|

Ivy VIP Science and Technology | |

|

Summary Prospectus | April 30, 2018 |

CLASS I SHARES | CLASS II SHARES

Before you invest, you may want to review the Portfolio’s prospectus, which contains more information about the Portfolio and its risks. You can find the Portfolio’s prospectus and other information about the Portfolio (including the Portfolio’s statement of additional information (SAI)) online at www.ivyinvestments.com/vip-prospectus. You also can get this information at no cost by calling 800.777.6472 or by sending an e-mail request to prospectus.request@waddell.com. You also can get this information from your investment provider. The Portfolio’s prospectus and SAI dated April 30, 2018 (as each may be amended or supplemented), are incorporated herein by reference. This summary prospectus is intended for use in connection with certain life insurance policies and variable annuity contracts offered by certain select insurance companies (Participating Insurance Companies) and is not intended for use by other investors.

Objective

To seek to provide growth of capital.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the Portfolio. The table below does not reflect any fees and expenses imposed under the variable life insurance policies and variable annuity contracts (collectively, Policies) through which this Portfolio is offered. See the Policy prospectus for a description of those fees and expenses.

Shareholder Fees

| (fees paid directly from your investment) | N/A |

Annual Portfolio Operating Expenses

| (expenses that you pay each year as a % of the value of your investment) | Class I | Class II | ||||||

| Management Fees |

0.85% | 0.85% | ||||||

| Distribution and Service (12b-1) Fees |

0.00% | 0.25% | ||||||

| Other Expenses |

0.05% | 0.05% | ||||||

| Total Annual Portfolio Operating Expenses1 |

0.90% | 1.15% | ||||||

| 1 | Through April 30, 2019, Ivy Distributors, Inc. (IDI), the Portfolio’s distributor, and/or Waddell & Reed Services Company (doing business as WI Services Company (WISC)), the Portfolio’s transfer agent, have contractually agreed to reimburse sufficient fees to ensure that the total annual ordinary portfolio operating expenses (which would exclude interest, taxes, brokerage commissions, acquired fund fees and expenses and extraordinary expenses, if any) of the Class I shares are at all times equal to the total annual ordinary portfolio operating expenses of the Class II shares less 0.25%, as calculated at the end of each month. Prior to that date, the expense limitation may not be terminated without the consent of the Board of Trustees. |

Example

This example is intended to help you compare the cost of investing in the shares of the Portfolio with the cost of investing in other portfolios. This example does not reflect any fees and expenses imposed under the Policies.

The example assumes that you invest $10,000 in the particular class of shares of the Portfolio for the time periods indicated. The example also assumes that your investment has a 5% return each year and that the Portfolio’s operating expenses remain the same. The costs are the same for each time period if you continue to hold your shares or if you redeem all your shares at the end of those periods. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Class I |

$ | 92 | $ | 287 | $ | 498 | $ | 1,108 | ||||||||

| Class II |

117 | 365 | 633 | 1,398 | ||||||||||||

Portfolio Turnover

The Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual portfolio operating expenses or in the example, affect the Portfolio’s performance. During the most recent fiscal year, the Portfolio’s portfolio turnover rate was 27% of the average value of its portfolio.

Principal Investment Strategies

Ivy VIP Science and Technology invests primarily in the equity securities of science and technology companies around the globe. Under normal circumstances, the Portfolio invests at least 80% of its net assets in securities of science or technology companies. Such companies may include companies that, in the opinion of Ivy Investment Management Company (IICO), the Portfolio’s investment manager, derive a competitive advantage by the application of scientific or technological developments or discoveries to grow their business or increase their competitive advantage. Science and technology companies are companies whose products, processes or services, in the opinion of IICO, are being, or are expected to be, significantly benefited by the use or commercial application of scientific or technological developments or discoveries. The Portfolio also may invest in companies that utilize science and/or technology as an agent of change to significantly enhance their business opportunities. The Portfolio may invest in securities issued by companies of any size, and may invest without limitation in foreign securities, including securities of issuers within emerging markets.

The Portfolio is non-diversified, meaning that it may invest a significant portion of its total assets in a limited number of issuers.

IICO typically emphasizes growth potential in selecting stocks; that is, IICO seeks companies in which earnings are likely to grow faster than the economy. IICO aims to identify strong secular trends within industries and then applies a largely bottom-up (researching individual issuers) stock selection process by considering a number of factors in selecting securities for the Portfolio. These may include but are not limited to a company’s growth potential, earnings potential, quality of management, valuation, financial statements, industry position/market size potential and applicable economic and market conditions, as well as whether a company’s products and services have high barriers to entry. The Portfolio typically holds a limited number of stocks (generally 40 to 60).

Many of the companies in which the Portfolio may invest have diverse operations, with products or services in foreign markets. Therefore, the Portfolio may have indirect exposure to various foreign markets through investments in these companies, even if the Portfolio is not invested directly in such markets.

Generally, in determining whether to sell a security, IICO uses the same type of analysis that it uses in buying securities in order to determine whether the security has ceased to offer significant growth potential, has become overvalued and/or whether the company prospects of the issuer have deteriorated due to a change in management, change in strategy and/or a change in its financial characteristics. IICO also may sell a security to reduce the Portfolio’s holding in that security, to take advantage of what it believes are more attractive investment opportunities or to raise cash.

Principal Investment Risks

As with any mutual fund, the value of the Portfolio’s shares will change, and you could lose money on your investment. The Portfolio is not intended as a complete investment program.

A variety of factors can affect the investment performance of the Portfolio and prevent it from achieving its objective. These include:

| ∎ | Company Risk. A company may be more volatile or perform worse than the overall market due to specific factors, such as adverse changes to its business or investor perceptions about the company. |

| ∎ | Concentration Risk. Because the Portfolio invests more than 25% of its total assets in the science and technology industry, the Portfolio’s performance may be more susceptible to a single economic, regulatory or technological occurrence than a fund that does not concentrate its investments in this industry. Securities of companies within specific industries or sectors of the economy may periodically perform differently than the overall market. In addition, the Portfolio’s performance may be more volatile than an investment in a portfolio of broad market securities and may underperform the market as a whole, due to the relatively limited number of issuers of science and technology related securities. |

| ∎ | Emerging Market Risk. Investments in countries with emerging economies or securities markets may carry greater risk than investments in more developed countries. Political and economic structures in many such countries may be undergoing significant evolution and rapid development, and such countries may lack the social, political and economic stability characteristics of more developed countries. Investments in securities issued in these countries may be more volatile and less liquid than securities issued in more developed countries. Emerging markets are more susceptible to capital controls, governmental interference, local taxes being imposed on international investments, restrictions on gaining access to sales proceeds, and less efficient trading markets. |

| ∎ | Foreign Exposure Risk. The securities of many companies may have significant exposure to foreign markets as a result of the company’s operations, products or services in those foreign markets. As a result, a company’s domicile and/or the markets in which the company’s securities trade may not be fully reflective of its sources of revenue. Such securities would be subject to some of the same risks as an investment in foreign securities, including the risk that political and economic events unique to a country or region will adversely affect those markets in which the company’s products or services are sold. |

| ∎ | Foreign Securities Risk. Investing in foreign securities involves a number of economic, financial, legal, and political considerations that are not associated with the U.S. markets and that could affect the Portfolio’s performance unfavorably, depending upon the prevailing conditions at any given time. Among these potential risks are: greater price volatility; comparatively weak supervision and regulation of securities exchanges, brokers and issuers; higher brokerage costs; social, political or economic instability; fluctuations in foreign currency exchange rates and related conversion costs or currency redenomination; nationalization or expropriation of assets; adverse foreign tax consequences; different and/or less stringent financial reporting standards; and settlement, custodial or other operational delays. The risks may be exacerbated in connection with investments in emerging markets. World markets, or those in a particular region, all may react in similar fashion to important economic or political developments. In addition, key information about the issuer, the markets or the local government or economy may be unavailable, incomplete or inaccurate. Securities of issuers traded on exchanges may be suspended, either by the issuers themselves, by an exchange or by governmental authorities. The likelihood of such suspensions may be higher for securities of issuers in emerging markets than in more developed markets. In the event that the Portfolio holds material positions in such suspended securities, the Portfolio’s ability to liquidate its positions or provide liquidity to investors may be compromised and the Portfolio could incur significant losses. |

| ∎ | Growth Stock Risk. Prices of growth stocks may be more sensitive to changes in current or expected earnings than the prices of other stocks. Growth stocks may be more volatile or not perform as well as value stocks or the stock market in general. |

| ∎ | Holdings Risk. The Portfolio typically holds a limited number of stocks (generally 40 to 60), and the Portfolio’s manager also tends to invest a significant portion of the Portfolio’s total assets in a limited number of stocks. As a result, the appreciation or depreciation of any one security held by the Portfolio may have a greater impact on the Portfolio’s net asset value (NAV) than it would if the Portfolio invested in a larger number of securities or if the Portfolio’s manager invested a greater portion of the Portfolio’s total assets in a larger number of stocks. |

| ∎ | Information Technology Sector Risk. Investment risks associated with investing in the information technology sector, in addition to other risks, include the intense competition to which information technology companies may be subject; the dramatic and often unpredictable changes in growth rates and competition for qualified personnel among information technology companies; effects on profitability from being heavily dependent on patent and intellectual property rights and the loss or impairment of those rights; obsolescence of existing technology; general economic conditions; and government regulation. |

| ∎ | Large Company Risk. Large-capitalization companies may go in and out of favor based on market and economic conditions. Large-capitalization companies may be unable to respond quickly to new competitive challenges, such as changes in technology, and also may not be able to attain the high growth rate of successful smaller companies, especially during extended periods of economic expansion. Although the securities of larger companies may be less volatile than those of companies with smaller market capitalizations, returns on investments in securities of large-capitalization companies could trail the returns on investments in securities of smaller companies. |

| ∎ | Liquidity Risk. Generally, a security is liquid if the Portfolio is able to sell the security at a fair price within a reasonable time. Liquidity generally is related to the market trading volume for a particular security. Illiquid securities may trade at a discount from comparable, more liquid investments, and may be subject to wider fluctuations in market value. Less liquid securities are more difficult to dispose of at their recorded values and are subject to increased spreads and volatility. Also, the Portfolio may not be able to dispose of illiquid securities when that would be beneficial at a favorable time or price. Certain investments that were liquid when the Portfolio purchased them may become illiquid, sometimes abruptly. |

| ∎ | Management Risk. Portfolio performance is primarily dependent on IICO’s skill in evaluating and managing the Portfolio’s holdings. There can be no guarantee that its decisions will produce the desired results, and the Portfolio may not perform as well as other similar mutual funds. |

| ∎ | Market Risk. Markets can be volatile, and the Portfolio’s holdings can decline in response to adverse issuer, political, regulatory, market or economic developments or conditions that may cause a broad market decline. Different parts of the market, including different sectors and different types of securities, can react differently to these developments. Since the financial crisis that started in 2008, the U.S. and many foreign economies continue to experience its after-effects, which have resulted, and may continue to result, in volatility in the financial markets, both U.S. and foreign. Global economies and financial markets are becoming increasingly interconnected, which increases the possibilities that conditions in one country or region may adversely affect issuers in another country or region, which in turn may adversely affect securities held by the Portfolio. These circumstances also have decreased liquidity in some markets and may continue to do so. In addition, certain events, such as natural disasters, terrorist attacks, war, and other geopolitical events, have led, and may in the future lead, to increased short-term market volatility and may have adverse long-term effects on world economies and markets generally. |

| ∎ | Mid Size Company Risk. Securities of mid-capitalization companies may be more vulnerable to adverse developments than those of larger companies due to such companies’ limited product lines, limited markets and financial resources and dependence upon a relatively small management group. Securities of mid-capitalization companies may be more volatile and less liquid than the securities of larger companies and may be affected to a greater extent than other types of securities by the underperformance of a sector or during market downturns. |

| ∎ | Non-Diversification Risk. The Portfolio is a “non-diversified” mutual fund and, as such, its investments are not required to meet certain diversification requirements under Federal law. Compared with “diversified” portfolios, the Portfolio may invest a greater percentage of its assets in the securities of an issuer. Thus, the Portfolio may hold fewer securities than other portfolios. A decline in the value of those investments would cause the Portfolio’s overall value to decline to a greater degree than if the Portfolio held more diversified holdings. |

| ∎ | Science and Technology Industry Risk. Investment risks associated with investing in science and technology securities, in addition to other risks, include: operating in rapidly changing fields, abrupt or erratic market movements, limited product lines, markets or financial resources, management that is dependent on a limited number of people, short product cycles, aggressive pricing of products and services, new market entrants and obsolescence of existing technology. In addition, these securities may be impacted by commodity and energy prices, which can be volatile, and may increase the volatility of these securities. |

| ∎ | Sector Risk. At times, the Portfolio may have a significant portion of its assets invested in securities of companies conducting business in a broadly related group of industries within an economic sector. Individual sectors may be more volatile, and may perform differently, than the broader market. Companies in the same economic sector may be similarly affected by economic or market events, making the Portfolio more vulnerable to unfavorable developments in that economic sector than funds that invest more broadly. |

| ∎ | Small Company Risk. Securities of small-capitalization companies are subject to greater price volatility, lower trading volume and less liquidity due to, among other things, such companies’ small size, limited product lines, limited access to financing sources and limited management depth. In addition, the frequency and volume of trading of such securities may be less than is typical of larger companies, making them subject to wider price fluctuations and such securities may be affected to a greater extent than other types of securities by the underperformance of a sector or during market downturns. In some cases, there could be difficulties in selling securities of small-capitalization companies at the desired time. |

Performance

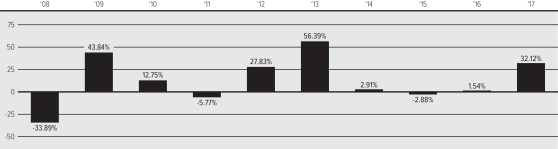

The chart and table below provide some indication of the risks of investing in the Portfolio. The chart shows how performance has varied from year to year for Class II shares of the Portfolio. The table shows the average annual total returns for Class II shares of the Portfolio and also compares the Portfolio’s returns with those of a broad-based securities market index and a Lipper peer group (a universe of mutual funds with investment objectives similar to that of the Portfolio). The performance results do not reflect any Policy-related fees and expenses, which would reduce the performance results. No performance information is presented for the Portfolio’s Class I shares because the share class has not been in existence for a full calendar year. Once that class has a full calendar year of performance, it will be included in the table below.

Performance results include the effect of expense reduction arrangements for some or all of the periods shown. If those arrangements had not been in place, the performance results for those periods would have been lower.

Prior to April 30, 2012, the Portfolio’s investment objective was to seek long-term capital growth. Effective as of April 30, 2012, the Portfolio changed its investment objective to seeking to provide growth of capital.

The Portfolio’s past performance does not necessarily indicate how it will perform in the future. Current performance may be lower or higher. Please call 800.777.6472 for the Portfolio’s updated performance.

Chart of Year-by-Year Returns

as of December 31 each year

|

|

In the period shown in the chart, the highest quarterly return was 20.14% (the first quarter of 2012) and the lowest quarterly return was -18.81% (the fourth quarter of 2008). |

Average Annual Total Returns

| as of December 31, 2017 | 1 Year | 5 Years | 10 Years | |||||||||

| Class II Shares of Ivy VIP Science and Technology |

32.12% | 15.96% | 10.48% | |||||||||

| S&P North American Technology Sector Index (reflects no deduction for fees, expenses or taxes) |

37.78% | 21.68% | 12.25% | |||||||||

| Lipper Variable Annuity Science & Technology Funds Universe Average (net of fees and expenses) |

33.40% | 18.47% | 9.92% | |||||||||

Investment Adviser

The Portfolio is managed by Ivy Investment Management Company (IICO).

Portfolio Managers

Zachary H. Shafran, Senior Vice President of IICO, has managed the Portfolio since February 2001, and Bradley J. Warden, Senior Vice President of IICO, has managed the Portfolio since October 2016.

Purchase and Sale of Portfolio Shares

Shares of the Portfolio are currently sold only to separate accounts of Participating Insurance Companies to fund benefits payable under the Policies. Class I shares may be purchased only through fund of funds, advisory or trust accounts, wrap accounts or other asset allocation or fee-based investment arrangements.

The Portfolio’s shares are redeemable. Shares are purchased or redeemed at the Portfolio’s NAV per share next calculated after your order is received in proper form on any business day. The Portfolio does not have initial and subsequent investment minimums. Please refer to your Policy prospectus for more information on purchasing and redeeming Portfolio shares.

Tax Information

Because the Portfolio’s only shareholders are separate accounts of Participating Insurance Companies, distributions the Portfolio makes of its net investment income and net realized gains, if any — most or all of which it intends to distribute annually — and redemptions or exchanges of Portfolio shares generally will not be taxable to its shareholders (or to the holders of the underlying Policies). See the prospectus for your Policy for further tax information.

Payments to Broker-Dealers and other Financial Intermediaries

The Portfolio and its related companies may make payments to a Participating Insurance Company (or its affiliates) or other financial intermediary for distribution and/or other services. These payments may create a conflict of interest by influencing the Participating Insurance Company or other financial intermediary and your financial advisor to recommend the Portfolio over another investment or by influencing a Participating Insurance Company to include the Portfolio as an underlying investment option in the Policy. The prospectus (or other offering document) for your Policy may contain additional information about these payments.

VIPSUM-SCTEC