|

Exhibit 5(a)

Amy L. Schneider Vice President, Corporate Secretary and Securities

414 Nicollet Mall, 401-8 Minneapolis, Minnesota 55401 |

April 18, 2024

Xcel Energy Inc.

414 Nicollet Mall

Minneapolis, Minnesota 55401

Ladies and Gentlemen:

I am Vice President, Corporate Secretary and Securities of Xcel Energy Inc., a Minnesota corporation (the “Company”), and, as such, I and the attorneys that I supervise have acted as counsel for the Company in the preparation of the Registration Statement on Form S-3 (as the same may be amended from time to time, the “Registration Statement”) to be filed with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Securities Act”), relating to the registration and the possible issuance and sale from time to time, on a delayed basis, by the Company of an unspecified amount of: (i) Senior Debt Securities of the Company (the “Senior Debt Securities”), in one or more series; (ii) Subordinated Debt Securities of the Company (the “Subordinated Debt Securities”), in one or more series; (iii) Junior Subordinated Debt Securities of the Company (the “Junior Subordinated Debt Securities” and, together with the Senior Debt Securities and the Subordinated Debt Securities, the “Debt Securities”), in one or more series; (iv) shares of common stock, par value $2.50 per share, of the Company (the “Common Stock”); (v) shares of preferred stock, par value $100.00 per share, of the Company (the “Preferred Stock”), in one or more series, certain of which may be convertible into or exchangeable for Common Stock; (vi) depositary shares representing fractional interests in Preferred Stock (the “Depositary Shares”), in one or more series, certain of which may be convertible into or exchangeable for Common Stock; (vii) warrants to purchase Debt Securities, Common Stock, Preferred Stock, Depositary Shares or any combination thereof (the “Warrants”); (viii) subscription rights to purchase Common Stock or Preferred Stock (the “Rights”); (ix) purchase contracts for the purchase or sale of Common Stock, Preferred Stock, Debt Securities, Depositary Shares, Warrants, Rights or other property at a future date or dates (the “Purchase Contracts”), which may be issued separately or as part of units consisting of a Purchase Contract and other debt securities, preferred securities, warrants or other obligations of third parties securing the holder’s obligations under a Purchase Contract; and (x) units consisting of one or more of the securities described in clauses (i) through (ix) above and which may include debt obligations of third parties (the “Units”).

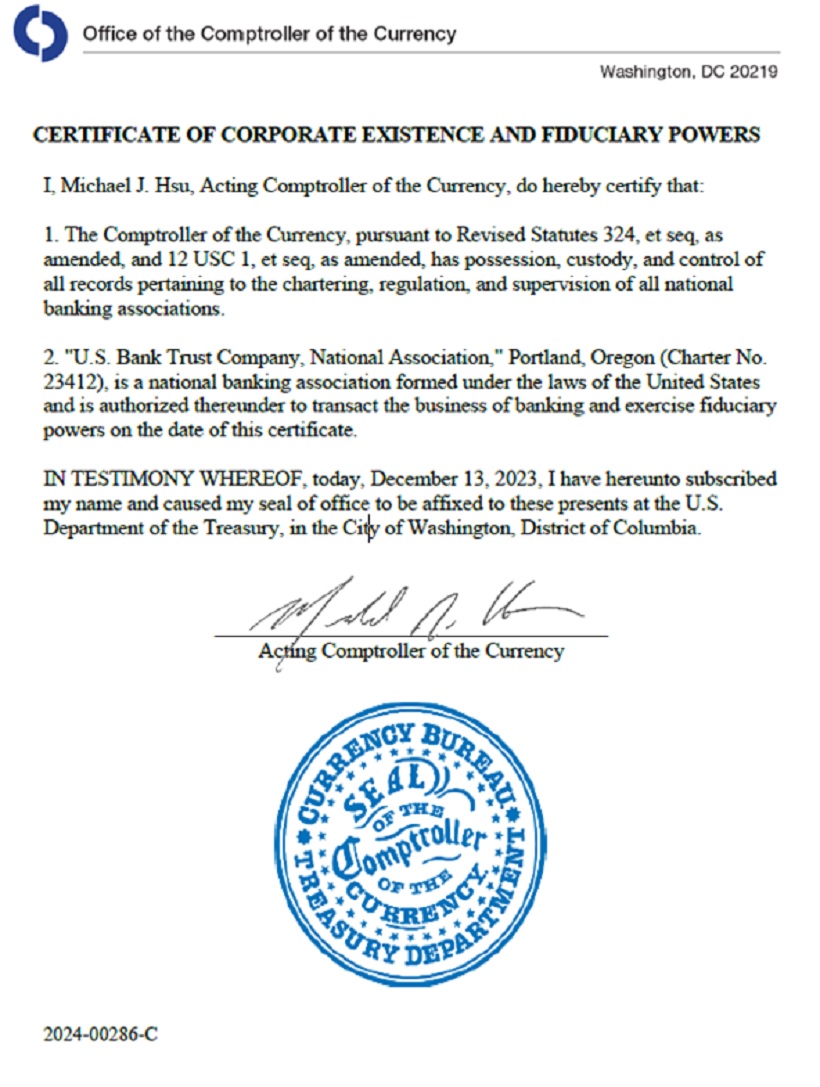

The Debt Securities, the Common Stock, the Preferred Stock, the Depositary Shares, the Warrants, the Rights, the Purchase Contracts, and the Units are collectively referred to herein as the “Securities” and each, a “Security.” The Securities are to be issued from time to time pursuant to Rule 415 under the Securities Act. The Senior Debt Securities are to be issued under the Indenture, dated as of December 1, 2000 (as supplemented from time to time, the “Senior Debt Indenture”), between the Company and U.S. Bank Trust Company, National Association (as successor to Computershare Trust Company, N.A.), as trustee. The Subordinated Debt

Xcel Energy Inc.

April 18, 2024

Page 2

Securities are to be issued under one or more indentures, a form of which has been filed as an exhibit to the Registration Statement (as supplemented from time to time, the “Subordinated Debt Indenture”), to be entered into between the Company and a trustee to be named therein, as trustee. The Junior Subordinated Debt Securities are to be issued under one or more indentures, a form of which has been filed as an exhibit to the Registration Statement, to be entered into between the Company and a trustee to be named therein, as trustee (as supplemented from time to time, the “Junior Subordinated Debt Indenture” and together with the Senior Debt Indenture and the Subordinated Debt Indenture, the “Indentures”).

As part of the corporate action taken and to be taken in connection with the issuance of the Securities (the “Corporate Proceedings”), certain terms of the Securities to be issued by the Company from time to time will be approved by the Board of Directors of the Company or an authorized committee thereof or certain authorized officers of the Company.

I, or attorneys that I supervise, have examined or are otherwise familiar with the Amended and Restated Articles of Incorporation of the Company, the Bylaws, as amended and restated, of the Company, the Registration Statement, such Corporate Proceedings as have occurred as of the date hereof and such other documents, records and instruments as necessary or appropriate for the purposes of this opinion letter.

Based upon the foregoing and assumptions that follow, I am of the opinion that:

| 1. | When and if (a) a supplemental indenture relating to the Senior Debt Securities is duly authorized, executed and delivered, (b) all required Corporate Proceedings with respect to the issuance and the sale of such Senior Debt Securities have been completed and (c) the Senior Debt Securities are duly authorized, executed, authenticated and delivered, and the consideration for the Senior Debt Securities has been received by the Company, all in the manner contemplated by the applicable prospectus, supplements thereto and the Registration Statement, the Senior Debt Securities will be valid and binding obligations of the Company enforceable in accordance with their terms. |

| 2. | When and if (a) the Subordinated Debt Indenture and any supplemental indenture relating to the Subordinated Debt Securities is duly authorized, executed and delivered, (b) all required Corporate Proceedings with respect to the issuance and the sale of such Subordinated Debt Securities have been completed and (c) the Subordinated Debt Securities are duly authorized, executed, authenticated and delivered, and the consideration for the Subordinated Debt Securities has been received by the Company, all in the manner contemplated by the applicable prospectus, supplements thereto and the Registration Statement, the Subordinated Debt Securities will be valid and binding obligations of the Company enforceable in accordance with their terms. |

| 3. | When and if (a) the Junior Subordinated Debt Indenture and any supplemental indenture relating to the Junior Subordinated Debt Securities is duly authorized, executed and delivered, (b) all required Corporate Proceedings with respect to the issuance and the sale of such Junior Subordinated |

Xcel Energy Inc.

April 18, 2024

Page 3

| Debt Securities have been completed and (c) the Junior Subordinated Debt Securities are duly authorized, executed, authenticated and delivered, and the consideration for the Junior Subordinated Debt Securities has been received by the Company, all in the manner contemplated by the applicable prospectus, supplements thereto and the Registration Statement, the Junior Subordinated Debt Securities will be valid and binding obligations of the Company enforceable in accordance with their terms. |

| 4. | When and if (a) all required Corporate Proceedings with respect to the issuance and the sale of such Common Stock have been completed and (b) the Company shall have received such lawful consideration therefor having a value not less than the par value thereof as the Company’s Board of Directors (or an authorized committee thereof) may determine, all in the manner contemplated by the applicable prospectus, supplements thereto and the Registration Statement, the shares of Common Stock will be validly issued, fully paid and nonassessable. |

| 5. | When and if (a) all required Corporate Proceedings (including the filing with the Minnesota Office of the Secretary of State of the appropriate statement, resolutions or form containing the terms of such Preferred Stock) with respect to the issuance and the sale of such Preferred Stock have been completed and (b) the Company shall have received such lawful consideration therefor having a value not less than the par value thereof as the Company’s Board of Directors (or an authorized committee thereof) may determine, all in the manner contemplated by the applicable prospectus, supplements thereto and the Registration Statement, the shares of Preferred Stock will be validly issued, fully paid and nonassessable. |

| 6. | When and if (a) all required Corporate Proceedings (including the filing with the Minnesota Office of the Secretary of State of the appropriate statement, resolutions or form containing the terms of such Depositary Shares, if needed) with respect to the issuance and the sale of such Depositary Shares have been completed and (b) the Company shall have received such lawful consideration therefor as the Company’s Board of Directors (or an authorized committee thereof) may determine, all in the manner contemplated by the applicable prospectus, supplements thereto and the Registration Statement, the Depositary Shares will be validly issued, fully paid and nonassessable. |

| 7. | When and if (a) all required Corporate Proceedings with respect to the issuance and the sale of such Warrants have been completed and (b) the Company shall have received such lawful consideration therefor as the Company’s Board of Directors (or an authorized committee thereof) may determine, all in the manner contemplated by the applicable prospectus, supplements thereto and the Registration Statement, the Warrants will be validly issued, fully paid and nonassessable. |

| 8. | When and if (a) all required Corporate Proceedings with respect to the issuance and the sale of such Rights have been completed and (b) the Company shall have received such lawful consideration therefor as the Company’s Board of Directors (or an authorized committee thereof) may determine, all in the manner contemplated by the applicable prospectus, supplements thereto and the Registration Statement, the Rights will be validly issued, fully paid and nonassessable. |

Xcel Energy Inc.

April 18, 2024

Page 4

| 9. | When and if (a) all required Corporate Proceedings with respect to the issuance and the sale of such Purchase Contracts have been completed and (b) the Company shall have received such lawful consideration therefor as the Company’s Board of Directors (or an authorized committee thereof) may determine, all in the manner contemplated by the applicable prospectus, supplements thereto and the Registration Statement, the Purchase Contracts will be validly issued, fully paid and nonassessable. |

| 10. | When and if (a) all required Corporate Proceedings with respect to the issuance and the sale of such Units have been completed and (b) the Company shall have received such lawful consideration therefor as the Company’s Board of Directors (or an authorized committee thereof) may determine, all in the manner contemplated by the applicable prospectus, supplements thereto and the Registration Statement, the shares of Units will be validly issued, fully paid and nonassessable. |

The foregoing opinions assume that (a) with respect to paragraphs 1, 2 and 3, each of the Indentures and any respective supplemental indenture thereto has been duly authorized, executed and delivered by all parties thereto other than the Company; (b) the Registration Statement will remain effective at the time of issuance of any securities thereunder; (c) with respect to paragraph 6, the Depositary Shares are issued and delivered after authorization, execution, and delivery of the deposit agreement, approved by us, entered into between the Company and an entity selected to act as depository and issued after the Company deposits with the depository shares of Preferred Stock to be represented by such Depositary Shares that are authorized, validly issued, and fully paid as contemplated by the Registration Statement and deposit agreement, (d) a prospectus supplement describing each class or series of Securities offered pursuant to the Registration Statement, to the extent required by applicable law and relevant rules and regulations of the Commission, will be timely filed with the Commission; (e) the Company will issue and deliver the Securities in the manner contemplated by the Registration Statement and any Securities issuable upon conversion, exchange or exercise of any other Security, will have been authorized and reserved for issuance, in each case within the limits of the then remaining authorized but unreserved and unissued amounts of such Securities; and (f) at the time of the delivery of the Securities, the Corporate Proceedings related thereto will not have been modified or rescinded, there will not have occurred any change in the law affecting the authorization, execution, delivery, validity or enforceability of such Securities, none of the particular terms of such Securities will violate any applicable law and neither the issuance and sale thereof nor the compliance by the Company with the terms thereof will result in a violation of any issuance limit in the Corporate Proceedings, any agreement or instrument then binding upon the Company or any order of any court or governmental body having jurisdiction over the Company.

To the extent they relate to enforceability, each of the foregoing opinions is subject to:

Xcel Energy Inc.

April 18, 2024

Page 5

| (i) | the limitation that the provisions of the referenced agreements and instruments may be limited by bankruptcy, reorganization, insolvency, moratorium or other laws of general application affecting the enforcement of creditors’ rights; |

| (ii) | general equity principles (regardless of whether enforcement is considered in a proceeding in equity or at law); and |

| (iii) | the effect of generally applicable laws that (a) limit the availability of a remedy under certain circumstances where another remedy has been elected, (b) limit the enforceability of provisions releasing, exculpating or exempting a party from, or requiring indemnification of a party for, liability for its own action or inaction, to the extent the action or inaction involves gross negligence, recklessness, willful misconduct or unlawful conduct, or (c) may, where less than all of a contract may be unenforceable, limit the enforceability of the balance of the contract to circumstances in which the unenforceable portion is not an essential part of the agreed exchange. |

I express no opinion as to the laws of any jurisdiction other than the laws of the State of Minnesota and the federal laws of the United States of America. The opinions herein expressed are limited to the specific issues addressed and to the laws existing on the date hereof. By rendering this opinion letter, I do not undertake to advise you with respect to any other matter or any change in such laws or the interpretation thereof that may occur after the date hereof.

I hereby consent to the use of my name in the Registration Statement filed by the Company to register the Securities under the Securities Act and to the filing of this opinion letter as Exhibit 5(a) to the Registration Statement. In giving such consent, I do not hereby admit that I am included in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission promulgated thereunder.

Xcel Energy Inc.

April 18, 2024

Page 6

| Respectfully submitted, |

| /s/ Amy L. Schneider |

| Amy L. Schneider |

| Vice President, Corporate Secretary and Securities |