| Ivy Funds VIP Global Natural Resources |

| Ivy Funds VIP Global Natural Resources |

| Objective |

| To seek to provide capital growth and appreciation. |

| Fees and Expenses |

| This table describes the fees and expenses that you may pay if you buy and hold shares of the Portfolio. The table below does not reflect any fees and expenses imposed under the variable life insurance policies and variable annuity contracts (collectively, Policies) through which this Portfolio is offered. See the Policy prospectus for a description of those fees and expenses. |

Shareholder Fees

(fees paid directly from your investment) |

|

|

Annual Portfolio Operating Expenses

(expenses that you pay each year as a % of the value of your investment) |

|

|

| Example |

This example is intended to help you compare the cost of investing in the shares of the Portfolio with the cost of investing in other portfolios. This example does not reflect any fees and expenses imposed under the Policies.

The example assumes that you invest $10,000 in the shares of the Portfolio for the time periods indicated. The example also assumes that your investment has a 5% return each year and that the Portfolio’s operating expenses remain the same. The costs are the same for each time period if you continue to hold your shares or if you redeem all your shares at the end of those periods. Although your actual costs may be higher or lower, based on these assumptions, your costs would be: |

|

Expense Example

(USD $)

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

Ivy Funds VIP Global Natural Resources

|

138 |

431 |

745 |

1,635 |

|

|

Expense Example, No Redemption

(USD $)

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

Ivy Funds VIP Global Natural Resources

|

138 |

431 |

745 |

1,635 |

|

| Portfolio Turnover |

| The Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual portfolio operating expenses or in the example, affect the Portfolio’s performance. During the most recent fiscal year, the Portfolio’s portfolio turnover rate was 102% of the average value of its portfolio. |

| Principal Investment Strategies |

Ivy Funds VIP Global Natural Resources seeks to achieve its objective by investing, under normal circumstances, at least 80% of its net assets in equity securities of companies throughout the world that own, explore or develop natural resources and other basic commodities or supply goods and services to such companies.

For these purposes, "natural resources" generally includes, but is not limited to: energy (such as utilities, producers/developers, refiners, service/drilling), alternative energy (such as uranium, coal, hydrogen, wind, solar, fuel cells), industrial products (such as building materials, cement, packaging, chemicals, supporting transport and machinery), forest products (such as lumber, plywood, pulp, paper, newsprint, tissue), base metals (such as aluminum, copper, nickel, zinc, iron ore and steel), precious metals and minerals (such as gold, silver, platinum, diamonds), and agricultural products (grains and other foods, seeds, fertilizers, water).

The Portfolio's investment subadviser, Mackenzie Financial Corporation (Mackenzie), uses an equity style that focuses on both growth and value, as well as utilizing both a top-down (the creation of macro-economic models to prepare an outlook for economic and market conditions) and a bottom-up (fundamental, company by company) approach. Mackenzie targets companies for investment that, in its opinion, have strong management and financial positions, adding balance with established low-cost, low-debt producers or positions that are based on anticipated commodity price trends. The Portfolio seeks to be diversified internationally, and therefore, Mackenzie invests in foreign companies and U.S. companies that have principal operations in foreign jurisdictions. While Mackenzie seeks to anchor the Portfolio's assets in the United States, international exposure may exceed 50% of the Portfolio's total assets. Exposure to companies in any one particular foreign country other than Canada is typically less than 20% of the Portfolio's total assets. The Portfolio also may have exposure to companies located in, and/or doing business in, emerging markets.

Under normal circumstances, the Portfolio invests at least 65% of its total assets in issuers of at least three countries, which may include the U.S. An investment in foreign securities presents additional risks such as currency fluctuations and political or economic conditions affecting the foreign country. Many companies have diverse operations, with products or services in foreign markets. Therefore, the Portfolio will have an indirect exposure to foreign markets through investments in these companies.

Generally, in determining to sell a security, Mackenzie considers various factors, including whether the holding has sufficiently exceeded its target price, whether a growth-oriented company has failed to deliver growth, and the effect of commodity price trends on certain holdings. Mackenzie may also sell a security to take advantage of what it believes to be more attractive investment opportunities, to reduce the Fund's holding in that security, or to raise cash.

The Portfolio may use a range of derivative instruments in seeking to hedge market risk on equity securities, increase exposure to specific sectors or companies, and manage exposure to various foreign currencies and precious metals. In an effort to hedge market risk and increase exposure to equity markets, the Portfolio may utilize futures on equity indices and/or purchase option contracts on individual equity securities and exchange-traded funds (ETFs). In seeking to manage foreign currency exposure, the Portfolio may utilize forward contracts to either increase or decrease exposure to a given currency. In seeking to manage the Portfolio's exposure to precious metals, the Portfolio may utilize futures contracts, both long and short positions, as well as options contracts, both written and purchased, on precious metals. |

| Principal Investment Risks |

As with any mutual fund, the value of the Portfolio’s shares will change, and you could lose money on your investment. The Portfolio is not intended as a complete investment program.

A variety of factors can affect the investment performance of the Portfolio and prevent it from achieving its objective. These include:- Commodities Risk. Commodity trading is generally considered speculative because of the significant potential for investment loss. Among the factors that could affect the value of the Portfolio’s investments in commodities are cyclical economic conditions, sudden political events and adverse international monetary policies. Markets for commodities are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising. Also, the Portfolio may pay more to store and accurately value its commodity holdings than it does with its other portfolio investments. Moreover, under the Federal tax law, the Portfolio may not earn more than 10% of its annual gross income from gains resulting from selling commodities (and other non-qualifying income). Accordingly, the Portfolio may be required to hold its commodities or to sell them at a loss, or to sell portfolio securities at a gain, when for investment reasons it would not otherwise do so.

- Company Risk. A company may perform worse than the overall market due to specific factors, such as adverse changes to its business or investor perceptions about the company.

- Derivatives Risk. The use of derivatives presents several risks, including the risk that these instruments may change in value in a manner that adversely affects the Portfolio’s net asset value (NAV) and the risk that fluctuations in the value of the derivatives may not correlate with securities markets or the underlying asset upon which the derivative’s value is based. Moreover, some derivatives are more sensitive to interest rate changes and market price fluctuations than others. To the extent the judgment of Mackenzie as to certain anticipated price movements is incorrect, the risk of loss may be greater than if the derivative technique(s) had not been used. Derivatives also may be subject to counterparty risk, which includes the risk that a loss may be sustained by the Portfolio as a result of the insolvency or bankruptcy of, or other non-compliance by, another party to the transaction.

- Emerging Market Risk. Investments in countries with emerging economies or securities markets may carry greater risk than investments in more developed countries. Political and economic structures in many such countries may be undergoing significant evolution and rapid development, and such countries may lack the social, political and economic stability characteristic of more developed countries.

- Foreign Currency Risk. Foreign securities may be denominated in foreign currencies. The value of the Portfolio’s investments, as measured in U.S. dollars, may be unfavorably affected by changes in foreign currency exchange rates and exchange control regulations.

- Foreign Exposure Risk. The securities of many companies may have significant exposure to foreign markets as a result of the company’s products or services in those foreign markets. As a result, a company’s domicile and/or the markets in which the company’s securities trade may not be fully reflective of its sources of revenue. Such securities would be subject to some of the same risks as an investment in foreign securities, including the risk that political and economic events unique to a country or region will adversely affect those markets in which the company’s products or services are sold.

- Foreign Securities Risk. Investing in foreign securities involves a number of economic, financial, legal, and political considerations that may not be associated with the U.S. markets and that could affect the Portfolio’s performance unfavorably, depending upon the prevailing conditions at any given time. Among these potential risks are: greater price volatility; comparatively weak supervision and regulation of securities exchanges, brokers and issuers; higher brokerage costs; fluctuations in foreign currency exchange rates and related conversion costs; adverse foreign tax consequences; different and/or less stringent financial reporting standards; custody; and settlement delays. In addition, key information about the issuer, the markets or the local government or economy may be unavailable, incomplete or inaccurate.

- Global Natural Resources Industry Risk. Investment risks associated with investing in global natural resources securities, in addition to other risks, include price fluctuation caused by real and perceived inflationary trends and political developments, the cost assumed by natural resource companies in complying with environmental and safety regulations, changes in supply of, or demand for, various natural resources, changes in energy prices, the success of exploration projects, changes in commodity prices, and special risks associated with natural or man-made disasters.

- Growth Stock Risk. Prices of growth stocks may be more sensitive to changes in current or expected earnings than the prices of other stocks. Growth stocks may not perform as well as value stocks or the stock market in general.

- Investment Company Securities Risk. The risks of investment in other investment companies typically reflect the risk of the types of securities in which the investment companies invest. Investments in ETFs and closed-end funds are subject to the additional risk that shares of the fund may trade at a premium or discount to their NAV per share. When the Portfolio invests in another investment company, shareholders of the Portfolio bear their proportionate share of the other investment company’s fees and expenses as well as their share of the Portfolio’s fees and expenses, which could result in duplication of certain fees.

- Liquidity Risk. Generally, a security is liquid if the Portfolio is able to sell the security at a fair price within a reasonable time. Liquidity is generally related to the market trading volume for a particular security. Illiquid securities may trade at a discount from comparable, more liquid investments, and may be subject to wider fluctuations in market value. Less liquid securities are more difficult to dispose of at their recorded values and are subject to increased spreads and volatility. Also, the Portfolio may not be able to dispose of illiquid securities when that would be beneficial at a favorable time or price.

- Management Risk. Portfolio performance is primarily dependent on Mackenzie’s skill in evaluating and managing the Portfolio’s holdings and the Portfolio may not perform as well as other similar mutual funds.

- Market Risk. Adverse market conditions, sometimes in response to general economic or industry news, may cause the prices of the Portfolio’s holdings to fall as part of a broad market decline. The financial crisis in the U.S. and foreign economies over the past several years, including the European sovereign debt crisis, has resulted, and may continue to result, in an unusually high degree of volatility in the financial markets, both U.S. and foreign, and in the NAVs of many mutual funds, including to some extent the Portfolio. Global economies and financial markets are becoming increasingly interconnected, which increases the possibilities that conditions in one country or region may adversely affect issuers in another country or region, which in turn may adversely affect securities held by the Portfolio. These circumstances have also decreased liquidity in some markets and may continue to do so. In addition, certain unanticipated events, such as natural disasters, terrorist attacks, war, and other geopolitical events, can have a dramatic adverse effect on securities held by the Portfolio.

- Sector Risk. At times, the Portfolio may have a significant portion of its assets invested in securities of companies conducting business in a broadly related group of industries within an economic sector. Companies in the same economic sector may be similarly affected by economic or market events, making the Portfolio more vulnerable to unfavorable developments in that economic sector than funds that invest more broadly.

- Value Stock Risk. Value stocks are stocks of companies that may have experienced adverse business or industry developments or may be subject to special risks that have caused the stocks to be out of favor and, in the opinion of Mackenzie, undervalued. The value of a security believed by Mackenzie to be undervalued may never reach what is believed to be its full value, or such security’s value may decrease.

|

| Performance |

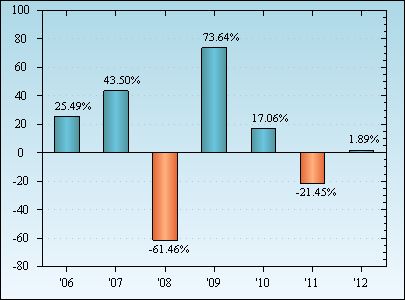

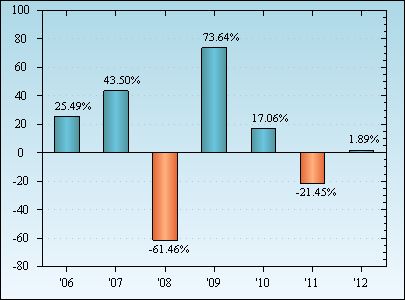

The chart and table below provide some indication of the risks of investing in the Portfolio. The chart shows how performance has varied from year to year for the Portfolio. The table shows the average annual total returns for the Portfolio and also compares the performance with those of two broad-based securities market indices and a Lipper peer group (a universe of mutual funds with investment objectives similar to that of the Portfolio). The performance results do not reflect any Policy-related fees and expenses, which would reduce the performance results.

Prior to April 30, 2012, the Portfolio’s investment objective was to seek to provide long-term growth and any income realized was incidental. Effective as of April 30, 2012, the Portfolio changed its investment objective to seeking to provide capital growth and appreciation.

The Portfolio’s past performance does not necessarily indicate how it will perform in the future. Current performance may be lower or higher. Please call 888.WADDELL for the Portfolio’s updated performance. |

Chart of Year-by-Year Returns

as of December 31 each year |

|

| In the period shown in the chart, the highest quarterly return was 31.63% (the second quarter of 2009) and the lowest quarterly return was -41.06% (the fourth quarter of 2008). |

Average Annual Total Returns

as of December 31, 2012 |

|

Average Annual Total Returns

|

1 Year

|

5 Years

|

Life of Portfolio

|

Inception Date

|

|

Ivy Funds VIP Global Natural Resources

|

1.89% |

(8.91%) |

4.70% |

Apr. 28,

2005 |

|

Ivy Funds VIP Global Natural Resources Morgan Stanley Commodity Related Index (reflects no deduction for fees, expenses or taxes) (Index comparison begins on April 30, 2005.)

|

(0.51%) |

(0.86%) |

10.16% |

Apr. 30,

2005 |

|

Ivy Funds VIP Global Natural Resources MSCI AC World IMI 55% Energy + 45% Materials Index (reflects no deduction for fees, expenses or taxes) (Index comparison begins on April 30, 2005.)

|

6.30% |

(2.24%) |

8.63% |

Apr. 30,

2005 |

|

Ivy Funds VIP Global Natural Resources Lipper Variable Annuity Natural Resources Funds Universe Average (net of fees and expenses) (Index comparison begins on April 30, 2005.)

|

2.61% |

(3.24%) |

8.44% |

Apr. 30,

2005 |

|