UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05010

Mutual Fund and Variable Insurance Trust

(Exact name of registrant as specified in charter)

36 North New York Avenue

Huntington, NY 11743

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

Corporate Trust Center

1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-631-629-4237

Date of fiscal year end: April 30

Date of reporting period: April 30, 2019

| Item 1. | Reports to Shareholders. |

|

| TREND AGGREGATION DIVIDEND AND INCOME FUND |

| Institutional Shares: TRDVX |

| TREND AGGREGATION GROWTH FUND |

| Institutional Shares: TRAGX |

| Annual Shareholder Report |

| April 30, 2019 |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website, Tuttlefunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by following the instructions included with paper Funds documents that have been mailed to you.

Management’s Discussion of Fund Performance

Dear Shareholder:

The Trend Aggregation Dividend and Income Fund (TRDVX) seeks current income while maintaining a secondary emphasis on long-term capital appreciation and low volatility. The Fund seeks to achieve its investment objective by employing a tactical approach to obtain exposure to income-producing securities.

For the fiscal period ended April 30, 2019, TRDVX generated a positive return of 1.02% since the commencement date of 5/17/2018.

The primary driver of the low performance was the market weakness during the fourth quarter of 2018.

We are pleased with the performance of the Fund and our quantitative models. The models performed as expected, and we believe that our disciplined approach will allow the Fund to outperform over the long-term. We appreciate your confidence and continued interest in the Fund.

Sincerely,

Matthew Tuttle

Portfolio Manager

4747-NLD-6/10/2019

1

Management’s Discussion of Fund Performance

Dear Shareholder:

The Trend Aggregation Growth Fund (TRAGX) seeks long-term capital appreciation while maintaining a secondary emphasis on capital preservation. The Fund seeks to achieve its investment objective by employing a tactical approach to obtain exposure to U.S. equity markets.

For the fiscal period ended April 30, 2019, TRAGX generated a negative return of 0.89% since the commencement date of 5/17/2018.

The primary driver of the negative performance was the market weakness during the fourth quarter of 2018.

We are pleased with the performance of the Fund and our quantitative models. The models performed as expected, and we believe that our disciplined approach will allow the Fund to outperform over the long-term. We appreciate your confidence and continued interest in the Fund.

Sincerely,

Matthew Tuttle

Portfolio Manager

4746-NLD-6/10/2019

2

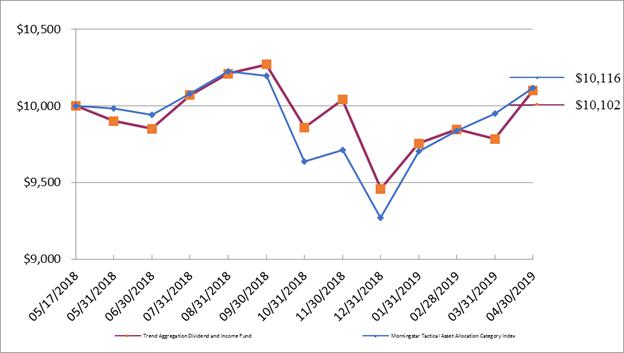

Trend Aggregation Dividend and Income Fund

PORTFOLIO REVIEW (Unaudited)

April 30, 2019

The Fund’s performance figures* for the period ended April 30, 2019, compared to its benchmark:

| Since Inception** | |

| Trend Aggregation Dividend and Income Fund - Institutional Class | 1.02% |

| Morningstar Tactical Asset Allocation Category Index (a) | 1.16% |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. See the financial highlights for the current expense ratios. Per the fee table in the Fund’s April 19, 2018 prospectus, the total annual operating expense is 2.12% before fee waivers. For performance information current to the most recent month-end, please call toll-free 1-844-828-3203. |

| ** | Inception date is May 17, 2018. |

| (a) | Morningstar Tactical A Allocation sset Category Index - Tactical Allocation portfolios seek to provide capital appreciation and income by actively shifting allocations across investments. These portfolios have material shifts across equity regions, and bond sectors on a frequent basis. To qualify for the tactical allocation category, a fund must have minimum exposures of 10% in bonds and 20% in equity. Next, the fund must historically demonstrate material shifts in sector or regional allocations either through a gradual shift over three years or through a series of material shifts on a quarterly basis. Within a three year period, typically the average quarterly changes between equity regions and bond sectors exceeds 15% or the difference between the maximum and minimum exposure to a single equity region or bond sector exceeds 50%. Investors cannot directly invest in an index and unmanaged index returns do not reflect any fees, expenses, or sales charges. |

Comparison of the Change in Value of a $10,000 Investment

| Holdings by Industry/Asset Type | % of Net Assets | |||

| Exchange Traded Funds | 14.6 | % | ||

| Diversified Financial Services | 8.3 | % | ||

| Retail | 8.1 | % | ||

| Commercial Services | 6.6 | % | ||

| Beverages | 6.2 | % | ||

| Software | 6.1 | % | ||

| Media | 5.2 | % | ||

| Semiconductors | 4.1 | % | ||

| Private Equity | 3.1 | % | ||

| Pharmaceuticals | 3.1 | % | ||

| Other/Short-Term Investments | 34.6 | % | ||

| 100.0 | % | |||

Please refer to the Portfolio of Investments for a more detailed breakdown of the Fund’s assets.

3

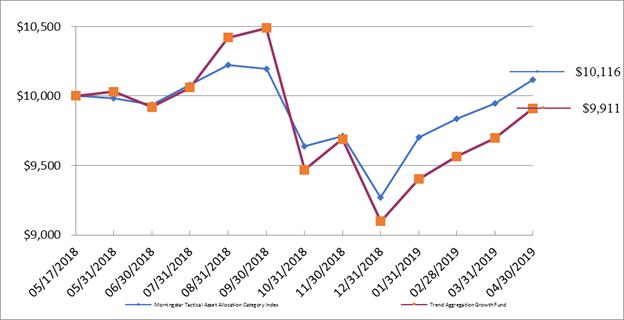

Trend Aggregation Growth Fund

PORTFOLIO REVIEW (Unaudited)

April 30, 2019

The Fund’s performance figures* for the period ended April 30, 2019, compared to its benchmark:

| Since Inception** | |

| Trend Aggregation Growth Fund - Institutional Class | (0.89)% |

| Morningstar Tactical Asset Allocation Category Index (a) | 1.16% |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. See the financial highlights for the current expense ratios. Per the fee table in the Fund’s April 19, 2018 prospectus, the total annual operating expense is 2.10% before fee waivers. For performance information current to the most recent month-end, please call toll-free 1-844-828-3203. |

| ** | Inception date is May 17, 2018. |

| (a) | Morningstar Tactical Asset Allocation Category Index - Tactical Allocation portfolios seek to provide capital appreciation and income by actively shifting allocations across investments. These portfolios have material shifts across equity regions, and bond sectors on a frequent basis. To qualify for the tactical allocation category, a fund must have minimum exposures of 10% in bonds and 20% in equity. Next, the fund must historically demonstrate material shifts in sector or regional allocations either through a gradual shift over three years or through a series of material shifts on a quarterly basis. Within a three year period, typically the average quarterly changes between equity regions and bond sectors exceeds 15% or the difference between the maximum and minimum exposure to a single equity region or bond sector exceeds 50%. Investors cannot directly invest in an index and unmanaged index returns do not reflect any fees, expenses, or sales charges. |

Comparison of the Change in Value of a $10,000 Investment

| Holdings by Industry/Asset Type | % of Net Assets | |||

| Exchange Traded Funds | 29.6 | % | ||

| Internet | 13.8 | % | ||

| Software | 9.3 | % | ||

| Lodging | 3.2 | % | ||

| Transportation | 1.6 | % | ||

| Semiconductors | 1.5 | % | ||

| Electric | 1.5 | % | ||

| Other/Short-Term Investments | 39.5 | % | ||

| 100.0 | % | |||

Please refer to the Portfolio of Investments for a more detailed breakdown of the Fund’s assets.

4

| Trend Aggregation Dividend and Income Fund |

| PORTFOLIO OF INVESTMENTS |

| April 30, 2019 |

| Shares | Value | |||||||

| COMMON STOCKS - 76.8% | ||||||||

| ADVERTISING - 2.0% | ||||||||

| 19,677 | Omnicom Group, Inc. | $ | 1,574,750 | |||||

| APPAREL - 2.0% | ||||||||

| 16,967 | VF Corp. | 1,601,854 | ||||||

| BEVERAGES - 6.2% | ||||||||

| 25,157 | Coca-Cola Co. | 1,234,202 | ||||||

| 7,424 | Diageo PLC - ADR | 1,251,983 | ||||||

| 19,752 | PepsiCo., Inc. | 2,529,244 | ||||||

| 5,015,429 | ||||||||

| CHEMICALS - 2.0% | ||||||||

| 13,727 | PPG Industries, Inc. | 1,612,923 | ||||||

| COMMERCIAL SERVICES - 6.6% | ||||||||

| 12,398 | Moody’s Corp. | 2,437,695 | ||||||

| 15,923 | Total System Services, Inc. | 1,627,967 | ||||||

| 8,987 | Verisk Analytics, Inc. | 1,268,425 | ||||||

| 5,334,087 | ||||||||

| COSMETICS / PERSONAL CARE - 1.5% | ||||||||

| 11,519 | Procter & Gamble Co. | 1,226,543 | ||||||

| DIVERSIFIED FINANCIAL SERVICES - 8.3% | ||||||||

| 14,327 | American Express Co. | 1,679,554 | ||||||

| 10,094 | Mastercard, Inc. | 2,566,299 | ||||||

| 14,706 | Visa, Inc. | 2,418,108 | ||||||

| 6,663,961 | ||||||||

| HAND / MACHINE TOOLS - 2.0% | ||||||||

| 10,924 | Stanley Black & Decker, Inc. | 1,601,458 | ||||||

| INSURANCE - 1.6% | ||||||||

| 5,755 | Berkshire Hathaway, Inc. * | 1,247,166 | ||||||

| INVESTMENT COMPANIES - 2.0% | ||||||||

| 31,964 | Oaktree Capital Group LLC | 1,618,018 | ||||||

| LODGING - 1.5% | ||||||||

| 8,931 | Marriott International, Inc. | 1,218,367 | ||||||

| MACHINERY - DIVERSIFIED - 3.1% | ||||||||

| 6,869 | Roper Technologies, Inc. | 2,470,779 | ||||||

| MEDIA - 5.2% | ||||||||

| 30,472 | Walt Disney Co. | 4,173,750 | ||||||

| OIL & GAS - 2.3% | ||||||||

| 25,849 | Anadarko Petroleum Corp. | 1,883,100 | ||||||

| PHARMACEUTICALS - 3.1% | ||||||||

| 17,515 | Johnson & Johnson | 2,473,118 | ||||||

| PRIVATE EQUITY - 3.1% | ||||||||

| 25,094 | Brookfield Asset Management, Inc. | 1,209,280 | ||||||

| 51,694 | KKR & Co., Inc. | 1,263,918 | ||||||

| 2,473,198 | ||||||||

| REITS - 3.0% | ||||||||

| 6,141 | American Tower Corp. | 1,199,337 | ||||||

| 6,055 | SBA Communications Corp. * | 1,233,585 | ||||||

| 2,432,922 | ||||||||

See accompanying notes to financial statements.

5

| Trend Aggregation Dividend and Income Fund |

| PORTFOLIO OF INVESTMENTS (Continued) |

| April 30, 2019 |

| Shares | Value | |||||||

| COMMON STOCKS - 76.8% (Continued) | ||||||||

| RETAIL - 8.1% | ||||||||

| 17,467 | CarMax, Inc. * | $ | 1,359,981 | |||||

| 22,311 | Dollar Tree, Inc. * | 2,482,768 | ||||||

| 22,223 | Kohl’s Corp. | 1,580,055 | ||||||

| 2,954 | O’Reilly Automotive, Inc. * | 1,118,296 | ||||||

| 6,541,100 | ||||||||

| SEMICONDUCTORS - 4.1% | ||||||||

| 19,634 | QUALCOMM, Inc. | 1,691,076 | ||||||

| 36,719 | Taiwan Semiconductor Manufacturing Co. Ltd. - ADR | 1,609,027 | ||||||

| 3,300,103 | ||||||||

| SOFTWARE - 6.1% | ||||||||

| 18,602 | Microsoft Corp. | 2,429,421 | ||||||

| 44,190 | Oracle Corp. | 2,445,033 | ||||||

| 4,874,454 | ||||||||

| TELECOMMUNICATIONS - 3.0% | ||||||||

| 21,504 | Cisco Systems, Inc. | 1,203,149 | ||||||

| 7,188 | Ubiquiti Networks, Inc. | 1,225,195 | ||||||

| 2,428,344 | ||||||||

| TOTAL COMMON STOCKS (Cost - $59,873,373) | 61,765,424 | |||||||

| EXCHANGE TRADED FUNDS - 14.6% | ||||||||

| 32,215 | iShares 20+ Year Treasury Bond ETF | 3,983,385 | ||||||

| 14,017 | iShares iBoxx High Yield Corporate Bond ETF | 1,218,638 | ||||||

| 10,564 | iShares S&P 500 Value ETF | 1,239,791 | ||||||

| 12,152 | iShares Select Dividend ETF | 1,228,081 | ||||||

| 75,732 | ProShares VIX Short-Term Futures ETF * | 1,599,460 | ||||||

| 4,598 | SPDR Dow Jones Industrial Average ETF Trust | 1,222,102 | ||||||

| 11,933 | SPDR S&P Dividend ETF | 1,211,438 | ||||||

| TOTAL EXCHANGE TRADED FUNDS (Cost - $11,567,351) | 11,702,895 | |||||||

| SHORT-TERM INVESTMENT - 11.5% | ||||||||

| 9,224,833 | Fidelity Institutional Government Portfolio, Institutional Class, 2.35% ** | 9,224,833 | ||||||

| TOTAL SHORT-TERM INVESTMENT (Cost - $9,224,833) | ||||||||

| TOTAL INVESTMENTS - 102.9% (Cost - $80,665,557) | $ | 82,693,152 | ||||||

| LIABILITES IN EXCESS OF OTHER ASSETS - (2.9)% | (2,287,809 | ) | ||||||

| NET ASSETS - 100.0% | $ | 80,405,343 | ||||||

ADR - American Depository Receipt

ETF - Exchange Traded Fund

REIT - Real Estate Investment Trust

SPDR - Standard & Poor’s Depositary Receipt

| * | Non-income producing security. |

| ** | Rate shown represents the rate at April 30, 2019, it is subject to change and resets daily. |

See accompanying notes to financial statements.

6

| Trend Aggregation Growth Fund |

| PORTFOLIO OF INVESTMENTS |

| April 30, 2019 |

| Shares | Value | |||||||

| COMMON STOCKS - 30.9% | ||||||||

| ELECTRIC - 1.5% | ||||||||

| 59,032 | PG&E Corp. * | $ | 1,329,401 | |||||

| INTERNET - 13.8% | ||||||||

| 1,161 | Alphabet, Inc. * | 1,379,825 | ||||||

| 748 | Amazon.com, Inc. * | 1,441,037 | ||||||

| 21,291 | Facebook, Inc. * | 4,117,680 | ||||||

| 6,307 | IAC/InterActiveCorp. * | 1,418,066 | ||||||

| 22,498 | Match Group, Inc. | 1,358,879 | ||||||

| 3,663 | Netflix, Inc. * | 1,357,288 | ||||||

| 13,370 | Okta, Inc. * | 1,390,881 | ||||||

| 12,463,656 | ||||||||

| LODGING - 3.2% | ||||||||

| 157,362 | Caesars Entertainment Corp. * | 1,472,908 | ||||||

| 16,493 | Hilton Worldwide Holdings, Inc. | 1,434,726 | ||||||

| 2,907,634 | ||||||||

| SEMICONDUCTORS - 1.5% | ||||||||

| 32,831 | Micron Technology, Inc. * | 1,380,872 | ||||||

| SOFTWARE - 9.3% | ||||||||

| 14,493 | Adobe, Inc. * | 4,192,100 | ||||||

| 21,306 | Microsoft Corp. | 2,782,564 | ||||||

| 8,360 | salesforce.com, Inc. * | 1,382,326 | ||||||

| 8,356,990 | ||||||||

| TRANSPORTATION - 1.6% | ||||||||

| 6,204 | Canadian Pacific Railway Ltd. | 1,390,130 | ||||||

| TOTAL COMMON STOCKS (Cost - $27,209,063) | 27,828,683 | |||||||

| EXCHANGE TRADED FUNDS - 29.6% | ||||||||

| 49,411 | Financial Select Sector SPDR Fund | 1,384,496 | ||||||

| 23,530 | Invesco QQQ Trust Series 1 | 4,459,876 | ||||||

| 7,009 | iShares Core S&P Mid-Cap ETF | 1,380,002 | ||||||

| 8,693 | iShares Russell 2000 ETF | 1,376,015 | ||||||

| 23,598 | iShares S&P 500 Value ETF | 2,769,461 | ||||||

| 8,397 | iShares S&P Mid-Cap 400 Value ETF | 1,379,711 | ||||||

| 6,607 | iShares US Aerospace & Defense ETF | 1,384,959 | ||||||

| 84,500 | ProShares Ultra S&P 500 | 10,722,205 | ||||||

| 6,203 | SPDR S&P 500 ETF Trust | 1,823,806 | ||||||

| TOTAL EXCHANGE TRADED FUNDS (Cost - $26,636,605) | 26,680,531 | |||||||

| SHORT-TERM INVESTMENT - 19.7% | ||||||||

| 17,729,885 | Fidelity Institutional Government Portfolio, Institutional Class, 2.35% ** | 17,729,885 | ||||||

| TOTAL SHORT-TERM INVESTMENT (Cost - $17,729,885) | ||||||||

| TOTAL INVESTMENTS - 80.2% (Cost - $71,575,553) | $ | 72,239,099 | ||||||

| OTHER ASSETS IN EXCESS OF LIABILITIES - 19.8% | 17,915,408 | |||||||

| NET ASSETS - 100.0% | $ | 90,154,507 | ||||||

ETF - Exchange Traded Fund

SPDR - Standard & Poor’s Depositary Receipt

| * | Non-income producing security. |

| ** | Rate shown represents the rate at April 30, 2019, it is subject to change and resets daily. |

See accompanying notes to financial statements.

7

| TREND FUNDS |

| Statements of Assets and Liabilities |

| April 30, 2019 |

| Trend Aggregation | Trend Aggregation | |||||||

| Dividend and Income Fund | Growth Fund | |||||||

| ASSETS: | ||||||||

| Investments in securities, at cost | $ | 80,665,557 | $ | 71,575,553 | ||||

| Investments, at value | $ | 82,693,152 | $ | 72,239,099 | ||||

| Receivable for securities sold | 14,366,013 | 49,089,155 | ||||||

| Receivable for fund shares sold | 118,398 | 51,414 | ||||||

| Dividends and interest receivable | 57,890 | 36,363 | ||||||

| Prepaid expenses and other assets | 17,357 | 16,949 | ||||||

| Total Assets | 97,252,810 | 121,432,980 | ||||||

| LIABILITIES: | ||||||||

| Payable for securities purchased | 16,605,552 | 30,975,712 | ||||||

| Payable for fund shares redeemed | 152,205 | 202,619 | ||||||

| Management fees payable | 65,993 | 75,461 | ||||||

| Fees payable to related parties | 11,966 | 13,138 | ||||||

| Shareholder servicing fee | 2,199 | 1,856 | ||||||

| Payable for trustee fees | 178 | 178 | ||||||

| Accrued expenses and other liabilities | 9,374 | 9,509 | ||||||

| Total Liabilities | 16,847,467 | 31,278,473 | ||||||

| NET ASSETS | $ | 80,405,343 | $ | 90,154,507 | ||||

| NET ASSETS CONSIST OF: | ||||||||

| Paid in capital | $ | 81,048,968 | $ | 92,461,038 | ||||

| Accumulated loss | (643,625 | ) | (2,306,531 | ) | ||||

| NET ASSETS | $ | 80,405,343 | $ | 90,154,507 | ||||

| Net Assets | $ | 80,405,343 | $ | 90,154,507 | ||||

| Shares of beneficial interest outstanding (a) | 8,141,526 | 9,247,073 | ||||||

| Net asset value (net assets ÷ shares outstanding), offering and redemption price per share | $ | 9.88 | $ | 9.75 | ||||

| (a) | Unlimited number of shares of no par value beneficial interest authorized. |

See accompanying notes to financial statements.

8

| TREND FUNDS |

| Statements of Operations |

| For the Period Ended April 30, 2019 |

| Trend Aggregation | Trend Aggregation | |||||||

| Dividend and Income Fund (a) | Growth Fund (a) | |||||||

| INVESTMENT INCOME: | ||||||||

| Dividend income | $ | 1,069,228 | $ | 538,727 | ||||

| Interest income | 282,059 | 347,228 | ||||||

| Foreign tax withheld | (2,022 | ) | — | |||||

| TOTAL INVESTMENT INCOME | 1,349,265 | 885,955 | ||||||

| OPERATING EXPENSES: | ||||||||

| Investment management fees | 663,530 | 768,067 | ||||||

| Administration fees | 70,974 | 81,809 | ||||||

| MFund services fees | 51,938 | 59,535 | ||||||

| Registration expense | 25,049 | 24,366 | ||||||

| Legal fees | 13,630 | 13,630 | ||||||

| Compliance officer fees | 13,149 | 13,379 | ||||||

| Printing expense | 13,088 | 13,589 | ||||||

| Audit fees | 12,999 | 12,999 | ||||||

| Trustees’ fees | 8,869 | 8,869 | ||||||

| Custody fees | 8,451 | 8,770 | ||||||

| Shareholder servicing fees | 6,164 | 5,268 | ||||||

| Insurance expense | 2,000 | 2,200 | ||||||

| Miscellaneous expense | 1,885 | 1,885 | ||||||

| TOTAL OPERATING EXPENSES | 891,726 | 1,014,366 | ||||||

| NET INVESTMENT INCOME (LOSS) | 457,539 | (128,411 | ) | |||||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | ||||||||

| Net realized loss from: | ||||||||

| Investments | (1,296,662 | ) | (1,405,973 | ) | ||||

| Net change in unrealized appreciation on: | ||||||||

| Investments | 2,027,595 | 663,546 | ||||||

| NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | 730,933 | (742,427 | ) | |||||

| NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | $ | 1,188,472 | $ | (870,838 | ) | |||

| (a) | The Funds commenced operations on May 17, 2018. |

See accompanying notes to financial statements.

9

| TREND FUNDS |

| Statements of Changes in Net Assets |

| Trend Aggregation | Trend Aggregation | |||||||

| Dividend and Income Fund (a) | Growth Fund (a) | |||||||

| Period Ended | Period Ended | |||||||

| April 30, 2019 | April 30, 2019 | |||||||

| OPERATIONS: | ||||||||

| Net investment income (loss) | $ | 457,539 | $ | (128,411 | ) | |||

| Net realized loss from investments | (1,296,662 | ) | (1,405,973 | ) | ||||

| Net change in unrealized appreciation on investments | 2,027,595 | 663,546 | ||||||

| Net increase (decrease) in net assets resulting from operations | 1,188,472 | (870,838 | ) | |||||

| DISTRIBUTIONS TO SHAREHOLDERS: | ||||||||

| Total distributions paid | ||||||||

| Institutional Class | (1,841,457 | ) | (1,445,053 | ) | ||||

| Net decrease in net assets from distributions to shareholders | (1,841,457 | ) | (1,445,053 | ) | ||||

| SHARE TRANSACTIONS OF BENEFICIAL INTEREST: | ||||||||

| Net proceeds from shares sold | ||||||||

| Institutional Class | 115,497,111 | 127,512,596 | ||||||

| Reinvestment of distributions | ||||||||

| Institutional Class | 1,841,457 | 1,445,053 | ||||||

| Cost of shares redeemed | ||||||||

| Institutional Class | (36,280,240 | ) | (36,487,251 | ) | ||||

| Net increase in net assets from share transactions of beneficial interest | 81,058,328 | 92,470,398 | ||||||

| TOTAL INCREASE IN NET ASSETS | 80,405,343 | 90,154,507 | ||||||

| NET ASSETS: | ||||||||

| Beginning of Period | — | — | ||||||

| End of Period | $ | 80,405,343 | $ | 90,154,507 | ||||

| SHARE ACTIVITY: | ||||||||

| Institutional Class | ||||||||

| Shares sold | 11,659,708 | 12,864,570 | ||||||

| Shares reinvested | 199,292 | 164,211 | ||||||

| Shares redeemed | (3,717,474 | ) | (3,781,708 | ) | ||||

| Net increase in shares of beneficial interest | 8,141,526 | 9,247,073 | ||||||

| (a) | The Funds commenced operations on May 17, 2018. |

See accompanying notes to financial statements.

10

| TREND FUNDS |

| Financial Highlights |

For a Share Outstanding Throughout the Period

| Trend Aggregation | Trend Aggregation | |||||||

| Dividend and Income Fund (a) | Growth Fund (a) | |||||||

| For the Period | For the Period | |||||||

| Ended April 30, | Ended April 30, | |||||||

| 2019 | 2019 | |||||||

| Net asset value, beginning of period | $ | 10.00 | $ | 10.00 | ||||

| INCOME (LOSS) FROM INVESTMENT OPERATIONS: | ||||||||

| Net investment income (loss) (b) | 0.06 | (0.02 | ) | |||||

| Net realized and unrealized gain (loss) on investments | 0.02 | (c) | (0.08 | ) | ||||

| Total gain (loss) from investment operations | 0.08 | (0.10 | ) | |||||

| LESS DISTRIBUTIONS: | ||||||||

| From net investment income | (0.03 | ) | — | |||||

| From net realized gains on investments | (0.17 | ) | (0.15 | ) | ||||

| Total distributions | (0.20 | ) | (0.15 | ) | ||||

| Net asset value, end of period | $ | 9.88 | $ | 9.75 | ||||

| Total return (d,e) | 1.02 | % | (0.89 | )% | ||||

| RATIOS/SUPPLEMENTAL DATA: | ||||||||

| Net assets, end of period (in 000’s) | $ | 80,405 | $ | 90,155 | ||||

| Ratio of expenses to average net assets (f,g) | 1.35 | % | 1.32 | % | ||||

| Ratios of net investment income (loss) (f,g,h) | 0.69 | % | (0.17 | )% | ||||

| Portfolio turnover rate (e) | 3207 | % | 3634 | % | ||||

| (a) | The Funds commenced operations on May 17, 2018. |

| (b) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (c) | Realized and unrealized gains per share in this caption are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with aggregate gains and losses in the Statement of Operations due to timing of share transactions during the period. |

| (d) | Assumes reinvestment of all dividends and distributions and does not assume the effects of any sales charges. Aggregate (not annualized) total return is shown for any period shorter than one year. Total return does not reflect the deduction of taxes that a shareholder would pay on distributions or on the redemption of shares. |

| (e) | Not annualized. |

| (f) | Annualized for periods less than one year. |

| (g) | The ratios shown do not include the Fund’s proportionate shares of the expenses of the underlying funds in which it invests. |

| (h) | Recognition of net investment income (loss) by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

See accompanying notes to financial statements.

11

| TREND FUNDS | |

| NOTES TO FINANCIAL STATEMENTS | |

| April 30, 2019 | ANNUAL REPORT |

| (1) | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES |

The Mutual Fund and Variable Insurance Trust (the “Trust”) was organized as a Delaware statutory trust on June 23, 2006. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. As of April 30, 2019, the Trust operated 13 separate series, or mutual funds, each with its own investment objective and strategy. This report contains financial statements and financial highlights of the funds listed below (individually referred to as a “Fund”, or collectively as the “Funds”):

| Fund | Primary Objective | |

| Trend Aggregation Dividend and Income Fund (“Dividend & Income”) | Seek current income while maintaining a secondary emphasis on long-term capital appreciation and low volatility. | |

| Trend Aggregation Growth Fund (“Growth”) | Seek long-term capital appreciation while maintaining a secondary emphasis on capital preservation. |

The Funds are registered as non-diversified.

Currently, the Funds offer Institutional Class shares, which commenced operations on May 17, 2018. The price at which the Funds will offer or redeem shares is the net asset value (“NAV”) per share next determined after the order is considered received. Each Fund’s prospectus provides a description of each Fund’s investment objectives, policies and strategies along with information on the classes of shares currently being offered.

| (2) | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies consistently followed by the Funds and are in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Each Fund is an investment company and accordingly follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 – Financial Services – Investment Companies including FASB Accounting Standard Update (“ASU”) 2013-08.

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts of assets, liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates.

| A. | Investment Valuations |

In computing the NAV of the Funds, fair value is based on market valuations with respect to portfolio securities for which market quotations are readily available. Pursuant to trustee-approved policies, the Trust relies on certain security pricing services to provide the current market value of securities. Those security pricing services value equity securities (including foreign equity securities, exchange-traded funds and closed-end funds) traded on a securities exchange at the last reported sales price on the principal exchange. Equity securities quoted by NASDAQ are valued at the NASDAQ official closing price. If there is no reported sale on the principal exchange, and in the case of over-the counter securities, equity securities are valued at a bid price estimated by the security pricing service. Investments in open-end investment companies are valued at their respective net asset value as reported by such companies. Short-term debt obligations having 60 days or less remaining until maturity, at time of purchase, may be valued at amortized cost.

Securities for which market quotations are not readily available are valued at fair value under Trust procedures approved by the Board of Trustees (the “Board”). In these cases, a Pricing Committee, established and appointed by the Trustees, determines in good faith, subject to Trust procedures, the fair value of portfolio securities held by a Fund (“good faith fair valuation”). When a good faith fair valuation of a security is required, consideration is generally given to a number of factors including, but not limited to the following: dealer quotes, published analyses by dealers or analysts regarding the

12

| TREND FUNDS | |

| NOTES TO FINANCIAL STATEMENTS (Continued) | |

| April 30, 2019 | ANNUAL REPORT |

security, transactions which provide implicit valuation of the security (such as a merger or tender offer transaction), the value of other securities or contracts which derive their value from the security at issue, and the implications of any other circumstances which have caused trading in the security to halt. With respect to certain categories of securities, the procedures utilized by the Pricing Committee detail specific valuation methodologies to be applied in lieu of considering the aforementioned list of factors.

Fair valuation procedures are also used when a significant event affecting the value of a portfolio security is determined to have occurred between the time when the price of the portfolio security is determined and the close of trading on the NYSE, which is when each Fund’s NAV is computed. An event is considered significant if there is both an affirmative expectation that the security’s value will change in response to the event and a reasonable basis for quantifying the resulting change in value. Significant events include significant securities’ market movements occurring between the time the price of the portfolio security is determined and the close of trading on the NYSE. For securities normally priced at their last sale price in a foreign market, such events can occur between the close of trading in the foreign market and the close of trading on the NYSE.

In some cases, events affecting the issuer of a portfolio security may be considered significant events. Examples of potentially significant events include announcements concerning earnings, acquisitions, new products, management changes, litigation developments, a strike or natural disaster affecting the company’s operations or regulatory changes or market developments affecting the issuer’s industry occurring between the time when the price of the portfolio security is determined and the close of trading on the NYSE. For securities of foreign issuers, such events could also include political or other developments affecting the economy or markets in which the issuer conducts its operations or its securities are traded.

There can be no assurance that a Fund could purchase or sell a portfolio security at the price used to calculate the Fund’s NAV. In the case of good faith fair valued portfolio securities, lack of information and uncertainty as to the significance of information may lead to a conclusion that a prior valuation is the best indication of a portfolio security’s present value. Good faith fair valuations generally remain unchanged until new information becomes available. Consequently, changes in good faith fair valuation of portfolio securities may be less frequent and of greater magnitude than changes in the price of portfolio securities valued at their last sale price, by an independent pricing service, or based on market quotations.

Valuation of Fund of Funds – The Funds may invest in portfolios of open-end investment companies. Open-end investment companies are valued at their respective net asset values as reported by such investment companies. Open-end investment companies value securities in their portfolios for which market quotations are readily available at their market values (generally the last reported sale price) and all other securities and assets at their fair value based on the methods established by the board of directors of the open-end investment companies.

The Trust calculates the NAV for each of the Funds by valuing securities held based on fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The valuation techniques described below maximize the use of observable inputs and minimize the use of unobservable inputs in determining fair value. The inputs used for valuing the Funds’ investments are summarized in the three broad levels listed below:

| ● | Level 1 - unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date. |

| ● | Level 2 - other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

| ● | Level 3 - significant unobservable inputs (including the Funds’ own assumptions in determining the fair value of investments). |

13

| TREND FUNDS | |

| NOTES TO FINANCIAL STATEMENTS (Continued) | |

| April 30, 2019 | ANNUAL REPORT |

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The inputs or methodology used for valuing investments is not necessarily an indication of the risk associated with investing in those investments.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following tables summarize the inputs used as of April 30, 2019, for each Fund’s assets and liabilities measured at fair value:

| Dividend & Income | ||||||||||||||||

| Assets* | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stocks | $ | 61,765,424 | $ | — | $ | — | $ | 61,765,424 | ||||||||

| Exchange Traded Funds | 11,702,895 | — | — | 11,702,895 | ||||||||||||

| Short-Term Investment | 9,224,833 | — | — | 9,224,833 | ||||||||||||

| Total Assets | $ | 82,693,152 | $ | — | $ | — | $ | 82,693,152 | ||||||||

| Growth | ||||||||||||||||

| Assets* | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stocks | $ | 27,828,683 | $ | — | $ | — | $ | 27,828,683 | ||||||||

| Exchange Traded Funds | 26,680,531 | — | — | 26,680,531 | ||||||||||||

| Short-Term Investment | 17,729,885 | — | — | 17,729,885 | ||||||||||||

| Total Assets | $ | 72,239,099 | $ | — | $ | — | $ | 72,239,099 | ||||||||

| * | Refer to the Portfolios of Investments for industry classifications. |

There were no level 3 securities held during the period.

| B. | Security Transactions and Related Income |

During the period, investment transactions are accounted for no later than the first calculation of the NAV on the business day following the trade date. For financial reporting purposes, however, security transactions are accounted for on the trade date on the last business day of the reporting period. Discounts and premiums on securities purchased are accreted and amortized over the lives of the respective securities using the effective interest method. Securities gains and losses are calculated on the identified cost basis. Interest income and expenses are accrued daily. Dividends, less foreign tax withholding (if any), are recorded on the ex-dividend date. Withholding taxes and capital gains on foreign dividends have been provided for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates.

| C. | Dividends and Distributions to Shareholders |

Dividends from net investment income are declared and paid annually. Net realized capital gains, if any, are distributed at least annually.

The amount of dividends from net investment income and net realized gains recorded on the ex-dividend date are determined in accordance with the federal income tax regulations, which may differ from GAAP and are recorded on ex-date. These “book/tax” differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature (e.g. tax treatment of foreign currency gain/loss, non-deductible stock issuance costs, distributions and income received from pass through investments and net investment loss adjustments), such amounts are reclassified within the capital accounts based on their nature for federal income tax purposes; temporary differences do not require reclassification. Temporary differences are primarily due to market discounts, capital loss carryforwards and losses deferred due to wash sales, straddles and return of capital from investments.

Certain Funds may own shares of real estate investment trusts (“REITs”) which report information on the source of their distributions annually. Distributions received from investments in REITs in excess of income from underlying investments are recorded as realized gain and/or as a reduction to the cost of the individual REIT.

14

| TREND FUNDS | |

| NOTES TO FINANCIAL STATEMENTS (Continued) | |

| April 30, 2019 | ANNUAL REPORT |

| D. | Allocation of Expenses, Income, and Gains and Losses |

Expenses directly attributable to a Fund are charged to that Fund. Expenses not directly attributable to a Fund are allocated proportionally among various Funds or all Funds within the Trust in relation to the net assets of each Fund or on another reasonable basis.

| E. | Federal Income Taxes |

It is the policy of each Fund to qualify or continue to qualify as a regulated investment company by complying with the provisions available to certain investment companies, as defined in applicable sections of the Internal Revenue Code, and to make distributions of net investment income and net realized capital gains sufficient to relieve it from all, or substantially all, federal income taxes.

The Funds recognize the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Funds’ tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions expected to be taken in the Funds’ April 30, 2019 period-end tax returns. Each Fund identifies its major tax jurisdictions as U.S. Federal, and foreign jurisdictions where the Funds make significant investments; however, the Funds are not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statements of Operations. During the period, the Funds did not incur any interest or penalties.

| F. | Indemnification |

The Trust indemnifies its Officers and Trustees for certain liabilities that may arise from the performance of their duties to the Trust. Additionally, in the normal course of business, the Funds enter into contracts that contain a variety of representations and warranties and which provide general indemnities. The Funds’ maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Funds that have not yet occurred. However, based on experience, the risk of loss due to these warranties and indemnities appears to be remote.

| (3) | FEES AND OTHER TRANSACTIONS WITH AFFILIATES AND OTHER SERVICE PROVIDERS |

Investment Advisory Fee— Tuttle Tactical Management, LLC, (the “Advisor”) serves as the Funds’ investment adviser. Under the terms of the Management Agreement, the Advisor manages the investment operations of the Funds in accordance with each Fund’s respective investment policies and restrictions. The Advisor oversees the day-to-day management of the Funds. The Advisor provides the Funds with investment advice and supervision and furnishes an investment program for the Funds. For its investment management services, the Funds pay to the Advisor, as of the last day of each month, an annualized fee shown in the below table, such fees to be computed daily based upon daily average net assets of the Funds.

The Advisor has contractually agreed to waive all or a portion of its investment advisory fee (based on average daily net assets) and/or reimburse certain operating expenses of each Fund to the extent necessary in order to limit each Fund’s total annual fund operating expenses (after the fee waivers and/or expense reimbursements, and exclusive of acquired fund fees and expenses, brokerage costs, interest, taxes and dividends on securities sold short, and extraordinary expenses) as listed below:

| Fund | Advisory Fee | Expense Limitation | Expense Cap Expiration Date |

| Dividend & Income - Institutional Class | 1.00% | 1.50% | August 31, 2020 |

| Growth - Institutional Class | 1.00% | 1.50% | August 31, 2020 |

Amounts waived or reimbursed in the contractual period may be recouped by the Advisor within three years of the waiver and/or reimbursement. As of April 30, 2019, there were no waivers and/or reimbursement for the Funds.

15

| TREND FUNDS | |

| NOTES TO FINANCIAL STATEMENTS (Continued) | |

| April 30, 2019 | ANNUAL REPORT |

The Independent Trustees are paid a quarterly retainer, and receive compensation for each committee meeting, telephonic Board meeting, and special in-person Board meeting attended. Officers receive no compensation from the Trust. The Trust reimburses each of the Independent Trustees for travel and other expenses incurred in connection with attendance at such meetings. The Trust has no retirement or pension plans. Additional information regarding the Trust’s Trustees is available in the Funds’ Statement of Additional Information.

The Board has adopted the Trust’s Distribution Plan (the “12b-1 Plan”) which allows each Fund to pay fees up to 0.25% for the Institutional shares based on average daily net assets of each class to financial intermediaries (which may be paid through the Funds’ distributor) for the sale and distribution of these shares. Pursuant to the 12b-1 Plan, the Funds may finance from their assets certain activities or expenses that are intended primarily to result in the sale of Fund shares and to reimburse Northern Lights Distributors, LLC. (the “Distributor” or “NLD”) and Advisor for distribution related expenses. However, the 12b-1 Plan has not been implemented.

Shareholder Servicing Fees – The Trust has adopted a Shareholder Services Plan pursuant to which the Funds may pay Shareholder Services Fees up to 0.25% of the average daily net assets to financial intermediaries for providing shareholder assistance, maintaining shareholder accounts and communicating or facilitating purchases and redemptions of shares for Institutional Class.

In addition, certain affiliates of the Distributor provide services to the Funds as follows:

Gemini Fund Services, LLC (“GFS”) – GFS, an affiliate of the Distributor, provides administrative, fund accounting, and transfer agency services to the Funds pursuant to agreements with the Trust, for which it receives from each Fund the greater of an annual minimum fee or an asset based fee, which scales downward based upon net assets for fund administration, fund accounting and transfer agency services and are reflected as such on the Statements of Operations. The Funds also pay GFS for any out-of-pocket expenses. Officers of the Trust are also employees of GFS, and are not paid any fees directly by the Trust for serving in such capacity.

Blu Giant, LLC (“Blu Giant”) – Blu Giant, an affiliate of GFS and the Distributor, provides EDGAR conversion and filing services as well as print management services for the Funds on an ad-hoc basis. For the provision of these services, Blu Giant receives customary fees from the Funds, which is included in printing expense on the Statements of Operations.

Effective February 1, 2019, NorthStar Financial Services Group, LLC, the parent company of GFS and its affiliated companies including NLD, and Blu Giant (collectively, the “Gemini Companies”), sold its interest in the Gemini Companies to a third party private equity firm that contemporaneously acquired Ultimus Fund Solutions, LLC (an independent mutual fund administration firm) and its affiliates (collectively, the “Ultimus Companies”). As a result of these separate transactions, the Gemini Companies and the Ultimus Companies are now indirectly owned through a common parent entity, The Ultimus Group, LLC.

Pursuant to the Management Services Agreement between the Trust and MFund Services LLC (“MFund”), an affiliate of the Advisor, MFund provides the Funds with various management and administrative services. For these services, the Funds pay MFund an annual base fee plus an annual asset-based fee, which scales downward based upon net assets. In addition, the Funds reimburse MFund for any reasonable out- of- pocket expenses incurred in the performance of its duties under the Management Services Agreement. These fees are included in MFund Services Fees on the Statements of Operations.

Pursuant to the Compliance Services Agreement, MFund provides chief compliance officer services to the Funds. For these services, the Funds pay MFund an annual base fee plus an annual asset-based fee based upon net assets. In addition, the Funds reimburse MFund for any reasonable out- of- pocket expenses incurred in the performance of its duties under the Compliance Services Agreement. The amounts due to MFund at April 30, 2019 for management and chief compliance officer services are listed in the Statements of Assets and Liabilities under “Fees payable to related parties.”

An Officer of the Trust is also the controlling member of MFund, and is not paid any fees directly by the Trust for serving in such capacity.

16

| TREND FUNDS | |

| NOTES TO FINANCIAL STATEMENTS (Continued) | |

| April 30, 2019 | ANNUAL REPORT |

| (4) | INVESTMENT TRANSACTIONS |

For the period ended April 30, 2019, aggregate purchases and proceeds from sales of investment securities (excluding short-term investments) for the Funds were as follows:

| Fund | Purchases | Sales | ||||||

| Dividend & Income | $ | 1,826,401,250 | $ | 1,753,658,729 | ||||

| Growth | 2,312,800,348 | 2,257,543,649 | ||||||

| (5) | AGGREGATE UNREALIZED APPRECIATION AND DEPRECIATION – TAX BASIS |

The identified cost of investments in securities owned by each Fund for federal income tax purposes, and its respective gross unrealized appreciation and depreciation at April 30, 2019, were as follows:

| Gross | Gross | Net Unrealized | ||||||||||||||

| Tax | Unrealized | Unrealized | Appreciation/ | |||||||||||||

| Cost | Appreciation | Depreciation | (Depreciation) | |||||||||||||

| Dividend & Income | $ | 81,502,966 | $ | 2,113,454 | $ | (923,268 | ) | $ | 1,190,186 | |||||||

| Growth | $ | 77,021,358 | $ | 800,749 | $ | (5,583,008 | ) | $ | (4,782,259 | ) | ||||||

| (6) | DISTRIBUTIONS TO SHAREHOLDERS AND TAX COMPONENTS OF CAPITAL |

The tax character of fund distributions paid for the period ended April 30, 2019 was as follows:

| For fiscal period ended | Ordinary | Long-Term | Return of | |||||||||||||

| 4/30/2019 | Income | Capital Gains | Capital | Total | ||||||||||||

| Trend Aggregation Dividend and Income Fund | $ | 1,841,457 | $ | — | $ | — | $ | 1,841,457 | ||||||||

| Trend Aggregation Growth Fund | 1,445,053 | — | — | 1,445,053 | ||||||||||||

As of April 30, 2019, the components of accumulated earnings/ (deficit) on a tax basis were as follows:

| Undistributed | Undistributed | Post October Loss | Capital Loss | Other | Unrealized | Total | ||||||||||||||||||||||

| Ordinary | Long-Term | and | Carry | Book/Tax | Appreciation/ | Accumulated | ||||||||||||||||||||||

| Income | Capital Gains | Late Year Loss | Forwards | Differences | (Depreciation) | Earnings/(Deficits) | ||||||||||||||||||||||

| Trend Aggregation Dividend and Income Fund | $ | 140,324 | $ | — | $ | (1,974,135 | ) | $ | — | $ | — | $ | 1,190,186 | $ | (643,625 | ) | ||||||||||||

| Trend Aggregation Growth Fund | 2,472,775 | 2,953 | — | — | — | (4,782,259 | ) | (2,306,531 | ) | |||||||||||||||||||

The difference between book basis and tax basis undistributed net investment income/(loss), accumulated net realized gain/(loss), and unrealized appreciation/(depreciation) from investments is primarily attributable to the tax deferral of losses on wash sales.

Capital losses incurred after October 31 within the fiscal year are deemed to arise on the first business day of the following fiscal year for tax purposes. The Trend Aggregation Dividend & Income Fund incurred and elected to defer such capital losses of $1,974,135.

17

| TREND FUNDS | |

| NOTES TO FINANCIAL STATEMENTS (Continued) | |

| April 30, 2019 | ANNUAL REPORT |

Permanent book and tax differences, primarily attributable to the book/tax basis treatment of non-deductible expenses, resulted in reclassifications for the Funds’ for the period ended April 30, 2019 as follows:

| Paid | Accumulated | |||||||

| In | Earnings | |||||||

| Capital | (Loss) | |||||||

| Trend Aggregation Dividend and Income Fund | $ | (9,360 | ) | $ | 9,360 | |||

| Trend Aggregation Growth Fund | (9,360 | ) | 9,360 | |||||

| (7) | BENEFICIAL OWNERSHIP |

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a)(9) of the 1940 Act. As of April 30, 2019, the companies that held more than 25% of the voting securities of the Funds, and may be deemed to control each respective Fund, are as follows:

| Dividend & Income | Growth | |||||||

| E*TRADE Savings Bank | 88.06 | % | 89.99 | % | ||||

| (8) | NEW ACCOUNTING PRONOUNCEMENT |

In August 2018, the Securities and Exchange Commission adopted amendments to certain disclosure requirements under Regulation S-X to conform to US GAAP, including: (i) an amendment to require presentation of the total, rather than the components, of distributable earnings on the Statements of Assets and Liabilities; and (ii) an amendment to require presentation of the total, rather than the components, of distributions to shareholders, except for tax return of capital distributions, on the Statements of Changes in Net Assets. The amendments also removed the requirement for parenthetical disclosure of undistributed net investment income on the Statements of Changes in Net Assets. These amendments have been adopted with these financial statements.

In August 2018, the FASB issued ASU No. 2018-13, which changes certain fair value measurement disclosure requirements. The new ASU, in addition to other modifications and additions, removes the requirement to disclose the amount and reasons for transfers between Level 1 and Level 2 of the fair value hierarchy, and the policy for the timing of transfers between levels. For investment companies, the amendments are effective for financial statements issued for fiscal years beginning after December 15, 2019, and interim periods within those fiscal years. Early adoption is allowed. These amendments have been adopted with these financial statements.

| (9) | SUBSEQUENT EVENTS |

Subsequent events after the date of the Statements of Assets and Liabilities have been evaluated through the date the financial statements were issued. Management has determined that no events or transactions occurred requiring adjustment or disclosure in the financial statements.

18

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of Trend Aggregation Dividend and Income Fund and Trend Aggregation Growth Fund and Board of Trustees of Mutual Fund and Variable Insurance Trust

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities, including the portfolios of investments, of Trend Aggregation Dividend and Income Fund and Trend Aggregation Growth Fund (the “Funds”), each a series of Mutual Fund and Variable Insurance Trust, as of April 30, 2019, and the related statements of operations and changes in net assets, including the related notes, and the financial highlights for the period May 17, 2018 (commencement of operations) through April 30, 2019 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the each of the Funds as of April 30, 2019, the results of their operations, the changes in their net assets, and the financial highlights for the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Funds’ management. Our responsibility is to express an opinion on the Funds’ financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of April 30, 2019, by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers or counterparties were not received. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

We have served as the Funds’ auditor since 2018.

COHEN & COMPANY, LTD.

Chicago, Illinois

June 28, 2019

C O H E N & C O M P A N Y , L T D .

800.229.1099 | 866.818.4538 fax | cohencpa.com

Registered with the Public Company Accounting Oversight Board

19

| TREND FUNDS |

| Supplemental Information (Unaudited) |

| Shareholder Expense Examples |

Fund Expenses. As a shareholder of a Fund, you incur ongoing costs, including management fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

These examples are based on an investment of $1,000.00 invested at the beginning of the period and held for the entire six-month period from November 1, 2018 to April 30, 2019.

Actual Expenses. The “Actual” lines of the table provide information about actual account values and actual expenses. You may use the information on this line together with the amount you invested to estimate the expense that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000.00 = 8.60), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The “Hypothetical” lines of the table provide information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as withdrawal charges, mortality and expense risk fees and other charges that may be assessed by participating insurance companies under the separate accounts, variable annuity contracts or variable life insurance policies. Therefore, the “Actual” and “Hypothetical” lines of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning | Annualized | Ending | Expenses | |||||||||||||

| Account | Expense Ratio | Account | Paid During | |||||||||||||

| Value 11/1/2018 | For the period | Value 4/30/2019 | the Period | |||||||||||||

| Trend Aggregation Growth Fund | ||||||||||||||||

| Actual * | $ | 1,000.00 | 1.30 | % | $ | 1,046.60 | $ | 6.60 | ||||||||

| Hypothetical | 1,000.00 | 1.30 | % | 1,018.35 | 6.51 | |||||||||||

| Trend Aggregation Dividend & Income Fund | ||||||||||||||||

| Actual * | $ | 1,000.00 | 1.32 | % | $ | 1,024.50 | $ | 6.63 | ||||||||

| Hypothetical | 1,000.00 | 1.32 | % | 1,018.25 | 6.61 | |||||||||||

| * | Expenses are equal to the Funds annualized expense ratio multiplies by the number of days in the period (181) divided by the number of days in the fiscal year (365). |

20

| TREND FUNDS | |

| NOTES TO FINANCIAL STATEMENTS (Unaudited) | |

| April 30, 2019 | ANNUAL REPORT |

Independent Trustees Background

| Name, Address and Year of Birth |

Position

with the Trust |

Term

of Office and Length of Time Served* |

Principal

Occupation(s) During Past 5 Years |

Number

of Portfolios in Fund Complex Overseen by Trustee** |

Other

Directorships Held During Past 5 Years |

| Tobias Caldwell Year of Birth: 1967 |

Chairman of the Board and Trustee | Since January 2016 | Managing Member, Genovese Family Enterprises, LLC (1999 – present) (real estate firm); Managing member, PTL Real Estate, LLC (2000 – present) (real estate/investment firm); Managing member, Bear Properties, LLC (2006 - present) (real estate firm). | 56 | Chairman of the Board, Strategy Shares (2016-present); Lead Independent Trustee and Chair of Audit Committee, Mutual Fund Series Trust (2006-present); Independent Trustee and Chair of Audit Committee, Variable Insurance Trust (2010-present); Trustee, M3Sixty Trust (2016-present); Chairman of the Board, AlphaCentric Prime Meridian Income Fund (July 2018 to present). |

| Stephen

P. Lachenauer Year of Birth: 1967 |

Chair of the Audit Committee and Trustee | Since January 2016 | Attorney, private practice (2011 to present). | 17 | Trustee and Chair of the Audit Committee, Strategy Shares (2016 – present); Trustee, TCG Financial Series Trusts I-X (2015- present); Trustee and Chair of the Audit Committee, AlphaCentric Prime Meridian Income Fund (July 2018 – present). |

| Donald McIntosh Year of Birth: 1967 |

Trustee | Since January 2016 | Credit risk review analyst, Santander Holdings USA (May 2015 – present); Governance analyst, Santander Bank (2011 – April 2015). | 17 | Trustee, Strategy Shares (2016– present); Trustee, TCG Financial Series Trusts I-X (2015-present); Trustee, AlphaCentric Prime Meridian Income Fund (July 2018 – present). |

| * | The term of office of each Trustee is indefinite. |

| ** | The “Fund Complex” includes the Trust, Strategy Shares, Mutual Fund Series Trust, Variable Insurance Trust, AlphaCentric Prime Meridian Income Fund and the TCG Financial Series Trusts I-X, each a registered investment company. |

21

| TREND FUNDS | |

| NOTES TO FINANCIAL STATEMENTS (Unaudited)(Continued) | |

| April 30, 2019 | ANNUAL REPORT |

Officers*

| Name,

Address, Year of Birth |

Position(s) Held with |

Term

and Length Served* |

Principal

Occupation(s) During Past 5 Years |

| Jerry

Szilagyi 36 N. New York Avenue Huntington, NY 11743 Year of Birth: 1962 |

President | Since April 2016 | President, Rational Advisors, Inc., 1/2016 - present; Chief Executive Officer, Catalyst Capital Advisors LLC, 1/2006- present; Member, AlphaCentric Advisors LLC, 2/2014 to Present; Managing Member, MFund Distributors LLC, 10/2012-present; Managing Member, MFund Services LLC, 1/2012 – Present; President, Abbington Capital Group LLC, 1998- present; CEO, Catalyst Capital International, LLC 2017- present; President, USA Mutuals, Inc., 3/2011 to 7/2016; President, Cross Sound LLC, 6/11 to 7/2016. |

| Erik

Naviloff 80 Arkay Drive Hauppauge, New York 11788 Year of Birth: 1968 |

Treasurer | Since April 2016 | Vice President – Fund Administration, Gemini Fund Services, LLC, since 2012. |

| Aaron

Smith 80 Arkay Drive. Hauppauge, New York 11788 Year of Birth: 1974 |

Assistant Treasurer | Since April 2016 | Manager - Fund Administration, Gemini Fund Services, LLC, since 2012. |

| Frederick

J. Schmidt 36 N. New York Avenue Huntington, NY 11743 Year of Birth: 1959 |

Chief Compliance Officer | Since April 2016 | Director, MFund Services LLC since 5/2015; Director & Chief Compliance Officer, Citi Fund Services, 2010-2015. |

| Jennifer

A. Bailey 36 N. New York Avenue Huntington, NY 11743 Year of Birth: 1968 |

Secretary | Since April 2016 | Director of Legal Services, MFund Services LLC, 2/2012 to present. |

| Michael

Schoonover 36 N. New York Avenue Huntington, NY 11743 Year of Birth: 1983 |

Vice President | Since June 2018 | Chief Operating Officer, Catalyst Capital Advisors LLC & Rational Advisors, Inc., June 2017 to present; Portfolio Manager, Catalyst Capital Advisors LLC 12/2013 to present; Portfolio Manager, Rational Advisors, Inc. 1/2016 to 5/2018; Senior Analyst, Catalyst Capital Advisors LLC, 3/2013 to 12/2013. |

| * | Officers do not receive any compensation from the Trust. |

The Funds’ Statement of Additional Information includes additional information about the Trustees and is available free of charge, upon request, by calling toll-free at 1-844-828-3203.

22

PRIVACY NOTICE

Mutual Fund & Variable Insurance Trust

Rev. July 2017

| FACTS | WHAT DOES MUTUAL FUND & VARIABLE INSURANCE TRUST DO WITH YOUR PERSONAL INFORMATION? |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some, but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| What? | The types of personal information we collect and share depends on the product or service that you have with us. This information can include:

● Social Security number and wire transfer instructions

● account transactions and transaction history

● investment experience and purchase history

When you are no longer our customer, we continue to share your information as described in this notice. |

| How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons Mutual Fund & Variable Insurance Trust chooses to share; and whether you can limit this sharing. |

| Reasons

we can share your personal information: |

Does

Mutual Fund & Variable Insurance Trust share information? |

Can

you limit this sharing? |

| For our everyday business purposes - such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus. | YES | NO |

| For our marketing purposes - to offer our products and services to you. | NO | We don’t share |

| For joint marketing with other financial companies. | NO | We don’t share |

| For our affiliates’ everyday business purposes - information about your transactions and records. | NO | We don’t share |

| For our affiliates’ everyday business purposes - information about your credit worthiness. | NO | We don’t share |

| For our affiliates to market to you | NO | We don’t share |

| For non-affiliates to market to you | NO | We don’t share |

| QUESTIONS? | Call 1-844-828-3203 |

23

PRIVACY NOTICE

Mutual Fund & Variable Insurance Trust

| What we do: | |

How does Mutual Fund & Variable Insurance Trust protect my personal information? |

To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings.

Our service providers are held accountable for adhering to strict policies and procedures to prevent any misuse of your nonpublic personal information. |

How does Mutual Fund & Variable Insurance Trust collect my personal information? |

We collect your personal information, for example, when you: ● open an account or deposit money

● direct us to buy securities or direct us to sell your securities

● seek advice about your investments

We also collect your personal information from others, such as credit bureaus, affiliates, or other companies. |

Why can’t I limit all sharing? |

Federal law gives you the right to limit only: ● sharing for affiliates’ everyday business purposes – information about your creditworthiness.

● affiliates from using your information to market to you.

● sharing for non-affiliates to market to you.

State laws and individual companies may give you additional rights to limit sharing. |

| Definitions | |

| Affiliates | Companies related by common ownership or control. They can be financial and non-financial companies.

● Mutual Fund & Variable Insurance Trust does not share with our affiliates. |

| Non-affiliates | Companies not related by common ownership or control. They can be financial and non-financial companies.

● Mutual Fund & Variable Insurance Trust does not share with non-affiliates so they can market to you. |

| Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you.

● Mutual Fund & Variable Insurance Trust doesn’t jointly market. |

24

A copy of the policies and procedures that the Funds use to determine how to vote proxies relating to securities held in the Funds’ portfolios, as well as a record of how the Funds voted any such proxies during the most recent 12-month period ended June 30, is available without charge and upon request by calling 844-828-3203. This information is also available from the EDGAR database on the SEC’s website at www.sec.gov.

The Funds file with the SEC a complete schedule of their portfolio holdings, as of the close of the first and third quarters of their fiscal year, on “Form N-Q.” These filings are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. (call 202-551-8090 for information on the operation of the Public Reference Room.).

Tuttle Tactical Management LLC, serves as Investment Advisor to the Funds.

This report is authorized for distribution to prospective investors only when preceded or accompanied by a prospectus which contains facts concerning the Funds’ objectives and policies, management fees, expenses and other information.

Shareholder Services: 844-828-3203

| Item 2. | Code of Ethics. |

(a) The Registrant has, as of the end of the period covered by this report, adopted a code of ethics that applies to the Registrant's principal executive officer, principal financial officer, and principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the Registrant or a third party.

(b) During the period covered by this report, there were no amendments to any provision of the code of ethics.

(c) During the period covered by the report, with respect to the registrant’s code of ethics that applies to its Principal Executive Officer and Principal Financial Officer: there have been no amendments to a provision that relates to any element of the code of ethics definition enumerated in paragraph (b) of this Item 2.

| Item 3. | Audit Committee Financial Expert. |

3(a) The registrant’s board of trustees has determined that the registrant does not have an audit committee financial expert. The audit committee determined that, although none of its members meet the technical definition of an audit committee financial expert, the committee has sufficient financial expertise to adequately perform its duties under the Audit Committee Charter without the addition of a qualified expert.

| Item 4. | Principal Accountant Fees and Services. |

(a) Audit Fees. The aggregate fees billed for each of the last two fiscal years for professional services rendered by the registrant's principal accountant for the audit of the registrant's annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years are as follows:

Fiscal year ended 2019: $21,000

(b) Audit-Related Fees. There were no fees billed in each of the last two fiscal years for assurances and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this item.

Fiscal year ended 2019: $0

(c) Tax Fees. The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance are as follows:

Fiscal year ended 2019: $5,000

(d) All other fees billed to the registrant by its principal accountants for the two most recent fiscal years:

Fiscal year ended 2019: $0

(e)(1) The audit committee does not have pre-approval policies and procedures. Instead, the audit committee or audit committee chairman approves on a case-by-case basis each audit or non-audit service before the principal accountant is engaged by the Registrant.

|

(e)(2) There were no services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| (f) Not applicable. The percentage of hours expended on the principal accountant's engagement to audit the Registrant's financial statements for the most recent fiscal year that were attributed to work performed by persons other than the principal accountant's full-time, permanent employees was zero percent (0%). |

(g) All non-audit fees billed by the Registrant's principal accountant for services rendered to the Registrant for the fiscal year ended April 30 2019, are disclosed in (b)-(d) above. There were no audit or non-audit services performed by the Registrant's principal accountant for the Registrant's adviser.

|

Item 5. |

Audit Committee of Listed Registrants. |

Not applicable.

| Item 6. | Schedule of Investments. |

Included in annual report to shareholders filed under item 1 of this form.

| Item 7. | Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies. |

Not applicable.

| Item 8. | Portfolio Managers of Closed-End Management Investment Companies. |

Not applicable.

| Item 9. | Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers. |

Not applicable.

| Item 10. | Submission of Matters to a Vote of Security Holders. |

Not applicable.

| Item 11. | Controls and Procedures. |

(a) The registrant’s Principal Executive Officer and Principal Financial Officer, or persons performing similar functions, have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Act) are effective in design and operation and are sufficient to form the basis of the certifications required by Rule 30a-2 under the Act, based on their evaluation of these disclosure controls and procedures within 90 days of the filing of this report on Form N-CSR.

(b) There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act (17 CFR 270.30a-3(d)) that occurred during the second fiscal quarter of the period covered by this report that have materially affected or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Disclosure of Securities Lending Activities for Closed-Ended Management Investment Companies

Not applicable.

| Item 13. | Exhibits. |

(1) Code of Ethics for Principal Executive and Senior Financial Officers is attached hereto.

(2) Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 are filed herewith.

(3) Certifications

pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 are filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) Mutual Fund and Variable Insurance Trust

| By (Signature and Title) |

/s/ Jerry Szilagyi | ||||

| Jerry Szilagyi, President and Principal Executive Officer | |||||

| Date |

7/5/19 |

||||

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By (Signature and Title) |

/s/ Jerry Szilagyi | |

| Jerry Szilagyi, President and Principal Executive Officer |

| Date |

7/5/19 |

| By (Signature and Title) |

/s/ Erik Naviloff | ||||

| Erik Naviloff, Treasurer and Principal Financial Officer | |||||

| Date | 7/5/19 | ||||