Table of Contents

|

VARIABLE INSURANCE PORTFOLIOS |

Prospectus

IVY VARIABLE INSURANCE PORTFOLIOS

APRIL 30, 2018 |

Ivy Variable Insurance Portfolios (Trust) is a management investment company, commonly known as a mutual fund, that has twenty-nine separate portfolios (each, a Portfolio, and collectively, the Portfolios), each with separate objectives and investment policies. This Prospectus offers six Portfolios of the Trust.

This Prospectus contains concise information about the Portfolios of which you should be aware before applying for certain variable life insurance policies and variable annuity contracts (collectively, Policies) offered by certain select insurance companies (Participating Insurance Companies). This Prospectus should be read together with the prospectus for the particular Policy.

The Securities and Exchange Commission (SEC) has not approved or disapproved these securities, or determined whether this Prospectus is accurate or complete. It is a criminal offense to state otherwise.

Table of Contents

| TABLE OF CONTENTS | ||||

| PORTFOLIO SUMMARIES — DOMESTIC EQUITY PORTFOLIOS | ||||

| 3 | ||||

| 7 | ||||

| PORTFOLIO SUMMARIES — SPECIALTY PORTFOLIOS | ||||

| 11 | ||||

| 18 | ||||

| 23 | ||||

| 29 | ||||

| 34 | ||||

| 34 | Additional Information about Principal Investment Strategies, Other Investments and Risks | |||

| 43 | ||||

| 44 | ||||

| 58 | ||||

| 61 | ||||

| 66 | ||||

| 67 | ||||

| 2 | Prospectus |

Table of Contents

Objective

To seek to provide growth of capital.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the Portfolio. The table below does not reflect any fees and expenses imposed under the variable life insurance policies and variable annuity contracts (collectively, Policies) through which this Portfolio is offered. See the Policy prospectus for a description of those fees and expenses.

Shareholder Fees

| (fees paid directly from your investment) | N/A |

Annual Portfolio Operating Expenses

| (expenses that you pay each year as a % of the value of your investment) | Class II | |||

| Management Fees |

0.70% | |||

| Distribution and Service (12b-1) Fees |

0.25% | |||

| Other Expenses |

0.04% | |||

| Total Annual Portfolio Operating Expenses |

0.99% | |||

Example

This example is intended to help you compare the cost of investing in the shares of the Portfolio with the cost of investing in other portfolios. This example does not reflect any fees and expenses imposed under the Policies.

The example assumes that you invest $10,000 in the shares of the Portfolio for the time periods indicated. The example also assumes that your investment has a 5% return each year and that the Portfolio’s operating expenses remain the same. The costs are the same for each time period if you continue to hold your shares or if you redeem all your shares at the end of those periods. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Class II |

$ | 101 | $ | 315 | $ | 547 | $ | 1,213 | ||||||||

Portfolio Turnover

The Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual portfolio operating expenses or in the example, affect the Portfolio’s performance. During the most recent fiscal year, the Portfolio’s portfolio turnover rate was 41% of the average value of its portfolio.

Principal Investment Strategies

Ivy VIP Growth seeks to achieve its objective by investing primarily in a diversified portfolio of common stocks issued by large-capitalization, growth-oriented companies with above-average levels of profitability and that Ivy Investment Management Company (IICO), the Portfolio’s investment manager, believes have the ability to sustain growth over the long term. Large-capitalization companies typically are companies with market capitalizations of at least $10 billion at the time of acquisition. Growth-oriented companies are those whose earnings IICO believes are likely to grow faster than the economy.

IICO primarily utilizes a bottom-up (researching individual issuers) strategy in selecting securities for the Portfolio and seeks to invest for the Portfolio in companies that it believes possess, or have the potential to achieve, dominant market positions and/or structural competitive advantages. IICO believes that these characteristics can help to mitigate competition and lead to more resilient and sustainable revenue and earnings growth.

| Domestic Equity Portfolios | Prospectus | 3 |

Table of Contents

IICO begins its investment process by screening large-capitalization companies based on profitability, and then attempts to focus on companies operating in large, growing, addressable markets (generally, the total potential markets for their goods and services) whose competitive market position IICO believes will allow them to grow faster than the general economy. The key factors IICO typically analyzes consist of: a company’s brand equity, proprietary technology, economies of scale, barriers to entry, strength of management, and level of competitive intensity; return of capital in the form of higher dividends or share repurchases; strong balance sheets and cash flows; the threat of substitute products; and the interaction and bargaining power between a company, its customers, suppliers and competitors. The Portfolio typically holds a limited number of stocks (generally 40 to 60).

Many of the companies in which the Portfolio may invest have diverse operations, with products or services in foreign markets. Therefore, the Portfolio may have indirect exposure to various foreign markets through investments in these companies, even if the Portfolio is not invested directly in such markets.

In general, IICO may sell a security when, in IICO’s opinion, a company experiences deterioration in its growth and/or profitability characteristics, or a fundamental breakdown of its sustainable competitive advantages. IICO also may sell a security if it believes that the security no longer presents sufficient appreciation potential; this may be caused by, or be an effect of, changes in the industry or sector of the issuer, loss by the company of its competitive position, poor execution by management, the threat of technological disruption and/or poor use of resources. IICO also may sell a security to reduce the Portfolio’s holding in that security, to take advantage of what it believes are more attractive investment opportunities or to raise cash.

Principal Investment Risks

As with any mutual fund, the value of the Portfolio’s shares will change, and you could lose money on your investment. The Portfolio is not intended as a complete investment program.

A variety of factors can affect the investment performance of the Portfolio and prevent it from achieving its objective. These include:

| ∎ | Company Risk. A company may be more volatile or perform worse than the overall market due to specific factors, such as adverse changes to its business or investor perceptions about the company. |

| ∎ | Foreign Exposure Risk. The securities of many companies may have significant exposure to foreign markets as a result of the company’s operations, products or services in those foreign markets. As a result, a company’s domicile and/or the markets in which the company’s securities trade may not be fully reflective of its sources of revenue. Such securities would be subject to some of the same risks as an investment in foreign securities, including the risk that political and economic events unique to a country or region will adversely affect those markets in which the company’s products or services are sold. |

| ∎ | Growth Stock Risk. Prices of growth stocks may be more sensitive to changes in current or expected earnings than the prices of other stocks. Growth stocks may be more volatile or not perform as well as value stocks or the stock market in general. |

| ∎ | Holdings Risk. The Portfolio typically holds a limited number of stocks (generally 40 to 60), and the Portfolio’s managers also tend to invest a significant portion of the Portfolio’s total assets in a limited number of stocks. As a result, the appreciation or depreciation of any one security held by the Portfolio may have a greater impact on the Portfolio’s net asset value (NAV) than it would if the Portfolio invested in a larger number of securities or if the Portfolio’s managers invested a greater portion of the Portfolio’s total assets in a larger number of stocks. |

| ∎ | Information Technology Sector Risk. Investment risks associated with investing in the information technology sector, in addition to other risks, include the intense competition to which information technology companies may be subject; the dramatic and often unpredictable changes in growth rates and competition for qualified personnel among information technology companies; effects on profitability from being heavily dependent on patent and intellectual property rights and the loss or impairment of those rights; obsolescence of existing technology; general economic conditions; and government regulation. |

| ∎ | Large Company Risk. Large-capitalization companies may go in and out of favor based on market and economic conditions. Large-capitalization companies may be unable to respond quickly to new competitive challenges, such as changes in technology, and also may not be able to attain the high growth rate of successful smaller companies, especially during extended periods of economic expansion. Although the securities of larger companies may be less volatile than those of companies with smaller market capitalizations, returns on investments in securities of large-capitalization companies could trail the returns on investments in securities of smaller companies. |

| 4 | Prospectus | Domestic Equity Portfolios |

Table of Contents

| ∎ | Management Risk. Portfolio performance is primarily dependent on IICO’s skill in evaluating and managing the Portfolio’s holdings. There can be no guarantee that its decisions will produce the desired results, and the Portfolio may not perform as well as other similar mutual funds. |

| ∎ | Market Risk. Markets can be volatile, and the Portfolio’s holdings can decline in response to adverse issuer, political, regulatory, market or economic developments or conditions that may cause a broad market decline. Different parts of the market, including different sectors and different types of securities, can react differently to these developments. Since the financial crisis that started in 2008, the U.S. and many foreign economies continue to experience its after-effects, which have resulted, and may continue to result, in volatility in the financial markets, both U.S. and foreign. Global economies and financial markets are becoming increasingly interconnected, which increases the possibilities that conditions in one country or region may adversely affect issuers in another country or region, which in turn may adversely affect securities held by the Portfolio. These circumstances also have decreased liquidity in some markets and may continue to do so. In addition, certain events, such as natural disasters, terrorist attacks, war, and other geopolitical events, have led, and may in the future lead, to increased short-term market volatility and may have adverse long-term effects on world economies and markets generally. |

| ∎ | Sector Risk. At times, the Portfolio may have a significant portion of its assets invested in securities of companies conducting business in a broadly related group of industries within an economic sector. Individual sectors may be more volatile, and may perform differently, than the broader market. Companies in the same economic sector may be similarly affected by economic or market events, making the Portfolio more vulnerable to unfavorable developments in that economic sector than funds that invest more broadly. |

Performance

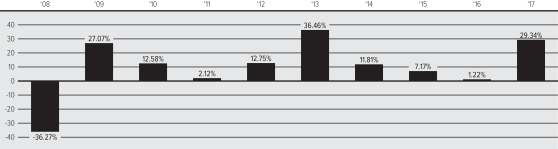

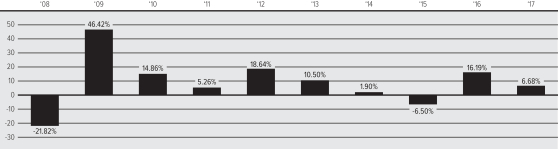

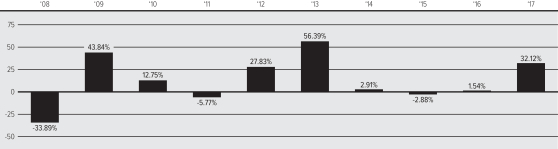

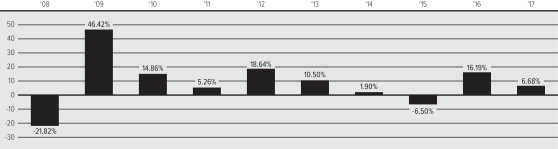

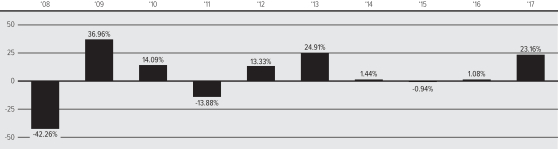

The chart and table below provide some indication of the risks of investing in the Portfolio. The chart shows how performance has varied from year to year for Class II shares of the Portfolio. The table shows the average annual total returns for Class II shares of the Portfolio and also compares the Portfolio’s returns with those of a broad-based securities market index and a Lipper peer group (a universe of mutual funds with investment objectives similar to that of the Portfolio). The performance results do not reflect any Policy-related fees and expenses, which would reduce the performance results.

Performance results include the effect of expense reduction arrangements for some or all of the periods shown. If those arrangements had not been in place, the performance results for those periods would have been lower.

Prior to April 30, 2012, the Portfolio’s investment objective was to seek capital growth, with current income as a secondary objective. Effective as of April 30, 2012, the Portfolio changed its investment objective to seeking to provide growth of capital.

The Portfolio’s past performance does not necessarily indicate how it will perform in the future. Current performance may be lower or higher. Please call 800.777.6472 for the Portfolio’s updated performance.

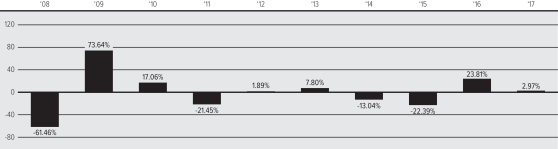

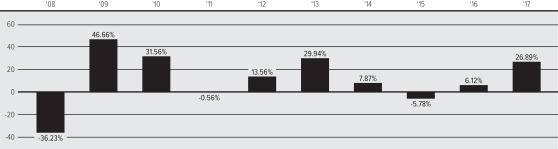

Chart of Year-by-Year Returns

as of December 31 each year

|

|

In the period shown in the chart, the highest quarterly return was 14.22% (the first quarter of 2012) and the lowest quarterly return was -20.44% (the fourth quarter of 2008). |

Average Annual Total Returns

| as of December 31, 2017 | 1 Year | 5 Years | 10 Years | |||||||||

| Class II Shares of Ivy VIP Growth |

29.34% | 16.44% | 8.43% | |||||||||

| Russell 1000 Growth Index (reflects no deduction for fees, expenses or taxes) |

30.21% | 17.33% | 10.00% | |||||||||

| Lipper Variable Annuity Large-Cap Growth Funds Universe Average (net of fees and expenses) |

30.86% | 16.29% | 8.73% | |||||||||

| Domestic Equity Portfolios | Prospectus | 5 |

Table of Contents

Investment Adviser

The Portfolio is managed by Ivy Investment Management Company (IICO).

Portfolio Manager

Bradley M. Klapmeyer, Senior Vice President of IICO, has managed the Portfolio since August 2016.

Purchase and Sale of Portfolio Shares

Shares of the Portfolio are currently sold only to separate accounts of Participating Insurance Companies to fund benefits payable under the Policies.

The Portfolio’s shares are redeemable. Shares are purchased or redeemed at the Portfolio’s NAV per share next calculated after your order is received in proper form on any business day. The Portfolio does not have initial and subsequent investment minimums. Please refer to your Policy prospectus for more information on purchasing and redeeming Portfolio shares.

Tax Information

Because the Portfolio’s only shareholders are separate accounts of Participating Insurance Companies, distributions the Portfolio makes of its net investment income and net realized gains, if any — most or all of which it intends to distribute annually — and redemptions or exchanges of Portfolio shares generally will not be taxable to its shareholders (or to the holders of the underlying Policies). See the prospectus for your Policy for further tax information.

Payments to Broker-Dealers and other Financial Intermediaries

The Portfolio and its related companies may make payments to a Participating Insurance Company (or its affiliates) or other financial intermediary for distribution and/or other services. These payments may create a conflict of interest by influencing the Participating Insurance Company or other financial intermediary and your financial advisor to recommend the Portfolio over another investment or by influencing a Participating Insurance Company to include the Portfolio as an underlying investment option in the Policy. The prospectus (or other offering document) for your Policy may contain additional information about these payments.

| 6 | Prospectus | Domestic Equity Portfolios |

Table of Contents

Objective

To seek to provide growth of capital.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the Portfolio. The table below does not reflect any fees and expenses imposed under the variable life insurance policies and variable annuity contracts (collectively, Policies) through which this Portfolio is offered. See the Policy prospectus for a description of those fees and expenses.

Shareholder Fees

| (fees paid directly from your investment) | N/A |

Annual Portfolio Operating Expenses

| (expenses that you pay each year as a % of the value of your investment) | Class I | Class II | ||||||

| Management Fees |

0.85% | 0.85% | ||||||

| Distribution and Service (12b-1) Fees |

0.00% | 0.25% | ||||||

| Other Expenses |

0.04% | 0.05% | ||||||

| Total Annual Portfolio Operating Expenses |

0.89% | 1.15% | ||||||

| Fee Waiver and/or Expense Reimbursement1 |

0.04% | 0.05% | ||||||

| Total Annual Portfolio Operating Expenses After Fee Waiver and/or Expense Reimbursement2 |

0.85% | 1.10% | ||||||

| 1 | Through April 30, 2019, Ivy Investment Management Company (IICO), the Portfolio’s investment manager, Ivy Distributors, Inc. (IDI), the Portfolio’s distributor, and/or Waddell & Reed Services Company, doing business as WI Services Company (WISC), the Portfolio’s transfer agent, have contractually agreed to reimburse sufficient management fees, Rule 12b-1 fees (Class II only) and/or shareholder servicing fees to cap the total annual ordinary portfolio operating expenses (which would exclude interest, taxes, brokerage commissions, acquired fund fees and expenses and extraordinary expenses, if any) as follows: Class I Shares at 0.85% and Class II Shares at 1.10%. Prior to that date, the expense limitation may not be terminated without the consent of the Board of Trustees. |

| 2 | The Total Annual Portfolio Operating Expenses After Fee Waiver and/or Expense Reimbursement ratio shown above does not correlate to the expense ratio shown in the Financial Highlights table because it has been restated to reflect a change in the Portfolio’s contractual class waiver. |

Example

This example is intended to help you compare the cost of investing in the particular class of shares of the Portfolio with the cost of investing in other portfolios. This example does not reflect any fees and expenses imposed under the Policies.

The example assumes that you invest $10,000 in the shares of the Portfolio for the time periods indicated. The example also assumes that your investment has a 5% return each year, that the Portfolio’s operating expenses remain the same, and that expenses were capped for a one-year period, as indicated above. The costs are the same for each time period if you continue to hold your shares or if you redeem all your shares at the end of those periods. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Class I |

$ | 87 | $ | 280 | $ | 489 | $ | 1,092 | ||||||||

| Class II |

112 | 360 | 628 | 1,393 | ||||||||||||

Portfolio Turnover

The Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual portfolio operating expenses or in the example, affect the Portfolio’s performance. During the most recent fiscal year, the Portfolio’s portfolio turnover rate was 25% of the average value of its portfolio.

Principal Investment Strategies

Ivy VIP Mid Cap Growth seeks to achieve its objective by investing primarily in common stocks of mid-capitalization companies that IICO believes are high quality and/or offer above-average growth potential. Under normal

| Domestic Equity Portfolios | Prospectus | 7 |

Table of Contents

circumstances, the Portfolio invests at least 80% of its net assets in the securities of mid-capitalization companies, which, for purposes of this Portfolio, typically are companies with market capitalizations within the range of companies in the Russell Midcap Growth Index at the time of acquisition. As of June 30, 2017 (the quarter-end closest to the index’s rebalance), this range of market capitalizations was between approximately $2.16 billion and $30.62 billion.

In selecting securities for the Portfolio, IICO primarily emphasizes a bottom-up (researching individual issuers) approach and focuses on companies it believes have the potential for strong growth, increasing profitability, stable and sustainable revenue and earnings streams, attractive valuations and sound capital structures. IICO may look at a number of factors in its consideration of a company, such as: new or innovative products or services; adaptive or creative management; strong financial and operational capabilities to sustain multi-year growth; stable and consistent revenue, earnings, and cash flow; strong balance sheet; market potential; and profit potential. Part of IICO’s investment process also includes a review of the macroeconomic environment, with a focus on factors such as interest rates, inflation, consumer confidence and corporate spending.

Generally, in determining whether to sell a security, IICO considers many factors, including what it believes to be excessive valuation given company growth prospects, deterioration of fundamentals, weak cash flow to support shareholder returns, and unexpected and poorly explained management changes. IICO also may sell a security to reduce the Portfolio’s holding in that security, to take advantage of what it believes are more attractive investment opportunities or to raise cash.

Principal Investment Risks

As with any mutual fund, the value of the Portfolio’s shares will change, and you could lose money on your investment. The Portfolio is not intended as a complete investment program.

A variety of factors can affect the investment performance of the Portfolio and prevent it from achieving its objective. These include:

| ∎ | Company Risk. A company may be more volatile or perform worse than the overall market due to specific factors, such as adverse changes to its business or investor perceptions about the company. |

| ∎ | Growth Stock Risk. Prices of growth stocks may be more sensitive to changes in current or expected earnings than the prices of other stocks. Growth stocks may be more volatile or not perform as well as value stocks or the stock market in general. |

| ∎ | Information Technology Sector Risk. Investment risks associated with investing in the information technology sector, in addition to other risks, include the intense competition to which information technology companies may be subject; the dramatic and often unpredictable changes in growth rates and competition for qualified personnel among information technology companies; effects on profitability from being heavily dependent on patent and intellectual property rights and the loss or impairment of those rights; obsolescence of existing technology; general economic conditions; and government regulation. |

| ∎ | Management Risk. Portfolio performance is primarily dependent on IICO’s skill in evaluating and managing the Portfolio’s holdings. There can be no guarantee that its decisions will produce the desired results, and the Portfolio may not perform as well as other similar mutual funds. |

| ∎ | Market Risk. Markets can be volatile, and the Portfolio’s holdings can decline in response to adverse issuer, political, regulatory, market or economic developments or conditions that may cause a broad market decline. Different parts of the market, including different sectors and different types of securities, can react differently to these developments. Since the financial crisis that started in 2008, the U.S. and many foreign economies continue to experience its after-effects, which have resulted, and may continue to result, in volatility in the financial markets, both U.S. and foreign. Global economies and financial markets are becoming increasingly interconnected, which increases the possibilities that conditions in one country or region may adversely affect issuers in another country or region, which in turn may adversely affect securities held by the Portfolio. These circumstances also have decreased liquidity in some markets and may continue to do so. In addition, certain events, such as natural disasters, terrorist attacks, war, and other geopolitical events, have led, and may in the future lead, to increased short-term market volatility and may have adverse long-term effects on world economies and markets generally. |

| ∎ | Mid Size Company Risk. Securities of mid-capitalization companies may be more vulnerable to adverse developments than those of larger companies due to such companies’ limited product lines, limited markets and financial resources and dependence upon a relatively small management group. Securities of mid-capitalization companies may be more volatile and less liquid than the securities of larger companies, and may be affected to a greater extent than other types of securities by the underperformance of a sector or during market downturns. |

| 8 | Prospectus | Domestic Equity Portfolios |

Table of Contents

| ∎ | Sector Risk. At times, the Portfolio may have a significant portion of its assets invested in securities of companies conducting business in a broadly related group of industries within an economic sector. Individual sectors may be more volatile, and may perform differently, than the broader market. Companies in the same economic sector may be similarly affected by economic or market events, making the Portfolio more vulnerable to unfavorable developments in that economic sector than funds that invest more broadly. |

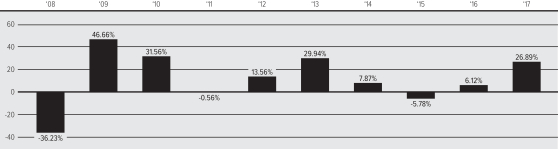

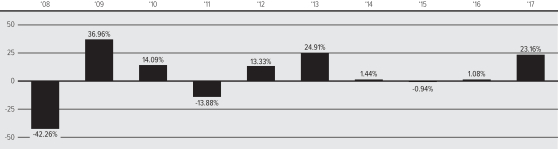

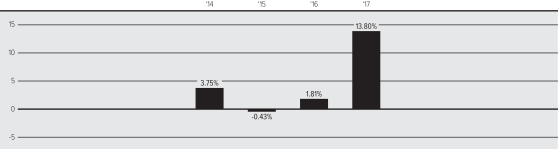

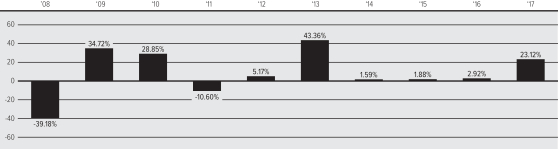

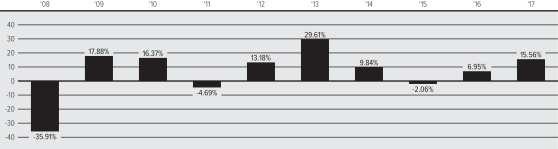

Performance

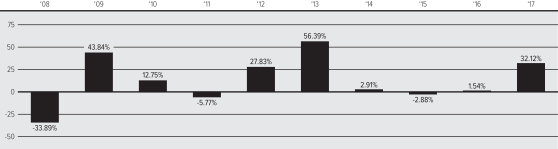

The chart and table below provide some indication of the risks of investing in the Portfolio. The chart shows how performance has varied from year to year for Class II shares of the Portfolio. The table shows the average annual total returns for Class II shares of the Portfolio and also compares the Portfolio’s returns with those of a broad-based securities market index and a Lipper peer group (a universe of mutual funds with investment objectives similar to that of the Portfolio). The performance results do not reflect any Policy-related fees and expenses, which would reduce the performance results. No performance information is presented for the Portfolio’s Class I shares because the share class has not been in existence for a full calendar year. Once that class has a full calendar year of performance, it will be included in the table below.

Performance results include the effect of expense reduction arrangements for some or all of the periods shown. If those arrangements had not been in place, the performance results for those periods would have been lower.

Prior to April 30, 2012, the Portfolio’s investment objective was to seek to provide growth of your investment. Effective as of April 30, 2012, the Portfolio changed its investment objective to seeking to provide growth of capital.

The Portfolio’s past performance does not necessarily indicate how it will perform in the future. Current performance may be lower or higher. Please call 800.777.6472 for the Portfolio’s updated performance.

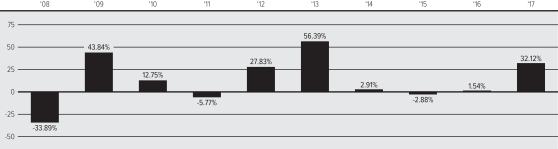

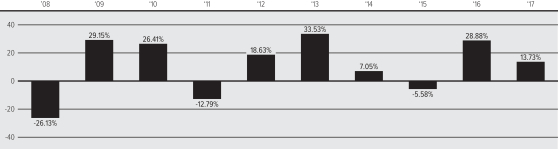

Chart of Year-by-Year Returns

as of December 31 each year

|

|

In the period shown in the chart, the highest quarterly return was 20.43% (the second quarter of 2009) and the lowest quarterly return was -22.11% (the fourth quarter of 2008). |

Average Annual Total Returns

| as of December 31, 2017 | 1 Year | 5 Years | 10 Years | |||||||||

| Class II Shares of Ivy VIP Mid Cap Growth |

26.89% | 12.20% | 9.47% | |||||||||

| Russell Midcap Growth Index (reflects no deduction for fees, expenses or taxes) |

25.27% | 15.30% | 9.10% | |||||||||

| Lipper Variable Annuity Mid-Cap Growth Funds Universe Average (net of fees and expenses) |

25.59% | 14.11% | 7.86% | |||||||||

Investment Adviser

The Portfolio is managed by Ivy Investment Management Company (IICO).

Portfolio Managers

Kimberly A. Scott, Senior Vice President of IICO, has managed the Portfolio since April 2005, and Nathan A. Brown, Senior Vice President of IICO, has managed the Portfolio since October 2016.

Purchase and Sale of Portfolio Shares

Shares of the Portfolio are currently sold only to separate accounts of Participating Insurance Companies to fund benefits payable under the Policies. Class I shares may be purchased only through fund of funds, advisory or trust accounts, wrap accounts or other asset allocation or fee-based investment arrangements.

| Domestic Equity Portfolios | Prospectus | 9 |

Table of Contents

The Portfolio’s shares are redeemable. Shares are purchased or redeemed at the Portfolio’s NAV per share next calculated after your order is received in proper form on any business day. The Portfolio does not have initial and subsequent investment minimums. Please refer to your Policy prospectus for more information on purchasing and redeeming Portfolio shares.

Tax Information

Because the Portfolio’s only shareholders are separate accounts of Participating Insurance Companies, distributions the Portfolio makes of its net investment income and net realized gains, if any — most or all of which it intends to distribute annually — and redemptions or exchanges of Portfolio shares generally will not be taxable to its shareholders (or to the holders of the underlying Policies). See the prospectus for your Policy for further tax information.

Payments to Broker-Dealers and other Financial Intermediaries

The Portfolio and its related companies may make payments to a Participating Insurance Company (or its affiliates) or other financial intermediary for distribution and/or other services. These payments may create a conflict of interest by influencing the Participating Insurance Company or other financial intermediary and your financial advisor to recommend the Portfolio over another investment or by influencing a Participating Insurance Company to include the Portfolio as an underlying investment option in the Policy. The prospectus (or other offering document) for your Policy may contain additional information about these payments.

| 10 | Prospectus | Domestic Equity Portfolios |

Table of Contents

Objective

To seek to provide total return.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the Portfolio. The table below does not reflect any fees and expenses imposed under the variable life insurance policies and variable annuity contracts (collectively, Policies) through which this Portfolio is offered. See the Policy prospectus for a description of those fees and expenses.

Shareholder Fees

| (fees paid directly from your investment) | N/A |

Annual Portfolio Operating Expenses

| (expenses that you pay each year as a % of the value of your investment) | Class I | Class II | ||||||

| Management Fees |

0.70% | 0.70% | ||||||

| Distribution and Service (12b-1) Fees |

0.00% | 0.25% | ||||||

| Other Expenses1 |

0.06% | 0.06% | ||||||

| Total Annual Portfolio Operating Expenses2, 3 |

0.76% | 1.01% | ||||||

| 1 | Other Expenses includes the expenses of Ivy VIP ASF II, Ltd., a wholly-owned subsidiary of the Portfolio organized in the Cayman Islands. |

| 2 | Through April 30, 2019, Ivy Distributors, Inc. (IDI), the Portfolio’s distributor, and/or Waddell & Reed Services Company (doing business as WI Services Company (WISC)), the Portfolio’s transfer agent, have contractually agreed to reimburse sufficient fees to ensure that the total annual ordinary portfolio operating expenses (which would exclude interest, taxes, brokerage commissions, acquired fund fees and expenses and extraordinary expenses, if any) of the Class I shares are at all times equal to the total annual ordinary portfolio operating expenses of the Class II shares less 0.25%, as calculated at the end of each month. Prior to that date, the expense limitation may not be terminated without the consent of the Board of Trustees. |

| 3 | The Total Annual Portfolio Operating Expenses ratio shown above does not correlate to the expense ratio shown in the Financial Highlights table because it has been restated to reflect a change in the Portfolio’s contractual class waiver. |

Example

This example is intended to help you compare the cost of investing in the shares of the Portfolio with the cost of investing in other portfolios. This example does not reflect any fees and expenses imposed under the Policies.

The example assumes that you invest $10,000 in the particular class of shares of the Portfolio for the time periods indicated. The example also assumes that your investment has a 5% return each year and that the Portfolio’s operating expenses remain the same. The costs are the same for each time period if you continue to hold your shares or if you redeem all your shares at the end of those periods. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Class I |

$ | 78 | $ | 243 | $ | 422 | $ | 942 | ||||||||

| Class II |

103 | 322 | 558 | 1,236 | ||||||||||||

Portfolio Turnover

The Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual portfolio operating expenses or in the example, affect the Portfolio’s performance. During the most recent fiscal year, the Portfolio’s portfolio turnover rate was 39% of the average value of its portfolio.

Principal Investment Strategies

Ivy VIP Asset Strategy seeks to achieve its objective by allocating its assets among different asset classes of varying correlation around the globe. Ivy Investment Management Company (IICO), the Portfolio’s investment manager, begins its investment process by investing a portion of the Portfolio’s assets in global equity securities that IICO believes can outperform the Portfolio’s benchmark index, the MSCI ACWI Index, over a full market cycle (the Equity Sleeve). IICO

| Specialty Portfolios | Prospectus | 11 |

Table of Contents

then invests the Portfolio’s remaining assets in various additional asset classes, including global fixed-income securities, United States Treasury instruments, precious metals, commodities and cash (the Diversifying Sleeve), which seek to provide returns to the Portfolio while having less correlation to the Equity Sleeve. IICO may allocate the Portfolio’s investments among these different asset classes in different proportions at different times, but generally seeks to invest 50% - 80% of the Portfolio’s total assets (with a long-term target of approximately 65%) in the Equity Sleeve and 20% - 50% of the Portfolio’s total assets (with a long-term target of approximately 35%) in the Diversifying Sleeve.

In selecting securities for the Portfolio, IICO primarily emphasizes a bottom-up (researching individual issuers) approach and seeks to find relative value across the asset classes noted above. Part of IICO’s investment process also includes a top-down (assessing the market and economic environment) analysis.

With respect to the Equity Sleeve, IICO seeks what it believes are well-positioned companies with a strong and / or growing sustainable competitive advantage in attractive industries across the globe which IICO believes can exceed current earnings estimates. IICO looks for companies that are taking market share within their industries, which results in high levels of cash, as well as stable to improving margins and returns. IICO generally focuses on companies that are growing, innovating, improving margins, returning capital through dividend growth or share buybacks and / or offering what IICO believes to be sustainable high free cash flow.

Within the Equity Sleeve, the Portfolio has the flexibility to invest in both growth and value companies. Although the Portfolio primarily invests in securities issued by large-capitalization companies (typically, companies with market capitalizations of at least $10 billion at the time of acquisition), it may invest in securities issued by companies of any size. The Equity Sleeve typically holds a limited number of stocks (generally 50 to 70).

Within the Diversifying Sleeve, the Portfolio has the flexibility to invest in a wide range of assets that, in IICO’s view, present attractive risk-adjusted returns as compared to the Equity Sleeve, and/or reduce the Portfolio’s overall risk profile because such assets have less correlation to the assets within the Equity Sleeve. Diversifying assets are comprised of global fixed-income instruments including investment grade and high yield (or junk) bonds, as well as emerging market, corporate and sovereign bonds and bank loans. Such fixed-income instruments may include a significant amount, up to 35% of the Portfolio’s total assets, in high-yield/high-risk bonds, or junk bonds, which include bonds rated BB+ or below by S&P Global Ratings, a division of S&P Global Inc. (S&P) or comparably rated by another nationally recognized statistical rating organization (NRSRO) or, if unrated, determined by IICO to be of comparable quality. When selecting these instruments, IICO focuses heavily on free cash flow and an issuer’s ability to deleverage itself through the credit cycle. The Portfolio can also invest in government securities issued by the U.S. Treasury (such as Treasury bills, notes or bonds), obligations issued or guaranteed as to principal and interest (but not as to market value) by the U.S. government, its agencies or instrumentalities, and mortgage-backed securities issued or guaranteed by government agencies or government-sponsored enterprises, as well as Treasury inflation-protected securities (TIPS), and cash.

Within each of the Equity Sleeve and the Diversifying Sleeve, the Portfolio may invest in U.S. and foreign securities. The Portfolio generally will invest at least 30% of its assets, and may invest up to 75%, in foreign securities and in securities denominated in currencies other than the U.S. dollar, including issuers located in and/or generating revenue from emerging markets. Many of the companies in which the Portfolio may invest have diverse operations, with products or services in foreign markets. Therefore, the Portfolio may have indirect exposure to various foreign markets through investments in these companies, even if the Portfolio is not invested directly in such markets.

IICO may allocate the Portfolio’s investments among the different types of assets noted above in different proportions at different times (keeping in mind the general percentages noted above) and may exercise a flexible strategy in selecting investments. IICO does not intend to concentrate the Portfolio in any geographic region or industry sector; however, it is not limited by investment style or by the issuer’s location or industry sector.

Subject to diversification limits, the Portfolio also may invest up to 10% of its total assets in precious metals. The Portfolio gains exposure to commodities, including precious metals, derivatives and commodity-linked instruments, by investing in a subsidiary organized in the Cayman Islands (Subsidiary). The Subsidiary is wholly owned and controlled by the Portfolio. The Portfolio’s investment in the Subsidiary is expected to provide the Portfolio with exposure to investment returns from commodities, derivatives and commodity-linked instruments within the limits of the Federal tax requirements applicable to regulated investment companies, such as the Portfolio.

Generally, in determining whether to sell a security within the Equity Sleeve, IICO considers many factors, which may include a deterioration in a company’s fundamentals caused by global-specific factors such as geo-political landscape changes, regulatory or currency changes, or increased competition, as well as company-specific factors, such as

| 12 | Prospectus | Specialty Portfolios |

Table of Contents

reduced pricing power, diminished market opportunity, or increased competition. IICO also may sell a security if the price of the security reaches what IICO believes is fair value, to reduce the Portfolio’s holding in that security, to take advantage of what it believes are more attractive investment opportunities, or to raise cash. Within the Diversifying Sleeve, IICO generally sells assets when, in IICO’s view, such assets no longer have the ability to provide equity-like returns or no longer provide the desired portfolio diversification.

Principal Investment Risks

As with any mutual fund, the value of the Portfolio’s shares will change, and you could lose money on your investment. The Portfolio is not intended as a complete investment program.

A variety of factors can affect the investment performance of the Portfolio and prevent it from achieving its objective. These include:

| ∎ | Commodities Risk. Commodity trading, including trading in precious metals, generally is considered speculative because of the significant potential for investment loss. Among the factors that could affect the value of the Portfolio’s investments in commodities are resource availability, commodity price volatility, speculation in the commodities markets, cyclical economic conditions, sudden political events and adverse international monetary policies. Markets for commodities are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising. Also, the Portfolio may pay more to store and accurately value its commodity holdings than it does with its other portfolio investments. Moreover, under the Federal tax law, the Portfolio may not derive more than 10% of its annual gross income from gains (without regard to losses) resulting from selling or otherwise disposing of commodities (and other “non-qualifying” income). Accordingly, the Portfolio may be required to hold its commodities or to sell them at a loss, or to sell portfolio securities at a gain, when for investment reasons it would not otherwise do so. |

| ∎ | Company Risk. A company may be more volatile or perform worse than the overall market due to specific factors, such as adverse changes to its business or investor perceptions about the company. |

| ∎ | Credit Risk. An issuer of a fixed-income obligation may not make payments on the obligation when due or may default on its obligation. There also is the risk that an issuer could suffer adverse changes in its financial condition that could lower the credit quality of a security. This could lead to greater volatility in the price of the security, could affect the security’s liquidity, and could make it more difficult to sell. A downgrade or default affecting any of the Portfolio’s securities could affect the Portfolio’s performance. In general, the longer the maturity and the lower the credit quality of a bond, the more sensitive it is to credit risk. |

| ∎ | Emerging Market Risk. Investments in countries with emerging economies or securities markets may carry greater risk than investments in more developed countries. Political and economic structures in many such countries may be undergoing significant evolution and rapid development, and such countries may lack the social, political and economic stability characteristics of more developed countries. Investments in securities issued in these countries may be more volatile and less liquid than securities issued in more developed countries. Emerging markets are more susceptible to capital controls, governmental interference, local taxes being imposed on international investments, restrictions on gaining access to sales proceeds, and less efficient trading markets. |

| ∎ | Foreign Currency Risk. Foreign securities may be denominated in foreign currencies. The value of the Portfolio’s investments, as measured in U.S. dollars, may be unfavorably affected by changes in foreign currency exchange rates and exchange control regulations. |

| ∎ | Foreign Exposure Risk. The securities of many companies may have significant exposure to foreign markets as a result of the company’s operations, products or services in those foreign markets. As a result, a company’s domicile and/or the markets in which the company’s securities trade may not be fully reflective of its sources of revenue. Such securities would be subject to some of the same risks as an investment in foreign securities, including the risk that political and economic events unique to a country or region will adversely affect those markets in which the company’s products or services are sold. |

| ∎ | Foreign Securities Risk. Investing in foreign securities involves a number of economic, financial, legal, and political considerations that are not associated with the U.S. markets and that could affect the Portfolio’s performance unfavorably, depending upon the prevailing conditions at any given time. Among these potential risks are: greater price volatility; comparatively weak supervision and regulation of securities exchanges, brokers and issuers; higher brokerage costs; social, political or economic instability; fluctuations in foreign currency exchange rates and related conversion costs or currency redenomination; nationalization or expropriation of assets; adverse foreign tax consequences; different and/or less stringent financial reporting standards; and settlement, custodial or other operational delays. The risks may be exacerbated in connection with investments in emerging markets. World markets, or those in a particular region, all may react in similar fashion to important economic or political |

| Specialty Portfolios | Prospectus | 13 |

Table of Contents

| developments. In addition, key information about the issuer, the markets or the local government or economy may be unavailable, incomplete or inaccurate. Securities of issuers traded on exchanges may be suspended, either by the issuers themselves, by an exchange or by governmental authorities. The likelihood of such suspensions may be higher for securities of issuers in emerging markets than in more developed markets. In the event that the Portfolio holds material positions in such suspended securities, the Portfolio’s ability to liquidate its positions or provide liquidity to investors may be compromised and the Portfolio could incur significant losses. Sovereign debt instruments also are subject to the risk that a government or agency issuing the debt may be unable to pay interest and/or repay principal due to cash flow problems, insufficient foreign currency reserves or political concerns. In such instance, the Portfolio may have limited recourse against the issuing government or agency. |

| ∎ | Growth Stock Risk. Prices of growth stocks may be more sensitive to changes in current or expected earnings than the prices of other stocks. Growth stocks may be more volatile or not perform as well as value stocks or the stock market in general. |

| ∎ | Holdings Risk. The Equity Sleeve of the Portfolio typically holds a limited number of stocks (generally 50 to 70). As a result, the appreciation or depreciation of any one security held by the Portfolio may have a greater impact on the Portfolio’s net asset value (NAV) than it would if the Equity Sleeve of the Portfolio invested in a larger number of securities. |

| ∎ | Interest Rate Risk. A rise in interest rates may cause a decline in the value of the Portfolio’s securities, especially securities with longer maturities. Typically, the longer the maturity or duration of a debt security, the greater the effect a change in interest rates could have on the security’s price. Thus, the sensitivity of the Portfolio’s debt securities to interest rate risk will increase with any increase in the duration of those securities. A decline in interest rates may cause the Portfolio to experience a decline in its income. Interest rates in the U.S. are at, or near, historic lows, which may increase the Portfolio’s exposure to risks associated with rising rates. The Portfolio may be subject to heightened interest rate risk as a result of a rise or anticipated rise in interest rates. In addition, a general rise in rates may result in decreased liquidity and increased volatility in the fixed-income markets generally. |

| ∎ | Large Company Risk. Large-capitalization companies may go in and out of favor based on market and economic conditions. Large-capitalization companies may be unable to respond quickly to new competitive challenges, such as changes in technology, and also may not be able to attain the high growth rate of successful smaller companies, especially during extended periods of economic expansion. Although the securities of larger companies may be less volatile than those of companies with smaller market capitalizations, returns on investments in securities of large-capitalization companies could trail the returns on investments in securities of smaller companies. |

| ∎ | Liquidity Risk. Generally, a security is liquid if the Portfolio is able to sell the security at a fair price within a reasonable time. Liquidity generally is related to the market trading volume for a particular security. Illiquid securities may trade at a discount from comparable, more liquid investments, and may be subject to wider fluctuations in market value. Less liquid securities are more difficult to dispose of at their recorded values and are subject to increased spreads and volatility. Also, the Portfolio may not be able to dispose of illiquid securities when that would be beneficial at a favorable time or price. Certain investments that were liquid when the Portfolio purchased them may become illiquid, sometimes abruptly. |

| ∎ | Loan Risk. In addition to the risks typically associated with fixed-income securities, loans carry other risks, including the risk of insolvency of the lending bank or other intermediary. The risks associated with loans are similar to the risks of low-rated debt securities or “junk” bonds since loans typically are below investment grade. Loans may be unsecured or not fully collateralized, may be subject to restrictions on resale, may be difficult to value, sometimes trade infrequently on the secondary market and generally are subject to extended settlement periods. Any of these factors may impair the Portfolio’s ability to sell or realize promptly the full value of its loans in the event of a need to liquidate such loans. Accordingly, loans that have been sold may not be immediately available to meet redemptions. Extended trade settlement periods may result in cash not being immediately available to the Portfolio. As a result, the Portfolio may have to sell other investments or engage in borrowing transactions to raise cash to meet its obligations. Interests in secured loans have the benefit of collateral and, typically, of restrictive covenants limiting the ability of the borrower to further encumber its assets. There is a risk that the value of the collateral securing a loan in which the Portfolio has an interest may decline and that the collateral may not be sufficient to cover the amount owed on the loan. In the event the borrower defaults, the Portfolio’s access to the collateral may be limited or delayed by bankruptcy and other insolvency laws. These risks could cause the Portfolio to lose income or principal on a particular investment, which could affect the Portfolio’s returns. In addition, loans also are subject to the risk that a court could subordinate the loan to presently existing or future indebtedness or take other action detrimental to the holders of the loan. Further, in the event of a default, second or lower lien secured loans will generally be paid only if the value of the collateral exceeds the amount of the borrower’s obligations to the senior secured lenders, and the remaining collateral may not be sufficient to cover the full amount owed on the loan in which the Portfolio has an |

| 14 | Prospectus | Specialty Portfolios |

Table of Contents

| interest. Loans made to finance highly leveraged companies or to finance corporate acquisitions or other transactions may be especially vulnerable to adverse changes in economic or market conditions. |

With loan assignments, as an assignee, the Portfolio normally will succeed to all rights and obligations of its assignor with respect to the portion of the loan that is being assigned. However, the rights and obligations acquired by the purchaser of a loan assignment may differ from, and be more limited than, those held by the original lenders or the assignor. With loan participations, the Portfolio may not be able to control the exercise of any remedies that the lender would have under the loan and likely would not have any rights against the borrower directly, so that delays and expense may be greater than those that would be involved if the Portfolio could enforce its rights directly against the borrower.

| ∎ | Low-Rated Securities Risk. In general, low-rated debt securities (commonly referred to as “high yield” or “junk” bonds) offer higher yields due to the increased risk that the issuer will be unable to meet its obligations on interest or principal payments at the time called for by the debt instrument. For this reason, these bonds are considered speculative and could significantly weaken the Portfolio’s returns. In adverse economic or other circumstances, issuers of these low-rated securities and obligations are more likely to have difficulty making principal and interest payments than issuers of higher-rated securities and obligations. In addition, these low-rated securities and obligations may fluctuate more widely in price and yield than higher-rated securities and obligations and may fall in price during times when the economy is weak or is expected to become weak. Issuers of securities that are in default or have defaulted may fail to resume principal or interest payments, in which case the Portfolio may lose its entire investment. The creditworthiness of issuers of low-rated securities may be more complex to analyze than that of issuers of investment-grade debt securities. |

| ∎ | Management Risk. Portfolio performance is primarily dependent on IICO’s skill in evaluating and managing the Portfolio’s holdings. There can be no guarantee that its decisions will produce the desired results, and the Portfolio may not perform as well as other similar mutual funds. |

| ∎ | Market Risk. Markets can be volatile, and the Portfolio’s holdings can decline in response to adverse issuer, political, regulatory, market or economic developments or conditions that may cause a broad market decline. Different parts of the market, including different sectors and different types of securities, can react differently to these developments. Since the financial crisis that started in 2008, the U.S. and many foreign economies continue to experience its after-effects, which have resulted, and may continue to result, in volatility in the financial markets, both U.S. and foreign. Global economies and financial markets are becoming increasingly interconnected, which increases the possibilities that conditions in one country or region may adversely affect issuers in another country or region, which in turn may adversely affect securities held by the Portfolio. These circumstances also have decreased liquidity in some markets and may continue to do so. In addition, certain events, such as natural disasters, terrorist attacks, war, and other geopolitical events, have led, and may in the future lead, to increased short-term market volatility and may have adverse long-term effects on world economies and markets generally. |

| ∎ | Mortgage-Backed and Asset-Backed Securities Risk. Mortgage-backed and asset-backed securities are subject to prepayment risk and extension risk. When interest rates decline, unscheduled prepayments can be expected to accelerate, shortening the average lives of such securities, and the Portfolio may be required to reinvest the proceeds of the prepayments at the lower interest rates then available. Unscheduled prepayments also would limit the potential for capital appreciation on mortgage-backed and asset-backed securities, thereby reducing the Portfolio’s income. Conversely, when interest rates rise, the values of mortgage-backed and asset-backed securities generally fall. Rising interest rates typically result in decreased prepayments and longer average lives of such securities. This could cause the value of such securities to be more volatile or decline more than other fixed-income securities, and may magnify the effect of the rate increase on the price of such securities. |

Certain mortgage-backed securities are U.S. government securities. See U.S. Government Securities Risk for the risks of these types of securities. For non-U.S. government securities, there is the risk that payments on a security will not be made when due, or the value of such security will decline, because the security is not issued or guaranteed as to principal or interest by the U.S. government or by agencies or authorities controlled or supervised by and acting as instrumentalities of the U.S. government or supported by the right of the issuer to borrow from the U.S. government.

| ∎ | Subsidiary Investment Risk. By investing in the Subsidiary, the Portfolio is exposed to the risks associated with the Subsidiary’s investments. The Subsidiary is not registered under the Investment Company Act of 1940, as amended (1940 Act), and is not subject to all of the investor protections of the 1940 Act. Thus, the Portfolio, as an investor in the Subsidiary, would not have all of the protections offered to investors in registered investment companies. However, because the Portfolio wholly owns and controls the Subsidiary, and the Portfolio and Subsidiary are managed by IICO, it is unlikely that the Subsidiary would take action contrary to the interests of the Portfolio or the Portfolio’s shareholders. In addition, changes in the laws of the United States and/or the Cayman Islands, under which the Portfolio and the Subsidiary are organized, respectively, could result in the inability of the Portfolio and/or the |

| Specialty Portfolios | Prospectus | 15 |

Table of Contents

| Subsidiary to operate as intended and could negatively affect the Portfolio and its shareholders. Although, under the Federal tax law, the Portfolio may not derive more than 10% of its annual gross income from gains resulting from selling or otherwise disposing of commodities (and other “non-qualifying” income), the Portfolio has received an opinion of counsel, which is not binding on the Internal Revenue Service (IRS) or the courts, that income the Portfolio receives from the Subsidiary should constitute “qualifying” income. |

| ∎ | U.S. Government Securities Risk. Certain U.S. government securities, such as U.S. Treasury (Treasury) securities and securities issued by the Government National Mortgage Association (Ginnie Mae), are backed by the full faith and credit of the U.S. government. Other U.S. government securities, such as securities issued by the Federal National Mortgage Association (Fannie Mae), the Federal Home Loan Mortgage Corporation (Freddie Mac) and the Federal Home Loan Banks (FHLB), are not backed by the full faith and credit of the U.S. government and, instead, may be supported only by the credit of the issuer or by the right of the issuer to borrow from the Treasury. |

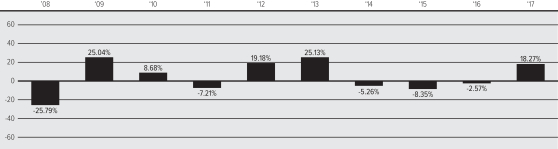

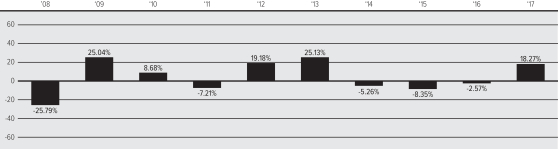

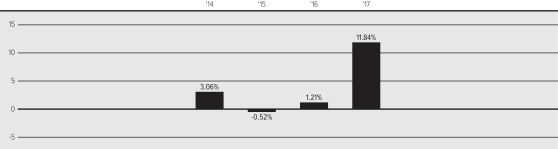

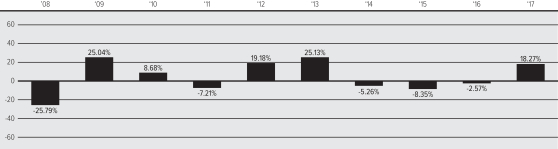

Performance

The chart and table below provide some indication of the risks of investing in the Portfolio. The chart shows how performance has varied from year to year for Class II shares of the Portfolio. The table shows the average annual total returns for Class II shares of the Portfolio and also compares the Portfolio’s returns with those of various broad-based securities market indexes and a Lipper peer group (a universe of mutual funds with investment objectives similar to that of the Portfolio). The performance results do not reflect any Policy-related fees and expenses, which would reduce the performance results. No performance information is presented for the Portfolio’s Class I shares because the share class has not been in existence for a full calendar year. Once that class has a full calendar year of performance, it will be included in the table below.

Performance results include the effect of expense reduction arrangements for some or all of the periods shown. If those arrangements had not been in place, the performance results for those periods would have been lower.

Prior to April 30, 2012, the Portfolio’s investment objective was to seek high total return over the long term. Effective as of April 30, 2012, the Portfolio changed its investment objective to seeking to provide total return.

The Portfolio’s past performance does not necessarily indicate how it will perform in the future. Current performance may be lower or higher. Please call 800.777.6472 for the Portfolio’s updated performance.

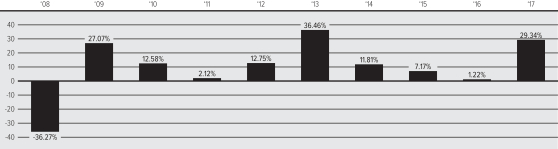

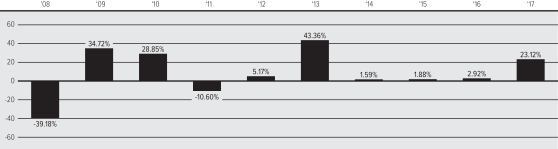

Chart of Year-by-Year Returns

as of December 31 each year

|

|

In the period shown in the chart, the highest quarterly return was 13.96% (the first quarter of 2012) and the lowest quarterly return was -18.90% (the third quarter of 2011). |

| 16 | Prospectus | Specialty Portfolios |

Table of Contents

Average Annual Total Returns

| as of December 31, 2017 | 1 Year | 5 Years | 10 Years | |||||||||

| Class II Shares of Ivy VIP Asset Strategy |

18.27% | 4.60% | 3.39% | |||||||||

| MSCI ACWI Index (reflects no deduction for fees, expenses or taxes) (Effective February 6, 2018, the MSCI ACWI Index is the Portfolio’s new benchmark index. IICO believes that this index is a more representative index for the types of securities that the Portfolio purchases than the three indexes noted below.) |

23.97% | 10.80% | 4.65% | |||||||||

| S&P 500 Index (reflects no deduction for fees, expenses or taxes) |

21.83% | 15.79% | 8.50% | |||||||||

| Bloomberg Barclays U.S. Aggregate Bond Index (reflects no deduction for fees, expenses or taxes) |

3.54% | 2.10% | 4.01% | |||||||||

| Bloomberg Barclays U.S. Treasury Bills: 1-3 Month Index (reflects no deduction for fees, expenses or taxes) |

0.81% | 0.23% | 0.34% | |||||||||

| Lipper Variable Annuity Alternative Other Funds Universe Average (net of fees and expenses) |

9.60% | 4.91% | 4.20% | |||||||||

Investment Adviser

The Portfolio is managed by Ivy Investment Management Company (IICO).

Portfolio Managers

F. Chace Brundige, Senior Vice President of IICO, has managed the Portfolio since August 2014, and W. Jeffery Surles, Senior Vice President of IICO, has managed the Portfolio since February 2018.

Purchase and Sale of Portfolio Shares

Shares of the Portfolio are currently sold only to separate accounts of Participating Insurance Companies to fund benefits payable under the Policies. Class I shares may be purchased only through fund of funds, advisory or trust accounts, wrap accounts or other asset allocation or fee-based investment arrangements.

The Portfolio’s shares are redeemable. Shares are purchased or redeemed at the Portfolio’s NAV per share next calculated after your order is received in proper form on any business day. The Portfolio does not have initial and subsequent investment minimums. Please refer to your Policy prospectus for more information on purchasing and redeeming Portfolio shares.

Tax Information

Because the Portfolio’s only shareholders are separate accounts of Participating Insurance Companies, distributions the Portfolio makes of its net investment income and net realized gains, if any — most or all of which it intends to distribute annually — and redemptions or exchanges of Portfolio shares generally will not be taxable to its shareholders (or to the holders of the underlying Policies). See the prospectus for your Policy for further tax information.

Payments to Broker-Dealers and other Financial Intermediaries

The Portfolio and its related companies may make payments to a Participating Insurance Company (or its affiliates) or other financial intermediary for distribution and/or other services. These payments may create a conflict of interest by influencing the Participating Insurance Company or other financial intermediary and your financial advisor to recommend the Portfolio over another investment or by influencing a Participating Insurance Company to include the Portfolio as an underlying investment option in the Policy. The prospectus (or other offering document) for your Policy may contain additional information about these payments.

| Specialty Portfolios | Prospectus | 17 |

Table of Contents

Objective

To seek to provide capital growth and appreciation.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the Portfolio. The table below does not reflect any fees and expenses imposed under the variable life insurance policies and variable annuity contracts (collectively, Policies) through which this Portfolio is offered. See the Policy prospectus for a description of those fees and expenses.

Shareholder Fees

| (fees paid directly from your investment) | N/A |

Annual Portfolio Operating Expenses

| (expenses that you pay each year as a % of the value of your investment) | Class I | Class II | ||||||

| Management Fees |

0.85% | 0.85% | ||||||

| Distribution and Service (12b-1) Fees |

0.00% | 0.25% | ||||||

| Other Expenses |

0.09% | 0.09% | ||||||

| Total Annual Portfolio Operating Expenses1, 2 |

0.94% | 1.19% | ||||||

| 1 | Through April 30, 2019, Ivy Distributors, Inc. (IDI), the Portfolio’s distributor, and/or Waddell & Reed Services Company (doing business as WI Services Company (WISC)), the Portfolio’s transfer agent, have contractually agreed to reimburse sufficient fees to ensure that the total annual ordinary portfolio operating expenses (which would exclude interest, taxes, brokerage commissions, acquired fund fees and expenses and extraordinary expenses, if any) of the Class I shares are at all times equal to the total annual ordinary portfolio operating expenses of the Class II shares less 0.25%, as calculated at the end of each month. Prior to that date, the expense limitation may not be terminated without the consent of the Board of Trustees. |

| 2 | The Total Annual Portfolio Operating Expenses ratio shown above does not correlate to the expense ratio shown in the Financial Highlights table because it has been restated to reflect a change in the Portfolio’s contractual class waiver. |

Example

This example is intended to help you compare the cost of investing in the shares of the Portfolio with the cost of investing in other portfolios. This example does not reflect any fees and expenses imposed under the Policies.

The example assumes that you invest $10,000 in the particular class of shares of the Portfolio for the time periods indicated. The example also assumes that your investment has a 5% return each year and that the Portfolio’s operating expenses remain the same. The costs are the same for each time period if you continue to hold your shares or if you redeem all your shares at the end of those periods. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Class I |

$ | 96 | $ | 300 | $ | 520 | $ | 1,155 | ||||||||

| Class II |

121 | 378 | 654 | 1,443 | ||||||||||||

Portfolio Turnover

The Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual portfolio operating expenses or in the example, affect the Portfolio’s performance. During the most recent fiscal year, the Portfolio’s portfolio turnover rate was 22% of the average value of its portfolio.

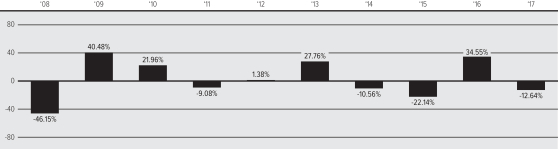

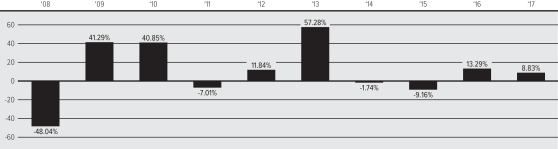

Principal Investment Strategies

Ivy VIP Energy seeks to achieve its objective by investing, under normal circumstances, at least 80% of its net assets in securities of companies within the energy sector, which includes all aspects of the energy industry, such as exploration, discovery, production, distribution or infrastructure of energy and/or alternative energy sources.

| 18 | Prospectus | Specialty Portfolios |

Table of Contents

These companies may include, but are not limited to, oil companies, oil and gas drilling, equipment and services companies, oil and gas exploration and production companies, oil and gas storage and transportation companies, natural gas pipeline companies, refinery companies, energy conservation companies, coal, transporters, utilities, alternative energy companies and innovative energy technology companies. The Portfolio also may invest in companies that are not within the energy sector that are engaged in the development of products and services to enhance energy efficiency for the users of those products and services.

After conducting a top-down (assessing the market environment) market analysis of the energy industry and geopolitical issues and then identifying trends and sectors, Ivy Investment Management Company (IICO), the Portfolio’s investment manager, uses a research-oriented, bottom-up (researching individual issuers) investment approach when selecting securities for the Portfolio, focusing on company fundamentals and growth prospects. In general, the Portfolio emphasizes companies that IICO believes are strongly managed and can generate above average, capital growth and appreciation. IICO analyzes net asset value, free cash flow and balance sheet strength and focuses on companies that exhibit capital discipline with a low cost structure and strong assets. The Portfolio invests in a blend of value and growth companies domiciled throughout the world, which may include companies that are offered in initial public offerings (IPOs). While IICO typically seeks to invest a majority of the Portfolio’s assets in U.S. securities, the Portfolio may invest up to 100% of its total assets in foreign securities. The Portfolio typically holds a limited number of stocks (generally 40 to 55).

Many of the companies in which the Portfolio may invest have diverse operations, with products or services in foreign markets. Therefore, the Portfolio may have indirect exposure to various foreign markets through investments in these companies, potentially including companies domiciled or traded or doing business in emerging markets, even if the Portfolio is not invested directly in such markets.

Generally, in determining whether to sell a security, IICO uses the same type of analysis that it uses in buying securities to determine whether the security has ceased to offer significant growth potential, has sufficiently exceeded its target price, has become undervalued and/or whether the prospects of the issuer have deteriorated. IICO also will consider the effect of commodity price trends on certain holdings, poor capital management or whether a company has experienced a change or deterioration in its fundamentals, its valuation or its competitive advantage. IICO also may sell a security to take advantage of what it believes are more attractive investment opportunities, to reduce the Portfolio’s holding in that security or to raise cash.

Principal Investment Risks

As with any mutual fund, the value of the Portfolio’s shares will change, and you could lose money on your investment. The Portfolio is not intended as a complete investment program.

A variety of factors can affect the investment performance of the Portfolio and prevent it from achieving its objective. These include:

| ∎ | Company Risk. A company may be more volatile or perform worse than the overall market due to specific factors, such as adverse changes to its business or investor perceptions about the company. |

| ∎ | Concentration Risk. Because the Portfolio invests more than 25% of its total assets in the energy related industry, the Portfolio’s performance may be more susceptible to a single economic, regulatory or technological occurrence than a fund that does not concentrate its investments in this industry. Securities of companies within specific industries or sectors of the economy may periodically perform differently than the overall market. In addition, the Portfolio’s performance may be more volatile than an investment in a portfolio of broad market securities and may underperform the market as a whole, due to the relatively limited number of issuers of energy-related securities. |

| ∎ | Energy Sector Risk. Investment risks associated with investing in energy securities, in addition to other risks, include price fluctuation caused by real and perceived inflationary trends and political developments, the cost assumed in complying with environmental safety regulations, demand of energy fuels, energy conservation, the success of exploration projects, and tax and other governmental regulations. |

| ∎ | Foreign Exposure Risk. The securities of many companies may have significant exposure to foreign markets as a result of the company’s operations, products or services in those foreign markets. As a result, a company’s domicile and/or the markets in which the company’s securities trade may not be fully reflective of its sources of revenue. Such securities would be subject to some of the same risks as an investment in foreign securities, including the risk that political and economic events unique to a country or region will adversely affect those markets in which the company’s products or services are sold. |

| ∎ | Foreign Securities Risk. Investing in foreign securities involves a number of economic, financial, legal, and political considerations that are not associated with the U.S. markets and that could affect the Portfolio’s performance |

| Specialty Portfolios | Prospectus | 19 |

Table of Contents

| unfavorably, depending upon the prevailing conditions at any given time. Among these potential risks are: greater price volatility; comparatively weak supervision and regulation of securities exchanges, brokers and issuers; higher brokerage costs; social, political or economic instability; fluctuations in foreign currency exchange rates and related conversion costs or currency redenomination; nationalization or expropriation of assets; adverse foreign tax consequences; different and/or less stringent financial reporting standards; and settlement, custodial or other operational delays. The risks may be exacerbated in connection with investments in emerging markets. World markets, or those in a particular region, all may react in similar fashion to important economic or political developments. In addition, key information about the issuer, the markets or the local government or economy may be unavailable, incomplete or inaccurate. Securities of issuers traded on exchanges may be suspended, either by the issuers themselves, by an exchange or by governmental authorities. The likelihood of such suspensions may be higher for securities of issuers in emerging markets than in more developed markets. In the event that the Portfolio holds material positions in such suspended securities, the Portfolio’s ability to liquidate its positions or provide liquidity to investors may be compromised and the Portfolio could incur significant losses. |

| ∎ | Growth Stock Risk. Prices of growth stocks may be more sensitive to changes in current or expected earnings than the prices of other stocks. Growth stocks may be more volatile or not perform as well as value stocks or the stock market in general. |

| ∎ | Holdings Risk. The Portfolio typically holds a limited number of stocks (generally 40 to 55). As a result, the appreciation or depreciation of any one security held by the Portfolio may have a greater impact on the Portfolio’s net asset value (NAV) than it would if the Portfolio invested in a larger number of securities. |

| ∎ | Initial Public Offering (IPO) Risk. Any positive effect of investments in IPOs may not be sustainable because of a number of factors. Namely, the Portfolio may not be able to buy shares in some IPOs, or may be able to buy only a small number of shares. Also, the performance of IPOs generally is volatile, and is dependent on market psychology and economic conditions. To the extent that IPOs have a significant positive impact on the Portfolio’s performance, this may not be able to be replicated in the future. The relative performance impact of IPOs also is likely to decline as the Portfolio grows. |

| ∎ | Management Risk. Portfolio performance is primarily dependent on IICO’s skill in evaluating and managing the Portfolio’s holdings. There can be no guarantee that its decisions will produce the desired results, and the Portfolio may not perform as well as other similar mutual funds. |