ex10_1.htm

Exhibit 10.1

CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR THE REDACTED PORTIONS OF THIS AGREEMENT. THE REDACTIONS ARE INDICATED WITH SIX ASTERISKS (“******”). A COMPLETE VERSION OF THIS AGREEMENT HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

ASSET PURCHASE AGREEMENT

AMONG

ASI HOLDINGS LIMITED,

ASI AUDIO TECHNOLOGIES, LLC,

AND

AURASOUND, INC.

July 10, 2010

TABLE OF CONTENTS

|

ARTICLE I ASSET PURCHASE

|

1

|

| |

|

|

|

1.1

|

Purchase and Sale of Assets; Assumption of Liabilities

|

1

|

|

1.2

|

Purchase Price and Related Matters

|

3

|

|

1.3

|

The Closing

|

4

|

|

1.4

|

Common Stock Certificate

|

4

|

|

1.5

|

Consents to Assignment

|

5

|

|

1.6

|

Further Assurances

|

5

|

| |

|

|

|

ARTICLE II REPRESENTATIONS AND WARRANTIES OF SELLERS

|

6

|

| |

|

|

|

2.1

|

Organization, Qualification and Corporate Power

|

6

|

|

2.2

|

Authority

|

6

|

|

2.3

|

Noncontravention

|

6

|

|

2.4

|

Financial Statements

|

7

|

|

2.5

|

Absence of Certain Changes

|

7

|

|

2.6

|

Undisclosed Liabilities

|

7

|

|

2.7

|

Foreign Corrupt Practices

|

7

|

|

2.8

|

Ownership of Personal Property

|

7

|

|

2.9

|

Real Property

|

8

|

|

2.10

|

Intellectual Property

|

8

|

|

2.11

|

Contracts

|

9

|

|

2.12

|

Intentionally Omitted

|

9

|

|

2.13

|

Litigation

|

9

|

|

2.14

|

Employment Matters

|

9

|

|

2.15

|

Employee Benefits

|

11

|

|

2.16

|

Environmental Matters

|

11

|

|

2.17

|

Legal Compliance

|

12

|

|

2.18

|

Permits

|

12

|

|

2.19

|

Business Relationships with Affiliates

|

12

|

|

2.20

|

Brokers’ Fees

|

12

|

|

2.21

|

Inventory

|

12

|

|

2.22

|

Intentionally Omitted

|

12

|

|

2.23

|

Insurance

|

12

|

|

2.24

|

Warranty Matters

|

13

|

|

2.25

|

Customers, Distributors and Suppliers

|

13

|

|

2.26

|

Investment

|

13

|

|

2.27

|

Tax Compliance

|

13

|

|

2.28

|

Disclaimer of Sellers

|

14

|

| |

ARTICLE III REPRESENTATIONS AND WARRANTIES OF BUYER

|

14

|

|

3.1

|

Organization

|

14

|

|

3.2

|

Authority

|

14

|

|

3.3

|

Noncontravention

|

14

|

|

3.4

|

Litigation

|

15

|

|

3.5

|

SEC Documents

|

15

|

|

3.6

|

Capitalization

|

15

|

|

3.7

|

Financial Statements

|

16

|

|

3.8

|

Events Subsequent to Financial Statements

|

16

|

|

3.9

|

No Brokers

|

17

|

| |

|

|

|

ARTICLE IV PRE-CLOSING COVENANTS

|

17

|

| |

|

|

|

4.1

|

Closing Efforts

|

17

|

|

4.2

|

Operation of Business

|

17

|

|

4.3

|

Access

|

19

|

|

4.4

|

Exclusivity

|

19

|

|

4.5

|

Supplement to Disclosure Schedules

|

19

|

| |

|

|

|

ARTICLE V CONDITIONS PRECEDENT TO CLOSING

|

20

|

| |

|

|

|

5.1

|

Conditions to Obligations of Buyer

|

20

|

|

5.2

|

Conditions to Obligations of Sellers

|

21

|

| |

|

|

|

ARTICLE VI INDEMNIFICATION

|

22

|

| |

|

|

|

6.1

|

Indemnification by Sellers

|

22

|

|

6.2

|

Indemnification by Buyer

|

22

|

|

6.3

|

Claims for Indemnification

|

23

|

|

6.4

|

Survival

|

24

|

|

6.5

|

Limitations on Indemnification by Sellers

|

24

|

|

6.6

|

Limitations on Indemnification by Buyer

|

25

|

|

6.7

|

Exclusive Remedy

|

25

|

|

6.8

|

Treatment of Indemnification Payments

|

25

|

|

6.9

|

Mitigation

|

25

|

|

6.10

|

Claims Involving Pre-Closing and Post-Closing Liability

|

26

|

| |

|

|

|

ARTICLE VII TAX MATTERS

|

26

|

| |

|

|

|

7.1

|

Preparation and Filing of Tax Returns; Payment of Taxes

|

26

|

|

7.2

|

Allocation of Certain Taxes

|

26

|

|

7.3

|

Cooperation on Tax Matters; Tax Audits

|

26

|

|

7.4

|

Termination of Tax Sharing Agreements

|

27

|

| |

|

|

|

ARTICLE VIII TERMINATION

|

27

|

| |

|

|

|

8.1

|

Termination of Agreement

|

27

|

|

8.2

|

Effect of Termination

|

27

|

|

ARTICLE EX EMPLOYEE MATTERS

|

27

|

| |

|

|

|

9.1

|

Offers of Employment

|

27

|

| |

|

|

|

ARTICLE X OTHER POST-CLOSING COVENANTS

|

28

|

| |

|

|

|

10.1

|

Access to Information; Record Retention; Cooperation

|

28

|

|

10.2

|

Non-Solicitation and No Hiring

|

29

|

|

10.3

|

Non-Competition

|

30

|

|

10.4

|

Payment of Assumed Liabilities

|

30

|

|

10.5

|

Insurance

|

30

|

|

10.6

|

Name Change

|

30

|

|

10.7

|

Registration Statement

|

31

|

|

10.8

|

Working Capital

|

31

|

| |

|

|

|

ARTICLE XI DEFINITIONS

|

31

|

| |

|

|

|

ARTICLE XII MISCELLANEOUS

|

37

|

| |

|

|

|

12.1

|

Press Releases and Announcements

|

37

|

|

12.2

|

No Third Party Beneficiaries

|

37

|

|

12.3

|

Intentionally Omitted

|

37

|

|

12.4

|

Entire Agreement

|

37

|

|

12.5

|

Succession and Assignment

|

37

|

|

12.6

|

Notices

|

38

|

|

12.7

|

Amendments and Waivers

|

38

|

|

12.8

|

Severability

|

38

|

|

12.9

|

Expenses

|

39

|

|

12.10

|

Specific Performance

|

39

|

|

12.11

|

Governing Law

|

39

|

|

12.12

|

Submission to Jurisdiction

|

39

|

|

12.13

|

Construction

|

39

|

|

12.14

|

WAIVER OF JURY TRIAL

|

39

|

|

12.15

|

Incorporation of Exhibits and Schedules

|

39

|

|

12.16

|

Counterparts and Facsimile Signature

|

39

|

Disclosure Schedule

Schedules:

| |

|

|

| |

|

|

|

Schedule 1.1(a)(ii)

|

—

|

Personal Property

|

|

Schedule 1.1 (b)

|

—

|

Excluded Assets

|

|

Schedule 1.1 (c)

|

—

|

Assumed Liabilities

|

|

Schedule 1.2(a)(ii)

|

—

|

Personal Property

|

|

Schedule 1.2(c)

|

—

|

Allocation of Purchase Price

|

|

Schedule 5.1(i)

|

—

|

Required Third Party Consents

|

|

Schedule 5.2(1)

|

—

|

Cancelled Debt

|

|

Schedule 9.1

|

—

|

Employees Offered Employment by Buyer

|

| |

|

|

|

Exhibits:

|

|

|

| |

|

|

|

Exhibit A

|

—

|

Form of Lock-Up Agreement

|

|

Exhibit B

|

—

|

Form of Warrant

|

|

Exhibit C

|

—

|

Form of Bill of Sale

|

|

Exhibit D

|

—

|

Form of Trademark Assignment Agreement

|

|

Exhibit E

|

—

|

Form of Patent Assignment Agreement

|

|

Exhibit F

|

—

|

Form of Assignment and Assumption Agreement

|

|

Exhibit G

|

—

|

Form of Weisshaupt Employment Agreement

|

|

Exhibit H

|

—

|

Form of Noncompetition Agreement

|

ASSET PURCHASE AGREEMENT

This ASSET PURCHASE AGREEMENT (“Agreement”) is entered into as of July 10,2010 by and among ASI Holdings Limited, a Hong Kong corporation (“ASI Holdings”), ASI Audio Technologies, LLC, an Arizona limited liability company and wholly-owned subsidiary of ASI Holdings (“ASI Arizona”) (ASI Holdings and ASI Arizona are referred to sometimes collectively herein as “Sellers”, and each individually as “Seller”), and AuraSound, Inc., a Nevada corporation (the “Buyer”). Sellers and Buyer are referred to sometimes collectively herein as the “Parties.”

RECITALS

|

1.

|

Sellers are currently engaged in the business of design and distribution of sound speaker systems (the “Business”).

|

| |

|

|

2.

|

Buyer desires to purchase from each Seller, and each Seller desires to sell to Buyer, the assets of such Seller used in or relating to the Business described herein, subject to the assumption of certain related liabilities and upon the terms and subject to the conditions set forth herein.

|

| |

|

|

3.

|

Capitalized terms used in this Agreement shall have the meanings ascribed to them in Article XI.

|

NOW, THEREFORE, in consideration of the representations, warranties, covenants and agreements contained in this Agreement and other good and valuable consideration, the receipt of which is hereby acknowledged, the Parties agree as follows:

ARTICLE I

ASSET PURCHASE

1.1 Purchase and Sale of Assets: Assumption of Liabilities.

(a) Transfer of Assets. On the basis of the representations, warranties, covenants and agreements and subject to the satisfaction or waiver of the conditions set forth in this Agreement, at the Closing, each Seller shall sell, convey, assign, transfer and deliver to Buyer, and Buyer shall purchase and acquire from each Seller, free and clear of all Security Interests, all of such Seller’s right, title and interest in and to all assets used by such Seller in or relating to the Business (collectively, the “Acquired Assets”), including, without limitation, the following assets:

(i) except as otherwise described herein, all of such Seller’s right, title and interest in and to all inventories, wherever located, of Business Products, including all finished goods, consigned goods, work-in-progress, raw materials, spare parts, packaging, accessories and all other materials and supplies to be used, consumed, sold, resold or distributed by such Seller, and all warranties and guarantees, if any, express or implied, by the manufacturers or Seller of any such item or component part thereof, rights of return, rebate rights, over-payment recovery rights and any other rights of such Seller relating to these items (collectively, the “Inventory”):

(ii) all machinery, equipment, tools, furniture, office equipment, computer hardware, supplies, materials, vehicles and other items of tangible personal property (other than the Inventory) used in or relating to the Business (other than the Excluded Assets) and all warranties and guarantees, if any, express or implied, rights of return, rebate rights, over-payment recovery rights and any other rights of such Seller relating to these items, in each case existing for the benefit of such Seller in connection therewith to the extent transferable (collectively, the “Personal Property”):

(iii) all of such Seller’s right, title and interest in and to the Designated Contracts;

(iv) all of such Seller’s right, title and interest in and to all Business Intellectual Property;

(v) to the extent assignable, all of such Seller’s right, title and interest in and to all Permits relating to the Business;

(vi) all other assets relating to existing customer relationships and all written materials, data and records relating to the Business (in whatever form or medium), including (A) client, customer, prospect, supplier, dealer and distributor lists and records, (B) information regarding referral sources, (C) product catalogs and brochures, (D) sales and marketing, advertising and promotional materials, (E) research and development materials, reports and records, (F) production reports and records, (G) equipment logs, (H) service, warranty and claim records, (I) records relating to the Inventory, (J) maintenance records and other documents relating to the Personal Property, (K) purchase orders and invoices, (L) sales orders and sales order log books, (M) material safety data sheets, (N) price lists, (O) quotations and bids, (P) operating guides and manuals, (Q) correspondence, (R) financial books, records, journals and ledgers, (S) product ideas and developments and (T) plans and specifications, plats, surveys, drawings, blueprints and photographs;

(vii) all other intangible rights and property of such Seller relating to the Business, including (A) going concern value, (B) the goodwill of such Seller relating to the Business as conducted by such Seller, (C) directory, telecopy names, numbers, addresses and listings, and all rights that such Seller may have to institute or maintain any action to protect the same and recover damages for any misappropriation or misuses thereof;

(viii) all insurance benefits, including rights under and proceeds from, insurance policies providing coverage for the Acquired Assets or such Seller relating to the Business, where such rights, benefits and proceeds relate to events occurring prior to the Closing;

(ix) all rights with respect to deposits, prepaid expenses, claims for refunds and rights to offset related to the Business (excluding rights relating to the prior payment of Taxes) and interest payable with respect to any of the foregoing;

(x) all claims (including claims for past infringement or misappropriation of Business Intellectual Property or rights related thereto included in the Acquired Assets) and causes of action of such Seller relating to the Business against any other Person, whether or not such claims and causes of action have been asserted, and all rights of indemnity, warranty rights, rights of contribution, rights to refunds, rights of reimbursement and other rights of recovery of such Seller (regardless of whether such rights are currently exercisable) relating to the Acquired Assets;

(xi) all leasehold interests in the HK Leased Property, including all improvements and fixtures thereon and all rights and easements appurtenant thereto;

(xii) all leasehold or other contractual interests in the California Warehouse Property;

(xiii) all leasehold interests in the Arizona Leased Property, including all improvements and fixtures thereon and all rights and easements appurtenant thereto; and

(xiv) all accounts receivable of such Seller of any kind.

(b) Excluded Assets. Notwithstanding anything to the contrary in this Agreement, the Acquired Assets shall not include any of the assets of such Seller listed on Schedule 1.1 (b) (collectively, the “ExcludedAssets”).

(c) Assumed Liabilities. On the basis of the representations, warranties, covenants and agreements and subject to the satisfaction or waiver of the conditions set forth in this Agreement, at the Closing, Buyer shall assume and agree to pay, perform and discharge when due only the liabilities of Sellers relating to the Business that are specifically set forth on Schedule 1.1 (c) (the “Assumed Liabilities”).

(d) Excluded Liabilities. Notwithstanding anything to the contrary in this Agreement, the Assumed Liabilities shall not include any liability, obligation, agreement, undertaking or arrangement (contingent or otherwise) other than those which are specifically set forth on Schedule 1.1 (c) (collectively, the “Excluded Liabilities”).

(e) Treatment of Product Returns. In the event a customer of a Seller returns to such Seller or to Buyer after the Closing a Business Product purchased by such customer from such Seller in the course of the Business prior to the Closing (a “Returned Product”) and such customer either claims a credit for such Returned Product after the Closing against amounts owed by such customer to such Seller or demands payment as a result of such return after the Closing, Buyer shall be solely responsible for granting the credit or making the payment, as appropriate. Sellers shall be solely responsible for granting any credit or making any payment in respect of a product returned prior to the Closing.

1.2 Purchase Price and Related Matters.

(a) Purchase Price. In consideration for the sale and transfer of the Acquired Assets, Buyer shall at the Closing assume and agree to pay the Assumed Liabilities and shall deliver to ASI Holdings the following (together with the value of the Assumed Liabilities, the “Purchase Price”):

(i) at the Closing, Buyer shall issue 5,988,005 shares (the “Shares”) of Buyer’s unregistered common stock, par value US$0.01 per share (“Common Stock”) as follows: 5,389,204 Shares to Sunny World Associates Limited, a British Virgin Islands corporation, and 598,801 Shares to Faithful Aim Limited, which Shares shall be subject to certain transfer restrictions as provided in the Lock-Up Agreement in the form of Exhibit A hereto (the “Lock-Up Agreement”):

(ii) at the Closing, Buyer shall issue to Sunny World Associates Limited, a British Virgin Islands corporation a warrant, in the form of Exhibit B hereto (the “Warrant”), to purchase 3,000,000 shares of Common Stock at an exercise price of US$1.00 per share, which shall vest as provided in the Warrant, and which shall not be exercisable until Buyer shall have duly amended its Articles of Incorporation, in accordance with Chapter 78 of the Nevada Revised Statutes and Regulation 14A or 14C under the Exchange Act, to increase Buyer’s authorized Common Stock to a number sufficient to enable the full exercise or conversion into Common Stock of all outstanding securities of Buyer that are convertible into or exercisable for Common Stock (the “Authorized Shares Increase”).

(b) Allocation of Purchase Price. The Purchase Price shall be allocated among the Acquired Assets and the covenant contained in Section 10.3 as set forth on Schedule 1.2(c) hereto. Buyer and Sellers agree to allocate the Purchase Price among the Acquired Assets and the covenant set forth in Section 10.3 for all purposes (including financial accounting and Tax purposes) in accordance with Schedule 1.2(c). Buyer and ASI Arizona shall prepare or cause to be prepared IRS Forms 8594 in accordance with such allocation and consistent with one another and in accordance with the Code and Treasury Regulations. Buyer and ASI Holdings, on behalf of ASI Arizona, shall each deliver such Forms to one another for review and comment no later than 20 business days prior to filing with the IRS.

1.3 The Closing.

(a) Time and Location. The Closing shall take place at such physical location, or by electronic means, as determined by the Parties, on the Closing Date.

(b) Actions at the Closing. At the Closing:

(i) Each Seller shall deliver (or cause to be delivered) to Buyer the various certificates, instruments, agreements and documents required to be delivered by such Seller under Section 5.1;

(ii) Buyer shall deliver (or cause to be delivered) to ASI Holdings the various certificates, instruments, agreements and documents required to be delivered under Section 5.2;

(iii) Sellers and Buyer shall execute and deliver a Bill of Sale in substantially the form attached hereto as Exhibit C:

(iv) Sellers shall execute and deliver a Trademark Assignment Agreement in substantially the form attached hereto as Exhibit D:

(v) Sellers shall execute and deliver a Patent Assignment Agreement in substantially the form attached hereto as Exhibit E;

(vi) Buyer and Sellers shall execute and deliver an Assignment and Assumption Agreement in substantially the form attached hereto as Exhibit F;

(vii) Each Seller shall transfer to Buyer all the books, records, files and other data (or copies thereof), financial or otherwise, within the possession of such Seller relating to the Acquired Assets and reasonably necessary for the continued operation of the Business by Buyer;

(viii) Each Seller shall deliver to Buyer a list of all open customer and supplier purchase orders of such Seller as of the Closing Date;

(ix) Each Seller shall execute and deliver such other instruments of conveyance as Buyer may reasonably request in order to effect the sale, transfer, conveyance and assignment to Buyer of valid ownership of the Acquired Assets owned by such Seller; and

(x) Each Seller shall deliver to Buyer, or otherwise put Buyer in possession and control of, all of the Acquired Assets of a tangible nature owned by such Seller.

1.4 Common Stock Certificate.

(a) Sellers agree that the certificate representing the Shares to be issued by Buyer to ASI Holdings at the Closing will be imprinted with a legend substantially in the following form:

THE SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES COMMISSION OF ANY STATE IN RELIANCE UPON AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND, ACCORDINGLY, MAY NOT BE OFFERED OR SOLD EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS AS EVIDENCED BY A LEGAL OPINION OF COUNSEL TO THE TRANSFEROR TO SUCH EFFECT, THE SUBSTANCE OF WHICH SHALL BE REASONABLY ACCEPTABLE TO THE COMPANY.

THE TRANSFER OF THESE SECURITIES IS SUBJECT TO CERTAIN RESTRICTIONS SET FORTH IN A LOCK-UP AGREEMENT DATED AS OF JULY________, 2010 BETWEEN THE ISSUER OF THESE SECURITIES AND THE PERSON TO WHOM THESE SECURITIES ORIGINALLY WERE ISSUED. THE ISSUER OF THESE SECURITIES WILL FURNISH A COPY OF SUCH LOCK-UP AGREEMENT TO THE HOLDER OF THESE SECURITIES WITHOUT CHARGE UPON WRITTEN REQUEST.

1.5 Consents to Assignment. Anything in this Agreement to the contrary notwithstanding, this Agreement shall not constitute an agreement to assign or transfer any contract, lease, authorization, license or Permit, or any claim, right or benefit arising thereunder or resulting therefrom, if an attempted assignment or transfer thereof, without the consent of a third party thereto or of the issuing Governmental Entity, as the case may be, would constitute a breach thereof. If a Deferred Consent is not obtained, or if an attempted assignment or transfer thereof would be ineffective or would affect the rights thereunder so that Buyer would not receive all such rights, then, in each such case, (a) the Deferred Item shall be withheld from sale pursuant to this Agreement without any reduction in the Purchase Price, (b) from and after the Closing, Sellers and Buyer will cooperate, in all reasonable respects, to obtain such Deferred Consent as soon as practicable after the Closing, and (c) until such Deferred Consent is obtained, Sellers and Buyer will cooperate, in all reasonable respects, to provide to Buyer the benefits under the Deferred Item to which such Deferred Consent relates (with Buyer entitled to all the gains and responsible for all the losses, Taxes, liabilities and/or obligations thereunder). In particular, in the event that any such Deferred Consent is not obtained prior to the Closing, then Buyer and Seller shall enter into such arrangements (including subleasing or subcontracting if permitted) to provide to the Parties the economic and operational equivalent of obtaining such Deferred Consent and assigning or transferring such contract, lease, authorization, license or Permit, including enforcement for the benefit of Buyer of all claims or rights arising thereunder, and the performance by Buyer of the obligations thereunder on a prompt and punctual basis.

1.6 Further Assurances. At any time and from time to time after the Closing Date, as and when requested by any Party hereto and at such Party’s expense, the other Party shall promptly execute and deliver, or cause to be executed and delivered, all such documents, instruments and certificates and shall take, or cause to be taken, all such further or other actions as are necessary to evidence and effectuate the transactions contemplated by this Agreement.

ARTICLE II

REPRESENTATIONS AND WARRANTIES OF SELLERS

Sellers jointly and severally represent and warrant to Buyer that, except as set forth in the Disclosure Schedule, the statements contained in this Article II are true and correct as of the date hereof as to each Seller. The Disclosure Schedule shall be arranged in sections and subsections corresponding to the numbered and lettered sections and subsections contained in this Article II. The disclosures in any section or subsection of the Disclosure Schedule shall qualify other sections and subsections in this Article II only to the extent it is reasonably clear from a reading of the disclosure that such disclosure is applicable to such other sections and subsections.

2.1 Organization, Qualification and Corporate Power. ASI Holdings is a corporation duly incorporated or organized, validly existing and in good standing under the laws of Hong Kong, ASI Arizona is a limited liability company duly organized, validly existing and in good standing under the laws of the State of Arizona, USA, and each is duly qualified to conduct business under the laws of each jurisdiction where the character of the properties owned, leased or operated by it or the nature of its activities makes such qualification necessary, except for any such failure to be qualified that would not reasonably be expected to result in a Business Material Adverse Effect. Seller has not established any place of business other than in Hong Kong and the States of California and Arizona, USA. Seller has all requisite corporate power and authority to carry on the business in which it is now engaged and to own and use the properties now owned and used by it.

2.2 Authority. Seller has all requisite corporate power and authority to execute and deliver this Agreement and the Ancillary Agreements to which it will be a party and to perform its obligations hereunder and thereunder. The execution and delivery by Seller of this Agreement and such Ancillary Agreements and the consummation by Seller of the transactions contemplated hereby and thereby have been validly authorized by all necessary corporate action on the part of Seller. This Agreement has been, and such Ancillary Agreements will be, validly executed and delivered by Seller and, assuming this Agreement and each such Ancillary Agreement constitute the valid and binding obligation of Buyer, constitutes or will constitute a valid and binding obligation of Seller, enforceable against Seller in accordance with its terms, except as enforceability may be limited by bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium or other similar laws relating to or affecting the rights of creditors generally and by equitable principles, including those limiting the availability of specific performance, injunctive relief and other equitable remedies and those providing for equitable defenses.

2.3 Noncontravention. Subject to compliance with applicable antitrust or trade regulation laws, neither the execution and delivery by Seller of this Agreement or the Ancillary Agreements to which Seller will be a party, nor the consummation by Seller of the transactions contemplated hereby or thereby, will:

(a) conflict with or violate any provision of the charter or bylaws or comparable organizational documents of Seller;

(b) except as would not have a Business Material Adverse Effect, require on the part of Seller any filing with, or any Permit, authorization, consent or approval of, any Governmental Entity, except for any filing, Permit, authorization, consent or approval that has been obtained;

(c) except as set forth on Section 2.3(c) of the Disclosure Schedules, and except as would not have a Business Material Adverse Effect, conflict with, result in a breach of, constitute (with or without due notice or lapse of time or both) a default under, result in the acceleration of obligations under, create in any party the right to terminate or modify, or require any notice, consent or waiver under, any contract, lease, sublease, license, sublicense, franchise, permit, indenture, agreement or mortgage for borrowed money, instrument of indebtedness or Security Interest to which Seller is a party or by which Seller is bound or to which any of its assets is subject; or

(d) violate any order, writ, injunction or decree specifically naming, or statute, rule or regulation applicable to, Seller or any of its properties or assets.

2.4 Financial Statements. Section 2.4 of the Disclosure Schedule includes copies of the Financial Statements. The Financial Statements have been prepared in accordance with GAAP and the methodologies described in the footnotes thereto and fairly present, in all material respects, the financial condition and combined results of operations and cash flows of the Business as of the respective dates thereof and for the periods referred to therein.

2.5 Absence of Certain Changes. Except as set forth in Section 2.5 of the Disclosure Schedule, (a) since the Balance Sheet Date, there have not been any changes in the business, financial condition or results of operations of the Business that would reasonably be expected to result in a Business Material Adverse Effect and (b) since the Balance Sheet Date, Seller has not taken any of the actions (or permitted any of the events to occur) set forth in clauses (i) through (xi) of Section 4.2(b).

2.6 Undisclosed Liabilities. The Business does not have any liability of a nature which is material to the Business, except for (a) liabilities shown on the Most Recent Balance Sheet, (b) liabilities which have arisen since the Balance Sheet Date in the ordinary course of business, (c) contractual and other liabilities which are not required by GAAP to be reflected on a balance sheet, (d) the Excluded Liabilities and (e) liabilities which would not have a Business Material Adverse Effect.

2.7 Foreign Corrupt Practices. Neither Seller, nor to the Knowledge of Seller, any agent or other person acting on behalf of Seller, has (a) directly or indirectly, used any corporate funds for unlawful contributions, gifts, entertainment or other unlawful expenses related to foreign or domestic political activity, (b) made any unlawful payment to foreign or domestic government officials or employees or to any foreign or domestic political parties or campaigns from corporate funds, (c) failed to disclose fully any contribution made by Seller (or made by any person acting on its behalf of which Seller is aware) which is in violation of applicable law, or (d) violated in any material respect any provision of the U.S. Foreign Corrupt Practices Act of 1977, as amended.

2.8 Ownership of Personal Property.

(a) Seller is the true and lawful owner of, and has good and marketable title to, or has a valid leasehold interest in or a valid license or right to use, all of the Acquired Assets, free and clear of all Security Interests. Except as set forth on Section 2.8(a) of the Disclosure Schedule, no financing statement under the Uniform Commercial Code with respect to any of the Personal Property is active in any jurisdiction in the United States, and Seller has not signed any such active financing statement or any security agreement authorizing any secured party thereunder to file any such financing statement.

(b) Section 2.8(b) of the Disclosure Schedule lists individually (i) all pieces of Personal Property which are fixed assets (within the meaning of GAAP) having a book value greater than US$5,000, indicating the cost, location, accumulated book depreciation (if any) and the net book value of each such fixed asset as of the Balance Sheet Date, and (ii) all other Personal Property of a tangible nature (other than Inventory) whose book value exceeds US$5,000.

2.9 Real Property.

(a) Seller does not own any real property. The real properties demised by the leases listed on Section 2.9(b) of the Disclosure Schedule constitute all of the real property leased (whether or not occupied and including any leases assigned or leased premises sublet for which Seller remains liable), used or occupied by Seller relating to the Business.

(b) The leases of real property listed on Section 2.9(b) of the Disclosure Schedule as being leased by Seller (the “Leased Real Property”) are in full force and effect, and Seller holds a valid and existing leasehold interest under each of the leases for the term listed on Section 2.9(b) of the Disclosure Schedule.

(c) Other than as set forth on Section 2.9(c) of the Disclosure Schedule, Seller has not received written notice of any violation of any applicable zoning ordinance or other law relating to the Leased Real Property, and Seller has not received any written notice of the existence of any condemnation or other proceeding with respect to any of the Leased Real Property.

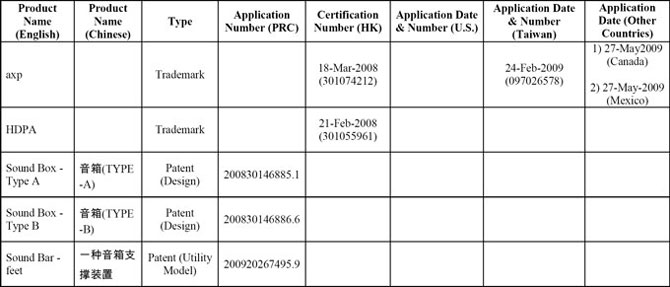

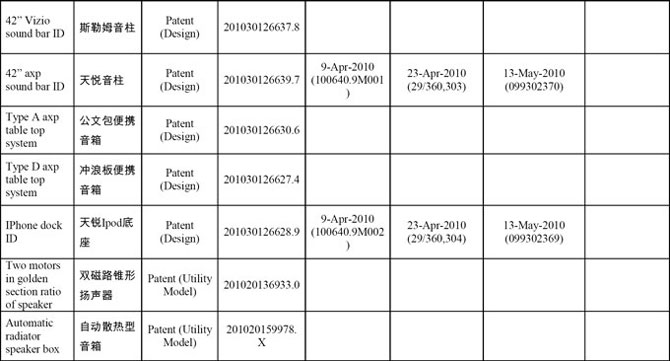

2.10 Intellectual Property.

(a) Section 2.10(a) of the Disclosure Schedule lists all material or registered Business Intellectual Property. Seller owns, or is licensed or, to the Knowledge of Seller, otherwise possesses valid rights to use, each item of Business Intellectual Property indicated as being owned by Seller on Section 2.10(a) of the Disclosure Schedule.

(b) Other than as set forth on Section 2.10(b) of the Disclosure Schedule, with respect to the Business, Seller has not received written notice that it has been named, nor to Seller’s Knowledge has it been named, in any pending suit, action or proceeding which involves a claim of infringement of any Third Party Rights.

(c) Seller has performed the obligations required to be performed by it under the terms of any agreement pursuant to which Seller has rights in any Business Intellectual Property, and neither Seller nor, to the Knowledge of Seller, any third party is in default under any such agreement, except in each case as would not reasonably be expected to have a Business Material Adverse Effect.

(d) Other than rights and licenses granted in the ordinary course of business, Seller has not granted to any third party any license or right to the commercial use of any of the Business Intellectual Property.

(e) Other than as set forth on Section 2.10(e) of the Disclosure Schedule, there are no pending, or, to the Knowledge of Seller, threatened claims against Seller or any of its former or current employees alleging that (i) any of the Business Intellectual Property or the Business infringes or violates any Third Party Rights or (ii) Seller or any of its employees has misappropriated any Third Party Rights in furtherance of the Business.

(f) To the Knowledge of Seller, neither the operation of the Business by Seller nor any activity by Seller nor any use by Seller of the Business Intellectual Property infringes or violates any Third Party Rights. Seller has not received any written communications alleging that any of the Business Intellectual Property is invalid or unenforceable. To the Knowledge of Seller, no third party has violated or infringed or is violating or infringing any of the Business Intellectual Property. Except as listed in Schedule 2.10(f), Seller does not have any licenses or other agreements under which it is granted rights by others in any Business Intellectual Property.

(g) To the Knowledge of Seller, no current or former employee or consultant of Seller owns or has claimed any ownership rights in or to, or any right to use, any of the Business Intellectual Property, and to the Knowledge of Seller no employee of Seller has entered into any agreement that restricts or limits in any way the scope or type of work in which the employee may be engaged or requires the employee to transfer, assign or disclose any Business Intellectual Property to anyone other than Seller.

(h) Except as disclosed in Schedule 2.10(h), the Seller (i) has not directly or indirectly licensed or granted to anyone rights of any nature with respect to any of the Business Intellectual Property; and (ii) is not obligated to and does not pay royalties or other fees to anyone with respect to the ownership, use, license or transfer of any of the Business Intellectual Property.

2.11 Contracts.

(a) Section 2.11 (a) of the Disclosure Schedule lists all of the written contracts or agreements to which Seller is a party as of the date of this Agreement that are used in or related to the Business (other than contracts or agreements relating to Excluded Assets or Excluded Liabilities) (the “Designated Contracts”) and that provide for either Seller to receive or make total annual payments in excess of $5,000..

(b) Seller has delivered or made available to Buyer a complete and accurate copy of each Designated Contract. Each Designated Contract is a valid and binding obligation of Seller, and, to the Knowledge of Seller, of each other party thereto, enforceable in accordance with its terms, except as the same may be limited by bankruptcy, insolvency, reorganization, moratorium or other laws affecting the rights of creditors generally and subject to the rules of law governing (and all limitations on) specific performance, injunctive relief and other equitable remedies. Neither Seller nor, to the Knowledge of Seller, any other party to any Designated Contract, is in default in complying with any provisions thereof, and no condition or event or fact exists which, with notice, lapse of time or both would constitute a default thereof on the part of Seller or, to the Knowledge of Seller, on the part of any other party thereto.

2.12 Intentionally Omitted.

2.13 Litigation. Section 2.13 of the Disclosure Schedule lists (other than with respect to Taxes), as of the date of this Agreement, each (a) judgment, order, decree, stipulation or injunction of any Governmental Entity naming Seller that relates to the Business and (b) action, suit or proceeding by or before any Governmental Entity to which Seller is a party and that relates to the Business.

2.14 Employment Matters.

(a) Seller is currently in compliance in all material respects with, and has at all times complied in all material respects with, all applicable laws governing the hiring, employment and classification of employees. Section 2.14(a) of the Disclosure Schedule contains a complete and accurate list of all Business Employees, describing for each such Business Employee, the position, date of hire, business location, annual base salary, monthly/weekly/hourly rates of compensation, average scheduled hours per week, status (i.e., active or inactive and if inactive, the type of leave and estimated duration) and the total amount of bonus, severance and other amounts to be paid to such Business Employee at the Closing or otherwise in connection with the transactions contemplated hereby. Section 2.14(a) of the Disclosure Schedule contains a complete and accurate list of all Contingent Workers, describing for each Contingent Worker such individual’s role in the Business, fee or compensation arrangements and other contractual terms with Seller.

(b) Each current Business Employee has entered into a confidentiality and assignment of inventions agreement with Seller, a copy or form of which has previously been delivered to Buyer. Section 2.14(b) of the Disclosure Schedule contains a list of all Business Employees who are a party to a non-competition agreement and/or non-solicitation agreement with Seller (indicating the type of agreement for each such individual); copies of such agreements have previously been delivered to Buyer.

(c) Section 2.14(c) of the Disclosure Schedule lists each Business Employee as of the date of this Agreement who is required by applicable law to hold a temporary work authorization or a particular class of non-immigrant visa in order to work in any jurisdiction in which such employee is employed (each a “Work Permit”), and shows for each such employee the type of Work Permit held by such Business Employee and the remaining period of validity of such Work Permit. With respect to each Work Permit, all of the information that Seller has provided to the relevant Governmental Entities (collectively, “Immigration Authorities”) in the application for such Work Permit was true and complete. Seller has received the appropriate notice of approval from the Immigration Authorities with respect to each such Work Permit. None of the Sellers has received any notice from the Immigration Authorities that any Work Permit has been revoked. There is no action pending or, to Seller’s Knowledge, threatened to revoke or adversely modify the terms of any Work Permit. Except as disclosed in Section 2.14(c) of the Disclosure Schedule, no employee of Seller is a non-immigrant employee of a nationality other than that of the jurisdiction in which he or she is employed whose right to remain in such employment would terminate or otherwise be affected by the transactions contemplated by this Agreement.

(d) Seller is not a party to or bound by any collective bargaining agreement relating to the Business, nor has Seller, with respect to the Business, experienced, since 2007, any material strikes, grievances, claims of unfair labor practices or other collective bargaining disputes.

(e) To the Knowledge of Seller, no Business Employee has any plans to terminate employment with Seller (other than for the purpose of accepting employment with Buyer following the Closing) or not to accept employment with Buyer.

(f) The employment of any terminated former employee of Seller engaged in the Business has been terminated in material compliance with any applicable contract terms and applicable law, and, to Seller’s Knowledge, Seller does not have any material liability under any contract or applicable Law toward any such terminated employee, except as may be set forth in any Plan.

(g) Except as set forth on Schedule 2.14(g) of the Disclosure Schedule, Seller has not made any loans (except advances for business expenses in the ordinary course of business) to any Business Employee that have not been fully repaid, forgiven or otherwise satisfied.

(h) Except as set forth on Schedule 2.14(h) of the Disclosure Schedule, the Seller has paid in full to all employees all wages, salaries, bonuses and commissions due and payable to such employees and Buyer assumes no obligation for any unpaid amounts.

(i) No orders, awards, improvements, prohibitions or other notices have been served upon and no other enforcement or similar proceedings have been taken against Seller in the past two years pursuant to any legislation, regulations, orders or codes of conduct of any Governmental Entity in respect of employees.

(j) There are no current negotiations for any change in the rate of remuneration or the bonus, incentives, prerequisites or emoluments or pension benefits of any Business Employee.

2.15 Employee Benefits.

(a) Section 2.15(a) of the Disclosure Schedule contains a complete and accurate list of all Business Benefit Plans. Complete and accurate copies of all Business Benefit Plans and all related trust agreements, insurance contracts and summary plan descriptions have been made available to Buyer.

(b) Seller has complied with all applicable requirements of the MPFO. Seller has no obligations to make any voluntary contribution under the Employee Benefit Plan maintained under the MPFO above the mandatory contribution.

(c) Seller has made all contributions (including all employer contributions and employee salary reduction contributions) due within the time period prescribed by the MPFO and all contributions for any period ending on or before the Closing Date which are not yet due have been made to each such Employee Benefit Plan. All premiums or other payments for all periods ending on or before the Closing Date have been paid with respect to each Employee Benefit Plan.

(d) There are no criminal proceedings against, and no material civil, arbitration, administrative or other proceedings or disputes by or against, the trustees, managers or administrators of the Business Benefit Plans or Seller in relation to the Business Benefit Plans and none is pending or, to Seller’s Knowledge, threatened.

(e) There are no unfunded obligations under any Business Benefit Plan providing welfare benefits after termination of employment to any Business Employee (or to any beneficiary of any such employee), excluding continuation of health coverage required to be continued under Section 4980B of the Code or other similar applicable laws.

(f) Section 2.15(f) of the Disclosure Schedule sets forth the policy of Seller with respect to accrued vacation, personal and sick time and earned time off applicable to the Business Employees and the total amount of such liabilities with respect to the Business Employees as of the date hereof (and updated as of the Closing Date).

(g) No undertaking or assurance (whether or not constituting a legally binding commitment) has been given to any Business Employee as to the continuation and assumption by Buyer of the Business Benefit Plans after the Closing.

2.16 Environmental Matters. Except as described or identified in Section 2.16 of the Disclosure Schedule:

(i) Except as would not have a Business Material Adverse Effect, the Business’ operations are currently in compliance with, and have at all times complied with, applicable Environmental Laws and, to the Knowledge of Seller, there are no circumstances that may prevent or interfere with such compliance in the future;

(ii) there is no pending civil or criminal litigation, written notice of violation or formal administrative proceeding, investigation or claim relating to any Environmental Law involving any Leased Real Property or any property formerly owned or operated by the Business;

(iii) no Materials of Environmental Concern have been Released by the Business at any Leased Real Property in violation of applicable Environmental Law; and

(iv) Seller is not aware of any liability under Environmental Laws of any solid or hazardous waste transporter or treatment, storage or disposal facility that has been used in connection with the operations of the Business.

2.17 Legal Compliance. Except as would not have a Business Material Adverse Effect, Seller, with respect to the Business, has been and remains in material compliance with all applicable laws (including rules and regulations thereunder, other than with respect to Taxes) of any federal, state or foreign government, or any Governmental Entity, in effect with respect to the Business. Seller has not received written notice of, or to Seller’s Knowledge is not subject to, any pending or threatened civil, criminal or administrative action, suit, proceeding, hearing, demand letter, investigation, claim, complaint, demand, request for information, or notice relating to the Business (other than with respect to Taxes). To Seller’s Knowledge, there is no act, omission, event or circumstance that would reasonably be expected to give rise to any such action, suit, proceeding, hearing, demand letter, investigation, claim, complaint, demand, request for information or notice (other than with respect to Taxes).

2.18 Permits. Section 2.18 of the Disclosure Schedule lists all Permits. Except as would not have a Business Material Adverse Effect, each Permit listed in the Disclosure Schedule is in full force and effect, and Seller is not in material violation of or default under any Permit. No suspension or cancellation of any such Permit has been threatened in writing. The Permits include, but are not limited to, those required in order for Seller to conduct the Business under federal, state, local or foreign statutes, ordinances, orders, requirements, rules, regulations, Environmental Laws and laws pertaining to public health and safety, worker health and safety, buildings, highways or zoning. To the Knowledge of Seller, none of the Permits is subject to termination as a result of the execution of this Agreement or the consummation of the transactions contemplated hereby, and, to Seller’s Knowledge, Buyer will not be required to obtain any further Permits to continue to conduct the Business immediately after the Closing. To the Knowledge of Seller, Seller has not made any false statements on, or omissions from, any notifications, applications, approvals, reports and other submissions to any Governmental Entity or in or from any other records and documentation prepared or maintained to comply with the requirements of any Governmental Entity.

2.19 Business Relationships with Affiliates. Section 2.19 of the Disclosure Schedule lists any agreements with respect to the Business whereby any Affiliate of Seller, directly or indirectly, (a) owns any property or right, tangible or intangible, which is used in the Business, (b) has any material claim or cause of action against the Business, or (c) owes any money to, or is owed any money by, the Business. Section 2.19 of the Disclosure Schedule describes any commercial transactions or relationships between Seller and any Affiliate thereof (as well as any commercial transactions or relationships between any such Affiliates and Suppliers) which occurred or have existed since the beginning of the time period covered by the Financial Statements.

2.20 Brokers’ Fees. Seller has no liability or obligation to pay any fees or commissions to any broker, finder or agent with respect to the transactions contemplated by this Agreement that would constitute an Assumed Liability.

2.21 Inventory. All of the Inventory as of the Balance Sheet Date is set forth in Section 2.21 of the Disclosure Schedule, which shall be updated as of the Closing.

2.22 Intentionally Omitted.

2.23 Insurance. Section 2.23 of the Disclosure Schedule lists each insurance policy (including fire, theft, casualty, comprehensive general liability, workers compensation, business interruption, environmental, product liability and automobile insurance policies and bond and surety arrangements) relating to the Business to which Seller is a party, all of which are in full force and effect. There is no claim pending under any such policy as to which coverage has been questioned, denied or disputed by the underwriter of such policy, and Seller is otherwise in compliance in all material respects with the terms of such policies. Seller has not received written notice of any threatened termination of any such policy.

2.24 Warranty Matters. None of the Business Products manufactured, sold, leased, licensed or delivered by Seller is subject to any guaranty, warranty, right of return, right of credit or other indemnity other than (i) the applicable standard terms and conditions of sale or lease of the Business, which are set forth in Section 2.24 of the Disclosure Schedule, (ii) manufacturers’ warranties for which the Business has no liability or (iii) warranties imposed by applicable law. The reserves for Warranty Obligations reflected on the Most Recent Balance Sheet are reasonable in amount, are consistent with the past practice of Seller with respect to the Business. Section 2.24 of the Disclosure Schedule sets forth the aggregate expenses incurred by Seller in fulfilling its obligations under its guaranty, warranty, right of return and indemnity provisions with respect to the Business during each of the fiscal years and the interim period covered by the Financial Statements.

2.25 Customers, Distributors and Suppliers. Section 2.25 of the Disclosure Schedule sets forth a true and complete list of all customers, sales representatives, dealers and distributors (whether pursuant to a commission, royalty or other arrangement) that accounted for US$100,000 or more of the sales of the Business for the fiscal year ended December 31,2009, showing with respect to each, the name, address and dollar value involved (collectively, the “Customers and Distributors”). Section 2.25 of the Disclosure Schedule also sets forth a true and complete list of all suppliers of the Business to whom during the fiscal year ended December 31,2009, Seller made payments aggregating US$25,000 or more, showing with respect to each, the name, address and dollar value involved (the “Suppliers”). No Customer, Distributor or Supplier has canceled or otherwise terminated its relationship with Seller, or, during the last twelve (12) months, has decreased materially its services, supplies or materials to Seller or its usage or purchase of the services or products of Seller nor, to the knowledge of Seller, does any Customer, Distributor or Supplier have any plan or intention to do any of the foregoing.

2.26 Investment. Seller (a) understands that the Shares have not been registered under the Securities Act or under any state securities laws, is being offered and sold in reliance upon federal and state exemptions for transactions not involving any public offering and will contain a legend restricting transfer; (b) is acquiring the Shares solely for Seller’s own account for investment purposes, and not with a view to the distribution thereof (other than to Seller’s shareholders); (c) is a sophisticated investor with knowledge and experience in business and financial matters; (d) has received certain information concerning Buyer and has had the opportunity to obtain additional information as desired in order to evaluate the merits and the risks inherent in holding the Shares; and (e) is able to bear the economic risk and lack of liquidity inherent in holding the Shares.

2.27 Tax Compliance.

(a) Seller has filed all Tax Returns that it was required to file. All such Tax Returns and all information supplied, including Tax Returns to be filed to the Inland Revenue Department of Hong Kong or other Taxing Authority were correct, complete and proper in all material respects. All Taxes owed by Seller (whether or not shown on any Tax Return) have been timely paid. Seller currently is not the beneficiary of any extension of time within which to file any Tax Return. To Seller’s Knowledge, no claim has ever been made by an authority in a jurisdiction where Seller does not file Tax Returns that it is or may be subject to taxation by that jurisdiction. There are no Security Interests on any of the assets of Seller that arose in connection with any failure (or alleged failure) to pay any Tax.

(b) Seller has withheld and paid all material Taxes required to have been withheld and paid in connection with amounts paid or owing to any employee, independent contractor, creditor, stockholder, or other third party.

2.28 Disclaimer of Sellers. Sellers make no representations or warranties to Buyer relating to Sellers or the Business or otherwise in connection with the transactions contemplated by this Agreement other than those expressly set forth in this Agreement, the Disclosure Schedule and any other schedule or exhibit hereto. Without limiting the generality of the foregoing, Sellers have made no representations or warranties in the materials relating to the Business made available to Buyer or in any presentation of the Business in connection with the transaction contemplated hereby, and no statement contained in any of such materials or made in any such presentation shall be deemed a representation or warranty hereunder.

ARTICLE III

REPRESENTATIONS AND WARRANTIES OF BUYER

Buyer represents and warrants to Sellers that, except as otherwise disclosed in Buyer’s reports and filings made with the Securities and Exchange Commission, the statements contained in this Article III are true and correct as of the date hereof, and will be true and correct as of the Closing Date as though made as of the Closing Date, except to the extent such representations and warranties are specifically made as of a particular date (in which case such representations and warranties will be true and correct as of such date).

3.1 Organization. Buyer is a corporation duly incorporated, validly existing and in good standing under the laws of the State of Nevada and is duly qualified to conduct business under the laws of each jurisdiction where the character of the properties owned, leased or operated by it or the nature of its activities makes such qualification necessary, except for any such failure to be qualified that would not reasonably be expected to result in a material adverse effect.

3.2 Authority. Buyer has all requisite corporate power and authority to execute and deliver this Agreement and the Ancillary Agreements to which it will be a party and to perform its obligations hereunder and thereunder. The execution and delivery by Buyer of this Agreement and such Ancillary Agreements and the consummation by Buyer of the transactions contemplated hereby and thereby have been validly authorized by all necessary company action on the part of Buyer. This Agreement has been, and such Ancillary Agreements will be, validly executed and delivered by Buyer and, assuming this Agreement and each such Ancillary Agreement constitute the valid and binding obligation of Seller, constitutes or will constitute a valid and binding obligation of Buyer, enforceable against Buyer in accordance with its terms, except as enforceability may be limited by bankruptcy, insolvency, reorganization, fraudulent transfer, moratorium or other similar laws relating to or affecting the rights of creditors generally and by equitable principles, including those limiting the availability of specific performance, injunctive relief and other equitable remedies and those providing for equitable defenses.

3.3 Noncontravention. Subject to compliance with the applicable requirements of applicable antitrust or trade regulation laws, neither the execution and delivery by Buyer of this Agreement or the Ancillary Agreements to which Buyer will be a party, nor the consummation by Buyer of the transactions contemplated hereby or thereby, will:

(a) conflict with or violate any provision of the organizational documents of Buyer;

(b) require on the part of Buyer any filing with, or permit, authorization, consent or approval of, any Governmental Entity, except for any filing, permit, authorization, consent or approval that has been obtained;

(c) conflict with, result in a breach of, constitute (with or without due notice or lapse of time or both) a default under, result in the acceleration of obligations under, create in any party any right to terminate or modify, or require any notice, consent or waiver under, any contract or agreement to which Buyer is a party or by which Buyer is bound; or

(d) violate any order, writ, injunction or decree specifically naming, or statute, rule or regulation applicable to, Buyer or any of its properties or assets.

3.4 Litigation. There are no actions, suits, claims or legal, administrative or arbitratorial proceedings pending against, or, to Buyer’s knowledge, threatened against, Buyer which would adversely affect Buyer’s performance under this Agreement or the consummation of the transactions contemplated by this Agreement.

3.5 SEC Documents. Buyer hereby makes reference to the following documents filed by it with the United States Securities and Exchange Commission (the “SEC”), as posted on the SEC’s website, www.sec.gov: (collectively, the “SEC Documents”): (a) Annual Report on Form 10-KSB for the fiscal year ended June 30,2009; and (b) Quarterly Reports on Form 10-Q for the periods ended September 30 and December 31,2009 and March 31,2010; and any amendments thereto. As of their respective dates, the SEC Documents complied in all material respects with the requirements of the Securities Act and/or the Exchange Act, as the case may require, and the rules and regulations promulgated thereunder and none of the SEC Documents contained an untrue statement of a material fact or omitted to state a material fact required to be stated therein or necessary to make the statements therein, in light of the circumstances under which they were made, not misleading. The financial statements of Buyer included in the SEC Documents comply as to form in all material respects with applicable accounting requirements and the published rules and regulations of the SEC with respect thereto, have been prepared in accordance GAAP (except, in the case of unaudited statements, as permitted by the applicable form under the Securities Act or the Exchange Act) applied on a consistent basis during the periods involved (except as may be indicated in the notes thereto) and fairly present the financial position of Buyer as of the dates thereof and its consolidated statements of operations, stockholders’ equity and cash flows for the periods then ended (subject, in the case of unaudited statements, to normal and recurring year-end audit adjustments which were and are not expected to have a material adverse effect on Buyer, its business, financial condition or results of operations).

3.6 Capitalization. Buyer’s authorized capital stock consists of (i) 16,666,667 shares of Common Stock, of which 4,678,662 shares are issued and outstanding, and (ii) 3,333,333 shares of preferred stock, none of which are issued and outstanding. All issued and outstanding shares of Common Stock are duly authorized, validly issued, fully paid, non-assessable and free of preemptive rights. When issued, the Shares will be duly authorized, validly issued, fully paid, non-assessable and free of preemptive rights. Except as set forth in the SEC Documents, there are no outstanding or authorized options, rights, warrants, calls, convertible securities, rights to subscribe, conversion rights or other agreements or commitments to which Buyer is a party or which are binding upon Buyer providing for the issuance by Buyer or transfer by Buyer of additional shares of Buyer’s capital stock. To Buyer’s knowledge, there are no voting trusts or any other agreements or understandings with respect to the voting of Buyer’s capital stock.

3.7 Financial Statements.

(a) Included in the SEC Documents is the audited balance sheet of Buyer as at June 30,2009, and the related statements of operations, stockholders’ equity and cash flows for the two years then ended, together with the unqualified report thereon (except with respect to continuation as a going concern) of Kabani & Co. (“Kabani”), independent auditors (collectively, “Buyer’s Audited Financials”).

(b) Included in the SEC Documents are the unaudited balance sheet of Buyer as at March 31,2010, and the related statements of operations, stockholders’ equity and cash flows for the three months then ended, as reviewed by Kabani (“Buyer’s Interim Financials”).

(c) Buyer’s Audited Financials and Buyer’s Interim Financials (collectively “Buyer’s Financial Statements”) (i) are in accordance with the books and records of Buyer, (ii) are correct and complete in all material respects, (iii) fairly present the financial position and results of operations of Buyer as of the dates indicated, and (iv) are prepared in accordance with GAAP (except that (x) unaudited financial statements may not be in accordance with GAAP because of the absence of footnotes normally contained therein, and (y) interim (unaudited) financials are subject to normal year-end audit adjustments that in the aggregate will not have a material adverse effect on Buyer, its business, financial condition or results of operations.

(d) Schedule 3.7(d) sets forth a list of all of Buyer’s liabilities (both current and long term) required to be disclosed on a balance sheet in accordance with GAAP.

3.8 Events Subsequent to Financial Statements. Since March 31,2010, there has not been:

(a) Any sale, lease, transfer, license or assignment of any assets, tangible or intangible, of Buyer outside Buyer’s ordinary course of business;

(b) Any damage, destruction or property loss, whether or not covered by insurance, affecting materially and adversely the properties or business of Buyer;

(c) Any declaration or setting aside or payment of any dividend or distribution with respect to the shares of capital stock of Buyer or any redemption, purchase or other acquisition of any such shares;

(d) Any lien placed on any of the assets, tangible or intangible, of Buyer outside the ordinary course of business;

(e) Any incurrence of indebtedness or liability or assumption of obligations by Buyer outside Buyer’s ordinary course of business;

(f) Any waiver or release by Buyer of any right of any material value; or

(g) Any material adverse change in the condition (financial or otherwise) of the properties, assets, liabilities or business of Buyer.

3.9 No Brokers. No Person has acted, directly or indirectly, as a broker, finder or financial advisor for Buyer in connection with the transactions contemplated by this Agreement and no Person is entitled to any fee or commission or like payment in respect thereof.

ARTICLE IV

PRE-CLOSING COVENANTS

4.1 Closing Efforts.

(a) Subject to the terms hereof, including Section 4.l(b), each of the Parties shall use reasonable commercial efforts to take all actions and to do all things reasonably necessary or advisable to consummate the transactions contemplated by this Agreement, including using reasonable commercial efforts to: (i) obtain all Third Party Consents, (ii) effect all Governmental Filings, including as necessary to effect a transfer of ownership to Buyer of any applicable regulatory approvals, registrations, licenses or authorizations, and (iii) otherwise comply in all material respects with all applicable laws and regulations in connection with the consummation of the transactions contemplated by this Agreement. Buyer shall pay any out-of-pocket costs (excluding legal fees, for which the parties will each bear their own costs) associated with obtaining such Third Party Consents. Each of the Parties shall promptly notify each of the other Parties of any fact, condition or event known to it that would reasonably be expected to prohibit, make unlawful or delay the consummation of the transactions contemplated by this Agreement.

(b) Each of the Parties shall use reasonable commercial efforts to resolve any objections that may be asserted by any Governmental Entity with respect to the transactions contemplated hereby, and shall cooperate with each other to contest any challenges to the transactions contemplated hereby by any Governmental Entity; provided, however, that Buyer shall have no obligation under this Section 4.1 to dispose or hold separately or make any change in or to any portion of its business or assets (or in or to any portion of the Acquired Assets), to incur any other burden with respect thereto or to agree to do any of the foregoing, as a condition of such governmental clearances or approvals. Each of the Parties shall promptly inform each other of any material communication received by such Party from any Governmental Entity regarding any of the transactions contemplated hereby (unless the provision of such information would (i) violate the provisions of any applicable laws or regulations (including without limitation those relating to security clearance or export controls) or any confidentiality agreement or (ii) cause the loss of the attorney-client privilege with respect thereto).

4.2 Operation of Business.

(a) During the period from the date of this Agreement until the Closing Date, Sellers shall:

(i) conduct the operations of the Business in the ordinary course, consistent with past practice;

(ii) maintain consistent with past practice the assets, properties, facilities and equipment of the Business in good working order and condition as of the date hereof (excluding ordinary wear and tear);

(iii) perform in all material respects all of its obligations under all agreements relating to or affecting the Business or the assets, liabilities, properties, equipment or rights thereof;

(iv) use its commercially reasonable efforts to (A) preserve the Business organization intact, (B) retain the Business’s present employees, but in no event shall a Seller be required to increase compensation or benefits or extend bonuses and (C) maintain the relationships and agreements with the Business’s suppliers, distributors, customers and others having dealings with the Business, all in a manner consistent with past practices, but in no event shall a Seller be required to extend any discounts or rebates or agree to any cost increases, in each case to the extent inconsistent with past practice;

(v) continue in full force and effect all existing insurance policies (or comparable insurance) relating to the Business; and

(vi) comply in all material respects with all Permits, rules, laws and regulations applicable to the Business.

(b) Prior to the Closing, a Seller shall not, without the prior written consent of Buyer:

(i) sell, assign, transfer, lease, exchange or dispose of any portion of the Acquired Assets, except for sales of Inventory in the ordinary course of business consistent with past practice; provided, however, that nothing in this clause (i) shall prohibit the collection by a Seller of accounts receivable of the Business;

(ii) incur or guarantee any indebtedness for borrowed money relating to the Business, except in the ordinary course of business consistent with past practice;

(iii) grant any rights to severance benefits, “stay pay” or termination pay to any Business Employee, or increase the compensation or other benefits payable or potentially payable to, any Business Employee under any previously existing severance benefits, “stay-pay” or termination pay arrangements except for “stay pay” or termination pay to a Business Employee not to exceed US$10,000 in the aggregate;

(iv) make any capital expenditures or commitments therefor with respect to the Business in an amount in excess of US$20,000 in the aggregate;

(v) acquire any operating business, whether by merger, stock purchase, asset purchase or otherwise (except for any business that will not become part of the Business);

(vi) increase the current compensation or benefits of, or current level of payments to, or enter into any employment, compensation or deferred compensation agreement (or any amendment to any such existing agreement) with any Business Employees except in the ordinary course of business consistent with past practice;

(vii) materially amend the terms of any existing Business Benefit Plan, except as required by law;

(viii) materially change the accounting principles, methods or practices insofar as they relate to the Business, except in each case to conform to changes in GAAP;

(ix) enter into any contract, agreement, obligation or commitment relating to the Business, other than contracts, agreements, obligations or commitments entered into in the ordinary course of business consistent with past practice (provided, however, if Seller enters into any such contract, agreement, obligations or commitment that would require a Seller to make payments or incur costs or expenses in an amount more than $20,000, Seller shall provide Buyer a copy of such contract within three (3) Business Days after the date thereof);

(x) create any Security Interests in any of the Acquired Assets; or (xi) agree in writing or otherwise to take any of the foregoing actions.

4.3 Access.

(a) Sellers shall permit representatives of Buyer to have access (at reasonable times, on reasonable prior written notice and in a manner so as not to interfere with the normal business operations of the Business) to the Business Employees and the counsel and auditors of Sellers as well as the premises, properties, financial and accounting records, contracts and other records and documents, of or pertaining to the Business; provided, however, such counsel shall not be obligated to disclose any information or documents covered by the attorney-client privilege or the attorney work product privilege. Prior to the Closing, Buyer and its representatives shall not contact or communicate with the customers, sales representatives, dealers, distributors and suppliers of Sellers in connection with the transactions contemplated by this Agreement, except with the prior written consent of ASI Holdings.

(b) Sellers will provide Buyer, Buyer’s representatives and Buyer’s independent registered public accountants reasonable access during normal business hours to such books, records, workpapers, data and other information as may be reasonably requested by the Buyer to allow Buyer and its independent registered public accountants to conduct an audit or review of the Business and Acquired Assets for such periods as Buyer may require for its financial reporting purposes required in connection with any report required to be filed with the SEC under the Securities Exchange Act of 1934. Sellers shall cooperate with Buyer’s independent registered public accountants in the preparation of audited and/or pro forma financial statements in respect of the Business and Acquired Assets for such periods as Buyer may require; provided, that Buyer shall be responsible for the cost of such audit.

(c) Buyer and Sellers acknowledge and agree that the Confidentiality Agreement remains in full force and effect and that Information provided by Sellers or any of their respective Affiliates to Buyer pursuant to this Agreement prior to the Closing shall be treated in accordance with the Confidentiality Agreement. If this Agreement is terminated prior to the Closing, the Confidentiality Agreement shall remain in full force and effect in accordance with its terms. If the Closing occurs, the Confidentiality Agreement, insofar as it covers Information relating to the Business, shall terminate effective as of the Closing, but shall remain in effect insofar as it covers other Information disclosed thereunder.

4.4 Exclusivity. After the date hereof and until the earlier of the Closing or the termination of this Agreement pursuant to Article VIII, Sellers shall not, and shall require each of their respective managers, employees, directors, officers, partners, Affiliates, attorneys, investment bankers, accountants, representatives and agents not to, directly or indirectly, initiate, solicit, encourage or otherwise facilitate any inquiry, proposal, offer or discussion with any party (other than Buyer) concerning any merger, reorganization, consolidation, recapitalization, business combination, liquidation, dissolution, share exchange, lease, sale of stock, sale of material assets, disposition or similar business transaction involving the Business or Sellers (any such inquiry, proposal, offer or discussion, an “Acquisition Proposal”).

(b) If a Seller receives any Acquisition Proposal, such Seller shall, within two Business Days after such receipt, notify Buyer of such Acquisition Proposal, including the identity of the other party and the terms of such Acquisition Proposal.

4.5 Supplement to Disclosure Schedules. In the event that a Seller becomes aware of any fact or condition occurring after the date hereof that would require a change to any Disclosure Schedule such Seller may deliver a supplement to the Disclosure Schedules specifying the change. Buyer shall promptly determine prior to Closing whether it desires to terminate the Agreement under Article VIII hereof or proceed to Closing with such changed Disclosure Schedules. In the event that Buyer proceeds to Closing without terminating the Agreement, Buyer shall be deemed to have waived its right to recover Damages from Sellers resulting from such change.

ARTICLE V

CONDITIONS PRECEDENT TO CLOSING

5.1 Conditions to Obligations of Buyer. The obligation of Buyer to consummate the transactions to be consummated at the Closing is subject to the satisfaction (or waiver by Buyer) of the following conditions: