Ivy Funds VIP Balanced

Summary Prospectus | April 30, 2012

Before you invest, you may want to review the Portfolio’s prospectus, which contains more information about the Portfolio and its risks. You can find the Portfolio’s prospectus and other information about the Portfolio (including the Portfolio’s statement of additional information (SAI)) online at www.waddell.com/prospectus. You can also get this information at no cost by calling 888.WADDELL or by sending an e-mail request to IMcompliance@waddell.com. You can also get this information from your investment provider. The Portfolio’s prospectus dated April 30, 2012, and SAI dated April 30, 2012 (as each may be amended or supplemented) are incorporated herein by reference. This summary prospectus is intended for use in connection with certain life insurance policies and variable annuity contracts offered by certain select insurance companies (Participating Insurance Companies) and is not intended for use by other investors.

Objective

To seek to provide total return through a combination of capital appreciation and current income.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the Portfolio. The table below does not reflect any fees and expenses imposed under the variable life insurance policies and variable annuity contracts (collectively, Policies) through which this Portfolio is offered. See the Policy prospectus for a description of those fees and expenses.

Shareholder Fees

| (fees paid directly from your investment) | N/A |

Annual Portfolio Operating Expenses

| (expenses that you pay each year as a % of the value of your investment) | ||||

| Management Fees |

0.70% | |||

| Distribution and Service (12b-1) Fees |

0.25% | |||

| Other Expenses |

0.06% | |||

| Total Annual Portfolio Operating Expenses |

1.01% | |||

Example

This example is intended to help you compare the cost of investing in the shares of the Portfolio with the cost of investing in other portfolios. This example does not reflect any fees and expenses imposed under the Policies.

The example assumes that you invest $10,000 in the shares of the Portfolio for the time periods indicated. The example also assumes that your investment has a 5% return each year and that the Portfolio’s operating expenses remain the same. The costs are the same for each time period if you continue to hold your shares or if you redeem all your shares at the end of those periods. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||

| $103 |

$ | 322 | $ | 558 | $ | 1,236 | ||||||

Portfolio Turnover

The Portfolio bears transaction costs, such as commissions and/or spreads between bid and asked prices, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual portfolio operating expenses or in the example, affect the Portfolio’s performance. During the most recent fiscal year, the Portfolio’s portfolio turnover rate was 32% of the average value of its portfolio.

Principal Investment Strategies

Ivy Funds VIP Balanced seeks to achieve its objective by investing primarily in a mix of stocks, debt securities and short-term instruments, depending on market conditions. Regarding its equity investments, the Portfolio invests primarily in medium to large, well-established companies that usually issue dividend-paying securities. The Portfolio owns common stocks in order to provide possible appreciation of capital and some dividend income. In general, the Portfolio invests a portion of its total assets in either debt securities or preferred stocks, or both, in order to provide income and relative stability of capital. The Portfolio ordinarily invests at least 25% of its total assets in fixed-income securities. The majority of the Portfolio’s debt securities are either U.S. government securities or investment-grade corporate bonds, including bonds rated BBB- or higher by Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (S&P), or comparably rated by another nationally recognized statistical rating organization (NRSRO) or, if unrated, determined by Waddell & Reed Investment Management Company (WRIMCO), the Portfolio’s investment manager, to be of comparable quality. The Portfolio may invest up to 20% of its total assets in non-investment grade debt securities, which may include secured bank loans or floating rate notes. The Portfolio has no limitations on the range of maturities of the debt securities in which it may invest, or on the size of companies in which it may invest.

In selecting equity securities for the Portfolio, WRIMCO follows a core investing strategy and seeks companies that it believes possess attractive business economics, are in a strong financial condition and are selling at attractive valuations both on a relative and an absolute basis. WRIMCO also considers a company’s potential for dividend growth, its growth and profitability opportunities and sustainability, its relative strength in earnings, its management, improving fundamentals and valuation, its balance sheet, its stock price value, and the condition of the respective industry. In selecting debt securities for the Portfolio, WRIMCO seeks high-quality securities with minimal credit risk.

Many U.S. companies have diverse operations, with products or services in foreign markets. Therefore, the Portfolio will have an indirect exposure to foreign markets through investments in these companies.

Generally, in determining whether to sell an equity security or a debt security, WRIMCO uses the same analysis as identified above in order to determine if the equity security is still undervalued or has met its anticipated price. In determining whether to sell a debt security, WRIMCO will consider whether the security continues to maintain its minimal credit risk. WRIMCO may also sell a security if the security ceases to produce income, to reduce the Portfolio’s holding in that security, to take advantage of more attractive investment opportunities or to raise cash.

Principal Investment Risks

As with any mutual fund, the value of the Portfolio’s shares will change, and you could lose money on your investment.

A variety of factors can affect the investment performance of the Portfolio and prevent it from achieving its objective. These include:

| n | Company Risk. A company may perform worse than the overall market due to specific factors, such as adverse changes to its business or investor perceptions about the company. |

| n | Credit Risk. An issuer of a fixed-income obligation may not make payments on the obligation when due or may default on its obligation. |

| n | Foreign Market Risk. The securities of many companies may have significant exposure to foreign markets as a result of the company’s products or services in foreign markets so that its domicile and/or the markets in which its securities trade may not be reflective of its sources of revenue. Such securities would be subject to some of the same risks as an investment in foreign securities, including the risk that political and economic events unique to a country or region will adversely affect those markets in which the company’s products or services are sold. |

| n | Growth Stock Risk. Prices of growth stocks may be more sensitive to changes in current or expected earnings than the prices of other stocks. Growth stocks may not perform as well as value stocks or the stock market in general. |

| n | Interest Rate Risk. A rise in interest rates may cause a decline in the value of the Portfolio’s securities, especially bonds with longer maturities. A decline in interest rates may cause the Portfolio to experience a decline in its income. |

| n | Large Company Risk. Large capitalization companies may be unable to respond quickly to new competitive challenges, such as changes in technology, and also may not be able to attain the high growth rate of successful smaller companies, especially during extended periods of economic expansion. |

| n | Loan Participation Risk. In addition to the risks typically associated with fixed-income securities, loan participations carry other risks, including the risk of insolvency of the lending bank or other intermediary. Loan participations may be unsecured or not fully collateralized, may be subject to restrictions on resale and sometimes trade infrequently on the secondary market. |

| n | Low-rated Securities Risk. In general, low-rated debt securities (commonly referred to as “high yield” or “junk” bonds) offer higher yields due to the increased risk that the issuer will be unable to meet its obligations on interest or principal payments at the time called for by the debt instrument. For this reason, these securities are considered speculative and could significantly weaken the Portfolio’s returns. In adverse economic or other circumstances, issuers of these low-rated securities and obligations are more likely to have difficulty making principal and interest payments than issuers of higher-rated securities and obligations. |

| n | Management Risk. Portfolio performance is primarily dependent on WRIMCO’s skill in evaluating and managing the Portfolio’s holdings and the Portfolio may not perform as well as other similar mutual funds. |

| n | Market Risk. Adverse market conditions, sometimes in response to general economic or industry news, may cause the prices of the Portfolio’s holdings to fall as part of a broad market decline. The financial crisis in the U.S. and foreign economies over the past several years, including the European sovereign debt crisis, has resulted, and may continue to result, in an unusually high degree of volatility in the financial markets, both U.S. and foreign, and in the net asset values (NAVs) of many mutual funds, including to some extent the Portfolio. Global economies and financial markets are becoming increasingly interconnected, which increases the possibilities that conditions in one country or region may adversely affect issuers in another country or region, which may adversely affect securities held by the Portfolio. These circumstances have also decreased liquidity in some markets and may continue to do so. In addition, certain unanticipated events, such as natural disasters, terrorist attacks, war, and other geopolitical events, can have a dramatic adverse effect on securities held by the Portfolio. |

| n | Mid Size Company Risk. Securities of mid capitalization companies may be more vulnerable to adverse developments than those of large companies due to such companies’ limited product lines, limited markets and financial resources and dependence upon a relatively small management group. |

| n | Reinvestment Risk. A decline in interest rates may cause issuers to prepay higher-yielding bonds held by the Portfolio, resulting in the Fund reinvesting in securities with lower yields, which may cause a decline in its income. |

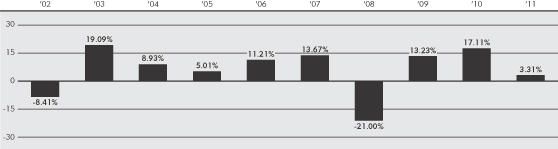

Performance

The chart and table below provide some indication of the risks of investing in the Portfolio. The chart shows how performance has varied from year to year for the Portfolio. The table shows the average annual total returns for the Portfolio and also compares the performance with those of two indexes and a Lipper peer group (a universe of mutual funds with investment objectives similar to that of the Portfolio). The performance results do not reflect any Policy-related fees and expenses, which would reduce the performance results.

During the periods for which performance is shown, the Portfolio’s investment objective was to seek to provide current income and, as a secondary objective, to seek long-term appreciation of capital. Effective as of the date of this Prospectus, the Portfolio changed its investment objective to seeking to provide total return through a combination of capital appreciation and current income.

The Portfolio’s past performance does not necessarily indicate how it will perform in the future. Current performance may be lower or higher. Please call 888.WADDELL for the Portfolio’s updated performance.

Chart of Year-by-Year Returns

as of December 31 each year

|

|

In the period shown in the chart, the highest quarterly return was 9.59% (the fourth quarter of 2010) and the lowest quarterly return was -10.91% (the fourth quarter of 2008). |

Average Annual Total Returns

| as of December 31, 2011 | 1 Year | 5 Years | 10 Years | |||||||||

| Shares of Ivy Funds VIP Balanced |

3.31% | 4.23% | 5.49% | |||||||||

| S&P 500 Index (reflects no deduction for fees, expenses or taxes) |

2.11% | -0.25% | 2.92% | |||||||||

| Citigroup Treasury/Govt Sponsored/Credit Index (reflects no deduction for fees, expenses or taxes) |

8.58% | 6.65% | 5.94% | |||||||||

| Barclays Capital U.S. Government/Credit Index (reflects no deduction for fees, expenses or taxes) (The Portfolio’s benchmark changed from Citigroup Treasury/Govt Sponsored/Credit Index, effective March 2012. WRIMCO believes that the Barclays Capital U.S. Government/Credit Index provides a better benchmark for the Portfolio in light of the types of securities in which the Portfolio invests. Both indexes will be presented in this year’s prospectus for comparison purposes.) |

8.74% | 6.55% | 5.85% | |||||||||

| Lipper Variable Annuity Mixed-Asset Target Allocation Growth Funds Universe Average (net of fees and expenses) |

-1.41% | 0.90% | 3.76% | |||||||||

Investment Adviser

The Portfolio is managed by Waddell & Reed Investment Management Company (WRIMCO).

Portfolio Manager

Cynthia P. Prince-Fox, Senior Vice President of WRIMCO, has managed the Portfolio since July 1994.

Purchase and Sale of Portfolio Shares

Shares of the Portfolio are currently sold only to separate accounts of Participating Insurance Companies to fund benefits payable under the Policies.

The Portfolio’s shares are redeemable. Shares are purchased or redeemed at the Portfolio’s NAV per share next calculated after the order is received in proper form on any business day. The Portfolio does not have initial and subsequent investment minimums. Please refer to your Policy prospectus for more information on purchasing and redeeming Portfolio shares.

Tax Information

Because the Portfolio currently only sells its shares to separate accounts of Participating Insurance Companies, distributions the Portfolio makes of its net investment income and net realized gains, if any — most or all of which it intends to distribute annually — and redemptions or exchanges of Portfolio shares generally will not be taxable to its shareholders (or to the holders of the underlying Policies). See the prospectus for your Policy for further tax information.

Payments to Broker-Dealers and other Financial Intermediaries

The Portfolio and its related companies may make payments to a Participating Insurance Company (or its affiliates) or other financial intermediary for distribution and/or other services. These payments may create a conflict of interest by influencing the Participating Insurance Company or other financial intermediary and your financial advisor to recommend the Portfolio over another investment or by influencing a Participating Insurance Company to include the Portfolio as an underlying investment option in the Policy. The prospectus (or other offering document) for your Policy may contain additional information about these payments.

VIPSUM-BAL