Wasatch-Hoisington U.S. Treasury Fund®

(Investor Class Shares)

(Investor Class Shares)

| Summary Prospectus —January 31, 2018 | Ticker: WHOSX |

Before you

invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus and other information about the Fund online at

www.WasatchFunds.com.You can also get this information at no cost by calling 800.551.1700 or by sending an email to shareholderservice@wasatchfunds.com. The Fund’s

prospectus and statement of additional information, each dated January 31, 2018, are incorporated by reference into this summary prospectus.

Investment Objective

The Fund’s investment objective is to

provide a rate of return that exceeds the rate of inflation over a business cycle by investing in U.S. Treasury securities with an emphasis on both income and capital appreciation.

Fees and Expenses of the Fund

The tables below describe the fees and

expenses that you may pay if you buy, sell or hold Investor Class shares of the Fund.

| Shareholder Fees (fees paid directly from your investment) | Investor

Class Shares |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) | None |

| Redemption Fee (as a % of amount redeemed on shares held 60 days or less) | 2.00% |

| Exchange Fee | None |

| Maximum Account Fee | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | Investor

Class Shares |

| Management Fee | 0.50% |

| Distribution/Service (12b-1) Fee | None |

| Other Expenses | 0.22% |

| Total Annual Fund Operating Expenses1 | 0.72% |

| 1 | Wasatch Advisors, Inc. (Advisor), the Fund’s investment advisor, has contractually agreed to reimburse the Investor Class shares of the Fund for Total Annual Fund Operating Expenses in excess of 0.75% of average daily net assets until at least January 31, 2019 (excluding interest, dividend expense on short sales/interest expense, taxes, brokerage commissions, other investment related costs, acquired fund fees and expenses, and extraordinary expenses, such as litigation and other expenses not incurred in the ordinary course of business). The Board of Trustees is the only party that can terminate the contractual limitation prior to the contract’s expiration. The Advisor can rescind the contractual limitation on expenses at any time after its expiration date. |

Example

This example is intended to help you compare

the cost of investing in the Investor Class of the Fund with the cost of investing in other mutual funds. The example assumes that you invested $10,000 in the Investor Class of the Fund for the time periods indicated and then redeemed all of your

shares at the end of those periods. The example also assumes that your investment had a

1

5% return each year and that operating expenses (as a percentage of net

assets) of the Fund’s Investor Class remained the same. This example reflects contractual fee waivers and reimbursements through January 31, 2019. Although your actual costs may be higher or lower, based on these assumptions your costs would

be:

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Wasatch-Hoisington U.S. Treasury Fund — Investor Class | $74 | $231 | $401 | $896 |

Portfolio Turnover

The Fund pays transaction costs, such as

commissions, when it buys and sells securities (or “turns over” its portfolio). Higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs,

which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 20% of the average value of its portfolio.

Principal Strategies

In pursuit of the Fund’s investment objective, Hoisington

Investment Management Company (HIMCO), the Fund’s Sub-Advisor, will:

| • | Typically invest at least 90% of the Fund’s total assets in U.S. Treasury securities and in repurchase agreements collateralized by such securities. |

| • | Adjust the average maturity and effective duration of the Fund’s portfolio based on HIMCO’s assessment of multi-year trends in national and international economic conditions. |

| • | Invest in long-term U.S. Treasury bonds, including U.S. Treasury Strips (zero coupon Treasury securities), when HIMCO determines that economic conditions suggest lower inflation and the multi-year trend is toward decreasing interest rates. |

| • | Invest in U.S. Treasury bills or notes, Treasury Inflation-Protected Securities (TIPS), and Floating Rate Notes (FRNs) (maturities less than five years) when HIMCO determines that economic conditions suggest rising inflation and the multi-year trend is toward increasing interest rates. |

Over the course of a

business cycle, under normal market conditions:

| • | The effective duration of the Fund’s holdings is expected to vary from less than a year to a maximum of 25 years. |

| • | The Fund’s holdings will range in maturity from less than a year to a maximum of the longest maturity Treasury bonds available. As of September 30, 2017, the effective duration of the Fund’s holdings was 22.60 years, and the average maturity of the Fund’s holdings was 27.66 years. |

| • | When the Fund is invested in securities with longer weighted average maturities it will be more sensitive to changes in market interest rates and its share price may be subject to greater volatility. |

| • | The Fund’s portfolio turnover rate will vary substantially from year to year. During some periods, turnover will be well below 50%. At other times, turnover could exceed 200% annually. At these times, increased portfolio turnover may result in higher transaction costs and may also result in taxable capital gains. |

| • | Portfolio adjustments may require the sale of securities prior to their maturity date. The goal of these transactions will be to increase income and/or change the duration of the overall portfolio. |

Principal Risks

All investments carry some degree of risk

that will affect the value of the Fund, its investment performance and the price of its shares. As a result, you may lose money if you invest in the Fund. An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the

Federal Deposit Insurance Corporation (FDIC) or any other government agency.

The Fund is subject to the following principal investment

risks:

Credit Risk.

Credit risk is the risk that the issuer of a debt security will fail to repay principal and interest on the security when due. HIMCO seeks to limit credit risk by investing in U.S. Treasury securities, which are backed by the full faith and credit

of the U.S. government and viewed as carrying minimal credit risk.

Interest Rate Risk.

Interest rate risk is the risk that a debt security’s value will decline due to an increase in market interest rates. Even though U.S. Treasury securities offer a stable stream of income, their prices will still fluctuate with changes in

interest rates. The Fund may be subject to greater risk of rising interest rates than would normally be the case due to the current period of historically low rates and the effect of potential government fiscal policy initiatives and resulting

market reaction to those initiatives. When interest rates change, the values of longer-duration debt securities usually change more than the values of shorter-duration debt securities.

Income Risk. Income risk

is the potential for a decline in the Fund’s income due to falling interest rates.

Effective Duration.

Effective duration is a measure of the responsiveness of a bond’s price to market interest rate changes. For example, if the interest rate increased 1%, a bond with an effective duration of five years would experience a decline in price of

approximately 5%. Similarly, if the interest rate increased 1%, the price of a bond with an effective duration of 15 years would decline approximately 15%. The effective duration of the longest maturity U.S. zero coupon bond is 30 years. If the

interest rate increased 1%, the value of the longest maturity zero coupon bond would decline approximately 30%. Similarly, if the interest rate decreased 1%, the value of the longest maturity zero coupon bond would increase approximately

30%.

2

Repurchase Agreements Risk.

The main risk of a repurchase agreement is that the original seller might default on its obligation to repurchase the securities. If the seller defaults, the Fund will seek to recover its investment by selling the collateral and could encounter

restrictions, costs or delays. The Fund will suffer a loss if it sells the collateral for less than the repurchase price.

Risks of Zero Coupon Treasury Securities. The market prices of zero coupon securities, which do not entitle the holder to periodic interest payments, are generally more volatile than the market prices of securities of comparable quality and similar maturity

that do pay interest periodically. Zero coupon securities are more sensitive to fluctuations in interest rates than coupon securities of the same maturity.

Volatility Risk.

Longer-term bonds are more sensitive to interest rate changes than shorter-term notes and bills. Prices of debt securities move inversely to interest rates. As a result, when the Fund is invested in longer-term securities, it may experience

significant negative returns when long-term interest rates increase.

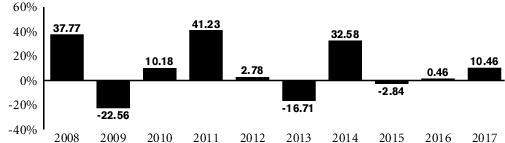

Historical Performance

The following tables provide information on

how the Investor Class of the Fund has performed over time. The past performance, before and after taxes, of the Fund’s Investor Class is not necessarily an indication of how these shares will perform in the future. The bar chart below is

intended to provide you with an indication of the risks of investing in the Fund by showing the Fund’s performance from year to year, as represented by the Investor Class of the Fund. The table below is designed to help you evaluate your risk

tolerance by showing the best and worst quarterly performance of the Fund’s Investor Class for the calendar years shown in the bar chart. The average annual total returns table below allows you to compare the Fund’s performance over the

time periods indicated to that of a broad-based bond market index. Performance information is updated regularly and is available on the Fund’s website www.WasatchFunds.com.

Wasatch-Hoisington U.S. Treasury Fund — Investor

Class

Year by Year Total Returns

Best and Worst Quarterly

Returns

| Best — 9/30/2011 | 36.15% |

| Worst — 12/31/2016 | -14.62% |

| Average Annual Total Returns — (as of 12/31/17) | 1 Year | 5 Years | 10 Years |

| Wasatch-Hoisington U.S. Treasury Fund — Investor Class | |||

| Return Before Taxes | 10.46% | 3.55% | 7.35% |

| Return After Taxes on Distributions | 9.49% | 1.90% | 5.63% |

| Return After Taxes on Distributions and Sale of Fund Shares | 5.90% | 2.19% | 5.38% |

| Bloomberg Barclays US Aggregate Bond Index (reflects no deductions for fees, expenses or taxes) | 3.54% | 2.10% | 4.01% |

After-tax returns are calculated

using the historical highest individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown. The after-tax

returns are not relevant to investors who hold Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

The Fund’s returns after taxes on distributions and

sale of Fund shares may be higher than returns before taxes and after taxes on distributions because they include the effect of a tax benefit an investor may receive from the capital losses that would have been incurred.

3

Portfolio Management

Investment Advisor

Investment Sub-Advisor

| Wasatch Advisors, Inc. | Hoisington Investment Management Company (HIMCO) |

Portfolio Managers

| Van

Hoisington Lead Portfolio Manager Since 1996 |

Van

R. Hoisington, Jr., “V.R.” Portfolio Manager Since January 2016 |

David

Hoisington Portfolio Manager Since January 2016 |

Purchase and Sale of Fund Shares

| Investment Minimums | Investor Class |

| New Accounts | $2,000 |

| New Accounts with an Automatic Investment Plan | $1,000 |

| Individual Retirement Accounts (IRAs) | $2,000 |

| Coverdell Education Savings Accounts | $1,000 |

| Subsequent Purchases | Investor Class |

| Regular Accounts and IRAs | $100 |

| Automatic Investment Plan | $50

per month and/or $100 per quarter |

| • | You may purchase, sell (redeem) or exchange Fund shares on any day the New York Stock Exchange is open for business. |

| • | To open a new account directly with Wasatch Funds or to purchase shares for an existing account, go online at www.WasatchFunds.com. For a new account, complete and electronically submit the online application. Accounts for third parties, trusts, corporations, partnerships and other entities may not be opened online and are not eligible for online transactions. By telephone, complete the appropriate application and call a shareholder services representative at 800.551.1700 for instructions on how to open or add to an account via wire. To open a new account by mail, complete and mail the application and any other materials (such as a corporate resolution for corporate accounts) and a check. To add to an existing account, complete the additional investment form from your statement or write a note that includes the Fund name and Class of shares (i.e., Investor Class), name(s) of investor(s) on the account and the account number. Send materials to: Wasatch Funds, P.O. Box 2172, Milwaukee, WI 53201-2172 or via overnight delivery to: Wasatch Funds, 235 W. Galena St., Milwaukee, WI 53212. |

| • | To sell shares purchased directly from Wasatch Funds, go online at www.WasatchFunds.com, or call a shareholder services representative at 800.551.1700 if you did not decline the telephone redemption privilege when establishing your account. Redemption requests may be sent by mail or overnight delivery to the appropriate address shown above. Include your name, Fund name, Class of shares (i.e., Investor Class), account number, dollar amount of shares to be sold, your daytime telephone number, signature(s) of account owners (sign exactly as the account is registered) and Medallion signature guarantee (if required). For IRA accounts, please obtain an IRA Distribution Form from www.WasatchFunds.com or by calling a shareholder services representative. |

| • | Fund shares may be bought or sold through banks or investment professionals, including brokers. They may charge you a transaction fee for this service. |

Tax Information

The Fund intends to make distributions. You

will generally have to pay federal income taxes, and any applicable state or local taxes, on the distributions you receive from the Fund as ordinary income or capital gains unless you are investing through a tax exempt account such as a qualified

retirement plan. Distributions on investments made through tax-deferred vehicles, such as 401(k) plans or IRAs, may be taxed later upon withdrawal of assets from those plans or accounts.

Payments to Broker-Dealers and Other Financial

Intermediaries

If you purchase shares

of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Advisor or its affiliates may pay the intermediary for the sale of shares and related services. These payments may create a conflict of interest by influencing

the broker-dealer or other intermediary or your individual financial advisor to recommend the Fund over another investment. Ask your individual financial advisor or visit your financial intermediary’s website for more information.

WHOSX

4