Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant [X] | ||||

| Filed by a Party other than the Registrant [ ] | ||||

| Check the appropriate box: | ||||

| [ ] | Preliminary Proxy Statement | [ ] | Soliciting Material Under Rule 14a-12 | |

| [ ] | Confidential, For Use of

the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|||

| [X] | Definitive Proxy Statement | |||

| [ ] | Definitive Additional Materials | |||

| PHOTRONICS, INC. | ||

| (Name of Registrant as Specified In Its Charter) | ||

|

(Name

of Person(s) Filing Proxy Statement, if Other Than the

Registrant) |

| Payment of Filing Fee (Check the appropriate box): | ||||

| [X] | No fee required. | |||

|

[

] |

Fee computed on

table below per Exchange Act Rules 14a-6(i)(4) and

0-11. | |||

| 1) | Title of each class of securities to which transaction applies: | |||

| 2) | Aggregate number of securities to which transaction applies: | |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) | Proposed maximum aggregate value of transaction: | |||

| 5) | Total fee paid: | |||

|

[

] |

Fee paid previously

with preliminary materials: | |||

|

[

] |

Check box if any part of the fee is offset as provided by Exchange

Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee

was paid previously. Identify the previous filing by registration

statement number, or the form or schedule and the date of its

filing. | |||

| 1) | Amount previously paid: | |||

| 2) | Form, Schedule or Registration Statement No.: | |||

| 3) | Filing Party: | |||

| 4) | Date Filed: | |||

PHOTRONICS,

INC.

15 Secor Road

Brookfield,

Connecticut 06804

(203) 775-9000

NOTICE OF ANNUAL MEETING OF

SHAREHOLDERS

TO BE HELD ON MARCH 28,

2012

___________________________________________________________

TO THE SHAREHOLDERS OF PHOTRONICS, INC.:

Notice is hereby given that the Annual Meeting of Shareholders of Photronics, Inc. will be held at NASDAQ OMX, 4 Times Square, Second Floor, New York, NY 10036, at 10:30 a.m. Eastern Time, for the following purposes:

| 1) | To elect 6 members of the Board of Directors; |

| 2) | To ratify the selection of Deloitte & Touche LLP as independent registered public accounting firm for the fiscal year ending October 28, 2012; |

| 3) | To approve an amendment to the Photronics, Inc. Employee Stock Purchase Plan to increase the number of authorized shares of Common Stock available for issuance from 1,200,000 to 1,500,000; |

| 4) | To approve, by non-binding vote, the compensation of our named executive officers; |

| 5) | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

The Board of Directors has fixed February 9, 2012, as the record date for determining the holders of common stock entitled to notice of and to vote at the meeting.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, YOU ARE REQUESTED TO COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY IN THE ENCLOSED ENVELOPE. NO POSTAGE IS REQUIRED FOR MAILING IN THE UNITED STATES.

| By Order of the Board of Directors, | |

| /s/ Richelle E. Burr | |

| Richelle E. Burr | |

| General Counsel and Secretary |

February 23, 2012

PHOTRONICS, INC.

15 Secor

Road

Brookfield, Connecticut 06804

(203)

775-9000

_____________________________________

PROXY STATEMENT

For the Annual Meeting of

Shareholders

to be held on March 28, 2012

GENERAL INFORMATION

The enclosed proxy is solicited by the Board of Directors (the “Board” or “Board of Directors”) of Photronics, Inc. (the “Company”), to be voted at the Annual Meeting of Shareholders to be held on March 28, 2012 at 10:30 a.m. Eastern Time at NASDAQ OMX, 4 Times Square, Second Floor, New York, NY 10036, or any adjournments or postponements thereof (the “Annual Meeting”). This proxy statement and the enclosed proxy card are first being sent or given to shareholders on or about February 21, 2012.

The persons named as proxies on the accompanying proxy card have informed the Company of their intention, if no contrary instructions are given, to vote the shares of the Company’s common stock (“Common Stock”) represented by such proxies “FOR” Proposals 1, 2, 3 and 4, and in accordance with their best judgment on any other matters which may come before the Annual Meeting. The Board of Directors does not know of any business to be brought before the Annual Meeting other than as set forth in the Notice of Annual Meeting of Shareholders.

Any shareholder who executes and delivers a proxy may revoke it at any time prior to its use upon (a) receipt by the Secretary of the Company of written notice of such revocation; (b) receipt by the Secretary of the Company of a properly executed proxy bearing a later date; or (c) appearance by the shareholder at the Annual Meeting and his or her request to revoke the proxy. Any such notice or proxy should be sent to Photronics, Inc., 15 Secor Road, Brookfield, Connecticut 06804, Attention: Secretary. Appearance at the Annual Meeting without a request to revoke a proxy will not revoke a previously executed and delivered proxy.

QUORUM; REQUIRED VOTES

Only shareholders of record at the close of business on February 9, 2012, are entitled to notice of and to vote at the Annual Meeting. As of February 9, 2012, there were 60,344,376 shares of Common Stock issued and outstanding, each of which is entitled to one vote. At the Annual Meeting, the presence in person or by proxy of the holders of a majority of the total number of shares of outstanding Common Stock will be necessary to constitute a quorum. Assuming a quorum is present, the matters to come before the Annual Meeting that are listed in the Notice of Annual Meeting of Shareholders require the following votes to be approved: (1) Proposal 1 (Election of Directors) a plurality of the votes cast by the shareholders entitled to vote at the Annual Meeting is required to elect 6 members of the Board of Directors; (2) Proposal 2 (Ratification of Selection of Independent Registered Public Accounting Firm for the Fiscal Year Ending October 28, 2012) a majority of the votes cast by the shareholders entitled to vote at the Annual Meeting is required to ratify the selection of Deloitte & Touche LLP; (3) Proposal 3 (To approve an amendment to the Photronics, Inc. Employee Stock Purchase Plan to increase the number of authorized shares of Common Stock available for issuance from 1,200,000 to 1,500,000) a majority of the votes cast by the shareholders entitled to vote at the Annual Meeting is required to approve an amendment to the Photronics, Inc, Employee Stock Purchase Plan; (4) Proposal 4 (Executive Compensation) a majority of the votes cast by the shareholders entitled to vote at the Annual Meeting is required to approve the non-binding resolution approving the compensation of the named executive officers as described in the Compensation Discussion and Analysis and the narrative disclosure as included in this proxy statement. Abstentions will be considered as present but will not be considered as votes in favor of any matter; broker non-votes will not be considered as present for the matter as to which the shares are not voted.

2

Neither the approval nor the disapproval of Proposal 4 will be binding on the Company or the Board of Directors or will be construed as overruling a decision by the Company or the Board of Directors. Neither the approval nor the disapproval of Proposal 4 will create or imply any change to our fiduciary duties or create or imply any additional fiduciary duties for the Company or the Board of Directors. However, the Company will consider the results of these advisory votes in making future decisions on the Company’s compensation policies, and the compensation of the Company’s named executive officers.

Pursuant to the rules that govern brokers and nominees who have record ownership of shares that are held in “street name” for account holders (who are the beneficial owners of the shares), brokers and nominees typically have the discretion to vote such shares on routine matters, but not on non-routine matters. If a broker or nominee has not received voting instructions from an account holder and does not have discretionary authority to vote shares on a particular item because it is a non-routine matter, a “broker-non-vote” occurs. Under the rules governing brokers, an uncontested director election is considered a non-routine matter for which brokers do not have discretionary authority to vote shares held by an account holder. Additionally, as required by Section 957 of the recently adopted Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”), advisory votes on executive compensation and on the frequency of such votes are also considered non-routine matters for which brokers do not have discretionary authority to vote shares held by account holders. Only the ratification of our independent registered public accounting firm under Proposal 2 is considered a routine matter.

Shareholders who hold their shares through a broker (in “street name”) must provide specific instructions to their brokers as to how to vote their shares, in the manner prescribed by their broker.

CORPORATE GOVERNANCE AND ETHICS

Photronics is committed to the values of effective corporate governance and high ethical standards. Our Board believes that these values are conducive to long-term performance and periodically reevaluates our policies to ensure they meet the Company’s needs. Set forth below are a few of the corporate governance practices and policies that we have adopted.

- Related Party Transaction Policy.

Our Audit Committee is responsible for

approving or ratifying transactions involving

the Company and related parties and determining if such transactions are, or

are not, consistent with the best interests of

the Company and our shareholders.

- Executive Sessions. The Company’s Board of Directors’ meetings regularly include executive

sessions without the presence of management,

including the Chairman and Chief Executive Officer.

- Shareholders Rights Plan Policy. The Company does not have a shareholders rights plan and is not currently considering adopting one. The Board of Directors’ position is that it will only adopt a shareholders’ rights plan if the Board of Directors determines that it is in the best interests of the Company, taking into consideration all factors that it deems advisable and appropriate.

3

BOARD OF DIRECTORS’ POLICIES AND COMMITTEE CHARTERS

The Company has adopted a code of ethics and corporate governance policy to assist the Board and its committees in the exercise of their responsibilities. The code of ethics and corporate governance policies apply generally to the Board and the Company’s named executive officers. Each of the Board committees has a written charter that sets forth the goals and responsibilities of the committee. Each of the charters can be found on the Company’s website at www.photronics.com.

The number of directors on our Board will be no less than three nor more than fifteen members. Currently the Board has fixed the number of directors at six members. The Board is responsible for nominating members to the Board and for filling vacancies on the Board that may occur between annual meetings of shareholders, in each case upon the recommendation of the Nominating Committee. The Nominating Committee seeks input from other Board members and senior management and may engage a search firm to identify and evaluate potential candidates. The Board and each of the committees of the Board conduct annual self-assessments to determine their effectiveness. Additionally, each committee reviews the adequacy of its charter annually and considers any proposed changes.

The Board of Directors believes that the current Board leadership structure, in which the roles of Chairman and Chief Executive Officer are held by one person, is appropriate for the Company and its shareholders at this time. The current Board leadership structure is believed to be appropriate because it demonstrates to our employees, suppliers, customers, and other shareholders that the Company is under strong leadership, with a single person setting the tone and having primary responsibility for managing the Company’s operations. Having a single leader for both the Company and the Board reduces the potential for confusion or duplication of efforts, and provides clear leadership for the Company.

The Board will continue to reexamine our corporate governance policies and leadership structure on an ongoing basis to ensure that they continue to meet the Company’s needs.

THE BOARD OF DIRECTOR’S ROLE IN RISK OVERSIGHT AND ASSESSMENT

The Company has a risk management program overseen by senior management and approved by the Board of Directors. Risks are identified and prioritized by senior management and each prioritized risk is assigned to either a Board committee or the full Board for oversight. For example, strategic risks are overseen by the full Board; financial and business conduct risks are overseen by the Audit Committee or the full Board; risks related to related party transactions are overseen by the Audit Committee and compensation risks are overseen by the Compensation Committee. Management regularly reports on enterprise risks to the relevant committee or the Board. Additional review or reporting on enterprise risk is conducted as needed or as requested by the Board or relevant committee.

COMPENSATION RELATED RISK

The Company regularly assesses the risks related to our compensation programs, including our executive compensation programs and does not believe that the risks arising from our compensation policies and practices are reasonably likely to have a material effect on the Company. Incentive award targets and opportunities are reviewed annually allowing the Compensation Committee to maintain an appropriate balance between rewarding high performance without encouraging excessive risk as the Company’s business evolves.

4

OWNERSHIP OF COMMON

STOCK BY

DIRECTORS, OFFICERS

AND CERTAIN

BENEFICIAL OWNERS

The following table sets forth certain information on the beneficial ownership of the Company’s Common Stock as of February 9, 2012, by: (i) beneficial owners of more than five percent of the Common Stock; (ii) each director; (iii) each named executive officer named in the summary compensation table set forth below; and (iv) all directors and currently employed named executive officers of the Company as a group.

| Name and Address of Beneficial Owner (1) | Amount and Nature of Beneficial Ownership (2) | Percentage of Class | |||

| Waddell & Reed Financial, Inc. | |||||

| 6300 Lamar Avenue | |||||

| Overland Park, KS 66202 | 5,459,359 | 9.1%(3) | |||

| Donald Smith & Co., Inc. | |||||

| 152 West 57th Street | |||||

| New York, NY 10019 | 5,340,834 | 8.87%(4) | |||

| Dimensional Fund Advisors | |||||

| Palisades West, Building One | |||||

| 6300 Bee Cove Road | |||||

| Austin, Texas 78746 | 4,290,091 | 7.34%(5) | |||

| Letko, Brosseau & Ass. Inc. | |||||

| 1800 McGill College Ave. | |||||

| Suite 2510 | |||||

| Montreal, QC H3A 356 | |||||

| Canada | 4,050,638 | 6.77%(6) | |||

| Black Rock, Inc. | |||||

| 40 East 52nd Street | |||||

| New York, NY 10022 | 3,170,442 | 5.30%(7) | |||

| Walter M. Fiederowicz | 101,583 | (8) | * | ||

| Joseph A. Fiorita, Jr. | 191,483 | (8)(9) | * | ||

| L. C. Hsia | 8,000 | * | |||

| Soo Hong Jeong | 438,527 | (8) | * | ||

| Peter Kirlin | 72,500 | (8) | * | ||

| Constantine S. Macricostas | 1,323,649 | (8)(10) | * | ||

| George Macricostas | 51,874 | (8) | * | ||

| Christopher J. Progler | 213,293 | (8) | * | ||

| Sean T. Smith | 329,565 | (8) | * | ||

| Mitchell G. Tyson | 107,750 | (8) | * | ||

| Directors and Named Executive Officers | |||||

| as a group (10 persons) | 2,838,224 | (11) | * | ||

* Less than 5%

| (1) | The address for all officers and directors is 15 Secor Road, Brookfield, Connecticut 06804. | |

| (2) | Except as otherwise indicated, the named person has the sole voting and investment power with respect to the shares of Common Stock set forth opposite such person’s name. | |

| (3) | According to Schedule 13G filed February 14, 2012, Waddel & Reed Financial, Inc. has sole voting and dispositive power over 5,459,359 shares of Common Stock as of December 31, 2011. | |

| (4) | According to Schedule 13G filed February 13, 2012, Donald Smith & Co., Inc. has sole voting and dispositive power over 5,340,834 shares of Common Stock as of December 31, 2011. | |

| (5) | According to Schedule 13G filed on February 14, 2012, Dimensional Fund Advisors, has sole voting and dispositive power over 4,290,091 shares of Common Stock as of December 31, 2011. | |

5

| (6) | According to Schedule 13G filed February 14, 2012, Letko Brosseau & Ass. Inc. has sole voting and dispositive power over 4,050,638 shares of Common Stock as of December 31, 2011. | |

| (7) | According to Schedule 13G filed February 9, 2012, Black Rock, Inc. has sole voting and dispositive power over 3,170,442 shares of Common Stock as of December 31, 2011. | |

| (8) | Includes shares of Common Stock subject to stock options exercisable as of February 9, 2012, (or within 60 days thereof), as follows: Mr. Fiederowicz: 80,833; Mr. Fiorita: 81,900; Dr. Jeong: 280,627; Dr. Kirlin: 52,500; Mr. Constantine Macricostas: 270,625; Mr. George Macricostas: 33,750; Dr. Progler 165,493; Mr. Smith: 247,950; and Mr. Tyson: 53,750. | |

| (9) | Includes 300 shares owned by the wife of Mr. Fiorita as to which shares he disclaims beneficial ownership. | |

| (10) | Includes 34,568 shares held by the wife of Mr. Macricostas as to which shares he disclaims beneficial ownership. | |

| (11) | Includes the shares listed in notes (8), (9) and (10) above. | |

PROPOSAL 1

ELECTION OF DIRECTORS

The Board has nominated 6 directors to be elected at the 2012 Annual Meeting to serve for a one year term. Each of the 6 directors of the Company that is elected at the Annual Meeting will serve until the 2013 Annual Meeting of Shareholders and until their successors are elected and qualified. Each nominee is currently a director of the Company and has agreed to serve if elected. The names of, and certain information with respect to, the nominees for election as directors are set forth below.

The Company is open and receptive to shareholder communication. Last year some shareholders communicated their desire to see the Board appoint a Director with technical and semiconductor industry experience as well as someone of Asian descent. In January of 2012 the Company announced that Dr. L.C. Hsia, a Taiwanese national, with many years of experience in the semiconductor industry has joined the Board.

If, for any reason, any of the nominees shall become unable to stand for election, the individuals named in the enclosed proxy may exercise their discretion to vote for any substitutes chosen by the Board of Directors, unless the Board of Directors should decide to reduce the number of directors to be elected at the Annual Meeting. The Company has no reason to believe that any nominee will be unable to serve as a director.

The Board of Directors recommends that you vote “FOR” the election of each of the following nominees:

Nominees:

| Name and (Age) | Director Since | Position with the Company | |||||

| Walter M. Fiederowicz | 1984 | Director | |||||

| (65 years) | |||||||

| Joseph A. Fiorita, Jr. | 1987 | Director | |||||

| (67 years) | |||||||

| Dr. L. C. Hsia | 2012 | Director | |||||

| (63 years) | |||||||

| Constantine S. Macricostas | 1974 | Chairman of the Board | |||||

| (76 years) | |||||||

| George Macricostas | 2002 | Director | |||||

| (42 years) | |||||||

| Mitchell G. Tyson | 2004 | Director | |||||

| (57 years) | |||||||

Messrs. Fiederowicz, Fiorita, Hsia, and Tyson qualify as independent under applicable NASDAQ National Market (“NASDAQ”) rules.

6

In addition to the information set forth in the table above, the following provides certain information about each nominee for election as director, including his principal occupation for at least the past five years. Also set forth below is a brief discussion of the specific experience, qualifications, attributes or skills that led to the conclusion that each nominee and director should serve as a director as of the date of this proxy statement, in light of the Company’s business and structure.

Walter M. Fiederowicz has been a private investor and consultant since August 1997. During 2011, he served as Managing Director of Painter Hill Ventures and Painter Hill Venture Fund, entities that invest in financial services and technology companies. Mr. Fiederowicz is Chairman of the Compensation Committee, and Vice Chairman of the Audit Committee. Mr. Fiederowicz brings to the Board of Directors substantial experience in analyzing and forecasting economic conditions both domestically and internationally. Through his service on the boards of other companies, he also gained extensive experience in leadership, risk oversight and corporate governance matters.

Joseph A. Fiorita, Jr., CPA, has been a partner since 1973 at Fiorita, Kornhaas & Company, P.C., an independent certified public accounting firm located in Danbury, Connecticut. He is a member of the Connecticut Society of Certified Public Accountants (CSCPA) and American Institute of Certified Public Accountants (AICPA). He serves as an advisory board member of various closely-held companies and charitable organizations. He is also a Corporator for Newtown Savings Bank. Mr. Fiorita is Chairman of the Audit Committee and Vice Chairman of the Compensation Committee. Mr. Fiorita qualifies as an audit committee financial expert under applicable Securities and Exchange Commission (“SEC”) audit committee rules. Mr. Fiorita brings to the Board of Directors broad experience in corporate finance, and is highly qualified in the fields of accounting and internal controls, both of which contribute to effective service on the Board of Directors. Through his service on the board of directors of other companies, he has gained additional experience in risk management and corporate governance.

Liang-Choo Hsia, was formerly Senior Vice President and Senior Technical Advisor at Global Foundries. He joined Global Foundries as a result of the acquisition of Chartered Semiconductor Manufacturing where, for over ten years, he played a pivotal role in defining roadmaps for advanced node migration and oversaw the company’s participation in the Joint Development Alliance with IBM for advanced manufacturing to the 22/20nm nodes. He joined Chartered after serving for three years as Director of Technology Development of United Microelectronics Corporation in Taiwan. Prior to that, he spent over a decade with IBM as an advisory scientist in various divisions. Dr. Hsia has authored or co-authored over 100 papers and over 50 patents. He resides in Taiwan and has offices in Taiwan and Singapore. Dr. Hsia is Chairman of the Strategy and Technology Committee and is a member of the Nominating Committee.

Constantine S. Macricostas is Chairman of the Board, Chief Executive Officer and President. From July 20, 2008, Mr. Macricostas assumed the responsibility of Interim Chief Executive Officer and on April 3, 2009 he became Chief Executive Officer and President. From February 23, 2004 to June 7, 2005, Mr. Macricostas also served as Chief Executive Officer. Mr. Macricostas also served as Chief Executive Officer of the Company from 1974 until August 1997. Mr. Macricostas is a founder, Vice Chairman of the Board and a director of RagingWire Enterprise Solutions, Inc., (“RagingWire”). Mr. Macricostas is the father of George Macricostas. Mr. Macricostas’ knowledge of the Company and its operations is invaluable to the Board of Directors in evaluating and directing the Company’s future. Through his long service to the Company and experience in the industry, he has developed extensive knowledge in the areas of leadership, safety, risk oversight, management and corporate governance, each of which provides great value to the Board of Directors.

George Macricostas is the Executive Chairman of the Board and founder of RagingWire, a company that provides secure managed information technology services and data center infrastructure to data intensive enterprise companies. Mr. Macricostas is a member of the Strategy and Technology Committee of the Company. Mr. Macricostas is a member of the Board of Directors of the Jane Goodall Institute, and was a finalist in the 2007 Ernst and Young Entrepreneur of the Year program. From November 2005 to January 2007, Mr. Macricostas was Executive Vice Chairman of RagingWire. From May 2000 through November 2010, Mr. Macricostas was Chief Executive Officer of RagingWire. Prior to the founding of RagingWire, from February 1996 until April 2000, Mr. Macricostas was a senior vice president of the Company, where he was responsible for all aspects of the Company’s global information technology infrastructure. Mr. Macricostas brings over 20 years of technical and business management experience in operations and information technology to the Board of Directors. Through his service on the Board, he has gained additional experience in risk management and corporate governance.

7

Mitchell G. Tyson is an independent business strategy and clean energy consultant and serves on multiple industry, government and corporate boards of directors. He is also an Adjunct Professor at the Brandeis International Business School. Until October 2010, he was the Chief Executive Officer and a Director of Advanced Electron Beams. Advanced Electron Beams’ compact electron beam emitters replace thermal and chemical processes for cleaner, more efficient, lower cost manufacturing. Prior to joining Advanced Electron Beams in 2005, Mr. Tyson was a corporate consultant and lecturer. Previously, Mr. Tyson served as the Chief Executive Officer of PRI Automation, a publicly traded corporation that supplied automation systems including hardware, software and services for the semiconductor industry. From 1987 to 2002, he held positions of increasing management responsibility and helped transform PRI Automation from a small robotics manufacturer to the world’s leading supplier of semiconductor fab automation systems. Prior to joining PRI Automation, Mr. Tyson worked at GCA Corporation from 1985 to 1987 as Director of Product Management and served as science advisor and legislative assistant to the late U.S. Senator Paul Tsongas from1979 to 1985. Mr. Tyson is Chairman of the Nominating Committee and a member of the Audit Committee of the Company.

MEETINGS AND COMMITTEES OF THE BOARD

The Board of Directors met 5 times during the 2011 fiscal year. During fiscal 2011, each director attended 100% of the total number of meetings of the Board of Directors and 100% of committee meetings of the Board on which such director served.

The Company’s Board of Directors has Audit, Compensation, Nominating and Strategy and Technology Committees. Membership of the Audit, Compensation and Nominating Committees is comprised of independent, non-employee directors.

The Audit Committee’s functions include the appointment of the Company’s independent registered public accountants, reviewing with such accountants the plan for and results of their auditing engagement and the independence of such accountants. Messrs. Fiederowicz, Fiorita and Tyson are members of the Audit Committee. All members of this Committee are independent, non-employee directors under applicable NASDAQ rules. Mr. Fiorita qualifies as an audit committee financial expert under applicable SEC audit committee rules. The Audit Committee held 9 meetings during the 2011 fiscal year.

The Compensation Committee’s functions include establishing compensation policies and programs for the executive officers of the Company and administration of the Company’s stock plans. Messrs. Fiederowicz and Fiorita are members of the Compensation Committee. All members of this Committee are independent, non-employee directors under applicable NASDAQ rules. The Compensation Committee held 5 meetings during the 2011 fiscal year.

The Nominating Committee’s functions include the consideration and nomination of candidates for election to the Board. Messrs. Tyson and Hsia are members of the Nominating Committee. All members of this Committee are independent, non-employee directors under applicable NASDAQ rules. This Committee held 2 meetings during the 2011 fiscal year.

The minimum qualifications for nominees to be considered by the Nominating Committee are experience as a business or technology leader, possession of the qualities or skills necessary and the ability to deliver value and leadership to the Company and the ability to understand, in a comprehensive manner, the technology utilized by the Company and its customers for the production of photomasks and flat panel displays. If an opening for a Director arises, the Board will conduct a search for qualified candidates. The Nominating Committee utilizes its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The Nominating Committee will also consider qualified candidates for Director suggested by shareholders in written submissions to Photronics, Inc., 15 Secor Road, Brookfield, Connecticut 06804, Attention: Secretary. The Nominating Committee also considers the diversity of backgrounds and expertise represented in the Board’s composition and whether a nominee is qualified to serve may depend in part on the backgrounds of the other directors, so that the Board of Directors as a whole has an appropriate mix of backgrounds and breadth of experience. The Nominating Committee reviews its effectiveness in balancing these considerations through its ongoing consideration of directors and nominees, as well as the Nominating Committee’s annual self-evaluation process. The Nominating Committee does not intend to alter the manner in which it evaluates candidates, whether the candidate was recommended by a shareholder or not.

The Nominating Committee did not receive any recommendations for nomination of a Director from a shareholder or group who, individually or in the aggregate, beneficially owned greater than 5 percent of the Company’s voting Common Stock for at least one year.

8

The Board provides a process for shareholders to send communications to the Board or to any Director individually. Shareholders may send written communications to the Board or to any Director c/o Photronics, Inc., 15 Secor Road, Brookfield, Connecticut 06804, Attention: Secretary. All communications will be compiled by the Secretary and submitted to the Board, or the individual Directors, on a periodic basis.

The Audit Committee Charter, the Compensation Committee Charter, the Nominating Committee Charter and the Strategy and Technology Committee Charter are posted on the Company’s website at www.photronics.com.

It is the Company’s policy that the Directors who stand for election at the Annual Meeting attend the Annual Meeting unless the Director has an irreconcilable conflict and attendance has been excused by the Board. All of the nominees who were Directors during the last fiscal year and who are standing for election at the 2012 Annual Meeting of Shareholders attended the 2011 Annual Meeting of Shareholders with the exception of George Macricostas and Mitch Tyson who were excused. Dr. Hsia was not at the 2011 Annual Meeting as he became a director on January 3, 2012.

AUDIT COMMITTEE REPORT

The Audit Committee is composed of three directors, each of whom meets the independence requirements of the applicable NASDAQ and SEC rules. The Audit Committee operates under a written charter adopted by the Board of Directors of the Company. The Audit Committee Charter can be found on the Company’s website at www.photronics.com. The Audit Committee also undertakes a written performance evaluation of the Committee on an annual basis.

The Audit Committee held 9 meetings during the 2011 fiscal year. For the fiscal year ended October 30, 2011, the Audit Committee reviewed and discussed the audited financial statements with management, discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 (communication with Audit Committees) as amended, as adopted by PCAOB in Rule 3200T. In addition, the Audit Committee has the letter from Deloitte & Touche LLP required by the applicable requirement of PCAOB regarding Deloitte & Touche LLP’s communication with the Audit Committee concerning independence and has discussed with them their independence from the Company and its management. The Audit Committee reviewed and discussed with management and the independent auditors, as appropriate, (1) the audited financial statements and (2) management’s report on internal control over financial reporting and the independent accounting firm’s related opinions. The Committee considered whether the provision of non-audit services by Deloitte & Touche LLP to the Company is compatible with maintaining the independence of Deloitte & Touche LLP and concluded that the independence of Deloitte & Touche LLP was not compromised by the provision of such services. The Audit Committee met with management periodically during the fiscal year to review the Company’s Sarbanes-Oxley Section 404 compliance efforts related to internal controls over financial reporting. Additionally, the Audit Committee pre-approved all audit and non-audit services provided to the Company by Deloitte & Touche LLP. Based on the foregoing meetings, reviews and discussions, the Audit Committee recommended to the Board of Directors that the audited financial statements for fiscal 2011 be included in the Company’s Annual Report on Form 10-K for filing with the Securities and Exchange Commission.

In 2003, the Audit Committee adopted a formal complaint procedure for accounting and auditing matters and violations of Company policy.

9

Fees Paid to the Independent Registered Public Accounting Firm

For the fiscal years ended October 31, 2010 and October 30, 2011, the aggregate fees for professional services rendered by D&T were as follows:

| Fiscal 2010 | Fiscal 2011 | |||||

| Audit Fees (a) | $ | 970,367 | $ | 1,150,487 | ||

| Audit-Related Fees (b) | 13,378 | 20,375 | ||||

| Tax Fees (c) | 44,275 | 142,172 | ||||

| All Other Fees | 0 | 0 | ||||

| Total | $ | 1,028,020 | $ | 1,313,034 | ||

| (a) | Represents aggregate fees in connection with the audit of the Company’s annual financial statements, internal controls over financial reporting and review of the Company’s quarterly financial statements or services normally provided by D&T, including, among other items, fees related to the Company’s issuance of convertible securities. | ||

| (b) | Represents assurance and other activities not directly related to the audit of the Company’s financial statements. | ||

| (c) | Represents aggregate fees in connection with tax compliance, tax advice and tax planning. | ||

This report is submitted by:

Joseph A.

Fiorita, Jr.

Chairman

Walter M. Fiederowicz

Mitchell G. Tyson

EXECUTIVE OFFICERS

The names of the executive officers (the “Named Executive Officers”) of the Company are set forth below together with the positions held by each person in the Company. All executive officers are elected annually by the Board of Directors and serve until their successors are duly elected and qualified.

| Name and Age | Position | Served as an Officer Since | |||||

| Richelle E. Burr, 48 | Vice President, General Counsel | 2010 | |||||

| and Secretary | |||||||

| Soo Hong Jeong, 56 | Chief Operating Officer, | 2001 | |||||

| President, Asia Operations | |||||||

| Peter S. Kirlin, 51 | Senior Vice President, US and | 2008 | |||||

| Europe | |||||||

| Constantine S. Macricostas, 76 | Chief Executive Officer and | 2008 | |||||

| President | |||||||

| Christopher J. Progler, 48 | Vice President, Chief Technology | 2004 | |||||

| Officer and Strategic Planning | |||||||

| Sean T. Smith, 51 | Senior Vice President, | 2000 | |||||

| Chief Financial Officer | |||||||

10

Richelle E. Burr joined Photronics in 2003 as Corporate Counsel and was appointed General Counsel in January 2010. She was promoted to Vice President, Associate General Counsel in 2008 and was appointed Secretary in April of 2009 prior to her election as General Counsel in January 2010.

Dr. Soo Hong Jeong was appointed Chief Operating Officer on June 21, 2006, and continues to serve as President of Asia Operations, a position he has served in since March 22, 2004. Prior to that, Dr. Jeong served as a Vice President of the Company and President and Chief Executive Officer of PK, Ltd. (“PKL”), since August 2001.

Dr. Peter S. Kirlin joined Photronics in August, 2008 as Senior Vice President, US and Europe. Prior to joining Photronics, Dr. Kirlin was Executive Chairman of Akrion, Inc. from January 2007 to July 2008. Prior to that Dr. Kirlin was Vice President of Business Development at Entegris, Inc. from May 2004 to September 2006. Prior to that Dr. Kirlin was Chairman and Chief Executive Officer of DuPont Photomask, Inc.

Constantine S. Macricostas has served as Chief Executive Officer and President since April 3, 2009. Prior to that he served as Interim Chief Executive Officer from July 20, 2008 to April 3, 2009. From February 23, 2004 to June 7, 2005, he also served as Chief Executive Officer. From January 2002 through March 2002, he temporarily assumed the position of President. Mr. Macricostas also served as Chief Executive Officer of the Company from 1974 until August 1997.

Dr. Christopher J. Progler became an executive officer on June 21, 2006. Dr. Progler has been employed by Photronics since 2001 starting with the position of Corporate Chief Scientist. He was promoted to Vice President and Chief Technology Officer in 2004. In 2011 Dr. Progler assumed the added responsibility of Strategic Planning for the Company. Dr. Progler is a Fellow and Board Member of SPIE - The International Society for Optical Engineering. He is Co-Chair of SPIE Advanced Lithography Symposium and Associate Editor for the SPIE Journal of Microlithography, Microfabrication and Microsystems.

Sean T. Smith was promoted to Senior Vice President on January 25, 2005, and continues to serve as Chief Financial Officer. In March 2002, Mr. Smith was promoted to Vice President and Chief Financial Officer. Prior to that Mr. Smith had been Vice President-Controller. He joined Photronics in April 2000.

COMPENSATION DISCUSSION AND ANALYSIS

The Compensation Committee of the Board of Directors (the “Compensation Committee”) was established in 1992 and is comprised of two of the independent, non-employee members of the Board of Directors. Neither of these individuals was an officer or employee of the Company at any time during fiscal year 2011 or at any other time, and neither of them have interlocking relationships as described in Item 407 of Regulation S-K. The Compensation Committee is responsible for setting and administering the policies governing compensation of executive officers. The key objectives of the Compensation Committee are to provide competitive compensation to attract and retain talented employees, to advance the goals of the Company by aligning executive compensation with shareholder interests and minimizing risks associated with compensation. The Compensation Committee reviews and approves, among other things, overall annual performance for the Named Executive Officers as well as all participants in the Company’s 2011 Executive Incentive Compensation Plan. The Compensation Committee considers each executive officer’s performance and makes recommendations regarding his/her base salary, annual cash incentive and stock-based awards to the full Board of Directors. The Compensation Committee periodically reviews its approach to executive compensation and makes changes when appropriate.

Philosophy

The Company’s philosophy is that executive compensation must be competitive with other comparable employers to insure that qualified employees can be attracted and retained and that the Company’s compensation practices should provide incentives for creating a return to the Company’s shareholders. The Compensation Committee uses three components to achieve these goals: base salary, annual cash incentives and stock-based awards. The Company’s executive officer compensation program is designed so that: compensation is competitive; pay is aligned with creating shareholder value and compensation risks are assessed and managed appropriately in the context of the Company’s business strategy. When determining compensation, the Compensation Committee assesses the overall performance

11

of the Company, the Named Executive Officer’s role in that performance, the compensation previously received by the Named Executive Officers and the compensation of similarly situated executive officers working for peer group companies. The Compensation Committee also uses a subjective approach when linking the Company’s performance and the total compensation of the Named Executive Officers.

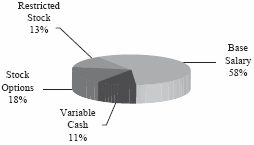

| Total Direct Compensation Chief Executive Officer  |

Total Compensation All Other Named Executive Officers  |

Elements of Compensation

In establishing compensation levels for the Named Executive Officers of the Company, identified in the Summary Compensation Table, the Compensation Committee considers compensation at fifteen publicly traded companies in the semiconductor/electronics industries with similar levels of sales and capital. These companies are Advanced Energy Industries, Inc., ATMI, Inc., Axcelis Technologies, Inc., Brooks Automation, Inc., Cabot Microelectronics Corp., Credence Systems Corp., Cymer, Inc., Entegris, Inc., FEI Co, Kulicke & Soffa Industries, Inc., MEMC Electronic Materials, Inc., Novellus Systems, Inc., Varian Semiconductor Equipment Associates, Inc., and Veeco Instruments, Inc. The Compensation Committee adjusts executive compensation in connection with this review. Generally, the Compensation Committee believes that the compensation of its executive officers should be set near the median compensation of this comparison group; however it is also important to the Compensation Committee that compensation reflect individual performance and that may warrant compensation up to 20% above or below the median. The Compensation Committee believes that the three components of the Company’s compensation: base salary, annual cash incentives and stock-based awards result in a compensation program which is competitive and aligns the Named Executive Officer’s interests with shareholder value creation. Actual base salary increases, annual cash incentive and stock-based award compensation vary based on an individual’s experience, job responsibilities, performance, the Company’s financial results, and the discretion of the Compensation Committee. The Compensation Committee does not use tally sheets or any formulas in determining executive compensation. The Compensation Committee does not believe that there are any risks arising from the Company’s compensation policies and practices for its employees that are reasonably likely to have a material adverse effect on the Company. The benefits program enjoyed by the Company’s Named Executive Officers is the same as that offered to all other domestic employees. Dr. Jeong, Mr. Smith, Dr. Kirlin, Dr. Progler and Ms. Burr have employment agreements that outline the terms and provisions of their employment. Each agreement covers title, duties and responsibilities, stipulates compensation terms and provides for post-termination compensation in certain circumstances.

Base Salary

The Compensation Committee evaluates and establishes base salary levels in light of economic conditions (generally and in the regions where executives work) and comparisons to other similarly situated companies. Base salary is designed to recognize an executive’s knowledge, skills, abilities and ongoing performance. The Compensation Committee targets base salary for all executives to be at a level consistent with our assessment of their value relative to their peers in the labor market, while also taking into account our need to maintain costs in light of business conditions and the challenging economic times. Any recommendations for salary changes (other than the Chief Executive Officer) are made by the Chief Executive Officer and presented to the Compensation Committee for approval.

12

Annual Incentives

The Company had record revenue for the second quarter, third quarter and for the year ended October 30, 2011. The Company also ended the fiscal year with 20% year over year sales growth. The Compensation Committee met on December 9, 2011, and based on the performance results of the Company for fiscal year 2011, the Compensation Committee set $600,000 (or 3.7% of fiscal 2011 net income attributable to the Company) as an available pool for cash bonuses for the Named Executive Officers. Furthermore, the Compensation Committee used its subjective discretion to determine an appropriate amount of a cash bonus for the Chief Executive Officer. The Compensation Committee, together with the recommendations of the Chief Executive Officer, determined an appropriate amount for a cash bonus for each of the other Named Executive Officers to receive.

During the 2011 Annual Meeting, our shareholders approved the 2011 Executive Incentive Compensation Plan (the “2011 EICP”). Participation in the 2011 EICP is limited to key employees of the Company as designated by the Compensation Committee. The 2011 EICP is administered by the Compensation Committee which has full power and authority to determine which key employees of the Company receive awards under the 2011 EICP, to set performance goals and bonus targets for each fiscal year, to interpret and construe the terms of the 2011 EICP and to make all determinations it deems necessary in the administration of the 2011 EICP, including any determination with respect to the achievement of performance goals and the application of such achievement to the bonus targets. The 2011 EICP sets out quantitative and qualitative categories of business criteria upon which performance goals are based. The business criteria measures within each category are assigned different weightings based upon their relative degree of importance as determined by the Compensation Committee.

In the quantitative category one or more of the following business criteria may be used as performance measures: (i) net sales, (ii) operating income, (iii) net income, (iv) earnings per share of common stock, (v) net cash flows provided by operating activities, (vi) net increase in working capital, (vii) return on invested capital, (viii) return on equity and/or (ix) debt reduction. In the qualitative category, the business criteria relates to objective individual performance, taking into account individual goals and objectives. The performance goals with respect to each category of business criteria are established by the Compensation Committee within ninety days of the commencement of each fiscal year. In addition, within ninety days of the commencement of the fiscal year, a performance threshold for each performance goal is established with respect to each participant, representing the minimum level of achievement that the participant must attain in order to receive a bonus under the 2011 EICP. Annual bonus targets are either expressed as a percentage of current salary or a fixed monetary amount with respect to each category of business criteria applied. At the end of each fiscal year for which a bonus may be earned, the Compensation Committee determines each participant’s level of achievement of the established performance goals. Consistent with the relevant provisions of the Dodd-Frank Act, the Company will “clawback,” or adjust if the relevant performance measures that awards are based upon are restated or otherwise adjusted in a manner that would reduce the size of the award or payment. The Compensation Committee may amend or terminate the 2011 EICP at any time provided that no amendment will be effective prior to approval of the Company’s shareholders to the extent such approval is required to preserve deductibility of compensation paid pursuant to the 2011 EICP under Section 162(m) of the Code or otherwise required by law.

Because the 2011 EICP was adopted half way through the 2011 fiscal year, the Compensation Committee will establish defined quantitative and qualitative business criteria to use for performance measures for fiscal 2012.

Long Term Equity Incentives

The Company’s long term incentive program uses restricted stock and stock options. Stock options have an exercise price equal to the fair market value of our common stock on the date of grant. The Compensation Committee evaluates the competitiveness of the Company’s current long term incentive program in relationship to our peer group. Each year the Compensation Committee assesses each element of Photronics’ executive compensation including base salary, target total cash compensation (base salary plus target incentive award opportunity), actual total cash compensation (base salary plus last bonus paid), long term incentives and actual total direct compensation.

The Company maintains stock option plans which allow for the grant of stock options and restricted stock awards to directors and executive officers of the Company, as well as, other employees of the Company. The Compensation

13

Committee believes that the grant of stock options and restricted stock awards provides a strong link between executive compensation and shareholder return, aligning the long term interests of its executives with those of the Company’s shareholders and thereby promoting strategic planning while minimizing excessive risk.

In March of 2007, the Company adopted a Long Term Equity Incentive Plan (“LTEIP”). In April of 2010, the LTEIP was amended to increase the number of shares available for issuance under the plan from 3 million to 6 million and the amount of restricted stock allowed to be issued thereunder from 10% to 15% of the total shares issued cumulatively. The LTEIP permits the grant of stock options, restricted stock, stock appreciation rights, performance shares and performance units as well as restricted stock units and other equity-based awards. The annual schedule for granting of equity awards under the LTEIP is decided every December at the Company’s Board of Directors meeting. Grants to executive officers under the LTEIP are based on job responsibilities and potential for individual contribution impacting the Company’s overall performance. When considering grants, the Compensation Committee exercises judgment and discretion and also considers previous stock award grants in order to align generally with its overall compensation philosophy. For example, the Compensation Committee may consider reducing grants in a particular year, when a Named Executive Officer has large realizable gains from stock award grants in previous years. The Company generally provides restricted stock awards and stock options to the executive officers pursuant to the terms of the LTEIP.

The annual option granting process generally begins with the Compensation Committee providing direction to the Chief Executive Officer as to the total number of shares available for grant for the year. The Chief Executive Officer then provides individual grant recommendations to the Compensation Committee (except for his own) for review and approval. The Chief Executive Officer’s recommendation is a subjective evaluation of the Named Executive Officers contribution to the Company’s future success, the level of incentive compensation previously received as well as the market price of the common stock on the date of grant. The Compensation Committee considers the aggregate number of shares available, the number of shares previously awarded and the number of individuals to whom the Company wishes to grant stock options or restricted stock awards. The Compensation Committee reserves the right to consider the factors it considers relevant under the circumstances then prevailing in reaching its determination regarding the amount of each stock option and/or restricted stock award.

Options awards typically vest 25% per year beginning one year after the grant date, with full vesting on the fourth anniversary of the grant date. The term of such options is ten years after which the options expire, unless the employee separates earlier from the Company, at which point the options expire 30 days after separation. The exercise price is established as of the date of grant. Restricted stock awards typically vest 25% per year beginning one year after the grant date, with full vesting on the fourth anniversary of the grant date. Any stock not fully vested on the date the employee separates from the Company are forfeited.

The Chief Executive Officer’s grant is determined by the Compensation Committee at its sole discretion, based on the Compensation Committee’s evaluation of the Chief Executive Officer’s expected contribution to the Company’s future success, the level of incentive compensation previously awarded , the overall performance of the Company, a review of the Chief Executive Officer’s peer group compensation as well as the market price of the Company’s common stock on the date of grant.

Health and Welfare and Retirement Benefits

The Named Executive Officers participate in a variety of health and welfare and paid time off benefits designed to allow the Company to retain its workforce. The Company does not have a defined benefit pension plan or supplemental retirement plan. However, the Company does have a Profit Sharing and Saving Plan (the “Plan”). The Plan is a 401(k) compliant plan which enables participating employees to make contributions from their earnings and share in the contributions the Company makes to a trust fund maintained by the trustee. An account in the trust fund is maintained by the trustee for the Plan. All employees are eligible to participate in the Plan except for nonresident aliens with no United States earned income from the Company and temporary employees or interns. The minimum amount that an employee can contribute is 1% and the maximum amount is 50%. In fiscal year 2011, the Company provided a matching contribution based on the contributions that participating employees made to the Plan. Participating employees received a matching contribution of 50% of the first 4% of their contribution to the Plan.

14

Dr. Jeong is entitled to participate in the PKL employee benefit plans and arrangements as may be established from time to time in Korea (which may include, without limitation, medical plan, dental plan, disability plan, basic life insurance and business travel accident insurance plan, as well as the Company’s bonus plan(s), and stock award plans or any successor plans thereto). The Company and PKL have the right to terminate or change any such plans or programs at any time. Upon termination of Dr. Jeong’s employment with PKL, Dr. Jeong will receive a lump sum payment of U.S. $108,000 multiplied by the total number of years that Dr. Jeong was employed by PKL (including years prior to the date of this Agreement). The sum of $108,000 shall be fixed and is not subject to escalation or increase based on any bonus or salary increase that Dr. Jeong may receive during the term of his agreement.

Employment Agreements

In order to retain the Named Executive Officers and retain continuity of management in the event of an actual or threatened change of control, the Company has entered into employment agreements with each of the Named Executive Officers except for Mr. Macricostas. Each employment agreement sets forth the severance benefits due in the event of a change in control or termination without cause. These employment agreements are described below under the caption Certain Agreements. The estimate of the compensation that would be payable in the event of a change in control or termination without cause is described below under the caption Potential Payments Upon Termination or Change in Control. The Compensation Committee believes that these agreements are a competitive requirement to attract and retain highly qualified executive officers. Before authorizing the Company to enter into the employment agreements with the Named Executive Officers, the Compensation Committee analyzed each of the termination and change in control arrangements and determined that each arrangement was necessary and appropriate under the circumstances of the Company and given the circumstances of each of the individual Named Executive Officers. The Compensation Committee will review these arrangements again upon the renewal of each employment agreement. Mr. Macricostas does not have an employment agreement but does have a consulting agreement with the Company. However, the consulting agreement has been suspended for the period of time that Mr. Macricostas is an employee of the Company. Mr. Macricostas became an employee of the Company on November 10, 2008.

The Compensation Committee understands that excise tax gross up upon a change of control is considered to be a pay practice that may be unfavored by some shareholders. The Compensation Committee is evaluating its policy of including this in the Named Executive Officers employment agreements prospectively.

Tax and Accounting Impact on Compensation

Financial reporting and income tax consequences to the Company of individual compensation elements are important considerations for the Compensation Committee when it is analyzing the overall level of compensation and the mix of compensation. Overall, the Compensation Committee seeks to balance its objective of ensuring an effective compensation package for the Named Executive Officers while attempting to ensure the deductibility of such compensation – while ensuring an appropriate and transparent impact on reported earnings and other closely followed financial measures.

Section 162(m) of the Internal Revenue Code limits the amount of compensation paid to each Named Executive Officer that may be deducted by the Company to $1 million in any year. There is an exception to the $1 million limitation for performance-based compensation that meets certain requirements. Historically, the compensation paid to our executive officers has not exceeded this limit. To the extent that it is practicable and consistent with the Company’s executive compensation philosophy, the Company intends to design its executive officer compensation policy to ensure the deductibility of such compensation under Section 162(m) or if it is determined not to be in the best interest of stockholders, the Compensation Committee will abide by its compensation philosophy even if it results in a loss of deductibility.

15

2011 EXECUTIVE COMPENSATION

Base salaries for executive officers of the Company are established primarily upon an evaluation of the executive officer’s position in the Company, competitive market practices, individual performance, level of responsibility and technical expertise. The base salaries for the Named Executive Officers are set forth in their respective employment agreements which are described below under the caption Certain Agreements. For executive officers other than the Chief Executive Officer, changes in base salary are proposed to the Compensation Committee by the Chief Executive Officer based on his evaluation of each individual’s performance for the year and expected future contributions as well as target pay position relative to the peer group and the Company’s overall salary budget guidelines. The Chief Executive Officer’s recommendations are reviewed and approved by the Compensation Committee. In December of 2011 (which is part of the Company’s fiscal year 2012), the Named Executive Officers received restricted stock and stock option awards and also received a cash bonus. Mr. Smith and Ms. Burr each received a $15,000 salary increase. The Compensation Committee believes that the salary increases properly align the incumbents with competitive norms commensurate with their level of accountability.

2011 CHIEF EXECUTIVE OFFICER COMPENSATION

Mr. Macricostas’ base compensation as Chief Executive Officer is $600,000. The Compensation Committee based Mr. Macricostas’ 2011 base compensation on competitive chief executive officer salaries. Mr. Macricostas received a grant of 112,500 options and 56,250 shares of restricted stock in December of 2011 and also received a cash bonus of $130,000 in December of 2011. Mr. Macricostas declined a salary increase recommended by the Compensation Committee in December 2011.

2011 COMPENSATION DECISIONS

On December 10, 2010, the Compensation Committee awarded Dr. Jeong 16,250 shares of restricted stock and 32,500 options; Mr. Smith 12,500 shares of restricted stock and 25,000 options; Dr. Kirlin 10,000 shares of restricted stock and 20,000 options, Dr. Progler 8,750 shares of restricted stock and 17,500 options and Ms. Burr 7,500 shares of restricted stock and 15,000 options. The awards were based on recommendations of the Chief Executive Officer. The awards were made in fiscal 2011 but were made for fiscal 2010 performance.

On December 9, 2011, the Compensation Committee awarded Dr. Jeong a cash bonus of $75,000; Mr. Smith a cash bonus of $85,000; Dr. Kirlin a cash bonus of $65,000, Dr. Progler a cash bonus of $55,000 and Ms. Burr a cash bonus of $40,000 for their 2011 performances. On December 9, 2011, the Compensation Committee also awarded Dr. Jeong 16,250 shares of restricted stock and 32,500 options; Mr. Smith 12,500 shares of restricted stock and 25,000 options; Dr. Kirlin 10,000 shares of restricted stock and 20,000 options, Dr. Progler 8,750 shares of restricted stock and 17,500 options and Ms. Burr 7,500 shares of restricted stock and 15,000 options. The awards were based on recommendations of the Chief Executive Officer. The awards were made in fiscal 2012 but were for fiscal 2011 performance.

When determining 2011 compensation the Compensation Committee considered the overall performance of the Company, including the fact that the Company had record revenue for the second quarter, third quarter and for the year ended October 30, 2011. Additionally, the Company ended the fiscal year with 20% year over year sales growth. The Compensation Committee considered each Named Executive Officer’s role in the Company’s performance, the compensation previously received by each of the Named Executive Officers and the compensation of similarly situated executive officers working for peer group companies. The Compensation Committee also used a subjective approach when linking the performance of the Company with the compensation of the Named Executive Officers.

16

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee, comprised of independent directors, reviewed and discussed the above Compensation Discussion and Analysis (CD&A) with the Company’s management. Based on the review and discussions, the Compensation Committee recommended to the Company’s Board of Directors that the CD&A be included in these Proxy Materials.

Respectfully submitted,

Walter M. Fiederowicz, Chairman

Joseph

A. Fiorita, Jr.

17

EXECUTIVE COMPENSATION

The following table sets forth certain information regarding compensation paid or accrued by the Company for services rendered for the three-year period ended October 30, 2011, to each of the individuals who served (i) as the Chief Executive Officer; (ii) Chief Financial Officer and (iii) the three other most highly compensated executive officers of the Company whose total salary and bonus exceeded $100,000 (such executives are collectively referred to as the “Named Executive Officers”).

SUMMARY COMPENSATION TABLE

| All | |||||||||||||||||

| Stock | Option | Other | |||||||||||||||

| Name and Principal | Salary | Bonus | Awards | Awards | Compensation | Total | |||||||||||

| Position | Year | ($)(1) | ($) | ($) | ($) | ($) | ($) | ||||||||||

| Soo Hong Jeong | |||||||||||||||||

| Chief Operating Officer | 2011 | 475,000 | 75,000 | 109,038 | (2) | 152,555 | (3) | 108,000 | (4) | 919,593 | |||||||

| President, Asia Operations | 2010 | 386,640 | 45,000 | 0 | 193,245 | 153,256 | 778,141 | ||||||||||

| 2009 | 367,308 | 0 | 0 | 44,000 | 141,289 | 552,597 | |||||||||||

| Peter S. Kirlin | |||||||||||||||||

| Senior Vice President, | 2011 | 320,000 | 65,000 | 67,100 | (2) | 93,880 | (3) | 17,062 | (5) | 563,042 | |||||||

| US and Europe Operations | 2010 | 280,000 | 35,000 | 0 | 104,055 | 17,600 | 436,655 | ||||||||||

| 2009 | 266,000 | 0 | 0 | 22,000 | 108,982 | 396,982 | |||||||||||

| Constantine S. Macricostas | |||||||||||||||||

| Chairman, Chief Executive | 2011 | 600,000 | 130,000 | 377,438 | (2) | 528,075 | (3) | 22,296 | (6) | 1,657,809 | |||||||

| Officer and President | 2010 | 600,000 | 60,000 | 0 | 668,925 | 923 | 1,329,848 | ||||||||||

| 2009 | 516,923 | 0 | 0 | 132,000 | 16,224 | 665,147 | |||||||||||

| Christopher J. Progler | |||||||||||||||||

| Vice President, | 2011 | 285,000 | 55,000 | 58,713 | (2) | 82,145 | (3) | 17,571 | (7) | 498,429 | |||||||

| Chief Technology Officer, | 2010 | 243,000 | 27,500 | 0 | 104,055 | 16,860 | 391,415 | ||||||||||

| Strategic Planning | 2009 | 230,849 | 7,500 | 0 | 22,000 | 14,170 | 274,519 | ||||||||||

| Sean T. Smith | |||||||||||||||||

| Senior Vice President, | 2011 | 360,000 | 85,000 | 83,875 | (2) | 117,350 | (3) | 7,765 | (8) | 653,990 | |||||||

| Chief Financial Officer | 2010 | 300,438 | 40,000 | 0 | 148,650 | 8,900 | 497,988 | ||||||||||

| 2009 | 285,415 | 15,000 | 0 | 28,600 | 5,081 | 334,096 |

| (1) | 2009 salary reflects a 10% reduction in pay implemented for two quarters of fiscal 2009. There were no salary increases for fiscal 2010. | |

| (2) | The amounts shown in the “Stock Awards” column represents the closing price of the Company’s Common Stock on the date of grant multiplied by the amount of the award granted calculated in accordance with ASC No. 718, Compensation, Stock Compensation. | |

| (3) | The amounts included in this column represent the grant date fair value of the options calculated in accordance with ASC No. 718. The assumptions used in determining the fair value of these options are set forth in Note 10 of the Company’s Annual Report on Form 10-K. | |

| (4) | Upon termination of Dr. Jeong’s employment with PKL, Dr. Jeong will receive a lump sum payment of $108,000 multiplied by the total number of years that Dr. Jeong was employed by PKL (including years prior to the date of the agreement). The sum of $108,000 shall be fixed and is not subject to escalation or increase based on any bonus or salary increase that Dr. Jeong may receive. | |

| (5) | Represents $12,000 car allowance and $5,062 matching contribution pursuant to the Company’s 401(k) Savings and Profit Sharing Plan. | |

| (6) | Represents $1059 for personal use of a Company car. Medical reimbursement for 2010 paid in 2011 of $14,133 and receipt of Company car with value of $7,104 | |

| (7) | Represents $12,000 car allowance and $5,571 for matching contribution pursuant to the Company’s 401(k) Savings and Profit Sharing Plan. | |

| (8) | Represents $2,865 for personal use of a Company car and $4,900 matching contribution pursuant to the Company’s 401(k) Savings and Profit Sharing Plan. | |

18

GRANT OF PLAN-BASED AWARDS TABLE

During the fiscal year ended October

30, 2011, the following plan based awards were granted to the

Named Executive

Officers

| Grant Date Fair | ||||||||||||||

| Stock Awards | All Other Stock | Value of Stock and | ||||||||||||

| Shares of Stock or | Awards: Number of | Option Awards | ||||||||||||

| Name | Grant Date | Units (#) | Shares of Stock(1) | $ | ||||||||||

| Soo Hong Jeong | 12/10/2010 | 16,250 | 32,500 | 261,593 | ||||||||||

| Peter S. Kirlin | 12/10/2010 | 10,000 | 20,000 | 160,980 | ||||||||||

| Constantine S. Macricostas | 12/10/2010 | 56,250 | 112,500 | 905,513 | ||||||||||

| Christopher J. Progler | 12/10/2010 | 8,750 | 17,500 | 140,858 | ||||||||||

| Sean T. Smith | 12/10/2010 | 12,500 | 25,000 | 201,225 | ||||||||||

| (1) | The number of shares of Common Stock underlying each option is equal to such number of options. The exercise price of each option awarded is $6.71. |

19

OUTSTANDING EQUITY AWARDS AT FISCAL

YEAR-END

OCTOBER 30, 2011

| Name | Option Awards | Stock Awards | |||||||||||||||

| Market | |||||||||||||||||

| No. of | Value | ||||||||||||||||

| Shares | of | ||||||||||||||||

| or | Shares | ||||||||||||||||

| Units | or | ||||||||||||||||

| No. of | No. of | of | Units of | ||||||||||||||

| Securities | Securities | Stock | Stock | ||||||||||||||

| Underlying | Underlying | That | That | ||||||||||||||

| Unexercised | Unexercised | Option | Have | Have | |||||||||||||

| Options | Options | Exercise | Option | Not | Not | ||||||||||||

| (#) | (#) | Price | Expiration | Vested | Vested | ||||||||||||

| Grant Date | Exercisable | Un-exercisable | ($) | Date | (#) | ($) | |||||||||||

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | |||||||||||

| Soo Hong Jeong | 12/9/2002 | 10,002 | (1) | 0 | 12.93 | 12/09/2012 | |||||||||||

| 2/17/2004 | 15,000 | (1) | 0 | 19.58 | 2/17/2014 | ||||||||||||

| 1/17/2005 | 125,000 | (1) | 0 | 14.56 | 1/17/2015 | ||||||||||||

| 6/2/2006 | 90,000 | (1) | 0 | 17.02 | 6/02/2016 | ||||||||||||

| 11/10/2008 | 50,000 | (1) | 50,000 | (2) | 0.76 | 11/10/2018 | |||||||||||

| 12/21/2009 | 16,250 | (1) | 48,750 | (2) | 4.42 | 12/21/2019 | |||||||||||

| 6/2/2006 | 11,250 | (3) | 73,013 | ||||||||||||||

| 1/21/2008 | 3,750 | (4) | 24,338 | ||||||||||||||

| 12/10/2010 | 16,250 | (4) | 105,463 | ||||||||||||||

| 12/10/2010 | 0 | 32,500 | (2) | 6.71 | 12/10/2020 | ||||||||||||

| Peter S. Kirlin | 8/29/2008 | 30,000 | (1) | 20,000 | (2) | 3.27 | 8/29/2018 | ||||||||||

| 11/10/2008 | 0 | 25,000 | (2) | 0.76 | 11/10/2018 | ||||||||||||

| 12/21/2009 | 8,750 | (1) | 26,250 | (2) | 4.42 | 12/21/2019 | |||||||||||

| 12/10/2010 | 10,000 | (4) | 64,900 | ||||||||||||||

| 12/10/2010 | 0 | 20,000 | (2) | 6.71 | 12/10/2020 | ||||||||||||

| Constantine S. Macricostas | 12/3/2001 | 60,000 | (1) | 0 | 26.95 | 12/3/2011 | |||||||||||

| 7/10/2002 | 20,000 | (1) | 0 | 15.90 | 7/10/2012 | ||||||||||||

| 2/17/2004 | 5,000 | (1) | 0 | 19.58 | 2/17/2014 | ||||||||||||

| 1/17/2005 | 25,000 | (1) | 0 | 14.56 | 1/17/2015 | ||||||||||||

| 2/14/2005 | 5,000 | (1) | 0 | 16.65 | 2/14/2015 | ||||||||||||

| 11/10/2008 | 0 | 150,000 | (2) | 0.76 | 11/10/2018 | ||||||||||||

| 12/21/2009 | 56,250 | (1) | 168,750 | (2) | 4.42 | 12/21/2019 | |||||||||||

| 12/10/2010 | 56,250 | (4) | 365,062 | ||||||||||||||

| 12/10/2010 | 0 | 112,500 | (2) | 6.71 | 12/10/2020 | ||||||||||||

| Christopher J. Progler | 12/3/2001 | 12,500 | (1) | 0 | 26.95 | 12/3/2011 | |||||||||||

| 7/10/2002 | 3,750 | (1) | 0 | 15.90 | 7/10/2012 | ||||||||||||

| 12/9/2002 | 2,368 | (1) | 0 | 12.93 | 12/09/2012 | ||||||||||||

| 1/17/2005 | 35,000 | (1) | 0 | 14.56 | 1/17/2015 | ||||||||||||

| 6/2/2006 | 80,000 | (1) | 0 | 17.02 | 6/02/2016 | ||||||||||||

| 11/10/2008 | 10,000 | (1) | 25,000 | (2) | 0.76 | 11/10/2018 | |||||||||||

| 12/21/2009 | 8,750 | (1) | 26,250 | (2) | 4.42 | 12/21/2019 | |||||||||||

| 6/2/2006 | 11,250 | (3) | 94,350.00 | ||||||||||||||

| 1/21/2008 | 2,500 | (4) | 31,450.00 | ||||||||||||||

| 12/10/2010 | 8,750 | (4) | 56,787 | ||||||||||||||

| 12/10/2010 | 0 | 17,500 | (2) | 6.71 | 12/10/2020 | ||||||||||||

20

| Name | Option Awards | Stock Awards | |||||||||||||||||||

| Market | |||||||||||||||||||||

| No. of | Value | ||||||||||||||||||||

| Shares | of | ||||||||||||||||||||

| or | Shares | ||||||||||||||||||||

| Units | or | ||||||||||||||||||||

| No. of | No. of | of | Units of | ||||||||||||||||||

| Securities | Securities | Stock | Stock | ||||||||||||||||||

| Underlying | Underlying | That | That | ||||||||||||||||||

| Unexercised | Unexercised | Option | Have | Have | |||||||||||||||||

| Options | Options | Exercise | Option | Not | Not | ||||||||||||||||

| (#) | (#) | Price | Expiration | Vested | Vested | ||||||||||||||||

| Grant Date | Exercisable | Un-exercisable | ($) | Date | (#) | ($) | |||||||||||||||

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | |||||||||||||||

| Sean T. Smith | 12/3/2001 | 4,401 | (1) | 0 | 26.95 | 12/3/2011 | |||||||||||||||

| 12/3/2001 | 8,099 | (1) | 0 | 26.95 | 12/3/2011 | ||||||||||||||||

| 7/10/2002 | 17,758 | (1) | 0 | 15.90 | 7/10/2012 | ||||||||||||||||

| 7/10/2002 | 7,242 | (1) | 0 | 15.90 | 7/10/2012 | ||||||||||||||||

| 12/9/2002 | 10,450 | (1) | 0 | 12.93 | 12/9/2012 | ||||||||||||||||

| 1/17/2005 | 75,000 | (1) | 0 | 14.56 | 1/17/2015 | ||||||||||||||||

| 6/2/2006 | 90,000 | (1) | 0 | 17.02 | 6/2/2016 | ||||||||||||||||

| 11/10/2008 | 0 | 32,500 | (2) | 0.76 | 11/10/2018 | ||||||||||||||||

| 6/2/2006 | 15,000 | (3) | 97,350 | ||||||||||||||||||

| 1/21/2008 | 3,125 | (4) | 20,281 | ||||||||||||||||||

| 12/21/2009 | 12,500 | (1) | 37,500 | (2) | 4.42 | 12/21/2019 | |||||||||||||||

| 12/10/2010 | 12,500 | (4) | 81,125 | ||||||||||||||||||

| 12/10/2010 | 0 | 25,000 | (2) | 6.71 | 12/10/2020 | ||||||||||||||||

| (1) | The options are fully vested and exercisable. | |

| (2) | The options vest 25% over 4 years on the anniversary date of the grant. | |

| (3) | Represents restricted stock award which vests 12.5% over 8 years on the anniversary date of the grant. | |

| (4) | Represents restricted stock award which vests 25% over 4 years on the anniversary date of the grant. | |

OPTION EXERCISES AND STOCK

VESTED

FISCAL YEAR ENDED OCTOBER 30, 2011

| Option Awards | Stock Awards | ||||||||||||

| No. of | No. of | ||||||||||||

| Shares | Value | Shares | Value | ||||||||||

| Acquired | Realized | Acquired | Realized | ||||||||||

| on Exercise | on Exercise | on Vesting | on Vesting | ||||||||||

| Name | (#) | ($) | (#) | ($) | |||||||||

| (a) | (b) | (c) | (d) | (e) | |||||||||

| Soo Hong Jeong | 0 | 0 | 7,500 | 60,563 | |||||||||

| Peter S. Kirlin | 30,000 | 142,565 | 0 | 0 | |||||||||

| 12,500 | 76,000 | 0 | 0 | ||||||||||

| Constantine S. Macricostas | 150,000 | 1,050,000 | 0 | 0 | |||||||||

| Christopher J. Progler | 2,500 | 12,250 | 6,250 | 52,538 | |||||||||

| Sean T. Smith | 16,250 | 98,432 | 8,125 | 68,713 | |||||||||

21

PENSION BENEFITS

The Company does not have a Defined Benefit Pension Plan that the Named Executive Officers participate in.

CERTAIN AGREEMENTS

Mr. Constantine Macricostas, Chairman of the Board of the Company and the Company entered into a 7 year consulting agreement dated July 11, 2005. Mr. Macricostas became Interim Chief Executive Officer on July 20, 2008, and became an employee of the Company on November 10, 2008. Mr. Macricostas became Chief Executive Officer and President on April 3, 2009. Mr. Macricostas receives a base salary of $600,000 as Chief Executive Officer. The consulting agreement between the Company and Mr. Macricostas is suspended for the period of time that Mr. Macricostas is an employee of the Company; however the term of the consulting agreement will be extended for the period of time that Mr. Macricostas is Chief Executive Officer and an employee of the Company. The Company also provides Mr. Macricostas with supplemental health insurance, provided the premiums do not exceed $15,000 per year, and use of an automobile owned by the Company. In Fiscal 2011, Mr. Macricostas was given a bonus of $130,000.00. He was also given his company car as a bonus as well. The value of his Company car was $7,104.