UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-04998

| T. Rowe Price Spectrum Fund, Inc. |

|

|

| (Exact name of registrant as specified in charter) |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

|

| (Address of principal executive offices) |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area

code: (410) 345-2000

Date of fiscal year end: December 31

Date of reporting period: June 30, 2017

Item 1. Report to Shareholders

|

|

Spectrum Fund |

June 30,

2017 |

The views and opinions in this report were current as of June 30, 2017. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

REPORTS ON THE WEB

Sign up for our Email Program, and you can begin to receive updated fund reports and prospectuses online rather than through the mail. Log in to your account at troweprice.com for more information.

Manager’s Letter

Fellow Shareholders

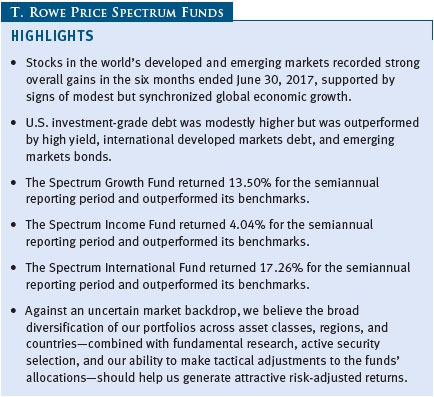

Stocks in U.S. and international developed markets generated strong gains in the six months ended June 30, 2017, supported by stabilizing political environments in key regions and data suggesting modest but synchronized global economic growth. A recovery in global economic growth translated into increased trade activity, which contributed to a risk-on environment that helped to boost emerging markets equities. In the fixed income universe, U.S. investment-grade bonds were modestly positive, and high yield bonds generated solid returns. Non-U.S. dollar-denominated debt gained as most global currencies strengthened against the dollar, driven by expectations of improving growth leading to higher interest rates in overseas developed markets. Emerging markets bonds also performed well as relatively higher interest rates in developing countries drew yield-seeking investors. The Spectrum Funds recorded solid gains in this market environment, and each fund outperformed its respective benchmarks.

MARKET ENVIRONMENT

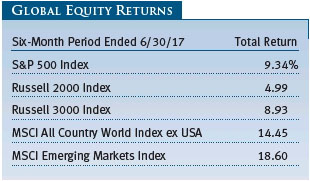

U.S. stocks generated solid gains in the first six months of 2017, with many major indexes reaching all-time highs during the period. U.S. stocks continued the rally that started in the wake of Donald Trump’s presidential election victory in November 2016 amid hopes for lower taxes and higher infrastructure spending—although there has been little substantive progress on these initiatives. Strong first-quarter corporate earnings and moves by the Trump administration to reduce the regulatory burden in certain industries were supportive. The market was relatively unfazed by lackluster first-quarter economic growth and a pair of interest rate hikes by the Federal Reserve. Investors also appeared to shake off concerns about ongoing political controversies involving the White House, failed attempts by Congress to repeal the Affordable Care Act, and heightened geopolitical tensions surrounding the Korean Peninsula. The large-cap S&P 500 Index advanced more than 9% for the six-month reporting period. Large-cap U.S. stocks generally outpaced mid-caps and small-caps while growth stocks significantly outperformed value shares across all market capitalizations.

International developed markets stocks comfortably outperformed U.S. shares, with a weaker U.S. dollar versus major non-U.S. currencies boosting returns for U.S. investors. In Europe, stocks gained nearly 16% in dollar terms. The region’s first-quarter economic growth was revised higher to a 0.6% quarterly rate (1.9% year over year), the strongest pace of growth in nearly two years. The European Central Bank (ECB) removed its bias toward easy policy in June, but monetary policy remains broadly accommodative. Centrist election victories in the Netherlands and France allayed fears about rising populism and added to the positive market sentiment. UK shares trailed with a 10% gain as Prime Minister Theresa May’s government prepared to start formal Brexit negotiations with the European Union. Japanese shares gained roughly 10%. The nation’s economy expanded 0.3% in the first quarter of 2017 (1.0% annualized) and marked a fifth consecutive quarter of growth. Improving global growth and a weaker yen versus last year contributed to stronger exports while domestic consumption and business capital expenditures also improved, supported by spending for the upcoming 2020 Olympic games in Tokyo.

Emerging markets stocks rallied approximately 18% as signs of economic recovery worldwide instilled more confidence in the global growth outlook. Emerging markets assets plunged last November shortly after the U.S. election as worries about protectionism and rising U.S. interest rates caused a sell-off in developing world assets. However, the asset class rebounded in subsequent months as steady growth in China and improved earnings growth helped to revive investors’ risk appetite.

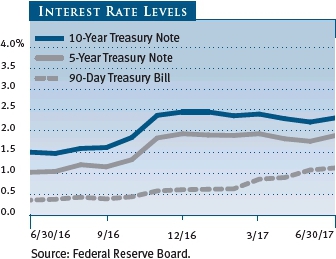

U.S. investment-grade bonds posted positive returns in the first half of 2017. The Bloomberg Barclays U.S. Aggregate Bond Index, which measures the performance of U.S. investment-grade bonds, returned 2.27%. Although the Fed raised short-term interest rates in March and again in June, longer-term Treasury interest rates declined as inflation decelerated, economic growth remained lackluster, and new fiscal stimulus measures failed to materialize. In the investment-grade universe, long-term Treasuries and corporate bonds did best while mortgage- and asset-backed securities posted more modest gains. High yield issues outpaced higher-quality bonds as the asset class saw strong demand given investors continued search for attractive yields.

International dollar-denominated bonds in developed markets outpaced U.S. investment-grade issues as most currencies appreciated against the dollar, boosting returns for international developed markets debt for U.S. investors. The euro, British pound, and Japanese yen rallied against the dollar in the first half of the year as expectations grew that several major central banks worldwide were preparing to tighten monetary policy. The gains in most currencies versus the dollar helped offset declining prices of government bonds in local currency terms as yields increased in many developed markets. Dollar-denominated emerging markets bonds produced strong returns, overcoming a postelection sell-off as relatively higher interest rates in developing countries attracted yield-seeking investors.

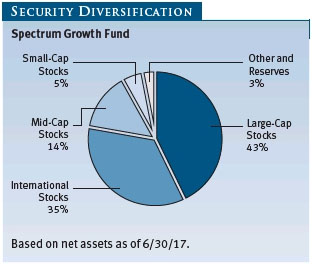

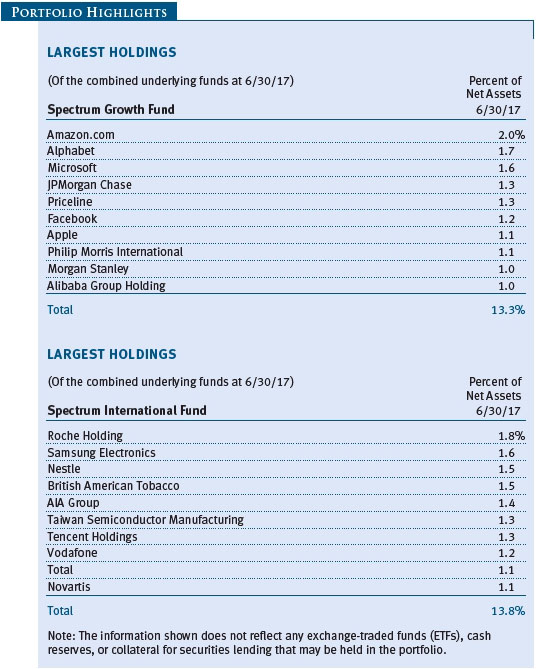

SPECTRUM GROWTH FUND

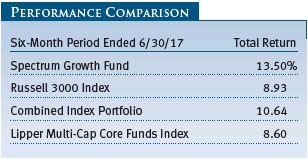

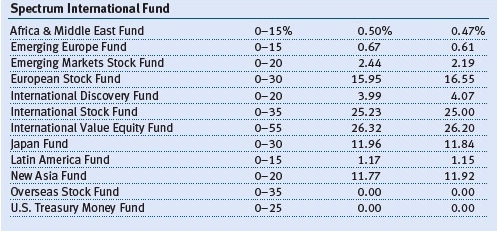

As shown in the Performance Comparison table, the Spectrum Growth Fund returned 13.50% for the six months ended June 30, 2017. The fund outperformed the Russell 3000 Index, the Lipper Multi-Cap Core Funds Index, and its combined index portfolio for the period.

Portfolio Performance

Security selection in our underlying funds

was a large positive contributor to results versus the Russell 3000 Index over

the reporting period. In a reversal of 2016’s underperformance, results were

particularly strong in our U.S. large-cap portfolios, including the Growth Stock

Fund, Blue Chip Growth Fund, and Value Fund.

Selection in the International Value Equity Fund, which invests in undervalued

large-cap stocks outside the U.S., also helped results. (Please note: Effective

January 1, 2017, the International Growth & Income Fund was renamed the

International Value Equity Fund. Its investment objective and approach remain

unchanged.) The positive impact from these funds was partially offset by

modestly negative security selection in the Mid-Cap Value Fund and Real Assets

Fund.

Tactical decisions to overweight/underweight asset classes helped relative results modestly. The lion’s share of the benefit came from an underweight position in the Real Assets Fund, which trailed the broader market during an unfavorable environment for oil and certain other commodities. An overweight position in large-cap growth versus large-cap value shares was also positive. Our modest underweight to emerging markets equities, which outperformed developed markets during the period, weighed on results.

Strategic allocations to diversifying asset classes not included in the fund’s broad market benchmark detracted from results, primarily due to our allocation to real assets equities.

Portfolio

Positioning

The Spectrum Growth Fund

invests in several underlying funds that focus on U.S. equities across the full

range of market capitalizations and international stocks in both developing and

emerging markets.

We started the reporting period with a neutral position in international equities versus U.S. stocks but gradually moved to overweight international. In Europe, economic growth expectations have improved, and the central bank remains broadly accommodative despite its recent acknowledgement that economic growth was improving. The political environment stabilized after centrist election victories in the Netherlands and France, and corporate earnings growth expectations have risen. Japanese growth appears to be stabilizing at low but positive levels, although there is still little evidence of inflation. On the corporate front, many companies are advancing shareholder-friendly policies, including share repurchases, and improving profitability and corporate governance.

Among U.S. equities, we are overweight growth versus value based on the former’s more attractive valuations and expectations for a protracted period of modest economic growth. Lower-quality value sectors, such as industrials and materials, rallied after the U.S. elections, but the rebound faded as the Trump administration and Congress made little substantive progress on pro-growth policy initiatives. Growth stocks significantly outperformed value shares since the start of 2017. While increased spending, tax cuts, and deregulation may provide support for cyclical sectors like financials and energy, the scope of these measures and their prospects for receiving legislative approval remain uncertain.

We moved from an overweight position in U.S. large-caps versus U.S. small-caps to a small-cap overweight at the end of the period. Small-caps lagged large-caps in the first half of 2017 amid fading optimism about pro-growth economic and fiscal policies in the U.S., and, as a result, valuations have become more attractive. Higher U.S. fiscal spending and lower corporate taxes, should they come to pass, could benefit small-caps more than large-caps, while protectionist policies and a stronger U.S. dollar could weigh more heavily on large-caps given their higher exposure to foreign trade.

Within international equities, we maintained an underweight in emerging markets versus developed markets. While emerging markets valuations are cheaper than developed markets on an absolute basis, they are expensive versus their historical averages. Emerging markets growth is showing signs of stabilization and should benefit from improved global trade. However they remain vulnerable to a decline in energy and commodity prices. Protectionist rhetoric, higher developed markets interest rates, and a strong U.S. dollar are still risks to emerging markets, although concerns have decreased recently.

We favor international value over growth stocks. Valuations for overseas value stocks remain broadly attractive as growth sectors, such as consumer staples, appear increasingly expensive. However, value sectors like financials and energy face headwinds from modest global growth and persistently low energy prices. We maintained a modest overweight to international small-cap stocks versus international large-caps throughout the period. International small-caps offer selective opportunities in domestic economies that are in earlier stages of recovery than the U.S. Uncertain Brexit negotiations lie ahead, but the eurozone’s economy and earnings have improved, and political risks have eased. While growth in Europe may be tempered over the near term by the impact of Brexit, growth has stabilized at modest levels, borrowing costs are low, credit is expanding, and employment is rising. Broadly accommodative monetary policy continues to support growth in Europe and Japan in contrast to the U.S., where the Fed has started to tighten its policy.

We are underweight real assets versus global equities as a long-term supply/demand imbalance continues to weigh on energy and commodities prices. The potential for increased U.S. infrastructure spending is supportive, but its ultimate form, timing, and scope remain uncertain. Higher energy prices in 2016 were met by a sharp rise in U.S. production, renewing price pressures and reigniting concerns about global oversupply. Fundamentals for developed markets real estate investment trusts (REITs) appear generally solid, supported by modest economic growth and limited supply.

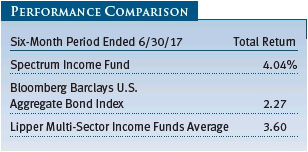

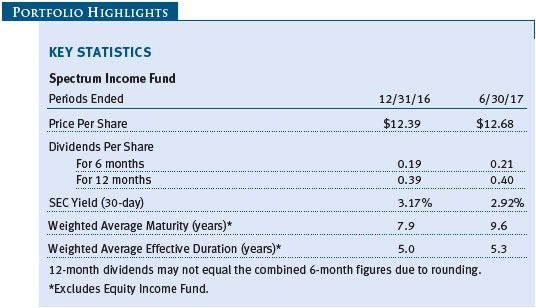

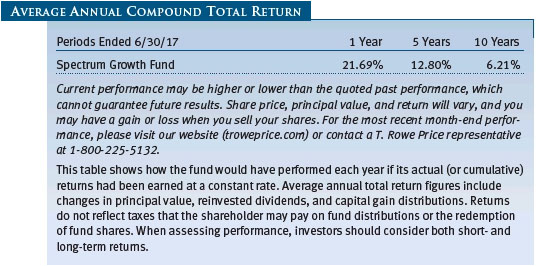

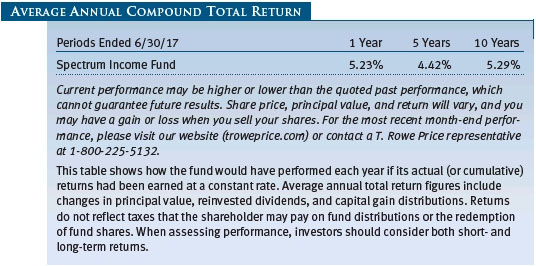

SPECTRUM INCOME FUND

As shown in the Performance Comparison table on page 7, the Spectrum Income Fund returned 4.04% for the six months ended June 30, 2017. The fund outperformed the Bloomberg Barclays U.S. Aggregate Bond Index and its Lipper peer group average.

Portfolio

Performance

Strategic allocations to

diversifying asset classes not included in the fund’s broad market benchmark

boosted the fund’s relative performance for the six-month period. Allocations to

overseas debt offered the largest aggregate benefit and included exposure to the

International Bond Fund, Emerging Markets Bond Fund, and Emerging Markets

Local Currency Bond Fund. Positions in the High

Yield Fund and Equity Income Fund, which invests in large-cap dividend-paying

U.S. stocks, were also positive.

Security selection among the underlying funds was also beneficial. The Equity Income Fund, New Income Fund, which invests primarily in investment-grade U.S. debt, and International Bond Fund showed the best results. The Floating Rate Fund, which invests in leveraged loans where the borrowing companies are typically below investment grade, was a slight detractor.

Tactical decisions to overweight/underweight underlying asset classes had a minimal net impact on results. The positive impact from an overweight to emerging markets debt denominated in local currencies was largely offset by an underweight to international nondollar developed markets bonds.

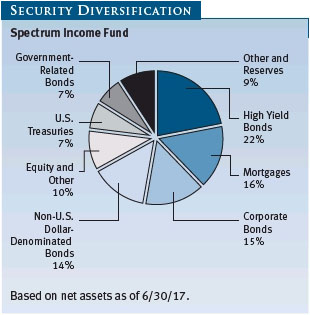

Portfolio

Positioning

The Spectrum Income Fund

invests primarily in fixed income securities through a diversified mix of

U.S.-focused and international T. Rowe Price mutual funds. The fund also has an

allocation to a fund focusing on dividend-paying U.S. large-cap

stocks.

We started the semiannual reporting period with an overweight allocation to high yield bonds versus U.S. investment-grade debt but reduced this allocation during the six-month period. High yield valuations are trending above historical averages after strong performance in the segment despite renewed weakness in energy prices. High yield bonds continue to offer a yield advantage over investment-grade bonds, but current yields provide less opportunity for further appreciation and are vulnerable to a further pullback in commodity prices. Within our high yield sleeve, we have a preference for floating rate bank loans due to their attractive duration profile and lesser exposure to the challenging energy sector.

We favor emerging markets bonds but reduced the size of our overweight as valuations for emerging markets bonds are less compelling after the risk-on rally since the U.S. election. Emerging markets economies enjoy better fundamentals than during the taper-tantrum sell-off in 2013, and increased fiscal spending in key developed markets could be supportive for emerging markets exports. We note, however, the considerable disparity between individual countries in their fiscal positions, political stability, and progress toward reforms and their ability to use fiscal and monetary policy levers to stimulate growth and/or defend their currencies. Within our emerging markets debt sleeve, we favor emerging markets debt denominated in local currencies due to its relatively attractive yields.

We reduced our underweight to nondollar international bonds. Bond yields and extended duration profiles outside the U.S. continue to offer an unattractive risk/return trade-off. After declining in the first half of 2017, the U.S. dollar may find support as the Fed continues to normalize its interest rate policy and begins to wind down its balance sheet late this year. Overseas economic growth is improving, and some central banks, including the ECB, are expected to take initial steps to rein in accommodative policies, which could put upward pressure on yields and support for the euro.

We are underweight to dividend-paying stocks. A low-yield environment and rising interest rates suggest modest returns for bonds, but equity valuations appear extended amid uncertainty about the potential for pro-growth economic and fiscal policies—if, when, and how they come to pass remain in doubt—to fuel further upside in stocks.

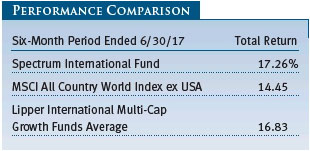

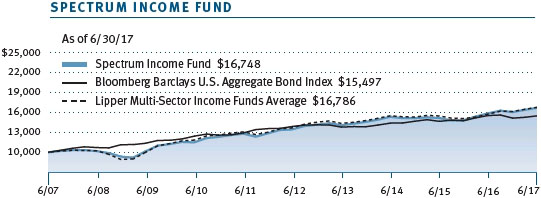

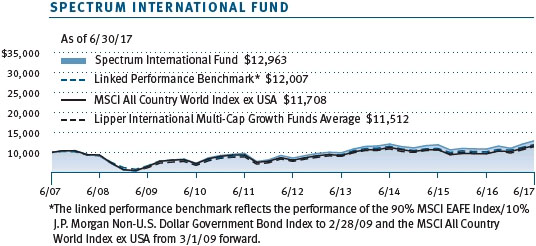

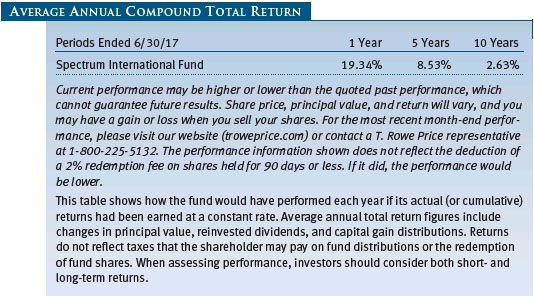

SPECTRUM INTERNATIONAL FUND

As shown in the Performance Comparison table, the Spectrum International Fund returned 17.26% for the six months ended June 30, 2017. The fund outperformed the MSCI All Country World Index ex USA and the Lipper International Multi-Cap Growth Funds Average over the period.

Security selection in the fund’s underlying portfolios benefited performance versus its MSCI benchmark index over the six-month period. The Japan Fund and the International Value Equity Fund, which focuses on undervalued large-cap stocks outside the U.S., were the biggest positive contributors. (Please note: Effective January 1, 2017, the International Growth & Income Fund was renamed the International Value Equity Fund. Its investment objective and approach remain unchanged.) Selection in the European Stock Fund, New Asia Fund, and International Discovery Fund also helped relative results.

Portfolio

Performance

On a regional basis, our

Pacific ex Japan stocks recorded the fund’s largest absolute gains. The region

benefited from positive global economic data and steady demand for risk assets.

Our stocks in developed Europe gained as the political environment stabilized

and markets became more optimistic that the

region’s moderate economic recovery is becoming more durable. The fund’s

Japanese stocks rose as Japan’s economy continued to grow, albeit at a modest

pace.

On a sector basis, our information technology shares fared best in the last six months. The fund’s financial and telecommunication services stocks rose and also outperformed the broader international equities market. Energy was the lone sector to decline as increased North American shale production contributed to renewed weakness in oil prices, and modest Chinese growth led to expectations of tepid demand for other commodities.

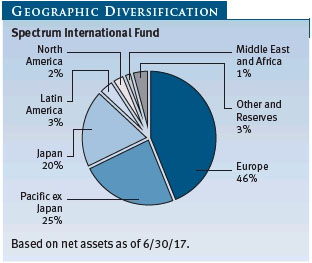

Portfolio Positioning

The Spectrum International Fund offers

investors broadly diversified exposure to international equities from both

developed and emerging markets.

Among developed markets, we are overweight Japanese equities as valuations are the most attractive among developed markets. Japan’s economic growth is showing signs of stabilization, albeit at low levels and with stubbornly low inflation, and corporations are advancing more shareholder-friendly policies. We are modestly overweight Europe. The region is supported by diminished political uncertainty following Emmanuel Macron’s election victory in France, stronger economic growth and earnings expectations, and monetary policies that remain broadly accommodative despite recent indications that the central bank may start to rein in its policy later this year.

We have a broadly neutral position in emerging markets equities. While growth is expected to improve in 2017, export-oriented economies may be challenged by the recent decline in energy prices if weakness persists. Although concerns over protectionist trade policies, higher developed market interest rates, and a stronger U.S. dollar have abated recently, they remain potential risks.

Outside the U.S., we favor value stocks over growth stocks. Valuations for overseas value stocks remain broadly attractive as growth sectors, such as consumer staples, appear increasingly expensive. However, value sectors like financials and energy face headwinds from modest global growth and global commodities oversupply.

OUTLOOK

Global economic growth gained some positive momentum toward the end of 2016 and continued to improve in 2017. Economic data showed improvements across most developed and emerging markets—an uncommon synchronization in the current economic cycle—that should support corporate earnings growth.

The U.S. economy grew at a 1.4% annualized rate in the first quarter of 2017, and we expect a pickup in growth over the remainder of the year. There is uncertainty surrounding the Trump administration’s growth proposals, and inflation declined as support from higher energy prices continues to fade. The Fed raised interest rates in March and again in June, and it signaled a modest pace for rate increases over the remainder of 2017 and into 2018. Corporate leverage has increased, but balance sheets appear generally healthy and provide flexibility to increase capital spending, engage in mergers and acquisitions, and return capital to shareholders through dividends and share repurchases. A positive trend for corporate earnings growth should last through the second half of 2017, with results expected in the high single to low double digits.

In Europe, growth expectations are improving, with support from resilient household consumption, increased business investment, and stronger global trade. The ECB removed its bias toward easy monetary policy in June, acknowledging the improved growth prospects and downplaying concerns about stubbornly low inflation. Risks remain, however. Recent strength in the euro could weigh on Europe’s export sector. Although Brexit negotiations have yet to begin in earnest, it continues to be a looming concern. Political uncertainty is still modestly elevated with upcoming elections in Germany and Italy, but fears about a wave of populist victories have abated. Long-term structural issues such as high debt and elevated unemployment continue to plague growth in many European countries.

Japan’s economy grew in the first quarter of 2017—the fifth consecutive quarter of expansion—supported by stronger exports, improvements in consumer and business spending, and government spending for the 2020 Tokyo Olympics. The positive growth momentum suggests that Prime Minister Shinzo Abe’s efforts to reform the economy and stimulate growth may finally be gaining traction. However, tepid wage growth and stubbornly low inflation indicate that broader success is still elusive. While investors have been skeptical of Mr. Abe’s and the Bank of Japan’s progress on stimulating economic growth and inflation, Japanese corporations are showing positive movement toward improving corporate governance and enhancing shareholder value. Further improvement in global trade should support Japan’s important export sector.

Emerging markets growth should improve broadly in 2017, although commodity export-oriented economies may be challenged by any persistent decline in energy prices. Country-specific conditions vary in terms of economic growth, monetary and fiscal policy flexibility, dependence on commodity exports, and progress toward structural reforms. Concerns about protectionist trade policies, higher developed markets interest rates, and a stronger U.S. dollar have abated in recent months, but they pose ongoing risks. China’s policymakers are using a number of fiscal and monetary policy tools to achieve their growth target—currently around 6.5%—as they try to engineer an orderly transition to a consumer-based growth model. A recent downgrade of China’s sovereign debt rating, however, highlights concerns over rising debt levels and a lower growth trajectory as the central government works to curtail excesses in housing and credit and stave off capital outflows.

Key risks to global markets include the potential for missteps in global monetary policies, impacts of protectionist policies on global trade, fiscal policy disappointment in the U.S., political instability in Europe, and the sustainability of energy prices. Heightened geopolitical tensions in the Middle East, on the Korean Peninsula, and in the South China Sea pose additional risks.

Against an uncertain market backdrop, we reaffirm our belief that the broad diversification of our portfolios across asset classes, regions, and countries—combined with fundamental research, active security selection, and our ability to make tactical adjustments to the funds’ allocations—should help us generate attractive risk-adjusted returns.

Respectfully submitted,

Charles M. Shriver

Portfolio manager, Spectrum Growth, Spectrum Income, and

Spectrum International Funds

July 24, 2017

RISKS OF INVESTING

As with all stock and bond mutual funds, each fund’s share price can fall because of weakness in the stock or bond markets, a particular industry, or specific holdings. Stock markets can decline for many reasons, including adverse political or economic developments, changes in investor psychology, or heavy institutional selling. The prospects for an industry or company may deteriorate because of a variety of factors, including disappointing earnings or changes in the competitive environment. In addition, the investment manager’s assessment of companies held in a fund may prove incorrect, resulting in losses or poor performance, even in rising markets.

Bonds are subject to interest rate risk, the decline in bond prices that usually accompanies a rise in interest rates, and credit risk, the chance that any fund holding could have its credit rating downgraded or that a bond issuer will default (fail to make timely payments of interest or principal), potentially reducing the fund’s income level and share price. High yield corporate bonds could have greater price declines than funds that invest primarily in high-quality bonds. Companies issuing high yield bonds are not as strong financially as those with higher credit ratings, so the bonds are usually considered speculative investments.

Funds that invest overseas may carry more risk than funds that invest strictly in U.S. assets. Risks can result from varying stages of economic and political development; differing regulatory environments, trading days, and accounting standards; and higher transaction costs of non-U.S. markets. Non-U.S. investments are also subject to currency risk, or a decline in the value of a foreign currency versus the U.S. dollar, which reduces the dollar value of securities denominated in that currency.

GLOSSARY

Bloomberg Barclays U.S. Aggregate Bond Index: An unmanaged index that tracks investment-grade corporate and government bonds.

J.P. Morgan Non-U.S. Dollar Government Bond Index: An unmanaged index that tracks the performance of major non-U.S. bond markets.

Lipper averages: The averages of available mutual fund performance returns for specified time periods in categories defined by Lipper Inc.

Lipper indexes: Fund benchmarks that consist of a small number of the largest mutual funds in a particular category as tracked by Lipper Inc.

MSCI All Country World Index ex USA: An index that measures equity market performance of developed and emerging countries, excluding the U.S.

MSCI EAFE Index: An unmanaged index that tracks the stocks of about 1,000 companies in Europe, Australasia, and the Far East (EAFE).

MSCI Emerging Markets Index: An unmanaged index that tracks stocks in 26 emerging market countries.

Russell 2000 Index: An unmanaged index that tracks the stocks of 2,000 small U.S. companies.

Russell 3000 Index: An index that tracks the performance of the 3,000 largest U.S. companies, representing approximately 98% of the investable U.S. equity market.

S&P 500 Index: An unmanaged index that tracks the stocks of 500 U.S. primarily large-cap companies.

Weighted average effective duration (years): A measure of a security’s price sensitivity to changes in interest rates. Securities with longer durations are more sensitive to changes in interest rates than securities of shorter durations.

Weighted average maturity: A measure of a fund’s sensitivity to interest rates. In general, the longer the average maturity, the greater the fund’s sensitivity to interest rate changes. The weighted average maturity may take into account interest rate readjustment dates for certain securities. Money funds must maintain a weighted average maturity of less than 60 days.

Note: Bloomberg Index Services Ltd. Copyright 2017, Bloomberg Index Services Ltd. Used with permission.

Note: MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI.

Note: Russell Investment Group is the source and owner of the trademarks, service marks, and copyrights related to the Russell indexes. Russell® is a trademark of Russell Investment Group.

Performance and Expenses

| Growth of $10,000 |

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

| Growth of $10,000 |

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

| Growth of $10,000 |

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

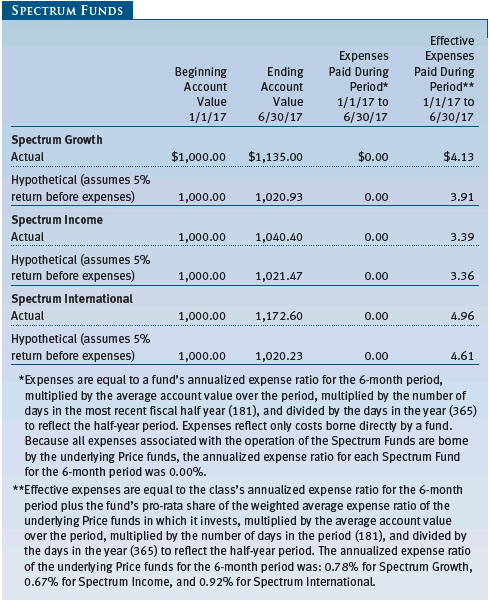

| Fund Expense Example |

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Actual Expenses

The first line of the following table (Actual) provides

information about actual account values and expenses based on the fund’s actual

returns. You may use the information on this line, together with your account

balance, to estimate the expenses that you paid over the period. Simply divide

your account value by $1,000 (for example, an $8,600 account value divided by

$1,000 = 8.6), then multiply the result by the number on the first line under

the heading “Expenses Paid During Period” to estimate the expenses you paid on

your account during this period.

Hypothetical Example for Comparison

Purposes

The information on the second

line of the table (Hypothetical) is based on hypothetical account values and

expenses derived from the fund’s actual expense ratio and an assumed 5% per year

rate of return before expenses (not the fund’s actual return). You may compare

the ongoing costs of investing in the fund with other funds by contrasting this

5% hypothetical example and the 5% hypothetical examples that appear in the

shareholder reports of the other funds. The hypothetical account values and

expenses may not be used to estimate the actual ending account balance or

expenses you paid for the period.

Note: T. Rowe Price charges an annual account service fee of $20, generally for accounts with less than $10,000. The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $50,000 or more; accounts electing to receive electronic delivery of account statements, transaction confirmations, prospectuses, and shareholder reports; or accounts of an investor who is a T. Rowe Price Personal Services or Enhanced Personal Services client (enrollment in these programs generally requires T. Rowe Price assets of at least $250,000). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

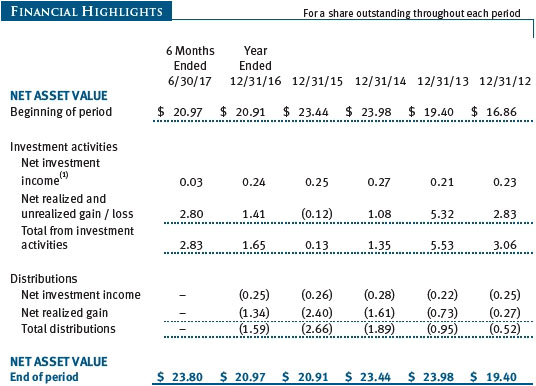

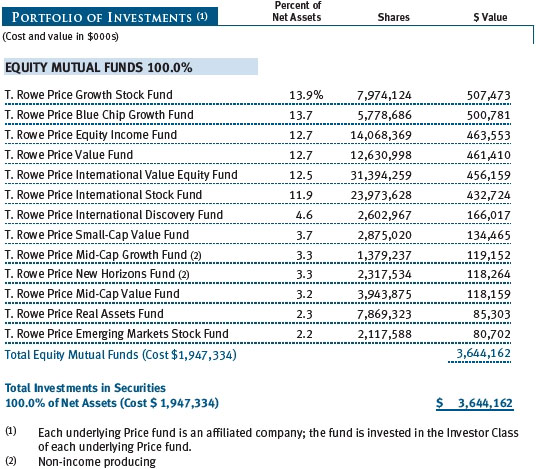

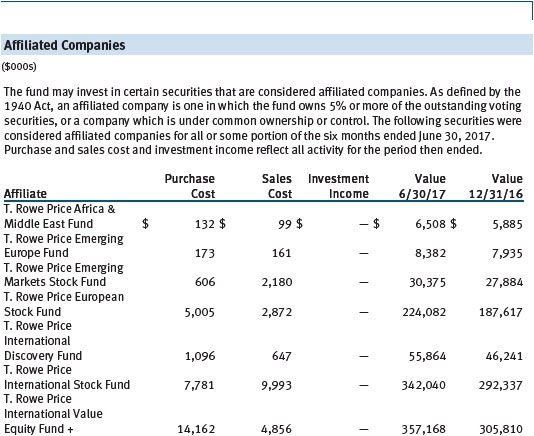

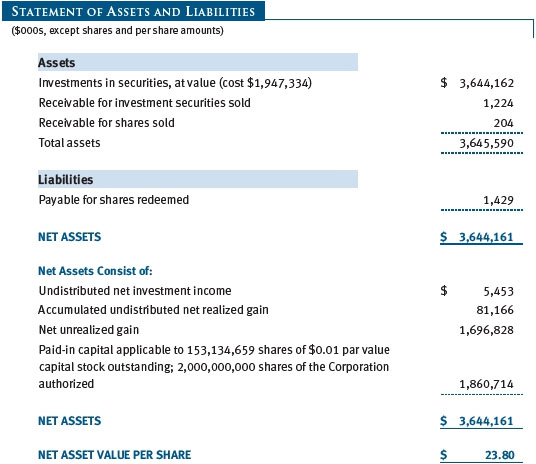

| T. Rowe Price Spectrum Growth Fund |

|

|

Unaudited

The accompanying notes are an integral part of these financial statements.

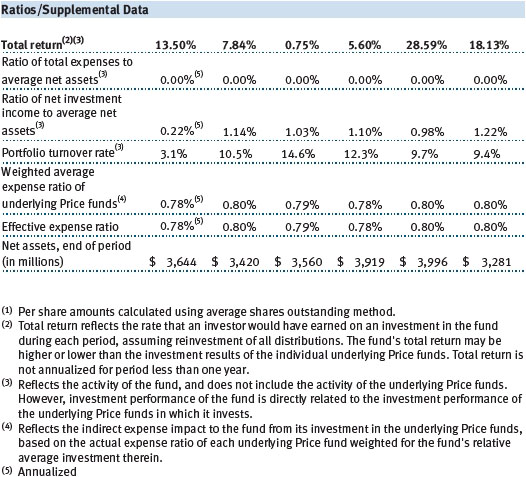

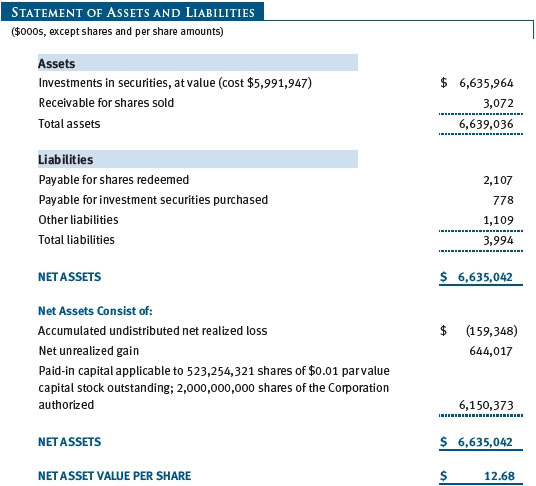

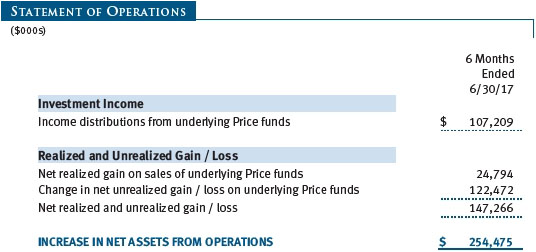

| T. Rowe Price Spectrum Income Fund |

|

|

Unaudited

The accompanying notes are an integral part of these financial statements.

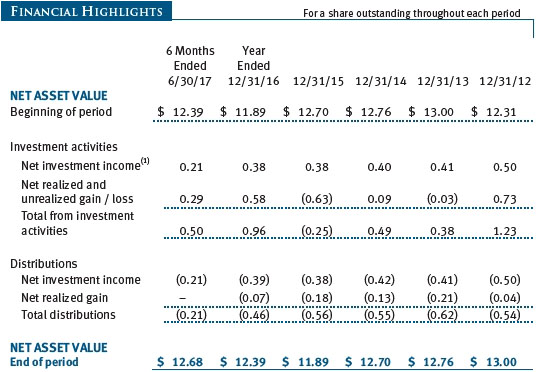

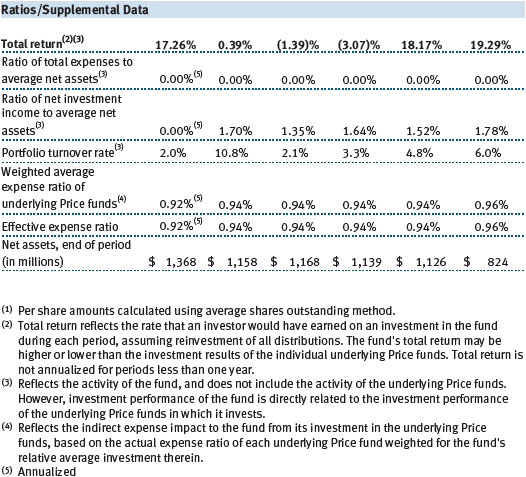

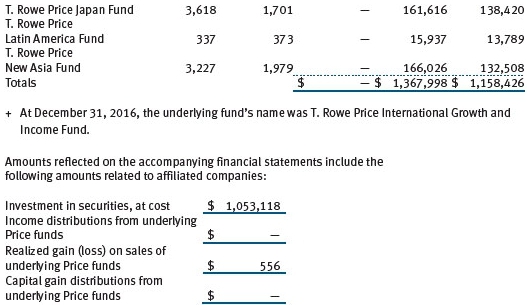

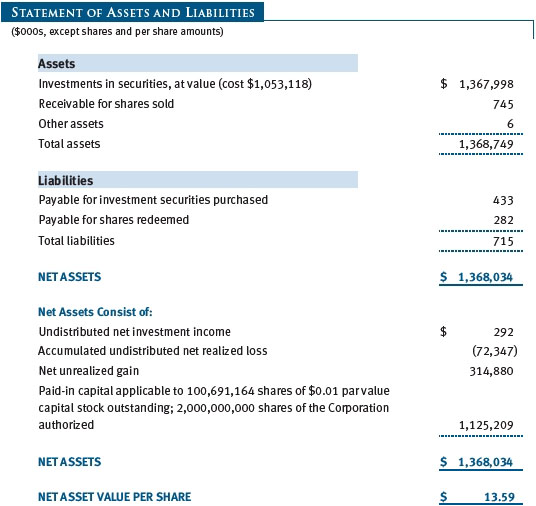

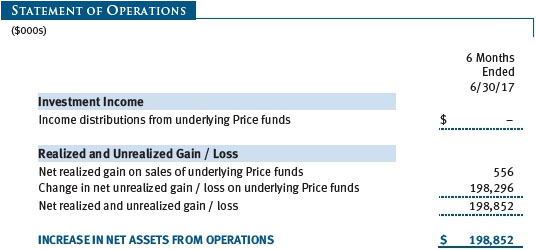

| T. Rowe Price Spectrum International Fund |

|

|

Unaudited

The accompanying notes are an integral part of these financial statements.

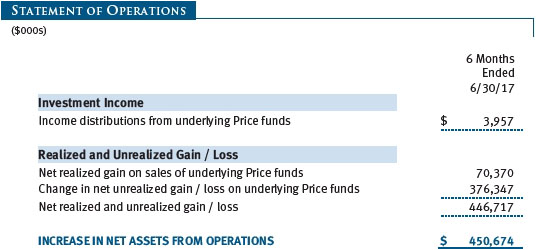

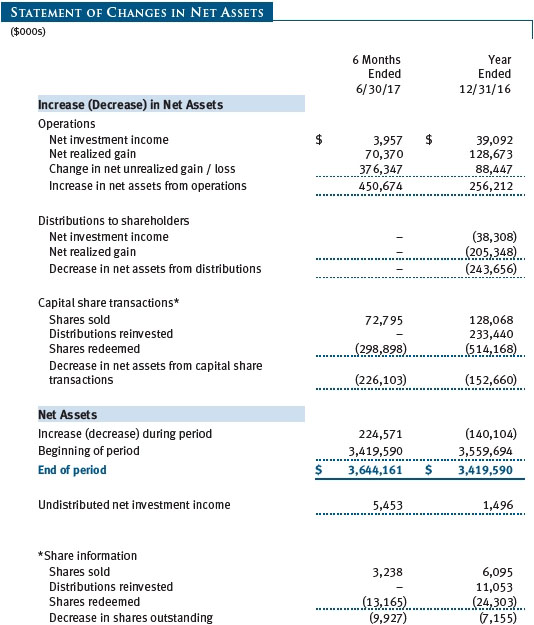

| T. Rowe Price Spectrum Growth Fund |

|

|

Unaudited

The accompanying notes are an integral part of these financial statements.

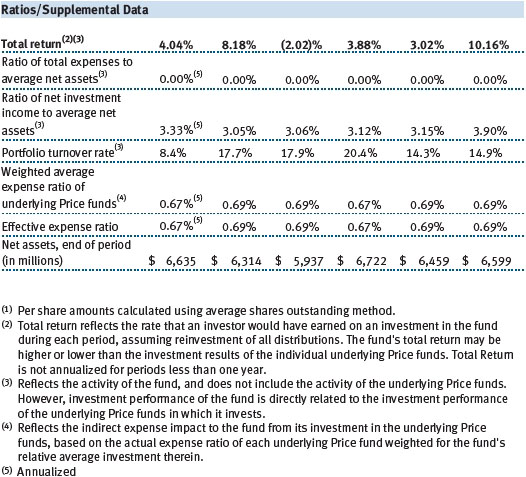

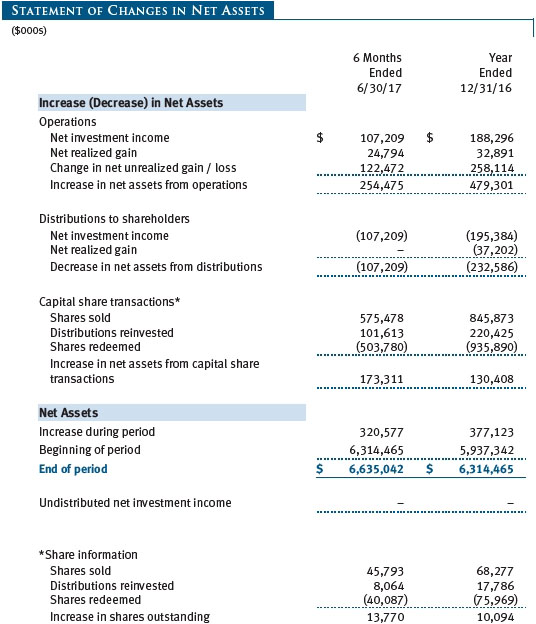

| T. Rowe Price Spectrum Income Fund |

|

|

Unaudited

The accompanying notes are an integral part of these financial statements.

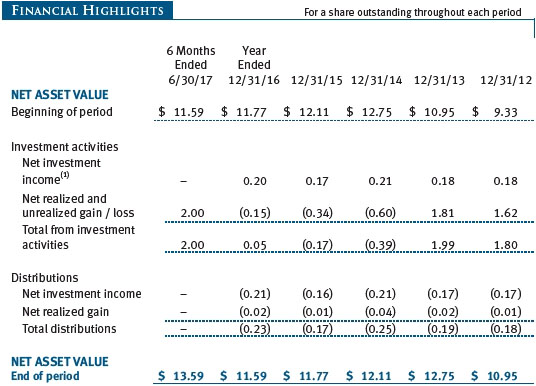

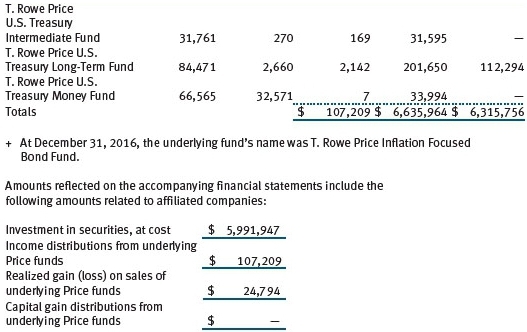

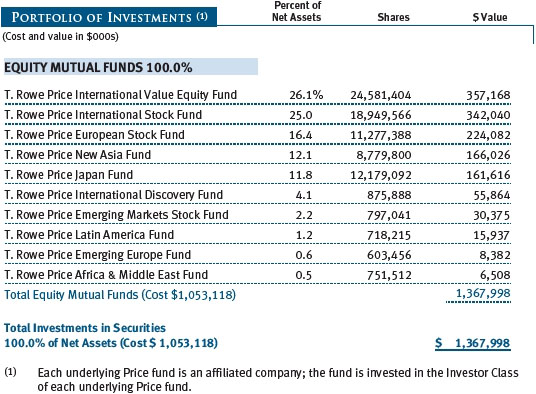

| T. Rowe Price Spectrum International Fund |

|

|

Unaudited

The accompanying notes are an integral part of these financial statements.

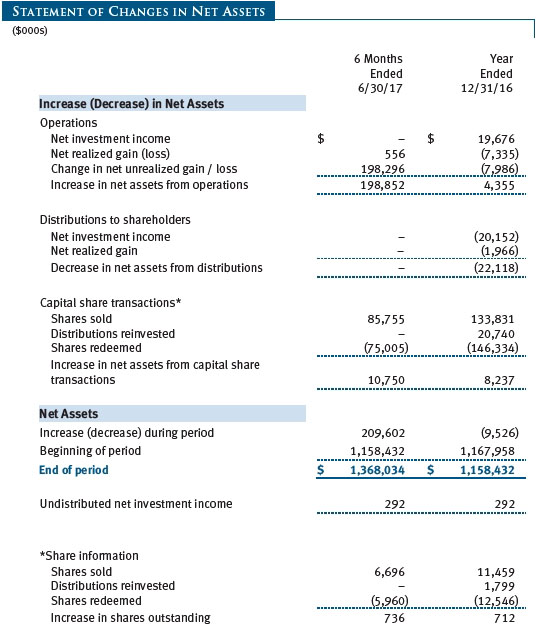

| T. Rowe Price Spectrum Growth Fund |

|

|

Unaudited

The accompanying notes are an integral part of these financial statements.

| T. Rowe Price Spectrum Income Fund |

|

|

Unaudited

The accompanying notes are an integral part of these financial statements.

| T. Rowe Price Spectrum International Fund |

|

|

Unaudited

The accompanying notes are an integral part of these financial statements.

| T. Rowe Price Spectrum Growth Fund |

|

|

Unaudited

The accompanying notes are an integral part of these financial statements.

| T. Rowe Price Spectrum Income Fund |

|

|

Unaudited

The accompanying notes are an integral part of these financial statements.

| T. Rowe Price Spectrum International Fund |

|

|

Unaudited

The accompanying notes are an integral part of these financial statements.

| T. Rowe Price Spectrum Growth Fund |

|

|

Unaudited

The accompanying notes are an integral part of these financial statements.

| T. Rowe Price Spectrum Income Fund |

|

|

Unaudited

The accompanying notes are an integral part of these financial statements.

| T. Rowe Price Spectrum International Fund |

|

|

Unaudited

The accompanying notes are an integral part of these financial statements.

| T. Rowe Price Spectrum Funds |

|

|

Unaudited

| Notes to Financial Statements |

T. Rowe Price Spectrum Fund, Inc. (the corporation), is registered under the Investment Company Act of 1940 (the 1940 Act) as an open-end management investment company. Spectrum Growth Fund, Spectrum Income Fund, and Spectrum International Fund (collectively, the Spectrum Funds) are three portfolios established by the corporation.

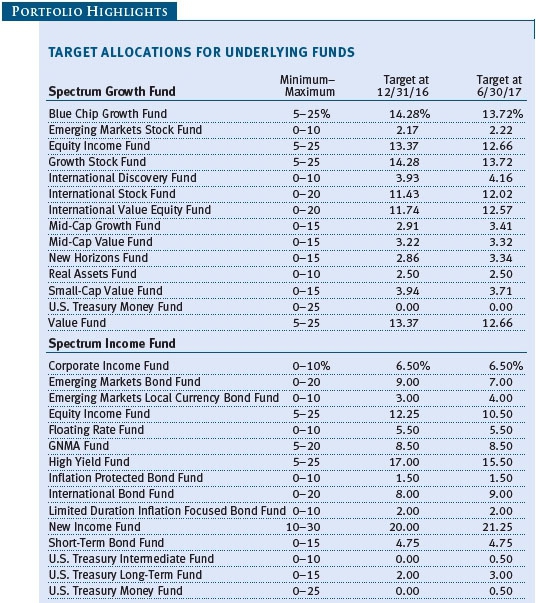

Each Spectrum Fund diversifies its assets within specified ranges among a set of T. Rowe Price mutual funds (underlying Price funds) representing specific market segments. Each Spectrum Fund is nondiversified for purposes of the 1940 Act, due to its limited number of investments; however, its investments in underlying Price funds are selected to provide exposure to a diversified portfolio of securities. Spectrum Growth seeks long-term capital appreciation and growth of income with current income as a secondary objective. Spectrum Income seeks a high level of current income with moderate share price fluctuation. Spectrum International seeks long-term capital appreciation.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation Each fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board Accounting Standards Codification Topic 946 (ASC 946). The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), including, but not limited to, ASC 946. GAAP requires the use of estimates made by management. Management believes that estimates and valuations of the underlying Price funds are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale of the underlying Price funds.

Investment Transactions, Investment Income, and Distributions Income is recorded on the accrual basis. Income and capital gain distributions from the underlying Price funds are recorded on the ex-dividend date. Dividends received from underlying Price fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Purchases and sales of the underlying Price funds are accounted for on the trade date. Gains and losses realized on sales of the underlying Price funds are reported on the identified cost basis. Income tax-related interest and penalties, if incurred, would be recorded as income tax expense. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared by Spectrum Income daily and paid monthly. Income distributions are declared and paid by Spectrum Growth and Spectrum International annually. A capital gain distribution may also be declared and paid by each fund annually.

Redemption Fees A 2% fee is assessed on redemptions of Spectrum International shares held for 90 days or less to deter short-term trading and to protect the interests of long-term shareholders. Redemption fees are withheld from proceeds that shareholders receive from the sale or exchange of fund shares and are paid to the fund. Redemption fees received by Spectrum International are allocated to each underlying Price fund in proportion to the average daily value of its shares owned by the fund. Accordingly, redemption fees have no effect on the net assets of Spectrum International. The fees may cause the redemption price per share to differ from the net asset value per share.

New Accounting Guidance In October 2016, the Securities and Exchange Commission (SEC) issued a new rule, Investment Company Reporting Modernization, which, among other provisions, amends Regulation S-X to require standardized, enhanced disclosures in investment company financial statements. Compliance with the guidance is effective for financial statements related to periods ending on or after August 1, 2017; adoption will have no effect on the fund’s net assets or results of operations.

NOTE 2 - VALUATION

Each fund’s financial instruments are valued, and its net asset value (NAV) per share is computed at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day the NYSE is open for business. However, the NAV per share may be calculated at a time other than the normal close of the NYSE if trading on the NYSE is restricted, if the NYSE closes earlier, or as may be permitted by the SEC. Each fund’s financial instruments are reported at fair value, which GAAP defines as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Investments in the underlying Price funds are valued at their closing NAV per share on the day of valuation. Assets and liabilities other than financial instruments, including short-term receivables and payables, are carried at cost, or estimated realizable value, if less, which approximates fair value.

The T. Rowe Price Valuation Committee (the Valuation Committee) is an internal committee that has been delegated certain responsibilities by the funds’ Board of Directors (the Board) to ensure that financial instruments are appropriately priced at fair value in accordance with GAAP and the 1940 Act. Subject to oversight by the Board, the Valuation Committee develops and oversees pricing-related policies and procedures and approves all fair value determinations. Specifically, the Valuation Committee establishes procedures to value securities; determines pricing techniques, sources, and persons eligible to effect fair value pricing actions; oversees the selection, services, and performance of pricing vendors; oversees valuation-related business continuity practices; and provides guidance on internal controls and valuation-related matters. The Valuation Committee reports to the Board and has representation from legal, portfolio management and trading, operations, risk management, and the funds’ treasurer.

Various valuation techniques and inputs are used to determine the fair value of financial instruments. GAAP establishes the following fair value hierarchy that categorizes the inputs used to measure fair value:

Level 1 – quoted prices (unadjusted) in active markets for identical financial instruments that the fund can access at the reporting date

Level 2 – inputs other than Level 1 quoted prices that are observable, either directly or indirectly (including, but not limited to, quoted prices for similar financial instruments in active markets, quoted prices for identical or similar financial instruments in inactive markets, interest rates and yield curves, implied volatilities, and credit spreads)

Level 3 – unobservable inputs

Observable inputs are developed using market data, such as publicly available information about actual events or transactions, and reflect the assumptions that market participants would use to price the financial instrument. Unobservable inputs are those for which market data are not available and are developed using the best information available about the assumptions that market participants would use to price the financial instrument. GAAP requires valuation techniques to maximize the use of relevant observable inputs and minimize the use of unobservable inputs. When multiple inputs are used to derive fair value, the financial instrument is assigned to the level within the fair value hierarchy based on the lowest-level input that is significant to the fair value of the financial instrument. Input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level but rather the degree of judgment used in determining those values. On June 30, 2017, all of the investments in underlying Price funds were classified as Level 1, based on the inputs used to determine their fair values.

NOTE 3 - INVESTMENTS IN UNDERLYING PRICE FUNDS

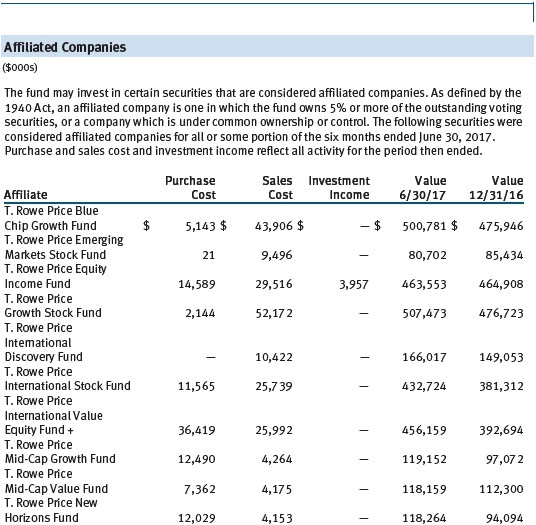

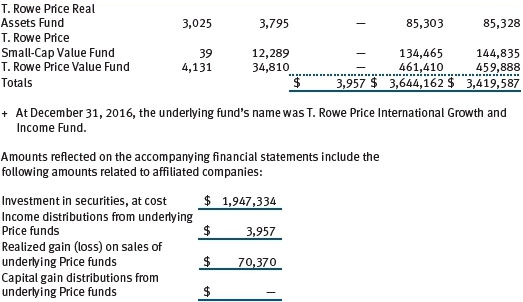

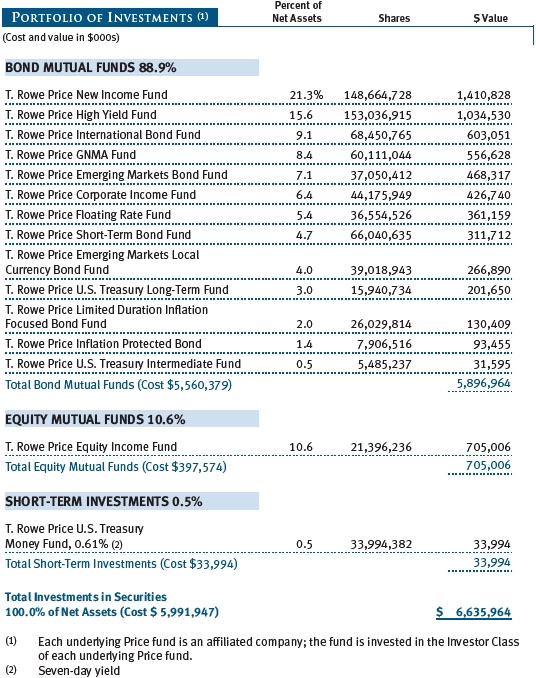

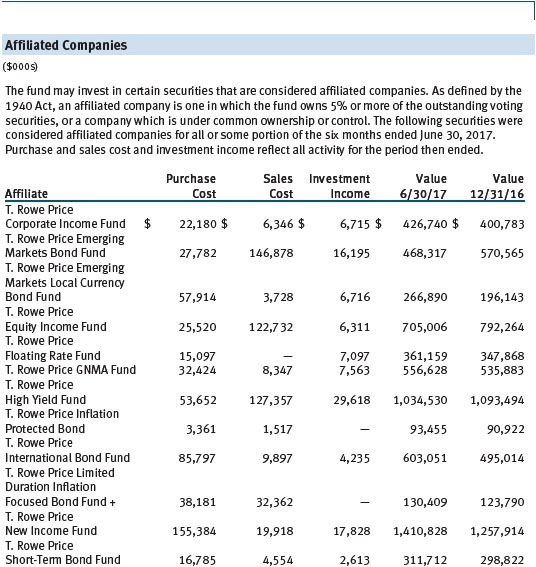

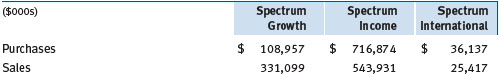

Purchases and sales of the underlying Price funds during the six months ended June 30, 2017, were as follows:

NOTE 4 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since each fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences. The amount and character of tax-basis distributions and composition of net assets are finalized at fiscal year-end; accordingly, tax-basis balances have not been determined as of the date of this report.

Each fund intends to retain realized gains to the extent of available capital loss carryforwards. Because capital loss carryforwards that do not expire are required to be used before capital loss carryforwards with expiration dates, it is possible that all or a portion of Spectrum International’s capital loss carryforwards subject to expiration could ultimately go unused. As of December 31, 2016, Spectrum Growth had no available capital loss carryforwards. Spectrum Income had no available capital loss carryforwards as of December 31, 2016. Additionally, as of December 31, 2016, Spectrum International had $7,173,000 of available capital loss carryforwards, expire as follows: $2,786,000 in 2018; $4,387,000 have no expiration.

At June 30, 2017, the cost of investments for federal income tax purposes and net unrealized gain (loss) on investments was as follows:

NOTE 5 - RELATED PARTY TRANSACTIONS

The Spectrum Funds are managed by T. Rowe Price Associates, Inc. (Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. (Price Group). Price Associates, directly or through sub-advisory agreements with its wholly owned subsidiaries, also provides investment management services to all the underlying Price funds. Pursuant to various service agreements, Price Associates and its wholly owned subsidiaries provide shareholder servicing and administrative services as well as certain accounting, marketing, and other services to the Spectrum Funds. Certain officers and directors of the Spectrum Funds are also officers and directors of Price Associates and its subsidiaries and of the underlying Price funds.

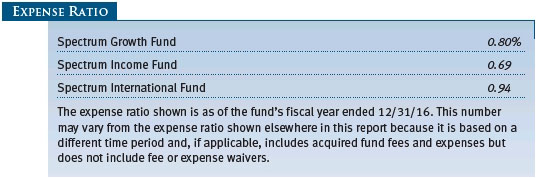

The Spectrum Funds pay no management fees; however, Price Associates receives management fees from the underlying Price funds. The Spectrum Funds operate in accordance with the investment management and special servicing agreements between and among the corporation, the underlying Price funds, and Price Associates. Pursuant to these agreements, expenses associated with the operation of the Spectrum Funds are borne by each underlying Price fund to the extent of estimated savings to it and in proportion to the average daily value of its shares owned by the Spectrum Funds. Therefore, each Spectrum Fund operates at a zero expense ratio. However, each Spectrum Fund indirectly bears its proportionate share of the management fees and operating costs of the underlying Price funds in which it invests.

The Spectrum Funds do not invest in the underlying Price funds for the purpose of exercising management or control; however, investments by the Spectrum Funds may represent a significant portion of an underlying Price fund’s net assets. At June 30, 2017, Spectrum Growth Fund held less than 25% of the outstanding shares of any underlying Price fund; Spectrum Income Fund held approximately 45% of the outstanding shares of the Corporate Income Fund, 82% of the Emerging Markets Local Currency Bond Fund, 37% of the Floating Rate Fund, 39% of the GNMA Fund, 45% of the U.S. Treasury Long-Term Fund, and less than 25% of any other underlying Price fund; Spectrum International Fund held approximately 27% of the outstanding shares of the Japan Fund and less than 25% of any other underlying Price fund.

Additionally, Spectrum Income Fund is one of several mutual funds in which certain college savings plans managed by Price Associates may invest. Shareholder servicing costs associated with each college savings plan are allocated to Spectrum Income Fund in proportion to the average daily value of its shares owned by the college savings plan and, in turn, are borne by the underlying Price funds in accordance with the terms of the investment management and special servicing agreements. At June 30, 2017, approximately 34% of the outstanding shares of Spectrum Income Fund were held by the college savings plans.

As of June 30, 2017, T. Rowe Price Group, Inc., or its wholly owned subsidiaries owned 1,840,264 shares of the Spectrum Growth Fund, representing approximately 1% of the fund’s net assets.

| Information on Proxy Voting Policies, Procedures, and Records |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information. You may request this document by calling 1-800-225-5132 or by accessing the SEC’s website, sec.gov.

The description of our proxy voting policies and procedures is also available on our corporate website. To access it, please visit the following Web page:

https://www3.troweprice.com/usis/corporate/en/utility/policies.html

Scroll down to the section near the bottom of the page that says, “Proxy Voting Policies.” Click on the Proxy Voting Policies link in the shaded box.

Each fund’s most recent annual proxy voting record is available on our website and through the SEC’s website. To access it through T. Rowe Price, visit the website location shown above, and scroll down to the section near the bottom of the page that says, “Proxy Voting Records.” Click on the Proxy Voting Records link in the shaded box.

| How to Obtain Quarterly Portfolio Holdings |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s website (sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 100 F St. N.E., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| T. Rowe Price Spectrum Growth Fund |

|

|

| Approval of Investment Management Agreement |

Each year, the fund’s Board of Directors (Board) considers the continuation of the investment management agreement (Advisory Contract) between the fund and its investment advisor, T. Rowe Price Associates, Inc. (Advisor), as well as a Special Servicing Agreement among the fund, the Advisor, and each of the underlying funds in which it invests (Special Servicing Agreement). The Special Servicing Agreement allows the T. Rowe Price Spectrum Funds (Spectrum Funds) to pass through their operating expenses to the underlying funds in which they invest if the benefit to the underlying funds equals or exceeds the costs of absorbing these expenses and provides that the Advisor will be responsible for bearing any expenses that would result from an underlying fund’s share of the aggregate expenses of the Spectrum Funds exceeding the estimated savings to the underlying fund from the operation of the Spectrum Funds. In that regard, at an in-person meeting held on March 6–7, 2017 (Meeting), the Board, including a majority of the fund’s independent directors, approved the continuation of the fund’s Advisory Contract and Special Servicing Agreement. At the Meeting, the Board considered the factors and reached the conclusions described below relating to the selection of the Advisor and approval of the Advisory Contract and the continuation of the Special Servicing Agreement. The independent directors were assisted in their evaluation of the Advisory Contract and Special Servicing Agreement by independent legal counsel, from whom they received separate legal advice and with whom they met separately.

In providing information to the Board, the Advisor was guided by a detailed set of requests for information submitted by independent legal counsel on behalf of the independent directors. In considering and approving the Advisory Contract and Special Servicing Agreement, the Board considered the information it believed was relevant, including, but not limited to, the information discussed below. The Board considered not only the specific information presented in connection with the Meeting but also the knowledge gained over time through interaction with the Advisor about various topics. The Board meets regularly and, at each of its meetings, covers an extensive agenda of topics and materials and considers factors that are relevant to its annual consideration of the renewal of the T. Rowe Price funds’ advisory contracts, including performance and the services and support provided to the funds and their shareholders.

Services Provided by the

Advisor

The Board considered the nature,

quality, and extent of the services provided to the fund by the Advisor. These

services included, but were not limited to, directing the fund’s investments in

accordance with its investment program and the overall management of the fund’s

portfolio, as well as a variety of related activities such as financial,

investment operations, and administrative services; compliance; maintaining the

fund’s records and registrations; and shareholder communications. The Board also

reviewed the background and experience of the Advisor’s senior management team

and investment personnel involved in the management of the fund, as well as the

Advisor’s compliance record. The Board concluded that it was satisfied with the

nature, quality, and extent of the services provided by the Advisor.

Investment Performance of the

Fund

The Board took into account

discussions with the Advisor and reports that it receives throughout the year

relating to fund performance. In connection with the Meeting, the Board reviewed

the fund’s net annualized total returns for the 1-, 2-, 3-, 4-, 5-, and 10-year

periods as of September 30, 2016, and compared these returns with the

performance of a peer group of funds with similar investment programs and a wide

variety of other previously agreed-upon comparable performance measures and

market data, including those supplied by Broadridge, which is an independent

provider of mutual fund data.

On the basis of this evaluation and the Board’s ongoing review of investment results and factoring in the relative market conditions during certain of the performance periods, the Board concluded that the fund’s performance was satisfactory.

Costs, Benefits, Profits, and Economies

of Scale

The Advisor does not receive

management fees from the fund, and operating expenses of the fund are borne by

the underlying T. Rowe Price funds in which it invests pursuant to the Special

Servicing Agreement. In connection with its review of the Special Servicing

Agreement, the Board reviewed various cost/benefit analyses to demonstrate the

benefits to the underlying funds versus the costs they incur, which illustrate

that the primary benefit provided by the Spectrum Funds to the underlying funds

is the reduction in expenses associated with the consolidation of shareholder

accounts that would otherwise be invested directly in the underlying

funds.

The Advisor receives management fees from other T. Rowe Price funds in which the fund invests. However, since the Advisor does not receive any management fees directly from the fund, the Board did not review information relating to revenues received by the Advisor under the Advisory Contract. The Board did review information regarding benefits that the Advisor (and its affiliates) may have realized from its relationship with the fund or other T. Rowe Price funds in which the fund invests, including any research received under “soft dollar” agreements and commission-sharing arrangements with broker-dealers. The Board considered that the Advisor may receive some benefit from its soft-dollar arrangements pursuant to which it receives research from broker-dealers that execute the applicable fund’s portfolio transactions. The Board also received information on the estimated costs incurred and profits realized by the Advisor and its affiliates from advising T. Rowe Price funds and concluded that the Advisor’s profits were reasonable. Although the Advisor does not receive management fees directly from the fund under the Advisory Contract, the fund’s shareholders benefit from potential economies of scale through a decline in the fund’s total expense ratio as the fund grows in size.

Fees and Expenses

The Board was provided with information regarding industry

trends in management fees and expenses. Among other things, the Board reviewed

data for peer groups that were compiled by Broadridge, which compared: (i) total

expenses, actual management fees, and nonmanagement expenses of the fund with a

group of competitor funds selected by Broadridge (Expense Group) and (ii)

total expenses, actual management fees, and nonmanagement expenses of the fund

with a broader set of funds within the Lipper investment classification (Expense

Universe). The Board considered the fund’s actual management fee rate (which

reflects the management fees actually received from the fund by the Advisor

after any applicable waivers, reductions, or reimbursements), operating

expenses, and total expenses (which reflect the net total expense ratio of the

fund after any waivers, reductions, or reimbursements) in comparison with the

information for the Broadridge peer groups. Broadridge generally constructed the

peer groups by seeking the most comparable funds based on similar investment

classifications and objectives, expense structure, asset size, and operating

components and attributes. The fund would normally be ranked within a quintile,

with the first quintile representing the funds with the lowest relative expenses

and the fifth quintile representing the funds with the highest relative

expenses. However, there were not a sufficient number of funds in the peer group

to meaningfully rank within quintiles. The information provided to the Board

indicated that the fund’s actual management fee rate ranked first of four funds

(Expense Group) and first of five funds (Expense Universe) and the fund’s total

expenses ranked first of four funds (Expense Group) and first of five funds

(Expense Universe).

The Board also reviewed the fee schedules for institutional accounts and private accounts with similar mandates that are advised or subadvised by the Advisor and its affiliates. Management provided the Board with information about the Advisor’s responsibilities and services provided to subadvisory and other institutional account clients, including information about how the requirements and economics of the institutional business are fundamentally different from those of the mutual fund business. The Board considered information showing that the Advisor’s mutual fund business is generally more complex from a business and compliance perspective than its institutional account business and considered various relevant factors, such as the broader scope of operations and oversight, more extensive shareholder communication infrastructure, greater asset flows, heightened business risks, and differences in applicable laws and regulations associated with the Advisor’s proprietary mutual fund business. In assessing the reasonableness of the fund’s management fee rate, the Board considered the differences in the nature of the services required for the Advisor to manage its mutual fund business versus managing a discrete pool of assets as a subadvisor to another institution’s mutual fund or for an institutional account and that the Advisor generally performs significant additional services and assumes greater risk in managing the fund and other T. Rowe Price funds than it does for institutional account clients.

On the basis of the information provided and the factors considered, the Board concluded that the fees paid by the fund under the Advisory Contract are reasonable.

Approval of the Advisory Contract and

Special Servicing Agreement

As noted, the

Board approved the continuation of the Advisory Contract as well as the Special

Servicing Agreement. No single factor was considered in isolation or to be

determinative to the decision. Rather, the Board concluded, in light of a

weighting and balancing of all factors considered, that it was in the best

interests of the fund and its shareholders for the Board to approve the

continuation of the Advisory Contract and that there is a reasonable basis to

conclude that the benefits to the underlying funds exceed the costs they incur

and that it was in the best interests of the fund and its underlying funds to

approve continuation of the Special Servicing Agreement.

| T. Rowe Price Spectrum Income Fund |

|

|

| Approval of Investment Management Agreement |

Each year, the fund’s Board of Directors (Board) considers the continuation of the investment management agreement (Advisory Contract) between the fund and its investment advisor, T. Rowe Price Associates, Inc. (Advisor), as well as a Special Servicing Agreement among the fund, the Advisor, and each of the underlying funds in which it invests (Special Servicing Agreement). The Special Servicing Agreement allows the T. Rowe Price Spectrum Funds (Spectrum Funds) to pass through their operating expenses to the underlying funds in which they invest if the benefit to the underlying funds equals or exceeds the costs of absorbing these expenses and provides that the Advisor will be responsible for bearing any expenses that would result from an underlying fund’s share of the aggregate expenses of the Spectrum Funds exceeding the estimated savings to the underlying fund from the operation of the Spectrum Funds. In that regard, at an in-person meeting held on March 6–7, 2017 (Meeting), the Board, including a majority of the fund’s independent directors, approved the continuation of the fund’s Advisory Contract and Special Servicing Agreement. At the Meeting, the Board considered the factors and reached the conclusions described below relating to the selection of the Advisor and approval of the Advisory Contract and the continuation of the Special Servicing Agreement. The independent directors were assisted in their evaluation of the Advisory Contract and Special Servicing Agreement by independent legal counsel, from whom they received separate legal advice and with whom they met separately.

In providing information to the Board, the Advisor was guided by a detailed set of requests for information submitted by independent legal counsel on behalf of the independent directors. In considering and approving the Advisory Contract and Special Servicing Agreement, the Board considered the information it believed was relevant, including, but not limited to, the information discussed below. The Board considered not only the specific information presented in connection with the Meeting but also the knowledge gained over time through interaction with the Advisor about various topics. The Board meets regularly and, at each of its meetings, covers an extensive agenda of topics and materials and considers factors that are relevant to its annual consideration of the renewal of the T. Rowe Price funds’ advisory contracts, including performance and the services and support provided to the funds and their shareholders.

Services Provided by the

Advisor

The Board considered the nature,

quality, and extent of the services provided to the fund by the Advisor. These

services included, but were not limited to, directing the fund’s investments in

accordance with its investment program and the overall management of the fund’s

portfolio, as well as a variety of related activities such as financial,

investment operations, and administrative services; compliance; maintaining the

fund’s records and registrations; and shareholder communications. The Board also

reviewed the background and experience of the Advisor’s senior management team

and investment personnel involved in the management of the fund, as well as the

Advisor’s compliance record. The Board concluded that it was satisfied with the

nature, quality, and extent of the services provided by the Advisor.

Investment Performance of the

Fund

The Board took into account

discussions with the Advisor and reports that it receives throughout the year

relating to fund performance. In connection with the Meeting, the Board reviewed

the fund’s net annualized total returns for the 1-, 2-, 3-, 4-, 5-, and 10-year

periods as of September 30, 2016, and compared these returns with the

performance of a peer group of funds with similar investment programs and a wide

variety of other previously agreed-upon comparable performance measures and

market data, including those supplied by Broadridge, which is an independent

provider of mutual fund data.

On the basis of this evaluation and the Board’s ongoing review of investment results and factoring in the relative market conditions during certain of the performance periods, the Board concluded that the fund’s performance was satisfactory.

Costs, Benefits, Profits, and Economies

of Scale

The Advisor does not receive

management fees from the fund, and operating expenses of the fund are borne by

the underlying T. Rowe Price funds in which it invests pursuant to the Special

Servicing Agreement. In connection with its review of the Special Servicing

Agreement, the Board reviewed various cost/benefit analyses to demonstrate the

benefits to the underlying funds versus the costs they incur, which illustrate

that the primary benefit provided by the Spectrum Funds to the underlying funds

is the reduction in expenses associated with the consolidation of shareholder

accounts that would otherwise be invested directly in the underlying

funds.

The Advisor receives management fees from other T. Rowe Price funds in which the fund invests. However, since the Advisor does not receive any management fees directly from the fund, the Board did not review information relating to revenues received by the Advisor under the Advisory Contract. The Board did review information regarding benefits that the Advisor (and its affiliates) may have realized from its relationship with the fund or other T. Rowe Price funds in which the fund invests, including any research received under “soft dollar” agreements and commission-sharing arrangements with broker-dealers. The Board considered that the Advisor may receive some benefit from its soft-dollar arrangements pursuant to which it receives research from broker-dealers that execute the applicable fund’s portfolio transactions. The Board also received information on the estimated costs incurred and profits realized by the Advisor and its affiliates from advising T. Rowe Price funds and concluded that the Advisor’s profits were reasonable. Although the Advisor does not receive management fees directly from the fund under the Advisory Contract, the fund’s shareholders benefit from potential economies of scale through a decline in the fund’s total expense ratio as the fund grows in size.

Fees and Expenses

The Board was provided with information regarding industry

trends in management fees and expenses. Among other things, the Board reviewed

data for peer groups that were compiled by Broadridge, which compared: (i) total

expenses, actual management fees, and nonmanagement expenses of the fund with a

group of competitor funds selected by Broadridge

(Expense Group) and (ii) total expenses, actual management fees, and

nonmanagement expenses of the fund with a broader set of funds within the Lipper

investment classification (Expense Universe). The Board considered the fund’s

actual management fee rate (which reflects the management fees actually received

from the fund by the Advisor after any applicable waivers, reductions, or

reimbursements), operating expenses, and total expenses (which reflect the net

total expense ratio of the fund after any waivers, reductions, or

reimbursements) in comparison with the information for the Broadridge peer

groups. Broadridge generally constructed the peer groups by seeking the most

comparable funds based on similar investment classifications and objectives,

expense structure, asset size, and operating components and attributes. For the

Expense Universe, the fund was ranked within a quintile, with the first quintile

representing the funds with the lowest relative expenses and the fifth quintile

representing the funds with the highest relative expenses. However, there were

not a sufficient number of funds in the Expense Group to meaningfully rank

within quintiles. The information provided to the Board for the Expense Group

indicated that the fund’s actual management fee rate ranked first of five funds

in the Expense Group and the fund’s total expenses ranked first of five funds in

the Expense Group. The information provided to the Board for the Expense

Universe indicated that fund’s actual management fee rate ranked in the first

quintile and the fund’s total expenses ranked in the first quintile.

The Board also reviewed the fee schedules for institutional accounts and private accounts with similar mandates that are advised or subadvised by the Advisor and its affiliates. Management provided the Board with information about the Advisor’s responsibilities and services provided to subadvisory and other institutional account clients, including information about how the requirements and economics of the institutional business are fundamentally different from those of the mutual fund business. The Board considered information showing that the Advisor’s mutual fund business is generally more complex from a business and compliance perspective than its institutional account business and considered various relevant factors, such as the broader scope of operations and oversight, more extensive shareholder communication infrastructure, greater asset flows, heightened business risks, and differences in applicable laws and regulations associated with the Advisor’s proprietary mutual fund business. In assessing the reasonableness of the fund’s management fee rate, the Board considered the differences in the nature of the services required for the Advisor to manage its mutual fund business versus managing a discrete pool of assets as a subadvisor to another institution’s mutual fund or for an institutional account and that the Advisor generally performs significant additional services and assumes greater risk in managing the fund and other T. Rowe Price funds than it does for institutional account clients.

On the basis of the information provided and the factors considered, the Board concluded that the fees paid by the fund under the Advisory Contract are reasonable.

Approval of the Advisory Contract and

Special Servicing Agreement

As noted, the

Board approved the continuation of the Advisory Contract as well as the Special

Servicing Agreement. No single factor was considered in isolation or to be

determinative to the decision. Rather, the Board concluded, in light of a

weighting and balancing of all factors considered, that it was in the best

interests of the fund and its shareholders for the Board to approve the

continuation of the Advisory Contract and that there is a reasonable basis to

conclude that the benefits to the underlying funds exceed the costs they incur

and that it was in the best interests of the fund and its underlying funds to

approve continuation of the Special Servicing Agreement.

| T. Rowe Price Spectrum International Fund |

|

|

| Approval of Investment Management Agreement |

Each year, the fund’s Board of Directors (Board) considers the continuation of the investment management agreement (Advisory Contract) between the fund and its investment advisor, T. Rowe Price Associates, Inc. (Advisor), as well as a Special Servicing Agreement among the fund, the Advisor, and each of the underlying funds in which it invests (Special Servicing Agreement). The Special Servicing Agreement allows the T. Rowe Price Spectrum Funds (Spectrum Funds) to pass through their operating expenses to the underlying funds in which they invest if the benefit to the underlying funds equals or exceeds the costs of absorbing these expenses and provides that the Advisor will be responsible for bearing any expenses that would result from an underlying fund’s share of the aggregate expenses of the Spectrum Funds exceeding the estimated savings to the underlying fund from the operation of the Spectrum Funds. In that regard, at an in-person meeting held on March 6–7, 2017 (Meeting), the Board, including a majority of the fund’s independent directors, approved the continuation of the fund’s Advisory Contract and Special Servicing Agreement. At the Meeting, the Board considered the factors and reached the conclusions described below relating to the selection of the Advisor and approval of the Advisory Contract and the continuation of the Special Servicing Agreement. The independent directors were assisted in their evaluation of the Advisory Contract and Special Servicing Agreement by independent legal counsel, from whom they received separate legal advice and with whom they met separately.

In providing information to the Board, the Advisor was guided by a detailed set of requests for information submitted by independent legal counsel on behalf of the independent directors. In considering and approving the Advisory Contract and Special Servicing Agreement, the Board considered the information it believed was relevant, including, but not limited to, the information discussed below. The Board considered not only the specific information presented in connection with the Meeting but also the knowledge gained over time through interaction with the Advisor about various topics. The Board meets regularly and, at each of its meetings, covers an extensive agenda of topics and materials and considers factors that are relevant to its annual consideration of the renewal of the T. Rowe Price funds’ advisory contracts, including performance and the services and support provided to the funds and their shareholders.

Services Provided by the

Advisor

The Board considered the nature,

quality, and extent of the services provided to the fund by the Advisor. These

services included, but were not limited to, directing the fund’s investments in

accordance with its investment program and the overall management of the fund’s

portfolio, as well as a variety of related activities such as financial,

investment operations, and administrative services; compliance; maintaining the

fund’s records and registrations; and shareholder communications. The Board also

reviewed the background and experience of the Advisor’s senior management team

and investment personnel involved in the management of the fund, as well as the

Advisor’s compliance record. The Board concluded that it was satisfied with the

nature, quality, and extent of the services provided by the Advisor.

Investment Performance of the

Fund

The Board took into account

discussions with the Advisor and reports that it receives throughout the year

relating to fund performance. In connection with the Meeting, the Board reviewed

the fund’s net annualized total returns for the 1-, 2-, 3-, 4-, 5-, and 10-year

periods as of September 30, 2016, and compared these returns with the

performance of a peer group of funds with similar investment programs and a wide

variety of other previously agreed-upon comparable performance measures and

market data, including those supplied by Broadridge, which is an independent

provider of mutual fund data.

On the basis of this evaluation and the Board’s ongoing review of investment results and factoring in the relative market conditions during certain of the performance periods, the Board concluded that the fund’s performance was satisfactory.

Costs, Benefits, Profits, and Economies

of Scale

The Advisor does not receive

management fees from the fund, and operating expenses of the fund are borne by

the underlying T. Rowe Price funds in which it invests pursuant to the Special

Servicing Agreement. In connection with its review of the Special Servicing

Agreement, the Board reviewed various cost/benefit analyses to demonstrate the

benefits to the underlying funds versus the costs they incur, which illustrate

that the primary benefit provided by the Spectrum Funds to the underlying funds