Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended 31 December 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number 0-16350

WPP plc

(Exact Name of Registrant as specified in its charter)

Jersey

(Jurisdiction of incorporation or organization)

27 Farm Street

London, United Kingdom, W1J 5RJ

(Address of principal executive offices)

Andrea Harris, Esq.

Group Chief Counsel

27 Farm Street, London, United Kingdom, W1J 5RJ

Telephone: +44(0) 20 7408 2204

Facsimile: +44(0) 20 7493 6819

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class |

Name of each exchange on which registered | |

| Not applicable | Not applicable |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Ordinary Shares of 10p each

(Title of Class)

American Depositary Shares, each representing five Ordinary Shares (ADSs)

(Title of Class)

Table of Contents

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

At December 31, 2015, the number of outstanding ordinary shares was 1,329,366,024 which included at such date ordinary shares represented by 15,237,016 ADSs.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YES x NO ¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

YES ¨ NO x

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YES ¨ NO ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ¨ |

International Financial Reporting Standards issued by the International Accounting Standards Board x |

Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES ¨ NO x

Table of Contents

| Page | ||||||||

| 1 | ||||||||

| 1 | ||||||||

| Item 1 |

1 | |||||||

| Item 2 |

1 | |||||||

| Item 3 |

1 | |||||||

| A | 1 | |||||||

| B | 4 | |||||||

| C | 4 | |||||||

| D | 4 | |||||||

| Item 4 |

6 | |||||||

| A | 6 | |||||||

| B | 7 | |||||||

| C | 11 | |||||||

| D | 14 | |||||||

| Item 4A |

15 | |||||||

| Item 5 |

15 | |||||||

| A | 15 | |||||||

| B | 24 | |||||||

| C | 25 | |||||||

| D | 26 | |||||||

| E | 26 | |||||||

| F | 27 | |||||||

| Item 6 |

36 | |||||||

| A | 36 | |||||||

| B | 38 | |||||||

| C | 62 | |||||||

| D | 74 | |||||||

| E | Share Ownership | 75 | ||||||

| Item 7 |

76 | |||||||

| A | 76 | |||||||

| B | 77 | |||||||

| C | 77 | |||||||

| Item 8 |

77 | |||||||

| A | 77 | |||||||

| B | 77 | |||||||

| Item 9 |

78 | |||||||

| A | 78 | |||||||

| B | 79 | |||||||

| C | 79 | |||||||

| D | 79 | |||||||

| E | 79 | |||||||

| F | 79 | |||||||

Table of Contents

| Page | ||||||||

| Item 10 |

80 | |||||||

| A | 80 | |||||||

| B | 80 | |||||||

| C | 88 | |||||||

| D | 92 | |||||||

| E | 92 | |||||||

| F | 97 | |||||||

| G | 97 | |||||||

| H | 97 | |||||||

| I | 97 | |||||||

| Item 11 |

98 | |||||||

| Item 12 |

98 | |||||||

| A | 98 | |||||||

| B | 98 | |||||||

| C | 98 | |||||||

| D | 99 | |||||||

| 101 | ||||||||

| Item 13 |

101 | |||||||

| Item 14 |

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

101 | ||||||

| Item 15 |

101 | |||||||

| Item 16A |

103 | |||||||

| Item 16B |

103 | |||||||

| Item 16C |

104 | |||||||

| Item 16D |

104 | |||||||

| Item 16E |

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

104 | ||||||

| Item 16F |

105 | |||||||

| Item 16G |

105 | |||||||

| Item 16H |

106 | |||||||

| 106 | ||||||||

| Item 17 |

106 | |||||||

| Item 18 |

106 | |||||||

| Item 19 |

106 | |||||||

Table of Contents

In connection with the provisions of the Private Securities Litigation Reform Act of 1995 (the Reform Act), the Company (as defined below) may include forward-looking statements (as defined in the Reform Act) in oral or written public statements issued by or on behalf of the Company. These forward-looking statements may include, among other things, plans, objectives, projections and anticipated future economic performance based on assumptions and the like that are subject to risks and uncertainties. As such, actual results or outcomes may differ materially from those discussed in the forward-looking statements. Important factors which may cause actual results to differ include but are not limited to: the unanticipated loss of a material client or key personnel, delays or reductions in client advertising budgets, shifts in industry rates of compensation, regulatory compliance costs or litigation, natural disasters or acts of terrorism, the Company’s exposure to changes in the values of major currencies other than the UK pound sterling (because a substantial portion of its revenues are derived and costs incurred outside of the United Kingdom) and the overall level of economic activity in the Company’s major markets (which varies depending on, among other things, regional, national and international political and economic conditions and government regulations in the world’s advertising markets). In addition, you should consider the risks described in Item 3D, captioned “Risk Factors,” which could also cause actual results to differ from forward-looking information. In light of these and other uncertainties, the forward-looking statements included in this document should not be regarded as a representation by the Company that the Company’s plans and objectives will be achieved.

The Company undertakes no obligation to update or revise any such forward-looking statements, whether as a result of new information, future events or otherwise.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

Overview

WPP plc and its subsidiaries (WPP) comprise one of the largest communications services businesses in the world. At 31 December 2015, the Group had 128,123 employees. Including all employees of associated companies, this figure was approximately 190,000. For the year ended 31 December 2015, the Group had revenue of £12,235 million and operating profit of £1,632 million.

Unless the context otherwise requires, the terms “Company”, “Group” and “Registrant” as used herein shall also mean WPP plc and its subsidiaries.

The selected financial data should be read in conjunction with, and is qualified in its entirety by reference to, the Consolidated Financial Statements of the Company, including the notes thereto.

The selected income statement data for each of the years ended 31 December 2015, 2014 and 2013 and the selected balance sheet data as at 31 December 2015, 2014 and 2013 are derived from the Consolidated

1

Table of Contents

Financial Statements of the Company that appear elsewhere in this Form 20-F. The selected financial data for prior periods is derived from the Consolidated Financial Statements of the Company previously filed with the Securities and Exchange Commission (SEC) as part of the Company’s Annual Reports on Form 20-F. The Consolidated Financial Statements were prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB).

The reporting currency of the Group is the UK pound sterling and the selected financial data has been prepared on this basis.

Selected Consolidated Income Statement Data

| Year ended 31 December | ||||||||||||||||||||

| 2015 £m |

2014 £m |

2013 £m |

2012 £m |

2011 £m |

||||||||||||||||

| Revenue |

12,235.2 | 11,528.9 | 11,019.4 | 10,373.1 | 10,021.8 | |||||||||||||||

| Net sales1 |

10,524.3 | 10,064.8 | 10,076.1 | 9,514.8 | 9,238.5 | |||||||||||||||

| Operating profit |

1,632.0 | 1,507.3 | 1,410.3 | 1,241.1 | 1,192.2 | |||||||||||||||

| Profit for the year |

1,245.1 | 1,151.5 | 1,012.1 | 894.7 | 916.5 | |||||||||||||||

| Profit attributable to equity holders of the parent |

1,160.2 | 1,077.2 | 936.5 | 822.7 | 840.1 | |||||||||||||||

| Earnings per ordinary share: |

||||||||||||||||||||

| Basic |

90.0 | p | 82.4 | p | 72.4 | p | 66.2 | p | 67.6 | p | ||||||||||

| Diluted |

88.4 | p | 80.5 | p | 69.6 | p | 62.8 | p | 64.5 | p | ||||||||||

| Earnings per ADS2: |

||||||||||||||||||||

| Basic |

450.0 | p | 412.0 | p | 362.0 | p | 331.0 | p | 338.0 | p | ||||||||||

| Diluted |

442.0 | p | 402.5 | p | 348.0 | p | 314.0 | p | 322.5 | p | ||||||||||

| Dividends per ordinary share |

42.49 | p | 35.27 | p | 30.27 | p | 25.94 | p | 19.28 | p | ||||||||||

| Dividends per ADS (US dollars)3 |

340.57 | ¢ | 280.73 | ¢ | 238.83 | ¢ | 207.14 | ¢ | 151.17 | ¢ | ||||||||||

|

1 The Group has previously used the term gross profit to refer to net sales. 2 Basic and diluted earnings per American Depositary Share (ADS) have been calculated using the same method as earnings per share, multiplied by a factor of five. 3 These figures have been translated for convenience purposes only, using the approximate average rates shown in the exchange rate table on page 3. This conversion should not be construed as a representation that the pound sterling amounts actually represent, or could be converted into, US dollars at the rates indicated. |

| |||||||||||||||||||

Selected Consolidated Balance Sheet Data

| At 31 December | ||||||||||||||||||||

| 2015 £m |

2014 £m |

2013 £m |

2012 £m |

2011 £m |

||||||||||||||||

| Total assets1 |

28,749.2 | 26,622.9 | 24,975.5 | 24,877.6 | 24,694.9 | |||||||||||||||

| Net assets |

8,015.8 | 7,826.8 | 7,846.5 | 7,060.6 | 6,894.3 | |||||||||||||||

| Called-up share capital |

132.9 | 132.6 | 134.9 | 126.5 | 126.6 | |||||||||||||||

| Number of shares (in millions) |

1,329.4 | 1,325.7 | 1,348.7 | 1,265.4 | 1,266.4 | |||||||||||||||

|

1 As described in note 15 to the Consolidated Financial Statements, the prior year balance sheets have been restated to reduce both the deferred tax assets and deferred tax liabilities, by a corresponding amount. No restatement was required in 2012 and 2011. |

| |||||||||||||||||||

Dividends

Dividends on the Company’s ordinary shares, when paid, are paid to share owners as of a record date, which is fixed by the Company. The table below sets forth the amounts of interim or first interim, final or second interim

2

Table of Contents

and total dividends paid on the Company’s ordinary shares in respect of each fiscal year indicated. In the United States, the Company’s ordinary shares are represented by ADSs, which are evidenced by American Depositary Receipts (ADRs) or held in book-entry form. The Group uses the terms ‘ADS’ and ‘ADR’ interchangeably. The dividends are also shown translated into US cents per ADS using the approximate average rates as shown in the exchange rate table below, for each year presented.

| Pence per ordinary share | US cents per ADS | |||||||||||||||||||||||

| In respect of the year ended 31 December: | Interim or First Interim |

Final or Second Interim |

Total | Interim or First Interim |

Final or Second Interim |

Total | ||||||||||||||||||

| 2011 |

7.46 | 17.14 | 24.60 | 59.80 | 137.39 | 197.19 | ||||||||||||||||||

| 2012 |

8.80 | 19.71 | 28.51 | 69.75 | 156.22 | 225.97 | ||||||||||||||||||

| 2013 |

10.56 | 23.65 | 34.21 | 82.61 | 185.01 | 267.62 | ||||||||||||||||||

| 2014 |

11.62 | 26.58 | 38.20 | 95.72 | 218.95 | 314.67 | ||||||||||||||||||

| 2015 |

15.91 | 28.78 | 44.69 | 121.62 | 219.99 | 341.61 | ||||||||||||||||||

The 2015 interim dividend was paid on 9 November 2015 to share owners on the register at 9 October 2015. The 2015 final dividend will be paid on 4 July 2016 to share owners on the register at 10 June 2016.

Exchange rates

Fluctuations in the exchange rate between the pound sterling and the US dollar will affect the dollar equivalent of the pound sterling prices of the Company’s ordinary shares on The London Stock Exchange Limited (The London Stock Exchange) and, as a result, are likely to affect the market price of the ADSs in the United States. US dollar amounts paid to holders of ADSs also depend on the sterling/US dollar exchange rate at the time of payment.

The following table sets forth for each of the most recent six months, the high and low exchange rates between the pound sterling and the US dollar. As at 27 April 2016, the closing exchange rate was 1.4555.

| Month ended | High | Low | ||||||

| 31 October 2015 |

1.5495 | 1.5149 | ||||||

| 30 November 2015 |

1.5446 | 1.5035 | ||||||

| 31 December 2015 |

1.5216 | 1.4734 | ||||||

| 31 January 2016 |

1.4747 | 1.4183 | ||||||

| 29 February 2016 |

1.4587 | 1.3876 | ||||||

| 31 March 2016 |

1.4490 | 1.3955 | ||||||

The annual average exchange rates between the pound sterling and the US dollar for each of the five years ended 31 December were:

| Year ended 31 December | Average | |||

| 2011 |

1.6032 | |||

| 2012 |

1.5852 | |||

| 2013 |

1.5646 | |||

| 2014 |

1.6475 | |||

| 2015 |

1.5288 | |||

3

Table of Contents

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

The Company is subject to a variety of possible risks that could adversely impact its revenues, results of operations, reputation or financial condition. Some of these risks relate to the industries in which the Company operates while others are more specific to the Company. The table below sets out principal risks the Company has identified that could adversely affect it. See also the discussion of Forward-Looking Statements preceding Item 1.

| Principal risk | Potential impact and any change from the prior year | |

| Clients | ||

| The Group competes for clients in a highly-competitive and evolving industry and client loss may have a material adverse effect on the Group’s market share and its business, revenues, results of operations, financial condition or prospects. | The competitive landscape in the industry in which we operate is constantly evolving. Competitors include large multinational advertising and marketing communication companies and regional and national marketing services companies, database marketing and modelling companies, telemarketers, information and measurement, social media and consulting internet companies.

Service agreements with clients are generally terminable by the client on 90 days’ notice and many clients put their business up for competitive review from time to time. The ability to attract new clients and to retain or increase the amount of work from existing clients may be impacted by loss of reputation and be limited by clients’ policies on conflicts of interest. | |

| The Group receives a significant portion of its revenues from a limited number of large clients and the net loss of some of these clients could have a material adverse effect on the Group’s prospects, business, financial condition and results of operations. | A relatively small number of clients contribute a significant percentage of the Group’s consolidated revenues. The Group’s 10 largest clients accounted for 16.2% of revenues in the year ended 31 December 2015. Clients generally are able to reduce advertising and marketing spend or cancel projects on short notice. The loss of one or more of the Group’s largest clients, if not replaced by new client accounts or an increase in business from existing clients, would adversely affect the Group’s financial condition. | |

| Data security | ||

| The Group is subject to strict data protection and privacy legislation in the jurisdictions in which it operates and relies extensively on information technology systems. The Group stores, transmits and relies on critical and sensitive data such as strategic plans, personally identifiable information and trade secrets. Security of this type of data is exposed to escalating external threats that are increasing in sophistication as well as internal data breaches.

Existing and new data protection laws, in particular the General Data Protection Regulation (GDPR) in the EU, concerning user privacy, use of personal information and online tracking may restrict some of the Group’s activities and increase costs.

The Group is carrying out an IT transformation project and is reliant on third parties for the performance of a significant portion of its worldwide information technology and operations functions. A failure to provide these functions could have an adverse effect on our business. |

The Group may be subject to investigative or enforcement action or legal claims or incur fines, damages, or costs and client loss if the Group fails to adequately protect data or observe privacy legislation in every instance. A system breakdown or intrusion could have a material adverse effect on the Group’s business, revenues, results of operations, financial condition or prospects.

The risk of a data breach, cyber attack or potential infringement of data protection laws has increased in 2015. |

4

Table of Contents

| Principal risk | Potential impact and any change from the prior year | |

| Financial | ||

| The Group is subject to credit risk through the default of a client or other counterparty. | The Group is generally paid in arrears for its services. Invoices are typically payable within 30 to 60 days.

The Group commits to media and production purchases on behalf of some of its clients as principal or agent depending on the client and market circumstances. If a client is unable to pay sums due, media and production companies may look to the Group to pay such amounts to which it committed on behalf of those clients. | |

| Operational | ||

| The Group’s performance could be adversely impacted if it failed to ensure adequate internal control procedures are in place in relation to the Group’s increased media trading. | Failure to ensure that media trading activities are compliant with client obligations where relevant could adversely impact client relationships and business volumes. The risks associated with media trading have increased in 2015 as the volume of media trading has increased. | |

| People and succession | ||

| The Group’s performance could be adversely affected if it were unable to attract and retain key talent or had inadequate talent management and succession planning for key roles at the parent and operating companies, including but not limited to the founder CEO and long-serving members of the management team. | The Group is highly dependent on the talent, creative abilities and technical skills of our personnel as well as their relationships with clients. The Group is vulnerable to the loss of personnel to competitors and clients leading to disruption to the business.

The founder CEO has over 30 years’ service with the Company and is identified with the success of the Group’s strategy and a failure to plan for his succession could impact investor confidence in the Company. | |

| Regulatory, sanctions, anti-trust and taxation | ||

| The Group may be subject to regulations restricting its activities or effecting changes in taxation. | Changes in local or international tax rules, for example prompted by the OECD’s emerging recommendations on Base Erosion and Profit Shifting (a global initiative to improve the fairness and integrity of tax systems), or new challenges by tax or competition authorities, may expose the Group to significant additional tax liabilities or impact the carrying value of our deferred tax assets, which would affect the future tax charge.

These risks to the Group have increased in 2015. | |

| The Group is subject to strict anti-corruption, anti-bribery and anti-trust legislation and enforcement in the countries in which it operates. | The Group operates in a number of markets where the corruption risk has been identified as high by groups such as Transparency International. Failure to comply or to create a corporate environment opposed to corruption or failing to instil business practices that prevent corruption could expose the Group and senior officers to civil and criminal sanctions. | |

| The Group is subject to the laws of the US, the EU and other jurisdictions that impose sanctions and regulate the supply of services to certain countries. | Failure to comply with these laws could expose the Group to civil and criminal penalties including fines and the imposition of economic sanctions against the Group and reputational damage which could materially impact the Group’s results. As certain EU sanctions in relation to Iran have been lifted the risk of non-compliance has reduced since 2015. | |

| Civil liabilities or judgements against the Company or its directors or officers based on United States federal or state securities laws may not be enforceable in the United States or in England and Wales or in Jersey. | The Company is a public limited company incorporated under the laws of Jersey. Some of the Company’s directors and officers reside outside of the United States. In addition, a substantial portion of the directly owned assets of the Company are located outside of the United States. As a result, it may be difficult or impossible for investors to effect service of process within the United States against the Company or its directors and officers or to enforce against them any of the judgements, including those obtained in original actions or in actions to enforce judgements of the U.S. courts, predicated upon the civil liability provisions of the federal or state securities laws of the United States. |

5

Table of Contents

ITEM 4. INFORMATION ON THE COMPANY

The Company operates through a number of established global, multinational and national advertising and marketing services companies that are organised into four business segments. Our largest segment is Advertising and Media Investment Management where we operate the well-known advertising networks Ogilvy & Mather Advertising, J. Walter Thompson Worldwide, Y&R, Grey and Bates CHI&Partners, as well as Media Investment Management companies such as MediaCom, MEC, Mindshare, Maxus, Xaxis and tenthavenue. Our other segments are Data Investment Management, where our operations are conducted through Kantar; Public Relations & Public Affairs, where we operate through well-known companies such as Burson-Marsteller, Cohn & Wolfe, Hill+Knowlton Strategies and Ogilvy Public Relations; and Branding & Identity, Healthcare and Specialist Communications, where our operations are conducted by Landor, Group XP, The Partnership, ghg, Wunderman, Sudler & Hennessey, OgilvyOne Worldwide, Ogilvy CommonHealth Worldwide, Geometry Global, POSSIBLE, AKQA and other companies.

The Company’s ordinary shares are admitted to the Official List of the UK Listing Authority and trade on The London Stock Exchange and American Depositary Shares (which are evidenced by ADRs or held in book-entry form) representing deposited ordinary shares are quoted on the NASDAQ Global Select Market (NASDAQ). At 27 April 2016 the Company had a market capitalisation of approximately £20.905 billion.

The Company’s executive office is located at 27 Farm Street, London, United Kingdom, W1J 5RJ, Tel:+44 (0)20 7408 2204 and its registered office is located at Queensway House, Hilgrove Street, St Helier, Jersey JE1 IES.

A. History and Development of the Company

WPP plc was incorporated in Jersey on 25 October 2012 under the name WPP 2012 plc.

On 2 January 2013, under a scheme of arrangement between WPP 2012 Limited (formerly known as WPP plc), (Old WPP), the former holding company of the Group, and its share owners pursuant to Article 125 of the Companies (Jersey) Law 1991, and as sanctioned by the Royal Court of Jersey (the Jersey Court), a Jersey incorporated and United Kingdom tax resident company, WPP 2012 plc became the new parent company of the WPP Group and adopted the name WPP plc. Under the scheme of arrangement, all the issued shares in Old WPP were cancelled and the same number of new shares were issued to WPP plc in consideration for the allotment to share owners of one share in WPP plc for each share in Old WPP held on the record date, 31 December 2012. Citibank, N.A., depositary for the ADSs representing Old WPP shares, cancelled Old WPP ADSs held in book-entry uncertificated form in the direct registration system maintained by it and issued ADSs representing shares of WPP plc in book entry uncertificated form in the direct registration system maintained by it to the holders. Holders of certificated ADSs, or ADRs, of Old WPP were entitled to receive ADSs of WPP plc upon surrender of the Old WPP ADSs, or ADRs, to the Depositary. Each Old WPP ADS represented five shares of Old WPP and each WPP plc ADS represents five shares of WPP plc.

Pursuant to Rule 12g-3 under the Securities Exchange Act of 1934, as amended (the Exchange Act), WPP plc succeeded to Old WPP’s registration and periodic reporting obligations under the Exchange Act.

Old WPP was incorporated in Jersey on 12 September 2008 and became the holding company of the WPP Group on 19 November 2008 when the company now known as WPP 2008 Limited, the prior holding company of the WPP Group which was incorporated in England and Wales, completed a reorganisation of its capital and corporate structure. WPP 2008 Limited had become the holding company of the Group on 25 October 2005 when the company now known as WPP 2005 Limited, the original holding company of the WPP Group, completed a reorganisation of its capital and corporate structure. WPP 2005 Limited was incorporated and registered in England and Wales in 1971 and is a private limited company under the Companies Act 1985, and until 1985 operated as a manufacturer and distributor of wire and plastic products. In 1985, new investors acquired a

6

Table of Contents

significant interest in WPP and changed the strategic direction of the Company from being a wire and plastics manufacturer and distributor to being a multinational communications services organisation. Since then, the Company has grown both organically and by the acquisition of companies, most significantly the acquisitions of J. Walter Thompson Group, Inc. (now known as J. Walter Thompson Company LLC) in 1987, The Ogilvy Group, Inc. (now known as The Ogilvy Group, LLC) in 1989, Young & Rubicam Inc. (Young & Rubicam or Young & Rubicam Brands, as the group is now known) in 2000, Tempus Group plc (Tempus) in 2001, Cordiant Communications Group plc (Cordiant) in 2003, Grey Global Group, LLC (Grey) in 2005, 24/7 Real Media Inc (now known as Xaxis, Inc) in 2007, Taylor Nelson Sofres plc (TNS) in 2008, AKQA Holdings, Inc. (AKQA) in 2012, and IBOPE Participações Ltda (IBOPE) in 2015.

The Company spent £693.1 million, £494.7 million and £221.0 million for acquisitions and investments in 2015, 2014 and 2013, respectively, including payments in respect of loan note redemptions and earnout payments resulting from acquisitions in prior years, net of cash and cash equivalents acquired (net) and proceeds on disposal of investments. For the same periods, cash spent on purchases of property, plant and equipment and other intangible assets was £246.4 million, £214.4 million and £284.5 million, respectively, and cash spent on share repurchases and buy-backs was £587.6 million, £510.8 million and £197.0 million, respectively.

The Company’s business comprises the provision of communications services on a national, multinational and global basis. It operates from over 3,000 offices in 112 countries including associates. The Company organises its businesses in the following areas: Advertising and Media Investment Management; Data Investment Management; Public Relations & Public Affairs; and Branding & Identity, Healthcare and Specialist Communications (including direct, digital, promotion and relationship marketing).

Approximately 45% of the Company’s reported revenues in 2015 were from Advertising and Media Investment Management, with the remaining 55% of its revenues being derived from the business segments of Data Investment Management; Public Relations & Public Affairs; and Branding & Identity, Healthcare and Specialist Communications.

The following tables show, for the last three fiscal years, reported revenue and net sales attributable to each business segment in which the Company operates.

| Revenue1 | 2015 | 2014 | 2013 | |||||||||||||||||||||

| £m | % of total |

£m | % of total |

£m | % of total |

|||||||||||||||||||

| Advertising and Media Investment Management |

5,552.8 | 45.4 | 5,134.3 | 44.5 | 4,578.8 | 41.5 | ||||||||||||||||||

| Data Investment Management |

2,425.9 | 19.8 | 2,429.3 | 21.1 | 2,549.7 | 23.1 | ||||||||||||||||||

| Public Relations & Public Affairs |

945.8 | 7.7 | 891.9 | 7.7 | 920.7 | 8.4 | ||||||||||||||||||

| Branding & Identity, Healthcare and Specialist Communications |

3,310.7 | 27.1 | 3,073.4 | 26.7 | 2,970.2 | 27.0 | ||||||||||||||||||

| Total |

12,235.2 | 100.0 | 11,528.9 | 100.0 | 11,019.4 | 100.0 | ||||||||||||||||||

| 1 | Intersegment sales have not been separately disclosed as they are not material. |

| Net Sales | 2015 | 2014 | 2013 | |||||||||||||||||||||

| £m | % of total |

£m | % of total |

£m | % of total |

|||||||||||||||||||

| Advertising and Media Investment Management |

4,652.0 | 44.2 | 4,502.0 | 44.7 | 4,463.6 | 44.3 | ||||||||||||||||||

| Data Investment Management |

1,768.1 | 16.8 | 1,748.9 | 17.4 | 1,843.7 | 18.3 | ||||||||||||||||||

| Public Relations & Public Affairs |

929.7 | 8.8 | 880.4 | 8.7 | 907.5 | 9.0 | ||||||||||||||||||

| Branding & Identity, Healthcare and Specialist Communications |

3,174.5 | 30.2 | 2,933.5 | 29.2 | 2,861.3 | 28.4 | ||||||||||||||||||

| Total |

10,524.3 | 100.0 | 10,064.8 | 100.0 | 10,076.1 | 100.0 | ||||||||||||||||||

7

Table of Contents

The following tables show, for the last three fiscal years, reported revenue and net sales attributable to each geographic area in which the Company operates and demonstrates the Company’s regional diversity.

| Revenue1 | 2015 | 2014 | 2013 | |||||||||||||||||||||

| £m | % of total |

£m | % of total |

£m | % of total |

|||||||||||||||||||

| North America2 |

4,491.2 | 36.7 | 3,899.9 | 33.8 | 3,744.7 | 34.0 | ||||||||||||||||||

| United Kingdom |

1,777.4 | 14.5 | 1,640.3 | 14.2 | 1,414.0 | 12.8 | ||||||||||||||||||

| Western Continental Europe |

2,425.6 | 19.8 | 2,568.8 | 22.3 | 2,592.6 | 23.5 | ||||||||||||||||||

|

Asia Pacific, Latin America, Africa & Middle East and Central & Eastern Europe |

3,541.0 | 29.0 | 3,419.9 | 29.7 | 3,268.1 | 29.7 | ||||||||||||||||||

| Total |

12,235.2 | 100.0 | 11,528.9 | 100.0 | 11,019.4 | 100.0 | ||||||||||||||||||

| 1 | Intersegment sales have not been separately disclosed as they are not material. |

| 2 | North America includes the US with revenue of £4,257.4 million (2014: £3,664.9 million, 2013: £3,498.1 million). |

| Net Sales | 2015 | 2014 | 2013 | |||||||||||||||||||||

| £m | % of total |

£m | % of total |

£m | % of total |

|||||||||||||||||||

| North America1 |

3,882.3 | 36.9 | 3,471.7 | 34.5 | 3,547.0 | 35.2 | ||||||||||||||||||

| United Kingdom |

1,504.5 | 14.3 | 1,396.0 | 13.9 | 1,303.9 | 12.9 | ||||||||||||||||||

| Western Continental Europe |

2,016.2 | 19.1 | 2,142.6 | 21.3 | 2,217.8 | 22.0 | ||||||||||||||||||

|

Asia Pacific, Latin America, Africa & Middle East and Central & Eastern Europe |

3,121.3 | 29.7 | 3,054.5 | 30.3 | 3,007.4 | 29.9 | ||||||||||||||||||

| Total |

10,524.3 | 100.0 | 10,064.8 | 100.0 | 10,076.1 | 100.0 | ||||||||||||||||||

| 1 | North America includes the US with net sales of £3,674.3 million (2014: £3,254.2 million, 2013: £3,310.8 million). |

The Company’s principal disciplines within each of its business segments are described below. Item 4C sets forth the Group brands operating within each discipline.

Advertising and Media Investment Management

Advertising – The principal functions of an advertising agency are the planning and creation of marketing and branding campaigns and the design and production of advertisements for all types of media such as television, cable, the internet, radio, magazines, newspapers and outdoor locations such as billboards.

Media Investment Management – GroupM is WPP’s leading global media investment management operation. With its agencies, GroupM has capabilities in business science, consumer insight, communications and media planning implementation, interactions, content development, and sports and entertainment marketing. The primary purpose of GroupM is to maximise the performance of WPP’s media agencies, operating not only as a parent company but as a collaborator on performance-enhancing activities, such as media trading, content creation, sports, digital, finance, proprietary tool development and other business-critical capabilities, in order to leverage the combination of GroupM’s core and talent resources. Our offering in this discipline also includes the network tenthavenue, which integrates some of the Group’s key specialist media offerings in online, mobile, experiential and out of home (OOH).

Data Investment Management

To help optimise its worldwide research offering to clients, the Company’s separate global research and strategic marketing consultancy businesses are managed on a centralised basis under the umbrella of the Kantar Group. The Kantar Group offering includes: custom research in a wide range of business sectors and areas of marketplace information including strategic market studies; brand positioning; equity research; customer

8

Table of Contents

satisfaction surveys; product development; international research; advanced modeling; advertising research; pre-testing, tracking and sales modeling; and trends and futures research and consultancy.

Public Relations & Public Affairs

Public Relations & Public Affairs companies advise clients who are seeking to communicate with consumers, governments and/or the business and financial communities. Public Relations & Public Affairs activities include national and international corporate, financial and marketing communications, crisis management, reputation management, public affairs and government lobbying.

Branding & Identity, Healthcare and Specialist Communications

Branding & Identity – consumer, corporate and employee branding and design services, covering identity, packaging, literature, events, training and architecture.

Healthcare Communications – provide integrated healthcare marketing solutions from advertising to medical education and online marketing.

Direct, Digital, Promotion & Relationship Marketing – the full range of general and specialist customer, channel, direct, field, retail, promotional and point-of-sale services.

Specialist Communications – a comprehensive range of specialist services, from custom media and multicultural marketing to event, sports, youth and entertainment marketing; corporate and business-to-business; and media, technology and production services.

WPP Digital – Through WPP Digital, WPP makes acquisitions and strategic investments in companies that bolster the Group’s presence in digital marketing & media and provide access for WPP companies and their clients to a portfolio of digital experts. Services provided by WPP Digital full-service interactive agencies include: digital marketing solutions for advertisers and publishers; integrated digital marketing strategy services; mobile solutions for handset manufacturers and wireless operators; creating measurable interactive marketing; and proprietary platforms which enable advertisers to engage with global audiences across the universe of digital media.

WPP Head Office

WPP, the parent company, with its offices in London, New York, Tokyo, Hong Kong, Singapore, Shanghai and São Paulo develops the professional and financial strategy of the Group, promotes operating efficiencies, coordinates cross referrals of clients among the Group companies and monitors the financial performance of its operating companies. The principal activity of the Group continues to be the provision of communications services worldwide. WPP acts only as a parent company and does not trade. The parent company complements the operating companies in three distinct ways.

| • | First, the parent company relieves them of much administrative work. Financial matters (such as planning, budgeting, reporting, control, treasury, tax, mergers, acquisitions, investor relations, legal affairs and internal audit) are co-ordinated centrally. |

| • | Second, the parent company encourages and enables operating companies of different disciplines to work together for the benefit of clients. The parent company also plays an across-the-Group role in the management of talent, property, procurement, information technology (IT), knowledge sharing, practice development, and sustainability. |

| • | And, finally, the parent company itself can function as the 21st-century equivalent of the full-service agency. For some clients, predominantly those with a vast geographical spread and a need for a wide range of marketing services, WPP can act as a portal to provide a single point of contact and accountability. |

9

Table of Contents

The parent company operates with a limited group of approximately 400 people.

WPP Strategy

Our reason for being, the justification for WPP’s existence, continues to be to add value to our clients’ businesses and our people’s careers. Our goal remains to be the world’s most admired and respected communications services advisor to global, multinational, regional and local companies.

The Group has four core strategic priorities.

| • | Advance ‘horizontality’ by ensuring our people work together for the benefit of clients, primarily through two horizontal integrators: Global Client Leaders and Regional, Sub-Regional and Country Managers. |

| • | Increase the combined geographic share of revenues from the faster-growing markets of Asia Pacific, Latin America, Africa & Middle East and Central & Eastern Europe to 40-45% of revenues. |

| • | Increase the share of revenues from new media to 40-45% of revenues. |

| • | Maintain the share of more measurable marketing services – such as Data Investment Management and direct, digital and interactive – at 50% of revenues, with a focus on the application of technology, data and content. |

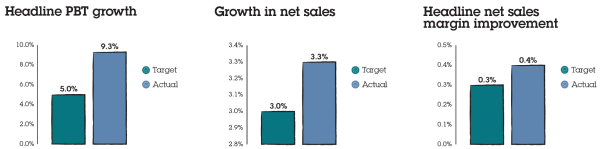

If we implement this strategy effectively then our business will be geographically and functionally well-positioned to compete successfully and to deliver on our long-term financial targets:

| • | Revenue and net sales growth greater than the industry average. |

| • | Annual improvement in net sales margin of 0.3 margin points or more, excluding the impact of currency, depending on net sales growth and staff cost-to-net sales ratio improvement of 0.2 margin points or more. |

Sustainability

Sustainability issues increasingly impact the products, operations, strategies and communications of leading brands. As these brands – our clients – adapt to social and environmental challenges they look to our companies for the best advice and insight. By developing our sustainability expertise and by improving our own social and environmental performance, we can forge stronger relationships with our clients and generate value for our business and society.

Clients

| • | Clients who engaged with us on sustainability were worth at least £1.29 billion to the Group in 2015, equivalent to 11% of revenues. |

People

| • | We invested £41.1 million on training in 2015. |

| • | At year-end 2015, women comprised 29% of the WPP Board, 33% of directors and executive leaders of our companies and 54% of total employees. |

Environment

| • | We have cut our carbon footprint per employee to 2.07 tonnes of CO2e, a 39% reduction from 2006. |

10

Table of Contents

Social contribution

| • | In 2015, our social investment was worth £19.4 million, equivalent to 1.3% of reported profit before tax. |

| • | In addition, WPP media agencies negotiated free media space worth £24.4 million on behalf of pro bono clients. |

Clients

The Group services 352 of the Fortune Global 500 companies, all 30 of the Dow Jones 30, 77 of the NASDAQ 100, and 830 national or multinational clients in three or more disciplines. Over 550 clients are served in four disciplines and these clients account for over 52% of Group revenue. The Group also works with 448 clients in six or more countries.

The Company’s 10 largest clients accounted for 16.2% of the Company’s revenues in the year ended 31 December 2015. No client of the Company represented more than 5% of the Company’s aggregate revenues in 2015. The Group’s companies have maintained long-standing relationships with many of their clients, with an average length of relationship for the top 10 clients of approximately 50 years.

Government Regulation

From time to time, governments, government agencies and industry self-regulatory bodies in the United States, European Union and other countries in which the Company operates have adopted statutes, regulations, and rulings that directly or indirectly affect the form, content, and scheduling of advertising, public relations and public affairs, and market research, or otherwise limit the scope of the activities of the Company and its clients. Some of the foregoing relate to privacy and data protection and general considerations such as truthfulness, substantiation and interpretation of claims made, comparative advertising, relative responsibilities of clients and advertising, public relations and public affairs firms, and registration of public relations and public affairs firms’ representation of foreign governments.

In addition, there is an increasing trend towards expansion of specific rules, prohibitions, media restrictions, labeling disclosures and warning requirements with respect to advertising for certain products, such as over-the-counter drugs and pharmaceuticals, cigarettes, food and certain alcoholic beverages, and to certain groups, such as children. Proposals have been made for the adoption of additional laws and regulations that could further restrict the activities of advertising, public relations and public affairs, and market research firms and their clients. Though the Company does not expect any existing or proposed regulations to have a material adverse impact on the Company’s business, the Company is unable to estimate the effect on its future operations of the application of existing statutes or regulations or the extent or nature of future regulatory action.

The Company’s business comprises the provision of communications services on a national, multinational and global basis. It operates out of over 3,000 offices in 112 countries (including associates). For a list of the Company’s principal subsidiary undertakings and their country of incorporation see note 29 to the Consolidated Financial Statements.

11

Table of Contents

The Company organises its businesses in the following segments: Advertising and Media Investment Management; Data Investment Management; Public Relations & Public Affairs; and Branding & Identity, Healthcare & Specialist Communications. These business segments are comprised of the following principal disciplines: Advertising; Media Investment Management and Data Investment Management; Public Relations & Public Affairs; Branding & Identity; Healthcare Communications; Direct, Digital, Promotion & Relationship Marketing; Specialist Communications; WPP Digital; WPP Digital partner companies; and WPP knowledge communities. A listing of the Group brands operating within these disciplines as at April 2016 is set forth below.

| Advertising ADK1 Bates CHI&Partners Berlin Cameron Blue Hive CHI&Partners1 Cole & Weber Grey HS Ad1 J. Walter Thompson Worldwide Ogilvy & Mather Advertising Santo WPP-Scangroup Scholz & Friends10 Sra. Rushmore Soho Square TAXI4 Team Detroit The Jupiter Drawing Room1 WPP AUNZ Y&R4

Media Investment Management and Data Investment Management GroupM: Catalyst KR Media Maxus MediaCom MEC MetaVision Media Mindshare QUISMA Xaxis tenthavenue: Forward Joule Kinetic Worldwide Spafax TMARC Other media agencies Gain Theory m/SIX2 Kantar: Added Value Benenson Strategy Group IMRB International Kantar Health Kantar Japan Kantar Media Kantar Retail Kantar Worldpanel Lightspeed GMI Millward Brown The Futures Company TNS comScore3,12 |

Public Relations & Public Affairs Blanc & Otus8 Buchanan Communications Burson-Marsteller4 BWR9 Clarion Communications Cohn & Wolfe4 Dewey Square Group Finsbury Glover Park Group HERING SCHUPPENER Hill+Knowlton Strategies Ogilvy Government Relations9 Ogilvy Public Relations9 Penn Schoen Berland4 Prime Policy Group QGA Wexler & Walker Public Policy Associates8

Branding & Identity Addison Group7 BDG architecture + design Brand Union6 CBA9 Coley Porter Bell9 Dovetail FITCH6 Lambie-Nairn7 Landor4 PeclersParis7 The Partners7 SET6 VBAT7

Notes 1 Associate 2 Joint venture 3 Investment 4 A Young & Rubicam Group company 5 Part of the Wunderman network 6 A member of Group XP 7 A member of The Partnership 8 A Hill+Knowlton Strategies company 9 An Ogilvy company 10 A Commarco company 11 A J. Walter Thompson company 12 Partnership with GroupM/Kantar |

12

Table of Contents

| Healthcare Communications Feinstein Kean Healthcare9 GCI Health ghg Ogilvy CommonHealth Worldwide9 Sudler & Hennessey4 Wunderman World Health5

Direct, Digital, Promotion & Relationship Marketing AdPeople Worldwide5 A. Eicoff & Co9 AKQA Barrows1 Blast Radius5 Cerebra deepblue networks10 Digit6 EWA FullSIX3 Grass Roots1 Geometry Global HighCo1 iconmobile4 KBM Group5 Mando Maxx Marketing9 Mirum11 OgilvyOne Worldwide9 SJR8 Smollan Group1 VML4 Wunderman4

Specialist Communications Corporate/B2B OgilvyOne Business9 Demographic marketing Bravo4 UniWorld1 Wing Employer branding/recruitment JWT INSIDE11 Event/face-to-face marketing MJM Metro Richard Attias & Associates1 Foodservice marketing The Food Group Sports marketing 9ine Sports & Entertainment Bruin Sports Capital3 Chime Communications1 ESP PRISM Group Real estate marketing PACE Media & production services The Farm Group H+O Imagina3 United Visions10 Policy & regulation Global Counsel1 |

WPP Digital Acceleration Blue State Digital Cognifide The Data Alliance F.biz Globant1 Hogarth Worldwide Interlude1 Johannes Leonardo1 Mutual Mobile1 POSSIBLE Rockfish Salmon Syzygy

WPP Digital partner companies Ace Metrix3 AppNexus3 CMC Capital3 Domo3 Fullscreen3 HDT Holdings Technology3 Indigenous Media3 In Game Ad Interactive3 Invidi3 Mitú3 mySupermarket3 Moment Systems3 MRC3 OrderDynamics3 Percolate3 Polestar3 Proclivity Media3 Say Media3 SFX Entertainment3 Vice Media3 The Weinstein Company3 WildTangent3

WPP knowledge communities Government & Public Sector Practice The Store

Notes 1 Associate 2 Joint venture 3 Investment 4 A Young & Rubicam Group company 5 Part of the Wunderman network 6 A member of Group XP 7 A member of The Partnership 8 A Hill+Knowlton Strategies company 9 An Ogilvy company 10 A Commarco company 11 A J. Walter Thompson company 12 Partnership with GroupM/Kantar |

13

Table of Contents

D. Property, Plant and Equipment

The majority of the Company’s properties are leased, although certain properties which are used mainly for office space are owned. In the United States the sole owned property is the 214,000 square foot Young & Rubicam office condominium for their headquarters located at 3 Columbus Circle in New York, New York. The Company also leases an additional 160,700 square feet of space for Young & Rubicam at the 3 Columbus Circle location. Other owned properties are in Latin America (principally in Argentina, Brazil, Chile, Mexico, Peru and Puerto Rico), Asia (India and China) and in Europe (Spain, France, UK and Italy). In Europe, owned properties include the 135,626 square foot TNS office located at 2 Rue Francis Pedron, Chambourcy, Paris, France and the 101,592 square foot TNS House at Westgate, Hangar Lane, London. Manufacturing facilities are owned in the United Kingdom. Principal leased properties, which are accounted for as operating leases, include office space at the following locations:

| Location | Use | |

Approximate square footage |

| ||

| 636 Eleventh Avenue, New York, NY |

Ogilvy & Mather | 564,000 | ||||

| 3 World Trade Center, New York, NY |

GroupM (Estimated 2018 Occupancy) | 690,000 | ||||

| 399 Heng Feng Road, Zhabei, Shanghai |

Ogilvy & Mather, GroupM, Kantar, Hill+Knowlton Strategies, Rice5, Bluehive, Sudler MDS, Burson-Marsteller, Peclars, Hogarth, J Walter Thompson. (2016 Occupancy) | 453,800 | ||||

| 498 Seventh Avenue, New York, NY |

GroupM, Mindshare, Maxus, Mediacom | 394,000 | ||||

| 200 Fifth Avenue and 23 West 23rd Street, New York, NY |

Grey Global Group, Cohn & Wolfe | 349,000 | ||||

| 230 Park Avenue South, New York, NY |

Burson-Marsteller, Landor, Sudler & Hennessey, Hogarth | 301,000 | ||||

| 222 Merchandise Mart / 350 N Orleans, Chicago IL |

Ogilvy & Mather, J. Walter Thompson, Geometry, Millward Brown, GroupM, Burson-Marsteller, TNS, Hill+Knowlton Strategies, The Futures Company, Kinetic, Kantar Media, Team Detroit | 287,700 | ||||

| 500/550 Town Center Drive, Dearborn, MI |

Team Detroit, J. Walter Thompson, Ogilvy & Mather, Y&R Advertising, PRISM, Burrows, Possible | 282,900 | ||||

| 466 Lexington Avenue, New York, NY |

J. Walter Thompson | 270,300 | ||||

| Sea Containers House, Upper Ground, London SE1 |

Ogilvy & Mather, MEC | 226,000 |

The Company considers its properties, owned or leased, to be in good condition and generally suitable and adequate for the purposes for which they are used. At 31 December 2015, the fixed asset value (cost less depreciation) representing land, freehold buildings and leasehold buildings as reflected in the Company’s consolidated financial statements was £534.3 million.

In 2015, we saw the benefit of more ‘agile working’, supported by more technology in the office environment, as our property portfolio was reduced by nearly 1% to end the year with 24.0 million square feet while net sales were up almost 6% in constant currency and average headcount grew by almost 3%. As a result, the establishment cost-to-net-sales ratio dropped by 0.2 margin points to 6.9%, contributing substantially to the Group’s overall margin improvement.

We have also ensured our new buildings are designed to focus on sustainability and we look to achieve BREEAM standard in the UK and LEED standard in the US and similar standards elsewhere. Our operating companies’ workplaces continue to be cited for their creativity, innovation and effectiveness.

2016 will see the completion of our Shanghai WPP Plaza co-location, housing 3,000 of our people, the shared space at Sea Containers House in London housing 2,300 people, and the renovation of our shared space on Lexington Avenue in New York. These new co-location projects all meet our new planning standards and support our horizontality goal. Longer-term co-location projects are in the planning stage for New York, São Paulo and central Madrid, where the former Telefónica building will house more than 40 Group companies.

Our goal is to continue to deliver excellent work space, while reducing the portfolio further and so mitigate the impact of property inflation. Our focus on continuing to reduce the establishment cost-to-net-sales ratio will help the Group achieve its margin targets for 2016, and beyond.

14

Table of Contents

See note 3 to the Consolidated Financial Statements for a schedule by years of future minimum rental payments to be made and future sublease rental payments to be received, as at 31 December 2015, under non-cancelable operating leases of the Company.

ITEM 4A. UNRESOLVED STAFF COMMENTS

Not applicable.

ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS

Introduction

Certain Non-GAAP measures included in this operating and financial review and prospects have been derived from amounts calculated in accordance with IFRS but are not themselves IFRS measures. They should not be viewed in isolation as alternatives to the equivalent IFRS measure, rather they should be read in conjunction with the equivalent IFRS measure. These include constant currency, pro-forma (‘like-for-like’), headline PBIT (Profit Before Interest and Taxation), net sales margin, headline PBT (Profit Before Taxation), headline EBITDA (Earnings before Interest, Taxation, Depreciation and Amortisation), headline operating costs, billings, estimated net new billings, free cash flow and net debt and average net debt, which we define, explain the use of and reconcile to the nearest IFRS measure on pages 28 to 31.

Management believes that these measures are both useful and necessary to present herein because they are used by management for internal performance analyses; the presentation of these measures facilitates comparability with other companies, although management’s measures may not be calculated in the same way as similarly titled measures reported by other companies; and these measures are useful in connection with discussions with the investment community.

Overview

The Company is one of the world’s most comprehensive marketing communications groups. It operates through a large number of established national, multinational and global advertising and marketing services companies. The Company offers services in four reportable segments:

| • | Advertising and Media Investment Management; |

| • | Data Investment Management; |

| • | Public Relations & Public Affairs; and |

| • | Branding & Identity, Healthcare and Specialist Communications. |

In 2015, approximately 45% of the Company’s consolidated revenues were derived from Advertising and Media Investment Management, with the remaining 55% of its revenues being derived from the remaining three segments.

The following objectives represent the Group’s key performance indicators.

| 1. | First, to continue to improve net sales margins. In 2015, we achieved a net sales margin of 16.9%, the highest-reported level in the industry. We continue to believe a net sales margin of well over 19%, is a tough, but realistic, objective given that our best-performing companies in each services sector have already demonstrated they can perform at a combined Group net sales margin of 18%. |

| 2. | Second, to increase flexibility in the cost structure. In 2015, flexible staff costs (including incentives, freelance and consultants) remained close to historical highs of above 8% of net sales and continue to position the Group extremely well should current market conditions deteriorate. |

15

Table of Contents

| 3. | Third, to enhance share owner value and maximise the return on investment on the Company’s substantial free cash flow. As capital expenditure remains relatively stable, there are broadly three alternative uses of funds: acquisitions, share buy-backs and dividends. We have increasingly come to the view, based on co-operative research with leading investment institutions that, currently, the markets favour consistent increases in dividends and higher sustainable pay-out ratios, along with anti-dilutive progressive buy-backs and, of course, sensibly-priced small-to-medium sized strategic acquisitions. |

| 4. | Fourth, we will continue to develop the value added by the parent company and build unique integrated marketing approaches for clients. WPP is not just a holding company focused on planning, budgeting, reporting and financial issues, but a parent company that can add value to our clients and our people in the areas of human resources, property, procurement, IT and practice development, including sustainability. This does not mean that we seek to diminish the strength of our operating brands, but rather to learn from one another. Our objective is to maximise the added value for our clients in their businesses and our people in their careers. |

| 5. | Fifth, to emphasise revenue and net sales growth more as margins improve through our practice development activities, aimed at helping us position our portfolio in the faster-growing geographic and functional areas. |

| 6. | Sixth, to build on, still further, the impressive creative reputation WPP now enjoys globally. Training and development programs remain a key focus, as of course does the judicious use of our M&A skills to identify the best and most like-minded creative businesses to join us. |

The following discussion is based on the Company’s audited Consolidated Financial Statements beginning on page F-1 of this report. The Group’s consolidated financial statements have been prepared in accordance with IFRS as issued by the IASB.

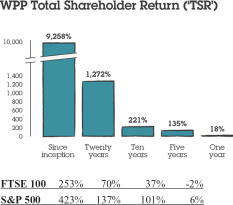

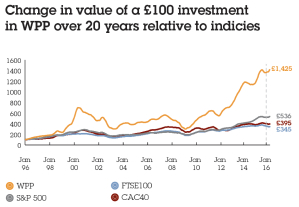

The Company celebrated its thirtieth birthday in 2015 with another record year: revenue, profitability, net sales margins and earnings per share all reached new highs, despite strong currency headwinds in the second half and a generally low-growth global environment. For the fifth successive year, WPP was named Creative Holding Company of the Year at the Cannes International Festival of Creativity, in recognition of the Company’s collective creative excellence; and also for the fourth consecutive year, WPP was ranked Most Effective Holding Company in the Effie Global Effectiveness Index; and, for the second year in a row, Warc’s Most Effective Holding Company. At the same time, the Company responded to the changing competitive landscape by accelerating the implementation of its strategic goals. Sector targets for faster-growth markets and new media have been raised to 40-45% of revenue over the next five years and horizontality across clients, countries and regions has been raised to our number one strategic priority.

The share price increased by over 16% in 2015, closing at 1,563.0p at year end. Since then it has strengthened further to 1,616.0p, up a further 3%, at 27 April 2016, reflecting our record results for 2015, as well as slightly stronger global stock markets in recent weeks. Dividends increased by 17% to 44.69p, a new high.

Revenue was up over 6% to £12.2 billion and up well over 7% in constant currencies. Net sales were up well over 4% and almost 6% in constant currencies. Reported billings were £47.6 billion, up almost 5% in constant currencies, driven by a strong overall leadership position in net new business league tables for the fourth year in a row and GroupM topping both the RECMA media tsunami net new business and retention tables.

Group revenue is more weighted to the second half of the year across all regions and sectors, especially in the faster-growing markets of Asia Pacific and Latin America. As a result, the Group’s profitability and margin continue to be skewed to the second half of the year, with the Group earning approximately one-third of its profits in the first half and two-thirds in the second half.

Reported profit before interest and tax rose 7% to £1.679 billion from £1.569 billion, up well over 10% in constant currencies. Headline PBIT was up well over 5% to £1.774 billion and up well over 8% in constant

16

Table of Contents

currencies. Net sales margins increased by 0.2 margin points to an industry-leading 16.9% and, on a constant currency basis, were up 0.4 margin points, ahead of the targeted constant currency increase of 0.3 margin points.

Profit for the year increased by over 8% to £1.245 billion. Headline EBITDA increased by almost 5% to £2.002 billion, crossing £2 billion for the first time, up well over 7% in constant currencies. Headline profit before tax was up over 7% to £1.622 billion and reported profit before tax was up almost 3% to £1.493 billion. Diluted reported earnings per share were up almost 10% to 88.4p, reflecting strong like-for-like revenue and net sales growth, margin improvement and the benefit of acquisitions.

Net cash inflow from operating activities decreased to £1.4 billion in the year. Free cash flow amounted to almost £1.3 billion in 2015, over £1 billion for the fifth consecutive year. This free cash flow was absorbed by £0.7 billion of net cash acquisition payments and investments, £0.6 billion of share buy-backs and £0.5 billion of dividends, a total outflow of £1.8 billion. This resulted in a net cash outflow of £0.5 billion, before any changes in working capital. Average net debt was therefore £3.6 billion in 2015, compared to £3.1 billion in 2014, at 2015 exchange rates, and net debt at 31 December 2015 was £3.2 billion, against £2.3 billion at 31 December 2014.

Estimated net new business billings of £5.6 billion ($8.6 billion) were won in 2015.

Segment performance

Performance of the Group’s businesses is reviewed by management based on headline PBIT. A table showing these amounts by operating sector and geographical area for each of the three years ended 31 December 2015, 2014 and 2013 is presented in note 2 to the Consolidated Financial Statements. To supplement the reportable currency segment information presented in note 2 to the Consolidated Financial Statements, the following tables give details of revenue growth and net sales growth by geographical area and operating sector on a reported, constant currency, and like-for-like basis.

Geographical area

| Revenue Analysis | ||||||||||||||||||||||||

| Reported revenue growth %+/(-) |

Constant currency revenue growth %+/(-) |

Like-for-like revenue growth %+/(-) |

||||||||||||||||||||||

| 2015 | 2014 | 2015 | 2014 | 2015 | 2014 | |||||||||||||||||||

| North America |

15.2 | 4.1 | 7.9 | 10.0 | 7.1 | 9.5 | ||||||||||||||||||

| United Kingdom |

8.4 | 16.0 | 8.4 | 16.0 | 4.1 | 12.9 | ||||||||||||||||||

| Western Continental Europe |

(5.6 | ) | (0.9 | ) | 4.7 | 5.1 | 4.7 | 3.8 | ||||||||||||||||

| Asia Pacific, Latin America, Africa & Middle East and Central & Eastern Europe |

3.5 | 4.6 | 8.5 | 15.8 | 4.2 | 8.0 | ||||||||||||||||||

| Total Group |

6.1 | 4.6 | 7.5 | 11.3 | 5.3 | 8.2 | ||||||||||||||||||

| Net sales analysis | ||||||||||||||||||||||||

| Reported net sales |

Constant net sales |

Like-for-like net sales growth %+/(-) |

||||||||||||||||||||||

| 2015 | 2014 | 2015 | 2014 | 2015 | 2014 | |||||||||||||||||||

| North America |

11.8 | (2.1 | ) | 4.7 | 3.4 | 4.1 | 3.0 | |||||||||||||||||

| United Kingdom |

7.8 | 7.1 | 7.8 | 7.1 | 2.9 | 4.8 | ||||||||||||||||||

| Western Continental Europe |

(5.9 | ) | (3.4 | ) | 4.3 | 2.5 | 2.5 | 1.1 | ||||||||||||||||

| Asia Pacific, Latin America, Africa & Middle East and Central & Eastern Europe |

2.2 | 1.6 | 7.3 | 12.5 | 3.0 | 4.6 | ||||||||||||||||||

| Total Group |

4.6 | (0.1 | ) | 5.8 | 6.3 | 3.3 | 3.3 | |||||||||||||||||

17

Table of Contents

North America, with constant currency revenue growth of over 11% in the final quarter and like-for-like growth of well over 9%, strengthened further, exceeding the strong growth seen in the first nine months, an improvement over the third quarter year-to-date constant currency growth of well over 6% and like-for-like growth of over 6%. Particularly strong growth was achieved in Advertising and Media Investment Management, parts of the Group’s Public Relations & Public Affairs businesses and Branding & Identity, direct, digital and interactive operations. On a full-year basis, constant currency revenue was up almost 8%, with like-for-like up over 7%. Net sales were up well over 4% in constant currency, with like-for-like up over 4%.

The UK rate of growth in the final quarter, although lower than quarter three, remained strong at well over 6% in constant currency, compared to well over 7% in quarter three, with like-for-like growth of almost 3%, well ahead of the 1% seen in quarter three. The Group’s Advertising, Public Relations & Public Affairs, Branding & Identity and direct, digital and interactive businesses performed particularly well. Despite the slight slow-down in the rate of revenue growth, net sales remained strong, with constant currency growth of almost 7%, slightly down on quarter three, with like-for-like growth of 3.5% compared with over 2% in quarter three. On a full-year basis, constant currency revenue was up over 8%, with like-for-like up over 4%. Net sales were up almost 8% in constant currency, with like-for-like up almost 3%.

Western Continental Europe, although remaining patchy from a macroeconomic point of view, continued the improvement seen in quarter three, with constant currency revenue growth of well over 6%, the highest rate of quarterly growth in 2015, and partly driven by acquisitions. Like-for-like revenue was up over 5% in the final quarter, down slightly on the 6% seen in quarter three. Similarly, net sales growth on a constant currency basis was up over 7% in the final quarter, the highest rate of quarterly growth in 2015, compared to over 4% in quarter three, again partly driven by acquisitions. On a like-for-like basis, net sales were up 3% in the final quarter, compared with well over 4% in quarter three. For the year, Western Continental Europe revenue grew by well over 4% like-for-like (well over 5% in the second half), compared with almost 4% in 2014, with net sales growth of 2.5% like-for-like (well over 3% in the second half), compared to over 1% in 2014. Belgium, Denmark, Germany, Italy and Turkey all showed good growth in the final quarter, but Austria, France, Ireland, the Netherlands, Spain, Sweden and Switzerland were tougher.

In Asia Pacific, Latin America, Africa & Middle East and Central & Eastern Europe, on a constant currency basis, revenue growth in the fourth quarter remained strong at over 9%, ahead of the first nine months growth of over 8%. Like-for-like revenue growth in the final quarter was over 6%, the second highest quarter of 2015, slightly lower than the almost 7% seen in quarter one. Growth in the fourth quarter was driven principally by Asia Pacific, Latin America and Africa. Central & Eastern Europe, after the improvement seen in quarter three, slipped back slightly, with full-year like-for-like revenue down over 1%. Constant currency net sales growth in the region as a whole was over 7%, with like-for-like net sales up 3%. In Asia, Bangladesh, Cambodia, India, Indonesia, Myanmar, Pakistan and Vietnam, had double-digit like-for-like growth, while Japan and Malaysia were more challenging.

Quarter four in Latin America was the strongest of the year, with like-for-like revenue up almost 8%, compared with quarter three, the next highest, with over 4%. Like-for-like net sales grew over 7% in quarter four, also the highest quarterly growth in 2015, with full-year growth of almost 5% (over 6% in the second half compared with well over 2% in the first half).

Africa also grew strongly, with like-for-like revenue up over 8% in both quarter four and the full year, driven by the Group’s Media Investment Management, Data Investment Management and direct, digital and interactive businesses. In Central & Eastern Europe, like-for-like revenue was up over 1% in quarter four, compared with 3% in quarter three, with Croatia, the Czech Republic, Hungary and Kazakhstan up strongly. Poland, Russia and the Slovak Republic were tougher.

18

Table of Contents

Full-year revenue for the BRICs1, which account for over $2.8 billion of revenue, was up well over 3% on a like-for-like basis. In 2015, 29% of the Group’s revenue came from Asia Pacific, Latin America, Africa & Middle East and Central & Eastern Europe - down slightly from almost 30% in 2014, due to the strength of sterling against the currencies of many of the markets in these regions still having a significant impact. On a net sales basis, there was also a slight drop to almost 30%, which compares with the Group’s strategic objective of 40-45% in the next five years. Markets outside North America now account for 63% of our revenue.

Operating Sector

| Revenue Analysis | ||||||||||||||||||||||||

| Reported revenue growth %+/(-) |

Constant growth %+/(-) |

Like-for-like revenue growth %+/(-) |

||||||||||||||||||||||

| 2015 | 2014 | 2015 | 2014 | 2015 | 2014 | |||||||||||||||||||

| Advertising and Media Investment Management |

8.2 | 12.1 | 9.9 | 19.8 | 8.4 | 16.1 | ||||||||||||||||||

| Data Investment Management |

(0.1 | ) | (4.7 | ) | 3.5 | 1.5 | (0.2 | ) | 0.6 | |||||||||||||||

| Public Relations & Public Affairs |

6.0 | (3.1 | ) | 4.7 | 2.6 | 3.0 | 2.5 | |||||||||||||||||

| Branding & Identity, Healthcare and Specialist Communications |

7.7 | 3.5 | 7.3 | 9.5 | 5.3 | 4.0 | ||||||||||||||||||

| Total Group |

6.1 | 4.6 | 7.5 | 11.3 | 5.3 | 8.2 | ||||||||||||||||||

| Net sales analysis | ||||||||||||||||||||||||

| Reported net sales |

Constant net sales |

Like-for-like net sales growth %+/(-) |

||||||||||||||||||||||

| 2015 | 2014 | 2015 | 2014 | 2015 | 2014 | |||||||||||||||||||

| Advertising and Media Investment Management |

3.3 | 0.9 | 5.3 | 7.8 | 3.8 | 5.0 | ||||||||||||||||||

| Data Investment Management |

1.1 | (5.1 | ) | 4.6 | 0.9 | 0.3 | 0.6 | |||||||||||||||||

| Public Relations & Public Affairs |

5.6 | (3.0 | ) | 4.3 | 2.7 | 3.4 | 2.7 | |||||||||||||||||

| Branding & Identity, Healthcare and Specialist Communications |

8.2 | 2.5 | 7.8 | 8.6 | 4.2 | 2.5 | ||||||||||||||||||

| Total Group |

4.6 | (0.1 | ) | 5.8 | 6.3 | 3.3 | 3.3 | |||||||||||||||||

Advertising and Media Investment Management was the strongest performing sector, with constant currency revenue growth of almost 10% for the year, and 9% in quarter four. Like-for-like revenue was up over 8% for both the year and quarter four. Advertising grew strongly in North America and Latin America in quarter four, but the UK, Continental Europe and Africa were more difficult and, overall, Advertising remained challenged. Media Investment Management showed strong like-for-like growth, with double-digit growth in all regions and sub-regions, except the UK and the Middle East.

Of the Group’s advertising networks, J. Walter Thompson Worldwide, Ogilvy & Mather and Grey performed well in quarter four. Growth in the Group’s Media Investment Management businesses has been very consistent throughout the year, with constant currency and like-for-like revenue up strongly for the year, but with a slightly weaker second half, principally in the UK. tenthavenue, the ‘engagement’ network focused on out-of-home media, also performed strongly in the fourth quarter, with like-for-like net sales growth up almost 9%. The strong revenue and net sales growth across most of the Group’s businesses, partly offset by the challenges in the Group’s Advertising businesses in most regions, resulted in the combined net sales margin of this sector dropping 0.2 margin points to 18.4%, but improving by 0.2 margin points in constant currency.

| 1 | Brazil, Russia, India and China. |

19

Table of Contents

In 2015, J. Walter Thompson Worldwide, Ogilvy & Mather, Y&R and Grey generated estimated net new business billings of almost £1.1 billion ($1.7 billion). GroupM (the Group’s Media Investment Management arm, which includes Mindshare, MEC, MediaCom, Maxus, GroupM Connect, Xaxis and now Essence), together with tenthavenue, generated estimated net new business billings of £3.8 billion ($6.0 billion). The Group’s net new billings totalled £5.6 billion ($8.6 billion), slightly down on the £5.8 billion ($9.3 billion) recorded in 2014.

Data Investment Management revenue grew by almost 6% in the fourth quarter on a constant currency basis, the strongest quarter of 2015, and 1.4% like-for-like. Net sales showed a similar pattern, up over 5% in constant currency in quarter four and almost 1% like-for-like. On a full-year basis, revenue was up 3.5% in constant currency, but down 0.2% like-for-like, with the second half stronger than the first half. Net sales showed a similar trend, with a stronger second half on both a constant currency and like-for-like basis. The mature markets were more difficult, remaining under pressure, but in the faster growth markets net sales were up almost 2%. Syndicated research continues to show resilience, with like-for-like net sales growth up well over 2%, but custom research, which accounts for almost half of Data Investment Management net sales, was down by a similar amount.

Kantar Worldpanel, Kantar Health, Kantar Retail and IMRB all showed strong like-for-like net sales growth, while TNS, Millward Brown and Lightspeed were more challenged. There seems to be a growing recognition of the value of ‘real’ first-party data businesses, rather than those that depend on third-party data. Net sales margins improved by 0.6 margin points to 16.2% and by 1.1 margin points in constant currency. Good cost control and the continued benefits of restructuring contributed to the improvement in net sales margins. Although there has been further improvement during 2015, the slowest sub-sector continues to be like-for-like net sales growth in the custom businesses in mature markets, where discretionary spending remains under review by clients.

The Group’s Public Relations & Public Affairs businesses continued the growth shown earlier in the year, with a stronger second half and even stronger quarter four. Constant currency revenue growth in quarter four was over 8%, and like-for-like net sales were up almost 6%, with strong growth in all regions, but particularly in the UK, Latin America and Africa & the Middle East. On a full-year basis, revenues were up well over 4% in constant currency and 3% like-for-like. Ogilvy Public Relations, Cohn & Wolfe and the specialist Public Relations & Public Affairs businesses in the US, the UK and Germany performed well, with Burson-Marsteller and Hill+Knowlton Strategies less buoyant. An improving top-line and good control of costs resulted in net sales margins for the year improving by 0.9 margin points to 16.7% and by 1.0 margin point in constant currency.