Bridgeway Funds, Inc.

THIS PAGE INTENTIONALLY LEFT BLANK

|

|

|

|

| TABLE OF CONTENTS |

|

|

|

|

|

|

| |

|

|

Bridgeway Funds Standardized Returns as of June 30, 2011*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Annualized |

|

|

|

|

|

|

|

| Fund |

|

June Qtr.

4/1/11

to 6/30/114 |

|

|

Six Months

1/1/11

to 6/30/114 |

|

|

1 Year |

|

5 Years |

|

|

10 Years |

|

|

Inception

to Date |

|

|

Inception

Date |

|

|

Gross

Expense

Ratio2 |

|

|

Aggressive Investors 1

|

|

|

-1.98% |

|

|

|

7.76% |

|

|

40.81% |

|

|

-3.29% |

|

|

|

3.35% |

|

|

|

13.64% |

|

|

|

8/5/1994 |

|

|

|

1.20%3 |

|

|

Aggressive Investors 2

|

|

|

-1.23% |

|

|

|

8.16% |

|

|

37.05% |

|

|

-1.63% |

|

|

|

NA |

|

|

|

5.32% |

|

|

|

10/31/2001 |

|

|

|

1.02% |

|

|

Ultra-Small Company

|

|

|

-5.45% |

|

|

|

2.03% |

|

|

30.12% |

|

|

0.22% |

|

|

|

12.30% |

|

|

|

16.06% |

|

|

|

8/5/1994 |

|

|

|

1.17% |

|

|

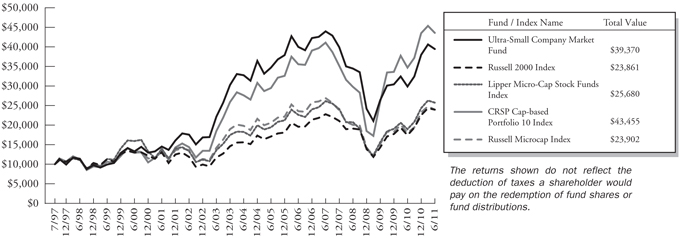

Ultra-Small Co Market

|

|

|

-2.85% |

|

|

|

3.86% |

|

|

32.22% |

|

|

-0.25% |

|

|

|

10.48% |

|

|

|

10.35% |

|

|

|

7/31/1997 |

|

|

|

0.79%1 |

|

|

Micro-Cap Limited

|

|

|

-5.69% |

|

|

|

4.74% |

|

|

35.47% |

|

|

-3.23% |

|

|

|

4.98% |

|

|

|

10.28% |

|

|

|

6/30/1998 |

|

|

|

1.47%3 |

|

|

Small-Cap Momentum

|

|

|

-0.93% |

|

|

|

7.88% |

|

|

37.49% |

|

|

NA |

|

|

|

NA |

|

|

|

25.66% |

|

|

|

5/28/2010 |

|

|

|

1.29%1 |

|

|

Small-Cap Growth

|

|

|

0.16% |

|

|

|

12.70% |

|

|

36.17% |

|

|

-3.27% |

|

|

|

NA |

|

|

|

2.95% |

|

|

|

10/31/2003 |

|

|

|

0.93%1 |

|

|

Small-Cap Value

|

|

|

-1.37% |

|

|

|

10.69% |

|

|

32.73% |

|

|

-0.78% |

|

|

|

NA |

|

|

|

5.80% |

|

|

|

10/31/2003 |

|

|

|

0.91% |

|

|

Large-Cap Growth

|

|

|

0.98% |

|

|

|

7.73% |

|

|

32.31% |

|

|

2.55% |

|

|

|

NA |

|

|

|

4.23% |

|

|

|

10/31/2003 |

|

|

|

0.86%1 |

|

|

Large-Cap Value

|

|

|

-0.41% |

|

|

|

7.98% |

|

|

30.02% |

|

|

2.59% |

|

|

|

NA |

|

|

|

6.90% |

|

|

|

10/31/2003 |

|

|

|

1.11%1 |

|

|

Blue Chip 35 Index

|

|

|

-0.26% |

|

|

|

3.40% |

|

|

25.10% |

|

|

3.03% |

|

|

|

2.15% |

|

|

|

4.45% |

|

|

|

7/31/1997 |

|

|

|

0.27%1 |

|

|

Managed Volatility

|

|

|

-0.94% |

|

|

|

2.39% |

|

|

14.15% |

|

|

1.33% |

|

|

|

3.58% |

|

|

|

3.58% |

|

|

|

6/30/2001 |

|

|

|

1.05%1 |

|

1 Some of the Funds’ fees were waived or expenses reimbursed; otherwise, returns would have been lower. The Adviser has contractually agreed to waive fees and/or reimburse expenses. Any

material change to this Fund policy would require a vote by shareholders.

2 Expense ratios are as stated in the current prospectus. Please see financials for expense ratios as of June 30, 2011.

3 The management fee included in the gross expense ratio for the Aggressive Investors 1 and Micro-Cap Limited Funds has been restated to reflect only the base management fee payable under the

Fund’s performance-based management fee structure. The total actual management fee for the fiscal year ended June 30, 2010 was -0.81% and -0.57%, respectively. The actual total management fee for the prior fiscal year was negative due to the negative performance adjustment of the investment management fee under the Fund’s performance-based management fee structure.

4 Return is not annualized.

Bridgeway Funds Returns for Calendar Years 1997 through 2010*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1997 |

|

|

1998 |

|

|

1999 |

|

|

2000 |

|

|

2001 |

|

|

2002 |

|

|

2003 |

|

|

2004 |

|

|

2005 |

|

|

2006 |

|

|

2007 |

|

|

2008 |

|

|

2009 |

|

|

2010 |

|

|

Aggressive Investors 1

|

|

|

18.27% |

|

|

|

19.28% |

|

|

|

120.62% |

|

|

|

13.58% |

|

|

|

-11.20% |

|

|

|

-18.01% |

|

|

|

53.97% |

|

|

|

12.21% |

|

|

|

14.93% |

|

|

|

7.11% |

|

|

|

25.80% |

|

|

|

-56.16% |

|

|

|

23.98% |

|

|

|

17.82% |

|

|

Aggressive Investors 2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-19.02% |

|

|

|

44.01% |

|

|

|

16.23% |

|

|

|

18.59% |

|

|

|

5.43% |

|

|

|

32.19% |

|

|

|

-55.07% |

|

|

|

29.84% |

|

|

|

12.10% |

|

|

Ultra-Small Company

|

|

|

37.99% |

|

|

|

-13.11% |

|

|

|

40.41% |

|

|

|

4.75% |

|

|

|

34.00% |

|

|

|

3.98% |

|

|

|

88.57% |

|

|

|

23.33% |

|

|

|

2.99% |

|

|

|

21.55% |

|

|

|

-2.77% |

|

|

|

-46.24% |

|

|

|

48.93% |

|

|

|

23.55% |

|

|

Ultra-Small Co Market

|

|

|

|

|

|

|

-1.81% |

|

|

|

31.49% |

|

|

|

0.67% |

|

|

|

23.98% |

|

|

|

4.90% |

|

|

|

79.43% |

|

|

|

20.12% |

|

|

|

4.08% |

|

|

|

11.48% |

|

|

|

-5.40% |

|

|

|

-39.49% |

|

|

|

25.95% |

|

|

|

24.86% |

|

|

Micro-Cap Limited

|

|

|

|

|

|

|

|

|

|

|

49.55% |

|

|

|

6.02% |

|

|

|

30.20% |

|

|

|

-16.61% |

|

|

|

66.97% |

|

|

|

9.46% |

|

|

|

22.55% |

|

|

|

-2.34% |

|

|

|

-4.97% |

|

|

|

-41.74% |

|

|

|

17.65% |

|

|

|

29.11% |

|

|

Small-Cap Momentum5

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Small-Cap Growth

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11.59% |

|

|

|

18.24% |

|

|

|

5.31% |

|

|

|

6.87% |

|

|

|

-43.48% |

|

|

|

15.04% |

|

|

|

11.77% |

|

|

Small-Cap Value

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17.33% |

|

|

|

18.92% |

|

|

|

12.77% |

|

|

|

6.93% |

|

|

|

-45.57% |

|

|

|

26.98% |

|

|

|

16.55% |

|

|

Large-Cap Growth

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.77% |

|

|

|

9.33% |

|

|

|

4.99% |

|

|

|

19.01% |

|

|

|

-45.42% |

|

|

|

36.66% |

|

|

|

13.34% |

|

|

Large-Cap Value

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15.15% |

|

|

|

11.62% |

|

|

|

18.52% |

|

|

|

4.49% |

|

|

|

-36.83% |

|

|

|

24.92% |

|

|

|

14.51% |

|

|

Blue Chip 35 Index

|

|

|

|

|

|

|

39.11% |

|

|

|

30.34% |

|

|

|

-15.12% |

|

|

|

-9.06% |

|

|

|

-18.02% |

|

|

|

28.87% |

|

|

|

4.79% |

|

|

|

0.05% |

|

|

|

15.42% |

|

|

|

6.07% |

|

|

|

-33.30% |

|

|

|

26.61% |

|

|

|

10.60% |

|

|

Managed Volatility

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-3.51% |

|

|

|

17.82% |

|

|

|

7.61% |

|

|

|

6.96% |

|

|

|

6.65% |

|

|

|

6.58% |

|

|

|

-19.38% |

|

|

|

12.39% |

|

|

|

5.41% |

|

5 Commenced operations on 5/28/10, therefore the Fund has no 1 year return as of 12/31/10.

* Numbers with green highlighting indicate periods when the Fund outperformed its primary benchmark.

Performance figures quoted represent past performance and are no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than original cost. To obtain performance current to the most recent month-end, please visit our

website at www.bridgeway.com or call 1-800-661-3550. Total return figures include the reimbursement of dividends and capital gains.

|

|

|

|

|

(continued)

|

|

|

This report is submitted for the general information of the shareholders of each Fund. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus, which includes information regarding a Fund’s risks, objectives, fees and expenses, experience of its management, and other information. Investors should read the prospectus carefully

before investing in a Fund. For questions or other Fund information, call 1-800-661-3550 or visit the Funds’ website at www.bridgeway.com. Funds are available for purchase by residents of the United States, Puerto Rico, U.S. Virgin Islands and Guam only. Foreside Fund Services, LLC, Distributor.

The views expressed here are exclusively those of Fund management. These views, including those relating to the market, sectors or individual stocks are not meant as investment advice and should not be considered predictive in nature.

|

|

|

|

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM |

|

|

Dear Fellow Shareholders,

Six of our twelve Funds beat their primary market benchmarks in the June quarter. For the fiscal year ending June 30, eight of eleven Funds beat their primary market benchmarks; the twelfth, Managed Volatility, met its risk target (40% or less of the market risk), while returning more than 40% of its primary market benchmark return.

A review of the recent market environment appears on page 2. In an unusual demonstration of accountability and transparency, each fiscal year we commit to reporting to shareholders what we think is the worst thing at Bridgeway during the year. This year’s choice was a first. Details are on page 3. Another of Bridgeway’s Funds turned 10 years old with the completion of fiscal year 2011.

On page 4 we step back and take a look at the performance of both risk and return of this “lower octane” fund. This fund has beaten the S&P Index over this most recent (lower return) decade, while meeting its risk target in eight of ten fiscal years.

Its easy to get discouraged with much of the continuing economic and market news recently. Our president, Mike Mulcahy, presents his views on why we still believe in the long term health of our country on page 6. Our founder, John Montgomery, then follows suit with advice about how to handle the short term ups and downs of the market on page 7.

We have always thought a fair question of any financial adviser is, “How do you invest with your own money?” By way of disclosure, the head of our investment team publishes his own target asset allocation plan (page 8). Be forewarned: each investor’s situation is different; don’t just follow John’s plan. He has a steel stomach for market downturns, a characteristic

that has helped his financial picture over the last two and a half decades, but also has caused some short-term bumps along the way, notably in 1987 and 2008.

Audited financial statements begin on page 130. Our last section includes information on why the Bridgeway Funds’ Board of Directors renewed the advisory contract with Bridgeway (page 162).

As always, we appreciate your feedback. We take your comments very seriously and regularly discuss them internally to help in managing our Funds and this company. Please keep your ideas coming — both favorable and critical. They provide us with a vital tool, helping us to serve you better.

|

|

|

|

| |

|

| 1 |

|

Annual Report | June 30, 2011 |

|

|

|

|

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) |

|

|

Market Review

The Short Version: U.S. stock market returns were mixed within a limited range, as investors tried to understand the effects of poor global and domestic economic news during the June quarter.

The second quarter started strong in April. Equities enjoyed their best month of the year following positive corporate earnings and merger activity. Stocks quickly reversed direction in May and June; soft U.S. economic data, high energy costs, and concerns that Greece could default on its sovereign debt weighed on investors’ minds. A sharp rally in the final days of the quarter helped stocks

as a new Greek solution emerged, a favorable U.S. durable goods report was released, and the Federal Reserve ended the QE2 stimulus to little fanfare. The end-of-quarter surge even moved some stock indexes into positive territory. Since the market low point in March 2009, stocks (as measured by the S&P 500 Index) have risen 95% through June 30, 2011. Small- and mid-cap indexes have performed even better, rising well over 100%.

Sector performance was widely mixed. Healthcare shares performed best as investors favored market segments that tend to hold up well in a weaker economy. Utilities and consumer staples, as well as other defensive sectors, did well. Industrials and business services, materials, and information technology shares fell slightly amid concerns that slower growth could hurt earnings in these sectors.

Energy shares declined as oil prices tumbled in May and June, while financials fell due to housing and equity market weakness, new regulations that weighed on banks’ earnings, and economic uncertainty.

Looking at the market from a “style box” perspective below, returns were mixed across styles and market capitalizations. According to Morningstar, mid-cap growth stocks were the strongest market segment in the June quarter, up 2.1%.

Following are the stock market “style box” returns from Morningstar for the quarter and year ending June 30, 2011:

|

|

|

|

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) |

|

|

The Worst Thing of the Fiscal Year

The Short Version: The shareholders who “threw in the towel”* on either the market or specific Bridgeway equity funds over the last few years did so, in aggregate, with predictably poor timing. As a result, too many of our shareholders from before the market downturn in 2008 missed out on fiscal year 2011, one of the best in Bridgeway’s history. We realize we’re

“writing to the choir” right now — and parenthetically want to express our appreciation for your staying the course of long-term investing, our stated goal. Nevertheless, we take significant responsibility for not doing a better job of communicating, educating, and partnering with shareholders to stay the course in a major market downturn. In future letters we will describe some of the steps Bridgeway is taking to address this major concern.

In each annual report for the last thirteen fiscal years, Bridgeway has revealed its “worst thing of the year.” This section has become an important Bridgeway tradition. As a shareholder, you are the owner and “boss,” and we think you have a right to know the negatives as well as the positives. In previous years we have discussed company turnover, trading errors, compliance

issues, and specific periods of the performance of one or more of our Funds. Part of our firm’s culture is transparency (we’re the only Fund firm we know of that addresses this topic in an annual report), and we work hard to address problems and not repeat mistakes.

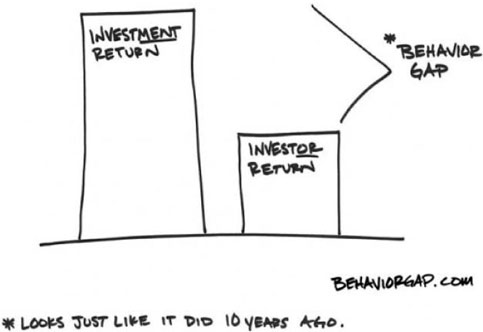

This year’s choice for “worst thing” was experiencing significant shareholder redemptions, the timing of which meant missing the best fiscal year in the past decade and second best year since the inception of Bridgeway Funds in 1994. If you have followed our letters through some years, you will recognize this as the problem we refer to as “chasing hot returns.” It

results in buying more shares “high” and selling more “low,” which destroys value over time. It is the exact opposite of the strategy practiced by Bridgeway’s founder, who heads up the investment management team. (See “Super Dollar Cost Averaging” from the December 2008 letter at http://www.bridgeway.com/assets/pdf/reports/Semi Annual Report 2008.12.31.pdf.) The phenomenon of chasing hot returns and panicking in market downturns is well

documented in the literature of behavioral finance. We recently came across a financial planner, Carl Richards, who uses drawings to illustrate the dangers of chasing hot returns, or what he refers to as the “behavior gap.” Visually, it tells the story of a phenomenon that has hurt the “take home” returns for too many previous shareholders.

*Of course, some shareholders redeem for other reasons, such as specific cash needs.

|

|

|

|

| |

|

| 3 |

|

Annual Report | June 30, 2011 |

|

|

|

|

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) |

|

|

The devastating financial impact of this phenomenon would probably make this year’s “worst thing” a candidate for the worst thing of the decade. It’s difficult to express how bad it feels to know that some of our previous investors missed the upturn.

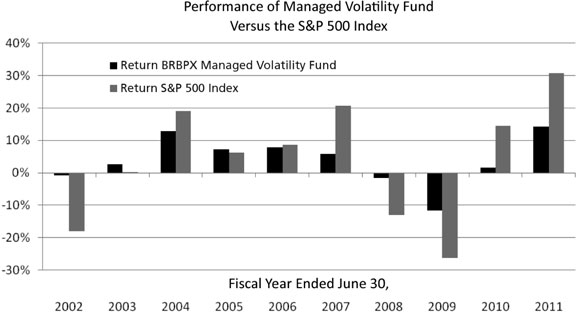

Happy Birthday: Managed Volatility Fund turns 10!

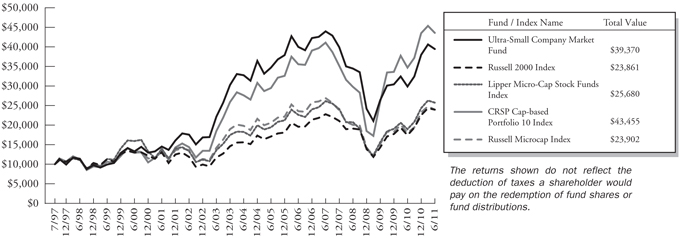

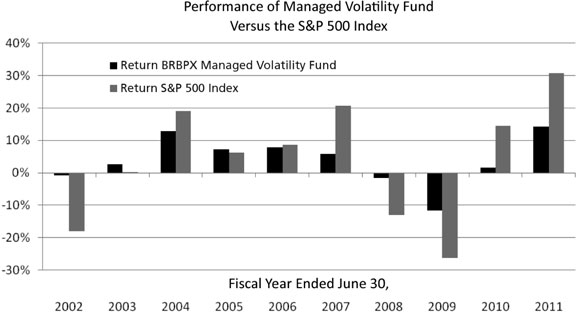

The Short Version: Most satisfying to our investment management team is designing a fund and seeing it perform exactly as designed. At the end of June we were able to step back and look at the big picture track record of another fund with a decade of performance. This is the single most complicated fund at Bridgeway — involving stocks, fixed income, and a conservative strategy to dampen

risk with exchange listed derivatives. It has accomplished well what we set out to do ten+ years ago.

Our most conservative fund, Managed Volatility, just celebrated a ten year anniversary, and we wish to thank our shareholders (new and old) for their continued confidence. Like any proud parent, we celebrate all of the important milestones in our “offspring’s” lives. In the mutual fund world, the best accomplishments come in the form of excellent performance over an extended

period of time.

But first, a bit of background. In 2001, Bridgeway set out to address a common complaint about our Funds: “Everything you guys do is high octane!” A great aspect of being an investment firm that uses data and statistics is that it is easier to design in the risk aspects of a Fund up front. With Managed Volatility we wanted to target a level of risk equal to about 40% of the

market’s risk, using the S&P 500 Index as a proxy for the market. This isn’t a number out of the blue; it’s roughly equivalent to the risk of long-term bonds. Thus, we wanted to design a fund with long-term returns that looked more like the stock market, but short-term total risk that looked more like a long-term bond fund, specifically 40% of the stock market’s return. So how has the Fund done?

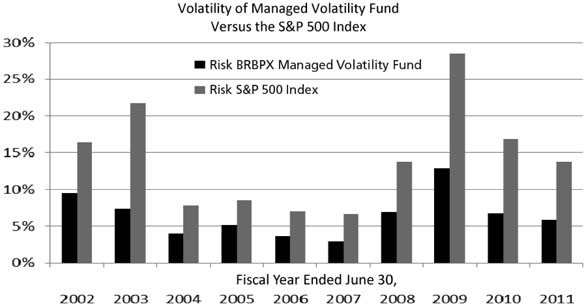

As presented in the graph on the next page, our Fund’s return has actually exceeded the return of the S&P 500 (3.59% versus 2.72%) over the full first decade of the Fund; we exceeded our return goal. On the risk side of the spectrum, we also exceeded our target for market risk (beta), providing 37% of the market risk, better than our goal. On the basis of overall volatility month to month

(standard deviation of monthly returns), we came in at 45% of the market volatility — although a majority of that volatility is on the upside — which is definitely not a problem. Downside volatility has clocked in at 40.6%, dead on target with our design goal.

|

|

|

|

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) |

|

|

Apart from aggregate data, sometimes it’s helpful to look at performance in individual years (here, fiscal years ending June 30). The graph demonstrates the concept of providing cushion in the down years, but giving some of that back in the up years — resulting in a less bumpy ride, but with an overall better return than just mixing 60% stocks with 40% cash (another way to achieve

a risk target of 40%). It also shows the Fund’s success in providing significant cushion in the three big bear market years.

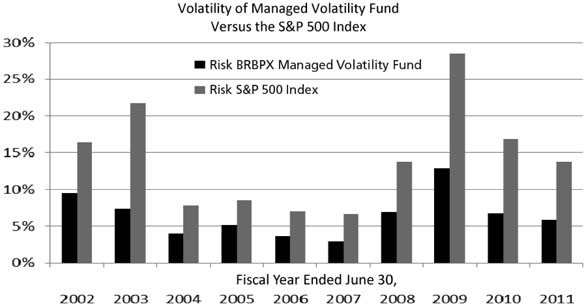

The graph above gives you the feel for risk over the full decade. The next graph shows the annual pattern of risk as measured by volatility, specifically the standard deviation of monthly returns, or how much the Fund and market prices “jump around”. The Fund has consistently controlled for risk, but not to the level of 40% of market in every market environment.

|

|

|

|

| |

|

| 5 |

|

Annual Report | June 30, 2011 |

|

|

|

|

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) |

|

|

While it’s a popular measure of risk, the problem with viewing standard deviation of returns as a primary measure of risk is that it gives equal weight to upside and downside volatility. Since most investors care a great deal about how quickly their Fund falls, but are not usually worried about it appreciating with a bit more energy, we also like to separate upside risk from downside risk.

One risk measure does exactly this and is called “upside and downside capture.” Since we target 40% of the market’s risk, a majority of the time we would hope to capture something more than 40% of the S&P 500 Index’s return in a majority of up years, but less than 40% in a majority of down years. The table below presents these statistics, also on a fiscal year basis. The numbers in green represent fiscal years where we were on the “right side” of

the 40% target; the non-highlighted numbers represent fiscal years we either fell more than 40% of the market in a downturn or captured less than 40% in an up year. Overall, we achieved our goal in eight of ten fiscal years. Notably, the two fiscal years we failed to meet our 40% targets were up years.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Fiscal Years Ended June 30, |

|

| |

|

2002 |

|

|

2003 |

|

|

2004 |

|

|

2005 |

|

|

2006 |

|

|

2007 |

|

|

2008 |

|

|

2009 |

|

|

2010 |

|

|

2011 |

|

|

Managed Volatility Fund

|

|

|

-0.78 |

% |

|

|

2.57 |

% |

|

|

12.94 |

% |

|

|

7.32 |

% |

|

|

7.83 |

% |

|

|

5.87 |

% |

|

|

-1.57 |

% |

|

|

-11.66 |

% |

|

|

1.67 |

% |

|

|

14.15 |

% |

|

S&P 500 Index

|

|

|

-17.99 |

% |

|

|

0.25 |

% |

|

|

19.11 |

% |

|

|

6.32 |

% |

|

|

8.63 |

% |

|

|

20.58 |

% |

|

|

-13.12 |

% |

|

|

-26.21 |

% |

|

|

14.43 |

% |

|

|

30.69 |

% |

|

Difference

|

|

|

17.21 |

% |

|

|

2.32 |

% |

|

|

-6.17 |

% |

|

|

1.00 |

% |

|

|

-0.80 |

% |

|

|

-14.71 |

% |

|

|

11.55 |

% |

|

|

14.55 |

% |

|

|

-12.76 |

% |

|

|

-16.54 |

% |

|

% Up/Down Capture

|

|

|

4

of Loss

|

%

|

|

|

1028

of Gain

|

%

|

|

|

68

of Gain

|

%

|

|

|

116

of Gain

|

%

|

|

|

91

of Gain

|

%

|

|

|

29

of Gain

|

%

|

|

|

12

of Loss

|

%

|

|

|

44

of Gain

|

%

|

|

|

12

of Gain

|

%

|

|

|

46

of Gain

|

%

|

|

Beta vs. S&P 500 Index

|

|

|

0.41 |

% |

|

|

0.25 |

% |

|

|

0.35 |

% |

|

|

0.50 |

% |

|

|

0.40 |

% |

|

|

0.36 |

% |

|

|

0.43 |

% |

|

|

0.41 |

% |

|

|

0.35 |

% |

|

|

0.41 |

% |

Begin, Commence, Start Moving!

The Short Version: With considerable negative economic news in the media and — post fiscal year end — the first official stock market correction (10% drop) since 2008, it’s easy to get down in the dumps, or worse, panic in the current economic environment. While unemployment is still high, and addressing the debt burden may remain painful for some time, Bridgeway remains

optimistic about the long term health of our country. We make no predictions about the short term direction of the economy or the stock market; but Bridgeway Capital Management’s President, Mike Mulcahy explains why we hold an optimistic long term view.

Good news! There is a record amount of cash in both corporate and personal accounts. Bad news! Very little is being invested and spent. In the 2001 comedy movie Rat Race, there is a group of confused tourists who unwittingly enter into a bizarre and humorous race for a $2 million prize. When the host of the race, Donald Sinclair, played by John Cleese of Monty Python fame, reveals they are in the

race and announces “go,” they all look bewildered, confused and out of sorts. When one of the contestants asks for clarity, Mr. Sinclair provides more definition… “Begin, commence, start moving…” When nothing happens, he finally pulls out a pistol, fires it into the air and THEN the race really begins.

|

|

|

|

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) |

|

|

In many ways I feel our economy is in the same situation. We are in a race to recovery but can’t seem to get past “go.” We are waiting for some strong signal (our metaphorical starter pistol) to “begin, commence, start moving.” Even though we are generally sitting in bewilderment, watching events unfold, I will remain an optimist for a recovery. I don’t know when

it will occur, but I am confident it will. Here are just two reasons why:

First, I have a great amount of confidence in our great nation. We are a wonderful group of diverse people with great ideas, innovative spirits and ambitious dreams. These ideals have not been taken away by any economic downturn. Despite the temporary feeling of gloom, political battles, tiresome rhetoric and blame, America is still the best place to pursue opportunities. Better days are ahead

because we won’t accept the alternative.

Second, the economy appears poised to grow, because there is significant cash sitting on the sidelines waiting to “begin, commence, start moving.” Moody’s and Standard and Poor’s both report that corporate cash levels are at an all time high (over $2 trillion in US companies), and the Wall Street Journal recently ran a story on the return of corporate earnings, which means

that more cash is being added on a daily basis. The CFO Report in June 2011 asserted that CFOs are holding back on hiring and investing until they can get a better glimpse of the future. This “cash hoarding” is under some criticism but is a logical response to lack of confidence in the future.

Another indication of more systematic “cash hoarding” is found in the levels of money supply. M1 and M2 are two measures of cash instruments tracked by the Federal Reserve. These numbers capture money that is in checking accounts, savings accounts, money market funds, and other short-term liquid holdings. Both of these numbers are also at all time highs, with M2 surpassing $9 Trillion

this June, up over 10% since the last recession began. Just like corporations, individuals are waiting for a strong signal to return to spending and investing. It is a big deal when consumer consumption represents about 70% of our GDP. A July 2011 study by UBS Wealth Management of 1,000 high net worth investors showed that 40% are holding off on investing. Why? Only 21% were cited as optimistic about the economy, down from 53% in April. Worse, 60% are pessimistic about the economy, up

from 27% in April.

In many ways, the data suggests our economy is in the same situation as the contestants in Rat Race. We have the cash, we have the creativity, we have the skills. What’s wrong? We are all just perplexed, waiting for that strong signal to announce that our race to recovery has begun. Sadly, for investors we usually respond too late (but that’s a separate story). Let’s hope that the

signal comes soon, as I know we are all tired of this “rat race!”

Whiplash (by John Montgomery)

The Short Version: The easiest cure for financial whiplash: turn off the news about the latest market moves and don’t check your own portfolio prices more than quarterly.

Thirty years ago, I worked in a different service industry: transportation. Specifically, I managed a small bus company in North Carolina. While one might not think there are many similarities between the investment business and the transportation business, I have found a number:

| |

• |

|

low costs make a big difference,

|

| |

• |

|

people on the receiving end of any service transaction want to be treated with respect, fairness, and integrity,

|

| |

• |

|

the most powerful business asset (the people providing the service) doesn’t even appear on an organization’s balance sheet; investing in those people and providing a great place to work is one of the single best uses of leaders’ time,

|

| |

• |

|

technology can help keep you ahead of the curve if you use it well, and

|

| |

• |

|

learning from mistakes and failure — and then not repeating them — is key.

|

I recently reflected on an investment phenomenon that took me back to my years in North Carolina. Bus passengers at that time would not infrequently sue the public bus company for damages, time off, and pain and suffering from an accident, even mild accidents. Whiplash is hard to prove, and that was a frequent claim. My assistant would visit accident victims at their homes, expressing sincere

concern, but also on the lookout for those who would wear a neck brace to work, but play football

|

|

|

|

| |

|

| 7 |

|

Annual Report | June 30, 2011 |

|

|

|

|

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) |

|

|

with the kids at home. Sadly, I have to admit I engaged in negative humor and cynicism around these claims of whiplash. You might imagine the jokes told in industry trade meetings. One day, that changed for me. While I was waiting to make a left turn, a taxi ran into the back of my own private car. The day after, my neck was in significant pain; I never took part in whiplash jokes again.

Fast forward to 2011. Last month I was reading an investment article entitled, “A Severe Case of Portfolio Whiplash” (New York Times, July 10, 2011), referring to the ups and downs of the quarter. While the newspaper image of a 25-year-old man in a neck brace took me right back to my experience in North Carolina, there was one major difference. I know how to cure every instance of

“whiplash” in the June quarter of 2011. Don’t look at daily prices. Four times a year is plenty. What possible value added is there to looking more frequently? The “upside”: potential sympathy following claims of whiplash. And the potential downside: ending up with sub par returns due to the “behavior gap” discussed two sections above. For long term investments, we believe holding through the downturns is the only way to ensure that an

individual investor’s returns don’t drop below that of the fund they are invested in.

“How do you invest your money?” (by John Montgomery)

The Short Version: We have a strong commitment to disclosure at Bridgeway, and I think it is fair for shareholders to know exactly how the head of their investment management team invests his money. Some people say I have a steel stomach in a market downturn. Thus, my target allocation for my personal investments may be more aggressive than would be considered appropriate for most people. I

rely very heavily on the funds we manage to build my “nest egg” for retirement (which is likely more than a handful of years away).

A Bridgeway partner recently informed me that our shareholders continue to ask the question, “How does John invest his money?” Since I haven’t shared my target asset allocation with you in a while, I thought I’d give you an update in this annual report. Bear in mind, everybody’s situation is different in terms of our goals, our risk tolerance, our investing experience,

and our time horizons. I am not recommending that you follow my target allocation. I share my allocation with you to show you my thought process and also by way of disclosure; you should not simply copy what I’m doing, because your situation is undoubtedly different than mine.

Personally, I have a high pain threshold in a market downturn. I don’t usually look at my account statements (though I do update them in “Quicken” often enough to ensure accuracy and tax and disclosure reporting). My rule of thumb, both professionally and personally, is, “If it doesn’t make a difference in a decision you make, don’t look.” I realize this is

hardly classical wisdom, but I see two big specific problems with following one’s investments too frequently. First, investors tend to become more nervous, especially in a downturn, which causes (in my opinion) unnecessary stress, and based on several studies, too much costly changing from one investment to another. Second, investors tend to “chase hot returns,” buying more after a big run-up and selling after a downturn — a formula for financial disaster.

So what’s the antidote to obsessing about returns? Is there a more productive way to spend time and energy? My philosophy is. . .

a) structure an asset allocation plan that matches your goals, investing time horizon, and tolerance for risk (generally, diversified short-term income investments for short-term needs and more stocks for long-term needs),

b) write it down,

c) implement it, and

d) rebalance it every one or two years (or as lifestyle changes occur).

By way of disclosure. . .

First, I am 55 years young and my three children have all completed college and become financially independent. My wife and I pay expenses out of the joint employment income from our respective workplaces, so my investments are essentially all long-term focused and earmarked for our retirement years. For near-term obligations (or maybe an emergency fund), I have historically used short-term bonds

(including inflation-protected bonds) and a small amount within a money market fund.

|

|

|

|

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) |

|

|

Second, at any given time, my actual allocation will vary somewhat from the target below, due to periodic cash flow and tax management considerations. Generally, I try to keep it in balance over time. By rebalancing on a periodic basis, I am able to invest more dollars in funds that have underperformed and trim what has done really well.

Third, I use Bridgeway-managed portfolios for 100% of my stock market investing needs. (No portfolio manager at Bridgeway is permitted to buy domestic equities directly; we “eat our own cooking.”)

Fourth, this table does not include my substantial, majority ownership in Bridgeway Capital Management, since I plan to retire off of my personal investments as detailed below. [The substantial allocation of Bridgeway Funds through my Bridgeway Capital Management ownership can be found in the Statement of Additional Information on our web site.]

Fifth, in addition to my mutual fund allocation, I also have some investments in an illiquid real estate partnership that my brother (also a director of Bridgeway Capital Management) manages, a holding that represents less than 10% of my retirement assets.

Finally, the following table depicts my personal targeted fund allocation, but does not show or explain how the Bridgeway managers (including me) manage money within each fund.

Whew! Here’s my long term target allocation:

|

|

|

|

|

|

| Fund |

|

Allocation |

|

|

Bridgeway Aggressive Investors 1 and 2 Funds

|

|

|

50.0% |

|

|

Bridgeway Ultra-Small Company Fund

|

|

|

26.4% |

|

|

Bridgeway Micro-Cap Limited Fund

|

|

|

10.0% |

|

|

Bridgeway Managed Volatility Fund

|

|

|

8.0% |

|

|

Bridgeway Blue Chip 35 Index Fund

|

|

|

0.7% |

|

|

Bridgeway Large-Cap Growth Fund

|

|

|

0.7% |

|

|

Bridgeway Large-Cap Value Fund

|

|

|

0.7% |

|

|

Bridgeway Small-Cap Growth Fund

|

|

|

0.7% |

|

|

Bridgeway Small-Cap Value Fund

|

|

|

0.7% |

|

|

Bridgeway Small-Cap Momentum Fund

|

|

|

0.7% |

|

|

Bridgeway Omni Tax-Managed Small-Cap Value Fund

|

|

|

0.7% |

|

|

Bridgeway Ultra-Small Company Market Fund

|

|

|

0.7% |

|

|

|

|

|

|

|

|

Total

|

|

|

100.0% |

|

Happy Birthday to the World’s Youngest Nation

As you may know, one of the unusual aspects of Bridgeway Capital Management, the Funds’ adviser, is that we donate half of our profits to non-profit organizations. One of the focus areas of that work took a colleague and me to Juba, Sudan early this year for a week as international election observers with the Carter Center. This historic election was not about electing people to office, but

rather determining whether southern Sudan would secede from the north, forming a new nation as provided for in the Comprehensive Peace Agreement (CPA). This agreement was brokered by President George W. Bush in 2005 and ended a 22-year civil war in which 2 million people died.

Reflection on the elections. Successful, peaceful elections by no means guarantee peace — the politics, tensions, and dynamics of the region are hugely complex — but the elections were an important step along the way. The presence of international election observers contributes significantly to peaceful and fair elections, and Bridgeway was doing its small part. I felt as if I

were in the room as citizens were signing their country’s own Declaration of Independence. This election was important to the people of South Sudan, to those in Darfur and Nubia, to the general stability of one of Africa’s largest nations, and to the surrounding African nations. But it also affects us here in America, as the future of Africa affects our own future.

Fast forward six months. I write this letter on July 9, five days after celebrating our own country’s independence, also, on the day of birth of the world’s newest nation, South Sudan. Even as this is a wonderful moment for many people in the south, full of hope for freedom, peace, and development, problems abound. The per capita income in the south is a small fraction (a

few dollars/day) of what it is in the north. There are ten registered nurses for a population of ten million people. (I personally

|

|

|

|

| |

|

| 9 |

|

Annual Report | June 30, 2011 |

|

|

|

|

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) |

|

|

know that many nurses in my home town in the U.S.) Today, a girl is several times more likely to die in childbirth than to learn to read. There remain a handful of rebel groups in South Sudan that are not aligned with the current/new government. There is as yet no agreement on a formula for sharing oil revenues between Sudan and South Sudan or on the status of the border states. Significant violence

continues in the border states of Abyei and South Kordofan, in addition to the ongoing tragedies in Darfur. In short, there are many opportunities for continued peacemaking and development. My hope and prayer is for peace at the most fundamental level, true unity, and the setting of a foundation for freedom that will be a model for others.

Context. At this point you may be wondering what a country in Africa has to do with Bridgeway and your Funds. It is Bridgeway’s view that taking a broader view of our work and world gives us a much stronger, healthier, and sustainable platform for producing attractive, long-term shareholder returns. Only one member of your investment management team went to the Sudan in the recently

completed fiscal year, but we encourage each partner throughout the firm to engage significantly, we say “transformatively,” in his or her own area of passion — both in our investment work and in our broader communities.

THIS PAGE INTENTIONALLY LEFT BLANK

|

|

|

|

| |

|

|

|

|

Annual Report | June 30, 2011 |

|

|

|

|

|

Aggressive Investors 1 Fund

MANAGER’S COMMENTARY

|

|

|

June 30, 2011

Dear Fellow Aggressive Investors 1 Fund Shareholder,

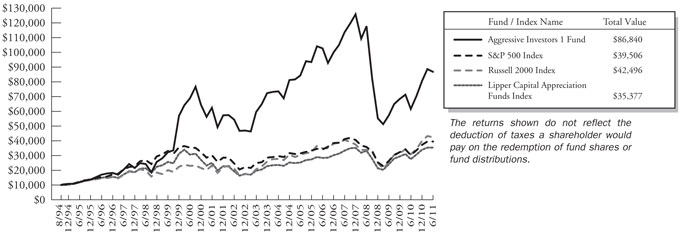

Aggressive Investors 1 Fund declined 1.98% for the quarter ended June 30, 2011 trailing, our primary benchmark, the S&P 500 Index (+0.10%), our peer benchmark, the Lipper Capital Appreciation Funds Index (-0.29%) and the Russell 2000 Index (-1.61%). It was a weak quarter on an absolute and relative basis.

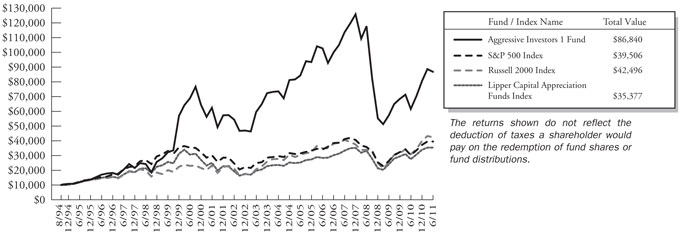

For the fiscal year ended June 30, 2011, our Fund appreciated 40.81%, outperforming all of our benchmarks, the S&P 500 Index (+30.69%), the Lipper Capital Appreciation Funds Index (+27.96%) and the Russell 2000 Index (+37.41%). We are very pleased with both the relative and absolute returns for the one year period. We continue to lead our primary benchmark for the ten-year and

life-to-date periods, but we still have ground to make up for the five year period.

The table below presents our June quarter, one-year, five-year, ten-year and life-to-date financial results according to the formula required by the SEC. See the next page for a graph of performance from inception to June 30, 2011.

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

June Qtr.

4/1/11

to 6/30/11 |

|

1 Year

7/1/10

to 6/30/11 |

|

5 Year

7/1/06

to 6/30/11 |

|

10 Year

7/1/01

to 6/30/11 |

|

Life-to-Date

8/5/94

to 6/30/11 |

|

|

|

|

|

|

|

|

Aggressive Investors 1 Fund

|

|

-1.98% |

|

40.81% |

|

-3.29% |

|

3.35% |

|

13.64% |

|

S&P 500 Index (large companies)

|

|

0.10% |

|

30.69% |

|

2.94% |

|

2.72% |

|

8.47% |

|

Lipper Capital Appreciation Funds Index

|

|

-0.29% |

|

27.96% |

|

4.53% |

|

3.46% |

|

7.76% |

|

Russell 2000 Index (small companies)

|

|

-1.61% |

|

37.41% |

|

4.08% |

|

6.27% |

|

8.94% |

Performance figures quoted in the table above and graph below represent past performance and are no guarantee of future results. Total return figures in the table above include the reinvestment of dividends and capital gains. The table above and the graph below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions, based on the average of 500 widely held common stocks with dividends reinvested. The Russell 2000 Index is an unmanaged, market value weighted index that measures performance of the 2,000 companies that are between the 1,000th and 3,000th largest in the market with dividends reinvested. The

Lipper Capital Appreciation Funds Index reflects the record of the 30 largest funds in the category of more aggressive domestic growth mutual funds, as reported by Lipper, Inc. It is not possible to invest directly in an index. Periods longer than one year are annualized.

According to data from Lipper, Inc. as of June 30, 2011, Aggressive Investors 1 Fund ranked 47th of 290 capital appreciation funds for the twelve months ending June 30, 2011, 215th of 220 over the last five years, 91st of 162 over the last ten years, and 2nd of 54 since inception in August, 1994. Lipper, Inc. is an independent mutual fund rating service that ranks funds in various fund

categories by making comparative calculations using total returns.

|

|

|

|

|

Aggressive Investors 1 Fund

MANAGER’S COMMENTARY (continued)

|

|

|

Aggressive Investors 1 Fund vs. S&P 500 Index, Lipper Capital Appreciation Funds Index & Russell 2000 Index

from Inception 8/5/94 to 6/30/11

Detailed Explanation of Quarterly Performance

The Short Version: Consumer Discretionary stocks were the bright spot in the quarter, while Materials and Industrial stocks detracted the most from Fund returns among the ten worst contributors.

Despite the fact that many consumers remained concerned about the economy and their individual job prospects for the future, Consumer Discretionary stocks highlighted the list of best performers for the quarter. Some luxury buyers have been jumping back in with more expensive purchases. Eight Consumer Discretionary companies made the top-ten list; combined, they contributed over two percent to the

Fund’s return.

These are the Fund’s ten best-contributing stocks for the quarter ended June 30, 2011:

|

|

|

|

|

|

|

|

| Rank |

|

Description |

|

Industry |

|

% Contribution to Return |

| 1 |

|

Fossil, Inc. |

|

Textiles, Apparel & Luxury Goods |

|

0.5% |

| 2 |

|

Dillard’s, Inc. |

|

Multiline Retail |

|

0.4% |

| 3 |

|

Polaris Industries, Inc. |

|

Leisure Equipment & Products |

|

0.4% |

| 4 |

|

Pier 1 Imports, Inc. |

|

Specialty Retail |

|

0.2% |

| 5 |

|

Credit Acceptance Corp. |

|

Consumer Finance |

|

0.2% |

| 6 |

|

Netflix, Inc. |

|

Internet & Catalog Retail |

|

0.2% |

| 7 |

|

Basic Energy Services, Inc. |

|

Energy Equipment & Services |

|

0.2% |

| 8 |

|

CBS Corp. |

|

Media |

|

0.2% |

| 9 |

|

Magna International, Inc. |

|

Auto Components |

|

0.2% |

| 10 |

|

TRW Automotive Holdings Corp. |

|

Auto Components |

|

0.2% |

Fossil manufactures watches and other fashion jewelry, primarily for the high-end market. While many consumers continue to hold off on discretionary purchases in these tight economic times, luxury buyers have begun to resurface. The company posted far better-than-expected earnings in the latest quarter, and revenues jumped over 30 percent to a seasonally adjusted all time high. While sales in

Europe have been lackluster at best, growth from Asian markets has been strong and more than picked up the slack — highlighting the fact that some of our U.S. stocks do have foreign exposure. The company projects double-digit percentage sales increases for each of the next two years and boasts “strong buy” recommendations by several analysts. Fossil hit a 52-week high late in the quarter and was the top contributor to the Fund’s performance.

|

|

|

|

| |

|

| 13 |

|

Annual Report | June 30, 2011 |

|

|

|

|

|

Aggressive Investors 1 Fund

MANAGER’S COMMENTARY (continued)

|

|

|

Luxury buyers not only have their eyes on nice watches these days; many of the thrill seekers of the bunch have also been in the market for off-road recreational vehicles. Polaris Industries reported a solid first quarter that beat analysts’ estimates and also raised its outlook for the future. Over the past five years, the company has realized stronger revenue and earnings growth in the March

and June quarters, a trend some analysts expect to occur in 2011 as well. Polaris has added to its product line with the acquisition of Global Electric Motorcars from Chrysler, as well as Indian Motorcycle, a legendary brand that still offers great appeal for true riders. The stock is trading at close to an all-time high and was the second best Fund performer for the period, increasing almost 30 percent.

The aftermath of the Japanese earthquake and tsunami has been felt throughout the manufacturing sector as supply chains have been impacted, particularly among auto makers and suppliers. Four industrial companies made the “bottom ten contributors” list; combined, they hindered the performance of the Fund by one percent. Additionally, metals and metal-related companies gave back a portion

of their stellar gains of the prior quarters.

These are the Fund’s ten worst-contributing stocks for the quarter ended June 30, 2011:

|

|

|

|

|

|

|

|

| Rank |

|

Description |

|

Industry |

|

% Contribution to Return |

| 1 |

|

Silvercorp Metals, Inc. |

|

Metals & Mining |

|

-0.6% |

| 2 |

|

ION Geophysical Corp. |

|

Energy Equipment & Services |

|

-0.6% |

| 3 |

|

Micron Technology, Inc. |

|

Semiconductors & Semiconductor Equipment |

|

-0.4% |

| 4 |

|

Silver Wheaton Corp. |

|

Metals & Mining |

|

-0.4% |

| 5 |

|

CNH Global N.V. |

|

Machinery |

|

-0.3% |

| 6 |

|

Tata Motors, Ltd. - Sponsored ADR |

|

Machinery |

|

-0.3% |

| 7 |

|

United Rentals, Inc. |

|

Trading Companies & Distributors |

|

-0.2% |

| 8 |

|

Timberland Co. |

|

Textiles, Apparel & Luxury Goods |

|

-0.2% |

| 9 |

|

Titan International, Inc. |

|

Machinery |

|

-0.2% |

| 10 |

|

Nabors Industries, Ltd. |

|

Energy Equipment & Services |

|

-0.2% |

What a difference a few months make! In the fourth quarter 2010, silver mining company Silvercorp was the Fund’s top performer and jumped more than 50% for the period. After pushing to 30-year highs, silver began to plummet in April, and some futures investors were forced out of the market by a series of margin increases. Additionally, with the Fed set to wind down its latest stimulus

program, known as QE2, in June (it has since ended), many precious metals began trading well off their highs as investors feared an end to the sizable commodity run. Silvercorp, the largest primary silver producer in China, struggled along with the metals themselves, and its stock price dropped 35% during the three month period. Late in the quarter, the company announced a major buyback program to take advantage of what management believes to be an undervaluation in its stock.

So what happens when a company misses revenues by $26 million or over 25% of analysts’ expectations? ION Geophysical can answer that question, as the energy company’s share price dropped over 25% in the quarter. While earnings were still slightly positive for the quarter, one of ION’s key business units took a sizable hit due to the ongoing turmoil in the Middle East, in

particular Libya. In fact, a multi-million dollar sale to the country was put on hold for an indefinite time frame. ION was the Fund’s second largest drag on Fund performance for the quarter and demonstrates the downside political risk of exposure to some foreign markets.

Detailed Explanation of Fiscal Year Performance

The Short Version: Consumer Discretionary stocks were the positive story for the fiscal year as well as the quarter. While IT stocks had the largest representation among the worst performers list, Industrial stocks actually hurt our relative performance the most.

A surge in retail activity in the second half of 2010 propelled a number of Consumer Discretionary companies to solid results for the fiscal year. All told, five related companies made the top performers list for the 12-month period. Combined, they returned over four percent to the Fund’s performance.

|

|

|

|

|

Aggressive Investors 1 Fund

MANAGER’S COMMENTARY (continued)

|

|

|

These are the Fund’s ten best-contributing stocks for the fiscal year ended June 30, 2011:

|

|

|

|

|

|

|

|

| Rank |

|

Description |

|

Industry |

|

% Contribution to Return |

| 1 |

|

Netflix, Inc. |

|

Internet & Catalog Retail |

|

1.5% |

| 2 |

|

TRW Automotive Holdings Corp. |

|

Auto Components |

|

1.3% |

| 3 |

|

Fossil, Inc. |

|

Textiles Apparel & Luxury Goods |

|

1.2% |

| 4 |

|

Dillard’s, Inc. |

|

Multiline Retail |

|

1.2% |

| 5 |

|

Pier 1 Imports, Inc. |

|

Specialty Retail |

|

1.2% |

| 6 |

|

ARM Holdings PLC - Sponsored ADR |

|

Semiconductors & Semiconductor Equipment |

|

1.1% |

| 7 |

|

CBS Corp. |

|

Media |

|

1.0% |

| 8 |

|

RPC, Inc. |

|

Energy Equipment & Services |

|

1.0% |

| 9 |

|

W.W. Grainger, Inc. |

|

Trading Companies & Distributors |

|

1.0% |

| 10 |

|

Ford Motor Co. |

|

Automobiles |

|

0.9% |

First, Blockbuster. Next, the cable companies? Netflix is the largest online movie rental subscription service in the United States, offering over 18,000 entertainment titles (movies, TV shows) delivered either via mail or streamed directly to users’ TVs or computers. Its business model was credited by some for the demise of one-time giant Blockbuster. Now, even cable companies are worried

that their current subscribers may cancel (or downgrade) their services and simply use Netflix more. In May, Netflix inked an agreement with Miramax to add to its library of movies. In April, the company posted earnings and revenues that beat expectations, after reporting similarly strong results in January. A major analyst recently upgraded the stock and claimed that subscribers could hit 50 million by 2013 from 24 million currently. Late in the fiscal year, Netflix’s

CEO joined Facebook’s board of directors, prompting speculation that some business relationship between the two companies may be in the works. For the 12-month period, Netflix stock more than doubled in price and was the top contributor to the Fund.

Perhaps it started with the “cash for clunkers” program? Perhaps the industry bailout helped? Perhaps it’s just par for the course for the economic recovery. The domestic auto sector has been on the rebound, and companies such as parts supplier TRW have benefited dramatically. In May, the company posted stellar earnings that grew by almost 40% and beat analysts’ forecasts.

TRW also reported strong revenues and improving margins and raised its sales estimates for the entire year. While management acknowledges some challenges due to supply chain disruptions from the Japanese earthquake and tsunami, it expects the impact to be short-lived and believes that any lost production should be recouped in the second half of the year. TRW enhanced the Fund’s return by over one-and-a-quarter-percent for the 12-month period.

While some analysts expected IT companies to lead the domestic recovery as businesses upgrade outdated systems and processes, four related stocks were among the worst performance drags to the Fund. Combined, these holdings cost the Fund about a percent-and-a-quarter in return for the fiscal year.

These are the Fund’s ten worst-contributing stocks for the fiscal year ended June 30, 2011:

|

|

|

|

|

|

|

|

| Rank |

|

Description |

|

Industry |

|

% Contribution to Return |

| 1 |

|

Sanmina-SCI Corp. |

|

Electronic, Equipment Instruments & Components |

|

-0.6% |

| 2 |

|

Corinthian Colleges, Inc. |

|

Diversified Consumer Services |

|

-0.5% |

| 3 |

|

ION Geophysical Corp. |

|

Energy Equipment & Services |

|

-0.4% |

| 4 |

|

JDS Uniphase Corp. |

|

Communications Equipment |

|

-0.4% |

| 5 |

|

Newcastle Investment Corp. |

|

Real Estate Investment Trusts (REITs) |

|

-0.2% |

| 6 |

|

Sinclair Broadcast Group, Inc. |

|

Media |

|

-0.2% |

| 7 |

|

Titan International, Inc. |

|

Machinery |

|

-0.2% |

| 8 |

|

Las Vegas Sands Corp. |

|

Hotels Restaurants & Leisure |

|

-0.2% |

| 9 |

|

Genworth Financial, Inc. |

|

Insurance |

|

-0.2% |

| 10 |

|

Ceradyne, Inc. |

|

Aerospace & Defense |

|

-0.2% |

An interesting debate has sprung up surrounding the regulation and funding of for-profit colleges. Some colleges have been soundly criticized for charging too much tuition to students who can least afford to repay the loans. These critics believe the for-profit colleges have raised unrealistic expectations for future employment and thus prospects for repayment. On the other

|

|

|

|

| |

|

| 15 |

|

Annual Report | June 30, 2011 |

|

|

|

|

|

Aggressive Investors 1 Fund

MANAGER’S COMMENTARY (continued)

|

|

|

hand, some feel that market forces should not be hampered by additional regulations and that the for-profit colleges fill a needed gap. As a result of some pretty dismal statistics released in August 2010 about industry-wide loan repayment rates, the Department of Education proposed new regulations that will penalize schools that fall below certain minimums and will potentially cut them off from

being allowed to offer federal student loans. Corinthian Colleges was one of many private education companies that failed to meet the minimum guidelines, and enrollment in its institutions could drop considerably should its students be unable to receive much needed aid. Company management dramatically lowered its earnings outlook as a result of the new proposed standards. For years, certain critics of these institutions have claimed that they fail to prepare students for the jobs market

(particularly a tough jobs market), and graduates often are unable to pay back government loans. These regulations could change the entire dynamic of the private education industry. Corinthian Colleges’ stock price dropped almost 50%, and it was the Fund’s second worst contributor.

Top Ten Holdings as of June 30, 2011

Four of the Fund’s top contributors for the June 2011 quarter were also among the largest holdings at the end of the fiscal year: Fossil, TRW Automotive, Dillard’s, Polaris. The Fund was broadly diversified across industries, and no single holding accounted for greater than 2.7% of the net assets. The ten largest positions represented just over 20% of the total assets of the Fund.

|

|

|

|

|

|

|

|

| Rank |

|

Description |

|

Industry |

|

% of Net

Assets |

| 1 |

|

RPC, Inc. |

|

Energy Equipment & Services |

|

2.7% |

| 2 |

|

Westlake Chemical Corp. |

|

Chemicals |

|

2.3% |

| 3 |

|

Fossil, Inc. |

|

Textiles, Apparel & Luxury Goods |

|

2.1% |

| 4 |

|

TRW Automotive Holdings Corp. |

|

Auto Components |

|

2.0% |

| 5 |

|

ARM Holdings PLC - Sponsored ADR |

|

Semiconductors & Semiconductor Equipment |

|

2.0% |

| 6 |

|

Sinclair Broadcast Group, Inc. |

|

Media |

|

2.0% |

| 7 |

|

Vonage Holdings Corp. |

|

Diversified Telecommunication Services |

|

2.0% |

| 8 |

|

Dillard’s, Inc. |

|

Multiline Retail |

|

1.9% |

| 9 |

|

Illumina, Inc. |

|

Life Sciences Tools & Services |

|

1.7% |

| 10 |

|

Polaris Industries, Inc. |

|

Leisure Equipment & Products |

|

1.7% |

| |

|

Total |

|

|

|

20.4% |

Industry Sector Representation as of June 30, 2011

The Fund’s most overweighted sector at quarter end was Consumer Discretionary, a sector that performed well in the market and especially in our Fund in the June quarter. The sector added about one and a half percent of relative performance to the Fund. On the other side of the ledger, our Fund is most underweighted in Financials, a riskier sector as demonstrated in the 2008 downturn.

|

|

|

|

|

|

|

|

| |

|

% of Net Assets |

|

% of S&P 500

Index

|

|

Difference |

|

Consumer Discretionary

|

|

19.9% |

|

10.7% |

|

9.2% |

|

Consumer Staples

|

|

7.2% |

|

10.7% |

|

-3.5% |

|

Energy

|

|

14.0% |

|

12.6% |

|

1.4% |

|

Financials

|

|

9.9% |

|

15.0% |

|

-5.1% |

|

Health Care

|

|

8.4% |

|

11.7% |

|

-3.3% |

|

Industrials

|

|

13.2% |

|

11.3% |

|

1.9% |

|

Information Technology

|

|

13.9% |

|

17.8% |

|

-3.9% |

|

Materials

|

|

10.1% |

|

3.7% |

|

6.4% |

|

Telecommunication Services

|

|

3.1% |

|

3.1% |

|

0.0% |

|

Utilities

|

|

0.0% |

|

3.4% |

|

-3.4% |

|

Cash & Other Assets

|

|

0.3% |

|

0.0% |

|

0.3% |

|

Total

|

|

100.0% |

|

100.0% |

|

|

|

|

|

|

|

Aggressive Investors 1 Fund

MANAGER’S COMMENTARY (continued)

|

|

|

Disclaimer

The views expressed here are exclusively those of Fund management. These views, including those related to market sectors or individual stocks, are not meant as investment advice and should not be considered predictive in nature. Any favorable (or unfavorable) description of a holding applies only as of the quarter-end, June 30, 2011, unless otherwise stated. Security positions can and do

change thereafter. Discussions of historical performance do not guarantee and may not be indicative of future performance.

Market volatility can significantly affect short-term performance. The Fund is not an appropriate investment for short-term investors. Investments in the small companies within this multi-cap fund generally carry greater risk than is customarily associated with larger companies. This additional risk is attributable to a number of factors, including the relatively limited financial resources that

are typically available to small companies and the fact that small companies often have comparatively limited product lines. In addition, the stock of small companies tends to be more volatile than the stock of large companies, particularly in the short term and particularly in the early stages of an economic or market downturn. The Fund’s use of options, futures, and leverage can magnify the risk of loss in an unfavorable market, and the Fund’s use of short-sale positions

can, in theory, expose shareholders to unlimited loss. Finally, the Fund exposes shareholders to “focus risk,” which may add to Fund volatility through the possibility that a single company could significantly affect total return. Shareholders of the Fund, therefore, are taking on more risk than they would if they invested in the stock market as a whole.

Conclusion

Thank you for your continued investment in Aggressive Investors 1 Fund. We encourage your feedback; your reactions and concerns are extremely important to us.

Sincerely,

The Investment Management Team

|

|

|

|

| |

|

| 17 |

|

Annual Report | June 30, 2011 |

|

|

|

|

|

Bridgeway Aggressive Investors 1 Fund

SCHEDULE OF INVESTMENTS

|

|

|

|

|

|

|

| Showing percentage of net assets as of June 30, 2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Industry

|

|

Company

|

|

|

Shares |

|

|

|

Value |

|

|

COMMON STOCKS - 99.77%

|

|

|

Aerospace & Defense - 1.96%

|

|

|

|

|

Ceradyne, Inc.*

|

|

|

24,600 |

|

|

$ |

959,154 |

|

|

|

|

L-3 Communications Holdings, Inc.

|

|

|

12,900 |

|

|

|

1,128,105 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,087,259 |

|

| |

|

Auto Components - 5.88%

|

|

|

|

|

BorgWarner, Inc.*

|

|

|

19,400 |

|

|

|

1,567,326 |

|

|

|

|

Magna International, Inc.

|

|

|

24,800 |

|

|

|

1,340,192 |

|

|

|

|

Tenneco, Inc.*

|

|

|

27,900 |

|

|

|

1,229,553 |

|

|

|

|

TRW Automotive Holdings Corp.*

|

|

|

36,200 |

|

|

|

2,136,886 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6,273,957 |

|

| |

|

Beverages - 3.24%

|

|

|

|

|

Brown-Forman Corp., Class B

|

|

|

13,700 |

|

|

|

1,023,253 |

|

|

|

|

Coca-Cola Enterprises, Inc.#

|

|

|

43,300 |

|

|

|

1,263,494 |

|

|

|

|

Dr. Pepper Snapple Group, Inc.

|

|

|

28,000 |

|

|

|

1,174,040 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,460,787 |

|

| |

|

Biotechnology - 1.00%

|

|

|

|

|

Alexion Pharmaceuticals, Inc.*

|

|

|

22,800 |

|

|

|

1,072,284 |

|

| |

|

Chemicals - 5.27%

|

|

|

|

|

CF Industries Holdings, Inc.

|

|

|

7,400 |

|

|

|

1,048,358 |

|

|

|

|

Mosaic Co. (The)

|

|

|

14,800 |

|

|

|

1,002,404 |

|

|

|

|

Sherwin-Williams Co. (The)

|

|

|

13,300 |

|

|

|

1,115,471 |

|

|

|

|

Westlake Chemical Corp.

|

|

|

47,300 |

|

|

|

2,454,870 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,621,103 |

|

| |

|

Commercial Banks - 0.94%

|

|

|

|

|

Royal Bank of Scotland Group PLC - Sponsored ADR*

|

|

|

80,200 |

|

|

|

998,490 |

|

| |

|

Communications Equipment - 2.32%