Table of Contents

Prospectus

IVY FUNDS VARIABLE

INSURANCE PORTFOLIOS

APRIL 29, 2011

| Ivy Funds VIP Small Cap Growth |

| Ivy Funds Variable Insurance Portfolios (Trust) is a management investment company, commonly known as a mutual fund, that has twenty-six separate portfolios (each, a Portfolio, and collectively, the Portfolios), each with separate objectives and investment policies. This Prospectus offers one Portfolio of the Trust, Ivy Funds VIP Small Cap Growth.

This Prospectus contains concise information about the Portfolio of which you should be aware before applying for certain variable life insurance policies and variable annuity contracts (collectively, Policies) offered by certain select insurance companies (Participating Insurance Companies). This Prospectus should be read together with the prospectus for the particular Policy.

The Securities and Exchange Commission has not approved or disapproved these securities, or determined whether this Prospectus is accurate or complete. It is a criminal offense to state otherwise. |

|

Table of Contents

| TABLE OF CONTENTS | ||||

| PORTFOLIO SUMMARY | ||||

| 3 | ||||

| 6 | ||||

| 6 | Additional Information about Principal Investment Strategies, | |||

| 7 | ||||

| 7 | ||||

| 9 | ||||

| 11 | ||||

| 15 | ||||

| 17 | ||||

| 20 | ||||

| 2 | Prospectus |

Table of Contents

Ivy Funds VIP Small Cap Growth

Objective

To seek growth of capital.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the Portfolio. The table below does not reflect any fees and expenses imposed under the variable life insurance policies and variable annuity contracts (collectively, Policies) through which this Portfolio is offered. See the Policy prospectus for a description of those fees and expenses.

Shareholder Fees

| (fees paid directly from your investment) | N/A |

Annual Portfolio Operating Expenses

| (expenses that you pay each year as a % of the value of your investment) | ||||

| Management Fees |

0.85% | |||

| Distribution and Service (12b-1) Fees |

0.25% | |||

| Other Expenses |

0.06% | |||

| Total Annual Portfolio Operating Expenses |

1.16% | |||

Example

This example is intended to help you compare the cost of investing in the shares of the Portfolio with the cost of investing in other portfolios. This example does not reflect any fees and expenses imposed under the Policies.

The example assumes that you invest $10,000 in the shares of the Portfolio for the time periods indicated. The example also assumes that your investment has a 5% return each year and that the Portfolio’s operating expenses remain the same. The costs are the same for each time period if you continue to hold your shares or if you redeem all your shares at the end of those periods. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||

| $118 |

$ | 368 | $ | 638 | $ | 1,409 | ||||||

Portfolio Turnover

The Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual portfolio operating expenses or in the example, affect the Portfolio’s performance. During the most recent fiscal year, the Portfolio’s portfolio turnover rate was 60% of the average value of its portfolio.

Principal Investment Strategies

Ivy Funds VIP Small Cap Growth seeks to achieve its objective by investing, under normal market conditions, at least 80% of its net assets in common stocks of small cap companies. Small cap companies typically are companies with market capitalizations below $3.5 billion. The Portfolio emphasizes relatively new or unseasoned companies in their early stages of development, or smaller companies positioned in new or emerging industries where there is opportunity for rapid growth. The Portfolio’s investment in equity securities may include common stocks that are offered in initial public offerings (IPOs).

In selecting securities for the Portfolio, Waddell & Reed Investment Management Company (WRIMCO), the Portfolio’s investment manager, utilizes a bottom-up stock picking process that focuses on companies it believes have sustainable long-term growth potential with superior financial characteristics and, therefore, are believed by WRIMCO to be of a higher quality than many other small cap companies. WRIMCO may look at a number of factors regarding a company, such as: aggressive or creative, yet strong, management; technological or specialized expertise; new or unique products or services; entry into new or emerging industries; growth in earnings/growth in revenue and sales/positive cash flows; and security size and liquidity.

| Ivy Funds VIP Small Cap Growth | Prospectus | 3 |

Table of Contents

Generally, in determining whether to sell a security, WRIMCO uses the same type of analysis that it uses in buying securities. For example, WRIMCO may sell a security if it determines that the stock no longer offers significant growth potential, which may be due to a change in the business or management of the company or a change in the industry of the company. WRIMCO also may sell a security to reduce the Portfolio’s holding in that security, to take advantage of more attractive investment opportunities or to raise cash.

Principal Investment Risks

As with any mutual fund, the value of the Portfolio’s shares will change, and you could lose money on your investment.

A variety of factors can affect the investment performance of the Portfolio and prevent it from achieving its objective. These include:

| n | Company Risk. A security may perform worse than the overall market due to specific factors, such as adverse changes to its financial position or in investor perceptions about the company. |

| n | Growth Stock Risk. Prices of growth stocks may be more sensitive to changes in current or expected earnings than the prices of other stocks. Growth stocks may not perform as well as value stocks or the stock market in general. |

| n | Initial Public Offering Risk. Investments in IPOs can have a significant positive impact on the Portfolio’s performance; however, the positive effect of investments in IPOs may not be sustainable because of a number of factors. The Portfolio may not be able to buy shares in some IPOs, or may be able to buy only a small number of shares. Also, the Portfolio may not be able to buy the shares at the commencement of the offering, and the general availability and performance of IPOs are dependent on market psychology and economic conditions. The relative performance impact of IPOs is also likely to decline as the Portfolio grows. |

| n | Liquidity Risk. Generally, a security is liquid if the Portfolio is able to sell the security at a fair price within a reasonable time. Liquidity is generally related to the market trading volume for a particular security. |

| n | Management Risk. Portfolio performance is primarily dependent on WRIMCO’s skill in evaluating and managing the Portfolio’s holdings and the Portfolio may not perform as well as other similar mutual funds. |

| n | Market Risk. Adverse market conditions, sometimes in response to general economic or industry news, may cause the prices of the Portfolio’s holdings to fall as part of a broad market decline. Recent events in the financial sector and in the economy have resulted, and may continue to result, in an unusually high degree of volatility in the financial markets, both U.S. and foreign, and in the net asset values (NAVs) of many mutual funds, including to some extent the Portfolio. These events have also decreased liquidity in some markets and may continue to do so. |

| n | Small Company Risk. Equity securities of small capitalization companies are subject to greater price volatility, lower trading volume and less liquidity due to, among other things, such companies’ small size, limited product lines, limited access to financing sources and limited management depth. In addition, the frequency and volume of trading of such securities may be less than is typical of larger companies, making them subject to wider price fluctuations. In some cases, there could be difficulties in selling securities of small capitalization companies at the desired time. |

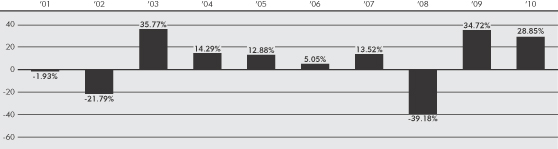

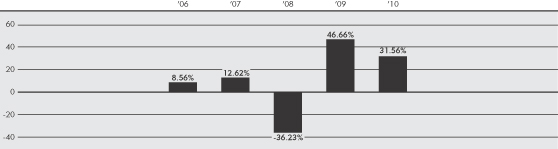

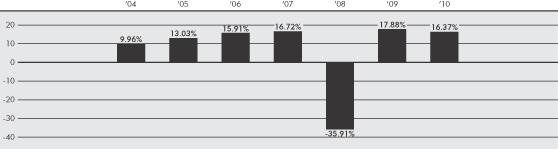

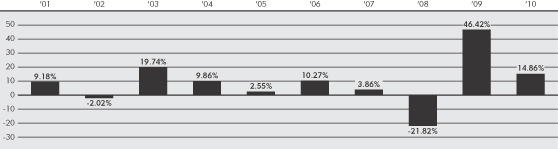

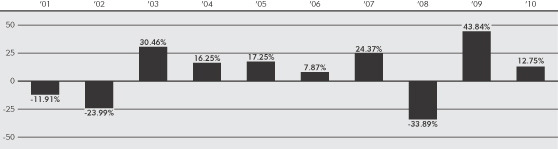

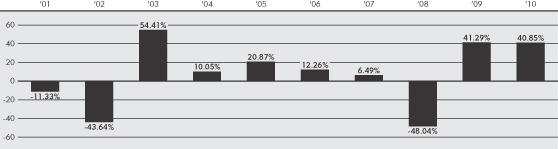

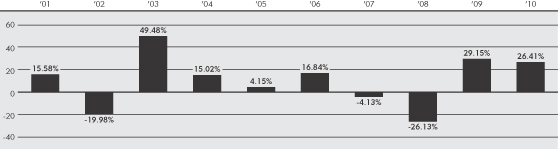

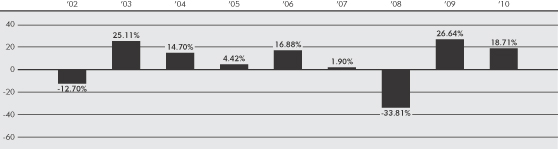

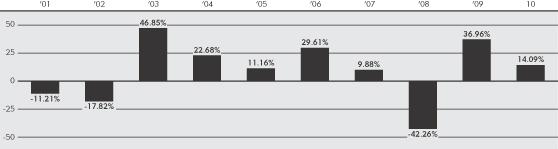

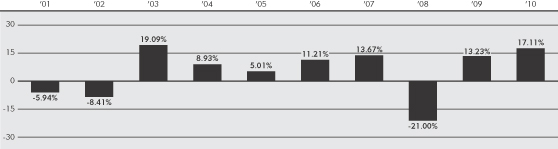

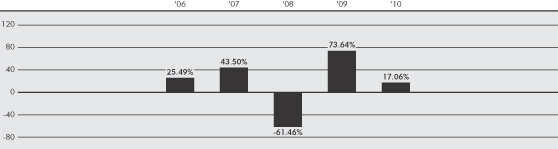

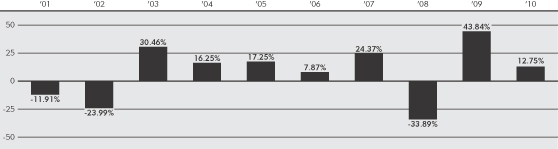

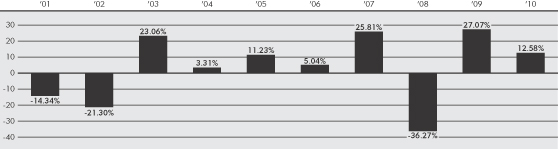

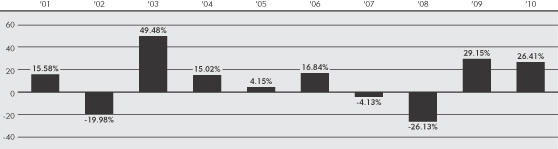

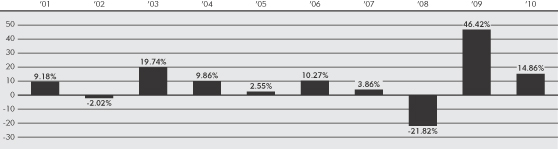

Performance

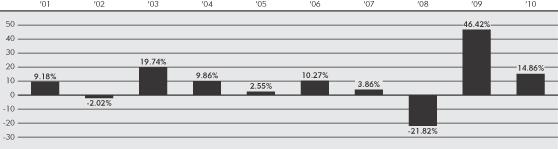

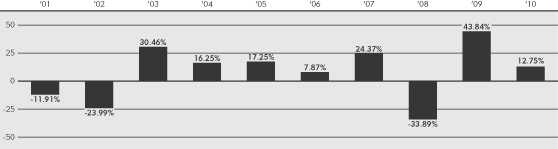

The chart and table below provide some indication of the risks of investing in the Portfolio. The chart shows how performance has varied from year to year for the Portfolio. The table shows the average annual total returns for the Portfolio and also compares the performance with those of an index and a peer group of mutual funds with investment objectives similar to that of the Portfolio. The performance results do not reflect any Policy-related fees and expenses, which would reduce the performance results.

Performance results include the effect of expense reduction arrangements for some or all of the periods shown. If those arrangements had not been in place, the performance results for those periods would have been lower.

The Portfolio’s past performance does not necessarily indicate how it will perform in the future. Current performance may be lower or higher. Please call 888.WADDELL for the Portfolio’s updated performance.

| 4 | Prospectus | Ivy Funds VIP Small Cap Growth |

Table of Contents

Chart of Year-by-Year Returns

as of December 31 each year

|

|

In the period shown in the chart, the highest quarterly return was 24.14% (the second quarter of 2009) and the lowest quarterly return was -21.73% (the third quarter of 2001). |

Average Annual Total Returns

| as of December 31, 2010 | 1 Year | 5 Years | 10 Years | |||||||||

| Shares of Ivy Funds VIP Small Cap Growth |

28.85% | 4.72% | 5.40% | |||||||||

| Russell 2000 Growth Index (reflects no deduction for fees, expenses or taxes) |

29.06% | 5.27% | 3.77% | |||||||||

| Lipper Variable Annuity Small-Cap Growth Funds Universe Average (net of fees and expenses) |

27.83% | 4.50% | 2.52% | |||||||||

Investment Adviser

The Portfolio is managed by Waddell & Reed Investment Management Company (WRIMCO).

Portfolio Manager

Kenneth G. McQuade, Vice President of WRIMCO, has managed the Portfolio since March 2006.

Purchase and Sale of Portfolio Shares

Shares of the Portfolio are currently sold only to separate accounts of Participating Insurance Companies to fund benefits payable under the Policies.

The Portfolio’s shares are redeemable. Shares are purchased or redeemed at the Portfolio’s NAV per share next calculated after the order is received in proper form on any business day. The Portfolio does not have initial and subsequent investment minimums. Please refer to your Policy prospectus for more information on purchasing and redeeming Portfolio shares.

Tax Information

Because the Portfolio currently only sells its shares to separate accounts of Participating Insurance Companies, distributions the Portfolio makes of its net investment income and net realized gains, if any — most or all of which it intends to distribute annually — and redemptions or exchanges of Portfolio shares generally will not be taxable to its shareholders (or to the holders of the underlying Policies). See the prospectus for your Policy for further tax information.

Payments to Broker-Dealers and other Financial Intermediaries

The Portfolio and its related companies may make payments to a Participating Insurance Company (or its affiliates) or other financial intermediary for distribution and/or other services. These payments may create a conflict of interest by influencing the Participating Insurance Company or other financial intermediary and your financial advisor to recommend the Portfolio over another investment or by influencing a Participating Insurance Company to include the Portfolio as an underlying investment option in the Policy. The prospectus (or other offering document) for your Policy may contain additional information about these payments.

| Ivy Funds VIP Small Cap Growth | Prospectus | 5 |

Table of Contents

Additional Information about Principal Investment Strategies, Other Investments and Risks

Ivy Funds VIP Small Cap Growth: The Portfolio seeks to achieve its objective of growth of capital by investing primarily in common stocks of small cap companies that are relatively new or unseasoned companies in their early stages of development, or smaller companies positioned in new or emerging industries where there is an opportunity for rapid growth. The emphasis on portfolio risk diversification is an important contributor to the ability to effectively manage risk, as a desired goal is to have a portfolio of securities that tend not to react in high correlation to one another under any economic or market condition. This emphasis is intended to result in a higher degree of diversification, reduced portfolio volatility, and a smoother more consistent pattern of portfolio returns over the long term. There is no guarantee, however, that the Portfolio will achieve its objective.

WRIMCO considers quality of management and superior financial characteristics (for example, return on assets, return on equity, operating margin) in its search for companies, thereby focusing on higher-quality companies. WRIMCO seeks companies that it believes exhibit defensible market positions by having one or more of the following characteristics: a company that is a strong niche player, that features the involvement of the founder, or that demonstrates a strong commitment to shareholders. WRIMCO believes that such companies generally have a replicable business model that allows for sustained growth. The focus on holding an investment is intermediate to long-term. WRIMCO considers selling a holding if its analysis reveals evidence of a meaningful deterioration in operating trends, it anticipates a decrease in the company’s ability to grow and gain market shares and/or the company’s founder departs.

Small cap companies typically are companies with market capitalizations below $3.5 billion. Some companies may outgrow the definition of small cap after the Portfolio has purchased their securities. Securities of a company whose capitalization range exceeds the small cap range after purchase will not be sold solely because of the company’s increased capitalization. From time to time, the Portfolio also will invest a lesser portion of its assets in securities of mid and large cap companies (that is, companies with market capitalizations larger than that defined above) that, in WRIMCO’s opinion, are being fundamentally changed or revitalized, have a position that is considered strong relative to the market as a whole or otherwise offer unusual opportunities for above-average growth.

In addition to common stocks, the Portfolio may invest in securities convertible into common stocks, in preferred stocks and debt securities, that are mostly of investment grade.

The Portfolio may invest up to 25% of its total assets in foreign securities. Investing in foreign securities may present additional risks such as currency fluctuations and political or economic conditions affecting the foreign country. Many U.S. companies have a diverse market of U.S. business and overseas operations. Therefore, the Portfolio may have an indirect exposure to foreign markets through these investments.

When WRIMCO believes that a temporary defensive position is desirable, the Portfolio may invest up to all of its assets in debt securities, including commercial paper and short-term U.S. government securities, and/or preferred stocks. The Portfolio also may invest in more established companies, such as those with longer operating histories than many small cap companies. As well, it may increase the number of issuers in which it invests and thereby limit the Portfolio’s position size in any particular security. By taking a temporary defensive position, however, the Portfolio may not achieve its investment objective.

Principal Risks. An investment in Ivy Funds VIP Small Cap Growth is subject to various risks, including the following:

|

n Company Risk n Growth Stock Risk n Initial Public Offering Risk n Liquidity Risk |

n Management Risk n Market Risk n Small Company Risk |

Non-Principal Risks. In addition to the Principal Risks identified above, an investment in Ivy Funds VIP Small Cap Growth may be subject to other, non-principal risks, including the following:

|

n Foreign Market Risk n Foreign Securities Risk |

n Large Company Risk n Mid Size Company Risk |

| 6 | Prospectus |

Table of Contents

A description of these risks is set forth in Defining Risks below. Additional risk information, as well as additional information on securities and other instruments in which the Portfolio may invest, is provided in the Portfolio’s Statement of Additional Information (SAI).

Additional Investment Considerations

The objective and investment policies of the Portfolio may be changed by the Board of Trustees (Board) without a vote of the Portfolio’s shareholders, unless a policy or restriction is otherwise described.

Because the Portfolio owns different types of investments, its performance will be affected by a variety of factors. The value of the Portfolio’s investments and the income it generates will vary from day to day, generally reflecting changes in interest rates, market conditions, and other company and economic news. Performance will also depend on the skill of WRIMCO in selecting investments. As with any mutual fund, you could lose money on your investment.

The Portfolio also may invest in and use certain other types of securities and instruments in seeking to achieve its objective. For example, the Portfolio may invest in options, futures contracts and other derivative instruments if it is permitted to invest in the type of asset by which the return on, or value of, the derivative is measured. Certain types of the Portfolio’s authorized investments and strategies, such as derivative instruments and foreign securities, involve special risks. Depending on how much the Portfolio invests or uses these strategies, these special risks may become significant.

The Portfolio may actively trade securities in seeking to achieve its objective. Factors that can lead to active trading include market volatility, a significant positive or negative development concerning a security, an attempt to maintain the Portfolio’s market capitalization target, and the need to sell a security to meet redemption activity. Actively trading securities may increase transaction costs (which may reduce performance) and increase distributions paid by the Portfolio.

The Portfolio generally seeks to be fully invested, except to the extent that it takes a temporary defensive position. In addition, at times, WRIMCO may invest a portion of the Portfolio’s assets in cash or cash equivalents if WRIMCO is unable to identify and acquire a sufficient number of securities that meet WRIMCO’s selection criteria for implementing the Portfolio’s investment objective, strategies and policies.

You will find more information in the SAI about the Portfolio’s permitted investments and strategies, as well as the restrictions that apply to them.

A description of the Portfolio’s policies and procedures with respect to the disclosure of the Portfolio’s securities holdings is available in the SAI.

Portfolio holdings can be found at www.waddell.com. Alternatively, a complete schedule of portfolio holdings of the Portfolio for the first and third quarters of each fiscal year is filed with the Securities and Exchange Commission (SEC) on the Trust’s Form N-Q. These holdings may be viewed in the following ways:

| n | On the SEC’s website at http://www.sec.gov. |

| n | For review and copy at the SEC’s Public Reference Room in Washington, DC. Information on the operations of the Public Reference Room may be obtained by calling 202.551.8090. |

Company Risk — An individual company may perform differently than the overall market. This may be a result of specific factors such as changes in corporate profitability due to the success or failure of specific products or management strategies, or it may be due to changes in investor perceptions regarding a company.

Foreign Market Risk — The securities of many companies may have significant exposure to foreign markets as a result of the company’s products or services in foreign markets so that its domicile and/or the markets in which its securities trade may not be reflective of its sources of revenue. Such securities would be subject to some of the same risks as an investment in foreign securities, including the risk that political and economic events unique to a country or region will adversely affect those markets in which the company’s products or services are sold.

| Prospectus | 7 |

Table of Contents

Foreign Securities Risk — Investing in foreign securities involves a number of economic, financial and political considerations that are not associated with the U.S. markets and that could affect the Portfolio’s performance unfavorably, depending upon prevailing conditions at any given time. For example, the securities markets of many foreign countries may be smaller, less liquid and subject to greater price volatility than those in the United States. Foreign investing also may involve brokerage costs and tax considerations that are not usually present in the U.S. markets.

Other factors that can affect the value of the Portfolio’s foreign investments include the comparatively weak supervision and regulation by some foreign governments of securities exchanges, brokers and issuers, and the fact that many foreign companies may not be subject to uniform accounting, auditing and financial reporting standards. It also may be difficult to obtain reliable information about the securities and business operations of certain foreign issuers. Settlement of portfolio transactions also may be delayed due to local restrictions or communication problems, which can cause the Portfolio to miss attractive investment opportunities or impair its ability to dispose of securities in a timely fashion (resulting in a loss if the value of the securities subsequently declines).

Growth Stock Risk — Growth stocks are stocks of companies believed to have above-average potential for growth in revenue and earnings. Prices of growth stocks may be more sensitive to changes in current or expected earnings than the prices of other stocks. Growth stocks may not perform as well as value stocks or the stock market in general.

Initial Public Offering Risk — Investments in IPOs can have a significant positive impact on the Portfolio’s performance; however, the positive effect of investments in IPOs may not be sustainable because of a number of factors. The Portfolio may not be able to buy shares in some IPOs, or may be able to buy only a small number of shares. Also, the Portfolio may not be able to buy the shares at the commencement of the offering, and the general availability and performance of IPOs are dependent on market psychology and economic conditions. The relative performance impact of IPOs is also likely to decline as the Portfolio grows.

Large Company Risk — A Portfolio with holdings of large capitalization company securities may underperform the market as a whole.

Liquidity Risk — Generally, a security is liquid if the Portfolio is able to sell the security at a fair price within a reasonable time. Liquidity is generally related to the market trading volume for a particular security. Investments in smaller companies, foreign companies, companies in emerging markets or certain instruments such as derivatives are subject to a variety of risks, including potential lack of liquidity.

Management Risk — WRIMCO applies the Portfolio’s investment strategies and selects securities for the Portfolio in seeking to achieve the Portfolio’s investment objective. Securities selected by the Portfolio may not perform as well as the securities held by other mutual funds with investment objectives that are similar to the investment objective of the Portfolio. In general, investment decisions made by WRIMCO may not produce the anticipated returns, may cause the Fund’s shares to lose value or may cause the Portfolio to perform less favorably than other mutual funds with investment objectives similar to the investment objective of the Portfolio.

Market Risk — All securities may be subject to adverse trends in equity markets. Securities are subject to price movements due to changes in general economic conditions, the level of prevailing interest rates or investor perceptions of the market. In addition, prices are affected by the outlook for overall corporate profitability. Market prices of equity securities are generally more volatile than debt securities. This may cause a security to be worth less than the price originally paid for it, or less than it was worth at an earlier time. Market risk may affect a single issuer or the market as a whole. As a result, a portfolio of such securities may underperform the market as a whole.

Mid Size Company Risk — Securities of mid capitalization companies may be more vulnerable to adverse developments than those of large companies due to such companies’ limited product lines, limited markets and financial resources and dependence upon a relatively small management group.

Small Company Risk — Equity and fixed income securities of small capitalization companies are subject to greater price volatility, lower trading volume and less liquidity due to, among other things, such companies’ small size, limited product lines, limited access to financing sources and limited management depth. In addition, the frequency and volume of trading of such securities may be less than is typical of larger companies, making them subject to wider price fluctuations. In some cases, there could be difficulties in selling securities of small capitalization companies at the desired time.

| 8 | Prospectus |

Table of Contents

The Management of the Portfolio

Portfolio Management

The Portfolio of the Trust is managed by WRIMCO, subject to the authority of the Trust’s Board. WRIMCO provides investment advice to each of the Portfolios and supervises each Portfolio’s investments. WRIMCO and/or its predecessor have served as investment manager to the Portfolios since their inception and to each of the registered investment companies within Waddell & Reed Advisors Funds and Waddell & Reed InvestEd Portfolios since their inception. WRIMCO is located at 6300 Lamar Avenue, P.O. Box 29217, Shawnee Mission, Kansas 66201-9217. WRIMCO had approximately $37.3 billion in assets under management as of December 31, 2010.

Ivy Funds VIP Small Cap Growth: Kenneth G. McQuade is primarily responsible for the day-to-day management of Ivy Funds VIP Small Cap Growth. Mr. McQuade has held his responsibilities for Ivy Funds VIP Small Cap Growth since March 2006. Mr. McQuade joined Waddell & Reed in 1997 as an investment analyst. He was an assistant portfolio manager of separately managed small cap accounts from August 2003 until March 2010. Mr. McQuade is Vice President of WRIMCO and Ivy Investment Management Company (IICO), an affiliate of WRIMCO, and Vice President of the Trust. He earned a BS degree in finance from Bradley University.

Additional information regarding the portfolio manager, including information about the portfolio manager’s compensation, other accounts managed by the portfolio manager and the portfolio manager’s ownership of securities, is included in the SAI.

Other members of WRIMCO’s investment management department provide input on market outlook, economic conditions, investment research and other considerations relating to the investments of the Portfolios.

Management and Other Fees

Like all mutual funds, the Portfolio pays fees related to its daily operations. Expenses paid out of the Portfolio’s assets are reflected in its share price or dividends; they are neither billed directly to shareholders nor deducted from shareholder accounts.

The Portfolio pays a management fee to WRIMCO for providing investment advice and supervising its investments. The Portfolio also pays other expenses, which are explained in the SAI.

The management fee is payable at the annual rates of: 0.85% of net assets up to $1 billion, 0.83% of net assets over $1 billion and up to $2 billion, 0.80% of net assets over $2 billion and up to $3 billion, and 0.76% of net assets over $3 billion.

Effective October 1, 2006, and at least through September 30, 2016, the investment management fee rates for certain Portfolios are reduced pursuant to a management fee waiver as follows: 0.83% of net assets up to $1 billion, 0.83% of net assets over $1 billion and up to $2 billion, 0.80% of net assets over $2 billion and up to $3 billion, and 0.76% of net assets over $3 billion.

For the fiscal year ended December 31, 2010, management fees for the Portfolio as a percent of the Portfolio’s average net assets were: 0.85%.

A discussion regarding the basis of the approval by the Board of the renewal of the advisory contract of the Portfolio is available in the Trust’s Annual Report to Shareholders for the period ended December 31, 2010.

The Trust has adopted a Service Plan (Plan) pursuant to Rule 12b-1 under the 1940 Act. Under the Plan, the Portfolio may pay daily a fee to Waddell & Reed, Inc. (Waddell & Reed), an affiliate of WRIMCO and the Trust’s principal underwriter, in an amount not to exceed 0.25% of the Portfolio’s average annual net assets. The fee is to be paid to compensate Waddell & Reed and unaffiliated third parties for amounts expended in connection with the provision of personal services to Policyowners. These fees are paid out of the Portfolio’s assets on an on-going basis, and over time, these fees will increase the cost of the investment and may cost you more than paying other types of sales charges.

In addition to commissions, Nationwide Life Insurance Company and Minnesota Life Insurance Company each pay Waddell & Reed a marketing allowance in an amount equal to 0.25% annually of the average daily account value of all variable annuity assets for products distributed by Waddell & Reed. The marketing allowance is paid to Waddell & Reed by Nationwide on a monthly basis and by Minnesota Life on a quarterly basis.

| Prospectus | 9 |

Table of Contents

Regulatory Matters

On July 24, 2006, WRIMCO, Waddell & Reed, Inc. and Waddell & Reed Services Company (collectively, W&R) reached a settlement with each of the SEC, the New York Attorney General (NYAG) and the Securities Commissioner of the State of Kansas to resolve proceedings brought by each regulator in connection with its investigation of frequent trading and market timing in certain funds within Waddell & Reed Advisors Funds.*

Under the terms of the SEC’s cease-and desist order (SEC Order), pursuant to which W&R neither admitted nor denied any of the findings contained therein, among other provisions W&R has agreed to: pay $40 million in disgorgement and $10 million in civil money penalties; cease and desist from violations of the antifraud provisions and certain other provisions of the Federal securities laws; maintain certain compliance and ethics oversight structures; retain an independent consultant to periodically review W&R’s supervisory, compliance, control and other policies and procedures; and retain an independent distribution consultant (described below). According to the SEC Order, the SEC found that some market timers made profits in some of the funds within Waddell & Reed Advisors Funds, and that this may have caused some dilution in those funds. Also, the SEC found that W&R failed to make certain disclosures to Waddell & Reed Advisors Funds’ Board of Trustees and shareholders regarding the market timing activity and W&R’s acceptance of service fees from some market timers.

The Assurance of Discontinuance with the NYAG (NYAG Settlement), pursuant to which W&R neither admitted nor denied any of the findings contained therein, among its conditions requires that W&R: reduce the aggregate investment management fees paid by the then-existing funds within Waddell & Reed Advisors Funds and Ivy Funds Variable Insurance Portfolios (the Affected Funds) by $5 million per year for five years, for a projected total of $25 million in investment management fee reductions; bear the costs of an independent fee consultant to be retained by the Affected Funds’ Disinterested Trustees to review and consult regarding the Affected Funds’ investment management fee arrangements; and make additional investment management fee-related disclosures to Affected Fund shareholders. The NYAG Settlement also effectively requires that the Affected Funds implement certain governance measures designed to maintain the independence of the Affected Funds’ Boards of Trustees and appoint an independent compliance consultant responsible for monitoring the Affected Funds’ and W&R’s compliance with applicable laws.

The consent order issued by the Securities Commissioner of the State of Kansas (Kansas Order), pursuant to which W&R neither admitted nor denied any of the findings contained therein, required W&R to pay a fine of $2 million to the Office of the Commissioner.

The SEC Order further requires that the $50 million in settlement amounts described above will be distributed in accordance with a distribution plan developed by an independent distribution consultant, in consultation with W&R, and that is agreed to by the SEC staff and for which the distribution methodology is acceptable to the Affected Funds’ Disinterested Trustees. The SEC Order requires that the independent distribution consultant develop a methodology and distribution plan pursuant to which Affected Fund shareholders shall receive their proportionate share of losses, if any, suffered by the Affected Funds due to market timing. Therefore, it is not currently possible to specify which particular Affected Fund shareholders or groups of Affected Fund shareholders will receive distributions of those settlement monies or in what proportion and amounts. However, as noted above, the SEC Order makes certain findings with respect to market timing activities in some of the funds within Waddell & Reed Advisors Funds only. Accordingly, it is not expected that shareholders of the Trust will receive distributions of settlement monies.

The foregoing is only a summary of the SEC Order, NYAG Settlement and Kansas Order. A copy of the SEC Order is available on the SEC’s website at http://www.sec.gov. A copy of the SEC Order, NYAG Settlement and Kansas Order is available as part of the Waddell & Reed Financial, Inc. Form 8-K as filed on July 24, 2006.

| * | In the “Regulatory Matters” section: any reference to funds within Waddell & Reed Advisors Funds means the corporate entities (or series thereof) to which such funds are the successors; any reference to the Trust means W&R Target Funds, Inc., which changed its name to Ivy Funds Variable Insurance Portfolios, Inc., to which the Trust is the successor; and any reference to a Board of Trustees or the Trustees means the Boards of Directors or the Directors, as applicable, of the respective predecessor entities of Waddell & Reed Advisors Funds and the Trust. |

| 10 | Prospectus |

Table of Contents

Buying and Selling Portfolio Shares

WHO CAN BUY SHARES OF THE PORTFOLIO

Shares of the Portfolio are currently sold to the separate accounts (Variable Accounts) of Participating Insurance Companies to fund benefits payable under the Policies under the Trust’s “Mixed and Shared” Exemptive Order (Order). Permitting both variable life insurance separate accounts and variable annuity separate accounts to invest in the same Portfolio is known as “mixed funding.” Shares of the Portfolio are not sold to individual investors.

The Variable Accounts purchase shares of the Portfolio in accordance with Variable Account allocation instructions received from Policyowners. The Portfolio then uses the proceeds to buy securities for its portfolio.

Because Policies may have different provisions with respect to the timing and method of purchases and exchanges, Policyowners should contact their Participating Insurance Company directly for details concerning these transactions.

Please check with your Participating Insurance Company to determine if the Portfolio is available under your Policy. This Prospectus should be read in conjunction with the prospectus of the Variable Account of your specific Policy.

The Portfolio currently does not foresee any disadvantages to Policyowners arising out of the fact that the Portfolio may offer its shares to the Variable Accounts of various Participating Insurance Companies to fund benefits of their Policies. Nevertheless, as a condition of the Order, the Trust’s Board will monitor events in order to identify any material irreconcilable conflicts that may arise (such as those arising from tax or other differences) and to determine what action, if any, should be taken in response to such conflicts. If such a conflict were to occur, one or more Variable Accounts might be required to withdraw their investments in the Portfolio and shares of another fund may be substituted. This might force the Portfolio to sell its securities at disadvantageous prices.

The principal underwriter of the Portfolio is Waddell & Reed.

Purchase Price

The purchase price of each share of the Portfolio is its NAV next determined after the order is received in good order by the Portfolio or its agent. No sales charge is imposed on the purchase of the Portfolio’s shares; however, your Policy may impose a sales charge. The NAV for a share of the Portfolio is determined by dividing the total market value of the securities and other assets of the Portfolio, less the liabilities of the Portfolio, by the total number of outstanding shares of the Portfolio. In general, NAV is determined at the close of regular trading on the New York Stock Exchange (NYSE), normally 4 p.m. Eastern Time, on each day the NYSE is open for trading. The Portfolio may reject any order to buy shares and may suspend the sale of shares at any time.

Net Asset Value

In the calculation of the Portfolio’s NAV:

| n | The securities held by the Portfolio that are traded on an exchange are ordinarily valued at the last sale price on each day prior to the time of valuation as reported by the principal securities exchange on which the securities are traded or, if no sale is recorded, the average of the last bid and asked prices. |

| n | Stocks that are traded over-the-counter are valued using the NASDAQ Official Closing Price (NOCP), as determined by NASDAQ, or, lacking an NOCP, the last current reported sales price as of the time of valuation on NASDAQ or, lacking any current reported sales on NASDAQ, at the time of valuation at the average of the last bid and asked prices. |

| n | Bonds (including foreign bonds), convertible bonds, municipal bonds, U.S. government securities, mortgage-backed securities and swap agreements are ordinarily valued according to prices quoted by an independent pricing service. |

| n | Short-term debt securities are valued at amortized cost, which approximates market value. |

| n | Precious metals are valued at the last traded spot price for the appropriate metal immediately prior to the time of valuation. |

| n | Other investment assets for which market prices are unavailable or are not reflective of current market value are valued at their fair value by or at the direction of the Board, as discussed below. |

The NAV per share of the Portfolio is normally computed daily as of the close of business of the NYSE, normally 4 p.m. Eastern time, except that an option or futures contract held by the Portfolio may be priced at the close of the regular session of any other securities or commodities exchange on which that instrument is traded.

| Prospectus | 11 |

Table of Contents

As noted in this Prospectus, the Portfolio may invest in securities listed on foreign exchanges, or otherwise traded in a foreign market, which may trade on Saturdays or on U.S. national business holidays when the NYSE is closed. Consequently, the NAV of the Portfolio’s shares may be significantly affected on days when the Portfolio does not price its shares and when you are not able to purchase or redeem the Portfolio’s shares.

When the Portfolio believes a reported market price for a security does not reflect the amount the Portfolio would receive on a current sale of that security, the Portfolio may substitute for the market price a fair-value determination made according to procedures approved by the Trust’s Board. The Portfolio also may use these procedures to value certain types of illiquid securities. In addition, fair value pricing generally will be used by the Portfolio if the exchange on which a security is traded closes early or if trading in a particular security is halted during the day and does not resume prior to the time the Portfolio’s NAV is calculated.

The Portfolio also may use these methods to value securities that trade in a foreign market if a significant event that appears likely to materially affect the value of foreign investments or foreign currency exchange rates occurs between the time that foreign market closes and the time the NYSE closes. Some Portfolios, which may invest a significant portion of their assets in foreign securities, also may be susceptible to a time zone arbitrage strategy in which shareholders attempt to take advantage of Portfolio share prices that may not reflect developments in foreign securities or derivatives markets that occurred after the close of such market but prior to the pricing of Portfolio shares. In that case, such securities investments may be valued at their fair values as determined according to the procedures approved by the Board. Significant events include, but are not limited to, (1) events impacting a single issuer, (2) governmental actions that affect securities in one sector, country or region, (3) natural disasters or armed conflicts affecting a country or region, and (4) significant U.S. or foreign market fluctuations.

WRIMCO has retained a third-party pricing service (the Service) to assist in fair valuing foreign securities and foreign derivatives (collectively, Foreign Securities), if any, held by the Portfolio. The Service conducts a screening process to indicate the degree of confidence, based on historical data, that the closing price in the principal market where a Foreign Security trades is not the current market value as of the close of the NYSE. For foreign securities where Waddell & Reed Services Company, the Portfolio’s transfer agent, doing business as WI Services Company (WISC), in accordance with guidelines adopted by the Board, believes, at the approved degree of confidence, that the price is not reflective of current market price, WISC may use the indication of fair value from the Service to determine the fair value of the Foreign Securities. The Service, the methodology or the degree of certainty may change from time to time. The Board regularly reviews, and WISC regularly monitors and reports to the Board, the Service’s pricing of the Portfolio’s Foreign Securities, as applicable.

Fair valuation has the effect of updating security prices to reflect market value based on, among other things, the recognition of a significant event — thus potentially alleviating arbitrage opportunities with respect to Portfolio shares. Another effect of fair valuation on the Portfolio is that the Portfolio’s NAV will be subject, in part, to the judgment of the Board or its designee instead of being determined directly by market prices. When fair value pricing is applied, the prices of securities used by the Portfolio to calculate its NAV may differ from quoted or published prices for the same securities, and therefore, the Portfolio purchasing or redeeming shares on a particular day might pay or receive more or less than would be the case if a security were valued differently. The use of fair value pricing also may affect all shareholders in that if Portfolio assets were paid out differently due to fair value pricing, all shareholders will be impacted incrementally. There is no assurance, however, that fair value pricing will more accurately reflect the value of a security on a particular day than the market price of such security on that day or that it will prevent or alleviate the impact of market timing activities. For a description of market timing activities, please see “Market Timing Policy.”

SELLING SHARES

Shares of the Portfolio may be sold (redeemed) at any time, subject to certain restrictions described below. The redemption price is the NAV per share next determined after the order is received in good order by the Portfolio or its agent. The value of the shares redeemed may be more or less than their original purchase price depending upon the market value of the Portfolio’s investments at the time of the redemption.

Because Policies may have different provisions with respect to the timing and method of redemptions, Policyowners should contact their Participating Insurance Company directly for details concerning these transactions.

Redemptions are made at the NAV per share of the Portfolio next determined after receipt of the request to redeem from the Participating Insurance Company. Payment is generally made within seven days after receipt of a proper request to redeem. No fee is charged to any Participating Insurance Company upon redemption of Portfolio shares. The Trust may suspend the right of redemption of shares of the Portfolio and may postpone payment for any period if any of the following conditions exist:

| n | the NYSE is closed other than customary weekend and holiday closings or trading on the NYSE is restricted |

| 12 | Prospectus |

Table of Contents

| n | the SEC has determined that a state of emergency exists which may make payment or transfer not reasonably practicable |

| n | the SEC has permitted suspension of the right of redemption of shares for the protection of the security holders of the Trust |

| n | applicable laws and regulations otherwise permit the Trust to suspend payment on the redemption of shares |

Redemptions are ordinarily made in cash.

Market Timing Policy of the Trust

The Portfolios are intended for long-term investment purposes. The Trust and/or the Participating Insurance Companies will take steps to seek to deter frequent purchases and/or redemptions in Portfolio shares (market timing activities). Market timing activities, especially those involving large dollar amounts, may disrupt portfolio investment management and may increase expenses and negatively impact investment returns for all Portfolio shareholders, including long-term shareholders. Market timing activities also may increase the expenses of WISC and/or Waddell & Reed, thereby indirectly affecting the Portfolio’s shareholders.

Certain Portfolios may be more attractive to investors seeking to engage in market timing activities. For example, to the extent that a Portfolio invests a significant portion of its assets in foreign securities, the Portfolio may be susceptible to a time zone arbitrage strategy in which investors seek to take advantage of Portfolio share prices that may not reflect developments in foreign securities markets that occurred after the close of such market but prior to the pricing of Portfolio shares. A Portfolio that invests in securities that are, among other things, thinly traded or traded infrequently is susceptible to the risk that the current market price for such securities may not accurately reflect current market values. An investor may seek to engage in short-term trading to take advantage of these pricing differences (commonly referred to as price arbitrage). Price arbitrage is more likely to occur in a Portfolio that invests a significant portion of its assets in small cap companies, such as Ivy Funds VIP Small Cap Growth, or in a Portfolio that invests a significant portion of its assets in high-yield fixed income securities.

To discourage market timing activities by investors, the Board has adopted a market timing policy and has approved the procedures of WISC, the Portfolios’ transfer agent, for implementing this policy. WISC’s procedures reflect the criteria that it has developed for purposes of identifying trading activity in Portfolio shares that may be indicative of market timing activities and outline how WISC will monitor transactions in Portfolio shares. In its monitoring of trading activity in Portfolio shares, on a periodic basis, WISC typically reviews Portfolio share transactions that exceed certain monetary thresholds and/or numerical transaction limits within a particular time period. In its attempt to identify market timing activities, WISC considers many factors, including (but not limited to) the frequency, size and/or timing of the investor’s transactions in Portfolio shares. If WISC identifies what it believes to be market timing activities, WISC and/or Waddell & Reed will coordinate with the applicable Participating Insurance Company so that it may notify the investors involved, reject or restrict a purchase or exchange order and/or prohibit those investors from making further purchases of Portfolio shares. The Portfolios also may restrict their exchange privileges in order to protect Portfolio shareholders. Transactions placed in violation of a Portfolio’s market timing policy are not deemed accepted by the Portfolio and may be cancelled or revoked by the Portfolio on the next business day following receipt by the Portfolio.

Due to the complexity and subjectivity involved in identifying market timing activities and the volume of shareholder transactions that WISC processes, there can be no assurance that the Portfolios’ and WISC’s policies and procedures will identify all trades or trading practices that may be considered market timing activity. WISC may modify its procedures for implementing the Portfolios’ market timing policy and/or its monitoring criteria at any time without prior notice. The Portfolios, WISC and/or Waddell & Reed shall not be liable for any loss resulting from rejected purchase orders or exchanges.

The Portfolio seeks to apply its market timing policy uniformly to all shareholders and prospective investors. Although the Portfolio, Waddell & Reed and WISC make efforts to monitor for market timing activities and will seek the assistance of the Participating Insurance Companies through which Portfolio shares are purchased or held, the Portfolio cannot always identify or detect excessive trading that may be facilitated by a Participating Insurance Company or made difficult to identify by the use of omnibus accounts by the Participating Insurance Companies, mainly due to the fact that the Participating Insurance Companies maintain the underlying Policyowner account, and the Portfolio must analyze omnibus account level activity and then request additional shareholder level activity on the underlying investors where omnibus account level activity warrants further review. Accordingly, there can be no assurance that the Portfolio will be able to eliminate all market timing activities.

| Prospectus | 13 |

Table of Contents

Apart from actions taken by the Portfolio, Policyowners also may be subject to restrictions imposed under their Policies with respect to short-term trading and the trading restrictions imposed by the Participating Insurance Companies that maintain the underlying account(s).

The Portfolio’s market timing policy, in conjunction with the use of fair value pricing, is intended to reduce a Policyowner’s ability to engage in market timing activities, although there can be no assurance that the Portfolio will eliminate market timing activities.

Additional Compensation to Intermediaries

Waddell & Reed and/or its affiliates (collectively, W&R) may make payments for marketing, promotional or related services by:

| n | Participating Insurance Companies for whose Policies the Portfolio is an underlying investment option or |

| n | broker-dealers and other financial intermediaries that sell Policies that include the Portfolio as an underlying investment option. |

These payments are often referred to as “revenue sharing payments.” The level of such payments may be based on factors that include, without limitation, differing levels or types of services provided by the insurance company, broker-dealer or other financial intermediary, the expected level of assets or sales of shares, the placing of the Portfolio on a recommended or preferred list, access to an intermediary’s personnel and other factors. Revenue sharing payments are paid from W&R’s own profits and may be in addition to any Rule 12b-1 payments, if applicable, that are paid by the Portfolio. Because revenue sharing payments are paid by W&R, and not from the Portfolio’s assets, the amount of any revenue sharing payments is determined by W&R.

In addition to the revenue sharing payments described above, W&R may offer other incentives to sell Policies for which the Portfolio is an investment option in the form of sponsorship of educational or other client seminars relating to current products and issues, assistance in training or educating an intermediary’s personnel, and/or entertainment or meals.

The recipients of such incentives may include:

| n | financial advisors affiliated with W&R; |

| n | broker-dealers and other financial intermediaries that sell such Policies and |

| n | insurance companies that include shares of the Portfolio as an underlying investment option. |

Payments may be based on current or past sales of Policies investing in shares of the Portfolio, current or historical assets, or a flat fee for specific services provided. In some circumstances, such payments may create an incentive for a Participating Insurance Company or intermediary or their employees or associated persons to recommend a particular Policy for which the Portfolio is an underlying investment option instead of recommending options offered by competing insurance companies.

In addition, W&R may compensate Participating Insurance Companies for administrative and shareholder services provided to Policyowners.

Notwithstanding the additional compensation described above, WRIMCO is prohibited from considering a broker-dealer’s sale of the Portfolio’s shares, or the inclusion of the Portfolio in a Policy provided by an insurance affiliate of the broker-dealer, in selecting such broker-dealer for execution of Portfolio transactions.

Portfolio transactions nevertheless may be executed with broker-dealers who coincidentally may have assisted customers in the purchase of Policies for which the Portfolio is an underlying investment option, issued by Participating Insurance Companies, although neither such assistance nor the volume of shares sold of the Portfolio or any affiliated investment company is a qualifying or disqualifying factor in WRIMCO’s selection of such broker-dealer for portfolio transaction execution.

The Participating Insurance Company that provides your Policy also may provide similar compensation to broker-dealers and other financial intermediaries in order to promote the sale of such Policies. Contact your insurance provider and/or financial intermediary for details about revenue sharing payments it may pay or receive.

| 14 | Prospectus |

Table of Contents

Distributions

The Portfolio distributes substantially all of its net investment income and net realized capital gains to its shareholders each year. Usually, the Portfolio distributes net investment income at the following times:

Declared and paid annually in May:

Net investment income from the Portfolio and net realized long-term and/or short-term capital gains from the Portfolio.

Dividends are paid by the Portfolio in additional full and fractional shares of the Portfolio.

All distributions from net realized long-term and/or short-term capital gains, if any, of the Portfolio are declared and paid annually in May in additional full and fractional shares of the Portfolio.

Taxes

The Portfolio is treated as a separate corporation, and intends to continue to qualify to be treated as a regulated investment company (RIC), for Federal tax purposes. The Portfolio will be so treated if it meets specified Federal income tax rules, including requirements regarding types of investments, limits on investments, types of income and distributions. A Portfolio that satisfies those requirements is not taxed at the entity level on the net income and gains it distributes to its shareholders.

It is important for the Portfolio to maintain its RIC status (and to satisfy certain other requirements), because the Portfolio shareholders, which are the Variable Accounts, will then be able to use a “look-through” rule in determining whether the Policies indirectly funded by the Portfolio meet the investment diversification rules that apply to those accounts. If the Portfolio failed to meet those diversification rules, owners of Policies funded through the Portfolio would be taxed immediately on the accumulated investment earnings under their Policies and would lose any benefit of tax deferral. Accordingly, WISC monitors the Portfolio’s compliance with the applicable RIC qualification and Variable Account diversification rules.

You will find additional information in the SAI about Federal income tax considerations generally affecting the Portfolio.

Because the only shareholders of the Portfolio are the Variable Accounts, no further discussion is included here as to the Federal income tax consequences to the Portfolio’s shareholders. For information concerning the Federal tax consequences to Policyowners, see the applicable prospectus for your Policy. Prospective investors are urged to consult with their tax advisors.

| Prospectus | 15 |

Table of Contents

This page left blank intentionally.

| 16 | Prospectus |

Table of Contents

Ivy Funds Variable Insurance Portfolios

The following information is to help you understand the financial performance of the Portfolio’s shares for the fiscal periods shown. Certain information reflects financial results for a single Portfolio share. Total return shows how much your investment would have increased (or decreased) during each period, assuming reinvestment of all dividends and other distributions. This information has been audited by Deloitte & Touche LLP, whose Report of Independent Registered Public Accounting Firm, along with the Portfolio’s financial statements and financial highlights for the fiscal period ended December 31, 2010, is included in the Trust’s Annual Report to Shareholders, which is available upon request.

| Prospectus | 17 |

Table of Contents

| IVY FUNDS VIP |

FOR A SHARE OF CAPITAL STOCK |

OUTSTANDING THROUGHOUT EACH PERIOD

|

|

Net |

Net Realized |

Total from |

Distributions |

Distributions |

Total |

||||||||||||||||||||||

| Small Cap Growth |

| |||||||||||||||||||||||||||

| Fiscal year ended 12-31-2010 |

8.1726 | (0.0753 | ) | 2.4329 | 2.3576 | — | — | — | ||||||||||||||||||||

| Fiscal year ended 12-31-2009 |

6.0933 | (0.0613 | ) | 2.1692 | 2.1079 | (0.0286 | ) | — | (0.0286 | ) | ||||||||||||||||||

| Fiscal year ended 12-31-2008 |

10.2422 | 0.0270 | (4.0469 | ) | (4.0199 | ) | — | (0.1290 | ) | (0.1290 | ) | |||||||||||||||||

| Fiscal year ended 12-31-2007 |

9.9749 | (0.0641 | ) | 1.4127 | 1.3486 | — | (1.0813 | ) | (1.0813 | ) | ||||||||||||||||||

| Fiscal year ended 12-31-2006 |

10.4866 | (0.0584 | ) | 0.5883 | 0.5299 | — | (1.0416 | ) | (1.0416 | ) | ||||||||||||||||||

(1) Ratios excluding expense waivers are included only for periods in which the Portfolio had waived or reimbursed expenses.

| 18 | Prospectus |

Table of Contents

| Net Asset |

Total Return |

Net Assets, |

Ratio of |

Ratio of Net |

Ratio of |

Ratio of Net |

Portfolio |

|||||||||||||||||||||||||

| Small Cap Growth |

|

|||||||||||||||||||||||||||||||

| Fiscal year ended 12-31-2010 |

10.5302 | 28.85 | 419 | 1.14 | -0.83 | 1.16 | -0.85 | 60 | ||||||||||||||||||||||||

| Fiscal year ended 12-31-2009 |

8.1726 | 34.72 | 356 | 1.17 | -0.88 | 1.19 | -0.90 | 44 | ||||||||||||||||||||||||

| Fiscal year ended 12-31-2008 |

6.0933 | -39.18 | 290 | 1.14 | 0.32 | 1.16 | 0.30 | 82 | ||||||||||||||||||||||||

| Fiscal year ended 12-31-2007 |

10.2422 | 13.52 | 544 | 1.14 | -0.61 | 1.16 | -0.63 | 101 | ||||||||||||||||||||||||

| Fiscal year ended 12-31-2006 |

9.9749 | 5.05 | 555 | 1.15 | -0.55 | 1.16 | -0.56 | 94 | ||||||||||||||||||||||||

| Prospectus | 19 |

Table of Contents

Appendix A: Hypothetical Investment and Expense Information

The following chart provides additional hypothetical information about the effect of the Portfolio’s expenses, including investment advisory fees and other Portfolio costs, on the Portfolio’s assumed returns over a ten-year period. These charts are provided pursuant to the NYAG Settlement, which is described in this Prospectus under “Regulatory Matters.”

The chart shows the estimated cumulative expenses that would be incurred in respect of a hypothetical investment of $10,000, assuming a 5% return each year, and no redemption of shares. The chart also assumes that the Portfolio’s annual expense ratio stays the same throughout the ten-year period and that all dividends and other distributions are reinvested. The annual expense ratio used in the chart is the same as stated in the “Fees and Expenses” table of this Prospectus (and thus may not reflect any fee waiver or expense reimbursement currently in effect). Mutual fund returns, as well as fees and expenses, may fluctuate over time, and your actual investment returns and total expenses may be higher or lower than those shown below. The chart does not reflect any fees and expenses imposed under the variable annuity contracts or variable life insurance policies through which the Portfolio is offered. If these fees and expenses were reflected, the hypothetical investment returns shown would be lower.

Ivy Funds VIP Small Cap Growth

| Annual expense ratio | 1.16% | |||||||||||||||||||

| Year | Hypothetical Investment |

Hypothetical Performance Earnings |

Investment After Returns |

Hypothetical Expenses |

Hypothetical Ending Investment |

|||||||||||||||

| 1 | $10,000.00 | $500.00 | $10,500.00 | $ 118.23 | $10,384.00 | |||||||||||||||

| 2 | 10,384.00 | 519.20 | 10,903.20 | 122.77 | 10,782.75 | |||||||||||||||

| 3 | 10,782.75 | 539.14 | 11,321.88 | 127.48 | 11,196.80 | |||||||||||||||

| 4 | 11,196.80 | 559.84 | 11,756.64 | 132.38 | 11,626.76 | |||||||||||||||

| 5 | 11,626.76 | 581.34 | 12,208.10 | 137.46 | 12,073.23 | |||||||||||||||

| 6 | 12,073.23 | 603.66 | 12,676.89 | 142.74 | 12,536.84 | |||||||||||||||

| 7 | 12,536.84 | 626.84 | 13,163.68 | 148.22 | 13,018.25 | |||||||||||||||

| 8 | 13,018.25 | 650.91 | 13,669.17 | 153.91 | 13,518.16 | |||||||||||||||

| 9 | 13,518.16 | 675.91 | 14,194.06 | 159.82 | 14,037.25 | |||||||||||||||

| 10 | 14,037.25 | 701.86 | 14,739.12 | 165.96 | 14,576.28 | |||||||||||||||

| Cumulative Total | $1,408.96 | |||||||||||||||||||

| 20 | Prospectus |

Table of Contents

IVY FUNDS VARIABLE INSURANCE PORTFOLIOS

| Prospectus | 21 |

Table of Contents

IVY FUNDS VARIABLE INSURANCE PORTFOLIOS

PROSPECTUS

You can get more information about the Portfolio in —

| n | the Statement of Additional Information (SAI), which contains detailed information about the Portfolio, particularly its investment policies and practices. You may not be aware of important information about the Portfolio unless you read both the Prospectus and the SAI. The current SAI is on file with the Securities and Exchange Commission (SEC) and it is incorporated into this Prospectus by reference (that is, the SAI is legally part of the Prospectus). |

| n | the Annual and Semiannual Reports to Shareholders, which detail the Portfolio’s actual investments and include financial statements as of the close of the particular annual or semiannual period. The annual report also contains a discussion of the market conditions and investment strategies that significantly affected the Portfolio’s performance during the year covered by the report. |

To request a copy of the current SAI or copies of the Portfolio’s most recent Annual and Semiannual reports, without charge, or for other inquiries, contact the Trust or Waddell & Reed, Inc. at the address and telephone number below. Copies of the SAI, Annual and/or Semiannual Report also may be requested via email at LegalCompliance@waddell.com. Additionally, the Prospectus, SAI and Annual and Semiannual Reports for the Portfolio are available on the Waddell & Reed website at www.waddell.com.

Information about the Trust (including its current SAI and most recent Annual and Semiannual Reports) is available from the SEC’s web site at http://www.sec.gov and also may be obtained, after paying a duplicating fee, by electronic request at publicinfo@sec.gov or from the SEC’s Public Reference Room, Room 1580, 100 F Street, N.E., Washington, D.C., 20549-1520. You can find out about the operation of the Public Reference Room and applicable copying charges by calling 202.551.8090.

WADDELL & REED, INC.

6300 Lamar Avenue

P. O. Box 29217

Shawnee Mission, Kansas 66201-9217

913.236.2000

888.WADDELL

The Trust’s SEC file number is: 811-5017.

| 22 | Prospectus |

Table of Contents

Prospectus

IVY FUNDS VARIABLE

INSURANCE PORTFOLIOS

APRIL 29, 2011

| Ivy Funds VIP Science and Technology | ||

| Ivy Funds Variable Insurance Portfolios (Trust) is a management investment company, commonly known as a mutual fund, that has twenty-six separate portfolios (each, a Portfolio, and collectively, the Portfolios), each with separate objectives and investment policies. This Prospectus offers one Portfolio of the Trust, Ivy Funds VIP Science and Technology.

This Prospectus contains concise information about the Portfolio of which you should be aware before applying for certain variable life insurance policies and variable annuity contracts (collectively, Policies) offered by certain select insurance companies (Participating Insurance Companies). This Prospectus should be read together with the prospectus for the particular Policy.

The Securities and Exchange Commission has not approved or disapproved these securities, or determined whether this Prospectus is accurate or complete. It is a criminal offense to state otherwise. |

|

Table of Contents

| TABLE OF CONTENTS | ||||

| PORTFOLIO SUMMARY | ||||

| 3 | ||||

| 7 | ||||

| 7 | Additional Information about Principal Investment Strategies, | |||

| 8 | ||||

| 9 | ||||

| 12 | ||||

| 14 | ||||

| 18 | ||||

| 19 | ||||

| 22 | ||||

| 2 | Prospectus |

Table of Contents

Ivy Funds VIP Science and Technology

Objective

To seek long-term capital growth.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the Portfolio. The table below does not reflect any fees and expenses imposed under the variable life insurance policies and variable annuity contracts (collectively, Policies) through which this Portfolio is offered. See the Policy prospectus for a description of those fees and expenses.

Shareholder Fees

| (fees paid directly from your investment) | N/A |

Annual Portfolio Operating Expenses

| (expenses that you pay each year as a % of the value of your investment) | ||||

| Management Fees |

0.85% | |||

| Distribution and Service (12b-1) Fees |

0.25% | |||

| Other Expenses |

0.08% | |||

| Total Annual Portfolio Operating Expenses |

1.18% | |||

Example

This example is intended to help you compare the cost of investing in the shares of the Portfolio with the cost of investing in other portfolios. This example does not reflect any fees and expenses imposed under the Policies.

The example assumes that you invest $10,000 in the shares of the Portfolio for the time periods indicated. The example also assumes that your investment has a 5% return each year and that the Portfolio’s operating expenses remain the same. The costs are the same for each time period if you continue to hold your shares or if you redeem all your shares at the end of those periods. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||

| $120 |

$ | 375 | $ | 649 | $ | 1,432 | ||||||

Portfolio Turnover

The Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual portfolio operating expenses or in the example, affect the Portfolio’s performance. During the most recent fiscal year, the Portfolio’s portfolio turnover rate was 27% of the average value of its portfolio.

Principal Investment Strategies

Ivy Funds VIP Science and Technology invests primarily in the equity securities of science and technology companies around the globe. Under normal market conditions, the Portfolio invests at least 80% of its net assets in securities of science or technology companies. Such companies may include companies that, in the opinion of Waddell & Reed Investment Management Company (WRIMCO), the Portfolio’s investment manager, derive a competitive advantage by the application of scientific or technological developments or discoveries to grow their business or increase their competitive advantage. Science and technology companies are companies whose products, processes or services, in the opinion of WRIMCO, are being or are expected to be significantly benefited by the use or commercial application of scientific or technological developments or discoveries. The Portfolio may also invest in companies that utilize science and/or technology to significantly enhance their business opportunities. The Portfolio may invest in companies of any size, and may invest without limitation in foreign securities, including securities of issuers within emerging markets.

WRIMCO typically emphasizes growth potential in selecting stocks; that is, WRIMCO seeks companies in which earnings are likely to grow faster than the economy. WRIMCO aims to identify strong secular trends within industries and then applies a bottom-up stock selection process by considering a number of factors in selecting securities for the Portfolio. These may include but are not

| Ivy Funds VIP Science and Technology | Prospectus | 3 |

Table of Contents

limited to a company’s growth potential, earnings potential, quality of management, industry position/market size potential and applicable economic and market conditions.

Many companies have a diverse market of business and overseas operations. Therefore, the Portfolio will have a direct exposure to additional foreign markets through these investments.

Generally, in determining whether to sell a security, WRIMCO uses the same type of analysis that it uses in buying securities in order to determine whether the security has ceased to offer significant growth potential, has become overvalued and/or whether the company prospects of the issuer have deteriorated due to a change in management, change in strategy and/or a change in its financial characteristics. WRIMCO may also sell a security to reduce the Portfolio’s holding in that security, to take advantage of more attractive investment opportunities or to raise cash.

Principal Investment Risks

As with any mutual fund, the value of the Portfolio’s shares will change, and you could lose money on your investment.

A variety of factors can affect the investment performance of the Portfolio and prevent it from achieving its objective. These include:

| n | Company Risk. A security may perform worse than the overall market due to specific factors, such as adverse changes to its financial position or in investor perceptions about the company. |

| n | Concentration Risk. Because the Portfolio invests more than 25% of its total assets in the science and technology industry, the Portfolio’s performance may be more susceptible to a single economic, regulatory or technological occurrence than a fund that does not concentrate its investments in this industry. Securities of companies within specific industries or sectors of the economy may periodically perform differently than the overall market. In addition, the Portfolio’s performance may be more volatile and may underperform the market as a whole, due to the limited number of issuers of science and technology related securities, than an investment in a portfolio of broad market securities. |

| n | Emerging Market Risk. Investments in countries with emerging economies or securities markets may carry greater risk than investments in more developed countries. Political and economic structures in many such countries may be undergoing significant evolution and rapid development, and such countries may lack the social, political and economic stability characteristic of more developed countries. |

| n | Foreign Market Risk. The securities of many companies may have significant exposure to foreign markets as a result of the company’s products or services in foreign markets so that its domicile and/or the markets in which its securities trade may not be reflective of its sources of revenue. Such securities would be subject to some of the same risks as an investment in foreign securities, including the risk that political and economic events unique to a country or region will adversely affect those markets in which the company’s products or services are sold. |

| n | Foreign Securities Risk. Investing in foreign securities involves a number of economic, financial and political considerations that may not be associated with the U.S. markets and that could affect the Portfolio’s performance unfavorably, depending upon the prevailing conditions at any given time. Among these potential risks are: greater price volatility; comparatively weak supervision and regulation of securities exchanges, brokers and issuers; higher brokerage costs; fluctuations in foreign currency exchange rates and related conversion costs; adverse foreign tax consequences; and settlement delays. |

| n | Growth Stock Risk. Prices of growth stocks may be more sensitive to changes in current or expected earnings than the prices of other stocks. Growth stocks may not perform as well as value stocks or the stock market in general. |

| n | Large Company Risk. A Portfolio with holdings of large capitalization company securities may underperform the market as a whole. |

| n | Liquidity Risk. Generally, a security is liquid if the Portfolio is able to sell the security at a fair price within a reasonable time. Liquidity is generally related to the market trading volume for a particular security. |

| n | Management Risk. Portfolio performance is primarily dependent on WRIMCO’s skill in evaluating and managing the Portfolio’s holdings and the Portfolio may not perform as well as other similar mutual funds. |

| n | Market Risk. Adverse market conditions, sometimes in response to general economic or industry news, may cause the prices of the Portfolio’s holdings to fall as part of a broad market decline. Recent events in the financial sector and in the economy have resulted, and may continue to result, in an unusually high degree of volatility in the financial markets, both U.S. and foreign, and in the net asset values (NAVs) of many mutual funds, including to some extent the Portfolio. These events have also decreased liquidity in some markets and may continue to do so. |

| n | Mid Size Company Risk. Securities of mid capitalization companies may be more vulnerable to adverse developments than those of large companies due to such companies’ limited product lines, limited markets and financial resources and dependence upon a relatively small management group. |

| 4 | Prospectus | Ivy Funds VIP Science and Technology |

Table of Contents

| n | Small Company Risk. Equity securities of small capitalization companies are subject to greater price volatility, lower trading volume and less liquidity due to, among other things, such companies’ small size, limited product lines, limited access to financing sources and limited management depth. In addition, the frequency and volume of trading of such securities may be less than is typical of larger companies, making them subject to wider price fluctuations. In some cases, there could be difficulties in selling securities of small capitalization companies at the desired time. |

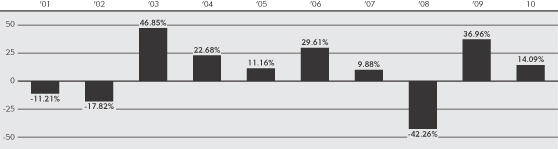

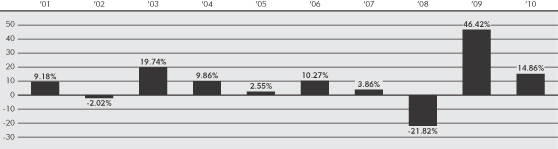

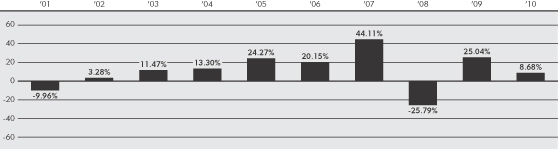

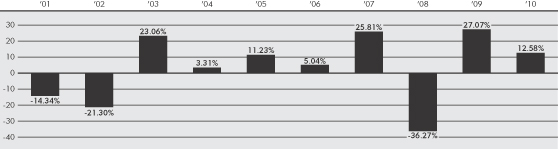

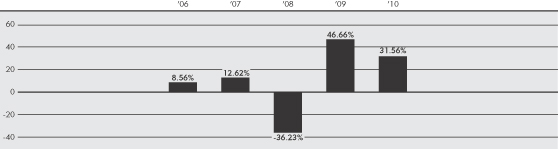

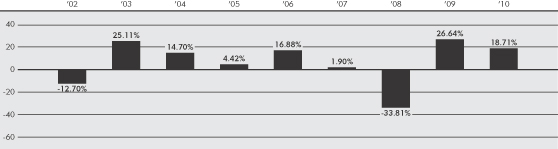

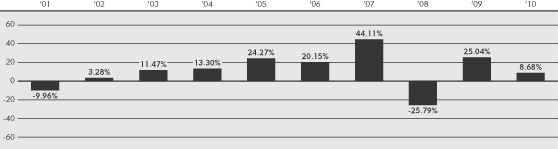

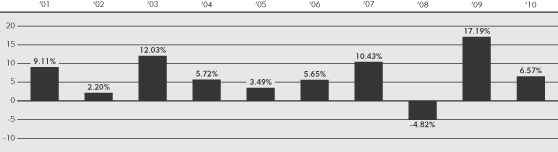

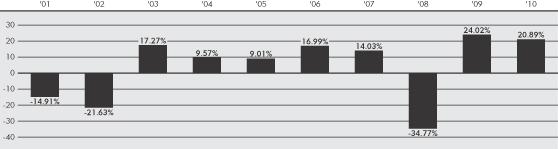

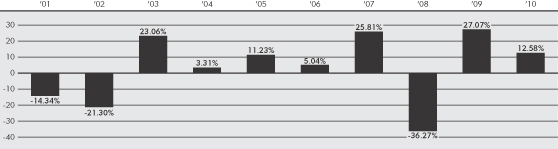

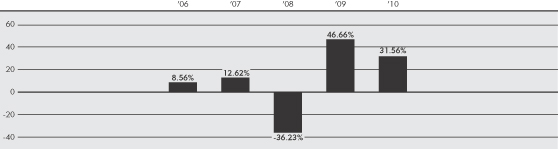

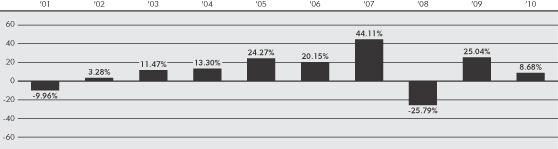

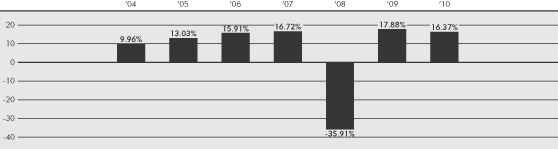

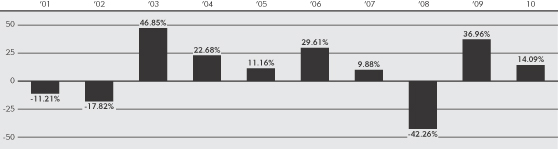

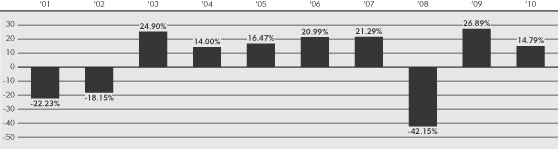

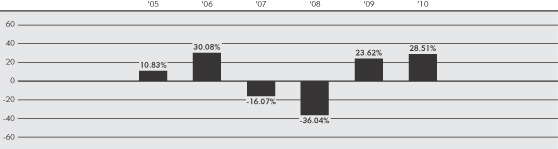

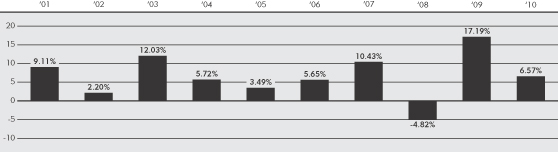

Performance

The chart and table below provide some indication of the risks of investing in the Portfolio. The chart shows how performance has varied from year to year for the Portfolio. The table shows the average annual total returns for the Portfolio and also compares the performance with those of an index and a peer group of mutual funds with investment objectives similar to that of the Portfolio. The performance results do not reflect any Policy-related fees and expenses, which would reduce the performance results.

Performance results include the effect of expense reduction arrangements for some or all of the periods shown. If those arrangements had not been in place, the performance results for those periods would have been lower.