|

Ivy VIP Global Natural Resources | |

|

Summary Prospectus | April 29, 2016, as supplemented September 30, 2016 |

Before you invest, you may want to review the Portfolio’s prospectus, which contains more information about the Portfolio and its risks. You can find the Portfolio’s prospectus and other information about the Portfolio (including the Portfolio’s statement of additional information (SAI)) online at www.ivyinvestments.com/vip-prospectus. You also can get this information at no cost by calling 800.777.6472 or by sending an e-mail request to IMCompliance@waddell.com. You also can get this information from your investment provider. The Portfolio’s prospectus dated April 29, 2016, and SAI dated April 29, 2016 (as each may be amended or supplemented) are incorporated herein by reference. This summary prospectus is intended for use in connection with certain life insurance policies and variable annuity contracts offered by certain select insurance companies (Participating Insurance Companies) and is not intended for use by other investors.

Objective

To seek to provide capital growth and appreciation.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the Portfolio. The table below does not reflect any fees and expenses imposed under the variable life insurance policies and variable annuity contracts (collectively, Policies) through which this Portfolio is offered. See the Policy prospectus for a description of those fees and expenses.

Shareholder Fees

| (fees paid directly from your investment) | N/A |

Annual Portfolio Operating Expenses

| (expenses that you pay each year as a % of the value of your investment) | ||||

| Management Fees |

1.00% | |||

| Distribution and Service (12b-1) Fees |

0.25% | |||

| Other Expenses |

0.10% | |||

| Total Annual Portfolio Operating Expenses |

1.35% | |||

Example

This example is intended to help you compare the cost of investing in the shares of the Portfolio with the cost of investing in other portfolios. This example does not reflect any fees and expenses imposed under the Policies.

The example assumes that you invest $10,000 in the shares of the Portfolio for the time periods indicated. The example also assumes that your investment has a 5% return each year and that the Portfolio’s operating expenses remain the same. The costs are the same for each time period if you continue to hold your shares or if you redeem all your shares at the end of those periods. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||

| $137 |

$ | 428 | $ | 739 | $ | 1,624 | ||||||

Portfolio Turnover

The Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual portfolio operating expenses or in the example, affect the Portfolio’s performance. During the most recent fiscal year, the Portfolio’s portfolio turnover rate was 34% of the average value of its portfolio.

Principal Investment Strategies

Ivy VIP Global Natural Resources seeks to achieve its objective by investing, under normal circumstances, at least 80% of its net assets in equity securities of companies with operations throughout the world that own, explore or develop natural resources and other basic commodities or supply goods and services to such companies.

For these purposes, “natural resources” generally includes, but is not limited to: energy (such as electricity and gas utilities, producers/developers, equipment/services, storage/transportation, gas/oil refining and marketing, service/drilling, pipelines and master limited partnerships (MLPs)), alternative energy (such as uranium, coal, nuclear, hydrogen, wind, solar, fuel cells), industrial products (such as building materials, cement, packaging, chemicals, materials infrastructure, supporting transport and machinery), forest products (such as lumber, plywood, pulp, paper, newsprint, tissue), base metals (such as aluminum, copper, nickel, zinc, iron ore and steel), precious metals and minerals (such as gold, silver, platinum, diamonds), and agricultural products (grains and other foods, seeds, fertilizers, water).

After conducting a top-down (assessing the market environment) market analysis of the natural resources industry and identifying trends and sectors, Ivy Investment Management Company (IICO), the Portfolio’s investment manager, uses a research-oriented, bottom-up (researching individual issuers) investment approach when selecting securities for the Portfolio, focusing on company fundamentals and growth prospects. IICO invests in a blend of value and growth companies domiciled throughout the world, and emphasizes companies that it believes are strongly managed and can generate above-average capital growth and appreciation. IICO focuses on companies that it believes have the potential for sustainable long-term growth and that are low-cost leaders that possess historically strong-producing assets. The Portfolio typically holds a limited number of stocks (generally 45 to 65). Under normal circumstances, IICO anticipates that a significant portion of the Portfolio’s holdings will consist of issuers in the energy sector.

The Portfolio seeks to be diversified internationally, and therefore, IICO invests in foreign companies and U.S. companies that have principal operations in foreign jurisdictions. While IICO typically seeks to anchor the Portfolio’s assets in the United States, the Portfolio may invest up to 100% of its total assets in foreign securities. Exposure to companies in any one particular foreign country typically is less than 20% of the Portfolio’s total assets. The Portfolio also may have exposure to companies located in, and/or doing business in, emerging markets.

Under normal circumstances, the Portfolio invests at least 65% of its total assets in issuers of at least three countries, which may include the U.S. An investment in foreign securities presents additional risks such as currency fluctuations and political or economic conditions affecting the foreign country. Many of the companies in which the Portfolio may invest have diverse operations, with products or services in foreign markets. Therefore, the Portfolio may have indirect exposure to various foreign markets through investments in these companies, even if the Portfolio is not invested directly in such markets.

Generally, in determining whether to sell a security, IICO uses the same type of analysis that it uses in buying securities to determine whether the security has ceased to offer significant growth potential, has sufficiently exceeded its target price, has become undervalued and/or whether the prospects of the issuer have deteriorated. IICO also will consider the effect of commodity price trends on certain holdings, poor capital management or whether a company has experienced a change or deterioration in its fundamentals, its valuation or its competitive advantage. IICO also may sell a security to take advantage of what it believes are more attractive investment opportunities, to reduce the Portfolio’s holding in that security or to raise cash.

In seeking to manage foreign currency exposure, the Portfolio may utilize derivative instruments, including, but not limited to, forward contracts, to either increase or decrease exposure to a given currency.

Principal Investment Risks

As with any mutual fund, the value of the Portfolio’s shares will change, and you could lose money on your investment. The Portfolio is not intended as a complete investment program.

A variety of factors can affect the investment performance of the Portfolio and prevent it from achieving its objective. These include:

| n | Commodities Risk. Investments in certain issuers, such as resource extraction and production companies, are sensitive to fluctuations in certain commodity markets, and changes in those markets may cause the Portfolio’s holdings to lose value. Commodity trading generally is considered speculative because of the significant potential for investment loss. Among the factors that could affect the value of commodities are cyclical economic conditions, weather, embargoes, tariffs, regulatory developments, sudden political events and adverse international monetary policies. Markets for commodities are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising. |

| n | Company Risk. A company may be more volatile or perform worse than the overall market due to specific factors, such as adverse changes to its business or investor perceptions about the company. |

| n | Derivatives Risk. The use of derivatives presents several risks, including the risk that these instruments may change in value in a manner that adversely affects the Portfolio’s net asset value (NAV) and the risk that fluctuations in the value of the derivatives may not correlate with the reference instrument underlying the derivative. Derivatives can be highly complex, can create investment leverage, may perform in unanticipated ways and may be highly volatile, and the Portfolio could lose more than the amount it invests. Derivatives may be difficult to value and may at times be highly illiquid, and the Portfolio may not be able to close out or sell a derivative position at a particular time or at an anticipated price. Moreover, some derivatives are more sensitive to interest rate changes and market price fluctuations than others. To the extent the judgment of IICO as to certain anticipated price movements is incorrect, the risk of loss may be greater than if the derivative technique(s) had not been used. When used for hedging, the change in value of the derivative also may not correlate specifically with the security or other risk being hedged. Suitable derivatives may not be available in all circumstances, and there can be no assurance that the Portfolio will use derivatives to reduce exposure to other risks when that might be beneficial. Derivatives also may be subject to counterparty risk, which includes the risk that the Portfolio may sustain a loss as a result of the insolvency or bankruptcy of, or other non-compliance by, another party to the transaction. When |

| the Portfolio uses derivatives, it likely will be required to provide margin or collateral and/or segregate cash or other liquid assets in a manner that satisfies contractual undertakings and regulatory requirements. The need to provide margin or collateral and/or segregate assets could limit the Portfolio’s ability to pursue other opportunities as they arise. Ongoing changes to regulation of the derivatives markets could limit the Portfolio’s ability to pursue its investment strategies. |

| n | Emerging Market Risk. Investments in countries with emerging economies or securities markets may carry greater risk than investments in more developed countries. Political and economic structures in many such countries may be undergoing significant evolution and rapid development, and such countries may lack the social, political and economic stability characteristics of more developed countries. Investments in securities issued in these countries may be more volatile and less liquid than securities issued in more developed countries. Emerging markets are more susceptible to capital controls, governmental interference, local taxes being imposed on international investments, restrictions on gaining access to sales proceeds, and less efficient trading markets. |

| n | Energy Sector Risk. Investment risks associated with investing in energy securities, in addition to other risks, include price fluctuation caused by real and perceived inflationary trends and political developments, the cost assumed in complying with environmental safety regulations, demand of energy fuels, energy conservation, the success of exploration projects, and tax and other governmental regulations. |

| n | Foreign Currency Exchange Transactions and Forward Foreign Currency Contracts Risk. The Portfolio may use foreign currency exchange transactions and forward foreign currency contracts to hedge certain market risks (such as interest rates, currency exchange rates and broad or specific market movement). These investment techniques involve a number of risks, including the possibility of default by the counterparty to the transaction and, to the extent IICO’s judgment as to certain market movements is incorrect, the risk of losses that are greater than if the investment technique had not been used. |

| n | Foreign Currency Risk. Foreign securities may be denominated in foreign currencies. The value of the Portfolio’s investments, as measured in U.S. dollars, may be unfavorably affected by changes in foreign currency exchange rates and exchange control regulations. |

| n | Foreign Exposure Risk. The securities of many companies may have significant exposure to foreign markets as a result of the company’s operations, products or services in those foreign markets. As a result, a company’s domicile and/or the markets in which the company’s securities trade may not be fully reflective of its sources of revenue. Such securities would be subject to some of the same risks as an investment in foreign securities, including the risk that political and economic events unique to a country or region will adversely affect those markets in which the company’s products or services are sold. |

| n | Foreign Securities Risk. Investing in foreign securities involves a number of economic, financial, legal, and political considerations that are not associated with the U.S. markets and that could affect the Portfolio’s performance unfavorably, depending upon the prevailing conditions at any given time. Among these potential risks are: greater price volatility; comparatively weak supervision and regulation of securities exchanges, brokers and issuers; higher brokerage costs; social, political or economic instability; fluctuations in foreign currency exchange rates and related conversion costs or currency redenomination; nationalization or expropriation of assets; adverse foreign tax consequences; different and/or less stringent financial reporting standards; and settlement, custodial or other operational delays. The risks may be exacerbated in connection with investments in emerging markets. World markets, or those in a particular region, all may react in similar fashion to important economic or political developments. In addition, key information about the issuer, the markets or the local government or economy may be unavailable, incomplete or inaccurate. Securities of issuers traded on exchanges may be suspended, either by the issuers themselves, by an exchange or by governmental authorities. The likelihood of such suspensions may be higher for securities of issuers in emerging markets than in more developed markets. In the event that the Portfolio holds material positions in such suspended securities, the Portfolio’s ability to liquidate its positions or provide liquidity to investors may be compromised and the Portfolio could incur significant losses. |

| n | Global Natural Resources Industry Risk. Investment risks associated with investing in securities of global natural resources companies, in addition to other risks, include price fluctuation caused by real and perceived inflationary trends and political developments, the cost assumed by natural resource companies in complying with environmental and safety regulations, changes in supply of, or demand for, various natural resources, changes in energy prices, environmental incidents, energy conservation, the success of exploration projects, changes in commodity prices, and special risks associated with natural or man-made disasters. Securities of global natural resource companies that are dependent on a single commodity, or are concentrated in a single commodity sector, may exhibit high volatility attributable to commodity prices. |

| n | Growth Stock Risk. Prices of growth stocks may be more sensitive to changes in current or expected earnings than the prices of other stocks. Growth stocks may be more volatile or not perform as well as value stocks or the stock market in general. |

| n | Holdings Risk. The Portfolio typically holds a limited number of stocks (generally 45 to 65). As a result, the appreciation or depreciation of any one security held by the Portfolio may have a greater impact on the Portfolio’s net asset value (NAV) than it would if the Portfolio invested in a larger number of securities. |

| n | Investment Company Securities Risk. Investment in other investment companies typically reflects the risks of the types of securities in which the investment companies invest. Investments in exchange-traded funds (ETFs) and closed-end funds are subject to the additional risk that shares of the fund may trade at a premium or discount to their NAV per share. When the Portfolio invests in another investment company, shareholders of the Portfolio bear their proportionate share of the other investment company’s fees and expenses as well as their share of the Portfolio’s fees and expenses, which could result in the duplication of certain fees. |

| n | Liquidity Risk. Generally, a security is liquid if the Portfolio is able to sell the security at a fair price within a reasonable time. Liquidity generally is related to the market trading volume for a particular security. Illiquid securities may trade at a discount from |

| comparable, more liquid investments, and may be subject to wider fluctuations in market value. Less liquid securities are more difficult to dispose of at their recorded values and are subject to increased spreads and volatility. Also, the Portfolio may not be able to dispose of illiquid securities when that would be beneficial at a favorable time or price. |

| n | Management Risk. Portfolio performance is primarily dependent on IICO’s skill in evaluating and managing the Portfolio’s holdings. There can be no guarantee that its decisions will produce the desired results, and the Portfolio may not perform as well as other similar mutual funds. |

| n | Market Risk. Markets can be volatile, and the Portfolio’s holdings can decline in response to adverse issuer, political, regulatory, market or economic developments or conditions that may cause a broad market decline. Different parts of the market, including different sectors and different types of securities, can react differently to these developments. Since the financial crisis that started in 2008, the U.S. and many foreign economies continue to experience its after-effects, which have resulted, and may continue to result, in volatility in the financial markets, both U.S. and foreign. Global economies and financial markets are becoming increasingly interconnected, which increases the possibilities that conditions in one country or region may adversely affect issuers in another country or region, which in turn may adversely affect securities held by the Portfolio. These circumstances also have decreased liquidity in some markets and may continue to do so. In addition, certain events, such as natural disasters, terrorist attacks, war, and other geopolitical events, have led, and may in the future lead, to increased short-term market volatility and may have adverse long-term effects on world economies and markets generally. |

| n | Sector Risk. At times, the Portfolio may have a significant portion of its assets invested in securities of companies conducting business in a broadly related group of industries within an economic sector. Companies in the same economic sector may be similarly affected by economic or market events, making the Portfolio more vulnerable to unfavorable developments in that economic sector than funds that invest more broadly. |

| n | Value Stock Risk. Value stocks are stocks of companies that may have experienced adverse business or industry developments or may be subject to special risks that have caused the stocks to be out of favor and, in the opinion of IICO, undervalued. The value of a security believed by IICO to be undervalued may never reach what is believed to be its full value, such security’s value may decrease or such security may be appropriately priced. |

Performance

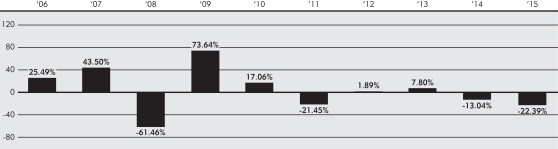

The chart and table below provide some indication of the risks of investing in the Portfolio. The chart shows how performance has varied from year to year for the Portfolio. The table shows the average annual total returns for the Portfolio and also compares the Portfolio’s returns with those of a broad-based securities market index and a Lipper peer group (a universe of mutual funds with investment objectives similar to that of the Portfolio). The performance results do not reflect any Policy-related fees and expenses, which would reduce the performance results.

Mackenzie Financial Corporation served as the investment subadviser to the Portfolio until July 1, 2013, at which time, Waddell & Reed Investment Management Company (WRIMCO) assumed direct investment management responsibilities for the Portfolio. On October 1, 2016, IICO, an affiliate of WRIMCO, became the Portfolio’s investment adviser.

Prior to April 30, 2012, the Portfolio’s investment objective was to seek to provide long-term growth and any income realized was incidental. Effective as of April 30, 2012, the Portfolio changed its investment objective to seeking to provide capital growth and appreciation.

The Portfolio’s past performance does not necessarily indicate how it will perform in the future. Current performance may be lower or higher. Please call 800.777.6472 for the Portfolio’s updated performance.

Chart of Year-by-Year Returns

as of December 31 each year

|

|

In the period shown in the chart, the highest quarterly return was 31.63% (the second quarter of 2009) and the lowest quarterly return was -41.06% (the fourth quarter of 2008). |

Average Annual Total Returns

| as of December 31, 2015 | 1 Year | 5 Years | 10 Years |

|||||||||

| Shares of Ivy VIP Global Natural Resources |

-22.39% | -10.25% | -1.95% | |||||||||

| MSCI ACWI IMI 55% Energy + 45% Materials Index (reflects no deduction for fees, expenses or taxes) |

-19.71% | -6.36% | 1.49% | |||||||||

| Lipper Variable Annuity Natural Resources Funds Universe Average (net of fees and expenses) |

-25.48% | -7.09% | 0.22% | |||||||||

Investment Adviser

The Portfolio is managed by Ivy Investment Management Company (IICO).

Portfolio Managers

David P. Ginther, Senior Vice President of IICO, has managed the Portfolio since July 2013, and Michael T. Wolverton, Vice President of IICO, has managed the Portfolio since October 2016.

Purchase and Sale of Portfolio Shares

Shares of the Portfolio are currently sold only to separate accounts of Participating Insurance Companies to fund benefits payable under the Policies.

The Portfolio’s shares are redeemable. Shares are purchased or redeemed at the Portfolio’s NAV per share next calculated after your order is received in proper form on any business day. The Portfolio does not have initial and subsequent investment minimums. Please refer to your Policy prospectus for more information on purchasing and redeeming Portfolio shares.

Tax Information

Because the Portfolio’s only shareholders are separate accounts of Participating Insurance Companies, distributions the Portfolio makes of its net investment income and net realized gains, if any — most or all of which it intends to distribute annually — and redemptions or exchanges of Portfolio shares generally will not be taxable to its shareholders (or to the holders of the underlying Policies). See the prospectus for your Policy for further tax information.

Payments to Broker-Dealers and other Financial Intermediaries

The Portfolio and its related companies may make payments to a Participating Insurance Company (or its affiliates) or other financial intermediary for distribution and/or other services. These payments may create a conflict of interest by influencing the Participating Insurance Company or other financial intermediary and your financial advisor to recommend the Portfolio over another investment or by influencing a Participating Insurance Company to include the Portfolio as an underlying investment option in the Policy. The prospectus (or other offering document) for your Policy may contain additional information about these payments.

VIPSUM-GNR