UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER

REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | 811-04997 | |

| Exact name of registrant as specified in charter: | Delaware Group® Equity Funds V | |

| Address of principal executive offices: | 2005 Market Street | |

| Philadelphia, PA 19103 | ||

| Name and address of agent for service: | David F. Connor, Esq. | |

| 2005 Market Street | ||

| Philadelphia, PA 19103 | ||

| Registrant’s telephone number, including area code: | (800) 523-1918 | |

| Date of fiscal year end: | November 30 | |

| Date of reporting period: | November 30, 2013 |

Item 1. Reports to Stockholders

|

Annual report

Income and growth mutual fund

Delaware

Dividend Income Fund

November

30, 2013

|

|

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Fund’s prospectus and its summary prospectus, which may be obtained by visiting delawareinvestments.com or calling 800 523-1918. Investors should read the prospectus and the summary prospectus carefully before investing. |

|

You can obtain shareholder reports

and prospectuses online instead of in the mail. Visit delawareinvestments.com/edelivery. |

Experience Delaware Investments

Delaware Investments is committed to the pursuit of consistently superior asset management and unparalleled client service. We believe in our investment processes, which seek to deliver consistent results, and in convenient services that help add value for our clients.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Investments or obtain a prospectus for Delaware Dividend Income Fund at delawareinvestments.com.

|

Manage your investments online |

|

Delaware Management Holdings, Inc. and its subsidiaries (collectively known by the marketing name of Delaware Investments) are wholly owned subsidiaries of Macquarie Group Limited, a global provider of banking, financial, advisory, investment and funds management services.

Investments in Delaware Dividend Income Fund are not and will not be deposits with or liabilities of Macquarie Bank Limited ABN 46 008 583 542 and its holding companies, including their subsidiaries or related companies (Macquarie Group), and are subject to investment risk, including possible delays in repayment and loss of income and capital invested. No Macquarie Group company guarantees or will guarantee the performance of the Fund, the repayment of capital from the Fund, or any particular rate of return.

|

Table of contents |

|

| Portfolio management review | 1 |

| Performance summary | 4 |

| Disclosure of Fund expenses | 8 |

| Security type/sector allocation | |

| and top 10 equity holdings | 10 |

| Schedule of investments | 13 |

| Statement of assets and liabilities | 36 |

| Statement of operations | 38 |

| Statements of changes in net assets | 40 |

| Financial highlights | 42 |

| Notes to financial statements | 52 |

| Report of independent registered | |

| public accounting firm | 69 |

| Other Fund information | 70 |

| Board of trustees/directors and | |

| officers addendum | 74 |

| About the organization | 82 |

Unless otherwise noted, views expressed herein are current as of Nov. 30, 2013, and subject to change.

Funds are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested.

Mutual fund advisory services provided by Delaware Management Company, a series of Delaware Management Business Trust, which is a registered investment advisor. Delaware Investments, a member of Macquarie Group, refers to Delaware Management Holdings, Inc. and its subsidiaries, including the Fund’s distributor, Delaware Distributors, L.P. Macquarie Group refers to Macquarie Group Limited and its subsidiaries and affiliates worldwide.

© 2013 Delaware Management Holdings, Inc.

All third-party marks cited are the property of their respective owners.

| Portfolio management review Delaware Dividend Income Fund |

December 10, 2013 |

| Performance preview (for the year ended November 30, 2013) | |||

| Delaware Dividend Income Fund (Class A shares) | 1-year return | +20.07% | |

| S&P 500® Index (benchmark) | 1-year return | +30.30% | |

| Lipper Mixed-Asset Target Allocation Moderate Funds Average | 1-year return | +14.14% | |

For its fiscal year ended Nov. 30, 2013, Delaware Dividend Income Fund (Class A shares) returned +20.07% at net asset value and +13.14% at maximum offer price (both figures reflect all distributions invested). The Fund underperformed its benchmark, the S&P 500 Index, which returned +30.30% for the same time frame. Complete annualized performance for Delaware Dividend Income Fund is shown in the table on page 4.

Stocks outpaced other asset classes

Developed market stocks enjoyed strong results during the fiscal year ended Nov. 30, 2013, aided by the presence of quantitative easing (QE) programs — large-scale economic stimulus efforts implemented by central banks in an effort to lift asset values.

The U.S. Federal Reserve, for example, implemented a third round of QE, consisting of $85 billion in monthly Treasury and mortgage-backed security purchases. In May 2013, Fed Chairman Ben Bernanke announced the central bank’s intention to begin tapering its bond purchases if the U.S. economy were to demonstrate signs of sustained economic growth.

1

Portfolio management

review

Delaware Dividend Income

Fund

Despite investors’ initial concerns about tapering, the bond-buying program remained in place through the remainder of the Fund’s fiscal year, as the U.S. economy continued its subdued growth.

Against this backdrop, equity investments performed particularly well. Income-oriented investments such as high yield bonds and real estate investment trusts (REITs) — both of which struggled in the summer months, concurrent with the heightened concerns about QE tapering — also generated positive performance, but did not keep pace with the equity market.

Challenges from REITs and convertibles

Given the equity market’s strong performance during the Fund’s fiscal year, our portfolio allocation to income-oriented asset classes weighed on results in relative terms. For example, REITs, which made up about 6% of the portfolio at period end, struggled amid a rising interest rate environment. As measured by the FTSE NAREIT Equity REITs Index, the REIT market was up 6% during the period — more than 20 percentage points behind the S&P 500 Index. Individual REIT holdings that detracted most from Fund performance included healthcare property company HCP, office industrial REIT Liberty Property Trust, and regional mall operator CBL & Associates Properties.

The Fund’s allocation to convertible securities — representing 14% of the portfolio at the end of the fiscal year — was another source of underperformance. Its holdings in convertible securities tended to be higher yielding than the overall convertibles market and priced at a premium, which made them less sensitive to strength in the equity market.

A beneficial equity allocation

The Fund’s sizeable equity-market exposure helped drive performance during the fiscal year. As of Nov. 30, 2013, about half of the portfolio was invested in U.S. large-cap value stocks — a segment of the market that enjoyed very strong results during the year — while the Fund’s roughly 5% stake in foreign developed-market equities also added to results.

The Fund’s leading individual equity contributors during the fiscal year included Johnson Controls, which makes heating and air conditioning systems; Xerox, a leading printer manufacturer; and defense contractor Northrop Grumman.

Of final note, the Fund maintained certain positions in derivative securities in an attempt to help the Fund generate attractive returns while also seeking to manage the Fund’s overall level of risk. These positions included high yield bond credit default swaps and foreign currency hedges to help manage currency risk associated with the Fund’s international fixed income investments. We also wrote options on stock positions in the portfolio in an attempt to provide additional downside protection. None of these positions had a material effect on the Fund’s performance during the fiscal year.

Consistent portfolio positioning

Our basic strategy remained the same during this reporting period, as it does throughout a variety of market conditions. We continued to strive to purchase a diversified collection of income-generating securities that we believe have the potential to provide a competitive yield but greater upside potential than bonds, while at the same time potentially providing higher yields than equities but with better downside protection.

2

During the Fund’s fiscal year, we kept the Fund’s portfolio positioning largely consistent. Well before the start of the fiscal year, we had determined that most income-oriented securities such as investment grade bonds, high yield bonds, utility-company stocks, master limited partnerships, and REITs had become expensive and, in our view, many of these securities no longer offered good value for the Fund. Accordingly, we began the period in December 2012 with relatively limited exposure to these yield-oriented asset classes and generally preserved that stance throughout the subsequent 12 months.

The Fund ended the fiscal year with an 18% allocation to high yield bonds, down from 22% at the start of the period. While we generally remained comfortable with the credit quality of high yield issuers, their high valuations were a source of some concern. Our search for better-valued opportunities continued to lead us to areas of the equity market.

Focused on total return

By the end of the Fund’s fiscal year, the Fund’s portfolio continued to emphasize equities; however, we were aware that stock valuations, after a long rally, were no longer as attractive as they had been in prior quarters. Accordingly, we remained focused on trying to identify what we considered to be good large-cap value stocks at a reasonable price. We also sought to take advantage of value wherever we believed we could find it, which involved establishing inaugural positions in two new asset classes for the Fund: municipal bonds and emerging market debt, both of which had begun to offer what we saw as a worthwhile risk-return trade-off.

We continue to believe that investors should consider taking a total-return approach to investing in income-oriented securities. We believe yield is an important criterion for deciding whether an investment is worth owning, but certainly not the only one. In short: We believe valuation matters. Accordingly, our investment discipline continues to focus not just on how much income a security may provide, but on how much value it may have the potential to deliver to the Fund’s shareholders over time.

3

| Performance

summary Delaware Dividend Income Fund |

November 30, 2013 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data current for the most recent month end by calling 800 523-1918 or visiting our website at delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

|

Fund and benchmark performance1,2 |

Average annual total returns through November 30, 2013 | ||||||||

| 1 year | 5 years | 10 years | |||||||

| Class A (Est. Dec. 2, 1996) | |||||||||

| Excluding sales charge | +20.07% | +17.43% | +6.89% | ||||||

| Including sales charge | +13.14% | +16.05% | +6.27% | ||||||

| Class B (Est. Oct. 1, 2003) | |||||||||

| Excluding sales charge | +19.15% | +16.57% | +6.25% | ||||||

| Including sales charge | +15.15% | +16.33% | +6.25% | ||||||

| Class C (Est. Oct. 1, 2003) | |||||||||

| Excluding sales charge | +19.13% | +16.56% | +6.10% | ||||||

| Including sales charge | +18.13% | +16.56% | +6.10% | ||||||

| Class R (Est. Oct. 1, 2003) | |||||||||

| Excluding sales charge | +19.77% | +17.16% | +6.60% | ||||||

| Including sales charge | +19.77% | +17.16% | +6.60% | ||||||

| Institutional Class (Est. Dec. 2, 1996) | |||||||||

| Excluding sales charge | +20.37% | +17.73% | +7.16% | ||||||

| Including sales charge | +20.37% | +17.73% | +7.16% | ||||||

| S&P 500 Index | +30.30% | +17.60% | +7.69% | ||||||

1 Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund performance” chart. Expenses for each class are listed on the “Fund expense ratios” table on page 5. Performance would have been lower had expense limitations not been in effect.

Class A shares are sold with a maximum front-end sales charge of 5.75%, and have an annual distribution and service fee of 0.25% of average daily net assets. Prior to Oct. 1, 2013, Class A shares had an annual distribution and service fee of 0.30% of average daily net assets. This fee was contractually limited to 0.25% during the period from Dec. 1, 2012 until Oct. 1, 2013. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

Class B shares may be purchased only through dividend reinvestment and certain permitted exchanges as described in the prospectus. Please see the prospectus for additional information on Class B shares. Class B shares have a contingent

4

deferred sales charge that declines from 4.00% to zero depending on the period of time the shares are held. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets. Class B shares will automatically convert to Class A shares on a quarterly basis approximately eight years after purchase. Ten-year performance figures for Class B shares reflect conversion to Class A shares after approximately eight years.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets.

Performance for Class B and C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Class R shares are available only for certain retirement plan products. They are sold without a sales charge and have an annual distribution and service fee of 0.50% of average daily net assets. Prior to Oct. 1, 2013, Class R shares had an annual distribution and service fee of 0.60% of average daily net assets. This fee was contractually limited to 0.50% during the period from Dec. 1, 2012 until Oct. 1, 2013.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible institutional accounts.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Fund may be prepaid prior to maturity, potentially forcing the Fund to reinvest that money at a lower interest rate.

High yielding, noninvestment grade bonds (junk bonds) involve higher risk than investment grade bonds. The high yield secondary market is particularly susceptible to liquidity problems when institutional investors, such as mutual funds and certain other financial institutions, temporarily stop buying bonds for regulatory, financial, or other reasons. In addition, a less liquid secondary market makes it more difficult for the Fund to obtain precise valuations of the high yield securities in its portfolio.

Diversification may not protect against market risk.

2 The Fund’s expense ratios, as described in the most recent prospectus and any applicable supplement(s), are disclosed in the following “Fund expense ratios” table.

| Fund expense ratios | Class A | Class B | Class C | Class R | Institutional Class | |||||||||||||||||||

| Total annual operating expenses | 1.16 | % | 1.91 | % | 1.91 | % | 1.41 | % | 0.91 | % | ||||||||||||||

| (without fee waivers) | ||||||||||||||||||||||||

| Net expenses | 1.16 | % | 1.91 | % | 1.91 | % | 1.41 | % | 0.91 | % | ||||||||||||||

| (including fee waivers, if any) | ||||||||||||||||||||||||

| Type of waiver | n/a | n/a | n/a | n/a | n/a | |||||||||||||||||||

5

Performance

summary

Delaware Dividend Income

Fund

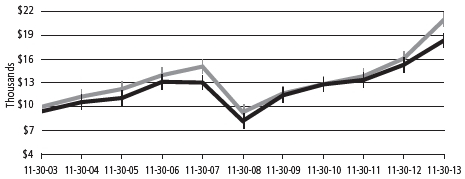

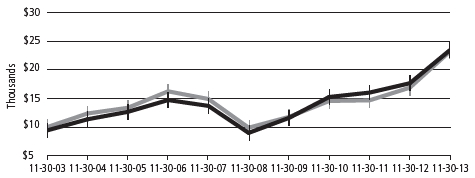

Performance of a $10,000

investment1

Average annual

total returns from Nov. 30, 2003, through Nov. 30, 2013

| For period beginning Nov. 30, 2003, through Nov. 30, 2013 | Starting value | Ending value | ||

|

|

S&P 500 Index | $10,000 | $20,968 | |

|

|

Delaware Dividend Income Fund — Class A shares | $9,425 | $18,358 | |

1 The “Performance of a $10,000 investment” graph assumes $10,000 invested in Class A shares of the Fund on Nov. 30, 2003, and includes the effect of a 5.75% front-end sales charge and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 5. Please note additional details on pages 4 through 6.

The chart also assumes $10,000 invested in the S&P 500 Index as of Nov. 30, 2003. The S&P 500 Index measures the performance of 500 mostly large-cap stocks weighted by market value, and is often used to represent performance of the U.S. stock market.

The FTSE NAREIT Equity REITs Index, mentioned on page 2, measures the performance of all publicly traded equity real estate investment trusts (REITs) traded on U.S. exchanges, excluding timber REITs.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

| Nasdaq symbols | CUSIPs | ||||||||

| Class A | DDIAX | 24610B107 | |||||||

| Class B | DDDBX | 24610B206 | |||||||

| Class C | DDICX | 24610B305 | |||||||

| Class R | DDDRX | 24610B842 | |||||||

| Institutional Class | DDIIX | 24610B404 | |||||||

6

Disclosure of Fund expenses

For the six-month period from June 1, 2013

to November 30, 2013 (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from June 1, 2013 to Nov. 30, 2013.

Actual expenses

The first section of the table shown, “Actual Fund return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the table shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Fund’s expenses shown in the table reflect fee waivers in effect. The expenses shown in the table assume reinvestment of all dividends and distributions.

8

Delaware Dividend Income

Fund

Expense analysis of an investment

of $1,000

| Beginning | Ending | Expenses | ||||||||||||||

| Account Value | Account Value | Annualized | Paid During Period | |||||||||||||

| 6/1/13 | 11/30/13 | Expense Ratio | 6/1/13 to 11/30/13* | |||||||||||||

| Actual Fund return† | ||||||||||||||||

| Class A | $ | 1,000.00 | $ | 1,067.30 | 1.12% | $ | 5.80 | |||||||||

| Class B | 1,000.00 | 1,063.10 | 1.87% | 9.67 | ||||||||||||

| Class C | 1,000.00 | 1,064.00 | 1.87% | 9.68 | ||||||||||||

| Class R | 1,000.00 | 1,066.00 | 1.37% | 7.10 | ||||||||||||

| Institutional Class | 1,000.00 | 1,068.60 | 0.87% | 4.51 | ||||||||||||

| Hypothetical 5% return (5% return before expenses) | ||||||||||||||||

| Class A | $ | 1,000.00 | $ | 1,019.45 | 1.12% | $ | 5.67 | |||||||||

| Class B | 1,000.00 | 1,015.69 | 1.87% | 9.45 | ||||||||||||

| Class C | 1,000.00 | 1,015.69 | 1.87% | 9.45 | ||||||||||||

| Class R | 1,000.00 | 1,018.20 | 1.37% | 6.93 | ||||||||||||

| Institutional Class | 1,000.00 | 1,020.71 | 0.87% | 4.41 | ||||||||||||

*“Expenses Paid During Period” are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period).

†Because actual returns reflect only the most recent six month period, the returns shown may differ significantly from fiscal year returns.

9

|

Security type/sector allocation and |

As of November 30, 2013 (Unaudited) |

Sector designations may be different than the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications, which may result in the sector designations for one fund being different than another fund’s sector designations.

| Sector | Percentage of net assets | |||

| Common Stock | 63.41 | % | ||

| Consumer Discretionary | 4.92 | % | ||

| Consumer Staples | 6.43 | % | ||

| Diversified REITs | 0.37 | % | ||

| Energy | 7.83 | % | ||

| Financials | 6.83 | % | ||

| Healthcare | 9.65 | % | ||

| Healthcare REITs | 0.47 | % | ||

| Hotel REITs | 0.68 | % | ||

| Industrial REITs | 0.27 | % | ||

| Industrials | 5.55 | % | ||

| Information Technology | 9.22 | % | ||

| Mall REITs | 0.95 | % | ||

| Manufactured Housing REITs | 0.22 | % | ||

| Materials | 1.91 | % | ||

| Mixed REITs | 0.94 | % | ||

| Multifamily REITs | 0.81 | % | ||

| Office REITs | 0.26 | % | ||

| Shopping Center REITs | 0.98 | % | ||

| Single Tenant REIT | 0.07 | % | ||

| Telecommunications | 3.43 | % | ||

| Utilities | 1.62 | % | ||

| Convertible Preferred Stock | 3.17 | % | ||

| Commercial Mortgage-Backed Securities | 0.35 | % | ||

10

| Sector | Percentage of net assets | |||

| Convertible Bonds | 10.73 | % | ||

| Basic Industry | 0.22 | % | ||

| Capital Goods | 0.97 | % | ||

| Communications | 2.27 | % | ||

| Consumer Cyclical | 1.46 | % | ||

| Consumer Non-Cyclical | 1.68 | % | ||

| Energy | 0.79 | % | ||

| Financials | 1.26 | % | ||

| Industrials | 0.11 | % | ||

| Insurance | 0.16 | % | ||

| Technology | 1.81 | % | ||

| Corporate Bonds | 13.77 | % | ||

| Automobiles | 0.62 | % | ||

| Banking | 0.32 | % | ||

| Basic Industry | 1.71 | % | ||

| Capital Goods | 0.70 | % | ||

| Communications | 1.43 | % | ||

| Consumer Cyclical | 1.10 | % | ||

| Consumer Non-Cyclical | 0.39 | % | ||

| Energy | 1.95 | % | ||

| Financials | 0.24 | % | ||

| Healthcare | 1.04 | % | ||

| Industrials | 0.05 | % | ||

| Insurance | 0.45 | % | ||

| Media | 1.07 | % | ||

| Service-Other | 1.24 | % | ||

| Technology | 0.94 | % | ||

| Utilities | 0.52 | % | ||

11

Security type/sector

allocation and

top 10 equity holdings

Delaware Dividend Income Fund

| Sector | Percentage of net assets | |||

| Municipal Bonds | 0.53 | % | ||

| Leveraged Non-Recourse Securities | 0.00 | % | ||

| Senior Secured Loans | 1.56 | % | ||

| Sovereign Bonds | 0.87 | % | ||

| Brazil | 0.46 | % | ||

| Mexico | 0.41 | % | ||

| Limited Partnership | 0.18 | % | ||

| Preferred Stock | 0.53 | % | ||

| Short-Term Investments | 5.01 | % | ||

| Total Value of Securities | 100.11 | % | ||

| Options Written | (0.01 | %) | ||

| Liabilities Net of Receivables and Other Assets | (0.10 | %) | ||

| Total Net Assets | 100.00 | % | ||

Holdings are for informational purposes only and are subject to change at any time. They are not a recommendation to buy, sell, or hold any security.

| Top 10 equity holdings | Percentage of net assets | |||

| Xerox | 1.66 | % | ||

| Johnson Controls | 1.65 | % | ||

| Cardinal Health | 1.63 | % | ||

| Merck | 1.56 | % | ||

| Raytheon | 1.55 | % | ||

| CVS Caremark | 1.54 | % | ||

| Baxter International | 1.52 | % | ||

| Waste Management | 1.52 | % | ||

| Marsh & McLennan | 1.51 | % | ||

| Bank of New York Mellon | 1.51 | % | ||

12

| Schedule of investments | |

| Delaware Dividend Income Fund | November 30, 2013 |

| Number of shares | Value (U.S. $) | |||||

| Common Stock – 63.41% | ||||||

| Consumer Discretionary – 4.92% | ||||||

| Abercrombie & Fitch Class A | 41,661 | $ | 1,428,139 | |||

| Asian Pay Television Trust | 1,643,000 | 1,021,107 | ||||

| Bayerische Motoren Werke | 4,245 | 487,683 | ||||

| Cablevision Systems Class A | 36,100 | 605,397 | ||||

| Carnival | 17,570 | 634,453 | ||||

| † | DIRECTV Class A | 6,350 | 419,799 | |||

| Don Quijote | 4,500 | 275,577 | ||||

| † | Hertz Global Holdings | 10,600 | 257,156 | |||

| Johnson Controls | 205,400 | 10,374,753 | ||||

| Lowe’s | 195,000 | 9,258,599 | ||||

| Nitori Holdings | 7,193 | 666,715 | ||||

| PPR | 2,130 | 472,364 | ||||

| Publicis Groupe | 9,133 | 807,181 | ||||

| † | Quiksilver | 36,764 | 327,200 | |||

| Tarkett | 33,550 | 1,317,146 | ||||

| Techtronic Industries | 126,000 | 338,865 | ||||

| Toyota Motor | 21,400 | 1,333,516 | ||||

| † | United Rentals | 2,575 | 176,980 | |||

| Yue Yuen Industrial Holdings | 214,500 | 670,948 | ||||

| 30,873,578 | ||||||

| Consumer Staples – 6.43% | ||||||

| † | Akorn | 10,895 | 280,546 | |||

| Archer-Daniels-Midland | 225,300 | 9,068,325 | ||||

| Aryzta | 17,587 | 1,310,537 | ||||

| Carlsberg Class B | 6,853 | 750,656 | ||||

| CVS Caremark | 144,400 | 9,669,024 | ||||

| Kraft Foods Group | 176,300 | 9,365,056 | ||||

| Mondelez International Class A | 271,900 | 9,116,807 | ||||

| TESCO | 129,681 | 738,430 | ||||

| 40,299,381 | ||||||

| Diversified REITs – 0.37% | ||||||

| Lexington Reality Trust | 63,700 | 654,199 | ||||

| Mapletree Commercial Trust | 725,000 | 710,529 | ||||

| Vornado Realty Trust | 10,500 | 923,265 | ||||

| 2,287,993 | ||||||

13

Schedule of

investments

Delaware Dividend

Income Fund

| Number of shares | Value (U.S. $) | |||||

| Common Stock (continued) | ||||||

| Energy – 7.83% | ||||||

| Chevron | 76,800 | $ | 9,403,391 | |||

| CNOOC | 337,000 | 690,288 | ||||

| ConocoPhillips | 125,300 | 9,121,840 | ||||

| † | Halcon Resources | 7,088 | 28,421 | |||

| Halliburton | 173,100 | 9,118,908 | ||||

| † | Kodiak Oil & Gas | 26,564 | 301,236 | |||

| Marathon Oil | 254,900 | 9,186,596 | ||||

| Occidental Petroleum | 92,400 | 8,774,304 | ||||

| Range Resources | 3,097 | 240,482 | ||||

| Saipem | 23,385 | 524,797 | ||||

| Subsea 7 | 25,056 | 487,512 | ||||

| Total | 12,236 | 741,258 | ||||

| Transocean | 9,239 | 465,461 | ||||

| 49,084,494 | ||||||

| Financials – 6.83% | ||||||

| Allstate | 167,700 | 9,101,079 | ||||

| AXA | 40,050 | 1,049,218 | ||||

| Bank of New York Mellon | 280,100 | 9,439,370 | ||||

| Bank Rakyat Indonesia Persero Tbk IRP | 391,500 | 243,818 | ||||

| Huntington Bancshares | 99,800 | 916,164 | ||||

| Marsh & McLennan | 199,200 | 9,452,041 | ||||

| Mitsubishi UFJ Financial Group | 164,600 | 1,059,446 | ||||

| Nordea Bank | 77,077 | 996,366 | ||||

| Standard Chartered | 24,095 | 571,165 | ||||

| Travelers | 102,300 | 9,282,702 | ||||

| UniCredit | 101,999 | 739,913 | ||||

| 42,851,282 | ||||||

| Healthcare – 9.65% | ||||||

| Baxter International | 139,600 | 9,555,620 | ||||

| Cardinal Health | 157,800 | 10,193,880 | ||||

| Johnson & Johnson | 96,500 | 9,134,690 | ||||

| Meda Class A | 5,524 | 68,122 | ||||

| Merck | 196,600 | 9,796,578 | ||||

| Novartis | 12,579 | 994,247 | ||||

| Pfizer | 286,538 | 9,091,851 | ||||

| Quest Diagnostics | 151,200 | 9,214,128 | ||||

| Sanofi | 9,696 | 1,025,272 | ||||

14

| Number of shares | Value (U.S. $) | |||||

| Common Stock (continued) | ||||||

| Healthcare (continued) | ||||||

| Stada Arzneimittel | 8,939 | $ | 461,866 | |||

| Teva Pharmaceutical Industries ADR | 23,261 | 948,118 | ||||

| 60,484,372 | ||||||

| Healthcare REITs – 0.47% | ||||||

| HCP | 11,600 | 426,532 | ||||

| Healthcare Realty Trust | 26,400 | 584,232 | ||||

| Healthcare Trust of America | 86,900 | 882,035 | ||||

| LTC Properties | 16,100 | 620,011 | ||||

| Ventas | 7,500 | 426,225 | ||||

| 2,939,035 | ||||||

| Hotel REITs – 0.68% | ||||||

| Ashford Hospitality Prime | 7,600 | 155,496 | ||||

| Ashford Hospitality Trust | 38,000 | 311,980 | ||||

| Concentradora Fibra Hotelera | 544,185 | 843,852 | ||||

| RLJ Lodging Trust | 47,300 | 1,141,822 | ||||

| † | Strategic Hotel & Resorts | 126,300 | 1,127,859 | |||

| Summit Hotel Properties | 73,696 | 669,160 | ||||

| 4,250,169 | ||||||

| Industrial REITs – 0.27% | ||||||

| First Industrial Realty Trust | 57,400 | 1,002,204 | ||||

| First Potomac Realty Trust | 54,900 | 658,800 | ||||

| 1,661,004 | ||||||

| Industrials – 5.55% | ||||||

| Delta Air Lines | 123 | 3,565 | ||||

| Deutsche Post | 27,707 | 979,732 | ||||

| East Japan Railway | 3,746 | 306,968 | ||||

| Eaton | 23,100 | 1,678,446 | ||||

| ITOCHU | 59,689 | 753,218 | ||||

| Koninklijke Philips Electronics | 21,753 | 778,504 | ||||

| Mueller Water Products Class A | 15,570 | 134,058 | ||||

| Northrop Grumman | 82,600 | 9,307,368 | ||||

| Raytheon | 109,900 | 9,745,932 | ||||

| † | Rexnord | 4,050 | 98,456 | |||

| Vinci | 13,602 | 874,454 | ||||

| Waste Management | 208,100 | 9,506,008 | ||||

| Westjet Airlines | 23,794 | 618,462 | ||||

| 34,785,171 | ||||||

15

Schedule of

investments

Delaware Dividend

Income Fund

| Number of shares | Value (U.S. $) | |||||

| Common Stock (continued) | ||||||

| Information Technology – 9.22% | ||||||

| Apple | 11,500 | $ | 6,394,805 | |||

| Broadcom Class A | 343,600 | 9,170,684 | ||||

| † | CGI Group Class A | 33,368 | 1,238,436 | |||

| Cisco Systems | 434,300 | 9,228,875 | ||||

| Intel | 384,700 | 9,171,248 | ||||

| Microsoft | 57,000 | 2,173,410 | ||||

| Motorola Solutions | 141,642 | 9,331,375 | ||||

| Teleperformance | 12,673 | 721,163 | ||||

| Xerox | 912,400 | 10,383,111 | ||||

| 57,813,107 | ||||||

| Mall REITs – 0.95% | ||||||

| CBL & Associates Properties | 42,500 | 767,550 | ||||

| General Growth Properties | 91,900 | 1,906,925 | ||||

| Macerich | 10,100 | 575,094 | ||||

| Simon Property Group | 12,263 | 1,837,611 | ||||

| Taubman Centers | 13,700 | 895,706 | ||||

| 5,982,886 | ||||||

| Manufactured Housing REITs – 0.22% | ||||||

| Equity Lifestyle Properties | 9,627 | 341,759 | ||||

| Sun Communities | 25,400 | 1,036,320 | ||||

| 1,378,079 | ||||||

| Materials – 1.91% | ||||||

| AuRico Gold | 43,907 | 170,360 | ||||

| duPont (E.I.) deNemours | 150,800 | 9,256,105 | ||||

| Lafarge | 9,947 | 706,163 | ||||

| Rexam | 73,682 | 602,421 | ||||

| Rio Tinto | 14,572 | 777,772 | ||||

| Rockwood Holdings | 1,767 | 120,969 | ||||

| Yamana Gold | 41,511 | 372,557 | ||||

| 12,006,347 | ||||||

| Mixed REITs – 0.94% | ||||||

| Duke Realty | 114,600 | 1,739,628 | ||||

| EPR Properties | 21,500 | 1,081,235 | ||||

| Gladstone Land | 51,010 | 836,054 | ||||

| Liberty Property Trust | 48,900 | 1,583,871 | ||||

| Nippon Prologis | 35 | 338,428 | ||||

| PS Business Parks | 3,900 | 305,448 | ||||

| 5,884,664 | ||||||

16

| Number of shares | Value (U.S. $) | |||||

| Common Stock (continued) | ||||||

| Multifamily REITs – 0.81% | ||||||

| American Campus Communities | 17,500 | $ | 567,525 | |||

| Apartment Investment & Management | 24,265 | 609,294 | ||||

| BRE Properties | 25,100 | 1,285,873 | ||||

| Equity Residential | 39,800 | 2,051,292 | ||||

| Post Properties | 13,700 | 587,182 | ||||

| 5,101,166 | ||||||

| Office REITs – 0.26% | ||||||

| Highwoods Properties | 25,800 | 926,736 | ||||

| Parkway Properties | 39,443 | 721,412 | ||||

| 1,648,148 | ||||||

| Shopping Center REITs – 0.98% | ||||||

| Agree Realty | 35,800 | 1,048,940 | ||||

| Amreit Class B | 7,700 | 134,057 | ||||

| DDR | 71,100 | 1,136,889 | ||||

| First Capital Realty | 43,366 | 716,334 | ||||

| Lippo Malls Indonesia Retail Trust | 2,477,000 | 809,187 | ||||

| Ramco-Gershenson Properties Trust | 113,300 | 1,812,800 | ||||

| Wheeler Real Estate Investment Trust | 113,393 | 476,251 | ||||

| 6,134,458 | ||||||

| Single Tenant REIT – 0.07% | ||||||

| National Retail Properties | 14,400 | 457,200 | ||||

| 457,200 | ||||||

| Telecommunications – 3.43% | ||||||

| AT&T | 260,600 | 9,175,726 | ||||

| = | Century Communications | 1,625,000 | 0 | |||

| CenturyLink | 6,206 | 190,524 | ||||

| KDDI | 6,778 | 425,673 | ||||

| Mobile TeleSystems ADR | 27,032 | 569,835 | ||||

| Telstra | 138,613 | 638,959 | ||||

| Verizon Communications | 181,500 | 9,006,030 | ||||

| Vivendi | 46,438 | 1,179,350 | ||||

| Vodafone Group | 82,930 | 307,801 | ||||

| 21,493,898 | ||||||

| Utilities – 1.62% | ||||||

| Edison International | 200,300 | 9,255,863 | ||||

| Mirant (Escrow) | 425,000 | 0 | ||||

| National Grid | 24,906 | 315,880 | ||||

17

Schedule of

investments

Delaware Dividend

Income Fund

| Number of shares | Value (U.S. $) | |||||

| Common Stock (continued) | ||||||

| Utilities (continued) | ||||||

| Nippon Telegraph & Telephone | 7,237 | $ | 363,317 | |||

| NRG Energy | 8,696 | 230,096 | ||||

| 10,165,156 | ||||||

| Total Common Stock (cost $315,810,023) | 397,581,588 | |||||

| Convertible Preferred Stock – 3.17% | ||||||

| # | Chesapeake Energy 144A 5.75% | |||||

| exercise price $27.83, expiration date 12/31/49 | 955 | 1,097,056 | ||||

| El Paso Energy Capital Trust I 4.75% | ||||||

| exercise price $34.49, expiration date 3/31/28 | 39,900 | 2,250,360 | ||||

| Goodyear Tire & Rubber 5.875% | ||||||

| exercise price $18.21, expiration date 3/31/14 | 20,950 | 1,328,360 | ||||

| Halcon Resources 5.75%, | ||||||

| exercise price $6.16, expiration date 12/31/49 | 2,055 | 1,769,098 | ||||

| HealthSouth 6.50% | ||||||

| exercise price $30.50, expiration date 12/31/49 | 1,753 | 2,323,163 | ||||

| Huntington Bancshares 8.50% | ||||||

| exercise price $11.95, expiration date 12/31/49 | 1,038 | 1,323,450 | ||||

| Intelsat 5.75% | ||||||

| exercise price $22.05, expiration date 5/1/16 | 30,358 | 1,758,032 | ||||

| Maiden Holding 7.25% | ||||||

| exercise price $15.50, expiration date 9/15/16 | 40,625 | 2,046,281 | ||||

| MetLife 5.00% | ||||||

| exercise price $44.28, expiration date 9/4/13 | 67,870 | 2,094,468 | ||||

| SandRidge Energy 7.00% | ||||||

| exercise price $7.76, expiration date 12/31/49 | 5,300 | 500,519 | ||||

| SandRidge Energy 8.50% | ||||||

| exercise price $8.01, expiration date 12/31/49 | 11,790 | 1,176,524 | ||||

| Wells Fargo 7.50% | ||||||

| exercise price $156.71, expiration date 12/31/49 | 1,411 | 1,589,139 | ||||

| Weyerhaeuser 6.375% | ||||||

| exercise price $33.30, expiration date 7/1/16 | 11,113 | 609,215 | ||||

| Total Convertible Preferred Stock | ||||||

| (cost $18,676,642) | 19,865,665 | |||||

18

| Principal amount° | Value (U.S. $) | |||||

| Commercial Mortgage-Backed Securities – 0.35% | ||||||

| Bank of America Commercial Mortgage Trust | ||||||

| Series 2006-4 A4 5.634% 7/10/46 | $1,000,000 | $ | 1,091,771 | |||

| • | Morgan Stanley Capital I | |||||

| Series 2007-T27 A4 5.814% 6/11/42 | 1,000,000 | 1,132,450 | ||||

| Total Commercial Mortgage-Backed Securities | ||||||

| (cost $1,997,930) | 2,224,221 | |||||

| Convertible Bonds – 10.73% | ||||||

| Basic Industry – 0.22% | ||||||

| Peabody Energy 4.75% | ||||||

| exercise price $57.95, expiration date 12/15/41 | 788,000 | 636,310 | ||||

| Steel Dynamics 5.125% | ||||||

| exercise price $17.21, expiration date 6/15/14 | 658,000 | 749,709 | ||||

| 1,386,019 | ||||||

| Capital Goods – 0.97% | ||||||

| L-3 Communications Holdings 3.00% | ||||||

| exercise price $90.24, expiration date 8/1/35 | 1,492,000 | 1,754,965 | ||||

| # | Owens-Brockway Glass Container 144A 3.00% | |||||

| exercise price $47.47, expiration date 5/28/15 | 2,517,000 | 2,616,107 | ||||

| Titan Machinery 3.75% | ||||||

| exercise price $43.17, expiration date 4/30/19 | 1,935,000 | 1,682,241 | ||||

| 6,053,313 | ||||||

| Communications – 2.27% | ||||||

| # | Alaska Communications Systems Group 144A 6.25% | |||||

| exercise price $10.28, expiration date 5/1/18 | 1,810,000 | 1,514,744 | ||||

| # | Blucora 144A 4.25% | |||||

| exercise price $21.66, expiration date 3/29/19 | 633,000 | 939,214 | ||||

| # | Clearwire Communications 144A 8.25% | |||||

| exercise price $7.08, expiration date 11/30/40 | 2,720,000 | 3,124,600 | ||||

| Leap Wireless International 4.50% | ||||||

| exercise price $93.21, expiration date 7/10/14 | 2,433,000 | 2,484,701 | ||||

| # | Liberty Interactive 144A 1.00% | |||||

| exercise price $74.31, expiration date 9/28/43 | 2,662,000 | 2,755,170 | ||||

| # | Liberty Interactive 144A 0.75% | |||||

| exercise price $1,000, expiration date 3/30/43 | 1,464,000 | 1,835,490 | ||||

| Rovi 2.625% | ||||||

| exercise price $47.36, expiration date 2/10/40 | 884,000 | 896,155 | ||||

19

Schedule of

investments

Delaware Dividend

Income Fund

| Principal amount° | Value (U.S. $) | ||||||

| Convertible Bonds (continued) | |||||||

| Communications (continued) | |||||||

| SBA Communications 4.00% | |||||||

| exercise price $ 30.38, expiration date 9/29/14 | $ | 271,000 | $ | 761,171 | |||

| 14,311,245 | |||||||

| Consumer Cyclical – 1.46% | |||||||

| Φ | ArvinMeritor 4.00% | ||||||

| exercise price $26.73, expiration date 2/12/27 | 3,072,000 | 2,839,680 | |||||

| Iconix Brand Group 2.50% | |||||||

| exercise price $30.75, expiration date 5/31/16 | 1,245,000 | 1,722,769 | |||||

| International Game Technology 3.25% | |||||||

| exercise price $19.93, expiration date 5/1/14 | 554,000 | 583,085 | |||||

| Live Nation Entertainment 2.875% | |||||||

| exercise price $27.14, expiration date 7/14/27 | 2,165,000 | 2,208,300 | |||||

| MGM Resorts International 4.25% | |||||||

| exercise price $18.58, expiration date 4/10/15 | 1,459,000 | 1,769,949 | |||||

| 9,123,783 | |||||||

| Consumer Non-Cyclical – 1.68% | |||||||

| Alere 3.00% | |||||||

| exercise price $43.98, expiration date 2/12/27 | 1,262,000 | 1,394,510 | |||||

| Dendreon 2.875% | |||||||

| exercise price $51.24, expiration date 1/13/16 | 1,139,000 | 737,503 | |||||

| Φ | Hologic 2.00% | ||||||

| exercise price $38.59, expiration date 12/15/43 | 1,666,000 | 1,762,836 | |||||

| Φ | Hologic 2.00% | ||||||

| exercise price $31.17, expiration date 2/27/42 | 1,168,000 | 1,195,740 | |||||

| # | Illumina 144A 0.25% | ||||||

| exercise price $83.55, expiration date 3/11/16 | 574,000 | 731,133 | |||||

| Mylan 3.75% | |||||||

| exercise price $13.32, expiration date 9/15/15 | 419,000 | 1,400,246 | |||||

| NuVasive 2.75% | |||||||

| exercise price $42.13, expiration date 6/30/17 | 2,636,000 | 2,886,419 | |||||

| # | Opko Health 144A 3.00% | ||||||

| exercise price $7.07, expiration date 1/28/33 | 278,000 | 436,286 | |||||

| 10,544,673 | |||||||

| Energy – 0.79% | |||||||

| Chesapeake Energy 2.50% | |||||||

| exercise price $50.90, expiration date 5/15/37 | 683,000 | 700,502 | |||||

| # | Energy XXI Bermuda 144A 3.00% | ||||||

| exercise price $40.40, expiration date 12/13/18 | 615,000 | 610,388 | |||||

20

| Principal amount° | Value (U.S. $) | ||||||

| Convertible Bonds (continued) | |||||||

| Energy (continued) | |||||||

| Helix Energy Solutions Group 3.25% | |||||||

| exercise price $25.02, expiration date 3/12/32 | $ | 1,387,000 | $ | 1,667,001 | |||

| # | Vantage Drilling 144A 5.50% | ||||||

| exercise price $2.39, expiration date 7/15/43 | 1,786,000 | 1,946,739 | |||||

| 4,924,630 | |||||||

| Financials – 1.26% | |||||||

| Ares Capital 5.75% | |||||||

| exercise price $19.13, expiration date 2/1/16 | 1,558,000 | 1,688,483 | |||||

| BGC Partners 4.50% | |||||||

| exercise price $9.84, expiration date 7/13/16 | 2,015,000 | 2,117,009 | |||||

| Blackstone Mortgage Trust 5.25% | |||||||

| exercise price $28.67, expiration date 12/1/18 | 1,331,000 | 1,350,965 | |||||

| # | Campus Crest Communities | ||||||

| Operating Partnership 144A 4.75%, | |||||||

| exercise price $12.56, expiration date 10/11/18 | 1,692,000 | 1,727,955 | |||||

| # | Forest City Enterprises 144A 3.625% | ||||||

| exercise price $24.21, expiration date 8/14/20 | 960,000 | 996,000 | |||||

| 7,880,412 | |||||||

| Industrials – 0.11% | |||||||

| Φ | General Cable 4.50% | ||||||

| exercise price $36.34, expiration date 11/15/29 | 623,000 | 665,442 | |||||

| 665,442 | |||||||

| Insurance – 0.16% | |||||||

| Wellpoint 2.75% | |||||||

| exercise price $75.31, expiration date 10/15/42 | 736,000 | 1,014,760 | |||||

| 1,014,760 | |||||||

| Technology – 1.81% | |||||||

| # | Ciena 144A 3.75% | ||||||

| exercise price $20.17, expiration date 10/15/18 | 1,141,000 | 1,573,867 | |||||

| Equinix 4.75% | |||||||

| exercise price $84.32, expiration date 6/13/16 | 455,000 | 909,147 | |||||

| Linear Technology 3.00% | |||||||

| exercise price $41.46, expiration date 4/30/27 | 1,912,000 | 2,069,740 | |||||

| Nuance Communications 2.75% | |||||||

| exercise price $32.30, expiration date 11/1/31 | 1,574,000 | 1,511,040 | |||||

| SanDisk 1.50% | |||||||

| exercise price $52.17, expiration date 8/11/17 | 1,204,000 | 1,729,998 | |||||

21

Schedule of

investments

Delaware Dividend

Income Fund

| Principal amount° | Value (U.S. $) | ||||||

| Convertible Bonds (continued) | |||||||

| Technology (continued) | |||||||

| TIBCO Software 2.25% | |||||||

| exercise price $50.57, expiration date 4/30/32 | $ | 2,064,000 | $ | 2,078,189 | |||

| VeriSign 3.25% | |||||||

| exercise price $34.37, expiration date 8/15/37 | 856,000 | 1,481,950 | |||||

| 11,353,931 | |||||||

| Total Convertible Bonds (cost $61,557,922) | 67,258,208 | ||||||

| Corporate Bonds – 13.77% | |||||||

| Automobiles – 0.62% | |||||||

| American Axle & Manufacturing 7.75% 11/15/19 | 274,000 | 312,360 | |||||

| # | Chassix 144A 9.25% 8/1/18 | 255,000 | 274,125 | ||||

| Chrysler Group 8.25% 6/15/21 | 1,070,000 | 1,222,475 | |||||

| # | Cooper-Standard Holdings PIK 144A 7.375% 4/1/18 | 505,000 | 512,575 | ||||

| # | International Automotive Components Group 144A | ||||||

| 9.125% 6/1/18 | 518,000 | 538,720 | |||||

| # | LKQ 144A 4.75% 5/15/23 | 610,000 | 574,925 | ||||

| Meritor | |||||||

| 6.75% 6/15/21 | 325,000 | 328,250 | |||||

| 10.625% 3/15/18 | 95,000 | 102,838 | |||||

| 3,866,268 | |||||||

| Banking – 0.32% | |||||||

| # | Credit Suisse 144A 6.50% 8/8/23 | 475,000 | 503,956 | ||||

| #• | HBOS Capital Funding 144A 6.071% 6/29/49 | 1,192,000 | 1,193,490 | ||||

| • | JPMorgan Chase 6.00% 12/29/49 | 300,000 | 290,250 | ||||

| 1,987,696 | |||||||

| Basic Industry – 1.71% | |||||||

| AK Steel 7.625% 5/15/20 | 228,000 | 216,600 | |||||

| # | APERAM 144A 7.75% 4/1/18 | 275,000 | 285,313 | ||||

| ArcelorMittal 6.125% 6/1/18 | 939,000 | 1,023,509 | |||||

| # | Builders FirstSource 144A 7.625% 6/1/21 | 504,000 | 524,160 | ||||

| # | Cemex Espana Luxembourg 144A 9.25% 5/12/20 | 285,000 | 311,006 | ||||

| # | Cemex SAB 144A 7.25% 1/15/21 | 315,000 | 320,119 | ||||

| # | CPG Merger Sub 144A 8.00% 10/1/21 | 540,000 | 565,649 | ||||

| # | Essar Steel Algoma 144A 9.375% 3/15/15 | 214,000 | 209,185 | ||||

| # | FMG Resources August 2006 144A | ||||||

| 6.875% 2/1/18 | 222,000 | 235,320 | |||||

| 6.875% 4/1/22 | 574,000 | 622,789 | |||||

22

| Principal amount° | Value (U.S. $) | ||||||

| Corporate Bonds (continued) | |||||||

| Basic Industry (continued) | |||||||

| HD Supply 11.50% 7/15/20 | $ | 425,000 | $ | 508,938 | |||

| Headwaters 7.625% 4/1/19 | 403,000 | 436,248 | |||||

| # | Inmet Mining 144A 8.75% 6/1/20 | 389,000 | 424,983 | ||||

| # | JMC Steel Group 144A 8.25% 3/15/18 | 527,000 | 525,683 | ||||

| # | LSB Industries 144A 7.75% 8/1/19 | 240,000 | 252,000 | ||||

| # | Masonite International 144A 8.25% 4/15/21 | 480,000 | 528,600 | ||||

| # | New Gold 144A 6.25% 11/15/22 | 394,000 | 389,075 | ||||

| Norcraft 10.50% 12/15/15 | 243,000 | 250,240 | |||||

| Nortek 8.50% 4/15/21 | 455,000 | 505,050 | |||||

| # | Perstorp Holding 144A 8.75% 5/15/17 | 435,000 | 467,625 | ||||

| Ryerson | |||||||

| 9.00% 10/15/17 | 277,000 | 291,889 | |||||

| 11.25% 10/15/18 | 112,000 | 118,160 | |||||

| # | Sappi Papier Holding 144A 8.375% 6/15/19 | 455,000 | 497,656 | ||||

| # | Taminco Global Chemical 144A 9.75% 3/31/20 | 359,000 | 410,158 | ||||

| # | TPC Group 144A 8.75% 12/15/20 | 523,000 | 555,033 | ||||

| # | U.S. Coatings Acquisition 144A 7.375% 5/1/21 | 265,000 | 282,225 | ||||

| 10,757,213 | |||||||

| Capital Goods – 0.70% | |||||||

| # | Allegion US Holding 144A 5.75% 10/1/21 | 315,000 | 328,388 | ||||

| # | BOE Intermediate Holding PIK 144A | ||||||

| 9.00% 11/1/17 | 187,735 | 194,306 | |||||

| # | BOE Merger PIK 144A 9.50% 11/1/17 | 469,000 | 499,484 | ||||

| # | Consolidated Container 144A 10.125% 7/15/20 | 419,000 | 451,473 | ||||

| # | Milacron 144A 7.75% 2/15/21 | 435,000 | 458,925 | ||||

| # | Plastipak Holdings 144A 6.50% 10/1/21 | 405,000 | 422,213 | ||||

| Reynolds Group Issuer | |||||||

| 8.25% 2/15/21 | 405,000 | 428,288 | |||||

| 9.875% 8/15/19 | 675,000 | 752,624 | |||||

| # | Silver II Borrower 144A 7.75% 12/15/20 | 400,000 | 424,000 | ||||

| TransDigm 7.50% 7/15/21 | 415,000 | 448,200 | |||||

| 4,407,901 | |||||||

| Communications – 1.43% | |||||||

| Centurylink 6.75% 12/1/23 | 370,000 | 379,019 | |||||

| # | Columbus International 144A 11.50% 11/20/14 | 295,000 | 320,075 | ||||

| # | Digicel Group 144A 8.25% 9/30/20 | 725,000 | 761,250 | ||||

| Hughes Satellite Systems 7.625% 6/15/21 | 368,000 | 407,560 | |||||

23

Schedule of

investments

Delaware Dividend

Income Fund

| Principal amount° | Value (U.S. $) | |||||||

| Corporate Bonds (continued) | ||||||||

| Communications (continued) | ||||||||

| # | Intelsat Luxembourg 144A | |||||||

| 7.75% 6/1/21 | $ | 935,000 | $ | 982,918 | ||||

| 8.125% 6/1/23 | 970,000 | 1,026,987 | ||||||

| Level 3 Communications 8.875% 6/1/19 | 153,000 | 168,491 | ||||||

| # | Level 3 Financing | |||||||

| #144A 6.125% 1/15/21 | 185,000 | 188,238 | ||||||

| 7.00% 6/1/20 | 466,000 | 496,290 | ||||||

| # | MetroPCS Wireless 144A 6.25% 4/1/21 | 210,000 | 219,188 | |||||

| # | RCN Telecom Services 144A 8.50% 8/15/20 | 270,000 | 274,050 | |||||

| # | Sprint 144A | |||||||

| 7.25% 9/15/21 | 240,000 | 260,700 | ||||||

| 7.875% 9/15/23 | 190,000 | 208,525 | ||||||

| Sprint Capital 6.90% 5/1/19 | 495,000 | 539,550 | ||||||

| Sprint Nextel 8.375% 8/15/17 | 333,000 | 387,945 | ||||||

| T-Mobile | ||||||||

| 6.125% 1/15/22 | 160,000 | 163,400 | ||||||

| 6.50% 1/15/24 | 100,000 | 101,500 | ||||||

| 6.731% 4/28/22 | 185,000 | 193,556 | ||||||

| # | Wind Acquisition Finance 144A | |||||||

| 7.25% 2/15/18 | 200,000 | 211,000 | ||||||

| 11.75% 7/15/17 | 225,000 | 239,344 | ||||||

| Windstream | ||||||||

| 7.50% 6/1/22 | 223,000 | 232,199 | ||||||

| #144A 7.75% 10/1/21 | 300,000 | 321,750 | ||||||

| Zayo Group 10.125% 7/1/20 | 739,000 | 857,240 | ||||||

| 8,940,775 | ||||||||

| Consumer Cyclical – 1.10% | ||||||||

| # | BI-LO Finance 144A 8.625% 9/15/18 | 375,000 | 390,469 | |||||

| Burlington Coat Factory Warehouse 10.00% 2/15/19 | 433,000 | 487,666 | ||||||

| # | Burlington Holdings 144A 9.00% 2/15/18 | 84,000 | 86,940 | |||||

| # | CDR DB Sub 144A 7.75% 10/15/20 | 636,000 | 632,819 | |||||

| # | Chinos Intermediate Holdings PIK 144A | |||||||

| 7.75% 5/1/19 | 600,000 | 606,000 | ||||||

| Dave & Buster’s 11.00% 6/1/18 | 331,000 | 366,586 | ||||||

| #^ | Dave & Buster’s Entertainment 144A | |||||||

| 10.004% 2/15/16 | 502,000 | 415,405 | ||||||

| # | Landry’s 144A 9.375% 5/1/20 | 531,000 | 581,445 | |||||

| # | Michaels FinCo Holdings 144A 7.50% 8/1/18 | 345,000 | 358,800 | |||||

24

| Principal amount° | Value (U.S. $) | |||||||

| Corporate Bonds (continued) | ||||||||

| Consumer Cyclical (continued) | ||||||||

| Michaels Stores 11.375% 11/1/16 | $ | 74,000 | $ | 76,036 | ||||

| Pantry 8.375% 8/1/20 | 406,000 | 435,435 | ||||||

| Party City Holdings 8.875% 8/1/20 | 450,000 | 501,750 | ||||||

| # | Quiksilver 144A 7.875% 8/1/18 | 520,000 | 562,900 | |||||

| Rite Aid 6.75% 6/15/21 | 505,000 | 529,619 | ||||||

| Tempur Sealy International 6.875% 12/15/20 | 330,000 | 358,050 | ||||||

| # | Wok Acquisition 144A 10.25% 6/30/20 | 467,000 | 506,695 | |||||

| 6,896,615 | ||||||||

| Consumer Non-Cyclical – 0.39% | ||||||||

| # | Beverage Packaging Holdings 144A | |||||||

| 5.625% 12/15/16 | 270,000 | 277,425 | ||||||

| # | Crestview DS Merger Sub II 144A 10.00% 9/1/21 | 330,000 | 351,450 | |||||

| Del Monte 7.625% 2/15/19 | 403,000 | 421,134 | ||||||

| # | JBS Investments GmbH 144A 7.75% 10/28/20 | 200,000 | 202,000 | |||||

| # | JBS USA 144A 8.25% 2/1/20 | 368,000 | 399,280 | |||||

| Smithfield Foods 6.625% 8/15/22 | 390,000 | 413,888 | ||||||

| # | Spectrum Brands Escrow 144A | |||||||

| 6.375% 11/15/20 | 77,000 | 82,198 | ||||||

| 6.625% 11/15/22 | 291,000 | 310,643 | ||||||

| 2,458,018 | ||||||||

| Energy – 1.95% | ||||||||

| AmeriGas Finance 7.00% 5/20/22 | 435,000 | 473,063 | ||||||

| Calumet Specialty Products Partners | ||||||||

| #144A 7.625% 1/15/22 | 295,000 | 297,950 | ||||||

| 9.375% 5/1/19 | 515,000 | 572,938 | ||||||

| Chaparral Energy | ||||||||

| 7.625% 11/15/22 | 189,000 | 205,538 | ||||||

| 8.25% 9/1/21 | 236,000 | 260,190 | ||||||

| CHC Helicopter 9.375% 6/1/21 | 220,000 | 223,850 | ||||||

| Chesapeake Energy | ||||||||

| 5.375% 6/15/21 | 90,000 | 93,375 | ||||||

| 6.125% 2/15/21 | 72,000 | 77,760 | ||||||

| 6.625% 8/15/20 | 325,000 | 365,625 | ||||||

| Comstock Resources 7.75% 4/1/19 | 421,000 | 444,155 | ||||||

| # | Drill Rigs Holdings 144A 6.50% 10/1/17 | 406,000 | 441,525 | |||||

| # | Exterran Partners 144A 6.00% 4/1/21 | 460,000 | 460,000 | |||||

| Genesis Energy 5.75% 2/15/21 | 530,000 | 539,275 | ||||||

| Halcon Resources 8.875% 5/15/21 | 492,000 | 501,840 | ||||||

25

Schedule of

investments

Delaware Dividend

Income Fund

| Principal amount° | Value (U.S. $) | ||||||

| Corporate Bonds (continued) | |||||||

| Energy (continued) | |||||||

| # | Hercules Offshore 144A | ||||||

| 7.50% 10/1/21 | $ | 255,000 | $ | 269,025 | |||

| 8.75% 7/15/21 | 140,000 | 155,400 | |||||

| Key Energy Services 6.75% 3/1/21 | 520,000 | 534,300 | |||||

| Laredo Petroleum | |||||||

| 7.375% 5/1/22 | 98,000 | 106,575 | |||||

| 9.50% 2/15/19 | 410,000 | 459,200 | |||||

| Linn Energy | |||||||

| 6.50% 5/15/19 | 187,000 | 189,338 | |||||

| #144A 7.00% 11/1/19 | 150,000 | 150,000 | |||||

| 8.625% 4/15/20 | 105,000 | 112,875 | |||||

| Markwest Energy Partners 5.50% 2/15/23 | 210,000 | 215,250 | |||||

| Midstates Petroleum 9.25% 6/1/21 | 715,000 | 749,855 | |||||

| # | Murphy Oil USA 144A 6.00% 8/15/23 | 360,000 | 369,000 | ||||

| Northern Oil and Gas 8.00% 6/1/20 | 430,000 | 452,575 | |||||

| NuStar Logistics 6.75% 2/1/21 | 315,000 | 326,025 | |||||

| # | Oasis Petroleum 144A 6.875% 3/15/22 | 580,000 | 626,399 | ||||

| Offshore Group Investment 7.125% 4/1/23 | 210,000 | 217,350 | |||||

| PDC Energy 7.75% 10/15/22 | 450,000 | 489,375 | |||||

| Pioneer Drilling 9.875% 3/15/18 | 482,000 | 518,150 | |||||

| Rosetta Resources 5.625% 5/1/21 | 290,000 | 292,538 | |||||

| # | Samson Investment 144A 10.50% 2/15/20 | 368,000 | 399,740 | ||||

| SandRidge Energy 8.125% 10/15/22 | 639,000 | 676,540 | |||||

| 12,266,594 | |||||||

| Financials – 0.24% | |||||||

| • | Barclays 8.25% 12/29/49 | 250,000 | 258,281 | ||||

| ETrade Financial 6.375% 11/15/19 | 642,000 | 690,150 | |||||

| # | Nuveen Investments 144A 9.50% 10/15/20 | 571,000 | 563,863 | ||||

| 1,512,294 | |||||||

| Healthcare – 1.04% | |||||||

| Air Medical Group Holdings 9.25% 11/1/18 | 358,000 | 390,220 | |||||

| Alere 6.50% 6/15/20 | 270,000 | 278,100 | |||||

| Biomet 6.50% 10/1/20 | 392,000 | 409,640 | |||||

| Community Health Systems | |||||||

| 7.125% 7/15/20 | 227,000 | 235,229 | |||||

| 8.00% 11/15/19 | 343,000 | 374,728 | |||||

| Immucor 11.125% 8/15/19 | 555,000 | 624,374 | |||||

26

| Principal amount° | Value (U.S. $) | ||||||

| Corporate Bonds (continued) | |||||||

| Healthcare (continued) | |||||||

| Kinetic Concepts | |||||||

| 10.50% 11/1/18 | $ | 334,000 | $ | 383,265 | |||

| 12.50% 11/1/19 | 245,000 | 273,175 | |||||

| # | MPH Intermediate Holding Company 2 144A | ||||||

| 8.375% 8/1/18 | 255,000 | 264,881 | |||||

| Par Pharmaceutical 7.375% 10/15/20 | 612,000 | 645,659 | |||||

| Radnet Management 10.375% 4/1/18 | 291,000 | 304,095 | |||||

| # | Service Corp International 144A 5.375% 1/15/22 | 480,000 | 486,000 | ||||

| Tenet Healthcare | |||||||

| # | 144A 6.00% 10/1/20 | 485,000 | 507,734 | ||||

| 8.125% 4/1/22 | 315,000 | 342,563 | |||||

| Truven Health Analytics 10.625% 6/1/20 | 178,000 | 202,253 | |||||

| # | Valeant Pharmaceuticals International 144A | ||||||

| 5.625% 12/1/21 | 440,000 | 443,300 | |||||

| 7.00% 10/1/20 | 95,000 | 102,363 | |||||

| # | VPI Escrow 144A 6.375% 10/15/20 | 237,000 | 250,924 | ||||

| 6,518,503 | |||||||

| Industrials – 0.05% | |||||||

| # | WESCO Distribution 144A 5.375% 12/15/21 | 50,000 | 50,500 | ||||

| # | Wise Metals Group 144A 8.75% 12/15/18 | 235,000 | 242,050 | ||||

| 292,550 | |||||||

| Insurance – 0.45% | |||||||

| • | American International Group 8.175% 5/15/58 | 620,000 | 747,410 | ||||

| •# | Hockey Merger Sub 144A 2 7.875% 10/1/21 | 400,000 | 415,500 | ||||

| •# | Liberty Mutual Group 144A 7.00% 3/15/37 | 443,000 | 462,935 | ||||

| •# | Onex USI Acquisition 144A 7.75% 1/15/21 | 446,000 | 458,265 | ||||

| • | XL Group 6.50% 12/29/49 | 758,000 | 746,630 | ||||

| 2,830,740 | |||||||

| Media – 1.07% | |||||||

| CCO Holdings 5.25% 9/30/22 | 402,000 | 380,895 | |||||

| # | Cequel Communications Holdings 1 144A | ||||||

| 6.375% 9/15/20 | 317,000 | 328,888 | |||||

| Clear Channel Worldwide Holdings | |||||||

| 7.625% 3/15/20 | 563,000 | 596,390 | |||||

| CSC Holdings 6.75% 11/15/21 | 305,000 | 330,163 | |||||

| DISH DBS 5.00% 3/15/23 | 665,000 | 636,738 | |||||

| # | Gray Television 144A 7.50% 10/1/20 | 510,000 | 539,325 | ||||

27

Schedule of

investments

Delaware Dividend Income Fund

| Principal amount° | Value (U.S. $) | |||||

| Corporate Bonds (continued) | ||||||

| Media (continued) | ||||||

| # | MDC Partners 144A 6.75% 4/1/20 | $ | 575,000 | $ | 600,875 | |

| # | Nara Cable Funding 144A 8.875% 12/1/18 | 400,000 | 429,000 | |||

| # | Nielsen 144A 5.50% 10/1/21 | 330,000 | 338,250 | |||

| # | Ono Finance II 144A 10.875% 7/15/19 | 260,000 | 283,400 | |||

| Satelites Mexicanos 9.50% 5/15/17 | 232,000 | 255,200 | ||||

| # | Univision Communications 144A 8.50% 5/15/21 | 884,000 | 983,449 | |||

| # | UPCB Finance VI 144A 6.875% 1/15/22 | 322,000 | 346,955 | |||

| # | Virgin Media Finance 144A 6.375% 4/15/23 | 620,000 | 643,250 | |||

| 6,692,778 | ||||||

| Service-Other – 1.24% | ||||||

| # | Algeco Scotsman Global Finance 144A | |||||

| 8.50% 10/15/18 | 490,000 | 531,650 | ||||

| 10.75% 10/15/19 | 894,000 | 934,230 | ||||

| # | ARAMARK 144A 5.75% 3/15/20 | 550,000 | 576,125 | |||

| Avis Budget Car Rental 5.50% 4/1/23 | 416,000 | 406,640 | ||||

| # | Carlson Wagonlit 144A 6.875% 6/15/19 | 425,000 | 442,000 | |||

| # | DigitalGlobe 144A 5.25% 2/1/21 | 450,000 | 441,000 | |||

| H&E Equipment Services 7.00% 9/1/22 | 364,000 | 399,490 | ||||

| M/I Homes 8.625% 11/15/18 | 490,000 | 531,650 | ||||

| # | Mattamy Group 144A 6.50% 11/15/20 | 402,000 | 397,980 | |||

| MGM Resorts International | ||||||

| 6.75% 10/1/20 | 135,000 | 145,463 | ||||

| 7.75% 3/15/22 | 197,000 | 219,655 | ||||

| 11.375% 3/1/18 | 560,000 | 718,200 | ||||

| PHH | ||||||

| 6.375% 8/15/21 | 200,000 | 202,250 | ||||

| 7.375% 9/1/19 | 219,000 | 237,615 | ||||

| Pinnacle Entertainment | ||||||

| 7.75% 4/1/22 | 163,000 | 178,485 | ||||

| 8.75% 5/15/20 | 25,000 | 27,750 | ||||

| # | PNK Finance 144A 6.375% 8/1/21 | 210,000 | 217,875 | |||

| Seven Seas Cruises 9.125% 5/15/19 | 479,000 | 531,091 | ||||

| Swift Services Holdings 10.00% 11/15/18 | 380,000 | 425,125 | ||||

| # | Watco 144A 6.375% 4/1/23 | 220,000 | 220,550 | |||

| 7,784,824 | ||||||

28

| Principal amount° | Value (U.S. $) | ||||||

| Corporate Bonds (continued) | |||||||

| Technology – 0.94% | |||||||

| # | ACI Worldwide 144A 6.375% 8/15/20 | $ | 295,000 | $ | 307,169 | ||

| # | Activision Blizzard 144A | ||||||

| 5.625% 9/15/21 | 370,000 | 385,263 | |||||

| 6.125% 9/15/23 | 445,000 | 467,250 | |||||

| # | BMC Software Finance 144A 8.125% 7/15/21 | 765,000 | 814,724 | ||||

| First Data | |||||||

| 11.25% 3/31/16 | 166,000 | 168,698 | |||||

| # | 144A 11.25% 1/15/21 | 685,000 | 756,924 | ||||

| # | 144A 11.75% 8/15/21 | 505,000 | 526,463 | ||||

| Freescale Semiconductor | |||||||

| # | 144A 6.00% 1/15/22 | 255,000 | 258,188 | ||||

| 10.75% 8/1/20 | 50,000 | 57,000 | |||||

| # | Healthcare Technology Intermediate PIK 144A | ||||||

| 7.375% 9/1/18 | 480,000 | 495,600 | |||||

| Infor US 9.375% 4/1/19 | 432,000 | 489,240 | |||||

| j2 Global 8.00% 8/1/20 | 618,000 | 668,985 | |||||

| # | Viasystems 144A 7.875% 5/1/19 | 430,000 | 469,775 | ||||

| 5,865,279 | |||||||

| Utilities – 0.52% | |||||||

| AES | |||||||

| 7.375% 7/1/21 | 699,000 | 793,365 | |||||

| 8.00% 6/1/20 | 45,000 | 52,875 | |||||

| # | Calpine 144A | ||||||

| 5.875% 1/15/24 | 125,000 | 125,000 | |||||

| 6.00% 1/15/22 | 500,000 | 516,250 | |||||

| Elwood Energy 8.159% 7/5/26 | 407,753 | 434,767 | |||||

| •# | Enel SpA 144A 8.75% 9/24/73 | 400,000 | 436,500 | ||||

| GenOn Energy 9.875% 10/15/20 | 402,000 | 453,255 | |||||

| Mirant Americas 8.50% 10/1/21 | 410,000 | 448,950 | |||||

| 3,260,962 | |||||||

| Total Corporate Bonds (cost $82,116,995) | 86,339,010 | ||||||

| Municipal Bonds – 0.53% | |||||||

| California Statewide Communities | |||||||

| Development Authority 5.00% 4/1/42 | 855,000 | 847,904 | |||||

| Grand Parkway Transportation 5.25% 10/1/51 | 1,000,000 | 1,012,960 | |||||

29

Schedule of

investments

Delaware Dividend Income Fund

| Principal amount° | Value (U.S. $) | |||||

| Municipal Bonds (continued) | ||||||

| New Jersey Transportation Trust Fund Authority | ||||||

| 5.00% 6/15/42 | $ | 240,000 | $ | 243,326 | ||

| 5.00% 6/15/44 | 760,000 | 766,300 | ||||

| Texas Private Activity Bond Surface Transportation | ||||||

| 6.75% 6/30/43 (AMT) | 450,000 | 472,226 | ||||

| Total Municipal Bonds (cost $3,198,889) | 3,342,716 | |||||

| Leveraged Non-Recourse Securities – 0.00% | ||||||

| #t@ | JPMorgan Fixed Income Pass Through Trust | |||||

| Series 2007-B 0.00% 1/15/87 | 1,300,000 | 0 | ||||

| Total Leveraged Non-Recourse Securities | ||||||

| (cost $1,105,000) | 0 | |||||

| «Senior Secured Loans – 1.56% | ||||||

| Akorn Tranche B 4.50% 11/13/20 | 295,000 | 296,383 | ||||

| Allegion US Holding Company Tranche B | ||||||

| 3.00% 12/26/20 | 165,000 | 165,619 | ||||

| Azure Midstream Tranche B 6.50% 10/21/18 | 170,000 | 171,169 | ||||

| BJ’S Wholesale Club Tranche 2nd Lien | ||||||

| 8.50% 3/31/20 | 280,000 | 286,213 | ||||

| Bmc Software Tranche 1st Lien 5.00% 8/9/20 | 250,000 | 252,526 | ||||

| Borgata Tranche B 1st Lien 6.75% 8/15/18 | 540,000 | 542,699 | ||||

| Citycenter Holdings Tranche B 5.00% 10/9/20 | 265,000 | 268,699 | ||||

| Clear Channel Communication | ||||||

| New Tranche B 3.65% 1/29/16 | 280,000 | 271,463 | ||||

| Tranche D 6.75% 1/30/19 | 250,000 | 237,110 | ||||

| Drillships Financing Holding Tranche B1 | ||||||

| 6.00% 2/17/21 | 255,000 | 260,865 | ||||

| Exopack Tranche B 1st Lien 5.25% 4/24/19 | 315,000 | 320,316 | ||||

| Gentiva Health Services Tranche B 6.50% 10/10/19 | 535,000 | 528,646 | ||||

| Getty Images Tranche B 4.75% 9/19/19 | 344,133 | 319,582 | ||||

| Gray Television Loan 4.75% 10/11/19 | 367,000 | 369,447 | ||||

| Hostess Brands Tranche 1st Lien 6.75% 3/12/20 | 330,000 | 340,725 | ||||

| Hudson’s Bay Tranche 2nd Lien 8.25% 10/7/21 | 240,000 | 246,360 | ||||

| Ineos US Finance Loan 4.50% 5/4/18 | 515,000 | 516,753 | ||||

| Kik Custom Products | ||||||

| Tranche 1st Lien 5.50% 5/23/19 | 80,000 | 78,950 | ||||

| Tranche 2nd Lien 9.50% 11/23/19 | 40,000 | 40,000 | ||||

30

| Principal amount° | Value (U.S. $) | ||||||

| «Senior Secured Loans (continued) | |||||||

| Lts Buyer Tranche 2nd Lien 8.00% 3/15/21 | $ | 130,000 | $ | 131,138 | |||

| Moxie Liberty Tranche B 7.50% 8/21/20 | 530,000 | 541,924 | |||||

| Neiman Marcus Group Loan 5.00% 10/18/20 | 560,000 | 564,159 | |||||

| Nuveen Investments Tranche 2nd Lien | |||||||

| 6.50% 2/28/19 | 280,000 | 274,808 | |||||

| Otter Products Tranche B 5.25% 4/29/19 | 105,000 | 105,350 | |||||

| Panda Temple Power II Tranche B 1st Lien | |||||||

| 7.25% 3/28/19 | 360,000 | 370,800 | |||||

| @ | Polymer Group Bridge Loan 7.00% 5/26/19 | 515,000 | 517,574 | ||||

| Quickrete Company Tranche 2nd Lien | |||||||

| 7.00% 3/19/21 | 50,000 | 51,266 | |||||

| Ranpak Tranche 2nd Lien 8.50% 4/10/20 | 72,000 | 74,160 | |||||

| Rite Aid Tranche 2nd Lien 5.75% 8/3/20 | 220,000 | 226,508 | |||||

| Samson Investment Company Tranche 2nd Lien | |||||||

| 6.00% 9/10/18 | 260,000 | 262,275 | |||||

| Smart & Final Tranche 2nd Lien 10.50% 11/8/20 | 344,615 | 351,508 | |||||

| State Class Tankers II Tranche 1st Lien | |||||||

| 6.75% 6/10/20 | 310,000 | 313,488 | |||||

| Toys R US Property Tranche B 6.00% 7/31/19 | 225,000 | 219,544 | |||||

| Usi Insurance Services Tranche B 5.25% 12/14/19 | 255,000 | 256,594 | |||||

| Total Senior Secured Loans (cost $9,665,239) | 9,774,621 | ||||||

| Sovereign Bonds – 0.87% | |||||||

| Brazil – 0.46% | |||||||

| Brazil Notas do Tesouro Nacional | |||||||

| Serie F 10.00% 1/1/18 | BRL | 7,281,000 | 2,888,932 | ||||

| 2,888,932 | |||||||

| Mexico – 0.41% | |||||||

| Mexican Bonos 8.00% 6/11/20 | MXN | 29,745,000 | 2,583,214 | ||||

| 2,583,214 | |||||||

| Total Sovereign Bonds (cost $5,942,671) | 5,472,146 | ||||||

| Number of shares | |||||||

| Limited Partnerships – 0.18% | |||||||

| Brookfield Infrastructure Partners | 14,200 | 543,576 | |||||

| Lehigh Gas Partners | 19,800 | 560,736 | |||||

| Total Limited Partnerships (cost $957,940) | 1,104,312 | ||||||

31

Schedule of

investments

Delaware Dividend Income Fund

| Number of shares | Value (U.S. $) | |||||

| Preferred Stock – 0.53% | ||||||

| # | Ally Financial 144A 7.00% | 500 | $ | 482,984 | ||

| Freddie Mac 6.02% | 40,000 | 294,400 | ||||

| • | GMAC Capital Trust I 8.125% | 17,000 | 456,280 | |||

| Regions Financial 6.375% | 17,000 | 378,590 | ||||

| Vornado Realty 6.625% | 27,300 | 656,565 | ||||

| @ | Wheeler REIT 9.00% | 1,028 | 1,072,393 | |||

| Total Preferred Stock (cost $3,910,352) | 3,341,212 | |||||

| Principal amount° | ||||||

| Short-Term Investments – 5.01% | ||||||

| ≠Discount Note – 0.06% | ||||||

| Federal Home Loan Bank 0.05% 12/27/13 | $ | 388,198 | 388,195 | |||

| 388,195 | ||||||

| Repurchase Agreements – 3.07% | ||||||

| Bank of America 0.04%, dated 11/29/13, to | ||||||

| be repurchased on 12/2/13, repurchase price | ||||||

| $3,562,908 (collateralized by U.S. government | ||||||

| obligations 0.375%-1.875% 11/15/14-6/30/15; | ||||||

| market value $3,634,155) | 3,562,897 | 3,562,897 | ||||

| BNP Paribas 0.06%, dated 11/29/13, to be | ||||||

| repurchased on 12/2/13, repurchase price | ||||||

| $15,706,182 (collateralized by U.S. government | ||||||

| obligations 0.625%-2.625% 6/30/14-11/30/19; | ||||||

| market value $16,020,226) | 15,706,103 | 15,706,103 | ||||

| 19,269,000 | ||||||

| ≠U.S. Treasury Obligations – 1.88% | ||||||

| U.S. Treasury Bills | ||||||

| 0.02% 12/19/13 | 4,864,527 | 4,864,499 | ||||

| 0.033% 1/23/14 | 3,151,035 | 3,150,984 | ||||

| 0.065% 4/24/14 | 3,781,242 | 3,779,907 | ||||

| 11,795,390 | ||||||

| Total Short-Term Investments (cost $31,452,805) | 31,452,585 | |||||

| Total Value of Securities – 100.11% | ||||||

| (cost $536,392,408) | $ | 627,756,284 | ||||

32

| Number of contracts | Value (U.S. $) | |||||

| Option Written – (0.01%) | ||||||

| Call Option – (0.01%) | ||||||

| ANF US, strike price $34.00, expires 12/21/13 (MSC) | (416 | ) | $ | (53,248 | ) | |

| Total Option Written (premium received ($46,460)) | (53,248 | ) | ||||

| ° | Principal amount shown is stated in U.S. Dollars unless noted that the security is denominated in another currency. |

| † | Non income producing security. |

| = | Security is being fair valued in accordance with the Fund’s fair valuation policy. At Nov. 30, 2013, the aggregate value of fair valued securities was $0, which represented 0.00% of the Fund’s net assets. See Note 1 in “Notes to financial statements.” |

| • | Variable rate security. The rate shown is the rate as of Nov. 30, 2013. Interest rates reset periodically. |

| # | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. At Nov. 30, 2013, the aggregate value of Rule 144A securities was $68,180,648, which represented 10.87% of the Fund’s net assets. See Note 11 in “Notes to financial statements.” |

| Φ | Step coupon bond. Coupon increases or decreases periodically based on a predetermined schedule. Stated rate in effect at Nov. 30, 2013. |

| @ | Illiquid security. At Nov. 30, 2013, the aggregate value of illiquid securities was $1,589,967 which represented 0.25% of the Fund’s net assets. See Note 11 in “Notes to financial statements.” |

| ^ | Zero coupon security. The rate shown is the yield at the time of purchase. |

| t | Pass Through Agreement. Security represents the contractual right to receive a proportionate amount of underlying payments due to the counterparty pursuant to various agreements related to the rescheduling of obligations and the exchange of certain notes. |

| « | Senior Secured Loans generally pay interest at rates which are periodically redetermined by reference to a base lending rate plus a premium. These base lending rates are generally: (i) the prime rate offered by one or more United States banks, (ii) the lending rate offered by one or more European banks such as the London Inter-Bank Offered Rate (LIBOR), and (iii) the certificate of deposit rate. Senior Secured Loans may be subject to restrictions on resale. Stated rate in effect at Nov. 30, 2013. |

| ≠ | The rate shown is the effective yield at the time of purchase. |

| § | All or a portion of this holding is subject to unfunded loan commitments. See Note 7 in “Notes to financial statements.” |

33

Schedule of

investments

Delaware Dividend Income Fund

Foreign Currency Exchange Contracts

| Unrealized | |||||||||||

| Appreciation | |||||||||||

| Counterparty | Contracts to Receive (Deliver) | In Exchange For | Settlement Date | (Depreciation) | |||||||

| MNB | JPY 32,063,920 | USD | (319,967 | ) | 12/3/13 | $(6,785) | |||||

Futures Contracts

| Unrealized | ||||||||

| Appreciation | ||||||||

| Contracts to Buy (Sell) | Notional Cost | Notional Value | Expiration Date | (Depreciation) | ||||

| (100) S&P 500 EMINI | $8,750,204 | $9,020,500 | 12/21/13 | ($270,296) | ||||

Swap Contracts

CDS Contracts2

| Annual | Unrealized | |||||||||

| Protection | Termination | Appreciation | ||||||||

| Counterparty | Swap Referenced Obligation | Notional Value | Payments | Date | (Depreciation) | |||||

| Protection Purchased: | ||||||||||

| CME | CDX.NA.HY.21 | $10,000,000 | 5.00% | 12/20/18 | $(286,249) | |||||

The use of foreign currency exchange contracts, futures contracts, written options and contracts involves elements of market risk and risks in excess of the amount recognized in the financial statements. The notional values and foreign currency exchange contracts presented above represent the Fund’s total exposure in such contracts, whereas only the net unrealized appreciation (depreciation) is reflected in the Fund’s net assets.

1See Note 9 in “Notes to

financial statements.”

2A CDS

contract is a risk-transfer instrument through which one party (purchaser of

protection) transfers to another party (seller of protection) the financial risk

of a credit event (as defined in the CDS agreement), as it relates to a

particular reference security or basket of securities (such as an index).

Periodic payments (receipts) on such contracts are accrued daily and recorded as

unrealized losses (gains) on swap contracts. Upon payment (receipt), such

amounts are recorded as unrealized losses (gains) on swap contracts. Upfront

payments made or received in connection with CDS contracts are amortized over

the expected life of the CDS contracts as unrealized losses (gains) on swap

contracts. The change in value of CDS contracts is recorded as unrealized

appreciation or depreciation daily. A realized gain or loss is recorded upon a

credit event (as defined in the CDS agreement) or the maturity or termination of

the agreement.

34

AMT — Subject to Alternative Minimum Tax

BRL — Brazilian Real

CDS — Credit Default Swap

CDX.NA.HY — Credit Default Swap Index North America High-Yield

CME — Chicago Mercantile Exchange

JPY — Japanese Yen

MNB — Mellon National Bank

MSC — Morgan Stanley Capital

MXN — Mexican Peso

PIK — Pay-in-kind

REIT — Real Estate Investment Trust

USD — United States Dollar

See accompanying notes, which are an integral part of the financial statements.

35

| Statement of assets and liabilities | |

| Delaware Dividend Income Fund | November 30, 2013 |

| Assets: | |||

| Investments, at value1 | $ | 596,303,699 | |

| Short-term investments, at value2 | 31,452,585 | ||

| Cash | 113,673 | ||

| Cash collateral for derivatives | 1,733,827 | ||

| Foreign currencies, at value3 | 69,660 | ||

| Receivable for securities sold | 1,119,735 | ||

| Receivable for fund shares sold | 1,505,041 | ||

| Dividends and interest receivable | 3,319,691 | ||

| Variation margin receivable on futures contracts | 1,000 | ||

| Other assets | 2,575 | ||

| Total assets | 635,621,486 | ||

| Liabilities: | |||

| Payable for securities purchased | 6,356,445 | ||

| Payable for fund shares redeemed | 463,958 | ||

| Unrealized loss on foreign currency exchange contracts | 6,785 | ||

| Unrealized loss on credit default swap contracts5 | 709,747 | ||

| Options written, at value4 | 53,248 | ||

| Investment management fees payable | 327,495 | ||

| Other accrued expenses | 209,985 | ||

| Annual protection payments on credit default swap contracts | 100,000 | ||

| Distribution fees payable to affiliates | 276,090 | ||

| Trustees’ fees and expenses payable | 4,294 | ||

| Other affiliates payable | 35,738 | ||

| Total liabilities | 8,543,785 | ||

| Total Net Assets | $ | 627,077,701 | |