UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER

REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | 811-04989 | |

| Exact name of registrant as specified in charter: | Voyageur Mutual Funds II | |

| Address of principal executive offices: | 2005 Market Street | |

| Philadelphia, PA 19103 | ||

| Name and address of agent for service: | David F. Connor, Esq. | |

| 2005 Market Street | ||

| Philadelphia, PA 19103 | ||

| Registrant’s telephone number, including area code: | (800) 523-1918 | |

| Date of fiscal year end: | August 31 | |

| Date of reporting period: | August 31, 2018 |

Item 1. Reports to Stockholders

Table of Contents

Fixed income mutual funds

Delaware Tax-Free Arizona Fund

Delaware Tax-Free California Fund

Delaware Tax-Free Colorado Fund

Delaware Tax-Free Idaho Fund

Delaware Tax-Free New York Fund

Delaware Tax-Free Pennsylvania Fund

August 31, 2018

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Funds’ prospectus and their summary prospectuses, which may be obtained by visiting delawarefunds.com/literature or calling 800 523-1918. Investors should read the prospectus and the summary prospectus carefully before investing.

You can obtain shareholder reports and prospectuses online instead of in the mail.

Visit delawarefunds.com/edelivery.

Table of Contents

Experience Delaware Funds® by Macquarie

Macquarie Investment Management (MIM) is a global asset manager with offices throughout the United States, Europe, Asia, and Australia. We are active managers who prioritize autonomy and accountability at the investment team level in pursuit of opportunities that matter for our clients. Delaware Funds is one of the longest-standing mutual fund families, with more than 75 years in existence.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Funds or obtain a prospectus for Delaware Tax-Free Arizona Fund, Delaware Tax-Free California Fund, Delaware Tax-Free Colorado Fund, Delaware Tax-Free Idaho Fund, Delaware Tax-Free New York Fund, and Delaware Tax-Free Pennsylvania Fund at delawarefunds.com/literature.

Table of Contents

| Delaware Funds® by Macquarie state tax-free funds | September 11, 2018 |

| Performance preview (for the year ended August 31, 2018) |

||||||||

| Delaware Tax-Free Arizona Fund (Institutional Class shares) | 1-year return | +1.36% | ||||||

| Delaware Tax-Free Arizona Fund (Class A shares) | 1-year return | +1.11% | ||||||

| Bloomberg Barclays Municipal Bond Index (benchmark) | 1-year return | +0.49% | ||||||

| Lipper Other States Municipal Debt Funds Average | 1-year return | +0.17% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Tax-Free Arizona Fund, please see the table on page 9. Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

The Lipper Other States Municipal Debt Funds Average compares funds that limit assets to those securities that are exempt from taxation on a specified city or state basis.

Please see page 12 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

| Delaware Tax-Free California Fund (Institutional Class shares) |

1-year return | +1.26% | ||||||

| Delaware Tax-Free California Fund (Class A shares) |

1-year return | +1.00% | ||||||

| Bloomberg Barclays Municipal Bond Index (benchmark) |

1-year return | +0.49% | ||||||

| Lipper California Municipal Debt Funds Average |

1-year return | +0.99% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Tax-Free California Fund, please see the table on page 13. Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

The Lipper California Municipal Debt Funds Average compares funds that limit assets to those securities that are exempt from taxation in California (double tax-exempt) or a city in California (triple tax-exempt).

Please see page 16 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

| Delaware Tax-Free Colorado Fund (Institutional Class shares) |

1-year return | +1.47% | ||||||

| Delaware Tax-Free Colorado Fund (Class A shares) |

1-year return | +1.22% | ||||||

| Bloomberg Barclays Municipal Bond Index (benchmark) |

1-year return | +0.49% | ||||||

| Lipper Other States Municipal Debt Funds Average |

1-year return | +0.17% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Tax-Free Colorado Fund, please see the table on page 17. Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

The Lipper Other States Municipal Debt Funds Average compares funds that limit assets to those securities that are exempt from taxation on a specified city or state basis.

Please see page 20 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

1

Table of Contents

Portfolio management review

Delaware Funds® by Macquarie state tax-free funds

| Delaware Tax-Free Idaho Fund (Institutional Class shares) |

1-year return | +0.82% | ||||||

| Delaware Tax-Free Idaho Fund (Class A shares) |

1-year return | +0.56% | ||||||

| Bloomberg Barclays Municipal Bond Index (benchmark) |

1-year return | +0.49% | ||||||

| Lipper Other States Municipal Debt Funds Average |

1-year return | +0.17% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Tax-Free Idaho Fund, please see the table on page 21. Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

The Lipper Other States Municipal Debt Funds Average compares funds that limit assets to those securities that are exempt from taxation on a specified city or state basis.

Please see page 24 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

| Delaware Tax-Free New York Fund (Institutional Class shares) |

1-year return | +0.93% | ||||||

| Delaware Tax-Free New York Fund (Class A shares) |

1-year return | +0.60% | ||||||

| Bloomberg Barclays Municipal Bond Index (benchmark) |

1-year return | +0.49% | ||||||

| Lipper New York Municipal Debt Funds Average |

1-year return | +0.55% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Tax-Free New York Fund, please see the table on page 25. Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

The Lipper New York Municipal Debt Funds Average compares funds that limit assets to those securities that are exempt from taxation in New York (double tax-exempt) or a city in New York (triple tax-exempt).

Please see page 28 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

| Delaware Tax-Free Pennsylvania Fund (Institutional Class shares) |

1-year return | +1.16% | ||||||

| Delaware Tax-Free Pennsylvania Fund (Class A shares) |

1-year return | +0.93% | ||||||

| Bloomberg Barclays Municipal Bond Index (benchmark) |

1-year return | +0.49% | ||||||

| Lipper Pennsylvania Municipal Debt Funds Average |

1-year return | +0.82% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Tax-Free Pennsylvania Fund, please see the table on page 29. Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

The Lipper Pennsylvania Municipal Debt Funds Average compares funds that limit assets to those securities that are exempt from taxation in Pennsylvania (double tax-exempt) or a city in Pennsylvania (triple tax-exempt).

Please see page 32 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

2

Table of Contents

3

Table of Contents

Portfolio management review

Delaware Funds® by Macquarie state tax-free funds

4

Table of Contents

5

Table of Contents

Portfolio management review

Delaware Funds® by Macquarie state tax-free funds

6

Table of Contents

7

Table of Contents

Portfolio management review

Delaware Funds® by Macquarie state tax-free funds

8

Table of Contents

| Performance summaries | ||

| Delaware Tax-Free Arizona Fund | August 31, 2018 |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| Fund and benchmark performance1,2 | Average annual total returns through August 31, 2018 | |||||||||||||||

| 1 year | 5 years | 10 years | Lifetime | |||||||||||||

| Class A (Est. April 1, 1991) |

||||||||||||||||

| Excluding sales charge |

+1.11% | +4.50% | +4.15% | +5.16% | ||||||||||||

| Including sales charge |

-3.43% | +3.55% | +3.67% | +4.98% | ||||||||||||

| Class C (Est. May 26, 1994) |

||||||||||||||||

| Excluding sales charge |

+0.36% | +3.72% | +3.37% | +3.95% | ||||||||||||

| Including sales charge |

-0.62% | +3.72% | +3.37% | +3.95% | ||||||||||||

| Institutional Class (Est. Dec. 31, 2013) |

||||||||||||||||

| Excluding sales charge |

+1.36% | n/a | n/a | +4.62% | ||||||||||||

| Including sales charge |

+1.36% | n/a | n/a | +4.62% | ||||||||||||

| Bloomberg Barclays Municipal Bond Index |

+0.49% | +4.12% | +4.32% | +3.87%* | ||||||||||||

*The benchmark lifetime return is for Institutional Class share comparison only and is calculated using the last business day in the month of the Fund’s Institutional Class inception date.

9

Table of Contents

Performance summaries

Delaware Tax-Free Arizona Fund

2The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Management Company has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total annual fund operating expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, short sale and dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations (collectively, nonroutine expenses)) from exceeding 0.59% of the Fund’s average daily net assets during the period from Sept. 1, 2017 to Aug. 31, 2018.* Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements. Please see the “Financial highlights” section in this report for the most recent expense ratios.

| Fund expense ratios | Class A | Class C | Institutional Class | |||||||

| Total annual operating expenses |

0.97% | 1.72% | 0.72% | |||||||

| (without fee waivers) |

||||||||||

| Net expenses |

0.84% | 1.59% | 0.59% | |||||||

| (including fee waivers, if any) |

||||||||||

| Type of waiver

|

Contractual

|

Contractual

|

Contractual

|

*The aggregate contractual waiver period covering this report is from Dec. 29, 2016 through Dec. 29, 2018.

10

Table of Contents

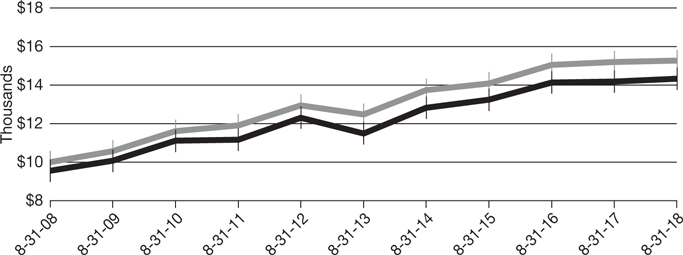

Performance of a $10,000 investment1

Class A shares

Average annual total returns from Aug. 31, 2008 through Aug. 31, 2018

|

For period beginning Aug. 31, 2008 through Aug. 31, 2018

|

Starting value

|

Ending value

|

||||||

|

|

$10,000 | $15,263 | ||||||

|

|

$9,550 | $14,336 | ||||||

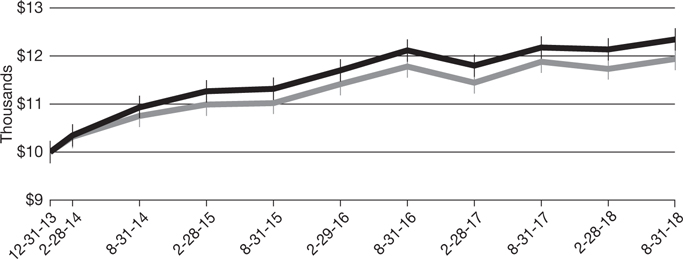

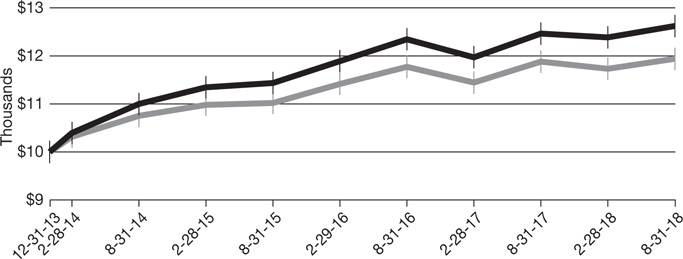

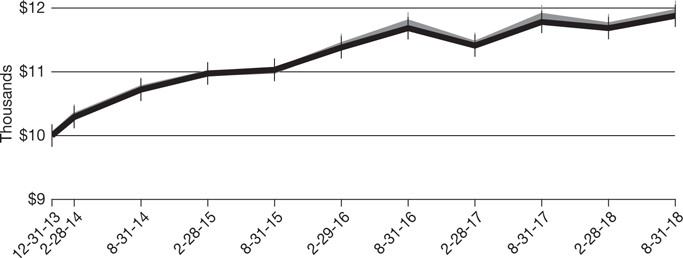

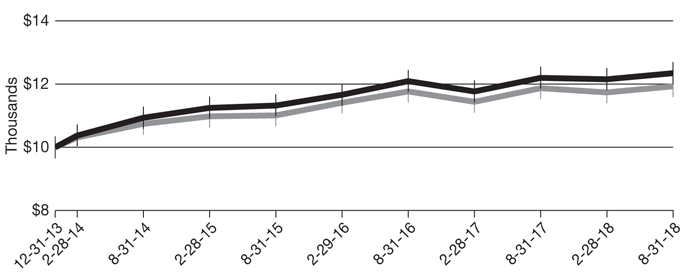

Institutional Class shares

Average annual total returns from Dec. 31, 2013 (inception date) through Aug. 31, 2018

|

For period beginning Dec. 31, 2013 through Aug. 31, 2018

|

Starting value

|

Ending value

|

||||||

|

|

$10,000 | $12,344 | ||||||

|

|

$10,000 | $11,936 | ||||||

11

Table of Contents

Performance summaries

Delaware Tax-Free Arizona Fund

| Nasdaq symbols | CUSIPs | |||||

| Class A |

VAZIX | 928916204 | ||||

| Class C |

DVACX | 928916501 | ||||

| Institutional Class |

DAZIX | 928916873 | ||||

|

| ||||||

12

Table of Contents

| Performance summaries | ||

| Delaware Tax-Free California Fund | August 31, 2018 |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| Fund and benchmark performance1,2 | Average annual total returns through August 31, 2018 | |||||||||||||||

| 1 year | 5 years | 10 years | Lifetime | |||||||||||||

| Class A (Est. March 2, 1995) |

||||||||||||||||

| Excluding sales charge |

+1.00% | +5.07% | +4.97% | +5.38% | ||||||||||||

| Including sales charge |

-3.56% | +4.11% | +4.48% | +5.18% | ||||||||||||

| Class C (Est. April 9, 1996) |

||||||||||||||||

| Excluding sales charge |

+0.25% | +4.30% | +4.19% | +4.52% | ||||||||||||

| Including sales charge |

-0.72% | +4.30% | +4.19% | +4.52% | ||||||||||||

| Institutional Class (Est. Dec. 31, 2013) |

||||||||||||||||

| Excluding sales charge |

+1.26% | n/a | n/a | +5.12% | ||||||||||||

| Including sales charge |

+1.26% | n/a | n/a | +5.12% | ||||||||||||

| Bloomberg Barclays Municipal Bond Index |

+0.49% | +4.12% | +4.32% | +3.87%* | ||||||||||||

*The benchmark lifetime return is for Institutional Class share comparison only and is calculated using the last business day in the month of the Fund’s Institutional Class inception date.

13

Table of Contents

Performance summaries

Delaware Tax-Free California Fund

2The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Management Company has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total annual fund operating expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, short sale and dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations (collectively, nonroutine expenses)) from exceeding 0.57% of the Fund’s average daily net assets during the period from Sept. 1, 2017 to Aug. 31, 2018.* Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements. Please see the “Financial highlights” section in this report for the most recent expense ratios.

| Fund expense ratios | Class A | Class C | Institutional Class | |||||||

|

Total annual operating expenses (without fee waivers) |

1.01% |

1.76% |

0.76% | |||||||

| Net expenses (including fee waivers, if any) |

0.82% | 1.57% | 0.57% | |||||||

| Type of waiver |

Contractual | Contractual | Contractual |

*The aggregate contractual waiver period covering this report is from Dec. 29, 2016 through Dec. 29, 2018.

14

Table of Contents

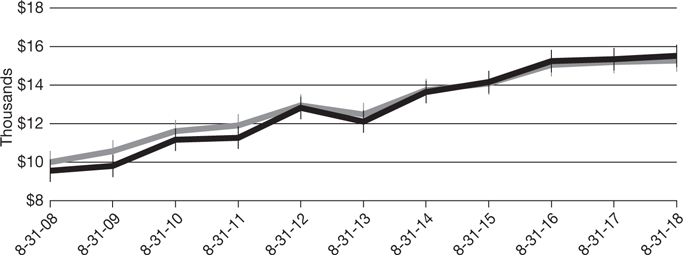

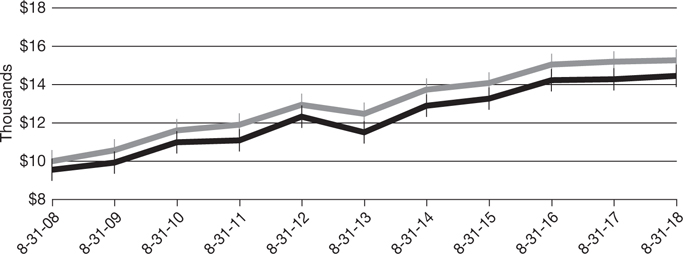

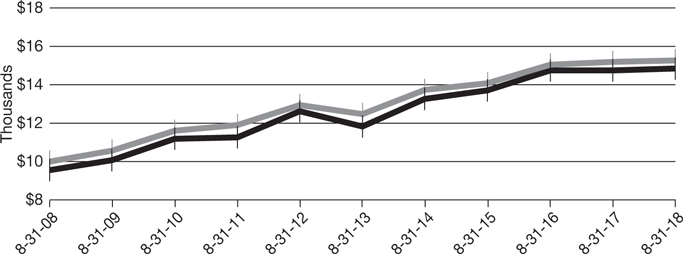

Performance of a $10,000 investment1

Class A shares

Average annual total returns from Aug. 31, 2008 through Aug. 31, 2018

|

For period beginning Aug. 31, 2008 through Aug. 31, 2018

|

Starting value

|

Ending value

|

||||||

|

|

$9,550 | $15,505 | ||||||

|

|

$10,000 | $15,263 | ||||||

Institutional Class shares

Average annual total returns from Dec. 31, 2013 (inception date) through Aug. 31, 2018

|

For period beginning Dec. 31, 2013 through Aug. 31, 2018

|

Starting value

|

Ending value

|

||||||

|

|

$10,000 | $12,623 | ||||||

|

|

$10,000 | $11,936 | ||||||

15

Table of Contents

Performance summaries

Delaware Tax-Free California Fund

| Nasdaq symbols | CUSIPs | |||||

| Class A |

DVTAX | 928928829 | ||||

| Class C |

DVFTX | 928928795 | ||||

| Institutional Class

|

DCTIX | 928928167 |

16

Table of Contents

| Performance summaries | ||

| Delaware Tax-Free Colorado Fund | August 31, 2018 |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| Fund and benchmark performance1,2 | Average annual total returns through August 31, 2018 | |||||||||||||||

| 1 year | 5 years | 10 years | Lifetime | |||||||||||||

| Class A (Est. April 23, 1987) |

||||||||||||||||

| Excluding sales charge |

+1.22% | +4.64% | +4.23% | +5.62% | ||||||||||||

| Including sales charge |

-3.32% | +3.68% | +3.75% | +5.47% | ||||||||||||

| Class C (Est. May 6, 1994) |

||||||||||||||||

| Excluding sales charge |

+0.47% | +3.85% | +3.46% | +4.04% | ||||||||||||

| Including sales charge |

-0.51% | +3.85% | +3.46% | +4.04% | ||||||||||||

| Institutional Class (Est. Dec. 31, 2013) |

||||||||||||||||

| Excluding sales charge |

+1.47% | n/a | n/a | +4.78% | ||||||||||||

| Including sales charge |

+1.47% | n/a | n/a | +4.78% | ||||||||||||

|

Bloomberg Barclays Municipal Bond Index

|

|

+0.49%

|

|

|

+4.12%

|

|

|

+4.32%

|

|

|

+3.87%*

|

| ||||

*The benchmark lifetime return is for Institutional Class share comparison only and is calculated using the last business day in the month of the Fund’s Institutional Class inception date.

17

Table of Contents

Performance summaries

Delaware Tax-Free Colorado Fund

2The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Management Company has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total annual fund operating expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, short sale and dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations (collectively, nonroutine expenses)) from exceeding 0.59% of the Fund’s average daily net assets during the period from Sept. 1, 2017 to Aug. 31, 2018.* Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements. Please see the “Financial highlights” section in this report for the most recent expense ratios.

| Fund expense ratios | Class A | Class C | Institutional Class | |||||||||||||

|

Total annual operating expenses |

|

0.96% |

|

|

1.71% |

|

|

0.71% |

| |||||||

| (without fee waivers) |

||||||||||||||||

| Net expenses |

0.84% | 1.59% | 0.59% | |||||||||||||

| (including fee waivers, if any) |

||||||||||||||||

| Type of waiver |

Contractual | Contractual | Contractual | |||||||||||||

*The aggregate contractual waiver period covering this report is from Dec. 29, 2016 through Dec. 29, 2018.

18

Table of Contents

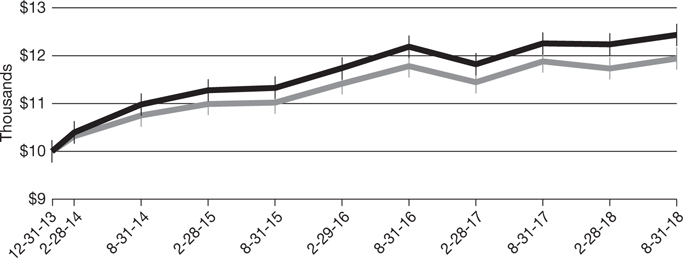

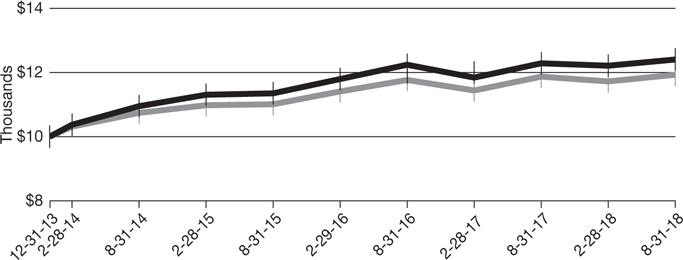

Performance of a $10,000 investment1

Class A shares

Average annual total returns from Aug. 31, 2008 through Aug. 31, 2018

|

For period beginning Aug. 31, 2008 through Aug. 31, 2018

|

Starting value

|

Ending value

|

||||||

|

|

$10,000 | $15,263 | ||||||

|

|

$9,550 | $14,456 | ||||||

Institutional Class shares

Average annual total returns from Dec. 31, 2013 (inception date) through Aug. 31, 2018

|

For period beginning Dec. 31, 2013 through Aug. 31, 2018

|

Starting value

|

Ending value

|

||||||

|

|

$10,000 | $12,436 | ||||||

|

|

$10,000 | $11,936 | ||||||

19

Table of Contents

Performance summaries

Delaware Tax-Free Colorado Fund

|

Nasdaq symbols |

CUSIPs | |||||

| Class A |

VCTFX | 928920107 | ||||

| Class C |

DVCTX | 92907R101 | ||||

| Institutional Class |

DCOIX | 92907R200 | ||||

|

| ||||||

20

Table of Contents

| Performance summaries | ||

| Delaware Tax-Free Idaho Fund | August 31, 2018 |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| Fund and benchmark performance1,2 | Average annual total returns through August 31, 2018 | |||||||||||||||

| 1 year | 5 years | 10 years | Lifetime | |||||||||||||

| Class A (Est. Jan. 4, 1995) |

||||||||||||||||

| Excluding sales charge |

+0.56% | +3.58% | +3.43% | +4.71% | ||||||||||||

| Including sales charge |

-3.95% | +2.63% | +2.96% | +4.51% | ||||||||||||

| Class C (Est. Jan. 11, 1995) |

||||||||||||||||

| Excluding sales charge |

-0.19% | +2.81% | +2.66% | +3.90% | ||||||||||||

| Including sales charge |

-1.17% | +2.81% | +2.66% | +3.90% | ||||||||||||

| Institutional Class (Est. Dec. 31, 2013) |

||||||||||||||||

| Excluding sales charge |

+0.82% | n/a | n/a | +3.76% | ||||||||||||

| Including sales charge |

+0.82% | n/a | n/a | +3.76% | ||||||||||||

| Bloomberg Barclays Municipal Bond Index |

+0.49% | +4.12% | +4.32% | +3.87%* | ||||||||||||

*The benchmark lifetime return is for Institutional Class share comparison only and is calculated using the last business day in the month of the Fund’s Institutional Class inception date.

21

Table of Contents

Performance summaries

Delaware Tax-Free Idaho Fund

2The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Management Company has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total annual fund operating expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, short sale and dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations (collectively, nonroutine expenses)) from exceeding 0.61% of the Fund’s average daily net assets during the period from Sept. 1, 2017 to Aug. 31, 2018.* Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements. Please see the “Financial highlights” section in this report for the most recent expense ratios.

| Fund expense ratios | Class A | Class C | Institutional Class | |||||||

|

Total annual operating expenses (without fee waivers) |

1.00% |

1.75% |

0.75% | |||||||

| Net expenses (including fee waivers, if any) |

0.86% | 1.61% | 0.61% | |||||||

| Type of waiver |

Contractual | Contractual | Contractual |

*The aggregate contractual waiver period covering this report is from Dec. 29, 2016 through Dec. 29, 2018.

22

Table of Contents

Performance of a $10,000 investment1

Class A shares

Average annual total returns from Aug. 31, 2008 through Aug. 31, 2018

|

For period beginning Aug. 31, 2008 through Aug. 31, 2018

|

Starting value

|

Ending value

|

||||||

|

|

$10,000 | $15,263 | ||||||

|

|

$9,550 | $13,384 | ||||||

Institutional Class shares

Average annual total returns from Dec. 31, 2013 (inception date) through Aug. 31, 2018

|

For period beginning Dec. 31, 2013 through Aug. 31, 2018

|

Starting value

|

Ending value

|

||||||

|

|

$10,000 | $11,936 | ||||||

|

|

$10,000 | $11,878 | ||||||

23

Table of Contents

Performance summaries

Delaware Tax-Free Idaho Fund

| Nasdaq symbols | CUSIPs | |||||

| Class A |

VIDAX | 928928704 | ||||

| Class C |

DVICX | 928928803 | ||||

| Institutional Class

|

DTIDX | 928928159 |

24

Table of Contents

| Performance summaries | ||

| Delaware Tax-Free New York Fund | August 31, 2018 |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| Fund and benchmark performance1,2 | Average annual total returns through August 31, 2018 | |||||||||||||||

| 1 year | 5 years | 10 years | Lifetime | |||||||||||||

| Class A (Est. Nov. 6, 1987) |

||||||||||||||||

| Excluding sales charge |

+0.60% | +4.64% | +4.53% | +5.50% | ||||||||||||

| Including sales charge |

-3.95% | +3.68% | +4.04% | +5.34% | ||||||||||||

| Class C (Est. April 26, 1995) |

||||||||||||||||

| Excluding sales charge |

-0.16% | +3.86% | +3.75% | +3.87% | ||||||||||||

| Including sales charge |

-1.14% | +3.86% | +3.75% | +3.87% | ||||||||||||

| Institutional Class (Est. Dec. 31, 2013) |

||||||||||||||||

| Excluding sales charge |

+0.93% | n/a | n/a | +4.72% | ||||||||||||

| Including sales charge |

+0.93% | n/a | n/a | +4.72% | ||||||||||||

| Bloomberg Barclays Municipal Bond Index |

+0.49% | +4.12% | +4.32% | +3.87%* | ||||||||||||

*The benchmark lifetime return is for Institutional Class share comparison only and is calculated using the last business day in the month of the Fund’s Institutional Class inception date.

25

Table of Contents

Performance summaries

Delaware Tax-Free New York Fund

2The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Management Company has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total annual fund operating expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, short sale and dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations (collectively, nonroutine expenses)) from exceeding 0.55% of the Fund’s average daily net assets during the period from Sept. 1, 2017 to Aug. 31, 2018.* Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements. Please see the “Financial highlights” section in this report for the most recent expense ratios.

| Fund expense ratios | Class A | Class C | Institutional Class | |||||||||||||

|

Total annual operating expenses |

|

1.03% |

|

|

1.78% |

|

|

0.78% |

| |||||||

| (without fee waivers) |

||||||||||||||||

| Net expenses |

0.80% | 1.55% | 0.55% | |||||||||||||

| (including fee waivers, if any) |

||||||||||||||||

| Type of waiver

|

|

Contractual

|

|

|

Contractual

|

|

|

Contractual

|

| |||||||

*The aggregate contractual waiver period covering this report is from Dec. 29, 2016 through Dec. 29, 2018.

26

Table of Contents

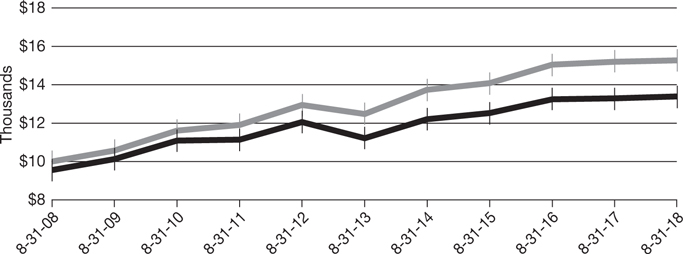

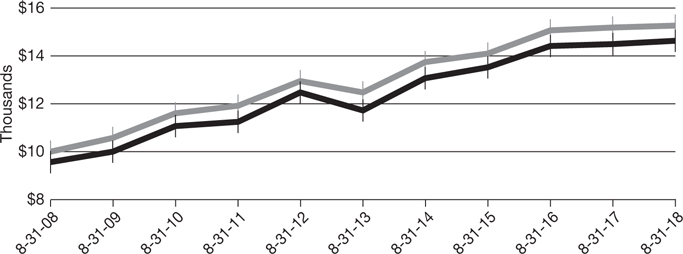

Performance of a $10,000 investment1

Class A shares

Average annual total returns from Aug. 31, 2008 through Aug. 31, 2018

|

For period beginning Aug. 31, 2008 through Aug. 31, 2018

|

Starting value

|

Ending value

|

||||||

|

|

$10,000 | $15,263 | ||||||

|

|

$9,550 | $14,860 | ||||||

Institutional Class shares

Average annual total returns from Dec. 31, 2013 (inception date) through Aug. 31, 2018

|

For period beginning Dec. 31, 2013 through Aug. 31, 2018

|

Starting value

|

Ending value

|

||||||

|

|

$10,000 | $12,404 | ||||||

|

|

$10,000 | $11,936 | ||||||

27

Table of Contents

Performance summaries

Delaware Tax-Free New York Fund

|

Nasdaq symbols |

CUSIPs | |||||

| Class A |

FTNYX | 928928274 | ||||

| Class C |

DVFNX | 928928258 | ||||

| Institutional Class |

DTNIX | 928928142 | ||||

|

| ||||||

28

Table of Contents

| Performance summaries | ||

| Delaware Tax-Free Pennsylvania Fund | August 31, 2018 |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| Fund and benchmark performance1,2 | Average annual total returns through August 31, 2018 | |||||||||||||||

| 1 year | 5 years | 10 years | Lifetime | |||||||||||||

| Class A (Est. March 23, 1977) |

||||||||||||||||

| Excluding sales charge |

+0.93% | +4.53% | +4.36% | +5.47% | ||||||||||||

| Including sales charge |

-3.58% | +3.56% | +3.88% | +5.35% | ||||||||||||

| Class C (Est. Nov. 29, 1995) |

||||||||||||||||

| Excluding sales charge |

+0.16% | +3.74% | +3.57% | +3.60% | ||||||||||||

| Including sales charge |

-0.81% | +3.74% | +3.57% | +3.60% | ||||||||||||

| Institutional Class (Est. Dec. 31, 2013) |

||||||||||||||||

| Excluding sales charge |

+1.16% | n/a | n/a | +4.61% | ||||||||||||

| Including sales charge |

+1.16% | n/a | n/a | +4.61% | ||||||||||||

| Bloomberg Barclays Municipal Bond Index |

+0.49% | +4.12% | +4.32% | +3.87%* | ||||||||||||

*The benchmark lifetime return is for Institutional Class share comparison only and is calculated using the last business day in the month of the Fund’s Institutional Class inception date.

29

Table of Contents

Performance summaries

Delaware Tax-Free Pennsylvania Fund

2The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Management Company has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total annual fund operating expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, short sale and dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations (collectively, nonroutine expenses)) from exceeding 0.64% of the Fund’s average daily net assets during the period from Sept. 1, 2017 to Aug. 31, 2018.* Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements. Please see the “Financial highlights” section in this report for the most recent expense ratios.

| Fund expense ratios | Class A | Class C | Institutional Class | |||||||||||||

| Total annual operating expenses |

0.94% | 1.70% | 0.70% | |||||||||||||

| (without fee waivers) |

||||||||||||||||

| Net expenses |

0.88% | 1.64% | 0.64% | |||||||||||||

| (including fee waivers, if any) |

||||||||||||||||

| Type of waiver |

Contractual | Contractual | Contractual | |||||||||||||

*The aggregate contractual waiver period covering this report is from Dec. 29, 2016 through Dec. 29, 2018.

30

Table of Contents

Performance of a $10,000 investment1

Class A shares

Average annual total returns from Aug. 31, 2008 through Aug. 31, 2018

|

For period beginning Aug. 31, 2008 through Aug. 31, 2018

|

Starting value

|

Ending value

|

||||||

|

|

$10,000 | $15,263 | ||||||

|

|

$9,550 | $14,627 | ||||||

Institutional Class shares

Average annual total returns from Dec. 31, 2013 (inception date) through Aug. 31, 2018

|

For period beginning Dec. 31, 2013 through Aug. 31, 2018

|

Starting value

|

Ending value

|

||||||

|

|

$10,000 | $12,342 | ||||||

|

|

$10,000 | $11,936 | ||||||

31

Table of Contents

Performance summaries

Delaware Tax-Free Pennsylvania Fund

| Nasdaq symbols | CUSIPs | |||||

| Class A |

DELIX | 233216100 | ||||

| Class C |

DPTCX | 233216308 | ||||

| Institutional Class

|

DTPIX | 24609H701 |

32

Table of Contents

For the six-month period from March 1, 2018 to August 31, 2018 (Unaudited)

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other Fund expenses. These following examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from March 1, 2018 to Aug. 31, 2018.

Actual expenses

The first section of the tables shown, “Actual Fund return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the tables shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of each table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Funds’ expenses shown in the tables reflect fee waivers in effect. The expenses shown in each table assume reinvestment of all dividends and distributions.

33

Table of Contents

Disclosure of Fund expenses

For the six-month period from March 1, 2018 to August 31, 2018 (Unaudited)

Delaware Tax-Free Arizona Fund

Expense analysis of an investment of $1,000

| Beginning Account Value 3/1/18 |

Ending Account Value 8/31/18 |

Annualized Expense Ratio |

Expenses Paid During Period 3/1/18 to 8/31/18* |

|||||||

| Actual Fund return† |

||||||||||

| Class A |

$1,000.00 | $1,016.50 | 0.84% | $4.27 | ||||||

| Class C |

1,000.00 | 1,012.60 | 1.59% | 8.07 | ||||||

| Institutional Class |

1,000.00 | 1,016.90 | 0.59% | 3.00 | ||||||

| Hypothetical 5% return (5% return before expenses) |

||||||||||

| Class A |

$1,000.00 | $1,020.97 | 0.84% | $4.28 | ||||||

| Class C |

1,000.00 | 1,017.19 | 1.59% | 8.08 | ||||||

| Institutional Class |

1,000.00 | 1,022.23 | 0.59% | 3.01 | ||||||

Delaware Tax-Free California Fund

Expense analysis of an investment of $1,000

| Beginning Account Value 3/1/18 |

Ending Account Value 8/31/18 |

Annualized Expense Ratio |

Expenses Paid During Period 3/1/18 to 8/31/18* |

|||||||

| Actual Fund return† |

||||||||||

| Class A |

$1,000.00 | $1,017.10 | 0.82% | $4.17 | ||||||

| Class C |

1,000.00 | 1,013.30 | 1.57% | 7.97 | ||||||

| Institutional Class |

1,000.00 | 1,018.40 | 0.57% | 2.90 | ||||||

| Hypothetical 5% return (5% return before expenses) |

||||||||||

| Class A |

$1,000.00 | $1,021.07 | 0.82% | $4.18 | ||||||

| Class C |

1,000.00 | 1,017.29 | 1.57% | 7.98 | ||||||

| Institutional Class |

1,000.00 | 1,022.33 | 0.57% | 2.91 | ||||||

34

Table of Contents

Delaware Tax-Free Colorado Fund

Expense analysis of an investment of $1,000

| Beginning Account Value 3/1/18 |

Ending Account Value 8/31/18 |

Annualized Expense Ratio |

Expenses Paid During Period 3/1/18 to 8/31/18* |

|||||||

| Actual Fund return† |

||||||||||

| Class A |

$1,000.00 | $1,014.40 | 0.84% | $4.27 | ||||||

| Class C |

1,000.00 | 1,010.60 | 1.59% | 8.06 | ||||||

| Institutional Class |

1,000.00 | 1,015.70 | 0.59% | 3.00 | ||||||

| Hypothetical 5% return (5% return before expenses) |

||||||||||

| Class A |

$1,000.00 | $1,020.97 | 0.84% | $4.28 | ||||||

| Class C |

1,000.00 | 1,017.19 | 1.59% | 8.08 | ||||||

| Institutional Class |

1,000.00 | 1,022.23 | 0.59% | 3.01 | ||||||

Delaware Tax-Free Idaho Fund

Expense analysis of an investment of $1,000

| Beginning Account Value 3/1/18 |

Ending Account Value 8/31/18 |

Annualized Expense Ratio |

Expenses Paid During Period 3/1/18 to 8/31/18* |

|||||||

| Actual Fund return† |

||||||||||

| Class A |

$1,000.00 | $1,014.70 | 0.86% | $4.37 | ||||||

| Class C |

1,000.00 | 1,010.90 | 1.61% | 8.16 | ||||||

| Institutional Class |

1,000.00 | 1,016.00 | 0.61% | 3.10 | ||||||

| Hypothetical 5% return (5% return before expenses) |

||||||||||

| Class A |

$1,000.00 | $1,020.87 | 0.86% | $4.38 | ||||||

| Class C |

1,000.00 | 1,017.09 | 1.61% | 8.19 | ||||||

| Institutional Class |

1,000.00 | 1,022.13 | 0.61% | 3.11 | ||||||

35

Table of Contents

Disclosure of Fund expenses

For the six-month period from March 1, 2018 to August 31, 2018 (Unaudited)

Delaware Tax-Free New York Fund

Expense analysis of an investment of $1,000

| Beginning Account Value 3/1/18 |

Ending Account Value 8/31/18 |

Annualized Expense Ratio |

Expenses Paid During Period 3/1/18 to 8/31/18* |

|||||||

| Actual Fund return† |

||||||||||

| Class A |

$1,000.00 | $1,013.50 | 0.80% | $4.06 | ||||||

| Class C |

1,000.00 | 1,009.60 | 1.55% | 7.85 | ||||||

| Institutional Class |

1,000.00 | 1,014.70 | 0.55% | 2.79 | ||||||

| Hypothetical 5% return (5% return before expenses) |

||||||||||

| Class A |

$1,000.00 | $1,021.17 | 0.80% | $4.08 | ||||||

| Class C |

1,000.00 | 1,017.39 | 1.55% | 7.88 | ||||||

| Institutional Class |

1,000.00 | 1,022.43 | 0.55% | 2.80 | ||||||

Delaware Tax-Free Pennsylvania Fund

Expense analysis of an investment of $1,000

| Beginning Account Value 3/1/18 |

Ending Account Value 8/31/18 |

Annualized Expense Ratio |

Expenses Paid During Period 3/1/18 to 8/31/18* |

|||||||

| Actual Fund return† |

||||||||||

| Class A |

$1,000.00 | $1,015.30 | 0.88% | $4.47 | ||||||

| Class C |

1,000.00 | 1,010.10 | 1.64% | 8.31 | ||||||

| Institutional Class |

1,000.00 | 1,015.20 | 0.64% | 3.25 | ||||||

| Hypothetical 5% return (5% return before expenses) |

||||||||||

| Class A |

$1,000.00 | $1,020.77 | 0.88% | $4.48 | ||||||

| Class C |

1,000.00 | 1,016.94 | 1.64% | 8.34 | ||||||

| Institutional Class |

1,000.00 | 1,021.98 | 0.64% | 3.26 | ||||||

| *“ | Expenses Paid During Period” are equal to the relevant Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| † | Because actual returns reflect only the most recent six-month period, the returns shown may differ significantly from fiscal year returns. |

36

Table of Contents

| Security type / sector / state / territory allocations | ||

| Delaware Tax-Free Arizona Fund | As of August 31, 2018 (Unaudited) | |

Sector designations may be different than the sector designations presented in other Fund materials.

| Security type / sector | Percentage of net assets | ||||||

| Municipal Bonds* |

98.09 | % | |||||

| Corporate Revenue Bonds |

10.77 | % | |||||

| Education Revenue Bonds |

28.80 | % | |||||

| Electric Revenue Bonds |

2.90 | % | |||||

| Healthcare Revenue Bonds |

18.82 | % | |||||

| Lease Revenue Bonds |

5.13 | % | |||||

| Local General Obligation Bond |

0.35 | % | |||||

| Pre-Refunded Bonds |

9.63 | % | |||||

| Special Tax Revenue Bonds |

6.23 | % | |||||

| Transportation Revenue Bonds |

8.43 | % | |||||

| Water & Sewer Revenue Bonds |

7.03 | % | |||||

| Short-Term Investment |

0.39 | % | |||||

| Total Value of Securities |

98.48 | % | |||||

| Receivables and Other Assets Net of Liabilities |

1.52 | % | |||||

| Total Net Assets |

100.00 | % | |||||

*As of the date of this report, Delaware Tax-Free Arizona Fund held bonds issued by or on behalf of territories and the states of the US as follows:

| State / territory | Percentage of net assets | ||||||

| Arizona |

95.33 | % | |||||

| Guam |

2.08 | % | |||||

| Puerto Rico |

1.07 | % | |||||

| Total Value of Securities |

98.48 | % | |||||

37

Table of Contents

| Security type / sector allocations | ||

| Delaware Tax-Free California Fund | As of August 31, 2018 (Unaudited) | |

Sector designations may be different than the sector designations presented in other Fund materials.

| Security type / sector | Percentage of net assets | ||||||

| Municipal Bonds |

99.70 | % | |||||

| Corporate Revenue Bonds |

5.81 | % | |||||

| Education Revenue Bonds |

19.24 | % | |||||

| Electric Revenue Bond |

0.58 | % | |||||

| Healthcare Revenue Bonds |

21.37 | % | |||||

| Housing Revenue Bonds |

4.21 | % | |||||

| Lease Revenue Bonds |

10.70 | % | |||||

| Local General Obligation Bonds |

2.94 | % | |||||

| Pre-Refunded Bonds |

10.05 | % | |||||

| Resource Recovery Revenue Bond |

1.05 | % | |||||

| Special Tax Revenue Bonds |

1.11 | % | |||||

| State General Obligation Bonds |

8.50 | % | |||||

| Transportation Revenue Bonds |

11.96 | % | |||||

| Water & Sewer Revenue Bonds |

2.18 | % | |||||

| Short-Term Investment |

0.33 | % | |||||

| Total Value of Securities |

100.03 | % | |||||

| Liabilities Net of Receivables and Other Assets |

(0.03 | %) | |||||

| Total Net Assets |

100.00 | % | |||||

38

Table of Contents

| Security type / sector / state / territory allocations | ||

| Delaware Tax-Free Colorado Fund | As of August 31, 2018 (Unaudited) | |

Sector designations may be different than the sector designations presented in other Fund materials.

| Security type / sector | Percentage of net assets | ||||||

| Municipal Bonds* |

98.84 | % | |||||

| Corporate Revenue Bonds |

1.41 | % | |||||

| Education Revenue Bonds |

11.15 | % | |||||

| Electric Revenue Bonds |

3.74 | % | |||||

| Healthcare Revenue Bonds |

24.16 | % | |||||

| Housing Revenue Bonds |

0.09 | % | |||||

| Lease Revenue Bonds |

3.35 | % | |||||

| Local General Obligation Bonds |

14.02 | % | |||||

| Pre-Refunded Bonds |

7.21 | % | |||||

| Special Tax Revenue Bonds |

19.44 | % | |||||

| Transportation Revenue Bonds |

12.94 | % | |||||

| Water & Sewer Revenue Bonds |

1.33 | % | |||||

| Short-Term Investments |

0.59 | % | |||||

| Total Value of Securities |

99.43 | % | |||||

| Receivables and Other Assets Net of Liabilities |

0.57 | % | |||||

| Total Net Assets |

100.00 | % | |||||

*As of the date of this report, Delaware Tax-Free Colorado Fund held bonds issued by or on behalf of territories and the states of the US as follows:

| State / territory | Percentage of net assets | ||||||

| Colorado |

96.02 | % | |||||

| Guam |

1.89 | % | |||||

| Puerto Rico |

1.00 | % | |||||

| US Virgin Islands |

0.52 | % | |||||

| Total |

99.43 | % | |||||

39

Table of Contents

| Security type / sector / state / territory allocations | ||

| Delaware Tax-Free Idaho Fund | As of August 31, 2018 (Unaudited) | |

Sector designations may be different than the sector designations presented in other Fund materials.

| Security type / sector | Percentage of net assets | ||||||

| Municipal Bonds* |

98.53 | % | |||||

| Corporate Revenue Bonds |

3.31 | % | |||||

| Education Revenue Bonds |

16.10 | % | |||||

| Electric Revenue Bonds |

3.36 | % | |||||

| Healthcare Revenue Bonds |

12.76 | % | |||||

| Housing Revenue Bonds |

1.03 | % | |||||

| Lease Revenue Bonds |

9.95 | % | |||||

| Local General Obligation Bonds |

25.76 | % | |||||

| Pre-Refunded Bonds |

6.91 | % | |||||

| Special Tax Revenue Bonds |

14.14 | % | |||||

| Transportation Revenue Bonds |

4.42 | % | |||||

| Water & Sewer Revenue Bonds |

0.79 | % | |||||

| Short-Term Investment |

0.88 | % | |||||

| Total Value of Securities |

99.41 | % | |||||

| Receivables and Other Assets Net of Liabilities |

0.59 | % | |||||

| Total Net Assets |

100.00 | % | |||||

*As of the date of this report, Delaware Tax-Free Idaho Fund held bonds issued by or on behalf of territories and the states of the US as follows:

| State / territory | Percentage of net assets | ||||||

| Guam |

4.74 | % | |||||

| Idaho |

91.97 | % | |||||

| Puerto Rico |

1.10 | % | |||||

| US Virgin Islands |

1.60 | % | |||||

| Total |

99.41 | % | |||||

40

Table of Contents

| Security type / sector / state / territory allocations | ||

| Delaware Tax-Free New York Fund | As of August 31, 2018 (Unaudited) | |

Sector designations may be different than the sector designations presented in other Fund materials.

| Security type / sector | Percentage of net assets | ||||||

| Municipal Bonds* |

100.48 | % | |||||

| Corporate Revenue Bonds |

8.43 | % | |||||

| Education Revenue Bonds |

22.68 | % | |||||

| Electric Revenue Bonds |

3.58 | % | |||||

| Healthcare Revenue Bonds |

15.16 | % | |||||

| Lease Revenue Bonds |

8.68 | % | |||||

| Local General Obligation Bonds |

2.24 | % | |||||

| Pre-Refunded Bonds |

11.38 | % | |||||

| Resource Recovery Revenue Bond |

1.75 | % | |||||

| Special Tax Revenue Bonds |

16.56 | % | |||||

| State General Obligation Bond |

0.58 | % | |||||

| Transportation Revenue Bonds |

6.56 | % | |||||

| Water & Sewer Revenue Bonds |

2.88 | % | |||||

| Short-Term Investments |

0.29 | % | |||||

| Total Value of Securities |

100.77 | % | |||||

| Liabilities Net of Receivables and Other Assets |

(0.77 | %) | |||||

| Total Net Assets |

100.00 | % | |||||

*As of the date of this report, Delaware Tax-Free New York Fund held bonds issued by or on behalf of territories and the states of the US as follows:

| State / territory | Percentage of net assets | ||||||

| Guam |

0.29 | % | |||||

| New York |

100.48 | % | |||||

| Total Value of Securities |

100.77 | % | |||||

41

Table of Contents

| Security type / sector / state / territory allocations | ||

| Delaware Tax-Free Pennsylvania Fund | As of August 31, 2018 (Unaudited) | |

Sector designations may be different than the sector designations presented in other Fund materials.

| Security type / sector | Percentage of net assets | ||||||

| Municipal Bonds* |

98.77 | % | |||||

| Corporate Revenue Bonds |

5.72 | % | |||||

| Education Revenue Bonds |

14.42 | % | |||||

| Healthcare Revenue Bonds |

29.26 | % | |||||

| Housing Revenue Bond |

0.48 | % | |||||

| Lease Revenue Bonds |

3.63 | % | |||||

| Local General Obligation Bonds |

4.27 | % | |||||

| Pre-Refunded/Escrowed to Maturity Bonds |

21.81 | % | |||||

| Resource Recovery Revenue Bonds |

0.62 | % | |||||

| Special Tax Revenue Bonds |

3.71 | % | |||||

| State General Obligation Bond |

0.64 | % | |||||

| Transportation Revenue Bonds |

10.14 | % | |||||

| Water & Sewer Revenue Bonds |

4.07 | % | |||||

| Short-Term Investments |

0.60 | % | |||||

| Total Value of Securities |

99.37 | % | |||||

| Receivables and Other Assets Net of Liabilities |

0.63 | % | |||||

| Total Net Assets |

100.00 | % | |||||

*As of the date of this report, Delaware Tax-Free Pennsylvania Fund held bonds issued by or on behalf of territories and the states of the US as follows:

| State / territory | Percentage of net assets | ||||||

| Guam |

0.79 | % | |||||

| Pennsylvania |

98.58 | % | |||||

| Total Value of Securities |

99.37 | % | |||||

42

Table of Contents

| Schedules of investments | ||

| Delaware Tax-Free Arizona Fund | August 31, 2018 | |

| Principal amount° | Value (US $) | |||||||

|

|

||||||||

|

Municipal Bonds – 98.09% |

||||||||

|

|

||||||||

|

Corporate Revenue Bonds – 10.77% |

||||||||

| Chandler Industrial Development Authority Revenue |

||||||||

| (Intel Corporation Project) 2.70% 12/1/37 (AMT) ● |

1,000,000 | $ | 1,003,210 | |||||

| Maricopa County Pollution Control |

||||||||

| (Public Service - Palo Verde Project) Series B 5.20% 6/1/43 ● |

1,500,000 | 1,572,885 | ||||||

| (Southern California Education Co.) Series A 5.00% 6/1/35 |

2,400,000 | 2,510,184 | ||||||

| Pima County Industrial Development Authority Pollution Control Revenue |

||||||||

| (Tucson Electric Power) Series A 5.25% 10/1/40 |

2,000,000 | 2,121,620 | ||||||

| Salt Verde Financial Senior Gas Revenue |

||||||||

| 5.00% 12/1/37 |

870,000 | 1,033,952 | ||||||

|

|

|

|||||||

| 8,241,851 | ||||||||

|

|

|

|||||||

| Education Revenue Bonds – 28.80% |

||||||||

| Arizona Health Facilities Authority Healthcare Education Revenue |

||||||||

| (Kirksville College) 5.125% 1/1/30 |

1,500,000 | 1,557,615 | ||||||

| Arizona Industrial Development Authority Revenue |

||||||||

| (Academies of Math & Science Projects) Series A 5.00% 7/1/51 |

1,000,000 | 1,092,320 | ||||||

| (ACCEL Schools Project) Series A 144A 5.25% 8/1/48 # |

350,000 | 350,518 | ||||||

| (American Charter Schools Foundation Project) 144A 6.00% 7/1/47 # |

400,000 | 420,932 | ||||||

| Arizona State University Energy Management Revenue |

||||||||

| (Arizona State University Tempe Campus II Project) |

||||||||

| 4.50% 7/1/24 |

1,000,000 | 1,021,830 | ||||||

| Glendale Industrial Development Authority Revenue |

||||||||

| (Midwestern University) |

||||||||

| 5.00% 5/15/31 |

645,000 | 700,115 | ||||||

| 5.125% 5/15/40 |

1,305,000 | 1,366,100 | ||||||

| La Paz County Industrial Development Authority Revenue |

||||||||

| (Charter School Solutions-Harmony Public Schools Project) Series A 5.00% 2/15/48 |

100,000 | 106,422 | ||||||

| Maricopa County Industrial Development Authority Revenue |

||||||||

| (Greathearts Arizona Projects) Series A 5.00% 7/1/52 |

725,000 | 804,576 | ||||||

| (Paradise Schools Projects) 144A 5.00% 7/1/36 # |

500,000 | 523,010 | ||||||

| (Reid Traditional Schools Projects) 5.00% 7/1/47 |

785,000 | 817,931 | ||||||

| McAllister Academic Village Revenue |

||||||||

| (Arizona State University Hassayampa Academic Village Project) 5.00% 7/1/31 |

1,000,000 | 1,153,550 | ||||||

| Northern Arizona University |

||||||||

| 5.00% 6/1/36 |

475,000 | 507,271 | ||||||

43

Table of Contents

| Schedules of investments | ||

| Delaware Tax-Free Arizona Fund

|

||

| Principal amount° | Value (US $) | |||||||

|

|

||||||||

|

Municipal Bonds (continued) |

||||||||

|

|

||||||||

| Education Revenue Bonds (continued) |

||||||||

| Northern Arizona University |

||||||||

| 5.00% 6/1/41 |

1,240,000 | $ | 1,321,530 | |||||

| Phoenix Industrial Development Authority |

||||||||

| (Basis School Projects) 144A 5.00% 7/1/35 # |

1,000,000 | 1,032,590 | ||||||

| (Choice Academies Project) 5.625% 9/1/42 |

1,250,000 | 1,299,900 | ||||||

| (Eagle College Preparatory Project) Series A 5.00% 7/1/43 |

500,000 | 500,825 | ||||||

| (Great Hearts Academic Project) 5.00% 7/1/46 |

1,000,000 | 1,053,160 | ||||||

| (Rowan University Project) 5.00% 6/1/42 |

2,000,000 | 2,144,040 | ||||||

| Pima County Industrial Development Authority Education Revenue |

||||||||

| (American Leadership Academy Project) |

||||||||

| 144A 5.00% 6/15/47 # |

100,000 | 100,986 | ||||||

| 144A 5.00% 6/15/52 # |

90,000 | 90,578 | ||||||

| (Edkey Charter School Project) 6.00% 7/1/48 |

1,000,000 | 944,270 | ||||||

| (Tucson Country Day School Project) 5.00% 6/1/37 |

750,000 | 685,920 | ||||||

| Tucson Industrial Development Authority Lease Revenue |

||||||||

| (University of Arizona-Marshall Foundation) Series A 5.00% 7/15/27 (AMBAC) |

980,000 | 981,372 | ||||||

| University of Arizona Board of Regents |

||||||||

| Series A 5.00% 6/1/38 |

1,000,000 | 1,103,500 | ||||||

| Unrefunded Balance Series A 5.00% 6/1/25 |

335,000 | 369,240 | ||||||

|

|

|

|||||||

| 22,050,101 | ||||||||

|

|

|

|||||||

| Electric Revenue Bonds – 2.90% |

||||||||

| Salt River Project Agricultural Improvement & Power |

||||||||

| District Electric System Revenue |

||||||||

| Series A 5.00% 12/1/30 |

1,000,000 | 1,089,660 | ||||||

| Series A 5.00% 12/1/45 |

1,000,000 | 1,130,930 | ||||||

|

|

|

|||||||

| 2,220,590 | ||||||||

|

|

|

|||||||

| Healthcare Revenue Bonds – 18.82% |

||||||||

| Arizona Health Facilities Authority Hospital System Revenue |

||||||||

| (Banner Health) |

||||||||

| Series A 5.00% 1/1/43 |

1,500,000 | 1,615,305 | ||||||

| Series A 5.00% 1/1/44 |

1,000,000 | 1,093,550 | ||||||

| (Phoenix Children’s Hospital) Series A 5.00% 2/1/34 |

995,000 | 1,057,277 | ||||||

| (Scottsdale Lincoln Hospital Project) 5.00% 12/1/42 |

1,000,000 | 1,099,830 | ||||||

| Glendale Industrial Development Authority Revenue |

||||||||

| (Glencroft Retirement Community Project) 5.00% 11/15/36 |

270,000 | 273,605 | ||||||

| Maricopa County Industrial Development Authority Health Facilities Revenue |

||||||||

| (Banner Health) Series A 4.00% 1/1/41 |

1,000,000 | 1,031,400 | ||||||

44

Table of Contents

| Principal amount° | Value (US $) | |||||||

|

|

||||||||

|

Municipal Bonds (continued) |

||||||||

|

|

||||||||

| Healthcare Revenue Bonds (continued) |

||||||||

| Maricopa County Industrial Development Authority Health Facilities Revenue |

||||||||

| (Catholic Healthcare West) Series A 6.00% 7/1/39 |

2,500,000 | $ | 2,580,425 | |||||

| Maricopa County Industrial Development Authority Senior Living Facility Revenue |

||||||||

| (Christian Care Surprise Project) 144A 6.00% 1/1/48 # |

405,000 | 413,732 | ||||||

| Puerto Rico Industrial Tourist Educational Medical & Environmental Control Facilities Financing Authority |

||||||||

| (Hospital Auxilio Mutuo Obligated Group Project) Series A 6.00% 7/1/33 |

790,000 | 821,655 | ||||||

| Tempe Industrial Development Authority Revenue |

||||||||

| (Friendship Village) Series A 6.25% 12/1/42 |

1,200,000 | 1,283,424 | ||||||

| (Mirabella at ASU Project) Series A 144A 6.125% 10/1/52 # |

250,000 | 275,668 | ||||||

| Yavapai County Industrial Development Authority Hospital Facility |

||||||||

| (Yavapai Regional Medical Center) Series A 5.25% 8/1/33 |

2,000,000 | 2,190,420 | ||||||

| Yuma Industrial Development Authority Hospital Revenue |

||||||||

| (Yuma Regional Medical Center) |

||||||||

| Series A 5.00% 8/1/32 |

295,000 | 329,751 | ||||||

| Series A 5.25% 8/1/32 |

300,000 | 339,744 | ||||||

|

|

|

|||||||

| 14,405,786 | ||||||||

|

|

|

|||||||

| Lease Revenue Bonds – 5.13% |

||||||||

| Arizona Certificates of Participation Department Administration |

||||||||

| Series A 5.25% 10/1/25 (AGM) |

1,500,000 | 1,553,055 | ||||||

| Arizona Game & Fish Department & Community Beneficial Interest Certificates |

||||||||

| (Administration Building Project) 5.00% 7/1/32 |

1,000,000 | 1,002,220 | ||||||

| Arizona Sports & Tourism Authority Senior Revenue |

||||||||

| (Multipurpose Stadium Facility) Series A 5.00% 7/1/36 |

350,000 | 368,483 | ||||||

| Maricopa County Industrial Development Authority |

||||||||

| Correctional Contract Revenue |

||||||||

| (Phoenix West Prison) Series B 5.375% 7/1/22 (ACA) |

1,000,000 | 1,002,300 | ||||||

|

|

|

|||||||

| 3,926,058 | ||||||||

|

|

|

|||||||

| Local General Obligation Bond – 0.35% |

||||||||

| Pinal County Community College District |

||||||||

| 4.00% 7/1/31 |

250,000 | 265,157 | ||||||

|

|

|

|||||||

| 265,157 | ||||||||

|

|

|

|||||||

| Pre-Refunded Bonds – 9.63% |

||||||||

| Gilbert Public Facilities Municipal Property Revenue |

||||||||

| 5.00% 7/1/25-19 § |

1,250,000 | 1,284,550 | ||||||

45

Table of Contents

| Schedules of investments | ||

| Delaware Tax-Free Arizona Fund | ||

| Principal amount° | Value (US $) | |||||||

|

|

||||||||

|

Municipal Bonds (continued) |

||||||||

|

|

||||||||

| Pre-Refunded Bonds (continued) |

||||||||

| Phoenix Civic Improvement Airport Revenue |

||||||||

| (Junior Lien) Series A 5.25% 7/1/33-20 § |

1,250,000 | $ | 1,329,263 | |||||

| Phoenix Industrial Development Authority |

||||||||

| (Great Hearts Academic Project) |

||||||||

| 6.30% 7/1/42-21 § |

500,000 | 560,010 | ||||||

| 6.40% 7/1/47-21 § |

500,000 | 561,380 | ||||||

| Pinal County Electric District No. 3 |

||||||||

| 5.25% 7/1/41-21 § |

750,000 | 819,570 | ||||||

| University Medical Center Hospital Revenue |

||||||||

| 6.50% 7/1/39-19 § |

2,000,000 | 2,078,000 | ||||||

| University of Arizona Board of Regents |

||||||||

| Series A 5.00% 6/1/25-22 § |

665,000 | 738,788 | ||||||

|

|

|

|||||||

| 7,371,561 | ||||||||

|

|

|

|||||||

| Special Tax Revenue Bonds – 6.23% |

||||||||

| Glendale Municipal Property Excise Tax Revenue |

||||||||

| (Senior Lien) Series B 5.00% 7/1/33 |

570,000 | 629,497 | ||||||

| Glendale Transportation Excise Tax Revenue |

||||||||

| 5.00% 7/1/30 (AGM) |

1,000,000 | 1,143,070 | ||||||

| Guam Government Business Privilege Tax Revenue |

||||||||

| Series A 5.125% 1/1/42 |

545,000 | 572,174 | ||||||

| Series A 5.25% 1/1/36 |

705,000 | 746,292 | ||||||

| Mesa Excise Tax Revenue |

||||||||

| 5.00% 7/1/32 |

1,000,000 | 1,093,620 | ||||||

| Regional Public Transportation Authority |

||||||||

| (Maricopa County Public Transportation) 5.25% 7/1/24 |

500,000 | 582,895 | ||||||

|

|

|

|||||||

| 4,767,548 | ||||||||

|

|

|

|||||||

| Transportation Revenue Bonds – 8.43% |

||||||||

| Arizona Department of Transportation State Highway Fund Revenue |

||||||||

| 5.00% 7/1/32 |

1,500,000 | 1,705,440 | ||||||

| 5.00% 7/1/35 |

500,000 | 575,260 | ||||||

| Phoenix Civic Improvement Airport Revenue |

||||||||

| Series B 5.00% 7/1/37 |

1,000,000 | 1,145,630 | ||||||

| (Junior Lien) Series A 5.00% 7/1/45 |

1,000,000 | 1,109,490 | ||||||

| (Senior Lien) 5.00% 7/1/32 (AMT) |

1,750,000 | 1,920,817 | ||||||

|

|

|

|||||||

| 6,456,637 | ||||||||

|

|

|

|||||||

| Water & Sewer Revenue Bonds – 7.03% |

||||||||

| Arizona Water Infrastructure Finance Authority |

||||||||

| (Water Quality Revenue) Series A 5.00% 10/1/26 |

1,000,000 | 1,156,480 | ||||||

| Central Arizona Water Conservation District |

||||||||

| (Central Arizona Project) 5.00% 1/1/31 |

600,000 | 691,110 | ||||||

46

Table of Contents

| Principal amount° | Value (US $) | |||||||

|

|

||||||||

|

Municipal Bonds (continued) |

||||||||

|

|

||||||||

| Water & Sewer Revenue Bonds (continued) |

||||||||

| Guam Government Waterworks Authority Revenue |

||||||||

| 5.00% 7/1/37 |

250,000 | $ | 276,840 | |||||

| Mesa Utility System Revenue |

||||||||

| 4.00% 7/1/31 |

850,000 | 910,681 | ||||||

| Phoenix Civic Improvement Corporation |

||||||||

| (Junior Lien) |

||||||||

| 5.00% 7/1/27 |

1,000,000 | 1,178,140 | ||||||

| 5.00% 7/1/31 |

1,000,000 | 1,165,770 | ||||||

|

|

|

|||||||

| 5,379,021 | ||||||||

|

|

|

|||||||

| Total Municipal Bonds (cost $72,592,697) |

75,084,310 | |||||||

|

|

|

|||||||

|

|

||||||||

|

Short-Term Investment – 0.39% |

||||||||

|

|

||||||||

| Variable Rate Demand Note – 0.39%¤ |

||||||||

| Arizona Health Facilities Authority (Banner Health) Series B |

||||||||

| 1.45% 1/1/46 (LOC - BK TOKYO-MITSUBISHI UFJ) |

300,000 | 300,000 | ||||||

|

|

|

|||||||

| Total Short-Term Investment (cost $300,000) |

|

300,000 |

| |||||

|

|

|

|||||||

| Total Value of Securities – 98.48% |

$ | 75,384,310 | ||||||

|

|

|

|||||||

| # | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. At Aug. 31, 2018, the aggregate value of Rule 144A securities was $3,208,014, which represents 4.19% of the Fund’s net assets. See Note 8 in “Notes to financial statements.” |

| ¤ | Tax-exempt obligations that contain a floating or variable interest rate adjustment formula and an unconditional right of demand to receive payment of the unpaid principal balance plus accrued interest upon a short notice period (generally up to 30 days) prior to specified dates either from the issuer or by drawing on a bank letter of credit, a guarantee, or insurance issued with respect to such instrument. Each rate shown is as of Aug. 31, 2018. |

| § | Pre-refunded bonds. Municipal bonds that are generally backed or secured by US Treasury bonds. For pre-refunded bonds, the stated maturity is followed by the year in which the bond will be pre-refunded. See Note 8 in “Notes to financial statements.” |

| ° | Principal amount shown is stated in US Dollars unless noted that the security is denominated in another currency. |

| ● | Variable rate investment. Rates reset periodically. Rate shown reflects the rate in effect at Aug. 31, 2018. For securities based on a published reference rate and spread, the reference rate and spread are indicated in their description above. The reference rate descriptions (i.e. LIBOR03M, LIBOR06M, etc.) used in this report are identical for different securities, but the underlying reference rates may differ due to the timing of the reset period. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on |

47

Table of Contents

Schedules of investments

Delaware Tax-Free Arizona Fund

| current market conditions, or for mortgage-backed securities, are impacted by the individual mortgages which are paying off over time. These securities do not indicate a reference rate and spread in their description above. |

Summary of abbreviations:

ACA – Insured by American Capital Access

AGM – Insured by Assured Guaranty Municipal Corporation

AMBAC – Insured by AMBAC Assurance Corporation

AMT – Subject to Alternative Minimum Tax

LOC – Letter of Credit

See accompanying notes, which are an integral part of the financial statements.

48

Table of Contents

| Schedules of investments | ||

| Delaware Tax-Free California Fund | August 31, 2018 | |

| Principal amount° | Value (US $) | |||||||

|

|

||||||||

|

Municipal Bonds – 99.70% |

| |||||||

|

|

||||||||

| Corporate Revenue Bonds – 5.81% |

||||||||

| Chula Vista Industrial Development Revenue |

||||||||

| (San Diego Gas & Electric) Series D 5.875% 1/1/34 |

1,000,000 | $ | 1,030,120 | |||||

| Golden State Tobacco Securitization Settlement Revenue (Asset-Backed) |

||||||||

| Series A-1 5.00% 6/1/29 |

1,000,000 | 1,148,550 | ||||||

| Series A-1 5.00% 6/1/47 |

1,000,000 | 1,028,050 | ||||||

| Series A-1 5.25% 6/1/47 |

1,500,000 | 1,564,950 | ||||||

| (Capital Appreciation Asset-Backed) Subordinate Series B 1.548% 6/1/47 ^ |

1,615,000 | 286,711 | ||||||

| M-S-R Energy Authority Revenue |

||||||||

| Series B 6.50% 11/1/39 |

500,000 | 702,295 | ||||||

|

|

|

|||||||

| 5,760,676 | ||||||||

|

|

|

|||||||

| Education Revenue Bonds – 19.24% |

||||||||

| California Educational Facilities Authority |

||||||||

| (Loma Linda University) Series A 5.00% 4/1/47 |

1,000,000 | 1,118,880 | ||||||

| California Municipal Finance Authority |

||||||||

| (Bella Mente Montessori Academy Project) Series A 144A 5.00% 6/1/48 # |

500,000 | 527,580 | ||||||

| (Biola University) 5.00% 10/1/39 |

1,000,000 | 1,130,650 | ||||||

| (California Baptist University) Series A 144A 5.375% 11/1/40 # |

1,000,000 | 1,117,060 | ||||||

| (Creative Center of Los Altos Project – Pinewood School & Oakwood School) Series B 144A 4.50% 11/1/46 # |

500,000 | 500,990 | ||||||

| (Julian Charter School Project) Series A 144A 5.625% 3/1/45 # |

500,000 | 504,180 | ||||||

| (Palmdale Aerospace Academy Project) Series A 144A 5.00% 7/1/46 # |

500,000 | 512,985 | ||||||

| (Southwestern Law School) 6.50% 11/1/41 |

1,140,000 | 1,274,908 | ||||||

| California Public Finance Authority University Housing Revenue |

||||||||

| (NCCD – Claremont Properties LLC – Claremont Colleges Project) Series A 144A 5.00% 7/1/32 # |

500,000 | 531,845 | ||||||

| California School Finance Authority |

||||||||

| (Aspire Public Schools – Obligated Group) Series A 144A 5.00% 8/1/45 # |

715,000 | 763,527 | ||||||

| (Encore Education Obligated Group) Series A 144A 5.00% 6/1/42 # |

500,000 | 452,915 | ||||||

| (Escuela Popular Project) 144A 6.50% 7/1/50 # |

250,000 | 250,967 | ||||||

| (Green Dot Public Schools Project) Series A 144A 5.00% 8/1/35 # |

1,000,000 | 1,074,770 | ||||||

| (Grimmway Schools – Obligated Group) Series A 144A 5.00% 7/1/36 # |

500,000 | 514,970 | ||||||

49

Table of Contents

Schedules of investments

Delaware Tax-Free California Fund

| Principal amount° | Value (US $) | |||||||

|

|

||||||||

|

Municipal Bonds (continued) |

||||||||

|

|

||||||||

| Education Revenue Bonds (continued) |

||||||||

| California School Finance Authority |

||||||||

| (ICEF - View Park Elementary & Middle Schools) Series A 5.625% 10/1/34 |

575,000 | $ | 609,017 | |||||

| (KIPP LA Projects) Series A 5.125% 7/1/44 |

1,000,000 | 1,083,780 | ||||||

| (Partnerships to Uplift Communities Valley Project) Series A 144A 6.75% 8/1/44 # |

1,000,000 | 1,075,570 | ||||||

| California State University Systemwide Revenue Series A 5.00% 11/1/47 |

1,000,000 | 1,150,610 | ||||||

| California Statewide Communities Development Authority Charter School Revenue |

||||||||

| (Green Dot Public Schools - Animo Inglewood Charter High School Project) Series A 7.25% 8/1/41 |

800,000 | 892,952 | ||||||

| California Statewide Communities Development Authority Revenue |

||||||||

| (California Baptist University) Series A 6.125% 11/1/33 |

750,000 | 866,573 | ||||||

| (Culinary Institute of America Project) Series B 5.00% 7/1/46 |

425,000 | 464,925 | ||||||

| California Statewide Communities Development Authority Student Housing Revenue |

||||||||

| (University of California Irvine East Campus Apartments) |

||||||||

| 5.00% 5/15/24 |

40,000 | 45,412 | ||||||

| 5.375% 5/15/38 |

1,000,000 | 1,061,520 | ||||||

| Mt. San Antonio Community College District Convertible |

||||||||

| Capital Appreciation Election 2008 |

||||||||

| Series A 0.00% 8/1/28 ~ |

1,000,000 | 971,030 | ||||||

| University of California General Revenue |

||||||||

| Series AZ 5.25% 5/15/58 |