UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05010

Mutual Fund and Variable Insurance Trust

(Exact name of registrant as specified in charter)

36 North New York Avenue

Huntington, NY 11743

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

Corporate Trust Center

1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-631-629-4237

Date of fiscal year end: December 31

Date of reporting period: December 31, 2018

| Item 1. | Reports to Shareholders. |

Annual Shareholder Report

December 31, 2018

CLASS A SHARES

CLASS C SHARES

INSTITUTIONAL SHARES

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website www.rationalmf.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by following the instructions included with paper Fund documents that have been mailed to you.

January 31, 2019

Rational Dividend Capture Fund

Dear Fellow Shareholders,

The Rational Dividend Capture Fund (the “Fund”) seeks total return on investment, with dividend income an important component of that return. The Fund focuses on high dividend paying stocks that also are attractively valued to provide an attractive return over a full market cycle. We define a full market cycle as both a bear market and a bull market. It is expected that this strategy will underperform when such sectors like technology are very strong but outperform when the more aggressive sectors of the market are weak. The dividend yield provides a nice consistent stream of income and stability to the long-term returns. An appropriate benchmark for this strategy is not a simple question, it has characteristics of both an equity portfolio but also the yield more resembling the bond market historically. Many of the higher yielding sectors of the market had very negative returns in 2018, such as the energy sectors and telecommunications. Business Development Companies and REITs also underperformed significantly. Lastly, value-oriented stocks also significantly underperformed growth stocks, and in fact have done so four of the last five years. The value stocks and yield oriented stocks are very attractive on a historical basis relative to the market and, in particular, the growth and momentum sectors. We were able to take advantage of the market downturn last year purchasing many high-quality undervalued dividend paying stocks. As a result, the fund currently has a very attractive dividend yield. We are confident in the long-term potential of the Fund and strategy, particularly relative to more aggressive types of investments given where the markets are versus their long-term norms.

Investment Strategy

The Fund normally invests at least 80% of its net assets in dividend paying stocks, including preferred stocks and real estate investment trusts (“REITs”).

The Fund uses a value approach to identify attractive, dividend paying stocks. The discipline focuses on cash flows and earnings of companies, their growth rate, and the valuation of their stock prices. As an example, the manager likes to buy REITs below their real estate value or operating companies below their intrinsic value, to gain from the appreciation of the stock overtime while collecting an attractive dividend yield. Stocks are sold when the fundamentals deteriorate; become too highly valued; or when there may be a better alternative including cash.

As part of the investment process, the Fund invests in both preferred stocks and common stocks.

Fund Performance

The Rational Dividend Capture Fund underperformed its S&P 500 Total Return Index benchmark in 2018. The fund performed in line or better in two quarters and underperformed in two quarters. During the third quarter of 2018, technology and momentum stocks were very strong, however, many of these stocks do not meet our discipline, and as a result, we did not have a significant weighting in technology. As we mentioned, the sectors the fund invests in to get an attractive dividend yield and long-term appreciation performed poorly in 2018. What typically happens in the late stage of a market cycle is momentum and speculative stocks perform very strongly and the value and income stocks lag considerably relative to the market. This is what happened again in 2018, although it seems the stocks the fund invests in seemed to be starting to improve on a relative basis at different times during the worse parts of the market’s decline in 2018. It is the expectation of management that the volatility of the markets is going to continue in 2019, and that having an attractive dividend yield and a cash reserve will help cushion the potential downside. Additionally, the cash can be invested opportunistically. As global economic growth slows, and central banks become

1

less accommodative, equity markets are likely to start to become more normal. In that environment, the Blue Chip and dividend-oriented stocks in the Fund could perform very well on a relative basis.

The Fund’s total annualized returns through 12/31/18 as compared to the S&P 500 Total Return Index were as follows:

| Since Inception | ||||

| 1 Year | 5 Years | 10 Years | (03/01/2001) | |

| Class A | -12.22% | -0.84% | 6.76% | 4.48% |

| Class I | -11.96% | -0.58% | 7.04% | 4.74% |

| Class A with Sales Charge | -16.39% | -1.81% | 6.24% | 4.20% |

| S&P 500 Total Return Index (1) | -4.38% | 8.49% | 13.12% | 6.11% |

| S&P 500 Value TR Index (2) | -8.95% | 6.06% | 11.21% | 5.30% |

The Fund’s maximum sales charge for Class “A” shares is 4.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month- end performance information or the Fund’s prospectus please call the Fund, toll free at 1-800-253-0412. You can also obtain a prospectus at www.RationalMF.com.

Summary

Given the market downturn in 2018, we are pleased to see attractive valuations for some of the securities that fit our investment criteria of low price to earnings multiples and attractive dividends. We are confident in the long-term success of the strategy. Successful investing requires a long-term outlook focused on objective criteria that create value. We have adopted this outlook for the Rational Dividend Capture Fund, and we are glad that you have decided to share in our vision.

Sincerely,

Patrick Adams and Rick Garcia

Portfolio Managers

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

| (1) | The S&P 500 Total Return Index by Standard & Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index, although individuals may invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. The Rational Dividend Capture Fund may or may not purchase the types of securities represented by the S&P 500 Total Return Index. |

| (2) | The S&P 500 Value Total Return Index® (“S&P 500 Value TR”) is an unmanaged market-capitalization weighted index consisting of those stocks within the S&P 500 that exhibit strong value characteristics. It uses a numerical ranking system based on four value factors and three growth factors to determine the constituents and their weightings. |

4227-NLD-2/1/2019

2

Rational Dividend Capture Fund

PORTFOLIO REVIEW (Unaudited)

December 31, 2018

The Fund’s performance figures* for each of the periods ended December 31, 2018, compared to its benchmarks:

| Annualized | Annualized | Annualized | ||

| 1 Year Return | 5 Year Return | 10 Year Return | Since Inception(a) | |

| Class A | (12.22)% | (0.84)% | 6.76% | N/A |

| Class A with load | (16.39)% | (1.81)% | 6.24% | N/A |

| Class C | (12.66)% | N/A | N/A | (1.27)% |

| Institutional Class | (11.96)% | (0.58)% | 7.04% | N/A |

| S&P 500 Total Return Index (b) | (4.38)% | 8.49% | 13.12% | 8.71% |

| S&P 500/Citigroup Value Total Return Index (c) | (8.95)% | 6.06% | 11.21% | 6.23% |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s May 1, 2018 prospectus, the total annual operating expense are 1.40% for Institutional Class shares, 1.64% for A shares and 2.40% for C shares before fee waivers. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. Class A shares are subject to a maximum load of 4.75%. |

| (a) | Inception date is February 28, 2001 for Class A, Institutional Class and the Benchmarks. |

| (a) | Inception date is January 2, 2014 for Class C and the Benchmarks. |

| (b) | The “S&P 500 Total Return Index”, a registered trademark of McGraw-Hill Co., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an Index. |

| (c) | The S&P 500/Citigroup Value Total Return Index uses a numerical ranking system based on four value factors and three growth factors to determine the constituents and their weightings. Investors cannot invest directly in an Index. |

Comparison of the Change in Value of a $10,000 Investment

| Top 10 Holdings by Industry | % of Net Assets | |||

| REITs | 14.5 | % | ||

| Telecommunications | 11.2 | % | ||

| Investment Companies | 8.4 | % | ||

| Banks | 7.2 | % | ||

| Exchange Traded Funds | 7.2 | % | ||

| Diversified Financial Services | 6.1 | % | ||

| Retail | 5.1 | % | ||

| Food | 4.7 | % | ||

| Media | 4.7 | % | ||

| Pharmaceuticals | 4.6 | % | ||

| Other/Short-Term Investments | 26.3 | % | ||

| 100.0 | % | |||

Please refer to the Portfolio of Investments for a more detailed breakdown of the Fund’s assets.

3

January 31, 2019

Rational Tactical Return Fund

Dear Fellow Shareholders,

The Rational Tactical Return Fund (the “Fund”) seeks total returns consisting of capital appreciation and income by making investments in long and short call and put options on futures contracts on the S&P 500 Index, as well as cash, and cash equivalents. 2018 was the first full year for Warrington to be the Sub Advisor for the Rational Tactical Return Fund. For the year, the Fund outperformed the S&P by a significant margin, posting a +9.66% (Class I) return versus the -4.38% for its S&P 500 TR Index (S&P).

Investment Strategy

The Sub Advisor’s strategy seeks to achieve its investment objective in three ways: (1) Premium Collection – the Fund collects premiums on options it sells; (2) Volatility Trading – the Fund may enter into positions designed to hedge or profit from either an increase or a decrease in Index volatility; and (3) Trend Following – the Fund may increase or decrease the balance of puts and calls based on trending market direction. The Fund is designed to produce returns that are not correlated with equity market returns. The Fund employs strict risk management procedures, supported by both technical and fundamental analysis, that are intended to provide consistency of returns and to mitigate the extent of losses.

Fund Performance

The Tactical Return Fund generated a 2018 return of +9.66%, versus -4.38% for its S&P 500 TR Index (S&P) benchmark and -13.82% return for the S&P GSCI TR Index.

The Fund outperformed its Morningstar category as heightened volatility hurt many other managers in the option trading space. Using both quantitative and fundamental indicators to ascertain near-term market movements, Warrington was able to navigate the markets and minimized losses during volatile periods due to stringent risk management, while concurrently seeking profit opportunities. This balance helped to generate a category-leading return for the year. The Fund’s worst monthly return for the year was +0.02% whereas the S&P was -9.03.

The Fund’s total annualized returns through 12/31/18 as compared to the S&P GSCI TR Index were as follows:

| Since Inception | ||||

| 1 Year | 3 Years | 5 Years | (05/02/07) | |

| Class A | 9.45% | 6.61% | -2.85% | -2.48% |

| Class I | 9.66% | 6.75% | -2.80% | -2.31% |

| Class A with Sales Charge | 4.28% | 4.89% | -3.79% | -2.89% |

| S&P 500 Total Return Index (1) | -4.38% | 9.26% | 8.49% | 6.84% |

| S&P GSCI TR Index (2) | -13.82% | 0.50% | -14.52% | -8.04% |

The Fund’s maximum sales charge for Class “A” shares is 4.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month- end performance information or the Fund’s prospectus please call the Fund, toll free at 1-800-253-0412. You can also obtain a prospectus at www.RationalMF.com.

4

Summary

In its first full year as the Fund’s Sub Advisor, Warrington continued to provide strong absolute and relative returns, while consistently managing market risks. The Fund’s assets grew significantly in 2018, and we seek to continue that growth as equity markets have become more volatile in recent months. In such volatile markets, Warrington ensures that risk management is paramount, while concurrently evaluating the risk / reward relationship of the opportunities presented by those volatile markets.

Sincerely,

Scott Kimple and Mark Adams

Portfolio Managers

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

| (1) | The S&P 500 Total Return Index by Standard & Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index, although individuals may invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. The Rational Strategic Allocation Fund may or may not purchase the types of securities represented by the S&P 500 Total Return Index. |

| (2) | The S&P GSCI Total Return Index by Standard & Poor’s Corp. measures general price movements and inflation in the world economy. The S&P GSCI is calculated primarily on a world production-weighted basis and is comprised of the principal physical commodities that are the subject of active, liquid futures markets. The Rational Tactical Return Fund may or may not purchase the types of securities represented by the S&P GSCI Total Return Index. |

4219-NLD-1/31/2019

5

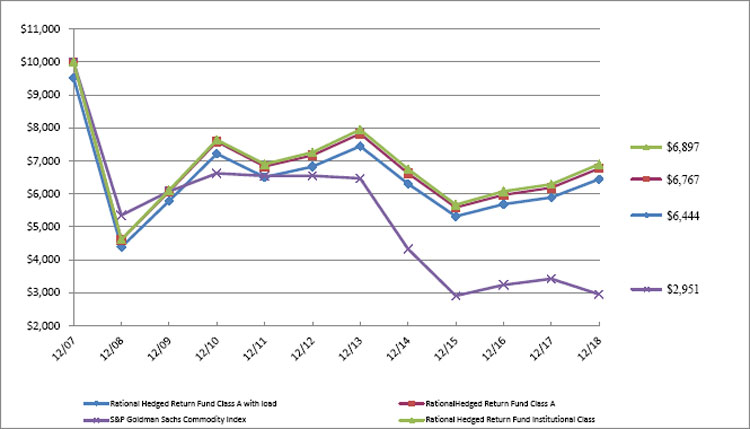

Rational Hedged Return Fund

PORTFOLIO REVIEW (Unaudited)

December 31, 2018

The Fund’s performance figures* for each of the periods ended December 31, 2018, compared to its benchmarks:

| Annualized | Annualized | Annualized | ||

| 1 Year Return | 5 Year Return | 10 Year Return | Since Inception(a) | |

| Class A | 9.45% | (2.85)% | 3.92% | N/A |

| Class A with load | 4.28% | (3.79)% | 3.41% | N/A |

| Class C | 8.62% | N/A | N/A | 6.63% |

| Institutional Class | 9.66% | (2.80)% | 4.10% | N/A |

| S&P 500 Total Return Index (b) | (4.38)% | 8.49% | 13.12% | 9.32% |

| S&P Goldman Sachs Commodity Index (c) | (13.82)% | (14.52)% | (5.78)% | (2.98)% |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s May 1, 2018 prospectus, the total annual operating expense are 5.20% for Institutional Class shares, 5.45% for A shares and 6.20% for C shares before fee waivers. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. Class A shares are subject to a maximum load of 4.75%. |

| (a) | Inception date is May 31, 2016 for Class C and the Benchmark. |

| (b) | The “S&P 500 Total Return Index”, a registered trademark of McGraw-Hill Co., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an Index. |

| (c) | The S&P Goldman Sachs Commodity Index® (“S&P GSCI”) measures general price movements and inflation in the world economy. The S&P GSCI is calculated primarily on a world production-weighted basis and is comprised of the principal physical commodities that are the subject of active, liquid futures markets. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an Index. |

Comparison of the Change in Value of a $10,000 Investment

| Top Holdings by Industry ^ | % of Net Assets | |||

| Short-Term Investments | 55.4 | % | ||

| Other/Short-term Investments | 44.6 | % | ||

| 100.0 | % | |||

| ^ Does not include derivatives in which the Fund invests. | ||||

Please refer to the Portfolio of Investments for a more detailed breakdown of the Fund’s assets.

6

January 31, 2019

Rational Dynamic Brands Fund

Dear Fellow Shareholders,

The Rational Dynamic Brands Fund (the “Fund”) seeks long-term capital appreciation by investing in a focused group (25-50 holdings) of the most attractive & relevant brands contained in the Alpha Brands Consumer Spending Index (the “Index”) which has 200 constituents. Security selection is driven by a combination of fundamental and technical factors. In times of economic turmoil or unusually high equity valuations where equity risk is deemed high, the Fund may also invest in cash and cash equivalents and in asset classes that have historically been safe havens when equities were experiencing drawdowns. De-risking is designed to happen in stages. Risk decisions are guided by: relative strength leadership, economic growth trajectory, the Fund management team’s assessment of the dominant equity trend, economic growth profile, consumer health, equity valuations, technical analysis, FED policy, investor sentiment, and changes in interest rates, credit spreads, and asset class volatility trends.

Investment Strategy

The Fund normally pursues its investment objective by investing primarily in equity securities contained in the Alpha Brands Consumer Spending Index. The Index contains 200 leading and relevant Brands across all sectors but focuses on 70+ consumption-focused sub-industries. The Fund invests primarily in U.S. companies with market capitalizations above $1 billion, although it may invest without limit in companies of any market capitalization so long as the companies are included in the Brands Index.

The Fund may invest in non-U.S. equities so long as those equities are included in the Index. The Fund is managed with a Core + Tactical approach where Core brands will typically hold higher portfolio weights than tactical brands. Core brands exhibit secular growth tailwinds and exhibit top ranked Growth (operating kings), Value & Dividend (sustainable yielders) and Price Momentum relative to the Brands Index universe. Core brands are often the leading brand(s) in large, sustainable secular growth markets with large total addressable market opportunities. Tactical brands exhibit attractive technical set-ups and/or have near-term catalysts that could offer investment opportunities in out-of-favor brands (or sub-industries) from within the Brands Index universe. Tactical brands are often contrarian in nature and complement or diversify Core brands. Tactical allocations are often follow-on ideas from within attractive industries where the Investment Committee has determined greater exposure is warranted. The Fund management team may also, at times, choose to add tactical exposure on oversold conditions using highly liquid index and/or sector ETF’s as a supplement to the leading brands in the portfolio. The final part of the investment process determines the tactical target for exposure to equities. Target equity exposure, and portfolio risk, are updated in real-time based on Economic, Household Consumption, Corporate, Technical, and Sentiment investment factors.

Fund Performance

On 10/17/17, the Rational Defensive Growth Fund was converted and renamed the Rational Dynamic Brands Fund. Since Accuvest took over as the sub-advisor for the fund, performance has been strong on a relative and absolute basis. Consumer stocks have performed well driven by the wealth effect as well as enthusiasm over personal and corporate tax reform. As of 12/31/18, the Rational Dynamic Brands Fund gained +6.47% (Class I) since being converted to the Brands portfolio on 10/17/17. Over the same timeframe, the S&P 500 TR Index was up +0.30%. Outperformance was driven mostly by the active decisions to overweight growth versus value, cyclicals versus defensives, and domestic versus international stocks. The Fund management team significantly reduced the exposure to growth brands beginning in late summer 2018 and increased its exposure to out-of-favor value and quality dividend aristocrat brands. The active decision to raise the level of cash as a defensive allocation decision also added value to the overall positive results.

The Fund’s top 3 over-weights relative to the S&P 500 are Consumer Discretionary, Consumer Staples, and Communication Services. The Funds top 3 under-weights relative to the S&P 500 are Financials, Industrials, and Energy. As of 12/31/2018, cash is a large overweight at roughly 30% and is being used as a defensive measure.

7

These allocations were driven by the fundamental and technical work done via the investment process highlighted in this document.

The Fund will typically be overweight the leading consumer discretionary and staples brands given its focus on consumer spending but has no mandate to do so on an ongoing basis.

The Fund’s total annualized returns through 12/31/18 as compared to the S&P 500 Total Return Index were as follows:

| Since Inception | ||||

| 1 Year | 5 Years | 10 Years | (09/27/02) | |

| Class A | 0.63% | 2.12% | 11.35% | 9.42% |

| Class I | 0.72% | 2.39% | 11.63% | 9.70% |

| Class A with Sales Charge | -4.03% | 1.13% | 10.81% | 9.09% |

| S&P 500 Total Return Index (1) | -4.38% | 8.49% | 13.12% | 9.27% |

The Fund’s maximum sales charge for Class “A” shares is 4.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month- end performance information or the Fund’s prospectus please call the Fund, toll free at 1-800-253-0412. You can also obtain a prospectus at www.RationalMF.com.

Summary

Consumer spending is the key driver of U.S. economic growth as well as global growth. An intelligently constructed and risk aware portfolio of the most relevant and powerful brands offers investors precise and thoughtful exposure to the engine of global economic growth and American Consumerism. Our goal is to construct portfolios that track “lifetime consumption” patterns via the leading brands winning our hearts and wallets. As we enter 2019, our view of the consumer sector is positive even as the macro-economic environment has softened year-over-year. Wages are rising, household debt to disposable income is low and consumer sentiment is positive. At the tail end of the economic cycle, consumer spending tends to shift from price insensitivity to price conscious. The Dynamic Brands portfolio currently reflects a focus on the brands that exhibit pricing power and resiliency in a slower overall economy. The Fund currently holds a combination of iconic brands across important spending categories like: telecom, food & beverage staples, media & entertainment, luxury & athleisure apparel, discount apparel and discount merchandise, e-commerce, consumer electronics, energy production, warehouse shopping, home improvement, video gaming, auto parts, pharmaceuticals, medical devices, credit card processing & mobile payments, household products, personal products, specialty restaurants, and brands vital to the consumption supply chain.

The Fund offers a dedicated allocation to the primary driver of U.S. economic growth, consumer spending. Our dynamic process identifies attractive brands serving a broad range of consumer spending categories and focuses on lifetime spending across all demographic groups. As demographics and spending patterns evolve and/or the economic data changes, so too will our allocations to the leading brands.

In times of uncertainty or high market stress, the Fund can reduce equity exposure. As of 12/31/2018, the Fund is holding a comfortable cash cushion of roughly 30%. Our cash allocation helped the Fund protect capital in Q4 2018 and particularly in December 2018. We have many tools at our disposal to help protect capital when we see evidence of a prolonged economic slowdown.

Successful investing requires a long-term outlook focused on objective criteria that creates value. We anticipate being opportunistic with the above average cash allocation and buying key brands as we see attractive entry points. We have adopted this outlook for the Rational Dynamic Brands Fund, and we are glad that you have decided to share in our vision.

8

Sincerely,

David Garff, Eric Clark, and James Calhoun

Portfolio Managers

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

| (1) | The S&P 500 Value Total Return Index® (“S&P 500 Value TR”) is an unmanaged market-capitalization weighted index consisting of those stocks within the S&P 500 that exhibit strong value characteristics. It uses a numerical ranking system based on four value factors and three growth factors to determine the constituents and their weightings. The S&P 500 Total Return Index® (“S&P 500 TR”) is an unmanaged index generally representing the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Indices are unmanaged and, unlike the Fund, are not affected by cash flows. It is not possible to invest directly in an Index. For additional disclosure relating to the S&P 500 Value TR and S&P 500 TR, please see “Additional Disclaimers” in the Fund’s Prospectus. |

4216-NLD-1/31/2019

9

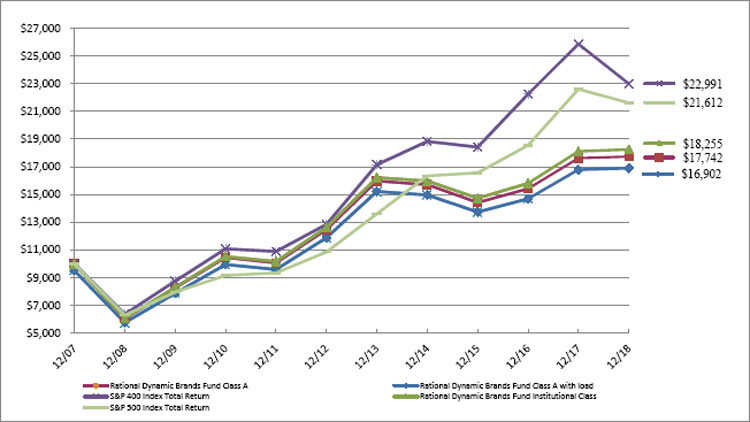

Rational Dynamic Brands Fund

PORTFOLIO REVIEW (Unaudited)

December 31, 2018

The Fund’s performance figures* for each of the periods ended December 31, 2018, compared to its benchmarks:

| Annualized | Annualized | Annualized | ||

| 1 Year Return | 5 Year Return | 10 Year Return | Since Inception(a) | |

| Class A | 0.63% | 2.12% | 11.35% | N/A |

| Class A with load | (4.03)% | 1.13% | 10.81% | N/A |

| Class C | (0.02)% | N/A | N/A | 1.80% |

| Institutional Class | 0.72% | 2.39% | 11.63% | N/A |

| S&P 500 Index Total Return (b) | (4.38)% | 8.49% | 13.12% | 8.71% |

| S&P 400 Index Total Return (c) | (11.08)% | 6.03% | 13.68% | 6.18% |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s May 1, 2018 prospectus, the total annual operating expense are 1.69% for Institutional Class shares, 1.94% for A shares and 2.69% for C shares before fee waivers. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. Class A shares are subject to a maximum load of 4.75%. |

| (a) | Inception date is January 2, 2014 for Class C and corresponding Benchmark. |

| (b) | The “S&P 500 Total Return Index”, a registered trademark of McGraw-Hill Co., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an Index. |

| (c) | The S&P 400 is a capitalization-weighted index comprised of common stocks representing major industries in the mid-range of the U.S. stock market. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an Index. |

Comparison of the Change in Value of a $10,000 Investment

| Top 10 Holdings by Industry | % of Net Assets | |||

| Retail | 19.3 | % | ||

| Pharmaceuticals | 7.7 | % | ||

| Beverages | 4.4 | % | ||

| Internet | 4.4 | % | ||

| Cosmetics / Personal Care | 3.7 | % | ||

| Telecommunications | 3.6 | % | ||

| Apparel | 3.4 | % | ||

| Diversified Financial Services | 3.3 | % | ||

| Software | 3.0 | % | ||

| Media | 2.5 | % | ||

| Other/Short-Term Investments | 44.7 | % | ||

| 100.0 | % | |||

Please refer to the Portfolio of Investments for a more detailed breakdown of the Fund’s assets.

10

January 31, 2019

Rational Strategic Allocation Fund

Dear Fellow Shareholders,

The Rational Strategic Allocation Fund (the “Fund”) seeks current income and moderate appreciation of capital by investing in a combination of mutual funds and exchange-traded funds (“ETFs”). During 2018, the Fund outperformed the S&P 500 Total Return Index (1) but underperformed its Strategic Allocation Indices Blend (“BAIB”) (2) benchmark with a -3.05% (Class A) return versus -4.38% for the S&P 500 Total Return Index and -2.28% for the BAIB benchmark. The Fund benefited from its allocations to fixed income funds. The Fund underperformed its benchmark, however, due its allocations to Emerging Markets and MLP (Master Limited Partnership) equity.

Investment Strategy

The Fund seeks to achieve its objective by investing in a combination of underlying mutual funds and ETFs. We invest in equity, income and uncorrelated investment strategies. We select underlying funds using a fundamental research process, including a top-down analysis of market conditions and investment category historical performance during various market conditions. We also perform a bottom-up analysis of each potential fund for investment, including investment allocations, investment valuations and characteristics, positioning, historical performance during various market conditions and that fund’s portfolio manager’s outlook.

Fund Performance

During 2018, the Fund returned -3.05% (Class A), outperforming the S&P 500 Total Return Index by 133 basis points. The Fund benefited from its allocations to fixed income and US equity funds. The Fund’s fixed income allocations performed strongly during the year, returning 2.17% in a rising rate environment driven by Federal Reserve rate hikes. The Fund’s allocations to US equity funds also added modestly to performance, adding 0.29% despite a 4Q sell-off in the US equity market.

The Fund’s exposure to Emerging Markets equity and MLP equity detracted from performance, causing the Fund to trail its BAIB benchmark by 77 basis points. Emerging markets equities were under significant pressure in 2018 due to macroeconomic and geopolitical uncertainty. Additionally, the impact of slowing global growth combined with a rising US Dollar caused the price of crude oil to decline, pressuring energy stocks. The Fund’s Emerging Markets and MLP allocations were down 2.79% and 2.22% respectively for the year.

The Fund’s total annualized returns through 12/31/18 as compared to the Strategic Allocation Indices Blend and the S&P 500 Total Return Index were as follows:

| Since Inception | ||||

| 1 Year | 3 Years | 5 Years | (07/30/09) | |

| Class A | -3.05% | 5.38% | 3.23% | 5.67% |

| Class A with Sales Charge | -7.64% | 3.68% | 2.22% | 5.13% |

| Strategic Allocation Indices Blend (2) | -2.28% | 6.57% | 6.33% | 9.25% |

| S&P 500 Total Return Index (1) | -4.38% | 9.26% | 8.49% | 12.73% |

The Fund’s maximum sales charge for Class “A” shares is 4.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month- end performance information or the Fund’s prospectus please call the Fund, toll free at 1-800-253-0412. You can also obtain a prospectus at www.RationalMF.com.

11

Summary

The Rational Strategic Allocation Fund outperformed the S&P 500 Total Return Index by 133 basis points during 2018. The majority of the holdings performed to our expectations and the Fund benefited from the balanced allocation to fixed income funds. Successful investing requires a long-term outlook focused on objective criteria that create value. We have adopted this outlook for the Rational Strategic Allocation Fund, and we are glad that you have decided to share in our vision.

Sincerely,

David Miller

Portfolio Manager

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

| (1) | The S&P 500 Total Return Index by Standard & Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index, although individuals may invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. The Rational Strategic Allocation Fund may or may not purchase the types of securities represented by the S&P 500 Total Return Index. |

| (2) | The Strategic Allocation Indices Blend (“BAIB”) is a custom blended index comprised of the following two indices with their noted respective weightings: Standard & Poor’s 500 Index® (“S&P 500”) (60%) and the Barclays U.S. Aggregate Bond Index (40%). The Barclays U.S. Aggregate Index is comprised of securities from the Barclays Government/Corporate Bond Index, Mortgage Securities Index and the Asset Based Index. Total return comprises price appreciation/depreciation and income as a percentage of the original investment. Indices are rebalanced monthly by market capitalization. The index is unmanaged and, unlike the Fund, is not affected by cash flows. The S&P 500 is an unmanaged index generally representing the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Investments cannot be made in an index. For additional disclosure relating to the S&P 500, please see “Additional Disclaimers” in this Prospectus. |

4217-NLD-1/31/2019

12

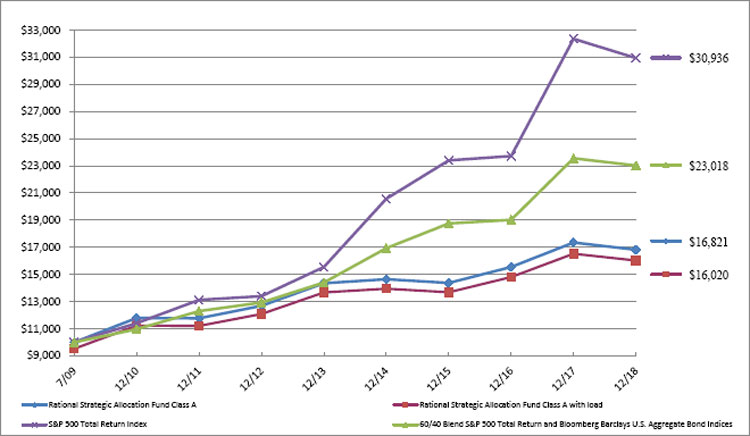

Rational Strategic Allocation Fund

PORTFOLIO REVIEW (Unaudited)

December 31, 2018

The Fund’s performance figures* for each of the periods ended December 31, 2018, compared to its benchmarks:

| Annualized | Annualized | Annualized | ||

| 1 Year Return | 5 Year Return | Since Inception(a) | Since Inception(b) | |

| Class A | (3.05)% | 3.23% | 5.67% | N/A |

| Class A with load | (7.64)% | 2.22% | 5.13% | N/A |

| Class C | (3.83)% | N/A | N/A | 4.27% |

| Institutional Class | (2.81)% | N/A | N/A | 5.32% |

| S&P 500 Total Return Index (c) | (4.38)% | 8.49% | 12.73% | 9.32% |

| Balanced Allocation Indices Blend Index (d) | (2.28)% | 6.33% | 9.25% | 6.17% |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s May 1, 2018 prospectus, the total annual operating expense are 1.94% for Institutional Class shares, 2.23% for A shares and 2.94% for C shares before fee waivers. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. Class A shares are subject to a maximum load of 4.75%. |

| (a) | Inception date is July 30, 2009 for Class A and the Benchmarks. |

| (b) | Inception date is May 31, 2016 for Class C, Institutional Class and the Benchmarks. |

| (c) | The “S&P 500 Total Return Index”, a registered trademark of McGraw-Hill Co., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an Index. |

| (d) | The Balanced Allocation Indices Blend (“BAIB”) is a custom blended index comprised of the following two indices with their noted respective weightings: Standard & Poor’s 500 Index® (“S&P 500”) (60%) and the Bloomberg Barclays U.S. Aggregate Bond Index (40%). The Barclays U.S. Aggregate Index is comprised of securities from the Barclays Government/Corporate Bond Index, Mortgage Securities Index and the Asset Based Index. Total return comprises price appreciation/depreciation and income as a percentage of the original investment. Indices are rebalanced monthly by market capitalization. The index is unmanaged and, unlike the Fund, is not affected by cash flows. The S&P 500 is an unmanaged index generally representing the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Investments cannot be made in an index. |

Comparison of the Change in Value of a $10,000 Investment

| Top Holdings | % of Net Assets | |||

| Debt Funds - Mutual Funds | 42.4 | % | ||

| Equity Funds - Mutual Funds | 34.3 | % | ||

| Equity Funds - Exchange Traded Funds | 19.3 | % | ||

| Other/Short-Term Investments | 4.0 | % | ||

| 100.0 | % | |||

Please refer to the Portfolio of Investments for a more detailed breakdown of the Fund’s assets.

13

January 31, 2019

Rational ReSolve Adaptive Asset Allocation Fund

Dear Fellow Shareholders,

The Rational ReSolve Adaptive Asset Allocation Fund (“the Fund”) commenced trading on March 16, 2018, when ReSolve officially became the Fund’s sub-advisor, replacing the previous manager. ReSolve Asset Management is a quantitative, systematic investment firm that relies on in-depth, academically backed and empirically proven practices for strategy construction.

Our Adaptive Asset Allocation1 methodology used in the Fund combines the strong historical return character of the momentum factor with global diversification and risk management, seeking to maximize both risk-adjusted returns and the compounding of positive rolling periods, with controlled maximum losses. The goal is to deliver an absolute-return strategy designed to thrive in most economic and market environments.

Investment Strategy

The Fund invests in futures contracts and occasionally in exchange traded funds to gain dynamic exposure to global market opportunities across country equity indexes, fixed income, tradeable real estate, currencies, and commodities.

Portfolios are formed using proprietary quantitative innovations to systematically emphasize global assets with strong and persistent trend and momentum characteristics, while maximizing diversification and minimizing total portfolio volatility. As portfolio weights and estimates of volatility and correlations change through time, the Fund will increase and decrease the gross exposure in an effort to maintain its target level of 12% annualized portfolio volatility.

Global Markets are in constant flux, from periods of strong growth, to inflationary regimes, to momentary deflationary busts. This reality means investors need to access strategies that can go anywhere in the world with agility. Adaptive Asset Allocation (AAA) fulfills this role by creating dynamic portfolios using proprietary quantitative innovations that systematically emphasize global assets with strong and persistent trend and momentum characteristics, while maximizing diversification and minimizing total portfolio volatility.

General Market Review

After a year of stellar performance, steady trends and muted volatility, global asset classes experienced a diametrically opposite 2018, with choppy markets riddled with volatility spikes, led by geopolitical skirmishes and policy shocks across the globe. This reversal of fortunes wasn’t driven by one dominant cause (unlike the Global Financial Crisis of 2008), but rather the sum of several factors that compounded into a steep sell-off in the last quarter of the year. It is, however, hard to deny the overwhelming impact that one country’s monetary and trade policies have had in leading virtually every major global asset class into negative territory for the year.

In an effort to re-align its relationship with its main trade partners, the US government used the threat of tariffs to secure more favorable terms from Canada, Mexico, and the European Union. But when it came to China, the world’s biggest economy and largest trade partner to the US, threats became actual tariffs (on both sides), and continued to escalate into an all-out trade war that has yet to be resolved. Meanwhile, the Fed continued to raise interest rates and unwind its balance sheet, both of which were largely expected by investors. But it was the tone and choice of words in its communications, especially those coming from the new chairman, that caused the two policy shocks (in February and October) that have rattled markets.

| 1 | For our 6-year track record, please visit: https://investresolve.com/ca/adaptive-asset-allocation-growth-cad/ |

14

The narrative emanating from other major economies has hardly been more reassuring. Europe faced an economic slowdown, further uncertainty surrounding Brexit, a budget showdown between Italy and the European Commission, as well as political crises in several countries including France and Spain. Asia’s two largest economies, Japan and China, experienced slowdowns of their own, with the latter suffering additionally from measures aimed at clamping down on the shadow banking sector and the pervasive excessive leverage in the system. Emerging market economies have had a few positive stories (notably Brazil’s recovery and the continued rise of India), but the steep losses in commodities, particularly in the energy complex, and the global risk off mood have drained liquidity and posed a significant headwind.

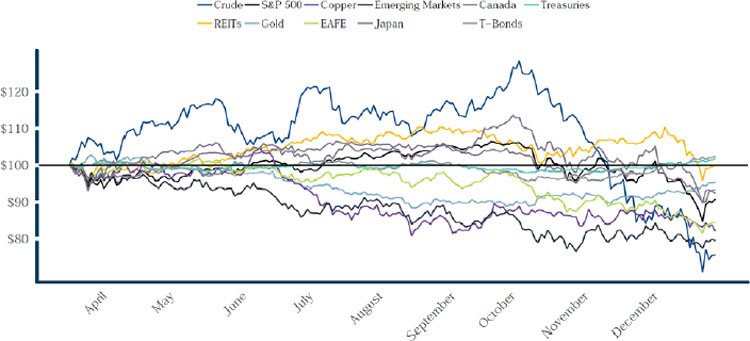

Figure 1. A Choppy Year for Global Asset Classes

*Source: ReSolve Asset Management. Data from CSI.

Fund Performance

It was certainly the most tumultuous period for multi-asset momentum strategies since 1994, leading the Fund to end its first (and incomplete) calendar year down –7.64% (Class I).

Where Adaptive Asset Allocation produced spectacular returns last year, it struggled this year. Where all markets were up in 2017, they were ALL down in 2018. In fact, the worst performing major market in 2017 outperformed the best performing market in 2018, and they were both the same market (US Treasuries)! Cash beat everything else, which hadn’t happened in living memory, and there was much greater volatility across all markets punctuated by several mini-crashes. What’s worse, two of the three crashes originated at or near long-term high prices, and manifested as acute reversals from highly constructive intermediate-term trends.

The shocks sustained by markets, which drove virtually every asset class (with the exception of a few meagerly positive sovereign bonds) down for the year, are the type of non-diversifiable risk that investors must necessarily incur if they wish to earn a return above cash. Growth shocks (such as the 2008 Great Financial Crisis, or 2016’s Brexit decision) cause capital to flow away from risky assets and towards the safety of Treasuries and gold, which still allows

15

diversification to thrive and produce positive returns. Policy shocks2, on the other hand, while are much rarer in nature, have the distinct characteristic of causing almost everything to fall at the same time, due to the repricing of short-term interest rates (and “cash becomes king”, as the famous saying goes).

Few and far between, this was one of the rare years when diversification (as well as investment factors) failed, as can be seen in the chart above. Our 10-Year Treasury exposure was the only major positive contributor to the portfolio, especially during the recovery of late November and early December (as the Fund rose by almost 4% from its lows). Canadian Equities and 30-Year Treasuries also provided the Fund with modest gains. There were detractors aplenty, led by US Stocks, Crude Oil and Real-Estate.

While October was the worst month for the strategy (-9.9%), the consequent rebalancing that occurred led the portfolio to be well-positioned to benefit from the risk-off capital flows, leading to a recovery in December (+1.5%).

The Fund’s total annualized returns through 12/31/18 as compared to the BarclayHedge CTA Index and the S&P 500 Total Return Index were as follows:

| 1 Year | 3 Years | 5 Years | Since Inception (3) | |

| Class I | -7.64% | -2.27% | 1.61% | 5.72% |

| BarclayHedge CTA Index (2) | -2.79% | -1.12% | 0.49% | 4.19% |

| S&P 500 Total Return Index (1) | -4.38% | 9.26% | 8.49% | 9.11% |

| Class A | -7.83% | n/a | n/a | -3.27% |

| Class C | -8.53% | n/a | n/a | -3.92% |

| BarclayHedge CTA Index (2) | -2.79% | n/a | n/a | -1.46% |

| S&P 500 Total Return Index (1) | -4.38% | n/a | n/a | 8.81% |

| Class A w/ Sales Charge | -13.12% | n/a | n/a | -5.49% |

The Fund’s maximum sales charge for Class “A” shares is 5.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month- end performance information or the Fund’s prospectus please call the Fund, toll free at 1-800-253-0412. You can also obtain a prospectus at www.RationalMF.com.

The Fund acquired all of the assets and liabilities of Chesapeake Fund, LLC (the “Predecessor Fund”) in a tax free reorganization on December 31, 2016. In connection with this acquisition, shares of the Predecessor Fund were exchanged for Institutional Shares of the Fund. At the time of the reorganization, the Predecessor Fund had an investment objective and strategies that were, in all material respects, the same as those of the Fund, and was managed in a manner that, in all material respects, complied with the investment guidelines and restrictions of the Fund. Effective February 27, 2018, the Fund’s investment strategy changed, and a new Sub Advisor replaced the prior sub-advisor. Consequently, prior performance may not reflect the Fund’s current operations.

Outlook

As investors prepare their portfolios to navigate the murky waters that lie ahead, it is important to remember the exceptional circumstances seen in global markets during the last 10 years. With monetary policy normalizing in the US and beyond, markets may once again be allowed to function on their own. Choppiness may cease, clear trends may re-emerge, and global leadership may shift away from the past decade’s clear leader – U.S. equities. Nimble and adaptive strategies could be ready to harness the next bull market, in whatever asset or region it may be.

Sincerely,

| 2 | We define a Policy Shock as the issuance of information by a central bank that is, to a significant degree, misaligned with investors’ expectations, leading to an abrupt adjustment in global asset prices. That information can be objective, such as unexpected changes in short-term policy rates or in expected future interest rate levels (the so-called “Dot Plot” provided by the US Federal Reserve’s Open Market Committee), or subjective, such as large deviations in the word choice or tone, in written, verbal or other communication form, when contrasted with previous communications. |

16

ReSolve Asset Management

Strategy Sub-Advisors

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

| (1) | The S&P 500 Total Return Index by Standard & Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index, although individuals may invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. The Rational Strategic Allocation Fund may or may not purchase the types of securities represented by the S&P 500 Total Return Index. |

| (2) | The Barclay CTA Index is a leading industry benchmark of representative performance of commodity trading advisors. There are currently 0 programs included in the calculation of the Barclay CTA Index for 2018. The Index is equally weighted and rebalanced at the beginning of each year. |

| (3) | Inception: Institutional 02/01/1994, Class A & C 09/30/2016. Performance shown before 09/30/2016 is for the Fund’s predecessor, theRational Dynamic Momentum Fund. . |

4221-NLD-1/31/2019

17

Rational/Resolve Adaptive Asset Allocation Fund (Formerly Rational Dynamic Momentum Fund)

PORTFOLIO REVIEW (Unaudited)

December 31, 2018

The Fund’s performance figures* for each of the periods ended December 31, 2018, compared to its benchmarks:

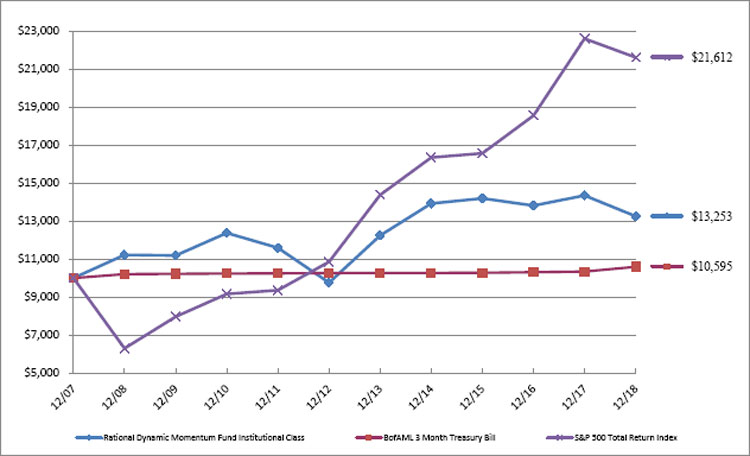

| Annualized | Annualized | Annualized | ||

| 1 Year Return | 5 Year Return | 10 Year Return | Since Inception(a) | |

| Class A | (7.83)% | N/A | N/A | (3.27)% |

| Class A with load | (13.12)% | N/A | N/A | (5.79)% |

| Class C | (8.53)% | N/A | N/A | (3.92)% |

| Institutional Class | (7.64)% | 1.61% | 1.68% | N/A |

| BofAML 3 Month Treasury Bill (b) | 1.88% | 0.63% | 0.37% | 1.25% |

| S&P 500 Total Return Index (c) | (4.38)% | 8.49% | 13.12% | 8.81% |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s May 1, 2018 prospectus, the total annual operating expense are 2.54% for Institutional Class shares, 2.95% for A shares and 3.70% for C shares before fee waivers. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. Class A shares are subject to a maximum load of 5.75%. |

| (a) | Inception date is May 31, 2016 for Class A, Class C and the Benchmarks. |

| (b) | BofA Merrill Lynch 3-Month U.S. Treasury Bill Index “BofAML 3-Month T-Bill,” is an index of short-term U.S. Government securities maturing in 90 days. Investors cannot invest directly in an Index. |

| (c) | The “S&P 500 Total Return Index”, a registered trademark of McGraw-Hill Co., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an Index. |

Comparison of the Change in Value of a $10,000 Investment

| Holdings by Asset Type ^ | % of Net Assets | |||

| Short-Term Investments | 95.2 | % | ||

| Other/Cash & Equivalents | 4.8 | % | ||

| 100.0 | % | |||

^ Does not include derivatives in which the Fund invests.

Please refer to the Consolidated Portfolio of Investments for a more detailed breakdown of the Fund’s assets.

18

January 31, 2019

Rational Iron Horse Fund

Dear Fellow Shareholders,

The Rational Iron Horse (the “Fund”) was down 1.08% (Class I) during the last fiscal year ended December 31, 2018. During that same period the S&P 500 was down 4.38% and the CBOE S&P 500 BuyWrite Index (BXM) was down 4.77%. The fund had an excellent year due to increased volatility and effective risk management.

Investment Strategy

The Fund seeks to achieve its investment objective by investing primarily in:

| ● | dividend-paying common stocks, and |

| ● | by writing call options on common stocks and common stock indices. |

The Fund selects common stocks of domestic and foreign issuers with market capitalizations of at least $2 billion that are traded on a U.S. stock exchange. We combine (1) fundamental analysis, (2) technical analysis and (3) proprietary risk management techniques to seek total returns with less volatility than equity markets in general.

Fund Performance

In a high volatile market, our covered calls fund tends to do very well. Uncertainty about the economic outlook and concern over rising interest rates led to higher volatility. We believe that volatility will stay higher in the coming quarters, and potentially that would be beneficial for our single stock option strategy, as we seek more income.

During the last 12 months, the Fund was mostly equal weighted relative to the S&P 500 sector. The covered call strategies the Fund utilizes seek to do well in a sideways to lower trending market. This is what the Fund managers’ long-term experience in managing covered call strategies has taught.

The Fund’s total annualized returns through 12/31/18 as compared to the CBOE BuyWrite Index were as follows:

| 1 Year | 3 Years | 5 Years | Since Inception (1) | |

| Class A | -1.30% | 3.53% | 3.17% | 4.67% |

| S&P 500 Total Return Index (2) | -4.38% | 9.26% | 8.49% | 10.90% |

| CBOE BuyWrite Index (BXM) (3) | -4.77% | 4.84% | 5.08% | 6.23% |

| Class A with Sales Charge | -6.93% | 1.51% | 1.95% | 3.84% |

| Class I | -1.08% | 3.73% | 3.43% | 6.09% |

| S&P 500 Total Return Index (2) | -4.38% | 9.26% | 8.49% | 12.77% |

| CBOE BuyWrite Index (BXM) (3) | -4.77% | 4.84% | 5.08% | 6.78% |

The Fund’s maximum sales charge for Class “A” shares is 5.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month- end performance information or the Fund’s prospectus please call the Fund, toll free at 1-800-253-0412. You can also obtain a prospectus at www.RationalMF.com.

Our covered call strategy on average seeks to run at 50-60% of the market volatility. When the market goes sideways to down like it has over the last year, a covered call strategy can tend to do well versus a long only strategy. The goal of the strategy is not to outperform the market on every market interval, but to seek a good total return with less volatility than the market.

19

Sincerely,

The Iron Horse Fund Team

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

| (1) | Inception date A Share: 7/7/2011. Returns greater than 1 year are annualized. Inception date I Share: 11/16/2011. Returns greater than 1 year are annualized. Class C Share launch date 4/06/2017. |

| (2) | The S&P 500 Total Return Index by Standard & Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index, although individuals may invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. The Rational Strategic Allocation Fund may or may not purchase the types of securities represented by the S&P 500 Total Return Index. |

| (3) | The CBOE S&P 500 BuyWrite Index (BXM) is a benchmark index designed to track the performance of a hypothetical buy-write strategy on the S&P 500 Index. The BXM is a passive total return index based on (1) buying an S&P 500 stock index portfolio, and (2) “writing” (or selling) the near-term S&P 500 Index (SPXSM) “covered” call option, generally on the third Friday of each month. |

4228-NLD-2/1/2019

20

Rational Iron Horse Fund

PORTFOLIO REVIEW (Unaudited)

December 31, 2018

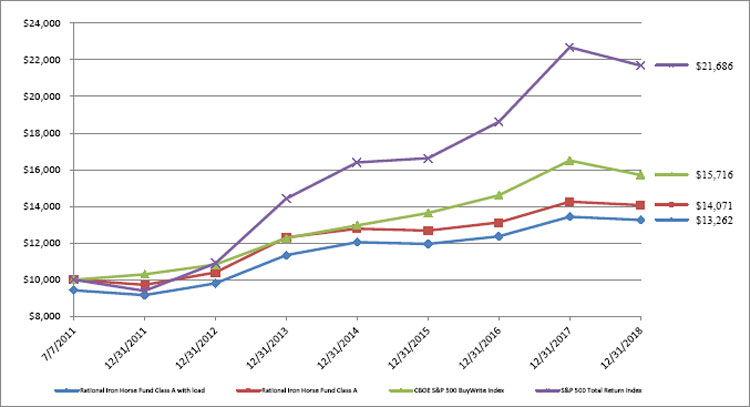

The Fund’s performance figures* for each of the periods ended December 31, 2018, compared to its benchmarks:

| Annualized | Annualized | Annualized | Annualized | ||

| 1 Year Return | 5 Year Return | Since Inception(a) | Since Inception(b) | Since Inception(c) | |

| Class A | (1.30)% | 3.17% | 4.67% | N/A | N/A |

| Class A with Load | (6.93)% | 1.95% | 3.84% | N/A | N/A |

| Class C | (1.71)% | N/A | N/A | N/A | 1.77% |

| Institutional Class | (1.08)% | 3.43% | N/A | 6.09% | N/A |

| S&P 500 Total Return Index (d) | (4.38)% | 8.49% | 10.90% | 12.77% | 5.70% |

| CBOE S&P Buy Write Index (e) | (4.77)% | 5.08% | 6.23% | 6.78% | 2.01% |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s May 1, 2018 prospectus, the total annual operating expense are 2.32% for Institutional Class shares, 2.43% for A shares and 3.18% for C shares before fee waivers. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. Class A shares are subject to a maximum load of 5.75%. |

| (a) | Inception date is July 7, 2011. |

| (b) | Inception date is November 16, 2011. |

| (c) | Inception date is April 7, 2017 |

| (d) | The “S&P 500 Total Return Index”, a registered trademark of McGraw-Hill Co., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an Index. |

| (e) | The CBOE S&P 500 BuyWrite Index (BXM) is a benchmark index designed to track the performance of a hypothetical buy-write strategy on the S&P 500 Index. The BXM is a passive total return index based on (1) buying an S&P 500 stock index portfolio, and (2) “writing” (or selling) the near-term S&P 500 Index “covered” call option, generally on the third Friday of each month. Index returns assume the reinvestment of dividends. Investors may not invest in the index directly; unlike the Fund’s returns, the index does not reflect any fees or expenses. |

Comparison of the Change in Value of a $10,000 Investment

| Top 10 Holdings by Industry ^ | % of Net Assets | |||

| Pharmaceuticals | 8.8 | % | ||

| Computers | 8.1 | % | ||

| Banks | 7.8 | % | ||

| Oil & Gas | 6.0 | % | ||

| Media | 5.8 | % | ||

| Electric | 5.4 | % | ||

| Mining | 4.2 | % | ||

| Miscellaneous Manufacturing | 3.5 | % | ||

| Semiconductors | 3.4 | % | ||

| Household Products/Wares | 3.2 | % | ||

| Other/Short-Term Investments | 43.8 | % | ||

| 100.0 | % | |||

^ Does not include derivatives in which the Fund invests.

Please refer to the Portfolio of Investments in this shareholder report for a detailed analysis of the Fund’s holdings.

21

January 31, 2019

Rational Income Opportunities Fund

Dear Fellow Shareholders,

The Rational Income Opportunities Fund (the “Fund”) seeks to combine stable monthly fixed coupon yields with price appreciation to generate a favorable rate of return for fixed income investors. Since inception, on April 23, 2018, the Fund achieved relatively strong gains, outperforming its Barclays US Agg. Benchmark with a 2.72% (Class I) return versus 2.46% for the benchmark.

Investment Strategy

The Fund seeks to achieve the investment objective by investing primarily in U.S. agency and non-agency CMBS and other commercial real estate related securities. The Fund’s investment strategy relies on rigorous credit analysis. We employ a comprehensive due diligence process on each investment, including, but not limited to, analysis of bond cash flows and analysis of property cash flows, sub-market vacancy and rental rates, potential lease rollovers and potential capital expenditures on underlying collateral properties.

Fund Performance

Since inception, the Fund returned 2.72% (Class I), leading its Barclays US Agg. benchmark’s return of 2.46%. The Fund benefitted from the receipt of monthly fixed coupon yields, partially offset by price depreciation in the mark-to-market of the portfolio. As of year-end, the Fund’s portfolio earned a weighted average coupon of 4.8%. Moderate mark-to-market price declines in our portfolio’s securities were a result of spread widening across all tranches of CMBS, amid overall market volatility. Spread widening was more extreme in subordinate classes. Spreads in BBB- widened 105bps from inception to year end, compared to spreads in A-rated securities, which widening 83bps over the same period. We successfully managed spread risk by targeting senior bonds. At year end, our portfolio had a composite rating of A+, on an equally weighted basis.

| Since Inception | ||||

| 6 Mos | YTD | 1 Year | (4/23/18) | |

| Class I | 1.60% | n/a | n/a | 2.72% |

| Class A | 1.49% | n/a | n/a | 2.56% |

| Class C | 1.03% | n/a | n/a | 1.93% |

| Barclays US Agg. Bond TR Index (1) | 1.65% | n/a | n/a | 2.46% |

| Class A w/ Sales Charge | -4.38% | n/a | n/a | -3.34% |

The Fund’s maximum sales charge for Class “A” shares is 5.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month- end performance information or the Fund’s prospectus please call the Fund, toll free at 1-800-253-0412. You can also obtain a prospectus at www.RationalMF.com.

Summary

The Rational Income Opportunities Fund achieved strong relative gains in 2018, consistent with our investment objective: Generate current income while mitigating risks and market volatility. On the backdrop of a volatile market, the majority of the Fund’s holding performed to our expectations, while generating current income to the benefit of our shareholders.

Sincerely,

Robert Neighoff and Evan Kurtz

Portfolio Managers

22

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

| (1) | The Barclays US Agg. Bond TR Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and nonagency. |

4229-NLD-2/1/2019

23

Rational Income Opportunities Fund

PORTFOLIO REVIEW (Unaudited)

December 31, 2018

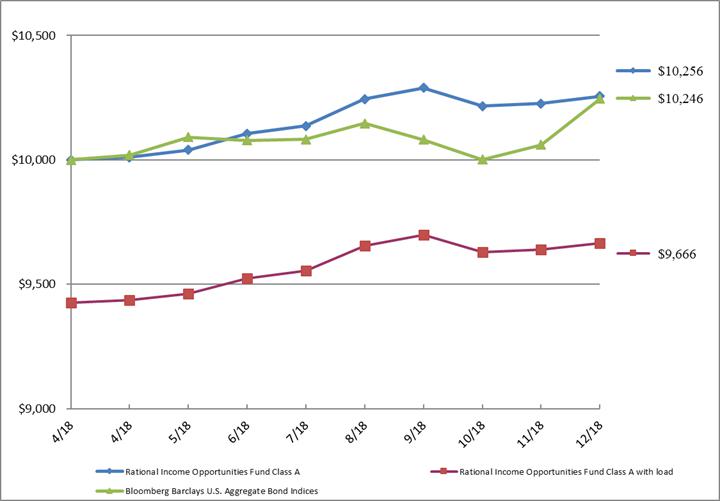

The Fund’s performance figures* for each of the periods ended December 31, 2018, compared to its benchmarks:

| Since Inception(a) | |

| Class A | 2.56% |

| Class A with load | (3.34)% |

| Class C | 1.93% |

| Institutional Class | 2.72% |

| Barclays US Intermediate Aggregate Bond Index (b) | 2.46% |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s April 20, 2018 prospectus, the total annual operating expense are 2.26% for Institutional Class shares, 2.51% for A shares and 3.26% for C shares before fee waivers. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. Class A shares are subject to a maximum load of 5.75%. |

| (a) | Inception date is April 23, 2018. |

| (b) | Barclays US Intermediate Aggregate Bond Index measures the performance of the U.S. investment grade bond market. The index invests in a wide spectrum of public, investment-grade, taxable, fixed income, securities in the United States - including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities, all with maturities of more than 1 year. Investors may not invest directly in an index. Unlike the Fund’s returns, the Index does not reflect any fees or expenses. |

Comparison of the Change in Value of a $10,000 Investment

| Top Holdings | % of Net Assets | |||

| Asset Backed Securities | 86.4 | % | ||

| Commercial Mortgage Obligations | 8.4 | % | ||

| Exchange Traded Funds | 2.0 | % | ||

| REIT | 1.3 | % | ||

| Other/Short-Term Investments | 1.9 | % | ||

| 100.0 | % | |||

Please refer to the Portfolio of Investments for a more detailed breakdown of the Fund’s assets.

24

January 31, 2019

Rational NuWave Enhanced Market Opportunity Fund

Dear Fellow Shareholders,

The Rational NuWave Enhanced Market Opportunity Fund (the “Fund”) seeks long-term capital appreciation (with the goal of generating superior risk-adjusted returns compared with a typical long-only, non-leveraged equity portfolio) by investing in a combination of equity securities and diversified managed futures. During 2018, the Fund posted a positive return of 3.00% (Class I), significantly outperforming both the SG CTA Mutual Fund Index and the S&P 500 Total Return Index (which generated a negative return of 5.23% and 4.38%, respectively). Since its conversion on February 28, 2018 through December 31, 2018, the Fund suffered losses (posted a negative return of 2.87%) that were largely in-line with those experienced by the S&P 500 Total Return Index, the Fund generated offsetting gains from its long and short exposures to both financial futures and commodity futures.

Investment Strategy

The Fund seeks to achieve its objective by investing in an actively managed equity portfolio (the “Equity Component”) and a broadly diversified managed futures portfolio (the “Futures Component”).

The Equity Component is comprised primarily of common stocks and exchange-traded funds invested in equity securities of US companies. Although the Fund may invest in companies of any market capitalization without limit, the Fund invests predominantly in companies with market capitalizations of $5 billion or more. The Equity Component employs a systematic process to identify repetitive patterns of price behavior that are indicative of prevailing market sentiment and/or institutional money flows into or out of individual securities and sectors. These factors are often indicative of large-scale asset allocation shifts, sector rotation opportunities and/or shifting sentiment indicators. Individual stocks that are expected to outperform the benchmark index are targeted for inclusion in the portfolio, while those that are expected to underperform are either liquidated or excluded. The systematic portfolio selection process is further constrained real-time with respect to individual positions size and sector exposures in order to ensure a meaningful variety of market exposures. Holding periods typically range from intraday to several weeks in length (depending upon the persistence of trending price behaviors).

The Futures Component holds long and short positions on futures contracts and maintains cash and cash equivalents to be utilized as margin or collateral. The Futures Component is allocated among various asset classes, including exposure to both financial futures (stock indices, fixed income and currencies) and commodity futures (energies, metals, grains, softs and meats). Investments may be made in domestic and foreign markets, either directly or indirectly by investing through a subsidiary. The Futures Component employs a multi-model approach and seeks to identify price trends through the application of hundreds of individual trading models, which collectively provide exposure to short-, intermediate- and long-term trading opportunities.

The combined portfolio is structured to be broadly diversified across markets, time horizons and trading styles, and the Fund hopes to achieve a substantial degree of non-correlation between the Equity Component and the Futures Component.

Fund Performance

During 2018, the Fund posted a positive return of 3.00% (Class I), significantly outperforming both the SG CTA Mutual Fund Index and the S&P 500 Total Return Index (which generated a negative return of 5.23% and 4.38%, respectively). Despite a marked increase in two-sided price volatility across the U.S. equity markets – owing in large part to persistent uncertainty tied to U.S. trade policy, changing rate expectations, shrinking growth forecasts and intermittent geopolitical concerns – the Fund deftly navigated the shifting cross-currents to finish the year with gains. For the year, the Fund’s actively managed equity portfolio suffered losses that were generally on par with the S&P 500 Total Return Index, as the major U.S. equity indices firmly entered correction territory during the fourth quarter; however, the Fund’s trend-based managed futures models recorded offsetting gains from two-sided directional

25

exposures to a wide variety of commodities markets (including gold, silver, platinum, natural gas, crude oil, gasoline, cotton, sugar, coffee, cattle and hogs).

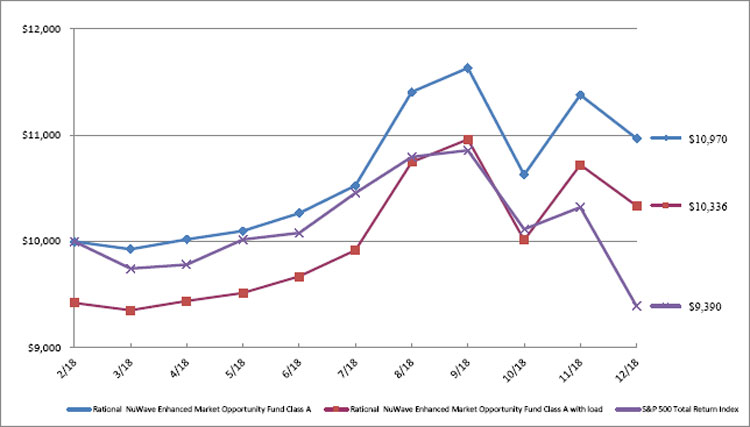

The Fund’s total annualized returns through 12/31/18 as compared to the S&P 500 Total Return Index and the SG CTA Mutual Fund Index were as follows:

| QTD | 1 Year | 5 Years | Since Inception (1) | |

| Class I | -5.65% | 3.00% | 8.12% | 8.19% |

| S&P 500 Total Return Index (2) | -13.52% | -4.38% | 8.49% | 10.75% |

| SG CTA Mutual Fund Index (3) | -1.27% | -5.23% | -0.26% | -0.18% |

| Class A | -5.71% | n/a | n/a | 9.70% |

| Class C | -5.86% | n/a | n/a | 9.08% |

| S&P 500 Total Return Index (2) | -13.52% | n/a | n/a | -6.10% |

| SG CTA Mutual Fund Index (3) | -1.27% | n/a | n/a | -2.72% |

| Class A with Sales Charge | -11.11% | n/a | n/a | 3.36% |

The Fund’s maximum sales charge for Class “A” shares is 5.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month- end performance information or the Fund’s prospectus please call the Fund, toll free at 1-800-253-0412. You can also obtain a prospectus at www.RationalMF.com.

The Fund acquired all of the assets and liabilities of NuWave Equity Enhanced Fund, LP (the “Predecessor Fund”) in a tax-free reorganization on March 1, 2018. In connection with this acquisition, shares of the Predecessor Fund were exchanged for Institutional Shares of the Fund. The Fund’s investment objectives, policies, restrictions and guidelines are, in all material respects, equivalent to the Predecessor Fund’s investment, objectives, policies, restrictions and guidelines. The Fund’s sub-adviser was the adviser to the Predecessor Fund. The financial statements for the Predecessor Fund can be found in the Fund’s Statement of Additional Information. The performance information set forth above reflects the historical performance of the Predecessor Fund shares. From its inception date, the Predecessor Fund was not subject to certain investment restrictions, diversification requirements and other restrictions of the Investment Company Act of 1940; if such requirements and restrictions had been applicable, it might have adversely affected performance. In addition, the Predecessor Fund was not subject to sales loads that would have adversely affected performance. Performance of the Predecessor Fund is not an indicator of future results.

Summary