UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

—————————

FORM 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2019

or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___ to ___

Commission File Number 001-36632

EMCORE Corporation

(Exact name of registrant as specified in its charter)

New Jersey (State or other jurisdiction of incorporation or organization) | 22-2746503 (I.R.S. Employer Identification No.) |

2015 W. Chestnut Street, Alhambra, California, 91803 (Address of principal executive offices) (Zip Code) | |

Registrant's telephone number, including area code: (626) 293-3400

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

Common stock, no par value | EMKR | The Nasdaq Stock Market LLC (Nasdaq Global Market) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act ¨ Yes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. ¨ Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þ Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). þ Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definition of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. ¨ Large accelerated filer þ Accelerated filer ¨ Non-accelerated filer þ Smaller reporting company ¨ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes þ No

The aggregate market value of our common stock held by non-affiliates as of March 29, 2019 (the last business day of our most recently completed second fiscal quarter) was approximately $98.4 million, based on the closing sale price of $3.65 per share of common stock as reported on the Nasdaq Global Market. For purposes of this disclosure, shares of common stock held by officers and directors and by each person known by us to own 10% or more of our outstanding common stock have been excluded. This determination of affiliate status is not necessarily a conclusive determination for any other purpose.

As of December 6, 2019, the number of shares outstanding of our no par value common stock totaled 28,904,853.

DOCUMENTS INCORPORATED BY REFERENCE

In accordance with General Instruction G(3) of Form 10-K, certain information required by Part III hereof will either be incorporated into this Form 10-K by reference to our Definitive Proxy Statement for our Annual Meeting of Shareholders filed within 120 days of September 30, 2019 or will be included in an amendment to this Form 10-K filed within 120 days of September 30, 2019.

CAUTIONARY STATEMENT

REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on our current expectations and projections about future events and financial trends affecting the financial condition of our business. Such forward-looking statements include, in particular, projections about our future results included in our Exchange Act reports and statements about our plans, strategies, business prospects, changes and trends in our business and the markets in which we operate. These forward-looking statements may be identified by the use of terms and phrases such as “anticipates,” “believes,” “can,” “could,” “estimates,” “expects,” “forecasts,” “intends,” “may,” “plans,” “projects,” “should,” “targets,” “will,” “would,” and similar expressions or variations of these terms and similar phrases. Additionally, statements concerning future matters such as our expected liquidity, development of new products, enhancements or technologies, sales levels, expense levels, expectations regarding the outcome of legal proceedings

and other statements regarding matters that are not historical are forward-looking statements. Management cautions that these forward-looking statements relate to future events or our future financial performance and are subject to business, economic, and other risks and uncertainties, both known and unknown, that may cause actual results, levels of activity, performance, or achievements of our business or our industry to be materially different from those expressed or implied by any forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include without limitation the following: (a) the rapidly evolving markets for the Company's products and uncertainty regarding the development of these markets; (b) the Company's historical dependence on sales to a limited number of customers and fluctuations in the mix of products and customers in any period; (c) delays and other difficulties in commercializing new products; (d) the failure of new products: (i) to perform as expected without material defects, (ii) to be manufactured at acceptable volumes, yields, and cost, (iii) to be qualified and accepted by our customers, and (iv) to successfully compete with products offered by our competitors; (e) uncertainties concerning the availability and cost of commodity materials and specialized product components that we do not make internally; (f) actions by competitors; (g) risks and uncertainties related to applicable laws and regulations, including the impact of changes to applicable tax laws and tariff regulations; (h) acquisition-related risks, including that (i) the revenues and net operating results obtained from the Systron Donner Inertial, Inc. ("SDI") business may not meet our expectations, (ii) the costs and cash expenditures for integration of the SDI business operations may be higher than expected, (iii) there could be losses and liabilities arising from the acquisition of SDI that we will not be able to recover from any source, and (iv) we may not realize sufficient scale in our navigation systems product line from the SDI acquisition and will need to take additional steps, including making additional acquisitions, to achieve our growth objectives for this product line; (i) risks related to our ability to obtain capital; (j) risks related to the transition of certain of our manufacturing operations from our Beijing facility to a contract manufacturer’s facility; and (k) other risks and uncertainties discussed in Part I, Item 1A, Risk Factors in this Annual Report as well as those discussed elsewhere in this Annual Report, as such risk factors may be amended, supplemented or superseded from time to time by our subsequent periodic reports we file with the Securities and Exchange Commission (“SEC”). These cautionary statements apply to all forward-looking statements wherever they appear in this Annual Report.

Forward-looking statements are based on certain assumptions and analysis made in light of our experience and perception of historical trends, current conditions and expected future developments as well as other factors that we believe are appropriate under the circumstances. While these statements represent our judgment on what the future may hold, and we believe these judgments are reasonable, these statements are not guarantees of any events or financial results. All forward-looking statements in this Annual Report are made as of the date hereof, based on information available to us as of the date hereof, and subsequent facts or circumstances may contradict, obviate, undermine, or otherwise fail to support or substantiate such statements. We caution you not to rely on these statements without also considering the risks and uncertainties associated with these statements and our business that are addressed in this Annual Report on Form 10-K. Certain information included in this Annual Report may supersede or supplement forward-looking statements in our other reports filed with the SEC. We assume no obligation to update any forward-looking statement to conform such statements to actual results or to changes in our expectations, except as required by applicable law or regulation.

EMCORE Corporation

FORM 10-K

For the Fiscal Year ended September 30, 2019

TABLE OF CONTENTS

Page | |||

4

PART I.

Item 1. Business

Company Overview

EMCORE Corporation, together with its subsidiaries (referred to herein as the “Company,” “we,” “our,” or “EMCORE”), was established in 1984 as a New Jersey corporation. The Company became publicly traded in 1997 and is listed on the Nasdaq Stock Exchange under the ticker symbol EMKR. EMCORE is a leading provider of sensors for navigation in the Aerospace and Defense market as well as a manufacturer of lasers and optical subsystems for use in the cable TV industry.

EMCORE pioneered the linear fiber optic transmission technology that enabled the world’s first delivery of Cable TV directly on fiber, and today is a leading provider of advanced Mixed-Signal Optics products serving the broadband communications and Aerospace and Defense markets. The Mixed-Signal Optics technology at the heart of our broadband communications products is shared with our fiber optic gyros and inertial sensors to provide the aerospace and defense markets with state-of-the-art navigations systems technology. With the acquisition of Systron Donner Inertial, Inc. (“SDI”), a navigation systems provider with a scalable, chip-based platform for higher volume gyro applications utilizing Quartz MEMS technology, in June of 2019, EMCORE further expanded its portfolio of gyros and inertial sensors with SDI’s quartz MEMS gyro and accelerometer technology.

EMCORE has fully vertically-integrated manufacturing capability through our Indium Phosphide (“InP”) compound semiconductor wafer fabrication facility at our headquarters in Alhambra, CA, and through our quartz processing and sensor manufacturing facility in Concord, CA. These facilities support EMCORE’s vertically-integrated manufacturing strategy for quartz and fiber optic gyro products, for Navigation systems, and for our chip, laser, transmitter, and receiver products for broadband applications.

For the fiscal year ended September 30, 2019, we had one reporting segment, comprised of three product lines: Navigation Systems, Broadband and Chip Devices. Please see our consolidated financial statements and notes included in this Annual Report for financial information regarding this segment.

For the fiscal year ending September 30, 2020, as a result of the acquisition of SDI and the increased size and growth expectations of our aerospace and defense business, we expect that we will have two reporting segments, Aerospace and Defense, and Broadband. Aerospace and Defense will be comprised of two product lines: (i) Navigation and Inertial Sensing, and (ii) Defense Optoelectronics. The Broadband segment will be comprised of three product lines: (i) Cable TV Lasers and Transmitters, (ii) Chip Devices, and (iii) Other. Due to a shift in customer base, the previously existing Satellite/Microwave Communications product line has been renamed “Defense Optoelectronics”.

This reporting change, detailing information for these two segments, will go into effect when EMCORE releases our results of operations for the period ending December 31, 2019.

EMCORE’s headquarters and principal executive offices are located at 2015 W. Chestnut Avenue, Alhambra, California, 91803 and our main telephone number is (626) 293-3400. For specific information about us, our products or the markets we serve, please visit our website at http://www.emcore.com. The information contained in or linked to our website is not a part of, nor incorporated by reference into, this Annual Report on Form 10-K or a part of any other report or filing with the Securities and Exchange Commission (the “SEC”).

We are subject to the information requirements of the Securities Exchange Act of 1934 (the “Exchange Act”). We file periodic reports, current reports, proxy statements, and other information with the SEC. The SEC maintains a website at http://www.sec.gov that contains all of our information that has been filed or furnished electronically with the SEC. We make available free of charge on our website a link to our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable, after such material is electronically filed with, or furnished to, the SEC.

5

Overview of Our Industry and Markets We Serve

InP compound semiconductor-based products provide the foundation of components, subsystems, and systems used in a broad range of technology markets. Compound semiconductor materials can provide electrical or electro-optical functions, such as emitting optical communications signals and detecting optical communications signals.

Specifically, within our Fiber Optics reporting segment, our Broadband products serve the Cable TV (“CATV”), Satellite Communications and Wireless markets; our Chip products serve the Telecommunications, Fiber-To-The-Premises (“FTTP”), Long-Term Evolution (“LTE”) and Data Center markets; and our Navigation Systems products primarily serve the Aerospace and Defense markets.

Navigation and Inertial Sensing Product Line

EMCORE, through our vertically-integrated infrastructure, has been able to adapt the same technologies, chip designs, and production assets applicable to our CATV products to the development of state-of-the-art Fiber Optic Gyroscopes (“FOG”) that have broad application within the aerospace and defense markets for land, sea, air and space navigation. This gives EMCORE the ability to leverage our high-volume infrastructure for lower volume, higher value-added product. EMCORE has expanded its FOG-based product line to include Inertial Measurement Units (“IMU or IMUs”) and Inertial Navigation Systems (“INS”) that provide superior Size, Weight and Power (“SWaP”) compared to competing or legacy systems. In June of 2019, EMCORE added the SDI series of Quartz MEMS (“QMEMS”) gyros and IMU products to our portfolio, expanding EMCORE’s portfolio to better address high volume markets and taking advantage of EMCORE’s core wafer fabrication and processing capabilities to further improve upon SDI’s base technology platforms.

To the extent sales of our navigation system products are related to U.S. government contracts or subcontracts, this portion of the business may be subject to renegotiation of profits or termination of contracts or subcontracts at the election of the U.S. government or an agency thereof.

• | Fiber Optic Gyroscope Products - EMCORE’s FOG program has received multiple U.S. patents and has been qualified for several key military programs for applications including Unmanned Aerial Systems (“UAS”), line-of-site stabilization, aviation and aeronautics. All EMCORE FOGs feature advanced optics with only three components for simplified assembly along with Digital Signal Processing (“DSP”) or Field Programmable Gate Array (“FPGA”) for higher accuracy, lower noise and greater efficiency. The integrated DSP or FGPA also improves optical drift stability and enables higher linearity and greater environmental flexibility. EMCORE’s FOG products range from tactical to navigational grade gyros where the critical specifications for fiber length, Angle Random Walk (“ARW”) and drift rate improves through the product line to provide customers greater flexibility in choosing the performance level that best meets their application. |

• | Quartz MEMS Gyroscope Products - EMCORE’s Systron Donner Inertial brand supplies the world’s highest performance MEMS Inertial Sensors & Systems. Our quartz MEMS Gyroscopes, Accelerometers, Inertial Measurement Units and GPS/INS products deliver a clear, continuously improving Size, Weight, Power, and Cost (“SWaPC”) advantages over alternative technologies. With more than 50 years of extensive experience EMCORE is continuously developing leading-edge disciplines with new innovative breakthrough products, which are enabling advanced performance capabilities in mission critical applications worldwide. |

6

Systron Donner Inertial products have no moving parts, no friction, no known modes of wear out, and require no recalibration or rebuilding. They deliver industry-leading reliability under the most demanding conditions through dedicated engineering technology and manufacturing operations excellence, and AS9100 Aerospace Quality System Certification. EMCORE’s QMEMS products provide precision system solutions and establish higher standards for price/performance characteristics across guidance, navigation, control, pointing and stabilization applications in commercial and military aircraft, unmanned autonomous vehicles, land vehicles, precision guided weapons, industrial and marine platforms.

• | FOG-Based Inertial Measurement Units and Navigation Systems Products - EMCORE’s FOG-based MU and INS systems provide superior SWaP compared to competing systems. Our products provide customers the flexibility to choose options from straightforward IMU operation to full navigation and are higher performance form, fit and function replacements for other IMUs and legacy systems. EMCORE’s FOG-based IMUs and INS products deliver high-precision with up to five-times better performance than competing units in compact, portable form-factors that provide standalone aircraft grade navigator performance at one-third the size of competing systems. |

7

Defense Optoelectronics Product Line (Formerly Satellite/Microwave Communications Products)

Satellite/Microwave Communications Products - EMCORE has an established history as a pioneer of innovative Radio Frequencey (“RF”) over fiber solutions for high-performance fiber optic links in the terrestrial portion of satellite communications networks. EMCORE’s satellite/microwave band components and complete systems transport an ultra-broadband frequency range including IF, L, S, C, X, DBS, Ku, K, Ka, and Ultra-Wideband signal transport. A wide range of high-dynamic-range applications are supported including satellite antenna remoting and signal distribution, inter- and intra-facility links, site diversity systems, high-performance supertrunking links, electronic warfare systems and radar testing. EMCORE’s complete line of satellite and microwave components, subassemblies and systems eliminate the distance limitations of copper-based coaxial systems. Our rack-mount Optiva Platform RF & Microwave Fiber Optic Transport System features a wide range of Simple Network Management Protocol (“SNMP”) managed fiber optic transmitters, receivers, optical amplifiers, RF and optical switches, passive devices and Ethernet products that provide high-performance fiber optic transmission between satellite hub equipment and antenna dishes. EMCORE also offers a series of ruggedized microwave flange-mount transmitters, receivers and optical delay line products that meet the reliability and durability requirements of the U.S. government and defense markets. These products are tailored to the requirements of higher frequency applications such as microwave antenna signal distribution, electronic warfare systems and radar system calibration and testing. They provide our customers with high frequency, dynamic range, compact form-factors, and extreme temperature, shock and vibration tolerance. To the extent sales of our satellite/microwave communications products are related to U.S. government contracts or subcontracts, this portion of the business may be subject to renegotiation of profits or termination of contracts or subcontracts at the election of the U.S. government or an agency thereof.

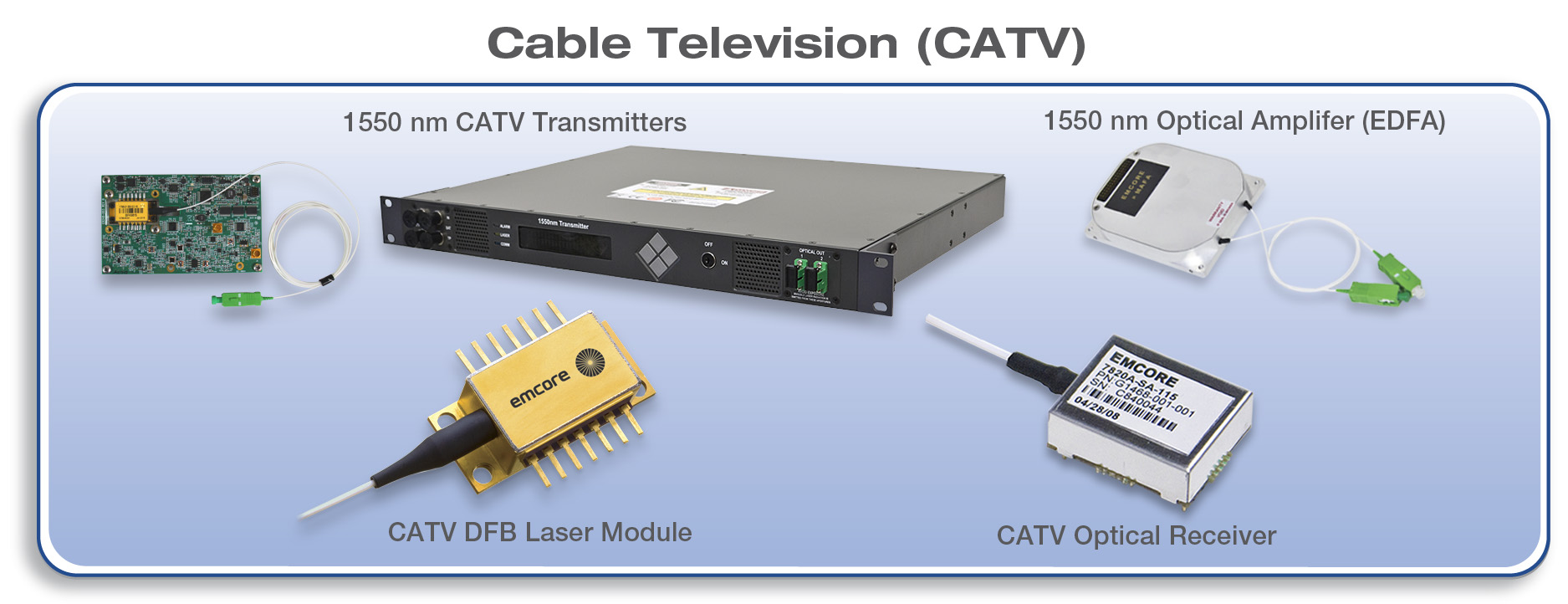

Cable TV Lasers and Transmitters Product Line

EMCORE is an established market leader in providing RF over fiber products for the CATV industry. Our products enable cable systems providers to increase data transmission distance, speed and bandwidth in Hybrid Fiber Coaxial (“HFC”) networks, with lower noise and power consumption. This empowers cable service operators to meet the growing demand for high-speed Internet, HDTV, Ultra HDTV, 4K, video streaming and other advanced services. Our CATV products include forward and return-path analog lasers, receivers, photodetectors and subassembly components; analog and digital fiber-optic transmitters, Quadrature Amplitude Modulation (“QAM”) transmitters, optical switches and CATV fiber amplifiers.

8

EMCORE’s latest series of CATV transmitters feature the Company’s breakthrough Linear Externally Modulated Laser (“L-EML”) technology that enables long distance optical link performance approaching traditional lithium niobate-based externally-modulated transmitters, but is more cost-effective and far exceeds the performance of Distributed Feedback (“DFB”) laser-based systems. EMCORE’s CATV transmitter products are offered on an OEM and ODM basis for integration into complete CATV transmission systems. The Company also offers its own branded line of EMCORE Medallion series rack-mount CATV transmitters, optical switches and fiber amplifiers. EMCORE’s Medallion series products include DOCSIS 3.1, 1550 nm externally-modulated transmitters, 1550 nm directly-modulated transmitters, optical A/B switches, and 1RU and 2RU rack-mount CATV fiber amplifiers. EMCORE’s Medallion series transmitters, optical switches and fiber amplifiers, in conjunction with EMCORE’s components and Radio Frequency over Glass (“RFoG”) products, comprise a complete end-to-end CATV system.

Chip Devices Product Line

Telecommunications companies throughout the world have been extending their Passive Optical Network (“PON”) infrastructure to business, enterprise and residential customers for several years. Since the sale of the Company’s telecom module products in 2015, EMCORE has supported this market through commercialization of products developed in our InP wafer fab to become a merchant supplier of high-performance chip devices to the Telecom industry. EMCORE’s semiconductor wafer fabrication facility features Metal-Organic Chemical Vapor Deposition (“MOCVD”) reactors for 2" or 3" wafer processing for InP-based devices including high-power gain chips, laser chips, Avalanche Photodiode (“APD”) and P-type Intrinsic N-type (“PIN”) photodetector chips. Our technical team has expertise in device design, epitaxial growth, wafer processing, device characterization, and Chip-On-Block (“COB”), TO-Can and Optical Sub-Assembly (“OSA”) from development through manufacturing.

• | High-Power Gain Chips Products - EMCORE, through our previous experience in the Telecom tunable module market, has design and engineering expertise in development and manufacturing of high-power gain chips for tunable lasers and transceivers utilized in coherent DWDM optical transmission systems. |

• | Photodiode Products - In addition to EMCORE’s offering of GPON and gain chip products, the Company also has an extensive offering of photodiodes for use in Telecommunications and Datacenter applications. These products include (but are not limited to) 2.5G and 10G APD top and bottom illuminated chips and COB, along with 10G PIN photodiode chips, with additional products in development. |

• | GPON Fiber-To-The-Premises (FTTP) and Data Center Chip Products - EMCORE’s chip devices portfolio is continually developing to support the latest advances in PON including GPON, 10G-EPON, XG-PON, XGS-PON, along with 4G LTE and data center applications. The Company’s laser chip devices offering includes 2.5G and 10G PON DFB and 10G Fabry-Perot laser chips. Wavelengths supported include 1270, 1290, 1310, 1330, 1490, 1550 and 1610 nm. |

Other Optical Product Line

The Other Optical Product Line is comprised of lasers and subsystems sold into a variety of applications, including wireless, distributed sensing, and Light Detecting and Ranging. (“LiDAR”).

9

• | Wireless Communications Products - The increasing dependence on wireless access for social media, text, email, uploading and downloading of apps, music, videos and photos has created greater demand for deployment of cost-effective, high-performance, integrated wireless Distributed Antenna System (“DAS”) networks. Wireless systems providers are building systems in subway tunnels, stadiums, hotels, high-speed trains and cruise ships. EMCORE has developed highly linear fiber optic products that are optimized for wireless applications which we believe integrate extremely well into these systems. They enhance bandwidth and linearity to enable the delivery of consistent, reliable signals in areas where interference is high or signals are weak. EMCORE’s products for wireless applications include DFB lasers and optical receivers specifically designed for wireless networks, 3 GHz and 6.5 GHz fiber optic links for cellular backhaul, 4G LTE and DAS. |

• | Laser, Receiver and Photodetector Component Products - We are a leading provider of optical components including lasers, receivers and photodetectors (also called “photodiodes”). Our products include CWDM (“Coarse Wavelength Division Multiplexing”) and DWDM (“Dense Wavelength Division Multiplexing”), 1310 nm and 1550 nm DFB lasers and optical receivers optimized for CATV, DOCSIS (Data Over Cable Service Interface Specification) 3.1 and wireless applications. In addition, we offer narrow linewidth 1310 and 1550 nm DFB lasers optimized for LiDAR and distributed sensing applications. Form-factors for laser products include 14-pin butterfly and coaxial TO-Can. In addition, we offer broadband photodiodes used in forward-and return-path broadband and FTTP applications. EMCORE’s component products to the global fiber optics industry leverage the benefits of our vertically-integrated infrastructure, low-cost manufacturing and early access to newly developed internally-produced components. |

Customers

Our major customers include: Cisco Systems Inc., Commscope Holding Company, Inc. and Raytheon Company and their respective affiliates. In the fiscal year ended September 30, 2019, Cisco Systems Inc., Commscope Holding Company, Inc. and Raytheon Company and their respective affiliates each represented greater than 10% of our consolidated revenue. See Note 15 - Geographical Information in the notes to our consolidated financial statements for additional information about our significant customers.

10

Strategic Plan

Strategy and Alternatives Committee of the Board of Directors

In addition to organic growth and development of our existing Fiber Optics business, we intend to pursue other strategies to enhance shareholder value. The Strategy and Alternatives Committee of the Company's Board of Directors (the "Strategy Committee"), which was established in December 2013, is charged with overseeing the Company’s strategic plan and evaluating strategic opportunities and alternatives available to the Company, including potential mergers, acquisitions, divestitures and other key strategic transactions outside the ordinary course of the Company’s business. Accordingly, the Strategy Committee may from time to time consider strategic opportunities to enhance shareholder value, which may include, at various times depending on the circumstances, acquisitions, investments in joint ventures, partnerships, and other strategic alternatives, such as dispositions, reorganizations, recapitalizations or other similar transactions, the repurchase of shares of our outstanding common stock or payment of dividends to our shareholders. The Strategy Committee may engage financial and other advisors to assist it in doing so. Accordingly, the Strategy Committee and our management may from time to time be engaged in evaluating potential strategic opportunities and may enter into definitive agreements with respect to such transactions or other strategic alternatives. However, there is no assurance that the Strategy Committee will identify further strategic opportunities that the Company will determine to pursue, or that the consideration of any such opportunity would result in the completion of a strategic transaction. The Strategy Committee met five (5) times during the fiscal year ended September 30, 2019.

Acquisition of Systron Donner Inertial, Inc.

On June 7, 2019, the Company acquired SDI, a private-equity backed navigation systems provider with a scalable, chip-based platform for higher volume gyro applications utilizing QMEMS technology. The total purchase price was approximately $25.0 million, consisting of (i) approximately $22.0 million in cash after working capital adjutments and (ii) the issuance of 811 thousand shares of common stock with an aggregate value of approximately $3.0 million as of the closing date.

Following the closing, we began integrating SDI into our Navigation and Inertial Sensing product line and have included the financial results of SDI in our condensed consolidated financial statements beginning on the acquisition date. Net revenue and net loss of SDI from the acquisition date through September 30, 2019 of $9.8 million and $0.6 million, respectively, is included in our consolidated statements of operations and comprehensive (loss) income for the fiscal year ended September 30, 2019.

Sources of Raw Materials

We depend on a limited number of suppliers for certain raw materials, components, and equipment used in our products, though no single supplier of raw materials or components accounts for more than 10% of our aggregate consolidated cost of goods sold. We continually review our supplier relationships to mitigate risks and lower costs, especially where we depend on one or two suppliers for critical components or raw materials. While maintaining inventories that we believe are sufficient to meet our near-term needs, we strive not to carry significant inventories of raw materials. Accordingly, we maintain ongoing communications with our suppliers in order to prevent any interruptions in supply, and have implemented a supply-chain management program to maintain quality and lower purchase prices through standardized purchasing efficiencies and design requirements. To date, we generally have been able to obtain sufficient quantities of critical supplies in a timely manner.

We are subject to rules promulgated by the SEC pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act regarding the use of "conflict minerals". These rules have imposed and will continue to impose additional costs and may introduce new risks related to our ability to verify the origin of any "conflict minerals" used in our products.

11

Manufacturing

We utilize MOCVD (metal-organic chemical vapor deposition) systems that are capable of processing virtually all compound semiconductor-based materials. Our operations include wafer fabrication, device design and production and fiber optic module, subsystem and system design and manufacture. Many of our manufacturing operations are computer monitored or controlled to enhance production output and statistical control. We employ a strategy of minimizing ongoing capital investments, while maximizing the variable nature of our cost structure. We maintain supply agreements with key suppliers. Where we can gain cost advantages while maintaining quality and intellectual property control, we outsource the production of certain products, subsystems, components, and subassemblies to contract manufacturers located overseas. Our contract manufacturers maintain comprehensive quality assurance and delivery systems, and we continuously monitor them for compliance.

Our various manufacturing processes involve extensive quality assurance systems and performance testing. Our facilities have acquired and maintain certification status for their quality management systems. Our manufacturing facilities located in Alhambra, California; and Beijing, China are registered to ISO 9001 standards. Our manufacturing facility located in Concord, California is registered to AS 9100 standards.

As part of the effort to better streamline operations and move to a variable cost model with respect to our Cable TV Lasers and Transmitters product line, on October 25, 2019, the Company entered into an Asset Purchase Agreement (the “Purchase Agreement”) with Hytera Communications (Hong Kong) Company Limited, a limited liability company incorporated in Hong Kong (“Hytera HK”), and Shenzhen Hytera Communications Co., Ltd., a corporation formed under the laws of the P.R.C. (“Shenzhen Hytera”, and together with Hytera HK, the “Buyers”), pursuant to which the Buyers agreed to purchase from EMCORE certain Cable TV Laser and Transmitter catv module and transmitter manufacturing equipment (the “Equipment”) owned by EMCORE and currently located at the manufacturing facility of EMCORE’s wholly-owned subsidiary, EMCORE Optoelectronics (Beijing) Co, Ltd., a corporation formed under the laws of the P.R.C., for an aggregate purchase price of approximately $5.54 million. The Equipment will be transferred to the Buyers in multiple closings, the last of which is expected to occur during the quarter ending March 31, 2020. Concurrently with entry into the Purchase Agreement, EMCORE entered into a Contract Manufacturing Agreement (the “Manufacturing Agreement”), dated as of October 25, 2019, with the Buyers pursuant to which the Buyers agreed to manufacture certain catv module and transmitter products for EMCORE from a manufacturing facility located in Thailand for an initial five year term at product prices agreed to between the parties. These manufacturing activities are expected to commence during the fiscal year ending September 30, 2020.

Sales and Marketing

We sell our products worldwide through our direct sales force, application engineers, third party sales representatives and distributors. Our sales force communicates with our customers' engineering, manufacturing, and purchasing personnel to provide optimized customer solutions through product design, qualifications, performance, and price. Our strategy is to use our direct sales force to sell to original equipment manufacturers and key accounts and to expand our use of distribution partners for increased coverage in both international markets and certain domestic segments.

Throughout our sales cycle, we work closely with our customers to qualify our products into their product lines and platforms. As a result, we develop strategic and long-lasting customer relationships with products and services that are tailored to our customers' requirements. We focus our marketing communication efforts on increasing brand awareness, communicating our technologies' advantages, and generating leads for our sales force. We use a variety of marketing methods, including our website, participation at trade shows, and selective advertising to achieve these goals.

Externally, our marketing group works with customers to define requirements, characterize market trends, define new product development activities, identify cost reduction initiatives, and manage new product introductions. Internally, our marketing group communicates and manages customer requirements with the goal of ensuring that our product development activities are aligned with our customers' needs. These product development activities allow our marketing group to manage new product introductions and market trends. See Note 15 - Geographical Information in the notes to the consolidated financial statements for disclosures related to geographic revenue and significant customers.

12

Research and Development

Our research and development efforts have been focused on maintaining our technological competitive edge by working to improve the quality and features of our product lines. We are also making investments to expand our existing technology and infrastructure in an effort to develop new products and production technology that we can use to expand into new markets. Our industry is characterized by rapid changes in process technologies with increasing levels of functional integration. Our efforts are focused on designing new proprietary processes and products, on improving the performance of our existing materials, components, and subsystems, and on reducing costs in the product manufacturing process.

As part of the ongoing effort to cut costs, many of our projects have focused on developing lower cost versions of our existing products. In view of the high cost of development, we solicit research contracts that provide opportunities to enhance our core technology base and promote the commercialization of targeted products. Generally, internal research and development funding is used for the development of products that will be released within twelve months and external funding is used for long-term research and development efforts.

We believe that in order to remain competitive, we must invest significant financial resources in developing new product features and enhancements and in maintaining customer satisfaction worldwide. Research and development expense was $19.4 million, $15.4 million and $12.5 million for the fiscal years ended September 30, 2019, 2018 and 2017, respectively. As a percentage of revenue, research and development expenses were 22.3%, 18.0% and 10.2% for the fiscal years ended September 30, 2019, 2018 and 2017, respectively. Our research and development expense consists primarily of compensation expense including non-cash stock-based compensation expense, as well as engineering and prototype costs, depreciation expense, and other overhead expenses, as they relate to the design, development, and testing of our products. These costs are expensed as incurred.

Intellectual Property and Licensing

We protect our proprietary technology by applying for patents, where appropriate, and in other cases by preserving the technology, related know-how, and information as trade secrets. The success and competitive advantage enjoyed by our product lines depends heavily on our ability to obtain intellectual property protection for our proprietary technologies. We also acquire, through license grants or assignments, rights to patents on inventions originally developed by others. As of September 30, 2019, we held approximately 76 U.S. patents and approximately 64 foreign patents and had over 9 additional patent applications pending. The issued patents cover various products in the major markets we serve. Our U.S. patents will expire on varying dates between 2020 and 2035. These patents and patent applications claim protection for various aspects of current or planned commercial versions of our materials, components, subsystems, and systems.

We also have entered into license agreements with other organizations, under which we have obtained exclusive or non-exclusive rights to practice inventions claimed in various patents and applications issued or pending in the U.S. or other foreign jurisdictions. We do not believe our financial obligations under any of these agreements adversely affects our business, financial condition, or results of operations.

We rely on trade secrets to protect our intellectual property when we believe that publishing patents would make it easier for others to reverse engineer our proprietary processes. We also rely on other intellectual property rights such as trademarks and copyrights where appropriate.

Environmental Regulations

We are subject to U.S. federal, state, and local laws and regulations concerning the use, storage, handling, generation, treatment, emission, release, discharge, and disposal of certain materials used in our research and development and production operations, as well as laws and regulations concerning environmental remediation, homeland security, and employee health and safety. The production of wafers and devices involves the use of certain hazardous raw materials, including, but not limited to, ammonia, phosphine, and arsine. We have in-house professionals to address compliance with applicable environmental, homeland security, and health and safety laws and regulations. We believe that we are currently in compliance with all applicable federal, state, and local environmental protection laws and regulations.

13

Competition

The markets for our products are extremely competitive and are characterized by rapid technological change, frequent introduction of new products, short product life cycles, and with respect to certain of our product lines, significant price erosion. We face actual and potential competition from numerous domestic and international companies. Many of these companies have significant engineering, manufacturing, marketing, and financial resources.

We also sell our products to current competitors and companies with the capability of becoming competitors. As the markets for our products grow, new competitors are likely to emerge and current competitors may increase their market share. In the European Union (“EU”) and certain countries throughout the world, political and legal arrangements encourage the purchase of domestically produced goods, which places us at a disadvantage in those regions or countries.

There are substantial barriers to entry by new competitors across our product lines. These barriers include the large number of existing patents, the time and costs required to develop products, the technical difficulty in manufacturing semiconductor-based products, the lengthy sales and qualification cycles, and the difficulties in hiring and retaining skilled employees with the required scientific and technical backgrounds. We believe that the primary competitive factors within our current markets are product cost, yield, throughput, performance and reliability, breadth of product line, product heritage, customer satisfaction, and customer commitment to competing technologies. Competitors may develop enhancements to or future generations of competitive products that offer superior price and performance characteristics. We believe that in order to remain competitive, we must invest significant financial resources in developing new product features and enhancements and in maintaining customer satisfaction worldwide.

Order Backlog

EMCORE's product sales are made pursuant to purchase orders, often with short lead times. These orders are subject to revision or cancellation and often are made without deposits. For certain of our product categories, products typically ship within the same quarter in which a purchase order is received; therefore, our order backlog at any particular date is not necessarily indicative of actual revenue or the level of orders for any succeeding period and may not be comparable to prior periods.

Seasonality

In certain of our previous fiscal years, we have experienced an increase in revenues in our third and fourth fiscal quarters due to increased sales of our CATV products resulting from an increased build of cable networks during seasons with warmer weather.

Employees

As of September 30, 2019, we had approximately 420 employees, including approximately 101 international employees that are located primarily in China. This represents an increase of approximately 29 employees when compared to September 30, 2018, primarily as a result of the purchase of SDI in June 2019, partially offset by a reduction of headcount in China and the U.S. during the fiscal year ended September 30, 2019. None of our employees are covered by a collective bargaining agreement. We have never experienced any labor-related work stoppage and believe that our employee relations are good.

Competition is intense in the recruiting of personnel in the semiconductor industry and fiber optics industries. Our ability to attract and retain qualified personnel is essential to our continued success. We are focused on retaining key contributors, developing our staff, and cultivating their commitment to our Company.

14

ITEM 1A. Risk Factors

We have incurred losses from continuing operations and our future profitability is not certain.

For the fiscal years ended September 30, 2019 and 2018, loss from continuing operations was $36.0 million and $17.5 million, respectively. For the fiscal year ended September 30, 2017, income from continuing operations was $8.2 million. Our operating results for future periods are subject to numerous uncertainties and we cannot be certain that we will be profitable or that we will not experience substantial losses in the future. If we are not able to increase revenue and reduce our costs, we may not be able to achieve profitability in future periods and our business, financial condition, results of operations and cash flows may be adversely affected.

We are a small company and dependent on a few products for our success.

We are a small company with a narrow, focused portfolio of products. Our small size could cause our cash flow and growth prospects to be more volatile and makes us more vulnerable to actions by our competitors. As a small company, we will be subject to greater revenue fluctuations if our older product lines’ sales were to decline faster than we anticipate or if we are unable to grow our revenue inour newer product lines in the manner we anticipate. In addition, we may not be able to appropriately restructure or maintain our supporting functions to fit the needs of a small company, which could adversely affect our business, financial condition, results of operations, and cash flows.

We may not be able to obtain capital when desired on favorable terms, if at all, or without dilution to our shareholders.

We believe that our existing cash and cash equivalents, and cash flows from our operating activities and funds available under our credit facilities, will be sufficient to meet our anticipated cash needs for at least the next 12 months. We operate in an industry, however, that makes our prospects difficult to evaluate. It is possible that we may not generate sufficient cash flow from operations or otherwise have the capital resources to meet our future capital needs. If this occurs, we may need additional financing to continue operations or execute on our current or future business strategies, including to:

• | invest in our research and development efforts, including by hiring additional technical and other personnel; |

• | maintain and expand our operating or manufacturing infrastructure; |

• | acquire complementary businesses, products, services or technologies; or |

• | otherwise pursue our strategic plans and respond to competitive pressures. |

If we raise additional funds through the issuance of equity or convertible debt securities, the percentage ownership of our shareholders could be significantly diluted, and these newly-issued securities may have rights, preferences or privileges senior to those of existing shareholders. We cannot be certain that additional financing will be available on terms favorable to us, or at all. In addition, as described in Note 11 - Credit Facilities in the notes to the consolidated financial statements, our Credit and Security Agreement with Wells Fargo Bank, N.A. (i) is subject to a borrowing base formula based on the Company's eligible accounts receivable, inventory, and machinery and equipment accounts and (ii) requires that for certain specific uses, the Company have liquidity of at least $25.0 million after such use. If adequate funds are not available or are not available on acceptable terms, if and when needed, our ability to fund our operations, take advantage of unanticipated opportunities, develop or enhance our products, or otherwise respond to competitive pressures could be significantly limited. Furthermore, in the event adequate capital is not available to us as required, or is not available on favorable terms, our business, financial condition, results of operations, and cash flows may be adversely affected.

We are substantially dependent on revenues from a small number of customers. The loss of or decrease in sales from any one of these customers could adversely affect our business, financial condition, results of operations, and cash flows.

A small number of customers account for a significant portion of our revenue, and our dependence on orders from a relatively small number of customers makes our relationship with each customer critically important to our business. For example, for the fiscal year ended September 30, 2019, sales to three customers accounted for an aggregate of 55% of our total consolidated

15

revenues, for the fiscal year ended September 30, 2018, sales to two customers accounted for an aggregate of 60.3% of our total consolidated revenues, and for the fiscal year ended September 30, 2017, sales to three customers accounted for an aggregate of 71% of our total consolidated revenues. Sales from any of our major customers may decline or fluctuate significantly in the future. We may not be able to offset any decline in sales from our existing major customers with sales from new customers or other existing customers. Because of our reliance on a limited number of customers, any decrease in sales from, or loss of, one or more of these customers without a corresponding increase in sales from other customers would harm our business, operating results, financial condition and cash flows.

In addition, any negative developments in the business of existing significant customers could result in significantly decreased sales to these customers, which could seriously harm our business, operating results, financial condition and cash flows, and if there is consolidation among our customer base, our customers may be able to command increased leverage in negotiating prices and other terms of sale, which could adversely affect our profitability. If we are required to reduce our pricing, our revenue and gross margins would be adversely impacted. Consolidation among our customer base may also lead to reduced demand for our products, replacement of our products by the combined entity with those of our competitors and cancellations of orders, each of which could adversely affect our business, financial condition, results of operations, and cash flows.

Although we are attempting to expand our customer base, the markets in which we sell our products are dominated by a relatively small number of companies, thereby limiting the number of potential customers. Accordingly, our success will depend on our continued ability to develop and manage relationships with significant customers, and we expect that the majority of our sales will continue to depend on sales of our products to a limited number of customers for the foreseeable future.

Our future revenue is inherently unpredictable. As a result, our operating results are likely to fluctuate from period to period, and we may fail to meet the expectations of our analysts and/or investors, which may cause volatility in our stock price and may cause our stock price to decline.

Our quarterly and annual operating results have fluctuated substantially in the past and are likely to fluctuate significantly in the future due to a variety of factors, some of which are outside of our control. Factors that could cause our quarterly or annual operating results to fluctuate include:

• | a downturn in the markets for our customers’ products; |

• | discontinuation by our vendors of, or unavailability of, components or services used in our products; |

• | disruptions or delays in our manufacturing processes or in our supply of raw materials or product components; |

• | a failure to anticipate changing customer product requirements; |

• | market acceptance of our products; |

• | cancellations or postponements of previously placed orders; |

• | increased financing costs or any inability to obtain necessary financing; |

• | the impact on our business of current or future cost reduction measures; |

• | a loss of key personnel or the shortage of available skilled workers; |

• | economic conditions in various geographic areas where we or our customers do business; |

• | the impact of political uncertainties, such as government sequestration and uncertainties surrounding the federal budget, customer spending and demand for our products; |

• | significant warranty claims, including those not covered by our suppliers; |

• | product liability claims; |

16

• | other conditions affecting the timing of customer orders; |

• | reductions in prices for our products or increases in the costs of our raw materials; |

• | effects of competitive pricing pressures, including decreases in average selling prices of our products; |

• | fluctuations in manufacturing yields; |

• | obsolescence of products; |

• | research and development expenses incurred associated with new product introductions; |

• | natural disasters, such as hurricanes, earthquakes, fires, and floods; |

• | the emergence of new industry standards; |

• | the loss or gain of significant customers; |

• | the introduction of new products and manufacturing processes; |

• | changes in technology; |

• | intellectual property disputes; |

• | customs (including tariffs imposed on our products or raw materials, equipment or components used in the production of our products), import/export, and other regulations of the countries in which we do business; |

• | the occurrence of M&A activities; and |

• | acts of terrorism or violence and international conflicts or crises. |

In addition, the limited lead times with which several of our customers order our products restrict our ability to forecast

revenue. We may also experience a delay in generating or recognizing revenue for a number of reasons. For example, orders at the beginning of each quarter typically represent a small percentage of expected revenue for that quarter. We depend on obtaining orders during each quarter for shipment in that quarter to achieve our revenue objectives. Failure to ship these products by the end of a quarter may adversely affect our results of operations and cash flows.

As a result of the foregoing factors, we believe that period-to-period comparisons of our results of operations should not be solely relied upon as indicators of future performance.

We are subject to the cyclical nature of the markets in which we compete and any future downturn may reduce demand for our products and revenue.

In the past, the markets in which we compete have experienced significant downturns, often connected with, or in anticipation of, the maturation of product cycles, for both manufacturers’ and their customers’ products, and declining general economic conditions. These downturns have been characterized by diminished product demand, production overcapacity, high inventory levels, and accelerated erosion of average selling prices. These markets are impacted by the aggregate capital expenditures of service providers and enterprises as they build out and upgrade their network infrastructure. These markets are highly cyclical and characterized by constant and rapid technological change, pricing pressures, evolving standards, and wide fluctuations in product supply and demand.

We may experience substantial period-to-period fluctuations in future results of operations. Any future downturn in the markets in which we compete, or changes in demand for our products from our customers, could result in a significant reduction in our revenue and may also increase the volatility of the price of our common stock.

17

In addition, the communication networks industry from time to time has experienced and may again experience a pronounced downturn. To respond to a downturn, many service providers and enterprises may slow their capital expenditures, cancel or delay new developments, reduce their workforces and inventories, and take a cautious approach to acquiring new equipment and technologies, any of which could cause our results of operations to fluctuate from period to period and harm our business.

Customer demand is difficult to forecast and, as a result, we may be unable to optimally match production with customer demand.

We make planning and spending decisions, including determining the levels of business that we will seek and accept, production schedules, component procurement commitments, personnel needs and other resource requirements, based on our estimates of customer demand. While our customers generally provide us with their demand forecasts, they are typically not contractually committed to buy any quantity of products beyond firm purchase orders. The short-term nature of our customer commitments and the possibility of unexpected changes in demand for their products limit our ability to accurately predict future customer demand. On occasion, customers have required rapid increases in production, which has strained our resources. We may not have sufficient capacity at any given time to meet the volume demands of our customers, or one or more of our suppliers may not have sufficient capacity at any given time to meet our volume demands. Conversely, a downturn in the markets in which our customers compete can cause, and in the past has caused, our customers to significantly reduce the amount of products ordered from us or to cancel existing orders, leading to lower utilization of our facilities. Because many of our costs and operating expenses are relatively fixed, reduction in customer demand would have an adverse effect on our gross margin, results of operations, and cash flow. During an industry downturn, there is also a higher risk that a larger portion of our trade receivables would be uncollectible. In addition, certain of our arrangements with component vendors require us to purchase minimum quantities of components within specific time periods, which could cause us to hold excess inventories of these components during periods concurrent with a decrease in customer demand for our products.

Our acquisition of Systron Donner Inertial, Inc., and acquisitions of other companies or investments in joint ventures with other companies could adversely affect our operating results, dilute our shareholders' equity, or cause us to incur additional debt or assume contingent liabilities.

To increase our business, maintain our competitive position or for other business or strategic reasons, we may acquire other companies or engage in joint ventures or similar transactions in the future. For example, in June 2019, we acquired SDI, a navigation systems provider with a scalable, chip-based platform for higher volume gyro applications utilizing Quartz MEMS technology. Our acquisition of SDI, and any other acquisitions, joint ventures and similar transactions that we may enter into from time to time, involve a number of risks that could harm our business and result in SDI or any other acquired business or joint venture not performing as expected, including:

• | problems integrating the acquired operations, personnel, technologies, or products with the existing business and products; |

• | failure to achieve cost savings or other financial or operating objectives with respect to an acquisition; |

• | possible adverse short-term effects on our cash flows or operating results, and the use of cash and other resources for the acquisition that might affect our liquidity, and that could have been used for other purposes; |

• | diversion of management's time and attention from our core business to the acquired business or joint venture; |

• | potential failure to retain key technical, management, sales, and other personnel of the acquired business or joint venture; |

• | difficulties in retaining relationships with suppliers and customers of the acquired business, particularly where such customers or suppliers compete with us; |

• | difficulties in the integration of financial reporting systems, which could cause a delay in the issuance of, or impact the reliability of our financial statements; |

18

• | failure to comply with Section 404 of the Sarbanes-Oxley Act of 2002, including a delay in or failure to successfully integrate these businesses into our internal control over financial reporting; |

• | insufficient experience with technologies and markets in which the acquired business is involved, which may be necessary to successfully operate and integrate the business; |

• | reliance upon joint ventures which we do not control; |

• | subsequent impairment of goodwill and acquired long-lived assets, including intangible assets; and |

• | assumption of liabilities including, but not limited to, lawsuits, environmental liabilities, regulatory liabilities, tax examinations and warranty issues. |

We may decide that it is in our best interests to enter into acquisitions, joint ventures or similar transactions that are dilutive to earnings per share or that adversely impact margins as a whole. In addition, acquisitions or joint ventures could require investment of significant financial resources and require us to obtain additional equity financing, which may dilute our shareholders' equity, or require us to incur indebtedness.

We expect to consider from time to time further strategic opportunities that may involve acquisitions, dispositions, investments in joint ventures, partnerships, and other strategic alternatives that may enhance shareholder value, any of which may result in the use of a significant amount of our management resources or significant costs, and we may not be able to fully realize the potential benefit of such transactions.

We expect to continue to consider acquisitions, dispositions, investments in joint ventures, partnerships, and other strategic alternatives that may enhance shareholder value. The Strategy and Alternatives Committee of the Board and our management may from time to time be engaged in evaluating potential transactions and other strategic alternatives. In addition, from time to time, we may engage financial advisors, enter into non-disclosure agreements, conduct discussions, and undertake other actions that may result in one or more transactions. Although there would be uncertainty that any of these activities or discussions would result in definitive agreements or the completion of any transaction, we may devote a significant amount of our management resources to analyzing and pursuing such a transaction, which could negatively impact our operations. In addition, we may incur significant costs in connection with seeking such transactions or other strategic alternatives regardless of whether the transaction is completed. In the event that we consummate an acquisition, disposition, partnership, or other or strategic alternative in the future, we cannot be certain that we would fully realize the potential benefit of such a transaction and cannot predict the impact that such strategic transaction might have on our operations or stock price. We do not undertake to provide updates or make further comments regarding the evaluation of strategic alternatives, unless otherwise required by law.

Our failure to successfully manage the transition of certain of our manufacturing operations from our Beijing facility to a contract manufacturer’s facility could harm our business, financial condition, results of operations and cash flows.

In October 2019, we entered into (i) an agreement with Hytera Communications (Hong Kong) Company Limited and Shenzhen Hytera Communications Co., Ltd. (collectively, “Hytera”) to transfer and sell to Hytera the equipment that was being used by us to manufacture certain of our CATV modules and transmitters and (ii) an agreement pursuant to which Hytera agreed to manufacture such CATV modules and transmitters for sale to us. In connection with these agreements, the manufacture of our product lines and sub-assemblies previously manufactured at our Beijing facility is in the process of being relocated to Hytera’s facility located in Thailand.

This transition could involve the re-acceptance and requalification of certain of our products by customers, potentially creating a competitive disadvantage for our products. These initiatives can be time-consuming, disruptive to our operations, and costly in the short-term. In addition, this transition has and will continue to cause us to incur costs associated with the shipment of complex manufacturing equipment. If we are unable to manage this transfer smoothly and comprehensively, we could suffer delays, resulting in harm to our reputation with our customers and potentially loss of customers. If we are unable to successfully manage the relocation or initiation of the manufacture of these products by our contract manufacturer, our business, financial condition, results of operations and cash flows could be harmed.

19

Changes in U.S. and international trade policies, particularly with regard to China, may adversely impact our business and operating results.

The U.S. government has recently taken certain actions with respect to its trade policies, including recently imposed tariffs affecting certain products manufactured in China, and may take further actions with respect to these policies in the future. For example, the U.S. and China have applied tariffs to certain of each other’s exports and announced additional tariffs to be applied in the future to certain of each other’s exports. Certain of our broadband products manufactured by our Chinese affiliate have been included in the tariffs imposed on imports into the U.S. from China, and these products manufactured by our Chinese affiliate may be subject to tariff increases that may be implemented in the future. China has imposed retaliatory tariffs affecting certain products manufactured in the U.S. and imported into China, including our chip products manufactured in the U.S., and other products manufactured by us in the U.S. may be included on lists of products to be targeted by proposed tariff increases that may be implemented by China in the future. The implementation of these tariffs could result in decreased sales of our products manufactured in China and shipped to the U.S. and sales of our products manufactured in the U.S. and shipped to China, which would negatively impact our business.

In addition, it is unknown whether and to what extent new tariffs (or other new laws or regulations) will be adopted that increase the cost of importing products into the U.S., or that might trigger retaliatory action by U.S. trading partners. Further, it is unknown what effect any such new tariffs or retaliatory actions would have on us or our industry and customers. For example, there are risks that the Chinese government may, among other things, require the use of local suppliers, compel companies that do business in China to partner with local companies to conduct business and provide incentives to government-backed local customers to buy from local suppliers. If any new tariffs, legislation and/or regulations are implemented, or if existing trade agreements are renegotiated or if China or other affected countries take retaliatory trade actions, such changes could have a material adverse effect on our business, financial condition, results of operations and cash flows.

We currently have substantial operations in China, which exposes us to risks inherent in doing business in China.

In an effort to keep manufacturing costs down, we currently operate a manufacturing facility and certain operations logistics functions in China. Our China-based activities are subject to greater political, legal, and economic risks than those faced by our other operations. In particular, the political, legal, and economic climate in China (both at the national and regional levels) is extremely volatile and unpredictable. Our ability to operate in China may be adversely affected by changes in, or our failure to comply with, Chinese laws and regulations, such as those relating to taxation, import and export tariffs, environmental regulations, land use rights, intellectual property, labor and employment laws and other matters, which laws and regulations remain underdeveloped and subject to change for political or other reasons, with little or no prior notice. Moreover, the enforceability of applicable existing Chinese laws and regulations is uncertain. For example, since Chinese administrative and court authorities have significant discretion in interpreting and implementing statutory and contract terms, it may be more difficult to evaluate the outcome of administrative and court proceedings and the level of legal protection we would receive. These uncertainties may impede our ability to enforce the contracts we have entered into with our distributors, business partners, customers and suppliers. In addition, protections of intellectual property rights and confidentiality in China may not be as effective as in the U.S. or other countries or regions. All of these uncertainties could limit the legal protections available to us and could materially and adversely affect our business, financial condition, cash flows and results of operations.

Also, if we are found to be, or to have been, in violation of Chinese laws or regulations governing technology import and export, the relevant regulatory authorities have broad discretion in dealing with such violations, including, but not limited to, issuing a warning, levying fines, restricting us from benefiting from these technologies inside or outside of China, confiscating our earnings generated from the import or export of such technology or even restricting our future import and export of any technology.

In addition, we may not obtain the requisite legal permits to continue to operate in China and costs or operational limitations may be imposed in connection with obtaining and complying with such permits. Our business could be adversely harmed by any changes in the political, legal, or economic climate in China, our failure to comply with applicable laws and regulations or our inability to enforce applicable Chinese laws and regulations.

20

While under certain circumstances we previously were not subject to certain Chinese taxes and were exempt from customs duty assessment on imported components or materials when our finished products were exported from China, we are no longer eligible for such exemptions due to our current Beijing facility being located in a non-economic zone. In addition, we are required to pay income taxes in China subject to certain tax relief. We may become subject to other forms of taxation and duty assessments in China, including import tariffs as described in more detail above, or may be required to pay for export license fees in the future. In the event that we become subject to any increased taxes or new forms of taxation imposed by authorities in China, our results of operations and cash flows could be adversely affected.

Retention of employees in China is a challenge as compared to companies headquartered in China. If our China employee turnover rates are higher than we expect, or we otherwise fail to adequately manage these rates, then our business and results of operations could be adversely affected.

We may have difficulty maintaining adequate management and financial controls over our China operations.

Businesses in China have historically not adopted a western style of management and financial reporting concepts and practices, which includes strong corporate governance, internal controls and computer, financial and other control systems. Moreover, familiarity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) principles and reporting procedures is less common in China. As a consequence and due to our current operations in China, we may have difficulty employing accounting personnel experienced with U.S. GAAP, and we may have difficulty integrating our China-based accounting staff with our U.S.-based finance organization. As a result of these factors, we may experience difficulty in maintaining adequate management and financial controls over our China operations. These difficulties include collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet U.S. public-company reporting requirements. We may, in turn, experience difficulties in implementing and maintaining adequate internal controls as required under Section 404 of the Sarbanes-Oxley Act. If we cannot provide reliable and timely financial reports, our brand, operating results, and the market value of our equity securities could be harmed.

We have a large amount of intercompany balances with our China entities, which may be subject to taxes and penalties when we try to pay them down or collect them.

Payments for goods and services into and out of China are subject to numerous and over-lapping government regulation with respect to foreign exchange controls, banking controls, import and export controls, and taxes. We have been operating in China for an extended period of time and have accumulated significant intercompany balances with our related entities. Our ability to repay or collect these balances may be restricted by Chinese laws and, as a result, we may be unable to successfully pay down or collect on these balances. As a consequence, we may be assessed additional taxes in China if we are unable to claim bad debt deductions or incur debt forgiveness income from the cancellation of these intercompany balances. Additionally, if we are found not to have complied with the various local laws surrounding cross border payments, we may incur penalties and fines for non-compliance. Any such taxes, penalties and/or fines could be significant in amount and, as a result, could have an adverse effect on our financial condition and results of operations, including our cash and cash equivalent balances.

Our products are complex and may take longer to develop and qualify than anticipated and we face lengthy sales and qualification cycles for our new products and, in many cases, must invest a substantial amount of time and money before we receive orders.

We are constantly developing new products and using new technologies in these products. These products often take substantial time to develop because of their complexity, rigorous testing and qualification requirements and because customer and market requirements can change during the product development or qualification process. Most of our products are tested by current and potential customers to determine whether they meet customer or industry specifications. The length of the qualification process, which can span a year or more, varies substantially by product and customer and, thus, can cause our results of operations and cash flows to be unpredictable. During a given qualification period, we invest significant resources and allocate substantial production capacity to manufacture these new products prior to any commitment to purchase by customers. In addition, it is difficult to obtain new customers during the qualification period as customers are reluctant to expend the resources necessary to qualify a new supplier if they have one or more existing qualified sources. If we are unable to meet applicable specifications or do not receive sufficient orders to profitably use our allocated production capacity, our business, financial condition, results of operations, and cash flows may be adversely affected.

21

Our historical and future budgets for operating expenses, capital expenditures, operating leases, and service contracts are based upon our assumptions as to the future market acceptance of our products. Because of the lengthy lead times required for product development and the changes in technology that typically occur while a product is being developed, it is difficult to accurately estimate customer demand for any given product. If our products do not achieve an adequate level of customer demand, our business, financial condition, results of operations, and cash flows may be adversely affected.

Our products are difficult to manufacture. Our production could be disrupted and our results of operations and cash flows could suffer if our production yields are low as a result of manufacturing difficulties.