UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04986

Franklin Investors Securities Trust

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area Code: (650) 312-2000

Date of fiscal year end: 10/31

Date of reporting period: 4/30/17

| Item 1. | Reports to Stockholders. |

Franklin Templeton Investments

Gain From Our Perspective®

At Franklin Templeton Investments, we’re dedicated to one goal: delivering exceptional asset management for our clients. By bringing together multiple, world-class investment teams in a single firm, we’re able to offer specialized expertise across styles and asset classes, all supported by the strength and resources of one of the world’s largest asset managers. This has helped us to become a trusted partner to individual and institutional investors across the globe.

Dear Shareholder:

1. Source: Morningstar.

See www.franklintempletondatasources.com for additional data provider information.

| Not FDIC Insured | May Lose Value | No Bank Guarantee |

| franklintempleton.com |

Not part of the semiannual report | 1 | ||

| 2 |

Semiannual Report | franklintempleton.com | ||

1. Source: Bureau of Labor Statistics.

2. Source: Morningstar.

See www.franklintempletondatasources.com for additional data provider information.

| franklintempleton.com |

Semiannual Report | 3 | ||

Franklin Balanced Fund

1. Source: Morningstar.

The indexes are unmanaged and include reinvestment of any income or distributions. They do not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 35.

| 4 |

Semiannual Report | franklintempleton.com | ||

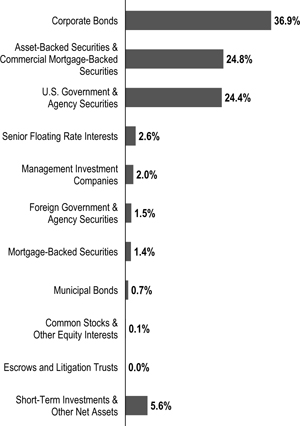

FRANKLIN BALANCED FUND

2. Banking companies are in financials in the equity section of the SOI.

| franklintempleton.com |

Semiannual Report | 5 | ||

FRANKLIN BALANCED FUND

| 6 |

Semiannual Report | franklintempleton.com | ||

FRANKLIN BALANCED FUND

4. Energy companies are in energy and utilities in the fixed income section of the SOI.

5. New position during the period.

See www.franklintempletondatasources.com for additional data provider information.

| franklintempleton.com |

Semiannual Report | 7 | ||

FRANKLIN BALANCED FUND

CFA® is a trademark owned by CFA Institute.

| 8 |

Semiannual Report | franklintempleton.com | ||

FRANKLIN BALANCED FUND

Performance Summary as of April 30, 2017

The performance tables do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 4/30/171

Cumulative total return excludes sales charges. Average annual total return include maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 5.75% and the minimum is 0%. Class A: 5.75% maximum initial sales charge; Advisor Class: no sales charges. For other share classes, visit franklintempleton.com.

| Share Class

|

Cumulative Total Return2

|

Average Annual Total Return3

| ||

| A

|

||||

| 6-Month

|

+6.24%

|

+0.14%

| ||

| 1-Year

|

+10.17%

|

+3.80%

| ||

| 5-Year

|

+43.14%

|

+6.16%

| ||

| 10-Year

|

+65.87%

|

+4.57%

| ||

| Advisor

|

||||

| 6-Month

|

+6.44%

|

+6.44%

| ||

| 1-Year

|

+10.50%

|

+10.50%

| ||

| 5-Year

|

+45.20%

|

+7.74%

| ||

| 10-Year

|

+70.96%

|

+5.51%

| ||

| Share Class | Distribution Rate4 |

30-Day Standardized Yield5 | ||||||

| (with waiver) | (without waiver) | |||||||

| A

|

2.82%

|

|

2.01%

|

|

1.98%

| |||

| Advisor

|

3.23%

|

|

2.38%

|

|

2.35%

| |||

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 10 for Performance Summary footnotes.

| franklintempleton.com |

Semiannual Report | 9 | ||

FRANKLIN BALANCED FUND

PERFORMANCE SUMMARY

Net Asset Value

| Share Class (Symbol) | 4/30/17 | 10/31/16 | Change | |||||||||||||||||

|

A (FBLAX)

|

|

$12.02

|

|

|

$11.65

|

|

|

+$0.37

|

| |||||||||||

|

C (FBMCX)

|

|

$11.91

|

|

|

$11.55

|

|

|

+$0.36

|

| |||||||||||

|

R (N/A)

|

|

$12.05

|

|

|

$11.67

|

|

|

+$0.38

|

| |||||||||||

|

R6 (FBFRX)

|

|

$12.04

|

|

|

$11.67

|

|

|

+$0.37

|

| |||||||||||

|

Advisor (FBFZX)

|

|

$12.04

|

|

|

$11.67

|

|

|

+$0.37

|

| |||||||||||

| Distributions (11/1/16–4/30/17) | ||||||||||||||||||||

| Share Class | Net Investment Income |

Long-Term Capital Gain |

Total | |||||||||||||||||

|

A

|

|

$0.1800

|

|

|

$0.1692

|

|

|

$0.3492

|

| |||||||||||

|

C

|

|

$0.1363

|

|

|

$0.1692

|

|

|

$0.3055

|

| |||||||||||

|

R

|

|

$0.1650

|

|

|

$0.1692

|

|

|

$0.3342

|

| |||||||||||

|

R6

|

|

$0.2008

|

|

|

$0.1692

|

|

|

$0.3700

|

| |||||||||||

|

Advisor

|

|

$0.1944

|

|

|

$0.1692

|

|

|

$0.3636

|

| |||||||||||

| Total Annual Operating Expenses6 | ||||||||||||

| Share Class | With Waiver | Without Waiver | ||||||||||

|

A

|

|

1.02

|

%

|

|

1.03%

|

| ||||||

|

Advisor

|

|

0.77

|

%

|

|

0.78%

|

| ||||||

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. The Fund’s share price and yield will be affected by interest rate movements. Bond prices generally move in the opposite direction of interest rates. As the prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has a fee waiver associated with any investment it makes in a Franklin Templeton money fund and/or other Franklin Templeton Fund, contractually guaranteed through 2/28/18. Fund investment results reflect the fee waiver; without this reduction, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Distribution rate is based on an annualization of the respective class’s April dividend and the maximum offering price (NAV for Advisor Class) per share on 4/30/17.

5. The Fund’s 30-day standardized yield is calculated over a trailing 30-day period using the yield to maturity on bonds and/or the dividends accrued on stocks. It may not equal the Fund’s actual income distribution rate, which reflects the Fund’s past dividends paid to shareholders.

6. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

| 10 |

Semiannual Report | franklintempleton.com | ||

FRANKLIN BALANCED FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| Actual (actual return after expenses) |

Hypothetical (5% annual return before expenses) |

|||||||||||||||||

| Share Class |

Beginning Account Value 11/1/16 |

Ending Account Value 4/30/17 |

Expenses Paid During |

Ending Account Value 4/30/17 |

Expenses Paid During |

Net Annualized Expense Ratio2 | ||||||||||||

| A |

$1,000 | $1,062.40 | $5.06 | $1,019.89 | $4.96 | 0.99% | ||||||||||||

| C |

$1,000 | $1,059.00 | $8.88 | $1,016.17 | $8.70 | 1.74% | ||||||||||||

| R |

$1,000 | $1,061.80 | $6.34 | $1,018.65 | $6.21 | 1.24% | ||||||||||||

| R6 |

$1,000 | $1,065.00 | $3.28 | $1,021.62 | $3.21 | 0.64% | ||||||||||||

| Advisor |

$1,000 | $1,064.40 | $3.79 | $1,021.12 | $3.71 | 0.74% | ||||||||||||

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 181/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

| franklintempleton.com |

Semiannual Report | 11 | ||

Franklin Convertible Securities Fund

1. Source: BofA Merrill Lynch.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

2. Not a Fund holding.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 46.

| 12 |

Semiannual Report | franklintempleton.com | ||

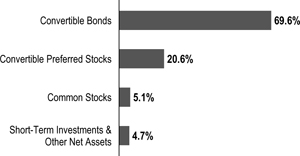

FRANKLIN CONVERTIBLE SECURITIES FUND

| franklintempleton.com |

Semiannual Report | 13 | ||

FRANKLIN CONVERTIBLE SECURITIES FUND

|

Alan E. Muschott, CFA | |

|

Matthew D. Quinlan | |

| Eric Webster, CFA | ||

| Portfolio Management Team | ||

| 14 |

Semiannual Report | franklintempleton.com | ||

FRANKLIN CONVERTIBLE SECURITIES FUND

Performance Summary as of April 30, 2017

The performance tables do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 4/30/171

Cumulative total return excludes sales charges. Average annual total return include maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 5.75% and the minimum is 0%. Class A: 5.75% maximum initial sales charge; Advisor Class: no sales charges. For other share classes, visit franklintempleton.com.

| Share Class | Cumulative Total Return2 |

Average Annual Total Return3 | ||

|

A

|

||||

| 6-Month |

+8.72%

|

+2.48%

| ||

|

1-Year |

+15.60%

|

+8.95%

| ||

|

5-Year |

+58.74%

|

+8.39%

| ||

|

10-Year

|

+79.30%

|

+5.38%

| ||

| Advisor4

|

||||

| 6-Month

|

+8.86%

|

+8.86%

| ||

| 1-Year

|

+15.90%

|

+15.90%

| ||

| 5-Year

|

+60.78%

|

+9.96%

| ||

| 10-Year

|

+83.44%

|

+6.25%

| ||

| Share Class | Distribution | 30-Day Standardized Yield6 | ||||||||||

| Rate5 | (with waiver) | (without waiver) | ||||||||||

| A

|

|

2.30%

|

|

|

1.33%

|

|

|

1.32%

|

| |||

| Advisor

|

|

2.68%

|

|

|

1.66%

|

|

|

1.64%

|

| |||

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 16 for Performance Summary footnotes.

| franklintempleton.com |

Semiannual Report | 15 | ||

FRANKLIN CONVERTIBLE SECURITIES FUND

PERFORMANCE SUMMARY

Distributions (11/1/16–4/30/17)

| Share Class | Net Investment Income |

Short-Term Capital Gain |

Long-Term Capital Gain |

Total | ||||||||||||||||||||||||||||||||||||

|

A

|

$0.2588 | $0.3076 | $0.0334 | $0.5998 | ||||||||||||||||||||||||||||||||||||

|

C

|

$0.1911 | $0.3076 | $0.0334 | $0.5321 | ||||||||||||||||||||||||||||||||||||

|

R6

|

$0.2930 | $0.3076 | $0.0334 | $0.6340 | ||||||||||||||||||||||||||||||||||||

|

Advisor

|

$0.2827 | $0.3076 | $0.0334 | $0.6237 | ||||||||||||||||||||||||||||||||||||

|

Total Annual Operating Expenses7

|

|

|||||||||||||||||||||||||||||||||||||||

| Share Class | With Waiver | Without Waiver | ||||

|

A

|

0.86% | 0.87% | ||||

|

Advisor

|

0.61% | 0.62% | ||||

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Convertible securities are subject to the risks of stocks when the underlying stock price is high relative to the conversion price (because more of the security’s value resides in the conversion feature) and debt securities when the underlying stock price is low relative to the conversion price (because the conversion feature is less valuable). A convertible security is not as sensitive to interest rate changes as a similar non-convertible debt security, and generally has less potential for gain or loss than the underlying stock. The Fund may invest in high yielding, fixed income securities. High yields reflect the higher credit risk associated with these lower rated securities and, in some cases, the lower market prices for these instruments. Interest rate movements may affect the Fund’s share price and yield. Bond prices generally move in the opposite direction of interest rates. As prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. The Fund may also invest in foreign securities, which involve special risks, including political uncertainty and currency volatility. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has a fee waiver associated with any investment it makes in a Franklin Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through 2/28/18. Fund investment results reflect the fee waiver; without this waiver, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Effective 5/15/08, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations for this class reflect the following methods of calculation: (a) For periods prior to 5/15/08, a restated figure is used based upon the Fund’s Class A performance, excluding the effect of Class A’s maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for periods after 5/15/08 actual Advisor Class performance is used reflecting all charges and fees applicable to that class. Since 5/15/08 (commencement of sales), the cumulative and average annual total returns of Advisor Class shares were +87.16% and +7.25%.

5. Distribution rate is based on the sum of the respective class’s past four quarterly dividends and the maximum offering price (NAV for Advisor Class) per share on 4/30/17.

6. The Fund’s 30-day standardized yield is calculated over a trailing 30-day period using the yield to maturity on bonds and/or the dividends accrued on stocks. It may not equal the Fund’s actual income distribution rate, which reflects the Fund’s past dividends paid to shareholders.

7. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

| 16 |

Semiannual Report | franklintempleton.com | ||

FRANKLIN CONVERTIBLE SECURITIES FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| Actual (actual return after expenses) |

Hypothetical (5% annual return before expenses) |

|||||||||||||||||

| Share Class |

Beginning Account Value 11/1/16 |

Ending Account Value 4/30/17 |

Expenses Paid During 11/1/16–4/30/171,2 |

Ending Account |

Expenses Paid During Period 11/1/16–4/30/171,2 |

Net Annualized Expense Ratio2 | ||||||||||||

| A |

$1,000 | $1,087.20 | $4.40 | $1,020.58 | $4.26 | 0.85% | ||||||||||||

| C |

$1,000 | $1,083.30 | $8.26 | $1,016.86 | $8.00 | 1.60% | ||||||||||||

| R6 |

$1,000 | $1,089.30 | $2.54 | $1,022.36 | $2.46 | 0.49% | ||||||||||||

| Advisor |

$1,000 | $1,088.60 | $3.11 | $1,021.82 | $3.01 | 0.60% | ||||||||||||

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above–in the far right column–multiplied by the simple average account value over the period indicated, and then multiplied by 181/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

| franklintempleton.com |

Semiannual Report | 17 | ||

1. Source: Morningstar.

2. Source: Lipper, a Thomson Reuters Company. For the 6-month period ended 4/30/17, this category consisted of 508 funds. Lipper calculations do not include sales charges, or expense subsidization by a fund’s manager. The Fund’s performance relative to the average may have differed if these and other factors had been considered.

The indexes are unmanaged and include reinvestment of any income or distributions. They do not include any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 55.

| 18 |

Semiannual Report | franklintempleton.com | ||

FRANKLIN EQUITY INCOME FUND

| franklintempleton.com |

Semiannual Report | 19 | ||

FRANKLIN EQUITY INCOME FUND

3. A new Fund holding.

4. Not held at period-end.

See www.franklintempletondatasources.com for additional data provider information.

| 20 |

Semiannual Report | franklintempleton.com | ||

FRANKLIN EQUITY INCOME FUND

| franklintempleton.com |

Semiannual Report | 21 | ||

FRANKLIN EQUITY INCOME FUND

Performance Summary as of April 30, 2017

The performance tables do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 4/30/171

Cumulative total return excludes sales charges. Average annual total return include maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 5.75% and the minimum is 0%. Class A: 5.75% maximum initial sales charge; Advisor Class: no sales charges. For other share classes, visit franklintempleton.com.

| Share Class

|

Cumulative Total Return2 |

Average Annual Total Return3 | ||

| A

|

||||

| 6-Month

|

+9.99% | +3.68% | ||

| 1-Year

|

+13.70% | +7.14% | ||

| 5-Year

|

+68.09% | +9.64% | ||

| 10-Year

|

+59.75% | +4.18% | ||

| Advisor4

|

||||

| 6-Month

|

+10.17% | +10.17% | ||

| 1-Year

|

+13.97% | +13.97% | ||

| 5-Year

|

+70.30% | +11.24% | ||

| 10-Year

|

+63.51% | +5.04% | ||

| Distribution | 30-Day Standardized Yield6 | |||||||||||

| Share Class | Rate5 | (with waiver) | (without waiver) | |||||||||

| A

|

|

2.13%

|

|

|

1.62%

|

|

|

1.62%

|

| |||

| Advisor

|

|

2.43%

|

|

|

1.97%

|

|

|

1.97%

|

| |||

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 23 for Performance Summary footnotes.

| 22 |

Semiannual Report | franklintempleton.com | ||

FRANKLIN EQUITY INCOME FUND

PERFORMANCE SUMMARY

Distributions (11/1/16–4/30/17)

| Share Class |

Net Investment Income |

Long-Term Capital Gain |

Total | |||||||||||||||||||||||||

| A

|

|

$0.2923

|

|

|

$0.8885

|

|

|

$1.1808

|

| |||||||||||||||||||

| C

|

|

$0.2078

|

|

|

$0.8885

|

|

|

$1.0963

|

| |||||||||||||||||||

| R

|

|

$0.2683

|

|

|

$0.8885

|

|

|

$1.1568

|

| |||||||||||||||||||

| R6

|

|

$0.3361

|

|

|

$0.8885

|

|

|

$1.2246

|

| |||||||||||||||||||

| Advisor

|

|

$0.3233

|

|

|

$0.8885

|

|

|

$1.2118

|

| |||||||||||||||||||

Total Annual Operating Expenses7

| Share Class | ||

| A

|

0.88%

| |

| Advisor

|

0.63%

|

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Convertible securities are subject to the risks of stocks when the underlying stock price is high relative to the conversion price and debt securities when the underlying stock price is low relative to the conversion price. The Fund’s investment in foreign securities also involves special risks, including currency fluctuations and economic as well as political uncertainty. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has a fee waiver associated with any investment it makes in a Franklin Templeton money fund and/or other Franklin Templeton Fund, contractually guaranteed through 2/28/18. Fund investment results reflect the fee waiver; without this waiver, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Effective 5/15/08, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations for this class reflect the following methods of calculation: (a) For periods prior to 5/15/08, a restated figure is used based upon the Fund’s Class A performance, excluding the effect of Class A’s maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for periods after 5/15/08, actual Advisor Class performance is used reflecting all charges and fees applicable to that class. Since 5/15/08 (commencement of sales), the cumulative and average annual total returns of Advisor Class shares were +77.77% and +6.63%.

5. Distribution rate is based on an annualization of the respective class’s current quarterly dividend and the maximum offering price (NAV for Advisor Class) per share on 4/30/17.

6. The Fund’s 30-day standardized yield is calculated over a trailing 30-day period using the yield to maturity on bonds and/or the dividends accrued on stocks. It may not equal the Fund’s actual income distribution rate, which reflects the Fund’s past dividends paid to shareholders.

7. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

| franklintempleton.com |

Semiannual Report | 23 | ||

FRANKLIN EQUITY INCOME FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| Actual (actual return after expenses) |

Hypothetical (5% annual return before expenses) |

|||||||||||||||||

| Share Class |

Beginning Value 11/1/16 |

Ending Account Value 4/30/17 |

Expenses Paid During 11/1/16–4/30/171,2 |

Ending Account Value 4/30/17 |

Expenses 11/1/16–4/30/171,2 |

Net Annualized Expense Ratio2 | ||||||||||||

| A |

$1,000 | $1,099.90 | $4.43 | $1,020.58 | $4.26 | 0.85% | ||||||||||||

| C |

$1,000 | $1,096.30 | $8.32 | $1,016.86 | $8.00 | 1.60% | ||||||||||||

| R |

$1,000 | $1,098.80 | $5.62 | $1,019.44 | $5.41 | 1.08% | ||||||||||||

| R6 |

$1,000 | $1,101.80 | $2.50 | $1,022.41 | $2.41 | 0.48% | ||||||||||||

| Advisor |

$1,000 | $1,101.70 | $3.13 | $1,021.82 | $3.01 | 0.60% | ||||||||||||

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 181/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

| 24 |

Semiannual Report | franklintempleton.com | ||

1. Source: Morningstar.

The indexes are unmanaged and include reinvestment of any income or distributions. They do not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

2. Source: Bureau of Labor Statistics, bls.gov/cpi.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 62.

| franklintempleton.com |

Semiannual Report | 25 | ||

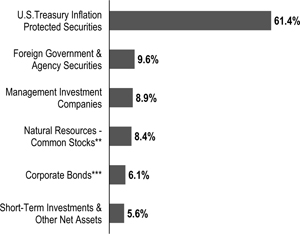

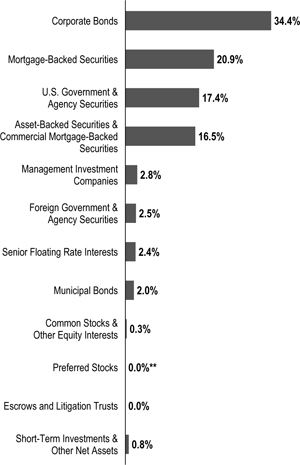

FRANKLIN REAL RETURN FUND

| 26 |

Semiannual Report | franklintempleton.com | ||

FRANKLIN REAL RETURN FUND

Performance Summary as of April 30, 2017

The performance tables do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 4/30/171

Cumulative total return excludes sales charges. Average annual total return include maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 4.25% and the minimum is 0%. Class A: 4.25% maximum initial sales charge; Advisor Class: no sales charges. For other share classes, visit franklintempleton.com.

| Share Class | Cumulative Total Return2 |

Average Annual Total Return3 | ||

| A

|

||||

| 6-Month

|

+0.98%

|

-3.33%

| ||

| 1-Year

|

+2.19%

|

-2.12%

| ||

| 5-Year

|

-0.33%

|

-0.93%

| ||

| 10-Year

|

+23.24%

|

+1.67%

| ||

| Advisor |

||||

| 6-Month

|

+1.11%

|

+1.11%

| ||

| 1-Year

|

+2.42%

|

+2.42%

| ||

| 5-Year

|

+0.84%

|

+0.17%

| ||

| 10-Year

|

+26.36%

|

+2.37%

| ||

| Distribution | 30-Day Standardized Yield5 | |||||||||||

| Share Class | Rate4 | (with waiver) | (without waiver) | |||||||||

| A |

0.99% | 1.58% | 1.37% | |||||||||

| Advisor |

2.58% | 1.91% | 1.68% | |||||||||

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 28 for Performance Summary footnotes.

| franklintempleton.com |

Semiannual Report | 27 | ||

FRANKLIN REAL RETURN FUND

PERFORMANCE SUMMARY

Distributions (11/1/16–4/30/17)

| Share Class | Net Investment Income |

|||

|

A

|

$0.0088 | |||

|

R6

|

$0.0292 | |||

|

Advisor

|

$0.0220 | |||

Total Annual Operating Expenses6

| Share Class | With Waiver | Without Waiver | ||||

| A |

0.93 | % | 1.15% | |||

| Advisor |

0.68 | % | 0.90% | |||

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Interest rate movements will affect the Fund’s share price and yield. Bond prices generally move in the opposite direction of interest rates. As prices of bonds in a Fund adjust to a rise in interest rates, the Fund’s share price may decline. Foreign securities involve special risks, including currency fluctuations and economic and political uncertainties. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has an expense reduction and a fee waiver associated with any investments it makes in a Franklin Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through 2/28/18. Fund investment results reflect the expense reduction and fee waiver; without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Distribution rate is based on an annualization of the respective class’s April dividend and the maximum offering price (NAV for Advisor Class) per share on 4/30/17.

5. The Fund’s 30-day standardized yield is calculated over a trailing 30-day period using the yield to maturity on bonds and/or the dividends accrued on stocks. It may not equal the Fund’s actual income distribution rate, which reflects the Fund’s past dividends paid to shareholders.

6. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

| 28 |

Semiannual Report | franklintempleton.com | ||

FRANKLIN REAL RETURN FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| Actual (actual return after expenses) |

Hypothetical (5% annual return before expenses) |

|||||||||||

| Share Class |

Beginning Account Value 11/1/16 |

Ending Account Value 4/30/17 |

Expenses Paid During 11/1/16–4/30/171,2 |

Ending Account Value 4/30/17 |

Expenses Paid During 11/1/16–4/30/171,2 |

Net Annualized Ratio2 | ||||||

|

|

|

|

| |||||||||

| A |

$1,000 | $1,009.80 | $4.48 | $1,020.33 | $4.51 | 0.90% | ||||||

| C |

$1,000 | $1,008.00 | $6.52 | $1,018.30 | $6.56 | 1.31% | ||||||

| R6 |

$1,000 | $1,011.70 | $2.44 | $1,022.36 | $2.46 | 0.49% | ||||||

| Advisor |

$1,000 | $1,011.10 | $3.24 | $1,021.57 | $3.26 | 0.65% | ||||||

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 181/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

| franklintempleton.com |

Semiannual Report | 29 | ||

FRANKLIN INVESTORS SECURITIES TRUST

Financial Highlights

Franklin Balanced Fund

| Six Months Ended April 30, 2017 (unaudited) |

||||||||||||||||||||||||

| Year Ended October 31, | ||||||||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||||||

|

Class A |

||||||||||||||||||||||||

| Per share operating performance |

||||||||||||||||||||||||

| (for a share outstanding throughout the period) |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$11.65 | $11.40 | $11.86 | $11.43 | $10.64 | $9.87 | ||||||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||||||

| Net investment incomeb |

0.14 | 0.30 | 0.30 | 0.31 | c | 0.27 | 0.30 | |||||||||||||||||

| Net realized and unrealized gains (losses) |

0.58 | 0.31 | (0.24 | ) | 0.65 | 1.02 | 0.83 | |||||||||||||||||

| Total from investment operations |

0.72 | 0.61 | 0.06 | 0.96 | 1.29 | 1.13 | ||||||||||||||||||

| Less distributions from: |

||||||||||||||||||||||||

| Net investment income |

(0.18 | ) | (0.36 | ) | (0.36 | ) | (0.36 | ) | (0.36 | ) | (0.36 | ) | ||||||||||||

| Net realized gains |

(0.17 | ) | (— | )d | (0.16 | ) | (0.17 | ) | (0.14 | ) | (— | )d | ||||||||||||

| Total distributions |

(0.35 | ) | (0.36 | ) | (0.52 | ) | (0.53 | ) | (0.50 | ) | (0.36 | ) | ||||||||||||

| Net asset value, end of period |

$12.02 | $11.65 | $11.40 | $11.86 | $11.43 | $10.64 | ||||||||||||||||||

| Total returne |

6.24% | 5.54% | 0.51% | 8.66% | 12.51% | 11.70% | ||||||||||||||||||

| Ratios to average net assetsf |

||||||||||||||||||||||||

| Expenses before waiver and payments by affiliates |

1.01% | 1.02% | 1.06% | 1.09% | 1.12% | 1.15% | ||||||||||||||||||

| Expenses net of waiver and payments by affiliates |

0.99% | g | 1.01% | g | 1.06% | g,h | 1.09% | g,h | 1.10% | g | 1.01% | |||||||||||||

| Net investment income |

2.36% | 2.62% | 2.56% | 2.64% | c | 2.51% | 2.95% | |||||||||||||||||

| Supplemental data |

||||||||||||||||||||||||

| Net assets, end of period (000’s) |

$2,633,337 | $2,532,459 | $2,371,133 | $2,053,623 | $1,354,710 | $627,287 | ||||||||||||||||||

| Portfolio turnover rate |

12.05% | 46.03% | 69.23% | 40.54% | 58.52% | 58.59% | ||||||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.03 per share related to income received in the form of a special dividend in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 2.39%.

dAmount rounds to less than $0.01 per share.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

hBenefit of waiver and payments by affiliates rounds to less than 0.01%.

| 30 |

Semiannual Report | The accompanying notes are an integral part of these financial statements. | franklintempleton.com | ||

FRANKLIN INVESTORS SECURITIES TRUST

FINANCIAL HIGHLIGHTS

Franklin Balanced Fund (continued)

| Six Months Ended April 30, 2017 (unaudited) |

Year Ended October 31, | |||||||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||||||

|

Class C |

||||||||||||||||||||||||

| Per share operating performance |

||||||||||||||||||||||||

| (for a share outstanding throughout the period) |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$11.55 | $11.31 | $11.77 | $11.34 | $10.57 | $9.81 | ||||||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||||||

| Net investment incomeb |

0.10 | 0.21 | 0.21 | 0.23 | c | 0.20 | 0.23 | |||||||||||||||||

| Net realized and unrealized gains (losses) |

0.57 | 0.31 | (0.23 | ) | 0.65 | 0.99 | 0.82 | |||||||||||||||||

| Total from investment operations |

0.67 | 0.52 | (0.02 | ) | 0.88 | 1.19 | 1.05 | |||||||||||||||||

| Less distributions from: |

||||||||||||||||||||||||

| Net investment income |

(0.14 | ) | (0.28 | ) | (0.28 | ) | (0.28 | ) | (0.28 | ) | (0.29 | ) | ||||||||||||

| Net realized gains |

(0.17 | ) | (— | )d | (0.16 | ) | (0.17 | ) | (0.14 | ) | (— | )d | ||||||||||||

| Total distributions |

(0.31 | ) | (0.28 | ) | (0.44 | ) | (0.45 | ) | (0.42 | ) | (0.29 | ) | ||||||||||||

| Net asset value, end of period |

$11.91 | $11.55 | $11.31 | $11.77 | $11.34 | $10.57 | ||||||||||||||||||

| Total returne |

5.90% | 4.73% | (0.20)% | 7.97% | 11.62% | 10.91% | ||||||||||||||||||

| Ratios to average net assetsf |

||||||||||||||||||||||||

| Expenses before waiver and payments by affiliates |

1.76% | 1.77% | 1.77% | 1.79% | 1.82% | 1.85% | ||||||||||||||||||

| Expenses net of waiver and payments by affiliates |

1.74% | g | 1.76% | g | 1.77% | g,h | 1.79% | g,h | 1.80% | g | 1.71% | |||||||||||||

| Net investment income |

1.61% | 1.87% | 1.85% | 1.94% | c | 1.81% | 2.25% | |||||||||||||||||

| Supplemental data |

||||||||||||||||||||||||

| Net assets, end of period (000’s) |

$663,322 | $630,110 | $563,419 | $492,514 | $354,359 | $187,991 | ||||||||||||||||||

| Portfolio turnover rate |

12.05% | 46.03% | 69.23% | 40.54% | 58.52% | 58.59% | ||||||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.03 per share related to income received in the form of a special dividend in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 1.69%.

dAmount rounds to less than $0.01 per share.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

hBenefit of waiver and payments by affiliates rounds to less than 0.01%.

| franklintempleton.com |

The accompanying notes are an integral part of these financial statements. | Semiannual Report | 31 | ||

FRANKLIN INVESTORS SECURITIES TRUST

FINANCIAL HIGHLIGHTS

Franklin Balanced Fund (continued)

| Six Months Ended April 30, 2017 (unaudited) |

Year Ended October 31, | |||||||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||||||

|

Class R |

||||||||||||||||||||||||

| Per share operating performance |

||||||||||||||||||||||||

| (for a share outstanding throughout the period) |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$11.67 | $11.42 | $11.89 | $11.45 | $10.66 | $9.89 | ||||||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||||||

| Net investment incomeb |

0.12 | 0.27 | 0.27 | 0.29 | c | 0.26 | 0.29 | |||||||||||||||||

| Net realized and unrealized gains (losses) |

0.60 | 0.32 | (0.24 | ) | 0.66 | 1.01 | 0.82 | |||||||||||||||||

| Total from investment operations |

0.72 | 0.59 | 0.03 | 0.95 | 1.27 | 1.11 | ||||||||||||||||||

| Less distributions from: |

||||||||||||||||||||||||

| Net investment income |

(0.17 | ) | (0.34 | ) | (0.34 | ) | (0.34 | ) | (0.34 | ) | (0.34 | ) | ||||||||||||

| Net realized gains |

(0.17 | ) | (— | )d | (0.16 | ) | (0.17 | ) | (0.14 | ) | (— | )d | ||||||||||||

| Total distributions |

(0.34 | ) | (0.34 | ) | (0.50 | ) | (0.51 | ) | (0.48 | ) | (0.34 | ) | ||||||||||||

| Net asset value, end of period |

$12.05 | $11.67 | $11.42 | $11.89 | $11.45 | $10.66 | ||||||||||||||||||

| Total returne |

6.18% | 5.28% | 0.21% | 8.51% | 12.26% | 11.46% | ||||||||||||||||||

| Ratios to average net assetsf |

||||||||||||||||||||||||

| Expenses before waiver and payments by affiliates |

1.26% | 1.27% | 1.27% | 1.29% | 1.32% | 1.35% | ||||||||||||||||||

| Expenses net of waiver and payments by affiliates |

1.24% | g | 1.26% | g | 1.27% | g,h | 1.29% | g,h | 1.30% | g | 1.21% | |||||||||||||

| Net investment income |

2.11% | 2.39% | 2.35% | 2.44% | c | 2.31% | 2.75% | |||||||||||||||||

| Supplemental data |

||||||||||||||||||||||||

| Net assets, end of period (000’s) |

$5,179 | $4,482 | $4,699 | $3,598 | $3,253 | $2,378 | ||||||||||||||||||

| Portfolio turnover rate |

12.05% | 46.03% | 69.23% | 40.54% | 58.52% | 58.59% | ||||||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.03 per share related to income received in the form of a special dividend in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 2.19%.

dAmount rounds to less than $0.01 per share.

eTotal return is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

hBenefit of waiver and payments by affiliates rounds to less than 0.01%.

| 32 |

Semiannual Report | The accompanying notes are an integral part of these financial statements. | franklintempleton.com | ||

FRANKLIN INVESTORS SECURITIES TRUST

FINANCIAL HIGHLIGHTS

Franklin Balanced Fund (continued)

| Six Months Ended April 30, 2017 (unaudited) |

Year Ended October 31, | |||||||||||||||||||

| 2016 | 2015 | 2014 | 2013a | |||||||||||||||||

|

Class R6 |

||||||||||||||||||||

| Per share operating performance |

||||||||||||||||||||

| (for a share outstanding throughout the period) |

||||||||||||||||||||

| Net asset value, beginning of period |

$11.67 | $11.42 | $11.89 | $11.45 | $11.08 | |||||||||||||||

| Income from investment operationsb: |

||||||||||||||||||||

| Net investment incomec |

0.14 | 0.34 | 0.35 | 0.37d | 0.19 | |||||||||||||||

| Net realized and unrealized gains (losses) |

0.60 | 0.31 | (0.25) | 0.65 | 0.38 | |||||||||||||||

| Total from investment operations |

0.74 | 0.65 | 0.10 | 1.02 | 0.57 | |||||||||||||||

| Less distributions from: |

||||||||||||||||||||

| Net investment income |

(0.20 | ) | (0.40 | ) | (0.41 | ) | (0.41 | ) | (0.20 | ) | ||||||||||

| Net realized gains |

(0.17) | (—)e | (0.16) | (0.17) | — | |||||||||||||||

| Total distributions |

(0.37) | (0.40) | (0.57) | (0.58) | (0.20) | |||||||||||||||

| Net asset value, end of period |

$12.04 | $11.67 | $11.42 | $11.89 | $11.45 | |||||||||||||||

| Total returnf |

6.50% | 5.90% | 0.81% | 9.29% | 5.15% | |||||||||||||||

| Ratios to average net assetsg |

||||||||||||||||||||

| Expenses before waiver and payments by affiliates |

0.70% | 0.73% | 0.70% | 0.68% | 1.82% | |||||||||||||||

| Expenses net of waiver and payments by affiliatesh |

0.64% | 0.66% | 0.67% | 0.68%i | 0.70% | |||||||||||||||

| Net investment income |

2.71% | 2.99% | 2.95% | 3.05%d | 2.91% | |||||||||||||||

| Supplemental data |

||||||||||||||||||||

| Net assets, end of period (000’s) |

$608 | $233 | $221 | $513 | $5 | |||||||||||||||

| Portfolio turnover rate |

12.05% | 46.03% | 69.23% | 40.54% | 58.52% | |||||||||||||||

aFor the period May 1, 2013 (effective date) to October 31, 2013.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dNet investment income per share includes approximately $0.03 per share related to income received in the form of a special dividend in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 2.80%.

eAmount rounds to less than $0.01 per share.

fTotal return is not annualized for periods less than one year.

gRatios are annualized for periods less than one year.

hBenefit of expense reduction rounds to less than 0.01%.

iBenefit of waiver and payments by affiliates rounds to less than 0.01%.

| franklintempleton.com |

The accompanying notes are an integral part of these financial statements. | Semiannual Report | 33 | ||

FRANKLIN INVESTORS SECURITIES TRUST

FINANCIAL HIGHLIGHTS

Franklin Balanced Fund (continued)

| Six Months Ended April 30, 2017 (unaudited) |

Year Ended October 31, | |||||||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||||||

|

Advisor Class |

||||||||||||||||||||||||

| Per share operating performance |

||||||||||||||||||||||||

| (for a share outstanding throughout the period) |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$11.67 | $11.42 | $11.88 | $11.45 | $10.66 | $9.89 | ||||||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||||||

| Net investment incomeb |

0.15 | 0.29 | 0.33 | 0.35 | c | 0.30 | 0.34 | |||||||||||||||||

| Net realized and unrealized gains (losses) |

0.58 | 0.35 | (0.24 | ) | 0.65 | 1.02 | 0.82 | |||||||||||||||||

| Total from investment operations |

0.73 | 0.64 | 0.09 | 1.00 | 1.32 | 1.16 | ||||||||||||||||||

| Less distributions from: |

||||||||||||||||||||||||

| Net investment income |

(0.19 | ) | (0.39 | ) | (0.39 | ) | (0.40 | ) | (0.39 | ) | (0.39 | ) | ||||||||||||

| Net realized gains |

(0.17 | ) | (— | )d | (0.16 | ) | (0.17 | ) | (0.14 | ) | (— | )d | ||||||||||||

| Total distributions |

(0.36 | ) | (0.39 | ) | (0.55 | ) | (0.57 | ) | (0.53 | ) | (0.39 | ) | ||||||||||||

| Net asset value, end of period |

$12.04 | $11.67 | $11.42 | $11.88 | $11.45 | $10.66 | ||||||||||||||||||

| Total returne |

6.44% | 5.79% | 0.81% | 8.97% | 12.82% | 12.01% | ||||||||||||||||||

| Ratios to average net assetsf |

||||||||||||||||||||||||

| Expenses before waiver and payments by affiliates |

0.76% | 0.77% | 0.77% | 0.79% | 0.82% | 0.85% | ||||||||||||||||||

| Expenses net of waiver and payments by affiliates |

0.74% | g | 0.76% | g | 0.77% | g,h | 0.79% | g,h | 0.80% | g | 0.71% | |||||||||||||

| Net investment income |

2.61% | 2.87% | 2.85% | 2.94% | c | 2.81% | 3.25% | |||||||||||||||||

| Supplemental data |

||||||||||||||||||||||||

| Net assets, end of period (000’s) |

$201,900 | $138,111 | $54,881 | $41,494 | $68,201 | $13,779 | ||||||||||||||||||

| Portfolio turnover rate |

12.05% | 46.03% | 69.23% | 40.54% | 58.52% | 58.59% | ||||||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.03 per share related to income received in the form of a special dividend in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 2.69%.

dAmount rounds to less than $0.01 per share.

eTotal return is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

hBenefit of waiver and payments by affiliates rounds to less than 0.01%.

| 34 |

Semiannual Report | The accompanying notes are an integral part of these financial statements. | franklintempleton.com | ||

FRANKLIN INVESTORS SECURITIES TRUST

Statement of Investments, April 30, 2017 (unaudited)

| Franklin Balanced Fund |

||||||||||||

| Country | Shares | Value | ||||||||||

| Common Stocks 44.2% |

||||||||||||

| Consumer Discretionary 4.5% |

||||||||||||

| Ford Motor Co. |

United States | 3,500,000 | $ | 40,145,000 | ||||||||

| General Motors Co. |

United States | 1,000,000 | 34,640,000 | |||||||||

| Lowe’s Cos. Inc. |

United States | 600,000 | 50,928,000 | |||||||||

| Nordstrom Inc. |

United States | 250,000 | 12,067,500 | |||||||||

| Target Corp. |

United States | 350,000 | 19,547,500 | |||||||||

|

|

|

|||||||||||

| 157,328,000 | ||||||||||||

|

|

|

|||||||||||

| Consumer Staples 5.7% |

||||||||||||

| Anheuser-Busch InBev SA/NV, ADR |

Belgium | 300,000 | 33,972,000 | |||||||||

| The Coca-Cola Co. |

United States | 1,200,000 | 51,780,000 | |||||||||

| Kimberly-Clark Corp. |

United States | 300,000 | 38,925,000 | |||||||||

| Philip Morris International Inc. |

United States | 300,000 | 33,252,000 | |||||||||

| Walgreens Boots Alliance Inc. |

United States | 500,000 | 43,270,000 | |||||||||

|

|

|

|||||||||||

| 201,199,000 | ||||||||||||

|

|

|

|||||||||||

| Energy 3.7% |

||||||||||||

| Chevron Corp. |

United States | 300,000 | 32,010,000 | |||||||||

| Exxon Mobil Corp. |

United States | 420,000 | 34,293,000 | |||||||||

| Occidental Petroleum Corp. |

United States | 400,000 | 24,616,000 | |||||||||

| Royal Dutch Shell PLC, A, ADR |

United Kingdom | 719,264 | 37,538,388 | |||||||||

|

|

|

|||||||||||

| 128,457,388 | ||||||||||||

|

|

|

|||||||||||

| Financials 7.3% |

||||||||||||

| Bank of America Corp. |

United States | 1,496,715 | 34,933,328 | |||||||||

| The Charles Schwab Corp. |

United States | 400,000 | 15,540,000 | |||||||||

| JPMorgan Chase & Co. |

United States | 450,000 | 39,150,000 | |||||||||

| T. Rowe Price Group Inc. |

United States | 400,000 | 28,356,000 | |||||||||

| The Toronto-Dominion Bank |

Canada | 750,000 | 35,317,500 | |||||||||

| U.S. Bancorp |

United States | 750,000 | 38,460,000 | |||||||||

| Wells Fargo & Co. |

United States | 1,200,000 | 64,608,000 | |||||||||

|

|

|

|||||||||||

| 256,364,828 | ||||||||||||

|

|

|

|||||||||||

| Health Care 4.1% |

||||||||||||

| AstraZeneca PLC, ADR |

United Kingdom | 985,000 | 29,796,250 | |||||||||

| Johnson & Johnson |

United States | 300,000 | 37,041,000 | |||||||||

| a Mylan NV |

United States | 355,800 | 13,289,130 | |||||||||

| Pfizer Inc |

United States | 1,250,000 | 42,400,000 | |||||||||

| Teva Pharmaceutical Industries Ltd., ADR |

Israel | 687,400 | 21,708,092 | |||||||||

|

|

|

|||||||||||

| 144,234,472 | ||||||||||||

|

|

|

|||||||||||

| Industrials 9.0% |

||||||||||||

| General Dynamics Corp. |

United States | 100,000 | 19,379,000 | |||||||||

| General Electric Co. |

United States | 2,000,000 | 57,980,000 | |||||||||

| Honeywell International Inc. |

United States | 225,000 | 29,506,500 | |||||||||

| Northrop Grumman Corp. |

United States | 125,000 | 30,745,000 | |||||||||

| Raytheon Co. |

United States | 360,000 | 55,875,600 | |||||||||

| Republic Services Inc. |

United States | 560,000 | 35,274,400 | |||||||||

| Union Pacific Corp. |

United States | 385,189 | 43,125,761 | |||||||||

| United Technologies Corp. |

United States | 353,592 | 42,073,912 | |||||||||

|

|

|

|||||||||||

| 313,960,173 | ||||||||||||

|

|

|

|||||||||||

| Information Technology 3.0% |

||||||||||||

| Microsoft Corp. |

United States | 1,000,000 | 68,460,000 | |||||||||

| Texas Instruments Inc. |

United States | 465,000 | 36,818,700 | |||||||||

|

|

|

|||||||||||

| 105,278,700 | ||||||||||||

|

|

|

|||||||||||

| franklintempleton.com |

Semiannual Report | 35 | ||

FRANKLIN INVESTORS SECURITIES TRUST

STATEMENT OF INVESTMENTS (UNAUDITED)

| Franklin Balanced Fund (continued) | ||||||||||||

| Country | Shares | Value | ||||||||||

| Common Stocks (continued) |

||||||||||||

| Materials 3.0% |

||||||||||||

| BASF SE |

Germany | 400,000 | $ | 38,979,513 | ||||||||

| The Dow Chemical Co. |

United States | 800,000 | 50,240,000 | |||||||||

| The Mosaic Co. |

United States | 560,000 | 15,080,800 | |||||||||

|

|

|

|||||||||||

| 104,300,313 | ||||||||||||

|

|

|

|||||||||||

| Real Estate 0.8% |

||||||||||||

| Host Hotels & Resorts Inc. |

United States | 1,500,000 | 26,925,000 | |||||||||

|

|

|

|||||||||||

| Telecommunication Services 2.2% |

||||||||||||

| Rogers Communications Inc., B |

Canada | 790,000 | 36,229,400 | |||||||||

| Verizon Communications Inc. |

United States | 900,000 | 41,319,000 | |||||||||

|

|

|

|||||||||||

| 77,548,400 | ||||||||||||

|

|

|

|||||||||||

| Utilities 0.9% |

||||||||||||

| Dominion Resources Inc. |

United States | 100,000 | 7,743,000 | |||||||||

| Entergy Corp. |

United States | 118,400 | 9,029,184 | |||||||||

| The Southern Co. |

United States | 330,000 | 16,434,000 | |||||||||

|

|

|

|||||||||||

| 33,206,184 | ||||||||||||

|

|

|

|||||||||||

| Total Common Stocks (Cost $1,322,630,221) |

1,548,802,458 | |||||||||||

|

|

|

|||||||||||

| Management Investment Companies 1.0% |

||||||||||||

| Financials 1.0% |

||||||||||||

| b Franklin Liberty Investment Grade Corporate ETF. |

United States | 750,000 | 18,262,500 | |||||||||

| iShares Core U.S. Aggregate Bond ETF |

United States | 160,000 | 17,480,000 | |||||||||

|

|

|

|||||||||||

| Total Management Investment Companies |

35,742,500 | |||||||||||

|

|

|

|||||||||||

| c Equity-Linked Securities 8.1% |

||||||||||||

| Energy 2.8% |

||||||||||||

| d Credit Suisse New York into Schlumberger Ltd., 7.50%, 144A |

United States | 320,000 | 23,478,176 | |||||||||

| d Royal Bank of Canada into Anadarko Petroleum Corp., 7.50%, 144A |

United States | 475,000 | 27,406,217 | |||||||||

| d The Goldman Sachs Group Inc. into Anadarko Petroleum Corp., 7.00%, 144A |

United States | 340,000 | 20,225,614 | |||||||||

| d Wells Fargo Bank National Assn. into Halliburton Co., 8.00%, 144A |

United States | 550,000 | 25,463,130 | |||||||||

|

|

|

|||||||||||

| 96,573,137 | ||||||||||||

|

|

|

|||||||||||

| Industrials 1.1% |

||||||||||||

| d Wells Fargo Bank National Assn. into The Boeing Co., 7.00%, 144A |

United States | 275,000 | 40,066,813 | |||||||||

|

|

|

|||||||||||

| Information Technology 3.2% |

||||||||||||

| d Citigroup Global Markets Holdings Inc. into Analog Devices Inc., 6.50%, 144A |

United States | 450,000 | 34,875,765 | |||||||||

| d Credit Suisse AG London into Apple Inc., 6.50%, 144A |

United States | 190,000 | 25,312,180 | |||||||||

| d Royal Bank of Canada into Texas Instruments Inc., 6.00%, 144A |

United States | 400,000 | 27,825,440 | |||||||||

| d UBS AG London into Intel Corp., 6.00%, 144A |

United States | 715,000 | 25,705,680 | |||||||||

|

|

|

|||||||||||

| 113,719,065 | ||||||||||||

|

|

|

|||||||||||

| Materials 1.0% |

||||||||||||

| d The Goldman Sachs Group Inc. into The Mosaic Co., 10.00%, 144A |

United States | 1,210,000 | 33,396,968 | |||||||||

|

|

|

|||||||||||

| Total Equity-Linked Securities (Cost $274,579,050) |

283,755,983 | |||||||||||

|

|

|

|||||||||||

| Convertible Preferred Stocks 3.7% |

||||||||||||

| Energy 0.7% |

||||||||||||

| Hess Corp., 8.00%, cvt. pfd. |

United States | 400,000 | 23,860,000 | |||||||||

|

|

|

|||||||||||

| Health Care 0.9% |

||||||||||||

| Allergan PLC, 5.50%, cvt. pfd. |

United States | 35,102 | 30,390,610 | |||||||||

|

|

|

|||||||||||

| 36 |

Semiannual Report | franklintempleton.com | ||

FRANKLIN INVESTORS SECURITIES TRUST

STATEMENT OF INVESTMENTS (UNAUDITED)

| Franklin Balanced Fund (continued) |

||||||||||||

| Country | Shares | Value | ||||||||||

| Convertible Preferred Stocks (continued) |

||||||||||||

| Real Estate 1.1% |

||||||||||||

| American Tower Corp., 5.50%, cvt. pfd. |

United States | 350,000 | $ | 40,348,875 | ||||||||

|

|

|

|||||||||||

| Utilities 1.0% |

||||||||||||

| Great Plains Energy Inc., 7.00%, cvt. pfd. |

United States | 324,000 | 17,528,400 | |||||||||

| NextEra Energy Inc., 6.371%, cvt. pfd. |

United States | 260,000 | 16,034,200 | |||||||||

|

|

|

|||||||||||

| 33,562,600 | ||||||||||||

|

|

|

|||||||||||

| Total Convertible Preferred Stocks (Cost $118,785,263) |

128,162,085 | |||||||||||

|

|

|

|||||||||||

| Preferred Stocks (Cost $7,750,000) 0.2% |

||||||||||||

| Financials 0.2% |

||||||||||||

| Morgan Stanley, 6.375%, pfd., I |

United States | 310,000 | 8,608,700 | |||||||||

|

|

|

|||||||||||

| Principal Amount* |

||||||||||||

| Convertible Bonds (Cost $15,000,000) 0.5% |

||||||||||||

| Energy 0.5% |

||||||||||||

| Weatherford International Ltd., cvt., senior note, 5.875%, 7/01/21 |

United States | $ | 15,000,000 | 17,868,750 | ||||||||

|

|

|

|||||||||||

| Corporate Bonds 32.0% |

||||||||||||

| Consumer Discretionary 4.1% |

||||||||||||

| Charter Communications Operating LLC/Charter Communications Operating Capital Corp., senior secured note, first lien, 4.908%, 7/23/25 |

United States | 20,000,000 | 21,482,480 | |||||||||

| DISH DBS Corp., |

||||||||||||

| senior note, 5.875%, 7/15/22 |

United States | 12,000,000 | 12,741,480 | |||||||||

| senior note, 7.75%, 7/01/26 |

United States | 10,000,000 | 11,737,500 | |||||||||

| Dollar General Corp., |

||||||||||||

| senior bond, 3.25%, 4/15/23 |

United States | 15,000,000 | 15,203,490 | |||||||||

| senior bond, 3.875%, 4/15/27 |

United States | 10,000,000 | 10,141,190 | |||||||||

| Ford Motor Credit Co. LLC, senior note, 2.551%, 10/05/18 |

United States | 5,000,000 | 5,035,915 | |||||||||

| NIKE Inc., senior bond, 2.375%, 11/01/26 |

United States | 20,000,000 | 18,996,780 | |||||||||

| d Sirius XM Radio Inc., senior bond, 144A, 5.375%, 4/15/25 |

United States | 15,000,000 | 15,431,250 | |||||||||

| Tiffany & Co., senior bond, 4.90%, 10/01/44 |

United States | 7,000,000 | 6,586,797 | |||||||||

| Trinity Acquisition PLC, senior note, 4.625%, 8/15/23 |

United States | 7,000,000 | 7,423,150 | |||||||||

| Yum! Brands Inc., senior bond, 3.875%, 11/01/23 |

United States | 17,950,000 | 17,792,937 | |||||||||

|

|

|

|||||||||||

| 142,572,969 | ||||||||||||

|

|

|

|||||||||||

| Consumer Staples 3.6% |

||||||||||||

| Anheuser-Busch InBev Finance Inc., senior bond, 4.90%, 2/01/46 |

Belgium | 15,000,000 | 16,449,075 | |||||||||

| CVS Health Corp., senior note, 3.875%, 7/20/25 |

United States | 10,000,000 | 10,415,780 | |||||||||

| Kraft Heinz Foods Co., |

||||||||||||

| senior bond, 3.50%, 6/06/22 |