital Appreciation and Zero Coupon Bonds |

Other Municipal Bonds |

Colorado Taxable Bonds/ Certificates/ Notes |

Totals | |||||||||||||||||||

| Level 3 Beginning Balance September 30, 2013 |

28,196,564 | 22,000,000 | 8,497,344 | 6,464,915 | 6,407,152 | 71,565,975 | ||||||||||||||||||

| Unrealized Losses |

— | — | — | — | — | — | ||||||||||||||||||

| Unrealized Gains |

— | — | — | — | — | — | ||||||||||||||||||

| Realized Losses |

— | — | — | — | — | — | ||||||||||||||||||

| Realized Gains |

369,904 | — | — | — | — | 369,904 | ||||||||||||||||||

| Purchases |

371,700 | — | — | — | — | 371,700 | ||||||||||||||||||

| Sales |

(922,208 | ) | (1,000,000 | ) | — | — | — | (1,922,208 | ) | |||||||||||||||

| Transfers In to Level 3* |

— | — | — | — | — | — | ||||||||||||||||||

| Transfers Out of Level 3* |

— | — | — | — | — | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance as of March 31, 2014 |

28,015,960 | 21,000,000 | 8,497,344 | 6,464,915 | 6,407,152 | 70,385,371 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

* Transferred from Level 2 to Level 3 because of a lack, or change of observable inputs or reduced market data reliability. Transferred from Level 3 to Level 2 are the result of observable inputs becoming available or increased market data reliability. The Fund’s policy is to recognize transfers into and out of Level 3 when management becomes aware of a change to significant observable input or market data reliability.

From September 30, 2013 to March 31, 2014, there were no Level 1 Securities.

PURCHASE ACCRUED INTEREST (note 7)

| Purchase Accrued Beginning Balance September 30, 2013 |

44,026,872 | |||

| Unrealized Losses |

— | |||

| Unrealized Gains |

— | |||

| Realized Losses |

— | |||

| Realized Gains |

— | |||

| Purchases |

— | |||

| Sales |

— | |||

| Transfers In to |

— | |||

| Transfers Out of |

— | |||

|

|

|

|||

| Ending Balance March 31, 2014 |

44,026,872 | |||

|

|

|

The purchase accrued receivable of $44,543,697 at March 31, 2014 is comprised of $44,026,872 for the Meadows Metropolitan Districts No. 1, 2 and 7; the $516,825 difference is attributable to other municipal bonds.

19

Colorado BondShares

A Tax-Exempt Fund

Notes to Financial Statements (unaudited) — (Continued)

Significant Unobservable Inputs Quantitative Disclosure

| Level 3 Securities* |

Fair Value March 31, 2014 |

Valuation Technique(s)** |

Unobservable Inputs |

Low | High | Weighted Average |

||||||||||||||

| Colorado Municipal Bonds |

28,015,960 | discounted cash flow | probability of default | 0.00% | 100.00% | 12.43 | % | |||||||||||||

| Short-Term Municipal Bonds |

21,000,000 | discounted cash flow | probability of default | 5.00% | 5.00% | 5.00 | % | |||||||||||||

| Colorado Capital Appreciation and Zero Coupon Bonds |

8,497,344 | discounted cash flow | probability of default | 5.00% | 100.00% | 44.23 | % | |||||||||||||

| Other Municipal Bonds |

6,464,915 | discounted cash flow | probability of default | 1.00% | 5.00% | 1.97 | % | |||||||||||||

| Colorado Taxable Bonds/Certificates/Notes |

6,407,152 | discounted cash flow | probability of default | 5.00% | 100.00% | 8.97 | % | |||||||||||||

|

|

|

|||||||||||||||||||

| Total Level 3 Securities at March 31, 2014 |

70,385,371 | |||||||||||||||||||

|

|

|

|||||||||||||||||||

The significant unobservable inputs used in the fair value measurement of the Fund’s securities are collateral value, probability of default, and loss severity in the event of default. Significant increases (decreases) in any of those inputs in insolation would result in a significantly lower (higher) fair value measurement.

* The inputs for these securities are not readily available or cannot be reasonably estimated and are generally those inputs described in Note 2(a). The appropriateness of fair values for these securities is based on results of back testing, broker due diligence, unchanged price review and consideration of macro or security specific events.

** Other unobservable inputs used in the discounted cash flow technique include collateral value and loss severity. These unobservable inputs are specific to the characteristics of each security being valued.

| (b) | Income Tax Information and Distributions to Shareholders |

The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code, as amended, applicable to regulated investment companies and to distribute all its net investment income and any net realized gain on investments not offset by capital loss carryforwards to shareholders. The Fund distributes investment income monthly and due to the tax-exempt nature of its investments the income is generally non-taxable to the shareholders. The Fund distributes net realized capital gains, if any, to its shareholders at least annually. Income distributions and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. These differences are primarily due to the differing treatment of tax allocations.

Management has reviewed the Fund’s tax position for all open tax years. As of March 31, 2014, the Fund did not have a liability for any unrecognized tax benefits. The fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. The Fund has no examinations in progress.

20

Colorado BondShares

A Tax-Exempt Fund

Notes to Financial Statements (unaudited) — (Continued)

At March 31, 2014, the cost and unrealized appreciation (depreciation) of investments, as determined on a federal income tax basis, were as follows:

| Cost of investments |

$ | 805,134,753 | ||

|

|

|

|||

| Gross unrealized appreciation |

$ | 20,245,611 | ||

| Gross unrealized depreciation |

(53,423,823 | ) | ||

|

|

|

|||

| Net unrealized depreciation of investments |

$ | (33,178,212 | ) | |

|

|

|

For tax purposes, capital losses may be carried over to offset future capital gains, if any. Under the Regulated Investment Company Modernization Act of 2010, capital losses incurred by the Fund in taxable years beginning after December 22, 2010 are not subject to expiration and such losses retain their character as either short-term or long-term, rather than being considered short-term as under previous law. Post-enactment capital losses must be fully utilized prior to utilizing any losses incurred in pre-enactment tax years. At March 31, 2014, the Fund did not have any capital loss carryforwards.

| (c) | Defaulted or Non-income Producing Investments |

The Fund discontinues the accrual of interest income on municipal bonds when the securities become delinquent as to payment of principal or interest, or when the Fund’s investment adviser determines that an uncertainty exists as to the realization of all or a portion of the principal balance. The face amount of bonds for which the accrual of interest income has been discontinued approximates $39,307,347 and such bonds have a value of $18,611,701 or 2.16% of net assets, as of March 31, 2014. These securities have been identified in the accompanying Schedule of Investments.

The Fund has entered into forbearance agreements with two districts under which it agrees that the issuer may pay a reduced rate of interest in lieu of the contract rate for a period of time. Face amount of the bonds for which the Fund has entered into forbearance agreements total $7,480,000 and have a value of $6,688,731 or less than 1% of net assets, as of March 31, 2014. These securities has been identified in the Schedule of Investments.

| (d) | Investment Transactions and Revenue Recognition |

Investment transactions are accounted for on the date the investments are purchased or sold (trade date). Purchases and sales of securities, other than short-term securities, aggregated to $52,028,182 and $30,520,598, respectively.

Dividends to shareholders are declared each business day and paid monthly. Distributions to shareholders are recorded on the ex-dividend date. Realized gains and losses from investment transactions are calculated using the identified-cost basis, which is the same basis the Fund uses for federal income tax purposes. Interest income is recorded on the accrual basis.

21

Colorado BondShares

A Tax-Exempt Fund

Notes to Financial Statements (unaudited) — (Continued)

Variable Rate Demand Obligations (“VRDO”) purchased by the Fund are floating rate obligations that have a nominal long-term maturity but have a coupon rate that is reset periodically (e.g., daily or weekly). The investor has the option to put the issue back to the trustee or tender agent at any time with specified (e.g., seven days) notice, accordingly the Fund treats these obligations as short-term holdings. On March 31, 2014, the interest rates paid on these obligations ranged from 0.06% to 2.66%.

| (e) | Classification of Distributions to Shareholders |

The character of distributions made during the year from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. Also, due to timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or realized gain was recorded by the Fund.

| (f) | Securities Purchased on a When-Issued Basis |

The Fund may purchase securities on a when-issued basis with payment and delivery scheduled for a future date. These transactions are subject to market fluctuations and may increase or decrease in value prior to the delivery date. The Fund maintains segregated assets with a value equal to or greater than the amount of its purchase commitments. The Fund did not have any when-issued securities at March 31, 2014.

| (3) | Shares of Beneficial Interest |

The Fund has an unlimited number of no par value shares of beneficial interest authorized. Transactions in shares of beneficial interest were as follows:

| Six Months Ended March 31, 2014 |

Year Ended September 30, 2013 |

|||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||

| (unaudited) | ||||||||||||||||

| Shares sold |

3,782,386 | $ | 34,103,623 | 12,760,248 | $ | 117,309,816 | ||||||||||

| Dividends and distributions reinvested |

1,423,528 | 12,828,273 | 2,627,092 | 24,105,749 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 5,205,914 | 46,931,896 | 15,387,340 | 141,415,565 | |||||||||||||

| Shares redeemed |

(6,752,779 | ) | (60,841,619 | ) | (12,483,752 | ) | (114,158,432 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase (decrease) in shares outstanding |

(1,546,865 | ) | $ | (13,909,723 | ) | 2,903,588 | $ | 27,257,133 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

22

Colorado BondShares

A Tax-Exempt Fund

Notes to Financial Statements (unaudited) — (Continued)

| (4) | Management Fees and Other Transactions with Affiliates |

Management fees paid to Freedom Funds were in accordance with the investment advisory agreement with the Fund which provides for an annual fee equivalent to 0.5% of the net assets of the Fund. Freedom Funds pays all expense associated with advertising, marketing, and distributing the Fund’s shares and serves as the transfer agent, dividend disbursing agent, and registrar for the Fund. Freedom Funds provided certain transfer agency and shareholder services as part of the management fee arrangement for the period ended March 31, 2014. Transfer agency expenses on the Statement of Operations represent direct expenses charged to the Fund by third parties.

Allen Insurance, an affiliate of the investment adviser, acted as agent for the Fidelity Bond and the Errors and Omissions insurance policy maintained by the Fund and as a result received compensation in the form of commissions. The policies were provided by Traveler’s Insurance Company and all the commissions referred to above were paid by Travelers. Allen Insurance received no compensation directly from the assets of the Fund.

The Fund does not have any Trustees who are affiliated with the Advisor or Distributor. The Board of Trustees appointed a Chief Compliance Officer to the Fund in accordance with federal securities regulations. The Fund does not reimburse the Advisor for any compensation or fees associated with the Chief Compliance Officer.

| (5) | Custody Credits |

Expenses paid indirectly by the Fund represent earnings credits on cash balances maintained with the Fund’s custodian bank, UMB Bank, N.A. The earnings credits resulted in offsetting custodian fees of $658 for the period ended March 31, 2014.

| (6) | Indemnification |

From time to time the Fund may be involved in certain disputes and legal actions arising in the ordinary course of its business. While it is not feasible to predict or determine the outcome of these proceedings, in management’s opinion, based on a review with legal counsel, none of these disputes and legal actions is expected to have a material impact on its financial position or results of operations. However, litigation is subject to inherent uncertainties, and an adverse result in these matters may arise from time to time that may harm the Fund’s business.

In the normal course of business, the Fund enters into contracts that contain a variety of representations which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

23

Colorado BondShares

A Tax-Exempt Fund

Notes to Financial Statements (unaudited) — (Continued)

| (7) | Purchase Accrued Interest |

Purchase accrued interest is typically a component of a municipal bond purchase and is paid on settlement date. The accrual period begins on the last interest payment date (or original issue date) and runs through the day immediately preceding the settlement date. The Fund has purchased three bonds from the Meadows Metropolitan Districts No. 1, 2 and 7 with an aggregate balance of purchase accrued of $44,026,872 (98.84% of the March 31, 2014 balance of $44,543,697). Approximately $38,566,482 of additional interest has accrued on the purchase accrued interest since its purchase in 2007. This additional accrued interest has been fair valued in accordance with ASC 820 at approximately $28,897,041 and is included in other assets net of liabilities in the Schedule of Investments. This amount bears interest at the rate of 7.999% and will be received over an uncertain period of years. The value of the Meadows bonds is contained within three separate line items of the financial statements which all relate to a single set of bonds that cannot be sold separately.

| (8) | Litigation |

Colorado BondShares (the “Fund”)is periodically involved in various legal proceedings. At March 31, 2014 the Fund has a litigation accrual of $412,992 for all pending litigation matters primarily for the purpose of paying lawyer’s fees. Possible additional amounts cannot be currently estimated but will be set aside as needed. Although there can be no assurances, based on information available, management believes that it is probable that the ultimate outcome of each of the actions described below and other matters that are pending or threatened will not have a material effect the Fund’s financial condition.

Marin Metropolitan District LTD Tax G.O. Series 2008

The Fund is the beneficial owner of bonds issued in 2008 (the “Bonds”) by Marin Metropolitan District (the “District”) as described more fully in the Fund’s semi-annual report for the period ended March 31, 2014. The original principal amount of Bonds was $30,485,000. The current principal amount of Bonds is $17,485,000.

On June 1, 2011, an action entitled Landmark Towers Ass’n, et al. v. UMB Bank, et al., Case Number 2011-CV-1076 was filed in Arapahoe County District Court, Colorado (“Landmark Litigation #1”). The complaint filed in Landmark Litigation #1 sought a temporary restraining order, declaratory relief and permanent injunction against the District, the Fund, and UMB Bank, (“UMB”), the trustee, alleging that the taxes imposed by the District pledged to pay the Bonds violated Colorado’s Tax Payer Bill of Rights (“TABOR”). The petitioner, Landmark Towers Association, Inc. (“Landmark”), is a homeowner association and filed suit on behalf of its members.

In August 2011, Landmark sought to freeze approximately $13,000,000 in original proceeds from the sale of the Bonds to the Fund, which moneys were held by UMB as trustee. The District Court denied Landmark’s efforts to freeze the $13,000,000 and allowed those moneys to be paid to the Fund, which reduced the principal amount of Bonds to the current level.

24

Colorado BondShares

A Tax-Exempt Fund

Notes to Financial Statements (unaudited) — (Continued)

In July and August 2013, a bench trial was held regarding Landmark’s claims for declaratory relief and permanent injunction. On September 6, 2013, the District Court issued an order (“Order”) that the District was properly formed and that the election approving the taxes was proper, but nonetheless held that there were violations of TABOR relating to the property taxes. In particular, the District Court held that (1) bond proceeds were used to pay improper charges of the developer; (2) the taxes exceeded the maximum mill levy for debt service; and (3) the taxes did not benefit the Landmark taxpayers. After holding that the taxes did not provide a benefit to the Landmark taxpayers, the Court enjoined the District from imposing its taxes on the Landmark members for purposes of paying the Bonds. The Fund, the District and UMB filed a motion for reconsideration of the Order, which was denied by the District Court in an order dated October 31, 2013.

While the Fund was not found to be in anyway responsible for damages based on the asserted TABOR violations, the Court on March 10, 2014 entered an order allowing Landmark to pursue claims for fraudulent transfer and constructive trust that could result in the Fund being ordered to pay some or all of the tax refund obligations of the District.

The Fund believes that the District Court decisions are contrary to Colorado law and intends to vigorously defend the newly allowed claims and pursue appeals of the District Court decisions. The injunction, if upheld, would reduce the current tax revenues pledged to pay the Bonds. However, it is impossible to determine the direction, cost, duration or ultimate outcome of the Landmark Litigation #1. In addition, litigation is expensive and time consuming and, while the Fund fully intends to recover its costs, there can be no assurance that this will occur and there could be further adverse effects on dividend distributions and net asset values of the Fund while the matter is pending.