Press Release

Exhibit 99.1

|

|

|

|

|

|

|

Navistar International Corporation 2701 Navistar Dr. Lisle, IL 60532 USA |

|

P : 331-332-5000 W : navistar.com |

|

|

|

|

|

|

|

| Media Contact: |

|

Karen Denning, 331-332-3535 |

|

|

|

|

| Investor Contact: |

|

Heather Kos, 331-332-2406 |

|

|

|

|

| Web site: |

|

www.Navistar.com/newsroom |

|

|

|

|

NAVISTAR ANNOUNCES MANAGEMENT REORGANIZATION, REPORTS SECOND

QUARTER RESULTS

| |

• |

|

Management reorganization to drive improved execution around integration strategy |

| |

• |

|

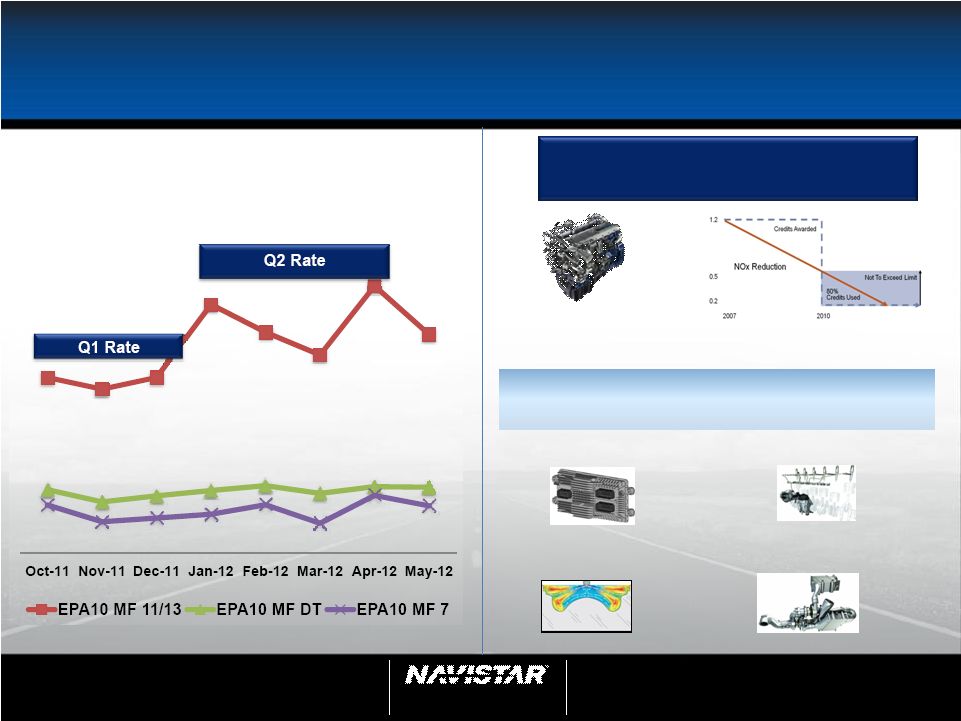

Second quarter loss driven by higher warranty, engine certification speculation |

| |

• |

|

Company projects significant profit improvement in second half 2012 |

LISLE, Ill. (June 7, 2012) – Navistar International Corporation (NYSE: NAV) today announced a management realignment designed

to give further momentum to its strategy of great products, competitive cost and profitable growth. The company also released second quarter results and acknowledged that discussions with the U.S. Environmental Protection Agency (EPA) for its

EGR-only 0.2 NOx emissions engine certification are ongoing.

Navistar reported a loss of $172 million, or $2.50 per diluted

share, for the second quarter ended April 30, 2012. After pre-tax adjustments to exclude net impact of pre-existing warranty charges of $104 million related to 2010 emission standard engines, asset impairment charges of $38 million, engineering

integration costs of $29 million, a charge of $10 million for non-conformance penalties, and the release of an $181 million income tax valuation allowance related to Canadian deferred tax assets, Navistar’s loss for the second quarter 2012 was

$137 million, or a loss of $1.99 per diluted share.

“Certainly, our first half performance was unacceptable. It included a warranty

reserve to repair early 2010 and 2011 vehicles,” said Daniel C. Ustian, Navistar chairman, president and chief executive officer. “We were also affected by speculation surrounding our engine certification for our Class 8 engine, which is

why we are working tirelessly with the U.S. EPA to get resolution.”

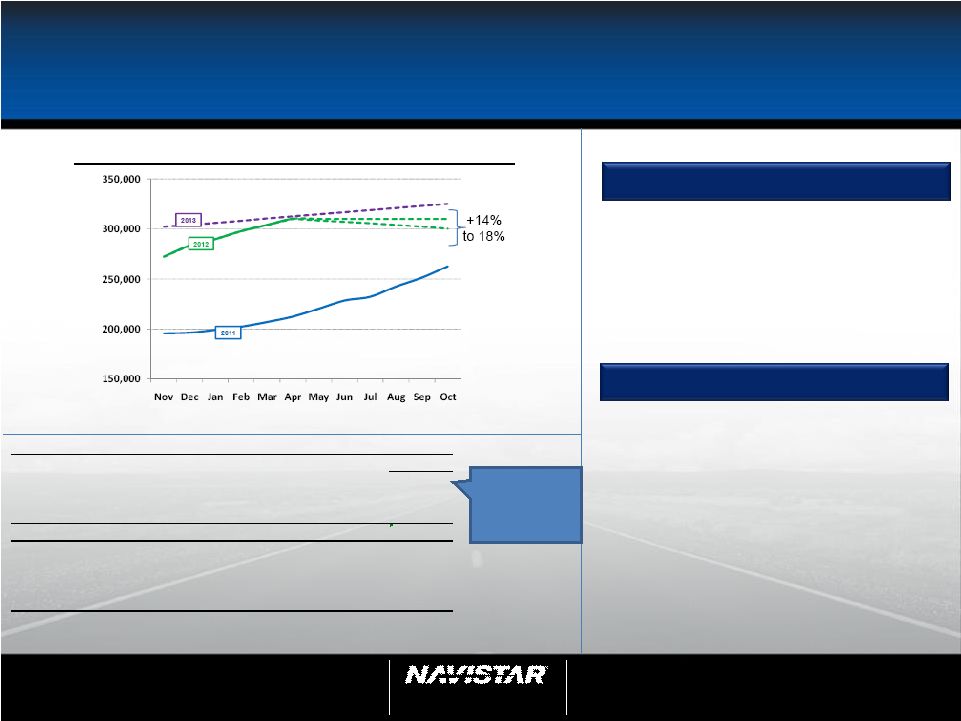

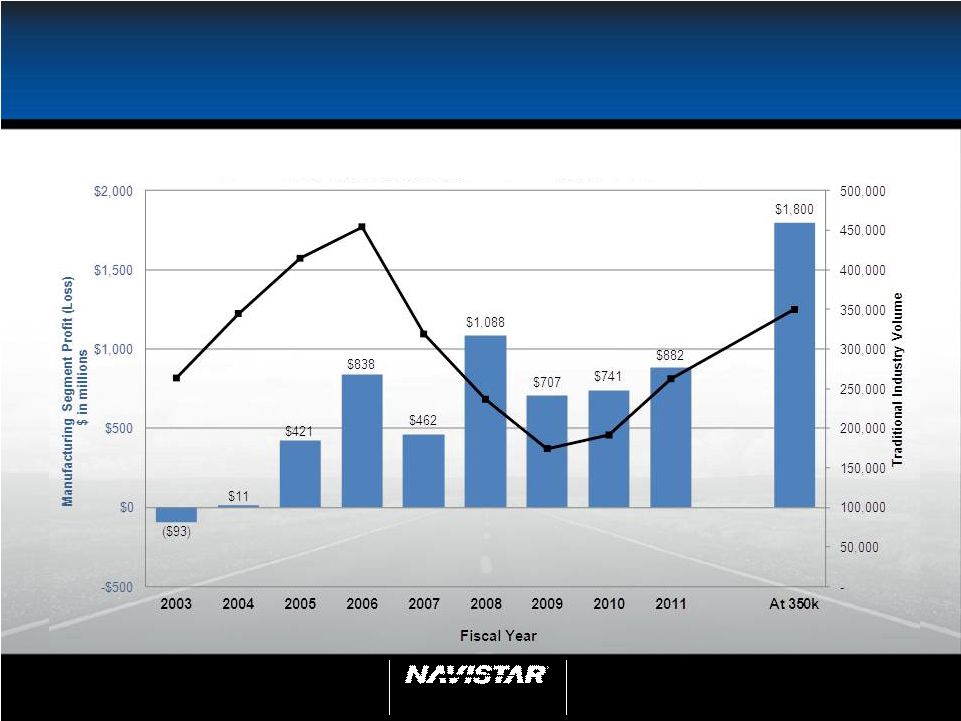

Based on its second quarter 2012 results, the

company updated its guidance for adjusted manufacturing segment profit for fiscal year ending October 31, 2012, to be between $600 million and $750 million. This equates to adjusted net income attributable to Navistar International Corporation to be

between breakeven and $140 million, or $0 to $2.00 adjusted diluted earnings per share. This expectation also includes the absorption of approximately $90 million in higher post retirement health care costs.

“Going forward, we’ve identified a path for delivering strong profits in the second half of 2012,” Ustian said.

“Historically, the second half is stronger across our businesses, and we expect to build on this with improved market share in North America, stronger global performance and further cost reductions across all operations.

Additionally, we’re making management and operational structure changes to align our

organization in a more effective manner to drive these results.”

Troy Clarke, currently president of Navistar Asia

Pacific, will assume responsibility for all Navistar’s operations in the newly-created role of President, Truck and Engine, under which the Truck, Engine, Parts, Product Development and Purchasing organizations will have the opportunity to

integrate and deliver the highest quality products and services. Jack Allen will become president of North America Truck and Parts, an expansion of his current role, and Engine Group President Eric Tech will expand his role to become

president of Global Truck and Engine, responsible for all of our business operations outside of North America. The changes will take effect July 1, following Board approval.

“I am confident that our new management structure will lead to greater planning and execution around our integration strategy, further enabling us to deliver enterprise-wide profitability, leverage

assets more effectively, streamline decision making and bring renewed energy to our team,” Ustian said.

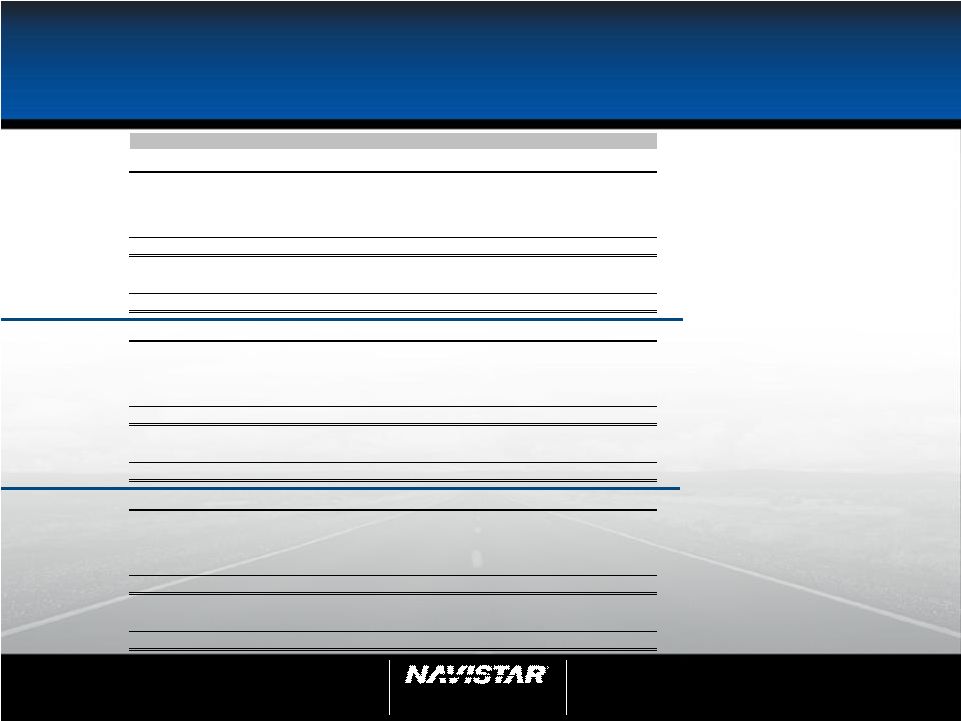

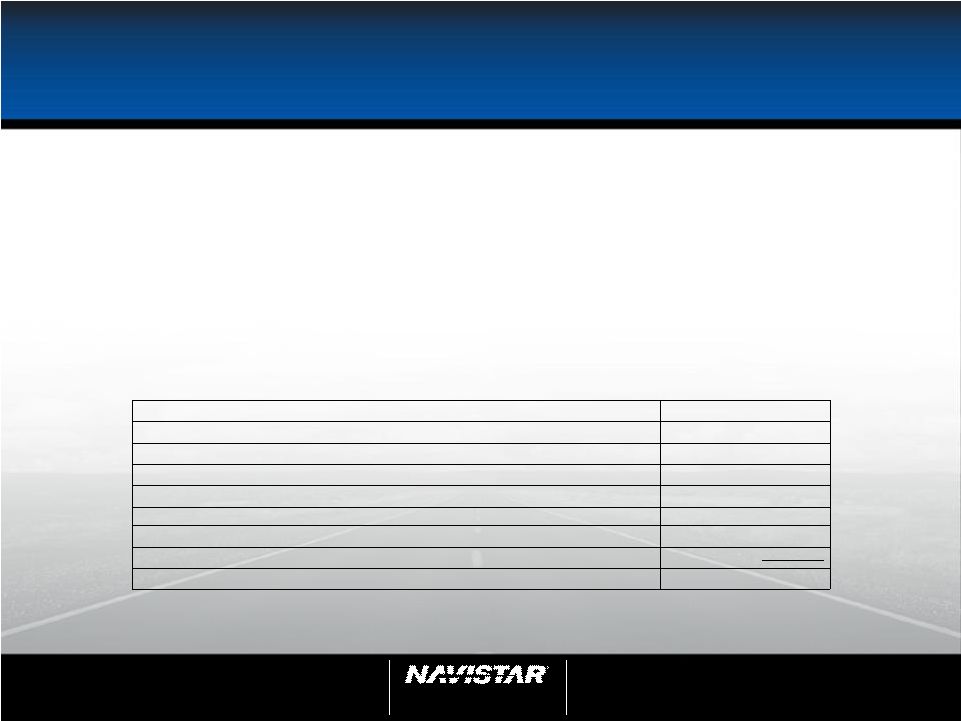

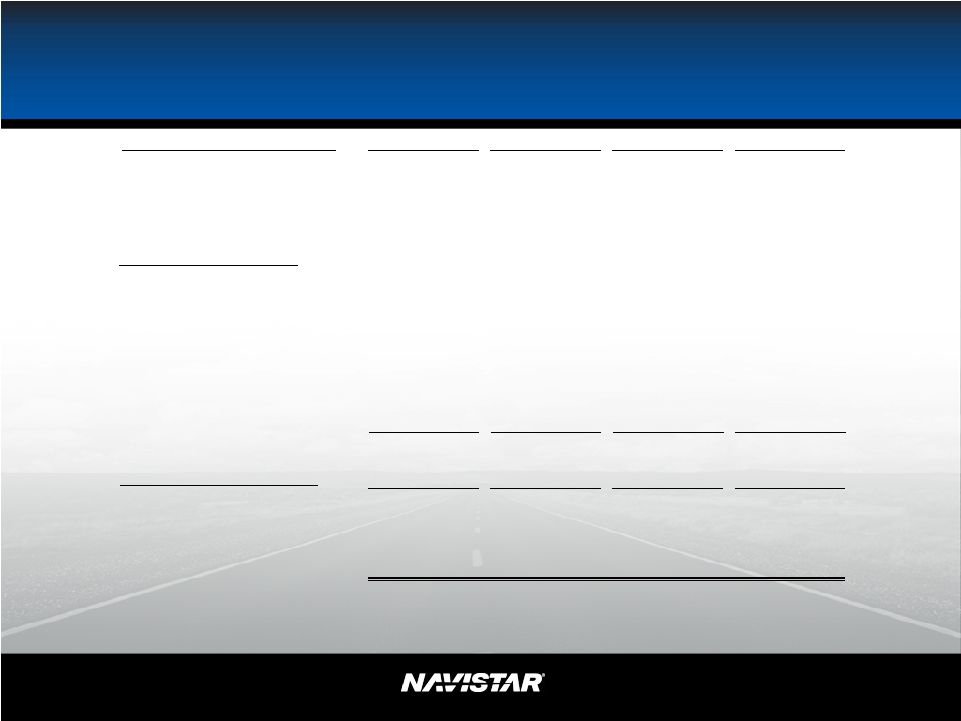

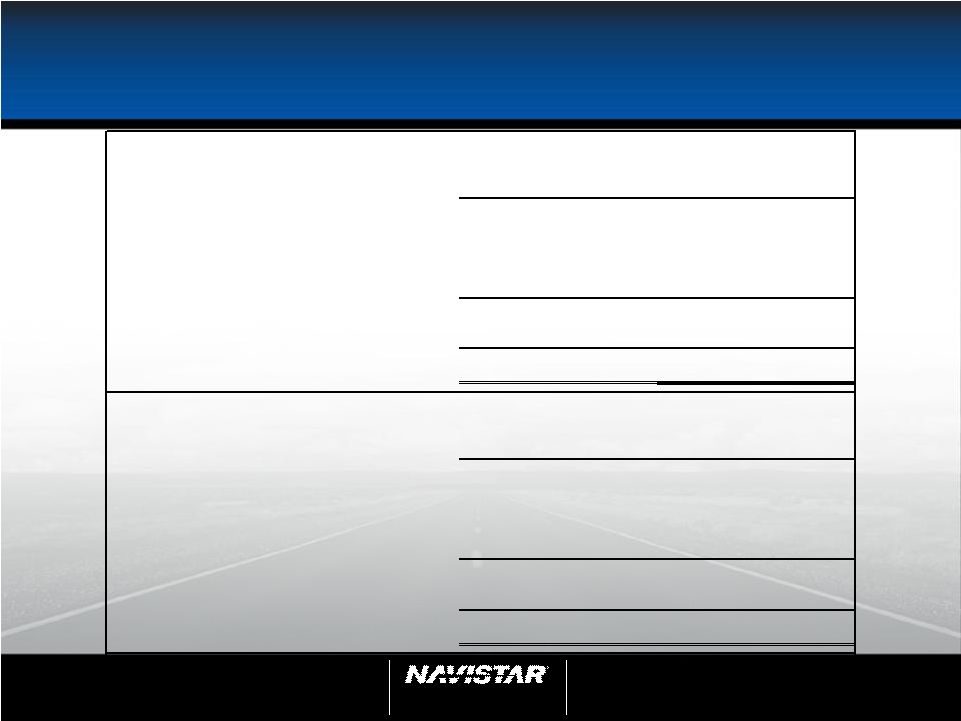

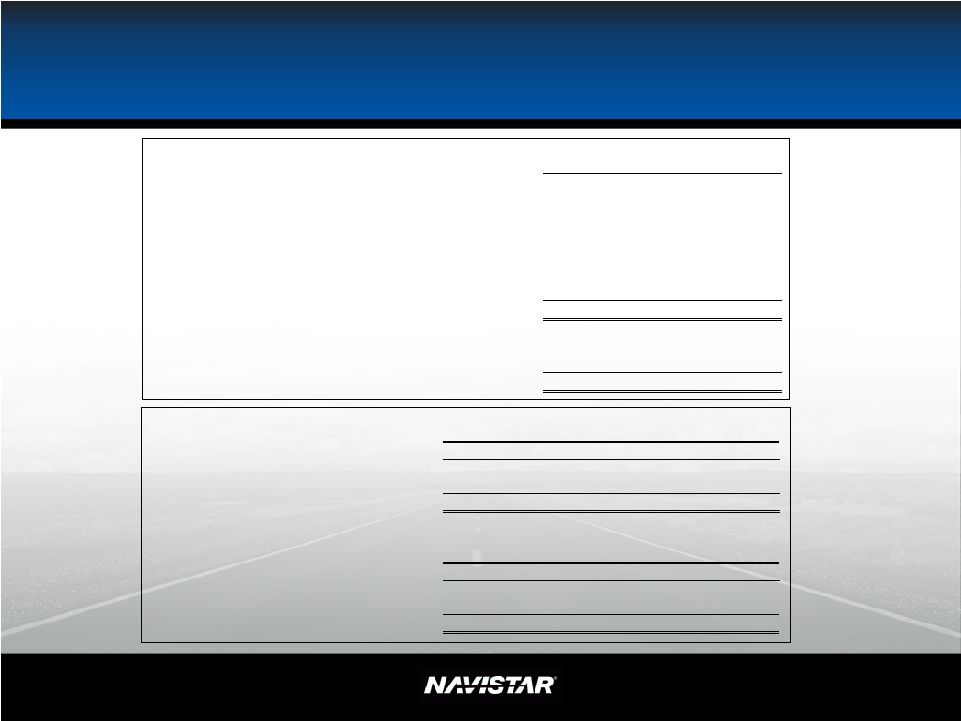

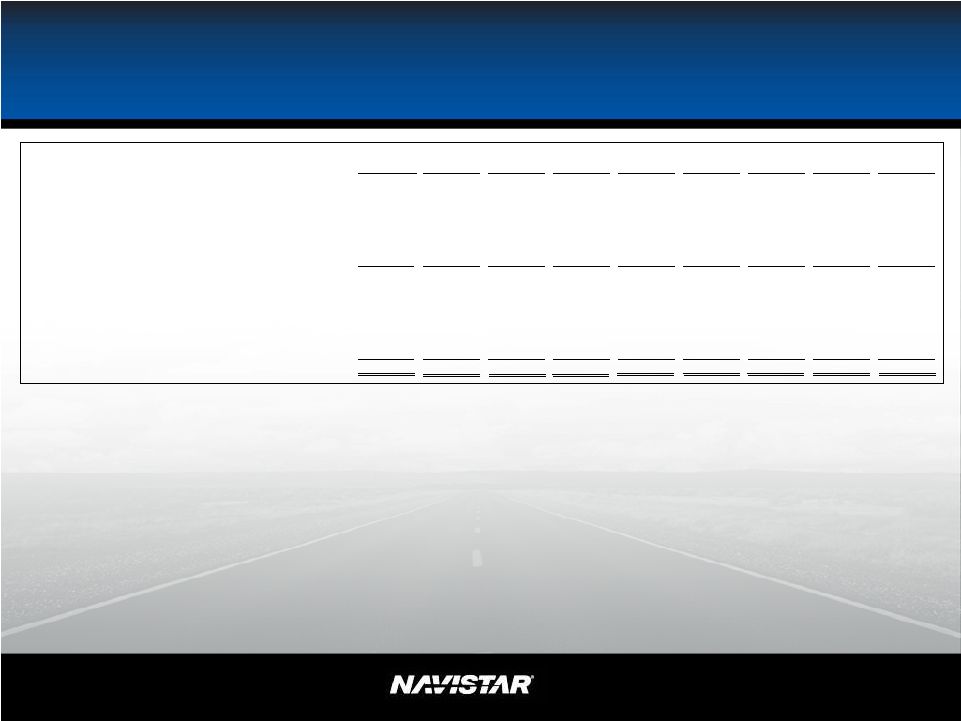

FINANCIALS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

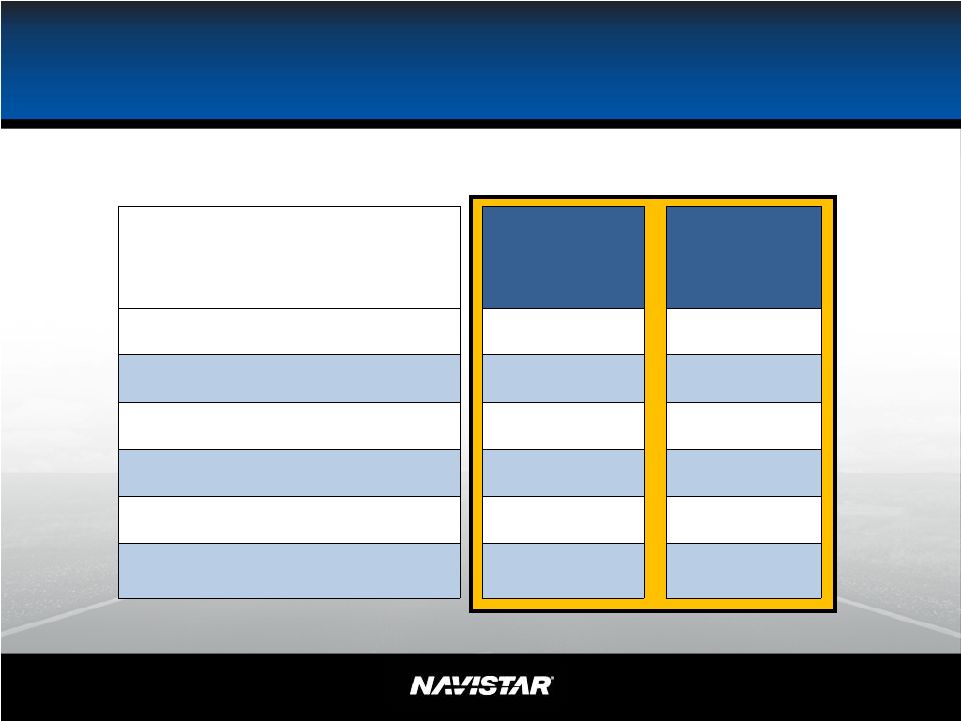

| |

|

Second Quarter |

|

|

Six Months |

|

| (in millions, except per share data) |

|

2012 |

|

|

2011 |

|

|

2012 |

|

|

2011 |

|

| Sales and revenues, net |

|

$ |

3,298 |

|

|

$ |

3,355 |

|

|

$ |

6,350 |

|

|

$ |

6,098 |

|

| Segment Results: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Truck |

|

$ |

(89 |

) |

|

$ |

92 |

|

|

$ |

(130 |

) |

|

$ |

124 |

|

| Engine |

|

|

(108 |

) |

|

|

2 |

|

|

|

(228 |

) |

|

|

(6 |

) |

| Parts |

|

|

41 |

|

|

|

74 |

|

|

|

91 |

|

|

|

130 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Manufacturing segment profit (loss)(A) |

|

$ |

(156 |

) |

|

$ |

168 |

|

|

$ |

(267 |

) |

|

$ |

248 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) before income taxes |

|

$ |

(295 |

) |

|

$ |

93 |

|

|

$ |

(516 |

) |

|

$ |

99 |

|

| Net income (loss) attributable to Navistar International Corporation |

|

|

(172 |

) |

|

|

74 |

|

|

|

(325 |

) |

|

|

68 |

|

| Diluted earnings (loss) per share attributable to Navistar International Corporation |

|

|

(2.50 |

) |

|

|

0.93 |

|

|

|

(4.69 |

) |

|

|

0.87 |

|

| Adjusted net income (loss) attributable to Navistar International Corporation(A) |

|

|

(137 |

) |

|

|

102 |

|

|

|

(201 |

) |

|

|

123 |

|

| Adjusted diluted earnings (loss) per share attributable to Navistar International Corporation(A) |

|

|

(1.99 |

) |

|

|

1.30 |

|

|

|

(2.90 |

) |

|

|

1.59 |

|

| (A) |

Non-GAAP measure, see SEC Regulation G Non-GAAP Reconciliation for additional information. |

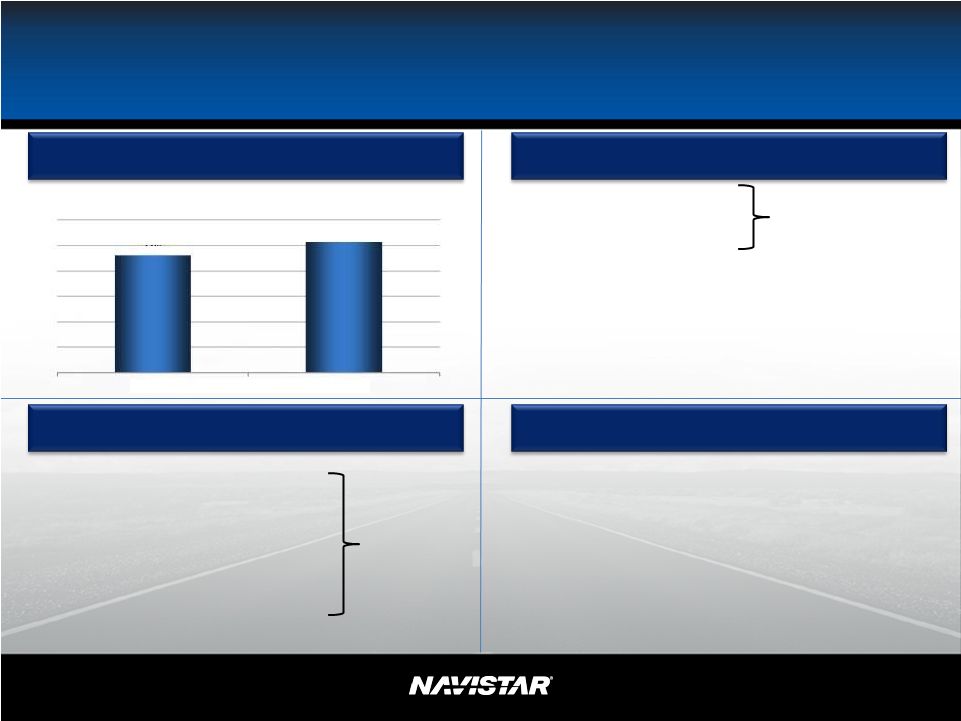

Consolidated net sales and revenues of $3.3 billion declined slightly in the second quarter of 2012, versus the year-ago second quarter,

which reflects higher net sales in the truck segment that were more than offset by lower net sales in the engine and parts segments. In the year-ago second quarter, Navistar reported sales and revenues of $3.4 billion and net income of $74 million,

or $0.93 per diluted share. Adjusted to exclude engineering integration costs and charges for pre-existing warranties, the company reported income of $102 million, or $1.30 diluted earnings per share.

For the six months ended April 30, 2012, Navistar reported a loss of $325 million, equal to

$4.69 per diluted share. After adjustments to exclude the impact of the items previously discussed above, Navistar’s loss for the first half of 2012 is $201 million, equal to $2.90 per diluted share.

Truck — For the second quarter 2012, the truck segment recorded a loss of $89 million, compared with a year-ago second

quarter profit of $92 million. Results included unfavorable shifts in military product mix reflective of lower military budgets, industry-wide higher commodity and fuel costs, an asset impairment charge of $28 million relating to the company’s

decision to idle its Workhorse Custom Chassis business, and a charge for $24 million for certain extended warranty costs.

The

segment sales increased 4 percent due to increased volumes in traditional markets and strong volume in South America. Traditional and worldwide chargeouts were up, partially offset by lower military sales and shifts in military product mix.

Engine — For the second quarter 2012, the engine segment recorded a loss of $108 million, compared with a

year-ago second quarter profit of $2 million. Segment sales decreased by 6 percent due to lower sales volumes in South America and a pre-buy of pre-Euro V emissions engines in prior quarters. The segment results include $78 million in pre-existing

warranty costs primarily for 2010 emission standard engines.

The engine segment also announced it received government

approval for its engine joint venture with Chinese company Anhui Jianghuai Automobile Co (JAC).

Parts — For the

second quarter 2012, the parts segment recorded $41 million in profit, compared with a year-ago second quarter profit of $74 million. The decrease in profitability year-over-year is driven by a decrease in military sales, a shift in military order

mix and an asset impairment charge of $10 million for Uptime Parts related to the Workhorse Custom Chassis business.

Financial Services — For the second quarter 2012, the financial services segment recorded $26 million in profit, compared

with a year-ago second quarter profit of $40 million. Earnings from the company’s financial services segment will continue to slowly decline as its U.S. retail loan portfolio liquidates, reflecting the U.S. retail financing now provided by GE

Capital.

MANAGEMENT CHANGES

Troy Clarke assumes the newly created position of president, Truck and Engine, accountable for all Navistar operations. In his current role as president of Navistar Asia Pacific, Clarke led the

development of joint ventures in China and India, and worked across regions to execute Navistar’s global growth strategy. He joined Navistar in January 2010 after a 35-year tenure at General Motors where he held numerous leadership positions,

including group president of GM North America, president of GM Asia Pacific, president and managing director of GM Mexico, and vice president of manufacturing and labor relations.

Jack Allen is expanding his role as president of North America Truck to now include

the Parts business. He will leverage the natural integration between Truck and Parts as well as his previous experience as Parts president. Allen is a 30-year Navistar veteran and was Engine president from 2004 – 2008, where he led major

initiatives including the acquisition of Brazilian engine producer MWM Motores Diesel Ltd.

Eric Tech is expanding his

role from Engine president to become president of Global Truck and Engine, responsible for all of our business operations outside of North America. Tech joined Navistar six years ago from Ford Motor Company, and he has been instrumental in creating

Navistar’s Pure Power Technology business.

About Navistar

Navistar International Corporation (NYSE: NAV) is a holding company whose subsidiaries and affiliates produce

International® brand commercial and military trucks,

MaxxForce® brand diesel engines, IC Bus™ brand school and commercial buses,

Monaco® RV brands of recreational vehicles, and Workhorse® brand chassis for motor homes and step vans. It also is a private-label designer and manufacturer of diesel engines for the pickup truck, van and SUV markets. The

company also provides truck and diesel engine service parts. Another affiliate offers financing services. Additional information is available at www.Navistar.com/newsroom.

Forward-Looking Statement

Information provided and statements contained in this report

that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities

Litigation Reform Act of 1995. Such forward-looking statements only speak as of the date of this report and the company assumes no obligation to update the information included in this report. Such forward-looking statements include information

concerning our possible or assumed future results of operations, including descriptions of our business strategy. These statements often include words such as “believe,” “expect,” “anticipate,” “intend,”

“plan,” “estimate,” or similar expressions. These statements are not guarantees of performance or results and they involve risks, uncertainties, and assumptions. These statements are not guarantees of performance or results and

they involve risks, uncertainties, and assumptions. For a further description of these factors, see the risk factors set forth in our filings with the Securities and Exchange Commission, including our annual report on Form 10-K for the fiscal year

ended October 31, 2011 and quarterly reports for fiscal 2012. Although we believe that these forward-looking statements are based on reasonable assumptions, there are many factors that could affect our actual financial results or results of

operations and could cause actual results to differ materially from those in the forward-looking statements. All future written and oral forward-looking statements by us or persons acting on our behalf are expressly qualified in their entirety by

the cautionary statements contained or referred to above. Except for our ongoing obligations to disclose material information as required by the federal securities laws, we do not have any obligations or intention to release publicly any revisions

to any forward-looking statements to reflect events or circumstances in the future or to reflect the occurrence of unanticipated events.

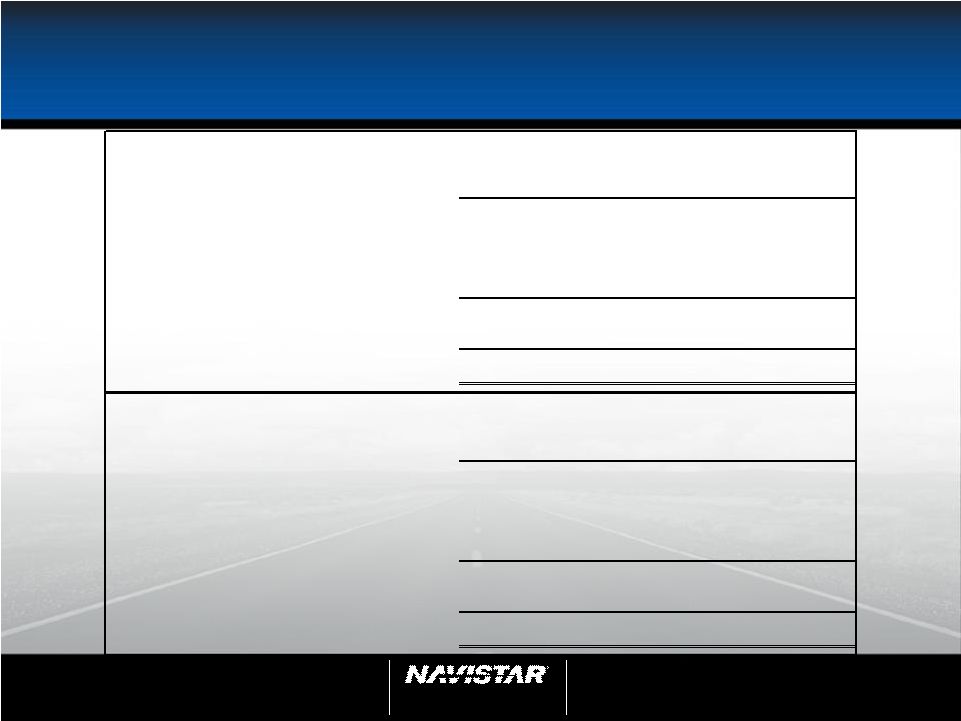

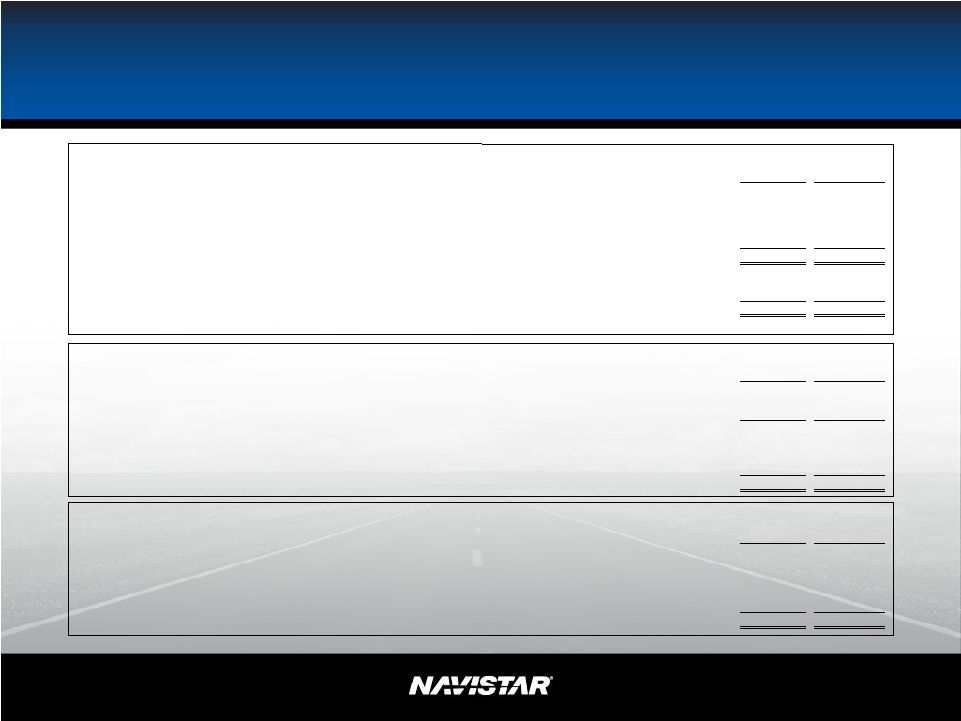

Navistar International Corporation and Subsidiaries

Consolidated Statements of Operations

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

April 30, |

|

|

April 30, |

|

| (in millions, except per share data) |

|

2012 |

|

|

2011 |

|

|

2012 |

|

|

2011 |

|

| Sales and revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales of manufactured products, net |

|

$ |

3,255 |

|

|

$ |

3,298 |

|

|

$ |

6,263 |

|

|

$ |

5,991 |

|

| Finance revenues |

|

|

43 |

|

|

|

57 |

|

|

|

87 |

|

|

|

107 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales and revenues, net |

|

|

3,298 |

|

|

|

3,355 |

|

|

|

6,350 |

|

|

|

6,098 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs and expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs of products sold |

|

|

2,944 |

|

|

|

2,701 |

|

|

|

5,642 |

|

|

|

4,900 |

|

| Restructuring charges |

|

|

20 |

|

|

|

2 |

|

|

|

20 |

|

|

|

24 |

|

| Impairment of intangible assets |

|

|

38 |

|

|

|

— |

|

|

|

38 |

|

|

|

— |

|

| Selling, general and administrative expenses |

|

|

378 |

|

|

|

354 |

|

|

|

740 |

|

|

|

672 |

|

| Engineering and product development costs |

|

|

134 |

|

|

|

137 |

|

|

|

271 |

|

|

|

266 |

|

| Interest expense |

|

|

62 |

|

|

|

62 |

|

|

|

123 |

|

|

|

125 |

|

| Other expense (income), net |

|

|

13 |

|

|

|

(10 |

) |

|

|

21 |

|

|

|

(21 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total costs and expenses |

|

|

3,589 |

|

|

|

3,246 |

|

|

|

6,855 |

|

|

|

5,966 |

|

| Equity in loss of non-consolidated affiliates |

|

|

(4 |

) |

|

|

(16 |

) |

|

|

(11 |

) |

|

|

(33 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) before income taxes |

|

|

(295 |

) |

|

|

93 |

|

|

|

(516 |

) |

|

|

99 |

|

| Income tax benefit (expense) |

|

|

133 |

|

|

|

(5 |

) |

|

|

214 |

|

|

|

(5 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

|

(162 |

) |

|

|

88 |

|

|

|

(302 |

) |

|

|

94 |

|

| Less: Net income attributable to non-controlling interests |

|

|

10 |

|

|

|

14 |

|

|

|

23 |

|

|

|

26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to Navistar International Corporation |

|

$ |

(172 |

) |

|

$ |

74 |

|

|

$ |

(325 |

) |

|

$ |

68 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings (loss) per share attributable to Navistar International Corporation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(2.50 |

) |

|

$ |

1.01 |

|

|

$ |

(4.69 |

) |

|

$ |

0.93 |

|

| Diluted |

|

|

(2.50 |

) |

|

|

0.93 |

|

|

|

(4.69 |

) |

|

|

0.87 |

|

| Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

68.7 |

|

|

|

73.0 |

|

|

|

69.3 |

|

|

|

72.8 |

|

| Diluted |

|

|

68.7 |

|

|

|

78.6 |

|

|

|

69.3 |

|

|

|

77.3 |

|

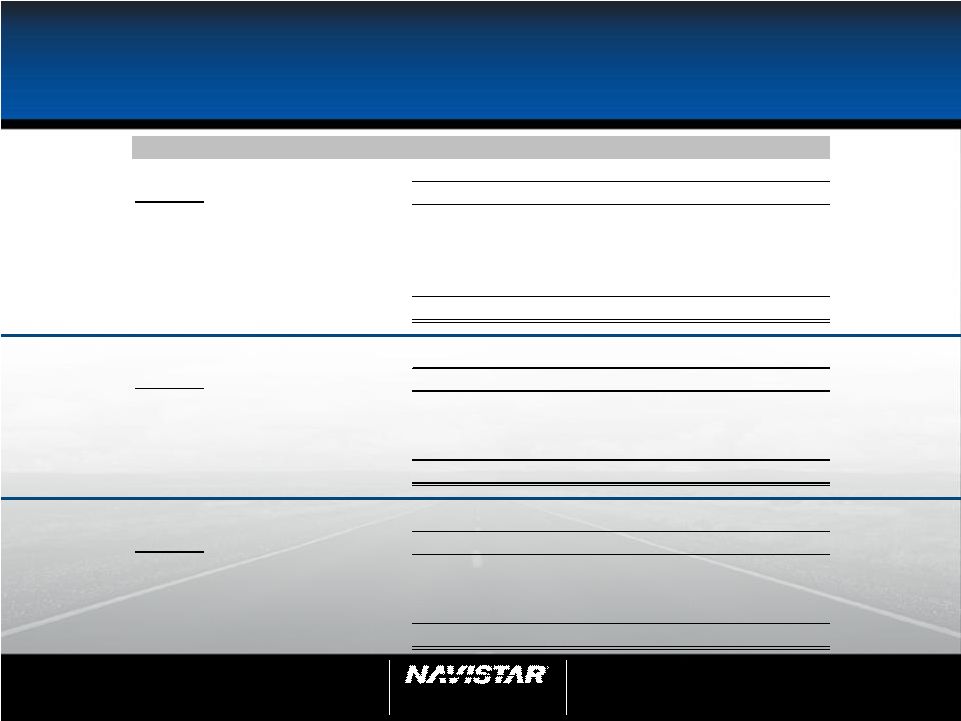

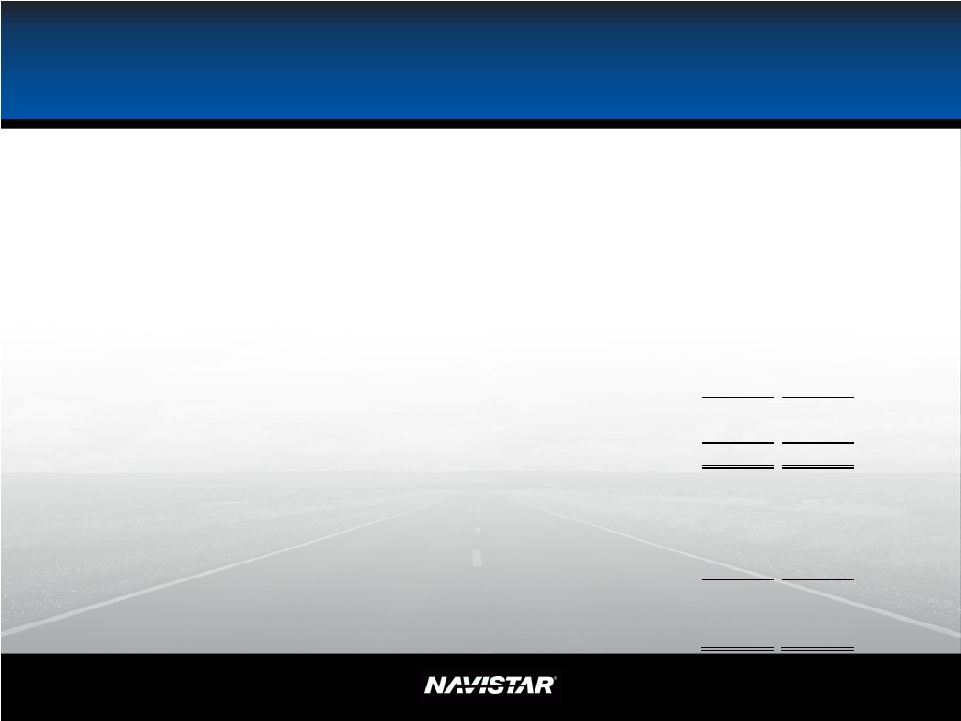

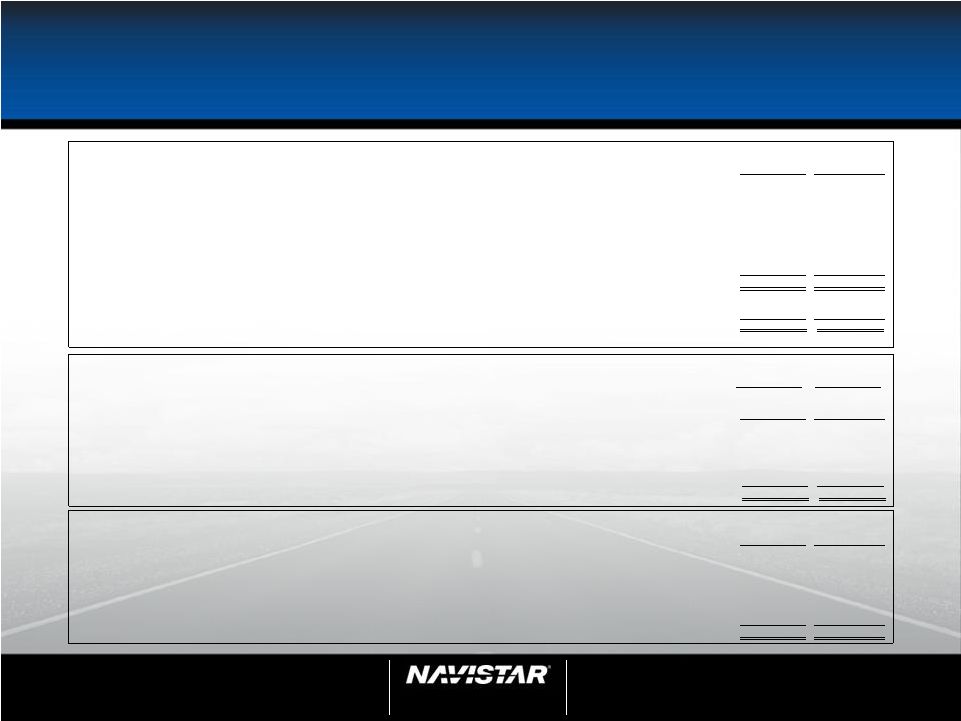

Navistar International Corporation and Subsidiaries

Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

| |

|

April 30, |

|

|

October 31, |

|

| |

|

2012 |

|

|

2011 |

|

| (in millions, except per share data) |

|

(Unaudited) |

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

400 |

|

|

$ |

539 |

|

| Restricted cash |

|

|

— |

|

|

|

100 |

|

| Marketable securities |

|

|

337 |

|

|

|

718 |

|

| Trade and other receivables, net |

|

|

845 |

|

|

|

1,219 |

|

| Finance receivables, net |

|

|

2,066 |

|

|

|

2,198 |

|

| Inventories |

|

|

1,948 |

|

|

|

1,714 |

|

| Deferred taxes, net |

|

|

479 |

|

|

|

474 |

|

| Other current assets |

|

|

303 |

|

|

|

273 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

6,378 |

|

|

|

7,235 |

|

| Restricted cash |

|

|

145 |

|

|

|

227 |

|

| Trade and other receivables, net |

|

|

114 |

|

|

|

122 |

|

| Finance receivables, net |

|

|

574 |

|

|

|

715 |

|

| Investments in non-consolidated affiliates |

|

|

58 |

|

|

|

60 |

|

| Property and equipment (net of accumulated depreciation and amortization of $2,159 and $2,056, at the respective

dates) |

|

|

1,690 |

|

|

|

1,570 |

|

| Goodwill |

|

|

295 |

|

|

|

319 |

|

| Intangible assets (net of accumulated amortization of $97 and $99, at the respective dates) |

|

|

178 |

|

|

|

234 |

|

| Deferred taxes, net |

|

|

1,759 |

|

|

|

1,583 |

|

| Other noncurrent assets |

|

|

193 |

|

|

|

226 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

11,384 |

|

|

$ |

12,291 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES and STOCKHOLDERS’ EQUITY (DEFICIT) |

|

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

| Notes payable and current maturities of long-term debt |

|

$ |

1,509 |

|

|

$ |

1,379 |

|

| Accounts payable |

|

|

1,927 |

|

|

|

2,122 |

|

| Other current liabilities |

|

|

1,284 |

|

|

|

1,297 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

4,720 |

|

|

|

4,798 |

|

| Long-term debt |

|

|

2,988 |

|

|

|

3,477 |

|

| Postretirement benefits liabilities |

|

|

3,095 |

|

|

|

3,210 |

|

| Deferred taxes, net |

|

|

59 |

|

|

|

59 |

|

| Other noncurrent liabilities |

|

|

929 |

|

|

|

719 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

11,791 |

|

|

|

12,263 |

|

| Redeemable equity securities |

|

|

5 |

|

|

|

5 |

|

| Stockholders’ equity (deficit) |

|

|

|

|

|

|

|

|

| Series D convertible junior preference stock |

|

|

3 |

|

|

|

3 |

|

| Common stock ($0.10 par value per share, 220.0 shares authorized, and 75.4 shares issued, at both dates) |

|

|

8 |

|

|

|

7 |

|

| Additional paid in capital |

|

|

2,272 |

|

|

|

2,253 |

|

| Accumulated deficit |

|

|

(480 |

) |

|

|

(155 |

) |

| Accumulated other comprehensive loss |

|

|

(1,982 |

) |

|

|

(1,944 |

) |

| Common stock held in treasury, at cost (6.8 and 4.9 shares, at the respective dates) |

|

|

(276 |

) |

|

|

(191 |

) |

|

|

|

|

|

|

|

|

|

| Total stockholders’ deficit attributable to Navistar International Corporation |

|

|

(455 |

) |

|

|

(27 |

) |

| Stockholders’ equity attributable to non-controlling interests |

|

|

43 |

|

|

|

50 |

|

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity (deficit) |

|

|

(412 |

) |

|

|

23 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity (deficit) |

|

$ |

11,384 |

|

|

$ |

12,291 |

|

|

|

|

|

|

|

|

|

|

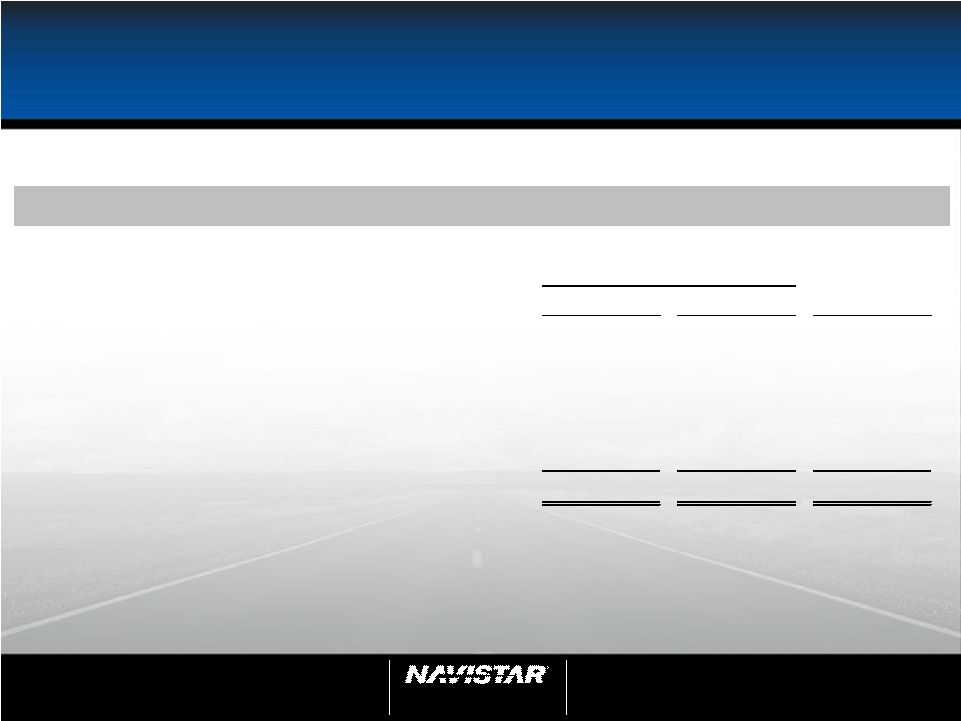

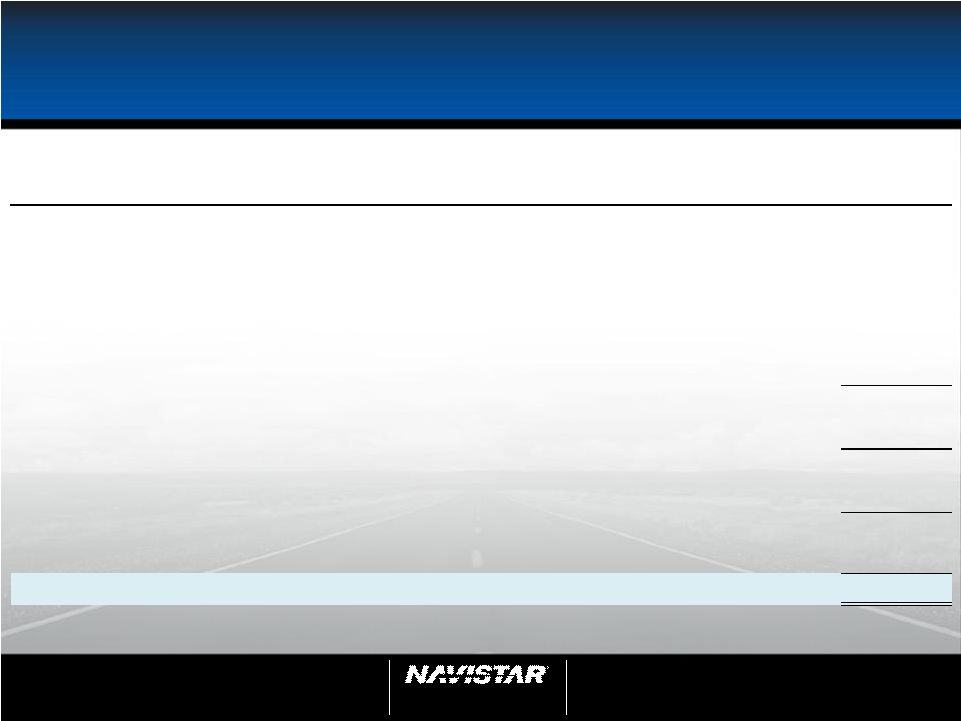

Navistar International Corporation and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(Unaudited)

|

|

|

xxxxx |

|

|

|

xxxxx |

|

| |

|

Six Months Ended |

|

| |

|

April 30, |

|

| (in millions) |

|

2012 |

|

|

2011 |

|

| Cash flows from operating activities |

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

(302 |

) |

|

$ |

94 |

|

| Adjustments to reconcile net income (loss) to cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

136 |

|

|

|

143 |

|

| Depreciation of equipment leased to others |

|

|

24 |

|

|

|

18 |

|

| Deferred taxes, including change in valuation allowance |

|

|

(203 |

) |

|

|

(5 |

) |

| Impairment of intangible assets |

|

|

38 |

|

|

|

— |

|

| Amortization of debt issuance costs and discount |

|

|

19 |

|

|

|

22 |

|

| Stock-based compensation |

|

|

14 |

|

|

|

31 |

|

| Equity in loss of non-consolidated affiliates, net of dividends |

|

|

15 |

|

|

|

35 |

|

| Write-off of debt issuance cost and discount |

|

|

8 |

|

|

|

— |

|

| Other non-cash operating activities |

|

|

2 |

|

|

|

5 |

|

| Changes in other assets and liabilities, exclusive of the effects of businesses acquired and disposed |

|

|

298 |

|

|

|

(117 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

|

49 |

|

|

|

226 |

|

|

|

|

|

|

|

|

|

|

| Cash flows from investing activities |

|

|

|

|

|

|

|

|

| Purchases of marketable securities |

|

|

(563 |

) |

|

|

(721 |

) |

| Sales or maturities of marketable securities |

|

|

944 |

|

|

|

569 |

|

| Net change in restricted cash and cash equivalents |

|

|

182 |

|

|

|

(8 |

) |

| Capital expenditures |

|

|

(176 |

) |

|

|

(185 |

) |

| Purchase of equipment leased to others |

|

|

(28 |

) |

|

|

(23 |

) |

| Proceeds from sales of property and equipment |

|

|

6 |

|

|

|

23 |

|

| Investments in non-consolidated affiliates |

|

|

(17 |

) |

|

|

(27 |

) |

| Proceeds from sales of affiliates |

|

|

1 |

|

|

|

6 |

|

| Business acquisitions, net of cash received |

|

|

(10 |

) |

|

|

(1 |

) |

| Acquisition of intangibles |

|

|

(14 |

) |

|

|

(7 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by (used in) investing activities |

|

|

325 |

|

|

|

(374 |

) |

|

|

|

|

|

|

|

|

|

| Cash flows from financing activities |

|

|

|

|

|

|

|

|

| Proceeds from issuance of securitized debt |

|

|

281 |

|

|

|

348 |

|

| Principal payments on securitized debt |

|

|

(666 |

) |

|

|

(334 |

) |

| Proceeds from issuance of non-securitized debt |

|

|

555 |

|

|

|

61 |

|

| Principal payments on non-securitized debt |

|

|

(537 |

) |

|

|

(64 |

) |

| Net increase (decrease) in notes and debt outstanding under revolving credit facilities |

|

|

2 |

|

|

|

(12 |

) |

| Principal payments under financing arrangements and capital lease obligations |

|

|

(20 |

) |

|

|

(48 |

) |

| Debt issuance costs |

|

|

(15 |

) |

|

|

(5 |

) |

| Purchase of treasury stock |

|

|

(75 |

) |

|

|

— |

|

| Proceeds from exercise of stock options |

|

|

2 |

|

|

|

28 |

|

| Dividends paid by subsidiaries to non-controlling interest |

|

|

(34 |

) |

|

|

(32 |

) |

| Other financing activities |

|

|

(3 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Net cash used in financing activities |

|

|

(510 |

) |

|

|

(58 |

) |

|

|

|

|

|

|

|

|

|

| Effect of exchange rate changes on cash and cash equivalents |

|

|

(3 |

) |

|

|

11 |

|

|

|

|

|

|

|

|

|

|

| Decrease in cash and cash equivalents |

|

|

(139 |

) |

|

|

(195 |

) |

| Cash and cash equivalents at beginning of the period |

|

|

539 |

|

|

|

585 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at end of the period |

|

$ |

400 |

|

|

$ |

390 |

|

|

|

|

|

|

|

|

|

|

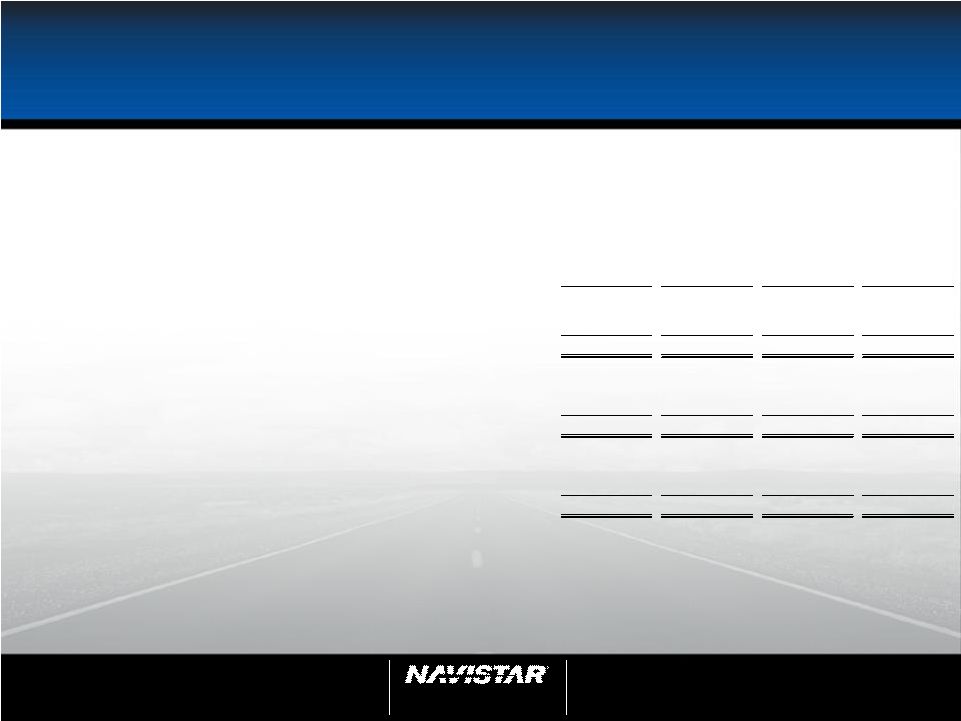

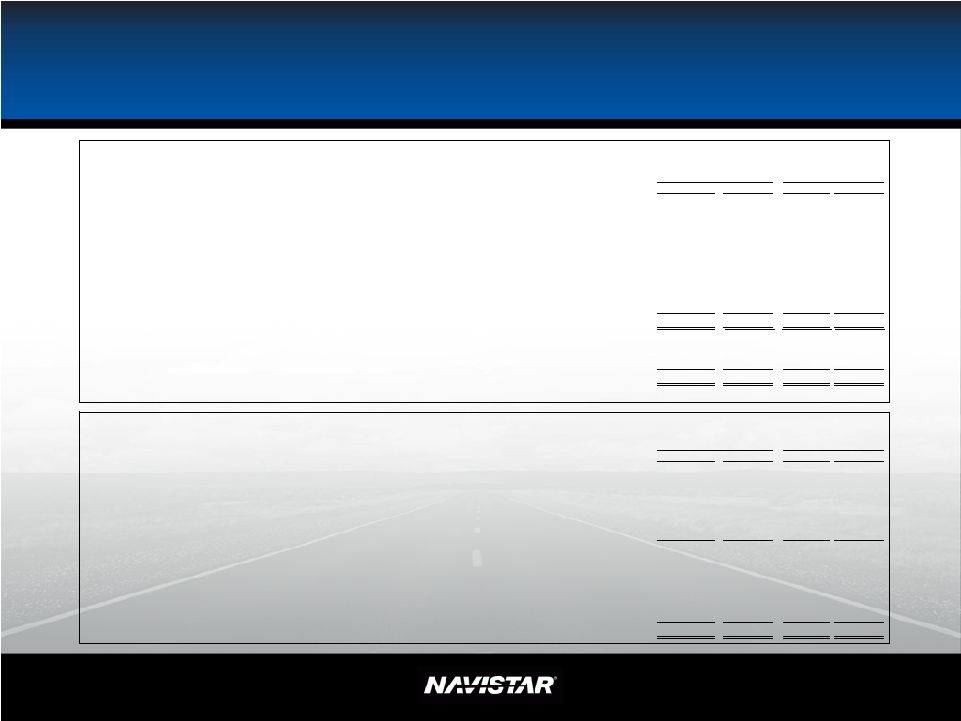

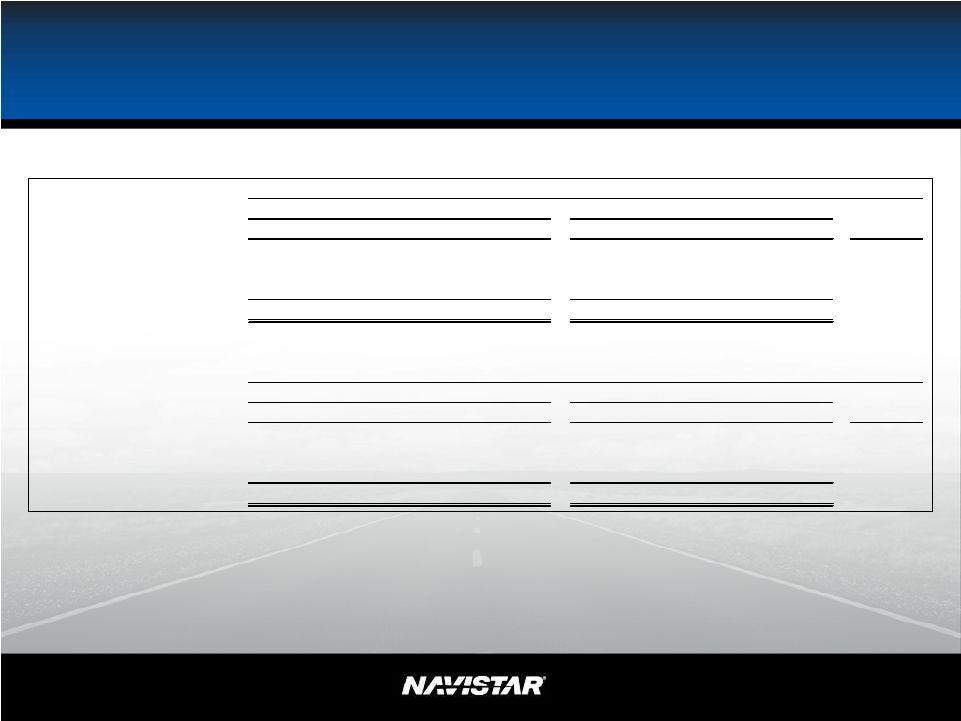

Navistar International Corporation and Subsidiaries

Segment Reporting

(Unaudited)

We define segment profit (loss) as net income (loss) attributable to Navistar

International Corporation excluding income tax benefit (expense). Our results from interim periods are not necessarily indicative of results for a full year. Selected financial information is as follows:

|

|

|

xxxxxxxxx |

|

|

|

xxxxxxxxx |

|

|

|

xxxxxxxxx |

|

|

|

xxxxxxxxx |

|

|

|

xxxxxxxxx |

|

|

|

xxxxxxxxx |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Financial |

|

|

and |

|

|

|

|

| (in millions) |

|

Truck

(A) |

|

|

Engine |

|

|

Parts

(A) |

|

|

Services(B) |

|

|

Eliminations |

|

|

Total |

|

| Three Months Ended April 30, 2012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| External sales and revenues, net |

|

$ |

2,353 |

|

|

$ |

440 |

|

|

$ |

462 |

|

|

$ |

43 |

|

|

$ |

— |

|

|

$ |

3,298 |

|

| Intersegment sales and revenues |

|

|

2 |

|

|

|

454 |

|

|

|

34 |

|

|

|

24 |

|

|

|

(514 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total sales and revenues, net |

|

$ |

2,355 |

|

|

$ |

894 |

|

|

$ |

496 |

|

|

$ |

67 |

|

|

$ |

(514 |

) |

|

$ |

3,298 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to NIC |

|

$ |

(89 |

) |

|

$ |

(108 |

) |

|

$ |

41 |

|

|

$ |

26 |

|

|

$ |

(42 |

) |

|

$ |

(172 |

) |

| Income tax benefit |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

133 |

|

|

|

133 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment profit (loss) |

|

$ |

(89 |

) |

|

$ |

(108 |

) |

|

$ |

41 |

|

|

$ |

26 |

|

|

$ |

(175 |

) |

|

$ |

(305 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

$ |

35 |

|

|

$ |

30 |

|

|

$ |

4 |

|

|

$ |

8 |

|

|

$ |

5 |

|

|

$ |

82 |

|

| Interest expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

22 |

|

|

|

40 |

|

|

|

62 |

|

| Equity in income (loss) of non-consolidated affiliates |

|

|

(6 |

) |

|

|

— |

|

|

|

2 |

|

|

|

— |

|

|

|

— |

|

|

|

(4 |

) |

| Capital expenditures(C) |

|

|

16 |

|

|

|

36 |

|

|

|

5 |

|

|

|

1 |

|

|

|

15 |

|

|

|

73 |

|

|

|

|

|

|

|

|

| Three Months Ended April 30, 2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| External sales and revenues, net |

|

$ |

2,262 |

|

|

$ |

524 |

|

|

$ |

512 |

|

|

$ |

57 |

|

|

$ |

— |

|

|

$ |

3,355 |

|

| Intersegment sales and revenues |

|

|

9 |

|

|

|

431 |

|

|

|

50 |

|

|

|

26 |

|

|

|

(516 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total sales and revenues, net |

|

$ |

2,271 |

|

|

$ |

955 |

|

|

$ |

562 |

|

|

$ |

83 |

|

|

$ |

(516 |

) |

|

$ |

3,355 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to NIC |

|

$ |

92 |

|

|

$ |

2 |

|

|

$ |

74 |

|

|

$ |

40 |

|

|

$ |

(134 |

) |

|

$ |

74 |

|

| Income tax expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(5 |

) |

|

|

(5 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment profit (loss) |

|

$ |

92 |

|

|

$ |

2 |

|

|

$ |

74 |

|

|

$ |

40 |

|

|

$ |

(129 |

) |

|

$ |

79 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

$ |

38 |

|

|

$ |

30 |

|

|

$ |

3 |

|

|

$ |

6 |

|

|

$ |

4 |

|

|

$ |

81 |

|

| Interest expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

26 |

|

|

|

36 |

|

|

|

62 |

|

| Equity in income (loss) of non-consolidated affiliates |

|

|

(17 |

) |

|

|

(2 |

) |

|

|

3 |

|

|

|

— |

|

|

|

— |

|

|

|

(16 |

) |

| Capital expenditures(C) |

|

|

22 |

|

|

|

52 |

|

|

|

3 |

|

|

|

— |

|

|

|

13 |

|

|

|

90 |

|

|

|

|

|

|

|

|

| Six Months Ended April 30, 2012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| External sales and revenues, net |

|

$ |

4,507 |

|

|

$ |

860 |

|

|

$ |

896 |

|

|

$ |

87 |

|

|

$ |

— |

|

|

$ |

6,350 |

|

| Intersegment sales and revenues |

|

|

13 |

|

|

|

893 |

|

|

|

69 |

|

|

|

48 |

|

|

|

(1,023 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total sales and revenues, net |

|

$ |

4,520 |

|

|

$ |

1,753 |

|

|

$ |

965 |

|

|

$ |

135 |

|

|

$ |

(1,023 |

) |

|

$ |

6,350 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to NIC |

|

$ |

(130 |

) |

|

$ |

(228 |

) |

|

$ |

91 |

|

|

$ |

53 |

|

|

$ |

(111 |

) |

|

$ |

(325 |

) |

| Income tax expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

214 |

|

|

|

214 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment profit (loss) |

|

$ |

(130 |

) |

|

$ |

(228 |

) |

|

$ |

91 |

|

|

$ |

53 |

|

|

$ |

(325 |

) |

|

$ |

(539 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

$ |

69 |

|

|

$ |

59 |

|

|

$ |

6 |

|

|

$ |

16 |

|

|

$ |

10 |

|

|

$ |

160 |

|

| Interest expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

47 |

|

|

|

76 |

|

|

|

123 |

|

| Equity in income (loss) of non-consolidated affiliates |

|

|

(15 |

) |

|

|

1 |

|

|

|

3 |

|

|

|

— |

|

|

|

— |

|

|

|

(11 |

) |

| Capital expenditures(C) |

|

|

32 |

|

|

|

76 |

|

|

|

12 |

|

|

|

2 |

|

|

|

54 |

|

|

|

176 |

|

|

|

|

xxxxxxxxx |

|

|

|

xxxxxxxxx |

|

|

|

xxxxxxxxx |

|

|

|

xxxxxxxxx |

|

|

|

xxxxxxxxx |

|

|

|

xxxxxxxxx |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Financial |

|

|

and |

|

|

|

|

| |

|

Truck

(A) |

|

|

Engine |

|

|

Parts

(A) |

|

|

Services(B) |

|

|

Eliminations |

|

|

Total |

|

| Six Months Ended April 30, 2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| External sales and revenues, net |

|

$ |

4,053 |

|

|

$ |

980 |

|

|

$ |

958 |

|

|

$ |

107 |

|

|

$ |

— |

|

|

$ |

6,098 |

|

| Intersegment sales and revenues |

|

|

18 |

|

|

|

758 |

|

|

|

99 |

|

|

|

49 |

|

|

|

(924 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total sales and revenues, net |

|

$ |

4,071 |

|

|

$ |

1,738 |

|

|

$ |

1,057 |

|

|

$ |

156 |

|

|

$ |

(924 |

) |

|

$ |

6,098 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to NIC |

|

$ |

124 |

|

|

$ |

(6 |

) |

|

$ |

130 |

|

|

$ |

72 |

|

|

$ |

(252 |

) |

|

$ |

68 |

|

| Income tax expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(5 |

) |

|

|

(5 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment profit (loss) |

|

$ |

124 |

|

|

$ |

(6 |

) |

|

$ |

130 |

|

|

$ |

72 |

|

|

$ |

(247 |

) |

|

$ |

73 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

$ |

75 |

|

|

$ |

59 |

|

|

$ |

5 |

|

|

$ |

13 |

|

|

$ |

9 |

|

|

$ |

161 |

|

| Interest expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

56 |

|

|

|

69 |

|

|

|

125 |

|

| Equity in income (loss) of non-consolidated affiliates |

|

|

(35 |

) |

|

|

(2 |

) |

|

|

4 |

|

|

|

— |

|

|

|

— |

|

|

|

(33 |

) |

| Capital expenditures(C) |

|

|

38 |

|

|

|

84 |

|

|

|

4 |

|

|

|

— |

|

|

|

59 |

|

|

|

185 |

|

|

|

|

|

|

|

|

| As of April 30, 2012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment assets |

|

$ |

2,685 |

|

|

$ |

1,823 |

|

|

$ |

698 |

|

|

$ |

3,043 |

|

|

$ |

3,135 |

|

|

$ |

11,384 |

|

| As of October 31, 2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment assets |

|

|

2,771 |

|

|

|

1,849 |

|

|

|

700 |

|

|

|

3,580 |

|

|

|

3,391 |

|

|

|

12,291 |

|

| (A) |

See Note 2, Restructurings and Impairments, for further discussion. |

| (B) |

Total sales and revenues in the Financial Services segment include interest revenues of $66 million and $133 million for the three and six months ended April 30,

2012, respectively, and $82 million and $153 million for the three and six months ended April 30, 2011, respectively. |

| (C) |

Exclusive of purchases of equipment leased to others. |

SEC Regulation G Non-GAAP Reconciliation

The financial measures presented below of adjusted income (loss) and adjusted diluted earnings(loss) per share attributable to Navistar International

Corporation, manufacturing segment profit (loss), and adjusted manufacturing segment profit (loss) are unaudited and not in accordance with, or an alternative for, financial measures presented in accordance with U.S. generally accepted accounting

principles (GAAP). The non-GAAP financial information presented herein should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP.

We believe manufacturing segment profit (loss), which includes the segment profits(losses) of our Truck, Engine, and Parts reporting segments,

provides meaningful information of our core manufacturing business and therefore we use it to supplement our GAAP reporting by identifying items that may not be related to the core manufacturing business. We have chosen to provide this supplemental

information to investors, analysts and other interested parties to enable them to perform additional analyses of operating results, to illustrate the results of operations giving effect to the non-GAAP adjustments shown in the below reconciliation,

and to provide an additional measure of performance.

In addition, we believe that adjusted income (loss) and adjusted diluted earnings

(loss) per share attributable to Navistar International Corporation and manufacturing segment profit (loss) excluding certain items, which are not considered to be part of our ongoing business, improves the comparability of year to year results and

is representative of our underlying performance. We have chosen to provide this supplemental information to investors, analysts and other interested parties to enable them to perform additional analyses of operating results, to illustrate the

results of operations giving effect to the non-GAAP adjustments shown in the reconciliations below, and to provide an additional measure of performance.

Adjusted net income (loss) and diluted earnings (loss) per share attributable to Navistar International Corporation reconciliation:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

April 30, |

|

|

April 30, |

|

| (in millions, except per share data) |

|

2012 |

|

|

2011 |

|

|

2012 |

|

|

2011 |

|

| Income (loss) attributable to Navistar International Corporation |

|

$ |

(172 |

) |

|

$ |

74 |

|

|

$ |

(325 |

) |

|

$ |

68 |

|

| Plus: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Engineering integration costs, net of tax(A) |

|

|

31 |

|

|

|

4 |

|

|

|

39 |

|

|

|

23 |

|

| Restructuring of North American manufacturing operations, net of tax(B) |

|

|

37 |

|

|

|

— |

|

|

|

37 |

|

|

|

— |

|

| Adjustments to pre-existing warranties, net of tax(C) |

|

|

138 |

|

|

|

24 |

|

|

|

219 |

|

|

|

32 |

|

| Charges for non-conformance penalties, net of tax(D) |

|

|

10 |

|

|

|

— |

|

|

|

10 |

|

|

|

— |

|

| Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net impact of income tax valuation allowance release(E) |

|

|

181 |

|

|

|

— |

|

|

|

181 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net income (loss) attributable to Navistar International Corporation |

|

$ |

(137 |

) |

|

$ |

102 |

|

|

$ |

(2.01 |

) |

|

$ |

123 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings (loss) per share attributable to Navistar International Corporation |

|

$ |

(2.50 |

) |

|

$ |

0.93 |

|

|

$ |

(4.69 |

) |

|

$ |

0.87 |

|

| Effect of adjustments on diluted earnings (loss) per share attributable to Navistar International Corporation |

|

|

0.51 |

|

|

|

0.37 |

|

|

|

1.79 |

|

|

|

0.72 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted diluted earnings (loss) per share attributable to Navistar International Corporation |

|

$ |

(1.99 |

) |

|

$ |

1.30 |

|

|

$ |

(2.90 |

) |

|

$ |

1.59 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted weighted shares outstanding |

|

|

68.7 |

|

|

|

78.6 |

|

|

|

69.3 |

|

|

|

77.3 |

|

Manufacturing segment profit (loss) and adjusted manufacturing segment profit reconciliation:

|

|

|

xxxxxxx |

|

|

|

xxxxxxx |

|

|

|

xxxxxxx |

|

|

|

xxxxxxx |

|

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

April 30, |

|

|

April 30, |

|

| (in millions) |

|

2012 |

|

|

2011 |

|

|

2012 |

|

|

2011 |

|

| Net income (loss) attributable to Navistar International Corporation |

|

$ |

(172 |

) |

|

$ |

74 |

|

|

$ |

(325 |

) |

|

$ |

68 |

|

| Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financial services segment profit |

|

|

26 |

|

|

|

40 |

|

|

|

53 |

|

|

|

72 |

|

| Corporate and eliminations |

|

|

(175 |

) |

|

|

(129 |

) |

|

|

(325 |

) |

|

|

(247 |

) |

| Income tax benefit (expense) |

|

|

133 |

|

|

|

(5 |

) |

|

|

214 |

|

|

|

(5 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Manufacturing segment profit (loss) |

|

$ |

(156 |

) |

|

$ |

168 |

|

|

$ |

(267 |

) |

|

$ |

248 |

|

| Plus: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Engineering integration costs(A) |

|

|

11 |

|

|

|

3 |

|

|

|

19 |

|

|

|

21 |

|

| Restructuring of North American manufacturing operations(B) |

|

|

38 |

|

|

|

— |

|

|

|

38 |

|

|

|

— |

|

| Adjustments to pre-existing warranties(C) |

|

|

104 |

|

|

|

27 |

|

|

|

227 |

|

|

|

36 |

|

| Charges for non-conformance penalties(D) |

|

|

10 |

|

|

|

— |

|

|

|

10 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted manufacturing segment profit |

|

$ |

7 |

|

|

$ |

198 |

|

|

$ |

27 |

|

|

$ |

305 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

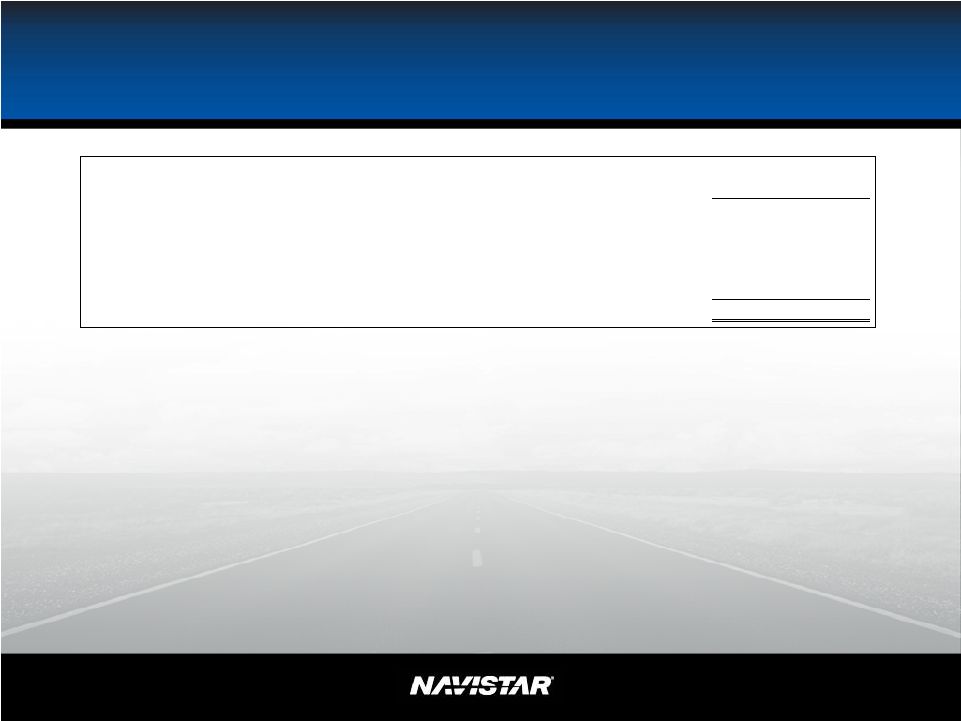

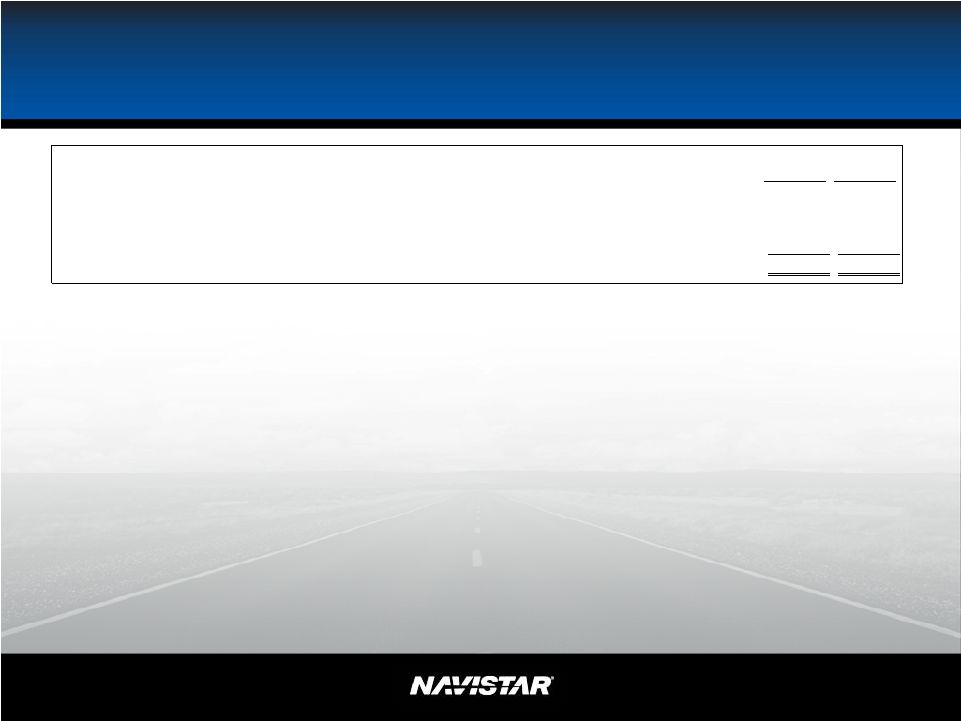

Revised 2012 Guidance

Adjusted net income and diluted earnings per share attributable to Navistar International Corporation reconciliation:

|

|

|

|

|

|

|

|

|

| ($ in millions, except per share data) |

|

Lower |

|

|

Upper |

|

| Net income attributable to Navistar International Corporation |

|

$ |

(200 |

) |

|

$ |

(60 |

) |

| Plus: |

|

|

|

|

|

|

|

|

| Engineering integration costs, net of tax(A) |

|

|

87 |

|

|

|

87 |

|

| Restructuring of North American manufacturing operations, net of tax(B) |

|

|

37 |

|

|

|

37 |

|

| Adjustments to pre-existing warranties, net of tax(C) |

|

|

219 |

|

|

|

219 |

|

| Charges for non-conformance penalties, net of tax(D) |

|

|

39 |

|

|

|

39 |

|

| Less: |

|

|

|

|

|

|

|

|

| Net impact of valuation allowance release(E) |

|

|

181 |

|

|

|

181 |

|

|

|

|

|

|

|

|

|

|

| Adjusted net income attributable to Navistar International Corporation |

|

$ |

— |

|

|

$ |

140 |

|

|

|

|

|

|

|

|

|

|

| Diluted earnings per share attributable to Navistar International Corporation |

|

$ |

(2.85 |

) |

|

$ |

(0.85 |

) |

| Effect of adjustments on diluted earnings per share attributable to Navistar International Corporation |

|

|

2.85 |

|

|

|

2.85 |

|

|

|

|

|

|

|

|

|

|

| Adjusted diluted earnings per share attributable to Navistar International Corporation |

|

$ |

— |

|

|

$ |

2.00 |

|

|

|

|

|

|

|

|

|

|

| Approximate diluted average weighted shares outstanding |

|

|

69.8 |

|

|

|

69.8 |

|

Revised 2012 Guidance

Manufacturing segment profit and adjusted manufacturing segment profit reconciliation:

|

|

|

|

|

|

|

|

|

| ($ in millions) |

|

Lower |

|

|

Upper |

|

| Net income attributable to Navistar International Corporation |

|

$ |

(200 |

) |

|

$ |

(60 |

) |

| Less: Financial services segment profit, Corporate and eliminations, and income taxes |

|

|

(430 |

) |

|

|

(440 |

) |

|

|

|

|

|

|

|

|

|

| Manufacturing segment profit |

|

|

230 |

|

|

|

380 |

|

| Plus: |

|

|

|

|

|

|

|

|

| Engineering integration costs(A) |

|

|

65 |

|

|

|

65 |

|

| Restructuring of North American manufacturing operations(B) |

|

|

38 |

|

|

|

38 |

|

| Adjustments to pre-existing warranties (C) |

|

|

227 |

|

|

|

227 |

|

| Charges for non-conformance penalties(D) |

|

|

40 |

|

|

|

40 |

|

|

|

|

|

|

|

|

|

|

| Adjusted manufacturing segment profit |

|

$ |

600 |

|

|

$ |

750 |

|

|

|

|

|

|

|

|

|

|

| (A) |

Engineering integration costs relate to the consolidation of our truck and engine engineering operations, as well as the relocation of our world headquarters. For the

three months ended April 30, 2012, the charges included restructuring charges of $20 million and other related costs of $9 million. The tax impact of the second quarter adjustments was income tax expense of $2 million. For the six months ended April

30, 2012, the charges included restructuring charges of $20 million and other related costs of $21 million. The tax impact of the first half adjustments was income tax benefit of $2 million. For the three and six months ended April 30, 2011, the

charges included restructuring charges of $1 million and $19 million, respectively, and other related costs of $5 million and $7 million, respectively. For the three and six months ended April 30, 2011, the tax impact of the adjustments was income

tax benefits of $2 million and $3 million, respectively. Our manufacturing operations, primarily our Truck segment, recognized charges of $11 million and $19 million relating to these actions in the three and six months ended April 30, 2012,

respectively, compared to $3 million and $21 million in the three and six months ended April 30, 2011, respectively. For more information, see Note 2, Restructurings and Impairments, to the accompanying consolidated financial statements.

|

| (B) |

Restructuring of North American manufacturing operations are charges primarily related to our ongoing restructuring plans related to our plans to close our Chatham,

Ontario heavy truck plant and WCC chassis plant in Union City, Indiana, and to significantly scale back operations at our Monaco recreational vehicle headquarters and motor coach manufacturing plant in Coburg, Oregon. In the three and six months

ended April 30, 2012, the charges included impairments of certain intangible assets of $38 million. The tax impact of the adjustments was an income tax benefit of $1 million. The Truck and Parts segments recognized charges of $28 million and $10

million, respectively. For more information, see Note 2, Restructurings and Impairments, to the accompanying consolidated financial statements. |

| (C) |

During the three and six months ended April 30, 2012, the Company incurred charges of $104 million and $227 million, respectively, for adjustments to pre-existing

warranties. For the three and six months ended April 30, 2012, the tax impact of the adjustments was income tax expense of $34 million and income tax benefit of $8 million, respectively. During the three and six months ended April 30, 2011, the

Company incurred charges of $27 million and $36 million, respectively. For the three and six months ended April 30, 2011, the tax impact of the adjustments was income tax benefits of $3 million and $4 million, respectively. For more information, see

Note 1, Summary of Significant Accounting Policies, to the accompanying consolidated financial statements. |

| (D) |

In the three months ended April 30, 2012, the Company recorded charges totaling $10 million for NCPs for certain 13L engine sales that did not comply with emission

standards, recognized in the Engine segment. The adjustment did not have a material impact on income taxes. For more information, see Note 12, Commitments and Contingencies, to the accompanying consolidated financial statements.

|

| (E) |

In the three months ended April 30, 2012, we recognized an income tax benefit of $181 million from the release of a significant portion of our income tax valuation

allowance on our Canadian deferred tax assets. For more information, see Note 9, Income Taxes, to the accompanying consolidated financial statements. |

The above charges, A through D, have been adjusted to reflect the impact of income taxes which are calculated based on the respective periods estimated annual effective tax rate. The income tax impact of

the second quarter adjustments reflects the impact of a change in the quarter to the Company’s estimated annual effective tax rate. The change is the result of updates to the forecasted earnings and the jurisdictional mix. The tax impact of the

adjustments may be adjusted for future changes in the estimated annual effective tax rate.