Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04992

MFS HIGH YIELD MUNICIPAL TRUST

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199

(Address of principal executive offices) (Zip code)

Christopher R. Bohane

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: November 30

Date of reporting period: November 30, 2020

Table of Contents

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Item 1(a):

Table of Contents

Annual Report

November 30, 2020

MFS® High Yield Municipal Trust

CMU-ANN

Table of Contents

MFS® High Yield Municipal Trust

New York Stock Exchange Symbol: CMU

| Contact information | back cover |

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Table of Contents

Dear Shareholders:

Markets experienced dramatic swings this year as the coronavirus pandemic brought the global economy to a standstill for several months early in the year. The speedy

development of vaccines and therapeutics later brightened the economic and market outlook, but a great deal of uncertainty remains as case counts in the United States and Europe remain very high and it is still unclear how quickly vaccines can be made widely available. In the United States, political uncertainty eased after former Vice President Joe Biden won the presidential election and the Democrats gained control of a closely divided Senate.

Global central banks have taken aggressive steps to cushion the economic and market fallout related to the virus, and governments are deploying unprecedented levels of fiscal support.

Additional U.S. stimulus is anticipated with the Democrats in the White House and holding a majority in both houses of Congress. The measures already put in place have helped build a supportive environment and are encouraging economic recovery; however, if markets disconnect from fundamentals, they can also sow the seeds of instability. In the aftermath of the crisis, societal changes may be likely as households, businesses, and governments adjust to a new reality, and any such alterations could affect the investment landscape. For investors, events such as the COVID-19 outbreak demonstrate the importance of having a deep understanding of company fundamentals, and we have built our global research platform to do just that.

At MFS®, we put our clients’ assets to work responsibly by carefully navigating the increasing complexity of our global markets and economies. Guided by our long-term philosophy and adhering to our commitment to sustainable investing, we tune out the noise and aim to uncover what we believe are the best, most durable investment opportunities in the market. Our unique global investment platform combines collective expertise, long-term discipline and thoughtful risk management to create sustainable value for investors.

Respectfully,

Michael W. Roberge

Chief Executive Officer

MFS Investment Management

January 14, 2021

The opinions expressed in this letter are subject to change and may not be relied upon for investment advice. No forecasts can be guaranteed.

1

Table of Contents

| (a) | For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. If none of the 3 rating agencies above assign a rating, but the security is rated by DBRS Morningstar, then the DBRS Morningstar rating is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). Securities rated BBB or higher are considered investment grade. All ratings are subject to change. Not Rated includes fixed income securities and fixed income derivatives that have not been rated by any rating agency. The fund may or may not have held all of these instruments on this date. The fund is not rated by these agencies. |

2

Table of Contents

Portfolio Composition – continued

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value due to the interest rate move. This calculation is based on net assets applicable to common shares as of November 30, 2020. |

| (i) | For purposes of this presentation, the components include the value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may be negative from time to time. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than value. The bond component will include any accrued interest amounts. |

| (m) | In determining each instrument’s effective maturity for purposes of calculating the fund’s dollar-weighted average effective maturity, MFS uses the instrument’s stated maturity or, if applicable, an earlier date on which MFS believes it is probable that a maturity-shortening device (such as a put, pre-refunding or prepayment) will cause the instrument to be repaid. Such an earlier date can be substantially shorter than the instrument’s stated maturity. This calculation is based on gross assets, which consists of net assets applicable to common shares plus the value of preferred shares, as of November 30, 2020. |

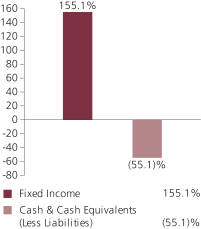

Cash & Cash Equivalents includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. Liabilities include the value of the aggregate liquidation preference of the variable rate municipal term preferred shares (VMTPS) issued by the fund. Cash & Cash Equivalents is negative due to the aggregate liquidation value of VMTPS. Please see the Statement of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities. Please see Note 8 in the Notes to Financial Statements for more information on the VMTPS issued by the fund.

Percentages are based on net assets applicable to common shares as of November 30, 2020.

The portfolio is actively managed and current holdings may be different.

3

Table of Contents

Summary of Results

For the twelve months ended November 30, 2020, shares of the MFS High Yield Municipal Trust (fund) provided a total return of 0.84%, at net asset value and a total return of –3.99%, at market value. This compares with a return of 4.89% for the fund’s benchmark, the Bloomberg Barclays Municipal Bond Index.

The performance commentary below is based on the net asset value performance of the fund, which reflects the performance of the underlying pool of assets held by the fund. The total return at market value represents the return earned by owners of the shares of the fund, which are traded publicly on the exchange.

Market Environment

Markets experienced an extraordinarily sharp selloff and, in many cases, an unusually rapid recovery late in the period. Central banks and fiscal authorities undertook astonishing levels of stimulus to offset the economic effects of government-imposed social-distancing measures implemented to slow the spread of the COVID-19 virus. At this point, the global economy looks to have experienced the deepest, steepest and possibly shortest recession in the postwar period. However, the recovery remains subject to more than the usual number of uncertainties due to questions about the evolution of the virus, what its continued impact will be and how quickly vaccines to guard against it can be manufactured and distributed at scale, as well as the public’s willingness to be inoculated.

Around the world, central banks responded quickly and massively to the crisis with programs to improve liquidity and support markets. These programs proved largely successful in helping to restore market function, ease volatility and stimulate a continued market rebound. Late in the period, the US Federal Reserve adopted a new, flexible average-inflation-targeting framework, which is expected to result in the federal funds rate remaining at low levels for a longer period. In developed countries, monetary easing measures were complemented by large fiscal stimulus initiatives, although late in the period there was uncertainty surrounding the timing and scope of additional US recovery funding. Due to relatively manageable external liabilities and balances of payments in many countries, along with persistently low inflation, even emerging market countries were able to implement countercyclical policies – a departure from the usual market-dictated response to risk-off crises.

Compounding market uncertainty earlier in the pandemic was a crash in the price of crude oil due to a sharp drop in global demand and a disagreement between Saudi Arabia and Russia over production cuts, which resulted in an oil price war. The subsequent decline in prices undercut oil exporters, many of which are in emerging markets, as well as a large segment of the high-yield credit market. The OPEC+ group later agreed on output cuts, with shale oil producers in the US also decreasing production, which, along with the gradual reopening of some major economies and the resultant boost in demand, helped stabilize the price of crude oil.

As has often been the case in a crisis, market vulnerabilities have been revealed. For example, companies that have added significant leverage to their balance sheets in recent years by borrowing to fund dividend payments and stock buybacks have, in

4

Table of Contents

Management Review – continued

many cases, halted share repurchases and cut dividends, while some firms have been forced to recapitalize. Conversely, some companies find themselves flush with liquidity, having borrowed preemptively during the worst of the crisis, only to end up with excess cash on their balance sheets.

Municipal markets experienced challenges as well over the last twelve months. As in other risk markets, differentiation has been the theme as the pandemic widened the fundamental gap between stronger and weaker credits. Ratings agencies responded with downgrades, however, the level of defaults remained contained. Many municipalities entered the current downturn in a position of strength after years of growth that bolstered their financial condition. The robust stimulus from policymakers and liquidity supplied by the US Federal Reserve has had positive effects on the economy and flow of credit, and tax revenues have been more resilient than many expected.

The result was low-to-mid single-digit positive returns in municipal bonds for the trailing year. Over the full period, investment-grade and longer duration outperformed below-investment-grade and shorter duration segments of the muni market. The below-investment-grade portion of the market experienced heightened differentiation. Higher yielding tobacco and Puerto Rico bonds significantly outperformed sectors that were heavily impacted by the pandemic, including transportation, airlines and hospitals.

Detractors from Performance

The fund’s asset allocation decisions were a primary driver of relative underperformance versus the Bloomberg Barclays Municipal Bond Index. Notably, from a quality perspective, the fund’s out-of-benchmark exposure to both non-rated (r) and “BB” rated bonds, its greater exposure to “BBB” rated securities, and its lesser exposure to “AA” rated issuers, detracted from relative returns. From a sector perspective, the fund’s greater exposure to bonds within the health care sector also weakened relative results.

The fund employs leverage that has been created through the issuance of variable rate municipal term preferred shares. To the extent that investments are purchased through the use of leverage, the fund’s net asset value may increase or decrease at a greater rate than a comparable unleveraged fund. During the reporting period, the fund’s use of leverage was a detractor from relative performance.

Contributors to Performance

The fund’s longer duration (d) stance was a primary contributor to positive relative performance as interest rates generally declined over the reporting period. Favorable bond selection in both the special tax and education sectors also supported relative returns.

Respectfully,

Portfolio Manager(s)

Gary Lasman and Geoffrey Schechter

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value. |

5

Table of Contents

Management Review – continued

| (r) | Bonds rated “BBB”, “Baa”, or higher are considered investment grade; bonds rated “BB”, “Ba”, or below are considered non-investment grade. The source for bond quality ratings is Moody’s Investors Service, Standard & Poor’s, and Fitch, Inc. and are applied using the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. If none of the 3 rating agencies above assign a rating, but the security is rated by DBRS Morningstar, then the DBRS Morningstar rating is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). For securities that are not rated by any of the rating agencies, the security is considered Not Rated. |

The views expressed in this report are those of the portfolio manager(s) only through the end of the period of the report as stated on the cover and do not necessarily reflect the views of MFS or any other person in the MFS organization. These views are subject to change at any time based on market or other conditions, and MFS disclaims any responsibility to update such views. These views may not be relied upon as investment advice or an indication of trading intent on behalf of any MFS portfolio. References to specific securities are not recommendations of such securities, and may not be representative of any MFS portfolio’s current or future investments.

6

Table of Contents

PERFORMANCE SUMMARY THROUGH 11/30/20

The following chart presents the fund’s historical performance in comparison to its benchmark(s). Investment return and principal value will fluctuate, and shares, when sold, may be worth more or less than their original cost; current performance may be lower or higher than quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on fund distributions or the sale of fund shares. Performance data shown represents past performance and is no guarantee of future results.

Price Summary for MFS High Yield Municipal Trust

| Date | Price | |||||||||||

|

Year Ended 11/30/20 |

Net Asset Value | 11/30/20 | $4.71 | |||||||||

| 11/30/19 | $4.91 | |||||||||||

| New York Stock Exchange Price | 11/30/20 | $4.32 | ||||||||||

| 2/25/20 | (high) (t) | $4.98 | ||||||||||

| 3/23/20 | (low) (t) | $3.33 | ||||||||||

| 11/30/19 | $4.73 | |||||||||||

Total Returns vs Benchmark(s)

|

Year Ended 11/30/20 |

MFS High Yield Municipal Trust at | |||||||||

| New York Stock Exchange Price (r) |

(3.99)% | |||||||||

| Net Asset Value (r) |

0.84% | |||||||||

| Bloomberg Barclays Municipal Bond Index (f) | 4.89% | |||||||||

| (f) | Source: FactSet Research Systems Inc. |

| (r) | Includes reinvestment of all distributions. |

| (t) | For the period December 1, 2019 through November 30, 2020. |

Benchmark Definition(s)

Bloomberg Barclays Municipal Bond Index (a) – a market capitalization-weighted index that measures the performance of the tax-exempt bond market.

It is not possible to invest directly in an index.

| (a) | BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith. |

7

Table of Contents

Performance Summary – continued

Notes to Performance Summary

The fund’s shares may trade at a discount or premium to net asset value. When fund shares trade at a premium, buyers pay more than the net asset value underlying fund shares, and shares purchased at a premium would receive less than the amount paid for them in the event of the fund’s concurrent liquidation.

The fund’s monthly distributions may include a return of capital to shareholders to the extent that distributions are in excess of the fund’s net investment income and net capital gains, determined in accordance with federal income tax regulations.

Distributions that are treated for federal income tax purposes as a return of capital will reduce each shareholder’s basis in his or her shares and, to the extent the return of capital exceeds such basis, will be treated as gain to the shareholder from a sale of shares. Returns of shareholder capital may have the effect of reducing the fund’s assets and increasing the fund’s expense ratio.

Net asset values and performance results based on net asset value per share do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from amounts reported in the Statement of Assets and Liabilities or the Financial Highlights.

A portion of the fund’s monthly distributions may be subject to state, federal, and/or alternative minimum tax. Capital gains, if any, are subject to a capital gains tax.

From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower.

In accordance with Section 23(c) of the Investment Company Act of 1940, the fund hereby gives notice that it may from time to time repurchase shares of the fund in the open market at the option of the Board of Trustees and on such terms as the Trustees shall determine.

8

Table of Contents

INVESTMENT OBJECTIVE, PRINCIPAL INVESTMENT STRATEGIES, PRINCIPAL INVESTMENT TYPES AND PRINCIPAL RISKS

Investment Objective

The fund’s investment objective is to seek high current income exempt from federal income tax, but may also consider capital appreciation. The fund’s objective may be changed without shareholder approval.

Principal Investment Strategies

The fund invests, under normal market conditions, at least 80% of its net assets, including assets attributable to preferred shares and borrowings for investment purposes, in tax-exempt bonds and tax-exempt notes. This policy may not be changed without shareholder approval. Tax-exempt bonds and tax-exempt notes are municipal instruments, the interest of which is exempt from federal income tax. Interest from the fund’s investments may be subject to the federal alternative minimum tax.

MFS (Massachusetts Financial Services Company, the fund’s investment adviser) may invest 25% or more of the fund’s total assets in municipal instruments that finance similar projects, such as those relating to education, healthcare, housing, utilities, water, or sewers. Although MFS seeks to invest the funds’ assets in municipal instruments whose interest is exempt from federal personal income tax, MFS may also invest in taxable instruments, including derivatives.

MFS may invest up to 100% of the fund’s assets in below investment grade quality debt instruments.

MFS may invest a significant percentage of the fund’s assets in issuers in a single state, territory, or possession, or a small number of states, territories, or possessions.

While MFS may use derivatives for any investment purpose, to the extent MFS uses derivatives, MFS expects to use derivatives primarily to increase or decrease exposure to a particular market, segment of the market, or security, to increase or decrease interest rate exposure, or as alternatives to direct investments.

MFS uses an active bottom-up investment approach to buying and selling investments for the fund. Investments are selected primarily based on fundamental analysis of individual instruments and their issuers in light of the issuers’ financial condition and market, economic, political, and regulatory conditions. Factors considered may include the instrument’s credit quality and terms, any underlying assets and their credit quality, and the issuer’s management ability, capital structure, leverage, and ability to meet its current obligations. MFS may also consider environmental, social, and governance (ESG) factors in its fundamental investment analysis. Quantitative screening tools that systematically evaluate the structure of a debt instrument and its features may also be considered. In structuring the fund, MFS also considers top-down factors, including sector allocations, yield curve positioning, duration, macroeconomic factors, and risk management factors.

The fund uses leverage through the issuance of preferred shares and/or the creation of tender option bonds, and then investing the proceeds pursuant to its investment strategies. If approved by the fund’s Board of Trustees, the fund may use leverage by other methods.

9

Table of Contents

Investment Objective, Principal Investment Strategies, Principal Investment Types and Principal Risks – continued

MFS may engage in active and frequent trading in pursuing the fund’s principal investment strategies.

In response to market, economic, political, or other conditions, MFS may depart from the fund’s principal investment strategies by temporarily investing for defensive purposes.

Principal Investment Types

The principal investment types in which the fund may invest are:

Debt Instruments: Debt instruments represent obligations of corporations, governments, and other entities to repay money borrowed, or other instruments believed to have debt-like characteristics. The issuer or borrower usually pays a fixed, variable, or floating rate of interest, and must repay the amount borrowed, usually at the maturity of the instrument. Debt instruments generally trade in the over-the-counter market and can be less liquid than other types of investments, particularly during adverse market and economic conditions. During certain market conditions, debt instruments in some or many segments of the debt market can trade at a negative interest rate (i.e., the price to purchase the debt instrument is more than the present value of expected interest payments and principal due at the maturity of the instrument). Some debt instruments, such as zero coupon bonds or payment-in-kind bonds, do not pay current interest. Other debt instruments, such as certain mortgage-backed securities and other securitized instruments, make periodic payments of interest and/or principal. Some debt instruments are partially or fully secured by collateral supporting the payment of interest and principal.

Municipal Instruments: Municipal instruments are issued by or for states, territories, or possessions of the United States or by their political subdivisions, agencies, authorities, or other government entities, to raise money for a variety of public and private purposes, including general financing for state and local governments, or financing for a specific project or public facility. Municipal instruments include general obligation bonds of municipalities, state or local governments, project or revenue-specific bonds, municipal lease obligations, and prerefunded or escrowed bonds. Municipal instruments may be fully or partially supported by the state or local governments, by the credit of a private issuer, by the current or anticipated revenues from a specific project or assets, by the issuer’s pledge to make annual appropriations for lease payments, or by domestic or foreign entities providing credit support, such as insurance, letters of credit, or guarantees. Many municipal instruments are supported by insurance, which typically guarantees the timely payment of all principal and interest due on the underlying municipal instrument.

Tender Option Bonds: Tender option bonds are created when municipal instruments are transferred to a special purpose trust which issues two classes of certificates. The first class, commonly called floating rate certificates, pays an interest rate that is typically reset weekly based on a specified index. Each holder of a floating rate certificate has the option at specified times, and/or may be required under specified circumstances, to tender its certificate to the issuer or a specified third party acting as agent for the issuer for purchase at the stated amount of the certificate plus accrued interest. The second class, commonly called inverse floaters, pays an interest rate based

10

Table of Contents

Investment Objective, Principal Investment Strategies, Principal Investment Types and Principal Risks – continued

on the difference between the interest rate earned on the underlying municipal instruments and the interest rate paid on the floating rate certificates after expenses.

Derivatives: Derivatives are financial contracts whose value is based on the value of one or more underlying indicators or the difference between underlying indicators. Underlying indicators may include a security or other financial instrument, asset, interest rate, credit rating, commodity, volatility measure, or index. Derivatives often involve a counterparty to the transaction. Derivatives include futures, forward contracts, options, inverse floating rate instruments, swaps, and certain complex structured securities.

Principal Risks

The share price of the fund will change daily based on changes in interest rates and market, economic, industry, political, regulatory, geopolitical, environmental, public health, and other conditions. As with any mutual fund, the fund may not achieve its objective and/or you could lose money on your investment in the fund. An investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. The significance of any specific risk to an investment in the fund will vary over time depending on the composition of the fund’s portfolio, market conditions, and other factors. You should read all of the risk information below carefully, because any one or more of these risks may result in losses to the fund.

The principal risks of investing in the fund are:

Investment Selection Risk: MFS’ investment analysis and its selection of investments may not produce the intended results and/or can lead to an investment focus that results in the fund underperforming other funds with similar investment strategies and/or underperforming the markets in which the fund invests. In addition, MFS or the fund’s other service providers may experience disruptions or operating errors that could negatively impact the fund.

Debt Market Risk: Debt markets can be volatile and can decline significantly in response to, or investor perceptions of, issuer, market, economic, industry, political, regulatory, geopolitical, environmental, public health, and other conditions. These conditions can affect a single instrument, issuer, or borrower, a particular type of instrument, issuer, or borrower, a segment of the debt markets, or debt markets generally. Certain changes or events, such as political, social, or economic developments, including increasing and negative interest rates or the U.S. government’s inability at times to agree on a long-term budget and deficit reduction plan (which has in the past resulted and may in the future result in a government shutdown); market closures and/or trading halts; government or regulatory actions, including the imposition of tariffs or other protectionist actions and changes in fiscal, monetary, or tax policies; natural disasters; outbreaks of pandemic and epidemic diseases; terrorist attacks; war; and other geopolitical changes or events can have a dramatic adverse effect on debt markets and may lead to periods of high volatility and reduced liquidity in a debt market or a segment of a debt market.

11

Table of Contents

Investment Objective, Principal Investment Strategies, Principal Investment Types and Principal Risks – continued

Interest Rate Risk: The price of a debt instrument typically changes in response to interest rate changes. Interest rates can change in response to the supply and demand for credit, government and/or central bank monetary policy and action, inflation rates, general economic and market conditions, and other factors. In general, the price of a debt instrument falls when interest rates rise and rises when interest rates fall. Interest rate risk is generally greater for instruments with longer maturities, or that do not pay current interest. In addition, short-term and long-term interest rates do not necessarily move in the same direction or by the same amount. An instrument’s reaction to interest rate changes depends on the timing of its interest and principal payments and the current interest rate for each of those time periods. Instruments with floating interest rates can be less sensitive to interest rate changes. The price of an instrument trading at a negative interest rate responds to interest rate changes like other debt instruments; however, an instrument purchased at a negative interest rate is expected to produce a negative return if held to maturity.

Credit Risk: The price of a debt instrument depends, in part, on the issuer’s or borrower’s credit quality or ability to pay principal and interest when due. The price of a debt instrument is likely to fall if an issuer or borrower defaults on its obligation to pay principal or interest, if the instrument’s credit rating is downgraded by a credit rating agency, or based on other changes in, or perceptions of, the financial condition of the issuer or borrower. For certain types of instruments, including derivatives, the price of the instrument depends in part on the credit quality of the counterparty to the transaction. For other types of debt instruments, including securitized instruments and some municipal instruments, the price of the debt instrument also depends on the credit quality and adequacy of the underlying assets or collateral as well as whether there is a security interest in the underlying assets or collateral. Enforcing rights, if any, against the underlying assets or collateral may be difficult.

Below investment grade quality debt instruments can involve a substantially greater risk of default or can already be in default, and their values can decline significantly over short periods of time. Below investment grade quality debt instruments are regarded as having predominantly speculative characteristics with respect to capacity to pay interest and principal. Below investment grade quality debt instruments tend to be more sensitive to adverse news about the issuer, or the market or economy in general, than higher quality debt instruments. The market for below investment grade quality debt instruments can be less liquid, especially during periods of recession or general market decline.

The credit quality of, and the ability to pay principal and interest when due by, an issuer of a municipal instrument depends on the credit quality of the entity supporting the municipal instrument, how essential any services supported by the municipal instrument are, the sufficiency of any revenues or taxes that support the municipal instrument, and/or the willingness or ability of the appropriate government entity to approve any appropriations necessary to support the municipal instrument. In addition, the price of a municipal instrument also depends on its credit quality and ability to meet the credit support obligations of any insurer or other entity providing credit support to a municipal instrument.

12

Table of Contents

Investment Objective, Principal Investment Strategies, Principal Investment Types and Principal Risks – continued

Municipal Risk: The price of a municipal instrument can be volatile and significantly affected by adverse tax changes or court rulings, legislative or political changes, market and economic conditions and developments, issuer, industry-specific and other conditions, including as the result of events that cannot be reasonably anticipated or controlled such as social conflict or unrest, labor disruption and natural disasters. Municipal instruments can be less liquid than other types of investments and there may be less publicly available information about the issuers of municipal instruments compared to other issuers. If the Internal Revenue Service or a state taxing authority determines that an issuer of a municipal instrument has not complied with applicable tax requirements, interest from the instrument could become taxable (including retroactively) and the instrument could decline significantly in price. Because many municipal instruments are issued to finance similar projects, especially those relating to education, health care, housing, utilities, and water and sewer, conditions in these industries can significantly affect the fund and the overall municipal market. In addition, changes in the financial condition of an individual municipal insurer can affect the overall municipal market.

Municipal instruments may be more susceptible to downgrades or defaults during economic downturns or similar periods of economic stress, which in turn could affect the market values and marketability of many or all municipal obligations of issuers in a state, U.S. territory, or possession. For example, the novel coronavirus (COVID-19) pandemic has significantly stressed the financial resources of many municipal issuers, which may impair a municipal issuer’s ability to meet its financial obligations when due and may adversely impact the value of its bonds, which could negatively impact the performance of the fund. Factors contributing to the economic stress on municipal issuers may include an increase in expenses associated with combatting the COVID-19 pandemic and a decrease in revenues supporting the issuer’s bonds due to factors such as lower sales tax revenue as a result of decreased consumer spending, lower income tax revenue due to higher unemployment, and a decrease in the value of collateral backing revenue bonds due to closures and/or curtailment of services and/or changes in consumer behavior. In light of the uncertainty surrounding the magnitude, duration, reach, costs and effects of the COVID-19 pandemic, as well as actions that have been or could be taken by governmental authorities or other third parties, it is difficult to predict the level of financial stress and duration of such stress municipal issuers may experience.

Focus Risk: The fund’s performance will be closely tied to the issuer, market, economic, industry, political, regulatory, geopolitical, environmental, public health, and other conditions in the states, territories, and possessions of the United States in which the fund’s assets are invested. These conditions include constitutional or statutory limits on an issuer’s ability to raise revenues or increase taxes, anticipated or actual budget deficits or other financial difficulties, or changes in the credit quality of municipal issuers in such states, territories, and possessions. If MFS invests a significant percentage of the fund’s assets in a single state, territory, or possession, or a small number of states, territories, or possessions, these conditions will have a significant impact on the fund’s performance and the fund’s performance may be more volatile than the performance of more geographically-diversified funds. A prolonged increase

13

Table of Contents

Investment Objective, Principal Investment Strategies, Principal Investment Types and Principal Risks – continued

in unemployment or a significant decline in the local and/or national economies, such as the increase in unemployment and economic downturn caused by the COVID-19 pandemic and the costs associated with combatting this pandemic, could result in decreased tax revenues.

Prepayment/Extension Risk: Many types of debt instruments, including mortgage-backed securities, securitized instruments, certain corporate bonds, and municipal housing bonds, and certain derivatives, are subject to the risk of prepayment and/or extension. Prepayment occurs when unscheduled payments of principal are made or the instrument is called or redeemed prior to an instrument’s maturity. When interest rates decline, the instrument is called, or for other reasons, these debt instruments may be repaid more quickly than expected. As a result, the holder of the debt instrument may not be able to reinvest the proceeds at the same interest rate or on the same terms, reducing the potential for gain. When interest rates increase or for other reasons, these debt instruments may be repaid more slowly than expected, increasing the potential for loss. In addition, prepayment rates are difficult to predict and the potential impact of prepayment on the price of a debt instrument depends on the terms of the instrument.

Leveraging Risk: If the fund utilizes investment leverage, there can be no assurance that such a leveraging strategy will be successful during any period in which it is employed. The use of leverage is a speculative investment technique that results in greater volatility in the fund’s net asset value. To the extent that investments are purchased with the proceeds from the borrowings from a bank, the issuance of preferred shares, or the creation of tender option bonds, the fund’s net asset value will increase or decrease at a greater rate than a comparable unleveraged fund. If the investment income or gains earned from the investments purchased with the proceeds from the borrowings from a bank, the issuance of preferred shares, or the creation of tender option bonds, fails to cover the expenses of leveraging, the fund’s net asset value is likely to decrease more quickly than if the fund weren’t leveraged. In addition, the fund’s distributions could be reduced. The fund is currently required under the 1940 Act to maintain asset coverage of 200% on outstanding preferred shares and 300% on outstanding indebtedness. The fund may be required to sell a portion of its investments at a time when it may be disadvantageous to do so in order to redeem preferred shares or to reduce outstanding indebtedness to comply with asset coverage or other restrictions including those imposed by the 1940 Act and the rating agencies that rate the preferred shares. The expenses of leveraging are paid by the holders of common shares. Borrowings from a bank or preferred shares may have a stated maturity. If this leverage is not extended prior to maturity or replaced with the same or a different form of leverage, distributions to common shareholders may be decreased.

Certain transactions and investment strategies can result in leverage. Because movements in a fund’s share price generally correlate over time with the fund’s net asset value, the market price of a leveraged fund will also tend to be more volatile than that of a comparable unleveraged fund. The costs of an offering of preferred shares and/or borrowing program would be borne by shareholders.

Under the terms of any loan agreement or of a purchase agreement between the fund and the investor in the preferred shares, as the case may be, the fund may be required

14

Table of Contents

Investment Objective, Principal Investment Strategies, Principal Investment Types and Principal Risks – continued

to, among other things, limit its ability to pay distributions in certain circumstances, incur additional debts, engage in certain transactions, and pledge some or all of its assets. Such agreements could limit the fund’s ability to pursue its investment strategies. The terms of any loan agreement or purchase agreement could be more or less restrictive than those described.

Under guidelines generally required by a rating agency providing a rating for any preferred shares, the fund may be required to, among other things, maintain certain asset coverage requirements, restrict certain investments and practices, and adopt certain redemption requirements relating to preferred shares. Such guidelines or the terms of a purchase agreement between a fund and the investor in the preferred shares could limit the fund’s ability to pursue its investment strategies. The guidelines imposed with respect to preferred shares by a rating agency or an investor in the preferred shares could be more or less restrictive than those described.

In addition, the management fee paid to the Adviser is calculated based on net assets, including assets applicable to preferred shares, so the fee will be higher when leverage through the issuance of preferred shares is utilized, which may create an incentive for the Adviser to use leverage through the issuance of preferred shares.

Tender Option Bond Risk: The underlying municipal instruments held by the special purpose trust are sold or distributed in-kind by the trustee if specified events occur, such as a downgrade in the rating of the underlying municipal instruments, a specified decline in the value of the underlying municipal instruments, a failed remarketing of the floating rate certificates, the bankruptcy of the issuer of the underlying municipal instruments and, if the municipal instruments are insured, of both the issuer and the insurer, and the failure of the liquidity provider to pay in accordance with the trust agreement. In the event the trustee sells or distributes in-kind the underlying municipal instruments to pay amounts owed to the floating rate certificate holders, with the remaining amount paid to the inverse floater holders, the fund’s leverage will be reduced.

Derivatives Risk: Derivatives can be highly volatile and involve risks in addition to, and potentially greater than, the risks of the underlying indicator(s). Gains or losses from derivatives can be substantially greater than the derivatives’ original cost and can sometimes be unlimited. Derivatives can involve leverage. Derivatives can be complex instruments and can involve analysis and processing that differs from that required for other investment types used by the fund. If the value of a derivative does not change as expected relative to the value of the market or other indicator to which the derivative is intended to provide exposure, the derivative may not have the effect intended. Derivatives can also reduce the opportunity for gains or result in losses by offsetting positive returns in other investments. Derivatives can be less liquid than other types of investments.

Anti-Takeover Provisions Risk: The fund’s declaration of trust includes provisions that could limit the ability of other persons or entities to acquire control of the fund, to convert the fund to an open-end fund, or to change the composition of the fund’s Board of Trustees. These provisions could reduce the opportunities for shareholders to sell their Common shares at a premium over the then-current market price.

15

Table of Contents

Investment Objective, Principal Investment Strategies, Principal Investment Types and Principal Risks – continued

Market Discount/Premium Risk: The market price of Common shares of the fund will be based on factors such as the supply and demand for Common shares in the market and general market, economic, industry, political or regulatory conditions. Whether shareholders will realize gains or losses upon the sale of Common shares of the fund will depend on the market price of Common shares at the time of the sale, not on the fund’s net asset value. The market price may be lower or higher than the fund’s net asset value. Shares of closed-end funds frequently trade at a discount to their net asset value.

Counterparty and Third Party Risk: Transactions involving a counterparty other than the issuer of the instrument, including clearing organizations, or a third party responsible for servicing the instrument or effecting the transaction, are subject to the credit risk of the counterparty or third party, and to the counterparty’s or third party’s ability or willingness to perform in accordance with the terms of the transaction. If a counterparty or third party fails to meet its contractual obligations, goes bankrupt, or otherwise experiences a business interruption, the fund could miss investment opportunities, lose value on its investments, or otherwise hold investments it would prefer to sell, resulting in losses for the fund.

Liquidity Risk: Certain investments and types of investments are subject to restrictions on resale, may trade in the over-the-counter market, or may not have an active trading market due to adverse market, economic, industry, political, regulatory, geopolitical, environmental, public health, and other conditions, including investors trying to sell large quantities of a particular investment or type of investment, or lack of market makers or other buyers for a particular investment or type of investment. At times, all or a significant portion of a market may not have an active trading market. Without an active trading market, it may be difficult to value, and it may not be possible to sell, these investments and the fund could miss other investment opportunities and hold investments it would prefer to sell, resulting in losses for the fund. In addition, the fund may have to sell certain of these investments at prices or times that are not advantageous in order to meet redemptions or other cash needs, which could result in dilution of remaining investors’ interests in the fund. The prices of illiquid securities may be more volatile than more liquid investments.

Defensive Investing Risk: When MFS invests defensively, different factors could affect the fund’s performance and the fund may not achieve its investment objective. In addition, the defensive strategy may not work as intended.

Frequent Trading Risk: Frequent trading increases transaction costs, which may reduce the fund’s return. Frequent trading can also result in the realization of a higher percentage of short-term capital gains and a lower percentage of long-term capital gains as compared to a fund that trades less frequently. Because short-term capital gains are distributed as ordinary income, this would generally increase your tax liability unless you hold your shares through a tax-advantaged or tax-exempt vehicle.

16

Table of Contents

The following table is furnished in response to requirements of the Securities and Exchange Commission (the “SEC”). It is designed to, among other things, illustrate the effects of leverage through the use of senior securities, as that term is defined under Section 18 of the Investment Company Act of 1940 (the “1940 Act”), on common share total return, assuming investment portfolio total returns (consisting of income and changes in the value of investments held in a fund’s portfolio) of –10%, –5%, 0%, 5% and 10%. The table below assumes the fund’s continued use of leverage through Preferred Shares issued and outstanding (currently VMTPS) (“leverage”), as applicable, as of November 30, 2020, as a percentage of total assets (including assets attributable to such leverage), the estimated annual effective Preferred Share dividend rate (based on market conditions and other factors as of November 30, 2020), and the annual return that the fund’s portfolio would need to experience (net of expenses) in order to cover such costs. The information below does not reflect the fund’s possible use of certain other forms of economic leverage through the use of other instruments or transactions not considered to be senior securities under the 1940 Act, if any.

The assumed investment portfolio returns in the table below are hypothetical figures and are not necessarily indicative of the investment portfolio returns experienced or expected to be experienced by the fund. Your actual returns may be greater or less than those appearing below. In addition, the actual dividend rate payable on the Preferred Shares may vary frequently and may be significantly higher or lower than the rate used for the example below.

| VMTPS as a Percentage of Total Assets (Including Assets Attributable to Leverage) | 35.99% | |||

| Estimated Annual Effective VMTPS Dividend Rate | 1.26% | |||

| Annual Return Fund Portfolio Must Experience (net of expenses) to Cover Estimated Annual Effective VMTPS Dividend Rate | 0.45% |

| Assumed Return on Portfolio (Net of Expenses) | -10.00% | -5.00% | 0.00% | 5.00% | 10.00% | |||||||||||||||

| Corresponding Return to Common Shareholder | -16.33% | -8.52% | -0.71% | 7.10% | 14.91% |

Common share total return is composed of two elements – the distributions paid by the fund to holders of common shares (the amount of which is largely determined by the net investment income of the fund after paying dividend payments on any Preferred Shares issued by the fund and expenses on any other forms of leverage outstanding) and gains or losses on the value of the securities and other instruments the fund owns. As required by SEC rules, the table assumes that the fund is more likely to suffer capital losses than to enjoy capital appreciation. For example, to assume a total return of 0%, the fund must assume that the income it receives on its investments is entirely offset by losses in the value of those investments. The table reflects hypothetical performance of the fund’s portfolio and not the actual performance of the fund’s common shares, the value of which is determined by market forces and other factors.

Should the fund elect to add additional leverage to its portfolio, any benefits of such additional leverage cannot be fully achieved until the proceeds resulting from the use of such leverage have been received by the fund and invested in accordance with the fund’s investment objectives and policies. The fund’s willingness to use additional leverage, and the extent to which leverage is used at any time, will depend on many factors.

17

Table of Contents

| Portfolio Manager | Primary Role | Since | Title and Five Year History | |||

| Gary Lasman | Portfolio Manager |

2007 | Investment Officer of MFS; employed in the investment management area of MFS since 2002. | |||

| Geoffrey Schechter | Portfolio Manager |

2007 | Investment Officer of MFS; employed in the investment management area of MFS since 1993. | |||

18

Table of Contents

DIVIDEND REINVESTMENT AND CASH

PURCHASE PLAN

The fund offers a Dividend Reinvestment and Cash Purchase Plan (the “Plan”) that allows common shareholders to reinvest either all of the distributions paid by the fund or only the long-term capital gains. Generally, purchases are made at the market price unless that price exceeds the net asset value (the shares are trading at a premium). If the shares are trading at a premium, purchases will be made at a price of either the net asset value or 95% of the market price, whichever is greater. You can also buy shares on a quarterly basis in any amount $100 and over. The Plan Agent will purchase shares under the Cash Purchase Plan on the 15th of January, April, July, and October or shortly thereafter.

If shares are registered in your own name, new shareholders will automatically participate in the Plan, unless you have indicated that you do not wish to participate. If your shares are in the name of a brokerage firm, bank, or other nominee, you can ask the firm or nominee to participate in the Plan on your behalf. If the nominee does not offer the Plan, you may wish to request that your shares be re-registered in your own name so that you can participate. There is no service charge to reinvest distributions, nor are there brokerage charges for shares issued directly by the fund. However, when shares are bought on the New York Stock Exchange or otherwise on the open market, each participant pays a pro rata share of the transaction expenses, including commissions. The tax status of dividends and capital gain distributions does not change whether received in cash or reinvested in additional shares – the automatic reinvestment of distributions does not relieve you of any income tax that may be payable (or required to be withheld) on the distributions.

If your shares are held directly with the Plan Agent, you may withdraw from the Plan at any time by going to the Plan Agent’s Web site at www.computershare.com/investor, by calling 1-800-637-2304 any business day from 9 a.m. to 5 p.m. Eastern time or by writing to the Plan Agent at P.O. Box 505005, Louisville, KY 40233-5005. Please have available the name of the fund and your account number. For certain types of registrations, such as corporate accounts, instructions must be submitted in writing. Please call for additional details. When you withdraw from the Plan, you can receive the value of the reinvested shares in one of three ways: your full shares will be held in your account, the Plan Agent will sell your shares and send the proceeds to you, or you may transfer your full shares to your investment professional who can hold or sell them. Additionally, the Plan Agent will sell your fractional shares and send the proceeds to you.

If you have any questions or for further information or a copy of the Plan, contact the Plan Agent Computershare Trust Company, N.A. (the Transfer Agent for the fund) at 1-800-637-2304, at the Plan Agent’s Web site at www.computershare.com/investor, or by writing to the Plan Agent at P.O. Box 505005, Louisville, KY 40233-5005.

19

Table of Contents

11/30/20

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by jurisdiction.

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - 152.8% | ||||||||

| Alabama - 3.0% | ||||||||

| Birmingham, AL, Airport Authority Rev., BAM, 4%, 7/01/2040 | $ | 55,000 | $ | 64,240 | ||||

| Birmingham, AL, Special Care Facilities Financing Authority Rev. (Methodist Home for the Aging), 5.5%, 6/01/2030 | 85,000 | 89,099 | ||||||

| Birmingham, AL, Special Care Facilities Financing Authority Rev. (Methodist Home for the Aging), 5.75%, 6/01/2035 | 95,000 | 98,757 | ||||||

| Birmingham, AL, Special Care Facilities Financing Authority Rev. (Methodist Home for the Aging), 5.75%, 6/01/2045 | 130,000 | 132,820 | ||||||

| Birmingham, AL, Special Care Facilities Financing Authority Rev. (Methodist Home for the Aging), 6%, 6/01/2050 | 135,000 | 139,131 | ||||||

| Jefferson County, AL, Sewer Rev. Warrants, Capital Appreciation, Senior Lien, “B”, AGM, 0%, 10/01/2026 | 105,000 | 89,532 | ||||||

| Jefferson County, AL, Sewer Rev. Warrants, Capital Appreciation, Senior Lien, “B”, AGM, 0%, 10/01/2029 | 150,000 | 104,302 | ||||||

| Jefferson County, AL, Sewer Rev. Warrants, Capital Appreciation, Senior Lien, “B”, AGM, 0%, 10/01/2034 | 210,000 | 102,764 | ||||||

| Jefferson County, AL, Sewer Rev. Warrants, Capital Appreciation, Senior Lien, “B”, AGM, 0%, 10/01/2035 | 400,000 | 183,288 | ||||||

| Jefferson County, AL, Sewer Rev. Warrants, Subordinate Lien, “D”, 5%, 10/01/2021 | 75,000 | 77,780 | ||||||

| Jefferson County, AL, Sewer Rev. Warrants, Subordinate Lien, “D”, 5%, 10/01/2023 | 115,000 | 129,213 | ||||||

| Pell City, AL, Special Care Facilities Financing Authority Rev. (Noland Health Services, Inc.), 5%, 12/01/2039 | 175,000 | 180,743 | ||||||

| Tuscaloosa County, AL, Industrial Development Authority, Gulf Opportunity Zone (Hunt Refining Project), “A”, 4.5%, 5/01/2032 (n) | 500,000 | 554,215 | ||||||

| Tuscaloosa County, AL, Industrial Development Authority, Gulf Opportunity Zone (Hunt Refining Project), “A”, 5.25%, 5/01/2044 (n) | 1,360,000 | 1,527,906 | ||||||

| University of South Alabama, Facilities Rev., “A”, BAM, 5%, 4/01/2044 | 245,000 | 300,368 | ||||||

| University of South Alabama, Facilities Rev., “A”, BAM, 5%, 4/01/2049 | 150,000 | 182,512 | ||||||

|

|

|

|||||||

| $ | 3,956,670 | |||||||

| Arizona - 3.0% | ||||||||

| Arizona Industrial Development Authority Education Rev. (Academies of Math & Science), 4%, 7/01/2029 (n) | $ | 25,000 | $ | 26,607 | ||||

| Arizona Industrial Development Authority Education Rev. (Academies of Math & Science), 5%, 7/01/2039 (n) | 30,000 | 33,475 | ||||||

| Arizona Industrial Development Authority Education Rev. (Academies of Math & Science), 5%, 7/01/2049 (n) | 50,000 | 54,894 | ||||||

20

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Arizona - continued | ||||||||

| Arizona Industrial Development Authority Education Rev. (Academies of Math & Science), 5%, 7/01/2054 (n) | $ | 70,000 | $ | 76,528 | ||||

| Arizona Industrial Development Authority Education Rev. (Academies of Math & Science), “A”, 5%, 7/01/2038 | 15,000 | 17,927 | ||||||

| Arizona Industrial Development Authority Education Rev. (Academies of Math & Science), “A”, 5%, 7/01/2048 | 45,000 | 52,762 | ||||||

| Arizona Industrial Development Authority Education Rev. (Academies of Math & Science), “A”, 5%, 7/01/2052 | 55,000 | 64,300 | ||||||

| Arizona Industrial Development Authority Education Rev. (Academies of Math & Science), “B”, 5.5%, 7/01/2038 (n) | 45,000 | 50,571 | ||||||

| Arizona Industrial Development Authority Education Rev. (Academies of Math & Science), “B”, 5.625%, 7/01/2048 (n) | 90,000 | 100,547 | ||||||

| Arizona Industrial Development Authority Education Rev. (Academies of Math & Science), “B”, 5.75%, 7/01/2053 (n) | 135,000 | 151,346 | ||||||

| Arizona Industrial Development Authority Education Rev. (Basis Schools Projects), “D”, 5%, 7/01/2037 | 25,000 | 28,060 | ||||||

| Arizona Industrial Development Authority Education Rev. (Basis Schools Projects), “D”, 5%, 7/01/2047 | 30,000 | 33,106 | ||||||

| Arizona Industrial Development Authority Education Rev. (Basis Schools Projects), “D”, 5%, 7/01/2051 | 85,000 | 93,588 | ||||||

| Arizona Industrial Development Authority Education Rev. (Somerset Academy of Las Vegas - Lone Mountain Campus), “A”, 3.75%, 12/15/2029 (n) | 15,000 | 15,632 | ||||||

| Arizona Industrial Development Authority Education Rev. (Somerset Academy of Las Vegas - Lone Mountain Campus), “A”, 5%, 12/15/2039 (n) | 15,000 | 16,180 | ||||||

| Arizona Industrial Development Authority Education Rev. (Somerset Academy of Las Vegas - Lone Mountain Campus), “A”, 5%, 12/15/2049 (n) | 25,000 | 26,664 | ||||||

| Arizona Industrial Development Authority Senior Living Rev. (Great Lakes Senior Living Facilities LLC, First Tier), “A”, 5%, 1/01/2043 | 125,000 | 113,208 | ||||||

| Arizona Industrial Development Authority Senior Living Rev. (Great Lakes Senior Living Facilities LLC, First Tier), “A”, 5%, 1/01/2054 | 205,000 | 178,022 | ||||||

| Glendale, AZ, Industrial Development Authority Refunding Rev. (Terraces of Phoenix Project), “A”, 5%, 7/01/2048 | 55,000 | 56,549 | ||||||

| Phoenix, AZ, Industrial Development Authority Rev. (Guam Facilities Foundation, Inc.), 5.125%, 2/01/2034 | 345,000 | 354,253 | ||||||

| Phoenix, AZ, Industrial Development Authority Rev. (Guam Facilities Foundation, Inc.), 5.375%, 2/01/2041 | 220,000 | 225,856 | ||||||

| Phoenix, AZ, Industrial Development Authority, Education Facility Rev. (Basis Schools Projects), “A”, 5%, 7/01/2035 | 100,000 | 109,124 | ||||||

| Phoenix, AZ, Industrial Development Authority, Education Facility Rev. (Basis Schools Projects), “A”, 5%, 7/01/2035 | 35,000 | 38,193 | ||||||

21

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Arizona - continued | ||||||||

| Phoenix, AZ, Industrial Development Authority, Education Facility Rev. (Basis Schools Projects), “A”, 5%, 7/01/2045 | $ | 165,000 | $ | 177,411 | ||||

| Phoenix, AZ, Industrial Development Authority, Education Facility Rev. (Basis Schools Projects), “A”, 5%, 7/01/2046 | 90,000 | 96,730 | ||||||

| Phoenix, AZ, Industrial Development Authority, Education Facility Rev. (Great Hearts Academies Project), “A”, 5%, 7/01/2034 | 350,000 | 380,936 | ||||||

| Phoenix, AZ, Industrial Development Authority, Education Facility Rev. (Great Hearts Academies Project), “A”, 5%, 7/01/2044 | 220,000 | 236,559 | ||||||

| Phoenix, AZ, Industrial Development Authority, Education Facility Rev. (Legacy Traditional Schools Project), 6.5%, 7/01/2034 | 115,000 | 130,827 | ||||||

| Phoenix, AZ, Industrial Development Authority, Education Facility Rev. (Legacy Traditional Schools Project), 5%, 7/01/2035 | 155,000 | 166,455 | ||||||

| Phoenix, AZ, Industrial Development Authority, Education Facility Rev. (Legacy Traditional Schools Project), 6.75%, 7/01/2044 | 180,000 | 204,386 | ||||||

| Phoenix, AZ, Industrial Development Authority, Education Facility Rev. (Legacy Traditional Schools Project), 5%, 7/01/2045 | 170,000 | 179,743 | ||||||

| Phoenix, AZ, Industrial Development Authority, Student Housing Refunding Rev. (Downtown Phoenix Student Housing LLC-Arizona State University Project), “A”, 5%, 7/01/2042 | 80,000 | 85,236 | ||||||

| Pima County, AZ, Industrial Development Authority Education Facility Rev. (American Leadership Academy Project), 4.75%, 6/15/2037 | 150,000 | 152,352 | ||||||

| Tempe, AZ, Industrial Development Authority Rev. (Friendship Village), “A”, 6%, 12/01/2032 | 60,000 | 61,381 | ||||||

| Tempe, AZ, Industrial Development Authority Rev. (Friendship Village), “A”, 6.25%, 12/01/2042 | 180,000 | 183,832 | ||||||

| Tempe, AZ, Industrial Development Authority Rev. (Friendship Village), “A”, 6.25%, 12/01/2046 | 70,000 | 71,422 | ||||||

|

|

|

|||||||

| $ | 4,044,662 | |||||||

| Arkansas - 1.0% | ||||||||

| Arkansas Development Finance Authority, Charter School Capital Improvement Rev. (LISA Academy Project), 4%, 7/01/2028 | $ | 30,000 | $ | 30,928 | ||||

| Arkansas Development Finance Authority, Charter School Capital Improvement Rev. (LISA Academy Project), 4.5%, 7/01/2033 | 60,000 | 62,051 | ||||||

| Arkansas Development Finance Authority, Charter School Capital Improvement Rev. (LISA Academy Project), 4.5%, 7/01/2039 | 10,000 | 10,282 | ||||||

| Arkansas Development Finance Authority, Health Care Rev. (Baptist Memorial Health Care Corp.), “B-1”, 5%, 9/01/2044 | 200,000 | 242,568 | ||||||

| Arkansas Development Finance Authority, Hospital Rev. (Washington Regional Medical Center), “A”, 5%, 2/01/2035 | 30,000 | 33,432 | ||||||

| Arkansas Development Finance Authority, Hospital Rev. (Washington Regional Medical Center), “C”, 5%, 2/01/2033 | 50,000 | 55,877 | ||||||

| Arkansas Development Finance Authority, Tobacco Settlement Rev. (Cancer Research Center Project), Capital Appreciation, AAC, 0%, 7/01/2046 | 485,000 | 230,317 | ||||||

22

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Arkansas - continued | ||||||||

| Pulaski County, AR, Public Facilities Board, Healthcare Rev. (Baptist Health), 5%, 12/01/2039 | $ | 505,000 | $ | 564,610 | ||||

| Pulaski County, AR, Public Facilities Board, Healthcare Rev. (Baptist Health), 5%, 12/01/2042 | 125,000 | 139,155 | ||||||

|

|

|

|||||||

| $ | 1,369,220 | |||||||

| California - 12.3% | ||||||||

| Beverly Hills, CA, Unified School District (Election of 2008), Capital Appreciation, 0%, 8/01/2029 | $ | 2,195,000 | $ | 1,996,550 | ||||

| Beverly Hills, CA, Unified School District (Election of 2008), Capital Appreciation, 0%, 8/01/2031 | 275,000 | 238,964 | ||||||

| Beverly Hills, CA, Unified School District (Election of 2008), Capital Appreciation, 0%, 8/01/2032 | 280,000 | 237,059 | ||||||

| Beverly Hills, CA, Unified School District (Election of 2008), Capital Appreciation, 0%, 8/01/2033 | 560,000 | 462,431 | ||||||

| California County Tobacco Securitization Agency Settlement (Los Angeles County Securitization Corp.), “A”, 4%, 6/01/2040 | 40,000 | 47,078 | ||||||

| California Department of Water Resources, Center Valley Project Rev., “AJ”, 5%, 12/01/2035 (Prerefunded 12/01/2021) | 1,010,000 | 1,058,692 | ||||||

| California Educational Facilities Authority Rev. (Chapman University), 5%, 4/01/2031 | 145,000 | 146,937 | ||||||

| California M-S-R Energy Authority Gas Rev., “A”, 7%, 11/01/2034 | 155,000 | 247,338 | ||||||

| California Municipal Finance Authority Rev. (Community Medical Centers), “A”, 5%, 2/01/2042 | 85,000 | 98,724 | ||||||

| California Municipal Finance Authority Rev. (NorthBay Healthcare Group), 5%, 11/01/2035 | 35,000 | 38,449 | ||||||

| California Municipal Finance Authority Rev. (NorthBay Healthcare Group), “A”, 5.25%, 11/01/2036 | 85,000 | 98,654 | ||||||

| California Municipal Finance Authority Rev. (NorthBay Healthcare Group), “A”, 5.25%, 11/01/2041 | 80,000 | 91,902 | ||||||

| California Municipal Finance Authority Rev. (NorthBay Healthcare Group), “A”, 5.25%, 11/01/2047 | 15,000 | 17,085 | ||||||

| California Municipal Finance Authority Rev. (William Jessup University), 5%, 8/01/2039 | 145,000 | 152,201 | ||||||

| California Municipal Finance Authority, Charter School Lease Rev. (Palmdale Aerospace Academy Project), “A”, 3.875%, 7/01/2028 (n) | 100,000 | 104,920 | ||||||

| California Municipal Finance Authority, Charter School Lease Rev. (Palmdale Aerospace Academy Project), “A”, 5%, 7/01/2049 (n) | 100,000 | 109,769 | ||||||

| California Pollution Control Financing Authority, Solid Waste Disposal Rev. (CalPlant I Project), 8%, 7/01/2039 (a)(d)(z) | 385,000 | 250,250 | ||||||

| California Pollution Control Financing Authority, Solid Waste Disposal Subordinate Rev. (CalPlant I Project), 7.5%, 12/01/2039 (a)(d)(z) | 500,000 | 155,000 | ||||||

| California Public Works Board Lease Rev., Department of Corrections and Rehabilitation (Various Correctional Facilities), “A”, 5%, 9/01/2033 | 1,025,000 | 1,187,770 | ||||||

23

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| California - continued | ||||||||

| California School Finance Authority, School Facility Rev. (Alliance for College-Ready Public Schools Projects), “A”, 5%, 7/01/2030 | $ | 35,000 | $ | 40,186 | ||||

| California School Finance Authority, School Facility Rev. (Alliance for College-Ready Public Schools Projects), “A”, 5%, 7/01/2045 | 100,000 | 112,133 | ||||||

| California School Finance Authority, School Facility Rev. (ICEF View Park Elementary and Middle Schools), “A”, 5.875%, 10/01/2044 | 115,000 | 124,835 | ||||||

| California Statewide Communities Development Authority Rev. (899 Charleston Project), “A”, 5.25%, 11/01/2044 (n) | 40,000 | 41,383 | ||||||

| California Statewide Communities Development Authority Rev. (899 Charleston Project), “A”, 5.375%, 11/01/2049 (n) | 55,000 | 57,047 | ||||||

| California Statewide Communities Development Authority Rev. (California Baptist University), “A”, 6.125%, 11/01/2033 | 100,000 | 109,415 | ||||||

| California Statewide Communities Development Authority Rev. (California Baptist University), “A”, 5%, 11/01/2041 | 100,000 | 107,485 | ||||||

| California Statewide Communities Development Authority Rev. (Lancer Plaza Project), 5.625%, 11/01/2033 | 110,000 | 118,060 | ||||||

| California Statewide Communities Development Authority Rev. (Loma Linda University Medical Center), “A”, 5.25%, 12/01/2034 | 195,000 | 215,615 | ||||||

| California Statewide Communities Development Authority Rev. (Loma Linda University Medical Center), “A”, 5.25%, 12/01/2044 | 390,000 | 423,856 | ||||||

| California Statewide Communities Development Authority Rev. (Loma Linda University Medical Center), “A”, 5%, 12/01/2046 (n) | 295,000 | 323,503 | ||||||

| California Statewide Communities Development Authority Rev. (Loma Linda University Medical Center), “A”, 5.25%, 12/01/2056 | 230,000 | 256,245 | ||||||

| California Statewide Communities Development Authority, College Housing Rev. (NCCD-Hooper Street LLC College of the Arts Project), 5.25%, 7/01/2049 | 145,000 | 143,150 | ||||||

| Chula Vista, CA, Industrial Development Rev. (San Diego Gas & Electric Co.), “E”, 5.875%, 1/01/2034 | 245,000 | 245,909 | ||||||

| Downey, CA, Unified School District (Election of 2014), “B”, 4%, 8/01/2041 | 1,585,000 | 1,875,372 | ||||||

| Golden State, CA, Tobacco Securitization Corp., Tobacco Settlement Rev., “A”, 3.5%, 6/01/2036 | 95,000 | 96,757 | ||||||

| Golden State, CA, Tobacco Securitization Corp., Tobacco Settlement Rev., “A”, 5.25%, 6/01/2047 | 140,000 | 145,120 | ||||||

| Hastings Campus Housing Finance Authority Rev., “A”, 5%, 7/01/2061 (n) | 465,000 | 485,865 | ||||||

| Hastings Campus Housing Finance Authority Rev., Convertible Capital Appreciation, “B”, 0% to 7/01/2035, 6.75% to 7/01/2061 (n) | 470,000 | 188,616 | ||||||

| Hawthorne, CA, School District (Election of 2018), “A”, BAM, 4%, 8/01/2047 | 710,000 | 811,132 | ||||||

| Jurupa, CA, Public Financing Authority, Special Tax Rev., “A”, 5%, 9/01/2042 | 170,000 | 191,026 | ||||||

24

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| California - continued | ||||||||

| La Verne, CA, Brethren Hillcrest Homes, COP, 5%, 5/15/2036 (Prerefunded 5/15/2022) | $ | 50,000 | $ | 53,932 | ||||

| Long Beach, CA, Marina Rev. (Alamitos Bay Marina Project), 5%, 5/15/2035 | 30,000 | 33,655 | ||||||

| Los Angeles County, CA, Regional Financing Authority Rev. (Montecedro, Inc. Project), “A”, CALHF, 5%, 11/15/2034 | 35,000 | 37,866 | ||||||

| Los Angeles County, CA, Regional Financing Authority Rev. (Montecedro, Inc. Project), “A”, CALHF, 5%, 11/15/2044 | 65,000 | 69,909 | ||||||

| Morongo Band of Mission Indians California Rev., “B”, 5%, 10/01/2042 (n) | 150,000 | 165,288 | ||||||

| San Francisco, CA, City & County Airports Commission, International Airport Rev., “A”, 5%, 1/01/2047 | 200,000 | 241,618 | ||||||

| San Francisco, CA, City & County Redevelopment Successor Agency, Tax Allocation (Mission Bay South Redevelopment Project), “A”, 5%, 8/01/2043 | 25,000 | 27,980 | ||||||

| State of California, 5.25%, 10/01/2028 | 335,000 | 348,745 | ||||||

| State of California, 5.25%, 9/01/2030 | 790,000 | 819,040 | ||||||

| Transbay Joint Powers Authority, CA, Senior Tax Allocation, “A”, 5%, 10/01/2049 | 75,000 | 93,174 | ||||||

| Whittier, CA, Health Facility Rev. (PIH Health), 5%, 6/01/2044 | 335,000 | 378,557 | ||||||

| Yorba Linda, CA, Redevelopment Agency, Tax Allocation Rev., Capital Appreciation, “A”, NATL, 0%, 9/01/2024 | 1,325,000 | 1,279,301 | ||||||

|

|

|

|||||||

| $ | 16,401,548 | |||||||

| Colorado - 6.0% | ||||||||

| Arvada, CO, Vauxmont Metropolitan District Rev., AGM, 5%, 12/15/2030 | $ | 14,000 | $ | 16,405 | ||||

| Arvada, CO, Vauxmont Metropolitan District Rev., AGM, 5%, 12/01/2050 | 61,000 | 75,187 | ||||||

| Colorado Educational & Cultural Facilities Authority Rev. (Classical Academy Project), 5%, 12/01/2031 | 65,000 | 73,594 | ||||||

| Colorado Educational & Cultural Facilities Authority Rev. (Classical Academy Project), “A”, 5%, 12/01/2038 | 75,000 | 83,901 | ||||||

| Colorado Educational & Cultural Facilities Authority Rev. (Peak to Peak Charter School Project), 5%, 8/15/2030 | 40,000 | 45,135 | ||||||

| Colorado Educational & Cultural Facilities Authority Rev. (Peak to Peak Charter School Project), 5%, 8/15/2034 | 35,000 | 39,140 | ||||||

| Colorado Educational & Cultural Facilities Authority, Charter School Refunding and Improvement Rev. (American Academy Project), 5%, 12/01/2055 | 950,000 | 1,183,311 | ||||||

| Colorado Educational & Cultural Facilities Authority, Charter School Refunding and Improvement Rev. (Prospect Ridge Academy Project), “A”, 5%, 3/15/2055 | 455,000 | 558,594 | ||||||

25

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Colorado - continued | ||||||||

| Colorado Health Facilities Authority Rev. (American Baptist Homes), 8%, 8/01/2043 | $ | 375,000 | $ | 398,711 | ||||

| Colorado Health Facilities Authority Rev. (CommonSpirit Health), “A-2”, 4%, 8/01/2044 | 140,000 | 156,038 | ||||||

| Colorado Health Facilities Authority Rev. (Evangelical Lutheran Good Samaritan Society), 5.625%, 6/01/2043 (Prerefunded 6/01/2023) | 100,000 | 113,319 | ||||||

| Colorado Health Facilities Authority, Hospital Rev. (AdventHealth Obligated Group), “A”, 4%, 11/15/2038 | 2,360,000 | 2,776,611 | ||||||

| Colorado Regional Transportation District, Private Activity Rev. (Denver Transportation Partners), 6%, 1/15/2034 | 630,000 | 632,117 | ||||||

| Colorado Regional Transportation District, Private Activity Rev. (Denver Transportation Partners), 6%, 1/15/2041 | 300,000 | 301,008 | ||||||

| Denver, CO, Broadway Station Metropolitan District No. 2, “A”, 5.125%, 12/01/2048 | 500,000 | 525,390 | ||||||

| Denver, CO, Convention Center Hotel Authority Rev., 5%, 12/01/2035 | 60,000 | 67,195 | ||||||

| Denver, CO, Convention Center Hotel Authority Rev., 5%, 12/01/2036 | 40,000 | 44,686 | ||||||

| Denver, CO, Convention Center Hotel Authority Rev., 5%, 12/01/2040 | 105,000 | 116,427 | ||||||

| Denver, CO, Health & Hospital Authority Rev. (550 Acoma, Inc.), COP, 5%, 12/01/2048 | 75,000 | 87,870 | ||||||

| Denver, CO, Health & Hospital Authority Rev., “A”, 4%, 12/01/2040 | 205,000 | 226,792 | ||||||

| Denver, CO, Health & Hospital Authority Rev., “A”, 5.25%, 12/01/2045 | 100,000 | 107,404 | ||||||

| Park Creek Metropolitan District, CO, Senior Limited Property Tax Supported Rev., “A”, NATL, 5%, 12/01/2045 | 370,000 | 427,494 | ||||||

|

|

|

|||||||

| $ | 8,056,329 | |||||||

| Connecticut - 0.8% | ||||||||

| Connecticut Health & Educational Facilities Authority Rev. (Griffin Hospital), “G-1”, 5%, 7/01/2050 (n) | $ | 120,000 | $ | 129,576 | ||||

| Hartford County, CT, Metropolitan District, “C”, AGM, 5%, 11/01/2030 | 185,000 | 227,443 | ||||||

| Hartford County, CT, Metropolitan District, “C”, AGM, 5%, 11/01/2031 | 160,000 | 195,883 | ||||||

| Mohegan Tribal Finance Authority, CT, Economic Development Bonds, 7%, 2/01/2045 (n) | 540,000 | 533,115 | ||||||

|

|

|

|||||||

| $ | 1,086,017 | |||||||

| Delaware - 0.6% | ||||||||

| Delaware Economic Development Authority Rev. (Delaware Military Academy, Inc. Project), 4.625%, 9/01/2034 | $ | 95,000 | $ | 100,632 | ||||

| Delaware Economic Development Authority Rev. (Delaware Military Academy, Inc. Project), 5%, 9/01/2044 | 95,000 | 100,772 | ||||||

| Delaware Economic Development Authority Rev. (Delaware Military Academy, Inc. Project), 5%, 9/01/2049 | 110,000 | 116,408 | ||||||

26

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Delaware - continued | ||||||||

| Delaware Health Facilities Authority Rev. (Beebe Medical Center Project), 5%, 6/01/2043 | $ | 185,000 | $ | 220,857 | ||||

| Delaware Health Facilities Authority Rev. (Beebe Medical Center Project), 5%, 6/01/2048 | 90,000 | 106,788 | ||||||

| Kent County, DE, Student Housing and Dining Facility Rev. (CHF-Dover LLC-Delaware State University Project), “A”, 5%, 7/01/2058 | 175,000 | 165,387 | ||||||

|

|

|

|||||||

| $ | 810,844 | |||||||

| District of Columbia - 1.5% | ||||||||

| District of Columbia Rev. (Rocketship D.C.), “A”, 5%, 6/01/2056 (n) | $ | 250,000 | $ | 261,847 | ||||

| District of Columbia Student Dormitory Rev. (Provident Group - Howard Properties LLC), 5%, 10/01/2030 | 145,000 | 139,564 | ||||||

| District of Columbia Student Dormitory Rev. (Provident Group - Howard Properties LLC), 5%, 10/01/2035 | 670,000 | 627,884 | ||||||

| District of Columbia Student Dormitory Rev. (Provident Group - Howard Properties LLC), 5%, 10/01/2045 | 775,000 | 705,250 | ||||||

| Metropolitan Washington, D.C., Airport Authority, Toll Road Subordinate Lien Refunding Rev. (Dulles Metrorail and Capital Improvement Project), “B”, AGM, 4%, 10/01/2053 | 255,000 | 288,104 | ||||||

|

|

|

|||||||

| $ | 2,022,649 | |||||||

| Florida - 7.8% | ||||||||