INVESTMENT COMPANIES

| Investment Company Act file number: | 811-04973 | |

| Exact name of registrant as specified in charter: |

Voyageur Insured Funds

|

|

| Address of principal executive offices: | 2005 Market Street | |

| Philadelphia, PA 19103 | ||

| Name and address of agent for service: | David F. Connor, Esq. | |

| 2005 Market Street | ||

| Philadelphia, PA 19103 | ||

| Registrant’s telephone number, including area code: | (800) 523-1918 | |

| Date of fiscal year end: | August 31 | |

| Date of reporting period: | August 31, 2011 |

|

Annual report

Delaware Tax-Free Arizona Fund

Delaware Tax-Free California Fund Delaware Tax-Free Colorado Fund Delaware Tax-Free Idaho Fund Delaware Tax-Free New York Fund August 31, 2011

Fixed income mutual funds

|

|

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Funds’ prospectus and, if available, their summary prospectuses, which may be obtained by visiting www.delawareinvestments.com or calling 800 523-1918. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

|

|

You can obtain shareholder reports and prospectuses online instead of in the mail.

Visit www.delawareinvestments.com/edelivery. |

- 24-hour access to your account information

- Obtain share prices

- Check your account balance and recent transactions

- Request statements or literature

- Make purchases and redemptions

| Portfolio management review | 1 |

| Performance summaries | 9 |

| Disclosure of Fund expenses | 24 |

| Security type/sector allocations | 27 |

| Statements of net assets | 32 |

| Statements of operations | 72 |

| Statements of changes in net assets | 74 |

| Financial highlights | 84 |

| Notes to financial statements | 114 |

| Report of independent registered | |

| public accounting firm | 129 |

| Other Fund information | 130 |

| Board of trustees/directors and | |

| officers addendum | 136 |

| About the organization | 146 |

| Portfolio management review | ||

| Delaware Investments® state tax-free funds | September 6, 2011 | |

| Performance preview (for the year ended August 31, 2011) | ||||

| Delaware Tax-Free Arizona Fund (Class A shares) | 1-year return | +0.57% | ||

| Barclays Capital Municipal Bond Index (benchmark) | 1-year return | +2.66% | ||

| Lipper Arizona Municipal Debt Funds Average | 1-year return | +1.43% | ||

For complete, annualized performance for Delaware Tax-Free Arizona Fund, please see the table on page 9.

The Lipper Arizona Municipal Debt Funds Average compares funds that limit assets to those securities that are exempt from taxation in Arizona (double tax-exempt) or a city in Arizona (triple tax-exempt).

| Delaware Tax-Free California Fund (Class A shares) | 1-year return | +0.83% | ||

| Barclays Capital Municipal Bond Index (benchmark) | 1-year return | +2.66% | ||

| Lipper California Municipal Debt Funds Average | 1-year return | +1.30% |

For complete, annualized performance for Delaware Tax-Free California Fund, please see the table on page 12.

The Lipper California Municipal Debt Funds Average compares funds that limit assets to those securities that are exempt from taxation in California (double tax-exempt) or a city in California (triple tax-exempt).

| Delaware Tax-Free Colorado Fund (Class A shares) | 1-year return | +0.71% | ||

| Barclays Capital Municipal Bond Index (benchmark) | 1-year return | +2.66% | ||

| Lipper Colorado Municipal Debt Funds Average | 1-year return | +1.75% |

For complete, annualized performance for Delaware Tax-Free Colorado Fund, please see the table on page 15.

The Lipper Colorado Municipal Debt Funds Average compares funds that limit assets to those securities that are exempt from taxation in Colorado (double tax-exempt) or a city in Colorado (triple tax-exempt).

Delaware Investments® state tax-free funds

| Delaware Tax-Free Idaho Fund (Class A shares) | 1-year return | +0.56% | ||

| Barclays Capital Municipal Bond Index (benchmark) | 1-year return | +2.66% | ||

| Lipper Other States Municipal Debt Funds Average | 1-year return | +1.49% |

For complete, annualized performance for Delaware Tax-Free Idaho Fund, please see the table on page 18.

The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions.

The Lipper Other States Municipal Debt Funds Average compares funds that limit assets to those securities that are exempt from taxation on a specified city or state basis.

| Delaware Tax-Free New York Fund (Class A shares) | 1-year return | +0.63% | ||

| Barclays Capital Municipal Bond Index (benchmark) | 1-year return | +2.66% | ||

| Lipper New York Municipal Debt Funds Average | 1-year return | +1.03% |

For complete, annualized performance for Delaware Tax-Free New York Fund, please see the table on page 21.

The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions.

The Lipper New York Municipal Debt Funds Average compares funds that limit assets to those securities that are exempt from taxation in New York (double tax-exempt) or a city in New York (triple tax-exempt).

- In the third and fourth quarters of 2010, U.S. GDP expanded by annualized rates of 2.5% and 2.3%, respectively.

- During the first quarter of 2011, GDP grew at an annualized rate of just 0.4% — the weakest showing in seven quarters.

- Growth in the second quarter of 2011 came in only slightly better, at an estimated annualized rate of 1.0%.

- In March 2011, the massive earthquake that struck Japan, followed by a devastating tsunami and nuclear crisis, hurt factory production and reduced worldwide economic output.

- The European debt crisis resurfaced and threatened to ensnare some of the continent’s larger economies, such as Italy and Spain.

- A political battle in Washington, D.C. over government spending and the lifting of the federal debt ceiling increased investor uncertainty and anxiety.

- Citing these severe political disagreements in the face of rising debt, credit-rating agency Standard & Poor’s (S&P) downgraded the long-term rating on U.S. sovereign debt. In what was the first such downgrade in history, the United States’ S&P rating went to AA+, one notch down from its former rating of AAA.

Delaware Investments® state tax-free funds

- Many investors worried that renewed federal economic stimulus efforts would increase the risk of inflation.

- Expectations grew that Republican congressional election victories would mean the end of the federal Build America Bonds program and a potential increase in the supply of traditional tax-exempt debt.

- Worries mounted about the fiscal condition of many state and local governments and their ability to repay their debt. Investor anxiety about state finances was exacerbated by a heavy dose of negative headlines from various media outlets, including articles in The Wall Street Journal, The New York Times, and a particularly troubling segment that aired on the television program 60 Minutes in mid-December 2010.

Delaware Investments® state tax-free funds

Delaware Investments® state tax-free funds

| Performance summaries | |

| Delaware Tax-Free Arizona Fund | August 31, 2011 |

| Fund performance1,2 | Average annual total returns through Aug. 31, 2011 | |||||

| 1 year | 5 years | 10 years | ||||

| Class A (Est. April 1, 1991) | ||||||

| Excluding sales charge | +0.57% | +4.12% | +4.33% | |||

| Including sales charge | -3.92% | +3.17% | +3.86% | |||

| Class B (Est. March 10, 1995) | ||||||

| Excluding sales charge | -0.18% | +3.32% | +3.71% | |||

| Including sales charge | -4.03% | +3.06% | +3.71% | |||

| Class C (Est. May 26, 1994) | ||||||

| Excluding sales charge | -0.17% | +3.34% | +3.56% | |||

| Including sales charge | -1.13% | +3.34% | +3.56% | |||

Delaware Tax-Free Arizona Fund

| Fund expense ratios | Class A | Class B | Class C | |||

| Total annual operating expenses | 0.92% | 1.67% | 1.67% | |||

| (without fee waivers) | ||||||

| Net expenses | 0.84% | 1.59% | 1.59% | |||

| (including fee waivers, if any) | ||||||

| Type of waiver | Contractual | Contractual | Contractual |

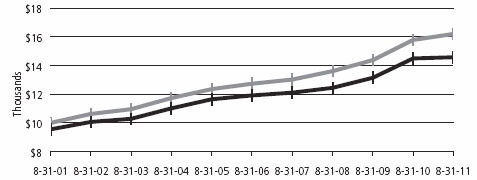

Average annual total returns from Aug. 31, 2001, through Aug. 31, 2011

| For period beginning Aug. 31, 2001, through Aug. 31, 2011 | Starting value | Ending value | ||

|

|

Barclays Capital Municipal Bond Index | $10,000 | $16,208 | |

|

|

Delaware Tax-Free Arizona Fund — Class A Shares | $9,550 | $14,582 | |

| Nasdaq symbols | CUSIPs | ||||||

| Class A | VAZIX | 928916204 | |||||

| Class B | DVABX | 928928639 | |||||

| Class C | DVACX | 928916501 | |||||

| Performance summaries | |

| Delaware Tax-Free California Fund | August 31, 2011 |

| Fund performance1,2 | Average annual total returns through Aug. 31, 2011 | |||||

| 1 year | 5 years | 10 years | ||||

| Class A (Est. March 2, 1995) | ||||||

| Excluding sales charge | +0.83% | +3.93% | +4.70% | |||

| Including sales charge | -3.75% | +2.97% | +4.22% | |||

| Class B (Est. Aug. 23, 1995) | ||||||

| Excluding sales charge | +0.09% | +3.14% | +4.06% | |||

| Including sales charge | -3.77% | +2.88% | +4.06% | |||

| Class C (Est. April 9, 1996) | ||||||

| Excluding sales charge | -0.01% | +3.13% | +3.91% | |||

| Including sales charge | -0.97% | +3.13% | +3.91% | |||

| Fund expense ratios | Class A | Class B | Class C | ||||||

| Total annual operating expenses | 0.98 | % | 1.73 | % | 1.73 | % | |||

| (without fee waivers) | |||||||||

| Net expenses | 0.82 | % | 1.57 | % | 1.57 | % | |||

| (including fee waivers, if any) | |||||||||

| Type of waiver | Contractual | Contractual | Contractual | ||||||

Delaware Tax-Free California Fund

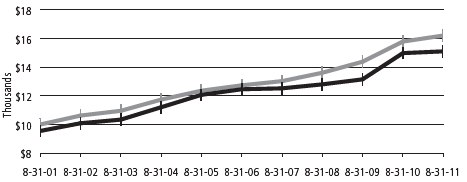

Average annual total returns from Aug. 31, 2001, through Aug. 31, 2011

| For period beginning Aug. 31, 2001, through Aug. 31, 2011 | Starting value | Ending value | ||

|

|

Barclays Capital Municipal Bond Index | $10,000 | $16,208 | |

|

|

Delaware Tax-Free California Fund — Class A Shares | $9,550 | $15,105 | |

| Nasdaq symbols | CUSIPs | ||||||

| Class A | DVTAX | 928928829 | |||||

| Class B | DVTFX | 928928811 | |||||

| Class C | DVFTX | 928928795 | |||||

| Delaware Tax-Free Colorado Fund | August 31, 2011 |

| Fund performance1,2 | Average annual total returns through Aug. 31, 2011 | |||||

| 1 year | 5 years | 10 years | ||||

| Class A (Est. April 23, 1987) | ||||||

| Excluding sales charge | +0.71% | +4.00% | +4.29% | |||

| Including sales charge | -3.82% | +3.05% | +3.81% | |||

| Class B (Est. March 22, 1995) | ||||||

| Excluding sales charge | -0.04% | +3.23% | +3.67% | |||

| Including sales charge | -3.90% | +2.97% | +3.67% | |||

| Class C (Est. May 6, 1994) | ||||||

| Excluding sales charge | -0.03% | +3.22% | +3.53% | |||

| Including sales charge | -1.00% | +3.22% | +3.53% | |||

Delaware Tax-Free Colorado Fund

| Fund expense ratios | Class A | Class B | Class C | |||||

| Total annual operating expenses | 0.95 | % | 1.70 | % | 1.70 | % | ||

| (without fee waivers) | ||||||||

| Net expenses | 0.84 | % | 1.59 | % | 1.59 | % | ||

| (including fee waivers, if any) | ||||||||

| Type of waiver | Contractual | Contractual | Contractual | |||||

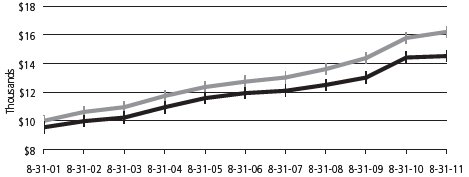

Average annual total returns from Aug. 31, 2001, through Aug. 31, 2011

| For period beginning Aug. 31, 2001, through Aug. 31, 2011 | Starting value | Ending value | ||

|

|

Barclays Capital Municipal Bond Index | $10,000 | $16,208 | |

|

|

Delaware Tax-Free Colorado Fund — Class A Shares | $9,550 | $14,521 | |

| Nasdaq symbols | CUSIPs | ||||||

| Class A | VCTFX | 928920107 | |||||

| Class B | DVBTX | 928928787 | |||||

| Class C | DVCTX | 92907R101 | |||||

| Performance summaries | |

| Delaware Tax-Free Idaho Fund | August 31, 2011 |

| Fund performance1,2 | Average annual total returns through Aug. 31, 2011 | |||||

| 1 year | 5 years | 10 years | ||||

| Class A (Est. Jan. 4, 1995) | ||||||

| Excluding sales charge | +0.56% | +4.42% | +4.54% | |||

| Including sales charge | -3.96% | +3.46% | +4.06% | |||

| Class B (Est. March 16, 1995) | ||||||

| Excluding sales charge | -0.19% | +3.65% | +3.90% | |||

| Including sales charge | -4.07% | +3.39% | +3.90% | |||

| Class C (Est. Jan. 11, 1995) | ||||||

| Excluding sales charge | -0.20% | +3.64% | +3.76% | |||

| Including sales charge | -1.17% | +3.64% | +3.76% | |||

| Fund expense ratios | Class A | Class B | Class C | |||||

| Total annual operating expenses | 0.96 | % | 1.71 | % | 1.71 | % | ||

| (without fee waivers) | ||||||||

| Net expenses | 0.88 | % | 1.63 | % | 1.63 | % | ||

| (including fee waivers, if any) | ||||||||

| Type of waiver | Contractual | Contractual | Contractual | |||||

Delaware Tax-Free Idaho Fund

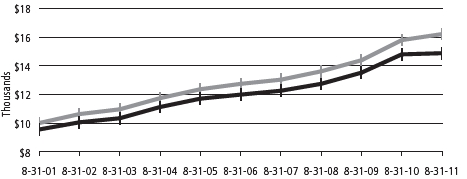

Average annual total returns from Aug. 31, 2001, through Aug. 31, 2011

| For period beginning Aug. 31, 2001, through Aug. 31, 2011 | Starting value | Ending value | ||

|

|

Barclays Capital Municipal Bond Index | $10,000 | $16,208 | |

|

|

Delaware Tax-Free Idaho Fund — Class A Shares | $9,550 | $14,874 | |

| Nasdaq symbols | CUSIPs | ||||||

| Class A | VIDAX | 928928704 | |||||

| Class B | DVTIX | 928928746 | |||||

| Class C | DVICX | 928928803 | |||||

| Delaware Tax-Free New York Fund | August 31, 2011 |

| Fund performance1,2 | Average annual total returns through Aug. 31, 2011 | |||||

| 1 year | 5 years | 10 years | ||||

| Class A (Est. Nov. 6, 1987) | ||||||

| Excluding sales charge | +0.63% | +4.56% | +4.80% | |||

| Including sales charge | -3.94% | +3.59% | +4.32% | |||

| Class B (Est. Nov. 14, 1994) | ||||||

| Excluding sales charge | -0.04% | +3.78% | +4.18% | |||

| Including sales charge | -3.92% | +3.52% | +4.18% | |||

| Class C (Est. April 26, 1995) | ||||||

| Excluding sales charge | -0.04% | +3.78% | +4.03% | |||

| Including sales charge | -1.01% | +3.78% | +4.03% | |||

Delaware Tax-Free New York Fund

| Fund expense ratios | Class A | Class B | Class C | |||||

| Total annual operating expenses | 1.07 | % | 1.82 | % | 1.82 | % | ||

| (without fee waivers) | ||||||||

| Net expenses | 0.80 | % | 1.55 | % | 1.55 | % | ||

| (including fee waivers, if any) | ||||||||

| Type of waiver | Contractual | Contractual | Contractual | |||||

Average annual total returns from Aug. 31, 2001, through Aug. 31, 2011

| For period beginning Aug. 31, 2001, through Aug. 31, 2011 | Starting value | Ending value | ||

|

|

Barclays Capital Municipal Bond Index | $10,000 | $16,208 | |

|

|

Delaware Tax-Free New York Fund — Class A Shares | $9,550 | $15,253 | |

| Nasdaq symbols | CUSIPs | ||||||

| Class A | FTNYX | 928928274 | |||||

| Class B | DVTNX | 928928266 | |||||

| Class C | DVFNX | 928928258 | |||||

For the six-month period from March 1, 2011 to August 31, 2011

Expense analysis of an investment of $1,000

| Beginning | Ending | Expenses | ||||||||||||

| Account Value | Account Value | Annualized | Paid During Period | |||||||||||

| 3/1/11 | 8/31/11 | Expense Ratio | 3/1/11 to 8/31/11* | |||||||||||

| Actual Fund return | ||||||||||||||

| Class A | $ | 1,000.00 | $ | 1,056.30 | 0.84% | $ | 4.35 | |||||||

| Class B | 1,000.00 | 1,051.40 | 1.59% | 8.22 | ||||||||||

| Class C | 1,000.00 | 1,052.20 | 1.59% | 8.22 | ||||||||||

| Hypothetical 5% return (5% return before expenses) | ||||||||||||||

| Class A | $ | 1,000.00 | $ | 1,020.97 | 0.84% | $ | 4.28 | |||||||

| Class B | 1,000.00 | 1,017.19 | 1.59% | 8.08 | ||||||||||

| Class C | 1,000.00 | 1,017.19 | 1.59% | 8.08 | ||||||||||

Expense analysis of an investment of $1,000

| Beginning | Ending | Expenses | |||||||||||||

| Account Value | Account Value | Annualized | Paid During Period | ||||||||||||

| 3/1/11 | 8/31/11 | Expense Ratio | 3/1/11 to 8/31/11* | ||||||||||||

| Actual Fund return | |||||||||||||||

| Class A | $ | 1,000.00 | $ | 1,074.50 | 0.82 | % | $ | 4.29 | |||||||

| Class B | 1,000.00 | 1,069.30 | 1.57 | % | 8.19 | ||||||||||

| Class C | 1,000.00 | 1,069.50 | 1.57 | % | 8.19 | ||||||||||

| Hypothetical 5% return (5% return before expenses) | |||||||||||||||

| Class A | $ | 1,000.00 | $ | 1,021.07 | 0.82 | % | $ | 4.18 | |||||||

| Class B | 1,000.00 | 1,017.29 | 1.57 | % | 7.98 | ||||||||||

| Class C | 1,000.00 | 1,017.29 | 1.57 | % | 7.98 | ||||||||||

Expense analysis of an investment of $1,000

| Beginning | Ending | Expenses | |||||||||||||

| Account Value | Account Value | Annualized | Paid During Period | ||||||||||||

| 3/1/11 | 8/31/11 | Expense Ratio | 3/1/11 to 8/31/11* | ||||||||||||

| Actual Fund return | |||||||||||||||

| Class A | $ | 1,000.00 | $ | 1,059.80 | 0.84 | % | $ | 4.36 | |||||||

| Class B | 1,000.00 | 1,055.80 | 1.59 | % | 8.24 | ||||||||||

| Class C | 1,000.00 | 1,055.70 | 1.59 | % | 8.24 | ||||||||||

| Hypothetical 5% return (5% return before expenses) | |||||||||||||||

| Class A | $ | 1,000.00 | $ | 1,020.97 | 0.84 | % | $ | 4.28 | |||||||

| Class B | 1,000.00 | 1,017.19 | 1.59 | % | 8.08 | ||||||||||

| Class C | 1,000.00 | 1,017.19 | 1.59 | % | 8.08 | ||||||||||

Expense analysis of an investment of $1,000

| Beginning | Ending | Expenses | |||||||||||||

| Account Value | Account Value | Annualized | Paid During Period | ||||||||||||

| 3/1/11 | 8/31/11 | Expense Ratio | 3/1/11 to 8/31/11* | ||||||||||||

| Actual Fund return | |||||||||||||||

| Class A | $ | 1,000.00 | $ | 1,054.10 | 0.88 | % | $ | 4.56 | |||||||

| Class B | 1,000.00 | 1,050.20 | 1.63 | % | 8.42 | ||||||||||

| Class C | 1,000.00 | 1,050.20 | 1.63 | % | 8.42 | ||||||||||

| Hypothetical 5% return (5% return before expenses) | |||||||||||||||

| Class A | $ | 1,000.00 | $ | 1,020.77 | 0.88 | % | $ | 4.48 | |||||||

| Class B | 1,000.00 | 1,016.99 | 1.63 | % | 8.29 | ||||||||||

| Class C | 1,000.00 | 1,016.99 | 1.63 | % | 8.29 | ||||||||||

Expense analysis of an investment of $1,000

| Beginning | Ending | Expenses | |||||||||||||

| Account Value | Account Value | Annualized | Paid During Period | ||||||||||||

| 3/1/11 | 8/31/11 | Expense Ratio | 3/1/11 to 8/31/11* | ||||||||||||

| Actual Fund return | |||||||||||||||

| Class A | $ | 1,000.00 | $ | 1,059.40 | 0.80 | % | $ | 4.15 | |||||||

| Class B | 1,000.00 | 1,056.50 | 1.55 | % | 8.03 | ||||||||||

| Class C | 1,000.00 | 1,056.50 | 1.55 | % | 8.03 | ||||||||||

| Hypothetical 5% return (5% return before expenses) | |||||||||||||||

| Class A | $ | 1,000.00 | $ | 1,021.17 | 0.80 | % | $ | 4.08 | |||||||

| Class B | 1,000.00 | 1,017.39 | 1.55 | % | 7.88 | ||||||||||

| Class C | 1,000.00 | 1,017.39 | 1.55 | % | 7.88 | ||||||||||

| Security type/sector allocations Delaware Tax-Free Arizona Fund |

As of August 31, 2011 |

| Security type/sector | Percentage of net assets | |

| Municipal Bonds | 98.42 | % |

| Corporate Revenue Bonds | 8.50 | % |

| Education Revenue Bonds | 12.08 | % |

| Electric Revenue Bonds | 3.94 | % |

| Healthcare Revenue Bonds | 16.63 | % |

| Lease Revenue Bonds | 11.24 | % |

| Local General Obligation Bonds | 5.96 | % |

| Pre-Refunded Bonds | 3.16 | % |

| Special Tax Revenue Bonds | 14.14 | % |

| State & Territory General Obligation Bonds | 6.75 | % |

| Transportation Revenue Bonds | 6.22 | % |

| Water & Sewer Revenue Bonds | 9.80 | % |

| Total Value of Securities | 98.42 | % |

| Receivables and Other Assets Net of Liabilities | 1.58 | % |

| Total Net Assets | 100.00 | % |

| Security type/sector allocations Delaware Tax-Free California Fund |

As of August 31, 2011 |

| Security type/sector | Percentage of net assets | |

| Municipal Bonds | 98.42 | % |

| Corporate Revenue Bonds | 7.75 | % |

| Education Revenue Bonds | 9.36 | % |

| Electric Revenue Bonds | 7.75 | % |

| Healthcare Revenue Bonds | 12.61 | % |

| Housing Revenue Bonds | 5.81 | % |

| Lease Revenue Bonds | 7.23 | % |

| Local General Obligation Bonds | 8.83 | % |

| Pre-Refunded Bonds | 3.90 | % |

| Resource Recovery Revenue Bond | 1.24 | % |

| Special Tax Revenue Bonds | 17.42 | % |

| State & Territory General Obligation Bonds | 9.07 | % |

| Transportation Revenue Bonds | 3.34 | % |

| Water & Sewer Revenue Bonds | 4.11 | % |

| Short-Term Investment | 0.71 | % |

| Total Value of Securities | 99.13 | % |

| Receivables and Other Assets Net of Liabilities | 0.87 | % |

| Total Net Assets | 100.00 | % |

| Delaware Tax-Free Colorado Fund | As of August 31, 2011 |

| Security type/sector | Percentage of net assets | |

| Municipal Bonds | 99.09 | % |

| Corporate Revenue Bond | 1.16 | % |

| Education Revenue Bonds | 8.58 | % |

| Electric Revenue Bonds | 9.48 | % |

| Healthcare Revenue Bonds | 24.84 | % |

| Housing Revenue Bonds | 2.86 | % |

| Lease Revenue Bonds | 2.27 | % |

| Local General Obligation Bonds | 14.65 | % |

| Pre-Refunded Bonds | 10.91 | % |

| Special Tax Revenue Bonds | 10.76 | % |

| State & Territory General Obligation Bonds | 7.87 | % |

| Transportation Revenue Bonds | 5.11 | % |

| Water & Sewer Revenue Bonds | 0.60 | % |

| Short-Term Investment | 0.06 | % |

| Total Value of Securities | 99.15 | % |

| Receivables and Other Assets Net of Liabilities | 0.85 | % |

| Total Net Assets | 100.00 | % |

| Security type/sector allocations Delaware Tax-Free Idaho Fund |

As of August 31, 2011 |

| Security type/sector | Percentage of net assets | |

| Municipal Bonds | 98.67 | % |

| Corporate Revenue Bonds | 5.99 | % |

| Education Revenue Bonds | 10.78 | % |

| Electric Revenue Bonds | 5.08 | % |

| Healthcare Revenue Bonds | 5.97 | % |

| Housing Revenue Bonds | 4.11 | % |

| Lease Revenue Bonds | 7.10 | % |

| Local General Obligation Bonds | 21.56 | % |

| Pre-Refunded Bonds | 5.05 | % |

| Special Tax Revenue Bonds | 14.97 | % |

| State General Obligation Bonds | 7.09 | % |

| Transportation Revenue Bonds | 8.51 | % |

| Water & Sewer Revenue Bonds | 2.46 | % |

| Short-Term Investments | 2.03 | % |

| Total Value of Securities | 100.70 | % |

| Liabilities Net of Receivables and Other Assets | (0.70 | %) |

| Total Net Assets | 100.00 | % |

| Delaware Tax-Free New York Fund | As of August 31, 2011 |

| Security type/sector | Percentage of net assets | |

| Municipal Bonds | 98.08 | % |

| Corporate Revenue Bonds | 9.51 | % |

| Education Revenue Bonds | 26.53 | % |

| Electric Revenue Bonds | 3.69 | % |

| Healthcare Revenue Bonds | 11.70 | % |

| Housing Revenue Bonds | 1.42 | % |

| Lease Revenue Bonds | 6.73 | % |

| Local General Obligation Bonds | 5.71 | % |

| Pre-Refunded Bonds | 2.80 | % |

| Special Tax Revenue Bonds | 15.69 | % |

| State & Territory General Obligation Bonds | 5.55 | % |

| Transportation Revenue Bonds | 6.72 | % |

| Water & Sewer Revenue Bonds | 2.03 | % |

| Total Value of Securities | 98.08 | % |

| Receivables and Other Assets Net of Liabilities | 1.92 | % |

| Total Net Assets | 100.00 | % |

| Statements of net assets | |

| Delaware Tax-Free Arizona Fund | August 31, 2011 |

| Principal amount | Value | |||||

| Municipal Bonds – 98.42% | ||||||

| Corporate Revenue Bonds – 8.50% | ||||||

| Maricopa County Pollution Control (Palo Verde Project) | ||||||

| Series A 5.05% 5/1/29 (AMBAC) | $ | 2,000,000 | $ | 2,005,700 | ||

| •Series B 5.20% 6/1/43 | 1,500,000 | 1,551,015 | ||||

| • | Navajo County Pollution Control Revenue | |||||

| (Arizona Public Services-Cholla) | ||||||

| Series D 5.75% 6/1/34 | 1,500,000 | 1,713,600 | ||||

| Pima County Industrial Development Authority Pollution | ||||||

| Control Revenue (Tucson Electric Power San Juan) | ||||||

| 5.75% 9/1/29 | 750,000 | 759,990 | ||||

| Series A 4.95% 10/1/20 | 1,450,000 | 1,443,548 | ||||

| Series A 5.25% 10/1/40 | 400,000 | 363,108 | ||||

| Puerto Rico Port Authority Revenue (American Airlines) | ||||||

| Series A 6.25% 6/1/26 (AMT) | 1,115,000 | 918,715 | ||||

| 8,755,676 | ||||||

| Education Revenue Bonds – 12.08% | ||||||

| Arizona Health Facilities Authority | ||||||

| Healthcare Education Revenue (Kirksville College) | ||||||

| 5.125% 1/1/30 | 1,500,000 | 1,529,955 | ||||

| Arizona State University Certificates of Participation | ||||||

| (Research Infrastructure Project) | ||||||

| 5.00% 9/1/30 (AMBAC) | 2,000,000 | 2,034,780 | ||||

| Arizona State University Energy Management Revenue | ||||||

| (Arizona State University-Tempe Campus II Project) | ||||||

| 4.50% 7/1/24 | 1,385,000 | 1,443,890 | ||||

| Arizona State University Series C 5.50% 7/1/25 | 330,000 | 373,728 | ||||

| Energy Management Services Conservation Revenue | ||||||

| (Arizona State University-Main Campus Project) | ||||||

| 5.25% 7/1/17 (NATL-RE) | 1,500,000 | 1,547,145 | ||||

| Glendale Industrial Development Authority Revenue | ||||||

| (Midwestern University) 5.125% 5/15/40 | 1,305,000 | 1,275,168 | ||||

| Pima County Industrial Development Authority Educational | ||||||

| Revenue (Tucson Country Day School Project) | ||||||

| 5.00% 6/1/37 | 1,500,000 | 1,144,140 | ||||

| South Campus Group Student Housing Revenue | ||||||

| (Arizona State University-South Campus Project) | ||||||

| 5.625% 9/1/35 (NATL-RE) | 2,000,000 | 2,000,940 | ||||

| Principal amount | Value | |||||

| Municipal Bonds (continued) | ||||||

| Education Revenue Bonds (continued) | ||||||

| Tucson Industrial Development Authority Lease Revenue | ||||||

| (University of Arizona-Marshall Foundation) | ||||||

| Series A 5.00% 7/15/27 (AMBAC) | $ | 1,000,000 | $ | 1,006,140 | ||

| University of Arizona Certificates of Participation | ||||||

| (University of Arizona Project) | ||||||

| Series A 5.125% 6/1/21 (AMBAC) | 85,000 | 87,440 | ||||

| 12,443,326 | ||||||

| Electric Revenue Bonds – 3.94% | ||||||

| Mesa Utilities System Revenue 5.00% 7/1/18 | ||||||

| (NATL-RE) (FGIC) | 2,150,000 | 2,544,160 | ||||

| Salt River Project Agricultural Improvement & | ||||||

| Power District Electric System Revenue | ||||||

| Series B 5.00% 1/1/31 (NATL-RE) (IBC) | 1,460,000 | 1,515,830 | ||||

| 4,059,990 | ||||||

| Healthcare Revenue Bonds – 16.63% | ||||||

| Arizona Health Facilities Authority Revenue | ||||||

| (Catholic Healthcare West) Series D 5.00% 7/1/28 | 1,500,000 | 1,510,530 | ||||

| Glendale Industrial Development Authority Hospital | ||||||

| Revenue (John C. Lincoln Health) 5.00% 12/1/42 | 2,205,000 | 1,851,913 | ||||

| Maricopa County Industrial Development Authority Health | ||||||

| Facilities Revenue (Catholic Healthcare West) Series A | ||||||

| 5.25% 7/1/32 | 1,250,000 | 1,257,388 | ||||

| 5.50% 7/1/26 | 1,000,000 | 1,020,390 | ||||

| 6.00% 7/1/39 | 2,500,000 | 2,592,950 | ||||

| Puerto Rico Industrial Tourist Educational Medical & | ||||||

| Environmental Control Facilities Financing Authority | ||||||

| (Auxilio Mutuo) Series A 6.00% 7/1/33 | 1,500,000 | 1,543,620 | ||||

| Scottsdale Industrial Development Authority Hospital | ||||||

| Revenue (Scottsdale Healthcare) | ||||||

| Series A 5.25% 9/1/30 | 1,250,000 | 1,254,700 | ||||

| University of Arizona Medical Center Hospital Revenue | ||||||

| 6.00% 7/1/39 | 1,500,000 | 1,505,370 | ||||

| 6.50% 7/1/39 | 2,500,000 | 2,589,575 | ||||

| Yavapai County Industrial Development Authority | ||||||

| Revenue (Yavapai Regional Medical Center) | ||||||

| Series A 5.25% 8/1/21 (RADIAN) | 2,000,000 | 2,013,180 | ||||

| 17,139,616 | ||||||

Delaware Tax-Free Arizona Fund

| Principal amount | Value | |||||

| Municipal Bonds (continued) | ||||||

| Lease Revenue Bonds – 11.24% | ||||||

| Arizona Game & Fish Department & Community | ||||||

| Beneficial Interest Certificates (Administration | ||||||

| Building Project) 5.00% 7/1/32 | $ | 1,000,000 | $ | 1,008,900 | ||

| Arizona State Certificates of Participation Department | ||||||

| Administration Series A 5.25% 10/1/25 (AGM) | 1,500,000 | 1,617,615 | ||||

| Marana Municipal Property Facilities Revenue | ||||||

| 5.00% 7/1/28 (AMBAC) | 575,000 | 586,621 | ||||

| Maricopa County Industrial Development Authority | ||||||

| Correctional Contract Revenue (Phoenix West Prison) | ||||||

| Series B 5.375% 7/1/22 (ACA) | 1,000,000 | 1,001,490 | ||||

| Phoenix Industrial Development Authority Lease Revenue | ||||||

| (Capitol Mall II, LLC Project) 5.00% 9/15/28 (AMBAC) | 2,000,000 | 2,005,180 | ||||

| Pima County Industrial Development Authority Lease | ||||||

| Revenue Metro Police Facility (Nevada Project) Series A | ||||||

| 5.25% 7/1/31 | 1,500,000 | 1,520,070 | ||||

| 5.375% 7/1/39 | 1,500,000 | 1,524,315 | ||||

| Pinal County Certificates of Participation 5.00% 12/1/29 | 1,300,000 | 1,307,254 | ||||

| University of Arizona Certificates of Participation | ||||||

| (University of Arizona Project) Series B 5.00% | ||||||

| 6/1/31 (AMBAC) | 1,000,000 | 1,012,200 | ||||

| 11,583,645 | ||||||

| Local General Obligation Bonds – 5.96% | ||||||

| Coconino & Yavapai Counties Joint Unified School | ||||||

| District #9 (Sedona Oak Creek Project of 2007) | ||||||

| Series A 4.50% 7/1/18 (AGM) | 1,000,000 | 1,146,180 | ||||

| Series B 5.375% 7/1/28 | 1,350,000 | 1,471,324 | ||||

| DC Ranch Community Facilities 5.00% 7/15/27 (AMBAC) | 1,000,000 | 1,009,540 | ||||

| • | Gila County Unified School District #10 | |||||

| (Payson School Improvement Project of 2006) Series A | ||||||

| 5.25% 7/1/27 (AMBAC) | 1,000,000 | 1,057,210 | ||||

| Phoenix Unrefunded Balance (Various Purpose) | ||||||

| 5.00% 7/1/27 | 1,415,000 | 1,460,931 | ||||

| 6,145,185 | ||||||

| §Pre-Refunded Bonds – 3.16% | ||||||

| Phoenix Variable Purpose Series B 5.00% 7/1/27-12 | 1,020,000 | 1,060,698 | ||||

| Puerto Rico Commonwealth Highway & Transportation | ||||||

| Authority Revenue Series K 5.00% 7/1/35-15 | 750,000 | 880,328 | ||||

| Principal amount | Value | |||||

| Municipal Bonds (continued) | ||||||

| §Pre-Refunded Bonds (continued) | ||||||

| Puerto Rico Public Buildings Authority Revenue | ||||||

| (Guaranteed Government Facilities) Series I | ||||||

| 5.25% 7/1/33-14 | $ | 5,000 | $ | 5,656 | ||

| Southern Arizona Capital Facilities Finance Revenue | ||||||

| (University of Arizona Project) | ||||||

| 5.10% 9/1/33-12 (NATL-RE) | 1,250,000 | 1,310,999 | ||||

| 3,257,681 | ||||||

| Special Tax Revenue Bonds – 14.14% | ||||||

| Arizona Tourism & Sports Authority Tax Revenue | ||||||

| (Multipurpose Stadium Facilities) Series A | ||||||

| 5.00% 7/1/28 (NATL-RE) | 1,345,000 | 1,268,860 | ||||

| Arizona Transportation Board | ||||||

| (Maricopa County Regional Area Road) | ||||||

| 5.00% 7/1/25 | 1,000,000 | 1,119,390 | ||||

| Arizona Transportation Board Series A 5.00% 7/1/29 | 1,115,000 | 1,202,806 | ||||

| Flagstaff Aspen Place Sawmill Improvement District | ||||||

| Revenue 5.00% 1/1/32 | 875,000 | 875,333 | ||||

| Gilbert Public Facilities Municipal Property Revenue | ||||||

| 5.00% 7/1/25 | 1,250,000 | 1,348,550 | ||||

| Marana Tangerine Farm Road Improvement District | ||||||

| Revenue 4.60% 1/1/26 | 872,000 | 882,577 | ||||

| Mesa Street & Highway Revenue 5.00% 7/1/20 (AGM) | 1,000,000 | 1,149,540 | ||||

| Phoenix Civic Improvement Excise Tax Revenue | ||||||

| (Solid Waste Improvements) | ||||||

| Series A 5.00% 7/1/19 (NATL-RE) | 1,000,000 | 1,098,770 | ||||

| Phoenix Civic Improvement Transition Excise Tax | ||||||

| Revenue (Light Rail Project) | ||||||

| 5.00% 7/1/20 (AMBAC) | 1,570,000 | 1,709,038 | ||||

| Puerto Rico Commonwealth Infrastructure Financing | ||||||

| Authority Special Tax Revenue Series C | ||||||

| 5.50% 7/1/25 (AMBAC) | 455,000 | 480,052 | ||||

| Puerto Rico Sales Tax Financing Corporation Revenue | ||||||

|

First Subordinate Series A

|

||||||

|

5.00% 8/1/26

|

1,100,000 | 1,150,303 | ||||

|

5.375% 8/1/39

|

850,000 | 857,404 | ||||

|

5.75% 8/1/37

|

580,000 | 601,031 | ||||

| Ω(Convertible Capital Appreciation) 6.75% 8/1/32 | 960,000 | 826,973 | ||||

| 14,570,627 | ||||||

Delaware Tax-Free Arizona Fund

| Principal amount | Value | |||||

| Municipal Bonds (continued) | ||||||

| State & Territory General Obligation Bonds – 6.75% | ||||||

| Guam Government Series A 7.00% 11/15/39 | $ | 1,250,000 | $ | 1,290,625 | ||

| Puerto Rico Commonwealth Public Improvement Series A | ||||||

| 5.50% 7/1/19 | 765,000 | 847,712 | ||||

| 5.50% 7/1/19 (NATL-RE) (IBC) | 1,000,000 | 1,108,120 | ||||

| 5.75% 7/1/41 | 2,000,000 | 1,975,920 | ||||

| Series E 5.375% 7/1/30 | 600,000 | 590,190 | ||||

| Un-Refunded Balance Series A 5.125% 7/1/31 | 1,210,000 | 1,142,288 | ||||

| 6,954,855 | ||||||

| Transportation Revenue Bonds – 6.22% | ||||||

| Arizona State Transportation Board Highway Revenue | ||||||

| Subordinated Series A 5.00% 7/1/23 | 1,000,000 | 1,088,130 | ||||

| Phoenix Civic Improvement Airport Revenue | ||||||

| (Junior Lien) Series A 5.25% 7/1/33 | 1,250,000 | 1,306,050 | ||||

| (Senior Lien) Series B | ||||||

| 5.25% 7/1/27 (NATL-RE) (FGIC) | 1,000,000 | 1,005,350 | ||||

| 5.25% 7/1/32 (NATL-RE) (FGIC) | 3,000,000 | 3,007,050 | ||||

| 6,406,580 | ||||||

| Water & Sewer Revenue Bonds – 9.80% | ||||||

| Arizona Water Infrastructure Finance Authority | ||||||

| (Water Quality) Series A 5.00% 10/1/21 | 1,000,000 | 1,135,960 | ||||

| Guam Government Waterworks Authority 5.625% 7/1/40 | 700,000 | 645,736 | ||||

| Phoenix Civic Improvement Wastewater Corporation | ||||||

|

Systems Revenue (Junior Lien)

|

||||||

|

5.00% 7/1/19 (NATL-RE)

|

1,750,000 | 2,009,595 | ||||

|

5.00% 7/1/24 (NATL-RE) (FGIC)

|

1,000,000 | 1,001,360 | ||||

|

5.00% 7/1/26 (NATL-RE) (FGIC)

|

3,750,000 | 3,839,437 | ||||

| Scottsdale Water & Sewer Revenue 5.25% 7/1/22 | 1,150,000 | 1,462,881 | ||||

| 10,094,969 | ||||||

| Total Municipal Bonds (cost $98,074,040) | 101,412,150 | |||||

| Total Value of Securities – 98.42% | ||||||

| (cost $98,074,040) | 101,412,150 | |||||

| Receivables and Other Assets | ||||||

| Net of Liabilities – 1.58% | 1,633,217 | |||||

| Net Assets Applicable to 9,088,851 | ||||||

| Shares Outstanding – 100.00% | $ | 103,045,367 | ||||

| Net Asset Value – Delaware Tax-Free Arizona Fund | |||||

| Class A ($95,487,493 / 8,423,763 Shares) | $11.34 | ||||

| Net Asset Value – Delaware Tax-Free Arizona Fund | |||||

| Class B ($757,221 / 66,749 Shares) | $11.34 | ||||

| Net Asset Value – Delaware Tax-Free Arizona Fund | |||||

| Class C ($6,800,653 / 598,339 Shares) | $11.37 | ||||

| Components of Net Assets at August 31, 2011: | |||||

| Shares of beneficial interest (unlimited authorization – no par) | $ | 99,887,380 | |||

| Undistributed net investment income | 25,309 | ||||

| Accumulated net realized loss on investments | (205,432 | ) | |||

| Net unrealized appreciation of investments | 3,338,110 | ||||

| Total net assets | $ | 103,045,367 | |||

| • |

Variable rate security. The rate shown is the rate as of August 31, 2011. Interest rates reset periodically.

|

|

§

|

Pre-Refunded bonds. Municipal bonds that are generally backed or secured by U.S. Treasury bonds. For Pre-Refunded bonds, the stated maturity is followed by the year in which the bond is pre-refunded. See Note 8 in “Notes to financial statements.”

|

| Ω |

Step coupon bond. Indicates security that has a zero coupon that remains in effect until a predetermined date at which time the stated interest rate becomes effective.

|

ACA — Insured by American Capital Access

AGM — Insured by Assured Guaranty Municipal Corporation

AMBAC — Insured by AMBAC Assurance Corporation

AMT — Subject to Alternative Minimum Tax

FGIC — Insured by Financial Guaranty Insurance Company

IBC — Insured Bond Certificate

NATL-RE — Insured by National Public Finance Guarantee Corporation

RADIAN — Insured by Radian Asset Assurance

| Net Asset Value and Offering Price Per Share – | |||

| Delaware Tax-Free Arizona Fund | |||

| Net asset value Class A (A) | $ | 11.34 | |

| Sales charge (4.50% of offering price) (B) | 0.53 | ||

| Offering price | $ | 11.87 |

Delaware Tax-Free Arizona Fund

| (A) | Net asset value per share, as illustrated, is the amount which would be paid upon redemption or repurchase of shares. | |

| (B) | See the current prospectus for purchases of $100,000 or more. | |

| Delaware Tax-Free California Fund | August 31, 2011 |

| Principal amount | Value | |||||

| Municipal Bonds – 98.42% | ||||||

| Corporate Revenue Bonds – 7.75% | ||||||

| • | California Pollution Control Financing Authority | |||||

| Environmental Improvement Revenue | ||||||

| (BP West Coast Products, LLC) 2.60% 12/1/46 | $ | 500,000 | $ | 510,610 | ||

| Chula Vista Industrial Development Revenue | ||||||

| (San Diego Gas & Electric) Series D 5.875% 1/1/34 | 1,000,000 | 1,096,930 | ||||

| Golden State Tobacco Securitization Corporate | ||||||

|

Settlement Revenue

|

||||||

|

5.00% 6/1/45 (AMBAC)

|

950,000 | 839,173 | ||||

|

(Asset-Backed Senior Notes) Series A-1

|

||||||

|

5.125% 6/1/47

|

1,000,000 | 645,280 | ||||

|

5.75% 6/1/47

|

1,500,000 | 1,062,840 | ||||

| M-S-R Energy Authority Gas Revenue | ||||||

| Series A 6.50% 11/1/39 | 1,000,000 | 1,061,890 | ||||

| Series C 6.50% 11/1/39 | 500,000 | 530,945 | ||||

| Puerto Rico Ports Authority Special Facilities Revenue | ||||||

| (American Airlines) Series A 6.30% 6/1/23 (AMT) | 825,000 | 702,529 | ||||

| 6,450,197 | ||||||

| Education Revenue Bonds – 9.36% | ||||||

| California Educational Facilities Authority Revenue | ||||||

| (Woodbury University) 5.00% 1/1/36 | 1,000,000 | 824,130 | ||||

| California Municipal Finance Authority Educational Revenue | ||||||

| (American Heritage Education Foundation Project) | ||||||

| Series A 5.25% 6/1/36 | 1,000,000 | 811,430 | ||||

| California State Public Works Board Lease Revenue | ||||||

| (Regents University) Series A 5.00% 3/1/24 | 800,000 | 856,496 | ||||

| California Statewide Communities Development Authority | ||||||

| Charter School Revenue | ||||||

| (Green Dot Public Schools) Series A 7.25% 8/1/41 | 800,000 | 807,520 | ||||

| California Statewide Communities Development | ||||||

| Authority Revenue | ||||||

| (California Baptist University Project) | ||||||

| Series A 5.50% 11/1/38 | 1,000,000 | 848,490 | ||||

| (Viewpoint School Project) 5.75% 10/1/33 (ACA) | 1,000,000 | 968,379 | ||||

| California Statewide Communities Development Authority | ||||||

| School Facility Revenue (Aspire Public Schools Project) | ||||||

| 6.00% 7/1/40 | 1,000,000 | 955,140 | ||||

| California Statewide Communities Development Authority | ||||||

|

Student Housing Revenue (East Campus Apartments, LLC)

|

||||||

|

Series A 5.625% 8/1/34 (ACA)

|

785,000 | 747,610 | ||||

Delaware Tax-Free California Fund

| Principal amount | Value | |||||

| Municipal Bonds (continued) | ||||||

| Education Revenue Bonds (continued) | ||||||

| San Diego County Certificates of Participation | ||||||

| (University of San Diego) 5.375% 10/1/41 | $ | 1,000,000 | $ | 967,680 | ||

| 7,786,875 | ||||||

| Electric Revenue Bonds – 7.75% | ||||||

| Anaheim Public Financing Authority Electric System District | ||||||

| Facilities Series A 5.00% 10/1/25 | 800,000 | 879,992 | ||||

| Chino Basin Regional Financing Authority Revenue | ||||||

| Series A 5.00% 11/1/24 (AMBAC) | 845,000 | 894,754 | ||||

| Imperial Irrigation District Electric System Revenue | ||||||

| Series A 5.25% 11/1/24 | 500,000 | 561,205 | ||||

| Series B 5.00% 11/1/36 | 250,000 | 255,610 | ||||

| Puerto Rico Electric Power Authority Revenue | ||||||

| Series ZZ 5.00% 7/1/17 | 925,000 | 1,017,574 | ||||

| Southern California Public Power Authority Revenue | ||||||

| (Transmission Project) Series A 5.00% 7/1/22 | 1,000,000 | 1,127,970 | ||||

| Turlock Irrigation District Revenue Series A 5.00% 1/1/30 | 830,000 | 860,569 | ||||

| Vernon Electric System Revenue Series A 5.125% 8/1/21 | 850,000 | 850,238 | ||||

| 6,447,912 | ||||||

| Healthcare Revenue Bonds – 12.61% | ||||||

| Association Bay Area Governments Finance Authority for | ||||||

| California Nonprofit Corporations | ||||||

| (Sharp Health Care) Series B 6.25% 8/1/39 | 1,000,000 | 1,062,710 | ||||

| California Health Facilities Financing Authority Revenue | ||||||

| (Catholic Health Care West) | ||||||

| Series A 6.00% 7/1/39 | 855,000 | 906,377 | ||||

| Series E 5.625% 7/1/25 | 1,000,000 | 1,066,710 | ||||

| Series G 5.25% 7/1/23 | 1,000,000 | 1,030,410 | ||||

| (St. Joseph Health System) Series A 5.75% 7/1/39 | 1,000,000 | 1,030,400 | ||||

| (Stanford Hospital) Series A-2 5.25% 11/15/40 | 600,000 | 610,866 | ||||

| (The Episcopal Home) Series A 5.30% 2/1/32 (RADIAN) | 475,000 | 474,801 | ||||

| California Statewide Communities Development | ||||||

| Authority Revenue (Kaiser Permanente) | ||||||

| Series A 5.00% 4/1/19 | 1,000,000 | 1,163,449 | ||||

| Series B 5.25% 3/1/45 | 1,000,000 | 976,880 | ||||

| (Southern California Senior Living) 7.25% 11/15/41 | 500,000 | 537,290 | ||||

| (Valleycare Health Systems) Series A 5.125% 7/15/31 | 1,000,000 | 858,680 | ||||

| San Buenaventura Community Memorial Health Systems | ||||||

| 7.50% 12/1/41 | 785,000 | 779,293 | ||||

| 10,497,866 | ||||||

| Principal amount | Value | |||||

| Municipal Bonds (continued) | ||||||

| Housing Revenue Bonds – 5.81% | ||||||

| California Municipal Finance Authority Mobile Home Park | ||||||

| Revenue (Caritas Projects) Series A 6.40% 8/15/45 | $ | 995,000 | $ | 975,787 | ||

| California Statewide Communities Development Multifamily | ||||||

|

Housing Authority Revenue

|

||||||

|

(Citrus Gardens Apartments) Series D-1 5.375% 7/1/32

|

1,000,000 | 842,380 | ||||

| •(Silver Ridge Apartments) | ||||||

| Series H 5.80% 8/1/33 (FNMA) (AMT) | 1,000,000 | 1,021,120 | ||||

| Palm Springs Mobile Home Park Revenue | ||||||

| (Sahara Mobile Home Park) Series A 5.75% 5/15/37 | 1,000,000 | 998,570 | ||||

| Santa Clara County Multifamily Housing Authority Revenue | ||||||

| (Rivertown Apartments Project) | ||||||

| Series A 5.85% 8/1/31 (AMT) | 1,000,000 | 995,520 | ||||

| 4,833,377 | ||||||

| Lease Revenue Bonds – 7.23% | ||||||

| California State Public Works Board Lease Revenue | ||||||

| (General Services) Series A 6.25% 4/1/34 | 1,000,000 | 1,073,150 | ||||

| Elsinore Valley Municipal Water District Certificates of | ||||||

| Participation Series A 5.00% 7/1/24 (BHAC) | 1,000,000 | 1,103,520 | ||||

| Franklin-McKinley School District Certificates of | ||||||

| Participation (Financing Project) | ||||||

| Series B 5.00% 9/1/27 (AMBAC) | 1,060,000 | 1,024,872 | ||||

| • | Puerto Rico Public Buildings Authority Revenue | |||||

| (Guaranteed Government Facilities) | ||||||

| Series M-2 5.50% 7/1/35 (AMBAC) | 700,000 | 754,488 | ||||

| San Diego Public Facilities Financing Authority Lease | ||||||

| Revenue (Master Project) Series A 5.25% 3/1/40 | 1,000,000 | 975,470 | ||||

| San Mateo Joint Powers Financing Authority Lease | ||||||

| Revenue (Capital Projects) Series A 5.25% 7/15/26 | 1,000,000 | 1,085,550 | ||||

| 6,017,050 | ||||||

| Local General Obligation Bonds – 8.83% | ||||||

| ^ | Anaheim School District Election 2002 | |||||

| 4.58% 8/1/25 (NATL-RE) | 1,000,000 | 423,740 | ||||

| Bonita Unified School District Election 2008 | ||||||

| Series B 5.25% 8/1/28 | 800,000 | 864,496 | ||||

| Central Unified School District Election 2008 | ||||||

| Series A 5.625% 8/1/33 (ASSURED GTY) | 1,000,000 | 1,071,100 | ||||

| Cupertino Union School District Revenue | ||||||

| Series A 5.00% 8/1/26 | 820,000 | 938,925 | ||||

Delaware Tax-Free California Fund

| Principal amount | Value | |||||

| Municipal Bonds (continued) | ||||||

| Local General Obligation Bonds (continued) | ||||||

| Fairfield-Suisun Unified School District Election 2002 | ||||||

| 5.50% 8/1/28 (NATL-RE) | $ | 500,000 | $ | 531,755 | ||

| Grossmont Union High School District Election 2004 | ||||||

| 5.00% 8/1/23 (NATL-RE) | 500,000 | 532,550 | ||||

| Pittsburg Unified School District Financing Authority Revenue | ||||||

| (Pittsburg Unified School District Building Program) | ||||||

| 5.50% 9/1/46 (AGM) | 800,000 | 819,344 | ||||

| Santa Barbara Community College District Election 2008 | ||||||

| Series A 5.25% 8/1/33 | 1,000,000 | 1,061,500 | ||||

| Sierra Joint Community College Improvement District #2 | ||||||

| (Western Nevada) Series A 5.25% 8/1/21 (BHAC) (FGIC) | 1,000,000 | 1,102,990 | ||||

| 7,346,400 | ||||||

| §Pre-Refunded Bonds – 3.90% | ||||||

| California Department of Water Resources | ||||||

| (Central Valley Project) Series X | ||||||

| 5.00% 12/1/29-12 (NATL-RE) (FGIC) | 5,000 | 5,299 | ||||

| Prerefunded 2010 (Water System) | ||||||

| 5.00% 12/1/29-12 (NATL-RE) (FGIC) | 255,000 | 270,101 | ||||

| Commerce Joint Powers Financing Authority Revenue | ||||||

| (Redevelopment Projects) Series A | ||||||

| 5.00% 8/1/28-13 (RADIAN) | 60,000 | 65,339 | ||||

| Golden State Tobacco Securitization | ||||||

| Corporation Settlement Revenue | ||||||

| (Asset-Backed Senior Notes) Series B | ||||||

| 5.50% 6/1/43-13 (RADIAN) | 1,000,000 | 1,089,540 | ||||

| 5.625% 6/1/33-13 | 1,000,000 | 1,091,721 | ||||

| Port Oakland Revenue Series L 5.375% 11/1/27-12 | ||||||

| (NATL-RE) (FGIC) (AMT) | 110,000 | 116,272 | ||||

| Ω | San Mateo Union High School District Certificates of | |||||

| Participation Convertible Capital Appreciation | ||||||

| (Phase I Projects) Series B 5.00% 12/15/43-24 (AMBAC) | 800,000 | 608,880 | ||||

| 3,247,152 | ||||||

| Resource Recovery Revenue Bond – 1.24% | ||||||

| South Bayside Waste Management Authority Revenue | ||||||

| (Shoreway Environmental Center) Series A 6.00% 9/1/36 | 1,000,000 | 1,033,320 | ||||

| 1,033,320 | ||||||

| Principal amount | Value | |||||

| Municipal Bonds (continued) | ||||||

| Special Tax Revenue Bonds – 17.42% | ||||||

| California State Economic Recovery Refunding | ||||||

| Series A 5.25% 7/1/21 | $ | 1,000,000 | $ | 1,176,990 | ||

| Commerce Joint Powers Financing Authority Revenue | ||||||

| (Redevelopment Projects) Un-Refunded Balance | ||||||

| Series A 5.00% 8/1/28 (RADIAN) | 940,000 | 833,601 | ||||

| Fremont Community Facilities District #1 | ||||||

| (Special Tax Pacific Commons) 5.375% 9/1/36 | 1,000,000 | 859,700 | ||||

| Glendale Redevelopment Agency Tax Allocation Revenue | ||||||

| (Central Glendale Redevelopment Project) 5.50% 12/1/24 | 1,000,000 | 1,018,960 | ||||

| Lammersville School District Community Facilities | ||||||

| District #2002 (Mountain House) 5.125% 9/1/35 | 500,000 | 422,355 | ||||

| Lancaster Redevelopment Agency Tax Allocation Revenue | ||||||

| (Combined Redevelopment Project Areas) 6.875% 8/1/39 | 500,000 | 507,230 | ||||

| @ | Modesto Special Tax Community Facilities | |||||

| District #04-1 (Village 2) 5.15% 9/1/36 | 1,000,000 | 794,890 | ||||

| Poway Redevelopment Agency Tax Allocation Revenue | ||||||

| 5.75% 6/15/33 (NATL-RE) | 270,000 | 263,750 | ||||

| Poway Unified School District Community Facilities District #1 | ||||||

| Special Tax Refunding 5.00% 10/1/17 (AGM) | 1,000,000 | 1,163,730 | ||||

| Puerto Rico Sales Tax Financing Corporation Revenue | ||||||

| First Subordinate Series A | ||||||

| 5.25% 8/1/27 | 1,000,000 | 1,051,830 | ||||

| Ω(Convertible Capital Appreciation) 6.75% 8/1/32 | 660,000 | 568,544 | ||||

| Rancho Santa Fe Community Services District Financing | ||||||

| Authority Revenue Superior Lien Series A 5.75% 9/1/30 | 800,000 | 811,544 | ||||

| Riverside County Redevelopment Agency Tax Allocation | ||||||

| Housing Series A 6.00% 10/1/39 | 1,000,000 | 1,002,020 | ||||

| Roseville Westpark Special Tax Public Community Facilities | ||||||

| District #1 5.25% 9/1/37 | 500,000 | 419,885 | ||||

| San Bernardino County Special Tax Community Facilities | ||||||

| District #2002-1 5.90% 9/1/33 | 2,000,000 | 1,942,479 | ||||

| San Diego Redevelopment Agency Tax Allocation Revenue | ||||||

| (Naval Training Center) Series A 5.75% 9/1/40 | 1,000,000 | 963,180 | ||||

| Virgin Islands Public Finance Authority Revenue | ||||||

| (Senior Lien-Matching Fund Loan Note) | ||||||

| Series A 5.00% 10/1/29 | 715,000 | 694,665 | ||||

| 14,495,353 | ||||||

Delaware Tax-Free California Fund

| Principal amount | Value | |||||

| Municipal Bonds (continued) | ||||||

| State & Territory General Obligation Bonds – 9.07% | ||||||

| California State 5.25% 11/1/40 | $ | 1,000,000 | $ | 1,017,030 | ||

| California State Various Purposes | ||||||

| 5.00% 12/1/22 | 800,000 | 880,944 | ||||

| 5.25% 3/1/30 | 1,000,000 | 1,050,690 | ||||

| 6.00% 3/1/33 | 1,000,000 | 1,130,230 | ||||

| 6.00% 4/1/38 | 515,000 | 562,246 | ||||

| Guam Government Series A 6.75% 11/15/29 | 1,000,000 | 1,031,210 | ||||

| Puerto Rico Commonwealth Public Improvement Series A | ||||||

| 5.25% 7/1/15 | 1,000,000 | 1,087,290 | ||||

| 5.75% 7/1/41 | 800,000 | 790,368 | ||||

| 7,550,008 | ||||||

| Transportation Revenue Bonds – 3.34% | ||||||

| Bay Area Toll Authority Toll Bridge Revenue | ||||||

| (San Francisco Bay Area) Series F-1 5.25% 4/1/27 | 800,000 | 881,040 | ||||

| Port Oakland Revenue Series L 5.375% 11/1/27 | ||||||

| (NATL-RE) (FGIC) (AMT) | 890,000 | 894,575 | ||||

| San Diego Redevelopment Agency (Centre City | ||||||

| Redevelopment Project) Series A 6.40% 9/1/25 | 1,000,000 | 1,000,240 | ||||

| 2,775,855 | ||||||

| Water & Sewer Revenue Bonds – 4.11% | ||||||

| California State Department of Water Resources | ||||||

| Systems Revenue (Central Valley Project) | ||||||

| Series AG 5.00% 12/1/28 | 815,000 | 900,363 | ||||

| Un-Refunded 5.00% 12/1/29 (NATL-RE) (FGIC) | 740,000 | 769,755 | ||||

| San Francisco City & County Public Utilities Commission | ||||||

| Water Revenue Series B 5.00% 11/1/26 | 1,600,000 | 1,753,057 | ||||

| 3,423,175 | ||||||

| Total Municipal Bonds (cost $80,490,954) | 81,904,540 | |||||

| Number of shares | ||||||

| Short-Term Investment – 0.71% | ||||||

| Money Market Instrument – 0.71% | ||||||

| Federated California Municipal Cash Trust | 587,764 | 587,764 | ||||

| Total Short-Term Investment (cost $587,764) | 587,764 | |||||

| Total Value of Securities – 99.13% | |||||

| (cost $81,078,718) | $ | 82,492,304 | |||

| Receivables and Other Assets | |||||

| Net of Liabilities – 0.87% | 724,293 | ||||

| Net Assets Applicable to 7,450,100 | |||||

| Shares Outstanding – 100.00% | $ | 83,216,597 | |||

| Net Asset Value – Delaware Tax-Free California Fund | |||||

| Class A ($67,046,961 / 6,004,665 Shares) | $11.17 | ||||

| Net Asset Value – Delaware Tax-Free California Fund | |||||

| Class B ($1,306,558 / 116,533 Shares) | $11.21 | ||||

| Net Asset Value – Delaware Tax-Free California Fund | |||||

| Class C ($14,863,078 / 1,328,902 Shares) | $11.18 | ||||

| Components of Net Assets at August 31, 2011: | |||||

| Shares of beneficial interest (unlimited authorization – no par) | $ | 82,997,477 | |||

| Undistributed net investment income | 18,763 | ||||

| Accumulated net realized loss on investments | (1,213,229 | ) | |||

| Net unrealized appreciation of investments | 1,413,586 | ||||

| Total net assets | $ | 83,216,597 | |||

| • |

Variable rate security. The rate shown is the rate as of August 31, 2011. Interest rates reset periodically.

|

| ^ |

Zero coupon security. The rate shown is the yield at the time of purchase.

|

| § | Pre-Refunded bonds. Municipal bonds that are generally backed or secured by U.S. Treasury bonds. For Pre-Refunded bonds, the stated maturity is followed by the year in which the bond is pre-refunded. See Note 8 in “Notes to financial statements.” |

| Ω |

Step coupon bond. Indicates security that has a zero coupon that remains in effect until a predetermined date at which time the stated interest rate becomes effective.

|

| @ |

Illiquid security. At August 31, 2011, the aggregate amount of illiquid securities was $794,890, which represented 0.96% of the Fund’s net assets. See Note 8 in “Notes to financial statements.”

|

Delaware Tax-Free California Fund

|

Summary of abbreviations:

ACA — Insured by American Capital Access AGM — Insured by Assured Guaranty Municipal Corporation AMBAC — Insured by AMBAC Assurance Corporation AMT — Subject to Alternative Minimum Tax ASSURED GTY — Insured by Assured Guaranty Corporation BHAC — Insured by Berkshire Hathaway Assurance Company FGIC — Insured by Financial Guaranty Insurance Company FNMA — Federal National Mortgage Association collateral NATL-RE — Insured by National Public Finance Guarantee Corporation RADIAN — Insured by Radian Asset Assurance |

| Net Asset Value and Offering Price Per Share – | |||

| Delaware Tax-Free California Fund | |||

| Net asset value Class A (A) | $ | 11.17 | |

| Sales charge (4.50% of offering price) (B) | 0.53 | ||

| Offering price | $ | 11.70 |

| (A) | Net asset value per share, as illustrated, is the amount which would be paid upon redemption or repurchase of shares. | |

| (B) | See the current prospectus for purchases of $100,000 or more. |

| Delaware Tax-Free Colorado Fund | August 31, 2011 |

| Principal amount | Value | |||||

| Municipal Bonds – 99.09% | ||||||

| Corporate Revenue Bond – 1.16% | ||||||

| Public Authority Energy Natural Gas Revenue | ||||||

| Series 2008 6.50% 11/15/38 | $ | 2,500,000 | $ | 2,670,075 | ||

| 2,670,075 | ||||||

| Education Revenue Bonds – 8.58% | ||||||

| Boulder County Development Revenue | ||||||

| (University Corporation for Atmospheric Research) | ||||||

| 5.00% 9/1/33 (NATL-RE) | 1,000,000 | 1,003,820 | ||||

| 5.00% 9/1/35 (AMBAC) | 1,000,000 | 1,008,040 | ||||

| Colorado Educational & Cultural Facilities Authority Revenue | ||||||

| (Charter School Project) 5.50% 5/1/36 (SGI) | 2,280,000 | 2,258,545 | ||||

| (Johnson & Wales University Project) | ||||||

| Series A 5.00% 4/1/28 (SGI) | 1,000,000 | 948,100 | ||||

| (Liberty Common Charter School Project) | ||||||

| 5.125% 12/1/33 (SGI) | 2,740,000 | 2,625,769 | ||||

| (Montessori Districts Charter School Projects) | ||||||

| 6.125% 7/15/32 | 5,590,000 | 5,445,163 | ||||

| (Pinnacle Charter School Project) 5.00% 6/1/33 (SGI) | 2,170,000 | 2,046,288 | ||||

| (Woodrow Wilson Charter School Project) | ||||||

| 5.25% 12/1/34 (SGI) | 1,960,000 | 1,886,030 | ||||

| Colorado School Mines Auxiliary Facilities | ||||||

| 5.00% 12/1/37 (AMBAC) | 425,000 | 426,012 | ||||

| University of Colorado Enterprise System Revenue | ||||||

| Series A 5.00% 6/1/30 (AMBAC) | 2,000,000 | 2,090,460 | ||||

| 19,738,227 | ||||||

| Electric Revenue Bonds – 9.48% | ||||||

| Colorado Springs Utilities System Improvement Revenue | ||||||

| Series C 5.50% 11/15/48 | 3,250,000 | 3,497,358 | ||||

| Colorado Springs Utilities Un-Refunded Balance | ||||||

| Revenue (Senior Lien) | ||||||

| Series A 5.00% 11/15/29 | 3,895,000 | 3,920,278 | ||||

| Platte River Power Authority Revenue Series HH | ||||||

| 5.00% 6/1/27 | 2,795,000 | 3,082,270 | ||||

| 5.00% 6/1/29 | 2,355,000 | 2,562,005 | ||||

| Puerto Rico Electric Power Authority Revenue | ||||||

| Series WW 5.00% 7/1/28 | 2,400,000 | 2,395,776 | ||||

| Series ZZ 5.00% 7/1/17 | 2,500,000 | 2,750,200 | ||||

| Series ZZ 5.25% 7/1/26 | 3,500,000 | 3,590,510 | ||||

| 21,798,397 | ||||||

Delaware Tax-Free Colorado Fund

| Principal amount | Value | |||||

| Municipal Bonds (continued) | ||||||

| Healthcare Revenue Bonds – 24.84% | ||||||

| Aurora Hospital Revenue | ||||||

| (Children’s Hospital Association Project) | ||||||

| Series A 5.00% 12/1/40 | $ | 400,000 | $ | 392,136 | ||

| Series D 5.00% 12/1/23 (AGM) | 2,775,000 | 2,989,952 | ||||

| Colorado Health Facilities Authority Revenue | ||||||

| •(Adventist Health) 5.125% 11/15/24 | 1,375,000 | 1,457,569 | ||||

| (Catholic Health Initiatives) | ||||||

| Series A 4.75% 9/1/40 | 1,000,000 | 963,420 | ||||

| Series A 5.00% 7/1/39 | 1,540,000 | 1,537,598 | ||||

| Series C-1 5.10% 10/1/41 (AGM) | 2,000,000 | 2,020,660 | ||||

| Series D 6.25% 10/1/33 | 2,000,000 | 2,192,420 | ||||

| (Christian Living Communities Project) | ||||||

| Series A 5.75% 1/1/37 | 1,500,000 | 1,318,965 | ||||

| (Covenant Retirement Communities) | ||||||

| Series A 5.50% 12/1/33 (RADIAN) | 5,000,000 | 4,546,449 | ||||

| (Evangelical Lutheran) | ||||||

| 5.00% 6/1/35 | 2,000,000 | 1,826,140 | ||||

| Series A 5.25% 6/1/34 | 2,750,000 | 2,626,800 | ||||

| Series A 6.125% 6/1/38 | 5,250,000 | 5,278,979 | ||||

| (Parkview Medical Center) 5.00% 9/1/25 | 1,000,000 | 1,007,820 | ||||

| (Sisters Leavenworth) Series B 5.25% 1/1/25 | 2,500,000 | 2,701,075 | ||||

| (Total Long-Term Care) Series A | ||||||

| 6.00% 11/15/30 | 2,365,000 | 2,425,260 | ||||

| 6.25% 11/15/40 | 750,000 | 760,913 | ||||

| (Vail Valley Medical Center Project) 5.80% 1/15/27 | 3,475,000 | 3,481,881 | ||||

| (Valley View Hospital Association) 5.50% 5/15/28 | 1,000,000 | 990,220 | ||||

| Colorado Springs Hospital Revenue 6.25% 12/15/33 | 2,500,000 | 2,686,900 | ||||

| Delta County Memorial Hospital District Enterprise | ||||||

| Revenue 5.35% 9/1/17 | 4,000,000 | 4,062,120 | ||||

| Denver Health & Hospital Authority Health Care Revenue | ||||||

| (Recovery Zone Facilities) 5.625% 12/1/40 | 2,500,000 | 2,332,200 | ||||

| Series A 4.75% 12/1/36 | 1,500,000 | 1,230,720 | ||||

| Puerto Rico Industrial Tourist Educational Medical & | ||||||

| Environmental Control Facilities Financing Authority | ||||||

| Auxilio Mutuo Series A 6.00% 7/1/33 | 3,000,000 | 3,087,240 | ||||

| University of Colorado Hospital Authority Revenue Series A | ||||||

| 5.00% 11/15/37 | 2,690,000 | 2,598,352 | ||||

| 6.00% 11/15/29 | 2,460,000 | 2,610,109 | ||||

| 57,125,898 | ||||||

| Principal amount | Value | |||||

| Municipal Bonds (continued) | ||||||

| Housing Revenue Bonds – 2.86% | ||||||

| Colorado Housing & Finance Authority | ||||||

| (Multifamily Housing Insured Mortgage) | ||||||

| Series C3 6.15% 10/1/41 | $ | 1,590,000 | $ | 1,591,447 | ||

| (Single Family Mortgage) Series A 5.50% 11/1/29 | ||||||

| (FHA) (VA) (HUD) | 1,270,000 | 1,313,040 | ||||

| (Single Family Program) Series AA | ||||||

| 4.50% 5/1/23 (FHLMC) | 730,000 | 766,763 | ||||

| 4.50% 11/1/23 (FHLMC) | 750,000 | 787,770 | ||||

| Puerto Rico Housing Finance Authority Subordinate | ||||||

| (Capital Fund Modernization) 5.125% 12/1/27 | 2,040,000 | 2,115,439 | ||||

| 6,574,459 | ||||||

| Lease Revenue Bonds – 2.27% | ||||||

| Aurora Certificates of Participation Refunding | ||||||

| Series A 5.00% 12/1/30 | 2,370,000 | 2,505,137 | ||||

| • | Puerto Rico Public Buildings Authority Revenue | |||||

| (Guaranteed Government Facilities) | ||||||

| Series M-2 5.50% 7/1/35 (AMBAC) | 1,000,000 | 1,077,840 | ||||

| Regional Transportation District Certificates of | ||||||

| Participation Series A 5.375% 6/1/31 | 1,540,000 | 1,629,613 | ||||

| 5,212,590 | ||||||

| Local General Obligation Bonds – 14.65% | ||||||

| Adams & Arapahoe Counties Joint School | ||||||

| District #28J (Aurora) 6.00% 12/1/28 | 2,500,000 | 2,901,325 | ||||

| Arapahoe County Water & Wastewater Public | ||||||

| Improvement District | ||||||

| Series A 5.125% 12/1/32 (NATL-RE) | 2,555,000 | 2,575,414 | ||||

| Denver City & County | ||||||

| (Better Denver & Zoo) Series A 5.00% 8/1/25 | 3,215,000 | 3,685,291 | ||||

| (Justice System Facilities & Zoo) 5.00% 8/1/19 | 1,020,000 | 1,159,546 | ||||

| Denver City & County School District #1 | ||||||

| Series A 5.00% 12/1/29 | 960,000 | 1,049,798 | ||||

| Denver West Metropolitan District | ||||||

| 5.00% 12/1/33 (RADIAN) | 1,400,000 | 1,269,002 | ||||

| Douglas County School District #1 | ||||||

| (Douglas & Elbert Counties) | ||||||

| 5.00% 12/15/22 | 1,175,000 | 1,418,542 | ||||

| Series B 5.00% 12/15/24 | 2,355,000 | 2,584,636 | ||||

| Garfield County School District #2 5.00% 12/1/25 (AGM) | 2,280,000 | 2,483,330 | ||||

Delaware Tax-Free Colorado Fund

| Principal amount | Value | |||||

| Municipal Bonds (continued) | ||||||

| Local General Obligation Bonds (continued) | ||||||

| Grand County School District #2 (East Grand) | ||||||

| 5.25% 12/1/25 (AGM) | $ | 2,485,000 | $ | 2,754,598 | ||

| Gunnison Watershed School District #1J | ||||||

| Series 2009 5.25% 12/1/33 | 1,400,000 | 1,530,760 | ||||

| Jefferson County School District #R-001 5.25% 12/15/24 | 2,500,000 | 3,068,800 | ||||

| La Plata County School District #9-R (Durango) | ||||||

| 5.125% 11/1/24 (NATL-RE) | 1,000,000 | 1,073,970 | ||||

| @ | North Range Metropolitan | |||||

| District #1 4.50% 12/15/31 (ACA) | 1,500,000 | 997,320 | ||||

| District #2 5.50% 12/15/37 | 1,200,000 | 999,828 | ||||

| Rangely Hospital District 6.00% 11/1/26 | 2,250,000 | 2,395,913 | ||||

| Sand Creek Metropolitan District Refunding & | ||||||

| Improvement 5.00% 12/1/31 (SGI) | 500,000 | 462,185 | ||||

| Weld County School District #4 5.00% 12/1/19 (AGM) | 1,085,000 | 1,278,456 | ||||

| 33,688,714 | ||||||

| §Pre-Refunded Bonds – 10.91% | ||||||

| Colorado Educational & Cultural Facilities | ||||||

| Authority Revenue | ||||||

| (Arapahoe County Littleton Academy Charter School | ||||||

| Project) 6.125% 1/15/31-12 | 2,000,000 | 2,043,800 | ||||

| (Stargate Charter School Project) 6.125% 5/1/33-13 | 2,000,000 | 2,189,000 | ||||

| Colorado Health Facilities Authority Revenue | ||||||

| (Adventist Health) 5.125% 11/15/24-16 | 75,000 | 91,625 | ||||

| (Catholic Health Initiatives) Series A 5.50% 3/1/32-12 | 5,000,000 | 5,131,450 | ||||

| Douglas County School District #1 | ||||||

| (Douglas & Elbert Counties) | ||||||

| Series B 5.125% 12/15/25-12 (AGM) | 2,000,000 | 2,123,420 | ||||

| El Paso County Certificates of Participation | ||||||

| (Detention Facilities Project) | ||||||

| Series B 5.00% 12/1/27-12 (AMBAC) | 1,500,000 | 1,588,440 | ||||

| El Paso County School District #2 (Harrison) | ||||||

| 5.00% 12/1/27-12 (NATL-RE) | 2,115,000 | 2,241,075 | ||||

| Fremont County School District #1 (Canon City) | ||||||

| 5.00% 12/1/24-13 (NATL-RE) | 1,735,000 | 1,916,134 | ||||

| Garfield County School District #2 5.00% 12/1/25-12 (AGM) | 1,000,000 | 1,058,960 | ||||

| Garfield Pitkin & Eagle County School District #Re-1 | ||||||

| (Roaring Fork County) | ||||||

| Series A 5.00% 12/15/27-14 (AGM) | 1,500,000 | 1,722,030 | ||||

| Principal amount | Value | |||||

| Municipal Bonds (continued) | ||||||

| §Pre-Refunded Bonds (continued) | ||||||

| North Range Metropolitan District #1 | ||||||

| 7.25% 12/15/31-11 | $ | 3,380,000 | $ | 3,474,268 | ||

| Puerto Rico Commonwealth Series A 5.25% 7/1/30-16 | 1,235,000 | 1,497,981 | ||||

| Puerto Rico Public Buildings Authority Revenue | ||||||

| (Guaranteed Government Facilities) | ||||||

| Series I 5.25% 7/1/33-14 | 25,000 | 28,280 | ||||

| 25,106,463 | ||||||

| Special Tax Revenue Bonds – 10.76% | ||||||

| Aspen Sales Tax Revenue (Parks & Open Spaces) | ||||||

| Series B 5.25% 11/1/23 (AGM) | 2,040,000 | 2,228,231 | ||||

| @ | Baptist Road Rural Transportation Authority Sales & | |||||

| Use Tax Revenue 5.00% 12/1/26 | 2,000,000 | 1,338,020 | ||||

| Denver City & County Justice System Facilities | ||||||

| 5.00% 8/1/21 | 1,500,000 | 1,749,930 | ||||

| Denver Convention Center Hotel Authority Revenue | ||||||

| 5.00% 12/1/35 (SGI) | 3,495,000 | 2,991,545 | ||||

| Denver International Business Center | ||||||

| Metropolitan District #1 | ||||||

| 5.00% 12/1/30 | 350,000 | 333,946 | ||||

| 5.375% 12/1/35 | 1,750,000 | 1,692,320 | ||||

| Park Meadows Business Improvement District Shared | ||||||

| Sales Tax Revenue | ||||||

| 5.30% 12/1/27 | 950,000 | 860,425 | ||||

| 5.35% 12/1/31 | 720,000 | 634,781 | ||||

| Puerto Rico Commonwealth Highway & Transportation | ||||||

| Authority Revenue | ||||||

| Series K 5.00% 7/1/30 | 4,700,000 | 4,418,281 | ||||

| Puerto Rico Sales Tax Financing Corporation Revenue | ||||||

| First Subordinate | ||||||

| Ω(Convertible Capital Appreciation) Series A 6.75% 8/1/32 | 1,345,000 | 1,158,623 | ||||

| Series A 5.25% 8/1/27 | 1,100,000 | 1,157,013 | ||||

| Series A 5.75% 8/1/37 | 2,620,000 | 2,715,001 | ||||

| Series C 5.50% 8/1/40 | 1,000,000 | 1,016,500 | ||||

| Regional Transportation District Sales Tax Revenue | ||||||

| Refunding Series A 5.25% 11/1/18 | 2,000,000 | 2,461,640 | ||||

| 24,756,256 | ||||||

Delaware Tax-Free Colorado Fund

| Principal amount | Value | |||||

| Municipal Bonds (continued) | ||||||

| State & Territory General Obligation Bonds – 7.87% | ||||||

| Guam Government Series A 7.00% 11/15/39 | $ | 2,500,000 | $ | 2,581,250 | ||

| Puerto Rico Commonwealth Series A 5.50% 7/1/15 | 1,000,000 | 1,096,310 | ||||

| Puerto Rico Commonwealth Government Development | ||||||

| Bank Senior Notes | ||||||

| Series B 5.00% 12/1/15 | 1,000,000 | 1,083,650 | ||||

| Puerto Rico Commonwealth Public Improvement | ||||||

| Series A 5.25% 7/1/15 | 1,650,000 | 1,794,029 | ||||

| Series A 5.25% 7/1/21 | 4,000,000 | 4,056,559 | ||||

| Series A 5.50% 7/1/19 (NATL-RE) (IBC) | 2,220,000 | 2,460,026 | ||||

| Series A 5.75% 7/1/41 | 3,850,000 | 3,803,646 | ||||

| Series E 5.375% 7/1/30 | 1,250,000 | 1,229,563 | ||||

| 18,105,033 | ||||||

| Transportation Revenue Bonds – 5.11% | ||||||

| Denver City & County Airport Revenue | ||||||

| Series A 5.00% 11/15/25 (NATL-RE) (FGIC) | 2,000,000 | 2,109,860 | ||||

| Series A 5.25% 11/15/36 | 2,500,000 | 2,629,925 | ||||

| Series B 5.00% 11/15/33 (SGI) | 2,000,000 | 2,015,420 | ||||

| E-470 Public Highway Authority | ||||||

| 5.375% 9/1/26 | 2,000,000 | 1,938,960 | ||||

| Series C 5.25% 9/1/25 | 690,000 | 668,079 | ||||

| Regional Transportation District Revenue | ||||||

| (Denver Transit Partners) 6.00% 1/15/41 | 2,400,000 | 2,401,440 | ||||

| 11,763,684 | ||||||

| Water & Sewer Revenue Bonds – 0.60% | ||||||

| Eagle River Water & Sanitation District Enterprise | ||||||

| Revenue 5.00% 12/1/29 (ASSURED GTY) | 250,000 | 274,123 | ||||

| Pueblo Board of Waterworks Revenue 5.00% 11/1/21 (AGM) | 1,000,000 | 1,105,610 | ||||

| 1,379,733 | ||||||

| Total Municipal Bonds (cost $222,540,990) | 227,919,529 | |||||

| Principal amount | Value | |||||||

| Short-Term Investment – 0.06% | ||||||||

| Money Market Mutual Fund – 0.06% | ||||||||

| Dreyfus Cash Management Fund | $ | 133,198 | $ | 133,198 | ||||

| Total Short-Term Investment (cost $133,198) | 133,198 | |||||||

| Total Value of Securities – 99.15% | ||||||||

| (cost $222,674,188) | 228,052,727 | |||||||

| Receivables and Other Assets | ||||||||

| Net of Liabilities – 0.85% | 1,960,016 | |||||||

| Net Assets Applicable to 21,129,102 | ||||||||

| Shares Outstanding – 100.00% | $ | 230,012,743 | ||||||

| Net Asset Value – Delaware Tax-Free Colorado Fund | ||||||||

| Class A ($216,151,180 / 19,858,886 Shares) | $10.88 | |||||||

| Net Asset Value – Delaware Tax-Free Colorado Fund | ||||||||

| Class B ($609,260 / 55,924 Shares) | $10.89 | |||||||

| Net Asset Value – Delaware Tax-Free Colorado Fund | ||||||||

| Class C ($13,252,303 / 1,214,292 Shares) | $10.91 | |||||||

| Components of Net Assets at August 31, 2011: | ||||||||

| Shares of beneficial interest (unlimited authorization – no par) | $ | 228,353,972 | ||||||

| Undistributed net investment income | 352,563 | |||||||

| Accumulated net realized loss on investments | (4,072,331 | ) | ||||||

| Net unrealized appreciation of investments | 5,378,539 | |||||||

| Total net assets | $ | 230,012,743 | ||||||

| • | Variable rate security. The rate shown is the rate as of August 31, 2011. Interest rates reset periodically. |

| @ | Illiquid security. At August 31, 2011, the aggregate amount of illiquid securities was $3,335,168, which represented 1.45% of the Fund’s net assets. See Note 8 in “Notes to financial statements.” |

| § | Pre-Refunded bonds. Municipal bonds that are generally backed or secured by U.S. Treasury bonds. For Pre-Refunded bonds, the stated maturity is followed by the year in which the bond is pre-refunded. See Note 8 in “Notes to financial statements.” |

| Ω | Step coupon bond. Indicates security that has a zero coupon that remains in effect until a predetermined date at which time the stated interest rate becomes effective. |

Delaware Tax-Free Colorado Fund

ACA — Insured by American Capital Access

AGM — Insured by Assured Guaranty Municipal Corporation

AMBAC — Insured by AMBAC Assurance Corporation

ASSURED GTY — Insured by Assured Guaranty Corporation

FGIC — Insured by Financial Guaranty Insurance Company

FHA — Federal Housing Administration

FHLMC — Federal Home Loan Mortgage Corporation Collateral

HUD — Housing & Urban Development Section 8

IBC — Insured Bond Certificate

NATL-RE — Insured by National Public Finance Guarantee Corporation

RADIAN — Insured by Radian Asset Assurance

SGI — Insured by Syncora Guarantee Inc.

VA — Veterans Administration Collateral

| Net Asset Value and Offering Price Per Share – | ||

| Delaware Tax-Free Colorado Fund | ||

| Net asset value Class A (A) | $ | 10.88 |

| Sales charge (4.50% of offering price) (B) | 0.51 | |

| Offering price | $ | 11.39 |

| (A) | Net asset value per share, as illustrated, is the amount which would be paid upon redemption or repurchase of shares. |

| (B) | See the current prospectus for purchases of $100,000 or more. |

| Delaware Tax-Free Idaho Fund | August 31, 2011 |

| Principal amount | Value | |||||

| Municipal Bonds – 98.67% | ||||||

| Corporate Revenue Bonds – 5.99% | ||||||

| Nez Perce County Pollution Control Revenue | ||||||

| (Potlatch Project) 6.00% 10/1/24 | $ | 2,535,000 | $ | 2,534,949 | ||

| Power County Industrial Development Revenue | ||||||

| (FMC Project) 6.45% 8/1/32 (AMT) | 2,000,000 | 2,001,480 | ||||

| Power County Pollution Control Revenue | ||||||

| (FMC Project) 5.625% 10/1/14 | 2,475,000 | 2,474,852 | ||||

| Puerto Rico Ports Authority Special Facilities Revenue | ||||||

| (American Airlines) Series A 6.30% 6/1/23 (AMT) | 1,295,000 | 1,102,757 | ||||

| 8,114,038 | ||||||

| Education Revenue Bonds – 10.78% | ||||||

| Boise State University Revenue | ||||||

| (General Refunding) Series A | ||||||

| 4.25% 4/1/32 (NATL-RE) | 750,000 | 752,010 | ||||

| 5.00% 4/1/18 (NATL-RE) (FGIC) | 1,500,000 | 1,610,175 | ||||

| 5.00% 4/1/39 | 1,000,000 | 1,040,590 | ||||

| (Student Union & Housing System) | ||||||

| 5.00% 4/1/17 (AMBAC) | 500,000 | 525,165 | ||||

| Un-Refunded Series 07 5.375% 4/1/22 (FGIC) | 5,000 | 5,113 | ||||

| Idaho Housing & Financing Association Nonprofit | ||||||

| Facilities Revenue (North Star Charter School Project) | ||||||

| Series A 9.50% 7/1/39 | 1,000,000 | 1,052,640 | ||||

| Idaho State University Revenue Refunding & Improvement | ||||||

| 5.00% 4/1/20 (AGM) | 1,130,000 | 1,202,297 | ||||

| 5.00% 4/1/23 (AGM) | 2,115,000 | 2,173,522 | ||||

| University of Idaho (General Refunding) | ||||||

| •Series 2011 5.25% 4/1/41 | 2,000,000 | 2,310,660 | ||||

| Series A 5.00% 4/1/21 (AMBAC) | 1,150,000 | 1,232,329 | ||||

| •Series B 4.50% 4/1/41 (AGM) | 1,000,000 | 1,111,260 | ||||

| Series B 5.00% 4/1/28 | 1,000,000 | 1,073,140 | ||||

| Series B 5.00% 4/1/32 | 500,000 | 524,335 | ||||

| 14,613,236 | ||||||

| Electric Revenue Bonds – 5.08% | ||||||

| Boise-Kuna Irrigation District Revenue | ||||||

| (Arrowrock Hydroelectric Project) 6.30% 6/1/31 | 1,000,000 | 1,083,730 | ||||

| Puerto Rico Electric Power Authority Revenue | ||||||

| Series TT 5.00% 7/1/32 | 3,170,000 | 3,044,881 | ||||

| Series TT 5.00% 7/1/37 | 210,000 | 197,660 | ||||

| Series ZZ 5.25% 7/1/26 | 2,500,000 | 2,564,650 | ||||

| 6,890,921 | ||||||

Delaware Tax-Free Idaho Fund

| Principal amount | Value | |||||

| Municipal Bonds (continued) | ||||||

| Healthcare Revenue Bonds – 5.97% | ||||||

| Idaho Health Facilities Authority Revenue | ||||||

| (St. Luke’s Health System Project) Series A | ||||||

| 6.50% 11/1/23 | $ | 250,000 | $ | 285,915 | ||

| 6.75% 11/1/37 | 1,250,000 | 1,381,088 | ||||

| (St. Luke’s Regional Medical Center Project) | ||||||

| 5.00% 7/1/35 (AGM) | 2,500,000 | 2,583,675 | ||||

| (Trinity Health Center Group) | ||||||

| Series B 6.125% 12/1/28 | 1,000,000 | 1,119,170 | ||||

| Series D 4.50% 12/1/37 | 1,205,000 | 1,175,899 | ||||

| Puerto Rico Industrial Tourist Educational Medical & | ||||||

| Environmental Control Facilities Financing Authority | ||||||

| Auxilio Mutuo Series A 6.00% 7/1/33 | 1,500,000 | 1,543,620 | ||||

| 8,089,367 | ||||||

| Housing Revenue Bonds – 4.11% | ||||||

| Idaho Housing & Finance Association Single Family | ||||||

| Mortgage Revenue | ||||||

| Series A 6.05% 7/1/13 (AMBAC) (FHA) (VA) (AMT) | 10,000 | 10,021 | ||||

| Series A 6.10% 7/1/16 (FHA) (VA) (AMT) | 15,000 | 15,028 | ||||

| Series A Class II 4.375% 7/1/32 | 1,000,000 | 970,650 | ||||

| Series B 6.45% 7/1/15 (AMT) | 10,000 | 10,023 | ||||

| Series B Class I 5.00% 7/1/37 (AMT) | 815,000 | 816,679 | ||||

| Series B Class I 5.50% 7/1/38 | 600,000 | 628,308 | ||||

| Series C Class II 4.95% 7/1/31 | 1,000,000 | 1,020,500 | ||||