Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4992

MFS HIGH YIELD MUNICIPAL TRUST

(Exact name of registrant as specified in charter)

500 Boylston Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Susan S. Newton

Massachusetts Financial Services Company

500 Boylston Street

Boston, Massachusetts 02116

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: November 30

Date of reporting period: May 31, 2012

Table of Contents

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Table of Contents

MFS® High Yield Municipal Trust

SEMIANNUAL REPORT

May 31, 2012

CMU-SEM

Table of Contents

MFS® HIGH YIELD MUNICIPAL TRUST

New York Stock Exchange Symbol: CMU

NOT FDIC INSURED Ÿ MAY LOSE VALUE Ÿ NO BANK GUARANTEE

Table of Contents

LETTER FROM THE CHAIRMAN AND CEO

Dear Shareholders:

World financial markets remain a venue of uncertainty. The focus has shifted most recently to the eurozone, where policymakers are attempting to develop a plan that will help debt-laden countries and prevent their woes from spreading across the region. Volatility is likely to continue as investors test the resolve of European officials to make the tough decisions needed to solve the crisis.

The U.S. economy is experiencing a period of growth. However, markets have been jittery in reaction to events in Europe and ahead of the U.S. presidential election. Voters in the United States are watching the economy closely and waiting to see if Congress agrees to cut the budget and extend the Bush administration tax cuts. Failure to do so could ultimately send the U.S. economy back into recession.

Amid this global uncertainty, managing risk becomes a top priority for investors and their advisors. At MFS® our global research platform is designed to ensure the smooth functioning

of our investment process in all business climates. Through this integrated approach, our investment staff shares ideas and evaluates opportunities across geographies, across both fundamental and quantitative disciplines, and across companies’ entire capital structure. We employ this uniquely collaborative approach to build better insights for our clients.

Additionally, we have a team of quantitative analysts that measures and assesses the risk profiles of our portfolios and securities on an ongoing basis. The chief investment risk officer, who oversees the team, reports directly to the firm’s president and chief investment officer so that the risk associated with each portfolio can be assessed objectively and independently of the portfolio management team.

We, like our investors, are mindful of the many economic challenges faced at the local, national, and international levels. It is in times such as these that we want to emphasize the merits of maintaining a long-term view, adhering to basic investing principles such as asset allocation and diversification, and working closely with investment advisors to research and identify appropriate investment opportunities.

Respectfully,

Robert J. Manning

Chairman and Chief Executive Officer

MFS Investment Management®

July 17, 2012

The opinions expressed in this letter are subject to change, may not be relied upon for investment advice, and no forecasts can be guaranteed.

1

Table of Contents

| (a) | For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change. Not Rated includes fixed income securities, including fixed income futures, which have not been rated by any rating agency. Cash & Other includes cash, other assets less liabilities, offsets to derivative positions, and short-term securities. The fund may not hold all of these instruments. The fund is not rated by these agencies. |

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value due to the interest rate move. |

2

Table of Contents

Portfolio Composition – continued

| (i) | For purposes of this presentation, the components include the market value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may be negative from time to time. The bond component will include any accrued interest amounts. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than market value. Where the fund holds convertible bonds, these are treated as part of the equity portion of the portfolio. |

| (j) | For the purpose of managing the fund’s duration, the fund holds short treasury futures with a bond equivalent exposure of (13.8)%, which reduce the fund’s interest rate exposure but not its credit exposure. |

| (m) | In determining an instrument’s effective maturity for purposes of calculating the fund’s dollar-weighted average effective maturity, MFS uses the instrument’s stated maturity or, if applicable, an earlier date on which MFS believes it is probable that a maturity-shortening device (such as a put, pre-refunding or prepayment) will cause the instrument to be repaid. Such an earlier date can be substantially shorter than the instrument’s stated maturity. |

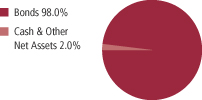

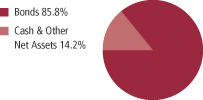

Percentages are based on net assets, including the value of auction preferred shares, as of 5/31/12.

The portfolio is actively managed and current holdings may be different.

3

Table of Contents

| Gary Lasman | — | Investment Officer of MFS; employed in the investment management area of MFS since 2002. Portfolio manager of the fund since June 2007. | ||

| Geoffrey Schechter | — | Investment Officer of MFS; employed in the investment management area of MFS since 1993. Portfolio manager of the fund since June 2007. | ||

The fund’s shares may trade at a discount or premium to net asset value. Shareholders do not have the right to cause the fund to repurchase their shares at net asset value. When fund shares trade at a premium, buyers pay more than the net asset value of underlying fund shares, and shares purchased at a premium would receive less than the amount paid for them in the event of the fund’s liquidation. As a result, the total return that is calculated based on the net asset value and New York Stock Exchange price can be different.

The fund’s monthly distributions may include a return of capital to shareholders to the extent that distributions are in excess of the fund’s net investment income and net capital gains, determined in accordance with federal income tax regulations. Distributions that are treated for federal income tax purposes as a return of capital will reduce each shareholder’s basis in his or her shares and, to the extent the return of capital exceeds such basis, will be treated as gain to the shareholder from a sale of shares. Returns of shareholder capital have the effect of reducing the fund’s assets and increasing the fund’s expense ratio.

In accordance with Section 23(c) of the Investment Company Act of 1940, the fund hereby gives notice that it may from time to time repurchase common and/or preferred shares of the fund in the open market at the option of the Board of Trustees and on such terms as the Trustees shall determine.

4

Table of Contents

5/31/12 (unaudited)

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| Municipal Bonds - 153.7% | ||||||||

| Issuer | Shares/Par | Value ($) | ||||||

| Airport Revenue - 3.1% | ||||||||

| Dallas Fort Worth, TX, International Airport Rev. Improvement, “B”, AGM, 5%, 2025 | $ | 3,000,000 | $ | 3,125,400 | ||||

| Houston, TX, Airport System Rev., “B”, 5%, 2026 | 175,000 | 200,197 | ||||||

| Houston, TX, Airport System Rev., Subordinate Lien, “A”, 5%, 2031 | 155,000 | 167,876 | ||||||

| Port Authority NY & NJ, Special Obligation Rev. (JFK International Air Terminal LLC), 6%, 2036 | 255,000 | 289,634 | ||||||

| Port Authority NY & NJ, Special Obligation Rev. (JFK International Air Terminal LLC), 6%, 2042 | 290,000 | 328,944 | ||||||

|

|

|

|||||||

| $ | 4,112,051 | |||||||

| General Obligations - General Purpose - 4.6% | ||||||||

| Chicago, IL, Metropolitan Water Reclamation District-Greater Chicago, “C”, 5%, 2030 | $ | 780,000 | $ | 903,107 | ||||

| Commonwealth of Puerto Rico, Public Improvement, “A”, 5.5%, 2039 | 2,015,000 | 2,101,988 | ||||||

| Las Vegas Valley, NV, Water District, “C”, 5%, 2029 | 925,000 | 1,048,756 | ||||||

| Luzerne County, PA, AGM, 6.75%, 2023 | 455,000 | 537,050 | ||||||

| State of California, 5.25%, 2028 | 335,000 | 385,588 | ||||||

| State of California, 5.25%, 2030 | 790,000 | 901,635 | ||||||

| State of Hawaii, “DZ”, 5%, 2031 | 200,000 | 234,080 | ||||||

|

|

|

|||||||

| $ | 6,112,204 | |||||||

| General Obligations - Improvement - 0.1% | ||||||||

| Guam Government, “A”, 7%, 2039 | $ | 90,000 | $ | 99,891 | ||||

| General Obligations - Schools - 2.5% | ||||||||

| Beverly Hills, CA, Unified School District (Election of 2008), Capital Appreciation, 0%, 2029 | $ | 2,195,000 | $ | 1,084,923 | ||||

| Beverly Hills, CA, Unified School District (Election of 2008), Capital Appreciation, 0%, 2031 | 275,000 | 121,960 | ||||||

| Beverly Hills, CA, Unified School District (Election of 2008), Capital Appreciation, 0%, 2032 | 280,000 | 117,617 | ||||||

| Beverly Hills, CA, Unified School District (Election of 2008), Capital Appreciation, 0%, 2033 | 560,000 | 222,079 | ||||||

| Chicago, IL, Board of Education, “A”, 5%, 2041 | 100,000 | 109,152 | ||||||

| Irving, TX, Independent School District, Capital Appreciation, “A”, PSF, 0%, 2016 | 1,000,000 | 969,510 | ||||||

| Los Angeles, CA, Unified School District, “D”, 5%, 2034 | 165,000 | 183,109 | ||||||

5

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| General Obligations - Schools - continued | ||||||||

| San Jacinto, TX, Community College District, 5.125%, 2038 | $ | 430,000 | $ | 467,156 | ||||

|

|

|

|||||||

| $ | 3,275,506 | |||||||

| Healthcare Revenue - Hospitals - 36.1% | ||||||||

| Allegheny County, PA, Hospital Development Authority Rev. (University of Pittsburgh Medical Center), “A”, 5.375%, 2029 | $ | 440,000 | $ | 489,091 | ||||

| Allegheny County, PA, Hospital Development Authority Rev. (West Penn Allegheny Health), “A”, 5%, 2028 | 435,000 | 366,553 | ||||||

| Allegheny County, PA, Hospital Development Authority Rev. (West Penn Allegheny Health), “A”, 5.375%, 2040 | 625,000 | 512,875 | ||||||

| Atchison, KS, Hospital Rev. (Atchison Hospital Assn.), “A”, 6.75%, 2030 | 320,000 | 345,040 | ||||||

| Brunswick, GA, Hospital Authority Rev. (Glynn-Brunswick Memorial Hospital), 5.625%, 2034 | 170,000 | 186,388 | ||||||

| Butler County, OH, Hospital Facilities Rev. (UC Health), 5.5%, 2040 | 590,000 | 631,743 | ||||||

| Butler County, OH, Hospital Facilities Rev. (UC Health), 5.75%, 2040 | 130,000 | 141,452 | ||||||

| California Health Facilities Financing Authority Rev. (St. Joseph Health System), “A”, 5.75%, 2039 | 185,000 | 207,305 | ||||||

| California Health Facilities Financing Authority Rev. (Sutter Health), “A”, 5%, 2042 | 500,000 | 522,650 | ||||||

| California Health Facilities Financing Authority Rev. (Sutter Health), “B”, 5.875%, 2031 | 660,000 | 791,076 | ||||||

| California Statewide Communities Development Authority Rev. (Catholic Healthcare West), “K”, ASSD GTY, 5.5%, 2041 | 625,000 | 658,831 | ||||||

| California Statewide Communities Development Authority Rev. (Kaiser Permanente), “A”, 5%, 2042 | 360,000 | 390,200 | ||||||

| Cullman County, AL, Health Care Authority (Cullman Regional Medical Center), “A”, 6.75%, 2029 | 60,000 | 62,068 | ||||||

| Delaware County, PA, Authority Rev. (Mercy Health Corp.), ETM, 6%, 2016 (c) | 965,000 | 1,084,206 | ||||||

| Delaware County, PA, Authority Rev. (Mercy Health Corp.), ETM, 6%, 2026 (c) | 500,000 | 569,705 | ||||||

| Erie County, PA, Hospital Authority Rev. (St. Vincent’s Health), “A”, 7%, 2027 | 410,000 | 442,156 | ||||||

| Gallia County, OH, Hospital Facilities Rev. (Holzer Health Systems), “A”, 8%, 2042 | 945,000 | 991,522 | ||||||

| Harris County, TX, Health Facilities Development Corp., Hospital Rev. (Memorial Hermann Healthcare Systems), “B”, 7.25%, 2035 | 205,000 | 254,659 | ||||||

| Idaho Health Facilities Authority Rev. (IHC Hospitals, Inc.), ETM, 6.65%, 2021 (c) | 2,750,000 | 3,781,608 | ||||||

| Illinois Finance Authority Rev. (Kewanee Hospital), 5.1%, 2031 | 390,000 | 376,997 | ||||||

| Illinois Finance Authority Rev. (Provena Health), “A”, 7.75%, 2034 | 485,000 | 621,106 | ||||||

6

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Healthcare Revenue - Hospitals - continued | ||||||||

| Illinois Finance Authority Rev. (Silver Cross Hospital & Medical Centers), 6.875%, 2038 | $ | 485,000 | $ | 553,167 | ||||

| Indiana Health & Educational Facilities Finance Authority Rev. (Sisters of St. Francis Health Services, Inc.), “E”, AGM, 5.25%, 2041 | 660,000 | 699,072 | ||||||

| Indiana Health & Educational Facilities Finance Authority, Hospital Rev. (Clarian Health), “A”, 5%, 2039 | 1,745,000 | 1,807,925 | ||||||

| Indiana Health & Educational Facilities Finance Authority, Hospital Rev. (Community Foundation of Northwest Indiana), 5.5%, 2037 | 945,000 | 997,646 | ||||||

| Indiana Health & Educational Financing Authority Rev. (Community Foundation of Northwest Indiana ), “A”, 6%, 2034 | 425,000 | 443,955 | ||||||

| Jefferson Parish, LA, Hospital Service District No. 2 (East Jefferson General Hospital), 6.25%, 2031 | 300,000 | 343,065 | ||||||

| Jefferson Parish, LA, Hospital Service District No. 2 (East Jefferson General Hospital), 6.375%, 2041 | 185,000 | 211,782 | ||||||

| Johnson City, TN, Health & Educational Facilities Board Hospital Rev. (Mountain States Health Alliance), “A”, 5.5%, 2031 | 1,120,000 | 1,185,542 | ||||||

| Johnson City, TN, Health & Educational Facilities Board Hospital Rev. (Mountain States Health Alliance), “A”, 5.5%, 2036 | 410,000 | 429,278 | ||||||

| Kentucky Economic Development Finance Authority, Hospital Facilities Rev. (Baptist Healthcare System), “A”, 5.375%, 2024 | 300,000 | 343,641 | ||||||

| Kentucky Economic Development Finance Authority, Hospital Facilities Rev. (Baptist Healthcare System), “A”, 5.625%, 2027 | 100,000 | 114,734 | ||||||

| Kentucky Economic Development Finance Authority, Hospital Facilities Rev. (Owensboro Medical Health System), “A”, 6.375%, 2040 | 570,000 | 659,262 | ||||||

| Lake County, OH, Hospital Facilities Rev. (Lake Hospital Systems, Inc.), 5.625%, 2029 | 435,000 | 464,802 | ||||||

| Laramie County, WY, Hospital Rev. (Cheyenne Regional Medical Center Project), 5%, 2032 | 40,000 | 43,188 | ||||||

| Laramie County, WY, Hospital Rev. (Cheyenne Regional Medical Center Project), 5%, 2037 | 100,000 | 107,272 | ||||||

| Laramie County, WY, Hospital Rev. (Cheyenne Regional Medical Center Project), 5%, 2042 | 195,000 | 210,087 | ||||||

| Lebanon County, PA, Health Facilities Authority Rev. (Good Samaritan Hospital), 5.9%, 2028 | 210,000 | 211,577 | ||||||

| Louisiana Public Facilities Authority Hospital Rev. (Lake Charles Memorial Hospital), 6.375%, 2034 | 880,000 | 918,482 | ||||||

| Louisville & Jefferson County, KY, Metro Government Health Facilities Rev. (Jewish Hospital & St. Mary’s Healthcare), 6.125%, 2018 (c) | 1,315,000 | 1,668,078 | ||||||

| Louisville & Jefferson County, KY, Metropolitan Government Healthcare Systems Rev. (Norton Healthcare, Inc.), 5.25%, 2036 | 1,265,000 | 1,317,940 | ||||||

| Lufkin, TX, Health Facilities Development Corp. Rev. (Memorial Health System), 5.5%, 2037 | 60,000 | 60,836 | ||||||

7

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Healthcare Revenue - Hospitals - continued | ||||||||

| Martin County, FL, Health Facilities Authority Rev. (Martin Memorial Medical Center), 5.5%, 2042 | $ | 300,000 | $ | 317,187 | ||||

| Maryland Health & Higher Educational Facilities Authority Rev. (Anne Arundel Health System, Inc.), “A”, 6.75%, 2039 | 735,000 | 888,600 | ||||||

| Massachusetts Development Finance Agency Rev. (Tufts Medical Center), “I”, 7.25%, 2032 | 445,000 | 536,145 | ||||||

| Massachusetts Health & Educational Facilities Authority Rev. (Jordan Hospital), “E”, 6.75%, 2033 | 250,000 | 255,348 | ||||||

| Massachusetts Health & Educational Facilities Authority Rev. (Milford-Whitinsville Hospital), “C”, 5.25%, 2018 | 500,000 | 500,195 | ||||||

| Massachusetts Health & Educational Facilities Authority Rev. (Saints Memorial Medical Center), “A”, 6%, 2023 | 260,000 | 254,920 | ||||||

| Michigan Finance Authority Rev. (Trinity Health Corp.), 5%, 2035 | 1,000,000 | 1,097,350 | ||||||

| Monroe County, PA, Hospital Authority Rev. (Pocono Medical Center), “A”, 5%, 2032 | 55,000 | 58,170 | ||||||

| Monroe County, PA, Hospital Authority Rev. (Pocono Medical Center), “A”, 5%, 2041 | 35,000 | 36,376 | ||||||

| Montgomery, AL, Medical Clinic Board Health Care Facility Rev. (Jackson Hospital & Clinic), 5.25%, 2031 | 125,000 | 127,624 | ||||||

| Montgomery, AL, Medical Clinic Board Health Care Facility Rev. (Jackson Hospital & Clinic), 5.25%, 2036 | 825,000 | 836,657 | ||||||

| New Hampshire Business Finance Authority Rev. (Elliot Hospital Obligated Group), “A”, 6%, 2027 | 585,000 | 657,014 | ||||||

| New Hampshire Health & Education Facilities Authority Rev. (Catholic Medical Center), “A”, 6.125%, 2032 | 25,000 | 25,277 | ||||||

| New Hampshire Health & Education Facilities Authority Rev. (Memorial Hospital at Conway), 5.25%, 2021 | 530,000 | 544,755 | ||||||

| New Hanover County, NC, Hospital Rev., AGM, 5.125%, 2031 | 895,000 | 979,112 | ||||||

| New Jersey Health Care Facilities, Financing Authority Rev. (St. Peter’s University Hospital), 5.75%, 2037 | 545,000 | 578,447 | ||||||

| New Mexico Hospital Equipment Loan Council, Hospital Rev. (Rehoboth McKinley Christian Hospital), “A”, 5%, 2017 | 245,000 | 241,791 | ||||||

| New York Dormitory Authority Rev., Non-State Supported Debt (Bronx-Lebanon Hospital Center), LOC, 6.5%, 2030 | 190,000 | 228,519 | ||||||

| New York Dormitory Authority Rev., Non-State Supported Debt (Bronx-Lebanon Hospital Center), LOC, 6.25%, 2035 | 115,000 | 133,796 | ||||||

| Norman, OK, Regional Hospital Authority Rev., 5%, 2027 | 155,000 | 156,480 | ||||||

| Norman, OK, Regional Hospital Authority Rev., 5.375%, 2029 | 90,000 | 91,301 | ||||||

| Norman, OK, Regional Hospital Authority Rev., 5.375%, 2036 | 235,000 | 235,818 | ||||||

| Norman, OK, Regional Hospital Authority Rev., 5.125%, 2037 | 415,000 | 405,488 | ||||||

| Olympia, WA, Healthcare Facilities Authority Rev. (Catholic Health Initiatives), “D”, 6.375%, 2036 | 1,095,000 | 1,335,221 | ||||||

8

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Healthcare Revenue - Hospitals - continued | ||||||||

| Palomar Pomerado Health Care District, CA, COP, 6.75%, 2039 | $ | 890,000 | $ | 980,727 | ||||

| Philadelphia, PA, Hospitals & Higher Education Facilities Authority Rev. (Temple University Health System), “A”, 6.625%, 2023 | 355,000 | 355,675 | ||||||

| Rhode Island Health & Educational Building Corp. Rev., Hospital Financing (Lifespan Obligated Group), “A”, ASSD GTY, 7%, 2039 | 660,000 | 775,507 | ||||||

| Royal Oak, MI, Hospital Finance Authority Rev. (William Beaumont Hospital), 8.25%, 2039 | 485,000 | 624,074 | ||||||

| Salida, CO, Hospital District Rev., 5.25%, 2036 | 694,000 | 699,011 | ||||||

| Skagit County, WA, Public Hospital District No. 001 Rev. (Skagit Valley Hospital), 5.75%, 2032 | 90,000 | 94,792 | ||||||

| South Dakota Health & Educational Facilities Authority Rev. (Avera Health), “A”, 5%, 2042 | 105,000 | 112,096 | ||||||

| South Lake County, FL, Hospital District Rev. (South Lake Hospital), 6.375%, 2034 | 250,000 | 258,143 | ||||||

| South Lake County, FL, Hospital District Rev. (South Lake Hospital), “A”, 6%, 2029 | 85,000 | 94,628 | ||||||

| South Lake County, FL, Hospital District Rev. (South Lake Hospital), “A”, 6.25%, 2039 | 125,000 | 138,183 | ||||||

| Sullivan County, TN, Health, Educational & Housing Facilities Board Hospital Rev. (Wellmont Health Systems Project), “C”, 5.25%, 2036 | 1,085,000 | 1,123,626 | ||||||

| Sumner County, TN, Health, Educational & Housing Facilities Board Rev. (Sumner Regional Health Systems, Inc.), “A”, 5.5%, 2046 (a)(d) | 375,000 | 4,688 | ||||||

| Tyler, TX, Health Facilities Development Corp. (East Texas Medical Center), “A”, 5.25%, 2032 | 230,000 | 233,443 | ||||||

| Tyler, TX, Health Facilities Development Corp. (East Texas Medical Center), “A”, 5.375%, 2037 | 190,000 | 193,690 | ||||||

| Virginia Small Business Financing Authority, Hospital Rev. (Wellmont Health Project), “A”, 5.25%, 2037 | 470,000 | 491,159 | ||||||

| Washington Health Care Facilities Authority Rev. (Multicare Health Systems), “B”, ASSD GTY, 6%, 2039 | 440,000 | 491,894 | ||||||

| West Contra Costa, CA, Healthcare District, AMBAC, 5.5%, 2029 | 105,000 | 108,289 | ||||||

| Wisconsin Health & Educational Facilities Authority Rev. (Aurora Health Care, Inc.), 6.4%, 2033 | 350,000 | 360,875 | ||||||

| Wisconsin Health & Educational Facilities Authority Rev. (Aurora Health Care, Inc.), “A”, 5%, 2026 | 200,000 | 222,070 | ||||||

| Wisconsin Health & Educational Facilities Authority Rev. (Aurora Health Care, Inc.), “A”, 5%, 2028 | 60,000 | 65,644 | ||||||

| Wisconsin Health & Educational Facilities Authority Rev. (Fort Healthcare, Inc.), 6.1%, 2034 | 750,000 | 798,473 | ||||||

| Wisconsin Health & Educational Facilities Authority Rev. (Meritor Hospital), “A”, 5.5%, 2031 | 725,000 | 802,909 | ||||||

9

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Healthcare Revenue - Hospitals - continued | ||||||||

| Wisconsin Health & Educational Facilities Authority Rev. (Meritor Hospital), “A”, 6%, 2041 | $ | 490,000 | $ | 558,855 | ||||

| Wisconsin Health & Educational Facilities Authority Rev. (Wheaton Franciscan Services), 5.25%, 2034 | 935,000 | 975,990 | ||||||

| Wisconsin Health & Educational Facilities Authority Rev. (Wheaton Franciscan Services), “A”, 5.25%, 2025 | 390,000 | 396,930 | ||||||

|

|

|

|||||||

| $ | 47,701,524 | |||||||

| Healthcare Revenue - Long Term Care - 18.5% | ||||||||

| Abilene, TX, Health Facilities Development Corp., Retirement Facilities Rev. (Sears Methodist Retirement Systems, Inc.), “A”, 5.9%, 2025 | $ | 723,000 | $ | 553,659 | ||||

| Abilene, TX, Health Facilities Development Corp., Retirement Facilities Rev. (Sears Methodist Retirement Systems, Inc.), “A”, 7%, 2033 | 200,000 | 153,202 | ||||||

| Bucks County, PA, Industrial Development Authority Retirement Community Rev. (Ann’s Choice, Inc.), “A”, 6.125%, 2025 | 500,000 | 505,970 | ||||||

| Bucks County, PA, Industrial Development Authority Rev. (Lutheran Community Telford Center), 5.75%, 2027 | 90,000 | 91,040 | ||||||

| Bucks County, PA, Industrial Development Authority Rev. (Lutheran Community Telford Center), 5.75%, 2037 | 120,000 | 117,674 | ||||||

| California Statewide Communities Development Authority Rev. (American Baptist Homes of the West), 6.25%, 2039 | 215,000 | 230,338 | ||||||

| Chartiers Valley, PA, Industrial & Commercial Development Authority (Friendship Village), “A”, 5.75%, 2020 | 1,000,000 | 1,002,070 | ||||||

| Chartiers Valley, PA, Industrial & Commercial Development Authority Rev. (Asbury Health Center), 6.375%, 2024 | 1,000,000 | 1,000,560 | ||||||

| Colorado Health Facilities Authority Rev. (Christian Living Communities Project), “A”, 5.75%, 2037 | 475,000 | 485,293 | ||||||

| Colorado Health Facilities Authority Rev. (Covenant Retirement Communities, Inc.), 5%, 2035 | 1,100,000 | 1,090,980 | ||||||

| Columbus, GA, Housing Authority Rev. (Calvary Community, Inc.), 7%, 2019 | 335,000 | 335,010 | ||||||

| Cumberland County, PA, Municipal Authority Rev. (Diakon Lutheran Social Ministries), 6.125%, 2029 | 695,000 | 769,018 | ||||||

| Fulton County, GA, Residential Care Facilities (Canterbury Court), “A”, 6.125%, 2026 | 500,000 | 505,450 | ||||||

| Hawaii Department of Budget & Finance, Special Purpose Rev. (15 Craigside Project), “A”, 9%, 2044 | 140,000 | 165,281 | ||||||

| Houston, TX, Health Facilities Development Corp. (Buckingham Senior Living Community), “A”, 7%, 2014 (c) | 500,000 | 559,720 | ||||||

| Howard County, MD, Retirement Facilities Rev. (Vantage House Corp.), “A”, 5.25%, 2033 | 200,000 | 179,654 | ||||||

10

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Healthcare Revenue - Long Term Care - continued | ||||||||

| Illinois Finance Authority Rev. (Evangelical Retirement Homes of Greater Chicago, Inc.), 7.25%, 2045 | $ | 850,000 | $ | 904,919 | ||||

| Illinois Finance Authority Rev. (Smith Village), “A”, 6.25%, 2035 | 1,000,000 | 966,580 | ||||||

| Illinois Health Facilities Authority Rev. (Smith Crossing), “A”, 7%, 2032 | 525,000 | 529,541 | ||||||

| Indiana Health Facilities Financing Authority Rev. (Hoosier Care, Inc.), “A”, 7.125%, 2034 | 955,000 | 955,048 | ||||||

| Iowa Finance Authority, Health Care Facilities Rev. (Care Initiatives), “B”, 5.75%, 2018 | 365,000 | 365,325 | ||||||

| Iowa Finance Authority, Health Care Facilities Rev. (Care Initiatives), “B”, 5.75%, 2028 | 1,475,000 | 1,475,428 | ||||||

| Kentucky Economic Development Finance Authority Health Facilities Rev. (AHF/Kentucky-Iowa, Inc.), 8%, 2029 | 351,000 | 357,792 | ||||||

| La Verne, CA, COP (Brethren Hillcrest Homes), “B”, 6.625%, 2025 | 525,000 | 537,332 | ||||||

| Massachusetts Development Finance Agency Rev. (Adventcare), “A”, 6.75%, 2037 | 695,000 | 710,867 | ||||||

| Massachusetts Development Finance Agency Rev. (Alliance Health of Brockton, Inc.), “A”, 7.1%, 2032 | 1,020,000 | 1,019,847 | ||||||

| Massachusetts Development Finance Agency Rev. (Linden Ponds, Inc.), “A-1”, 6.25%, 2031 | 130,267 | 107,520 | ||||||

| Massachusetts Development Finance Agency Rev. (Linden Ponds, Inc.), “A-1”, 6.25%, 2039 | 31,732 | 24,762 | ||||||

| Massachusetts Development Finance Agency Rev. (Linden Ponds, Inc.), “A-2”, 5.5%, 2046 | 8,656 | 5,885 | ||||||

| Massachusetts Development Finance Agency Rev. (Linden Ponds, Inc.), Capital Appreciation, “B”, 0%, 2056 | 43,059 | 524 | ||||||

| Massachusetts Development Finance Agency Rev. (Loomis Communities, Inc.), “A”, 5.625%, 2015 | 155,000 | 155,167 | ||||||

| Massachusetts Development Finance Agency Rev. (Loomis Communities, Inc.), “A”, 6.9%, 2032 | 125,000 | 127,629 | ||||||

| Massachusetts Development Finance Agency Rev. (The Groves in Lincoln), “A”, 7.75%, 2039 | 80,000 | 60,057 | ||||||

| Massachusetts Development Finance Agency Rev. (The Groves in Lincoln), “A”, 7.875%, 2044 | 115,000 | 86,335 | ||||||

| Montgomery County, PA, Industrial Development Authority Rev. (Whitemarsh Continuing Care), 6.125%, 2028 | 150,000 | 151,647 | ||||||

| Montgomery County, PA, Industrial Development Authority Rev. (Whitemarsh Continuing Care), 6.25%, 2035 | 600,000 | 605,472 | ||||||

| New Jersey Economic Development Authority Rev. (Lions Gate), “A”, 5.75%, 2025 | 400,000 | 405,024 | ||||||

| New Jersey Economic Development Authority Rev. (Lions Gate), “A”, 5.875%, 2037 | 300,000 | 298,632 | ||||||

11

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Healthcare Revenue - Long Term Care - continued | ||||||||

| New Jersey Economic Development Authority Rev. (Seabrook Village, Inc.), 5.25%, 2026 | $ | 500,000 | $ | 501,355 | ||||

| New Jersey Economic Development Authority Rev. (Seabrook Village, Inc.), 5.25%, 2036 | 500,000 | 495,225 | ||||||

| Norfolk, VA, Redevelopment & Housing Authority Rev. (Fort Norfolk Retirement Community), “A”, 6.125%, 2035 | 195,000 | 195,696 | ||||||

| Pell City, AL, Special Care Facilities, Financing Authority Rev. (Noland Health Services, Inc.), 5%, 2039 | 175,000 | 182,935 | ||||||

| Shelby County, TN, Health, Educational & Housing Facilities Board Rev. (Germantown Village), “A”, 7.25%, 2034 | 225,000 | 226,125 | ||||||

| South Carolina Jobs & Economic Development Authority Rev. (Woodlands at Furman), “A”, 6%, 2032 | 199,626 | 152,077 | ||||||

| South Carolina Jobs & Economic Development Authority Rev. (Woodlands at Furman), “A”, 6%, 2047 | 185,367 | 131,844 | ||||||

| South Carolina Jobs & Economic Development Authority Rev. (Woodlands at Furman), Capital Appreciation, “B”, 0%, 2047 | 85,554 | 2,861 | ||||||

| South Carolina Jobs & Economic Development Authority Rev. (Woodlands at Furman), Capital Appreciation, “B”, 0%, 2047 | 79,443 | 2,657 | ||||||

| St. John’s County, FL, Industrial Development Authority Rev. (Presbyterian Retirement), “A”, 6%, 2045 | 610,000 | 670,097 | ||||||

| Tarrant County, TX, Cultural Education Facilities Finance Corp. Retirement Facility (Air Force Village), 6.125%, 2029 | 550,000 | 606,353 | ||||||

| Tarrant County, TX, Cultural Education Facilities Finance Corp. Retirement Facility (Air Force Village), 6.375%, 2044 | 415,000 | 450,092 | ||||||

| Tarrant County, TX, Cultural Education Facilities Finance Corp. Retirement Facility (Stayton at Museum Way), 8.25%, 2044 | 770,000 | 836,205 | ||||||

| Tempe, AZ, Industrial Development Authority Rev. (Friendship Village), “A”, 6.25%, 2042 | 90,000 | 94,396 | ||||||

| Tempe, AZ, Industrial Development Authority Rev. (Friendship Village), “A”, 6.25%, 2046 | 70,000 | 73,314 | ||||||

| Travis County, TX, Health Facilities Development Corp. Rev. (Westminster Manor Health), 7%, 2030 | 130,000 | 149,098 | ||||||

| Travis County, TX, Health Facilities Development Corp. Rev. (Westminster Manor Health), 7.125%, 2040 | 195,000 | 221,280 | ||||||

| Westmoreland County, PA, Industrial Development Authority Rev. (Redstone Retirement Community), “A”, 5.875%, 2032 | 600,000 | 592,758 | ||||||

| Westmoreland County, PA, Industrial Development Retirement Authority Rev. (Redstone Retirement Community), “A”, 5.75%, 2026 | 1,250,000 | 1,264,388 | ||||||

|

|

|

|||||||

| $ | 24,445,008 | |||||||

| Healthcare Revenue - Other - 0.4% | ||||||||

| Massachusetts Health & Educational Facilities Authority Rev. (Civic Investments, Inc.), “A”, 9%, 2012 (c) | $ | 450,000 | $ | 477,446 | ||||

12

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Industrial Revenue - Airlines - 3.3% | ||||||||

| Clayton County, GA, Development Authority Special Facilities Rev. (Delta Airlines, Inc.), “A”, 8.75%, 2029 | $ | 200,000 | $ | 240,276 | ||||

| Clayton County, GA, Development Authority Special Facilities Rev. (Delta Airlines, Inc.), “B”, 9%, 2035 | 150,000 | 162,614 | ||||||

| Denver, CO, City & County Airport Rev. (United Airlines), 5.75%, 2032 | 355,000 | 363,783 | ||||||

| Houston, TX, Airport Systems Rev., Special Facilities (Continental Airlines, Inc.), “E”, 6.75%, 2029 | 155,000 | 155,716 | ||||||

| Houston, TX, Airport Systems Rev., Special Facilities (Continental Airlines, Inc.), “E”, 7%, 2029 | 200,000 | 200,960 | ||||||

| New Jersey Economic Development Authority, Special Facilities Rev. (Continental Airlines, Inc.), 6.25%, 2029 | 935,000 | 938,946 | ||||||

| New Jersey Economic Development Authority, Special Facilities Rev. (Continental Airlines, Inc.), 9%, 2033 | 1,250,000 | 1,343,888 | ||||||

| New York, NY, City Industrial Development Agencies Rev. (American Airlines, Inc.), 7.75%, 2031 (d)(q) | 385,000 | 395,984 | ||||||

| New York, NY, City Industrial Development Agency Special Facility Rev. (American Airlines, Inc.), “B”, 8.5%, 2028 (d)(q) | 500,000 | 511,195 | ||||||

|

|

|

|||||||

| $ | 4,313,362 | |||||||

| Industrial Revenue - Chemicals - 0.8% | ||||||||

| Brazos River, TX, Harbor Navigation District (Dow Chemical Co.), “B-2”, 4.95%, 2033 | $ | 400,000 | $ | 419,124 | ||||

| Port of Bay, TX, City Authority (Hoechst Celanese Corp.), 6.5%, 2026 | 660,000 | 660,581 | ||||||

|

|

|

|||||||

| $ | 1,079,705 | |||||||

| Industrial Revenue - Environmental Services - 0.9% | ||||||||

| California Pollution Control Financing Authority, Solid Waste Disposal Rev. (Republic Services, Inc.), “B”, 5.25%, 2023 (b) | $ | 135,000 | $ | 154,900 | ||||

| California Pollution Control Financing Authority, Solid Waste Disposal Rev. (Waste Management, Inc.), “C”, 5.125%, 2023 | 655,000 | 714,775 | ||||||

| Maine Finance Authority Solid Waste Disposal Rev. (Casella Waste Systems, Inc.), 6.25%, 2025 (b) | 360,000 | 363,427 | ||||||

|

|

|

|||||||

| $ | 1,233,102 | |||||||

| Industrial Revenue - Other - 1.5% | ||||||||

| Annawan, IL, Tax Increment Rev. (Patriot Renewable Fuels LLC), 5.625%, 2018 | $ | 280,000 | $ | 254,173 | ||||

| California Statewide Communities Development Authority Facilities (Microgy Holdings Project), 9%, 2038 (a)(d) | 50,491 | 505 | ||||||

| Gulf Coast, TX, Industrial Development Authority Rev. (CITGO Petroleum Corp.), 8%, 2028 | 375,000 | 375,281 | ||||||

| Houston, TX, Industrial Development Corp. (United Parcel Service, Inc.), 6%, 2023 | 435,000 | 409,357 | ||||||

13

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Industrial Revenue - Other - continued | ||||||||

| New Jersey Economic Development Authority Rev. (GMT Realty LLC), “B”, 6.875%, 2037 | $ | 1,000,000 | $ | 996,990 | ||||

|

|

|

|||||||

| $ | 2,036,306 | |||||||

| Industrial Revenue - Paper - 2.8% | ||||||||

| Beauregard Parish, LA (Boise Cascade Corp.), 6.8%, 2027 | $ | 1,000,000 | $ | 992,560 | ||||

| Courtland, AL, Industrial Development Board Solid Waste Disposal Rev. (Champion International Corp.), 6%, 2029 | 1,000,000 | 1,004,210 | ||||||

| Escambia County, FL, Environmental Improvement Rev. (International Paper Co.), “A”, 5%, 2026 | 980,000 | 980,363 | ||||||

| Escambia County, FL, Environmental Improvement Rev. (International Paper Co.), “A”, 4.75%, 2030 | 290,000 | 290,096 | ||||||

| Phenix City, AL, Industrial Development Board Environmental Improvement Rev., “A” (Mead Westvaco Coated Board Project), 6.35%, 2035 | 400,000 | 401,328 | ||||||

|

|

|

|||||||

| $ | 3,668,557 | |||||||

| Miscellaneous Revenue - Entertainment & Tourism - 1.1% | ||||||||

| Agua Caliente Band of Cahuilla Indians, CA, Rev., 5.6%, 2013 (n) | $ | 335,000 | $ | 337,998 | ||||

| Brooklyn, NY, Arena Local Development Corp. (Barclays Center Project), 6%, 2030 | 135,000 | 149,479 | ||||||

| Brooklyn, NY, Arena Local Development Corp. (Barclays Center Project), 6.25%, 2040 | 85,000 | 94,608 | ||||||

| Cow Creek Band of Umpqua Tribe of Indians, OR, “C”, 5.625%, 2026 (n) | 650,000 | 574,743 | ||||||

| Seminole Tribe, FL, Special Obligation Rev., “A”, 5.25%, 2027 (n) | 280,000 | 283,086 | ||||||

|

|

|

|||||||

| $ | 1,439,914 | |||||||

| Miscellaneous Revenue - Other - 3.2% | ||||||||

| Austin, TX, Convention Center (Convention Enterprises, Inc.), “A”, SYNCORA, 5.25%, 2024 | $ | 305,000 | $ | 320,256 | ||||

| Capital Trust Agency, FL (Aero Syracuse LLC), 6.75%, 2032 | 350,000 | 337,841 | ||||||

| Citizens Property Insurance Corp., FL, “A-1”, 5%, 2019 | 65,000 | 73,976 | ||||||

| Citizens Property Insurance Corp., FL, “A-1”, 5%, 2020 | 305,000 | 346,654 | ||||||

| Dallas, TX, Civic Center Convention Complex Rev., ASSD GTY, 5.25%, 2034 | 845,000 | 938,288 | ||||||

| District of Columbia Rev. (American Society Hematology), 5%, 2036 | 50,000 | 53,511 | ||||||

| District of Columbia Rev. (American Society Hematology), 5%, 2042 | 40,000 | 42,571 | ||||||

| Massachusetts Port Authority Facilities Rev. (Conrac Project), “A”, 5.125%, 2041 | 40,000 | 43,363 | ||||||

| New York Liberty Development Corp., Liberty Rev. (One Bryant Park LLC), 6.375%, 2049 | 545,000 | 614,324 | ||||||

| New York Liberty Development Corp., Liberty Rev. (World Trade Center Project), 5%, 2044 | 535,000 | 578,474 | ||||||

14

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Miscellaneous Revenue - Other - continued | ||||||||

| Summit County, OH, Port Authority Building Rev. (Twinsburg Township), “D”, 5.125%, 2025 | $ | 595,000 | $ | 588,003 | ||||

| V Lakes Utility District, MS, Water Systems Rev., 7%, 2037 | 300,000 | 289,677 | ||||||

|

|

|

|||||||

| $ | 4,226,938 | |||||||

| Multi-Family Housing Revenue - 4.7% | ||||||||

| Broward County, FL, Housing Finance Authority Rev. (Chaves Lakes Apartments Ltd.), “A”, 7.5%, 2040 | $ | 490,000 | $ | 490,132 | ||||

| Capital Trust Agency, FL, Housing Rev. (Atlantic Housing Foundation), “B”, 7%, 2032 (d)(q) | 625,000 | 278,194 | ||||||

| Charter Mac Equity Issuer Trust, FHLMC, 6%, 2052 (n) | 1,000,000 | 1,114,490 | ||||||

| District of Columbia Housing Finance Agency (Henson Ridge), “E”, FHA, 5.1%, 2037 | 655,000 | 669,155 | ||||||

| Durham, NC, Durham Housing Authority Rev. (Magnolia Pointe Apartments), 5.65%, 2038 | 913,072 | 821,710 | ||||||

| El Paso County, TX, Housing Finance Corp. (American Housing Foundation), “C”, 8%, 2032 | 270,000 | 271,990 | ||||||

| El Paso County, TX, Housing Finance Corp. (American Housing Foundation), “D”, 10%, 2032 | 275,000 | 277,002 | ||||||

| Mississippi Home Corp., Rev. (Kirkwood Apartments), 6.8%, 2037 | 605,000 | 384,847 | ||||||

| MuniMae TE Bond Subsidiary LLC, 5.8%, 2049 (z) | 1,000,000 | 715,050 | ||||||

| Resolution Trust Corp., Pass-Through Certificates, “1993”, 8.5%, 2016 (z) | 455,481 | 442,892 | ||||||

| Wilmington, DE, Multi-Family Housing Rev. (Electra Arms Senior Associates), 6.25%, 2028 | 755,000 | 714,887 | ||||||

|

|

|

|||||||

| $ | 6,180,349 | |||||||

| Parking - 0.3% | ||||||||

| Boston, MA, Metropolitan Transit Parking Corp., Systemwide Parking Rev., 5.25%, 2036 | $ | 300,000 | $ | 334,083 | ||||

| Port Revenue - 1.4% | ||||||||

| Maryland Economic Development Corp. Rev. (Port America Chesapeake Terminal Project), “B”, 5.75%, 2035 | $ | 285,000 | $ | 305,130 | ||||

| Port Authority NY & NJ, Cons Thirty Seventh, AGM, 5.125%, 2030 | 1,450,000 | 1,523,095 | ||||||

|

|

|

|||||||

| $ | 1,828,225 | |||||||

| Sales & Excise Tax Revenue - 5.2% | ||||||||

| Bolingbrook, IL, Sales Tax Rev., 6.25%, 2024 | $ | 500,000 | $ | 313,390 | ||||

| Chicago, IL, Transit Authority Sales Tax Receipts Rev., 5.25%, 2029 | 165,000 | 189,724 | ||||||

| Chicago, IL, Transit Authority Sales Tax Receipts Rev., 5.25%, 2030 | 330,000 | 377,431 | ||||||

| Chicago, IL, Transit Authority Sales Tax Receipts Rev., 5.25%, 2031 | 60,000 | 68,363 | ||||||

| Chicago, IL, Transit Authority Sales Tax Receipts Rev., 5.25%, 2040 | 505,000 | 563,302 | ||||||

15

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Sales & Excise Tax Revenue - continued | ||||||||

| Colorado Regional Transportation District, Private Activity Rev. (Denver Transportation Partners), 6%, 2034 | $ | 630,000 | $ | 714,181 | ||||

| Colorado Regional Transportation District, Private Activity Rev. (Denver Transportation Partners), 6%, 2041 | 300,000 | 338,979 | ||||||

| Massachusetts Bay Transportation Authority, Sales Tax Rev., “A”, 5%, 2024 | 1,095,000 | 1,377,433 | ||||||

| Massachusetts School Building Authority, Dedicated Sales Tax Rev., AMBAC, 4.75%, 2032 | 840,000 | 907,662 | ||||||

| Massachusetts School Building Authority, Dedicated Sales Tax Rev., “B”, 5%, 2032 | 390,000 | 456,359 | ||||||

| Metropolitan Pier & Exposition Authority, State Tax Rev., Capital Appreciation, ETM, FGIC, 0%, 2014 (c) | 1,010,000 | 995,991 | ||||||

| Puerto Rico Sales Tax Financing Corp., Sales Tax Rev., “C”, 5.25%, 2041 | 35,000 | 37,339 | ||||||

| Puerto Rico Sales Tax Financing Corp., Sales Tax Rev., Capital Appreciation, “A”, 0% to 2016, 6.75% to 2032 | 460,000 | 470,207 | ||||||

|

|

|

|||||||

| $ | 6,810,361 | |||||||

| Single Family Housing - Local - 1.1% | ||||||||

| Minneapolis & St. Paul Housing Authority Rev. (City Living), “A-2”, GNMA, 5%, 2038 | $ | 371,241 | $ | 376,787 | ||||

| Pittsburgh, PA, Urban Redevelopment Authority Rev., “C”, GNMA, 4.8%, 2028 | 1,000,000 | 1,018,370 | ||||||

|

|

|

|||||||

| $ | 1,395,157 | |||||||

| Single Family Housing - State - 1.3% | ||||||||

| California Housing Finance Agency Rev. (Home Mortgage), “G”, 5.5%, 2042 | $ | 290,000 | $ | 301,284 | ||||

| Colorado Housing & Finance Authority, “A”, 5.5%, 2029 | 1,045,000 | 1,072,818 | ||||||

| Iowa Finance Authority, Single Family Mortgage Rev., “E”, 5.4%, 2032 | 270,000 | 271,377 | ||||||

| Kentucky Counties Single Family Mortgage Rev., “A”, NATL, 9%, 2016 | 5,000 | 5,001 | ||||||

| North Dakota Housing Finance Agency Rev., “A”, 4.85%, 2021 | 100,000 | 102,466 | ||||||

|

|

|

|||||||

| $ | 1,752,946 | |||||||

| Solid Waste Revenue - 0.1% | ||||||||

| Pennsylvania Economic Development Financing Authority, Sewer Sludge Disposal Rev. (Philadelphia Biosolids Facility), 6.25%, 2032 | $ | 75,000 | $ | 83,544 | ||||

| State & Agency - Other - 0.4% | ||||||||

| Commonwealth of Puerto Rico (Mepsi Campus), “A”, 6.5%, 2037 | $ | 500,000 | $ | 511,420 | ||||

| State & Local Agencies - 4.4% | ||||||||

| Dorchester County, SC, School District No. 2, Growth Remedy Opportunity Tax Hike, 5.25%, 2029 | $ | 500,000 | $ | 535,985 | ||||

16

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| State & Local Agencies - continued | ||||||||

| Golden State, CA, Tobacco Securitization Corp., Tobacco Settlement Rev., Enhanced, “A”, FGIC, 5%, 2035 | $ | 110,000 | $ | 111,922 | ||||

| Guam Government Department of Education (John F. Kennedy High School), “A”, COP, 6.875%, 2040 | 295,000 | 319,928 | ||||||

| Laurens County, SC, School District No. 55, Installment Purchase Rev., 5.25%, 2030 | 700,000 | 731,010 | ||||||

| New York Metropolitan Transportation Authority, “A”, 5.125%, 2029 | 800,000 | 802,504 | ||||||

| Newberry, SC, Investing in Children’s Education (Newberry County School District Program), 5%, 2030 | 400,000 | 416,076 | ||||||

| Philadelphia, PA, Municipal Authority Rev., 6.5%, 2034 | 135,000 | 147,060 | ||||||

| Puerto Rico Public Finance Corp., “E”, ETM, 6%, 2026 (c) | 80,000 | 111,458 | ||||||

| Puerto Rico Public Finance Corp., “E”, ETM, 6%, 2026 (c) | 820,000 | 1,166,401 | ||||||

| Puerto Rico Public Finance Corp., Commonwealth Appropriations, “B”, 6%, 2026 | 225,000 | 260,510 | ||||||

| Puerto Rico Public Finance Corp., Commonwealth Appropriations, “B”, 5.5%, 2031 | 325,000 | 349,905 | ||||||

| Wisconsin General Fund Annual Appropriation Rev., “A”, 5.75%, 2033 (f) | 660,000 | 798,976 | ||||||

|

|

|

|||||||

| $ | 5,751,735 | |||||||

| Student Loan Revenue - 1.0% | ||||||||

| Iowa Student Loan Liquidity Corp., “A-2”, 5.5%, 2025 | $ | 200,000 | $ | 223,050 | ||||

| Iowa Student Loan Liquidity Corp., “A-2”, 5.6%, 2026 | 200,000 | 223,090 | ||||||

| Iowa Student Loan Liquidity Corp., “A-2”, 5.7%, 2027 | 20,000 | 22,341 | ||||||

| Iowa Student Loan Liquidity Corp., “A-2”, 5.75%, 2028 | 370,000 | 412,195 | ||||||

| Massachusetts Educational Financing Authority, Education Loan Rev., “H”, ASSD GTY, 6.35%, 2030 | 410,000 | 452,948 | ||||||

| Massachusetts Educational Financing Authority, Education Loan Rev., “I-A”, 5.5%, 2022 | 25,000 | 29,113 | ||||||

|

|

|

|||||||

| $ | 1,362,737 | |||||||

| Tax - Other - 2.0% | ||||||||

| Dallas County, TX, Flood Control District, 7.25%, 2032 | $ | 750,000 | $ | 764,385 | ||||

| Hudson Yards, NY, Infrastructure Corp. Rev., “A”, 5%, 2047 | 360,000 | 374,623 | ||||||

| Hudson Yards, NY, Infrastructure Corp. Rev., “A”, 5.75%, 2047 | 370,000 | 427,716 | ||||||

| New Jersey Economic Development Authority Rev., 5%, 2025 | 135,000 | 150,669 | ||||||

| New Jersey Economic Development Authority Rev., 5%, 2026 | 65,000 | 72,025 | ||||||

| New Jersey Economic Development Authority Rev., 5%, 2028 | 25,000 | 27,438 | ||||||

| New Jersey Economic Development Authority Rev., 5%, 2029 | 25,000 | 27,329 | ||||||

| New York, NY, City Transitional Finance Authority Building Aid Rev., “S-3”, 5.25%, 2039 | 440,000 | 483,446 | ||||||

17

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Tax - Other - continued | ||||||||

| Virgin Islands Public Finance Authority Rev. (Diageo Project), “A”, 6.75%, 2037 | $ | 205,000 | $ | 237,363 | ||||

|

|

|

|||||||

| $ | 2,564,994 | |||||||

| Tax Assessment - 5.6% | ||||||||

| Anne Arundel County, MD, Special Obligation (National Business Park-North Project), 6.1%, 2040 | $ | 140,000 | $ | 146,262 | ||||

| Atlanta, GA, Tax Allocation (Eastside Project), “B”, 5.4%, 2020 | 500,000 | 542,770 | ||||||

| Capital Region Community Development District, FL, Capital Improvement Rev., “A”, 7%, 2039 | 225,000 | 203,821 | ||||||

| Celebration Community Development District, FL, “A”, 6.4%, 2034 | 665,000 | 676,844 | ||||||

| Chicago, IL, Tax Increment Allocation (Pilsen Redevelopment), “B”, 6.75%, 2022 | 310,000 | 323,907 | ||||||

| Du Page County, IL, Special Service Area No. 31 Special Tax (Monarch Landing Project), 5.625%, 2036 | 250,000 | 238,798 | ||||||

| Heritage Harbour North Community Development District, FL, Capital Improvement Rev., 6.375%, 2038 | 315,000 | 294,065 | ||||||

| Homestead, Community Development District, FL, Special Assessment, “A”, 6%, 2037 | 365,000 | 255,902 | ||||||

| Homestead, Community Development District, FL, Special Assessment, “B”, 5.9%, 2013 (d) | 140,000 | 98,363 | ||||||

| Huntington Beach, CA, Community Facilities District, Special Tax (Grand Coast Resort), “2000-1”, 6.45%, 2031 | 500,000 | 506,090 | ||||||

| Lincolnshire, IL, Special Service Area No. 1 (Sedgebrook Project), 6.25%, 2034 | 250,000 | 250,440 | ||||||

| Main Street Community Development District, FL, “A”, 6.8%, 2038 | 280,000 | 261,304 | ||||||

| Oakmont Grove Community Development District, FL, “A”, 5.4%, 2038 (a)(d) | 300,000 | 111,000 | ||||||

| Ohio County, WV, Commission Tax Increment Rev. (Fort Henry Centre), “A”, 5.85%, 2034 | 125,000 | 129,751 | ||||||

| Orlando, FL, Special Assessment Rev. (Conroy Road Interchange Project), “A”, 5.8%, 2026 | 275,000 | 275,638 | ||||||

| Plano, IL, Special Service Area No. 4 (Lakewood Springs Project Unit 5-B), 6%, 2035 | 1,435,000 | 1,386,540 | ||||||

| Sweetwater Creek Community Development District, FL, Capital Improvement Rev., “A”, 5.5%, 2038 (a)(d) | 190,000 | 72,200 | ||||||

| Tolomato Community Development District, FL, Special Assessment, 6.65%, 2040 (d)(q) | 585,000 | 260,325 | ||||||

| Tuscany Reserve Community Development District, FL, Special Assessment, “B”, 5.25%, 2016 | 185,000 | 168,307 | ||||||

| West Villages Improvement District, FL, Special Assessment Rev. (Unit of Development No. 3), 5.5%, 2037 (a)(d) | 470,000 | 202,100 | ||||||

18

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Tax Assessment - continued | ||||||||

| Westridge, FL, Community Development District, Capital Improvement Rev., 5.8%, 2037 (a)(d) | $ | 960,000 | $ | 364,800 | ||||

| Yorba Linda, CA, Redevelopment Agency, Tax Allocation Rev., Capital Appreciation, “A”, NATL, 0%, 2024 | 1,325,000 | 678,824 | ||||||

|

|

|

|||||||

| $ | 7,448,051 | |||||||

| Tobacco - 8.3% | ||||||||

| Buckeye, OH, Tobacco Settlement Financing Authority, “A-2”, 5.125%, 2024 | $ | 3,270,000 | $ | 2,616,262 | ||||

| Buckeye, OH, Tobacco Settlement Financing Authority, “A-2”, 5.875%, 2047 | 250,000 | 189,475 | ||||||

| Golden State, CA, Tobacco Securitization Corp., Tobacco Settlement Rev., “A-1”, 6.25%, 2013 (c) | 785,000 | 819,571 | ||||||

| Golden State, CA, Tobacco Securitization Corp., Tobacco Settlement Rev., “A-1”, 5.75%, 2047 | 525,000 | 418,766 | ||||||

| Golden State, CA, Tobacco Securitization Corp., Tobacco Settlement Rev., Asset Backed, “A-1”, 5%, 2033 | 440,000 | 336,794 | ||||||

| Illinois Railsplitter Tobacco Settlement Authority, 6%, 2028 | 1,365,000 | 1,583,960 | ||||||

| New Jersey Tobacco Settlement Financing Corp., “1-A”, 5%, 2041 | 3,355,000 | 2,601,635 | ||||||

| Rhode Island Tobacco Settlement Authority, 6%, 2023 | 920,000 | 921,316 | ||||||

| Suffolk, NY, Tobacco Asset Securitization Corp., Tobacco Settlement, “B”, 5.25%, 2037 | 80,000 | 83,087 | ||||||

| Tobacco Securitization Authority, Minnesota Tobacco Settlement Rev., “B”, 5.25%, 2031 | 790,000 | 874,333 | ||||||

| Washington Tobacco Settlement Authority Rev., 6.625%, 2032 | 500,000 | 520,370 | ||||||

|

|

|

|||||||

| $ | 10,965,569 | |||||||

| Toll Roads - 6.3% | ||||||||

| E-470 Public Highway Authority, CO, Capital Appreciation, “B”, NATL, 0%, 2018 | $ | 1,500,000 | $ | 1,247,220 | ||||

| Mid-Bay Bridge Authority, FL, Springing Lien Rev., “A”, 7.25%, 2040 | 445,000 | 519,925 | ||||||

| North Texas Tollway Authority Rev., 6%, 2038 | 765,000 | 884,095 | ||||||

| North Texas Tollway Authority Rev. (Special Projects System), “D”, 5%, 2031 | 1,200,000 | 1,364,328 | ||||||

| San Joaquin Hills, CA, Transportation Corridor Agency, Toll Road Rev., Capital Appreciation, “A”, NATL, 0%, 2015 | 3,000,000 | 2,726,130 | ||||||

| Virginia Small Business Financing Authority Rev. (Elizabeth River Crossings Opco LLC Project), 5.25%, 2032 | 285,000 | 295,830 | ||||||

| Virginia Small Business Financing Authority Rev. (Elizabeth River Crossings Opco LLC Project), 6%, 2037 | 470,000 | 515,792 | ||||||

| Virginia Small Business Financing Authority Rev. (Elizabeth River Crossings Opco LLC Project), 5.5%, 2042 | 755,000 | 788,809 | ||||||

|

|

|

|||||||

| $ | 8,342,129 | |||||||

19

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Universities - Colleges - 10.0% | ||||||||

| Allegheny County, PA, Higher Education Building Authority Rev. (Chatham University), “A”, 5%, 2030 | $ | 80,000 | $ | 86,035 | ||||

| Brevard County, FL, Industrial Development Rev. (TUFF Florida Tech LLC Project), 6.75%, 2039 | 540,000 | 593,654 | ||||||

| California Educational Facilities Authority Rev. (Chapman University), 5%, 2031 | 145,000 | 157,592 | ||||||

| California Educational Facilities Authority Rev. (University of Southern California), “A”, 5.25%, 2038 | 1,270,000 | 1,446,721 | ||||||

| California Municipal Finance Authority Rev. (Biola University), 5.8%, 2028 | 100,000 | 109,805 | ||||||

| California State University Rev., “A”, 5%, 2037 | 990,000 | 1,089,762 | ||||||

| Florida Higher Educational Facilities, Financial Authority Rev. (University of Tampa Project), “A”, 5%, 2032 | 25,000 | 26,845 | ||||||

| Florida Higher Educational Facilities, Financial Authority Rev. (University of Tampa Project), “A”, 5.25%, 2042 | 210,000 | 227,585 | ||||||

| Florida State University Board of Governors, System Improvement Rev., 6.25%, 2030 | 1,000,000 | 1,196,130 | ||||||

| Grand Valley, MI, State University Rev., 5.5%, 2027 | 135,000 | 150,698 | ||||||

| Grand Valley, MI, State University Rev., 5.625%, 2029 | 65,000 | 72,173 | ||||||

| Harris County, TX, Cultural Education Facilities Rev. (Baylor College of Medicine), “D”, 5.625%, 2032 | 540,000 | 557,480 | ||||||

| Illinois Finance Authority Rev. (Illinois Institute of Technology), “A”, 5%, 2036 | 110,000 | 93,793 | ||||||

| Illinois Finance Authority Rev. (Roosevelt University Project), 6.25%, 2029 | 670,000 | 734,092 | ||||||

| Illinois Finance Authority Rev. (Roosevelt University Project), 6.5%, 2039 | 155,000 | 169,692 | ||||||

| Illinois Finance Authority Rev. (University of Chicago), “A”, 5%, 2051 | 165,000 | 180,142 | ||||||

| Massachusetts Development Finance Agency Rev. (The Broad Institute, Inc.), “A”, 5.25%, 2037 | 580,000 | 635,674 | ||||||

| Massachusetts Health & Educational Facilities Authority Rev. (Simmons College), “I”, 8%, 2029 | 255,000 | 303,113 | ||||||

| Massachusetts Health & Educational Facilities Authority Rev. (Suffolk University), “A”, 6.25%, 2030 | 725,000 | 838,608 | ||||||

| Massachusetts Health & Educational Facilities Authority Rev. (Suffolk University), “A”, 5.75%, 2039 | 455,000 | 501,847 | ||||||

| Savannah, GA, Economic Development Authority Rev. (AASU Student Union LLC), ASSD GTY, 5.125%, 2039 | 335,000 | 361,140 | ||||||

| Texas Tech University Rev., Refunding & Improvement, “A”, 5%, 2030 | 195,000 | 225,617 | ||||||

| Texas Tech University Rev., Refunding & Improvement, “A”, 5%, 2031 | 85,000 | 97,904 | ||||||

| Texas Tech University Rev., Refunding & Improvement, “A”, 5%, 2032 | 80,000 | 91,869 | ||||||

| Texas Tech University Rev., Refunding & Improvement, “A”, 5%, 2037 | 150,000 | 169,694 | ||||||

20

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Universities - Colleges - continued | ||||||||

| University of Illinois Rev. (Auxiliary Facilities Systems), “A”, 5.125%, 2029 | $ | 1,880,000 | $ | 2,066,289 | ||||

| University of Southern Indiana Rev. (Student Fee), “J”, ASSD GTY, 5.75%, 2028 | 300,000 | 349,995 | ||||||

| University of Southern Mississippi Educational Building Corp. Rev. (Campus Facilities Project), 5.25%, 2032 | 220,000 | 249,839 | ||||||

| University of Southern Mississippi Educational Building Corp. Rev. (Campus Facilities Project), 5.375%, 2036 | 80,000 | 90,662 | ||||||

| Washington Higher Education Facilities Authority Rev. (Whitworth University), 5.875%, 2034 | 280,000 | 307,801 | ||||||

|

|

|

|||||||

| $ | 13,182,251 | |||||||

| Universities - Dormitories - 2.2% | ||||||||

| Bowling Green, OH, Student Housing Rev. (State University Project), 5.75%, 2031 | $ | 175,000 | $ | 185,091 | ||||

| Buffalo & Erie County, NY, Industrial Land Development Corp. Rev. (Buffalo State College), “A”, 5.375%, 2041 | 200,000 | 217,318 | ||||||

| California Statewide Communities Development Authority Rev. (Lancer Educational Student Housing Project), 5.625%, 2033 | 735,000 | 749,222 | ||||||

| Illinois Finance Authority Student Housing Rev. (Illinois State University), 6.75%, 2031 | 240,000 | 270,557 | ||||||

| Illinois Finance Authority Student Housing Rev. (Northern Illinois University Project), 6.625%, 2031 | 615,000 | 697,023 | ||||||

| Mississippi State University, Educational Building Corp., 5%, 2036 | 440,000 | 486,578 | ||||||

| Oregon Facilities Authority, Student Housing Rev. (Southern Oregon University), ASSD GTY, 4.7%, 2033 | 50,000 | 52,328 | ||||||

| Oregon Facilities Authority, Student Housing Rev. (Southern Oregon University), ASSD GTY, 5%, 2044 | 60,000 | 63,402 | ||||||

| Pennsylvania Higher Educational Facilities Authority Rev. (Edinboro University Foundation), 5.8%, 2030 | 80,000 | 88,684 | ||||||

| Pennsylvania Higher Educational Facilities Authority Rev. (Edinboro University Foundation), 6%, 2043 | 110,000 | 121,374 | ||||||

|

|

|

|||||||

| $ | 2,931,577 | |||||||

| Universities - Secondary Schools - 0.8% | ||||||||

| Clifton, TX, Higher Education Finance Corp. Rev. (Idea Public Schools), 5.5%, 2031 | $ | 95,000 | $ | 103,426 | ||||

| Clifton, TX, Higher Education Finance Corp. Rev. (Idea Public Schools), 5.75%, 2041 | 75,000 | 82,346 | ||||||

| Clifton, TX, Higher Education Finance Corp. Rev. (Uplift Education), “A”, 6.125%, 2040 | 215,000 | 238,945 | ||||||

| Clifton, TX, Higher Education Finance Corp. Rev. (Uplift Education), “A”, 6.25%, 2045 | 135,000 | 150,507 | ||||||

21

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Universities - Secondary Schools - continued | ||||||||

| La Vernia, TX, Higher Education Finance Corp. Rev. (KIPP, Inc.), “A”, 6.25%, 2039 | $ | 195,000 | $ | 220,750 | ||||

| North Texas Education Finance Corp., Education Rev. (Uplift Education), “A”, 4.875%, 2032 | 70,000 | 71,866 | ||||||

| North Texas Education Finance Corp., Education Rev. (Uplift Education), “A”, 5.125%, 2042 | 170,000 | 175,843 | ||||||

| Philadelphia, PA, Authority for Industrial Development Rev. (MaST Charter School), 6%, 2035 | 50,000 | 53,727 | ||||||

|

|

|

|||||||

| $ | 1,097,410 | |||||||

| Utilities - Cogeneration - 0.2% | ||||||||

| Puerto Rico Industrial, Tourist, Educational, Medical & Environmental Central Facilities (Cogeneration Facilities - AES Puerto Rico Project), 6.625%, 2026 | $ | 320,000 | $ | 320,106 | ||||

| Utilities - Investor Owned - 5.2% | ||||||||

| Apache County, AZ, Industrial Development Authority, Pollution Control Rev. (Tucson Electric Power Co.),”A”, 4.5%, 2030 | $ | 325,000 | $ | 330,109 | ||||

| Brazos River Authority, TX, Pollution Control Rev. (TXU Electric Co. LLC), “C”, 6.75%, 2038 | 555,000 | 71,950 | ||||||

| Bryant, IL, Pollution Control Rev. (Central Illinois Light Co.), 5.9%, 2023 | 975,000 | 978,257 | ||||||

| Chula Vista, CA, Industrial Development Rev. (San Diego Gas), 5.875%, 2034 | 245,000 | 286,586 | ||||||

| Farmington, NM, Pollution Control Rev. (Public Service New Mexico), “D”, 5.9%, 2040 | 500,000 | 543,740 | ||||||

| Hawaii Department of Budget & Finance Special Purpose Rev. (Hawaiian Electric Co. & Subsidiary), 6.5%, 2039 | 390,000 | 448,754 | ||||||

| Massachusetts Development Finance Agency, Solid Waste Disposal Rev. (Dominion Energy Brayton), 5.75%, 2042 (b) | 85,000 | 101,882 | ||||||

| Matagorda County, TX, Pollution Control Rev. (Central Power & Light Co.), “A”, 6.3%, 2029 | 275,000 | 316,852 | ||||||

| Mississippi Business Finance Corp., Pollution Control Rev. (Systems Energy Resources Project), 5.875%, 2022 | 1,500,000 | 1,502,940 | ||||||

| New Hampshire Business Finance Authority, Pollution Control Rev. (Public Service of New Hampshire), “B”, NATL, 4.75%, 2021 | 250,000 | 262,423 | ||||||

| Owen County, KY, Waterworks System Rev. (American Water Co. Project), “A”, 6.25%, 2039 | 205,000 | 225,406 | ||||||

| Pennsylvania Economic Development Financing Authority (Allegheny Energy Supply Co. LLC), 7%, 2039 | 600,000 | 688,416 | ||||||

| Pima County, AZ, Industrial Development Authority Rev. (Tucson Electric Power Co.), 5.75%, 2029 | 1,015,000 | 1,077,280 | ||||||

|

|

|

|||||||

| $ | 6,834,595 | |||||||

22

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Utilities - Municipal Owned - 1.3% | ||||||||

| Harris County, TX, Cultural Education Facilities Financial Corp., Thermal Utilities Rev. (Teco Project), “A”, 5.25%, 2035 | $ | 140,000 | $ | 156,125 | ||||

| Long Island, NY, Power Authority, “A”, 5%, 2038 | 735,000 | 806,905 | ||||||

| Puerto Rico Electric Power Authority, Power Rev., “A”, 5%, 2042 | 370,000 | 374,662 | ||||||

| Sacramento, CA, Municipal Utility District, “X”, 5%, 2028 | 365,000 | 421,360 | ||||||

|

|

|

|||||||

| $ | 1,759,052 | |||||||

| Utilities - Other - 3.5% | ||||||||

| California M-S-R Energy Authority Gas Rev., “A”, 7%, 2034 | $ | 155,000 | $ | 203,279 | ||||

| California M-S-R Energy Authority Gas Rev., “A”, 6.5%, 2039 | 335,000 | 414,753 | ||||||

| Georgia Main Street Natural Gas, Inc., Gas Project Rev., “A”, 5.5%, 2028 | 335,000 | 378,322 | ||||||

| Indiana Bond Bank Special Program, Gas Rev., “A”, 5.25%, 2018 | 230,000 | 266,391 | ||||||

| Public Authority for Colorado Energy Natural Gas Purchase Rev., 6.5%, 2038 | 25,000 | 31,460 | ||||||

| Salt Verde Financial Corp., AZ, Senior Gas Rev., 5%, 2037 | 705,000 | 716,224 | ||||||

| Tennessee Energy Acquisition Corp., Gas Rev., “A”, 5.25%, 2021 | 1,710,000 | 1,908,617 | ||||||

| Tennessee Energy Acquisition Corp., Gas Rev., “A”, 5.25%, 2022 | 270,000 | 296,919 | ||||||

| Tennessee Energy Acquisition Corp., Gas Rev., “A”, 5.25%, 2026 | 165,000 | 181,551 | ||||||

| Tennessee Energy Acquisition Corp., Gas Rev., “C”, 5%, 2025 | 240,000 | 254,086 | ||||||

|

|

|

|||||||

| $ | 4,651,602 | |||||||

| Water & Sewer Utility Revenue - 9.5% | ||||||||

| Atlanta, GA, Water & Wastewater Rev., “A”, 6%, 2022 | $ | 370,000 | $ | 455,637 | ||||

| Birmingham, AL, Waterworks Board Water Rev., “A”, ASSD GTY, 5.125%, 2034 | 595,000 | 652,412 | ||||||

| California Department of Water Resources, Center Valley Project Rev., “AJ”, 5%, 2035 | 1,010,000 | 1,190,346 | ||||||

| Commonwealth of Puerto Rico Aqueduct & Sewer Authority Rev., “A”, 5.75%, 2037 | 290,000 | 304,225 | ||||||

| Commonwealth of Puerto Rico Aqueduct & Sewer Authority Rev., “A”, 6%, 2038 | 655,000 | 699,861 | ||||||

| Commonwealth of Puerto Rico Aqueduct & Sewer Authority Rev., “A”, 6%, 2044 | 135,000 | 143,586 | ||||||

| DeKalb County, GA, Water & Sewer Rev., “A”, 5.25%, 2028 | 125,000 | 147,608 | ||||||

| DeKalb County, GA, Water & Sewer Rev., “A”, 5.25%, 2029 | 115,000 | 134,677 | ||||||

| DeKalb County, GA, Water & Sewer Rev., “A”, 5.25%, 2030 | 75,000 | 87,173 | ||||||

| DeKalb County, GA, Water & Sewer Rev., “A”, 5.25%, 2031 | 15,000 | 17,304 | ||||||

| DeKalb County, GA, Water & Sewer Rev., “A”, 5.25%, 2041 | 420,000 | 466,364 | ||||||

| Houston, TX, Utility System Rev., “D”, 5%, 2036 | 435,000 | 493,825 | ||||||

| King County, WA, Sewer Rev., 5%, 2040 | 1,395,000 | 1,554,504 | ||||||

| Massachusetts Water Resources Authority, “B”, 5%, 2041 | 275,000 | 310,976 | ||||||

23

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Water & Sewer Utility Revenue - continued | ||||||||

| New York Environmental Facilities Corp., Clean Drinking Water Revolving Funds, 5%, 2024 | $ | 215,000 | $ | 260,322 | ||||

| New York Environmental Facilities Corp., Clean Drinking Water Revolving Funds, 5%, 2041 | 685,000 | 765,063 | ||||||

| New York Environmental Facilities, “C”, 5%, 2041 | 945,000 | 1,070,099 | ||||||

| New York, NY, Municipal Water Finance Authority, Water & Sewer System Rev., “AA”, 5%, 2034 | 1,980,000 | 2,265,872 | ||||||

| New York, NY, Municipal Water Finance Authority, Water & Sewer Systems Rev., “DD”, 4.75%, 2035 | 790,000 | 851,770 | ||||||

| Surprise, AZ, Municipal Property Corp., 4.9%, 2032 | 700,000 | 703,535 | ||||||

|

|

|

|||||||

| $ | 12,575,159 | |||||||

| Total Municipal Bonds (Identified Cost, $188,872,474) | $ | 202,904,566 | ||||||

| Money Market Funds - 0.1% | ||||||||

| MFS Institutional Money Market Portfolio, 0.13%, at Cost and Net Asset Value (v) |

181,744 | $ | 181,744 | |||||

| Total Investments (Identified Cost, $189,054,218) | $ | 203,086,310 | ||||||

| Other Assets, Less Liabilities - 3.0% | 3,963,409 | |||||||

| Preferred Shares (Issued by the Fund) - (56.8)% | (75,000,000 | ) | ||||||

| Net assets applicable to common shares - 100.0% | $ | 132,049,719 | ||||||

| (a) | Non-income producing security. |

| (b) | Mandatory tender date is earlier than stated maturity date. |

| (c) | Refunded bond. |

| (d) | In default. Interest and/or scheduled principal payment(s) have been missed. |

| (f) | All or a portion of the security has been segregated as collateral for open futures contracts. |

| (n) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. At period end, the aggregate value of these securities was $2,310,317, representing 1.7% of net assets applicable to common shares. |

| (q) | Interest received was less than stated coupon rate. |

| (v) | Underlying affiliated fund that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualized seven-day yield of the fund at period end. |

| (z) | Restricted securities are not registered under the Securities Act of 1933 and are subject to legal restrictions on resale. These securities generally may be resold in transactions exempt from registration or |

24

Table of Contents

Portfolio of Investments (unaudited) – continued

| to the public if the securities are subsequently registered. Disposal of these securities may involve time-consuming negotiations and prompt sale at an acceptable price may be difficult. The fund holds the following restricted securities: |

| Restricted Securities | Acquisition Date |

Cost | Value | |||||||

| MuniMae TE Bond Subsidiary LLC, 5.8%, 2049 | 10/14/04 | $1,000,000 | $715,050 | |||||||

| Resolution Trust Corp., Pass-Through Certificates, “1993”, 8.5%, 2016 | 10/17/01-1/14/02 | 455,481 | 442,892 | |||||||

| Total Restricted Securities | $1,157,942 | |||||||||

| % of Net assets applicable to common shares | 0.9% | |||||||||

The following abbreviations are used in this report and are defined:

| COP | Certificate of Participation |

| ETM | Escrowed to Maturity |

| LOC | Letter of Credit |

| Insurers | ||

| AGM | Assured Guaranty Municipal | |

| AMBAC | AMBAC Indemnity Corp. | |

| ASSD GTY | Assured Guaranty Insurance Co. | |

| FGIC | Financial Guaranty Insurance Co. | |

| FHA | Federal Housing Administration | |

| FHLMC | Federal Home Loan Mortgage Corp. | |

| GNMA | Government National Mortgage Assn. | |

| NATL | National Public Finance Guarantee Corp. | |

| PSF | Permanent School Fund | |

| SYNCORA | Syncora Guarantee Inc. | |

Derivative Contracts at 5/31/12

Futures Contracts Outstanding at 5/31/12

| Description | Currency | Contracts | Value | Expiration Date | Unrealized Appreciation (Depreciation) |

|||||||||||||

| Liability Derivatives | ||||||||||||||||||

| Interest Rate Futures | ||||||||||||||||||

| U.S. Treasury Bond 30 yr (Short) | USD | 22 | $3,293,813 | September - 2012 | $(51,640 | ) | ||||||||||||

| U.S. Treasury Note 10 yr (Short) | USD | 188 | 25,180,250 | September - 2012 | (173,971 | ) | ||||||||||||

|

|

|

|||||||||||||||||

| $(225,611 | ) | |||||||||||||||||

|

|

|

|||||||||||||||||

At May 31, 2012, the fund had liquid securities with an aggregate value of $357,118 to cover any commitments for certain derivative contracts.

See Notes to Financial Statements

25

Table of Contents

Financial Statements

STATEMENT OF ASSETS AND LIABILITIES

At 5/31/12 (unaudited)

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| Assets | ||||

| Investments- |

||||

| Non-affiliated issuers, at value (identified cost, $188,872,474) |

$202,904,566 | |||

| Underlying affiliated funds, at cost and value | 181,744 | |||

| Total investments, at value (identified cost, $189,054,218) |

$203,086,310 | |||

| Cash |

28 | |||

| Receivables for |

||||

| Investments sold |

892,125 | |||

| Interest |

3,221,125 | |||

| Other assets |

18,200 | |||

| Total assets |

$207,217,788 | |||

| Liabilities | ||||

| Payables for |

||||

| Distributions on preferred shares |

$2,263 | |||

| Daily variation margin on open futures contracts |

57,813 | |||

| Payable to affiliates |

||||

| Investment adviser |

7,563 | |||

| Transfer agent and dividend disbursing costs |

1,353 | |||

| Payable for independent Trustees’ compensation |

2,538 | |||

| Accrued expenses and other liabilities |

96,539 | |||

| Total liabilities |

$168,069 | |||

| Preferred shares | ||||

| Auction preferred shares (3,000 shares issued and outstanding at $25,000 per share) at liquidation value |

$75,000,000 | |||

| Net assets applicable to common shares |

$132,049,719 | |||

| Net assets consist of | ||||

| Paid-in capital – common shares |

$172,957,826 | |||

| Unrealized appreciation (depreciation) on investments |

13,806,481 | |||

| Accumulated net realized gain (loss) on investments |

(55,279,807 | ) | ||

| Undistributed net investment income |

565,219 | |||

| Net assets applicable to common shares |

$132,049,719 | |||

| Preferred shares, at liquidation value (3,000 shares issued and outstanding at $25,000 per share) |

75,000,000 | |||

| Net assets including preferred shares |

$207,049,719 | |||

| Common shares of beneficial interest outstanding |

28,216,306 | |||

| Net asset value per common share (net assets of |

$4.68 |

See Notes to Financial Statements

26

Table of Contents

Financial Statements

Six months ended 5/31/12 (unaudited)

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| Net investment income | ||||

| Income |

||||

| Interest |

$5,708,125 | |||

| Dividends from underlying affiliated funds |

1,294 | |||

| Total investment income |

$5,709,419 | |||

| Expenses |

||||

| Management fee |

$658,449 | |||

| Transfer agent and dividend disbursing costs |

23,498 | |||

| Administrative services fee |

20,331 | |||

| Independent Trustees’ compensation |

12,787 | |||

| Stock exchange fee |

12,617 | |||

| Preferred shares service fee |

38,227 | |||

| Custodian fee |

8,620 | |||

| Shareholder communications |

16,159 | |||

| Audit and tax fees |

38,231 | |||

| Legal fees |

1,873 | |||

| Miscellaneous |

20,067 | |||

| Total expenses |

$850,859 | |||

| Fees paid indirectly |

(5 | ) | ||

| Reduction of expenses by investment adviser |

(273 | ) | ||

| Net expenses |

$850,581 | |||

| Net investment income |

$4,858,838 | |||

| Realized and unrealized gain (loss) on investments | ||||

| Realized gain (loss) (identified cost basis) |

||||

| Investments |

$(1,287,927 | ) | ||

| Futures contracts |

(957,085 | ) | ||

| Net realized gain (loss) on investments |

$(2,245,012 | ) | ||

| Change in unrealized appreciation (depreciation) |

||||

| Investments |

$14,707,323 | |||

| Futures contracts |

(372,204 | ) | ||

| Net unrealized gain (loss) on investments |

$14,335,119 | |||

| Net realized and unrealized gain (loss) on investments |

$12,090,107 | |||

| Distributions declared to preferred shareholders |

$(90,429 | ) | ||

| Change in net assets from operations |

$16,858,516 |

See Notes to Financial Statements

27

Table of Contents

Financial Statements

STATEMENTS OF CHANGES IN NET ASSETS

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| Change in net assets | Six months ended 5/31/12 |

Year ended 11/30/11 |

||||||

| From operations | ||||||||

| Net investment income |

$4,858,838 | $9,910,163 | ||||||

| Net realized gain (loss) on investments |

(2,245,012 | ) | (5,216,349 | ) | ||||

| Net unrealized gain (loss) on investments |

14,335,119 | 5,561,140 | ||||||

| Distributions declared to preferred shareholders |

(90,429 | ) | (236,327 | ) | ||||

| Change in net assets from operations |

$16,858,516 | $10,018,627 | ||||||

| Distributions declared to common shareholders | ||||||||

| From net investment income |

$(4,876,681 | ) | $(10,006,832 | ) | ||||

| Net asset value of shares issued to common shareholders in reinvestment of distributions |

$222,140 | $461,392 | ||||||

| Total change in net assets |

$12,203,975 | $473,187 | ||||||

| Net assets applicable to common shares | ||||||||

| At beginning of period |

119,845,744 | 119,372,557 | ||||||

| At end of period (including undistributed net investment income of $565,219 and $673,491, respectively) |

$132,049,719 | $119,845,744 | ||||||

See Notes to Financial Statements

28

Table of Contents

Financial Statements

The financial highlights table is intended to help you understand the fund’s financial performance for the semiannual period and the past 5 fiscal years. Certain information reflects financial results for a single fund share. The total returns in the table represent the rate by which an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| Six months (unaudited) |

Years ended 11/30 | |||||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||||||

| Common Shares | ||||||||||||||||||||||||

| Net asset value, beginning of period |

$4.25 | $4.25 | $4.18 | $3.48 | $5.34 | $5.98 | ||||||||||||||||||

| Income (loss) from investment operations | ||||||||||||||||||||||||

| Net investment income (d) |

$0.17 | $0.35 | $0.37 | $0.38 | $0.43 | $ 0.45 | (z) | |||||||||||||||||

| Net realized and unrealized gain |

0.43 | 0.02 | 0.06 | 0.67 | (1.85 | ) | (0.66 | )(z) | ||||||||||||||||

| Distributions declared to |

(0.00 | )(w) | (0.01 | ) | (0.01 | ) | (0.02 | ) | (0.11 | ) | (0.12 | ) | ||||||||||||

| Total from investment operations |

$0.60 | $0.36 | $0.42 | $1.03 | $(1.53 | ) | $(0.33 | ) | ||||||||||||||||