UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04986

Franklin Investors Securities Trust

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: 650 312-2000

Date of fiscal year end: 10/31

Date of reporting period: 10/31/18

Item 1. Reports to Stockholders.

Franklin Templeton Investments

Successful investing begins with ambition. And achievement only comes when you reach for it. That’s why we continually strive to deliver better outcomes for investors. No matter what your goals are, our deep, global investment expertise allows us to offer solutions that can help.

During our more than 70 years of experience, we’ve managed through all kinds of markets—up, down and those in between. We’re always preparing for what may come next. It’s because of this, combined with our strength as one of the world’s largest asset managers that we’ve earned the trust of millions of investors around the world.

1. Source: Morningstar.

2. Source: Copyright © 2018, S&P Dow Jones Indices LLC. All rights reserved. The index levels for the S&P 500 shown above are based on total returns, which include reinvestment of any income or distributions.

3. Source: Bloomberg Barclays Indices. The index levels for the Bloomberg Barclays U.S. Aggregate Bond Index shown above are based on total returns, which include reinvestment of any income or distributions.

The indexes are unmanaged and include reinvestment of any income or distributions.

See www.franklintempletondatasources.com for additional data provider information.

| Not FDIC Insured | | May Lose Value | | No Bank Guarantee |

| franklintempleton.com |

Not part of the annual report | 1 | ||

| 2 | Not part of the annual report | franklintempleton.com | ||

1. Source: U.S. Bureau of Labor Statistics.

2. Source: Morningstar.

| See | www.franklintempletondatasources.com for additional data provider information. |

| franklintempleton.com |

Annual Report | 3 | ||

1. Source: Morningstar.

The indexes are unmanaged and include reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 38.

| 4 |

Annual Report | franklintempleton.com | ||

FRANKLIN BALANCED FUND

2. Not held at period-end.

| franklintempleton.com | Annual Report | 5 | ||

FRANKLIN BALANCED FUND

3. Banking companies are in financials in the fixed income section of the SOI. Consumer cyclical companies are in the consumer discretionary, consumer staples and health care sectors in the fixed income section of the SOI. Consumer non-cyclical companies are in the consumer discretionary, consumer staples and health care sectors in the fixed income section of the SOI.

See www.franklintempletondatasources.com for additional data provider information.

| 6 | Annual Report | franklintempleton.com | ||

FRANKLIN BALANCED FUND

CFA® is a trademark owned by CFA Institute.

| franklintempleton.com | Annual Report | 7 | ||

FRANKLIN BALANCED FUND

Performance Summary as of October 31, 2018

The performance tables and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 10/31/181

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 5.50% and the minimum is 0%. Class A: 5.50% maximum initial sales charge; Advisor Class: no sales charges. For other share classes, visit franklintempleton.com.

| Share Class | Cumulative Total Return2 |

Average Annual Total Return3 | ||

| A4 |

||||

| 1-Year |

+0.89% | -4.66% | ||

| 5-Year |

+28.94% | +4.02% | ||

| 10-Year |

+160.46% | +9.42% | ||

| Advisor |

||||

| 1-Year |

+1.14% | +1.14% | ||

| 5-Year |

+30.71% | +5.50% | ||

| 10-Year |

+167.94% | +10.36% | ||

| Share Class | Distribution Rate5 |

30-Day Standardized Yield6 | ||||||

| (with waiver) | (without waiver) | |||||||

| A |

2.86% | 2.14% | 2.14% | |||||

| Advisor |

3.27% | 2.53% | 2.53% | |||||

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 11 for Performance Summary footnotes.

| 8 | Annual Report | franklintempleton.com | ||

FRANKLIN BALANCED FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged indexes include reinvestment of any income or distributions. They differ from the Fund in composition and do not pay management fees or expenses. One cannot invest directly in an index.

Class A (11/1/08–10/31/18)

Advisor Class (11/1/08–10/31/18)

See page 11 for Performance Summary footnotes.

| franklintempleton.com | Annual Report | 9 | ||

FRANKLIN BALANCED FUND

PERFORMANCE SUMMARY

Net Asset Value

| Share Class (Symbol) | 10/31/18 | 10/31/17 | Change | |||||||||

|

|

||||||||||||

| A (FBLAX) |

$11.89 | $12.36 | -$0.47 | |||||||||

|

|

||||||||||||

| C (FBMCX) |

$11.78 | $12.25 | -$0.47 | |||||||||

|

|

||||||||||||

| R (FBFQX) |

$11.92 | $12.39 | -$0.47 | |||||||||

| R6 (FBFRX) |

$11.93 | $12.39 | -$0.46 | |||||||||

|

|

||||||||||||

| Advisor (FBFZX) |

$11.92 | $12.39 | -$0.47 | |||||||||

|

|

||||||||||||

Distributions (11/1/17–10/31/18)

| Share Class | Net Investment Income |

Short-Term Capital Gain |

Long-Term Capital Gain |

Total | ||||||||||||

|

|

||||||||||||||||

| A |

$0.3836 | $0.0474 | $0.1535 | $0.5845 | ||||||||||||

|

|

||||||||||||||||

| C |

$0.2927 | $0.0474 | $0.1535 | $0.4936 | ||||||||||||

|

|

||||||||||||||||

| R |

$0.3521 | $0.0474 | $0.1535 | $0.5530 | ||||||||||||

|

|

||||||||||||||||

| R6 |

$0.4256 | $0.0474 | $0.1535 | $0.6265 | ||||||||||||

|

|

||||||||||||||||

| Advisor |

$0.4139 | $0.0474 | $0.1535 | $0.6148 | ||||||||||||

|

|

||||||||||||||||

Total Annual Operating Expenses8

| Share Class | With Waiver | Without Waiver | ||||||

|

|

||||||||

| A |

1.01% | 1.03% | ||||||

|

|

||||||||

| Advisor |

0.76% | 0.78% | ||||||

|

|

||||||||

See page 11 for Performance Summary footnotes.

| 10 | Annual Report | franklintempleton.com | ||

FRANKLIN BALANCED FUND

PERFORMANCE SUMMARY

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. The Fund’s share price and yield will be affected by interest rate movements. Bond prices generally move in the opposite direction of interest rates. As the prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has a fee waiver associated with any investment it makes in a Franklin Templeton money fund and/or other Franklin Templeton Fund, contractually guaranteed through 2/28/19. Fund investment results reflect the fee waiver; without this reduction, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Prior to 9/10/18, these shares were offered at a higher initial sales charge of 5.75%, thus actual returns would have differed. Total returns with sales charges have been restated to reflect the current maximum initial sales charge of 5.50%.

5. Distribution rate is based on an annualization of the respective class’s October dividend and the maximum offering price (NAV for Advisor Class) per share on 10/31/18.

6. The Fund’s 30-day standardized yield is calculated over a trailing 30-day period using the yield to maturity on bonds and/or the dividends accrued on stocks. It may not equal the Fund’s actual income distribution rate, which reflects the Fund’s past dividends paid to shareholders.

7. Source: Morningstar. The S&P 500 is a market capitalization-weighted index of 500 stocks designed to measure total U.S. equity market performance. The Bloomberg Barclays U.S. Aggregate Bond Index is a market capitalization-weighted index representing the U.S. investment-grade, fixed-rate, taxable bond market with index components for government and corporate, mortgage pass-through and asset-backed securities. All issues included are SEC registered, taxable, dollar denominated and nonconvertible, must have at least one year to final maturity and must be rated investment grade (Baa3/BBB-/BBB- or higher) using the middle rating of Moody’s, S&P and Fitch, respectively.

8. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

| franklintempleton.com | Annual Report | 11 | ||

FRANKLIN BALANCED FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| Actual (actual return after expenses) |

Hypothetical (5% annual return before expenses) |

|||||||||||

| Share Class |

Beginning Account Value 5/1/18 |

Ending Value 10/31/18 |

Expenses Paid During 5/1/18–10/31/181,2 |

Ending Value 10/31/18 |

Expenses Paid During 5/1/18–10/31/181,2 |

Net Annualized Ratio2 | ||||||

|

|

|

|

| |||||||||

| A |

$1,000 | $1,007.30 | $5.16 | $1,020.06 | $5.19 | 1.02% | ||||||

| C |

$1,000 | $1,003.70 | $8.89 | $1,016.33 | $8.94 | 1.76% | ||||||

| R |

$1,000 | $1,006.00 | $6.42 | $1,018.75 | $6.46 | 1.27% | ||||||

| R6 |

$1,000 | $1,009.00 | $3.39 | $1,021.83 | $3.41 | 0.67% | ||||||

| Advisor |

$1,000 | $1,009.40 | $3.90 | $1,021.32 | $3.92 | 0.77% | ||||||

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 184/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

| 12 | Annual Report | franklintempleton.com | ||

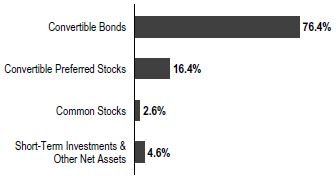

Franklin Convertible Securities Fund

1. Source: ICE BofA Merrill Lynch.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 48.

| franklintempleton.com |

Annual Report | 13 | ||

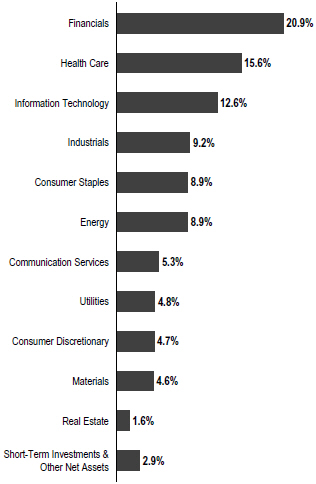

FRANKLIN CONVERTIBLE SECURITIES FUND

2. Not a Fund holding.

See www.franklintempletondatasources.com for additional data provider information.

| 14 | Annual Report | franklintempleton.com | ||

FRANKLIN CONVERTIBLE SECURITIES FUND

| franklintempleton.com | Annual Report | 15 | ||

FRANKLIN CONVERTIBLE SECURITIES FUND

Performance Summary as of October 31, 2018

The performance tables and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 10/31/181

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 5.50% and the minimum is 0%. Class A: 5.50% maximum initial sales charge; Advisor Class: no sales charges. For other share classes, visit franklintempleton.com.

| Share Class | Cumulative Total Return2 |

Average Annual Total Return3 | ||

| A4 |

||||

| 1-Year |

+7.65% | +1.75% | ||

| 5-Year |

+48.59% | +7.02% | ||

| 10-Year |

+240.47% | +12.40% | ||

| Advisor |

||||

| 1-Year |

+7.91% | +7.91% | ||

| 5-Year |

+50.41% | +8.51% | ||

| 10-Year |

+249.10% | +13.32% | ||

| Distribution | 30-Day Standardized Yield6 | |||||||||

| Share Class | Rate5 | (with waiver) | (without waiver) | |||||||

| A |

2.23% | 1.49% | 1.46% | |||||||

| Advisor |

2.61% | 1.84% | 1.81% | |||||||

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 18 for Performance Summary footnotes.

| 16 | Annual Report | franklintempleton.com | ||

FRANKLIN CONVERTIBLE SECURITIES FUND

PERFORMANCE SUMMARY

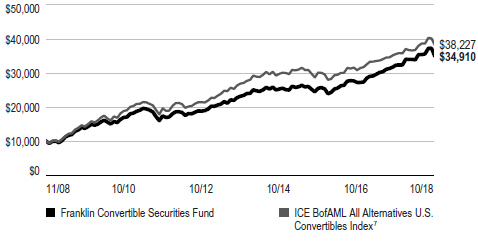

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

Class A (11/1/08–10/31/18)

Advisor Class (11/1/08–10/31/18)

See page 18 for Performance Summary footnotes.

| franklintempleton.com | Annual Report | 17 | ||

FRANKLIN CONVERTIBLE SECURITIES FUND

PERFORMANCE SUMMARY

Distributions (11/1/17–10/31/18)

| Share Class | Net Investment Income |

Short-Term Capital Gain |

Long-Term Capital Gain |

Total | ||||||||||||

| A |

$0.4883 | $0.2120 | $0.8333 | $1.5336 | ||||||||||||

| C |

$0.3392 | $0.2120 | $0.8333 | $1.3845 | ||||||||||||

| R6 |

$0.5591 | $0.2120 | $0.8333 | $1.6044 | ||||||||||||

| Advisor |

$0.5388 | $0.2120 | $0.8333 | $1.5841 | ||||||||||||

Total Annual Operating Expenses8

| Share Class | With Waiver | Without Waiver | ||||||

| A | 0.84% | 0.85% | ||||||

| Advisor |

0.59% | 0.60% | ||||||

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Convertible securities are subject to the risks of stocks when the underlying stock price is high relative to the conversion price (because more of the security’s value resides in the conversion feature) and debt securities when the underlying stock price is low relative to the conversion price (because the conversion feature is less valuable). A convertible security is not as sensitive to interest rate changes as a similar non-convertible debt security, and generally has less potential for gain or loss than the underlying stock. The Fund may invest in high yielding, fixed income securities. High yields reflect the higher credit risk associated with these lower rated securities and, in some cases, the lower market prices for these instruments. Interest rate movements may affect the Fund’s share price and yield. Bond prices generally move in the opposite direction of interest rates. As prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. The Fund may also invest in foreign securities, which involve special risks, including political uncertainty and currency volatility. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has a fee waiver associated with any investment it makes in a Franklin Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through 2/28/19. Fund investment results reflect the fee waiver; without this waiver, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Prior to 9/10/18, these shares were offered at a higher initial sales charge of 5.75%, thus actual returns would have differed. Total returns with sales charges have been restated to reflect the current maximum initial sales charge of 5.50%.

5. Distribution rate is based on the sum of the respective class’s past four quarterly dividends and the maximum offering price (NAV for Advisor Class) per share on 10/31/18.

6. The Fund’s 30-day standardized yield is calculated over a trailing 30-day period using the yield to maturity on bonds and/or the dividends accrued on stocks. It may not equal the Fund’s actual income distribution rate, which reflects the Fund’s past dividends paid to shareholders.

7. Source: Morningstar. The ICE BofAML All Alternatives U.S. Convertibles Index comprises domestic securities of all quality grades that are convertible into U.S. dollar-denominated common stock, ADRs or cash equivalents and have a delta (measure of equity sensitivity) that indicates the security likely has a balance between the debt and equity characteristics of the security.

8. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

| 18 | Annual Report | franklintempleton.com | ||

FRANKLIN CONVERTIBLE SECURITIES FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| Actual (actual return after expenses) |

Hypothetical (5% annual return before expenses) |

|||||||||||

| Share Class |

Beginning Account Value 5/1/18 |

Ending Value 10/31/18 |

Expenses Paid During 5/1/18–10/31/181,2 |

Ending Value 10/31/18 |

Expenses Paid During 5/1/18–10/31/181,2 |

Net Annualized Ratio2 | ||||||

|

|

|

|

| |||||||||

| A |

$1,000 | $1,029.30 | $4.40 | $1,020.87 | $4.38 | 0.86% | ||||||

| C |

$1,000 | $1,025.20 | $8.22 | $1,017.09 | $8.19 | 1.61% | ||||||

| R6 |

$1,000 | $1,031.30 | $2.51 | $1,022.74 | $2.50 | 0.49% | ||||||

| Advisor |

$1,000 | $1,030.00 | $3.12 | $1,022.13 | $3.11 | 0.61% | ||||||

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 184/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

| franklintempleton.com | Annual Report | 19 | ||

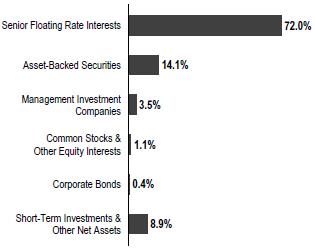

1. Source: Morningstar.

2. Source: Lipper, a Thomson Reuters Company. For the 12-month period ended 10/31/18, this category consisted of 536 funds. Lipper calculations do not include sales charges, or expense subsidization by a fund’s manager. The Fund’s performance relative to the average may have differed if these and other factors had been considered. The indexes are unmanaged and include reinvestment of any income or distributions. They do not include any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 57.

| 20 |

Annual Report | franklintempleton.com | ||

FRANKLIN EQUITY INCOME FUND

3. Not held at period-end.

See www.franklintempletondatasources.com for additional data provider information.

| franklintempleton.com | Annual Report | 21 | ||

FRANKLIN EQUITY INCOME FUND

| 22 | Annual Report | franklintempleton.com | ||

FRANKLIN EQUITY INCOME FUND

Performance Summary as of October 31, 2018

The performance tables and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 10/31/181

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 5.50% and the minimum is 0%. Class A: 5.50% maximum initial sales charge; Advisor Class: no sales charges. For other share classes, visit franklintempleton.com.

| Share Class | Cumulative Total Return2 |

Average Annual Total Return3 | ||

| A4 |

||||

| 1-Year |

+3.98% | -1.74% | ||

| 5-Year |

+46.61% | +6.74% | ||

| 10-Year |

+192.77% | +10.71% | ||

| Advisor |

||||

| 1-Year |

+4.22% | +4.22% | ||

| 5-Year |

+48.39% | +8.21% | ||

| 10-Year |

+200.35% | +11.63% | ||

| Distribution | 30-Day Standardized Yield6 | |||||||||

| Share Class | Rate5 | (with waiver) | (without waiver) | |||||||

| A |

2.75% | 1.61% | 1.60% | |||||||

| Advisor |

3.18% | 1.97% | 1.96% | |||||||

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 25 for Performance Summary footnotes.

| franklintempleton.com | Annual Report | 23 | ||

FRANKLIN EQUITY INCOME FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged indexes include reinvestment of any income or distributions. They differ from the Fund in composition and do not pay management fees or expenses. One cannot invest directly in an index.

Class A (11/1/08–10/31/18)

Advisor Class (11/1/08–10/31/18)

See page 25 for Performance Summary footnotes.

| 24 | Annual Report | franklintempleton.com | ||

FRANKLIN EQUITY INCOME FUND

PERFORMANCE SUMMARY

Distributions (11/1/17–10/31/18)

| Share Class | Net Investment Income |

Short-Term Capital Gain |

Long-Term Capital Gain |

Total | ||||||||||||

| A |

$0.5721 | $0.0013 | $0.6248 | $1.1982 | ||||||||||||

| C |

$0.3830 | $0.0013 | $0.6248 | $1.0091 | ||||||||||||

| R |

$0.5136 | $0.0013 | $0.6248 | $1.1397 | ||||||||||||

| R6 |

$0.6643 | $0.0013 | $0.6248 | $1.2904 | ||||||||||||

| Advisor |

$0.6323 | $0.0013 | $0.6248 | $1.2584 | ||||||||||||

Total Annual Operating Expenses10

| Share Class | With Waiver | Without Waiver | ||||||

| A |

0.85% | 0.85 | % | |||||

| Advisor |

0.60% | 0.60 | % | |||||

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Convertible securities are subject to the risks of stocks when the underlying stock price is high relative to the conversion price and debt securities when the underlying stock price is low relative to the conversion price. The Fund’s investment in foreign securities also involves special risks, including currency fluctuations and economic as well as political uncertainty. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has a fee waiver associated with any investment it makes in a Franklin Templeton money fund and/or other Franklin Templeton Fund, contractually guaranteed through 2/28/19. Fund investment results reflect the fee waiver; without this waiver, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Prior to 9/10/18, these shares were offered at a higher initial sales charge of 5.75%, thus actual returns would have differed. Total returns with sales charges have been restated to reflect the current maximum initial sales charge of 5.50%.

5. Distribution rate is based on an annualization of the respective class’s current quarterly dividend and the maximum offering price (NAV for Advisor Class) per share on 10/31/18.

6. The Fund’s 30-day standardized yield is calculated over a trailing 30-day period using the yield to maturity on bonds and/or the dividends accrued on stocks. It may not equal the Fund’s actual income distribution rate, which reflects the Fund’s past dividends paid to shareholders.

7. Source: Morningstar: The S&P 500 is a market capitalization-weighted index of 500 stocks designed to measure total U.S. equity market performance.

8. Source: Lipper, a Thomson Reuters Company. The Lipper Equity Income Funds Classification Average is an equally weighted average calculation of performance figures for all funds within the Lipper Equity Income Funds classification in the Lipper Open-End underlying funds universe. Lipper Equity Income Funds seek relatively high current income and growth of income through investing 60% or more of their portfolios in equities. For the one-year period ended 10/31/18, there were 536 funds in this category. Lipper calculations do not include sales charges or expense subsidization by a fund’s manager. The Fund’s performance relative to the average may have differed if these or other factors had been considered.

9. Source: Bureau of Labor Statistics, bls.gov/cpi. The Consumer Price Index (CPI) is a commonly used measure of the inflation rate.

10. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

| franklintempleton.com | Annual Report | 25 | ||

FRANKLIN EQUITY INCOME FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| Actual (actual return after expenses) |

Hypothetical (5% annual return before expenses) |

|||||||||||

| Share Class |

Beginning Account Value 5/1/18 |

Ending Value 10/31/18 |

Expenses Paid During 5/1/18–10/31/181,2 |

Ending Value 10/31/18 |

Expenses Paid During 5/1/18–10/31/181,2 |

Net Annualized Ratio2 | ||||||

|

|

|

|

| |||||||||

| A |

$1,000 | $1,022.30 | $4.33 | $1,020.92 | $4.33 | 0.85% | ||||||

| C |

$1,000 | $1,017.80 | $8.14 | $1,017.14 | $8.13 | 1.60% | ||||||

| R |

$1,000 | $1,020.70 | $5.50 | $1,019.76 | $5.50 | 1.08% | ||||||

| R6 |

$1,000 | $1,024.00 | $2.55 | $1,022.68 | $2.55 | 0.50% | ||||||

| Advisor |

$1,000 | $1,023.10 | $3.06 | $1,022.18 | $3.06 | 0.60% | ||||||

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 184/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

| 26 | Annual Report | franklintempleton.com | ||

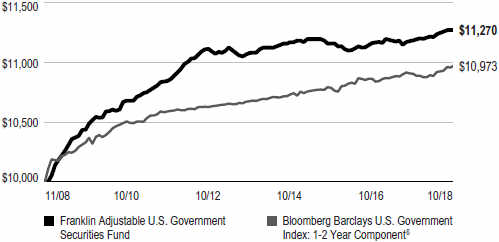

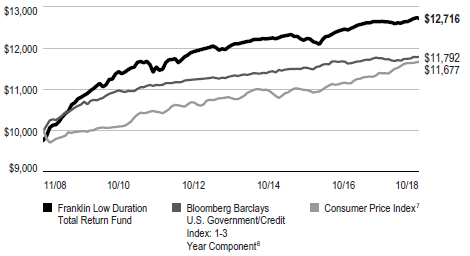

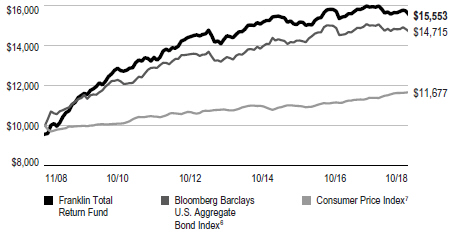

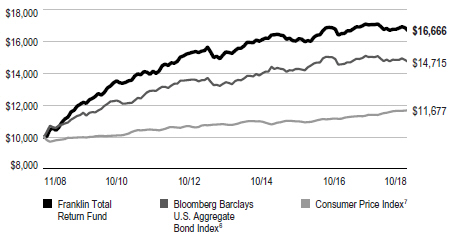

1. Source: Morningstar.

The indexes are unmanaged and include reinvestment of any income or distributions. They do not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

2. Source: Bureau of Labor Statistics, bls.gov/cpi.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 64.

| franklintempleton.com |

Annual Report | 27 | ||

FRANKLIN REAL RETURN FUND

| 28 | Annual Report | franklintempleton.com | ||

FRANKLIN REAL RETURN FUND

Performance Summary as of October 31, 2018

The performance tables and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 10/31/181

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 4.25% and the minimum is 0%. Class A: 4.25% maximum initial sales charge; Advisor Class: no sales charges. For other share classes, visit franklintempleton.com.

| Share Class | Cumulative Total Return2 |

Average Annual Total Return3 | ||

| A |

||||

| 1-Year |

-0.69% | -4.91% | ||

| 5-Year |

-1.96% | -1.26% | ||

| 10-Year |

+24.29% | +1.76% | ||

| Advisor |

||||

| 1-Year |

-0.47% | -0.47% | ||

| 5-Year |

-0.82% | -0.17% | ||

| 10-Year |

+27.32% | +2.44% | ||

| Distribution | 30-Day Standardized Yield5 | |||||||||||

| Share Class | Rate4 | (with waiver) | (without waiver) | |||||||||

| A |

0.00% | 1.81% | 1.51% | |||||||||

| Advisor |

0.00% | 2.15% | 1.84% | |||||||||

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 31 for Performance Summary footnotes.

| franklintempleton.com | Annual Report | 29 | ||

FRANKLIN REAL RETURN FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged indexes include reinvestment of any income or distributions. They differ from the Fund in composition and do not pay management fees or expenses. One cannot invest directly in an index.

Class A (11/1/08–10/31/18)

Advisor Class (11/1/08–10/31/18)

See page 31 for Performance Summary footnotes.

| 30 | Annual Report | franklintempleton.com | ||

FRANKLIN REAL RETURN FUND

PERFORMANCE SUMMARY

Distributions (11/1/17–10/31/18)

| Share Class | Net Investment Income |

|||

| A |

$0.3259 | |||

| C |

$0.2895 | |||

| R6 |

$0.3637 | |||

| Advisor |

$0.3479 | |||

Total Annual Operating Expenses8

| Share Class | With Waiver | Without Waiver | ||||||

| A |

0.93% | 1.17% | ||||||

| Advisor |

0.68% | 0.92% | ||||||

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Interest rate movements will affect the Fund’s share price and yield. Bond prices generally move in the opposite direction of interest rates. As prices of bonds in a fund adjust to a rise in interest rates, the Fund’s share price may decline. Foreign securities involve special risks, including currency fluctuations and economic and political uncertainties. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has an expense reduction and a fee waiver associated with any investments it makes in a Franklin Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through 2/28/19. Fund investment results reflect the expense reduction and fee waiver; without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Distribution rate is based on an annualization of the respective class’s October dividend and the maximum offering price (NAV for Advisor Class) per share on 10/31/18.

5. The Fund’s 30-day standardized yield is calculated over a trailing 30-day period using the yield to maturity on bonds and/or the dividends accrued on stocks. It may not equal the Fund’s actual income distribution rate, which reflects the Fund’s past dividends paid to shareholders.

6. Source: Morningstar. The Bloomberg Barclays U.S. TIPS Index comprises U.S. TIPS rated investment grade (Baa3/BBB- or better) with at least one year to final maturity and at least $250 million par amount outstanding.

7. Source: Bureau of Labor Statistics, bls.gov/cpi. The Consumer Price Index (CPI) is a commonly used measure of the inflation rate.

8. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

| franklintempleton.com | Annual Report | 31 | ||

FRANKLIN REAL RETURN FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| Actual (actual return after expenses) |

Hypothetical (5% annual return before expenses) |

|||||||||||

| Share Class |

Beginning Account Value 5/1/18 |

Ending Value 10/31/18 |

Expenses Paid During 5/1/18–10/31/181,2 |

Ending Value 10/31/18 |

Expenses Paid During 5/1/18–10/31/181,2 |

Net Annualized Ratio2 | ||||||

|

|

|

|

| |||||||||

| A |

$1,000 | $982.00 | $4.50 | $1,020.67 | $4.58 | 0.90% | ||||||

| C |

$1,000 | $979.20 | $6.49 | $1,018.65 | $6.61 | 1.30% | ||||||

| R6 |

$1,000 | $983.80 | $2.45 | $1,022.74 | $2.50 | 0.49% | ||||||

| Advisor |

$1,000 | $982.10 | $3.25 | $1,021.93 | $3.31 | 0.65% | ||||||

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 184/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

| 32 | Annual Report | franklintempleton.com | ||

FRANKLIN INVESTORS SECURITIES TRUST

Franklin Balanced Fund

| Year Ended October 31, | ||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

|

Class A |

||||||||||||||||||||

| Per share operating performance | ||||||||||||||||||||

| (for a share outstanding throughout the year) |

||||||||||||||||||||

| Net asset value, beginning of year |

$12.36 | $11.65 | $11.40 | $11.86 | $11.43 | |||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||

| Net investment incomeb |

0.27 | 0.33 | 0.30 | 0.30 | 0.31 | c | ||||||||||||||

| Net realized and unrealized gains (losses) |

(0.16 | ) | 0.91 | 0.31 | (0.24 | ) | 0.65 | |||||||||||||

| Total from investment operations |

0.11 | 1.24 | 0.61 | 0.06 | 0.96 | |||||||||||||||

| Less distributions from: |

||||||||||||||||||||

| Net investment income |

(0.38 | ) | (0.36 | ) | (0.36 | ) | (0.36 | ) | (0.36 | ) | ||||||||||

| Net realized gains |

(0.20 | ) | (0.17 | ) | (— | )d | (0.16 | ) | (0.17 | ) | ||||||||||

| Total distributions |

(0.58 | ) | (0.53 | ) | (0.36 | ) | (0.52 | ) | (0.53 | ) | ||||||||||

| Net asset value, end of year |

$11.89 | $12.36 | $11.65 | $11.40 | $11.86 | |||||||||||||||

| Total returne |

0.89% | 10.88% | 5.54% | 0.51% | 8.66% | |||||||||||||||

| Ratios to average net assets | ||||||||||||||||||||

| Expenses before waiver and payments by affiliates |

1.02% | 1.02% | 1.02% | 1.06% | 1.09% | |||||||||||||||

| Expenses net of waiver and payments by affiliatesf |

1.01% | 1.00% | 1.01% | 1.06% | g | 1.09% | g | |||||||||||||

| Net investment income |

2.22% | 2.72% | 2.62% | 2.56% | 2.64% | c | ||||||||||||||

| Supplemental data | ||||||||||||||||||||

| Net assets, end of year (000’s) |

$2,586,246 | $2,646,599 | $2,532,459 | $2,371,133 | $2,053,623 | |||||||||||||||

| Portfolio turnover rate |

63.64% | 34.99% | 46.03% | 69.23% | 40.54% | |||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.03 per share related to income received in the form of a special dividend in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 2.39%.

dAmount rounds to less than $0.01 per share.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

fBenefit of expense reduction rounds to less than 0.01%.

gBenefit of waiver and payments by affiliates rounds to less than 0.01%.

| franklintempleton.com | The accompanying notes are an integral part of these financial statements. | Annual Report | 33 | ||

FRANKLIN INVESTORS SECURITIES TRUST

FINANCIAL HIGHLIGHTS

Franklin Balanced Fund (continued)

| Year Ended October 31, | ||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

| Class C |

||||||||||||||||||||

| Per share operating performance | ||||||||||||||||||||

| (for a share outstanding throughout the year) |

||||||||||||||||||||

| Net asset value, beginning of year |

$12.25 | $11.55 | $11.31 | $11.77 | $11.34 | |||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||

| Net investment incomeb |

0.19 | 0.24 | 0.21 | 0.21 | 0.23 | c | ||||||||||||||

| Net realized and unrealized gains (losses) |

(0.17 | ) | 0.90 | 0.31 | (0.23 | ) | 0.65 | |||||||||||||

| Total from investment operations |

0.02 | 1.14 | 0.52 | (0.02 | ) | 0.88 | ||||||||||||||

| Less distributions from: |

||||||||||||||||||||

| Net investment income |

(0.29 | ) | (0.27 | ) | (0.28 | ) | (0.28 | ) | (0.28 | ) | ||||||||||

| Net realized gains |

(0.20 | ) | (0.17 | ) | (— | )d | (0.16 | ) | (0.17 | ) | ||||||||||

| Total distributions |

(0.49 | ) | (0.44 | ) | (0.28 | ) | (0.44 | ) | (0.45 | ) | ||||||||||

| Net asset value, end of year |

$11.78 | $12.25 | $11.55 | $11.31 | $11.77 | |||||||||||||||

| Total returne |

0.14% | 10.06% | 4.73% | (0.20)% | 7.97% | |||||||||||||||

| Ratios to average net assets | ||||||||||||||||||||

| Expenses before waiver and payments by affiliates |

1.76% | 1.77% | 1.77% | 1.77% | 1.79% | |||||||||||||||

| Expenses net of waiver and payments by affiliatesf |

1.75% | 1.75% | 1.76% | 1.77% | g | 1.79% | g | |||||||||||||

| Net investment income |

1.48% | 1.97% | 1.87% | 1.85% | 1.94% | c | ||||||||||||||

| Supplemental data | ||||||||||||||||||||

| Net assets, end of year (000’s) |

$493,762 | $633,108 | $630,110 | $563,419 | $492,514 | |||||||||||||||

| Portfolio turnover rate |

63.64% | 34.99% | 46.03% | 69.23% | 40.54% | |||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.03 per share related to income received in the form of a special dividend in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 1.69%.

dAmount rounds to less than $0.01 per share.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

fBenefit of expense reduction rounds to less than 0.01%.

gBenefit of waiver and payments by affiliates rounds to less than 0.01%.

| 34 | Annual Report | The accompanying notes are an integral part of these financial statements. | franklintempleton.com | ||

FRANKLIN INVESTORS SECURITIES TRUST

FINANCIAL HIGHLIGHTS

Franklin Balanced Fund (continued)

| Year Ended October 31, | ||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

| Class R |

||||||||||||||||||||

| Per share operating performance | ||||||||||||||||||||

| (for a share outstanding throughout the year) |

||||||||||||||||||||

| Net asset value, beginning of year |

$12.39 | $11.67 | $11.42 | $11.89 | $11.45 | |||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||

| Net investment incomeb |

0.26 | 0.30 | 0.27 | 0.27 | 0.29 | c | ||||||||||||||

| Net realized and unrealized gains (losses) |

(0.18 | ) | 0.92 | 0.32 | (0.24 | ) | 0.66 | |||||||||||||

| Total from investment operations |

0.08 | 1.22 | 0.59 | 0.03 | 0.95 | |||||||||||||||

| Less distributions from: |

||||||||||||||||||||

| Net investment income |

(0.35 | ) | (0.33 | ) | (0.34 | ) | (0.34 | ) | (0.34 | ) | ||||||||||

| Net realized gains |

(0.20 | ) | (0.17 | ) | (— | )d | (0.16 | ) | (0.17 | ) | ||||||||||

| Total distributions |

(0.55 | ) | (0.50 | ) | (0.34 | ) | (0.50 | ) | (0.51 | ) | ||||||||||

| Net asset value, end of year |

$11.92 | $12.39 | $11.67 | $11.42 | $11.89 | |||||||||||||||

| Total return |

0.63% | 10.66% | 5.28% | 0.21% | 8.51% | |||||||||||||||

| Ratios to average net assets | ||||||||||||||||||||

| Expenses before waiver and payments by affiliates |

1.27% | 1.27% | 1.27% | 1.27% | 1.29% | |||||||||||||||

| Expenses net of waiver and payments by affiliatese |

1.26% | 1.25% | 1.26% | 1.27% | f | 1.29% | f | |||||||||||||

| Net investment income |

1.97% | 2.47% | 2.37% | 2.35% | 2.44% | c | ||||||||||||||

| Supplemental data | ||||||||||||||||||||

| Net assets, end of year (000’s) |

$3,371 | $4,763 | $4,482 | $4,699 | $3,598 | |||||||||||||||

| Portfolio turnover rate |

63.64% | 34.99% | 46.03% | 69.23% | 40.54% | |||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.03 per share related to income received in the form of a special dividend in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 2.19%.

dAmount rounds to less than $0.01 per share.

eBenefit of expense reduction rounds to less than 0.01%.

fBenefit of waiver and payments by affiliates rounds to less than 0.01%.

| franklintempleton.com | The accompanying notes are an integral part of these financial statements. | Annual Report | 35 | ||

FRANKLIN INVESTORS SECURITIES TRUST

FINANCIAL HIGHLIGHTS

Franklin Balanced Fund (continued)

| Year Ended October 31, | ||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

| Class R6 |

||||||||||||||||||||

| Per share operating performance | ||||||||||||||||||||

| (for a share outstanding throughout the year) |

||||||||||||||||||||

| Net asset value, beginning of year |

$12.39 | $11.67 | $11.42 | $11.89 | $11.45 | |||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||

| Net investment incomeb |

0.31 | 0.41 | 0.34 | 0.35 | 0.37 | c | ||||||||||||||

| Net realized and unrealized gains (losses) |

(0.14 | ) | 0.88 | 0.31 | (0.25 | ) | 0.65 | |||||||||||||

| Total from investment operations |

0.17 | 1.29 | 0.65 | 0.10 | 1.02 | |||||||||||||||

| Less distributions from: |

||||||||||||||||||||

| Net investment income |

(0.43 | ) | (0.40 | ) | (0.40 | ) | (0.41 | ) | (0.41 | ) | ||||||||||

| Net realized gains |

(0.20 | ) | (0.17 | ) | (— | )d | (0.16 | ) | (0.17 | ) | ||||||||||

| Total distributions |

(0.63 | ) | (0.57 | ) | (0.40 | ) | (0.57 | ) | (0.58 | ) | ||||||||||

| Net asset value, end of year |

$11.93 | $12.39 | $11.67 | $11.42 | $11.89 | |||||||||||||||

| Total return |

1.23% | 11.33% | 5.90% | 0.81% | 9.29% | |||||||||||||||

| Ratios to average net assets | ||||||||||||||||||||

| Expenses before waiver and payments by affiliates |

0.68% | 0.71% | 0.73% | 0.70% | 0.68% | |||||||||||||||

| Expenses net of waiver and payments by affiliatese |

0.66% | 0.64% | 0.66% | 0.67% | 0.68% | f | ||||||||||||||

| Net investment income |

2.56% | 3.08% | 2.97% | 2.95% | 3.05% | c | ||||||||||||||

| Supplemental data | ||||||||||||||||||||

| Net assets, end of year (000’s) |

$138,923 | $342 | $233 | $221 | $513 | |||||||||||||||

| Portfolio turnover rate |

63.64% | 34.99% | 46.03% | 69.23% | 40.54% | |||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.03 per share related to income received in the form of a special dividend in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 2.80%.

dAmount rounds to less than $0.01 per share.

eBenefit of expense reduction rounds to less than 0.01%.

fBenefit of waiver and payments by affiliates rounds to less than 0.01%.

| 36 | Annual Report | The accompanying notes are an integral part of these financial statements. | franklintempleton.com | ||

FRANKLIN INVESTORS SECURITIES TRUST

FINANCIAL HIGHLIGHTS

Franklin Balanced Fund (continued)

| Year Ended October 31, | ||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

| Advisor Class |

||||||||||||||||||||

| Per share operating performance | ||||||||||||||||||||

| (for a share outstanding throughout the year) |

||||||||||||||||||||

| Net asset value, beginning of year |

$12.39 | $11.67 | $11.42 | $11.88 | $11.45 | |||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||

| Net investment incomeb |

0.30 | 0.35 | 0.29 | 0.33 | 0.35 | c | ||||||||||||||

| Net realized and unrealized gains (losses) |

(0.16 | ) | 0.93 | 0.35 | (0.24 | ) | 0.65 | |||||||||||||

| Total from investment operations |

0.14 | 1.28 | 0.64 | 0.09 | 1.00 | |||||||||||||||

| Less distributions from: |

||||||||||||||||||||

| Net investment income |

(0.41 | ) | (0.39 | ) | (0.39 | ) | (0.39 | ) | (0.40 | ) | ||||||||||

| Net realized gains |

(0.20 | ) | (0.17 | ) | (— | )d | (0.16 | ) | (0.17 | ) | ||||||||||

| Total distributions |

(0.61 | ) | (0.56 | ) | (0.39 | ) | (0.55 | ) | (0.57 | ) | ||||||||||

| Net asset value, end of year |

$11.92 | $12.39 | $11.67 | $11.42 | $11.88 | |||||||||||||||

| Total return |

1.14% | 11.21% | 5.79% | 0.81% | 8.97% | |||||||||||||||

| Ratios to average net assets | ||||||||||||||||||||

| Expenses before waiver and payments by affiliates |

0.77% | 0.77% | 0.77% | 0.77% | 0.79% | |||||||||||||||

| Expenses net of waiver and payments by affiliatese |

0.76% | 0.75% | 0.76% | 0.77% | f | 0.79% | f | |||||||||||||

| Net investment income |

2.47% | 2.97% | 2.87% | 2.85% | 2.94% | c | ||||||||||||||

| Supplemental data | ||||||||||||||||||||

| Net assets, end of year (000’s) |

$124,265 | $243,674 | $138,111 | $54,881 | $41,494 | |||||||||||||||

| Portfolio turnover rate |

63.64% | 34.99% | 46.03% | 69.23% | 40.54% | |||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.03 per share related to income received in the form of a special dividend in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 2.69%.

dAmount rounds to less than $0.01 per share.

eBenefit of expense reduction rounds to less than 0.01%.

fBenefit of waiver and payments by affiliates rounds to less than 0.01%.

| franklintempleton.com | The accompanying notes are an integral part of these financial statements. | Annual Report | 37 | ||

FRANKLIN INVESTORS SECURITIES TRUST

Statement of Investments, October 31, 2018

Franklin Balanced Fund

| Country | Shares | Value | ||||||||||

|

|

||||||||||||

| Common Stocks 40.5% |

||||||||||||

| Communication Services 1.7% |

||||||||||||

| a Verizon Communications Inc. |

United States | 980,100 | $ | 55,953,909 | ||||||||

|

|

|

|||||||||||

| Consumer Discretionary 1.9% |

||||||||||||

| b Amazon.com Inc. |

United States | 10,000 | 15,980,100 | |||||||||

| a Ford Motor Co. |

United States | 5,000,000 | 47,750,000 | |||||||||

|

|

|

|||||||||||

| 63,730,100 | ||||||||||||

|

|

|

|||||||||||

| Consumer Staples 6.0% |

||||||||||||

| The Coca-Cola Co. |

United States | 650,200 | 31,131,576 | |||||||||

| Nestle SA |

Switzerland | 500,000 | 41,925,000 | |||||||||

| PepsiCo Inc. |

United States | 337,200 | 37,894,536 | |||||||||

| a Philip Morris International Inc. |

United States | 300,000 | 26,421,000 | |||||||||

| a The Procter & Gamble Co. |

United States | 700,000 | 62,076,000 | |||||||||

|

|

|

|||||||||||

| 199,448,112 | ||||||||||||

|

|

|

|||||||||||

| Energy 3.5% |

||||||||||||

| Chevron Corp. |

United States | 375,000 | 41,868,750 | |||||||||

| Exxon Mobil Corp. |

United States | 535,000 | 42,628,800 | |||||||||

| Royal Dutch Shell PLC, A, ADR |

United Kingdom | 545,000 | 34,438,550 | |||||||||

|

|

|

|||||||||||

| 118,936,100 | ||||||||||||

|

|

|

|||||||||||

| Financials 6.0% |

||||||||||||

| Bank of America Corp. |

United States | 1,496,715 | 41,159,662 | |||||||||

| The Charles Schwab Corp. |

United States | 505,000 | 23,351,200 | |||||||||

| JPMorgan Chase & Co. |

United States | 500,000 | 54,510,000 | |||||||||

| The Toronto-Dominion Bank |

Canada | 415,000 | 23,015,900 | |||||||||

| Wells Fargo & Co. |

United States | 1,100,000 | 58,553,000 | |||||||||

|

|

|

|||||||||||

| 200,589,762 | ||||||||||||

|

|

|

|||||||||||

| Health Care 4.3% |

||||||||||||

| AbbVie Inc. |

United States | 200,000 | 15,570,000 | |||||||||

| AstraZeneca PLC, ADR |

United Kingdom | 1,100,000 | 42,658,000 | |||||||||

| a Johnson & Johnson |

United States | 267,000 | 37,377,330 | |||||||||

| a Pfizer Inc. |

United States | 1,150,000 | 49,519,000 | |||||||||

|

|

|

|||||||||||

| 145,124,330 | ||||||||||||

|

|

|

|||||||||||

| Industrials 3.6% |

||||||||||||

| General Dynamics Corp. |

United States | 100,000 | 17,258,000 | |||||||||

| a Honeywell International Inc. |

United States | 200,000 | 28,964,000 | |||||||||

| Northrop Grumman Corp. |

United States | 105,000 | 27,504,750 | |||||||||

| Raytheon Co. |

United States | 260,000 | 45,510,400 | |||||||||

| b Resideo Technologies Inc. |

United States | 33,333 | 701,667 | |||||||||

|

|

|

|||||||||||

| 119,938,817 | ||||||||||||

|

|

|

|||||||||||

| Information Technology 6.4% |

||||||||||||

| Analog Devices Inc. |

United States | 350,000 | 29,298,500 | |||||||||

| Apple Inc. |

United States | 200,000 | 43,772,000 | |||||||||

| Cisco Systems Inc. |

United States | 500,000 | 22,875,000 | |||||||||

| Intel Corp. |

United States | 500,000 | 23,440,000 | |||||||||

| Maxim Integrated Products Inc. |

United States | 325,000 | 16,256,500 | |||||||||

| Microsoft Corp. |

United States | 215,000 | 22,964,150 | |||||||||

| a Texas Instruments Inc. |

United States | 600,000 | 55,698,000 | |||||||||

|

|

|

|||||||||||

| 214,304,150 | ||||||||||||

|

|

|

|||||||||||

| 38 | Annual Report | franklintempleton.com | ||

FRANKLIN INVESTORS SECURITIES TRUST

STATEMENT OF INVESTMENTS

| Franklin Balanced Fund (continued)

|

| |||||||||||

| Country | Shares | Value | ||||||||||

|

|

||||||||||||

| Common Stocks (continued) |

||||||||||||

| Materials 1.6% |

||||||||||||

| BASF SE |

Germany | 400,000 | $ | 30,810,786 | ||||||||

| DowDuPont Inc. |

United States | 400,000 | 21,568,000 | |||||||||

|

|

|

|||||||||||

| 52,378,786 | ||||||||||||

|

|

|

|||||||||||

| Real Estate 2.3% |

||||||||||||

| American Tower Corp. |

United States | 305,970 | 47,673,186 | |||||||||

| Host Hotels & Resorts Inc. |

United States | 1,500,000 | 28,665,000 | |||||||||

|

|

|

|||||||||||

| 76,338,186 | ||||||||||||

|

|

|

|||||||||||

| Utilities 3.2% |

||||||||||||

| a Dominion Energy Inc. |

United States | 550,000 | 39,281,000 | |||||||||

| NextEra Energy Inc. |

United States | 115,440 | 19,913,400 | |||||||||

| a Sempra Energy |

United States | 300,000 | 33,036,000 | |||||||||

| The Southern Co. |

United States | 350,000 | 15,760,500 | |||||||||

|

|

|

|||||||||||

| 107,990,900 | ||||||||||||

|

|

|

|||||||||||

| Total Common Stocks (Cost $1,086,033,628) |

1,354,733,152 | |||||||||||

|

|

|

|||||||||||

| Management Investment Companies 1.9% |

||||||||||||

| Financials 1.9% |

||||||||||||

| c Franklin FTSE Europe Hedged ETF |

United States | 1,350,000 | 32,123,250 | |||||||||

| c Franklin FTSE Japan Hedged ETF |

United States | 1,250,000 | 30,808,000 | |||||||||

|

|

|

|||||||||||

| Total Management Investment Companies |

62,931,250 | |||||||||||

|

|

|

|||||||||||

| d Equity-Linked Securities 10.6% |

||||||||||||

| Communication Services 2.5% |

||||||||||||

| e Royal Bank of Canada into Comcast Corp., 7.50%, 144A |

United States | 1,485,000 | 53,968,201 | |||||||||

| e UBS AG London into Alphabet Inc., 6.00%, 144A |

United States | 29,000 | 30,558,982 | |||||||||

|

|

|

|||||||||||

| 84,527,183 | ||||||||||||

|

|

|

|||||||||||

| Industrials 1.7% |

||||||||||||

| e Barclays Bank PLC into General Electric Co., 7.00%, 144A |

United States | 2,390,000 | 25,659,640 | |||||||||

| e Goldman Sachs International into Union Pacific Corp., 7.50%, 144A |

United States | 200,000 | 29,112,501 | |||||||||

|

|

|

|||||||||||

| 54,772,141 | ||||||||||||

|

|

|

|||||||||||

| Information Technology 6.4% |

||||||||||||

| e Barclays Bank PLC into Broadcom Inc., 8.50%, 144A |

United States | 156,000 | 35,925,018 | |||||||||

| e BNP Paribas Arbitrage Issuance BV into Microsoft Corp., 6.50%, 144A |

United States | 410,000 | 41,992,428 | |||||||||

| e BNP Paribas Arbitrage Issuance BV into Oracle Corp., 6.50%, 144A |

United States | 582,000 | 28,197,753 | |||||||||

| e Credit Suisse AG London into Analog Devices Inc., 7.00%, 144A |

United States | 430,000 | 36,530,711 | |||||||||

| e Deutsche Bank AG London into Apple Inc., 6.50%, 144A |

United States | 200,000 | 39,037,959 | |||||||||

| e JPMorgan Chase Financial Co. LLC into Intel Corp., 9.00%, 144A |

United States | 685,000 | 32,855,447 | |||||||||

|

|

|

|||||||||||

| 214,539,316 | ||||||||||||

|

|

|

|||||||||||

| Total Equity-Linked Securities (Cost $359,820,760) |

353,838,640 | |||||||||||

|

|

|

|||||||||||

| Convertible Preferred Stocks (Cost $10,227,000) 0.3% |

||||||||||||

| Utilities 0.3% |

||||||||||||

| Sempra Energy, 6.00%, cvt. pfd., A |

United States | 100,000 | 9,916,000 | |||||||||

|

|

|

|||||||||||

| Units | ||||||||||||

| f Index-Linked Notes (Cost $33,147,500) 1.0% |

||||||||||||

| Financials 1.0% |

||||||||||||

| e,g Morgan Stanley Finance LLC, senior note, 144A, 5.89%, 10/03/19 | United States | 250,000 | 33,322,500 | |||||||||

|

|

|

|||||||||||

| franklintempleton.com | Annual Report | 39 | ||

FRANKLIN INVESTORS SECURITIES TRUST

STATEMENT OF INVESTMENTS

| Franklin Balanced Fund (continued)

|

| |||||||||||

| Country | |

Principal Amount |

* |

Value | ||||||||

|

|

||||||||||||

| Convertible Bonds (Cost $15,000,000) 0.3% |

||||||||||||

| Energy 0.3% |

||||||||||||

| Weatherford International Ltd., cvt., senior note, 5.875%, 7/01/21 |

United States | $ | 15,000,000 | $ | 11,550,435 | |||||||

|

|

|

|||||||||||

| Corporate Bonds 33.7% |

||||||||||||

| Communication Services 3.4% |

||||||||||||

| AT&T Inc., senior note, 3.95%, 1/15/25 |

United States | 11,700,000 | 11,369,530 | |||||||||

| CCO Holdings LLC/CCO Holdings Capital Corp., |

||||||||||||

| senior bond, 5.75%, 1/15/24 |

United States | 5,000,000 | 5,062,500 | |||||||||

| e senior bond, 144A, 5.125%, 5/01/27 |

United States | 15,000,000 | 14,156,250 | |||||||||

| Charter Communications Operating LLC/Charter Communications Operating Capital Corp., senior secured note, first lien, 4.908%, 7/23/25 |

United States | 20,000,000 | 20,169,344 | |||||||||

| DISH DBS Corp., senior bond, 5.875%, 7/15/22 |

United States | 12,000,000 | 11,385,000 | |||||||||

| e Sirius XM Radio Inc., senior bond, 144A, 5.375%, 4/15/25 |

United States | 15,000,000 | 14,896,875 | |||||||||

| Sprint Corp., senior note, 7.625%, 2/15/25 |

United States | 10,000,000 | 10,412,500 | |||||||||

| e Sprint Spectrum Co. LLC/Sprint Spectrum Co. II LLC, senior secured bond, first lien, 144A, 4.738%, 9/20/29 |

United States | 25,000,000 | 25,007,500 | |||||||||

|

|

|

|||||||||||

| 112,459,499 | ||||||||||||

|

|

|

|||||||||||

| Consumer Discretionary 3.4% |

||||||||||||

| Amazon.com Inc., |

||||||||||||

| senior note, 5.20%, 12/03/25 |

United States | 20,000,000 | 21,689,854 | |||||||||

| senior note, 2.40%, 2/22/23 |

United States | 10,000,000 | 9,563,019 | |||||||||

| Dollar General Corp., |

||||||||||||

| senior bond, 3.25%, 4/15/23 |

United States | 15,000,000 | 14,584,416 | |||||||||

| senior bond, 3.875%, 4/15/27 |

United States | 10,000,000 | 9,552,047 | |||||||||

| NIKE Inc., senior bond, 2.375%, 11/01/26 |

United States | 30,000,000 | 26,980,376 | |||||||||

| e Wynn Las Vegas LLC/Wynn Las Vegas Capital Corp., senior bond, 144A, 5.50%, 3/01/25 |

United States | 10,000,000 | 9,537,500 | |||||||||

| e Wynn Macau Ltd., senior bond, 144A, 5.50%, 10/01/27 |

Macau | 25,000,000 | 22,687,500 | |||||||||

|

|

|

|||||||||||

| 114,594,712 | ||||||||||||

|

|

|

|||||||||||

| Consumer Staples 4.2% |

||||||||||||

| Anheuser-Busch InBev Finance Inc., senior bond, 4.90%, 2/01/46 |

Belgium | 10,000,000 | 9,477,410 | |||||||||

| The Clorox Co., senior bond, 3.10%, 10/01/27 |

United States | 22,500,000 | 20,884,547 | |||||||||

| Costco Wholesale Corp., senior note, 2.75%, 5/18/24 |

United States | 30,000,000 | 28,925,395 | |||||||||

| Kraft Heinz Foods Co., senior bond, 3.50%, 6/06/22 |

United States | 15,000,000 | 14,837,343 | |||||||||

| Mondelez International Inc., senior bond, 4.00%, 2/01/24 |

United States | 15,000,000 | 15,030,828 | |||||||||