Press release

Exhibit 99.1

|

|

|

| Media Contact: |

|

Karen Denning, 630-753-3535 |

| Investor Contact: |

|

Heather Kos, 630-753-2406 |

| Web site: |

|

www.Navistar.com/newsroom |

NAVISTAR REPORTS 3Q PROFIT; ANNOUNCES STOCK REPURCHASE

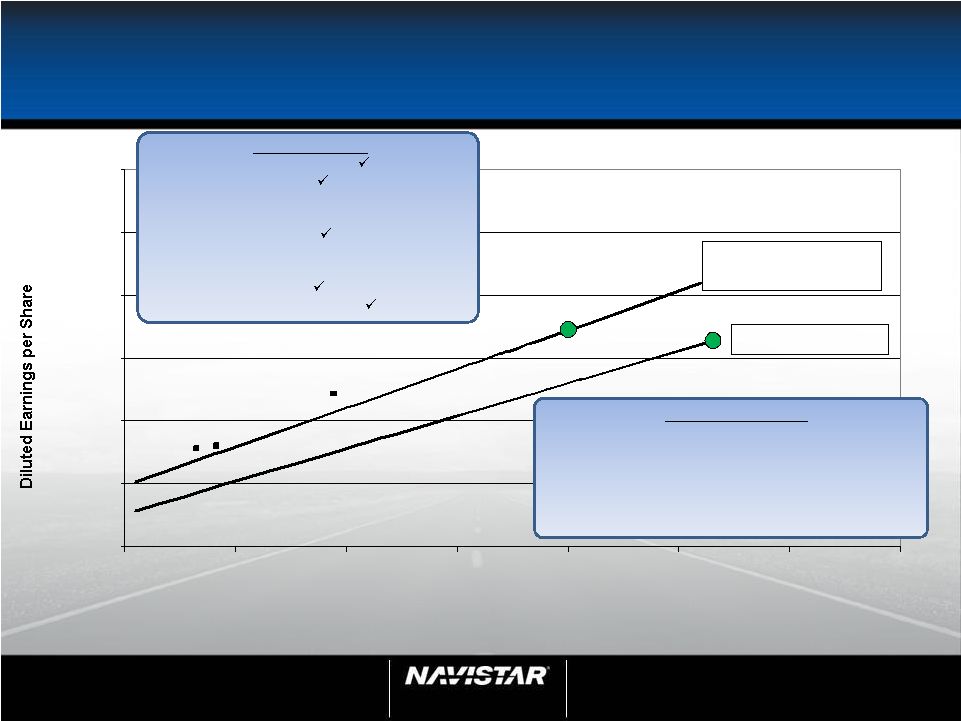

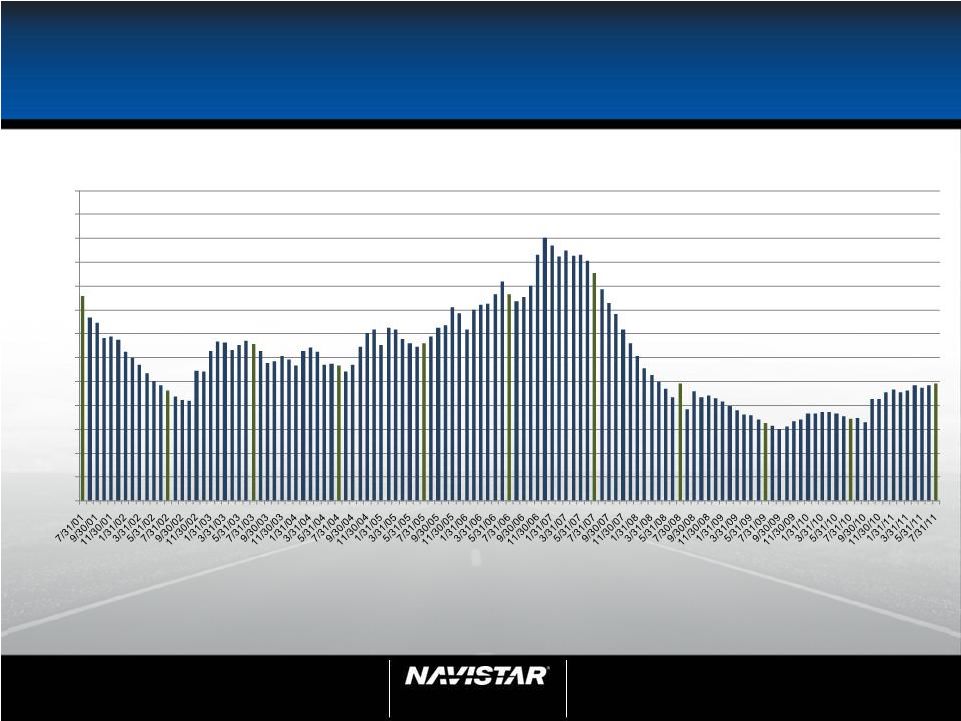

WARRENVILLE, Ill. (September 7, 2011) – Navistar International Corporation (NYSE: NAV) today reported net income for the third quarter, ended

July 31, 2011, of $1.4 billion, equal to $18.24 diluted earnings per share. These results include an income tax valuation allowance release and costs associated with the restructuring of North American manufacturing operations and engineering

integration. Excluding these items, adjusted net income attributable to Navistar International Corporation for the 2011 third quarter was $61 million, equal to $0.79 diluted earnings per share.

“The industry continued its recovery in the third quarter, and our results reflect this strengthening as well as our continued

investments for future growth. We introduced new products for our growing global presence, invested in our engineering integration and heavy engine strategies, and took additional actions to reduce costs and further increase our manufacturing

flexibility,” said Daniel C. Ustian, Navistar chairman, president and chief executive officer. “As a result, we are well positioned to deliver a strong fourth quarter, achieve our adjusted full-year earnings of $5 to $6 per share, and

enter 2012 with positive momentum.”

Included in the third quarter results were charges of $137 million for the

company’s plans to close its Chatham, Ontario operations; restructuring of its custom products business unit; and costs associated with engineering integration. Results also include $1.48 billion in net tax benefit from an income tax valuation

allowance release.

“Our proven ability to deliver consistent earnings, even in the toughest of times, coupled with our

future growth prospects gives us the confidence that we can capture the benefits of these deferred tax assets. As a result, Navistar is now in its best equity position in the last ten years,” said Ustian. “Given our strong cash position,

we are launching a significant buyback of our stock, which we believe is currently undervalued. We are also evaluating additional return on capital options and look forward to announcing them early in 2012.”

The company plans to undertake share repurchases of up to $175 million — approximately 5 percent — of Navistar’s common

stock in the upcoming months using a combination of approaches to execute the repurchase including open market repurchases and an accelerated repurchase program. The company has sufficient liquidity for this transaction and plans to use excess cash

reserves for the repurchase.

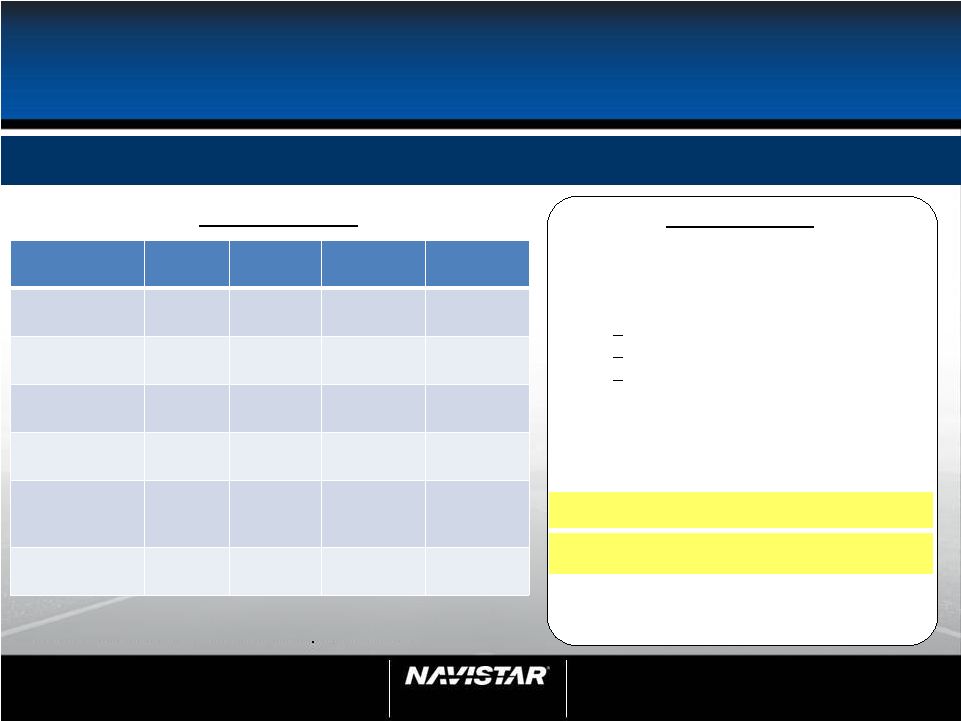

Navistar reports its adjusted net income attributable to Navistar International Corporation

guidance for fiscal year ending Oct. 31, 2011, to be between $388 million and $465 million, equal to $5.00 to $6.00 diluted earnings per share. Additionally, the company confirmed its full year forecast for manufacturing cash of $1.2 to $1.4

billion.

The company earned $117 million, equal to $1.56 diluted earnings per share in the year-ago

third quarter. Sales and revenues for the 2011 third quarter were $3.5 billion, compared with $3.2 billion in the year-ago third quarter.

|

|

|

|

|

|

|

|

|

| Summary Financial Results: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Third Quarter |

|

|

Nine Months |

|

| |

|

2011 |

|

|

2010 |

|

|

2011 |

|

|

2010 |

|

| (Dollars in Millions, except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales and revenues |

|

$ |

3,537 |

|

|

$ |

3,221 |

|

|

$ |

9,635 |

|

|

$ |

8,773 |

|

| Segment Results: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Truck |

|

$ |

(75 |

) |

|

$ |

227 |

|

|

$ |

49 |

|

|

$ |

338 |

|

| Engine |

|

|

32 |

|

|

|

(1 |

) |

|

|

26 |

|

|

|

68 |

|

| Parts |

|

|

70 |

|

|

|

52 |

|

|

|

200 |

|

|

|

189 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

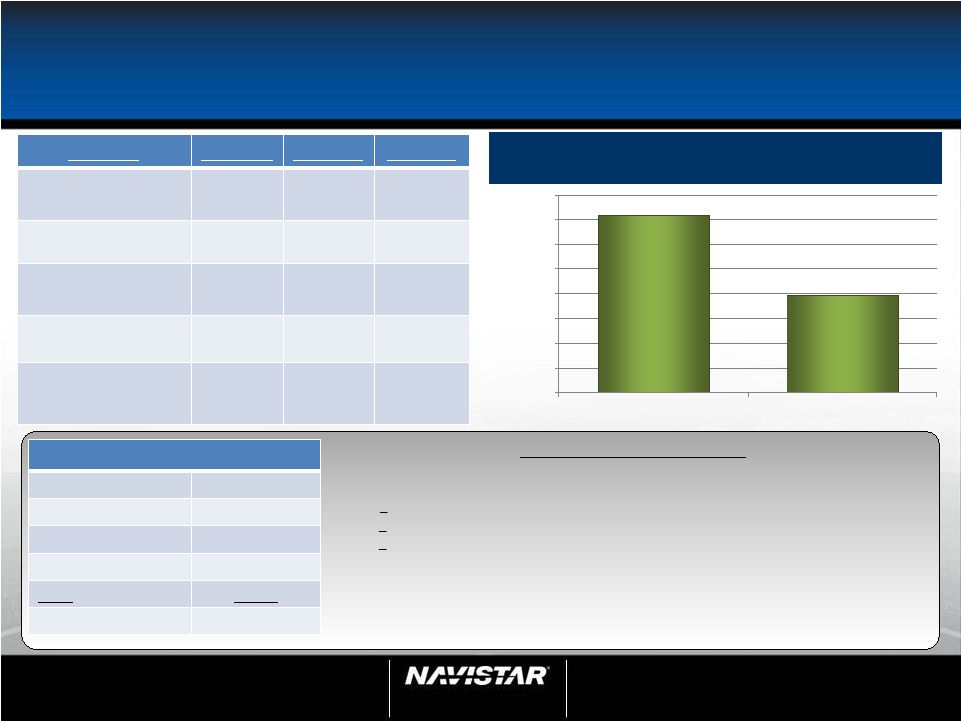

| Manufacturing segment profit(A) |

|

$ |

27 |

|

|

$ |

278 |

|

|

$ |

275 |

|

|

$ |

595 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before taxes |

|

$ |

(54 |

) |

|

$ |

148 |

|

|

$ |

45 |

|

|

$ |

234 |

|

| Net income attributable to Navistar International Corporation |

|

|

1,400 |

|

|

|

117 |

|

|

|

1,468 |

|

|

|

179 |

|

| Diluted earnings per share attributable to Navistar International Corporation |

|

|

18.24 |

|

|

|

1.56 |

|

|

|

19.04 |

|

|

|

2.44 |

|

| Adjusted income attributable to Navistar International Corporation(A) |

|

|

61 |

|

|

|

107 |

|

|

|

155 |

|

|

|

152 |

|

| Adjusted diluted earnings per share attributable to Navistar International Corporation(A) |

|

|

0.79 |

|

|

|

1.44 |

|

|

|

2.01 |

|

|

|

2.08 |

|

| (A) |

Non-GAAP measure, see SEC Regulation G Non-GAAP Reconciliation for additional information. |

Sales and revenues for the 2011 nine months were $9.6 billion, compared with $8.8 billion in the year-ago nine months. For the nine

months ended July 31, 2011, net income attributable to Navistar International Corporation was $1.5 billion, equal to $19.04 diluted earnings per share, including the $1.48 billion impact of the release of a portion of the income tax valuation

allowance, restructuring of North American manufacturing operations charges of $122 million and engineering integration costs of $41 million. Excluding the impacts of these items, adjusted net income attributable to Navistar International

Corporation for the 2011 nine months was $155 million, equal to $2.01 diluted earnings per share.

For the nine months ended

July 31, 2010, adjusted earnings were $152 million, equal to $2.08 diluted earnings per share, excluding the impact of benefits from the Ford restructuring and related activities. Including the impact of benefits from the Ford restructuring and

related activities, nine months 2010 reported earnings were $179 million, equal to $2.44 diluted earnings per share.

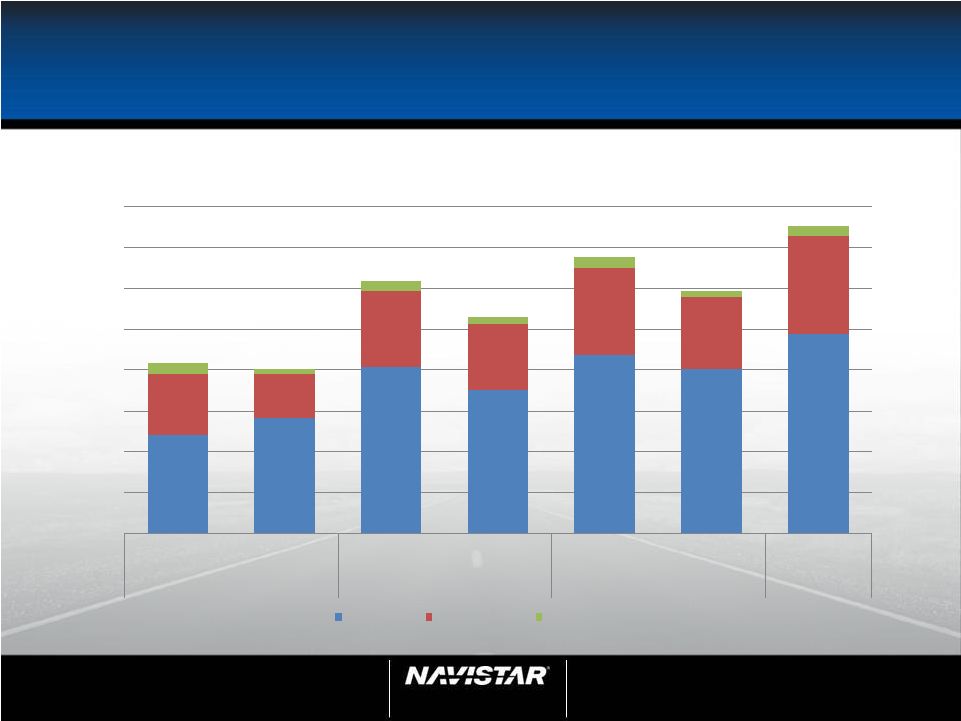

Segment Results

Truck — For the third quarter ended July 31, 2011, the truck segment recorded a loss of $75

million, compared with a year-ago third-quarter profit of $227 million. The $302 million decrease in segment profitability year-over-year included $119 million of charges for the restructuring of our North American manufacturing operations and $11

million of engineering integration charges.

The remaining year-over-year change of $172 million reflects the net impact of an increase in

commercial profit from increased volume and improved pricing across all traditional products, mainly through the use of 2010 emissions-compliant engines, offset by decreased military revenues due to timing of contracted deliveries and higher

commodity and fuel costs.

Traditional and Worldwide chargeouts were up on a stronger industry while sales improved in South America. Navistar

anticipates traditional industry volumes for the full year 2011 to be in the range of 240,000 to 260,000 units.

Engine — For the

third quarter ended July 31, 2011, the engine segment posted a profit of $32 million realizing substantial quarterly improvement to profitability compared to a prior year third quarter loss of $1 million. The increase in third-quarter profit

was driven primarily by strong intercompany sales and margins of big bore engines and continued strong performance in South America. Improved profitability from adjacent business segments with increased shipments to OEMs as well as improved

performance from Pure Power Technologies contributed to positive third-quarter results. Engine segment profit was partially offset by higher adjustments to pre-existing warranties.

Parts — The parts segment continues to deliver solid results reflective of increased commercial sales and profits. The segment realized a profit of $70 million, compared with a year-ago

third-quarter profit of $52 million.

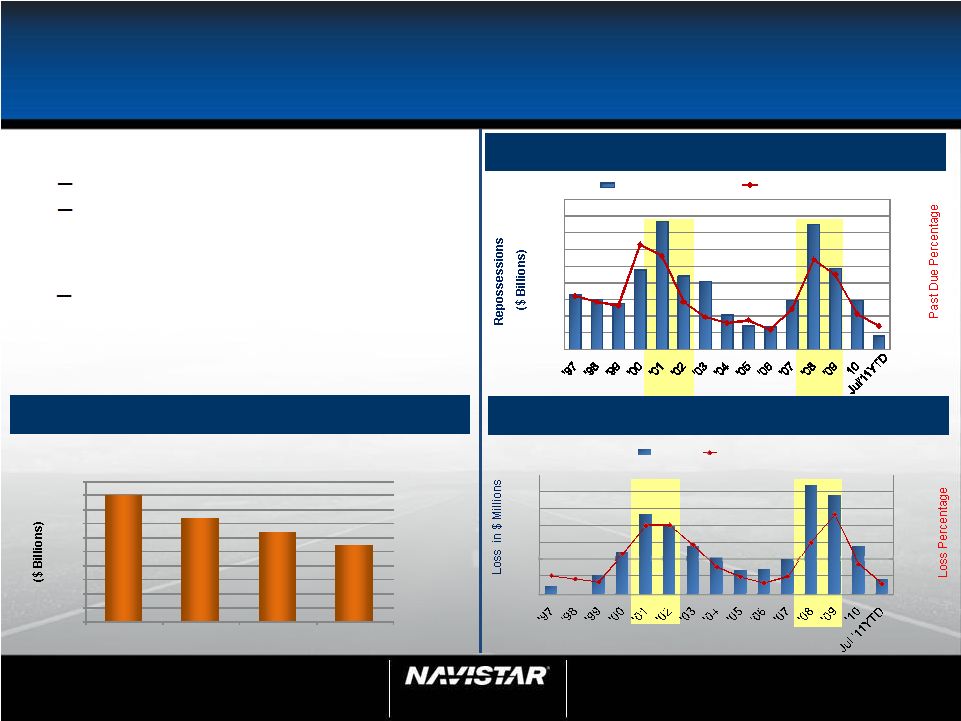

Financial Services — The financial services segment earned $30 million in the third quarter

of 2011 compared to $33 million in the third quarter of 2010. The decrease in year-over-year profits results from lower retail portfolio balances as originations are now funded under the GE Operating Agreement. This is partially offset by improved

wholesale note revenues, lower administrative costs, and a lower credit loss provision as portfolio quality has improved. The GE Operating Agreement will continue to reduce NFC origination and portfolio balances in the future. Liquidity currently

available to NFC is $622 million.

About Navistar

Navistar International Corporation (NYSE: NAV) is a holding company whose subsidiaries and affiliates produce International® brand commercial and military trucks,

MaxxForce® brand diesel engines, IC Bus™ brand school and commercial buses, Monaco® RV brands of recreational vehicles, and Workhorse® brand chassis for motor homes and step vans. It also is a private-label designer and manufacturer of diesel engines for the pickup

truck, van and SUV markets. The company also provides truck and diesel engine service parts. Another affiliate offers financing services. Additional information is available at

www.Navistar.com/newsroom.

Forward-Looking Statement

Information provided and statements contained in this report that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as

amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Such forward-looking statements only speak as of the date of this report and the company assumes no obligation to

update the information included in this report. Such forward-looking statements include information concerning our possible or assumed future results of operations, including descriptions of our business strategy. These statements often include

words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” or similar expressions. These statements are not guarantees of performance or results and they involve risks,

uncertainties, and assumptions. For a further description of these factors, see Item 1A, Risk Factors of our Form 10-K for the fiscal year ended October 31, 2010, which was filed on December 21, 2010 , and Part II, Item 1A, Risk

Factors, included within our Form 10-Q for the period ended July 31, 2011, which was filed on September 7, 2011. Although we believe that these forward-looking statements are based on reasonable assumptions, there are many factors that

could affect our actual financial results or results of operations and could cause actual results to differ materially from those in the forward-looking statements. All future written and oral forward-looking statements by us or persons acting on

our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to above. Except for our ongoing obligations to disclose material information as required by the federal securities laws, we do not have any

obligations or intention to release publicly any revisions to any forward-looking statements to reflect events or circumstances in the future or to reflect the occurrence of unanticipated events.

Navistar International Corporation and Subsidiaries

Consolidated Statements of Operations

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

July 31, |

|

|

Nine Months Ended

July 31, |

|

| |

|

2011 |

|

|

2010 |

|

|

2011 |

|

|

2010 |

|

| (in millions, except per share data) |

|

|

|

|

(Revised)(A) |

|

|

|

|

|

(Revised)(A) |

|

| Sales and revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales of manufactured products, net |

|

$ |

3,490 |

|

|

$ |

3,162 |

|

|

$ |

9,481 |

|

|

$ |

8,610 |

|

| Finance revenues |

|

|

47 |

|

|

|

59 |

|

|

|

154 |

|

|

|

163 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales and revenues, net |

|

|

3,537 |

|

|

|

3,221 |

|

|

|

9,635 |

|

|

|

8,773 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs and expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs of products sold |

|

|

2,930 |

|

|

|

2,525 |

|

|

|

7,830 |

|

|

|

6,976 |

|

| Restructuring charges (benefit) |

|

|

56 |

|

|

|

(9 |

) |

|

|

80 |

|

|

|

(23 |

) |

| Impairment of property and equipment and intangible assets |

|

|

64 |

|

|

|

— |

|

|

|

64 |

|

|

|

— |

|

| Selling, general and administrative expenses |

|

|

334 |

|

|

|

380 |

|

|

|

1,006 |

|

|

|

1,075 |

|

| Engineering and product development costs |

|

|

141 |

|

|

|

113 |

|

|

|

407 |

|

|

|

338 |

|

| Interest expense |

|

|

62 |

|

|

|

58 |

|

|

|

187 |

|

|

|

189 |

|

| Other income, net |

|

|

(18 |

) |

|

|

(7 |

) |

|

|

(39 |

) |

|

|

(48 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total costs and expenses |

|

|

3,569 |

|

|

|

3,060 |

|

|

|

9,535 |

|

|

|

8,507 |

|

| Equity in loss of non-consolidated affiliates |

|

|

(22 |

) |

|

|

(13 |

) |

|

|

(55 |

) |

|

|

(32 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) before income tax benefit (expense) |

|

|

(54 |

) |

|

|

148 |

|

|

|

45 |

|

|

|

234 |

|

| Income tax benefit (expense) |

|

|

1,463 |

|

|

|

(19 |

) |

|

|

1,458 |

|

|

|

(17 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

1,409 |

|

|

|

129 |

|

|

|

1,503 |

|

|

|

217 |

|

| Less: Net income attributable to non-controlling interests |

|

|

9 |

|

|

|

12 |

|

|

|

35 |

|

|

|

38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to Navistar International Corporation |

|

$ |

1,400 |

|

|

$ |

117 |

|

|

$ |

1,468 |

|

|

$ |

179 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share attributable to Navistar International Corporation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

19.10 |

|

|

$ |

1.61 |

|

|

$ |

20.13 |

|

|

$ |

2.49 |

|

| Diluted |

|

|

18.24 |

|

|

|

1.56 |

|

|

|

19.04 |

|

|

|

2.44 |

|

| Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

73.3 |

|

|

|

72.0 |

|

|

|

73.0 |

|

|

|

71.6 |

|

| Diluted |

|

|

76.8 |

|

|

|

74.3 |

|

|

|

77.1 |

|

|

|

73.1 |

|

| (A) |

Starting with the first quarter of 2011, the company changed its method of accruing for certain incentive compensation specifically relating to cash bonuses for interim

reporting purposes from a ratable method to a performance-based method. The company believes that the performance-based method is preferable because it links the accrual of incentive compensation with the achievement of performance. We have revised

our previously reported Consolidated Statement of Operations for the three and nine months ended July 31, 2010 and our Consolidated Statement of Stockholders’ Equity, and Condensed Consolidated Statement of Cash Flows for the nine months

ended July 31, 2010 on a retrospective basis to reflect this change in principle based on information that would have been available as of our previous filing. The change will have no impact on our annual financial results. See Note 1,

Summary of significant accounting policies of our Form 10Q for additional information. |

Navistar International Corporation and Subsidiaries

Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

| |

|

July 31,

2011 |

|

|

October 31,

2010 |

|

| (in millions, except per share data) |

|

(Unaudited) |

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

444 |

|

|

$ |

585 |

|

| Marketable securities |

|

|

620 |

|

|

|

586 |

|

| Trade and other receivables, net |

|

|

1,004 |

|

|

|

987 |

|

| Finance receivables, net |

|

|

1,996 |

|

|

|

1,770 |

|

| Inventories |

|

|

1,731 |

|

|

|

1,568 |

|

| Deferred taxes, net |

|

|

523 |

|

|

|

83 |

|

| Other current assets |

|

|

284 |

|

|

|

256 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

6,602 |

|

|

|

5,835 |

|

| Restricted cash and cash equivalents |

|

|

159 |

|

|

|

180 |

|

| Trade and other receivables, net |

|

|

132 |

|

|

|

44 |

|

| Finance receivables, net |

|

|

799 |

|

|

|

1,145 |

|

| Investments in non-consolidated affiliates |

|

|

111 |

|

|

|

103 |

|

| Property and equipment (net of accumulated depreciation and amortization of $2,039 and $1,928, at the respective

dates) |

|

|

1,492 |

|

|

|

1,442 |

|

| Goodwill |

|

|

334 |

|

|

|

324 |

|

| Intangible assets (net of accumulated amortization of $94 and $124, at the respective dates) |

|

|

225 |

|

|

|

262 |

|

| Deferred taxes, net |

|

|

1,049 |

|

|

|

63 |

|

| Other noncurrent assets |

|

|

275 |

|

|

|

332 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

11,178 |

|

|

$ |

9,730 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) |

|

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

| Notes payable and current maturities of long-term debt |

|

$ |

754 |

|

|

$ |

632 |

|

| Accounts payable |

|

|

1,921 |

|

|

|

1,827 |

|

| Other current liabilities |

|

|

1,119 |

|

|

|

1,130 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

3,794 |

|

|

|

3,589 |

|

| Long-term debt |

|

|

3,801 |

|

|

|

4,238 |

|

| Postretirement benefits liabilities |

|

|

2,036 |

|

|

|

2,097 |

|

| Deferred taxes, net |

|

|

72 |

|

|

|

142 |

|

| Other noncurrent liabilities |

|

|

718 |

|

|

|

588 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

10,421 |

|

|

|

10,654 |

|

| Redeemable equity securities |

|

|

5 |

|

|

|

8 |

|

| Stockholders’ equity (deficit) |

|

|

|

|

|

|

|

|

| Series D convertible junior preference stock |

|

|

3 |

|

|

|

4 |

|

| Common stock ($0.10 par value per share, 220.0 and 110.0 shares authorized, at the respective dates, 75.4 shares issued at

both dates) |

|

|

7 |

|

|

|

7 |

|

| Additional paid in capital |

|

|

2,289 |

|

|

|

2,206 |

|

| Accumulated deficit |

|

|

(410 |

) |

|

|

(1,878 |

) |

| Accumulated other comprehensive loss |

|

|

(1,066 |

) |

|

|

(1,196 |

) |

| Common stock held in treasury, at cost (2.5 and 3.6 shares, at the respective dates) |

|

|

(112 |

) |

|

|

(124 |

) |

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity (deficit) attributable to Navistar International Corporation |

|

|

711 |

|

|

|

(981 |

) |

| Stockholders’ equity attributable to non-controlling interests |

|

|

41 |

|

|

|

49 |

|

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity (deficit) |

|

|

752 |

|

|

|

(932 |

) |

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity (deficit) |

|

$ |

11,178 |

|

|

$ |

9,730 |

|

|

|

|

|

|

|

|

|

|

Navistar International Corporation and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(Unaudited)

|

|

|

|

|

|

|

|

|

| |

|

Nine Months Ended

July 31, |

|

| |

|

2011 |

|

|

2010 |

|

| (in millions) |

|

|

|

|

(Revised)(A) |

|

| Cash flows from operating activities |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

1,503 |

|

|

$ |

217 |

|

| Adjustments to reconcile net income to cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

217 |

|

|

|

198 |

|

| Depreciation of equipment leased to others |

|

|

28 |

|

|

|

38 |

|

| Deferred taxes |

|

|

(1,472 |

) |

|

|

9 |

|

| Impairment of property and equipment, goodwill, and intangible assets |

|

|

73 |

|

|

|

— |

|

| Amortization of debt issuance costs and discount |

|

|

33 |

|

|

|

29 |

|

| Stock-based compensation |

|

|

33 |

|

|

|

20 |

|

| Provision for doubtful accounts, net of recoveries |

|

|

(5 |

) |

|

|

33 |

|

| Equity in loss of non-consolidated affiliates, net of dividends |

|

|

57 |

|

|

|

35 |

|

| Other non-cash operating activities |

|

|

(9 |

) |

|

|

51 |

|

| Changes in other assets and liabilities, exclusive of the effects of businesses acquired and disposed |

|

|

81 |

|

|

|

34 |

|

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

|

539 |

|

|

|

664 |

|

|

|

|

|

|

|

|

|

|

| Cash flows from investing activities |

|

|

|

|

|

|

|

|

| Purchases of marketable securities |

|

|

(1,109 |

) |

|

|

(944 |

) |

| Sales or maturities of marketable securities |

|

|

1,075 |

|

|

|

643 |

|

| Net change in restricted cash and cash equivalents |

|

|

21 |

|

|

|

341 |

|

| Capital expenditures |

|

|

(291 |

) |

|

|

(162 |

) |

| Purchase of equipment leased to others |

|

|

(35 |

) |

|

|

(27 |

) |

| Proceeds from sales of property and equipment |

|

|

27 |

|

|

|

11 |

|

| Investments in non-consolidated affiliates |

|

|

(48 |

) |

|

|

(83 |

) |

| Proceeds from sales of affiliates |

|

|

6 |

|

|

|

4 |

|

| Acquisition of intangibles |

|

|

(15 |

) |

|

|

(12 |

) |

| Business acquisitions, net of cash received |

|

|

(1 |

) |

|

|

(2 |

) |

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

|

|

(370 |

) |

|

|

(231 |

) |

|

|

|

|

|

|

|

|

|

| Cash flows from financing activities |

|

|

|

|

|

|

|

|

| Proceeds from issuance of securitized debt |

|

|

348 |

|

|

|

1,170 |

|

| Principal payments on securitized debt |

|

|

(560 |

) |

|

|

(1,178 |

) |

| Proceeds from issuance of non-securitized debt |

|

|

158 |

|

|

|

609 |

|

| Principal payments on non-securitized debt |

|

|

(73 |

) |

|

|

(802 |

) |

| Net decrease in notes and debt outstanding under revolving credit facilities |

|

|

(85 |

) |

|

|

(832 |

) |

| Principal payments under financing arrangements and capital lease obligations |

|

|

(81 |

) |

|

|

(56 |

) |

| Debt issuance costs |

|

|

(6 |

) |

|

|

(26 |

) |

| Purchase of treasury stock |

|

|

(11 |

) |

|

|

— |

|

| Proceeds from exercise of stock options |

|

|

36 |

|

|

|

33 |

|

| Dividends paid by subsidiaries to non-controlling interest |

|

|

(43 |

) |

|

|

(45 |

) |

|

|

|

|

|

|

|

|

|

| Net cash used in financing activities |

|

|

(317 |

) |

|

|

(1,127 |

) |

|

|

|

|

|

|

|

|

|

| Effect of exchange rate changes on cash and cash equivalents |

|

|

7 |

|

|

|

(3 |

) |

|

|

|

|

|

|

|

|

|

| Decrease in cash and cash equivalents |

|

|

(141 |

) |

|

|

(697 |

) |

| Cash and cash equivalents at beginning of period |

|

|

585 |

|

|

|

1,212 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at end of the period |

|

$ |

444 |

|

|

$ |

515 |

|

|

|

|

|

|

|

|

|

|

| (A) |

Starting with the first quarter of 2011, the company changed its method of accruing for certain incentive compensation specifically relating to cash bonuses for interim

reporting purposes from a ratable method to a performance-based method. The company believes that the performance-based method is preferable because it links the accrual of incentive compensation with the achievement of performance. We have revised

our previously reported Consolidated Statement of Operations for the three and nine months ended July 31, 2010 and our Consolidated Statement of Stockholders’ Equity, and Condensed Consolidated Statement of Cash Flows for the nine months

ended July 31, 2010 on a retrospective basis to reflect this change in principle based on information that would have been available as of our previous filing. The change will have no impact on our annual financial results. See Note 1,

Summary of significant accounting policies of our Form 10Q for additional information. |

Navistar International Corporation and Subsidiaries

Segment Reporting

(Unaudited)

We define segment profit (loss) as net income (loss) attributable to Navistar

International Corporation excluding income tax expense. Our results for interim periods are not necessarily indicative of results for a full year. Selected financial information is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Truck(A) |

|

|

Engine(B) |

|

|

Parts |

|

|

Financial

Services(C)

|

|

|

Corporate

and

Eliminations |

|

|

Total |

|

| (in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Three Months Ended July 31, 2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| External sales and revenues, net |

|

$ |

2,457 |

|

|

$ |

546 |

|

|

$ |

487 |

|

|

$ |

47 |

|

|

$ |

— |

|

|

$ |

3,537 |

|

| Intersegment sales and revenues(D) |

|

|

— |

|

|

|

422 |

|

|

|

29 |

|

|

|

26 |

|

|

|

(477 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total sales and revenues, net |

|

$ |

2,457 |

|

|

$ |

968 |

|

|

$ |

516 |

|

|

$ |

73 |

|

|

$ |

(477 |

) |

|

$ |

3,537 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to NIC |

|

$ |

(75 |

) |

|

$ |

32 |

|

|

$ |

70 |

|

|

$ |

30 |

|

|

$ |

1,343 |

|

|

$ |

1,400 |

|

| Income tax benefit |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,463 |

|

|

|

1,463 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment profit (loss)(D)(E) |

|

$ |

(75 |

) |

|

$ |

32 |

|

|

$ |

70 |

|

|

$ |

30 |

|

|

$ |

(120 |

) |

|

$ |

(63 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

$ |

37 |

|

|

$ |

32 |

|

|

$ |

2 |

|

|

$ |

8 |

|

|

$ |

5 |

|

|

$ |

84 |

|

| Interest expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

28 |

|

|

|

34 |

|

|

|

62 |

|

| Equity in income (loss) of non-consolidated affiliates |

|

|

(22 |

) |

|

|

(1 |

) |

|

|

1 |

|

|

|

— |

|

|

|

— |

|

|

|

(22 |

) |

| Capital expenditures(F) |

|

|

15 |

|

|

|

47 |

|

|

|

7 |

|

|

|

1 |

|

|

|

36 |

|

|

|

106 |

|

| Three Months Ended July 31, 2010 (Revised)(G) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| External sales and revenues, net |

|

$ |

2,311 |

|

|

$ |

456 |

|

|

$ |

395 |

|

|

$ |

59 |

|

|

$ |

— |

|

|

$ |

3,221 |

|

| Intersegment sales and revenues |

|

|

— |

|

|

|

216 |

|

|

|

45 |

|

|

|

23 |

|

|

|

(284 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total sales and revenues, net |

|

$ |

2,311 |

|

|

$ |

672 |

|

|

$ |

440 |

|

|

$ |

82 |

|

|

$ |

(284 |

) |

|

$ |

3,221 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to NIC |

|

$ |

227 |

|

|

$ |

(1 |

) |

|

$ |

52 |

|

|

$ |

33 |

|

|

$ |

(194 |

) |

|

$ |

117 |

|

| Income tax expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(19 |

) |

|

|

(19 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment profit (loss)(E) |

|

$ |

227 |

|

|

$ |

(1 |

) |

|

$ |

52 |

|

|

$ |

33 |

|

|

$ |

(175 |

) |

|

$ |

136 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

$ |

40 |

|

|

$ |

26 |

|

|

$ |

2 |

|

|

$ |

6 |

|

|

$ |

4 |

|

|

$ |

78 |

|

| Interest expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

24 |

|

|

|

34 |

|

|

|

58 |

|

| Equity in income (loss) of non-consolidated affiliates |

|

|

(15 |

) |

|

|

1 |

|

|

|

1 |

|

|

|

— |

|

|

|

— |

|

|

|

(13 |

) |

| Capital expenditures(F) |

|

|

22 |

|

|

|

47 |

|

|

|

3 |

|

|

|

— |

|

|

|

12 |

|

|

|

84 |

|

| Nine Months Ended July 31, 2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| External sales and revenues, net |

|

$ |

6,510 |

|

|

$ |

1,526 |

|

|

$ |

1,445 |

|

|

$ |

154 |

|

|

$ |

— |

|

|

$ |

9,635 |

|

| Intersegment sales and revenues(D) |

|

|

18 |

|

|

|

1,180 |

|

|

|

128 |

|

|

|

75 |

|

|

|

(1,401 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total sales and revenues, net |

|

$ |

6,528 |

|

|

$ |

2,706 |

|

|

$ |

1,573 |

|

|

$ |

229 |

|

|

$ |

(1,401 |

) |

|

$ |

9,635 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to NIC |

|

$ |

49 |

|

|

$ |

26 |

|

|

$ |

200 |

|

|

$ |

102 |

|

|

$ |

1,091 |

|

|

$ |

1,468 |

|

| Income tax benefit |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,458 |

|

|

|

1,458 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment profit(D) (E) |

|

$ |

49 |

|

|

$ |

26 |

|

|

$ |

200 |

|

|

$ |

102 |

|

|

$ |

(367 |

) |

|

$ |

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

$ |

112 |

|

|

$ |

91 |

|

|

$ |

7 |

|

|

$ |

21 |

|

|

$ |

14 |

|

|

$ |

245 |

|

| Interest expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

84 |

|

|

|

103 |

|

|

|

187 |

|

| Equity in income (loss) of non-consolidated affiliates |

|

|

(57 |

) |

|

|

(3 |

) |

|

|

5 |

|

|

|

— |

|

|

|

— |

|

|

|

(55 |

) |

| Capital expenditures(F) |

|

|

53 |

|

|

|

131 |

|

|

|

11 |

|

|

|

1 |

|

|

|

95 |

|

|

|

291 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Truck |

|

|

Engine |

|

|

Parts |

|

|

Financial

Services(C)

|

|

|

Corporate

and

Eliminations |

|

|

Total |

|

| (in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nine Months Ended July 31, 2010 (Revised)(G) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| External sales and revenues, net |

|

$ |

5,874 |

|

|

$ |

1,525 |

|

|

$ |

1,211 |

|

|

$ |

163 |

|

|

$ |

— |

|

|

$ |

8,773 |

|

| Intersegment sales and revenues(D) |

|

|

1 |

|

|

|

645 |

|

|

|

143 |

|

|

|

70 |

|

|

|

(859 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total sales and revenues, net |

|

$ |

5,875 |

|

|

$ |

2,170 |

|

|

$ |

1,354 |

|

|

$ |

233 |

|

|

$ |

(859 |

) |

|

$ |

8,773 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to NIC |

|

$ |

338 |

|

|

$ |

68 |

|

|

$ |

189 |

|

|

$ |

61 |

|

|

$ |

(477 |

) |

|

$ |

179 |

|

| Income tax expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(17 |

) |

|

|

(17 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment profit(E) |

|

$ |

338 |

|

|

$ |

68 |

|

|

$ |

189 |

|

|

$ |

61 |

|

|

$ |

(460 |

) |

|

$ |

196 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

$ |

120 |

|

|

$ |

79 |

|

|

$ |

5 |

|

|

$ |

21 |

|

|

$ |

11 |

|

|

$ |

236 |

|

| Interest expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

85 |

|

|

|

104 |

|

|

|

189 |

|

| Equity in income (loss) of non-consolidated affiliates |

|

|

(33 |

) |

|

|

(1 |

) |

|

|

2 |

|

|

|

— |

|

|

|

— |

|

|

|

(32 |

) |

| Capital expenditures(F) |

|

|

56 |

|

|

|

81 |

|

|

|

7 |

|

|

|

1 |

|

|

|

17 |

|

|

|

162 |

|

| As of July 31, 2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment assets |

|

$ |

2,551 |

|

|

$ |

1,876 |

|

|

$ |

721 |

|

|

$ |

3,318 |

|

|

$ |

2,712 |

|

|

$ |

11,178 |

|

| As of October 31, 2010 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment assets |

|

|

2,457 |

|

|

|

1,715 |

|

|

|

811 |

|

|

|

3,497 |

|

|

|

1,250 |

|

|

|

9,730 |

|

| (A) |

Includes impairments of property and equipment and intangible assets. See Note 2, Restructurings and impairments. |

| (B) |

In the third quarter of 2011, the Engine segment recognized a $10 million gain on the extinguishment of a liability related to an equipment financing transaction.

Previously, such gains were not material and were recorded within Corporate. |

| (C) |

Total sales and revenues in the Financial Services segment include interest revenues of $72 million and $225 million for the three and nine months ended

July 31, 2011, respectively, and $67 million and $197 million for the three and nine months ended July 31, 2010, respectively. |

| (D) |

Beginning in the second quarter of 2011, certain purchases from the Engine segment by the Parts segment are recorded at market-based pricing. All other intersegment

purchases from the Truck and Engine segments by the Parts segment continue to be recorded at standard production cost. The effect of this change did not have a material impact on our segment reporting. |

| (E) |

In the first quarter of 2011, we began allocating gains and losses on commodities derivatives to the segment to which the underlying commodities relate. Previously, the

impacts of commodities derivatives were not material and were recorded within Corporate. |

| (F) |

Exclusive of purchase of equipment leased to others. |

| (G) |

Certain amounts have been revised to reflect a retrospective change in accounting principle. See Note 1, Summary of significant accounting policies.

|

SEC Regulation G Non-GAAP Reconciliation

The financial measures presented below of adjusted income and adjusted diluted earnings per share attributable to Navistar International Corporation,

manufacturing segment profit, and adjusted manufacturing segment profit are unaudited and not in accordance with, or an alternative for, financial measures presented in accordance with U.S. generally accepted accounting principles (GAAP). The

non-GAAP financial information presented herein should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP.

We believe manufacturing segment profit, which includes the segment profits of our Truck, Engine, and Parts reporting segments, provides meaningful information of our core manufacturing business and

therefore we use it to supplement our GAAP reporting by identifying items that may not be related to the core manufacturing business. We have chosen to provide this supplemental information to investors, analysts and other interested parties to

enable them to perform additional analyses of operating results, to illustrate the results of operations giving effect to the non-GAAP adjustments shown in the below reconciliation, and to provide an additional measure of performance.

In addition, we believe that adjusted income and adjusted diluted earnings per share attributable to Navistar International

Corporation and manufacturing segment profit excluding certain items, which are not considered to be part of our ongoing business, improves the comparability of year to year results and is representative of our underlying performance. We have chosen

to provide this supplemental information to investors, analysts and other interested parties to enable them to perform additional analyses of operating results, to illustrate the results of operations giving effect to the non-GAAP adjustments shown

in the reconciliationsbelow, and to provide an additional measure of performance.

Adjustments included in the following schedules have

not been adjusted to reflect their income tax effect as the adjustments are intended to represent the impact on the Company’s consolidated statement of operations without the incremental income tax effect that would result from the release of

the income tax valuation allowance. The charges related to our Canadian operations would not be impacted as a full income tax valuation allowance remains for Canada. In addition, on a non-GAAP basis no incremental income tax for the three and nine

months ended July 31, 2011 is presented because the cumulative impact from the increased effective tax rate was offset by the tax benefit from restructuring and impairment charges in the quarter.

Adjusted net income and diluted earnings per share attributable to Navistar International Corporation reconciliation:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended July 31, |

|

|

Nine Months Ended July 31, |

|

| |

|

2011 |

|

|

2010 |

|

|

2011 |

|

|

2010 |

|

| |

|

|

|

|

Revised(A) |

|

|

|

|

|

Revised(A) |

|

| (in millions, except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to Navistar International Corporation |

|

$ |

1,400 |

|

|

$ |

117 |

|

|

$ |

1,468 |

|

|

$ |

179 |

|

| Plus: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Engineering integration costs(B) |

|

|

15 |

|

|

|

— |

|

|

|

41 |

|

|

|

— |

|

| Restructuring of North American manufacturing operations(C) |

|

|

122 |

|

|

|

— |

|

|

|

122 |

|

|

|

— |

|

| Ford restructuring and related charges (benefits)(D) |

|

|

— |

|

|

|

(10 |

) |

|

|

— |

|

|

|

(27 |

) |

| Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax valuation allowance release(E) |

|

|

1,476 |

|

|

|

— |

|

|

|

1,476 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted income attributable to Navistar International Corporation |

|

$ |

61 |

|

|

$ |

107 |

|

|

$ |

155 |

|

|

$ |

152 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings per share attributable to Navistar International Corporation |

|

$ |

18.24 |

|

|

$ |

1.56 |

|

|

$ |

19.04 |

|

|

$ |

2.44 |

|

| Effect of adjustments on diluted earnings per share attributable to Navistar International Corporation |

|

|

(17.45 |

) |

|

|

(0.12 |

) |

|

|

(17.03 |

) |

|

|

(0.36 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted diluted earnings per share attributable to Navistar International Corporation |

|

$ |

0.79 |

|

|

$ |

1.44 |

|

|

$ |

2.01 |

|

|

$ |

2.08 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted weighted shares outstanding |

|

|

76.8 |

|

|

|

74.3 |

|

|

|

77.1 |

|

|

|

73.1 |

|

Manufacturing segment profit and adjusted manufacturing segment profit reconciliation:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended April 30, |

|

|

Nine Months Ended April 30, |

|

| |

|

2011 |

|

|

2010 |

|

|

2011 |

|

|

2010 |

|

| |

|

|

|

|

Revised(A) |

|

|

|

|

|

Revised(A) |

|

| (in millions, except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to Navistar International Corporation |

|

$ |

1,400 |

|

|

$ |

117 |

|

|

$ |

1,468 |

|

|

$ |

179 |

|

| Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financial services segment profit |

|

|

30 |

|

|

|

33 |

|

|

|

102 |

|

|

|

61 |

|

| Corporate and eliminations |

|

|

(120 |

) |

|

|

(175 |

) |

|

|

(367 |

) |

|

|

(460 |

) |

| Income tax benefit (expense) |

|

|

1,463 |

|

|

|

(19 |

) |

|

|

1,458 |

|

|

|

(17 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Manufacturing segment profit |

|

$ |

27 |

|

|

$ |

278 |

|

|

$ |

275 |

|

|

$ |

595 |

|

| Plus: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Engineering integration costs(B) |

|

|

12 |

|

|

|

— |

|

|

|

33 |

|

|

|

— |

|

| Restructuring of North American manufacturing operations (C) |

|

|

119 |

|

|

|

— |

|

|

|

119 |

|

|

|

— |

|

| Ford restructuring and related charges (benefits)(D) |

|

|

— |

|

|

|

(10 |

) |

|

|

— |

|

|

|

(17 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted manufacturing segment profit |

|

$ |

158 |

|

|

$ |

268 |

|

|

$ |

427 |

|

|

$ |

578 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (A) |

Net income attributable to Navistar International Corporation has been revised to reflect a retrospective change in accounting principle. See Note 1, Summary of

significant accounting policies of our Form 10Q for additional information. |

| (B) |

Engineering integration costs relate to the consolidation of our truck and engine engineering operations as well as the move of our world headquarters.

These costs include restructuring charges for activities at our Fort Wayne facility of $4 million and $23 million for the three and nine months ended July 31, 2011, respectively. The restructuring charges recorded are based on restructuring

plans that have been committed to by management and are based upon management’s best estimates of future events. Changes to the estimates may require future adjustments to the restructuring liabilities. We also incurred an additional $11

million and $18 million of other related costs for the three and nine months ended July 31, 2011, respectively. Our manufacturing segment recognized $12 million and $33 million of the engineering integration costs for the three and nine months

ended July 31, 2011, respectively. For the remainder of 2011, we expect to incur |

| |

approximately $36 million of additional charges related to these activities and between $80 million and $110 million of additional charges in 2012. We continue to develop plans for efficient

transitions related to these activities and the optimization of our operations and management structure. |

| (C) |

Restructuring of North American manufacturing operations are charges primarily related to our plans to close our Chatham, Ontario heavy truck plant and Workhorse

chassis plant in Union City, Indiana, and to significantly scale back operations at our Monaco recreational vehicle headquarters and motor coach manufacturing plant in Coburg, Oregon. These costs include restructuring charges of $53 million and

related charges of $5 million for the three and nine months ended July 31, 2011. The restructuring and related charges recorded are based on restructuring plans that have been committed to by management and are based upon management’s best

estimates of future events. Changes to the estimates may require future adjustments to the restructuring liabilities. In addition, the Company recognized $64 million of impairment charges related to certain intangible assets and property plant and

equipment primarily related to these facilities. The Truck segment recognized $119 million of restructuring of North American manufacturing operation charges for the three and nine months ended July 31, 2011. We expect to incur $40 million to

$90 million of additional charges related to these activities. |

| (D) |

Ford restructuring and related charges (benefits) are charges and benefits recognized in 2010 related to restructuring activity at our Indianapolis Casting Corporation

and Indianapolis Engine Plant. The net benefits were included in Restructuring charges in our Engine segment. |

| (E) |

In the third quarter of 2011, the Company recognized an income tax benefit of $1.476 billion from the release of a portion of our income tax valuation allowance.

|

|

|

|

|

|

|

|

|

|

| Fiscal 2011 guidance: adjusted net income and diluted earnings per share

attributable to Navistar International Corporation reconciliation: |

|

| |

|

Lower |

|

|

Upper |

|

| (in millions, except per share

data) |

|

|

|

|

|

|

|

|

| Net income attributable to Navistar International

Corporation |

|

$ |

1,647 |

|

|

$ |

1,764 |

|

| Plus: |

|

|

|

|

|

|

|

|

| Engineering integration costs(A) |

|

|

77 |

|

|

|

77 |

|

| Restructuring of North American manufacturing operations(B) |

|

|

140 |

|

|

|

100 |

|

| Less: |

|

|

|

|

|

|

|

|

| Income tax valuation allowance release(C) |

|

|

1,476 |

|

|

|

1,476 |

|

| |

|

|

|

|

|

|

|

|

| Adjusted net income attributable to Navistar International

Corporation |

|

$ |

388 |

|

|

$ |

465 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

| Diluted earnings per share attributable to Navistar International

Corporation |

|

$ |

21.13 |

|

|

$ |

22.13 |

|

| Effect of adjustments on diluted earnings per share attributable to

Navistar International Corporation |

|

|

(16.13 |

) |

|

|

(16.13 |

) |

| |

|

|

|

|

|

|

|

|

| Adjusted diluted earnings per share attributable to Navistar

International Corporation |

|

$ |

5.00 |

|

|

$ |

6.00 |

|

| |

|

|

|

|

|

|

|

|

| Approximate diluted weighted shares

outstanding(D) |

|

|

77.6 |

|

|

|

77.6 |

|

| (A) |

Engineering integration costs relate to the consolidation of our truck and engine engineering operations as well as the move of our world headquarters. We continue to

develop plans for efficient transitions related to these activities and the optimization of our operations and management structure. We expect to incur approximately $77 million of engineering integration costs in fiscal 2011 with approximately $67

million of the costs to be recognized by our manufacturing segment and approximately $10 million of corporate charges. |

| (B) |

Restructuring of North American manufacturing operations are charges primarily related to our plans to close our Chatham, Ontario heavy truck plant and Workhorse

chassis plant in Union City, Indiana, and to significantly scale back operations at our Monaco recreational vehicle headquarters and motor coach manufacturing plant in Coburg, Oregon. We expect to incur $100 million to $140 million of restructuring,

impairment and related charges in fiscal 2011 with approximately $3 million of corporate charges and the remainder of the costs to be recognized by our manufacturing segments. |

| (C) |

In the third quarter of 2011, the Company recognized an income tax benefit of $1.476 billion from the release of a portion of our income tax valuation allowance.

|

| (D) |

Approximate diluted weighted shares outstanding based on assumed average share price of $65 per share during the period. |