UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | 811-04997 |

| Exact name of registrant as specified in charter: | Delaware Group® Equity Funds V |

| Address of principal executive offices: | 610 Market Street |

| Philadelphia, PA 19106 | |

| Name and address of agent for service: | David F. Connor, Esq. |

| 610 Market Street | |

| Philadelphia, PA 19106 | |

| Registrant’s telephone number, including area code: | (800) 523-1918 |

| Date of fiscal year end: | November 30 |

| Date of reporting period: | November 30, 2023 |

Item 1. Reports to Stockholders

|

|

Annual report

US equity mutual fund

Delaware Small Cap Core Fund

November 30, 2023

Carefully consider the Fund's investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Fund's prospectus and its summary prospectus, which may be obtained by visiting delawarefunds.com/literature or calling 800 523-1918. Investors should read the prospectus and the summary prospectus carefully before investing.

You can obtain shareholder reports and prospectuses online instead of in the mail. Visit delawarefunds.com/edelivery.

Experience Delaware Funds by Macquarie®

Macquarie Asset Management (MAM) is a global asset manager that aims to deliver positive impact for everyone. MAM's public markets businesses trace their roots to 1929 and partner with institutional and individual clients to deliver specialist active investment capabilities across global equities, fixed income, and multi-asset solutions using a conviction-based, long-term approach to investing. In the US, retail investors recognize our Delaware Funds by Macquarie family of funds as one of the oldest mutual fund families.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Funds or obtain a prospectus for Delaware Small Cap Core Fund at delawarefunds.com/literature.

Manage your account online

· Check your account balance and transactions

· View statements and tax forms

· Make purchases and redemptions

Visit delawarefunds.com/account-access.

Macquarie Asset Management (MAM) is the asset management division of Macquarie Group. MAM is an integrated asset manager across public and private markets offering a diverse range of capabilities, including real assets, real estate, credit, equities, and multi-asset solutions.

The Fund is advised by Delaware Management Company, a series of Macquarie Investment Management Business Trust (MIMBT), a US registered investment adviser, and distributed by Delaware Distributors, L.P. (DDLP), an affiliate of MIMBT and Macquarie Group Limited.

Other than Macquarie Bank Limited ABN 46 008 583 542 (“Macquarie Bank”), any Macquarie Group entity noted in this document is not an authorized deposit-taking institution for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these other Macquarie Group entities do not represent deposits or other liabilities of Macquarie Bank. Macquarie Bank does not guarantee or otherwise provide assurance in respect of the obligations of these other Macquarie Group entities. In addition, if this document relates to an investment, (a) the investor is subject to investment risk including possible delays in repayment and loss of income and principal invested and (b) none of Macquarie Bank or any other Macquarie Group entity guarantees any particular rate of return on or the performance of the investment, nor do they guarantee repayment of capital in respect of the investment.

The Fund is governed by US laws and regulations.

This annual report is for the information of Delaware Small Cap Core Fund shareholders, but it may be used with prospective investors when preceded or accompanied by the Delaware Fund fact sheet for the most recently completed calendar quarter. These documents are available at delawarefunds.com/literature.

Unless otherwise noted, views expressed herein are current as of November 30, 2023, and subject to change for events occurring after such date. These views are not intended to be investment advice, to forecast future events, or to guarantee future results.

The Fund is not FDIC insured and is not guaranteed. It is possible to lose the principal amount invested.

All third-party marks cited are the property of their respective owners.

© 2024 Macquarie Management Holdings, Inc.

| Portfolio management review | |

| Delaware Small Cap Core Fund | November 30, 2023 (Unaudited) |

| Performance preview (for the year ended November 30, 2023) | ||

| Delaware Small Cap Core Fund (Institutional Class shares) | 1-year return | -3.59% |

| Delaware Small Cap Core Fund (Class A shares) | 1-year return | -3.86% |

| Russell 2000® Index (benchmark) | 1-year return | -2.57% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Small Cap Core Fund, please see the table on page 5. Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. The performance of both Institutional Class shares and Class A shares reflects the reinvestment of all distributions.

Please see page 7 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investment objective

The Fund seeks long-term capital appreciation.

Market review

For the Fund’s fiscal year ended November 30, 2023, small-cap stocks underperformed large-cap stocks, as the Russell 2000® Index, the Fund’s benchmark, declined 2.57% while the large-cap Russell 1000® Index advanced 13.57%. The smallest US companies posted the weakest performances for the period, with the Russell Microcap® Index declining 8.41%. Small-cap value stocks trailed small-cap growth stocks, with the Russell 2000® Value Index declining 4.73% and the Russell 2000® Growth Index declining 0.83%.

Sector-level performance within the Russell 2000 Index was mixed during the fiscal year, with 10 of 16 sectors advancing. The capital goods, transportation, and communications services sectors in the benchmark were the strongest-performing sectors. Companies in the media, utilities, healthcare, and finance sectors of the benchmark declined the most; each fell more than 10% during the fiscal year.

| Stock selection detracted from the Fund’s relative performance for the fiscal year. In the technology, energy, and transportation sectors, the Fund’s holdings declined while those sectors in the benchmark advanced. Stock selection contributed in the credit cyclicals, healthcare, and basic materials sectors. The Fund’s holdings in the credit cyclicals and basic materials sectors outperformed those in the benchmark while its holdings in the healthcare sector provided downside protection relative to those in the benchmark. |

| 1 |

Portfolio management review

Delaware Small Cap Core Fund

The third-quarter 2023 US gross domestic product (GDP) annualized growth rate of 5.2% was well above consensus and followed two consecutive quarters of 2%-plus GDP growth reports. Many economists have extended their expectations of a softer economy into 2024. With inflation no longer advancing, we think the US Federal Reserve is likely to cut rates in 2024. Valuations for small caps remain at historically low levels, and our preference is for companies with quality earnings. The combination of these factors creates periods of dislocation in the market, which we have used as an opportunity to buy mispriced securities.

Source: Bloomberg unless otherwise noted.

Within the Fund

For the fiscal year ended November 30, 2023, Delaware Small Cap Core Fund underperformed its benchmark, the Russell 2000 Index. The Fund’s Institutional Class shares declined 3.59%. The Fund’s Class A shares declined 3.86% at net asset value (NAV) and 9.39% at maximum offer price (both figures reflect all distributions reinvested). For the same period, the Fund’s benchmark declined 2.57%. For complete annualized performance of Delaware Small Cap Core Fund, please see the table on page 5.

Stock selection detracted from the Fund’s relative performance for the fiscal year. In the technology, energy, and transportation sectors, the Fund’s holdings declined while those sectors in the benchmark advanced. Stock selection contributed in the credit cyclicals, healthcare, and basic materials sectors. The Fund’s holdings in the credit cyclicals and basic materials sectors outperformed those in the benchmark while its holdings in the healthcare sector provided downside protection relative to those in the benchmark.

Patterson-UTI Energy Inc., a leading contract drilling and pressure pumping company, underperformed for the Fund’s fiscal year. As a provider of high-quality drilling and completion equipment to exploration and production (E&P) companies, Patterson’s stock is sensitive to changes in oil and natural gas prices; both commodities declined during the Fund’s fiscal year. During the period, Patterson acquired a competitor, NexTier Oilfield Solutions Inc., we owned in the Fund, bringing together two of the industry’s leading well completion services companies. We are optimistic about the synergies and cost savings that Patterson projects realizing in the first quarter of 2025 as well as the benefit from the size and scale of the transaction. We maintained the Fund’s position in Patterson as we believe the company has a sound plan to return capital to shareholders through dividends and share repurchases. We think it should continue to benefit from an extended demand cycle for oil service equipment companies based on both demand recovery and supply constraints.

The Fund’s position in commercial-stage biotechnology company Travere Therapeutics Inc. underperformed. Travere identifies, develops, commercializes, and distributes therapies to people living with rare diseases. Included among the company’s products the US Food and Drug Administration (FDA) have approved are Chenodal, Cholbam, Filspari (sparsentan), and Thiola. In February, the FDA granted accelerated approval for Filspari to reduce proteinuria in adults with primary IgA nephropathy (IgAN). IgAN is a leading cause of end-stage kidney disease. In September, the company released top-line results from its two-year study of Filspari in IgAN in which the drug missed achieving its statistical significance, resulting in a sharp stock selloff. Travere updated investors following a preliminary new drug application (NDA) meeting with the FDA for Filspari in

| 2 |

IgAN, stating that it will submit an NDA in the first quarter of 2024. We maintained the Fund’s position in Travere as the FDA continues to approve Filspari for treatment in the US and the company has implemented a strategic reorganization to focus its resources on Filspari.

In the technology sector, the Fund’s semiconductor positions detracted from performance, led lower by shares of MaxLinear Inc., a radio frequency (RF), analog, digital, and mixed-signal integrated circuits company. In 2022, MaxLinear entered into an agreement, subject to regulatory and conditional approvals, to acquire Silicon Motion Technology Corp. When the transaction was announced, we were focused on how the company would finance the transaction and manage financial leverage as we did see value in the combined company. During the Fund’s fiscal year, however, MaxLinear terminated the planned acquisition of Silicon Motion. We viewed this action favorably, but the market did not. We maintained the Fund’s position in MaxLinear as we think demand for its broadband and wireless infrastructure products should remain strong. Additionally, the company’s cost structure has improved.

Stock selection contributed to relative performance in the credit cyclicals sector as the Fund’s homebuilder companies outperformed. Arizona-based homebuilder Taylor Morrison Home Corp. contributed as the number of homes sold and average selling price grew above projections for the fiscal year. Taylor Morrison Home’s communities are catered toward favorable buyer groups such as entry level, move up, and adult resort lifestyle. We maintained the Fund’s position in Taylor Morrison Home since the company has a balanced capital allocation strategy aimed at delivering shareholder returns over the course of the housing cycle.

Boise Cascade Co. is one of the largest producers of engineered wood products and plywood in North America and a leading US wholesale distributor of building products. Boise Cascade outperformed for the Fund’s fiscal year, reporting multiple quarters of strong financial performance. Boise Cascade has benefited from continued demand in its wood products and building materials segments. Operating in these two segments gives the Fund’s portfolio exposure to residential construction and home remodeling activity. We maintained the Fund’s position in Boise Cascade as it has a strong balance sheet and management is returning capital to shareholders.

In the capital goods sector, shares of industrial parts manufacturer and distributor Applied Industrial Technologies Inc., outperformed. Applied Industrial Technologies has exceeded its organic sales and earnings growth projections as the company’s management has focused on operational execution and profit margins. Applied Industrial Technologies has benefited from secular growth tailwinds and end-market business diversification. This was part of our investment thesis for owning the company. We maintained the Fund’s position in Applied Industrial Technologies since it has a strong balance sheet, is returning capital to shareholders, and, in our view, is well positioned to react to its customer’s product needs.

The Fund ended the fiscal year overweight the benchmark in the healthcare, basic materials, and transportation sectors. The largest sector underweights were in business services, consumer discretionary, and energy. We believe the current market and economic environments should continue to support

| 3 |

Portfolio management review

Delaware Small Cap Core Fund

active management and our investment philosophy. We continue to maintain our strategy of investing in companies that we believe have strong balance sheets and cash flow, sustainable competitive advantages, and high-quality management teams with the potential to deliver value to shareholders. We appreciate your confidence and look forward to serving your investment needs in the next fiscal year.

| 4 |

| Performance summary | |

| Delaware Small Cap Core Fund | November 30, 2023 (Unaudited) |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| Fund and benchmark performance1,2 | Average annual total returns through November 30, 2023 | |||

| 1 year | 5 year | 10 year | Lifetime | |

| Class A (Est. December 29, 1998) | ||||

| Excluding sales charge | -3.86% | +5.84% | +7.08% | — |

| Including sales charge | -9.39% | +4.59% | +6.45% | — |

| Class C (Est. August 1, 2005) | ||||

| Excluding sales charge | -4.57% | +5.05% | +6.28% | — |

| Including sales charge | -5.49% | +5.05% | +6.28% | — |

| Class R (Est. August 1, 2005) | ||||

| Excluding sales charge | -4.09% | +5.58% | +6.82% | — |

| Including sales charge | -4.09% | +5.58% | +6.82% | — |

| Institutional Class (Est. December 29, 1998) | ||||

| Excluding sales charge | -3.59% | +6.11% | +7.35% | — |

| Including sales charge | -3.59% | +6.11% | +7.35% | — |

| Class R6 (Est. May 2, 2016) | ||||

| Excluding sales charge | -3.49% | +6.24% | — | +8.87% |

| Including sales charge | -3.49% | +6.24% | — | +8.87% |

| Russell 2000 Index | -2.57% | +4.78% | +6.13% | — |

1Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed in the “Fund expense ratios” table on page 6. Performance would have been lower had expense limitations not been in effect.

Class A shares are sold with a maximum front-end sales charge of 5.75%, and have an annual distribution and service (12b-1) fee of 0.25% of average daily net assets. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

Class C shares are sold with a contingent deferred sales charge (CDSC) of 1.00% if redeemed within one year of purchase. They are also subject to an annual 12b-1 fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that CDSCs did

| 5 |

Performance summary

Delaware Small Cap Core Fund

not apply or that the investment was not redeemed.

Class R shares are available only for certain retirement plan products. They are sold without a sales charge and have an annual 12b-1 fee of 0.50% of average daily net assets.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no 12b-1 fee.

Class R6 shares are available only to certain investors. In addition, Class R6 shares do not pay any service fees, sub-accounting fees, and/or sub-transfer agency fees to any brokers, dealers, or other financial intermediaries. Class R6 shares pay no 12b-1 fee.

Narrowly focused investments may exhibit higher volatility than investments in multiple industry sectors.

Investments in small and/or medium-sized companies typically exhibit greater risk and higher volatility than larger, more established companies.

REIT investments are subject to many of the risks associated with direct real estate ownership, including changes in economic conditions, credit risk, and interest rate fluctuations.

International investments entail risks including fluctuation in currency values, differences in accounting principles, or economic or political instability. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility, lower trading volume, and higher risk of market closures. In many emerging markets, there is substantially less publicly available information and the available information may be incomplete or misleading. Legal claims are generally more difficult to pursue.

The disruptions caused by natural disasters, pandemics, or similar events could prevent the Fund from executing advantageous investment decisions in a timely manner and could negatively impact the Fund’s ability to achieve its investment objective and the value of the Fund’s investments.

2The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. The expense ratios below may differ from the expense ratios in the "Financial highlights" since they are based on different time periods and the expense ratios in the prospectus include acquired fund fees and expenses, if any. See Note 2 in "Notes to financial statements" for additional details. Please see the “Financial highlights” section in this report for the most recent expense ratios.

| Institutional | ||||||||||

| Fund expense ratios | Class A | Class C | Class R | Class | Class R6 | |||||

| Total annual operating expenses (without fee waivers) | 1.05% | 1.80% | 1.30% | 0.80% | 0.69% | |||||

| Net expenses (including fee waivers, if any) | 1.05% | 1.80% | 1.30% | 0.80% | 0.69% | |||||

| Type of waiver | n/a | n/a | n/a | n/a | n/a |

| 6 |

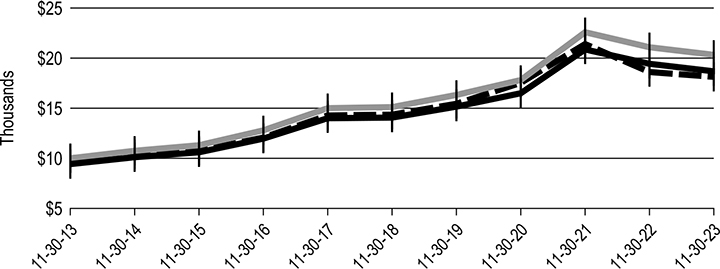

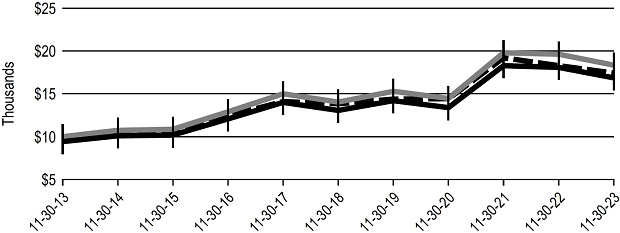

Performance of a $10,000 investment1

For the period November 30, 2013 through November 30, 2023

| Starting value | Ending value | ||||||||

|

Delaware Small Cap Core Fund - Institutional Class shares | $ | 10,000 | $ | 20,328 | ||||

|

Delaware Small Cap Core Fund - Class A shares | $ | 9,425 | $ | 18,681 | ||||

|

Russell 2000 Index | $ | 10,000 | $ | 18,136 | ||||

1The “Performance of a $10,000 investment” graph assumes $10,000 invested in Institutional Class and Class A shares of the Fund on November 30, 2013, and includes the effect of a 5.75% front-end sales charge (for Class A shares) and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 6. Please note additional details on pages 5 through 8.

The graph also assumes $10,000 invested in the Russell 2000 Index as of November 30, 2013. The Russell 2000 Index measures the performance of the small-cap segment of the US equity universe.

The Russell 1000 Index, mentioned on page 1, measures the performance of the large-cap segment of the US equity universe.

The Russell 2000 Growth Index, mentioned on page 1, measures the performance of the small-cap growth segment of the US equity universe. It includes those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values.

The Russell 2000 Value Index, mentioned on page 1, measures the performance of the small-cap value segment of the US equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values.

The Russell Microcap Index, mentioned on page 1, measures almost 1,550 small-cap and Performance summary Delaware Small Cap Core Fund 6 micro-cap stocks, including the

| 7 |

Performance summary

Delaware Small Cap Core Fund

smallest 1,000 companies in the Russell 2000 Index, plus 1,000 smaller US-based listed stocks.

Gross domestic product, mentioned on page 2, is a measure of all goods and services produced by a nation in a year. It is a measure of economic activity.

Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes.

Russell® is a trademark of Frank Russell Company.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Performance of other Fund classes will vary due to different charges and expenses.

| Nasdaq symbols | CUSIPs | |

| Class A | DCCAX | 24610B883 |

| Class C | DCCCX | 24610B867 |

| Class R | DCCRX | 24610B834 |

| Institutional Class | DCCIX | 24610B859 |

| Class R6 | DCZRX | 24610B826 |

| 8 |

For the six-month period from June 1, 2023 to November 30, 2023 (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from June 1, 2023 to November 30, 2023.

Actual expenses

The first section of the table shown, “Actual Fund return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the table shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Fund's expenses shown in the table assume reinvestment of all dividends and distributions.

| 9 |

Disclosure of Fund expenses

For the six-month period from June 1, 2023 to November 30, 2023 (Unaudited)

Delaware Small Cap Core Fund

Expense analysis of an investment of $1,000

| Beginning | Ending | Expenses | ||

| Account Value | Account Value | Annualized | Paid During Period | |

| 6/1/23 | 11/30/23 | Expense Ratio | 6/1/23 to 11/30/23* | |

| Actual Fund return† | ||||

| Class A | $1,000.00 | $1,040.00 | 1.11% | $5.68 |

| Class C | 1,000.00 | 1,036.30 | 1.86% | 9.49 |

| Class R | 1,000.00 | 1,038.50 | 1.36% | 6.95 |

| Institutional Class | 1,000.00 | 1,041.60 | 0.86% | 4.40 |

| Class R6 | 1,000.00 | 1,042.00 | 0.75% | 3.84 |

| Hypothetical 5% return (5% return before expenses) | ||||

| Class A | $1,000.00 | $1,019.50 | 1.11% | $5.62 |

| Class C | 1,000.00 | 1,015.74 | 1.86% | 9.40 |

| Class R | 1,000.00 | 1,018.25 | 1.36% | 6.88 |

| Institutional Class | 1,000.00 | 1,020.76 | 0.86% | 4.36 |

| Class R6 | 1,000.00 | 1,021.31 | 0.75% | 3.80 |

*“Expenses Paid During Period” are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period).

†Because actual returns reflect only the most recent six-month period, the returns shown may differ significantly from fiscal year returns.

In addition to the Fund's expenses reflected above, the Fund also indirectly bears its portion of the fees and expenses of any investment companies (Underlying Funds), in which it invests. The table above does not reflect the expenses of any Underlying Funds.

| 10 |

| Security type / sector allocations and top 10 equity holdings | |

| Delaware Small Cap Core Fund | As of November 30, 2023 (Unaudited) |

Sector designations may be different from the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications, which may result in the sector designations for one fund being different from another fund's sector designations.

| Security type / sector | Percentage of net assets | |

| Common Stocks | 98.18 | % |

| Basic Materials | 7.50 | % |

| Business Services | 3.83 | % |

| Capital Goods | 10.36 | % |

| Communications Services | 0.27 | % |

| Consumer Discretionary | 2.95 | % |

| Consumer Services | 1.96 | % |

| Consumer Staples | 3.65 | % |

| Credit Cyclicals | 3.87 | % |

| Energy | 5.84 | % |

| Financials | 14.58 | % |

| Healthcare | 15.71 | % |

| Media | 0.53 | % |

| Real Estate Investment Trusts | 6.58 | % |

| Technology | 14.84 | % |

| Transportation | 3.39 | % |

| Utilities | 2.32 | % |

| Short-Term Investments | 1.91 | % |

| Total Value of Securities | 100.09 | % |

| Liabilities Net of Receivables and Other Assets | (0.09 | )% |

| Total Net Assets | 100.00 | % |

Top 10 equity holdings are for informational purposes only and are subject to change at any time. They are not a recommendation to buy, sell, or hold any security.

| Top 10 equity holdings | Percentage of net assets | |

| Permian Resources | 1.78 | % |

| Federal Signal | 1.77 | % |

| Patterson-UTI Energy | 1.65 | % |

| Applied Industrial Technologies | 1.64 | % |

| Boise Cascade | 1.51 | % |

| Taylor Morrison Home | 1.50 | % |

| Steven Madden | 1.44 | % |

| Prestige Consumer Healthcare | 1.41 | % |

| Summit Materials Class A | 1.38 | % |

| Minerals Technologies | 1.32 | % |

| 11 |

| Schedule of investments | |

| Delaware Small Cap Core Fund | November 30, 2023 |

| Number of | ||||||||

| shares | Value (US $) | |||||||

| Common Stocks — 98.18% | ||||||||

| Basic Materials — 7.50% | ||||||||

| Balchem | 64,610 | $ | 8,058,159 | |||||

| Boise Cascade | 950,213 | 103,858,281 | ||||||

| Huntsman | 1,159,775 | 28,530,465 | ||||||

| Kaiser Aluminum | 636,241 | 37,207,374 | ||||||

| Minerals Technologies | 1,449,208 | 90,778,389 | ||||||

| Quaker Chemical | 270,303 | 48,327,473 | ||||||

| Summit Materials Class A † | 2,722,567 | 94,445,849 | ||||||

| Tecnoglass | 714,561 | 24,902,451 | ||||||

| Worthington Enterprises | 1,103,980 | 79,155,366 | ||||||

| 515,263,807 | ||||||||

| Business Services — 3.83% | ||||||||

| ABM Industries | 1,431,555 | 58,679,439 | ||||||

| ASGN † | 972,861 | 86,818,116 | ||||||

| BrightView Holdings † | 2,687,290 | 20,530,896 | ||||||

| Casella Waste Systems Class A † | 871,048 | 70,450,362 | ||||||

| WillScot Mobile Mini Holdings † | 635,631 | 26,518,525 | ||||||

| 262,997,338 | ||||||||

| Capital Goods — 10.36% | ||||||||

| Ameresco Class A † | 1,309,594 | 39,235,436 | ||||||

| Applied Industrial Technologies | 702,906 | 112,514,163 | ||||||

| Chart Industries † | 416,941 | 54,214,838 | ||||||

| Coherent † | 555,206 | 20,426,029 | ||||||

| Columbus McKinnon | 1,324,194 | 46,240,854 | ||||||

| Construction Partners Class A † | 814,160 | 34,162,154 | ||||||

| ESCO Technologies | 422,530 | 44,357,199 | ||||||

| Federal Signal | 1,764,169 | 121,621,811 | ||||||

| H&E Equipment Services | 750,550 | 33,256,870 | ||||||

| Kadant | 303,156 | 79,008,517 | ||||||

| MYR Group † | 563,973 | 70,169,521 | ||||||

| Zurn Elkay Water Solutions | 1,912,808 | 56,313,068 | ||||||

| 711,520,460 | ||||||||

| Communications Services — 0.27% | ||||||||

| ATN International | 600,449 | 18,277,668 | ||||||

| 18,277,668 | ||||||||

| Consumer Discretionary — 2.95% | ||||||||

| Hibbett | 509,879 | 31,892,931 | ||||||

| Malibu Boats Class A † | 1,081,529 | 47,846,843 | ||||||

| Sonic Automotive Class A | 470,792 | 24,137,506 | ||||||

| 12 |

| Number of | ||||||||

| shares | Value (US $) | |||||||

| Common Stocks (continued) | ||||||||

| Consumer Discretionary (continued) | ||||||||

| Steven Madden | 2,604,693 | $ | 98,769,959 | |||||

| 202,647,239 | ||||||||

| Consumer Services — 1.96% | ||||||||

| Brinker International † | 1,183,389 | 42,613,838 | ||||||

| Chuy's Holdings † | 875,906 | 30,831,891 | ||||||

| Jack in the Box | 457,653 | 33,088,312 | ||||||

| OneSpaWorld Holdings † | 572,764 | 6,901,806 | ||||||

| Texas Roadhouse | 188,192 | 21,182,892 | ||||||

| 134,618,739 | ||||||||

| Consumer Staples — 3.65% | ||||||||

| Helen of Troy † | 346,951 | 36,440,264 | ||||||

| J & J Snack Foods | 538,108 | 88,545,671 | ||||||

| Prestige Consumer Healthcare † | 1,692,423 | 97,060,459 | ||||||

| YETI Holdings † | 664,971 | 28,354,363 | ||||||

| 250,400,757 | ||||||||

| Credit Cyclicals — 3.87% | ||||||||

| Dana | 2,997,022 | 39,590,661 | ||||||

| KB Home | 1,393,858 | 72,620,002 | ||||||

| La-Z-Boy | 1,434,344 | 50,474,565 | ||||||

| Taylor Morrison Home † | 2,282,885 | 102,958,113 | ||||||

| 265,643,341 | ||||||||

| Energy — 5.84% | ||||||||

| Magnolia Oil & Gas Class A | 2,739,314 | 58,895,251 | ||||||

| Patterson-UTI Energy | 9,696,178 | 113,542,240 | ||||||

| Permian Resources | 9,315,248 | 122,402,359 | ||||||

| SM Energy | 1,534,735 | 57,475,826 | ||||||

| Southwestern Energy † | 7,423,158 | 48,918,611 | ||||||

| 401,234,287 | ||||||||

| Financials — 14.58% | ||||||||

| BRP Group Class A † | 2,367,613 | 41,409,551 | ||||||

| City Holding | 443,624 | 42,707,683 | ||||||

| CNO Financial Group | 1,759,730 | 46,632,845 | ||||||

| Enterprise Financial Services | 690,256 | 27,064,938 | ||||||

| Essent Group | 1,422,022 | 68,740,544 | ||||||

| First Bancorp | 1,015,127 | 31,814,080 | ||||||

| First Financial Bancorp | 1,812,730 | 36,635,273 | ||||||

| First Interstate BancSystem Class A | 1,662,775 | 43,049,245 | ||||||

| Hamilton Lane Class A | 873,231 | 85,445,653 | ||||||

| Independent Bank | 705,172 | 40,208,907 | ||||||

| 13 |

Schedule of investments

Delaware Small Cap Core Fund

| Number of | ||||||||

| shares | Value (US $) | |||||||

| Common Stocks (continued) | ||||||||

| Financials (continued) | ||||||||

| Independent Bank Group | 611,516 | $ | 23,653,439 | |||||

| NMI Holdings Class A † | 1,819,654 | 50,040,485 | ||||||

| Old National Bancorp | 4,217,667 | 62,801,062 | ||||||

| Pacific Premier Bancorp | 1,810,471 | 40,771,807 | ||||||

| PJT Partners Class A | 613,722 | 55,271,803 | ||||||

| Selective Insurance Group | 788,190 | 80,151,041 | ||||||

| SouthState | 680,210 | 50,369,551 | ||||||

| United Community Banks | 1,693,452 | 41,743,592 | ||||||

| Valley National Bancorp | 4,866,963 | 44,289,363 | ||||||

| WesBanco | 1,450,384 | 38,609,222 | ||||||

| WSFS Financial | 1,302,760 | 50,247,453 | ||||||

| 1,001,657,537 | ||||||||

| Healthcare — 15.71% | ||||||||

| Agios Pharmaceuticals † | 1,629,913 | 36,232,966 | ||||||

| Amicus Therapeutics † | 5,362,316 | 59,092,722 | ||||||

| Apellis Pharmaceuticals † | 753,839 | 40,609,307 | ||||||

| Artivion † | 2,359,339 | 41,854,674 | ||||||

| AtriCure † | 1,188,868 | 42,181,037 | ||||||

| Azenta † | 777,530 | 43,829,366 | ||||||

| Blueprint Medicines † | 1,168,609 | 81,381,931 | ||||||

| CONMED | 583,793 | 62,623,475 | ||||||

| Halozyme Therapeutics † | 1,816,982 | 70,153,675 | ||||||

| Insmed † | 2,634,311 | 65,910,461 | ||||||

| Intra-Cellular Therapies † | 985,300 | 60,467,861 | ||||||

| Lantheus Holdings † | 766,649 | 54,907,401 | ||||||

| Ligand Pharmaceuticals † | 740,914 | 43,202,695 | ||||||

| Merit Medical Systems † | 1,051,318 | 75,232,316 | ||||||

| NeoGenomics † | 2,468,392 | 44,850,683 | ||||||

| OmniAb † | 2,991,363 | 13,132,084 | ||||||

| OmniAb 12.5 =, † | 221,566 | 0 | ||||||

| OmniAb 15 =, † | 221,566 | 0 | ||||||

| Omnicell † | 696,865 | 23,247,416 | ||||||

| Pacific Biosciences of California † | 4,079,689 | 34,595,763 | ||||||

| Pacira BioSciences † | 1,113,792 | 30,384,246 | ||||||

| Shockwave Medical † | 78,158 | 13,642,479 | ||||||

| Supernus Pharmaceuticals † | 2,085,784 | 56,837,614 | ||||||

| TransMedics Group † | 822,240 | 62,227,123 | ||||||

| Travere Therapeutics † | 3,607,771 | 22,656,802 | ||||||

| 1,079,254,097 | ||||||||

| 14 |

| Number of | ||||||||

| shares | Value (US $) | |||||||

| Common Stocks (continued) | ||||||||

| Media — 0.53% | ||||||||

| IMAX † | 2,271,371 | $ | 36,228,368 | |||||

| 36,228,368 | ||||||||

| Real Estate Investment Trusts — 6.58% | ||||||||

| Armada Hoffler Properties | 2,924,056 | 32,106,135 | ||||||

| Cushman & Wakefield † | 3,807,453 | 31,259,189 | ||||||

| DiamondRock Hospitality | 5,526,068 | 45,976,886 | ||||||

| Four Corners Property Trust | 2,213,113 | 50,879,468 | ||||||

| Independence Realty Trust | 4,113,108 | 56,020,531 | ||||||

| Kite Realty Group Trust | 3,488,932 | 73,686,244 | ||||||

| LXP Industrial Trust | 5,203,441 | 45,686,212 | ||||||

| Phillips Edison & Co. | 1,271,967 | 44,824,117 | ||||||

| Physicians Realty Trust | 4,237,194 | 49,490,426 | ||||||

| RPT Realty | 1,868,501 | 21,711,981 | ||||||

| 451,641,189 | ||||||||

| Technology — 14.84% | ||||||||

| Atkore † | 250,236 | 32,505,656 | ||||||

| Box Class A † | 1,980,948 | 51,841,409 | ||||||

| Clearwater Analytics Holdings Class A † | 331,726 | 7,069,081 | ||||||

| ExlService Holdings † | 2,463,982 | 69,903,169 | ||||||

| Ichor Holdings † | 1,069,008 | 27,933,179 | ||||||

| Instructure Holdings † | 1,523,736 | 39,845,696 | ||||||

| MACOM Technology Solutions Holdings † | 735,045 | 61,729,079 | ||||||

| MaxLinear † | 1,845,736 | 34,570,635 | ||||||

| Progress Software | 661,366 | 35,621,173 | ||||||

| Q2 Holdings † | 1,863,842 | 66,203,668 | ||||||

| Rapid7 † | 1,129,556 | 61,165,458 | ||||||

| Semtech † | 1,749,987 | 28,647,287 | ||||||

| Silicon Laboratories † | 600,555 | 63,280,480 | ||||||

| Sprout Social Class A † | 849,298 | 48,325,056 | ||||||

| SPS Commerce † | 401,841 | 69,229,168 | ||||||

| Varonis Systems † | 2,023,396 | 84,760,059 | ||||||

| Verint Systems † | 1,485,879 | 36,508,047 | ||||||

| WNS Holdings ADR † | 851,293 | 50,634,908 | ||||||

| Workiva † | 530,486 | 51,016,839 | ||||||

| Yelp † | 1,472,025 | 64,342,213 | ||||||

| Ziff Davis † | 540,093 | 34,468,735 | ||||||

| 1,019,600,995 | ||||||||

| Transportation — 3.39% | ||||||||

| Allegiant Travel | 383,902 | 26,293,448 | ||||||

| ArcBest | 292,532 | 34,866,889 | ||||||

| 15 |

Schedule of investments

Delaware Small Cap Core Fund

| Number of | ||||||||

| shares | Value (US $) | |||||||

| Common Stocks (continued) | ||||||||

| Transportation (continued) | ||||||||

| Hub Group Class A † | 694,928 | $ | 52,501,810 | |||||

| Sun Country Airlines Holdings † | 3,116,304 | 47,305,495 | ||||||

| Werner Enterprises | 1,792,220 | 71,706,722 | ||||||

| 232,674,364 | ||||||||

| Utilities — 2.32% | ||||||||

| Black Hills | 984,643 | 50,797,732 | ||||||

| Northwestern Energy Group | 1,094,261 | 55,052,271 | ||||||

| Spire | 881,901 | 53,804,780 | ||||||

| 159,654,783 | ||||||||

| Total Common Stocks (cost $6,155,355,191) | 6,743,314,969 | |||||||

| Short-Term Investments — 1.91% | ||||||||

| Money Market Mutual Funds — 1.91% | ||||||||

| BlackRock Liquidity FedFund – Institutional Shares (seven-day effective yield 5.25%) | 32,804,503 | 32,804,503 | ||||||

| Fidelity Investments Money Market Government Portfolio – Class I (seven-day effective yield 5.24%) | 32,804,502 | 32,804,502 | ||||||

| Goldman Sachs Financial Square Government Fund – Institutional Shares (seven-day effective yield 5.39%) | 32,804,502 | 32,804,502 | ||||||

| Morgan Stanley Institutional Liquidity Funds Government Portfolio – Institutional Class (seven-day effective yield 5.26%) | 32,804,502 | 32,804,502 | ||||||

| Total Short-Term Investments (cost $131,218,009) | 131,218,009 | |||||||

| Total Value of Securities—100.09% (cost $6,286,573,200) | $ | 6,874,532,978 | ||||||

| † | Non-income producing security. |

| = | The value of this security was determined using significant unobservable inputs and is reported as a Level 3 security in the disclosure table located in Note 3 in “Notes to financial statements.” |

Summary of abbreviations:

ADR – American Depositary Receipt

See accompanying notes, which are an integral part of the financial statements.

| 16 |

| Statement of assets and liabilities | |

| Delaware Small Cap Core Fund | November 30, 2023 |

| Assets: | ||||

| Investments, at value* | $ | 6,874,532,978 | ||

| Cash | 54,721 | |||

| Receivable for fund shares sold | 12,037,108 | |||

| Dividends receivable | 10,679,183 | |||

| Prepaid expenses | 106,041 | |||

| Other assets | 52,780 | |||

| Total Assets | 6,897,462,811 | |||

| Liabilities: | ||||

| Payable for fund shares redeemed | 15,913,869 | |||

| Payable for securities purchased | 6,823,127 | |||

| Investment management fees payable to affiliates | 3,455,922 | |||

| Other accrued expenses | 2,148,680 | |||

| Administration expenses payable to affiliates | 576,452 | |||

| Distribution fees payable to affiliates | 120,027 | |||

| Total Liabilities | 29,038,077 | |||

| Total Net Assets | $ | 6,868,424,734 | ||

| Net Assets Consist of: | ||||

| Paid-in capital | $ | 6,105,910,614 | ||

| Total distributable earnings (loss) | 762,514,120 | |||

| Total Net Assets | $ | 6,868,424,734 | ||

| 17 |

Statement of assets and liabilities

Delaware Small Cap Core Fund

| Net Asset Value | ||||

| Class A: | ||||

| Net assets | $ | 254,989,799 | ||

| Shares of beneficial interest outstanding, unlimited authorization, no par | 10,104,788 | |||

| Net asset value per share | $ | 25.23 | ||

| Sales charge | 5.75 | % | ||

| Offering price per share, equal to net asset value per share / (1 - sales charge) | $ | 26.77 | ||

| Class C: | ||||

| Net assets | $ | 72,866,916 | ||

| Shares of beneficial interest outstanding, unlimited authorization, no par | 3,447,120 | |||

| Net asset value per share | $ | 21.14 | ||

| Class R: | ||||

| Net assets | $ | 25,702,735 | ||

| Shares of beneficial interest outstanding, unlimited authorization, no par | 1,070,465 | |||

| Net asset value per share | $ | 24.01 | ||

| Institutional Class: | ||||

| Net assets | $ | 4,976,768,203 | ||

| Shares of beneficial interest outstanding, unlimited authorization, no par | 191,296,801 | |||

| Net asset value per share | $ | 26.02 | ||

| Class R6: | ||||

| Net assets | $ | 1,538,097,081 | ||

| Shares of beneficial interest outstanding, unlimited authorization, no par | 59,001,766 | |||

| Net asset value per share | $ | 26.07 | ||

| *Investments, at cost | $ | 6,286,573,200 |

See accompanying notes, which are an integral part of the financial statements.

| 18 |

| Statement of operations | |

| Delaware Small Cap Core Fund | Year ended November 30, 2023 |

| Investment Income: | ||||

| Dividends | $ | 97,942,758 | ||

| Expenses: | ||||

| Management fees | 44,252,641 | |||

| Distribution expenses — Class A | 676,780 | |||

| Distribution expenses — Class C | 856,830 | |||

| Distribution expenses — Class R | 138,080 | |||

| Dividend disbursing and transfer agent fees and expenses | 10,118,342 | |||

| Accounting and administration expenses | 1,009,072 | |||

| Reports and statements to shareholders expenses | 639,791 | |||

| Legal fees | 360,822 | |||

| Trustees’ fees and expenses | 329,542 | |||

| Registration fees | 210,944 | |||

| Custodian fees | 32,333 | |||

| Audit and tax fees | 31,730 | |||

| Other | 368,505 | |||

| 59,025,412 | ||||

| Less expenses paid indirectly | (527 | ) | ||

| Total operating expenses | 59,024,885 | |||

| Net Investment Income (Loss) | 38,917,873 | |||

| Net Realized and Unrealized Gain (Loss): | ||||

| Net realized gain (loss) on: | ||||

| Investments | 245,318,575 | |||

| Net increase from payment by affiliates1 | 24,946 | |||

| Net realized gain (loss) | 245,343,521 | |||

| Net change in unrealized appreciation (depreciation) on investments | (572,820,302 | ) | ||

| Net Realized and Unrealized Gain (Loss) | (327,476,781 | ) | ||

| Net Increase (Decrease) in Net Assets Resulting from Operations | $ | (288,558,908 | ) |

| 1 | See Note 2 in “Notes to financial statements.” |

See accompanying notes, which are an integral part of the financial statements.

| 19 |

Statements of changes in net assets

Delaware Small Cap Core Fund

| Year ended | ||||||||

| 11/30/23 | 11/30/22 | |||||||

| Increase (Decrease) in Net Assets from Operations: | ||||||||

| Net investment income (loss) | $ | 38,917,873 | $ | 31,805,604 | ||||

| Net realized gain (loss) | 245,318,575 | 183,425,714 | ||||||

| Net increase from payment by affiliates1 | 24,946 | — | ||||||

| Net change in unrealized appreciation (depreciation) | (572,820,302 | ) | (785,793,771 | ) | ||||

| Net increase (decrease) in net assets resulting from operations | (288,558,908 | ) | (570,562,453 | ) | ||||

| Dividends and Distributions to Shareholders from: | ||||||||

| Distributable earnings: | ||||||||

| Class A | (9,782,777 | ) | (19,265,935 | ) | ||||

| Class C | (3,637,759 | ) | (9,463,365 | ) | ||||

| Class R | (992,220 | ) | (2,863,111 | ) | ||||

| Institutional Class | (187,750,406 | ) | (357,240,198 | ) | ||||

| Class R6 | (49,448,818 | ) | (83,096,087 | ) | ||||

| (251,611,980 | ) | (471,928,696 | ) | |||||

| Capital Share Transactions (See Note 6): | ||||||||

| Proceeds from shares sold: | ||||||||

| Class A | 62,963,286 | 84,786,905 | ||||||

| Class C | 5,659,555 | 9,612,206 | ||||||

| Class R | 3,744,025 | 7,797,361 | ||||||

| Institutional Class | 1,413,408,919 | 2,089,807,031 | ||||||

| Class R6 | 610,374,577 | 418,220,068 | ||||||

| Net asset value of shares issued upon reinvestment of dividends and distributions: | ||||||||

| Class A | 9,074,862 | 17,764,566 | ||||||

| Class C | 3,581,775 | 9,319,053 | ||||||

| Class R | 992,190 | 2,863,111 | ||||||

| Institutional Class | 156,894,836 | 264,151,848 | ||||||

| Class R6 | 41,330,661 | 74,281,941 | ||||||

| 2,308,024,686 | 2,978,604,090 | |||||||

| 20 |

| Year ended | ||||||||

| 11/30/23 | 11/30/22 | |||||||

| Capital Share Transactions (continued): | ||||||||

| Cost of shares redeemed: | ||||||||

| Class A | $ | (91,093,074 | ) | $ | (79,054,946 | ) | ||

| Class C | (28,656,296 | ) | (31,092,812 | ) | ||||

| Class R | (11,007,074 | ) | (14,542,161 | ) | ||||

| Institutional Class | (1,637,326,416 | ) | (1,835,591,261 | ) | ||||

| Class R6 | (402,929,386 | ) | (261,945,901 | ) | ||||

| (2,171,012,246 | ) | (2,222,227,081 | ) | |||||

| Increase in net assets derived from capital share transactions | 137,012,440 | 756,377,009 | ||||||

| Net Decrease in Net Assets | (403,158,448 | ) | (286,114,140 | ) | ||||

| Net Assets: | ||||||||

| Beginning of year | 7,271,583,182 | 7,557,697,322 | ||||||

| End of year | $ | 6,868,424,734 | $ | 7,271,583,182 | ||||

| 1 | See Note 2 in “Notes to financial statements.” |

See accompanying notes, which are an integral part of the financial statements.

| 21 |

Delaware Small Cap Core Fund Class A

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| Income (loss) from investment operations: |

| Net investment income (loss)1 |

| Net realized and unrealized gain (loss) |

| Total from investment operations |

| Less dividends and distributions from: |

| Net investment income |

| Net realized gain |

| Total dividends and distributions |

| Payment by affiliates |

| Net asset value, end of period |

| Total return4 |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets5 |

| Ratio of net investment income (loss) to average net assets |

| Portfolio turnover |

| 1 | Calculated using average shares outstanding. |

| 2 | Amount is less than $0.005 per share. |

| 3 | See Note 2 in “Notes to financial statements.” |

| 4 | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. |

| 5 | Expense ratios do not include expenses of any investment companies in which the Fund invests. |

See accompanying notes, which are an integral part of the financial statements.

| 22 |

| Year ended | ||||||||||||||||||

| 11/30/23 | 11/30/22 | 11/30/21 | 11/30/20 | 11/30/19 | ||||||||||||||

| $ | 27.21 | $ | 31.14 | $ | 24.79 | $ | 23.20 | $ | 23.91 | |||||||||

| 0.08 | 0.05 | (0.02 | ) | 0.02 | 0.03 | |||||||||||||

| (1.16 | ) | (2.05 | ) | 6.56 | 1.99 | 1.25 | ||||||||||||

| (1.08 | ) | (2.00 | ) | 6.54 | 2.01 | 1.28 | ||||||||||||

| (0.06 | ) | — | — | (0.04 | ) | (0.02 | ) | |||||||||||

| (0.84 | ) | (1.93 | ) | (0.19 | ) | (0.38 | ) | (1.97 | ) | |||||||||

| (0.90 | ) | (1.93 | ) | (0.19 | ) | (0.42 | ) | (1.99 | ) | |||||||||

| — | 2,3 | — | — | — | — | |||||||||||||

| $ | 25.23 | $ | 27.21 | $ | 31.14 | $ | 24.79 | $ | 23.20 | |||||||||

| (3.86 | )% | (6.87 | )% | 26.50 | % | 8.81 | % | 7.79 | % | |||||||||

| $ | 254,990 | $ | 295,128 | $ | 312,223 | $ | 264,888 | $ | 279,872 | |||||||||

| 1.09 | % | 1.05 | % | 1.06 | % | 1.10 | % | 1.10 | % | |||||||||

| 0.30 | % | 0.20 | % | (0.06 | )% | 0.09 | % | 0.15 | % | |||||||||

| 26 | % | 23 | % | 24 | % | 37 | % | 34 | % | |||||||||

| 23 |

Financial highlights

Delaware Small Cap Core Fund Class C

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| Income (loss) from investment operations: |

| Net investment loss1 |

| Net realized and unrealized gain (loss) |

| Total from investment operations |

| Less dividends and distributions from: |

| Net realized gain |

| Total dividends and distributions |

| Payment by affiliates |

| Net asset value, end of period |

| Total return5 |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets6 |

| Ratio of net investment loss to average net assets |

| Portfolio turnover |

| 1 | Calculated using average shares outstanding. |

| 2 | The per share amount of net investment income (loss) does not directly correlate to the amounts reported in the Statement of operations due to class specific expenses. |

| 3 | Amount is less than $0.005 per share. |

| 4 | See Note 2 in “Notes to financial statements.” |

| 5 | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. |

| 6 | Expense ratios do not include expenses of any investment companies in which the Fund invests. |

See accompanying notes, which are an integral part of the financial statements.

| 24 |

| Year ended | ||||||||||||||||||

| 11/30/23 | 11/30/22 | 11/30/21 | 11/30/20 | 11/30/19 | ||||||||||||||

| $ | 23.05 | $ | 26.86 | $ | 21.57 | $ | 20.35 | $ | 21.38 | |||||||||

| (0.10 | )2 | (0.13 | ) | (0.21 | ) | (0.12 | ) | (0.11 | ) | |||||||||

| (0.97 | ) | (1.75 | ) | 5.69 | 1.72 | 1.05 | ||||||||||||

| (1.07 | ) | (1.88 | ) | 5.48 | 1.60 | 0.94 | ||||||||||||

| (0.84 | ) | (1.93 | ) | (0.19 | ) | (0.38 | ) | (1.97 | ) | |||||||||

| (0.84 | ) | (1.93 | ) | (0.19 | ) | (0.38 | ) | (1.97 | ) | |||||||||

| — | 3,4 | — | — | — | — | |||||||||||||

| $ | 21.14 | $ | 23.05 | $ | 26.86 | $ | 21.57 | $ | 20.35 | |||||||||

| (4.57 | )% | (7.57 | )% | 25.54 | % | 8.00 | % | 6.99 | % | |||||||||

| $ | 72,867 | $ | 100,445 | $ | 132,294 | $ | 117,251 | $ | 139,808 | |||||||||

| 1.84 | % | 1.80 | % | 1.81 | % | 1.85 | % | 1.85 | % | |||||||||

| (0.45 | )% | (0.55 | )% | (0.81 | )% | (0.66 | )% | (0.60 | )% | |||||||||

| 26 | % | 23 | % | 24 | % | 37 | % | 34 | % | |||||||||

| 25 |

Financial highlights

Delaware Small Cap Core Fund Class R

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| Income (loss) from investment operations: |

| Net investment income (loss)1 |

| Net realized and unrealized gain (loss) |

| Total from investment operations |

| Less dividends and distributions from: |

| Net realized gain |

| Total dividends and distributions |

| Payment by affiliates |

| Net asset value, end of period |

| Total return4 |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets5 |

| Ratio of net investment income (loss) to average net assets |

| Portfolio turnover |

| 1 | Calculated using average shares outstanding. |

| 2 | Amount is less than $0.005 per share. |

| 3 | See Note 2 in “Notes to financial statements.” |

| 4 | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. |

| 5 | Expense ratios do not include expenses of any investment companies in which the Fund invests. |

See accompanying notes, which are an integral part of the financial statements.

| 26 |

| Year ended | ||||||||||||||||||

| 11/30/23 | 11/30/22 | 11/30/21 | 11/30/20 | 11/30/19 | ||||||||||||||

| $ | 25.93 | $ | 29.84 | $ | 23.82 | $ | 22.33 | $ | 23.12 | |||||||||

| 0.01 | (0.01 | ) | (0.09 | ) | (0.03 | ) | (0.02 | ) | ||||||||||

| (1.09 | ) | (1.97 | ) | 6.30 | 1.90 | 1.20 | ||||||||||||

| (1.08 | ) | (1.98 | ) | 6.21 | 1.87 | 1.18 | ||||||||||||

| (0.84 | ) | (1.93 | ) | (0.19 | ) | (0.38 | ) | (1.97 | ) | |||||||||

| (0.84 | ) | (1.93 | ) | (0.19 | ) | (0.38 | ) | (1.97 | ) | |||||||||

| — | 2,3 | — | — | — | — | |||||||||||||

| $ | 24.01 | $ | 25.93 | $ | 29.84 | $ | 23.82 | $ | 22.33 | |||||||||

| (4.09 | )% | (7.12 | )% | 26.19 | % | 8.51 | % | 7.55 | % | |||||||||

| $ | 25,703 | $ | 34,289 | $ | 44,366 | $ | 36,065 | $ | 27,631 | |||||||||

| 1.34 | % | 1.30 | % | 1.31 | % | 1.35 | % | 1.35 | % | |||||||||

| 0.05 | % | (0.05 | )% | (0.31 | )% | (0.16 | )% | (0.10 | )% | |||||||||

| 26 | % | 23 | % | 24 | % | 37 | % | 34 | % | |||||||||

| 27 |

Financial highlights

Delaware Small Cap Core Fund Institutional Class

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| Income (loss) from investment operations: |

| Net investment income1 |

| Net realized and unrealized gain (loss) |

| Total from investment operations |

| Less dividends and distributions from: |

| Net investment income |

| Net realized gain |

| Total dividends and distributions |

| Payment by affiliates |

| Net asset value, end of period |

| Total return4 |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets5 |

| Ratio of net investment income to average net assets |

| Portfolio turnover |

| 1 | Calculated using average shares outstanding. |

| 2 | Amount is less than $0.005 per share. |

| 3 | See Note 2 in “Notes to financial statements.” |

| 4 | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. |

| 5 | Expense ratios do not include expenses of any investment companies in which the Fund invests. |

See accompanying notes, which are an integral part of the financial statements.

| 28 |

| Year ended | ||||||||||||||||||

| 11/30/23 | 11/30/22 | 11/30/21 | 11/30/20 | 11/30/19 | ||||||||||||||

| $ | 28.02 | $ | 32.00 | $ | 25.46 | $ | 23.81 | $ | 24.50 | |||||||||

| 0.14 | 0.13 | 0.06 | 0.07 | 0.09 | ||||||||||||||

| (1.17 | ) | (2.12 | ) | 6.72 | 2.06 | 1.28 | ||||||||||||

| (1.03 | ) | (1.99 | ) | 6.78 | 2.13 | 1.37 | ||||||||||||

| (0.13 | ) | (0.06 | ) | (0.05 | ) | (0.10 | ) | (0.09 | ) | |||||||||

| (0.84 | ) | (1.93 | ) | (0.19 | ) | (0.38 | ) | (1.97 | ) | |||||||||

| (0.97 | ) | (1.99 | ) | (0.24 | ) | (0.48 | ) | (2.06 | ) | |||||||||

| — | 2,3 | — | — | — | — | |||||||||||||

| $ | 26.02 | $ | 28.02 | $ | 32.00 | $ | 25.46 | $ | 23.81 | |||||||||

| (3.59 | )% | (6.65 | )% | 26.80 | % | 9.09 | % | 8.06 | % | |||||||||

| $ | 4,976,768 | $ | 5,455,486 | $ | 5,743,601 | $ | 4,632,204 | $ | 3,888,603 | |||||||||

| 0.84 | % | 0.80 | % | 0.81 | % | 0.85 | % | 0.85 | % | |||||||||

| 0.55 | % | 0.45 | % | 0.19 | % | 0.34 | % | 0.40 | % | |||||||||

| 26 | % | 23 | % | 24 | % | 37 | % | 34 | % | |||||||||

| 29 |

Financial highlights

Delaware Small Cap Core Fund Class R6

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| Income (loss) from investment operations: |

| Net investment income1 |

| Net realized and unrealized gain (loss) |

| Total from investment operations |

| Less dividends and distributions from: |

| Net investment income |

| Net realized gain |

| Total dividends and distributions |

| Payment by affiliates |

| Net asset value, end of period |

| Total return4 |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets5 |

| Ratio of net investment income to average net assets |

| Portfolio turnover |

| 1 | Calculated using average shares outstanding. |

| 2 | Amount is less than $0.005 per share. |

| 3 | See Note 2 in “Notes to financial statements.” |

| 4 | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. |

| 5 | Expense ratios do not include expenses of any investment companies in which the Fund invests. |

See accompanying notes, which are an integral part of the financial statements.

| 30 |

| Year ended | ||||||||||||||||||

| 11/30/23 | 11/30/22 | 11/30/21 | 11/30/20 | 11/30/19 | ||||||||||||||

| $ | 28.08 | $ | 32.06 | $ | 25.51 | $ | 23.85 | $ | 24.54 | |||||||||

| 0.17 | 0.16 | 0.10 | 0.10 | 0.12 | ||||||||||||||

| (1.18 | ) | (2.11 | ) | 6.72 | 2.06 | 1.28 | ||||||||||||

| (1.01 | ) | (1.95 | ) | 6.82 | 2.16 | 1.40 | ||||||||||||

| (0.16 | ) | (0.10 | ) | (0.08 | ) | (0.12 | ) | (0.12 | ) | |||||||||

| (0.84 | ) | (1.93 | ) | (0.19 | ) | (0.38 | ) | (1.97 | ) | |||||||||

| (1.00 | ) | (2.03 | ) | (0.27 | ) | (0.50 | ) | (2.09 | ) | |||||||||

| — | 2,3 | — | — | — | — | |||||||||||||

| $ | 26.07 | $ | 28.08 | $ | 32.06 | $ | 25.51 | $ | 23.85 | |||||||||

| (3.49 | )% | (6.52 | )% | 26.92 | % | 9.24 | % | 8.20 | % | |||||||||

| $ | 1,538,097 | $ | 1,386,235 | $ | 1,325,213 | $ | 894,120 | $ | 677,315 | |||||||||

| 0.72 | % | 0.69 | % | 0.69 | % | 0.71 | % | 0.72 | % | |||||||||

| 0.67 | % | 0.57 | % | 0.31 | % | 0.48 | % | 0.53 | % | |||||||||

| 26 | % | 23 | % | 24 | % | 37 | % | 34 | % | |||||||||

| 31 |

| Notes to financial statements | |

| Delaware Small Cap Core Fund | November 30, 2023 |

Delaware Group® Equity Funds V (Trust) is organized as a Delaware statutory trust and offers three series: Delaware Small Cap Core Fund, Delaware Small Cap Value Fund, and Delaware Wealth Builder Fund. These financial statements and the related notes pertain to Delaware Small Cap Core Fund (Fund). The Trust is an open-end investment company. The Fund is considered diversified under the Investment Company Act of 1940, as amended (1940 Act), and offers Class A, Class C, Class R, Institutional Class, and Class R6 shares. Class A shares are sold with a maximum front-end sales charge of 5.75%. There is no front-end sales charge when you purchase $1 million or more of Class A shares. However, if Delaware Distributors, L.P. (DDLP) paid your financial intermediary a commission on your purchase of $1 million or more of Class A shares, you will have to pay a limited contingent deferred sales charge (Limited CDSC) of 1.00% if you redeem these shares within the first 18 months after your purchase, unless a specific waiver of the Limited CDSC applies. Class C shares have no upfront sales charge, but are sold with a contingent deferred sales charge (CDSC) of 1.00%, which will be incurred if redeemed during the first 12 months. Class R, Institutional Class, and Class R6 shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Class R6 shares do not pay any service fees, sub-accounting fees, and/or sub-transfer agency fees to any brokers, dealers, or other financial intermediaries.

1. Significant Accounting Policies

The Fund follows accounting and reporting guidance under Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services — Investment Companies. The following accounting policies are in accordance with US generally accepted accounting principles (US GAAP) and are consistently followed by the Fund.

Security Valuation — Equity securities and exchange-traded funds (ETFs), except those traded on the Nasdaq Stock Market LLC (Nasdaq), are valued at the last quoted sales price as of the time of the regular close of the New York Stock Exchange on the valuation date. Equity securities and ETFs traded on the Nasdaq are valued in accordance with the Nasdaq Official Closing Price, which may not be the last sales price. If, on a particular day, an equity security or ETF does not trade, the mean between the bid and the ask prices will be used, which approximates fair value. Open-end investment companies, other than ETFs, are valued at their published net asset value (NAV). Generally, other securities and assets for which market quotations are not readily available are valued at fair value as determined in good faith by Delaware Management Company (DMC). Subject to the oversight of the Trust's Board of Trustees (Board), DMC, as valuation designee, has adopted policies and procedures to fair value securities for which market quotations are not readily available consistent with the requirements of Rule 2a-5 under the 1940 Act. In determining whether market quotations are readily available or fair valuation will be used, various factors will be taken into consideration, such as market closures or suspension of trading in a security. Restricted securities and private placements are valued at fair value.

Federal Income Taxes — No provision for federal income taxes has been made as the Fund intends to continue to qualify for federal income tax purposes as a regulated investment

| 32 |

company under Subchapter M of the Internal Revenue Code of 1986, as amended, and make the requisite distributions to shareholders. The Fund evaluates tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the “more-likely-than-not” threshold are recorded as a tax benefit or expense in the current year. Management has analyzed the Fund’s tax positions taken or expected to be taken on the Fund’s federal income tax returns through the year ended November 30, 2023, and for all open tax years (years ended November 30, 2020–November 30, 2022), and has concluded that no provision for federal income tax is required in the Fund’s financial statements. If applicable, the Fund recognizes interest accrued on unrecognized tax benefits in interest expense and penalties in “Other” on the “Statement of operations.” During the year ended November 30, 2023, the Fund did not incur any interest or tax penalties.

Class Accounting — Investment income, common expenses, and realized and unrealized gain (loss) on investments are allocated to the various classes of the Fund on the basis of daily net assets of each class. Distribution expenses relating to a specific class are charged directly to that class. Class R6 shares will not be allocated any expenses related to service fees, sub-accounting fees, and/or sub-transfer agency fees paid to brokers, dealers, or other financial intermediaries.

Use of Estimates — The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the fair value of investments, the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates and the differences could be material.

Other — Expenses directly attributable to the Fund are charged directly to the Fund. Other expenses common to various funds within the Delaware Funds by Macquarie® (Delaware Funds) are generally allocated among such funds on the basis of average net assets. Management fees and certain other expenses are paid monthly. Security transactions are recorded on the date the securities are purchased or sold (trade date) for financial reporting purposes. Costs used in calculating realized gains and losses on the sale of investment securities are those of the specific securities sold. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Income and capital gain distributions from any investment companies (Underlying Funds) in which the Fund invests are recorded on the ex-dividend date. Distributions received from investments in real estate investment trusts (REITs) are recorded as dividend income on the ex-dividend date, subject to reclassification upon notice of the character of such distributions by the issuer, which are estimated. The Fund declares and pays dividends from net investment income and distributions from net realized gain on investments, if any, at least annually. The Fund may distribute more frequently, if necessary for tax purposes. Dividends and distributions, if any, are recorded on the ex-dividend date.

| 33 |

Notes to financial statements

Delaware Small Cap Core Fund

1. Significant Accounting Policies (continued)

The Fund receives earnings credits from its transfer agent when positive cash balances are maintained, which may be used to offset transfer agent fees. If the amount earned is greater than $1, the expenses paid under this arrangement are included on the “Statement of operations” under “Dividend disbursing and transfer agent fees and expenses” with the corresponding expenses offset included under “Less expenses paid indirectly.”

2. Investment Management, Administration Agreements, and Other Transactions with Affiliates

In accordance with the terms of its investment management agreement, the Fund pays DMC, a series of Macquarie Investment Management Business Trust and the investment manager, an annual fee which is calculated daily and paid monthly at the rates of 0.75% on the first $500 million of average daily net assets of the Fund, 0.70% on the next $500 million, 0.65% on the next $1.5 billion, and 0.60% on average daily net assets in excess of $2.5 billion.

DMC entered into a Sub-Advisory Agreement on behalf of the Fund with Macquarie Investment Management Global Limited, which is an affiliate of DMC (“Affiliated Sub-Advisor”). Pursuant to the terms of the Sub-Advisory Agreement, the investment sub-advisory fee is paid by DMC to the Affiliated Sub-Advisor based on the extent to which the Affiliated Sub-Advisor provides services to the Fund.

Delaware Investments Fund Services Company (DIFSC), an affiliate of DMC, provides fund accounting and financial administrative oversight services to the Fund. For these services, effective October 1, 2023, DIFSC’s fees are calculated daily and paid monthly, based on the aggregate daily net assets of all funds within the Delaware Funds at the following annual rates: 0.0050% of the first $60 billion; 0.00475% of the next $30 billion; and 0.0015% of aggregate average daily net assets in excess of $90 billion (Total Fee). Prior to October 1, 2023, DIFSC's fees were payable by the fund at the following annual rates: 0.00475% of the first $35 billion; 0.0040% of the next $10 billion; 0.0025% of the next $45 billion; and 0.0015% of aggregate average daily net assets in excess of $90 billion. Each fund in the Delaware Funds pays a minimum of $4,000, which, in aggregate, is subtracted from the Total Fee. Each fund then pays its portion of the remainder of the Total Fee on a relative NAV basis. This amount is included on the “Statement of operations” under “Accounting and administration expenses.” For the year ended November 30, 2023, the Fund paid $222,246 for these services.

DIFSC is also the transfer agent and dividend disbursing agent of the Fund. For these services, DIFSC’s fees are calculated daily and paid monthly, based on the aggregate daily net assets of the retail funds within the Delaware Funds at the following annual rates: 0.014% of the first $20 billion; 0.011% of the next $5 billion; 0.007% of the next $5 billion; 0.004% of the next $20 billion; 0.002% of the next $25 billion; and 0.0015% of average daily net assets in excess of $75 billion. The fees payable to DIFSC under the shareholder services agreement described above are allocated among all retail funds in the Delaware Funds on a relative NAV basis. This amount is included on the “Statement of operations” under “Dividend disbursing and transfer

| 34 |

agent fees and expenses.” For the year ended November 30, 2023, the Fund paid $453,234 for these services. Pursuant to a sub-transfer agency agreement between DIFSC and BNY Mellon Investment Servicing (US) Inc. (BNYMIS), BNYMIS provides certain sub-transfer agency services to the Fund. Sub-transfer agency fees are paid by the Fund and are also included on the “Statement of operations” under “Dividend disbursing and transfer agent fees and expenses.” The fees that are calculated daily and paid as invoices are received on a monthly or quarterly basis.

Pursuant to a distribution agreement and distribution plan, the Fund pays DDLP, the distributor and an affiliate of DMC, an annual 12b-1 fee of 0.25%, 1.00%, and 0.50% of the average daily net assets of the Class A, Class C, and Class R shares, respectively. The fees are calculated daily and paid monthly. Institutional Class and Class R6 shares do not pay 12b-1 fees.

As provided in the investment management agreement, the Fund bears a portion of the cost of certain resources shared with DMC, including the cost of internal personnel of DMC and/or its affiliates that provide legal and regulatory reporting services to the Fund. For the year ended November 30, 2023, the Fund paid $207,721 for internal legal and regulatory reporting services provided by DMC and/or its affiliates’ employees. This amount is included on the “Statement of operations” under “Legal fees.”

For the year ended November 30, 2023, DDLP earned $14,633 for commissions on sales of the Fund’s Class A shares. For the year ended November 30, 2023, DDLP received gross CDSC commissions of $1,986 and $3,266 on redemptions of the Fund’s Class A and Class C shares, respectively, and these commissions were entirely used to offset upfront commissions previously paid by DDLP to broker/dealers on sales of those shares.

Trustees’ fees include expenses accrued by the Fund for each Trustee’s retainer and meeting fees. Certain officers of DMC, DIFSC, and DDLP are officers and/or Trustees of the Trust. These officers and Trustees are paid no compensation by the Fund.

In addition to the management fees and other expenses of the Fund, the Fund indirectly bears the investment management fees and other expenses of any Underlying Funds, including ETFs, in which it invests. The amount of these fees and expenses incurred indirectly by the Fund will vary based upon the expense and fee levels of any Underlying Funds and the number of shares that are owned of any Underlying Funds at different times.

During the year ended November 30, 2023, DMC reimbursed the Fund $24,946 for losses related to a trade error. These amounts are included in “Net increase from payment by affiliates” in the "Statement of operations." Payment by affiliates had no impact on total return.

Cross trades for the year ended November 30, 2023 were executed by the Fund pursuant to procedures adopted by the Board designed to ensure compliance with Rule 17a-7 under the 1940 Act. Cross trading is the buying or selling of portfolio securities between funds of investment companies, or between a fund of an investment company and another entity, that are or could be considered affiliates by virtue of having a common investment advisor (or affiliated investment advisors), common directors/trustees and/or common officers. At its regularly

| 35 |

Notes to financial statements

Delaware Small Cap Core Fund

2. Investment Management, Administration Agreements, and Other Transactions with Affiliates (continued)

scheduled meetings, the Board reviews such transactions for compliance with the procedures adopted by the Board. Pursuant to these procedures, for the year ended November 30, 2023, the Fund engaged in Rule 17a-7 securities purchases and sales of $16,478,073 and $12,342,312 respectively, resulting in losses of $587,021.

3. Investments

For the year ended November 30, 2023, the Fund made purchases and sales of investment securities other than short-term investments and US government securities as follows:

| Purchases | $ | 1,787,805,502 | ||

| Sales | 1,823,220,133 |

The tax cost of investments includes adjustments to net unrealized appreciation (depreciation) which may not necessarily be the final tax cost basis adjustments but which approximate the tax basis unrealized gains and losses that may be realized and distributed to shareholders. At November 30, 2023, the cost and unrealized appreciation (depreciation) of investments for federal income tax purposes for the Fund were as follows:

| Cost of investments | $ | 6,367,337,496 | ||

| Aggregate unrealized appreciation of investments | $ | 1,290,755,840 | ||

| Aggregate unrealized depreciation of investments | (783,560,358 | ) | ||

| Net unrealized appreciation of investments | $ | 507,195,482 |

US GAAP defines fair value as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date under current market conditions. A three-level hierarchy for fair value measurements has been established based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions that market participants would use in pricing the asset or liability based on the best information available under the circumstances. The Fund's investment in its entirety is assigned a level based upon the observability of the inputs which are significant to the overall valuation. The three-level hierarchy of inputs is summarized as follows:

| Level 1 - | Inputs are quoted prices in active markets for identical investments. (Examples: equity securities, open-end investment companies, futures contracts, and exchange-traded options contracts) |

| Level 2 - | Other observable inputs, including, but not limited to: quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are |

| 36 |