PUBLIC SERVICE CO OF COLORADO000008101812/312023FYFALSE—P1YP1YP2YP1YP2YP1YP3YP2YP1YP1YP1YP2Yhttp://fasb.org/us-gaap/2023#AssetsCurrenthttp://fasb.org/us-gaap/2023#AssetsCurrenthttp://fasb.org/us-gaap/2023#Assetshttp://fasb.org/us-gaap/2023#Assetshttp://fasb.org/us-gaap/2023#LiabilitiesCurrenthttp://fasb.org/us-gaap/2023#LiabilitiesCurrenthttp://fasb.org/us-gaap/2023#Assetshttp://fasb.org/us-gaap/2023#Assetshttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrent00000810182023-01-012023-12-3100000810182024-02-21xbrli:shares00000810182023-06-30iso4217:USD00000810182022-01-012022-12-3100000810182021-01-012021-12-3100000810182022-12-3100000810182021-12-3100000810182020-12-3100000810182023-12-310000081018us-gaap:RelatedPartyMember2023-12-310000081018us-gaap:RelatedPartyMember2022-12-310000081018srt:AffiliatedEntityMember2023-12-310000081018srt:AffiliatedEntityMember2022-12-31iso4217:USDxbrli:shares0000081018us-gaap:CommonStockMember2020-12-310000081018us-gaap:AdditionalPaidInCapitalMember2020-12-310000081018us-gaap:RetainedEarningsMember2020-12-310000081018us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310000081018us-gaap:RetainedEarningsMember2021-01-012021-12-310000081018us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310000081018us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310000081018us-gaap:CommonStockMember2021-12-310000081018us-gaap:AdditionalPaidInCapitalMember2021-12-310000081018us-gaap:RetainedEarningsMember2021-12-310000081018us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000081018us-gaap:RetainedEarningsMember2022-01-012022-12-310000081018us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310000081018us-gaap:CommonStockMember2022-12-310000081018us-gaap:AdditionalPaidInCapitalMember2022-12-310000081018us-gaap:RetainedEarningsMember2022-12-310000081018us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000081018us-gaap:RetainedEarningsMember2023-01-012023-12-310000081018us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310000081018us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310000081018us-gaap:CommonStockMember2023-12-310000081018us-gaap:AdditionalPaidInCapitalMember2023-12-310000081018us-gaap:RetainedEarningsMember2023-12-310000081018us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-31xbrli:pure0000081018us-gaap:PublicUtilitiesInventorySuppliesMember2023-12-310000081018us-gaap:PublicUtilitiesInventorySuppliesMember2022-12-310000081018us-gaap:PublicUtilitiesInventoryFuelMember2023-12-310000081018us-gaap:PublicUtilitiesInventoryFuelMember2022-12-310000081018us-gaap:PublicUtilitiesInventoryNaturalGasMember2023-12-310000081018us-gaap:PublicUtilitiesInventoryNaturalGasMember2022-12-310000081018us-gaap:ElectricGenerationEquipmentMember2023-12-310000081018us-gaap:ElectricGenerationEquipmentMember2022-12-310000081018us-gaap:GasTransmissionEquipmentMember2023-12-310000081018us-gaap:GasTransmissionEquipmentMember2022-12-310000081018us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2023-12-310000081018us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2022-12-310000081018psco:PlantToBeRetiredMember2023-12-310000081018psco:PlantToBeRetiredMember2022-12-310000081018us-gaap:ConstructionInProgressMember2023-12-310000081018us-gaap:ConstructionInProgressMember2022-12-310000081018us-gaap:JointlyOwnedElectricityGenerationPlantMemberpsco:HaydenUnit1Member2023-12-310000081018psco:HaydenUnit2Memberus-gaap:JointlyOwnedElectricityGenerationPlantMember2023-12-310000081018psco:HaydenCommonFacilitiesMemberus-gaap:JointlyOwnedElectricityGenerationPlantMember2023-12-310000081018psco:CraigUnits1And2Memberus-gaap:JointlyOwnedElectricityGenerationPlantMember2023-12-310000081018psco:CraigCommonFacilities12And3Memberus-gaap:JointlyOwnedElectricityGenerationPlantMember2023-12-310000081018psco:ComancheUnit3Memberus-gaap:JointlyOwnedElectricityGenerationPlantMember2023-12-310000081018psco:ComancheCommonFacilitiesMemberus-gaap:JointlyOwnedElectricityGenerationPlantMember2023-12-310000081018us-gaap:JointlyOwnedElectricityTransmissionAndDistributionSystemMemberpsco:TransmissionandOtherFacilitiesincludingSubstationsMember2023-12-310000081018us-gaap:GasTransmissionMemberpsco:RifleToAvonMember2023-12-310000081018psco:GasTransportationCompressorMemberus-gaap:GasTransmissionMember2023-12-310000081018psco:PensionAndRetireeMedicalObligationsMember2023-12-310000081018psco:PensionAndRetireeMedicalObligationsMember2022-12-310000081018us-gaap:AssetRetirementObligationCostsMember2023-12-310000081018us-gaap:AssetRetirementObligationCostsMember2022-12-310000081018srt:MinimumMemberpsco:DepreciationDifferencesMember2023-12-310000081018srt:MaximumMemberpsco:DepreciationDifferencesMember2023-12-310000081018psco:DepreciationDifferencesMember2023-12-310000081018psco:DepreciationDifferencesMember2022-12-310000081018psco:RecoverableDeferredTaxesOnAfudcRecordedInPlantMember2023-12-310000081018psco:RecoverableDeferredTaxesOnAfudcRecordedInPlantMember2022-12-310000081018psco:ExcessdeferredtaxesTCJAMember2023-12-310000081018psco:ExcessdeferredtaxesTCJAMember2022-12-310000081018psco:EnvironmentalRemediationCostsMember2023-12-310000081018psco:EnvironmentalRemediationCostsMember2022-12-310000081018srt:MinimumMemberpsco:ConservationProgramsMember2023-12-310000081018srt:MaximumMemberpsco:ConservationProgramsMember2023-12-310000081018psco:ConservationProgramsMember2023-12-310000081018psco:ConservationProgramsMember2022-12-310000081018psco:RevenueDecouplingMember2023-12-310000081018psco:RevenueDecouplingMember2022-12-310000081018srt:MinimumMemberpsco:GasPipelineInspectionCostsMember2023-12-310000081018srt:MaximumMemberpsco:GasPipelineInspectionCostsMember2023-12-310000081018psco:GasPipelineInspectionCostsMember2023-12-310000081018psco:GasPipelineInspectionCostsMember2022-12-310000081018us-gaap:DeferredFuelCostsMembersrt:MaximumMember2023-12-310000081018srt:MinimumMemberus-gaap:DeferredFuelCostsMember2023-12-310000081018us-gaap:DeferredFuelCostsMember2023-12-310000081018us-gaap:DeferredFuelCostsMember2022-12-310000081018psco:PurchasedPowerAgreementsMember2023-12-310000081018psco:PurchasedPowerAgreementsMember2022-12-310000081018psco:GridModernizationCostsMember2023-12-310000081018psco:GridModernizationCostsMember2022-12-310000081018psco:PropertyTaxMember2023-12-310000081018psco:PropertyTaxMember2022-12-310000081018psco:OtherRegulatoryAssetsMember2023-12-310000081018psco:OtherRegulatoryAssetsMember2022-12-310000081018us-gaap:DeferredIncomeTaxChargesMember2023-12-310000081018us-gaap:DeferredIncomeTaxChargesMember2022-12-310000081018psco:PlantRemovalCostsMember2023-12-310000081018psco:PlantRemovalCostsMember2022-12-310000081018psco:EffectsofregulationonemployeebenefitcostsMember2023-12-310000081018psco:EffectsofregulationonemployeebenefitcostsMember2022-12-310000081018psco:RenewableResourcesAndEnvironmentalInitiativesMember2023-12-310000081018psco:RenewableResourcesAndEnvironmentalInitiativesMember2022-12-310000081018psco:SalesTrueUpandRevenueDecouplingMember2023-12-310000081018psco:SalesTrueUpandRevenueDecouplingMember2022-12-310000081018psco:InvestmentTaxCreditDeferralsMember2023-12-310000081018psco:InvestmentTaxCreditDeferralsMember2022-12-310000081018srt:MinimumMemberpsco:DeferredElectricGasAndSteamProductionCostsMember2023-12-310000081018psco:DeferredElectricGasAndSteamProductionCostsMember2023-12-310000081018psco:DeferredElectricGasAndSteamProductionCostsMember2022-12-310000081018srt:MinimumMemberpsco:ConservationProgramsMember2023-12-310000081018psco:ConservationProgramsMember2023-12-310000081018psco:ConservationProgramsMember2022-12-310000081018srt:MinimumMemberpsco:FormulaRatesMember2023-12-310000081018srt:MaximumMemberpsco:FormulaRatesMember2023-12-310000081018psco:FormulaRatesMember2023-12-310000081018psco:FormulaRatesMember2022-12-310000081018psco:OtherRegulatoryLiabilitiesMember2023-12-310000081018psco:OtherRegulatoryLiabilitiesMember2022-12-310000081018psco:MoneyPoolMember2023-12-310000081018psco:MoneyPoolMember2022-12-310000081018psco:MoneyPoolMember2021-12-310000081018psco:MoneyPoolMember2023-10-012023-12-310000081018psco:MoneyPoolMember2023-01-012023-12-310000081018psco:MoneyPoolMember2022-01-012022-12-310000081018psco:MoneyPoolMember2021-01-012021-12-310000081018us-gaap:CommercialPaperMember2023-12-310000081018us-gaap:CommercialPaperMember2022-12-310000081018us-gaap:CommercialPaperMember2021-12-310000081018us-gaap:CommercialPaperMember2023-10-012023-12-310000081018us-gaap:CommercialPaperMember2023-01-012023-12-310000081018us-gaap:CommercialPaperMember2022-01-012022-12-310000081018us-gaap:CommercialPaperMember2021-01-012021-12-310000081018us-gaap:LetterOfCreditMember2023-01-012023-12-310000081018us-gaap:LetterOfCreditMember2023-12-310000081018us-gaap:LetterOfCreditMember2022-12-310000081018us-gaap:RevolvingCreditFacilityMember2023-12-310000081018us-gaap:RevolvingCreditFacilityMember2022-12-310000081018us-gaap:RevolvingCreditFacilityMember2023-01-012023-12-310000081018us-gaap:RevolvingCreditFacilityMemberpsco:PscoMember2023-12-310000081018us-gaap:RevolvingCreditFacilityMemberpsco:PscoMember2023-12-310000081018us-gaap:BondsMemberpsco:SeriesDueMarch152023Member2023-12-31utr:Rate0000081018us-gaap:BondsMemberpsco:SeriesDueMarch152023Member2022-12-310000081018us-gaap:BondsMemberpsco:SeriesDueMay152025Member2023-12-310000081018us-gaap:BondsMemberpsco:SeriesDueMay152025Member2022-12-310000081018psco:SeriesDueJune152028Memberus-gaap:BondsMember2023-12-310000081018psco:SeriesDueJune152028Memberus-gaap:BondsMember2022-12-310000081018psco:SeriesDueJan152031Memberus-gaap:BondsMember2023-12-310000081018psco:SeriesDueJan152031Memberus-gaap:BondsMember2022-12-310000081018psco:SeriesDueJune152031Memberus-gaap:BondsMember2023-12-310000081018psco:SeriesDueJune152031Memberus-gaap:BondsMember2022-12-310000081018psco:SeriesDueJune120322Memberus-gaap:BondsMember2023-12-310000081018psco:SeriesDueJune120322Memberus-gaap:BondsMember2022-12-310000081018psco:SeriesDueSept.12037Memberus-gaap:BondsMember2023-12-310000081018psco:SeriesDueSept.12037Memberus-gaap:BondsMember2022-12-310000081018psco:SeriesDueAug.12038Memberus-gaap:BondsMember2023-12-310000081018psco:SeriesDueAug.12038Memberus-gaap:BondsMember2022-12-310000081018us-gaap:BondsMemberpsco:SeriesDueAug152041Member2023-12-310000081018us-gaap:BondsMemberpsco:SeriesDueAug152041Member2022-12-310000081018us-gaap:BondsMemberpsco:SeriesDueSept.152042Member2023-12-310000081018us-gaap:BondsMemberpsco:SeriesDueSept.152042Member2022-12-310000081018psco:SeriesDueMarch152043Memberus-gaap:BondsMember2023-12-310000081018psco:SeriesDueMarch152043Memberus-gaap:BondsMember2022-12-310000081018psco:SeriesDueMarch152044Memberus-gaap:BondsMember2023-12-310000081018psco:SeriesDueMarch152044Memberus-gaap:BondsMember2022-12-310000081018psco:SeriesDueJune152046Memberus-gaap:BondsMember2023-12-310000081018psco:SeriesDueJune152046Memberus-gaap:BondsMember2022-12-310000081018us-gaap:BondsMemberpsco:SeriesDueJune152047Member2023-12-310000081018us-gaap:BondsMemberpsco:SeriesDueJune152047Member2022-12-310000081018us-gaap:BondsMemberpsco:SeriesDueJune152048Member2023-12-310000081018us-gaap:BondsMemberpsco:SeriesDueJune152048Member2022-12-310000081018psco:SeriesDueSeptember152049Memberus-gaap:BondsMember2023-12-310000081018psco:SeriesDueSeptember152049Memberus-gaap:BondsMember2022-12-310000081018psco:SeriesDueMarch12050Memberus-gaap:BondsMember2023-12-310000081018psco:SeriesDueMarch12050Memberus-gaap:BondsMember2022-12-310000081018psco:SeriesDueJan152051Memberus-gaap:BondsMember2023-12-310000081018psco:SeriesDueJan152051Memberus-gaap:BondsMember2022-12-310000081018us-gaap:BondsMemberpsco:SeriesDueJune12052Member2023-12-310000081018us-gaap:BondsMemberpsco:SeriesDueJune12052Member2022-12-310000081018psco:SeriesDueApril12053Memberus-gaap:BondsMember2023-12-310000081018psco:SeriesDueApril12053Memberus-gaap:BondsMember2022-12-310000081018psco:PscoMember2023-12-310000081018psco:PscoMember2022-12-310000081018psco:RegulatedElectricMemberpsco:ResidentialCustomersMemberpsco:RetailDistributionMember2023-01-012023-12-310000081018psco:RegulatedNaturalGasMemberpsco:ResidentialCustomersMemberpsco:RetailDistributionMember2023-01-012023-12-310000081018us-gaap:AllOtherSegmentsMemberpsco:ResidentialCustomersMemberpsco:RetailDistributionMember2023-01-012023-12-310000081018psco:ResidentialCustomersMemberpsco:RetailDistributionMember2023-01-012023-12-310000081018psco:RegulatedElectricMemberpsco:CommercialandIndustrialCustomersMemberpsco:RetailDistributionMember2023-01-012023-12-310000081018psco:RegulatedNaturalGasMemberpsco:CommercialandIndustrialCustomersMemberpsco:RetailDistributionMember2023-01-012023-12-310000081018us-gaap:AllOtherSegmentsMemberpsco:CommercialandIndustrialCustomersMemberpsco:RetailDistributionMember2023-01-012023-12-310000081018psco:CommercialandIndustrialCustomersMemberpsco:RetailDistributionMember2023-01-012023-12-310000081018psco:OtherCustomersMemberpsco:RegulatedElectricMemberpsco:RetailDistributionMember2023-01-012023-12-310000081018psco:RegulatedNaturalGasMemberpsco:OtherCustomersMemberpsco:RetailDistributionMember2023-01-012023-12-310000081018psco:OtherCustomersMemberus-gaap:AllOtherSegmentsMemberpsco:RetailDistributionMember2023-01-012023-12-310000081018psco:OtherCustomersMemberpsco:RetailDistributionMember2023-01-012023-12-310000081018psco:RegulatedElectricMemberpsco:RetailDistributionMember2023-01-012023-12-310000081018psco:RegulatedNaturalGasMemberpsco:RetailDistributionMember2023-01-012023-12-310000081018us-gaap:AllOtherSegmentsMemberpsco:RetailDistributionMember2023-01-012023-12-310000081018psco:RetailDistributionMember2023-01-012023-12-310000081018psco:RegulatedElectricMemberpsco:WholesaleDistributionMember2023-01-012023-12-310000081018psco:RegulatedNaturalGasMemberpsco:WholesaleDistributionMember2023-01-012023-12-310000081018psco:WholesaleDistributionMemberus-gaap:AllOtherSegmentsMember2023-01-012023-12-310000081018psco:WholesaleDistributionMember2023-01-012023-12-310000081018psco:RegulatedElectricMemberpsco:TransmissionServicesMember2023-01-012023-12-310000081018psco:RegulatedNaturalGasMemberpsco:TransmissionServicesMember2023-01-012023-12-310000081018us-gaap:AllOtherSegmentsMemberpsco:TransmissionServicesMember2023-01-012023-12-310000081018psco:TransmissionServicesMember2023-01-012023-12-310000081018psco:RegulatedElectricMemberpsco:OtherServicesMember2023-01-012023-12-310000081018psco:RegulatedNaturalGasMemberpsco:OtherServicesMember2023-01-012023-12-310000081018us-gaap:AllOtherSegmentsMemberpsco:OtherServicesMember2023-01-012023-12-310000081018psco:OtherServicesMember2023-01-012023-12-310000081018psco:RegulatedElectricMemberus-gaap:ProductMember2023-01-012023-12-310000081018psco:RegulatedNaturalGasMemberus-gaap:ProductMember2023-01-012023-12-310000081018us-gaap:ProductMemberus-gaap:AllOtherSegmentsMember2023-01-012023-12-310000081018us-gaap:ProductMember2023-01-012023-12-310000081018psco:RegulatedElectricMemberpsco:AlternativeandOtherMember2023-01-012023-12-310000081018psco:RegulatedNaturalGasMemberpsco:AlternativeandOtherMember2023-01-012023-12-310000081018us-gaap:AllOtherSegmentsMemberpsco:AlternativeandOtherMember2023-01-012023-12-310000081018psco:AlternativeandOtherMember2023-01-012023-12-310000081018psco:RegulatedElectricMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310000081018psco:RegulatedNaturalGasMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310000081018us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310000081018us-gaap:OperatingSegmentsMember2023-01-012023-12-310000081018psco:RegulatedElectricMemberpsco:ResidentialCustomersMemberpsco:RetailDistributionMember2022-01-012022-12-310000081018psco:RegulatedNaturalGasMemberpsco:ResidentialCustomersMemberpsco:RetailDistributionMember2022-01-012022-12-310000081018us-gaap:AllOtherSegmentsMemberpsco:ResidentialCustomersMemberpsco:RetailDistributionMember2022-01-012022-12-310000081018psco:ResidentialCustomersMemberpsco:RetailDistributionMember2022-01-012022-12-310000081018psco:RegulatedElectricMemberpsco:CommercialandIndustrialCustomersMemberpsco:RetailDistributionMember2022-01-012022-12-310000081018psco:RegulatedNaturalGasMemberpsco:CommercialandIndustrialCustomersMemberpsco:RetailDistributionMember2022-01-012022-12-310000081018us-gaap:AllOtherSegmentsMemberpsco:CommercialandIndustrialCustomersMemberpsco:RetailDistributionMember2022-01-012022-12-310000081018psco:CommercialandIndustrialCustomersMemberpsco:RetailDistributionMember2022-01-012022-12-310000081018psco:OtherCustomersMemberpsco:RegulatedElectricMemberpsco:RetailDistributionMember2022-01-012022-12-310000081018psco:RegulatedNaturalGasMemberpsco:OtherCustomersMemberpsco:RetailDistributionMember2022-01-012022-12-310000081018psco:OtherCustomersMemberus-gaap:AllOtherSegmentsMemberpsco:RetailDistributionMember2022-01-012022-12-310000081018psco:OtherCustomersMemberpsco:RetailDistributionMember2022-01-012022-12-310000081018psco:RegulatedElectricMemberpsco:RetailDistributionMember2022-01-012022-12-310000081018psco:RegulatedNaturalGasMemberpsco:RetailDistributionMember2022-01-012022-12-310000081018us-gaap:AllOtherSegmentsMemberpsco:RetailDistributionMember2022-01-012022-12-310000081018psco:RetailDistributionMember2022-01-012022-12-310000081018psco:RegulatedElectricMemberpsco:WholesaleDistributionMember2022-01-012022-12-310000081018psco:RegulatedNaturalGasMemberpsco:WholesaleDistributionMember2022-01-012022-12-310000081018psco:WholesaleDistributionMemberus-gaap:AllOtherSegmentsMember2022-01-012022-12-310000081018psco:WholesaleDistributionMember2022-01-012022-12-310000081018psco:RegulatedElectricMemberpsco:TransmissionServicesMember2022-01-012022-12-310000081018psco:RegulatedNaturalGasMemberpsco:TransmissionServicesMember2022-01-012022-12-310000081018us-gaap:AllOtherSegmentsMemberpsco:TransmissionServicesMember2022-01-012022-12-310000081018psco:TransmissionServicesMember2022-01-012022-12-310000081018psco:RegulatedElectricMemberpsco:OtherServicesMember2022-01-012022-12-310000081018psco:RegulatedNaturalGasMemberpsco:OtherServicesMember2022-01-012022-12-310000081018us-gaap:AllOtherSegmentsMemberpsco:OtherServicesMember2022-01-012022-12-310000081018psco:OtherServicesMember2022-01-012022-12-310000081018psco:RegulatedElectricMemberus-gaap:ProductMember2022-01-012022-12-310000081018psco:RegulatedNaturalGasMemberus-gaap:ProductMember2022-01-012022-12-310000081018us-gaap:ProductMemberus-gaap:AllOtherSegmentsMember2022-01-012022-12-310000081018us-gaap:ProductMember2022-01-012022-12-310000081018psco:RegulatedElectricMemberpsco:AlternativeandOtherMember2022-01-012022-12-310000081018psco:RegulatedNaturalGasMemberpsco:AlternativeandOtherMember2022-01-012022-12-310000081018us-gaap:AllOtherSegmentsMemberpsco:AlternativeandOtherMember2022-01-012022-12-310000081018psco:AlternativeandOtherMember2022-01-012022-12-310000081018psco:RegulatedElectricMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310000081018psco:RegulatedNaturalGasMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310000081018us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310000081018us-gaap:OperatingSegmentsMember2022-01-012022-12-310000081018psco:RegulatedElectricMemberpsco:ResidentialCustomersMemberpsco:RetailDistributionMember2021-01-012021-12-310000081018psco:RegulatedNaturalGasMemberpsco:ResidentialCustomersMemberpsco:RetailDistributionMember2021-01-012021-12-310000081018us-gaap:AllOtherSegmentsMemberpsco:ResidentialCustomersMemberpsco:RetailDistributionMember2021-01-012021-12-310000081018psco:ResidentialCustomersMemberpsco:RetailDistributionMember2021-01-012021-12-310000081018psco:RegulatedElectricMemberpsco:CommercialandIndustrialCustomersMemberpsco:RetailDistributionMember2021-01-012021-12-310000081018psco:RegulatedNaturalGasMemberpsco:CommercialandIndustrialCustomersMemberpsco:RetailDistributionMember2021-01-012021-12-310000081018us-gaap:AllOtherSegmentsMemberpsco:CommercialandIndustrialCustomersMemberpsco:RetailDistributionMember2021-01-012021-12-310000081018psco:CommercialandIndustrialCustomersMemberpsco:RetailDistributionMember2021-01-012021-12-310000081018psco:OtherCustomersMemberpsco:RegulatedElectricMemberpsco:RetailDistributionMember2021-01-012021-12-310000081018psco:RegulatedNaturalGasMemberpsco:OtherCustomersMemberpsco:RetailDistributionMember2021-01-012021-12-310000081018psco:OtherCustomersMemberus-gaap:AllOtherSegmentsMemberpsco:RetailDistributionMember2021-01-012021-12-310000081018psco:OtherCustomersMemberpsco:RetailDistributionMember2021-01-012021-12-310000081018psco:RegulatedElectricMemberpsco:RetailDistributionMember2021-01-012021-12-310000081018psco:RegulatedNaturalGasMemberpsco:RetailDistributionMember2021-01-012021-12-310000081018us-gaap:AllOtherSegmentsMemberpsco:RetailDistributionMember2021-01-012021-12-310000081018psco:RetailDistributionMember2021-01-012021-12-310000081018psco:RegulatedElectricMemberpsco:WholesaleDistributionMember2021-01-012021-12-310000081018psco:RegulatedNaturalGasMemberpsco:WholesaleDistributionMember2021-01-012021-12-310000081018psco:WholesaleDistributionMemberus-gaap:AllOtherSegmentsMember2021-01-012021-12-310000081018psco:WholesaleDistributionMember2021-01-012021-12-310000081018psco:RegulatedElectricMemberpsco:TransmissionServicesMember2021-01-012021-12-310000081018psco:RegulatedNaturalGasMemberpsco:TransmissionServicesMember2021-01-012021-12-310000081018us-gaap:AllOtherSegmentsMemberpsco:TransmissionServicesMember2021-01-012021-12-310000081018psco:TransmissionServicesMember2021-01-012021-12-310000081018psco:RegulatedElectricMemberpsco:OtherServicesMember2021-01-012021-12-310000081018psco:RegulatedNaturalGasMemberpsco:OtherServicesMember2021-01-012021-12-310000081018us-gaap:AllOtherSegmentsMemberpsco:OtherServicesMember2021-01-012021-12-310000081018psco:OtherServicesMember2021-01-012021-12-310000081018psco:RegulatedElectricMemberus-gaap:ProductMember2021-01-012021-12-310000081018psco:RegulatedNaturalGasMemberus-gaap:ProductMember2021-01-012021-12-310000081018us-gaap:ProductMemberus-gaap:AllOtherSegmentsMember2021-01-012021-12-310000081018us-gaap:ProductMember2021-01-012021-12-310000081018psco:RegulatedElectricMemberpsco:AlternativeandOtherMember2021-01-012021-12-310000081018psco:RegulatedNaturalGasMemberpsco:AlternativeandOtherMember2021-01-012021-12-310000081018us-gaap:AllOtherSegmentsMemberpsco:AlternativeandOtherMember2021-01-012021-12-310000081018psco:AlternativeandOtherMember2021-01-012021-12-310000081018psco:RegulatedElectricMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310000081018psco:RegulatedNaturalGasMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310000081018us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310000081018us-gaap:OperatingSegmentsMember2021-01-012021-12-310000081018psco:IncomeTaxExpenseMember2023-01-012023-12-310000081018psco:IncomeTaxExpenseMember2022-01-012022-12-310000081018psco:IncomeTaxExpenseMember2021-01-012021-12-310000081018psco:NetDeferredTaxLiablilityMember2023-01-012023-12-310000081018psco:NetDeferredTaxLiablilityMember2022-01-012022-12-310000081018psco:NetDeferredTaxLiablilityMember2023-12-310000081018psco:NetDeferredTaxLiablilityMember2022-12-3100000810182023-01-0100000810182022-01-0100000810182021-01-010000081018us-gaap:InterestRateSwapMember2023-12-310000081018psco:ElectricCommodityMember2023-12-31utr:MWh0000081018psco:ElectricCommodityMember2022-12-310000081018psco:NaturalGasCommodityMember2023-12-31utr:MMBTU0000081018psco:NaturalGasCommodityMember2022-12-310000081018us-gaap:ExternalCreditRatingInvestmentGradeMemberus-gaap:CreditConcentrationRiskMember2023-12-31psco:Counterparty0000081018us-gaap:CreditConcentrationRiskMember2023-12-310000081018us-gaap:InternalInvestmentGradeMemberus-gaap:CreditConcentrationRiskMember2023-12-310000081018us-gaap:ExternalCreditRatingNonInvestmentGradeMemberus-gaap:CreditConcentrationRiskMember2023-12-310000081018psco:MunicipalorCooperativeEntitiesorOtherUtilitiesMemberus-gaap:CreditConcentrationRiskMember2023-12-310000081018us-gaap:NondesignatedMemberpsco:NaturalGasCommodityContractMember2023-01-012023-12-310000081018us-gaap:NondesignatedMember2023-01-012023-12-310000081018us-gaap:NondesignatedMemberpsco:NaturalGasCommodityContractMember2022-01-012022-12-310000081018us-gaap:NondesignatedMember2022-01-012022-12-310000081018us-gaap:NondesignatedMemberpsco:NaturalGasCommodityContractMember2021-01-012021-12-310000081018us-gaap:NondesignatedMember2021-01-012021-12-310000081018us-gaap:InterestRateContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-12-310000081018us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-12-310000081018us-gaap:NondesignatedMemberpsco:CommodityTradingContractMember2023-01-012023-12-310000081018us-gaap:InterestRateContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-01-012022-12-310000081018us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-01-012022-12-310000081018us-gaap:NondesignatedMemberpsco:CommodityTradingContractMember2022-01-012022-12-310000081018us-gaap:InterestRateContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-01-012021-12-310000081018us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-01-012021-12-310000081018us-gaap:NondesignatedMemberpsco:CommodityTradingContractMember2021-01-012021-12-310000081018us-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2023-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:CommodityContractMemberus-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2023-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:CommodityContractMemberus-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2023-12-310000081018us-gaap:CommodityContractMemberus-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2023-12-310000081018us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2023-12-310000081018us-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2022-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:CommodityContractMemberus-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2022-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:CommodityContractMemberus-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2022-12-310000081018us-gaap:CommodityContractMemberus-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2022-12-310000081018us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2022-12-310000081018us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMemberpsco:NaturalGasCommodityContractMember2023-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMemberpsco:NaturalGasCommodityContractMember2023-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMemberpsco:NaturalGasCommodityContractMember2023-12-310000081018us-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMemberpsco:NaturalGasCommodityContractMember2023-12-310000081018us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMemberpsco:NaturalGasCommodityContractMember2022-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMemberpsco:NaturalGasCommodityContractMember2022-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMemberpsco:NaturalGasCommodityContractMember2022-12-310000081018us-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMemberpsco:NaturalGasCommodityContractMember2022-12-310000081018us-gaap:FairValueInputsLevel1Memberus-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000081018us-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000081018us-gaap:FairValueMeasurementsRecurringMember2023-12-310000081018us-gaap:FairValueInputsLevel1Memberus-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000081018us-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000081018us-gaap:FairValueMeasurementsRecurringMember2022-12-310000081018us-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2023-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:CommodityContractMemberus-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2023-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:CommodityContractMemberus-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2023-12-310000081018us-gaap:CommodityContractMemberus-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2023-12-310000081018us-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2022-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:CommodityContractMemberus-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2022-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:CommodityContractMemberus-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2022-12-310000081018us-gaap:CommodityContractMemberus-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2022-12-310000081018us-gaap:FairValueInputsLevel1Memberus-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000081018us-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000081018us-gaap:FairValueInputsLevel1Memberus-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000081018us-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000081018us-gaap:CommodityContractMemberus-gaap:OtherCurrentLiabilitiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2023-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:CommodityContractMemberus-gaap:OtherCurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2023-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:CommodityContractMemberus-gaap:OtherCurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2023-12-310000081018us-gaap:CommodityContractMemberus-gaap:OtherCurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2023-12-310000081018us-gaap:CommodityContractMemberus-gaap:OtherCurrentLiabilitiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2022-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:CommodityContractMemberus-gaap:OtherCurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2022-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:CommodityContractMemberus-gaap:OtherCurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2022-12-310000081018us-gaap:CommodityContractMemberus-gaap:OtherCurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2022-12-310000081018us-gaap:OtherCurrentLiabilitiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:OtherCurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:OtherCurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000081018us-gaap:OtherCurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000081018us-gaap:OtherCurrentLiabilitiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:OtherCurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:OtherCurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000081018us-gaap:OtherCurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000081018us-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2023-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:CommodityContractMemberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2023-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:CommodityContractMemberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2023-12-310000081018us-gaap:CommodityContractMemberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2023-12-310000081018us-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2022-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:CommodityContractMemberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2022-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:CommodityContractMemberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2022-12-310000081018us-gaap:CommodityContractMemberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2022-12-310000081018us-gaap:FairValueInputsLevel1Memberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000081018us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000081018us-gaap:FairValueInputsLevel1Memberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000081018us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000081018us-gaap:CommodityContractMember2022-12-310000081018us-gaap:CommodityContractMember2021-12-310000081018us-gaap:CommodityContractMember2020-12-310000081018us-gaap:CommodityContractMember2023-01-012023-12-310000081018us-gaap:CommodityContractMember2022-01-012022-12-310000081018us-gaap:CommodityContractMember2021-01-012021-12-310000081018us-gaap:CommodityContractMember2023-12-310000081018us-gaap:FairValueInputsLevel2Member2023-12-310000081018us-gaap:FairValueInputsLevel2Member2022-12-310000081018us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMembersrt:ParentCompanyMember2023-12-310000081018us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMembersrt:ParentCompanyMember2022-12-310000081018us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2023-12-310000081018us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2022-12-310000081018us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMembersrt:ParentCompanyMember2023-01-012023-12-310000081018us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMembersrt:ParentCompanyMember2022-01-012022-12-310000081018us-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310000081018us-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310000081018us-gaap:PensionPlansDefinedBenefitMember2021-01-012021-12-310000081018us-gaap:PensionPlansDefinedBenefitMemberus-gaap:SubsequentEventMember2024-01-012024-12-310000081018us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:CashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000081018us-gaap:CashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000081018us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:CashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000081018us-gaap:CashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000081018us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberpsco:CommingledFundsMember2023-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberpsco:CommingledFundsMember2023-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberpsco:CommingledFundsMember2023-12-310000081018us-gaap:PensionPlansDefinedBenefitMemberpsco:CommingledFundsMember2023-12-310000081018us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberpsco:CommingledFundsMember2022-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberpsco:CommingledFundsMember2022-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberpsco:CommingledFundsMember2022-12-310000081018us-gaap:PensionPlansDefinedBenefitMemberpsco:CommingledFundsMember2022-12-310000081018us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DebtSecuritiesMember2023-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DebtSecuritiesMember2023-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DebtSecuritiesMember2023-12-310000081018us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DebtSecuritiesMember2023-12-310000081018us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DebtSecuritiesMember2022-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DebtSecuritiesMember2022-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DebtSecuritiesMember2022-12-310000081018us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DebtSecuritiesMember2022-12-310000081018us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:EquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:EquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000081018us-gaap:EquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000081018us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:EquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:EquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000081018us-gaap:EquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000081018us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherInvestmentsMember2023-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherInvestmentsMember2023-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherInvestmentsMember2023-12-310000081018us-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherInvestmentsMember2023-12-310000081018us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherInvestmentsMember2022-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherInvestmentsMember2022-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherInvestmentsMember2022-12-310000081018us-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherInvestmentsMember2022-12-310000081018us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000081018us-gaap:PensionPlansDefinedBenefitMember2023-12-310000081018us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000081018us-gaap:PensionPlansDefinedBenefitMember2022-12-310000081018us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:CashAndCashEquivalentsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000081018us-gaap:CashAndCashEquivalentsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000081018us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:CashAndCashEquivalentsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310000081018us-gaap:CashAndCashEquivalentsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310000081018us-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberpsco:InsuranceContractsMember2023-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberpsco:InsuranceContractsMember2023-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberpsco:InsuranceContractsMember2023-12-310000081018us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberpsco:InsuranceContractsMember2023-12-310000081018us-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberpsco:InsuranceContractsMember2022-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberpsco:InsuranceContractsMember2022-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberpsco:InsuranceContractsMember2022-12-310000081018us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberpsco:InsuranceContractsMember2022-12-310000081018us-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberpsco:CommingledFundsMember2023-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberpsco:CommingledFundsMember2023-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberpsco:CommingledFundsMember2023-12-310000081018us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberpsco:CommingledFundsMember2023-12-310000081018us-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberpsco:CommingledFundsMember2022-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberpsco:CommingledFundsMember2022-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberpsco:CommingledFundsMember2022-12-310000081018us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberpsco:CommingledFundsMember2022-12-310000081018us-gaap:FairValueInputsLevel1Memberus-gaap:DebtSecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:DebtSecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:DebtSecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000081018us-gaap:DebtSecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000081018us-gaap:FairValueInputsLevel1Memberus-gaap:DebtSecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:DebtSecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:DebtSecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310000081018us-gaap:DebtSecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310000081018us-gaap:FairValueInputsLevel1Memberus-gaap:OtherInvestmentsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:OtherInvestmentsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:OtherInvestmentsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000081018us-gaap:OtherInvestmentsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000081018us-gaap:FairValueInputsLevel1Memberus-gaap:OtherInvestmentsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:OtherInvestmentsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:OtherInvestmentsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310000081018us-gaap:OtherInvestmentsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310000081018us-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000081018us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000081018us-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310000081018us-gaap:FairValueInputsLevel2Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310000081018us-gaap:FairValueInputsLevel3Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310000081018us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310000081018us-gaap:PensionPlansDefinedBenefitMember2020-01-010000081018us-gaap:PensionPlansDefinedBenefitMember2019-01-010000081018us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-01-010000081018us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-01-010000081018us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-01-012023-12-310000081018us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-01-012022-12-310000081018us-gaap:PensionPlansDefinedBenefitMember2021-12-310000081018us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-12-310000081018us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-01-012021-12-310000081018us-gaap:PensionPlansDefinedBenefitMemberpsco:PscoMember2022-01-012022-12-310000081018us-gaap:PensionPlansDefinedBenefitMembersrt:ParentCompanyMember2023-12-31psco:Plan0000081018us-gaap:PensionPlansDefinedBenefitMemberpsco:XcelEnergyMemberus-gaap:SubsequentEventMember2024-01-012024-01-310000081018us-gaap:PensionPlansDefinedBenefitMemberpsco:XcelEnergyMember2023-01-012023-12-310000081018us-gaap:PensionPlansDefinedBenefitMemberpsco:PscoMember2023-01-012023-12-310000081018us-gaap:PensionPlansDefinedBenefitMemberpsco:XcelEnergyMember2022-01-012022-12-310000081018us-gaap:PensionPlansDefinedBenefitMemberpsco:XcelEnergyMember2021-01-012021-12-310000081018us-gaap:PensionPlansDefinedBenefitMemberpsco:PscoMember2021-01-012021-12-310000081018us-gaap:OverfundedPlanMemberpsco:XcelEnergyMember2024-01-012024-12-310000081018us-gaap:OverfundedPlanMemberpsco:PscoMember2024-01-012024-12-310000081018us-gaap:OverfundedPlanMemberpsco:XcelEnergyMember2023-01-012023-12-310000081018us-gaap:OverfundedPlanMemberpsco:PscoMember2023-01-012023-12-310000081018us-gaap:OverfundedPlanMemberpsco:XcelEnergyMember2022-01-012022-12-310000081018us-gaap:OverfundedPlanMemberpsco:PscoMember2022-01-012022-12-310000081018us-gaap:OverfundedPlanMemberpsco:XcelEnergyMember2021-01-012021-12-310000081018us-gaap:OverfundedPlanMemberpsco:PscoMember2021-01-012021-12-310000081018psco:LongDurationFixedIncomeandInterestRateSwapSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000081018psco:LongDurationFixedIncomeandInterestRateSwapSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000081018psco:LongDurationFixedIncomeandInterestRateSwapSecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000081018psco:LongDurationFixedIncomeandInterestRateSwapSecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310000081018us-gaap:EquitySecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000081018us-gaap:EquitySecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310000081018us-gaap:PensionPlansDefinedBenefitMemberpsco:AlternativeInvestmentsMember2023-12-310000081018us-gaap:PensionPlansDefinedBenefitMemberpsco:AlternativeInvestmentsMember2022-12-310000081018us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberpsco:AlternativeInvestmentsMember2023-12-310000081018us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberpsco:AlternativeInvestmentsMember2022-12-310000081018psco:ShorttointermediatefixedincomesecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000081018psco:ShorttointermediatefixedincomesecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000081018psco:ShorttointermediatefixedincomesecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000081018psco:ShorttointermediatefixedincomesecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-31psco:complaintpsco:numberOfPlaintiffs0000081018psco:OtherMGPLandfillOrDisposalSitesMember2023-12-31psco:Sitepsco:sitepsco:sites0000081018psco:FederalCoalAshRegulationMemberpsco:PscoMembersrt:MaximumMember2023-12-310000081018psco:ElectricPlantSteamAndOtherProductionAshContainmentMember2022-12-310000081018psco:ElectricPlantSteamAndOtherProductionAshContainmentMember2023-01-012023-12-310000081018psco:ElectricPlantSteamAndOtherProductionAshContainmentMember2023-12-310000081018psco:ElectricPlantWindProductionMember2022-12-310000081018psco:ElectricPlantWindProductionMember2023-01-012023-12-310000081018psco:ElectricPlantWindProductionMember2023-12-310000081018us-gaap:ElectricDistributionMember2022-12-310000081018us-gaap:ElectricDistributionMember2023-01-012023-12-310000081018us-gaap:ElectricDistributionMember2023-12-310000081018psco:NaturalGasPlantGasTransmissionAndDistributionMember2022-12-310000081018psco:NaturalGasPlantGasTransmissionAndDistributionMember2023-01-012023-12-310000081018psco:NaturalGasPlantGasTransmissionAndDistributionMember2023-12-310000081018psco:ElectricPlantSteamAndOtherProductionAshContainmentMember2021-12-310000081018psco:ElectricPlantSteamAndOtherProductionAshContainmentMember2022-01-012022-12-310000081018psco:ElectricPlantWindProductionMember2021-12-310000081018psco:ElectricPlantWindProductionMember2022-01-012022-12-310000081018us-gaap:ElectricDistributionMember2021-12-310000081018us-gaap:ElectricDistributionMember2022-01-012022-12-310000081018psco:NaturalGasPlantGasTransmissionAndDistributionMember2021-12-310000081018psco:NaturalGasPlantGasTransmissionAndDistributionMember2022-01-012022-12-310000081018psco:PurchasedPowerAgreementsMember2023-12-310000081018psco:PurchasedPowerAgreementsMember2022-12-310000081018us-gaap:PropertyPlantAndEquipmentOtherTypesMember2023-12-310000081018us-gaap:PropertyPlantAndEquipmentOtherTypesMember2022-12-310000081018psco:WYCOInc.Member2023-12-310000081018psco:GasStorageFacilitiesMember2023-12-310000081018psco:GasStorageFacilitiesMember2022-12-310000081018us-gaap:PipelinesMember2023-12-310000081018us-gaap:PipelinesMember2022-12-310000081018psco:PurchasedPowerAgreementsMember2023-01-012023-12-310000081018psco:PurchasedPowerAgreementsMember2022-01-012022-12-310000081018psco:PurchasedPowerAgreementsMember2021-01-012021-12-310000081018us-gaap:PropertyPlantAndEquipmentOtherTypesMember2023-01-012023-12-310000081018us-gaap:PropertyPlantAndEquipmentOtherTypesMember2022-01-012022-12-310000081018us-gaap:PropertyPlantAndEquipmentOtherTypesMember2021-01-012021-12-310000081018psco:CapacityPaymentsMember2023-01-012023-12-310000081018psco:CapacityPaymentsMember2022-01-012022-12-310000081018psco:CapacityPaymentsMember2021-01-012021-12-310000081018psco:CapacityPaymentsMember2023-12-310000081018psco:CoalMember2023-12-310000081018psco:NaturalGasSupplyMember2023-12-310000081018psco:NaturalGasStorageAndTransportationMember2023-12-310000081018us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2023-12-31utr:MW0000081018us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2022-12-310000081018us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2022-12-310000081018us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310000081018us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-01-012023-12-310000081018us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-12-310000081018us-gaap:InterestRateSwapMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-01-012023-12-310000081018us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:InterestRateSwapMember2023-01-012023-12-310000081018us-gaap:InterestRateSwapMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310000081018us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-12-310000081018us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310000081018us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2021-12-310000081018us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310000081018us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2022-01-012022-12-310000081018us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-12-310000081018us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310000081018us-gaap:InterestRateSwapMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2022-01-012022-12-310000081018us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:InterestRateSwapMember2022-01-012022-12-310000081018us-gaap:InterestRateSwapMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310000081018us-gaap:OperatingSegmentsMemberpsco:RegulatedElectricSegmentMember2023-01-012023-12-310000081018us-gaap:OperatingSegmentsMemberpsco:RegulatedElectricSegmentMember2022-01-012022-12-310000081018us-gaap:OperatingSegmentsMemberpsco:RegulatedElectricSegmentMember2021-01-012021-12-310000081018us-gaap:IntersegmentEliminationMemberpsco:RegulatedElectricSegmentMember2023-01-012023-12-310000081018us-gaap:IntersegmentEliminationMemberpsco:RegulatedElectricSegmentMember2022-01-012022-12-310000081018us-gaap:IntersegmentEliminationMemberpsco:RegulatedElectricSegmentMember2021-01-012021-12-310000081018psco:RegulatedElectricSegmentMember2023-01-012023-12-310000081018psco:RegulatedElectricSegmentMember2022-01-012022-12-310000081018psco:RegulatedElectricSegmentMember2021-01-012021-12-310000081018psco:RegulatedNaturalGasSegmentMember2023-01-012023-12-310000081018psco:RegulatedNaturalGasSegmentMember2022-01-012022-12-310000081018psco:RegulatedNaturalGasSegmentMember2021-01-012021-12-310000081018us-gaap:AllOtherSegmentsMember2023-01-012023-12-310000081018us-gaap:AllOtherSegmentsMember2022-01-012022-12-310000081018us-gaap:AllOtherSegmentsMember2021-01-012021-12-310000081018us-gaap:IntersegmentEliminationMember2023-01-012023-12-310000081018us-gaap:IntersegmentEliminationMember2022-01-012022-12-310000081018us-gaap:IntersegmentEliminationMember2021-01-012021-12-310000081018psco:XcelEnergyMemberpsco:OtherRevenueMember2023-01-012023-12-310000081018psco:XcelEnergyMemberpsco:OtherRevenueMember2022-01-012022-12-310000081018psco:XcelEnergyMemberpsco:OtherRevenueMember2021-01-012021-12-310000081018us-gaap:OtherExpenseMember2023-01-012023-12-310000081018us-gaap:OtherExpenseMember2022-01-012022-12-310000081018us-gaap:OtherExpenseMember2021-01-012021-12-310000081018us-gaap:InterestExpenseMember2023-01-012023-12-310000081018us-gaap:InterestExpenseMember2022-01-012022-12-310000081018us-gaap:InterestExpenseMember2021-01-012021-12-310000081018psco:XcelEnergyMemberus-gaap:ElectricityUsRegulatedMember2023-01-012023-12-310000081018psco:XcelEnergyMemberus-gaap:ElectricityUsRegulatedMember2022-01-012022-12-310000081018psco:XcelEnergyMemberus-gaap:ElectricityUsRegulatedMember2021-01-012021-12-310000081018psco:NspMinnesotaMember2023-12-310000081018psco:NspMinnesotaMember2022-12-310000081018psco:NSPWisconsinMember2023-12-310000081018psco:NSPWisconsinMember2022-12-310000081018psco:SpsMember2023-12-310000081018psco:SpsMember2022-12-310000081018srt:SubsidiariesMember2023-12-310000081018srt:SubsidiariesMember2022-12-310000081018psco:XcelEnergyMember2023-12-310000081018psco:XcelEnergyMember2022-12-310000081018psco:XcelEnergyMemberpsco:VoluntaryRetirementProgramMember2023-12-31psco:Employees0000081018psco:XcelEnergyMemberus-gaap:EmployeeSeveranceMember2023-12-310000081018psco:XcelEnergyMember2023-01-012023-12-310000081018psco:PscoMember2023-01-012023-12-310000081018us-gaap:AllowanceForCreditLossMember2022-12-310000081018us-gaap:AllowanceForCreditLossMember2021-12-310000081018us-gaap:AllowanceForCreditLossMember2020-12-310000081018us-gaap:AllowanceForCreditLossMember2023-01-012023-12-310000081018us-gaap:AllowanceForCreditLossMember2022-01-012022-12-310000081018us-gaap:AllowanceForCreditLossMember2021-01-012021-12-310000081018us-gaap:AllowanceForCreditLossMember2023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023 or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____ to _____

| | |

001-03280 |

| (Commission File Number) |

| | |

| Public Service Company of Colorado |

(Exact name of registrant as specified in its charter) |

|

| | | | | | | | | | | | | | |

Colorado | | 84-0296600 |

| (State or Other Jurisdiction of Incorporation or Organization) | | (IRS Employer Identification No.) |

| | | | |

1800 Larimer, Suite 1100 | Denver | Colorado | | 80202 |

| (Address of Principal Executive Offices) | | (Zip Code) |

| | | | | |

303 | 571-7511 |

| (Registrant’s Telephone Number, Including Area Code) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| N/A | | N/A | | N/A |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒ Yes ☐ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act. ☐ Large accelerated filer ☐ Accelerated filer ☒ Non-accelerated filer ☐ Smaller reporting company ☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☒ No

As of Feb. 21, 2024, 100 shares of common stock, par value $0.01 per share, were outstanding, all of which were held by Xcel Energy Inc., a Minnesota corporation.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Item 14 of Form 10-K is set forth under the heading “Independent Registered Public Accounting Firm – Audit and Non-Audit Fees” in Xcel Energy Inc.’s definitive Proxy Statement for the 2024 Annual Meeting of Shareholders which definitive Proxy Statement is expected to be filed with the SEC on or about April 9, 2024. Such information set forth under such heading is incorporated herein by this reference hereto.

Public Service Company of Colorado meets the conditions set forth in General Instructions I(1)(a) and (b) of Form 10-K and is therefore filing this form with the reduced disclosure format permitted by General Instruction I(2).

TABLE OF CONTENTS

| | | | | | | | |

| PART I | | |

| Item 1 — | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 1A — | | |

| Item 1B — | | |

| Item 1C — | | |

| Item 2 — | | |

| Item 3 — | | |

| Item 4 — | | |

| | |

| PART II | | |

| Item 5 — | | |

| Item 6 — | | |

| Item 7 — | | |

| Item 7A — | | |

| Item 8 — | | |

| Item 9 — | | |

| Item 9A — | | |

| Item 9B — | | |

| Item 9C — | | |

| | |

| PART III | | |

| Item 10 — | | |

| Item 11 — | | |

| Item 12 — | | |

| Item 13 — | | |

| Item 14 — | | |

| | |

| PART IV | | |

| Item 15 — | | |

| Item 16 — | | |

| | |

| |

This Form 10-K is filed by PSCo. PSCo is a wholly owned subsidiary of Xcel Energy Inc. Additional information on Xcel Energy is available in various filings with the SEC. This report should be read in its entirety.

PART I

Definitions of Abbreviations

| | | | | |

| Xcel Energy Inc.’s Subsidiaries and Affiliates (current and former) |

| |

| NSP-Minnesota | Northern States Power Company, a Minnesota corporation |

| NSP-Wisconsin | Northern States Power Company, a Wisconsin corporation |

| PSCo | Public Service Company of Colorado |

| SPS | Southwestern Public Service Company |

| Utility subsidiaries | NSP-Minnesota, NSP-Wisconsin, PSCo and SPS |

| WYCO | WYCO Development, LLC |

| Xcel Energy | Xcel Energy Inc. and its subsidiaries |

| | | | | |

| Federal and State Regulatory Agencies |

| CPUC | Colorado Public Utilities Commission |

| DOT | United States Department of Transportation |

| EPA | United States Environmental Protection Agency |

| FERC | Federal Energy Regulatory Commission |

| IRS | Internal Revenue Service |

| NERC | North American Electric Reliability Corporation |

| PHMSA | Pipeline and Hazardous Materials Safety Administration |

| SEC | Securities and Exchange Commission |

| | | | | |

| Electric, Purchased Gas and Resource Adjustment Clauses |

| DSM | Demand side management |

| ECA | Retail electric commodity adjustment |

| GCA | Gas cost adjustment |

| PSIA | Pipeline system integrity adjustment |

| RES | Renewable energy standard |

| | | | | |

| Other |

| AFUDC | Allowance for funds used during construction |

| ALJ | Administrative Law Judge |

| |

| ARO | Asset retirement obligation |

| ARRR | Application for Rehearing, Reargument, or Reconsideration |

| ASC | Financial Accounting Standards Board Accounting Standards Codification |

| C&I | Commercial and Industrial |

| CCR | Coal combustion residuals |

| CCR Rule | Final rule (40 CFR 257.50 - 257.107) published by the EPA regulating the management, storage and disposal of CCRs as a nonhazardous waste |

| CEO | Chief executive officer |

| CFO | Chief financial officer |

| CIG | Colorado Interstate Gas Company, LLC |

| |

| |

| |

| CWIP | Construction work in progress |

| |

| |

| | | | | |

| ETR | Effective tax rate |

| |

| GAAP | Generally accepted accounting principles |

| GHG | Greenhouse gas |

| IPP | Independent power producing entity |

| ISO | Independent System Operator |

| ITC | Investment tax credit |

| MGP | Manufactured gas plant |

| |

| Native load | Customer demand of retail and wholesale customers whereby a utility has an obligation to serve under statute or long-term contract |

| NAV | Net asset value |

| NOL | Net operating loss |

| O&M | Operating and maintenance |

| PIM | Performance Incentive Mechanism |

| PFAS | Per- and PolyFluoroAlkyl Substances |

| Post-65 | Post-Medicare |

| PPA | Purchased power agreement |

| Pre-65 | Pre-Medicare |

| PTC | Production tax credit |

| REC | Renewable energy credit |

| ROE | Return on equity |

| ROU | Right-of-use |

| RTO | Regional Transmission Organization |

| S&P | Standard & Poor’s Global Ratings |

| SERP | Supplemental executive retirement plan |

| SPP | Southwest Power Pool, Inc. |

| TCJA | 2017 federal tax reform enacted as Public Law No: 115-97, commonly referred to as the Tax Cuts and Jobs Act |

| VaR | Value at Risk |

| VIE | Variable interest entity |

| WACC | Weighted Average Cost of Capital |

| | | | | |

| Measurements |

| Bcf | Billion cubic feet |

| KV | Kilovolts |

| KWh | Kilowatt hours |

| MMBtu | Million British thermal units |

| MW | Megawatts |

| MWh | Megawatt hours |

| | |

Where to Find More Information |

PSCo is a wholly owned subsidiary of Xcel Energy Inc., and Xcel Energy’s website address is www.xcelenergy.com. Xcel Energy makes available, free of charge through its website, its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after the reports are electronically filed with or furnished to the SEC. The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically at http://www.sec.gov. The information on Xcel Energy’s website is not a part of, or incorporated by reference in, this annual report on Form 10-K.

| | |

Forward-Looking Statements |

Except for the historical statements contained in this report, the matters discussed herein are forward-looking statements that are subject to certain risks, uncertainties and assumptions. Such forward-looking statements, including those relating to future sales, future expenses, future tax rates, future operating performance, estimated base capital expenditures and financing plans, projected capital additions and forecasted annual revenue requirements with respect to rider filings, expected rate increases to customers, expectations and intentions regarding regulatory proceedings, and expected impact on our results of operations, financial condition and cash flows of resettlement calculations and credit losses relating to certain energy transactions, as well as assumptions and other statements are intended to be identified in this document by the words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “objective,” “outlook,” “plan,” “project,” “possible,” “potential,” “should,” “will,” “would” and similar expressions. Actual results may vary materially. Forward-looking statements speak only as of the date they are made, and we expressly disclaim any obligation to update any forward-looking information. The following factors, in addition to those discussed elsewhere in this Annual Report on Form 10-K for the fiscal year ended Dec. 31, 2023 (including risk factors listed from time to time by PSCo in reports filed with the SEC, including “Risk Factors” in Item 1A of this Annual Report on Form 10-K), could cause actual results to differ materially from management expectations as suggested by such forward-looking information: operational safety; successful long-term operational planning; commodity risks associated with energy markets and production; rising energy prices and fuel costs; qualified employee workforce and third-party contractor factors; violations of our Codes of Conduct; our ability to recover costs; changes in regulation; reductions in our credit ratings and the cost of maintaining certain contractual relationships; general economic conditions, including recessionary conditions, inflation rates, monetary fluctuations, supply chain constraints and their impact on capital expenditures and/or the ability of PSCo to obtain financing on favorable terms; availability or cost of capital; our customers’ and counterparties’ ability to pay their debts to us; assumptions and costs relating to funding our employee benefit plans and health care benefits; tax laws; uncertainty regarding epidemics, the duration and magnitude of business restrictions including shutdowns (domestically and globally), the potential impact on the workforce, including shortages of employees or third-party contractors due to quarantine policies, vaccination requirements or government restrictions, impacts on the transportation of goods and the generalized impact on the economy; effects of geopolitical events, including war and acts of terrorism; cybersecurity threats and data security breaches; seasonal weather patterns; changes in environmental laws and regulations; climate change and other weather events; natural disaster and resource depletion, including compliance with any accompanying legislative and regulatory changes; costs of potential regulatory penalties and wildfire damages in excess of liability insurance coverage; regulatory changes and/or limitations related to the use of natural gas as an energy source; challenging labor market conditions and our ability to attract and retain a qualified workforce; and our ability to execute on our strategies or achieve expectations related to environmental, social and governance matters including as a result of evolving legal, regulatory and other standards, processes, and assumptions, the pace of scientific and technological developments, increased costs, the availability of requisite financing, and changes in carbon markets.

| | | | | | | | | | | | | | | | | |

| | | | | |

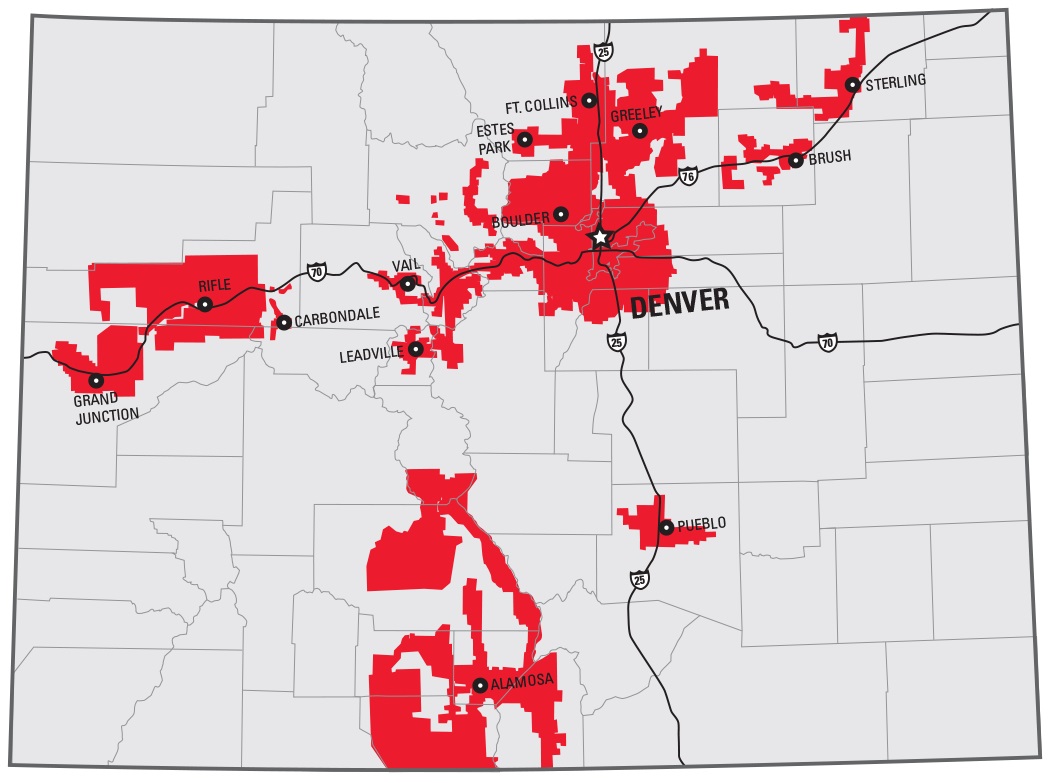

| Electric customers | 1.6 million | | | | PSCo was incorporated in 1924 under the laws of Colorado. PSCo conducts business in Colorado and generates, purchases, transmits, distributes and sells electricity in addition to purchasing, transporting, distributing and selling natural gas to retail customers and transporting customer-owned natural gas. |

| Natural gas customers | 1.5 million | | |

| Total assets | $24.6 billion | | |

| Rate Base (estimated) | $16.9 billion | | |

| GAAP ROE | 7.32% | | |

| Electric generating capacity | 6,203 MW | | |

| Gas storage capacity | 32.1 Bcf | | |

| Electric transmission lines (conductor miles) | 25,000 miles | | |

| Electric distribution lines (conductor miles) | 80,000 miles | | |

| Natural gas transmission lines | 2,000 miles | | | |

| Natural gas distribution lines | 23,000 miles | | | |

| | | | |

| | | | |

Electric operations consist of energy supply, generation, transmission and distribution activities. PSCo had electric sales volume of 33,811 (millions of KWh), 1.6 million customers and electric revenues of $3,731 million for 2023.

| | | | | | | | | | | | | | | | | | | | |

| Electric Operations (percentage of total) | | Sales Volume | | Number of Customers | | Revenues |

| Residential | | 28 | % | | 86 | % | | 35 | % |

| C&I | | 54 | | | 11 | | | 49 | |

| Other | | 18 | | | 3 | | | 17 | |

Retail Sales/Revenue Statistics (a)

| | | | | | | | | | | | | | |

| | 2023 | | 2022 |

| KWH sales per retail customer | | 17,781 | | | 18,456 | |

| Revenue per retail customer | | $ | 2,006 | | | $ | 2,074 | |

| Residential revenue per KWh | | 13.69 | ¢ | | 13.62 | ¢ |

| C&I revenue per KWh | | 9.90 | ¢ | | 9.86 | ¢ |

| Total retail revenue per KWh | | 11.28 | ¢ | | 11.24 | ¢ |

(a)See Note 6 to the consolidated financial statements for further information.

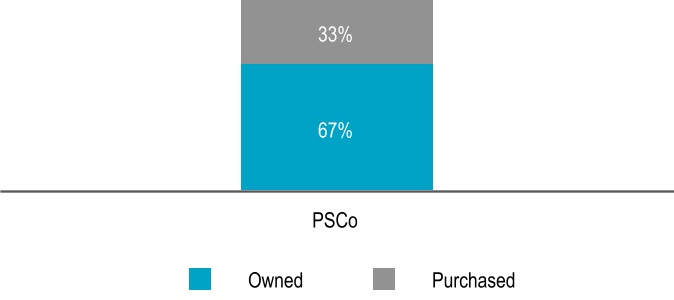

Owned and Purchased Energy Generation — 2023

Electric Energy Sources

Total electric energy generation by source for the year ended Dec. 31:

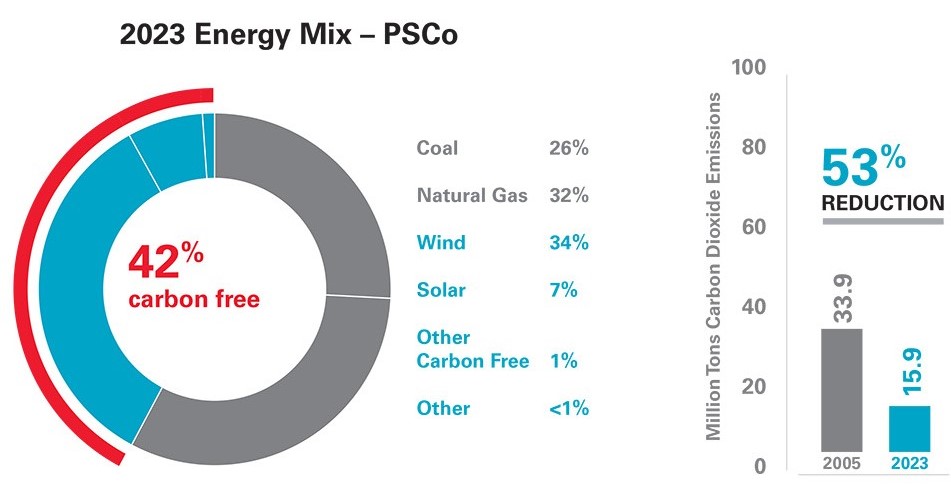

Carbon–Free

PSCo’s carbon–free energy portfolio includes wind, hydroelectric and solar power from both owned generating facilities and PPAs. Carbon–free percentages will vary year over year based on system additions, commodity costs, weather, system demand and transmission constraints.

See Item 2 — Properties for further information.

Wind

Wind capacity is shown as net maximum capacity. Net maximum capacity is attainable only when wind conditions are sufficiently available

Owned — Owned and operated wind farms with corresponding capacity:

| | | | | | | | | | | | | | | | | | | | |

| 2023 | | 2022 |

| Wind Farms | | Capacity (MW) | | Wind Farms | | Capacity (MW) |

| 2 | | | 1,059 | | | 2 | | | 1,059 | |

PPAs — Number of PPAs with capacity range: | | | | | | | | | | | | | | | | | | | | |

| 2023 | | 2022 |

| PPAs | | Range (MW) | | PPAs | | Range (MW) |

| 17 | | | 23 — 301 | | 17 | | | 23 — 301 |