UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

![]() ANNUAL REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

ANNUAL REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2003

![]() TRANSITION REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

TRANSITION REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 0-22175

EMCORE Corporation

(Exact name of registrant as specified in its charter)

| New

Jersey

(State or other jurisdiction of incorporation or organization) |

22-2746503

(I.R.S. Employer Identification No.) |

|||||

145 Belmont Drive,

Somerset, NJ 08873

(Address of principal executive

offices) (zip code)

(732)

271-9090

(Registrant's telephone number,

including area code)

Securities registered

pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the

Act:

Common Stock, No Par Value

Indicate by check mark whether the registrant (1) has

filed all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for

such shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for the

past 90 days.

Yes ![]() No

No ![]()

Indicate by check mark if disclosure of delinquent

filers pursuant to Item 405 of Regulation S-K is not contained herein,

and will not be contained, to the best of the registrant's

knowledge, in definitive proxy or information statements incorporated

by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. ![]()

Indicate by check mark whether

the registrant is an accelerated filer (as defined in Rule 12b-2 of the

Act).

Yes ![]() No

No ![]()

The aggregate market value of common stock held by non-affiliates of the registrant as of March 31, 2003 was approximately $45,545,163 (based on the closing sale price of $1.65 per share).

The number of shares outstanding of the registrant's no par value common stock as of December 12, 2003 was 38,244,800.

EMCORE Corporation

FORM 10-K

For the fiscal year ended September

30, 2003

INDEX

| Page | ||||||||||

| PART I | ||||||||||

| Item 1. | Business | 1 | ||||||||

| Item 2. | Properties | 31 | ||||||||

| Item 3. | Legal Proceedings | 31 | ||||||||

| Item 4. | Submission of Matters to a Vote of Security Holders | 31 | ||||||||

| PART II | ||||||||||

| Item 5. | Market for Registrant's Common Equity and Related Shareholder Matters | 32 | ||||||||

| Item 6. | Selected Financial Data | 33 | ||||||||

| Item 7. | Management's Discussion and Analysis of Financial

Condition and Results of Operations |

35 | ||||||||

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 52 | ||||||||

| Item 8. | Financial Statements and Supplementary Data | 53 | ||||||||

| Consolidated Statements of

Operations for the years ended September 30, 2003, 2002 and 2001 |

53 | |||||||||

| Consolidated Balance Sheets as of September 30, 2003 and 2002 | 54 | |||||||||

| Consolidated Statements of

Shareholders' Equity for the years ended September 30, 2003, 2002 and 2001 |

55 | |||||||||

| Consolidated

Statements of Cash Flows for the years ended September 30, 2003, 2002 and 2001 |

56 | |||||||||

| Notes to Consolidated Financial Statements | 58 | |||||||||

| Independent Auditors' Report | 78 | |||||||||

| Item 9. | Changes in and Disagreements with Accountants on Accounting

and Financial Disclosures |

79 | ||||||||

| Item 9A. | Controls and Procedures | 79 | ||||||||

| PART III | ||||||||||

| Item 10. | Directors and Executive Officers of the Registrant | 79 | ||||||||

| Item 11. | Executive Compensation | 81 | ||||||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management | 86 | ||||||||

| Item 13. | Certain Relationships and Related Transactions | 87 | ||||||||

| Item 14. | Principal Accounting Fees and Services | 87 | ||||||||

| PART IV | ||||||||||

| Item 15. | Exhibits, Financial Statement Schedules and Reports on Form 8-K | 89 | ||||||||

| SIGNATURES | 92 | |||||||||

Forward-Looking Statements

This Annual Report on Form 10-K includes forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. These forward-looking statements are based largely on our current expectations and projections about future events and financial trends affecting the financial condition of our business. These forward looking statements may be identified by the use of words such as "expects", "anticipates", "intends", "plans", "believes", "estimate", "target", "may", "will" and variations of these words and similar expressions. These forward-looking statements are subject to business, economic and other risks and uncertainties, and actual results may differ materially from those discussed in these forward-looking statements. Factors that could contribute to these differences include, but are not limited to, those discussed under "Risk Factors", "Forward-Looking Statements" and elsewhere in this report. The cautionary statements made in this report should be read as being applicable to all forward-looking statements wherever they appear in this report. This discussion should be read in conjunction with the Consolidated Financial Statements, including the related footnotes. These forward-looking statements include, without limitation, any and all statements or implications regarding:

| • | The ability of EMCORE Corporation (EMCORE) to remain competitive and a leader in its industry and the future growth of EMCORE, the industry and the economy in general; |

| • | difficulties arising from the separation of the TurboDisc business from EMCORE's ongoing business lines; |

| • | difficulties in integrating recent or future acquisitions into EMCORE's operations; |

| • | the expected level and timing of benefits to EMCORE from its restructuring and realignment efforts, including: |

| • | expected cost reductions and its impact on EMCORE's financial performance, |

| • | expected improvement to EMCORE's product and technology development programs, |

| • | the belief that restructuring and realignment efforts will position EMCORE better in its current business environment and prepare it for future growth with increasingly competitive new product offerings and improved long-term cost structure; and |

| • | guidance provided by EMCORE regarding its expected financial performance in current or future periods, including, without limitation, with respect to anticipated revenues for any period in fiscal 2004 and subsequent periods. |

These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected, including without limitation, the following:

| • | The disposition of our TurboDisc business may result in decreased revenues going forward as well as additional difficulties arising from the separation of its operations from our ongoing operations; and |

| • | other risks and uncertainties described in EMCORE's filings with the Securities and Exchange Commission (SEC) (including under the heading "Risk Factors" in this Annual Report), such as: |

| • | cancellations, rescheduling or delays in product shipments; |

| • | manufacturing capacity constraints; |

| • | lengthy sales and qualification cycles; |

| • | difficulties in the production process; |

| • | changes in semiconductor industry growth; |

| • | increased competition; and |

| • | delays in developing and commercializing new products. |

We assume no obligation to update the matters discussed in this Annual Report, except as required by applicable law or regulation.

PART I

Item 1. Business

For specific information about our Company, our products or the markets we serve, please visit our website at http://www.emcore.com. The information on EMCORE's web site is not incorporated by reference into and is not made a part of this report. All of our SEC filings are available free of charge on our website.

Company Overview

EMCORE Corporation, a New Jersey corporation established in 1984, offers a broad portfolio of compound semiconductor-based components and subsystems for the rapidly expanding broadband and wireless communication markets and the solid-state lighting industry. EMCORE continues to expand its comprehensive product portfolio to enable the transport of voice, data and video over copper, hybrid fiber/coax (HFC), fiber, satellite and wireless communication networks. The company is building upon its leading-edge compound semiconductor materials and device expertise to provide cost-effective components and subsystems for the cable television (CATV), telecommunications, data and storage, satellite and wireless communications markets. EMCORE supports these end markets through its EMCORE Fiber Optics, EMCORE Photovoltaics and EMCORE Electronic Materials and Devices product lines. Through its 49% ownership participation in GELcore, LLC, EMCORE plays a vital role in developing and commercializing next-generation LED technology for use in the general illumination market. Our target markets and main products that support these markets include:

CATV

| • | Optical components and subsystems for cable television (CATV) signal transmission over HFC, including hub transmitters based on linear 1310 nanometer (nm) and 1550 nm Distributed Feedback (DFB) and Fabry-Perot (FP) laser technologies, head-end transmitters based on 1550 nm DFB laser and external modulator technologies, and HFC node video detectors and receivers based on PIN (the "P", "I", "N" represent P-type, intrinsic and N-type semiconductor materials, respectively) photodiode technology. |

Telecommunications

| • | Optical components and subsystems for telecommunications and fiber-to-the-premise, business, curb or home (in general, FTTx), including high-speed long-wavelength edge emitting lasers and transmit optical subassemblies (TOSA) based on 1310 nm and 1550 nm DFB or FP technologies, head-end transmitters for FTTx applications based on 1550nm laser technology, passive optical network (PON) receivers for FTTx applications, high speed receivers and detectors based on avalanche photodetectors (APD) and PIN detector technologies, and 4- and 12-channel parallel optical transceiver modules for telecommunication switch applications based on 850 nm vertical cavity surface emitting laser (VCSEL) and PIN photodiode array technology. |

Data and Storage

| • | Optical components and subsystems for data communications and storage applications, including high-speed VCSELs and PIN photodiode components, 12-channel parallel optical transceiver modules for High Performance Computing (HPC) or "Super Computing" markets, LX4 and CX4 products for short reach 10 Gigabit per second (Gb/s) data communications and Ethernet networks, and 10 Gb/s TOSA and receive optical subassemblies (ROSA) for storage area networks (SAN). |

Satellite Communications

| • | Solar cells and solar panels for global satellite communications, featuring world-leading conversion efficiencies and satellite communication (Satcom) products, including transmitters, receivers, subsystems and systems to transport wideband microwave signals between satellite base stations and antenna dishes. |

1

Wireless Communications

| • | Electronic materials for the wireless handset and base station markets, which materials include 4-inch and 6-inch InGaP Hetero-junction Bipolar Transistor (HBT) and AlGaAs pseudomorphic high electron mobility transistors (pHEMT) and E-mode epi wafers that are used for power amplifiers and switches in GSM, TDMA and CDMA multiband wireless handsets. |

Solid-State Lighting

| • | High Brightness Light Emitting Diodes (HB-LEDs) for lighting applications. Through its 49% ownership participation in GELcore, LLC (GELcore), EMCORE plays a vital role in developing and commercializing next-generation LED technology for use in the general illumination market. GELcore's products include traffic lights, channel letters, flashlights and other signage and display products incorporating HB-LEDs. In the near term, GELcore expects to be deploying its HB-LED products in the automotive and general appliance markets. |

Acquisitions and Divestitures

Over the past twelve months, EMCORE has refocused its market and product strategy to address high growth opportunities for its compound semiconductor based components and subsystems in the CATV, telecom, data and storage, satellite and wireless communications markets. In addition to developing its internal capability to develop and manufacture products for these markets, EMCORE has expanded its portfolio of communications products and technologies through a series of strategic acquisitions:

| • | In December 2002, EMCORE acquired certain assets of privately held Alvesta Corporation (Alvesta) of Sunnyvale, California for $250,000 in cash. The transaction included the acquisition of intellectual property and inventory including several Alvesta product designers. Alvesta, which operates under EMCORE's fiber optics group, was an industry leader in the research and development of parallel optic transceivers for fiber optic communication networks. Alvesta pioneered four channel parallel optic transceivers for the Optical Internetworking Forum and 10 Gigabit (10G) Fibre Channel, Ethernet and Infiniband applications. The newly formed design center in Santa Clara, CA designs low-cost parallel optical module solutions used in Fibre Channel, Ethernet and Infiniband networks. The new products include media converter modules, copper XENPAK transceivers and active optical cables to address the short reach requirements of central offices and data centers. These components form the optical subsystem of the recently announced SmartLink product. |

| • | In January 2003, EMCORE purchased Agere Systems, Inc.'s CATV transmission systems, telecom access and Satcom components business, formerly Ortel Corporation (Ortel), for $26.2 million in cash. This business, now operating as the Ortel division within EMCORE's fiber optics group, designs and manufactures high performance optoelectronic solutions that enable voice, video and data networks. Ortel's product offerings include 1310 nm and 1550 nm analog and digital lasers, dense wavelength division multiplexing (DWDM) lasers, transmitter engines, photodiodes, FTTx components, wideband lasers and receivers, and optical links for long-haul antenna remoting. These products will enable EMCORE to have a broad presence in the CATV and Radio Frequency (RF) transport markets as well as the telecom access and emerging FTTx market. |

| • | On October 9, 2003, EMCORE announced that it had acquired Molex Inc.'s 10G Ethernet transceiver business (Molex) for an initial $1.0 million in cash and an additional $1.5 million in progress payments expected to be paid during fiscal 2004. This transaction included assets, products and intellectual property including several Molex product designers. Management believes that Molex, which operates under EMCORE's fiber optics group, gives EMCORE a significant competitive advantage and the most complete 10G Ethernet transceiver product portfolio in the industry. Molex specializes in coarse-wavelength-division-multiplexing (CWDM) products. The newly formed design center in Downers Grove, IL designs and manufactures serial 10 Gb/s and CWDM optical transceivers for the growing 10G Ethernet market. |

| • | On November 3, 2003, EMCORE sold its TurboDisc systems business to a subsidiary of Veeco Instruments Inc. (Veeco) in a transaction that could be valued at up to $80.0 million. The purchase |

2

| price was $60.0 million in cash at closing with an additional aggregate maximum payout of $20.0 million over the next two years. EMCORE will receive in cash 50% of all revenues from this business that exceed $40.0 million in each of the next two years, beginning January 1, 2004. Revenues for the systems business in fiscal 2003 were approximately $52.7 million, down from a peak of $131.1 million in fiscal 2001. This transaction included the assets, products, product warranty liabilities, hardware-related technology and intellectual property used primarily in the operation of this business, including its facilities located in Somerset, New Jersey. Approximately 150 employees of EMCORE were involved in the TurboDisc business of which approximately 120 became employees of Veeco. |

Management believes that the sale of the TurboDisc systems business was a critical step in reorienting EMCORE's market and product focus. The capital equipment business enabled the Company to develop the critical materials science expertise that has become the cornerstone of its compound semiconductor based communications products and our sole business focus. EMCORE retained a license to all systems related intellectual property and ownership of all its process and device technology. Moreover, the sale of TurboDisc business strengthened EMCORE's balance sheet and helped provide the resources necessary to implement its communications strategy.

As a result of these transactions, the focus of the discussion in this Annual Report will be on our compound semiconductor-based components and subsystems for the broadband and wireless communication markets and the solid-state lighting industry, rather than on our systems segment. Although the systems segment did represent a significant portion of our business and results of operations in fiscal 2003, results from operations in fiscal 2004 will be classified as "discontinued operations" and no impact thereafter. Accordingly, we believe that emphasizing our continuing businesses in the compound semiconductor related components and subsystems products will be more meaningful for investors.

Compound Semiconductor Industry Overview

Recent advances in information technologies have created a growing need for efficient and high-performance electronic systems that operate at very high frequencies, require higher transmission rates, require increased storage capacity, have augmented computational and display capabilities and can be produced cost-effectively in commercial volumes. In the past, manufacturers of electronic systems have relied on advances in silicon semiconductor technology to meet many of these demands; however, the new generation of high-performance electronic and optoelectronic applications require certain functions that are generally not achievable using silicon-based components. Advantages of compound semiconductor devices over traditional silicon devices include:

| • | Higher operating speeds to address 10 Gigabit per second (Gbps) and beyond applications; |

| • | Lower power consumption to meet the demand for higher bandwidth density; |

| • | Reduced noise and distortion for maximum signal to noise performance; |

| • | Higher temperature performance for both commercial and military applications; |

| • | Light emitting and detecting optoelectronic properties to power the optical interconnection market; |

| • | Higher detection efficiency to maximize conversion power in solar power applications; and |

| • | Higher light emission efficiency for converting electrical power in general and specialty lighting applications. |

Compound semiconductor devices can also be combined into integrated circuits, such as transmitters, receivers and alphanumeric displays. Electronics manufacturers are increasingly integrating compound semiconductor devices into their products to achieve higher performance in applications targeted for a wide variety of communication markets. Examples of such applications enabled by compound semiconductor devices include:

| • | High speed internet built upon optical devices that transport data over long distances; |

| • | Video-on-demand over high-speed cable modems using high efficiency lasers and low-noise receivers; |

3

| • | Storage Area Networks for the high speed transfer of data between computer systems and storage elements and among storage elements; |

| • | Satellite communication powered by high efficiency solar cells; |

| • | LED street lights and car tail lights built upon high-brightness LEDs; |

| • | Cellular telephones and wireless networks built upon power efficient RF devices; and |

| • | DVD players built upon short wavelength optical devices to maximize storage density. |

The systems that enable these applications consist of many component and subsystems that incorporate individual compound semiconductor devices. Companies that own unique leading-edge technologies will be able to continue to provide value-added components, subsystems and turnkey systems to meet the communication requirements of the future.

The diagram below shows the individual building blocks that enable the final user application. The trend in the industry is for companies to supply more and more of the entire pyramid in order to stay cost competitive and improve operating margins. EMCORE focuses its products in the materials, components and subsystems layers.

Consumer

Applications: Internet, CATV, Telephony, FTTx, Satcom, Wi-Fi networks, Storage

Systems: modems, cellphones, routers/switches, satellites, lighting

SubSystems: subassemblies, modules, transmitters/receivers, solar panels

Components: VCSELs, DFB lasers, PIN detectors, RF devices, solar cells, LEDs

Compound Semiconductor Materials: Gallium Arsenide, Indium Phosphide, Gallium Nitride

EMCORE's Strategy

EMCORE's objective is to maximize shareholder value by building upon its leading-edge compound semiconductor materials and device expertise to provide cost-effective components and subsystems for the CATV, telecom, data and storage, satellite and wireless communications markets. EMCORE's products enable the transport of voice, data and video over copper, HFC, fiber, satellite and wireless communication products. The key elements of EMCORE's strategy include:

| I. | Leverage EMCORE's Core Compound Semiconductor and Manufacturing Expertise Across Multiple Product Applications. |

The model of purchasing components from multiple vendors results in too many layers of margin stack-ups such that the final integrated subsystem is no longer cost competitive. We believe the trend in the component and subsystem industry is towards a vertically integrated structure in which key technologies are produced internally. By having the know-how and intellectual property to internally produce and supply compound semiconductor products, component and subsystem companies can stay ahead of the competition in both performance and cost effectiveness.

EMCORE continually leverages its proprietary core technology to develop compound semiconductor products for multiple applications in a variety of markets. Building upon the compound semiconductor materials expertise into components and subsystems products is a key focus of EMCORE's ongoing strategy. Our internally designed and manufactured VCSELs, digital DFB lasers, PIN and APD photodiodes are the optical components in our TOSA and ROSA products as well as our data and telecommunications receivers, transceivers and transponders. Similarly, our internally designed and manufactured analog DFB and FP lasers and PIN photodiodes are the optical components in our CATV transmitters, receivers and FTTx transceivers.

4

| II. | Target Potential High Growth Market Opportunities. |

EMCORE's strategy is to target potential high growth market opportunities where performance characteristics and high volume production efficiencies can give compound semiconductors a competitive advantage over other devices. Historically, while technologically superior, compound semiconductors have not been widely deployed because they are more expensive to manufacture than silicon-based semiconductors and other existing solutions. EMCORE believes that as compound semiconductor production costs are reduced, new customers will be compelled to use these products because of their higher performance characteristics. For example, EMCORE focuses its efforts in high-growth areas in communication infrastructure by providing complete solutions based on widely accepted platforms such as Synchronous Optical Network (SONET), Asynchronous Transfer Mode (ATM) and Gigabit Ethernet.

With the increased demand for high bandwidth services such as Internet, video-on-demand, on-line gaming and high definition television (HDTV), more and more systems are relying on optics to transport the signals. EMCORE is uniquely positioned to leverage its compound semiconductor expertise in the area of VCSELs, DFB lasers, PIN/APD detectors into value-added subsystems that meet the market demand.

Consistent with our strategy of pursuing market opportunities in which management believes that future growth will be strong, we evaluated our TurboDisc systems division and noted that the market for MOCVD reactors had become saturated in recent years with tremendous price competition on every new system sale. Accordingly, we sold the TurboDisc division as described above. We did, however, retain significant intellectual property rights in the TurboDisc technology and obtained favorable terms for future purchases of TurboDisc systems and related components.

III. Pursue Strategic Acquisitions and Partnerships with Industry Leading Companies.

EMCORE seeks to identify and develop long-term relationships with leading companies in each of the industries it serves. EMCORE develops these relationships in a number of ways that include long-term, high-volume supply agreements, joint ventures, acquisitions and other arrangements. In January 1999, General Electric Lighting and EMCORE formed GELcore, a joint venture to develop and market HB-LED lighting products. Since its inception, GELcore has had a compound annual growth rate (CAGR) of 23% with annual revenue approaching $55 million. General Electric Lighting and EMCORE have agreed that this joint venture will be the exclusive vehicle for each party's participation in solid-state lighting. Recently, acquisitions have been a focus in order to enhance technologies. Over the past two years, the acquisitions listed below have expanded not only our materials expertise, but also our components and subsystem technologies:

| • | Tecstar's solar panel technology to leverage our solar cell expertise; |

| • | Alvesta's low-cost pluggable optical and electrical module technology to leverage our VCSEL and PIN expertise; |

| • | Ortel's high-performance head-end transmitters and subscriber-end receivers to leverage our DFB laser, APD detector and analog RF expertise; and |

| • | Molex's industry leading CWDM optical modules to leverage our multi-wavelength DFB laser and PIN detector expertise. |

EMCORE is currently considering additional strategic acquisitions to acquire new technologies and products to broaden our market penetration in the communications sector.

| IV. | Continually Invest in Research and Development to Maintain Technology Leadership. |

Through substantial investment in research and development, EMCORE seeks to expand its leadership position in compound semiconductor based communications products and subsystems. EMCORE works with its customers to enhance the performance of its processes, materials science and fiber optic module design expertise, including the development of new low-cost, high-volume wafers, components and subsystems for its customers. In order to remain a leader in our market segments, EMCORE not only addresses our customers' current needs, but we also work with them regarding their evolving requirements to remain designed into their product lifecycle. In addition, EMCORE's

5

development efforts are focused on continually lowering the production costs of its products. For example, EMCORE recently released the latest version of its high-efficiency advanced triple junction solar cells, which now incorporates a monolithic integrated diode, a technology which is a more cost effective and robust solution for satellite integrators.

| V. | Target Positive Cash Flows From Operations. |

Management is committed to reducing EMCORE's cost structure by lowering the breakeven points for each of its product lines. In fiscal 2002, EMCORE proceeded with a restructuring program, consisting of the realignment of all engineering, manufacturing and sales/marketing operations, as well as workforce reductions. Management believes that these cost reductions saved EMCORE at least $5.0 million per quarter in fiscal 2003. EMCORE also essentially eliminated all outside contractors and significantly reduced overall expenditures for materials, software and capital assets. As part of the ongoing effort to cut costs, EMCORE also implemented a program to focus research and development efforts on projects that can be expected to generate returns within one year. As a result, EMCORE has been able to reduce overall research and development costs without, we believe, jeopardizing future revenue opportunities. To improve gross margins in fiscal 2004, product lines will be transferred to contract manufacturers for high volume production and management will implement additional programs to improve manufacturing process yields.

EMCORE's Products

The following chart summarizes (i) our products, (ii) the markets to which those products are directed, (iii) applications in which our products are used, and (iv) certain benefits and characteristics of compound semiconductor devices:

6

| Products | Market | Representative Applications |

Benefits/Characteristics | ||||||||||||||||||||||||||||||||||||

| DFB,

FP Lasers Photodetector Head-end transmitters Analog video receivers |

CATV | Cable

Television (CATV) Hybrid Fiber Coax networks Within Customer Premise Equipment (CPE) |

Increased network

capacity Increased data transmission speeds Increased bandwidth Lower power consumption Low noise video receive Increased transmission distance |

||||||||||||||||||||||||||||||||||||

| VCSEL components DFB and FP Lasers and optical receivers RF materials Photodiode Optical transceivers VSR transponders Passive optical network (PON) transceivers |

Telecommunications | High capacity

fiber optic lines Long reach and metro networks Fiber to the premise (FTTx) Very Short Reach (VSR) links including OC-768, OC-192, OC-48. SONET and SDH networks. |

Increased data transmission speeds Increased optical launched power to enable longer distance reach Lower power consumption Higher bandwidth density |

||||||||||||||||||||||||||||||||||||

| VCSEL components DFB, FP Lasers Photodetector RF devices & materials VSR Transponders XENPAK, X2, XFP transceivers Parallel optical modules |

Data and Storage | High-speed fiber optic networks and optical links (including Infiniband, Ethernet, Fibre Channel networks). Copper replacement or extention products in the data center Supercomputing High performance computing (HPC) systems Storage Area Networks (SAN) Network Attached Storage (NAS) |

Increased network

capacity Increased data transmission speeds Increased bandwidth Lower power consumption Improved cable management over copper interconnects Increased transmission distance Lowest cost optical interconnections for massively parallel muti- processors |

||||||||||||||||||||||||||||||||||||

| Solar cells and

panels RF materials SATCOM subsystems |

Satellite communications |

Power

modules for satellites Satellite to ground Communication |

Radiation

tolerance Conversion of more light to power than silicon Reduced launch costs Increased bandwidth |

||||||||||||||||||||||||||||||||||||

| RF and electronic materials RF and electronic devices Optical transmitters for remoting |

Wireless communications |

Cellular

telephones Pagers PCS handsets Direct broadcast systems PDAs Remoting |

Increased

network capacity Lower power consumption Reduced network congestion Extended battery life Improved signal to noise performance |

||||||||||||||||||||||||||||||||||||

| HB-LEDs Miniature lamps |

Solid-State Lighting | Flat

panel displays Solid state lighting Outdoor signage and displays Traffic signal |

Lower power

consumption Lower temperature operation Longer life |

||||||||||||||||||||||||||||||||||||

7

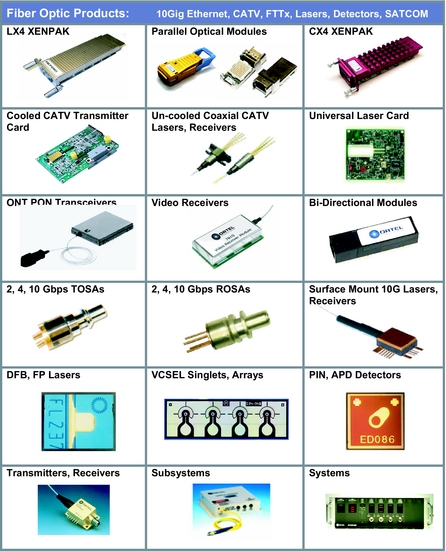

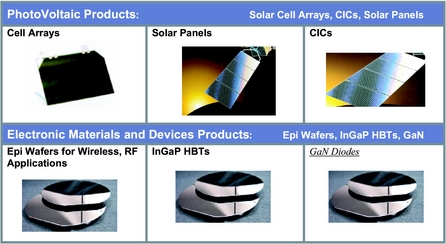

The following chart depicts some of our products as well as the application in which our customers use them.

8

EMCORE's Product Lines

Fiber Optics

Over the past several years, communication networks have experienced dramatic growth in data transmission traffic due to worldwide Internet access, e-mail and e-commerce. As Internet content expands to include full motion video on demand (including high definition television or HDTV), multi-channel high quality audio, online video conferencing, image transfer, online gaming and other broadband applications, the delivery of such data will place a greater demand on available bandwidth. The bulk of this traffic is already routed through the optical networking infrastructure used by local and long distance carriers as well as Internet service providers. Optical fiber offers substantially greater bandwidth capacity, is less error prone and is easier to administer than copper wire.

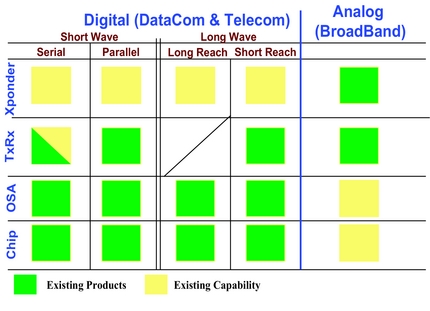

EMCORE's fiber optics group manufactures high-speed optical transmitter modules, receiver modules and transponders utilizing EMCORE's leading-edge VCSEL and PIN photodiode array components for the data communications and telecommunications markets. EMCORE's modules, designed to help solve the data bottle necking problems for distances under 300 meters in central office and point-of-presence environments, provide a cost effective alternative to more costly comparable serial interconnects and are targeted to replace bulky copper cabling solutions. Growing markets that will benefit from these cost-effective short reach products include the 10G Ethernet and HPC or "Super Computing" markets. As summarized in the table below, EMCORE has positioned itself as a component and subsystem manufacture that services a significant portion of the digital and analog communications market. Our main products include short wavelength (850 nm) VCSELs, long wavelength (1310 nm and 1550 nm) DFB and FP lasers, PIN and APD photodetectors and optical subsystems that include transmitters, receivers, transceivers and transponders.

9

Short Wavelength (850nm) VCSELs

EMCORE designs, develops and manufactures high-speed VCSELs and PIN photodiode components and subassemblies for the data communications and telecommunications markets. EMCORE offers a complete product line of VCSEL and PIN photodiode solutions, including bare die, packaged components and optical subassemblies for integration into Gigabit Ethernet, Fibre Channel, Infiniband, WDM, ATM systems, and high-speed telecom applications, including VSR OC-192 and high speed optical backplanes.

VCSELs are revolutionary compound semiconductor micro laser diodes that emit light vertically from the surface of a fabricated wafer. They combine the ability of batch process and on-wafer tests like LEDs and the superior electro-optical performance of traditional edge-emitting lasers. In addition, the cylindrical laser beam profile allows an easy and efficient coupling of the light into a multi-mode fiber. The manufacturability for both wafer processing and packaging enables a cost-effective high-bandwidth fiber optic communication solution.

VCSELs have many advantages, including ultra-high modulation rates for advanced information processing, extremely low power consumption, high fiber optic coupling efficiencies, circular output beams and photolithography-defined geometries. EMCORE's strategy is to capitalize on its oxide VCSEL manufacturing platform and expertise, by providing the industry with 1 Gb/s, 2.5 Gb/s, 10 Gb/s (OC-192), and 40 Gb/s (OC-768) solutions through single-channel serial, multi-channel parallel or WDM approaches. Our customers combine VCSEL technology with custom integrated circuits (IC) and system level designs for the final transceiver package. This package usually consists of a VCSEL, detector, a laser driver and various other electronic components all connected via a printed circuit board. This board is environmentally sealed, protected, and configured into the final transceiver product. Leading electronic systems manufacturers are integrating VCSELs into a broad array of end-market applications including Internet access, digital cross-connect telecommunications switches, Infiniband optical bus, fiber optic switching and routing, such as Gigabit Ethernet and storage area networks (SAN).

10

Long Wavelength (1310 nm and 1550 nm) DFB and FP Lasers

Recently, cable operators and traditional telephone service providers have been competing with each other to offer the lowest price for unlimited "triple play" (voice, data and video) communications through one cable. As Multi-System Cable Operators (MSOs) offer "triple play" services over CATV systems, Regional Bell Operating Companies (RBOCs) have responded by offering "triple play" services from the deployment of new FTTx systems.

EMCORE's newly acquired Ortel division designs, develops and manufactures high-speed, long-wavelength edge emitters based on DFB or FP technologies. These lasers are used for longer reach applications in the 2km, 10km, and 40+km distances. These devices are packaged into subsystems and used to transmit CATV or FTTx signals in the forward path from the central office to the subscriber and in the return path back to the central office.

The advantage of the longer wavelength (i.e., 1310 nm, 1490 nm and 1550 nm) and narrow spectral width (in the case of the DFB laser) is the reduced absorption and dispersion in the optical fiber. This results in increased distances between repeaters or amplifiers and saves the service providers in cost of deployment.

Through its Ortel division, EMCORE also manufactures and sells a line of fiber optic Satcom transmitters, subsystems and systems to transport wideband microwave signals between satellite base stations and antenna dishes.

Photodetectors (PIN and APD)

Photodetectors are discrete semiconductor devices that detect light in order to convert an optical signal into an electrical signal. Similar to VCSELs, photodetectors combine the ability of batch processing and on-wafer testing with superior electro-optical performance. The large aperture size readily permits efficient coupling of light from a multi-mode fiber.

EMCORE has successfully developed 850 nm, 1310 nm and 1550 nm photodetectors to cover all speed and distance applications. In addition, 1x4 and 1x12 arrays of 850 nm photodetectors can be incorporated into EMCORE's optical transceiver subsystems. The addition of photodetector products completes our line of optical devices such that EMCORE can supply all internally produced optical devices to our subsystems products that include packaged components, transmitters, receivers, transceivers and transponders.

Optical Subsystems (Transmitters, Receivers, Transceivers and Transponders)

EMCORE's optical subsystems products are built using our internally produced optical devices. By adding more value beyond our optical devices, we can improve margins as well as overall revenue. Many of these subsystem products are defined through multi-source agreements (MSAs) that specify form, fit and function to guarantee wide availability and interoperability between vendors. EMCORE's strategy is to leverage our optical device expertise in order to provide the most cost-effective subsystems in key markets that do not necessarily compete with our optical device customers.

These subsystems are becoming quite intelligent with functions that retime and clean up the transmitted and received signals that pass through them. Many of these subsystems have been widely adopted in Ethernet, SONET, and Fibre Channel equipment. The most widely available is the XENPAK form factor (for more information see www.xenpak.org). In 2003, EMCORE has developed, both internally and through the Molex acquisition, several value added subsystems in the XENPAK form factor. These include the LX4 and CX4 products for short reach 10 Gb/s data communications.

EMCORE's subsystem product strategy is to differentiate through technology and cost effectiveness by leveraging our compound semiconductor expertise and the growing know-how in subsystem design and manufacturing. EMCORE's family of subsystem products, built upon our optical device expertise, includes:

| • | Head-end transmitters for CATV and FTTx applications based on 1550 nm laser technology; |

| • | Subscriber-end video receivers for CATV and FTTx applications based on 1310 nm and 1550 nm PIN detectors and video receive technology; |

11

| • | XENPAK transponders using CWDM and copper CX4 technology for the 10G Ethernet market; |

| • | 4- and 12-channel parallel optical transceiver modules for HPC or "Super Computing" markets and telecommunication switch applications based on 850 nm VCSEL and PIN array technology; and |

| • | 10G transmit and receive optical subassemblies for storage area networks. |

Photovoltaics

The world-wide satellite industry has seen substantial improvement in 2003, with awards to build new satellites increasing from five in 2002 to 17 thus far in 2003. In addition, the industry has seen consolidation into more financially stable institutions. As a result, we are seeing progress toward the satellite industry developing into a communications backbone for video, voice and data.

EMCORE serves the global communications market by providing advanced solar cell products and solar panels for application in the space industry. Compound semiconductor solar cells are used to power satellites because they are more resistant to radiation levels in space and convert substantially more power from light, therefore weighing less per unit of power than silicon-based solar cells. These characteristics increase satellite useful life, increase payload capacity and reduce launch costs.

A solar cell works as follows: the "photovoltaic effect" is the basic physical process through which a solar cell converts sunlight into electricity. Sunlight is composed of photons, or particles of solar energy. These photons contain various amounts of energy corresponding to the different wavelengths of the solar spectrum. When photons strike a solar cell, they may be reflected or absorbed, or they may pass right through the cell. Only the absorbed photons generate electricity. When this happens, the energy of the photon is transformed into an electric current. Special electrical properties of the solar cell provide the voltage needed to drive the current through an external load (such as a solar array for a spacecraft).

EMCORE designs and manufactures multi-junction compound semiconductor solar cells for commercial satellite applications in its facility in Albuquerque, New Mexico. This facility includes an automated manufacturing system that monitors production processes, uses electronic run cards and provides real-time production rates and yields for process engineering. EMCORE currently manufactures the most efficient and most reliable commercially available radiation resistant solar cell in the world, using an advanced triple-junction cell design and with an average beginning of life efficiency of 27.5%. Satellite success and corresponding revenue depend on power efficiency and the satellite's capacity to transmit data.

In March 2002, EMCORE acquired Tecstar, which provides covered interconnect solar cells (CICs) and solar panel lay-down services. This acquisition augments EMCORE's capability to penetrate the satellite communications market by providing EMCORE with the capacity to manufacture complete solar panels using EMCORE's solar cells, thereby enabling us to provide satellite manufacturers with proven integrated satellite power solutions that considerably improve satellite economics. Satellite manufacturers and solar array integrators can now rely on EMCORE as a single supply source that meets all of their satellite power needs with proven flight heritage. Furthermore, EMCORE obtained significant patents in this acquisition that will enable EMCORE to significantly improve the engineering and design of solar cell products. EMCORE will continue Tecstar's impressive flight heritage and solar component manufacturing expertise, which dates back to 1958 when the Vanguard satellite with Tecstar solar cells was launched. Tecstar's solar panel technology has flown on numerous successful satellite missions, including Lockheed Martin's Chinastar, Loral's Telstar satellite and Orbital Sciences' ORBCOMM Constellation. EMCORE is currently completing the process of qualifying its advanced solar cells with Tecstar's proven solar panel processes for Low Earth Orbits (LEO) and Geosynchronous Earth Orbits (GEO). To date, EMCORE has completed GEO Qualification for SS/Loral in support of the MT Sat-1R and we have completed LEO Qualification for Astrium in support of the CRYOSAT and for ABLE Engineering for the UltraFlex Array. The combination of Tecstar's demonstrated success with well-known space programs and EMCORE's solar cell technology should enable EMCORE to dramatically improve satellite economics. Through well-established partnerships with major satellite manufacturers and a proven qualification process, EMCORE believes it can play a vital role in the evolution of telecommunications and data communications around the world.

12

Recent Highlights:

| • | EchoStar VIII was successfully launched in August 2002. EchoStar VIII is the first high-power GEO satellite in orbit powered by EMCORE high-efficiency solar cells. |

| • | EchoStar IX also was successfully launched in September 2003 and is the second high-power GEO satellite in orbit powered by EMCORE high efficiency solar cells. |

EMCORE has recently begun active research and development in terrestrial solar cell applications. EMCORE is conducting a National Renewable Energy Laboratory funded effort to adapt our triple junction solar cell technology for the terrestrial photovoltaic market. Due to a higher device cost when compared to silicon solar cells, we are working with solar concentrator systems to lower the cost per watt generated by our multi-junction solar cells. Major terrestrial solar power manufacturers have expressed interest in incorporating EMCORE's terrestrial solar cell technology into their commercial products.

Electronic Materials and Devices

Electronic Materials

RF materials are compound semiconductor materials used in wireless communications. Compound semiconductor RF materials have a broader bandwidth and superior performance at higher frequencies than silicon-based materials. EMCORE currently produces 4-inch and 6-inch InGaP HBT and AlGaAs pHEMT materials including E-mode devices that are used for power amplifiers in GSM, TDMA and CDMA multiband wireless handsets. InGaP HBT materials provide higher linearity, higher power added efficiency as well as greater reliability than first generation AlGaAs HBT technologies. In addition, recent developments and transfers to production of enhancement mode pHEMT technologies have demonstrated their continued competitiveness for handset applications. EMCORE believes that its ability to produce high volumes of RF materials at a low cost will encourage their adoption in new applications and products.

EMCORE's Somerset, New Jersey manufacturing facility has seven TurboDisc MOCVD production systems, one GaN production system and two GaN Discovery systems dedicated to electronic materials production. EMCORE also equipped its wafer fabrication area with state of the art cassette to cassette characterization equipment.

Electronic Devices

MR sensors are compound semiconductor devices that possess sensing capabilities. MR sensors improve vehicle performance through more accurate control of engine and crank shaft timing, which allows for improved spark plug efficiency and reduced emissions. EMCORE sells MR sensors using technology licensed from General Motors.

HB-LED Joint Venture

HB-LEDs are solid-state compound semiconductor devices that emit light and are used in miniature packages in everyday applications such as indicator lights on automobiles, computers and other electronic equipment. HB-LEDs offer substantial advantages over small incandescent bulbs, including longer life, lower maintenance costs and energy consumption and smaller space requirements. Groups of HB-LEDs can make up single or full-color electronic displays. Presently, HB-LED chips are used for backlighting in applications such as wireless handsets, computer monitors and automotive dashboard lighting. In addition, they are used in consumer products and office equipment as indicator lighting, in full color displays, message advertising and informational signs, landscape lighting and traffic signals. By passing blue HB-LED light through certain conversion materials such as phosphors, or by using blue in combination with HB-LEDs of other appropriate colors, white light emission can be obtained.

HB-LEDs have the potential to significantly reduce overall U.S. lighting energy consumption. Energy savings to date from HB-LEDs have been estimated to exceed the power produced from one large electric power plant — more than 8 billion kilowatt-hours. If solid-state lighting achieves anticipated price and performance targets, over the next two decades U.S. lighting energy consumption could be reduced by over 30 percent. HB-LED traffic signals use only 10 percent of the electricity consumed by the

13

incandescent lamps they replace. Moreover, LED signals last several times longer, allowing for additional savings through reduced maintenance costs. HB-LEDs have also made inroads into mobile applications such as brake and signal lights on trucks, buses and automobiles. In 2002, an estimated 41 million gallons of gasoline and 142 million gallons of diesel fuel were saved because of HB-LED use on these vehicles. If our nation's entire fleet of automobiles, trucks and buses were converted to HB-LED lighting, an estimated 1.4 billion gallons of gasoline and 1.1 billion gallons of diesel fuel could have been saved. The information in this paragraph is based on published reports prepared by Navigant Consulting for the US Department of Energy.

As mentioned above, in January 1999, EMCORE and General Electric Lighting formed GELcore, a joint venture to develop and market HB-LED lighting products. Under the terms of the joint venture agreement, EMCORE has a 49% non-controlling interest in the joint venture. Both parties have agreed that this joint venture will be the exclusive vehicle for each party's participation in solid-state lighting. GELcore combines EMCORE's materials science and device design expertise with General Electric Lighting's brand name recognition, phosphor technology and extensive marketing and distribution capabilities. GELcore's current product line includes traffic lights, channel letters, flashlights and other signage and display products incorporating HB-LEDs. In the near term, GELcore expects to be deploying its HB-LED products in the automotive and general appliance markets. GELcore's long-term goal is to develop products to replace traditional lighting. In September 2000, GELcore acquired Ecolux, Inc., adding HB-LED signaling products to its growing line of LED products. EMCORE believes that Ecolux is currently receiving the majority of contracts for which it submits bids for the replacement of traditional traffic lights with HB-LEDs.

TurboDisc Systems Segment

As mentioned above, on November 3, 2003, EMCORE sold its TurboDisc systems business to Veeco. Revenues for the systems segment were derived primarily from sales of TurboDisc systems, as well as spare parts, services and related products. The sale of the TurboDisc business will allow management to focus on its communications-related product lines, including its CATV, telecommunications, data and storage, wireless, and photovoltaic products as well as the GELcore joint venture with GE concentrating on HB-LED technology.

Revenues by Product Line and Financial Results by Segment

The table below sets forth the revenues and percentage of total revenues attributable to each of EMCORE's product lines for each of the past three fiscal years.

| (in thousands) | ||||||||||||||||||||||||||

| Product Revenue | FY 2003 | % of revenue |

FY 2002 | % of revenue |

FY 2001 | %

of revenue |

||||||||||||||||||||

| Systems-related | $ | 52,681 | 46.6 | % | $ | 35,878 | 40.9 | % | $ | 131,141 | 71.0 | % | ||||||||||||||

| Components and subsystems related: | ||||||||||||||||||||||||||

| Photovoltaics | 18,196 | 16.1 | % | 23,621 | 26.9 | % | 20,206 | 10.9 | % | |||||||||||||||||

| Fiber Optics | 32,658 | 28.9 | % | 9,077 | 10.3 | % | 13,606 | 7.4 | % | |||||||||||||||||

| Electronic Materials and Devices | 9,571 | 8.4 | % | 19,196 | 21.9 | % | 19,661 | 10.7 | % | |||||||||||||||||

| Total revenues | $ | 113,106 | 100.0 | % | $ | 87,772 | 100.0 | % | $ | 184,614 | 100.0 | % | ||||||||||||||

See Items 7 and 8, beginning on page 35, for information on EMCORE's financial results by segment.

14

Government Research Contract Funding

EMCORE derives a portion of its revenue from funding of research contracts with the U.S. Government (Government). These contracts typically cover work performed from over several months up to several years. These contracts may be modified or terminated at the convenience of the Government and therefore, these programs may be subject to Government budgetary fluctuations. Government contracts generally provide that we may elect to retain title to inventions made in the course of research with the Government obtaining a non-exclusive license to practice such inventions for Government purposes. In fiscal 2003, 2002, and 2001, Government research contract funding represented 5%, 4% and 1% of total EMCORE revenue, respectively.

In June 2002, EMCORE signed a contract with Defense Advanced Research Projects Agency (DARPA) under which it will participate in the Department of Defense agency's mission to develop wide bandgap semiconductor-based high power, high frequency electronics for use in military applications based on EMCORE's GaN technology. The contract consists of a $3.0 million baseline project to be completed over an 18-month period and $1.0 million of additional work to be performed at the Government's option over a subsequent 10-month period. The Government has not yet exercised this option. EMCORE will recognize revenue to the extent of costs incurred plus the estimated gross profit as stipulated within the contract, based upon contract performance. EMCORE intends to use the technology developed in this and other Government contracts to commercialize products based on its wide-bandgap materials technology.

Customers

EMCORE works closely with its customers to design and develop process technology and material science expertise for use in production systems for its customers' end-use applications. EMCORE has leveraged its process and materials science knowledge base to manufacture a broad range of compound semiconductor wafers and devices. EMCORE's customer base includes many of the largest semiconductor, telecommunications, consumer goods and computer manufacturing companies in the world. In fiscal 2003, revenues from Cree, Inc., associated with our systems segment, represented 11.5% of our total revenue. No other customer accounted for over 10% of EMCORE's revenue.

EMCORE has generated a significant portion of its revenue from sales to customers outside the United States. The following chart contains a breakdown of EMCORE's consolidated revenues by geographic region:

| For the fiscal years ended September 30, | |||||||||||||||||||||||||||

| Region | 2003 | 2002 | 2001 | ||||||||||||||||||||||||

| Revenue | % of revenue | Revenue | % of revenue | Revenue | % of revenue | ||||||||||||||||||||||

| (in thousands) | |||||||||||||||||||||||||||

| United States | $ | 64,189 | 56.8 | % | $ | 58,844 | 67.0 | % | $ | 96,551 | 52.3 | % | |||||||||||||||

| Asia | 34,132 | 30.2 | % | 15,268 | 17.4 | % | 76,848 | 41.6 | % | ||||||||||||||||||

| Europe | 14,785 | 13.0 | % | 13,660 | 15.6 | % | 11,215 | 6.1 | % | ||||||||||||||||||

| TOTAL | $ | 113,106 | 100 | % | $ | 87,772 | 100 | % | $ | 184,614 | 100 | % | |||||||||||||||

In fiscal 2002, sales to Asia and North America declined dramatically because of a large decrease in capital spending by our customers and a consequent decrease in demand for our MOCVD systems. Sales to the United States include sales to Canada, which have not, historically, been material.

Marketing and Sales

EMCORE actively markets its products through its dedicated sales force, external sales agents, marketing staff, applications engineers, select advertising and participation at trade shows. Our customers work directly with our internal sales force, external sales agents and senior management. EMCORE's strategy is to use its dedicated sales force for marketing and selling to key accounts. EMCORE has plans to expand its external sales agents for increased coverage outside the U.S. and for specific product lines, such as Satcom, in the U.S.

15

To market and sell certain products in Japan and China, EMCORE relies on Hakuto Co., Ltd. Hakuto has marketed and serviced EMCORE's products since 1988 via six branch offices and owns approximately 4% of EMCORE's common stock. Until he retired in 2002, Shigeo Takayama, the President of Hakuto had also been a member of EMCORE's Board of Directors since 1997.

EMCORE uses Indus Corporation to market photovoltaic products in India, UR Group to market Optical products in Europe, BUPT and MilliTech as sales agent in China for CATV, optical components and Satcom products. EMCORE has an established distribution and value added reseller channel to sell its Satcom products worldwide.

In addition to EMCORE's five manufacturing facilities, it also maintains one domestic sales office located in Santa Clara, California.

While there are common technologies used by each product line, the customers and market segments are much more diverse. Each product line has a marketing and sales organization that can focus completely on the customer needs, the service required both before and after the order is received, as well as on the competitive threats each product and market segment faces. EMCORE's sales cycle for component and subsystem products is usually three months to in excess of a year, during which time EMCORE works closely with its customers to qualify its products in its customers' product lines. Accordingly, EMCORE is able to develop strategic, and therefore long lasting, customer relationships with products and services that are uniquely tailored to our customers' requirements.

Backlog

As of September 30, 2003, EMCORE had a backlog (not including our systems-segment backlog of $18.4 million) believed to be firm of approximately $33.1 million. This compares to a backlog of $19.3 million (exclusive of systems-segment backlog) as reported at the end of the prior year. Half of the increase in backlog was attributable to the Ortel acquisition. Historically, significant portions of our components and subsystems revenue have not been reported in backlog since our customers have reduced lead times. Many of our components and subsystems sales usually occur within the same month when the purchase order is received. The backlog does not include orders for products that have not met qualification specifications. We believe the entire backlog could be filled during fiscal 2004, however, especially given the current market environment, customers may delay shipment of certain orders. Backlog also could be adversely affected if customers unexpectedly cancel purchase orders accepted by us.

Manufacturing

EMCORE's operations include wafer fabrication, design and device production, solar panel engineering and assembly and fiber optic module design and manufacture. Many of EMCORE's manufacturing operations are computer monitored or controlled to enhance reliability and yield. EMCORE employs a strategy of minimizing ongoing capital investments while maximizing the variable nature of its cost structure. EMCORE maintains a commercially advantageous contract supply agreement with Veeco for MOCVD systems, components and spare parts. Where EMCORE can gain significant cost advantages while maintaining strict quality and intellectual property control, EMCORE outsources to Contract Manufacturers (CMs) the production of certain components and sub-assemblies. EMCORE's contract manufacturing supply chain is an integral part of enabling this strategy. EMCORE develops assembly and testing procedures and transfers these procedures to the CMs. The CMs must maintain quality and delivery systems as comprehensive as EMCORE and are continuously monitored for compliance. As of September 30, 2003, EMCORE had 447 employees involved in manufacturing. The location of and products manufactured at EMCORE's facilities are summarized below:

16

| Location | EMCORE product line | ||||||||||||||||||||||||||||||||||||||

| Somerset,

New Jersey (headquarters) |

• Electronic materials and devices (HBTs, pHEMTs and MR sensors) | ||||||||||||||||||||||||||||||||||||||

| Albuquerque, New

Mexico |

• Photovoltaics (solar cells) | ||||||||||||||||||||||||||||||||||||||

| • Fiber optics (VCSELs and fiber optic modules) | |||||||||||||||||||||||||||||||||||||||

| City of Industry, California | • Photovoltaics (CICs and solar panels) | ||||||||||||||||||||||||||||||||||||||

| Alhambra, California | • Fiber Optics (CATV/ FTTx, Lasers, Modules and Subsystems) | ||||||||||||||||||||||||||||||||||||||

| Downers Grove, Illinois | • Fiber Optics (10G Ethernet Fiber Optical Components) | ||||||||||||||||||||||||||||||||||||||

EMCORE has combined clean room area totaling approximately 60,000 square feet. Unlike silicon semiconductor technology, which could involve up to a 100-step manufacturing process, our electronic materials and devices products are manufactured in a four-part process: epitaxial deposition, fabrication, testing and packaging. The epitaxial deposition process represents the growth of thin layers of GaAs, GaN or other materials on a polished wafer, depending on the nature of the device under production. Following epitaxy, chips are fabricated in a clean room environment. The final steps involve testing and packaging prior to shipment to the customer or further integration into a module or subsystem within EMCORE's manufacturing infrastructure. The module and subsystem assembly and test processes within EMCORE's manufacturing infrastructure involves the design and implementation of production processes as well as the transfer of some of these processes to CMs. EMCORE maintains an internal capability to transfer and monitor the ongoing processes at all CMs.

The manufacturing process also involves extensive quality assurance systems and performance testing. All of EMCORE's facilities have acquired and maintain certification status for their quality management systems. The New Jersey facility, which is used by EMCORE's Electronic Materials and Devices group, is registered to ISO 9001+ QS 9000-1998. Both the New Mexico and California facilities, which are used by EMCORE's Photovoltaics and Fiber Optics groups, are registered to ISO 9001.

Sources of Raw Materials

Outside contractors and vendors are used to supply raw materials and standard components and to assemble portions of end subsystems, components and modules from EMCORE specifications. In certain cases, EMCORE depends on sole, or a limited number of, vendors of components and raw materials; however, EMCORE is continually reviewing efforts to mitigate risks. We generally do not carry significant inventories of any raw materials. EMCORE maintains inventories it believes are sufficient to meet its near term needs. Because we often do not account for a significant part of our vendors' business, we may not have access to sufficient capacity from these vendors in periods of high demand. EMCORE maintains ongoing communications with its vendors to try to ensure against interruptions in supply and has, to date, generally been able to obtain sufficient supplies in a timely manner. EMCORE implemented a vendor program to inspect quality and review suppliers and prices in order to standardize purchasing efficiencies and design requirements in order to maintain as low a cost of sales as possible. If we were to change any of our limited or sole source vendors, we could be required to re-qualify the new vendor. Re-qualification could prevent or delay product shipments that could negatively affect our results of operations. In addition, our reliance on these vendors may negatively affect our production if the components vary in quality or quantity. If we are unable to obtain timely deliveries of sufficient components of acceptable quality, or if the prices of components for which we do not have alternative sources increase, our business, financial condition, results of operations and cash flows could be materially and adversely affected.

Research and Development

The scope of EMCORE's business is in the areas of semiconductor processes and communication components and subsystems. EMCORE's research and development efforts have been sharply focused to maintain the technology leading position of various product lines and to grow into new product areas by leveraging the existing technology base and infrastructure.

17

The semiconductor industry is characterized by rapid changes in process technologies with increasing levels of functional integration. To maintain and improve its competitive position, EMCORE invests significant resources in research and development. Our efforts are focused on designing new proprietary processes and products, improving the performance of our existing materials, devices and modules, and reducing costs in the product manufacturing process. EMCORE has dedicated 23 MOCVD systems and five device fabrication facilities for both research and production that are capable of processing virtually all compound semiconductor materials and devices. Nine of those MOCVD systems and three device fabrication areas are dedicated fully to research and development efforts and are used by a staff of over 100 scientists, engineers, technicians and staff, 46 of which have a Ph.D. degree. The research and development staff utilizes x-ray, optical and electrical characterization equipment as well as device and module fabrication and testing that generates data rapidly, allowing for shortened development cycles and rapid customer response.

During fiscal years 2003, 2002 and 2001, EMCORE invested $22.2 million, $41.0 million and $53.4 million towards our product research and development activities. As part of the ongoing effort to cut costs, EMCORE implemented a program to focus research and development efforts on projects that can be expected to generate returns within one year. As a result, EMCORE has been able to reduce overall research and development costs without, we believe, jeopardizing future revenue opportunities. EMCORE believes that several research and development projects have the potential to greatly improve its competitive position and to drive its revenue growth in the next few years. Listed below are several examples:

| • | EMCORE is currently designing new products for the high-performance optical communications market. In fiber optics, EMCORE is the leader in the development of high-speed VCSELs. 10G VCSEL chips and packages have been successfully developed and released to production. These high-speed VCSELs can be produced as singlets or as arrays for higher bandwidth transceivers. Along with its VCSEL efforts, EMCORE has developed 850 nm and 1310 nm photodetector arrays, which operate at speeds of up to 10 Gb/s and are designed to work with both VCSELs and DFB or FP laser devices. |

| • | EMCORE has invested aggressively in the development of array transceiver and WDM products that capitalize on its VCSEL, DFB laser, FP laser and photodetector components. By manufacturing these components in-house, EMCORE is able to reduce the overall cost of the transceiver module. Through its acquisition of Alvesta, EMCORE has added specific know-how and intellectual property in the area of low-cost, short-reach, 10G optical and electrical modules for the enterprise and data center. Products in development are targeted to replace the costly and bulky copper interconnect solutions at 10G and above. |

| • | Through its acquisition of Ortel, EMCORE has entered a new sector of the optical communication market which includes CATV, FTTx and Satcom applications. Ortel brings a broad product base along with new products in development that extends the reach and reduces the cost of deployment of bandwidth on demand. Ortel's key compound semiconductor products include: 1310nm and 1550nm DFB lasers, 1310nm FP lasers, InGaAs PIN photodetectors, APDs and analog RF video receive technologies. These devices are available as packaged components or integrated within subsystems that include entire transmitter and receiver capabilities for head-end or subscriber-end applications. Cost reduction activities through design improvements and off-shore manufacturing will enable the Ortel division to continue to meet the growing demand for CATV and FTTx subsystems. |

| • | Through its acquisition of Molex, EMCORE can now offer an expanded portfolio of products that address the growing 10G Ethernet market. Specific technologies brought in through Molex include: CWDM, pluggable transponder design and high-speed serial optical transceiver design. These added products will enable EMCORE to offer the lowest-cost solutions for the central office and data center. By leveraging the 850 nm VCSEL technology and the 1310 nm DFB technologies internally available to EMCORE, these new pluggable 10G Ethernet products will be able to meet the performance and cost targets of the growing enterprise networking market. |

| • | Regarding photovoltaics, EMCORE has the lead in the satellite industry for high efficiency cells with routine shipments averaging 27.5%. In pre-production, many cells averaging greater than 28.5% have |

18

| been demonstrated. EMCORE believes that terrestrial compound solar cells used in concentrator systems could have potential to be a significant product for EMCORE. Using government research funding, EMCORE has demonstrated solar cells that function in a solar concentrator system at over 1000 suns. |

| • | For electronic materials, EMCORE has continued to develop advanced HBTs and p-HEMTs using AlGaAs and InGaP structures, working with key customers. Our customers are suppliers of power amplifiers for wireless handsets. |

| • | EMCORE has also been developing newer structures for electronic materials using GaN and AlGaN. These GaN FET devices have both military and commercial applications. EMCORE has government research contracts with DARPA for developing GaN epitaxy on SiC for high power RF applications, and with the Air Force for scaling reactor and growth processes to large area production. Leveraging advanced reactor design and process development, EMCORE has achieved excellent material results, with devices showing uniformity (<2%) and yields (>90%) similar to the more established GaAs production lines. Working with both industrial and university collaborators, including Rockwell Scientific, Northrop Grumman, TriQuint, Cornell University and the University of Illinois; EMCORE has demonstrated record power densities at 18GHz (6.7W/mm) and 40GHz (2.8W/mm). These government research programs are expected to continue for the next year with wafer volumes increasing as device development advances. In addition, EMCORE has significantly expanded commercial production of GaN HEMT epitaxial wafers on substrates up to 100mm in diameter. These materials have been well received in the marketplace, and commercial sales are expected to continue to grow over the next year. |

EMCORE also competes for research and development funds. In view of the high cost of development, EMCORE solicits research contracts that provide opportunities to enhance its core technology base and promote the commercialization of targeted EMCORE products. Internal research and development funding is used for product development for products to be released within 12 months and external funding is used for longer range research and development.

Intellectual Property and Licensing

EMCORE's success and competitive position in its product lines depends significantly on its ability to obtain intellectual property protection for its research and development efforts. EMCORE's strategy is to rely on both patents and trade secrets to protect its intellectual property. A patent is the grant of a property right, which allows its holder to exclude others from, among other things, selling the subject invention in, or importing such invention into, the jurisdiction that granted the patent. In the United States, patents expire twenty years from the date of application. Through recent acquisitions, EMCORE has enriched its patent portfolio significantly. After giving effect to the transfer of system-related patents (19 patents) to Veeco, EMCORE has 22 U.S. patents and four foreign patents, and others are either pending (99 patent applications filed) or under in-house review (20 disclosures and draft patent applications). Included in these amounts are patents and patent applications acquired from Ortel in January 2003. In addition, through the Ortel acquisition, EMCORE obtained a royalty free license to approximately 5,700 patents and patent applications in the Agere Corporation portfolio, many of which originate with ATT Bell Laboratories.

The U.S. patents will expire between 2009 and 2022. These patents and patent applications claim material aspects of current or planned commercial versions of EMCORE's wafers, devices and modules. In addition, EMCORE actively markets and licenses its intellectual property. Some recently issued patents and filed patent applications include:

| • | U.S. Patent No. 6,583,902 granted on June 24, 2003 entitled "Modular Fiber Optic Transceiver" covers designs of parallel fiber optical modules. EMCORE purchased this patent through the Alvesta acquisition. |

| • | U.S. Patent No. 6,404,125 granted on June 11, 2002 entitled "Methold and Apparatus for Performing Wavelength Conversion Using Phosphors with Light Emitting Diodes" covers methods for creating white light from a single color LED, such as a blue or UV light source. |

19

| • | U.S. Patent No. 6,600,100 granted on July 29, 2003 entitled "Solar Cell Having an Integral Monolithically Grown Bypass Diode" is another patent that has been added to our blocking patent portfolio for a product that is likely to become the majority of our solar cell business. |

EMCORE relies on trade secrets to protect its intellectual property when it believes publishing patents would make it easier for others to reverse engineer EMCORE's proprietary processes. A "trade secret" is information that has value to the extent it is not generally known, not readily ascertainable by others through legitimate means and protected in a way that maintains its secrecy. Reliance on trade secrets is only an effective business practice insofar as trade secrets remain undisclosed and a proprietary product or process is not reverse engineered or independently developed. In order to protect its trade secrets, EMCORE takes certain measures to ensure their secrecy, such as partitioning the non-essential flow of information between its different groups and executing non-disclosure agreements with its employees, joint venture partners, customers and suppliers.

As is typical in our industry, we have, from time to time, received, and may continue to receive in the future, letters from third parties, asserting patent rights or other intellectual property rights against certain of our products and processes. None of the claims to date has resulted in the commencement of any litigation against us. From time to time, EMCORE licenses from third parties, technology and patent rights to manufacture and sell its products. For example, EMCORE is a licensee of certain VCSEL technology and associated patent rights owned by Sandia Corporation. The Sandia license grants EMCORE:

| • | non-exclusive rights to develop, manufacture and sell products containing Sandia VCSEL technologies under five U.S. patents that expire between 2007 and 2015; and |

| • | non-exclusive rights to employ a proprietary oxidation fabrication method in the manufacture of VCSEL products under a sixth U.S. patent that expires in 2014. EMCORE's success and competitive position as a producer of VCSEL products depends on the continuation of its rights under the Sandia license, the scope and duration of those rights and the ability of Sandia to protect its proprietary interests in the underlying technology and patents. |

In connection with the sale of TurboDisc, EMCORE retained a license to all system-related technology. EMCORE intends to use the license to further optimize the performance of its own reactors and develop improvements to its hardware that will increase yields on existing products and enable the fabrication of advanced, wide bandgap materials.

Environmental Regulations