UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-4984

AMERICAN BEACON FUNDS

(Exact name of registrant as specified in charter)

220 East Las Colinas Boulevard, Suite 1200

Irving, Texas 75039

(Address of principal executive offices)-(Zip code)

GENE L. NEEDLES, JR., PRESIDENT

220 East Las Colinas Boulevard, Suite 1200

Irving, Texas 75039

(Name and address of agent for service)

Registrant’s telephone number, including area code: (817) 391-6100

Date of fiscal year end: August 31, 2020

Date of reporting period: August 31, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

About American Beacon Advisors, Inc.

Since 1986, American Beacon Advisors, Inc. has offered a variety of products and investment advisory services to numerous institutional and retail clients, including a variety of mutual funds, corporate cash management, and separate account management.

Our clients include defined benefit plans, defined contribution plans, foundations, endowments, corporations, financial planners, and other institutional investors. With American Beacon Advisors, Inc., you can put the experience of a multi-billion dollar asset management firm to work for your company.

THE LONDON COMPANY INCOME EQUITY FUND

Investing in small- and medium-capitalization stocks may involve greater volatility and lower liquidity than larger company stocks. Investing in foreign securities may involve heightened risk due to currency fluctuations and economic and political risks. Investing in dividend-paying stocks may result in less earnings growth or capital appreciation than investing in non-dividend paying stocks. The use of fixed-income securities entails interest rate and credit risks. Because the Fund may invest in fewer issuers than a more diversified portfolio, the fluctuating value of a single holding may have a greater effect on the value of the Fund. The use of futures contracts for cash management may subject the Fund to losing more money than invested. The Fund participates in a securities lending program.

ZEBRA SMALL CAP EQUITY FUND

Investing in small-capitalization stocks may involve greater volatility and lower liquidity than larger company stocks. Investing in foreign securities may involve heightened risk due to currency fluctuations and economic and political risks. At times, certain securities may have limited marketability and may be difficult to sell. The use of futures contracts for cash management may subject the Fund to losing more money than invested. The Fund participates in a securities lending program.

Please see the prospectus for a complete discussion of the Funds’ risks. There can be no assurances that the investment objectives of these Funds will be met.

Any opinions herein, including forecasts, reflect our judgment as of the end of the reporting period and are subject to change. Each advisor’s strategies and the Fund’s portfolio composition will change depending on economic and market conditions. This report is not a complete analysis of market conditions and therefore, should not be relied upon as investment advice. Although economic and market information has been compiled from reliable sources, American Beacon Advisors, Inc. makes no representation as to the completeness or accuracy of the statements contained herein.

| American Beacon Funds |

August 31, 2020 |

| 1 | ||||

| 4 | ||||

| 9 | ||||

| 10 | ||||

| Schedules of Investments: |

||||

| 11 | ||||

| 14 | ||||

| 23 | ||||

| 27 | ||||

| Financial Highlights: |

||||

| 48 | ||||

| 54 | ||||

| 59 | ||||

| Disclosures Regarding the Approval of the Management and Investment Advisory Agreements |

60 | |||

| 65 | ||||

| 66 | ||||

| 72 | ||||

|

Additional Fund Information |

Back Cover |

|

Dear Shareholders,

Unlike anything we’ve experienced in our lifetimes, the COVID-19 pandemic continues to have an overwhelming effect on the world’s population, economies and markets. While news reports in the first half of this reporting period highlighted the many headwinds affecting the global economy and contributing to market volatility – including the U.S. trade war with China, Brexit, disruptions in the Middle East and protests in Hong Kong – the second half of this reporting period has been dominated by headlines related to the virus:

u On March 15, the Federal Reserve cut the federal funds rate by 100 basis points (1%) to a range of 0% to 0.25%, and announced quantitative easing would be unlimited. |

| u | Also in March, the U.S. government passed a stimulus package in three phases: phase one for approximately $8.3 billion, phase two for approximately $100 billion, and phase three for approximately $2 trillion. |

| u | On April 20, the price of U.S. oil turned negative for the first time in history, closing at -$37.60 per barrel for oil deliveries in May. However, by the end of August, the average crude oil spot price – which calculates an equally weighted price for West Texas Intermediate, Brent and Dubai crude oils – was $43.44 per barrel. |

| u | Although equity markets around the world have rebounded since the lows experienced earlier this year, uncertainty and volatility remain while economies continue to feel the effects of the pandemic. In the U.S., real gross domestic product had an annualized decline of 31.7% for the second quarter – reflecting the sharpest economic contraction in modern history, although slightly less than the 32.9% initially estimated. |

| u | As of August 30, the virus had infected more than 24.8 million individuals around the world, resulting in more than 838,000 deaths. The U.S. alone accounted for more than 5.8 million confirmed cases and more than 180,000 deaths. |

Now more than ever, we recognize that fear of loss can be a powerful emotion, leading many investors to make short-term decisions subject to a variety of potential error-leading biases. Unfortunately, short-term investment decisions may derail future plans. We encourage investors to maintain focus on their long-term financial goals, working with financial professionals to make thoughtful adjustments to their changing needs.

The three Ds – direction, discipline and diversification – may help frame this conversation.

| u | Direction: Achieving your long-term financial goals requires an individualized plan of action. You may want your plan to provide some measure of protection against periods of geopolitical turmoil, economic uncertainty, market volatility and job insecurity. Your plan should be reviewed annually and be adjusted in the event your long-range needs change. |

| u | Discipline: Long-term, systematic participation in an investment portfolio requires your resolution to stay the course. Spending time in the market – rather than trying to time the market – may place you in a better position to reach your long-term financial goals. |

| u | Diversification: By investing in different investment styles and asset classes, you may be able to help mitigate financial risks across your investment portfolio. By allocating your investment portfolio according to your risk-tolerance level, you may be better positioned to weather storms and achieve your long-term financial goals. |

1

President’s Message

American Beacon has endeavored to provide investors with a disciplined approach to realizing long-term financial goals since 1986. As a manager of managers, we strive to provide investment products that may enable investors to participate during market upswings while potentially insulating against market downswings. The investment teams behind our mutual funds seek to produce consistent, long-term results rather than focus only on short-term movements in the markets. In managing our investment products, we emphasize identifying opportunities that offer the potential for long-term rewards.

Thank you for staying the course with American Beacon. For additional information about our investment products or to access your account information, please visit our website at www.americanbeaconfunds.com.

Best Regards,

Gene L. Needles, Jr.

President

American Beacon Funds

2

Domestic Equity Market Overview

August 31, 2020 (Unaudited)

U.S. equities posted strong returns during the event-filled 12-month period ended August 31, 2020 – which included a global pandemic and significant monetary and fiscal stimulus during a domestic recession. The broader market, as measured by the Russell 3000 Index, rose 21.4%.

The period started with modest monthly gains from September through December 2019, driven by solid economic data and an accommodative Federal Reserve. Concerns about a slowing global economy led the Fed to reduce the federal funds rate a total of three times in 2019 – in August, September and October.

As we entered 2020, volatility in share prices picked up, reflecting concerns about the novel coronavirus. As COVID-19 began to spread around the world, share prices weakened. U.S. stocks declined in each of the first three months of the calendar year and at an accelerated pace each month. By March, many businesses across the country were shut down in an attempt to limit the spread of COVID-19. In February, the National Bureau of Economic Research declared a recession in the U.S.

In response to the recession, the Fed was very active and quickly reduced the federal funds rate to a range of 0% to 0.25%, announced unlimited quantitative easing and created an alphabet soup of facilities designed to improve liquidity across the economy. At the same time, the federal government passed fiscal stimulus bills to put more cash in the hands of consumers, including generous unemployment benefits for multiple months.

The fiscal and monetary stimulus helped the economy and improved investor sentiment for stocks. Beginning in April, stocks traded higher for the next five months. Signs of an improving economy, declining unemployment following a peak in April, a slowing in the growth rate of the virus, and hopes for a vaccine led to higher stock prices.

Over the period, large-cap stocks posted the strongest returns. The Russell 1000 Index rose 22.5%. In comparison, small-cap stocks lagged the broader market; the Russell 2000 Index rose 6.0%. Growth significantly outperformed Value across the market-cap spectrum. The Russell 3000 Growth Index rose more than 42% versus a roughly flat return for the Russell 3000 Value Index. The Value indexes posted negative one-year returns in the small- and mid-cap spaces. Cyclical sectors outperformed the more defensive sectors.

3

American Beacon The London Company Income Equity FundSM

August 31, 2020 (Unaudited)

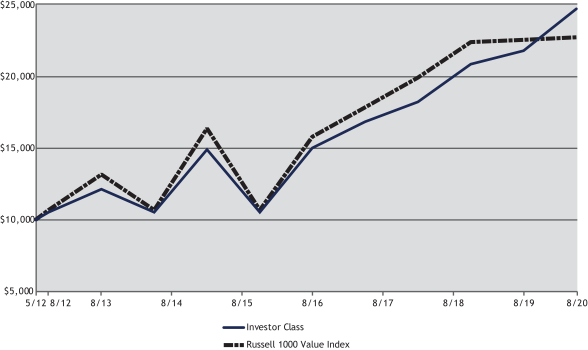

The Investor Class of the American Beacon The London Company Income Equity Fund (the “Fund”) returned 13.38% for the twelve-month period ended August 31, 2020, compared to the Russell 1000® Value Index (the “Index”) return of 0.84% for the same period.

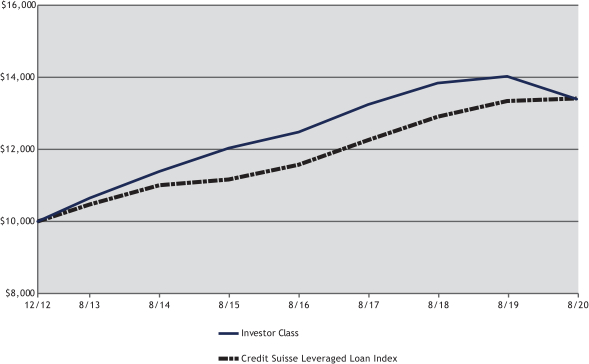

Comparison of Change in Value of a $10,000 Investment for the Period from 5/29/2012 through 8/31/2020

| Total Returns for the Period ended August 31, 2020 |

| |||||||||||||||||||||||||||||||

|

Ticker |

1 Year |

3 Years |

5 Years |

Since Inception |

Value of

$10,000 | |||||||||||||||||||||||||||

| R5 Class** (1,2,4) |

ABCIX | 13.81 | % | 11.02 | % | 10.85 | % | 11.92 | % | $ | 25,346 | |||||||||||||||||||||

| Y Class (1,2,4) |

ABCYX | 13.70 | % | 10.93 | % | 10.76 | % | 11.84 | % | $ | 25,189 | |||||||||||||||||||||

| Investor Class (1,2,4) |

ABCVX | 13.38 | % | 10.65 | % | 10.47 | % | 11.55 | % | $ | 24,657 | |||||||||||||||||||||

| A Class with sales Charge (1,2,4) |

ABCAX | 6.94 | % | 8.52 | % | 9.16 | % | 10.69 | % | $ | 23,137 | |||||||||||||||||||||

| A Class without sales charge (1,2,4) |

ABCAX | 13.44 | % | 10.67 | % | 10.47 | % | 11.49 | % | $ | 24,548 | |||||||||||||||||||||

| C Class with sales charge (1,2,4) |

ABECX | 11.59 | % | 9.83 | % | 9.63 | % | 10.65 | % | $ | 23,071 | |||||||||||||||||||||

| C Class without sales charge (1,2,4) |

ABECX | 12.59 | % | 9.83 | % | 9.63 | % | 10.65 | % | $ | 23,071 | |||||||||||||||||||||

| R6 Class (1,4,5) |

ABCRX | 13.75 | % | 11.00 | % | 10.84 | % | 11.91 | % | $ | 25,333 | |||||||||||||||||||||

| Russell 1000® Value Index (3) |

0.84 | % | 4.50 | % | 7.53 | % | 10.42 | % | $ | 22,685 | ||||||||||||||||||||||

| ** | Prior to February 28, 2020, the R5 Class was known as Institutional Class. |

| 1. | Performance shown is historical and is not indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is calculated based on the published end of day net asset values as of date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit www.americanbeaconfunds.com or call 1-800- 967-9009. Fund performance in the table above does not reflect the deduction of taxes a shareholder would pay on distributions or the redemption of shares. Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights. A Class shares have a maximum sales charge of 5.75%. The maximum contingent deferred sales charge for the C Class is 1.00% for shares redeemed within one year of the date of purchase. |

| 2. | A portion of the fees charged to the R5 Class of the Fund was waived from 2012 through 2014, partially recovered in 2015 and fully recovered in 2016. Performance prior to waiving fees was lower than actual returns shown for 2012 through 2014. A portion of the fees charged to the Investor Class of |

4

American Beacon The London Company Income Equity FundSM

Performance Overview

August 31, 2020 (Unaudited)

| the Fund was waived in 2012 and 2013 and fully recovered in 2014 and 2015. Performance prior to waiving fees was lower than actual returns shown in 2012 and 2013. A portion of the fees charged to the Y, A, and C Classes of the Fund was waived from 2012 through 2014 and fully recovered in 2015. Performance prior to waiving fees was lower than actual returns shown for 2012 through 2014. |

| 3. | The Russell 1000 Value Index is an unmanaged index of those stocks in the Russell 1000 Index with lower price-to-book ratios and lower forecasted growth values. The Russell 1000 Value Index and the Russell 1000 Index (each an “Index”) are trademarks of Frank Russell Company (“Russell”) and have been licensed for use by American Beacon Funds. The American Beacon The London Company Income Equity Fund is not in any way sponsored, endorsed, sold or promoted by Russell or the London Stock Exchange Group companies (“LSEG”) (together the “Licensor Parties”) and none of the Licensor Parties make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to (i) the results to be obtained from the use of the Index (upon which a fund is based), (ii) the figure at which the Index is said to stand at any particular time on any particular day or otherwise, or (iii) the suitability of the Index for the purpose to which it is being put in connection with a Fund. None of the Licensor Parties have provided or will provide any financial or investment advice or recommendation in relation to the Index to any fund or to its clients. The Index is calculated by Russell or its agent. None of the Licensor Parties shall be (a) liable (whether in negligence or otherwise) to any person for any error in the Index or (b) under any obligation to advise any person of any error therein. |

| 4. | The Total Annual Fund Operating Expense ratios set forth in the most recent Fund prospectus for the R5, Y, Investor, A, C, and R6 Class shares were 0.73%, 0.80%, 1.06%, 1.05%, 1.82%, and 0.83%, respectively. The expense ratios above may vary from the expense ratios presented in other sections of this report that are based on expenses incurred during the period covered by this report. |

| 5. | Fund performance for the periods shown represents the returns achieved by the R5 Class from 5/29/12 up to 8/25/20, the inception date of the R6 Class, and the returns of the R6 Class since its inception. Expenses of the R6 Class are lower than those of the R5 Class. Therefore, total returns shown may be lower than they would have been had the R6 Class been in existence since 5/29/12. |

The Fund outperformed the Index due to stock selection and sector allocation during the period.

From a security selection standpoint, the Fund’s holdings in the Information Technology and Industrials sectors were the largest contributors to the Fund’s outperformance relative to the Index. In the Information Technology sector, positions in Apple, Inc. (up 152.3%) and Microsoft Corp. (up 64.9%) contributed to relative returns. Companies contributing to performance in the Industrials sector included Fastenal Co. (up 62.1%) and United Parcel Service, Inc., Class B (up 42.1%). The aforementioned strong performance was somewhat offset by security selection in the Consumer Staples and Health Care sectors. In the Consumer Staples sector, a position in Diageo PLC, Sponsored ADR (down 19.9%) detracted, and an absence from index-position Danaher Corp. (up 46.0%) in the Health Care sector also hurt relative returns.

From a sector allocation perspective, the Fund’s overweight position in the Information Technology sector (up 13.9%), and underweight positions in the Energy sector (down 33.2%) and Financials sector (down 8.7%) helped relative performance. This performance was somewhat offset by an underweight position in the Health Care sector (up 19.1%).

5

American Beacon The London Company Income Equity FundSM

Performance Overview

August 31, 2020 (Unaudited)

The sub-advisor’s investment process focuses on downside protection, current income and total return appreciation.

| Top Ten Holdings (% Net Assets) | ||||||||

| Apple, Inc. | 5.7 | |||||||

| Berkshire Hathaway, Inc., Class B | 4.9 | |||||||

| Lowe’s Cos., Inc. | 4.5 | |||||||

| Microsoft Corp. | 4.5 | |||||||

| BlackRock, Inc. | 3.9 | |||||||

| Johnson & Johnson | 3.9 | |||||||

| United Parcel Service, Inc., Class B | 3.8 | |||||||

| Norfolk Southern Corp. | 3.7 | |||||||

| Texas Instruments, Inc. | 3.7 | |||||||

| Air Products and Chemicals, Inc. | 3.5 | |||||||

| Total Fund Holdings | 30 | |||||||

| Sector Allocation (% Equities) | ||||||||

| Information Technology | 23.4 | |||||||

| Financials | 14.2 | |||||||

| Consumer Staples | 12.3 | |||||||

| Industrials | 11.2 | |||||||

| Health Care | 11.1 | |||||||

| Consumer Discretionary | 8.1 | |||||||

| Communication Services | 6.4 | |||||||

| Materials | 3.8 | |||||||

| Real Estate | 3.7 | |||||||

| Utilities | 3.3 | |||||||

| Energy | 2.5 | |||||||

6

American Beacon Zebra Small Cap Equity FundSM

Performance Overview

August 31, 2020 (Unaudited)

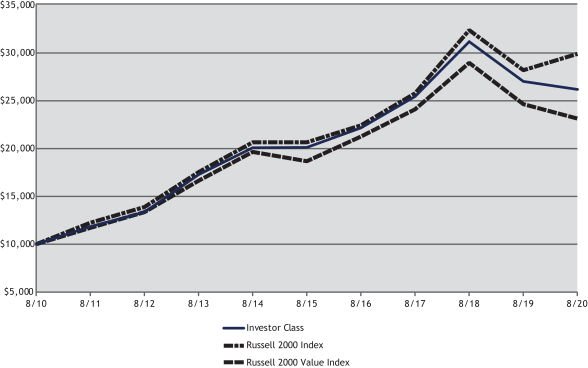

The Investor Class of the American Beacon Zebra Small Cap Equity Fund (the “Fund”) returned -3.05% for the twelve months ended August 31, 2020, which was less than the Russell 2000® Index (the “Index”) return of 6.02%. The Fund underperformed the Index due to stock selection and, to a lesser extent, sector allocation.

Comparison of Change in Value of a $10,000 Investment for the Period from 8/31/2010 through 8/31/2020

| Total Returns for the Period ended August 31, 2020 |

| |||||||||||||||||||||||||||||||

|

Ticker |

1 Year |

3 Years |

5 Years |

10 Years |

Value of $10,000 8/31/2010- 8/31/2020 | |||||||||||||||||||||||||||

| R5 Class** (1,2,4) |

AZSIX | (2.70 | )% | 1.37 | % | 5.81 | % | 10.49 | % | $ | 27,122 | |||||||||||||||||||||

| Y Class (1,2,4) |

AZSYX | (2.75 | )% | 1.27 | % | 5.71 | % | 10.40 | % | $ | 26,884 | |||||||||||||||||||||

| Investor Class (1,2,4) |

AZSPX | (3.05 | )% | 0.99 | % | 5.40 | % | 10.07 | % | $ | 26,104 | |||||||||||||||||||||

| A Class with sales Charge (1,2,4) |

AZSAX | (8.69 | )% | (1.01 | )% | 4.14 | % | 9.37 | % | $ | 24,493 | |||||||||||||||||||||

| A Class without sales charge (1,2,4) |

AZSAX | (3.10 | )% | 0.96 | % | 5.38 | % | 10.03 | % | $ | 25,997 | |||||||||||||||||||||

| C Class with sales charge (1,2,4) |

AZSCX | (4.78 | )% | 0.20 | % | 4.59 | % | 9.18 | % | $ | 24,077 | |||||||||||||||||||||

| C Class without sales charge (1,2,4) |

AZSCX | (3.78 | )% | 0.20 | % | 4.59 | % | 9.18 | % | $ | 24,077 | |||||||||||||||||||||

| Russell 2000® Index (3) |

6.02 | % | 5.03 | % | 7.65 | % | 11.53 | % | $ | 29,775 | ||||||||||||||||||||||

| Russell 2000® Value Index (3) |

(6.14 | )% | (1.39 | )% | 4.37 | % | 8.71 | % | $ | 23,050 | ||||||||||||||||||||||

| ** | Prior to February 28, 2020, the R5 Class was known as Institutional Class. |

| 1. | Performance shown is historical and is not indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is calculated based on the published end of day net asset values as of date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit www.americanbeaconfunds.com or call 1-800-967-9009. Fund performance in the table above does not reflect the deduction of taxes a shareholder would pay on distributions or the redemption of shares. Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights. A Class shares have a maximum sales charge of 5.75%. The maximum contingent deferred sales charge is 1.00% for C Class shares redeemed within one year of the date of purchase. |

7

American Beacon Zebra Small Cap Equity FundSM

Performance Overview

August 31, 2020 (Unaudited)

| 2. | A portion of the fees charged to each Class of the Fund has been waived since Fund inception. Performance prior to waiving fees was lower than the actual returns shown since inception. |

| 3. | The Russell 2000 Value Index is an unmanaged index of those stocks in the Russell 2000 Index with lower price-to-book ratios and lower forecasted growth values. The Russell 2000 Value Index and the Russell 2000 Index (each an “Index”) are trademarks of Frank Russell Company (“Russell”) and have been licensed for use by American Beacon Funds. The American Beacon Zebra Small Cap Equity Fund is not in any way sponsored, endorsed, sold or promoted by Russell or the London Stock Exchange Group companies (“LSEG”) (together the “Licensor Parties”) and none of the Licensor Parties make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to (i) the results to be obtained from the use of the Index (upon which a fund is based), (ii) the figure at which the Index is said to stand at any particular time on any particular day or otherwise, or (iii) the suitability of the Index for the purpose to which it is being put in connection with a Fund. None of the Licensor Parties have provided or will provide any financial or investment advice or recommendation in relation to the Index to any fund or to its clients. The Index is calculated by Russell or its agent. None of the Licensor Parties shall be (a) liable (whether in negligence or otherwise) to any person for any error in the Index or (b) under any obligation to advise any person of any error therein. |

| 4. | The Total Annual Fund Operating Expense ratios set forth in the most recent Fund prospectus for the R5, Y, Investor, A, and C Class shares were 1.22%, 1.24%, 1.50%, 1.53%, and 2.29%, respectively. The expense ratios above may vary from the expense ratios presented in other sections of this report that are based on expenses incurred during the period covered by this report. |

Stock selection in the Consumer Discretionary, Health Care and Industrials sectors detracted the most from relative performance. In the Consumer Discretionary sector, Denny’s Corp. (down 42.5%) negatively impacted performance, while positions in Orthofix Medical, Inc., (down 42.5%) and Herman Miller, Inc. (down 41.6%) in the Health Care and Industrials sectors, respectively, detracted from relative returns.

This was offset somewhat by positive stock selection in the Utilities sector, where the Fund was absent from Index-positions Portland General Electric (down 30.8%) and Allete, Inc. (down 34.6%).

From a sector allocation perspective, the Fund was hurt by an overweight allocation to Financials (down 15.9%). Underweighting Energy (down 42.1%), the worst performing sector in the Index, was positive for the Fund’s relative performance during the period.

The sub-advisor continues to focus on uncovering opportunities by investing in a portfolio of securities that are generally less popular with investors but nevertheless have strong fundamental characteristics. At the same time the portfolio will be underweight stocks that are heavily followed but have weak fundamentals. This contrarian style has tended to result in a portfolio with very good risk-adjusted returns over time.

| Top Ten Holdings (% Net Assets) | ||||||||

| WD-40 Co. | 1.7 | |||||||

| Sykes Enterprises, Inc. | 1.6 | |||||||

| Insight Enterprises, Inc. | 1.4 | |||||||

| Innospec, Inc. | 1.3 | |||||||

| Orthofix Medical, Inc. | 1.3 | |||||||

| Franklin Electric Co., Inc. | 1.2 | |||||||

| Getty Realty Corp. | 1.2 | |||||||

| McGrath RentCorp | 1.2 | |||||||

| OSI Systems, Inc. | 1.2 | |||||||

| PS Business Parks, Inc. | 1.2 | |||||||

| Total Fund Holdings | 284 | |||||||

| Sector Allocation (% Equities) | ||||||||

| Health Care | 16.3 | |||||||

| Industrials | 15.5 | |||||||

| Information Technology | 15.5 | |||||||

| Financials | 15.0 | |||||||

| Consumer Discretionary | 13.0 | |||||||

| Real Estate | 9.4 | |||||||

| Consumer Staples | 5.6 | |||||||

| Materials | 4.7 | |||||||

| Communication Services | 3.1 | |||||||

| Energy | 1.0 | |||||||

| Utilities | 0.9 | |||||||

8

American Beacon FundsSM

August 31, 2020 (Unaudited)

| American Beacon The London Company Income Equity Fund |

| ||||||||||||||

| Beginning Account Value 3/1/2020 |

Ending Account Value 8/31/2020 |

Expenses Paid During Period 3/1/2020-8/31/2020* | |||||||||||||

| R5 Class** | |||||||||||||||

| Actual | $1,000.00 | $1,160.20 | $4.13 | ||||||||||||

| Hypothetical*** | $1,000.00 | $1,021.32 | $3.86 | ||||||||||||

| Y Class | |||||||||||||||

| Actual | $1,000.00 | $1,159.60 | $4.45 | ||||||||||||

| Hypothetical*** | $1,000.00 | $1,021.01 | $4.17 | ||||||||||||

| Investor Class | |||||||||||||||

| Actual | $1,000.00 | $1,157.90 | $5.80 | ||||||||||||

| Hypothetical*** | $1,000.00 | $1,019.76 | $5.43 | ||||||||||||

| A Class | |||||||||||||||

| Actual | $1,000.00 | $1,158.50 | $5.75 | ||||||||||||

| Hypothetical*** | $1,000.00 | $1,019.81 | $5.38 | ||||||||||||

| C Class | |||||||||||||||

| Actual | $1,000.00 | $1,153.60 | $9.85 | ||||||||||||

| Hypothetical*** | $1,000.00 | $1,015.99 | $9.22 | ||||||||||||

| R6 Class**** | |||||||||||||||

| Actual | $1,000.00 | $1,007.40 | $0.12 | ||||||||||||

| Hypothetical | $1,000.00 | $1,021.47 | $3.71 | ||||||||||||

| * | Expenses are equal to the Fund’s annualized expense ratios for the six-month period of 0.76%, 0.82%, 1.07%, 1.06%, 1.82%, and 0.71% for the R5, Y, Investor, A, C, and R6 Classes, respectively, multiplied by the average account value over the period, multiplied by the number derived by dividing the number of days in the most recent fiscal half-year (184) by days in the year (366) to reflect the half-year period. |

| ** | Formerly known as Institutional Class. |

| *** | 5% return before expenses. |

| **** | American Beacon The London Company Income Equity Fund’s R6 Class commenced operations on August 26, 2020. Expenses are equal to the fund’s annualized expense ratio for the period, multiplied by the average account value over the period, multiplied by the number of days since inception (6), then divided by the number of days in the year (366) to reflect the period. The Ending Account Value is derived from the fund’s share class actual return since inception. The Hypothetical 5% Annual Return information reflects the (184) day period for the six months ended August 31, 2020 to allow for comparability. |

| American Beacon Zebra Small Cap Equity Fund |

| ||||||||||||||

| Beginning Account Value 3/1/2020 |

Ending Account Value 8/31/2020 |

Expenses Paid During Period 3/1/2020-8/31/2020* | |||||||||||||

| R5 Class** | |||||||||||||||

| Actual | $1,000.00 | $1,013.20 | $4.50 | ||||||||||||

| Hypothetical*** | $1,000.00 | $1,020.66 | $4.52 | ||||||||||||

| Y Class | |||||||||||||||

| Actual | $1,000.00 | $1,012.40 | $5.01 | ||||||||||||

| Hypothetical*** | $1,000.00 | $1,020.16 | $5.03 | ||||||||||||

| Investor Class | |||||||||||||||

| Actual | $1,000.00 | $1,011.20 | $6.42 | ||||||||||||

| Hypothetical*** | $1,000.00 | $1,018.75 | $6.44 | ||||||||||||

| A Class | |||||||||||||||

| Actual | $1,000.00 | $1,011.20 | $6.52 | ||||||||||||

| Hypothetical*** | $1,000.00 | $1,018.65 | $6.55 | ||||||||||||

| C Class | |||||||||||||||

| Actual | $1,000.00 | $1,007.90 | $10.30 | ||||||||||||

| Hypothetical*** | $1,000.00 | $1,014.88 | $10.33 | ||||||||||||

| * | Expenses are equal to the Fund’s annualized expense ratios for the six-month period of 0.89%, 0.99%, 1.27%, 1.29%, and 2.04% for the R5, Y, Investor, A, and C Classes, respectively, multiplied by the average account value over the period, multiplied by the number derived by dividing the number of days in the most recent fiscal half-year (184) by days in the year (366) to reflect the half-year period. |

| ** | Formerly known as Institutional Class. |

| *** | 5% return before expenses. |

9

American Beacon FundsSM

Report of Independent Registered Public Accounting Firm

To the Shareholders of American Beacon The London Company Income Equity Fund and American Beacon Zebra Small Cap Equity Fund and the Board of Trustees of American Beacon Funds

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities of American Beacon The London Company Income Equity Fund and American Beacon Zebra Small Cap Equity Fund (collectively referred to as the “Funds”), (two of the funds constituting American Beacon Funds (the “Trust”)), including the schedules of investments, as of August 31, 2020, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of each of the Funds (two of the funds constituting American Beacon Funds) at August 31, 2020, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended and their financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Trust’s management. Our responsibility is to express an opinion on each of the Funds’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Trust in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Trust is not required to have, nor were we engaged to perform, an audit of the Trust’s internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Trust’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of August 31, 2020, by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more American Beacon investment companies since 1987.

Dallas, Texas

October 28, 2020

10

American Beacon The London Company Income Equity FundSM

Schedule of Investments

August 31, 2020

| Shares | Fair Value | ||||||||||||||

| COMMON STOCKS - 93.51% | |||||||||||||||

| Communication Services - 5.98% | |||||||||||||||

| Diversified Telecommunication Services - 3.12% | |||||||||||||||

| Verizon Communications, Inc. | 695,649 | $ | 41,231,116 | ||||||||||||

|

|

|

||||||||||||||

| Entertainment - 2.86% | |||||||||||||||

| Nintendo Co., Ltd., ADRA | 560,386 | 37,753,205 | |||||||||||||

|

|

|

||||||||||||||

| Total Communication Services |

78,984,321 | ||||||||||||||

|

|

|

||||||||||||||

| Consumer Discretionary - 7.57% | |||||||||||||||

| Multiline Retail - 3.07% | |||||||||||||||

| Target Corp. | 268,071 | 40,535,016 | |||||||||||||

|

|

|

||||||||||||||

| Specialty Retail - 4.50% | |||||||||||||||

| Lowe’s Cos., Inc. | 360,927 | 59,441,067 | |||||||||||||

|

|

|

||||||||||||||

| Total Consumer Discretionary |

99,976,083 | ||||||||||||||

|

|

|

||||||||||||||

| Consumer Staples - 11.54% | |||||||||||||||

| Beverages - 4.05% | |||||||||||||||

| Coca-Cola Co. | 412,149 | 20,413,740 | |||||||||||||

| Diageo PLC, Sponsored ADRA | 246,290 | 33,101,376 | |||||||||||||

|

|

|

||||||||||||||

| 53,515,116 | |||||||||||||||

|

|

|

||||||||||||||

| Food Products - 2.71% | |||||||||||||||

| Nestle S.A., Sponsored ADR | 297,578 | 35,829,879 | |||||||||||||

|

|

|

||||||||||||||

| Tobacco - 4.78% | |||||||||||||||

| Altria Group, Inc. | 792,817 | 34,677,816 | |||||||||||||

| Philip Morris International, Inc. | 355,795 | 28,388,883 | |||||||||||||

|

|

|

||||||||||||||

| 63,066,699 | |||||||||||||||

|

|

|

||||||||||||||

| Total Consumer Staples |

152,411,694 | ||||||||||||||

|

|

|

||||||||||||||

| Energy - 2.37% | |||||||||||||||

| Oil, Gas & Consumable Fuels - 2.37% | |||||||||||||||

| Chevron Corp. | 372,178 | 31,236,900 | |||||||||||||

|

|

|

||||||||||||||

| Financials - 13.26% | |||||||||||||||

| Banks - 1.61% | |||||||||||||||

| Wells Fargo & Co. | 879,821 | 21,247,677 | |||||||||||||

|

|

|

||||||||||||||

| Capital Markets - 4.90% | |||||||||||||||

| BlackRock, Inc. | 85,818 | 50,992,197 | |||||||||||||

| Franklin Resources, Inc. | 654,326 | 13,780,106 | |||||||||||||

|

|

|

||||||||||||||

| 64,772,303 | |||||||||||||||

|

|

|

||||||||||||||

| Diversified Financial Services - 4.91% | |||||||||||||||

| Berkshire Hathaway, Inc., Class BB | 297,517 | 64,870,607 | |||||||||||||

|

|

|

||||||||||||||

| Insurance - 1.84% | |||||||||||||||

| Cincinnati Financial Corp. | 305,226 | 24,237,996 | |||||||||||||

|

|

|

||||||||||||||

| Total Financials |

175,128,583 | ||||||||||||||

|

|

|

||||||||||||||

| Health Care - 10.37% | |||||||||||||||

| Pharmaceuticals - 10.37% | |||||||||||||||

| Johnson & Johnson | 338,026 | 51,856,569 | |||||||||||||

| Merck & Co., Inc. | 529,335 | 45,136,395 | |||||||||||||

| Pfizer, Inc. | 1,056,332 | 39,918,786 | |||||||||||||

|

|

|

||||||||||||||

| 136,911,750 | |||||||||||||||

|

|

|

||||||||||||||

| Total Health Care |

136,911,750 | ||||||||||||||

|

|

|

||||||||||||||

See accompanying notes

11

American Beacon The London Company Income Equity FundSM

Schedule of Investments

August 31, 2020

| Shares | Fair Value | ||||||||||||||

| COMMON STOCKS - 93.51% (continued) | |||||||||||||||

| Industrials - 10.43% | |||||||||||||||

| Air Freight & Logistics - 3.83% | |||||||||||||||

| United Parcel Service, Inc., Class B | 309,184 | $ | 50,588,686 | ||||||||||||

|

|

|

||||||||||||||

| Road & Rail - 3.72% | |||||||||||||||

| Norfolk Southern Corp. | 231,037 | 49,102,294 | |||||||||||||

|

|

|

||||||||||||||

| Trading Companies & Distributors - 2.88% | |||||||||||||||

| Fastenal Co. | 779,515 | 38,087,103 | |||||||||||||

|

|

|

||||||||||||||

| Total Industrials |

137,778,083 | ||||||||||||||

|

|

|

||||||||||||||

| Information Technology - 21.91% | |||||||||||||||

| Communications Equipment - 2.86% | |||||||||||||||

| Cisco Systems, Inc. | 894,275 | 37,756,290 | |||||||||||||

|

|

|

||||||||||||||

| IT Services - 2.29% | |||||||||||||||

| Paychex, Inc. | 395,489 | 30,243,044 | |||||||||||||

|

|

|

||||||||||||||

| Semiconductors & Semiconductor Equipment - 6.57% | |||||||||||||||

| Intel Corp. | 749,288 | 38,176,224 | |||||||||||||

| Texas Instruments, Inc. | 342,349 | 48,664,910 | |||||||||||||

|

|

|

||||||||||||||

| 86,841,134 | |||||||||||||||

|

|

|

||||||||||||||

| Software - 4.49% | |||||||||||||||

| Microsoft Corp. | 262,850 | 59,280,560 | |||||||||||||

|

|

|

||||||||||||||

| Technology Hardware, Storage & Peripherals - 5.70% | |||||||||||||||

| Apple, Inc. | 583,116 | 75,245,289 | |||||||||||||

|

|

|

||||||||||||||

| Total Information Technology |

289,366,317 | ||||||||||||||

|

|

|

||||||||||||||

| Materials - 3.54% | |||||||||||||||

| Chemicals - 3.54% | |||||||||||||||

| Air Products and Chemicals, Inc. | 159,696 | 46,672,753 | |||||||||||||

|

|

|

||||||||||||||

| Real Estate - 3.49% | |||||||||||||||

| Equity Real Estate Investment Trusts (REITs) - 3.49% | |||||||||||||||

| Crown Castle International Corp. | 282,159 | 46,062,457 | |||||||||||||

|

|

|

||||||||||||||

| Utilities - 3.05% | |||||||||||||||

| Multi-Utilities - 3.05% | |||||||||||||||

| Dominion Energy, Inc. | 513,363 | 40,268,194 | |||||||||||||

|

|

|

||||||||||||||

| Total Common Stocks (Cost $878,983,117) |

1,234,797,135 | ||||||||||||||

|

|

|

||||||||||||||

| SHORT-TERM INVESTMENTS - 5.75% (Cost $75,939,009) | |||||||||||||||

| Investment Companies - 5.75% | |||||||||||||||

| American Beacon U.S. Government Money Market Select Fund, 0.01%C D | 75,939,009 | 75,939,009 | |||||||||||||

|

|

|

||||||||||||||

| TOTAL INVESTMENTS - 99.26% (Cost $954,922,126) |

1,310,736,144 | ||||||||||||||

| OTHER ASSETS, NET OF LIABILITIES - 0.74% |

9,831,862 | ||||||||||||||

|

|

|

||||||||||||||

| TOTAL NET ASSETS - 100.00% |

$ | 1,320,568,006 | |||||||||||||

|

|

|

||||||||||||||

| Percentages are stated as a percent of net assets. |

| ||||||||||||||

A All or a portion of this security is on loan, collateralized by either cash and/or U.S. Treasuries, at August 31, 2020 (Note 8).

B Non-income producing security.

C The Fund is affiliated by having the same investment advisor.

D 7-day yield.

See accompanying notes

12

American Beacon The London Company Income Equity FundSM

Schedule of Investments

August 31, 2020

ADR - American Depositary Receipt.

PLC - Public Limited Company.

| Long Futures Contracts Open on August 31, 2020: |

| |||||||||||||

| Equity Futures Contracts | ||||||||||||||

| Description | Number of Contracts |

Expiration Date |

Notional Amount |

Contract Value |

Unrealized Appreciation (Depreciation) |

|||||||||

| S&P 500 E-Mini Index Futures | 437 | September 2020 | $71,058,295 | $ | 76,450,965 | $ | 5,392,670 | |||||||

|

|

|

|

|

|

||||||||||

| $71,058,295 | $ | 76,450,965 | $ | 5,392,670 | ||||||||||

|

|

|

|

|

|

||||||||||

| Index Abbreviations: | ||

| S&P 500 | S&P 500 Index - U.S. Equity Large-Cap Index. | |

The Fund’s investments are summarized by level based on the inputs used to determine their values. As of August 31, 2020, the investments were classified as described below:

| The London Company Income Equity Fund |

Level 1 | Level 2 | Level 3 | Total | ||||||||||||||||||||||||

| Assets |

| |||||||||||||||||||||||||||

| Common Stocks |

$ | 1,234,797,135 | $ | – | $ | – | $ | 1,234,797,135 | ||||||||||||||||||||

| Short-Term Investments |

75,939,009 | – | – | 75,939,009 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total Investments in Securities – Assets |

$ | 1,310,736,144 | $ | – | $ | – | $ | 1,310,736,144 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Financial Derivative Instruments – Assets |

| |||||||||||||||||||||||||||

| Futures Contracts |

$ | 5,392,670 | $ | – | $ | – | $ | 5,392,670 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total Financial Derivative Instruments – Assets |

$ | 5,392,670 | $ | – | $ | – | $ | 5,392,670 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

U.S. GAAP requires transfers between all levels to/from level 3 be disclosed. During the year ended August 31, 2020, there were no transfers into or out of Level 3.

See accompanying notes

13

American Beacon Zebra Small Cap Equity FundSM

Schedule of Investments

August 31, 2020

| Shares | Fair Value | ||||||||||||||

| COMMON STOCKS - 98.39% | |||||||||||||||

| Communication Services - 3.01% | |||||||||||||||

| Diversified Telecommunication Services - 0.48% | |||||||||||||||

| Alaska Communications Systems Group, Inc. | 22,958 | $ | 51,426 | ||||||||||||

| IDT Corp., Class BA | 8,312 | 54,194 | |||||||||||||

| Ooma, Inc.A | 16,325 | 222,673 | |||||||||||||

|

|

|

||||||||||||||

| 328,293 | |||||||||||||||

|

|

|

||||||||||||||

| Interactive Media & Services - 1.99% | |||||||||||||||

| Cargurus, Inc.A | 13,489 | 328,862 | |||||||||||||

| DHI Group, Inc.A | 21,087 | 51,241 | |||||||||||||

| EverQuote, Inc., Class AA | 8,570 | 304,235 | |||||||||||||

| TrueCar, Inc.A | 50,877 | 240,648 | |||||||||||||

| Yelp, Inc.A | 19,005 | 439,396 | |||||||||||||

|

|

|

||||||||||||||

| 1,364,382 | |||||||||||||||

|

|

|

||||||||||||||

| Media - 0.54% | |||||||||||||||

| MSG Networks, Inc., Class AA B | 8,677 | 84,514 | |||||||||||||

| Saga Communications, Inc., Class A | 1,793 | 40,343 | |||||||||||||

| Tribune Publishing Co. | 9,843 | 111,718 | |||||||||||||

| WideOpenWest, Inc.A | 24,018 | 138,103 | |||||||||||||

|

|

|

||||||||||||||

| 374,678 | |||||||||||||||

|

|

|

||||||||||||||

| Total Communication Services |

2,067,353 | ||||||||||||||

|

|

|

||||||||||||||

| Consumer Discretionary - 12.79% | |||||||||||||||

| Auto Components - 0.50% | |||||||||||||||

| Standard Motor Products, Inc. | 1,118 | 50,802 | |||||||||||||

| XPEL, Inc. | 11,589 | 288,566 | |||||||||||||

|

|

|

||||||||||||||

| 339,368 | |||||||||||||||

|

|

|

||||||||||||||

| Distributors - 1.10% | |||||||||||||||

| Core-Mark Holding Co., Inc. | 20,337 | 679,662 | |||||||||||||

| Weyco Group, Inc. | 4,162 | 74,916 | |||||||||||||

|

|

|

||||||||||||||

| 754,578 | |||||||||||||||

|

|

|

||||||||||||||

| Diversified Consumer Services - 0.53% | |||||||||||||||

| American Public Education, Inc.A | 3,602 | 113,247 | |||||||||||||

| Collectors Universe, Inc. | 5,683 | 252,837 | |||||||||||||

|

|

|

||||||||||||||

| 366,084 | |||||||||||||||

|

|

|

||||||||||||||

| Hotels, Restaurants & Leisure - 0.13% | |||||||||||||||

| Bluegreen Vacations Corp. | 9,738 | 54,143 | |||||||||||||

| Nathan’s Famous, Inc. | 707 | 37,082 | |||||||||||||

|

|

|

||||||||||||||

| 91,225 | |||||||||||||||

|

|

|

||||||||||||||

| Household Durables - 4.33% | |||||||||||||||

| GoPro, Inc., Class AA | 88,639 | 406,853 | |||||||||||||

| Green Brick Partners, Inc.A | 14,728 | 209,727 | |||||||||||||

| Hamilton Beach Brands Holding Co., Class A | 4,073 | 88,995 | |||||||||||||

| Hooker Furniture Corp. | 9,180 | 226,287 | |||||||||||||

| iRobot Corp.A | 7,179 | 531,461 | |||||||||||||

| Legacy Housing Corp.A | 9,830 | 150,104 | |||||||||||||

| Lovesac Co.A | 12,163 | 321,955 | |||||||||||||

| Sonos, Inc.A | 34,587 | 486,639 | |||||||||||||

| Turtle Beach Corp.A | 19,018 | 372,182 | |||||||||||||

| Universal Electronics, Inc.A | 4,344 | 178,452 | |||||||||||||

|

|

|

||||||||||||||

| 2,972,655 | |||||||||||||||

|

|

|

||||||||||||||

See accompanying notes

14

American Beacon Zebra Small Cap Equity FundSM

Schedule of Investments

August 31, 2020

| Shares | Fair Value | ||||||||||||||

| COMMON STOCKS - 98.39% (continued) | |||||||||||||||

| Consumer Discretionary - 12.79% (continued) | |||||||||||||||

| Internet & Direct Marketing Retail - 2.04% | |||||||||||||||

| 1-800-Flowers.com, Inc., Class AA | 17,656 | $ | 528,444 | ||||||||||||

| Overstock.com, Inc.A | 1,929 | 168,788 | |||||||||||||

| Shutterstock, Inc. | 5,120 | 257,638 | |||||||||||||

| Stitch Fix, Inc., Class AA | 18,291 | 441,728 | |||||||||||||

|

|

|

||||||||||||||

| 1,396,598 | |||||||||||||||

|

|

|

||||||||||||||

| Leisure Products - 1.77% | |||||||||||||||

| Clarus Corp. | 39,695 | 499,760 | |||||||||||||

| Escalade, Inc. | 284 | 5,149 | |||||||||||||

| Johnson Outdoors, Inc., Class A | 1,623 | 139,108 | |||||||||||||

| Marine Products Corp. | 5,725 | 82,726 | |||||||||||||

| YETI Holdings, Inc.A | 9,514 | 488,829 | |||||||||||||

|

|

|

||||||||||||||

| 1,215,572 | |||||||||||||||

|

|

|

||||||||||||||

| Multiline Retail - 0.53% | |||||||||||||||

| Big Lots, Inc. | 7,662 | 361,263 | |||||||||||||

|

|

|

||||||||||||||

| Specialty Retail - 1.01% | |||||||||||||||

| Lumber Liquidators Holdings, Inc.A | 12,030 | 288,600 | |||||||||||||

| RHA | 1,224 | 404,593 | |||||||||||||

|

|

|

||||||||||||||

| 693,193 | |||||||||||||||

|

|

|

||||||||||||||

| Textiles, Apparel & Luxury Goods - 0.85% | |||||||||||||||

| Deckers Outdoor Corp.A | 2,819 | 574,710 | |||||||||||||

| Superior Group of Cos., Inc. | 352 | 8,145 | |||||||||||||

|

|

|

||||||||||||||

| 582,855 | |||||||||||||||

|

|

|

||||||||||||||

| Total Consumer Discretionary |

8,773,391 | ||||||||||||||

|

|

|

||||||||||||||

| Consumer Staples - 5.51% | |||||||||||||||

| Beverages - 0.46% | |||||||||||||||

| National Beverage Corp.A | 3,861 | 313,976 | |||||||||||||

|

|

|

||||||||||||||

| Food & Staples Retailing - 2.31% | |||||||||||||||

| Ingles Markets, Inc., Class A | 10,364 | 418,706 | |||||||||||||

| SpartanNash Co. | 11,310 | 225,974 | |||||||||||||

| Village Super Market, Inc., Class A | 10,089 | 256,664 | |||||||||||||

| Weis Markets, Inc. | 13,862 | 682,426 | |||||||||||||

|

|

|

||||||||||||||

| 1,583,770 | |||||||||||||||

|

|

|

||||||||||||||

| Food Products - 0.12% | |||||||||||||||

| Bridgford Foods Corp.A | 2,732 | 45,324 | |||||||||||||

| Seneca Foods Corp., Class AA | 767 | 36,325 | |||||||||||||

|

|

|

||||||||||||||

| 81,649 | |||||||||||||||

|

|

|

||||||||||||||

| Household Products - 1.79% | |||||||||||||||

| Oil-Dri Corp. of America | 1,693 | 59,289 | |||||||||||||

| WD-40 Co. | 5,740 | 1,173,141 | |||||||||||||

|

|

|

||||||||||||||

| 1,232,430 | |||||||||||||||

|

|

|

||||||||||||||

| Personal Products - 0.83% | |||||||||||||||

| Lifevantage Corp.A | 4,298 | 64,556 | |||||||||||||

| Medifast, Inc. | 1,410 | 229,435 | |||||||||||||

| USANA Health Sciences, Inc.A | 3,484 | 273,181 | |||||||||||||

|

|

|

||||||||||||||

| 567,172 | |||||||||||||||

|

|

|

||||||||||||||

| Total Consumer Staples |

3,778,997 | ||||||||||||||

|

|

|

||||||||||||||

See accompanying notes

15

American Beacon Zebra Small Cap Equity FundSM

Schedule of Investments

August 31, 2020

| Shares | Fair Value | ||||||||||||||

| COMMON STOCKS - 98.39% (continued) | |||||||||||||||

| Energy - 0.96% | |||||||||||||||

| Energy Equipment & Services - 0.57% | |||||||||||||||

| Matrix Service Co.A | 34,975 | $ | 323,169 | ||||||||||||

| Smart Sand, Inc.A | 49,903 | 68,866 | |||||||||||||

|

|

|

||||||||||||||

| 392,035 | |||||||||||||||

|

|

|

||||||||||||||

| Oil, Gas & Consumable Fuels - 0.39% | |||||||||||||||

| Evolution Petroleum Corp. | 28,073 | 76,640 | |||||||||||||

| Falcon Minerals Corp. | 11,336 | 31,854 | |||||||||||||

| Hallador Energy Co. | 50,429 | 38,931 | |||||||||||||

| NACCO Industries, Inc., Class A | 3,300 | 67,650 | |||||||||||||

| Panhandle Oil and Gas, Inc., Class A | 7,034 | 13,294 | |||||||||||||

| PrimeEnergy Resources Corp.A | 529 | 35,570 | |||||||||||||

|

|

|

||||||||||||||

| 263,939 | |||||||||||||||

|

|

|

||||||||||||||

| Total Energy |

655,974 | ||||||||||||||

|

|

|

||||||||||||||

| Financials - 14.78% | |||||||||||||||

| Banks - 10.04% | |||||||||||||||

| 1st Constitution Bancorp | 12,003 | 146,077 | |||||||||||||

| Bank of Commerce Holdings | 28,727 | 211,143 | |||||||||||||

| Bank of Princeton | 905 | 17,629 | |||||||||||||

| BCB Bancorp, Inc. | 31,690 | 258,115 | |||||||||||||

| C&F Financial Corp. | 1,744 | 55,756 | |||||||||||||

| Capital Bancorp, Inc.A | 9,423 | 98,093 | |||||||||||||

| CB Financial Services, Inc. | 879 | 16,349 | |||||||||||||

| Central Valley Community Bancorp | 7,096 | 85,365 | |||||||||||||

| Civista Bancshares, Inc. | 2,388 | 31,880 | |||||||||||||

| CNB Financial Corp. | 28,402 | 453,012 | |||||||||||||

| Codorus Valley Bancorp, Inc. | 3,543 | 45,705 | |||||||||||||

| Colony Bankcorp, Inc. | 4,240 | 46,640 | |||||||||||||

| Community Financial Corp. | 2,006 | 44,613 | |||||||||||||

| Community Trust Bancorp, Inc. | 5,425 | 175,065 | |||||||||||||

| Enterprise Bancorp, Inc. | 7,359 | 159,911 | |||||||||||||

| Evans Bancorp, Inc. | 1,376 | 31,373 | |||||||||||||

| Farmers National Banc Corp. | 11,338 | 132,201 | |||||||||||||

| Financial Institutions, Inc. | 10,389 | 179,002 | |||||||||||||

| First Bancorp, Inc. | 1,578 | 33,580 | |||||||||||||

| First Bank/Hamilton | 8,608 | 56,124 | |||||||||||||

| First Business Financial Services, Inc. | 2,108 | 32,674 | |||||||||||||

| First Choice Bancorp | 4,295 | 60,774 | |||||||||||||

| First Guaranty Bancshares, Inc. | 3,565 | 45,739 | |||||||||||||

| First Mid Bancshares, Inc. | 3,971 | 103,405 | |||||||||||||

| Franklin Financial Services Corp. | 1,906 | 45,439 | |||||||||||||

| Great Southern Bancorp, Inc. | 860 | 33,144 | |||||||||||||

| Horizon Bancorp, Inc. | 20,211 | 225,959 | |||||||||||||

| LCNB Corp. | 16,347 | 239,647 | |||||||||||||

| Macatawa Bank Corp. | 71,351 | 522,289 | |||||||||||||

| Mackinac Financial Corp. | 12,519 | 125,440 | |||||||||||||

| Midland States Bancorp, Inc. | 3,903 | 57,023 | |||||||||||||

| Northrim BanCorp, Inc. | 2,089 | 56,215 | |||||||||||||

| Oak Valley BancorpB | 4,944 | 66,744 | |||||||||||||

| Old Second Bancorp, Inc. | 3,288 | 26,863 | |||||||||||||

| Orrstown Financial Services, Inc. | 2,003 | 27,581 | |||||||||||||

| Parke Bancorp, Inc. | 13,719 | 168,744 | |||||||||||||

| PCB Bancorp | 43,111 | 411,710 | |||||||||||||

| Penns Woods Bancorp, Inc. | 7,746 | 160,730 | |||||||||||||

| Peoples Bancorp of North Carolina, Inc. | 2,768 | 47,056 | |||||||||||||

| Peoples Bancorp, Inc. | 9,777 | 206,686 | |||||||||||||

See accompanying notes

16

American Beacon Zebra Small Cap Equity FundSM

Schedule of Investments

August 31, 2020

| Shares | Fair Value | ||||||||||||||

| COMMON STOCKS - 98.39% (continued) | |||||||||||||||

| Financials - 14.78% (continued) | |||||||||||||||

| Banks - 10.04% (continued) | |||||||||||||||

| Plumas Bancorp | 733 | $ | 14,484 | ||||||||||||

| Premier Financial Bancorp, Inc. | 13,651 | 175,006 | |||||||||||||

| RBB Bancorp | 8,599 | 111,529 | |||||||||||||

| Republic Bancorp, Inc., Class A | 12,360 | 380,194 | |||||||||||||

| Shore Bancshares, Inc. | 16,628 | 162,123 | |||||||||||||

| Sierra Bancorp | 3,273 | 58,489 | |||||||||||||

| South Plains Financial, Inc. | 2,507 | 35,800 | |||||||||||||

| Southern National Bancorp of Virginia, Inc. | 29,178 | 249,472 | |||||||||||||

| Summit Financial Group, Inc. | 6,686 | 98,619 | |||||||||||||

| TriCo Bancshares | 6,651 | 184,166 | |||||||||||||

| United Security Bancshares | 48,892 | 297,752 | |||||||||||||

| Unity Bancorp, Inc. | 13,388 | 177,793 | |||||||||||||

|

|

|

||||||||||||||

| 6,886,922 | |||||||||||||||

|

|

|

||||||||||||||

| Capital Markets - 1.29% | |||||||||||||||

| B. Riley Financial, Inc. | 1,359 | 36,394 | |||||||||||||

| Cohen & Steers, Inc. | 5,797 | 350,718 | |||||||||||||

| Diamond Hill Investment Group, Inc. | 1,201 | 148,816 | |||||||||||||

| GAMCO Investors, Inc., Class A | 21,408 | 270,169 | |||||||||||||

| Pzena Investment Management, Inc., Class A | 7,246 | 35,868 | |||||||||||||

| Silvercrest Asset Management Group, Inc., Class A | 3,310 | 41,507 | |||||||||||||

|

|

|

||||||||||||||

| 883,472 | |||||||||||||||

|

|

|

||||||||||||||

| Diversified Financial Services - 0.13% | |||||||||||||||

| Alerus Financial Corp. | 3,562 | 73,342 | |||||||||||||

| Marlin Business Services Corp. | 2,720 | 18,224 | |||||||||||||

|

|

|

||||||||||||||

| 91,566 | |||||||||||||||

|

|

|

||||||||||||||

| Insurance - 1.21% | |||||||||||||||

| Crawford & Co., Class A | 24,858 | 170,526 | |||||||||||||

| Donegal Group, Inc., Class A | 11,925 | 172,078 | |||||||||||||

| Independence Holding Co. | 2,979 | 104,265 | |||||||||||||

| NI Holdings, Inc.A | 11,416 | 186,309 | |||||||||||||

| ProSight Global, Inc.A | 20,732 | 196,539 | |||||||||||||

|

|

|

||||||||||||||

| 829,717 | |||||||||||||||

|

|

|

||||||||||||||

| Thrifts & Mortgage Finance - 2.11% | |||||||||||||||

| ESSA Bancorp, Inc. | 5,453 | 69,798 | |||||||||||||

| FS Bancorp, Inc. | 3,131 | 124,050 | |||||||||||||

| Home Bancorp, Inc. | 2,980 | 71,997 | |||||||||||||

| Merchants Bancorp | 13,177 | 268,547 | |||||||||||||

| OP Bancorp | 12,440 | 75,884 | |||||||||||||

| Riverview Bancorp, Inc. | 126,853 | 523,903 | |||||||||||||

| Southern Missouri Bancorp, Inc. | 5,967 | 141,299 | |||||||||||||

| Sterling Bancorp, Inc. | 18,935 | 56,237 | |||||||||||||

| Timberland Bancorp, Inc. | 6,650 | 116,308 | |||||||||||||

|

|

|

||||||||||||||

| 1,448,023 | |||||||||||||||

|

|

|

||||||||||||||

| Total Financials |

10,139,700 | ||||||||||||||

|

|

|

||||||||||||||

| Health Care - 16.05% | |||||||||||||||

| Biotechnology - 4.75% | |||||||||||||||

| Avid Bioservices, Inc.A | 30,631 | 256,994 | |||||||||||||

| BioSpecifics Technologies Corp.A | 4,979 | 321,146 | |||||||||||||

| Castle Biosciences, Inc.A | 7,851 | 359,026 | |||||||||||||

| Celcuity, Inc.A | 10,887 | 60,423 | |||||||||||||

| Natera, Inc.A | 11,410 | 726,931 | |||||||||||||

See accompanying notes

17

American Beacon Zebra Small Cap Equity FundSM

Schedule of Investments

August 31, 2020

| Shares | Fair Value | ||||||||||||||

| COMMON STOCKS - 98.39% (continued) | |||||||||||||||

| Health Care - 16.05% (continued) | |||||||||||||||

| Biotechnology - 4.75% (continued) | |||||||||||||||

| Retrophin, Inc.A | 39,800 | $ | 779,682 | ||||||||||||

| Veracyte, Inc.A | 22,719 | 756,770 | |||||||||||||

|

|

|

||||||||||||||

| 3,260,972 | |||||||||||||||

|

|

|

||||||||||||||

| Health Care Equipment & Supplies - 4.87% | |||||||||||||||

| Antares Pharma, Inc.A | 136,922 | 387,489 | |||||||||||||

| Atrion Corp. | 6 | 3,790 | |||||||||||||

| Cardiovascular Systems, Inc.A | 15,266 | 498,740 | |||||||||||||

| Electromed, Inc.A | 5,952 | 73,686 | |||||||||||||

| iRadimed Corp.A | 1,709 | 36,231 | |||||||||||||

| iRhythm Technologies, Inc.A | 1,416 | 311,775 | |||||||||||||

| Orthofix Medical, Inc.A | 29,271 | 888,082 | |||||||||||||

| Stereotaxis, Inc.A | 15,767 | 55,500 | |||||||||||||

| Surmodics, Inc.A | 6,928 | 313,492 | |||||||||||||

| Tactile Systems Technology, Inc.A | 8,774 | 337,185 | |||||||||||||

| Utah Medical Products, Inc. | 379 | 31,135 | |||||||||||||

| Zynex, Inc.A | 27,467 | 406,511 | |||||||||||||

|

|

|

||||||||||||||

| 3,343,616 | |||||||||||||||

|

|

|

||||||||||||||

| Health Care Providers & Services - 2.06% | |||||||||||||||

| Apollo Medical Holdings, Inc.A B | 10,251 | 193,641 | |||||||||||||

| CorVel Corp.A | 834 | 69,239 | |||||||||||||

| Cross Country Healthcare, Inc.A | 62,310 | 398,161 | |||||||||||||

| InfuSystem Holdings, Inc.A | 3,595 | 52,307 | |||||||||||||

| National HealthCare Corp. | 1,048 | 66,758 | |||||||||||||

| National Research Corp. | 9,217 | 516,152 | |||||||||||||

| RadNet, Inc.A | 2,641 | 38,083 | |||||||||||||

| Viemed Healthcare, Inc.A | 7,139 | 77,601 | |||||||||||||

|

|

|

||||||||||||||

| 1,411,942 | |||||||||||||||

|

|

|

||||||||||||||

| Health Care Technology - 1.49% | |||||||||||||||

| Computer Programs & Systems, Inc. | 6,463 | 176,828 | |||||||||||||

| HealthStream, Inc.A | 4,788 | 99,184 | |||||||||||||

| iCAD, Inc.A | 7,527 | 81,517 | |||||||||||||

| Simulations Plus, Inc. | 11,092 | 660,861 | |||||||||||||

|

|

|

||||||||||||||

| 1,018,390 | |||||||||||||||

|

|

|

||||||||||||||

| Life Sciences Tools & Services - 0.36% | |||||||||||||||

| Champions Oncology, Inc.A | 3,023 | 25,030 | |||||||||||||

| ChromaDex Corp.A B | 44,341 | 219,488 | |||||||||||||

|

|

|

||||||||||||||

| 244,518 | |||||||||||||||

|

|

|

||||||||||||||

| Pharmaceuticals - 2.52% | |||||||||||||||

| BioDelivery Sciences International, Inc.A | 94,316 | 368,775 | |||||||||||||

| Corcept Therapeutics, Inc.A | 51,978 | 660,121 | |||||||||||||

| Harrow Health, Inc. | 13,512 | 93,098 | |||||||||||||

| SIGA Technologies, Inc.A | 87,264 | 606,485 | |||||||||||||

|

|

|

||||||||||||||

| 1,728,479 | |||||||||||||||

|

|

|

||||||||||||||

| Total Health Care |

11,007,917 | ||||||||||||||

|

|

|

||||||||||||||

| Industrials - 15.24% | |||||||||||||||

| Aerospace & Defense - 0.48% | |||||||||||||||

| Moog, Inc., Class A | 5,513 | 332,379 | |||||||||||||

|

|

|

||||||||||||||

| Air Freight & Logistics - 0.15% | |||||||||||||||

| Radiant Logistics, Inc.A | 19,179 | 101,265 | |||||||||||||

|

|

|

||||||||||||||

See accompanying notes

18

American Beacon Zebra Small Cap Equity FundSM

Schedule of Investments

August 31, 2020

| Shares | Fair Value | ||||||||||||||

| COMMON STOCKS - 98.39% (continued) | |||||||||||||||

| Industrials - 15.24% (continued) | |||||||||||||||

| Building Products - 0.46% | |||||||||||||||

| CSW Industrials, Inc. | 4,361 | $ | 315,082 | ||||||||||||

|

|

|

||||||||||||||

| Commercial Services & Supplies - 3.63% | |||||||||||||||

| CompX International, Inc. | 2,314 | 31,702 | |||||||||||||

| Deluxe Corp. | 17,461 | 495,892 | |||||||||||||

| Ennis, Inc. | 37,388 | 685,322 | |||||||||||||

| Kimball International, Inc., Class B | 32,953 | 369,403 | |||||||||||||

| McGrath RentCorp | 11,988 | 795,524 | |||||||||||||

| VSE Corp. | 3,870 | 112,346 | |||||||||||||

|

|

|

||||||||||||||

| 2,490,189 | |||||||||||||||

|

|

|

||||||||||||||

| Construction & Engineering - 2.43% | |||||||||||||||

| Aegion Corp.A | 8,458 | 136,893 | |||||||||||||

| IES Holdings, Inc.A | 3,657 | 105,431 | |||||||||||||

| MasTec, Inc.A | 12,536 | 579,289 | |||||||||||||

| MYR Group, Inc.A | 6,387 | 247,879 | |||||||||||||

| Primoris Services Corp. | 31,246 | 595,549 | |||||||||||||

|

|

|

||||||||||||||

| 1,665,041 | |||||||||||||||

|

|

|

||||||||||||||

| Electrical Equipment - 0.03% | |||||||||||||||

| LSI Industries, Inc. | 3,328 | 22,830 | |||||||||||||

|

|

|

||||||||||||||

| Machinery - 3.58% | |||||||||||||||

| Astec Industries, Inc. | 5,542 | 292,174 | |||||||||||||

| Columbus McKinnon Corp. | 964 | 35,066 | |||||||||||||

| Eastern Co. | 3,947 | 86,439 | |||||||||||||

| Franklin Electric Co., Inc. | 13,513 | 802,132 | |||||||||||||

| Gencor Industries, Inc.A | 3,314 | 41,790 | |||||||||||||

| Gorman-Rupp Co. | 35 | 1,118 | |||||||||||||

| Hurco Cos., Inc. | 2,926 | 82,747 | |||||||||||||

| Miller Industries, Inc. | 9,779 | 306,767 | |||||||||||||

| Mueller Industries, Inc. | 14,101 | 418,800 | |||||||||||||

| Omega Flex, Inc. | 2,300 | 303,002 | |||||||||||||

| Park-Ohio Holdings Corp. | 5,537 | 87,595 | |||||||||||||

|

|

|

||||||||||||||

| 2,457,630 | |||||||||||||||

|

|

|

||||||||||||||

| Professional Services - 2.23% | |||||||||||||||

| CRA International, Inc. | 3,211 | 136,500 | |||||||||||||

| Franklin Covey Co.A | 8,555 | 168,876 | |||||||||||||

| Kelly Services, Inc., Class A | 4,814 | 91,418 | |||||||||||||

| Kforce, Inc. | 12,459 | 427,842 | |||||||||||||

| Mastech Digital, Inc.A | 1,088 | 20,128 | |||||||||||||

| Resources Connection, Inc. | 24,396 | 299,827 | |||||||||||||

| TrueBlue, Inc.A | 22,870 | 386,960 | |||||||||||||

|

|

|

||||||||||||||

| 1,531,551 | |||||||||||||||

|

|

|

||||||||||||||

| Road & Rail - 0.16% | |||||||||||||||

| Universal Logistics Holdings, Inc. | 4,949 | 106,404 | |||||||||||||

|

|

|

||||||||||||||

| Trading Companies & Distributors - 2.09% | |||||||||||||||

| Lawson Products, Inc.A | 3,247 | 116,567 | |||||||||||||

| Rush Enterprises, Inc., Class A | 14,101 | 681,360 | |||||||||||||

| Systemax, Inc. | 23,674 | 525,326 | |||||||||||||

| Transcat, Inc.A | 2,336 | 68,702 | |||||||||||||

| Willis Lease Finance Corp.A | 1,863 | 39,831 | |||||||||||||

|

|

|

||||||||||||||

| 1,431,786 | |||||||||||||||

|

|

|

||||||||||||||

| Total Industrials |

10,454,157 | ||||||||||||||

|

|

|

||||||||||||||

See accompanying notes

19

American Beacon Zebra Small Cap Equity FundSM

Schedule of Investments

August 31, 2020

| Shares | Fair Value | ||||||||||||||

| COMMON STOCKS - 98.39% (continued) | |||||||||||||||

| Information Technology - 15.24% | |||||||||||||||

| Communications Equipment - 0.63% | |||||||||||||||

| Calix, Inc.A | 9,231 | $ | 179,543 | ||||||||||||

| DZX, Inc. | 22,932 | 238,952 | |||||||||||||

| TESSCO Technologies, Inc. | 2,595 | 16,011 | |||||||||||||

|

|

|

||||||||||||||

| 434,506 | |||||||||||||||

|

|

|

||||||||||||||

| Electronic Equipment, Instruments & Components - 3.36% | |||||||||||||||

| Daktronics, Inc. | 15,894 | 70,251 | |||||||||||||

| Insight Enterprises, Inc.A | 15,576 | 931,523 | |||||||||||||

| Kimball Electronics, Inc.A | 9,097 | 122,673 | |||||||||||||

| OSI Systems, Inc.A | 10,194 | 802,778 | |||||||||||||

| PC Connection, Inc. | 5,197 | 230,175 | |||||||||||||

| ScanSource, Inc.A | 5,818 | 143,646 | |||||||||||||

| Vishay Precision Group, Inc.A | 13 | 324 | |||||||||||||

|

|

|

||||||||||||||

| 2,301,370 | |||||||||||||||

|

|

|

||||||||||||||

| IT Services - 2.46% | |||||||||||||||

| Brightcove, Inc.A | 39,222 | 436,148 | |||||||||||||

| Hackett Group, Inc. | 9,941 | 125,356 | |||||||||||||

| Information Services Group, Inc.A | 15,394 | 31,635 | |||||||||||||

| PRGX Global, Inc.A | 5,361 | 29,593 | |||||||||||||

| Sykes Enterprises, Inc.A | 32,061 | 1,061,379 | |||||||||||||

|

|

|

||||||||||||||

| 1,684,111 | |||||||||||||||

|

|

|

||||||||||||||

| Semiconductors & Semiconductor Equipment - 0.04% | |||||||||||||||

| GSI Technology, Inc.A | 4,501 | 28,626 | |||||||||||||

|

|

|

||||||||||||||

| Software - 8.20% | |||||||||||||||

| A10 Networks, Inc.A | 64,377 | 550,423 | |||||||||||||

| Alarm.com Holdings, Inc.A | 7,118 | 426,155 | |||||||||||||

| American Software, Inc., Class A | 4,962 | 70,262 | |||||||||||||

| Appfolio, Inc., Class AA | 1,525 | 256,246 | |||||||||||||

| Box, Inc., Class AA | 33,217 | 652,050 | |||||||||||||

| ChannelAdvisor Corp.A | 19,762 | 332,397 | |||||||||||||

| CommVault Systems, Inc.A | 16,216 | 701,018 | |||||||||||||

| Mitek Systems, Inc.A | 41,445 | 525,937 | |||||||||||||

| MobileIron, Inc.A | 39,978 | 261,056 | |||||||||||||

| QAD, Inc., Class A | 7,831 | 356,154 | |||||||||||||

| Rimini Street, Inc.A | 69,101 | 302,662 | |||||||||||||

| Rosetta Stone, Inc.A | 15,988 | 485,715 | |||||||||||||

| ShotSpotter, Inc.A | 6,383 | 191,235 | |||||||||||||

| Smith Micro Software, Inc.A | 18,425 | 70,752 | |||||||||||||

| Tenable Holdings, Inc.A | 11,806 | 444,378 | |||||||||||||

|

|

|

||||||||||||||

| 5,626,440 | |||||||||||||||

|

|

|

||||||||||||||

| Technology Hardware, Storage & Peripherals - 0.55% | |||||||||||||||

| AstroNova, Inc. | 4,189 | 28,695 | |||||||||||||

| Avid Technology, Inc.A | 43,386 | 351,426 | |||||||||||||

|

|

|

||||||||||||||

| 380,121 | |||||||||||||||

|

|

|

||||||||||||||

| Total Information Technology |

10,455,174 | ||||||||||||||

|

|

|

||||||||||||||

| Materials - 4.66% | |||||||||||||||

| Chemicals - 3.63% | |||||||||||||||

| Chase Corp. | 2,023 | 197,384 | |||||||||||||

| Hawkins, Inc. | 5,862 | 294,390 | |||||||||||||

| Innospec, Inc. | 11,527 | 860,951 | |||||||||||||

See accompanying notes

20

American Beacon Zebra Small Cap Equity FundSM

Schedule of Investments

August 31, 2020

| Shares | Fair Value | ||||||||||||||

| COMMON STOCKS - 98.39% (continued) | |||||||||||||||

| Materials - 4.66% (continued) | |||||||||||||||

| Chemicals - 3.63% (continued) | |||||||||||||||

| Kronos Worldwide, Inc. | 46,571 | $ | 581,672 | ||||||||||||

| Tredegar Corp. | 32,970 | 558,182 | |||||||||||||

|

|

|

||||||||||||||

| 2,492,579 | |||||||||||||||

|

|

|

||||||||||||||

| Construction Materials - 0.32% | |||||||||||||||

| United States Lime & Minerals, Inc. | 2,417 | 222,678 | |||||||||||||

|

|

|

||||||||||||||

| Containers & Packaging - 0.61% | |||||||||||||||

| UFP Technologies, Inc.A | 10,147 | 418,158 | |||||||||||||

|

|

|

||||||||||||||

| Paper & Forest Products - 0.10% | |||||||||||||||

| Boise Cascade Co. | 1,446 | 66,227 | |||||||||||||

|

|

|

||||||||||||||

| Total Materials |

3,199,642 | ||||||||||||||

|

|

|

||||||||||||||

| Real Estate - 9.22% | |||||||||||||||

| Equity Real Estate Investment Trusts (REITs) - 6.47% | |||||||||||||||

| Alexander’s, Inc. | 1,461 | 372,657 | |||||||||||||

| BRT Apartments Corp. | 5,737 | 76,589 | |||||||||||||

| CIM Commercial Trust Corp. | 6,691 | 69,118 | |||||||||||||

| Clipper Realty, Inc. | 12,326 | 82,214 | |||||||||||||

| Franklin Street Properties Corp. | 34,480 | 152,746 | |||||||||||||

| Getty Realty Corp. | 27,305 | 799,764 | |||||||||||||

| Gladstone Land Corp. | 12,233 | 192,548 | |||||||||||||

| Industrial Logistics Properties Trust | 17,646 | 380,624 | |||||||||||||

| Monmouth Real Estate Investment Corp. | 43,809 | 635,669 | |||||||||||||

| Office Properties Income Trust | 9,823 | 234,180 | |||||||||||||

| One Liberty Properties, Inc. | 14,237 | 272,781 | |||||||||||||

| PotlatchDeltic Corp. | 6,820 | 313,993 | |||||||||||||

| PS Business Parks, Inc. | 6,240 | 787,488 | |||||||||||||

| Universal Health Realty Income Trust | 1,030 | 68,722 | |||||||||||||

|

|

|

||||||||||||||

| 4,439,093 | |||||||||||||||

|

|

|

||||||||||||||

| Real Estate Management & Development - 2.75% | |||||||||||||||

| CTO Realty Growth, Inc. | 752 | 31,712 | |||||||||||||

| eXp World Holdings, Inc.A | 7,087 | 315,230 | |||||||||||||

| Forestar Group, Inc.A | 5,659 | 100,561 | |||||||||||||

| Kennedy-Wilson Holdings, Inc. | 52,756 | 753,883 | |||||||||||||

| Marcus & Millichap, Inc.A | 14,581 | 411,330 | |||||||||||||

| Maui Land & Pineapple Co., Inc.A | 3,873 | 45,159 | |||||||||||||

| RMR Group, Inc., Class A | 4,183 | 118,044 | |||||||||||||

| St Joe Co.A | 4,619 | 107,207 | |||||||||||||

| Stratus Properties, Inc.A | 194 | 3,802 | |||||||||||||

|

|

|

||||||||||||||

| 1,886,928 | |||||||||||||||

|

|

|

||||||||||||||

| Total Real Estate |

6,326,021 | ||||||||||||||

|

|

|

||||||||||||||

| Utilities - 0.93% | |||||||||||||||

| Electric Utilities - 0.04% | |||||||||||||||

| Otter Tail Corp. | 703 | 27,312 | |||||||||||||

|

|

|

||||||||||||||

| Gas Utilities - 0.03% | |||||||||||||||

| RGC Resources, Inc. | 937 | 21,851 | |||||||||||||

|

|

|

||||||||||||||

| Independent Power & Renewable Electricity Producers - 0.19% | |||||||||||||||

| Atlantic Power Corp.A B | 63,360 | 131,156 | |||||||||||||

|

|

|

||||||||||||||

See accompanying notes

21

American Beacon Zebra Small Cap Equity FundSM

Schedule of Investments

August 31, 2020

| Shares | Fair Value | ||||||||||||||

| COMMON STOCKS - 98.39% (continued) | |||||||||||||||

| Utilities - 0.93% (continued) | |||||||||||||||

| Water Utilities - 0.67% | |||||||||||||||

| Artesian Resources Corp., Class A | 8,383 | $ | 294,998 | ||||||||||||

| Pure Cycle Corp.A | 6,545 | 63,879 | |||||||||||||

| York Water Co. | 2,135 | 97,377 | |||||||||||||

|

|

|

||||||||||||||

| 456,254 | |||||||||||||||

|

|

|

||||||||||||||

| Total Utilities |

636,573 | ||||||||||||||

|

|

|

||||||||||||||

| Total Common Stocks (Cost $70,608,636) |

67,494,899 | ||||||||||||||

|

|

|

||||||||||||||

| SHORT-TERM INVESTMENTS - 1.93% (Cost $1,323,905) | |||||||||||||||

| Investment Companies - 1.93% | |||||||||||||||

| American Beacon U.S. Government Money Market Select Fund, 0.01%C D |