Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04992

MFS HIGH YIELD MUNICIPAL TRUST

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199

(Address of principal executive offices) (Zip code)

Susan S. Newton

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: November 30

Date of reporting period: November 30, 2014

Table of Contents

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Table of Contents

ANNUAL REPORT

November 30, 2014

MFS® HIGH YIELD MUNICIPAL TRUST

CMU-ANN

Table of Contents

MFS® HIGH YIELD MUNICIPAL TRUST

New York Stock Exchange Symbol: CMU

NOT FDIC INSURED Ÿ MAY LOSE VALUE Ÿ NO BANK GUARANTEE

Table of Contents

Dear Shareholders:

The U.S. economy stands on firmer ground than the rest of the world, expanding at an annualized pace of more than 3%. The labor market has regained momentum,

consumer confidence has improved and gasoline prices have fallen sharply. Accordingly, expectations are strong for continued economic recovery into 2015.

In contrast, all other major economic regions are struggling. The eurozone economy is barely expanding, and deflation is a growing concern. The European Central Bank (ECB) has attempted to stimulate the region’s economy, and many market participants believe the ECB will introduce large-scale asset purchases.

Despite Japan’s efforts to strengthen its economy, its sales tax increase last spring tipped the country into a technical recession,

leading to additional monetary stimulus from the Bank of Japan. The Chinese economy is slowing down, and its growth rate will likely continue to fall as it transitions to a more sustainable basis.

As always, active risk management is integral to how we at MFS® manage your investments. We use a collaborative process, sharing insights across asset classes, regions and economic sectors. Our global investment team uses a diversified, multidisciplined, long-term approach.

Applying proven principles, such as asset allocation and diversification, can best serve investors over the long term. We are confident that this approach can help you as you work with your financial advisors to reach your goals in the years ahead.

Respectfully,

Robert J. Manning

Chairman

MFS Investment Management

January 15, 2015

The opinions expressed in this letter are subject to change and may not be relied upon for investment advice. No forecasts can be guaranteed.

1

Table of Contents

2

Table of Contents

Portfolio Composition – continued

| (a) | For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). Securities rated BBB or higher are considered investment grade. All ratings are subject to change. Not Rated includes fixed income securities, including fixed income futures contracts, which have not been rated by any rating agency. The fund may not hold all of these instruments. The fund is not rated by these agencies. |

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value due to the interest rate move. |

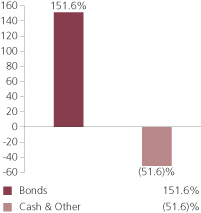

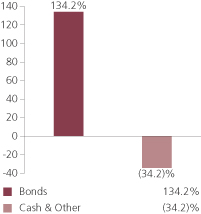

| (i) | For purposes of this presentation, the components include the value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may be negative from time to time. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than value. The bond component will include any accrued interest amounts. |

| (j) | For the purpose of managing the fund’s duration, the fund holds short treasury futures with a bond equivalent exposure of (19.7)%, which reduce the fund’s interest rate exposure but not its credit exposure. |

| (m) | In determining an instrument’s effective maturity for purposes of calculating the fund’s dollar-weighted average effective maturity, MFS uses the instrument’s stated maturity or, if applicable, an earlier date on which MFS believes it is probable that a maturity-shortening device (such as a put, pre-refunding or prepayment) will cause the instrument to be repaid. Such an earlier date can be substantially shorter than the instrument’s stated maturity. |

From time to time Cash & Other may be negative due to the aggregate liquidation value of auction rate preferred shares and variable rate municipal term preferred shares, timing of cash receipts, and/or equivalent exposure from any derivative holdings.

Where the fund holds convertible bonds, these are treated as part of the equity portion of the portfolio.

Cash & Other can include cash, other assets less liabilities, offsets to derivative positions, and short-term securities.

Percentages are based on net assets applicable to common shares as of 11/30/14.

The portfolio is actively managed and current holdings may be different.

3

Table of Contents

Summary of Results

MFS High Yield Municipal Trust (“fund”) is a closed-end fund. The fund’s investment objective is to seek high current income exempt from federal income tax, but may also consider capital appreciation. The fund invests, under normal market conditions, at least 80% of its net assets, including assets attributable to preferred shares and borrowings for investment purposes, in tax-exempt bonds and tax-exempt notes.

For the twelve months ended November 30, 2014, shares of the MFS High Yield Municipal Trust provided a total return of 16.42%, at net asset value and a total return of 16.03%, at market value. This compares with a return of 8.23% for the fund’s benchmark, the Barclays Municipal Bond Index.

The performance commentary below is based on the net asset value performance of the fund which reflects the performance of the underlying pool of assets held by the fund. The total return at market value represents the return earned by owners of the shares of the fund which are traded publicly on the exchange.

Market Environment

Prior to the reporting period, the decision by the US Federal Reserve (“Fed”) to postpone the tapering of its quantitative easing (“QE”) program surprised markets. Favorable market reactions were tempered, however, by tense negotiations over US fiscal policy which resulted in a 16-day partial shutdown of the federal government (from October 1 through October 16, 2013) and a short-term extension in the debt ceiling. The volatility was short-lived, however, as an extension of budget and debt ceiling deadlines allowed the government to re-open, and subsequent economic data reflected moderate but resilient US growth. Also well-received was the decision by the European Central Bank (“ECB”) to cut its policy rate as inflation pressures waned in the region. In addition, equity investors appeared to have concluded that there would be no major change in US monetary policy as a result of the nomination of Janet Yellen as the new Fed Chair for a term beginning in early 2014 and that tapering would have no major impact on the trajectory.

A generally risk-friendly, carry trade environment persisted from February 2014 until mid-year. While geopolitical tensions flared in the Middle East and Russia/Ukraine, any market setbacks were short-lived, as improving economic growth in the US coupled with prospects for easier monetary policy in regions with slowing growth such as Japan, Europe and China, supported risk assets. For example, the ECB cut policy interest rates into negative territory and, by the end of the period, expectations were for additional rate cuts and the announcement for non-conventional easing measures. Similarly, the Bank of Japan surprised markets late in the period with fresh stimulus measures given lackluster growth trends. The related decline in developed market government bond yields and credit spreads were also supportive for equity markets. At the end of the period, the US equity market was trading at all-time highs. However, credit markets did not fare as well in the second half of 2014, particularly US high yield and emerging market debt. The higher weightings of oil and gas credits in these asset classes resulted in widening spreads and increased volatility as oil prices began to decline in an accelerated fashion in the fourth quarter.

4

Table of Contents

Management Review – continued

The fortunes of the municipal bond market reversed course over the twelve months ended November 30, 2014. The beginning of the period was marked by a continuation of mutual fund outflows driven by “Taper Talk” (widespread speculation regarding the start of the Fed’s QE program pushed Treasury yields sharply higher in May and June of 2013). Investor flight through December 2013 appeared to have been fueled by comparatively weak performance in the asset class, the threat of higher Treasury yields, and worries about troubled high-profile issuers such as Detroit and Puerto Rico. Fund flows turned positive in January, however, and the remainder of the period was marked by steady, moderate inflows as the strong relative performance of municipal bonds appeared to have drawn investors back to the sector. On the supply side, new bond issuance proved manageable, supporting a supply/demand dynamic favorable for municipal bond prices. Concerns about the negative impact of higher interest rates diminished as Treasury yields fell on disappointing first quarter economic growth and generally trended lower over the course of the year as slowing global growth and broadly disinflationary developments – including a precipitous drop in oil prices – caused the market to push out its timetable for the first Fed Funds rate hike.

For the period, Treasury yields at the front end of the curve rose slightly, while longer yields declined. This was mirrored in the performance of the municipal bond market, where longer-maturity bonds solidly outperformed shorter maturities. Municipal credit spreads tightened significantly, enabling higher-yielding bonds to outperform higher-quality debt. At the end of the period, municipal bonds appeared fairly valued compared to Treasuries, but yields remained quite low versus historical levels.

Municipal credit fundamentals generally improved over the period as state and local tax receipts benefited from a fifth year of economic expansion. Headlines were mixed, however, with Puerto Rico and Detroit sharing attention with underfunded public pension liabilities. Optimism soared on Puerto Rico’s successful bond deal in mid-March, but faltered at the end of the second quarter on the passage of legislation paving the way for potential restructuring of the Commonwealth’s public corporations. Later, a forbearance agreement for the island’s electric utility secured more time to address pressing funding issues. Detroit’s bankruptcy proceedings came to a close with both pensioners and bondholders impaired, reinforcing concerns about the priority assigned to general obligation debt.

Contributors to Performance

The fund’s greater exposure to “BBB” and “B” rated (r) securities contributed to relative performance as these credit quality segments outperformed the market during the reporting period. Additionally, strong security selection in healthcare and education sectors also benefited relative returns.

The fund employs leverage which has been created through the issuance of auction rate preferred shares and variable rate municipal term preferred shares. To the extent that investments are purchased through the use of leverage, the fund’s net asset value will increase or decrease at a greater rate than a comparable unleveraged fund. During the reporting period, the fund’s leverage had a positive impact on performance.

5

Table of Contents

Management Review – continued

Detractors from Performance

Shorter relative duration (d), especially within “AAA” rated (r) securities weighed on relative performance.

Respectfully,

| Gary Lasman | Geoffrey Schechter | |

| Portfolio Manager | Portfolio Manager |

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value. |

| (r) | Bonds rated “BBB”, “Baa”, or higher are considered investment grade; bonds rated “BB”, “Ba”, or below are considered non-investment grade. The source for bond quality ratings is Moody’s Investors Service, Standard & Poor’s and Fitch, Inc. and are applied using the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). For securities which are not rated by any of the three agencies, the security is considered Not Rated. |

The views expressed in this report are those of the portfolio managers only through the end of the period of the report as stated on the cover and do not necessarily reflect the views of MFS or any other person in the MFS organization. These views are subject to change at any time based on market or other conditions, and MFS disclaims any responsibility to update such views. These views may not be relied upon as investment advice or an indication of trading intent on behalf of any MFS portfolio. References to specific securities are not recommendations of such securities, and may not be representative of any MFS portfolio’s current or future investments.

6

Table of Contents

PERFORMANCE SUMMARY THROUGH 11/30/14

The following chart represents the fund’s historical performance in comparison to its benchmark(s). Investment return and principal value will fluctuate, and shares, when sold, may be worth more or less than their original cost; current performance may be lower or higher than quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on fund distributions or the sale of fund shares. Performance data shown represents past performance and is no guarantee of future results.

Price Summary for MFS High Yield Municipal Trust

| Date | Price | |||||||||||

|

Year Ended 11/30/14 |

Net Asset Value | 11/30/14 | $4.85 | |||||||||

| 11/30/13 | $4.45 | |||||||||||

| New York Stock Exchange Price | 11/30/14 | $4.41 | ||||||||||

| 11/07/14 | (high) (t) | $4.58 | ||||||||||

| 12/05/13 | (low) (t) | $3.96 | ||||||||||

| 11/30/13 | $4.06 | |||||||||||

Total Returns vs Benchmark

|

Year Ended 11/30/14 |

MFS High Yield Municipal Trust at | |||||||||

| New York Stock Exchange Price (r) |

16.03% | |||||||||

| Net Asset Value (r) |

16.42% | |||||||||

| Barclays Municipal Bond Index (f) | 8.23% | |||||||||

| (f) | Source: FactSet Research Systems Inc. |

| (r) | Includes reinvestment of dividends and capital gain distributions. |

| (t) | For the period December 1, 2013 through November 30, 2014. |

Benchmark Definition

Barclays Municipal Bond Index – a market capitalization-weighted index that measures the performance of the tax-exempt bond market.

It is not possible to invest directly in an index.

Notes to Performance Summary

The fund’s shares may trade at a discount or premium to net asset value. When fund shares trade at a premium, buyers pay more than the net asset value underlying fund shares, and shares purchased at a premium would receive less than the amount paid for them in the event of the fund’s liquidation.

7

Table of Contents

Performance Summary – continued

The fund’s monthly distributions may include a return of capital to shareholders to the extent that distributions are in excess of the fund’s net investment income and net capital gains, determined in accordance with federal income tax regulations. Distributions that are treated for federal income tax purposes as a return of capital will reduce each shareholder’s basis in his or her shares and, to the extent the return of capital exceeds such basis, will be treated as gain to the shareholder from a sale of shares. Returns of shareholder capital have the effect of reducing the fund’s assets and increasing the fund’s expense ratio.

Net asset values and performance results based on net asset value per share do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from amounts reported in the Statement of Assets and Liabilities or the Financial Highlights.

From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower.

In accordance with Section 23(c) of the Investment Company Act of 1940, the fund hereby gives notice that it may from time to time repurchase common and/or preferred shares of the fund in the open market at the option of the Board of Trustees and on such terms as the Trustees shall determine.

8

Table of Contents

| Portfolio Manager | Primary Role | Since | Title and Five Year History | |||

| Gary Lasman | Portfolio Manager |

2007 | Investment Officer of MFS; employed in the investment management area of MFS since 2002. | |||

| Geoffrey Schechter | Portfolio Manager |

2007 | Investment Officer of MFS; employed in the investment management area of MFS since 1993. | |||

9

Table of Contents

DIVIDEND REINVESTMENT AND CASH PURCHASE PLAN

The fund offers a Dividend Reinvestment and Cash Purchase Plan (the “Plan”) that allows common shareholders to reinvest either all of the distributions paid by the fund or only the long-term capital gains. Generally, purchases are made at the market price unless that price exceeds the net asset value (the shares are trading at a premium). If the shares are trading at a premium, purchases will be made at a price of either the net asset value or 95% of the market price, whichever is greater. You can also buy shares on a quarterly basis in any amount $100 and over. The Plan Agent will purchase shares under the Cash Purchase Plan on the 15th of January, April, July, and October or shortly thereafter.

If shares are registered in your own name, new shareholders will automatically participate in the Plan, unless you have indicated that you do not wish to participate. If your shares are in the name of a brokerage firm, bank, or other nominee, you can ask the firm or nominee to participate in the Plan on your behalf. If the nominee does not offer the Plan, you may wish to request that your shares be re-registered in your own name so that you can participate. There is no service charge to reinvest distributions, nor are there brokerage charges for shares issued directly by the fund. However, when shares are bought on the New York Stock Exchange or otherwise on the open market, each participant pays a pro rata share of the transaction expenses, including commissions. Dividends and capital gains distributions are taxable whether received in cash or reinvested in additional shares – the automatic reinvestment of distributions does not relieve you of any income tax that may be payable (or required to be withheld) on the distributions.

You may withdraw from the Plan at any time by going to the Plan Agent’s website at www.computershare.com, by calling 1-800-637-2304 any business day from 9 a.m. to 5 p.m. Eastern time or by writing to the Plan Agent at P.O. Box 43078, Providence, RI 02940 - 3078. Please have available the name of the fund and your account number. For certain types of registrations, such as corporate accounts, instructions must be submitted in writing. Please call for additional details. When you withdraw from the Plan, you can receive the value of the reinvested shares in one of three ways: your full shares will be held in your account, the Plan Agent will sell your shares and send the proceeds to you, or you may transfer your full shares to your investment professional who can hold or sell them. Additionally, the Plan Agent will sell your fractional shares and send the proceeds to you.

If you have any questions or for further information or a copy of the Plan, contact the Plan Agent Computershare Trust Company, N.A. (the Transfer Agent for the fund) at 1-800-637-2304, at the Plan Agent’s website at www.computershare.com, or by writing to the Plan Agent at P.O. Box 43078, Providence, RI 02940 - 3078.

10

Table of Contents

11/30/14

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by jurisdiction.

| Municipal Bonds - 151.6% | ||||||||

| Issuer | Shares/Par | Value ($) | ||||||

| Alabama - 1.9% | ||||||||

| Alabama Incentives Financing Authority Special Obligation, “A”, 5%, 9/01/37 | $ | 65,000 | $ | 72,494 | ||||

| Birmingham, AL, Waterworks Board Water Rev., “A”, ASSD GTY, 5.125%, 1/01/34 | 595,000 | 661,283 | ||||||

| Cullman County, AL, Health Care Authority (Cullman Regional Medical Center), “A”, 6.75%, 2/01/29 | 60,000 | 65,781 | ||||||

| Jefferson County, AL, Sewer Rev. Warrants, Capital Appreciation, Senior Lien, “B”, AGM, 0%, 10/01/25 | 10,000 | 6,209 | ||||||

| Jefferson County, AL, Sewer Rev. Warrants, Capital Appreciation, Senior Lien, “B”, AGM, 0%, 10/01/26 | 105,000 | 61,672 | ||||||

| Jefferson County, AL, Sewer Rev. Warrants, Capital Appreciation, Senior Lien, “B”, AGM, 0%, 10/01/29 | 150,000 | 72,059 | ||||||

| Jefferson County, AL, Sewer Rev. Warrants, Capital Appreciation, Senior Lien, “B”, AGM, 0%, 10/01/34 | 210,000 | 68,901 | ||||||

| Jefferson County, AL, Sewer Rev. Warrants, Capital Appreciation, Senior Lien, “B”, AGM, 0%, 10/01/35 | 400,000 | 122,432 | ||||||

| Jefferson County, AL, Sewer Rev. Warrants, Subordinate Lien, “D”, 5%, 10/01/15 | 20,000 | 20,563 | ||||||

| Jefferson County, AL, Sewer Rev. Warrants, Subordinate Lien, “D”, 5%, 10/01/16 | 50,000 | 52,910 | ||||||

| Jefferson County, AL, Sewer Rev. Warrants, Subordinate Lien, “D”, 5%, 10/01/17 | 65,000 | 70,427 | ||||||

| Jefferson County, AL, Sewer Rev. Warrants, Subordinate Lien, “D”, 5%, 10/01/18 | 70,000 | 77,209 | ||||||

| Jefferson County, AL, Sewer Rev. Warrants, Subordinate Lien, “D”, 5%, 10/01/21 | 75,000 | 84,491 | ||||||

| Jefferson County, AL, Sewer Rev. Warrants, Subordinate Lien, “D”, 5%, 10/01/23 | 115,000 | 129,861 | ||||||

| Montgomery, AL, Medical Clinic Board Health Care Facility Rev. (Jackson Hospital & Clinic), 5.25%, 3/01/36 | 825,000 | 844,511 | ||||||

| Pell City, AL, Special Care Facilities, Financing Authority Rev. (Noland Health Services, Inc.), 5%, 12/01/39 | 175,000 | 186,795 | ||||||

|

|

|

|||||||

| $ | 2,597,598 | |||||||

| Arizona - 2.3% | ||||||||

| Phoenix, AZ, Industrial Development Authority Education Rev. (Choice Academies, Inc. Project), 5.625%, 9/01/42 | $ | 135,000 | $ | 139,389 | ||||

| Phoenix, AZ, Industrial Development Authority Education Rev. (Eagle College Prep Project), 5%, 7/01/33 | 65,000 | 63,461 | ||||||

11

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Arizona - continued | ||||||||

| Phoenix, AZ, Industrial Development Authority Education Rev. (Eagle College Prep Project), 5%, 7/01/43 | $ | 125,000 | $ | 116,040 | ||||

| Phoenix, AZ, Industrial Development Authority Education Rev. (Great Hearts Academies Project), “A”, 5%, 7/01/34 | 350,000 | 367,094 | ||||||

| Phoenix, AZ, Industrial Development Authority Education Rev. (Great Hearts Academies Project), “A”, 5%, 7/01/44 | 220,000 | 224,695 | ||||||

| Phoenix, AZ, Industrial Development Authority Education Rev. (Legacy Traditional Schools Project), 6.5%, 7/01/34 | 115,000 | 130,242 | ||||||

| Phoenix, AZ, Industrial Development Authority Education Rev. (Legacy Traditional Schools Project), 6.75%, 7/01/44 | 180,000 | 205,056 | ||||||

| Pima County, AZ, Industrial Development Authority Rev. (Tucson Electric Power Co.), 5.75%, 9/01/29 | 1,015,000 | 1,018,542 | ||||||

| Surprise, AZ, Municipal Property Corp., 4.9%, 4/01/32 | 700,000 | 734,335 | ||||||

| Tempe, AZ, Industrial Development Authority Rev. (Friendship Village), “A”, 6.25%, 12/01/42 | 90,000 | 97,398 | ||||||

| Tempe, AZ, Industrial Development Authority Rev. (Friendship Village), “A”, 6.25%, 12/01/46 | 70,000 | 75,625 | ||||||

|

|

|

|||||||

| $ | 3,171,877 | |||||||

| Arkansas - 0.5% | ||||||||

| Pulaski County, AR, Public Facilities Board Healthcare Rev. (Baptist Health), 5%, 12/01/39 | $ | 505,000 | $ | 556,768 | ||||

| Pulaski County, AR, Public Facilities Board Healthcare Rev. (Baptist Health), 5%, 12/01/42 | 125,000 | 136,724 | ||||||

|

|

|

|||||||

| $ | 693,492 | |||||||

| California - 16.4% | ||||||||

| Beverly Hills, CA, Unified School District (Election of 2008), Capital Appreciation, 0%, 8/01/29 | $ | 2,195,000 | $ | 1,378,153 | ||||

| Beverly Hills, CA, Unified School District (Election of 2008), Capital Appreciation, 0%, 8/01/31 | 275,000 | 157,328 | ||||||

| Beverly Hills, CA, Unified School District (Election of 2008), Capital Appreciation, 0%, 8/01/32 | 280,000 | 152,771 | ||||||

| Beverly Hills, CA, Unified School District (Election of 2008), Capital Appreciation, 0%, 8/01/33 | 560,000 | 291,474 | ||||||

| California Department of Water Resources, Center Valley Project Rev., “AJ”, 5%, 12/01/35 | 1,010,000 | 1,154,390 | ||||||

| California Educational Facilities Authority Rev., 5%, 2/01/26 | 235,000 | 247,429 | ||||||

| California Educational Facilities Authority Rev. (Chapman University), 5%, 4/01/31 | 145,000 | 158,017 | ||||||

| California Educational Facilities Authority Rev. (University of Southern California), “A”, 5.25%, 10/01/38 | 1,270,000 | 1,452,105 | ||||||

| California Health Facilities Financing Authority Rev. (St. Joseph Health System), “A”, 5.75%, 7/01/39 | 185,000 | 214,147 | ||||||

12

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| California - continued | ||||||||

| California Health Facilities Financing Authority Rev. (Sutter Health), “B”, 5.875%, 8/15/31 | $ | 660,000 | $ | 792,772 | ||||

| California Housing Finance Agency Rev. (Home Mortgage), “G”, 4.95%, 8/01/23 | 1,340,000 | 1,376,662 | ||||||

| California Housing Finance Agency Rev. (Home Mortgage), “G”, 5.5%, 8/01/42 | 120,000 | 127,454 | ||||||

| California M-S-R Energy Authority Gas Rev., “A”, 7%, 11/01/34 | 155,000 | 217,079 | ||||||

| California M-S-R Energy Authority Gas Rev., “A”, 6.5%, 11/01/39 | 335,000 | 456,498 | ||||||

| California Municipal Finance Authority Rev. (Biola University), 5.8%, 10/01/28 | 100,000 | 112,550 | ||||||

| California Pollution Control Financing Authority, Solid Waste Disposal Rev. (Republic Services, Inc.), “B”, 5.25%, 6/01/23 (Put Date 12/01/17) | 135,000 | 147,402 | ||||||

| California Pollution Control Financing Authority, Solid Waste Disposal Rev. (Waste Management, Inc.), “C”, 5.125%, 11/01/23 | 655,000 | 680,663 | ||||||

| California Pollution Control Financing Authority, Water Furnishing Rev. (Poseidon Resources Desalination Project), 5%, 11/21/45 | 470,000 | 500,132 | ||||||

| California Pollution Control Financing Authority, Water Furnishing Rev. (San Diego County Water Desalination Project Pipeline), 5%, 11/21/45 | 275,000 | 283,704 | ||||||

| California Public Works Board Lease Rev., Department of Corrections and Rehabilitation (Various Correctional Facilities), “A”, 5%, 9/01/33 | 1,025,000 | 1,174,660 | ||||||

| California School Finance Authority, School Facility Rev. (ICEF View Park Elementary and Middle Schools), “A”, 5.875%, 10/01/44 | 115,000 | 115,047 | ||||||

| California Statewide Communities Development Authority Facilities (Microgy Holdings Project), 9%, 12/01/38 (a)(d) | 50,491 | 505 | ||||||

| California Statewide Communities Development Authority Rev. (899 Charleston Project), “A”, 5.25%, 11/01/44 | 40,000 | 40,182 | ||||||

| California Statewide Communities Development Authority Rev. (899 Charleston Project), “A”, 5.375%, 11/01/49 | 55,000 | 55,144 | ||||||

| California Statewide Communities Development Authority Rev. (American Baptist Homes of the West), 6.25%, 10/01/39 | 215,000 | 242,331 | ||||||

| California Statewide Communities Development Authority Rev. (California Baptist University), “A”, 6.125%, 11/01/33 | 100,000 | 111,895 | ||||||

| California Statewide Communities Development Authority Rev. (Catholic Healthcare West), “K”, ASSD GTY, 5.5%, 7/01/41 | 625,000 | 681,000 | ||||||

| California Statewide Communities Development Authority Rev. (Lancer Educational Student Housing Project), 5.625%, 6/01/33 | 735,000 | 736,874 | ||||||

| California Statewide Communities Development Authority Rev. (Lancer Plaza Project), 5.625%, 11/01/33 | 110,000 | 116,023 | ||||||

| California Statewide Communities Development Authority Rev. (Los Angeles Jewish Home for The Aging - Fountainview at Gonda), “D”, 4.75%, 8/01/20 | 125,000 | 125,425 | ||||||

13

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| California - continued | ||||||||

| Chula Vista, CA, Industrial Development Rev. (San Diego Gas & Electric Co.), “E”, 5.875%, 1/01/34 | $ | 245,000 | $ | 291,067 | ||||

| Golden State, CA, Tobacco Securitization Corp., Tobacco Settlement Rev., “A-1”, 5.75%, 6/01/47 | 300,000 | 250,503 | ||||||

| Golden State, CA, Tobacco Securitization Corp., Tobacco Settlement Rev., Enhanced, “A”, FGIC, 5%, 6/01/35 | 110,000 | 112,470 | ||||||

| Jurupa, CA, Public Financing Authority, Special Tax Rev., “A”, 5%, 9/01/42 | 170,000 | 186,910 | ||||||

| La Verne, CA, COP (Brethren Hillcrest Homes), 5%, 5/15/36 | 50,000 | 53,399 | ||||||

| Los Angeles County, CA, Regional Financing Authority Rev. (Montecedro Inc. Project), “A”, CALHF, 5%, 11/15/44 | 65,000 | 71,053 | ||||||

| Los Angeles County, CA, Regional Financing Authority Rev. (Montecedro Inc. Project), “A”, CALHF, 5%, 11/15/34 | 35,000 | 39,027 | ||||||

| Los Angeles County, CA, Regional Financing Authority Rev. (Montecedro Inc. Project), “B-2”, CALHF, 3%, 11/15/20 | 35,000 | 35,601 | ||||||

| Los Angeles County, CA, Regional Financing Authority Rev. (Montecedro Inc. Project), “B-3”, CALHF, 2.5%, 11/15/20 | 85,000 | 86,184 | ||||||

| Los Angeles, CA, Department of Water & Power Rev. (Power System), “B”, 5%, 7/01/38 | 355,000 | 398,704 | ||||||

| Los Angeles, CA, Unified School District, “D”, 5%, 1/01/34 | 165,000 | 186,625 | ||||||

| Palomar Pomerado Health Care District, CA, COP, 6.75%, 11/01/39 | 890,000 | 950,253 | ||||||

| Rancho Cucamonga, CA, Redevelopment Agency Tax Allocation , AGM, 5%, 9/01/30 | 55,000 | 63,180 | ||||||

| Sacramento, CA, Municipal Utility District, “X”, 5%, 8/15/28 | 365,000 | 415,644 | ||||||

| San Francisco, CA, Bay Area Toll Authority, Bridge Rev., “B”, FRN, 1.5%, 4/01/47 (Put Date 4/02/18) | 355,000 | 359,338 | ||||||

| San Francisco, CA, City & County Redevelopment Successor Agency Tax Allocation (Mission Bay South Public Improvements), “A”, 5%, 8/01/43 | 25,000 | 27,216 | ||||||

| San Joaquin Hills, CA, Transportation Corridor Agency, Toll Road Rev., Capital Appreciation, “A”, NATL, 0%, 1/15/15 | 3,000,000 | 2,999,310 | ||||||

| State of California, 5.25%, 10/01/28 | 335,000 | 395,481 | ||||||

| State of California, 5.25%, 9/01/30 | 790,000 | 921,369 | ||||||

| West Contra Costa, CA, Healthcare District, AMBAC, 5.5%, 7/01/29 | 105,000 | 105,345 | ||||||

| Whittier, CA, Health Facility Rev. (PIH Health), 5%, 6/01/44 | 335,000 | 373,006 | ||||||

| Yorba Linda, CA, Redevelopment Agency, Tax Allocation Rev., Capital Appreciation, “A”, NATL, 0%, 9/01/24 | 1,325,000 | 854,718 | ||||||

|

|

|

|||||||

| $ | 22,476,219 | |||||||

| Colorado - 5.0% | ||||||||

| Colorado Educational & Cultural Facilities Authority Rev. (Peak to Peak Charter School Project), 5%, 8/15/30 | $ | 40,000 | $ | 44,135 | ||||

| Colorado Educational & Cultural Facilities Authority Rev. (Peak to Peak Charter School Project), 5%, 8/15/34 | 35,000 | 38,290 | ||||||

14

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Colorado - continued | ||||||||

| Colorado Health Care Facilities Rev. (American Baptist Homes), 8%, 8/01/43 | $ | 375,000 | $ | 443,201 | ||||

| Colorado Health Facilities Authority Rev. (Christian Living Communities Project), “A”, 5.75%, 1/01/37 | 475,000 | 484,742 | ||||||

| Colorado Health Facilities Authority Rev. (Covenant Retirement Communities, Inc.), 5%, 12/01/35 | 1,100,000 | 1,114,135 | ||||||

| Colorado Health Facilities Authority Rev. (Evangelical Lutheran Good Samaritan Society), 5.625%, 6/01/43 | 100,000 | 112,834 | ||||||

| Colorado Housing & Finance Authority, “A”, 5.5%, 11/01/29 | 675,000 | 703,850 | ||||||

| Colorado Regional Transportation District, Private Activity Rev. (Denver Transportation Partners), 6%, 1/15/34 | 630,000 | 713,084 | ||||||

| Colorado Regional Transportation District, Private Activity Rev. (Denver Transportation Partners), 6%, 1/15/41 | 300,000 | 336,306 | ||||||

| Denver, CO, City & County Airport Rev. (United Airlines), 5.75%, 10/01/32 | 475,000 | 493,250 | ||||||

| Denver, CO, Health & Hospital Authority Rev., “A”, 5%, 12/01/39 | 70,000 | 75,081 | ||||||

| Denver, CO, Health & Hospital Authority Rev., “A”, 5.25%, 12/01/45 | 100,000 | 109,682 | ||||||

| E-470 Public Highway Authority, CO, Capital Appreciation, “B”, NATL, 0%, 9/01/18 | 1,500,000 | 1,397,460 | ||||||

| Public Authority for Colorado Energy Natural Gas Purchase Rev., 6.5%, 11/15/38 | 25,000 | 34,334 | ||||||

| Salida, CO, Hospital District Rev., 5.25%, 10/01/36 | 689,000 | 693,720 | ||||||

|

|

|

|||||||

| $ | 6,794,104 | |||||||

| Delaware - 0.7% | ||||||||

| Delaware Economic Development Authority Rev. (Delaware Military Academy, Inc. Project, 4.625%, 9/01/34 | $ | 85,000 | $ | 84,940 | ||||

| Delaware Economic Development Authority Rev. (Delaware Military Academy, Inc. Project, 5%, 9/01/44 | 95,000 | 96,977 | ||||||

| Delaware Economic Development Authority Rev. (Delaware Military Academy, Inc. Project), 5%, 9/01/49 | 110,000 | 112,032 | ||||||

| Wilmington, DE, Multi-Family Housing Rev. (Electra Arms Senior Associates), 6.25%, 6/01/28 | 695,000 | 687,522 | ||||||

|

|

|

|||||||

| $ | 981,471 | |||||||

| District of Columbia - 1.8% | ||||||||

| District of Columbia Housing Finance Agency (Henson Ridge), “E”, FHA, 5.1%, 6/01/37 | $ | 655,000 | $ | 666,181 | ||||

| District of Columbia Rev. (Kipp, D.C. Charter School),“A”, 6%, 7/01/43 | 110,000 | 125,666 | ||||||

| District of Columbia Rev. (Kipp, D.C. Charter School),“A”, 6%, 7/01/33 | 45,000 | 52,367 | ||||||

| District of Columbia Student Dormitory Rev. (Provident Group - Howard Properties LLC), 5%, 10/01/30 | 130,000 | 139,017 | ||||||

15

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| District of Columbia - continued | ||||||||

| District of Columbia Student Dormitory Rev. (Provident Group - Howard Properties LLC), 5%, 10/01/35 | $ | 670,000 | $ | 699,949 | ||||

| District of Columbia Student Dormitory Rev. (Provident Group - Howard Properties LLC), 5%, 10/01/45 | 775,000 | 796,677 | ||||||

|

|

|

|||||||

| $ | 2,479,857 | |||||||

| Florida - 7.7% | ||||||||

| Alachua County, FL, Health Facilities Authority Rev. (East Ridge Retirement Village, Inc.), 6%, 11/15/34 | $ | 65,000 | $ | 70,151 | ||||

| Alachua County, FL, Health Facilities Authority Rev. (East Ridge Retirement Village, Inc.), 6.25%, 11/15/44 | 170,000 | 185,518 | ||||||

| Alachua County, FL, Health Facilities Authority Rev. (East Ridge Retirement Village, Inc.), 6.375%, 11/15/49 | 115,000 | 124,831 | ||||||

| Bellalago, FL, Educational Facilities Benefit District (Osceola County) Capital Improvement Refunding Rev., 4.375%, 5/01/30 | 85,000 | 85,749 | ||||||

| Bellalago, FL, Educational Facilities Benefit District (Osceola County) Capital Improvement Refunding Rev., 4.5%, 5/01/33 | 40,000 | 40,612 | ||||||

| Bellalago, FL, Educational Facilities Benefit District (Osceola County) Capital Improvement Refunding Rev., 4.6%, 5/01/34 | 60,000 | 61,146 | ||||||

| Brevard County, FL, Industrial Development Rev. (TUFF Florida Tech LLC Project), 6.75%, 11/01/39 | 540,000 | 597,483 | ||||||

| Broward County, FL, Housing Finance Authority Rev. (Chaves Lakes Apartments Ltd.), “A”, 7.5%, 7/01/40 (Put Date 7/01/30) | 475,000 | 475,451 | ||||||

| Capital Region Community Development District, FL, Capital Improvement Rev., “A”, 7%, 5/01/39 | 215,000 | 217,786 | ||||||

| Capital Trust Agency, FL, Housing Rev. (Atlantic Housing Foundation), “B”, 7%, 7/15/32 (d)(q) | 600,000 | 314,622 | ||||||

| Collier County, FL, Educational Facilities Authority Rev. (Ave Maria University, Inc. Project), “A”, 6.125%, 6/01/43 | 335,000 | 368,611 | ||||||

| Collier County, FL, Industrial Development Authority Continuing Care Community Rev. (The Arlington of Naples Project), “A”, 8.125%, 5/15/44 | 485,000 | 538,529 | ||||||

| Escambia County, FL, Environmental Improvement Rev. (International Paper Co.), “A”, 5%, 8/01/26 | 980,000 | 980,666 | ||||||

| Florida Citizens Property Insurance Corp., “A-1”, 5%, 6/01/19 | 65,000 | 75,036 | ||||||

| Florida Citizens Property Insurance Corp., “A-1”, 5%, 6/01/20 | 305,000 | 356,188 | ||||||

| Florida Development Finance Corp. Educational Facilities Rev. (Renaissance Charter School), “A”, 6%, 6/15/32 | 115,000 | 115,135 | ||||||

| Florida Development Finance Corp. Educational Facilities Rev. (Renaissance Charter School), “A”, 6.125%, 6/15/43 | 240,000 | 233,225 | ||||||

| Florida Development Finance Corp. Educational Facilities Rev. (Renaissance Charter School),“A”, 8.5%, 6/15/44 | 445,000 | 509,165 | ||||||

| Florida State University Board of Governors, System Improvement Rev., 6.25%, 7/01/30 | 1,000,000 | 1,180,100 | ||||||

16

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Florida - continued | ||||||||

| Heritage Harbour North Community Development District, FL, Capital Improvement Rev., 6.375%, 5/01/38 | $ | 315,000 | $ | 337,122 | ||||

| Homestead, Community Development District, FL, Special Assessment, “A”, 6%, 5/01/37 | 365,000 | 284,751 | ||||||

| Main Street Community Development District, FL, “A”, 6.8%, 5/01/38 | 280,000 | 284,200 | ||||||

| Miami-Dade County, FL, Industrial Development Authority Rev. (Pinecrest Academy Project), 5.25%, 9/15/44 | 195,000 | 201,772 | ||||||

| Mid-Bay Bridge Authority, FL, Springing Lien Rev., “A”, 7.25%, 10/01/40 | 445,000 | 536,830 | ||||||

| Midtown Miami, FL, Community Development District Special Assessment (Infrastructure Project), “B”, 5%, 5/01/29 | 175,000 | 191,046 | ||||||

| Palm Beach County, FL, Health Facilities Rev. (Sinai Residences of Boca Raton Project), 7.5%, 6/01/49 | 115,000 | 130,808 | ||||||

| Pasco County, FL, Estancia At Wiregrass Community Development District, Capital Improvement, 7%, 11/01/45 | 105,000 | 117,516 | ||||||

| Seminole Tribe, FL, Special Obligation Rev., “A”, 5.25%, 10/01/27 (n) | 280,000 | 297,181 | ||||||

| South Lake County, FL, Hospital District Rev. (South Lake Hospital), “A”, 6%, 4/01/29 | 85,000 | 95,825 | ||||||

| South Lake County, FL, Hospital District Rev. (South Lake Hospital), “A”, 6.25%, 4/01/39 | 125,000 | 140,180 | ||||||

| St. John’s County, FL, Industrial Development Authority Rev. (Presbyterian Retirement), “A”, 6%, 8/01/45 | 610,000 | 675,776 | ||||||

| Sumter County, FL, Industrial Development Authority Hospital Rev. (Central Florida Health Alliance Projects), “A”, 5%, 7/01/26 | 20,000 | 22,315 | ||||||

| Sumter County, FL, Industrial Development Authority Hospital Rev. (Central Florida Health Alliance Projects), “A”, 5%, 7/01/29 | 20,000 | 21,956 | ||||||

| Sumter County, FL, Industrial Development Authority Hospital Rev. (Central Florida Health Alliance Projects), “A”, 5.125%, 7/01/34 | 40,000 | 43,491 | ||||||

| Sumter County, FL, Industrial Development Authority Hospital Rev. (Central Florida Health Alliance Projects), “A”, 5.25%, 7/01/44 | 125,000 | 135,210 | ||||||

| Tuscany Reserve Community Development District, FL, Special Assessment, “B”, 5.25%, 5/01/16 | 155,000 | 156,074 | ||||||

| Westridge, FL, Community Development District, Capital Improvement Rev., 5.8%, 5/01/37 (a)(d) | 960,000 | 364,800 | ||||||

|

|

|

|||||||

| $ | 10,566,857 | |||||||

| Georgia - 2.6% | ||||||||

| Americus and Sumter County, GA, Hospital Authority Rev. (Magnolia Manor Obligated Group), “A”, 6.25%, 5/15/33 | $ | 95,000 | $ | 103,031 | ||||

| Americus and Sumter County, GA, Hospital Authority Rev. (Magnolia Manor Obligated Group), “A”, 6.375%, 5/15/43 | 95,000 | 102,619 | ||||||

| Atlanta, GA, Tax Allocation (Eastside Project), “B”, 5.4%, 1/01/20 | 500,000 | 513,890 | ||||||

| Atlanta, GA, Water & Wastewater Rev., “A”, 6%, 11/01/22 | 370,000 | 451,681 | ||||||

17

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Georgia - continued | ||||||||

| Brunswick, GA, Hospital Authority Rev. (Glynn-Brunswick Memorial Hospital), 5.625%, 8/01/34 | $ | 170,000 | $ | 184,987 | ||||

| Clayton County, GA, Development Authority Special Facilities Rev. (Delta Airlines, Inc.), “A”, 8.75%, 6/01/29 | 200,000 | 249,350 | ||||||

| Clayton County, GA, Development Authority Special Facilities Rev. (Delta Airlines, Inc.), “B”, 9%, 6/01/35 | 150,000 | 154,415 | ||||||

| DeKalb County, GA, Water & Sewer Rev., “A”, 5.25%, 10/01/31 | 15,000 | 17,380 | ||||||

| Georgia Main Street Natural Gas, Inc., Gas Project Rev., “A”, 5%, 3/15/22 | 660,000 | 774,503 | ||||||

| Georgia Main Street Natural Gas, Inc., Gas Project Rev., “A”, 5.5%, 9/15/28 | 335,000 | 404,070 | ||||||

| Marietta, GA, Development Facilities Authority Rev. (Life University), 7%, 6/15/39 | 265,000 | 277,945 | ||||||

| Savannah, GA, Economic Development Authority Rev. (AASU Student Union LLC), ASSD GTY, 5.125%, 6/15/39 | 335,000 | 365,033 | ||||||

|

|

|

|||||||

| $ | 3,598,904 | |||||||

| Guam - 0.4% | ||||||||

| Guam Government Department of Education (John F. Kennedy High School), “A”, COP, 6.875%, 12/01/40 | $ | 295,000 | $ | 328,668 | ||||

| Guam Government, “A”, 7%, 11/15/39 | 90,000 | 104,423 | ||||||

| Guam International Airport Authority Rev., “C”, 5%, 10/01/16 | 25,000 | 26,660 | ||||||

| Guam International Airport Authority Rev., “C”, 5%, 10/01/17 | 45,000 | 49,212 | ||||||

|

|

|

|||||||

| $ | 508,963 | |||||||

| Hawaii - 0.6% | ||||||||

| Hawaii Department of Budget & Finance, Special Purpose Rev. (15 Craigside Project), “A”, 9%, 11/15/44 | $ | 140,000 | $ | 174,786 | ||||

| Hawaii Department of Budget & Finance, Special Purpose Rev. (Hawaiian Electric Co. & Subsidiary), 6.5%, 7/01/39 | 390,000 | 452,494 | ||||||

| State of Hawaii, “DZ”, 5%, 12/01/31 | 200,000 | 232,460 | ||||||

|

|

|

|||||||

| $ | 859,740 | |||||||

| Idaho - 2.9% | ||||||||

| Idaho Health Facilities Authority Rev. (IHC Hospitals, Inc.), ETM, 6.65%, 2/15/21 | $ | 2,750,000 | $ | 3,593,013 | ||||

| Idaho Health Facilities Authority Rev. (The Terraces of Boise Project), “B2”, 6%, 10/01/21 | 210,000 | 211,699 | ||||||

| Idaho Health Facilities Authority Rev. (The Terraces of Boise Project), “B3”, 5.25%, 10/01/20 | 110,000 | 111,211 | ||||||

|

|

|

|||||||

| $ | 3,915,923 | |||||||

| Illinois - 9.6% | ||||||||

| Annawan, IL, Tax Increment Rev. (Patriot Renewable Fuels LLC), 5.625%, 1/01/18 | $ | 155,000 | $ | 146,686 | ||||

18

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Illinois - continued | ||||||||

| Bolingbrook, IL, Sales Tax Rev., 6.25%, 1/01/24 | $ | 500,000 | $ | 481,060 | ||||

| Chicago, IL, O’Hare International Airport Rev., Customer Facility Charge, AGM, 5.25%, 1/01/32 | 80,000 | 89,238 | ||||||

| Chicago, IL, O’Hare International Airport Rev., Customer Facility Charge, AGM, 5.25%, 1/01/33 | 40,000 | 44,530 | ||||||

| Chicago, IL, O’Hare International Airport Rev., Customer Facility Charge, AGM, 5.5%, 1/01/43 | 155,000 | 172,265 | ||||||

| Chicago, IL, Tax Increment Allocation (Pilsen Redevelopment), “B”, 6.75%, 6/01/22 | 290,000 | 290,104 | ||||||

| Chicago, IL, Transit Authority Sales Tax Receipts Rev., 5.25%, 12/01/29 | 165,000 | 188,154 | ||||||

| Chicago, IL, Transit Authority Sales Tax Receipts Rev., 5.25%, 12/01/30 | 330,000 | 373,864 | ||||||

| Chicago, IL, Transit Authority Sales Tax Receipts Rev., 5.25%, 12/01/31 | 60,000 | 67,414 | ||||||

| Du Page County, IL, Special Service Area No. 31 Special Tax (Monarch Landing Project), 5.625%, 3/01/36 | 250,000 | 251,415 | ||||||

| Illinois Finance Authority Rev. (Evangelical Retirement Homes of Greater Chicago, Inc.), 7.25%, 2/15/45 | 850,000 | 912,815 | ||||||

| Illinois Finance Authority Rev. (Franciscan Communities, Inc.), “A”, 4.75%, 5/15/33 | 200,000 | 200,686 | ||||||

| Illinois Finance Authority Rev. (Franciscan Communities, Inc.), “A”, 5.125%, 5/15/43 | 215,000 | 221,912 | ||||||

| Illinois Finance Authority Rev. (Lutheran Home & Services), 5.625%, 5/15/42 | 185,000 | 190,606 | ||||||

| Illinois Finance Authority Rev. (Provena Health), “A”, 7.75%, 8/15/34 | 485,000 | 607,007 | ||||||

| Illinois Finance Authority Rev. (Rehabilitation Institute of Chicago), “A”, 6%, 7/01/43 | 200,000 | 231,310 | ||||||

| Illinois Finance Authority Rev. (Roosevelt University Project), 6.25%, 4/01/29 | 670,000 | 731,245 | ||||||

| Illinois Finance Authority Rev. (Silver Cross Hospital & Medical Centers), 6.875%, 8/15/38 | 485,000 | 566,553 | ||||||

| Illinois Finance Authority Rev. (Smith Village), “A”, 6.25%, 11/15/35 | 1,000,000 | 1,007,050 | ||||||

| Illinois Finance Authority Student Housing Rev. (Illinois State University), 6.75%, 4/01/31 | 240,000 | 285,264 | ||||||

| Illinois Finance Authority Student Housing Rev. (Northern Illinois University Project), 6.625%, 10/01/31 | 615,000 | 734,495 | ||||||

| Illinois Railsplitter Tobacco Settlement Authority, 6%, 6/01/28 | 1,365,000 | 1,595,371 | ||||||

| Lincolnshire, IL, Special Service Area No. 1 (Sedgebrook Project), 6.25%, 3/01/34 | 198,000 | 202,318 | ||||||

| Plano, IL, Special Service Area No. 4 (Lakewood Springs Project Unit 5-B), 6%, 3/01/35 | 1,406,000 | 1,428,538 | ||||||

19

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Illinois - continued | ||||||||

| University of Illinois Rev. (Auxiliary Facilities Systems), “A”, 5.125%, 4/01/29 | $ | 1,880,000 | $ | 2,124,024 | ||||

|

|

|

|||||||

| $ | 13,143,924 | |||||||

| Indiana - 5.1% | ||||||||

| Indiana Bond Bank Special Program, Gas Rev., “A”, 5.25%, 10/15/18 | $ | 230,000 | $ | 261,814 | ||||

| Indiana Finance Authority Rev. (BHI Senior Living), “A”, 6%, 11/15/41 | 275,000 | 310,728 | ||||||

| Indiana Finance Authority Rev. (I-69 Section 5 Project), 5.25%, 9/01/34 | 205,000 | 226,894 | ||||||

| Indiana Finance Authority Rev. (I-69 Section 5 Project), 5.25%, 9/01/40 | 305,000 | 330,626 | ||||||

| Indiana Finance Authority Rev. (Ohio River Bridges East End Crossing Project), “A”, 5%, 7/01/35 | 180,000 | 193,633 | ||||||

| Indiana Finance Authority Rev. (Ohio River Bridges East End Crossing Project), “A”, 5%, 7/01/40 | 460,000 | 489,330 | ||||||

| Indiana Finance Authority Rev. (Ohio River Bridges East End Crossing Project), “A”, 5%, 7/01/44 | 125,000 | 132,321 | ||||||

| Indiana Finance Authority Rev. (Ohio River Bridges East End Crossing Project), “B”, 5%, 1/01/19 | 155,000 | 166,419 | ||||||

| Indiana Health & Educational Facilities Finance Authority Rev. (Sisters of St. Francis Health Services, Inc.), “E”, AGM, 5.25%, 5/15/41 | 660,000 | 709,342 | ||||||

| Indiana Health & Educational Facilities Finance Authority, Hospital Rev. (Clarian Health), “A”, 5%, 2/15/39 | 1,745,000 | 1,787,002 | ||||||

| Indiana Health & Educational Facilities Finance Authority, Hospital Rev. (Community Foundation of Northwest Indiana), 5.5%, 3/01/37 | 945,000 | 1,000,935 | ||||||

| University of Southern Indiana Rev. (Student Fee), “J”, ASSD GTY, 5.75%, 10/01/28 | 300,000 | 352,425 | ||||||

| Valparaiso, IN, Exempt Facilities Rev. (Pratt Paper LLC Project), 6.75%, 1/01/34 | 260,000 | 295,711 | ||||||

| Valparaiso, IN, Exempt Facilities Rev. (Pratt Paper LLC Project), 7%, 1/01/44 | 605,000 | 689,555 | ||||||

|

|

|

|||||||

| $ | 6,946,735 | |||||||

| Iowa - 0.9% | ||||||||

| Iowa Finance Authority Midwestern Disaster Area Rev. (Iowa Fertilizer Co.), 5%, 12/01/19 | $ | 205,000 | $ | 215,810 | ||||

| Iowa Finance Authority Midwestern Disaster Area Rev. (Iowa Fertilizer Co.), 5.5%, 12/01/22 | 215,000 | 224,937 | ||||||

| Iowa Finance Authority Midwestern Disaster Area Rev. (Iowa Fertilizer Co.), 5.25%, 12/01/25 | 215,000 | 227,145 | ||||||

| Iowa Student Loan Liquidity Corp., “A-2”, 5.5%, 12/01/25 | 145,000 | 155,225 | ||||||

| Iowa Student Loan Liquidity Corp., “A-2”, 5.6%, 12/01/26 | 145,000 | 155,092 | ||||||

| Iowa Student Loan Liquidity Corp., “A-2”, 5.7%, 12/01/27 | 20,000 | 21,388 | ||||||

20

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Iowa - continued | ||||||||

| Iowa Student Loan Liquidity Corp., “A-2”, 5.75%, 12/01/28 | $ | 275,000 | $ | 293,288 | ||||

|

|

|

|||||||

| $ | 1,292,885 | |||||||

| Kansas - 0.6% | ||||||||

| Atchison, KS, Hospital Rev. (Atchison Hospital Assn.), “A”, 6.75%, 9/01/30 | $ | 320,000 | $ | 344,790 | ||||

| Wichita, KS, Health Care Facilities Rev. (Presbyterian Manors, Inc.), “A”, 6.375%, 5/15/43 | 170,000 | 184,117 | ||||||

| Wichita, KS, Health Care Facilities Rev. (Presbyterian Manors, Inc.), “IV-B2”, 3.375%, 11/15/20 | 35,000 | 34,785 | ||||||

| Wyandotte County/Kansas City, KS, Unified Government Utility System Improvement Rev., “A”, 5%, 9/01/44 | 200,000 | 221,962 | ||||||

|

|

|

|||||||

| $ | 785,654 | |||||||

| Kentucky - 3.4% | ||||||||

| Kentucky Counties Single Family Mortgage Rev., “A”, NATL, 9%, 9/01/16 | $ | 5,000 | $ | 5,029 | ||||

| Kentucky Economic Development Finance Authority Health Care Rev. (Masonic Homes of Kentucky, Inc.), 5.375%, 11/15/42 | 130,000 | 131,885 | ||||||

| Kentucky Economic Development Finance Authority Health Care Rev. (Masonic Homes of Kentucky, Inc.), 5.5%, 11/15/45 | 80,000 | 81,596 | ||||||

| Kentucky Economic Development Finance Authority Health Facilities Rev. (AHF/Kentucky-Iowa, Inc.), 8%, 1/01/29 | 298,000 | 302,041 | ||||||

| Kentucky Economic Development Finance Authority, Hospital Facilities Rev. (Baptist Healthcare System), “A”, 5.375%, 8/15/24 | 300,000 | 338,100 | ||||||

| Kentucky Economic Development Finance Authority, Hospital Facilities Rev. (Baptist Healthcare System), “A”, 5.625%, 8/15/27 | 100,000 | 111,989 | ||||||

| Kentucky Economic Development Finance Authority, Hospital Facilities Rev. (Owensboro Medical Health System), “A”, 6.375%, 6/01/40 | 570,000 | 656,800 | ||||||

| Louisville & Jefferson County, KY, Metro Government Health Facilities Rev. (Jewish Hospital & St. Mary’s Healthcare), 6.125%, 2/01/37 (Prerefunded 2/01/18) | 1,315,000 | 1,536,735 | ||||||

| Louisville & Jefferson County, KY, Metropolitan Government Healthcare Systems Rev. (Norton Healthcare, Inc.), 5.25%, 10/01/36 | 1,265,000 | 1,320,723 | ||||||

| Owen County, KY, Waterworks System Rev. (American Water Co. Project), “A”, 6.25%, 6/01/39 | 205,000 | 234,579 | ||||||

|

|

|

|||||||

| $ | 4,719,477 | |||||||

| Louisiana - 2.1% | ||||||||

| Beauregard Parish, LA (Boise Cascade Corp.), 6.8%, 2/01/27 | $ | 1,000,000 | $ | 1,010,000 | ||||

| Jefferson Parish, LA, Hospital Service District No. 2 (East Jefferson General Hospital), 6.25%, 7/01/31 | 300,000 | 338,505 | ||||||

| Jefferson Parish, LA, Hospital Service District No. 2 (East Jefferson General Hospital), 6.375%, 7/01/41 | 185,000 | 205,441 | ||||||

21

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Louisiana - continued | ||||||||

| Louisiana Public Facilities Authority Hospital Rev. (Lake Charles Memorial Hospital), 6.375%, 12/01/34 | $ | 605,000 | $ | 662,360 | ||||

| St. Charles Parish, LA, Gulf Zone Opportunity Zone Rev. (Valero Energy Corp.), 4%, 12/01/40 (Put Date 6/01/22) | 605,000 | 655,905 | ||||||

|

|

|

|||||||

| $ | 2,872,211 | |||||||

| Maine - 0.3% | ||||||||

| Maine Finance Authority Solid Waste Disposal Rev. (Casella Waste Systems, Inc.), 6.25%, 1/01/25 (Put Date 2/01/17) | $ | 360,000 | $ | 379,336 | ||||

| Maryland - 0.8% | ||||||||

| Anne Arundel County, MD, Special Obligation (National Business Park-North Project), 6.1%, 7/01/40 | $ | 140,000 | $ | 150,770 | ||||

| Maryland Health & Higher Educational Facilities Authority Rev. (Anne Arundel Health System, Inc.), “A”, 6.75%, 7/01/39 | 735,000 | 919,147 | ||||||

|

|

|

|||||||

| $ | 1,069,917 | |||||||

| Massachusetts - 6.9% | ||||||||

| Boston, MA, Metropolitan Transit Parking Corp., Systemwide Parking Rev., 5.25%, 7/01/36 | $ | 300,000 | $ | 342,321 | ||||

| Commonwealth of Massachusetts, General Obligation, “B”, 5%, 8/01/21 | 910,000 | 1,097,078 | ||||||

| Massachusetts College Building Authority Rev., “C”, 3%, 5/01/42 | 80,000 | 70,062 | ||||||

| Massachusetts Development Finance Agency Rev. (Adventcare), “A”, 6.75%, 10/15/37 | 695,000 | 724,982 | ||||||

| Massachusetts Development Finance Agency Rev. (Alliance Health of Brockton, Inc.), “A”, 7.1%, 7/01/32 | 950,000 | 952,917 | ||||||

| Massachusetts Development Finance Agency Rev. (Linden Ponds, Inc.), “A-1”, 6.25%, 11/15/31 | 130,267 | 105,316 | ||||||

| Massachusetts Development Finance Agency Rev. (Linden Ponds, Inc.), “A-1”, 6.25%, 11/15/39 | 31,732 | 24,539 | ||||||

| Massachusetts Development Finance Agency Rev. (Linden Ponds, Inc.), “A-2”, 5.5%, 11/15/46 | 8,656 | 6,737 | ||||||

| Massachusetts Development Finance Agency Rev. (Linden Ponds, Inc.), Capital Appreciation, “B”, 0%, 11/15/56 | 43,059 | 212 | ||||||

| Massachusetts Development Finance Agency Rev. (North Hill Communities), “A”, 6.25%, 11/15/33 | 100,000 | 108,627 | ||||||

| Massachusetts Development Finance Agency Rev. (North Hill Communities), “A”, 6.5%, 11/15/43 | 100,000 | 109,131 | ||||||

| Massachusetts Development Finance Agency Rev. (The Broad Institute, Inc.), “A”, 5.25%, 4/01/37 | 580,000 | 656,821 | ||||||

| Massachusetts Development Finance Agency Rev. (Tufts Medical Center), “I”, 7.25%, 1/01/32 | 445,000 | 548,792 | ||||||

22

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Massachusetts - continued | ||||||||

| Massachusetts Development Finance Agency, Resource Recovery Rev. (Covanta Energy Project), “A”, 4.875%, 11/01/27 | $ | 410,000 | $ | 417,327 | ||||

| Massachusetts Development Finance Agency, Resource Recovery Rev. (Covanta Energy Project), “C”, 5.25%, 11/01/42 | 705,000 | 723,894 | ||||||

| Massachusetts Development Finance Agency, Solid Waste Disposal Rev. (Dominion Energy Brayton), 5.75%, 12/01/42 (Prerefunded 5/01/19) | 85,000 | 102,135 | ||||||

| Massachusetts Educational Financing Authority, Education Loan Rev., “H”, ASSD GTY, 6.35%, 1/01/30 | 290,000 | 311,103 | ||||||

| Massachusetts Educational Financing Authority, Education Loan Rev., “I-A”, 5.5%, 1/01/22 | 25,000 | 27,893 | ||||||

| Massachusetts Health & Educational Facilities Authority Rev. (Jordan Hospital), “E”, 6.75%, 10/01/33 | 250,000 | 250,528 | ||||||

| Massachusetts Health & Educational Facilities Authority Rev. (Simmons College), 8%, 10/01/29 | 150,000 | 159,359 | ||||||

| Massachusetts Health & Educational Facilities Authority Rev. (Suffolk University), “A”, 6.25%, 7/01/30 | 725,000 | 851,150 | ||||||

| Massachusetts Health & Educational Facilities Authority Rev. (Suffolk University), “A”, 5.75%, 7/01/39 | 455,000 | 501,178 | ||||||

| Massachusetts Port Authority Facilities Rev. (Conrac Project), “A”, 5.125%, 7/01/41 | 40,000 | 43,421 | ||||||

| Massachusetts School Building Authority, Dedicated Sales Tax Rev., AMBAC, 4.75%, 8/15/32 | 840,000 | 911,022 | ||||||

| Massachusetts School Building Authority, Dedicated Sales Tax Rev., “B”, 5%, 10/15/32 | 390,000 | 450,091 | ||||||

|

|

|

|||||||

| $ | 9,496,636 | |||||||

| Michigan - 3.2% | ||||||||

| Detroit, MI, Sewage Disposal System Rev., “B”, NATL, 5.5%, 7/01/22 | $ | 955,000 | $ | 1,095,509 | ||||

| Detroit, MI, Sewage Disposal System Rev., Senior Lien, “A”, 5.25%, 7/01/39 | 580,000 | 625,791 | ||||||

| Detroit, MI, Water Supply System Rev., Senior Lien, “A”, AGM, 5%, 7/01/23 | 15,000 | 15,657 | ||||||

| Detroit, MI, Water Supply System Rev., Senior Lien, “A”, AGM, 5%, 7/01/25 | 15,000 | 15,612 | ||||||

| Grand Valley, MI, State University Rev., 5.5%, 12/01/27 | 135,000 | 148,550 | ||||||

| Grand Valley, MI, State University Rev., 5.625%, 12/01/29 | 65,000 | 71,685 | ||||||

| Michigan Finance Authority Rev. (Trinity Health Corp.), 5%, 12/01/35 | 1,000,000 | 1,111,340 | ||||||

| Royal Oak, MI, Hospital Finance Authority Rev. (William Beaumont Hospital), 5%, 9/01/39 | 475,000 | 522,244 | ||||||

| Royal Oak, MI, Hospital Finance Authority Rev. (William Beaumont Hospital), 8.25%, 9/01/39 (Prerefunded 9/01/18) | 485,000 | 617,192 | ||||||

| Wayne County, MI, Airport Authority Rev. (Detroit Metropolitan Wayne County Airport), “B”, 5%, 12/01/44 | 35,000 | 38,496 | ||||||

23

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Michigan - continued | ||||||||

| Wayne County, MI, Airport Authority Rev. (Detroit Metropolitan Wayne County Airport), “B”, BAM, 5%, 12/01/39 | $ | 40,000 | $ | 45,095 | ||||

| Wayne County, MI, Airport Authority Rev. (Detroit Metropolitan Wayne County Airport), “C”, 5%, 12/01/39 | 30,000 | 32,477 | ||||||

| Wayne County, MI, Airport Authority Rev. (Detroit Metropolitan Wayne County Airport), “C”, 5%, 12/01/44 | 90,000 | 96,740 | ||||||

|

|

|

|||||||

| $ | 4,436,388 | |||||||

| Minnesota - 0.1% | ||||||||

| Minneapolis & St. Paul, MN, Housing Authority Rev. (City Living), “A-2”, GNMA, 5%, 12/01/38 | $ | 69,367 | $ | 70,111 | ||||

| Mississippi - 2.3% | ||||||||

| Mississippi Business Finance Corp., Pollution Control Rev. (Systems Energy Resources Project), 5.875%, 4/01/22 | $ | 1,500,000 | $ | 1,500,795 | ||||

| Mississippi Development Bank Special Obligation (Marshall County Industrial Development Authority Mississippi Highway Construction Project), 5%, 1/01/28 | 120,000 | 136,594 | ||||||

| Mississippi Home Corp., Rev. (Kirkwood Apartments), 6.8%, 11/01/37 | 600,000 | 393,996 | ||||||

| Mississippi State University, Educational Building Corp. Rev., 5%, 8/01/36 | 440,000 | 486,323 | ||||||

| University of Southern Mississippi Educational Building Corp. Rev. (Campus Facilities Project), 5.25%, 9/01/32 | 220,000 | 251,238 | ||||||

| University of Southern Mississippi Educational Building Corp. Rev. (Campus Facilities Project), 5.375%, 9/01/36 | 80,000 | 90,956 | ||||||

| V Lakes Utility District, MS, Water Systems Rev., 7%, 7/15/37 | 280,000 | 280,185 | ||||||

|

|

|

|||||||

| $ | 3,140,087 | |||||||

| National - 1.1% | ||||||||

| Charter Mac Equity Issuer Trust, FHLMC, 6%, 10/31/52 (n) | $ | 1,000,000 | $ | 1,109,780 | ||||

| Resolution Trust Corp., Pass-Through Certificates, “1993”, 9.75%, 12/01/16 (z) | 455,481 | 454,903 | ||||||

|

|

|

|||||||

| $ | 1,564,683 | |||||||

| New Hampshire - 0.9% | ||||||||

| New Hampshire Business Finance Authority Rev. (Elliot Hospital Obligated Group), “A”, 6%, 10/01/27 | $ | 585,000 | $ | 664,151 | ||||

| New Hampshire Business Finance Authority, Solid Waste Disposal Rev. (Casella Waste Systems, Inc. Project), FRN, 4%, 4/01/29 (Put Date 10/01/19) | 100,000 | 100,083 | ||||||

| New Hampshire Health & Education Facilities Authority Rev. (Memorial Hospital at Conway), 5.25%, 6/01/21 | 530,000 | 538,899 | ||||||

|

|

|

|||||||

| $ | 1,303,133 | |||||||

24

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| New Jersey - 9.8% | ||||||||

| New Jersey Casino Reinvestment Development Authority, Luxury Tax Rev., AGM, 5%, 11/01/31 | $ | 160,000 | $ | 174,211 | ||||

| New Jersey Casino Reinvestment Development Authority, Luxury Tax Rev., AGM, 5%, 11/01/32 | 65,000 | 70,495 | ||||||

| New Jersey Economic Development Authority Rev. (GMT Realty LLC), “B”, 6.875%, 1/01/37 | 1,000,000 | 1,015,390 | ||||||

| New Jersey Economic Development Authority Rev. (Kapkowski Road Landfill Project), 6.5%, 4/01/31 | 950,000 | 1,155,580 | ||||||

| New Jersey Economic Development Authority Rev. (Lions Gate Project), 5%, 1/01/34 | 30,000 | 30,480 | ||||||

| New Jersey Economic Development Authority Rev. (Lions Gate Project), 5.25%, 1/01/44 | 65,000 | 66,457 | ||||||

| New Jersey Economic Development Authority Rev. (Seabrook Village, Inc.), 5.25%, 11/15/26 | 500,000 | 515,295 | ||||||

| New Jersey Economic Development Authority Rev. (Seabrook Village, Inc.), 5.25%, 11/15/36 | 500,000 | 508,690 | ||||||

| New Jersey Economic Development Authority Rev. (The Goethals Bridge Replacement Project) , 5.375%, 1/01/43 | 255,000 | 276,810 | ||||||

| New Jersey Economic Development Authority Rev. (The Goethals Bridge Replacement Project), 5.5%, 1/01/27 | 40,000 | 46,141 | ||||||

| New Jersey Economic Development Authority Rev. (The Goethals Bridge Replacement Project), 5%, 1/01/28 | 40,000 | 44,303 | ||||||

| New Jersey Economic Development Authority Rev. (The Goethals Bridge Replacement Project), AGM, 5%, 1/01/31 | 125,000 | 136,523 | ||||||

| New Jersey Economic Development Authority, Special Facilities Rev. (Continental Airlines, Inc.), 4.875%, 9/15/19 | 515,000 | 544,520 | ||||||

| New Jersey Economic Development Authority, Special Facilities Rev. (Continental Airlines, Inc.), 5.125%, 9/15/23 | 365,000 | 392,174 | ||||||

| New Jersey Economic Development Authority, Special Facilities Rev. (Continental Airlines, Inc.), 5.25%, 9/15/29 | 515,000 | 547,368 | ||||||

| New Jersey Economic Development Authority, Special Facilities Rev. (Continental Airlines, Inc.), “A”, 5.625%, 11/15/30 | 105,000 | 114,633 | ||||||

| New Jersey Economic Development Authority, Special Facilities Rev. (Continental Airlines, Inc.), “B”, 5.625%, 11/15/30 | 95,000 | 103,866 | ||||||

| New Jersey Tobacco Settlement Financing Corp., “1-A”, 4.5%, 6/01/23 | 1,925,000 | 1,920,958 | ||||||

| New Jersey Tobacco Settlement Financing Corp., “1-A”, 4.75%, 6/01/34 | 3,405,000 | 2,570,128 | ||||||

| New Jersey Tobacco Settlement Financing Corp., “1-A”, 5%, 6/01/41 | 3,355,000 | 2,538,259 | ||||||

| New Jersey Tobacco Settlement Financing Corp., Capital Appreciation, “1-B”, 0%, 6/01/41 | 2,830,000 | 693,661 | ||||||

| New Jersey Tobacco Settlement Financing Corp., Capital Appreciation, “1-C”, 0%, 6/01/41 | 35,000 | 8,314 | ||||||

|

|

|

|||||||

| $ | 13,474,256 | |||||||

25

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| New Mexico - 0.5% | ||||||||

| Farmington, NM, Pollution Control Rev. (Public Service New Mexico), “D”, 5.9%, 6/01/40 | $ | 500,000 | $ | 555,815 | ||||

| New Mexico Hospital Equipment Loan Council, Hospital Rev. (Rehoboth McKinley Christian Hospital), “A”, 5%, 8/15/17 | 110,000 | 113,551 | ||||||

|

|

|

|||||||

| $ | 669,366 | |||||||

| New York - 9.1% | ||||||||

| Brooklyn, NY, Arena Local Development Corp. (Barclays Center Project), 6%, 7/15/30 | $ | 135,000 | $ | 157,135 | ||||

| Buffalo & Erie County, NY, Industrial Land Development Corp. Rev. (Buffalo State College), “A”, 5.375%, 10/01/41 | 200,000 | 222,912 | ||||||

| Build NYC Resource Corp. Rev. (South Bronx Charter School for International Cultures and the Arts), “A”, 5%, 4/15/43 | 100,000 | 98,209 | ||||||

| Hudson Yards, NY, Infrastructure Corp. Rev., “A”, 5%, 2/15/47 | 360,000 | 379,534 | ||||||

| Hudson Yards, NY, Infrastructure Corp. Rev., “A”, 5.75%, 2/15/47 | 370,000 | 424,901 | ||||||

| New York Dormitory Authority Rev., Non-State Supported Debt (Bronx-Lebanon Hospital Center), LOC, 6.5%, 8/15/30 | 190,000 | 225,199 | ||||||

| New York Dormitory Authority Rev., Non-State Supported Debt (Bronx-Lebanon Hospital Center), LOC, 6.25%, 2/15/35 | 115,000 | 134,136 | ||||||

| New York Dormitory Authority, State Sales Tax Rev., “A”, 5%, 3/15/37 | 200,000 | 232,898 | ||||||

| New York Dormitory Authority, State Sales Tax Rev., “A”, 5%, 3/15/44 | 690,000 | 793,824 | ||||||

| New York Environmental Facilities Corp., Clean Drinking Water Revolving Funds, 5%, 6/15/41 | 685,000 | 770,920 | ||||||

| New York Environmental Facilities, “C”, 5%, 5/15/41 | 945,000 | 1,063,333 | ||||||

| New York Liberty Development Corp. Liberty Rev. (3 World Trade Center Project), “1”, 5%, 11/15/44 | 190,000 | 192,974 | ||||||

| New York Liberty Development Corp. Liberty Rev. (3 World Trade Center Project), “2”, 5.375%, 11/15/40 | 395,000 | 411,839 | ||||||

| New York Liberty Development Corp. Liberty Rev. (3 World Trade Center Project), “3”, 7.25%, 11/15/44 | 220,000 | 245,084 | ||||||

| New York Liberty Development Corp., Liberty Rev. (One Bryant Park LLC), 6.375%, 7/15/49 | 545,000 | 620,259 | ||||||

| New York, NY, City Industrial Development Agencies Rev. (American Airlines, Inc.), 7.75%, 8/01/31 | 385,000 | 421,198 | ||||||

| New York, NY, City Industrial Development Agency Special Facility Rev. (American Airlines, Inc.), “B”, 8.5%, 8/01/28 | 500,000 | 520,285 | ||||||

| New York, NY, City Transitional Finance Authority Building Aid Rev., “S-3”, 5.25%, 1/15/39 | 440,000 | 493,451 | ||||||

| New York, NY, Municipal Water Finance Authority, Water & Sewer System Rev., “AA”, 5%, 6/15/34 | 1,980,000 | 2,244,726 | ||||||

| New York, NY, Municipal Water Finance Authority, Water & Sewer Systems Rev., “DD”, 4.75%, 6/15/35 | 790,000 | 848,681 | ||||||

26

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| New York - continued | ||||||||

| Niagara County, NY, Industrial Development Agency, Solid Waste Disposal Rev. (Covanta Energy Project), “A”, 5.25%, 11/01/42 | $ | 725,000 | $ | 746,431 | ||||

| Onondaga, NY, Civic Development Corp. Rev. (St. Joseph’s Hospital Health Center), 5%, 7/01/25 | 30,000 | 31,654 | ||||||

| Onondaga, NY, Civic Development Corp. Rev. (St. Joseph’s Hospital Health Center), 5.125%, 7/01/31 | 25,000 | 25,922 | ||||||

| Onondaga, NY, Civic Development Corp. Rev. (St. Joseph’s Hospital Health Center), 5%, 7/01/42 | 255,000 | 256,910 | ||||||

| Port Authority of NY & NJ, Special Obligation Rev. (JFK International Air Terminal LLC), 6%, 12/01/36 | 255,000 | 303,149 | ||||||

| Port Authority of NY & NJ, Special Obligation Rev. (JFK International Air Terminal LLC), 6%, 12/01/42 | 290,000 | 343,873 | ||||||

| Ulster County, NY, Capital Resource Corp Rev. (Health Alliance Senior Living- Woodland Pond at New Paltz), “B”, 7%, 9/15/44 | 330,000 | 333,204 | ||||||

|

|

|

|||||||

| $ | 12,542,641 | |||||||

| North Carolina - 1.5% | ||||||||

| Durham, NC, Durham Housing Authority Rev. (Magnolia Pointe Apartments), 5.65%, 2/01/38 | $ | 892,561 | $ | 890,678 | ||||

| New Hanover County, NC, Hospital Rev., AGM, 5.125%, 10/01/31 | 895,000 | 998,596 | ||||||

| University of North Carolina, Greensboro, Rev., 5%, 4/01/39 | 110,000 | 125,759 | ||||||

|

|

|

|||||||

| $ | 2,015,033 | |||||||

| Ohio - 2.9% | ||||||||

| Bowling Green, OH, Student Housing Rev. (State University Project), 5.75%, 6/01/31 | $ | 175,000 | $ | 189,077 | ||||

| Buckeye, OH, Tobacco Settlement Financing Authority, “A-2”, 6%, 6/01/42 | 230,000 | 188,255 | ||||||

| Buckeye, OH, Tobacco Settlement Financing Authority, “A-2”, 5.875%, 6/01/47 | 480,000 | 391,402 | ||||||

| Butler County, OH, Hospital Facilities Rev. (UC Health), 5.5%, 11/01/40 | 590,000 | 655,490 | ||||||

| Butler County, OH, Hospital Facilities Rev. (UC Health), 5.75%, 11/01/40 | 130,000 | 146,751 | ||||||

| Franklin County, OH, Health Care Facilities Improvement Rev. (Friendship Village of Dublin, OH, Inc.), 5%, 11/15/34 | 120,000 | 129,359 | ||||||

| Franklin County, OH, Health Care Facilities Improvement Rev. (Friendship Village of Dublin, OH, Inc.), 5%, 11/15/44 | 195,000 | 205,789 | ||||||

| Gallia County, OH, Hospital Facilities Rev. (Holzer Health Systems), “A”, 8%, 7/01/42 | 710,000 | 784,941 | ||||||

| Lake County, OH, Hospital Facilities Rev. (Lake Hospital Systems, Inc.), 5.625%, 8/15/29 | 435,000 | 483,877 | ||||||

| Muskingum County, OH, Hospital Facilities Rev. (Genesis Health System Obligated Group), 5%, 2/15/33 | 195,000 | 200,938 | ||||||

27

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Ohio - continued | ||||||||

| Muskingum County, OH, Hospital Facilities Rev. (Genesis Health System Obligated Group), 5%, 2/15/44 | $ | 100,000 | $ | 101,811 | ||||

| Muskingum County, OH, Hospital Facilities Rev. (Genesis Health System Obligated Group), 5%, 2/15/48 | 195,000 | 195,636 | ||||||

| Southeastern Ohio Port Authority, Hospital Facilities Rev. (Memorial Health System), 5.75%, 12/01/32 | 300,000 | 311,277 | ||||||

|

|

|

|||||||

| $ | 3,984,603 | |||||||

| Oklahoma - 1.2% | ||||||||

| Grand River Dam Authority Rev., OK, “A”, 5%, 6/01/39 | $ | 250,000 | $ | 286,155 | ||||

| Norman, OK, Regional Hospital Authority Rev., 5%, 9/01/27 | 155,000 | 162,308 | ||||||

| Norman, OK, Regional Hospital Authority Rev., 5.375%, 9/01/29 | 90,000 | 92,580 | ||||||

| Norman, OK, Regional Hospital Authority Rev., 5.375%, 9/01/36 | 235,000 | 239,780 | ||||||

| Oklahoma Development Finance Authority Continuing Care Retirement Community Rev. (Inverness Village), 5.75%, 1/01/37 | 305,000 | 314,717 | ||||||

| Tulsa, OK, Municipal Airport Trust Rev. (American Airlines, Inc.), “B”, 5.5%, 6/01/35 | 175,000 | 183,962 | ||||||

| Tulsa, OK, Municipal Airport Trust Rev. (American Airlines, Inc.), “B”, 5.5%, 12/01/35 | 385,000 | 407,195 | ||||||

|

|

|

|||||||

| $ | 1,686,697 | |||||||

| Oregon - 0.7% | ||||||||

| Cow Creek Band of Umpqua Tribe of Indians, OR, “C”, 5.625%, 10/01/26 (n) | $ | 650,000 | $ | 652,906 | ||||

| Forest Grove, OR, Campus Improvement Rev. (Pacific University Project), “A”, 4.5%, 5/01/29 | 90,000 | 98,284 | ||||||

| Forest Grove, OR, Campus Improvement Rev. (Pacific University Project), “A”, 5%, 5/01/40 | 110,000 | 121,289 | ||||||

| Multnomah County, OR, Hospital Facilities Authority Rev. (Mirabella at South Waterfront Project), “A”, 5.4%, 10/01/44 | 65,000 | 67,660 | ||||||

| Multnomah County, OR, Hospital Facilities Authority Rev. (Mirabella at South Waterfront Project), “A”, 5.5%, 10/01/49 | 85,000 | 87,862 | ||||||

|

|

|

|||||||

| $ | 1,028,001 | |||||||

| Pennsylvania - 8.8% | ||||||||

| Allegheny County, PA, Hospital Development Authority Rev. (University of Pittsburgh Medical Center), “A”, 5.375%, 8/15/29 | $ | 440,000 | $ | 500,562 | ||||

| Allentown, PA, Neighborhood Improvement Zone Development Authority Tax Rev., “A”, 5%, 5/01/35 | 100,000 | 108,562 | ||||||

| Allentown, PA, Neighborhood Improvement Zone Development Authority Tax Rev., “A”, 5%, 5/01/42 | 420,000 | 451,151 | ||||||

| Bucks County, PA, Industrial Development Authority Rev. (Lutheran Community Telford Center), 5.75%, 1/01/27 | 90,000 | 92,980 | ||||||

28

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Pennsylvania - continued | ||||||||

| Bucks County, PA, Industrial Development Authority Rev. (Lutheran Community Telford Center), 5.75%, 1/01/37 | $ | 120,000 | $ | 121,302 | ||||

| Chartiers Valley, PA, Industrial & Commercial Development Authority (Friendship Village), “A”, 5.75%, 8/15/20 | 1,000,000 | 1,002,110 | ||||||

| Clarion County, PA, Industrial Development Authority, Student Housing Rev. (Clarion University Foundation, Inc.), 5%, 7/01/34 | 35,000 | 36,626 | ||||||

| Cumberland County, PA, Municipal Authority Rev. (Asbury Atlantic, Inc.), 5.25%, 1/01/41 | 290,000 | 295,130 | ||||||

| Cumberland County, PA, Municipal Authority Rev. (Diakon Lutheran Social Ministries), 6.125%, 1/01/29 | 695,000 | 760,705 | ||||||

| Delaware County, PA, Authority Rev. (Mercy Health Corp.), ETM, 6%, 12/15/16 | 510,000 | 521,868 | ||||||

| Delaware County, PA, Authority Rev. (Mercy Health Corp.), ETM, 6%, 12/15/26 | 500,000 | 513,045 | ||||||

| East Hempfield, PA, Industrial Development Authority Rev. (Millersville University Student Services), 5%, 7/01/39 | 40,000 | 41,604 | ||||||

| East Hempfield, PA, Industrial Development Authority Rev. (Millersville University Student Services), 5%, 7/01/46 | 20,000 | 20,692 | ||||||

| Erie, PA, Water Authority Rev., AGM, 5%, 12/01/49 | 355,000 | 394,831 | ||||||

| Lebanon County, PA, Health Facilities Authority Rev. (Good Samaritan Hospital), 5.9%, 11/15/28 | 210,000 | 210,078 | ||||||

| Lehigh County, PA, Water and Sewer Authority Rev. (Allentown Concession), “A”, 5%, 12/01/43 | 1,135,000 | 1,242,473 | ||||||

| Lehigh County, PA, Water and Sewer Authority Rev. (Allentown Concession), Capital Appreciation, “B”, 0%, 12/01/37 | 955,000 | 354,219 | ||||||

| Luzerne County, PA, AGM, 6.75%, 11/01/23 | 435,000 | 503,578 | ||||||

| Montgomery County, PA, Higher Education & Health Authority Rev. (AHF/Montgomery), 6.875%, 4/01/36 | 75,000 | 78,232 | ||||||

| Montgomery County, PA, Industrial Development Authority Retirement Community Rev. (ACTS Retirement - Life Communities, Inc.), 5%, 11/15/28 | 350,000 | 379,621 | ||||||

| Pennsylvania Economic Development Financing Authority, Sewer Sludge Disposal Rev. (Philadelphia Biosolids Facility), 6.25%, 1/01/32 | 335,000 | 367,060 | ||||||

| Pennsylvania Higher Educational Facilities Authority Rev. (Edinboro University Foundation), 5.8%, 7/01/30 | 80,000 | 86,882 | ||||||

| Philadelphia, PA, Authority for Industrial Development Rev. (MaST Charter School), 6%, 8/01/35 | 50,000 | 54,385 | ||||||