File No. 811-5017

File No. 33-11466

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

Form N-1A

REGISTRATION STATEMENT

UNDER

| THE SECURITIES ACT OF 1933 | ☒ | |||

| Post-Effective Amendment No. 76 | ☒ |

and/or

REGISTRATION STATEMENT

UNDER

| THE INVESTMENT COMPANY ACT OF 1940 | ☒ | |||

| Amendment No. 76 | ☒ |

IVY VARIABLE INSURANCE PORTFOLIOS

(a Delaware statutory trust)

(Exact Name as Specified in Charter)

| 6300 Lamar Avenue, Shawnee Mission, Kansas | 66202-4200 | |

| (Address of Principal Executive Office) | (Zip Code) |

Registrant’s Telephone Number, including Area Code (913) 236-2000

Philip A. Shipp

6300 Lamar Avenue

Shawnee Mission, Kansas 66202-4200

(Name and Address of Agent for Service)

Approximate date of proposed public offering: As soon as practicable after the effectiveness of this amendment to the Registrant’s registration statement.

It is proposed that this filing will become effective

| ☒ | immediately upon filing pursuant to paragraph (b) |

| ☐ | on (date) pursuant to paragraph (b) |

| ☐ | 60 days after filing pursuant to paragraph (a)(1) |

| ☐ | on (date) pursuant to paragraph (a)(1) |

| ☐ | 75 days after filing pursuant to paragraph (a)(2) |

| ☐ | on (date) pursuant to paragraph (a)(2) of Rule 485 |

| ☐ | this post-effective amendment designates a new effective date for a previously filed post-effective amendment |

If appropriate, check the following box:

| ☐ | this post-effective amendment designates a new effective date for a previously filed post-effective amendment |

DECLARATION REQUIRED BY RULE 24f-2

The issuer has registered an indefinite amount of its securities under the Securities Act of 1933 pursuant to Rule 24f-2. Notice for the Registrant’s fiscal year ended December 31, 2017 was filed on March 15, 2018.

This Post-Effective Amendment No. 76 (Amendment) to the registration statement of Ivy Variable Insurance Portfolios (Registrant) on Form N-1A is being filed pursuant to Rule 485(b) under the Securities Act of 1933 (1933 Act) and the Investment Company Act of 1940 to amend and supplement Post-Effective Amendment No. 73 to the Registrant’s registration statement on Form N-1A filed on April 27, 2018 (Accession No. 0001193125-18-138980) as it relates only to the prospectus (Part A) and statement of additional information (SAI) (Part B) of the Ivy VIP Small Cap Growth (Portfolio), a series of the Registrant. The prospectus and SAI of the Portfolio, as filed in Post-Effective Amendment No. 73, are incorporated into this Amendment by reference. This Amendment is being filed to register an additional class of shares for the Portfolio under the 1933 Act. This Amendment does not otherwise delete, amend or supersede any other information relating to any other series of the Registrant.

Ivy Variable Insurance Portfolios

Supplement dated August 6, 2018 to the

Ivy Variable Insurance Portfolios Prospectus

dated April 30, 2018

as supplemented May 8, 2018 and June 29, 2018

In connection with an upcoming reorganization of the Ivy VIP Micro Cap Growth into the Ivy VIP Small Cap Growth (the Portfolio), which is expected to close in November 2018 (the Reorganization), the Portfolio will begin offering Class I shares upon the closing of the Reorganization. Therefore, the prospectus of the Portfolio is amended as follows:

| I. | In the Portfolio Summary, the table in the “Fees and Expenses” section of the prospectus is replaced with the following: |

Shareholder Fees

| (fees paid directly from your investment) | N/A | |||

Annual Portfolio Operating Expenses

| (expenses that you pay each year as a % of the value of your investment) | Class I1 | Class II | ||||||

| Management Fees |

0.85% | 0.85% | ||||||

| Distribution and Service (12b-1) Fees |

0.00% | 0.25% | ||||||

| Other Expenses |

0.07% | 0.07% | ||||||

| Total Annual Portfolio Operating Expenses |

0.92% | 1.17% | ||||||

| Fee Waiver and/or Expense Reimbursement2,3 |

0.03% | 0.03% | ||||||

| Total Annual Portfolio Operating Expenses After Fee Waiver and/or Expense Reimbursement4 |

0.89% | 1.14% | ||||||

| 1 | Class I shares of the Portfolio are new and have been created to be used in connection with an upcoming reorganization of the Ivy VIP Micro Cap Growth into the Portfolio, which is expected to close in November 2018 (the Reorganization). Class I shares of the Portfolio will not be offered until the closing of the Reorganization. Expenses of the Class I shares assume consummation of the Reorganization. |

| 2 | Through April 30, 2020, Ivy Investment Management Company (IICO), the Portfolio’s investment manager, Ivy Distributors, Inc. (IDI), the Portfolio’s distributor, and/or Waddell & Reed Services Company, doing business as WI Services Company (WISC), the Portfolio’s transfer agent, have contractually agreed to reimburse sufficient management fees, 12b-1 fees and/or shareholder servicing fees to cap the total annual ordinary portfolio operating expenses (which would exclude interest, taxes, brokerage commissions, acquired fund fees and expenses and extraordinary expenses, if any) for Class II shares at 1.14%. Prior to that date, the expense limitation may not be terminated without the consent of the Board of Trustees. |

| 3 | Through April 30, 2020, IDI and/or WISC have contractually agreed to reimburse sufficient fees to ensure that the total annual ordinary portfolio operating expenses (which would exclude interest, taxes, brokerage commissions, acquired fund fees and expenses and extraordinary expenses, if any) of the Class I shares are at all times equal to the total annual ordinary portfolio operating expenses of the Class II shares less 0.25%, as calculated at the end of each month. Prior to that date, the expense limitation may not be terminated without the consent of the Board of Trustees. |

| 4 | The Total Annual Portfolio Operating Expenses After Fee Waiver and/or Expense Reimbursement ratio shown above does not correlate to the expense ratio shown in the Financial Highlights table because it has been restated to reflect the Portfolio’s contractual class waiver. |

| II. | In the Portfolio Summary, the “Example” section of the prospectus is replaced with the following: |

Example

This example is intended to help you compare the cost of investing in the shares of the Portfolio with the cost of investing in other portfolios. This example does not reflect any fees and expenses imposed under the Policies.

The example assumes that you invest $10,000 in the shares of the Portfolio for the time periods indicated. The example also assumes that your investment has a 5% return each year, that the Portfolio’s operating expenses remain the same and that expenses were capped for the period indicated above. The costs are the same for each time period if you continue to hold your shares or if you redeem all your shares at the end of those periods. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Class I |

$ | 91 | $ | 287 | $ | 503 | $ | 1,126 | ||||||||

| Class II |

116 | 366 | 638 | 1,415 | ||||||||||||

| Supplement | Prospectus | 1 |

| III. | In the Portfolio Summary, the “Performance” section of the prospectus is replaced with the following: |

Performance

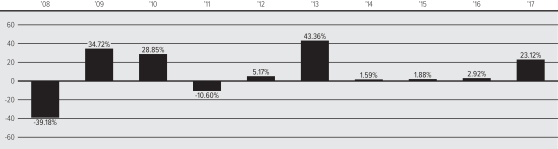

The chart and table below provide some indication of the risks of investing in the Portfolio. The chart shows how performance has varied from year to year for Class II shares of the Portfolio. The table shows the average annual total returns for Class II shares of the Portfolio and also compares the Portfolio’s returns with those of a broad-based securities market index and a Lipper peer group (a universe of mutual funds with investment objectives similar to that of the Portfolio). The performance results do not reflect any Policy-related fees and expenses, which would reduce the performance results.

Performance results include the effect of expense reduction arrangements for some or all of the periods shown. If those arrangements had not been in place, the performance results for those periods would have been lower.

The Portfolio’s past performance does not necessarily indicate how it will perform in the future. Current performance may be lower or higher. Please call 800.777.6472 for the Portfolio’s updated performance.

No performance information is presented for the Portfolio’s Class I shares because the share class has not been in existence for a full calendar year. Once that Class has a full calendar year of performance, it will be included in the table below.

Chart of Year-by-Year Returns

as of December 31 each year

|

|

In the period shown in the chart, the highest quarterly return was 24.14% (the second quarter of 2009) and the lowest quarterly return was -28.33% (the third quarter of 2011). The Class II return for the year through June 30, 2018 was 11.89%. |

Average Annual Total Returns

| as of December 31, 2017 | 1 Year | 5 Years | 10 Years | |||||||||

| Class II Shares of Ivy VIP Small Cap Growth |

23.12% | 13.46% | 6.44% | |||||||||

| Russell 2000 Growth Index (reflects no deduction for fees, expenses or taxes) |

22.17% | 15.21% | 9.19% | |||||||||

| Lipper Variable Annuity Small-Cap Growth Funds Universe Average (net of fees and expenses) |

24.34% | 14.40% | 8.69% | |||||||||

| IV. | In the Portfolio Summary, the first paragraph under “Purchase and Sale of Portfolio Shares” of the prospectus is replaced with the following: |

Shares of the Portfolio currently are sold only to separate accounts of Participating Insurance Companies to fund benefits payable under the Policies. Class I shares are expected to commence operations in November 2018, upon closing of the Reorganization. Class I shares may be purchased only through fund of funds, advisory or trust accounts, wrap accounts or other asset allocation or fee-based investment arrangements.

| V. | The first paragraph in the “The Management of the Portfolios — Multiple Class Information and Service Plan Arrangements” subsection of the prospectus is replaced with the following: |

Multiple Class Information and Service Plan Arrangements

The Trust offers two classes of shares: Class I and Class II. Each Portfolio offers Class II shares. In addition, Ivy VIP Micro Cap Growth, Ivy VIP Mid Cap Growth, Ivy VIP High Income, Ivy VIP Asset Strategy, Ivy VIP Energy, Ivy VIP Science and

| 2 | Prospectus | Supplement |

Technology and Ivy VIP Small Cap Growth (upon closing of the Reorganization) also offer Class I shares. The different classes of shares represent investments in the same portfolio of securities, but the classes are subject to different expenses and usually will have different share prices. Class II shares are subject to a service plan that is described below. Class I shares are not subject to a service plan and may be purchased only through fund of funds, advisory or trust accounts, wrap accounts or other asset allocation or fee-based investment arrangements. Different fees and expenses will affect performance.

| VI. | The “Financial Highlights” disclosure section of the prospectus is modified by adding the following paragraph: |

Class I shares of Ivy VIP Small Cap Growth are new and do not have an operating history as of the date of this Prospectus. Information on Class I shares, when available, will be included in the next Annual or Semiannual Report.

Please keep this supplement with your prospectus for future reference.

| Supplement | Prospectus | 3 |

Ivy Variable Insurance Portfolios

Supplement dated August 6, 2018 to the

Ivy Variable Insurance Portfolios

Statement of Additional Information

dated April 30, 2018

as supplemented May 8, 2018

In connection with an upcoming reorganization of the Ivy VIP Micro Cap Growth into the Ivy VIP Small Cap Growth (the Portfolio), which is expected to close in November 2018 (the Reorganization), the Portfolio will begin offering Class I shares upon the closing of the Reorganization. Therefore, the statement of additional information (SAI) of the Portfolio is amended as follows:

| I. | The first paragraph and corresponding table under the “Control Persons and Principal Holders of Securities” section on page 67 of the SAI as it relates to the Portfolio only are replaced with the following: |

The following table sets forth information with respect to the Portfolio, as of July 25, 2018, regarding the record or beneficial ownership of 5% or more of any class of the Portfolio’s shares.

| Class |

Ownership |

Shareholder Name |

City and State |

Amount of Shares Owned |

Percentage of Class Owned | |||||

| II | Record | AXA Equitable Life Insurance Co. | Jersey City, NJ | 7,129,733.306 | 24.14% | |||||

| II | Record | Minnesota Life Insurance Co. | St. Paul, MN | 2,706,581.652 | 9.16% | |||||

| II | Record | Nationwide Investment Services Corp. | Columbus, OH | 7,339,228.045 | 24.85% | |||||

| II | Record | United Investors Life | Birmingham, AL | 5,270,957.992 | 17.85% | |||||

| II | Record | Waddell & Reed, Inc. | Mission, KS | 1,993,413.056 | 6.75% | |||||

| II. | The paragraph immediately following the table under the “Control Persons and Principal Holders of Securities” section on page 73 of the SAI as it relates to the Portfolio only is replaced with the following: |

As of July 25, 2018, all of the Trustees and officers of the Trust, as a group, beneficially owned less than 1% of the outstanding shares of each class of the Portfolio.

| III. | The third paragraph in the “Trust Shares” section beginning on page 99 of the SAI is replaced with the following: |

Each Portfolio currently offers Class II shares. Ivy VIP Asset Strategy, Ivy VIP Energy, Ivy VIP High Income, Ivy VIP Micro Cap Growth, Ivy VIP Mid Cap Growth, Ivy VIP Science and Technology and Ivy VIP Small Cap Growth (upon closing of the Reorganization) currently also offer Class I shares. The different classes of shares represent investments in the same portfolio of securities, but the classes are subject to different expenses and usually will have different share prices. Class II shares are subject to a service plan that is described above. Class I shares are not subject to a service plan and may be purchased only through fund of funds, advisory or trust accounts, wrap accounts or other asset allocation or fee-based investment arrangements. Except as described below, all classes of shares of the Portfolios have identical voting, dividend, liquidation and other rights, preferences, terms and conditions. The only differences between the classes are (a) each class may be subject to different expenses specific to that class; (b) each class has a different identifying designation or name; and (c) each class has exclusive voting rights with respect to matters solely affecting that class.

Please keep this supplement for future reference.

| Supplement | Statement of Additional Information | 1 |

PART C: OTHER INFORMATION

Item 28. Exhibits:

| (a) | Articles of Incorporation: | |||

| (a)(1) | Trust Instrument for Ivy Funds Variable Insurance Portfolios dated January 15, 2009, filed with Post-Effective Amendment No. 47, and incorporated by reference herein. | |||

| (a)(2) | Schedule A to the Trust Instrument for Ivy Funds Variable Insurance Portfolios as amended and effective August 11, 2010, filed with Post-Effective Amendment No. 58, and incorporated by reference herein. | |||

| (a)(3) | Schedule A to the Trust Instrument for Ivy Funds Variable Insurance Portfolios, amended and effective May 22, 2013, filed with Post-Effective Amendment No. 61, and incorporated by reference herein. | |||

| (a)(4) | Schedule A to the Trust Instrument for Ivy Funds Variable Insurance Portfolios, amended and effective January 1, 2015, filed with Post-Effective Amendment No. 65, and incorporated by reference herein. | |||

| (a)(5) | Schedule A to the Trust Instrument for Ivy Variable Insurance Portfolios, amended and effective April 28, 2017, filed with Post-Effective Amendment No. 70, and incorporated by reference herein. | |||

| (a)(6) | Amended and Restated Agreement and Declaration of Trust for Ivy Variable Insurance Portfolios, dated August 16, 2017, filed with Post-Effective Amendment No. 73, and incorporated by reference herein. | |||

| (a)(7) | Amended and Restated Schedule A to the Amended and Restated Agreement and Declaration of Trust for Ivy Variable Insurance Portfolios, amended April 30, 2018, filed with Post-Effective Amendment No. 73, and incorporated by reference herein. | |||

| (a)(8) | Amended and Restated Schedule A to the Amended and Restated Agreement and Declaration of Trust for Ivy Variable Insurance Portfolios, filed with this Post-Effective Amendment No. 76. | |||

| (b) | By-laws: | |||

| (b)(1) | By-laws for Ivy Funds Variable Insurance Portfolios dated January 15, 2009, filed with Post-Effective Amendment No. 47, and incorporated by reference herein. | |||

| (b)(2) | Amended and Restated By-laws for Ivy Variable Insurance Portfolios dated August 16, 2017, filed with Post-Effective Amendment No. 73, and incorporated by reference herein. | |||

| (c) | Instruments Defining the Rights of Security Holders: | |||

| Articles IV, V, VI, and IX of the Trust Instrument and Articles II and VII of the Bylaws each define the rights of shareholders. | ||||

| (d) | Investment Advisory Contracts: | |||

| (d)(1) | Investment Management Agreement between Ivy Funds Variable Insurance Portfolios and Waddell & Reed Investment Management Company on behalf of each of the Funds in the Trust, dated April 10, 2009, filed with Post-Effective Amendment No. 49, and incorporated by reference herein. | |||

| (d)(2) | Investment Management Agreement between Ivy Funds Variable Insurance Portfolios and Waddell & Reed Investment Management Company on behalf of each of the Subadvised Funds in the Trust, dated April 10, 2009, filed with Post-Effective Amendment No. 49, and incorporated by reference herein. | |||

| (d)(3) | Investment Subadvisory Agreement between Waddell & Reed Investment Management Company and Advantus Capital Management, Inc., effective April 30, 2009, filed with Post-Effective Amendment No. 49, and incorporated by reference herein. | |||

| (d)(4) | Investment Subadvisory Agreement between Waddell & Reed Investment Management Company and Mackenzie Financial Corporation, effective April 30, 2009, filed with Post-Effective Amendment No. 49, and incorporated by reference herein. | |||

| (d)(5) | Investment Subadvisory Agreement between Templeton Investment Counsel, LLC, and Templeton Global Advisors Limited, effective April 30, 2009, filed with Post-Effective Amendment No. 49, and incorporated by reference herein. | |||

| (d)(6) | Investment Subadvisory Agreement between Waddell & Reed Investment Management Company and Templeton Investment Counsel, LLC, effective April 30, 2009, filed with Post-Effective Amendment No. 49, and incorporated by reference herein. | |||

| (d)(7) | Investment Subadvisory Agreement between Waddell & Reed Investment Management Company and Wall Street Associates, effective April 30, 2009, filed with Post-Effective Amendment No. 49, and incorporated by reference herein. | |||

| (d)(8) | Amendment to Investment Subadvisory Agreement between Waddell & Reed Investment Management Company and Advantus Capital Management, Inc., effective May 20, 2009, filed with Post-Effective Amendment No. 50, and incorporated by reference herein. | |||

| (d)(9) | Appendix A and Appendix B to the Investment Management Agreement between Ivy Funds Variable Insurance Portfolios and Waddell & Reed Investment Management Company on behalf of each series of the Trust listed in Appendix A, as amended April 1, 2010, filed with Post-Effective Amendment No. 51, and incorporated by reference herein. | |||

| (d)(10) | Appendix A and Appendix B to the Investment Management Agreement between Ivy Funds Variable Insurance Portfolios and Waddell & Reed Investment Management Company on behalf of each series of the Trust listed in Appendix A, as amended August 11, 2010, filed with Post-Effective Amendment No. 53, and incorporated by reference herein. | |||

| (d)(11) | Investment Management Fee Reduction Agreement between Waddell & Reed Investment Management Company and Ivy Funds Variable Insurance Portfolios on behalf of its series Ivy Funds VIP Real Estate Securities, effective December 3, 2012, filed with Post-Effective Amendment No. 58, and incorporated by reference herein. | |||

| (d)(12) | Investment Management Fee Reduction Agreement between Waddell & Reed Investment Management Company and Advantus Capital Management, Inc. regarding Ivy Funds VIP Real Estate Securities, effective December 3, 2012, filed with Post-Effective Amendment No. 58, and incorporated by reference herein. | |||

| (d)(13) | Commodity Exchange Act Agreement between Waddell & Reed Investment Management Company and Advantus Capital Management, Inc., dated February 20, 2013 and effective April 1, 2013, filed with Post-Effective Amendment No. 58, and incorporated by reference herein. | |||

| (d)(14) | Commodity Exchange Act Agreement between Waddell & Reed Investment Management Company and Mackenzie Financial Corporation, dated February 20, 2013 and effective April 1, 2013, filed with Post-Effective Amendment No. 58, and incorporated by reference herein. | |||

| (d)(15) | Commodity Exchange Act Agreement between Waddell & Reed Investment Management Company and Wall Street Associates, LLC, dated February 20, 2013 and effective April 1, 2013, filed with Post-Effective Amendment No. 58, and incorporated by reference herein. | |||

| (d)(16) | Appendix A and Appendix B to the Investment Management Agreement between Ivy Funds Variable Insurance Portfolios and Waddell & Reed Investment Management Company on behalf of each series of the Trust listed in Appendix A, filed with Post-Effective Amendment No. 61, and incorporated by reference herein. | |||

| (d)(17) | Investment Sub-Advisory Agreement between Waddell & Reed Investment Management Company and Advantus Capital Management, Inc. regarding Ivy Funds VIP Pathfinder Moderate – Managed Volatility, Ivy Funds VIP Pathfinder Moderately Aggressive – Managed Volatility and Ivy Funds VIP Pathfinder Moderately Conservative – Managed Volatility, filed with Post-Effective Amendment No. 61, and incorporated by reference herein. | |||

| (d)(18) | Appendix A to the Investment Management Agreement between Ivy Funds Variable Insurance Portfolios and Waddell & Reed Investment Management Company on behalf of each series of the Trust listed in Appendix A, as amended January 1, 2015, filed with Post-Effective Amendment No. 65, and incorporated by reference herein. | |||

| (d)(19) | Appendix B to the Investment Management Agreement between Ivy Funds Variable Insurance Portfolios and Waddell & Reed Investment Management Company on behalf of each series of the Trust listed in Appendix B, as amended January 1, 2015, filed with Post-Effective Amendment No. 65, and incorporated by reference herein. | |||

| (d)(20) | Investment Management Fee Reduction Agreement between Waddell & Reed Investment Management Company and Ivy Funds Variable Insurance Portfolios on behalf of its series Ivy Funds VIP Real Estate Securities, effective May 1, 2015, filed with Post-Effective Amendment No. 65, and incorporated by reference herein. | |||

| (d)(21) | Investment Management Fee Reduction Agreement between Waddell & Reed Investment Management Company and Advantus Capital Management, Inc. regarding Ivy Funds VIP Real Estate Securities, effective May 1, 2015, filed with Post-Effective Amendment No. 65, and incorporated by reference herein. | |||

| (d)(22) | Investment Management Fee Reduction Agreement between Waddell & Reed Investment Management Company and Ivy Funds Variable Insurance Portfolios on behalf of its series Ivy Funds VIP Real Estate Securities, effective May 1, 2016, filed Post-Effective Amendment No. 67, and incorporated by reference herein. | |||

| (d)(23) | Investment Management Agreement between Ivy Variable Insurance Portfolios and Ivy Investment Management Company on behalf of each series of the Trust listed in Appendix A, dated July 29, 2016, filed with Post-Effective Amendment No. 70, and incorporated by reference herein. | |||

| (d)(24) | Investment Management Agreement between Ivy Variable Insurance Portfolios and Ivy Investment Management Company regarding Ivy VIP Advantus Real Estate Securities, Ivy VIP International Core Equity, Ivy VIP Micro Cap Growth, Ivy VIP Natural Resources, Ivy VIP Pathfinder Moderate – Managed Volatility, Ivy VIP Pathfinder Moderately Aggressive – Managed Volatility, Ivy VIP Pathfinder Moderately Conservative – Managed Volatility and Ivy VIP Small Cap Core, dated July 29, 2016, filed with Post-Effective Amendment No. 70, and incorporated by reference herein. | |||

| (d)(25) | Investment Sub-Advisory Agreement between Ivy Investment Management Company and Advantus Capital Management, Inc. regarding Ivy VIP Advantus Real Estate Securities, filed with Post-Effective Amendment No. 70, and incorporated by reference herein. | |||

| (d)(26) | Investment Sub-Advisory Agreement between Ivy Investment Management Company and Advantus Capital Management, Inc. regarding Ivy VIP Pathfinder Moderate – Managed Volatility, Ivy VIP Pathfinder Moderately Aggressive – Managed Volatility and Ivy VIP Pathfinder Moderately Conservative – Managed Volatility, filed with Post-Effective Amendment No. 70, and incorporated by reference herein. | |||

| (d)(27) | Investment Management Fee Reduction Agreement between Ivy Investment Management Company and Ivy Variable Insurance Portfolios regarding Ivy VIP Advantus Real Estate Securities, effective May 1, 2017, filed with Post-Effective Amendment No. 70, and incorporated by reference herein. | |||

| (d)(28) | Amended and Restated Appendix A to the Investment Management Agreement between Ivy Variable Insurance Portfolios and Ivy Investment Management Company on behalf of each series of the Trust listed in Appendix A, amended and effective April 30, 2018, filed with Post-Effective Amendment No. 73, and incorporated by reference herein. | |||

| (d)(29) | Amended and Restated Appendix B to the Investment Management Agreement between Ivy Variable Insurance Portfolios and Ivy Investment Management Company on behalf of each series of the Trust listed in Appendix B, filed with Post-Effective Amendment No. 73, and incorporated by reference herein. | |||

| (d)(30) | Amended and Restated Appendix A to the Investment Management Agreement between Ivy Variable Insurance Portfolios and Ivy Investment Management Company on behalf of each series of the Trust listed in Appendix A, filed with Post-Effective Amendment No. 73, and incorporated by reference herein. | |||

| (d)(31) | Amended and Restated Appendix B to the Investment Management Agreement between Ivy Variable Insurance Portfolios and Ivy Investment Management Company on behalf of each series of the Trust listed in Appendix B, amended and effective April 30, 2018, filed with Post-Effective Amendment No. 73, and incorporated by reference herein. | |||

| (d)(32) | Investment Management Fee Reduction Agreement between Ivy Investment Management Company and Ivy Variable Insurance Portfolios regarding Ivy VIP Advantus Real Estate Securities, effective April 30, 2018, filed with Post-Effective Amendment No. 73, and incorporated by reference herein. | |||

| (e) | Underwriting Contracts: | |||

| Distribution Contract between TMK/United Funds, Inc. and United Investors Life Insurance Company, dated April 4, 1997, filed by EDGAR on March 1, 2001 as EX-99.B(e)tmkdist to Post-Effective Amendment No. 24 to the Registration Statement on Form N-1A* | ||||

| Agreement Amending Distribution Contract, dated March 3, 1998, reflecting termination of the agreement as of December 31, 1998 filed by EDGAR on March 1, 2001 as EX-99.B(e)tmkterm1 to Post-Effective Amendment No. 24 to the Registration Statement on Form N-1A* | ||||

| Agreement Amending Distribution Contract, effective December 31, 1998, to rescind the provision to terminate the agreement filed by EDGAR on March 1, 2001 as EX-99.B(e)amnddist to Post-Effective Amendment No. 24 to the Registration Statement on Form N-1A* | ||||

| Letter Agreement, dated July 8, 1999, filed by EDGAR on March 1, 2001 as EX-99.B(e)amendpua to Post-Effective Amendment No. 24 to the Registration Statement on Form N-1A* | ||||

| Limited Selling Agreement, dated May 16, 2001, filed by EDGAR on April 29, 2002 as EX-99.B(e)tgtuilicsel to Post-Effective Amendment No. 27 to the Registration Statement on Form N-1A* | ||||

| Fund Participation Agreement with Nationwide Life Insurance Company, dated December 1, 2000, filed by EDGAR on March 1, 2001 as EX-99.B(e)tgtnwpart to Post-Effective Amendment No. 24 to the Registration Statement on Form N-1A* | ||||

| Amendment 1, effective November 5, 2003, to the Fund Participation Agreement with Nationwide Life Insurance Company, dated December 1, 2000, filed by EDGAR on April 29, 2008 as EX-99.B(e)nwpartamend1 to Post-Effective Amendment No. 46 to the Registration Statement on Form N-1A* | ||||

| Amendment 2, dated December 11, 2007, to the Fund Participation Agreement with Nationwide Life Insurance Company, dated December 1, 2000, filed by EDGAR on April 29, 2008 as EX-99.B(e)nwpartamend2 to Post-Effective Amendment No. 46 to the Registration Statement on Form N-1A* | ||||

| Amendment 3, effective February 14, 2008, to the Fund Participation Agreement with Nationwide Life Insurance Company, dated December 1, 2000, filed by EDGAR on April 29, 2008 as EX-99.B(e)nwpartamend3 to Post-Effective Amendment No. 46 to the Registration Statement on Form N-1A* | ||||

| Fund Participation Agreement with Minnesota Life Insurance Company, dated September 19, 2003, filed by EDGAR September 19, 2003 as EX-99.B(e)tgtmlipart to Post-Effective Amendment No. 34 to the Registration Statement on Form N-1A* | ||||

| Amendment 1, effective April 29, 2005, to the Fund Participation Agreement with Minnesota Life Insurance Company, dated September 19, 2003, filed by EDGAR on April 29, 2008 as EX-99.B(e)mnl1partamend1 to Post-Effective Amendment No. 46 to the Registration Statement on Form N-1A* | ||||

| Amendment 2, dated July 1, 2007, to the Fund Participation Agreement with Minnesota Life Insurance Company, dated September 19, 2003, filed by EDGAR on April 29, 2008 as EX-99.B(e)mnl1partamend2 to Post-Effective Amendment No. 46 to the Registration Statement on Form N-1A* | ||||

| Fund Participation Agreement with Minnesota Life Insurance Company, dated December 12, 2003, filed by EDGAR on April 28, 2005 as EX-99.B(e)tgtmlipart2 to Post-Effective Amendment No. 39 to the Registration Statement on Form N-1A* | ||||

| Amendment 1, dated June 4, 2004, to the Fund Participation Agreement with Minnesota Life Insurance Company, dated December 12, 2003, filed by EDGAR on April 29, 2008 as EX-99.B(e)mnl2partamend1 to Post-Effective Amendment No. 46 to the Registration Statement on Form N-1A* | ||||

| Amendment 2, effective April 29, 2005, to the Fund Participation Agreement with Minnesota Life Insurance Company, dated December 12, 2003, filed by EDGAR on April 29, 2008 as EX-99.B(e)mnl2partamend2 to Post-Effective Amendment No. 46 to the Registration Statement on Form N-1A* | ||||

| Amendment 3, dated July 1, 2007, to the Fund Participation Agreement with Minnesota Life Insurance Company, dated December 12, 2003, filed by EDGAR on April 29, 2008 as EX-99.B(e)mnl2partamend3 to Post-Effective Amendment No. 46 to the Registration Statement on Form N-1A* | ||||

| Amendment 4, dated March 1, 2008, to the Fund Participation Agreement with Minnesota Life Insurance Company, dated December 12, 2003, filed by EDGAR on April 29, 2008 as EX-99.B(e)mnl2partamend4 to Post-Effective Amendment No. 46 to the Registration Statement on Form N-1A* | ||||

| Fund Participation Agreement with Northstar Life Insurance Company, dated April 30, 2004, filed by EDGAR on April 28, 2005 as EX-99.B(e)tgtnstrpart to Post-Effective Amendment No. 39 to the Registration Statement on Form N-1A* | ||||

| (e)(1) | Participation Agreement with The Union Central Life Insurance Company, dated November 3, 2008, filed with Post-Effective Amendment No. 49, and incorporated by reference herein. | |||

| (e)(2) | Participation Agreement with The Ohio National Life Insurance Company, dated September 22, 2008, filed with Post-Effective Amendment No. 49, and incorporated by reference herein. | |||

| (e)(3) | Participation Agreement with National Security Life and Annuity Company, dated September 22, 2008, filed with Post-Effective Amendment No. 49, and incorporated by reference herein. | |||

| (e)(4) | Trademark License Agreement by and among Ivy Funds Distributor, Inc., Waddell & Reed, Inc. and Ivy Funds Variable Insurance Portfolios, dated April 15, 2009, filed with Post-Effective Amendment No. 49, and incorporated by reference herein. | |||

| (e)(5) | Underwriting Agreement between Ivy Funds Variable Insurance Portfolios and Waddell & Reed, Inc., dated April 15, 2009, filed with Post-Effective Amendment No. 49, and incorporated by reference herein. | |||

| (e)(6) | Schedule A to the Underwriting Agreement between Ivy Funds Variable Insurance Portfolios and Waddell & Reed, Inc., as amended April 1, 2010, filed with Post-Effective Amendment No. 51, and incorporated by reference herein. | |||

| (e)(7) | Form of Participation Agreement, filed with Post-Effective Amendment No. 52, and incorporated by reference herein. | |||

| (e)(8) | Schedule A to the Underwriting Agreement between Ivy Funds Variable Insurance Portfolios and Waddell & Reed, Inc., as amended August 11, 2010, filed with Post-Effective Amendment No. 53, and incorporated by reference herein. | |||

| (e)(9) | Underwriting Agreement between Ivy Funds Variable Insurance Portfolios and Waddell & Reed, Inc., dated April 15, 2009, as amended May 22, 2012, filed with Post-Effective Amendment No. 58, and incorporated by reference herein. | |||

| (e)(10) | Schedule A to the Underwriting Agreement between Ivy Funds Variable Insurance Portfolios and Waddell & Reed, Inc., filed with Post-Effective Amendment No. 61, and incorporated by reference herein. | |||

| (e)(11) | Schedule A to the Underwriting Agreement between Ivy Funds Variable Insurance Portfolios and Waddell & Reed, Inc., as amended January 1, 2015, filed with Post-Effective Amendment No. 65, and incorporated by reference herein. | |||

| (e)(12) | Underwriting Agreement between Ivy Variable Insurance Portfolios and Ivy Distributors, Inc., dated October 1, 2016, as amended April 28, 2017, filed with Post-Effective Amendment No. 70, and incorporated by reference herein. | |||

| (e)(13) | Amended and Restated Schedule A to the Underwriting Agreement between Ivy Variable Insurance Portfolios and Ivy Distributors, Inc., amended and effective April 30, 2018, filed with Post-Effective Amendment No. 73, and incorporated by reference herein. | |||

| (e)(14) | Amended and Restated Schedule A to the Underwriting Agreement between Ivy Variable Insurance Portfolios and Ivy Distributors, Inc., filed with this Post-Effective Amendment No. 76. | |||

| (f) | Bonus or Profit Sharing Contracts: Not applicable. | |||

| (g) | Custodian Agreements: | |||

| Custodian Agreement for W&R Target Funds, Inc. on behalf of each of its Portfolios, filed by EDGAR on September 5, 2003 as EX-99.B(g)tgtca to Post-Effective Amendment No. 33 to the Registration Statement on Form N-1A* | ||||

| Appendix B to the Custodian Agreement, amended to include Global Natural Resources Portfolio and Mid Cap Growth Portfolio, filed by EDGAR on March 2, 2005 as EX-99.B(g)tgtcaexb to Post-Effective Amendment No. 38 to the Registration Statement on Form N-1A* | ||||

| Appendix B to the Custodian Agreement, amended November 9, 2005 to include Energy Portfolio, filed by EDGAR on April 3, 2006 as EX-99.B(g)tgtcaexb2 to Post-Effective Amendment No. 41 to the Registration Statement on Form N-1A* | ||||

| Appendix B to the Custodian Agreement, amended November 28, 2007 to include Pathfinder Aggressive Portfolio, Pathfinder Moderately Aggressive Portfolio, Pathfinder Moderate Portfolio, Pathfinder Moderately Conservative Portfolio and Pathfinder Conservative Portfolio, filed by EDGAR on December 28, 2007 as EX-99.B(g)tgtcaexb3 to Post-Effective Amendment No. 45 to the Registration Statement on Form N-1A* | ||||

| The Custodian Agreements and revised Appendix A for each of the predecessor funds of which the series of the Registrant are the successor are substantially identical to the Custodian Agreement that is incorporated by reference. | ||||

| (g)(1) | Assignment of the Custodian Agreements for the Registrant and for each of the predecessor funds to which a series of the Registrant is the successor, dated April 30, 2009, filed with Post-Effective Amendment No. 49, and incorporated by reference herein. | |||

| (g)(3) | Schedule A to the Assignment and Amendment of Custodian Agreements for the Registrant and for each of the predecessor funds to which a series of the Registrant is the successor, as amended April 1, 2010, filed with Post-Effective Amendment No. 51, and incorporated by reference herein. | |||

| (g)(5) | Schedule A to the Assignment and Amendment of Custodian Agreements for the Registrant and for each of the predecessor funds to which a series of the Registrant is the successor, as amended August 11, 2010, filed with Post-Effective Amendment No. 53, and incorporated by reference herein. | |||

| (g)(7) | Custody Agreement between Ivy Funds Variable Insurance Portfolios, on behalf of each of the funds listed on Schedule I, and The Bank of New York Mellon, dated March 9, 2012, filed with Post-Effective Amendment No. 58, and incorporated by reference herein. | |||

| (g)(8) | Schedule I to the Custody Agreement between Ivy Funds Variable Insurance Portfolios, on behalf of each of the funds listed on Schedule I, and The Bank of New York Mellon, as amended April 17, 2013, filed with Post-Effective Amendment No. 58, and incorporated by reference herein. | |||

| (g)(9) | Foreign Custody Manager Agreement between Ivy Funds Variable Insurance Portfolios, on behalf of each of its series on Annex I, and The Bank of New York Mellon, dated March 9, 2012, filed with Post-Effective Amendment No. 58, and incorporated by reference herein. | |||

| (g)(10) | Schedule I to the Custody Agreement between Ivy Funds Variable Insurance Portfolios, on behalf of each of the funds listed on Schedule I, and The Bank of New York Mellon, filed with Post-Effective Amendment No. 61, and incorporated by reference herein. | |||

| (g)(11) | Annex I to the Foreign Custody Manager Agreement between Ivy Funds Variable Insurance Portfolios, on behalf of each of its series on Annex I, and The Bank of New York Mellon, filed with Post-Effective Amendment No. 61, and incorporated by reference herein. | |||

| (g)(12) | Schedule I to the Custody Agreement between Ivy Funds Variable Insurance Portfolios, on behalf of each of the funds listed on Schedule I, and The Bank of New York Mellon, as amended January 1, 2015, filed with Post-Effective Amendment No. 65, and incorporated by reference herein. | |||

| (g)(13) | Annex I to the Foreign Custody Manager Agreement between Ivy Funds Variable Insurance Portfolios, on behalf of each of its series on Annex I, and The Bank of New York Mellon, as amended January 1, 2015, filed with Post-Effective Amendment No. 65, and incorporated by reference herein. | |||

| (g)(14) | Annex I to the Foreign Custody Manager Agreement between Ivy Variable Insurance Portfolios, on behalf of each of its series on Annex I, and The Bank of New York Mellon, as amended April 28, 2017, filed with Post-Effective Amendment No. 70, and incorporated by reference herein. | |||

| (g)(15) | Amended and Restated Schedule I to the Custody Agreement between Ivy Variable Insurance Portfolios, on behalf of each of the funds listed on Schedule I, and The Bank of New York Mellon, amended and effective April 30, 2018, filed with Post-Effective Amendment No. 73, and incorporated by reference herein. | |||

| (g)(16) | Amended and Restated Annex I to the Foreign Custody Manager Agreement between Ivy Variable Insurance Portfolios, on behalf of each of its series on Annex I, and The Bank of New York Mellon, amended and effective April 30, 2018, filed with Post-Effective Amendment No. 73, and incorporated by reference herein. | |||

| (g)(17) | Amended and Restated Schedule I to the Custody Agreement between Ivy Variable Insurance Portfolios, on behalf of each of the funds listed on Schedule I, and The Bank of New York Mellon, filed with this Post-Effective Amendment No. 76. | |||

| Rule 17f-5 Delegation Agreement for W&R Target Funds, Inc. on behalf of each of its Portfolios, filed by EDGAR on March 2, 2005 as EX-99.B(g)mcgpcadel to Post-Effective Amendment No. 38 to the Registration Statement on Form N-1A* | ||||

| The Rule 17f-5 Delegation Agreements for each for each of the predecessor funds of which the series of the Registrant are the successor are substantially identical to the Rule 17f-5 Delegation Agreement that is incorporated by Reference. | ||||

| (g)(2) | Assignment of Rule 17f-5 Delegation Agreements for the Registrant and for each of the predecessor funds to which a series of the Registrant is the successor, dated April 30, 2009, filed with Post-Effective Amendment No. 49, and incorporated by reference herein. | |||

| (g)(4) | Schedule A to the Assignment and Amendment of Rule 17f-5 Delegation Agreements for the Registrant and for each of the predecessor funds to which a series of the Registrant is the successor, as amended April 1, 2010, filed with Post-Effective Amendment No. 51, and incorporated by reference herein. | |||

| (g)(6) | Schedule A to the Assignment and Amendment of Rule 17f-5 Delegation Agreements for the Registrant and for each of the predecessor funds to which a series of the Registrant is the successor, as amended August 11, 2010, filed with Post-Effective Amendment No. 56, and incorporated by reference herein. | |||

| (h) | Other Material Contracts: | |||

| (h)(1) | Transfer Agency Agreement between Ivy Funds Variable Insurance Portfolios and Waddell & Reed Services Company, dated April 15, 2009, filed with Post-Effective Amendment No. 49, and incorporated by reference herein. | |||

| (h)(2) | Accounting Services Agreement between Ivy Funds Variable Insurance Portfolios and Waddell & Reed Services Company, effective April 30, 2009, filed with Post-Effective Amendment No. 49, and incorporated by reference herein. | |||

| (h)(3) | Exhibit B to the Transfer Agency Agreement between Ivy Funds Variable Insurance Portfolios and Waddell & Reed Services Company, as amended May 31, 2009, filed with Post-Effective Amendment No. 51, and incorporated by reference herein. | |||

| (h)(4) | Appendix A to the Transfer Agency Agreement between Ivy Funds Variable Insurance Portfolios and Waddell & Reed Services Company, as amended April 1, 2010, filed with Post-Effective Amendment No. 51, and incorporated by reference herein. | |||

| (h)(5) | Appendix A to the Accounting Services Agreement between Ivy Funds Variable Insurance Portfolios and Waddell & Reed Services Company, as amended April 1, 2010, filed with Post-Effective Amendment No. 51, and incorporated by reference herein. | |||

| (h)(6) | Exhibit B to the Transfer Agency Agreement between Ivy Funds Variable Insurance Portfolios and Waddell & Reed Services Company, as effective May 31, 2010, filed with Post-Effective Amendment No. 53, and incorporated by reference herein. | |||

| (h)(7) | Appendix A to the Transfer Agency Agreement between Ivy Funds Variable Insurance Portfolios and Waddell & Reed Services Company, as amended August 11, 2010, filed with Post-Effective Amendment No. 53, and incorporated by reference herein. | |||

| (h)(8) | Appendix A to the Accounting Services Agreement between Ivy Funds Variable Insurance Portfolios and Waddell & Reed Services Company, as amended August 11, 2010, filed with Post-Effective Amendment No. 53, and incorporated by reference herein. | |||

| (h)(9) | Expense Reimbursement Agreement between Waddell & Reed, Inc., Waddell & Reed Services Company and Ivy Funds Variable Insurance Portfolios, on behalf of its series Ivy Funds VIP Limited-Term Bond, dated August 11, 2010, filed with Post-Effective Amendment No. 53, and incorporated by reference herein. | |||

| (h)(10) | Exhibit B to the Transfer Agency Agreement between Ivy Funds Variable Insurance Portfolios and Waddell & Reed Services Company, as effective May 31, 2011, filed with Post-Effective Amendment No. 56, and incorporated by reference herein. | |||

| (h)(11) | Appendix A to the Accounting Services Agreement between Ivy Funds Variable Insurance Portfolios and Waddell & Reed Services Company, filed with Post-Effective Amendment No. 61, and incorporated by reference herein. | |||

| (h)(12) | Appendix C to the Accounting Services Agreement between Ivy Funds Variable Insurance Portfolios and Waddell & Reed Services Company, filed with Post-Effective Amendment No. 61, and incorporated by reference herein. | |||

| (h)(13) | Appendix A to the Transfer Agency Agreement between Ivy Funds Variable Insurance Portfolios and Waddell & Reed Services Company, filed with Post-Effective Amendment No. 61, and incorporated by reference herein. | |||

| (h)(14) | Appendix A to the Transfer Agency Agreement between Ivy Funds Variable Insurance Portfolios and Waddell & Reed Services Company, as amended January 1, 2015, filed with Post-Effective Amendment No. 65, and incorporated by reference herein. | |||

| (h)(15) | Appendix A to the Accounting Services Agreement between Ivy Funds Variable Insurance Portfolios and Waddell & Reed Services Company, as amended January 1, 2015, filed with Post-Effective Amendment No. 65, and incorporated by reference herein. | |||

| (h)(16) | Appendix A to the Accounting Services Agreement between Ivy Variable Insurance Portfolios and Waddell & Reed Services Company, as amended April 28, 2017, filed with Post-Effective Amendment No. 70, and incorporated by reference herein. | |||

| (h)(17) | Appendix C to the Accounting Services Agreement between Ivy Variable Insurance Portfolios and Waddell & Reed Services Company, as amended April 28, 2017, filed with Post-Effective Amendment No. 70, and incorporated by reference herein. | |||

| (h)(18) | Appendix A to the Transfer Agency Agreement between Ivy Variable Insurance Portfolios and Waddell & Reed Services Company, as amended April 28, 2017, filed with Post-Effective Amendment No. 70, and incorporated by reference herein. | |||

| (h)(19) | Expense Reimbursement Agreement between Ivy Investment Management Company, Ivy Distributors, Inc., Waddell & Reed Services Company and Ivy Variable Insurance Portfolios, on behalf of its series Ivy VIP Core Equity, Ivy VIP Global Growth and Ivy VIP Small Cap Growth, dated September 30, 2016, filed with Post-Effective Amendment No. 70, and incorporated by reference herein. | |||

| (h)(20) | Expense Reimbursement Agreement between Waddell & Reed, Inc., Waddell & Reed Services Company and Ivy Variable Insurance Portfolios, on behalf of its series Ivy VIP Energy, Ivy VIP Asset Strategy, Ivy VIP High Income, Ivy VIP Science and Technology, Ivy VIP Micro Cap Growth and Ivy VIP Mid Cap Growth, dated April 3, 2017, filed with Post-Effective Amendment No. 70, and incorporated by reference herein. | |||

| (h)(21) | Expense Reimbursement Agreement between Waddell & Reed, Inc., Waddell & Reed Services Company and Ivy Variable Insurance Portfolios, on behalf of its series Ivy VIP Mid Cap Growth, dated April 4, 2017, filed with Post-Effective Amendment No. 70, and incorporated by reference herein. | |||

| (h)(22) | Expense Reimbursement Agreement between Waddell & Reed, Inc., Waddell & Reed Services Company and Ivy Variable Insurance Portfolios, on behalf of its series Ivy VIP Mid Cap Growth, dated April 4, 2017, filed with Post-Effective Amendment No. 70, and incorporated by reference herein. | |||

| (h)(23) | Amended and Restated Appendix A to the Accounting Services Agreement between Ivy Variable Insurance Portfolios and Waddell & Reed Services Company, amended and effective April 30, 2018, filed with Post-Effective Amendment No. 73, and incorporated by reference herein. | |||

| (h)(24) | Expense Reimbursement Agreement between Ivy Distributors, Inc. and Waddell & Reed Services Company and Ivy Variable Insurance Portfolios, on behalf of its series Ivy VIP Asset Strategy, Ivy VIP Energy, Ivy VIP High Income, Ivy VIP Micro Cap Growth, Ivy VIP Mid Cap Growth and Ivy VIP Science and Technology, effective April 30, 2018, filed with Post-Effective Amendment No. 73, and incorporated by reference herein. | |||

| (h)(25) | Expense Reimbursement Agreement between Ivy Investment Management Company, Ivy Distributors, Inc., Waddell & Reed Services Company and Ivy Variable Insurance Portfolios, on behalf of its series Ivy VIP Core Equity, Ivy VIP Global Growth, Ivy VIP Small Cap Growth and Ivy VIP Mid Cap Growth, effective April 30, 2018, filed with Post-Effective Amendment No. 73, and incorporated by reference herein. | |||

| (h)(26) | Master Interfund Lending Agreement between Ivy Funds, Waddell & Reed Advisors Funds, Ivy Variable Insurance Portfolios, InvestEd Portfolios, Ivy Investment Management Company and Waddell & Reed Investment Management Company, effective August 13, 2014, filed with Post-Effective Amendment No. 73, and incorporated by reference herein. | |||

| (h)(27) | Amended and Restated Schedule A to the Master Interfund Lending Agreement, amended and effective April 30, 2018, filed with Post-Effective Amendment No. 73, and incorporated by reference herein. | |||

| (h)(28) | Amended and Restated Schedule B to the Master Interfund Lending Agreement, amended and effective April 30, 2018, filed with Post-Effective Amendment No. 73, and incorporated by reference herein. | |||

| (h)(29) | Expense Reimbursement Agreement between Ivy Distributors, Inc., Waddell & Reed Services Company and Ivy Variable Insurance Portfolios, on behalf of its series Ivy VIP Small Cap Growth, dated August 6, 2018, filed with this Post-Effective Amendment No. 76. | |||

| (i) | Opinion and consent of counsel: Filed with this Post-Effective Amendment No. 76. | |||

| (j) | Consent of Independent Registered Public Accounting Firm: Not applicable. | |||

| (k) | Omitted Financial Statements: Not applicable. | |||

| (l) | Initial Capital Agreements: | |||

| Agreement between United Investors Life Insurance Company and Income Portfolio filed April 21, 1992 as Exhibit No. 13 to Post-Effective Amendment No. 8 to the Registration Statement on Form N-1A* | ||||

| Agreement between United Investors Life Insurance Company and International Portfolio, Small Cap Portfolio, Balanced Portfolio and Limited-Term Bond Portfolio filed February 15, 1995 as EX-99.B13-tmkuil to Post-Effective Amendment No. 11 to the Registration Statement on Form N-1A* | ||||

| Agreement between United Investors Life Insurance Company and Asset Strategy Portfolio filed October 3, 1995 as EX-99.B13-tmkuilasp to Post-Effective Amendment No. 12 to the Registration Statement on Form N-1A* | ||||

| Agreement between United Investors Life Insurance Company and Science and Technology Portfolio filed October 31, 1996 as EX-B.13-tmkuilst to Post-Effective Amendment No. 14 to the Registration Statement on Form N-1A* | ||||

| (m) | Rule 12b-1 Plans: | |||

| (m)(1) | Service Plan for Ivy Funds Variable Insurance Portfolios, effective April 30, 2009, filed with Post-Effective Amendment No. 49, and incorporated by reference herein. | |||

| (m)(2) | Amended & Restated Service Plan for Ivy Variable Insurance Portfolios, effective October 1, 2016, as amended February 22, 2017, filed with Post-Effective Amendment No. 70, and incorporated by reference herein. | |||

| (m)(3) | Amended and Restated Appendix A to the Amended and Restated Ivy Variable Insurance Portfolios Service Plan for Class II Shares, amended and effective April 30, 2018, filed with Post-Effective Amendment No. 73, and incorporated by reference herein. | |||

| (n) | Rule 18f-3 Plans: | |||

| (n)(1) | Multiple Class Plan for Ivy Variable Insurance Portfolios, effective April 28, 2017, filed with Post-Effective Amendment No. 70, and incorporated by reference herein. | |||

| (n)(2) | Amended and Restated Appendix A to the Rule 18F-3 Multi-Class Plan for Ivy Variable Insurance Portfolios, amended and effective April 30, 2018, filed with Post-Effective Amendment No. 73, and incorporated by reference herein. | |||

| (n)(3) | Amended and Restated Appendix A to the Rule 18F-3 Multi-Class Plan for Ivy Variable Insurance Portfolios, filed with this Post-Effective Amendment No. 76. | |||

| (p) | Codes of Ethics: | |||

| Code of Ethics, as amended August 2007, filed by EDGAR on December 28, 2007 as EX-99.B(p)code to Post-Effective Amendment No. 45 to the Registration Statement on Form N-1A* | ||||

| Code of Ethics pursuant to the Sarbanes-Oxley Act of 2002, filed by EDGAR on November 19, 2003 as EX-99.B(p)code-so to Post-Effective Amendment No. 35 to the Registration Statement on Form N-1A* | ||||

| (p)(1) | Code of Ethics for Advantus Capital Management, Inc., dated January 2009, filed with Post-Effective Amendment No. 49, and incorporated by reference herein. | |||

| (p)(2) | Code of Ethics for Mackenzie Financial Corporation, dated October 2008, filed with Post-Effective Amendment No. 49, and incorporated by reference herein. | |||

| (p)(3) | Code of Ethics for Franklin Templeton Investments, dated May 2008, filed with Post-Effective Amendment No. 49, and incorporated by reference herein. | |||

| (p)(4) | Code of Ethics for Wall Street Associates, dated December 2008, filed with Post-Effective Amendment No. 49, and incorporated by reference herein. | |||

| (p)(5) | Code of Ethics for Wall Street Associates, dated December 2009, filed with Post-Effective Amendment No. 51, and incorporated by reference herein. | |||

| (p)(6) | Code of Ethics for Waddell & Reed Financial, Inc., Waddell & Reed, Inc., Waddell & Reed Investment Management Company, Fiduciary Trust Company of New Hampshire, Waddell & Reed Advisors Funds, Ivy Funds Variable Insurance Portfolios, Waddell & Reed InvestEd Portfolios, Ivy Funds, Ivy Investment Management Company, Ivy Funds Distributor, Inc. and Waddell & Reed Services Company, doing business as WI Services Company, as revised May 2010, filed with Post-Effective Amendment No. 52, and incorporated by reference herein. | |||

| (p)(7) | Code of Ethics for Waddell & Reed Financial, Inc., Waddell & Reed, Inc., Waddell & Reed Investment Management Company, Fiduciary Trust Company of New Hampshire, Waddell & Reed Advisors Funds, Ivy Funds Variable Insurance Portfolios, Waddell & Reed InvestEd Portfolios, Ivy Funds, Ivy Investment Management Company, Ivy Funds Distributor, Inc. and Waddell & Reed Services Company, doing business as WI Services Company, as revised May 2011, filed with Post-Effective Amendment No. 56, and incorporated by reference herein. | |||

| (p)(8) | Code of Ethics for Advantus Capital Management, Inc., dated July 2011, filed with Post-Effective Amendment No. 56, and incorporated by reference herein. | |||

| (p)(9) | Code of Ethics for Wall Street Associates, dated December 2011, filed with Post-Effective Amendment No. 56, and incorporated by reference herein. | |||

| (p)(10) | Code of Ethics for Waddell & Reed Financial, Inc., Waddell & Reed, Inc., Waddell & Reed | |||

| Investment Management Company, Fiduciary Trust Company of New Hampshire, Waddell & Reed Advisors Funds, Ivy Funds Variable Insurance Portfolios, InvestEd Portfolios, Ivy Funds, Ivy Investment Management Company, Ivy Funds Distributor, Inc. and Waddell & Reed Services Company, doing business as WI Services Company, as revised November 2012, filed with Post-Effective Amendment No. 58, and incorporated by reference herein. | ||||

| (p)(11) | Code of Ethics for Advantus Capital Management, Inc., dated September 2012, filed with Post-Effective Amendment No. 58, and incorporated by reference herein. | |||

| (p)(12) | Code of Business Conduct and Ethics for Mackenzie Financial Corporation, dated April 2012, filed with Post-Effective Amendment No. 58, and incorporated by reference herein. | |||

| (p)(13) | Code of Ethics for Wall Street Associates, dated December 2012, filed with Post-Effective Amendment No. 58, and incorporated by reference herein. | |||

| (p)(14) | Code of Ethics for Advantus Capital Management, Inc., dated February 2014, filed with Post-Effective Amendment No. 63, and incorporated by reference herein. | |||

| (p)(15) | Code of Ethics for Wall Street Associates, dated December 2013, filed with Post-Effective Amendment No. 63, and incorporated by reference herein. | |||

| (p)(16) | Code of Ethics for Waddell & Reed Financial, Inc., Waddell & Reed, Inc., Waddell & Reed Investment Management Company, Fiduciary Trust Company of New Hampshire, Waddell & Reed Advisors Funds, Ivy Variable Insurance Portfolios, InvestEd Portfolios, Ivy Funds, Ivy NextShares, Ivy Investment Management Company, Ivy Distributors, Inc., Waddell & Reed Services Company, doing business as WI Services Company, and Ivy High Income Opportunities Fund, as revised August 2015, filed with Post-Effective Amendment No. 70, and incorporated by reference herein. | |||

| (p)(17) | Code of Ethics for Advantus Capital Management, Inc., dated July 28, 2016, filed with Post-Effective Amendment No. 70, and incorporated by reference herein. | |||

| Item 29. | Persons Controlled by or Under Common Control with the Fund: Not applicable. |

| Item 30. | Indemnification |

Reference is made to Article IX of the Trust Instrument of Registrant filed by EDGAR on February 27, 2009, as Exhibit (a)(1) to Post-Effective Amendment No. 10 and to Section 14 of the Form of Participation Agreement filed by EDGAR on June 9, 2010, as Exhibit (e)(7) to Post-Effective Amendment No. 52, each of which provide indemnification.

Registrant undertakes to carry out all indemnification provisions of its Trust Instrument and the above-described contract in accordance with the Investment Company Act Release No. 11330 (September 4, 1980) and successor releases.

Insofar as indemnification for liability arising under the 1933 Act, as amended, may be provided to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment of the Registrant of expenses incurred or paid by a director, officer of controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer, or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

| Item 31. | Business and Other Connections of Investment Adviser |

Ivy Investment Management Company (IICO) is the investment manager of the Registrant. IICO is not

engaged in any business other than the provision of investment management services to those registered investment companies as described in Part A and Part B of this Post-Effective Amendment and to other investment advisory clients.

Each director and executive officer of IICO or its predecessors, has had as his sole business, profession, vocation or employment during the past two years only his duties as an executive officer and/or employee of IICO or its predecessors, except as to persons who are directors and/or officers of the Registrant and have served in the capacities shown in the Statement of Additional Information of the Registrant. The address of such officers is 6300 Lamar Avenue, Shawnee Mission, Kansas 66202-4200.

As to each director and officer of IICO, reference is made to the Prospectus and SAI of this Registrant.

| Item 32. | Principal Underwriter and Distributor |

| (a) | Ivy Distributors, Inc. is the Principal Underwriter and Distributor of the Registrant’s shares. It is the principal underwriter to the following investment companies: |

Ivy Funds

| (b) | The information contained in the underwriter’s application on Form BD, as filed on April 23, 2018, SEC No. 8-27030 under the Securities Exchange Act of 1934, is incorporated by reference herein. |

| (c) | No compensation was paid by the Registrant to any principal underwriter who is not an affiliated person of the Registrant or any affiliated person of such affiliated person. |

| Item 33. | Location of Accounts and Records |

The accounts, books and other documents required to be maintained by Registrant pursuant to Section 31(a) of the Investment Company Act and rules promulgated thereunder are under the possession of Mr. Philip A. Shipp and Mr. Joseph W. Kauten, as officers of the Registrant, each of whose business address is Post Office Box 29217, Shawnee Mission, Kansas 66201-9217.

| Item 34. | Management Services |

There are no service contracts other than as discussed in Part A and B of this Post-Effective Amendment and as listed in response to Items 28(h) and 28(m) hereof.

| Item 35. | Undertakings: Not applicable. |

| * | Incorporated by reference herein |

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS, That the undersigned, IVY VARIABLE INSURANCE PORTFOLIOS (hereinafter called the Trust), and certain trustees and officers for the Trust, do hereby constitute and appoint PHILIP J. SANDERS, MARK P. BUYLE, J. J. RICHIE and PHILIP A. SHIPP, and each of them individually, their true and lawful attorneys and agents to take any and all action and execute any and all instruments which said attorneys and agents may deem necessary or advisable to enable the Trust to comply with the Securities Act of 1933 and/or the Investment Company Act of 1940, as amended, and any rules, regulations, orders or other requirements of the United States Securities and Exchange Commission thereunder, in connection with the registration under the Securities Act of 1933 and/or the Investment Company Act of 1940, as amended, including specifically, but without limitation of the foregoing, power and authority to sign the names of each of such trustees and officers in his/her behalf as such trustee or officer as indicated below opposite his/her signature hereto, to any Registration Statement and to any amendment or supplement to the Registration Statement filed with the Securities and Exchange Commission under the Securities Act of 1933 and/or the Investment Company Act of 1940, as amended, and to any instruments or documents filed or to be filed as a part of or in connection with such Registration Statement or amendment or supplement thereto; and each of the undersigned hereby ratifies and confirms all that said attorneys and agents shall do or cause to be done by virtue hereof.

Date: May 16, 2018

| /s/ Philip J. Sanders | ||||

| Philip J. Sanders, President | ||||

| /s/ Joseph Harroz, Jr. |

Chairman and Trustee | |||

| Joseph Harroz, Jr. | ||||

| /s/ Jarold W. Boettcher |

Trustee | |||

| Jarold W. Boettcher | ||||

| /s/ James M. Concannon |

Trustee | |||

| James M. Concannon | ||||

| /s/ James D. Gressett |

Trustee | |||

| James D. Gressett | ||||

| /s/ Henry J. Herrmann |

Trustee | |||

| Henry J. Herrmann | ||||

| /s/ Glendon E. Johnson, Jr. |

Trustee | |||

| Glendon E. Johnson, Jr. | ||||

| /s/ Frank J. Ross, Jr. |

Trustee | |||

| Frank J. Ross, Jr. | ||||

| /s/ Michael G. Smith |

Trustee | |||

| Michael G. Smith | ||||

| /s/ Edward M. Tighe |

Trustee | |||

| Edward M. Tighe | ||||

| Attest: | ||||

| /s/ Jennifer K. Dulski |

||||

| Jennifer K. Dulski, Secretary | ||||

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933 and/or the Investment Company Act of 1940, the Registrant certifies that it meets all of the requirements for effectiveness of this Post-Effective Amendment pursuant to Rule 485(b) of the Securities Act of 1933 and has duly caused this Post-Effective Amendment to be signed on its behalf by the undersigned, thereunto duly authorized, in the city of Overland Park, and State of Kansas, on the 6th day of August, 2018.

IVY VARIABLE INSURANCE PORTFOLIOS

a Delaware statutory trust

(Registrant)

By /s/ Philip J. Sanders

Philip J. Sanders, President

Pursuant to the requirements of the Securities Act of 1933, and/or the Investment Company Act of 1940, this Post-Effective Amendment has been signed below by the following persons in the capacities indicated on the 6th day of August, 2018.

| Signatures |

Title | |

| /s/ Joseph Harroz, Jr.* |

Chairman and Trustee | |

| Joseph Harroz, Jr. | ||

| /s/ Philip J. Sanders |

President | |

| Philip J. Sanders | ||

| /s/ Joseph W. Kauten |

Vice President, Treasurer and | |

| Joseph W. Kauten | and Principal Financial Officer | |

| /s/ Jarold W. Boettcher* |

Trustee | |

| Jarold W. Boettcher | ||

| /s/ James M. Concannon* |

Trustee | |

| James M. Concannon | ||

| /s/ James D. Gressett* |

Trustee | |

| James D. Gressett | ||

| /s/ Henry J. Herrmann* |

Trustee | |

| Henry J. Herrmann | ||

| /s/ Glendon E. Johnson, Jr.* |

Trustee | |

| Glendon E. Johnson, Jr. | ||

| /s/ Frank J. Ross, Jr.* |

Trustee | |

| Frank J. Ross, Jr. | ||

| /s/ Michael G. Smith* |

Trustee | |

| Michael G. Smith | ||

| /s/ Edward M. Tighe* |

Trustee | |

| Edward M. Tighe | ||

| *By: | /s/ Philip A. Shipp | |

| Philip A. Shipp | ||

| Attorney-in-Fact | ||

| ATTEST: | /s/ Jennifer K. Dulski | |

| Jennifer K. Dulski | ||