Table of Contents

As filed with the Securities and Exchange Commission on September 1, 2017

Securities Act Registration No. 033-10451

Investment Company Act Registration No. 811-04920

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-1A

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 X

Post-Effective Amendment No. 96 X

and/or

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 X

Amendment No. 98 X

(Check appropriate box or boxes)

WASATCH FUNDS TRUST

(Exact Name of Registrant as Specified in Charter)

505 Wakara Way, 3rd Floor

Salt Lake City, UT 84108

(Address of Principal Executive Offices)

Registrant’s Telephone Number, including Area Code: (801) 533-0777

| (Name and Address of Agent for Service) | Copy to: | |||||

| Samuel S. Stewart, Jr. Wasatch Advisors, Inc. 505 Wakara Way, 3rd Floor Salt Lake City, UT 84108 |

Eric F. Fess Chapman and Cutler LLP 111 West Monroe Street Chicago, IL 60603 |

|||||

Approximate Date of Proposed Public Offering: As soon as practicable following effectiveness.

It is proposed that this filing will become effective:

| ( X ) | immediately upon filing pursuant to paragraph (b) |

| ( ) | on pursuant to paragraph (b) |

| ( ) | 60 days after filing pursuant to paragraph (a)(1) |

| ( ) | on pursuant to paragraph (a)(1) |

| ( ) | 75 days after filing pursuant to paragraph (a)(2) |

| ( ) | on pursuant to paragraph (a)(2) of Rule 485. |

If appropriate, check the following box:

( ) this Post-Effective Amendment designates a new effective date for a previously filed Post-Effective Amendment.

Table of Contents

PROSPECTUS

September 1, 2017

INVESTOR CLASS / EQUITY FUNDS / Wasatch Core Growth Fund (WGROX)

Wasatch Emerging India Fund (WAINX)

Wasatch Emerging Markets Select Fund (WAESX)

Wasatch Emerging Markets Small Cap Fund (WAEMX)

Wasatch Frontier Emerging Small Countries Fund (WAFMX)

Wasatch Global Opportunities Fund (WAGOX)

Wasatch International Growth Fund (WAIGX)

Wasatch International Opportunities Fund (WAIOX)

Wasatch Global Value Fund (FMIEX)

Wasatch Long/Short Fund (FMLSX)

Wasatch Micro Cap Fund (WMICX)

Wasatch Micro Cap Value Fund (WAMVX)

Wasatch Small Cap Growth Fund (WAAEX)

Wasatch Small Cap Value Fund (WMCVX)

Wasatch Strategic Income Fund (WASIX)

Wasatch Ultra Growth Fund (WAMCX)

Wasatch World Innovators Fund (WAGTX) BOND FUNDS / Wasatch-1st Source Income Fund (FMEQX)

Wasatch-Hoisington U.S. Treasury Fund (WHOSX)

As with all mutual funds, the Securities and Exchange Commission (SEC) has not approved or disapproved these securities or determined if this prospectus is truthful or complete. Any statement to the contrary is a criminal offense.

Table of Contents

| Shareholder Fees (fees paid directly from your investment) | Investor

Class Shares |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) | None |

| Redemption Fee (as a % of amount redeemed on shares held 60 days or less) | 2.00% |

| Exchange Fee | None |

| Maximum Account Fee | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | Investor

Class Shares |

| Management Fee | 1.00% |

| Distribution/Service (12b-1) Fee | None |

| Other Expenses | 0.21% |

| Total Annual Fund Operating Expenses1 | 1.21% |

| 1 | Wasatch Advisors, Inc. (Advisor), the Fund’s investment advisor, has contractually agreed to reimburse the Investor Class shares of the Fund for Total Annual Fund Operating Expenses in excess of 1.50% of average daily net assets until at least January 31, 2019 (excluding interest, dividend expense on short sales/interest expense, taxes, brokerage commissions, other investment related costs, acquired fund fees and expenses, and extraordinary expenses, such as litigation and other expenses not incurred in the ordinary course of business). The Board of Trustees is the only party that can terminate the contractual limitation prior to the contract’s expiration. The Advisor can rescind the contractual limitation on expenses at any time after its expiration date. |

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Core Growth Fund — Investor Class | $123 | $384 | $665 | $1,465 |

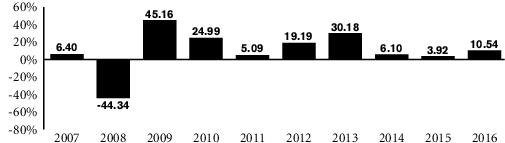

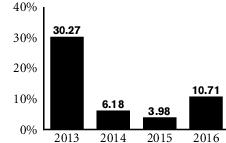

| 6/30/2017 | 9.24% |

| Best — 6/30/2009 | 29.50% |

| Worst — 12/31/2008 | -27.03% |

| Average Annual Total Returns — (as of 12/31/16) | 1 Year | 5 Years | 10 Years |

| Wasatch Core Growth Fund — Investor Class | |||

| Return Before Taxes | 10.54% | 13.59% | 7.88% |

| Return After Taxes on Distributions | 10.50% | 12.77% | 7.12% |

| Return After Taxes on Distributions and Sale of Fund Shares | 6.00% | 10.86% | 6.32% |

| Russell 2000® Index* (reflects no deductions for fees, expenses or taxes) | 21.31% | 14.46% | 7.07% |

| Russell 2000® Growth Index* (reflects no deductions for fees, expenses or taxes) | 11.32% | 13.74% | 7.76% |

| JB

Taylor Lead Portfolio Manager Since 2000 |

Paul

Lambert Portfolio Manager Since 2005 |

Mike

Valentine Portfolio Manager Since August 2017 |

| Investment Minimums | Investor Class |

| New Accounts | $2,000 |

| New Accounts with an Automatic Investment Plan | $1,000 |

| Individual Retirement Accounts (IRAs) | $2,000 |

| Coverdell Education Savings Accounts | $1,000 |

| Subsequent Purchases | Investor Class |

| Regular Accounts and IRAs | $100 |

| Automatic Investment Plan | $50

per month and/or $100 per quarter |

| • | You may purchase, sell (redeem) or exchange Fund shares on any day the New York Stock Exchange is open for business. |

| • | To open a new account directly with Wasatch Funds or to purchase shares for an existing account, go online at www.WasatchFunds.com. For a new account, complete and electronically submit the online application. Accounts for third parties, trusts, corporations, partnerships and other entities may not be opened online and are not eligible for online transactions. By telephone, complete the appropriate application and call a shareholder services representative at 800.551.1700 for instructions on how to open or add to an account via wire. To open a new account by mail, complete and mail the application and any other materials (such as a corporate resolution for corporate accounts) and a check. To add to an existing account, complete the additional investment form from your statement or write a note that includes the Fund name and Class of shares (i.e., Investor Class), name(s) of investor(s) on the account and the account number. Send materials to: Wasatch Funds, P.O. Box 2172, Milwaukee, WI 53201-2172 or via overnight delivery to: Wasatch Funds, 235 W. Galena St., Milwaukee, WI 53212. |

| • | To sell shares purchased directly from Wasatch Funds, go online at www.WasatchFunds.com, or call a shareholder services representative at 800.551.1700 if you did not decline the telephone redemption privilege when establishing your account. Redemption requests may be sent by mail or overnight delivery to the appropriate address shown above. Include your name, Fund name, Class of shares (i.e., Investor Class), account number, dollar amount of shares to be sold, your daytime telephone number, signature(s) of account owners (sign exactly as the account is registered) and Medallion signature guarantee (if required). For IRA accounts, please obtain an IRA Distribution Form from www.WasatchFunds.com or by calling a shareholder services representative. |

| • | Fund shares may be bought or sold through banks or investment professionals, including brokers. They may charge you a transaction fee for this service. |

| Shareholder Fees (fees paid directly from your investment) | Investor

Class Shares |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) | None |

| Redemption Fee (as a % of amount redeemed on shares held 60 days or less) | 2.00% |

| Exchange Fee | None |

| Maximum Account Fee | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | Investor

Class Shares |

| Management Fee1 | 1.25% |

| Distribution/Service (12b-1) Fee | None |

| Other Expenses | 0.62% |

| Total Annual Fund Operating Expenses | 1.87% |

| Expense Reimbursement2 | (0.12)% |

| Total Annual Fund Operating Expenses After Expense Reimbursement | 1.75% |

| 1 | Effective January 31, 2016, the management fee was reduced from 1.50% to 1.25%. The management fee and total annual fund operating expenses have been restated to reflect the current management fee. |

| 2 | Wasatch Advisors, Inc. (Advisor), the Fund’s investment advisor, has contractually agreed to reimburse the Investor Class shares of the Fund for Total Annual Fund Operating Expenses in excess of 1.75% of average daily net assets until at least January 31, 2019 (excluding interest, dividend expense on short sales/interest expense, taxes, brokerage commissions, other investment related costs, acquired fund fees and expenses, and extraordinary expenses, such as litigation and other expenses not incurred in the ordinary course of business). The Board of Trustees is the only party that can terminate the contractual limitation prior to the contract’s expiration. The Advisor can rescind the contractual limitation on expenses at any time after its expiration date. |

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Emerging India Fund — Investor Class | $178 | $564 | $988 | $2,170 |

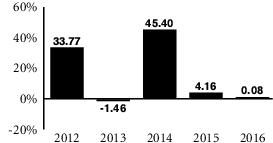

| 6/30/2017 | 34.00% |

| Best — 3/31/2012 | 21.43% |

| Worst — 12/31/2016 | -10.55% |

| Average Annual Total Returns — (as of 12/31/16) | 1 Year | 5 Years | Since

Inception (4/26/11) |

| Wasatch Emerging India Fund — Investor Class | |||

| Return Before Taxes | 0.08% | 14.85% | 8.05% |

| Return After Taxes on Distributions | -0.18% | 14.71% | 7.91% |

| Return After Taxes on Distributions and Sale of Fund Shares | 0.25% | 11.97% | 6.37% |

| MSCI India Investable Market Index* (reflects no deductions for fees, expenses or taxes) | -1.08% | 7.72% | -1.20% |

| Ajay

Krishnan, CFA Lead Portfolio Manager Since Inception |

Matthew

Dreith, CFA Associate Portfolio Manager Since January 31, 2016 |

| Investment Minimums | Investor Class |

| New Accounts | $2,000 |

| New Accounts with an Automatic Investment Plan | $1,000 |

| Individual Retirement Accounts (IRAs) | $2,000 |

| Coverdell Education Savings Accounts | $1,000 |

| Subsequent Purchases | Investor Class |

| Regular Accounts and IRAs | $100 |

| Automatic Investment Plan | $50

per month and/or $100 per quarter |

| • | You may purchase, sell (redeem) or exchange Fund shares on any day the New York Stock Exchange is open for business. |

| • | To open a new account directly with Wasatch Funds or to purchase shares for an existing account, go online at www.WasatchFunds.com. For a new account, complete and electronically submit the online application. Accounts for third parties, trusts, corporations, partnerships and other entities may not be opened online and are not eligible for online transactions. By telephone, complete the appropriate application and call a shareholder services representative at 800.551.1700 for instructions on how to open or add to an account via wire. To open a new account by mail, complete and mail the application and any other materials (such as a corporate resolution for corporate accounts) and a check. To add to an existing account, complete the additional investment form from your statement or write a note that includes the Fund name and Class of shares (i.e., Investor Class), name(s) of investor(s) on the account and the account number. Send materials to: Wasatch Funds, P.O. Box 2172, Milwaukee, WI 53201-2172 or via overnight delivery to: Wasatch Funds, 235 W. Galena St., Milwaukee, WI 53212. |

| • | To sell shares purchased directly from Wasatch Funds, go online at www.WasatchFunds.com, or call a shareholder services representative at 800.551.1700 if you did not decline the telephone redemption privilege when establishing your account. Redemption requests may be sent by mail or overnight delivery to the appropriate address shown above. Include your name, Fund name, Class of shares (i.e., Investor Class), account number, dollar amount of shares to be sold, your daytime telephone number, signature(s) of account owners (sign exactly as the account is registered) and Medallion signature guarantee (if required). For IRA accounts, please obtain an IRA Distribution Form from www.WasatchFunds.com or by calling a shareholder services representative. |

| • | Fund shares may be bought or sold through banks or investment professionals, including brokers. They may charge you a transaction fee for this service. |

| Shareholder Fees (fees paid directly from your investment) | Investor

Class Shares |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) | None |

| Redemption Fee (as a % of amount redeemed on shares held 60 days or less) | 2.00% |

| Exchange Fee | None |

| Maximum Account Fee | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | Investor

Class Shares |

| Management Fee1 | 1.00% |

| Distribution/Service (12b-1) Fee | None |

| Other Expenses | 0.87% |

| Interest Expense | 0.01% |

| Total Annual Fund Operating Expenses | 1.88% |

| Expense Reimbursement2 | (0.37)% |

| Total Annual Fund Operating Expenses After Expense Reimbursement | 1.51% |

| 1 | Effective January 31, 2016, the management fee was reduced from 1.25% to 1.00%. The management fee and total annual fund operating expenses have been restated to reflect the current management fee. |

| 2 | Wasatch Advisors, Inc. (Advisor), the Fund’s investment advisor, has contractually agreed to reimburse the Investor Class shares of the Fund for Total Annual Fund Operating Expenses in excess of 1.50% of average daily net assets until at least January 31, 2019 (excluding interest, dividend expense on short sales/interest expense, taxes, brokerage commissions, other investment related costs, acquired fund fees and expenses, and extraordinary expenses, such as litigation and other expenses not incurred in the ordinary course of business). The Board of Trustees is the only party that can terminate the contractual limitation prior to the contract’s expiration. The Advisor can rescind the contractual limitation on expenses at any time after its expiration date. |

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Emerging Markets Select Fund — Investor Class | $154 | $517 | $945 | $2,138 |

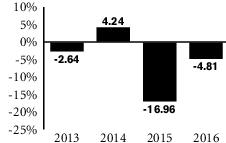

| 6/30/2017 | 26.31% |

| Best — 6/30/2014 | 4.37% |

| Worst — 9/30/2015 | -15.14% |

| Average Annual Total Returns — (as of 12/31/16) | 1 Year | Since

Inception (12/13/12) |

| Wasatch Emerging Markets Select Fund — Investor Class | ||

| Return Before Taxes | -5.09% | -5.20% |

| Return After Taxes on Distributions | -5.09% | -5.17% |

| Return After Taxes on Distributions and Sale of Fund Shares | -2.88% | -3.83% |

| MSCI Emerging Markets Index* (reflects no deductions for fees, expenses or taxes) | 11.19% | -2.20% |

| Ajay

Krishnan, CFA Lead Portfolio Manager Since Inception |

Roger

Edgley, CFA Portfolio Manager Since Inception |

Scott

Thomas, CFA, CPA Associate Portfolio Manager Since January 31, 2016 |

| Investment Minimums | Investor Class |

| New Accounts | $2,000 |

| New Accounts with an Automatic Investment Plan | $1,000 |

| Individual Retirement Accounts (IRAs) | $2,000 |

| Coverdell Education Savings Accounts | $1,000 |

| Subsequent Purchases | Investor Class |

| Regular Accounts and IRAs | $100 |

| Automatic Investment Plan | $50

per month and/or $100 per quarter |

| • | You may purchase, sell (redeem) or exchange Fund shares on any day the New York Stock Exchange is open for business. |

| • | To open a new account directly with Wasatch Funds or to purchase shares for an existing account, go online at www.WasatchFunds.com. For a new account, complete and electronically submit the online application. Accounts for third parties, trusts, corporations, partnerships and other entities may not be opened online and are not eligible for online transactions. By telephone, complete the appropriate application and call a shareholder services representative at 800.551.1700 for instructions on how to open or add to an account via wire. To open a new account by mail, complete and mail the application and any other materials (such as a corporate resolution for corporate accounts) and a check. To add to an existing account, complete the additional investment form from your statement or write a note that includes the Fund name and Class of shares (i.e., Investor Class), name(s) of investor(s) on the account and the account number. Send materials to: Wasatch Funds, P.O. Box 2172, Milwaukee, WI 53201-2172 or via overnight delivery to: Wasatch Funds, 235 W. Galena St., Milwaukee, WI 53212. |

| • | To sell shares purchased directly from Wasatch Funds, go online at www.WasatchFunds.com, or call a shareholder services representative at 800.551.1700 if you did not decline the telephone redemption privilege when establishing your account. Redemption requests may be sent by mail or overnight delivery to the appropriate address shown above. Include your name, Fund name, Class of shares (i.e., Investor Class), account number, dollar amount of shares to be sold, your daytime telephone number, signature(s) of account owners (sign exactly as the account is registered) and Medallion signature guarantee (if required). For IRA accounts, please obtain an IRA Distribution Form from www.WasatchFunds.com or by calling a shareholder services representative. |

| • | Fund shares may be bought or sold through banks or investment professionals, including brokers. They may charge you a transaction fee for this service. |

| Shareholder Fees (fees paid directly from your investment) | Investor

Class Shares |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) | None |

| Redemption Fee (as a % of amount redeemed on shares held 60 days or less) | 2.00% |

| Exchange Fee | None |

| Maximum Account Fee | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | Investor

Class Shares |

| Management Fee1 | 1.65% |

| Distribution/Service (12b-1) Fee | None |

| Other Expenses | 0.30% |

| Interest Expense | 0.01% |

| Total Annual Fund Operating Expenses2 | 1.96% |

| 1 | Effective January 31, 2016, the management fee was reduced from 1.75% to 1.65%. The management fee and total annual fund operating expenses have been restated to reflect the current management fee. |

| 2 | Wasatch Advisors, Inc. (Advisor), the Fund’s investment advisor, has contractually agreed to reimburse the Investor Class shares of the Fund for Total Annual Fund Operating Expenses in excess of 1.95% of average daily net assets until at least January 31, 2019 (excluding interest, dividend expense on short sales/interest expense, taxes, brokerage commissions, other investment related costs, acquired fund fees and expenses, and extraordinary expenses, such as litigation and other expenses not incurred in the ordinary course of business). The Board of Trustees is the only party that can terminate the contractual limitation prior to the contract’s expiration. The Advisor can rescind the contractual limitation on expenses at any time after its expiration date. |

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Emerging Markets Small Cap Fund — Investor Class | $199 | $615 | $1,057 | $2,285 |

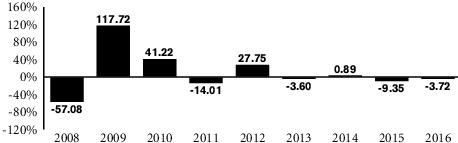

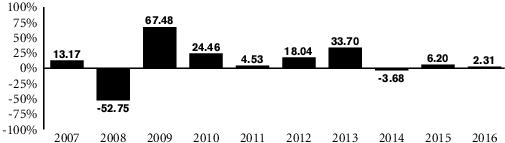

| 6/30/2017 | 20.17% |

| Best — 6/30/2009 | 56.10% |

| Worst — 12/31/2008 | -32.16% |

| Average Annual Total Returns — (as of 12/31/16) | 1 Year | 5 Years | Since

Inception (10/1/07) |

| Wasatch Emerging Markets Small Cap Fund — Investor Class | |||

| Return Before Taxes | -3.72% | 1.64% | 2.07% |

| Return After Taxes on Distributions | -3.72% | 1.56% | 2.00% |

| Return After Taxes on Distributions and Sale of Fund Shares | -2.11% | 1.34% | 1.64% |

| MSCI Emerging Markets Small Cap Index* (reflects no deductions for fees, expenses or taxes) | 2.28% | 3.51% | -0.33% |

| MSCI Emerging Markets Index* (reflects no deductions for fees, expenses or taxes) | 11.19% | 1.28% | -1.23% |

| Roger

Edgley, CFA Lead Portfolio Manager Since 2007 |

Andrey

Kutuzov, CFA Associate Portfolio Manager Since January 31, 2014 |

Scott

Thomas, CFA, CPA Associate Portfolio Manager Since January 31, 2015 |

| Investment Minimums | Investor Class |

| New Accounts | $2,000 |

| New Accounts with an Automatic Investment Plan | $1,000 |

| Individual Retirement Accounts (IRAs) | $2,000 |

| Coverdell Education Savings Accounts | $1,000 |

| Subsequent Purchases | Investor Class |

| Regular Accounts and IRAs | $100 |

| Automatic Investment Plan | $50

per month and/or $100 per quarter |

| • | You may purchase, sell (redeem) or exchange Fund shares on any day the New York Stock Exchange is open for business. |

| • | To open a new account directly with Wasatch Funds or to purchase shares for an existing account, go online at www.WasatchFunds.com. For a new account, complete and electronically submit the online application. Accounts for third parties, trusts, corporations, partnerships and other entities may not be opened online and are not eligible for online transactions. By telephone, complete the appropriate application and call a shareholder services representative at 800.551.1700 for instructions on how to open or add to an account via wire. To open a new account by mail, complete and mail the application and any other materials (such as a corporate resolution for corporate accounts) and a check. To add to an existing account, complete the additional investment form from your statement or write a note that includes the Fund name and Class of shares (i.e., Investor Class), name(s) of investor(s) on the account and the account number. Send materials to: Wasatch Funds, P.O. Box 2172, Milwaukee, WI 53201-2172 or via overnight delivery to: Wasatch Funds, 235 W. Galena St., Milwaukee, WI 53212. |

| • | To sell shares purchased directly from Wasatch Funds, go online at www.WasatchFunds.com, or call a shareholder services representative at 800.551.1700 if you did not decline the telephone redemption privilege when establishing your account. Redemption requests may be sent by mail or overnight delivery to the appropriate address shown above. Include your name, Fund name, Class of shares (i.e., Investor Class), account number, dollar amount of shares to be sold, your daytime telephone number, signature(s) of account owners (sign exactly as the account is registered) and Medallion signature guarantee (if required). For IRA accounts, please obtain an IRA Distribution Form from www.WasatchFunds.com or by calling a shareholder services representative. |

| • | Fund shares may be bought or sold through banks or investment professionals, including brokers. They may charge you a transaction fee for this service. |

| Shareholder Fees (fees paid directly from your investment) | Investor

Class Shares |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) | None |

| Redemption Fee (as a % of amount redeemed on shares held 60 days or less) | 2.00% |

| Exchange Fee | None |

| Maximum Account Fee | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | Investor

Class Shares |

| Management Fee | 1.75% |

| Distribution/Service (12b-1) Fee | None |

| Other Expenses | 0.64% |

| Total Annual Fund Operating Expenses | 2.39% |

| Expense Reimbursement1 | (0.14)% |

| Total Annual Fund Operating Expenses After Expense Reimbursement | 2.25% |

| 1 | Wasatch Advisors, Inc. (Advisor), the Fund’s investment advisor, has contractually agreed to reimburse the Investor Class shares of the Fund for Total Annual Fund Operating Expenses in excess of 2.25% of average daily net assets until at least January 31, 2019 (excluding interest, dividend expense on short sales/interest expense, taxes, brokerage commissions, other investment related costs, acquired fund fees and expenses, and extraordinary expenses, such as litigation and other expenses not incurred in the ordinary course of business). The Board of Trustees is the only party that can terminate the contractual limitation prior to the contract’s expiration. The Advisor can rescind the contractual limitation on expenses at any time after its expiration date. |

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Frontier Emerging Small Countries Fund — Investor Class | $228 | $718 | $1,249 | $2,703 |

| 6/30/2017 | 12.03% |

| Best — 3/31/2013 | 8.33% |

| Worst — 12/31/2016 | -8.37% |

| Average Annual Total Returns — (as of 12/31/16) | 1 Year | Since

Inception (1/31/12) |

| Wasatch Frontier Emerging Small Countries Fund — Investor Class | ||

| Return Before Taxes | -11.40% | 4.39% |

| Return After Taxes on Distributions | -11.40% | 4.38% |

| Return After Taxes on Distributions and Sale of Fund Shares | -6.45% | 3.56% |

| MSCI Frontier Emerging Markets Index* (reflects no deductions for fees, expenses or taxes) | 5.00% | 2.08% |

| MSCI Frontier Markets Index* (reflects no deductions for fees, expenses or taxes) | 2.66% | 5.21% |

| Roger

Edgley, CFA Lead Portfolio Manager Since June 6, 2016 |

Jared

Whatcott, CFA Portfolio Manager Since January 31, 2016 |

Scott

Thomas, CFA, CPA Portfolio Manager Since June 6, 2016 |

| Investment Minimums | Investor Class |

| New Accounts | $2,000 |

| New Accounts with an Automatic Investment Plan | $1,000 |

| Individual Retirement Accounts (IRAs) | $2,000 |

| Coverdell Education Savings Accounts | $1,000 |

| Subsequent Purchases | Investor Class |

| Regular Accounts and IRAs | $100 |

| Automatic Investment Plan | $50

per month and/or $100 per quarter |

| • | You may purchase, sell (redeem) or exchange Fund shares on any day the New York Stock Exchange is open for business. |

| • | To open a new account directly with Wasatch Funds or to purchase shares for an existing account, go online at www.WasatchFunds.com. For a new account, complete and electronically submit the online application. Accounts for third parties, trusts, corporations, partnerships and other entities may not be opened online and are not eligible for online transactions. By telephone, complete the appropriate application and call a shareholder services representative at 800.551.1700 for instructions on how to open or add to an account via wire. To open a new account by mail, complete and mail the application and any other materials (such as a corporate resolution for corporate accounts) and a check. To add to an existing account, complete the additional investment form from your statement or write a note that includes the Fund name and Class of shares (i.e., Investor Class), name(s) of investor(s) on the account and the account number. Send materials to: Wasatch Funds, P.O. Box 2172, Milwaukee, WI 53201-2172 or via overnight delivery to: Wasatch Funds, 235 W. Galena St., Milwaukee, WI 53212. |

| • | To sell shares purchased directly from Wasatch Funds, go online at www.WasatchFunds.com, or call a shareholder services representative at 800.551.1700 if you did not decline the telephone redemption privilege when establishing your account. Redemption requests may be sent by mail or overnight delivery to the appropriate address shown above. Include your name, Fund name, Class of shares (i.e., Investor Class), account number, dollar amount of shares to be sold, your daytime telephone number, signature(s) of account owners (sign exactly as the account is registered) and Medallion signature guarantee (if required). For IRA accounts, please obtain an IRA Distribution Form from www.WasatchFunds.com or by calling a shareholder services representative. |

| • | Fund shares may be bought or sold through banks or investment professionals, including brokers. They may charge you a transaction fee for this service. |

| Shareholder Fees (fees paid directly from your investment) | Investor

Class Shares |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) | None |

| Redemption Fee (as a % of amount redeemed on shares held 60 days or less) | 2.00% |

| Exchange Fee | None |

| Maximum Account Fee | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | Investor

Class Shares |

| Management Fee1 | 1.25% |

| Distribution/Service (12b-1) Fee | None |

| Other Expenses | 0.28% |

| Total Annual Fund Operating Expenses2 | 1.53% |

| 1 | Effective January 31, 2016, the management fee was reduced from 1.50% to 1.25%. The management fee and total annual fund operating expenses have been restated to reflect the current management fee. |

| 2 | Wasatch Advisors, Inc. (Advisor), the Fund’s investment advisor, has contractually agreed to reimburse the Investor Class shares of the Fund for Total Annual Fund Operating Expenses in excess of 1.75% of average daily net assets until at least January 31, 2019 (excluding interest, dividend expense on short sales/interest expense, taxes, brokerage commissions, other investment related costs, acquired fund fees and expenses, and extraordinary expenses, such as litigation and other expenses not incurred in the ordinary course of business). The Board of Trustees is the only party that can terminate the contractual limitation prior to the contract’s expiration. The Advisor can rescind the contractual limitation on expenses at any time after its expiration date. |

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Global Opportunities Fund — Investor Class | $156 | $484 | $834 | $1,824 |

| 6/30/2017 | 21.28% |

| Best — 6/30/2009 | 32.73% |

| Worst — 9/30/2011 | -18.94% |

| Average Annual Total Returns — (as of 12/31/16) | 1 Year | 5 Years | Since

Inception (11/17/08) |

| Wasatch Global Opportunities Fund — Investor Class | |||

| Return Before Taxes | -4.40% | 9.09% | 15.39% |

| Return After Taxes on Distributions | -6.32% | 6.37% | 13.19% |

| Return After Taxes on Distributions and Sale of Fund Shares | -0.94% | 7.34% | 12.95% |

| MSCI All Country (AC) World Small Cap Index* (reflects no deductions for fees, expenses or taxes) | 11.59% | 11.29% | 14.96% |

| JB

Taylor Lead Portfolio Manager Since 2011 |

Ajay

Krishnan, CFA Lead Portfolio Manager Since 2012 |

| Investment Minimums | Investor Class |

| New Accounts | $2,000 |

| New Accounts with an Automatic Investment Plan | $1,000 |

| Individual Retirement Accounts (IRAs) | $2,000 |

| Coverdell Education Savings Accounts | $1,000 |

| Subsequent Purchases | Investor Class |

| Regular Accounts and IRAs | $100 |

| Automatic Investment Plan | $50

per month and/or $100 per quarter |

| • | You may purchase, sell (redeem) or exchange Fund shares on any day the New York Stock Exchange is open for business. |

| • | To open a new account directly with Wasatch Funds or to purchase shares for an existing account, go online at www.WasatchFunds.com. For a new account, complete and electronically submit the online application. Accounts for third parties, trusts, corporations, partnerships and other entities may not be opened online and are not eligible for online transactions. By telephone, complete the appropriate application and call a shareholder services representative at 800.551.1700 for instructions on how to open or add to an account via wire. To open a new account by mail, complete and mail the application and any other materials (such as a corporate resolution for corporate accounts) and a check. To add to an existing account, complete the additional investment form from your statement or write a note that includes the Fund name and Class of shares (i.e., Investor Class), name(s) of investor(s) on the account and the account number. Send materials to: Wasatch Funds, P.O. Box 2172, Milwaukee, WI 53201-2172 or via overnight delivery to: Wasatch Funds, 235 W. Galena St., Milwaukee, WI 53212. |

| • | To sell shares purchased directly from Wasatch Funds, go online at www.WasatchFunds.com, or call a shareholder services representative at 800.551.1700 if you did not decline the telephone redemption privilege when establishing your account. Redemption requests may be sent by mail or overnight delivery to the appropriate address shown above. Include your name, Fund name, Class of shares (i.e., Investor Class), account number, dollar amount of shares to be sold, your daytime telephone number, signature(s) of account owners (sign exactly as the account is registered) and Medallion signature guarantee (if required). For IRA accounts, please obtain an IRA Distribution Form from www.WasatchFunds.com or by calling a shareholder services representative. |

| • | Fund shares may be bought or sold through banks or investment professionals, including brokers. They may charge you a transaction fee for this service. |

| Shareholder Fees (fees paid directly from your investment) | Investor

Class Shares |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) | None |

| Redemption Fee (as a % of amount redeemed on shares held 60 days or less) | 2.00% |

| Exchange Fee | None |

| Maximum Account Fee | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | Investor

Class Shares |

| Management Fee | 1.25% |

| Distribution/Service (12b-1) Fee | None |

| Other Expenses | 0.23% |

| Total Annual Fund Operating Expenses1 | 1.48% |

| 1 | Wasatch Advisors, Inc. (Advisor), the Fund’s investment advisor, has contractually agreed to reimburse the Investor Class shares of the Fund for Total Annual Fund Operating Expenses in excess of 1.75% of average daily net assets until at least January 31, 2019 (excluding interest, dividend expense on short sales/interest expense, taxes, brokerage commissions, other investment related costs, acquired fund fees and expenses, and extraordinary expenses, such as litigation and other expenses not incurred in the ordinary course of business). The Board of Trustees is the only party that can terminate the contractual limitation prior to the contract’s expiration. The Advisor can rescind the contractual limitation on expenses at any time after its expiration date. |

| 1 Year | 3 Years | 5 Years | 10 Years | |

| International Growth Fund — Investor Class | $151 | $468 | $808 | $1,769 |

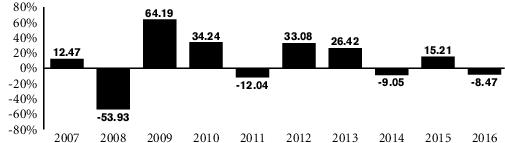

| 6/30/2017 | 19.22% |

| Best — 6/30/2009 | 41.88% |

| Worst — 9/30/2008 | -28.61% |

| Average Annual Total Returns — (as of 12/31/16) | 1 Year | 5 Years | 10 Years |

| Wasatch International Growth Fund — Investor Class | |||

| Return Before Taxes | -8.47% | 10.04% | 4.95% |

| Return After Taxes on Distributions | -9.31% | 9.66% | 4.45% |

| Return After Taxes on Distributions and Sale of Fund Shares | -4.10% | 7.98% | 3.90% |

| MSCI All Country (AC) World Ex-U.S.A. Small Cap Index*† (reflects no deductions for fees, expenses or taxes) | 3.91% | 7.74% | 2.90% |

| MSCI World Ex-U.S.A. Small Cap Index*† (reflects no deductions for fees, expenses or taxes) | 4.32% | 8.96% | 2.69% |

| Roger

Edgley, CFA Lead Portfolio Manager Since 2006 |

Ken

Applegate, CFA, CMT Portfolio Manager Since January 31, 2016 |

Linda

Lasater, CFA Associate Portfolio Manager Since January 31, 2014 |

Kabir

Goyal, CFA Associate Portfolio Manager Since January 31, 2015 |

| Investment Minimums | Investor Class |

| New Accounts | $2,000 |

| New Accounts with an Automatic Investment Plan | $1,000 |

| Individual Retirement Accounts (IRAs) | $2,000 |

| Coverdell Education Savings Accounts | $1,000 |

| Subsequent Purchases | Investor Class |

| Regular Accounts and IRAs | $100 |

| Automatic Investment Plan | $50

per month and/or $100 per quarter |

| • | You may purchase, sell (redeem) or exchange Fund shares on any day the New York Stock Exchange is open for business. |

| • | To open a new account directly with Wasatch Funds or to purchase shares for an existing account, go online at www.WasatchFunds.com. For a new account, complete and electronically submit the online application. Accounts for third parties, trusts, corporations, partnerships and other entities may not be opened online and are not eligible for online transactions. By telephone, complete the appropriate application and call a shareholder services representative at 800.551.1700 for instructions on how to open or add to an account via wire. To open a new account by mail, complete and mail the application and any other materials (such as a corporate resolution for corporate accounts) and a check. To add to an existing account, complete the additional investment form from your statement or write a note that includes the Fund name and Class of shares (i.e., Investor Class), name(s) of investor(s) on the account and the account number. Send materials to: Wasatch Funds, P.O. Box 2172, Milwaukee, WI 53201-2172 or via overnight delivery to: Wasatch Funds, 235 W. Galena St., Milwaukee, WI 53212. |

| • | To sell shares purchased directly from Wasatch Funds, go online at www.WasatchFunds.com, or call a shareholder services representative at 800.551.1700 if you did not decline the telephone redemption privilege when establishing your account. Redemption requests may be sent by mail or overnight delivery to the appropriate address shown above. Include your name, Fund name, Class of shares (i.e., Investor Class), account number, dollar amount of shares to be sold, your daytime telephone number, signature(s) of account owners (sign exactly as the account is registered) and Medallion signature guarantee (if required). For IRA accounts, please obtain an IRA Distribution Form from www.WasatchFunds.com or by calling a shareholder services representative. |

| • | Fund shares may be bought or sold through banks or investment professionals, including brokers. They may charge you a transaction fee for this service. |

| Shareholder Fees (fees paid directly from your investment) | Investor

Class Shares |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) | None |

| Redemption Fee (as a % of amount redeemed on shares held 60 days or less) | 2.00% |

| Exchange Fee | None |

| Maximum Account Fee | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | Investor

Class Shares |

| Management Fee1 | 1.75% |

| Distribution/Service (12b-1) Fee | None |

| Other Expenses | 0.47% |

| Total Annual Fund Operating Expenses2 | 2.22% |

| 1 | Effective January 31, 2016, the management fee was reduced from 1.95% to 1.75%. The management fee and total annual fund operating expenses have been restated to reflect the current management fee. |

| 2 | Wasatch Advisors, Inc. (Advisor), the Fund’s investment advisor, has contractually agreed to reimburse the Investor Class shares of the Fund for Total Annual Fund Operating Expenses in excess of 2.25% of average daily net assets until at least January 31, 2019 (excluding interest, dividend expense on short sales/interest expense, taxes, brokerage commissions, other investment related costs, acquired fund fees and expenses, and extraordinary expenses, such as litigation and other expenses not incurred in the ordinary course of business). The Board of Trustees is the only party that can terminate the contractual limitation prior to the contract’s expiration. The Advisor can rescind the contractual limitation on expenses at any time after its expiration date. |

| 1 Year | 3 Years | 5 Years | 10 Years | |

| International Opportunities Fund — Investor Class | $225 | $694 | $1,189 | $2,553 |

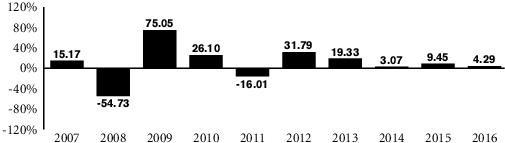

| 6/30/2017 | 15.75% |

| Best — 6/30/2009 | 44.35% |

| Worst — 9/30/2008 | -27.60% |

| Average Annual Total Returns — (as of 12/31/16) | 1 Year | 5 Years | 10 Years |

| Wasatch International Opportunities Fund — Investor Class | |||

| Return Before Taxes | 4.29% | 13.09% | 5.98% |

| Return After Taxes on Distributions | 4.29% | 12.00% | 4.71% |

| Return After Taxes on Distributions and Sale of Fund Shares | 2.43% | 10.40% | 4.61% |

| MSCI All Country (AC) World Ex-U.S.A. Small Cap Index* (reflects no deductions for fees, expenses or taxes) | 3.91% | 7.74% | 2.90% |

| MSCI World Ex-U.S.A. Small Cap Index* (reflects no deductions for fees, expenses or taxes) | 4.32% | 8.96% | 2.69% |

| Jared

Whatcott, CFA Portfolio Manager Since January 31, 2014 |

Linda

Lasater, CFA Portfolio Manager Since June 6, 2016 |

| Investment Minimums | Investor Class |

| New Accounts | $2,000 |

| New Accounts with an Automatic Investment Plan | $1,000 |

| Individual Retirement Accounts (IRAs) | $2,000 |

| Coverdell Education Savings Accounts | $1,000 |

| Subsequent Purchases | Investor Class |

| Regular Accounts and IRAs | $100 |

| Automatic Investment Plan | $50

per month and/or $100 per quarter |

| • | You may purchase, sell (redeem) or exchange Fund shares on any day the New York Stock Exchange is open for business. |

| • | To open a new account directly with Wasatch Funds or to purchase shares for an existing account, go online at www.WasatchFunds.com. For a new account, complete and electronically submit the online application. Accounts for third parties, trusts, corporations, partnerships and other entities may not be opened online and are not eligible for online transactions. By telephone, complete the appropriate application and call a shareholder services representative at 800.551.1700 for instructions on how to open or add to an account via wire. To open a new account by mail, complete and mail the application and any other materials (such as a corporate resolution for corporate accounts) and a check. To add to an existing account, complete the additional investment form from your statement or write a note that includes the Fund name and Class of shares (i.e., Investor Class), name(s) of investor(s) on the account and the account number. Send materials to: Wasatch Funds, P.O. Box 2172, Milwaukee, WI 53201-2172 or via overnight delivery to: Wasatch Funds, 235 W. Galena St., Milwaukee, WI 53212. |

| • | To sell shares purchased directly from Wasatch Funds, go online at www.WasatchFunds.com, or call a shareholder services representative at 800.551.1700 if you did not decline the telephone redemption privilege when establishing your account. Redemption requests may be sent by mail or overnight delivery to the appropriate address shown above. Include your name, Fund name, Class of shares (i.e., Investor Class), account number, dollar amount of shares to be sold, your daytime telephone number, signature(s) of account owners (sign exactly as the account is registered) and Medallion signature guarantee (if required). For IRA accounts, please obtain an IRA Distribution Form from www.WasatchFunds.com or by calling a shareholder services representative. |

| • | Fund shares may be bought or sold through banks or investment professionals, including brokers. They may charge you a transaction fee for this service. |

| Shareholder Fees (fees paid directly from your investment) | Investor

Class Shares |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) | None |

| Redemption Fee (as a % of amount redeemed on shares held 60 days or less) | 2.00% |

| Exchange Fee | None |

| Maximum Account Fee | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | Investor

Class Shares |

| Management Fee | 0.90% |

| Distribution/Service (12b-1) Fee | None |

| Other Expenses | 0.27% |

| Total Annual Fund Operating Expenses | 1.17% |

| Expense Reimbursement1 | (0.07)% |

| Total Annual Fund Operating Expenses After Expense Reimbursement | 1.10% |

| 1 | Wasatch Advisors, Inc. (Advisor), the Fund’s investment advisor, has contractually agreed to reimburse the Investor Class shares of the Fund for Total Annual Fund Operating Expenses in excess of 1.10% of average daily net assets until at least January 31, 2019 (excluding interest, dividend expense on short sales/interest expense, taxes, brokerage commissions, other investment related costs, acquired fund fees and expenses, and extraordinary expenses, such as litigation and other expenses not incurred in the ordinary course of business). The Board of Trustees is the only party that can terminate the contractual limitation prior to the contract’s expiration. The Advisor can rescind the contractual limitation on expenses at any time after its expiration date. |

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Global Value Fund — Investor Class | $112 | $365 | $638 | $1,414 |

| • | Calculating and reviewing standard ratios, such as price-to-sales, price-to-book, price-to-earnings, and price/earnings-to-growth. |

| • | Discounted cash flow models with sensitivity analysis for changes to revenue growth rates, operating margins, outstanding share counts, earnings multiples, and tangible book value. |

| 6/30/2017 | 4.03% |

| Best — 6/30/2009 | 14.66% |

| Worst — 12/31/2008 | -19.38% |

| Average Annual Total Returns — (as of 12/31/16) | 1 Year | 5 Years | 10 Years |

| Wasatch Global Value Fund — Investor Class | |||

| Return Before Taxes | 16.65% | 10.71% | 5.51% |

| Return After Taxes on Distributions | 15.25% | 6.76% | 3.32% |

| Return After Taxes on Distributions and Sale of Fund Shares | 10.54% | 8.14% | 4.14% |

| MSCI ACWI Index*† (reflects no deductions for fees, expenses or taxes) | 7.86% | 9.36% | 3.56% |

| Russell 1000® Value Index** (reflects no deductions for fees, expenses or taxes) | 17.34% | 14.80% | 5.72% |

†Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. This report is not approved or produced by MSCI.

** The Russell 1000 Value Index® is a market-capitalization weighted index of those firms in the Russell 1000 with lower price-to-book ratios and lower forecasted growth values. Consistent with the name and strategy change, effective 60 days following September 1, 2017, the Fund’s primary benchmark index will change from the Russell 1000 Value Index® to the MSCI ACWI Index. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell indexes. Russell® is a trademark of Russell Investment Group.

| David

Powers, CFA Lead Portfolio Manager Since August 2013 |

| Investment Minimums | Investor Class |

| New Accounts | $2,000 |

| New Accounts with an Automatic Investment Plan | $1,000 |

| Individual Retirement Accounts (IRAs) | $2,000 |

| Coverdell Education Savings Accounts | $1,000 |

| Subsequent Purchases | Investor Class |

| Regular Accounts and IRAs | $100 |

| Automatic Investment Plan | $50

per month and/or $100 per quarter |

| • | You may purchase, sell (redeem) or exchange Fund shares on any day the New York Stock Exchange is open for business. |

| • | To open a new account directly with Wasatch Funds or to purchase shares for an existing account, go online at www.WasatchFunds.com. For a new account, complete and electronically submit the online application. Accounts for third parties, trusts, corporations, partnerships and other entities may not be opened online and are not eligible for online transactions. By telephone, complete the appropriate application and call a shareholder services representative at 800.551.1700 for instructions on how to open or add to an account via wire. To open a new account by mail, complete and mail the application and any other materials (such as a corporate resolution for corporate accounts) and a check. To add to an existing account, complete the additional investment form from your statement or write a note that includes the Fund name and Class of shares (i.e., Investor Class), name(s) of investor(s) on the account and the account number. Send materials to: Wasatch Funds, P.O. Box 2172, Milwaukee, WI 53201-2172 or via overnight delivery to: Wasatch Funds, 235 W. Galena St., Milwaukee, WI 53212. |

| • | To sell shares purchased directly from Wasatch Funds, go online at www.WasatchFunds.com, or call a shareholder services representative at 800.551.1700 if you did not decline the telephone redemption privilege when establishing your account. Redemption requests may be sent by mail or overnight delivery to the appropriate address shown above. Include your name, Fund name, Class of shares (i.e., Investor Class), account number, dollar amount of shares to be sold, your daytime telephone number, signature(s) of account owners (sign exactly as the account is registered) and Medallion signature guarantee (if required). For IRA accounts, please obtain an IRA Distribution Form from www.WasatchFunds.com or by calling a shareholder services representative. |

| • | Fund shares may be bought or sold through banks or investment professionals, including brokers. They may charge you a transaction fee for this service. |

| Shareholder Fees (fees paid directly from your investment) | Investor

Class Shares |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) | None |

| Redemption Fee (as a % of amount redeemed on shares held 60 days or less) | 2.00% |

| Exchange Fee | None |

| Maximum Account Fee | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | Investor

Class Shares |

| Management Fee | 1.10% |

| Distribution/Service (12b-1) Fee | None |

| Other Expenses | 0.32% |

| Dividend Expense on Short Sales/Interest Expense1 | 0.41% |

| Total Annual Fund Operating Expenses2 | 1.83% |

| 1 | Dividends on short sales are the dividends paid to the lenders of borrowed securities. The expenses related to dividends on short sales are estimated and will vary depending on whether the securities the Fund sells short pay dividends and on the amount of any such dividends. Expenses also include borrowing costs paid to the broker in connection with borrowing the security to be sold short. The rate paid to brokers varies by security. |

| 2 | Wasatch Advisors, Inc. (Advisor), the Fund’s investment advisor, has contractually agreed to reimburse the Investor Class shares of the Fund for Total Annual Fund Operating Expenses in excess of 1.60% of average daily net assets until at least January 31, 2019 (excluding interest, dividend expense on short sales/interest expense, taxes, brokerage commissions, other investment related costs, acquired fund fees and expenses, and extraordinary expenses, such as litigation and other expenses not incurred in the ordinary course of business). The Board of Trustees is the only party that can terminate the contractual limitation prior to the contract’s expiration. The Advisor can rescind the contractual limitation on expenses at any time after its expiration date. |

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Long/Short Fund — Investor Class | $186 | $576 | $991 | $2,148 |

| • | Changes in market participant psychology and circumstances. |

| • | Imperfect information. |

| • | Forecasts and projections by Wall Street analysts and company representatives that differ from experienced reality. |

| • | Have earnings that appear to be reflected in the current stock price. |

| • | Are likely to fall short of market expectations. |

| • | Are in industries that exhibit weakness. |

| • | Have poor management. |

| • | Are likely to suffer an event affecting long-term earnings. |

| 6/30/2017 | -6.92% |

| Best — 6/30/2009 | 16.00% |

| Worst — 12/31/2008 | -15.94% |

| Average Annual Total Returns — (as of 12/31/16) | 1 Year | 5 Years | 10 Years |

| Wasatch Long/Short Fund — Investor Class | |||

| Return Before Taxes | 18.26% | 4.58% | 4.17% |

| Return After Taxes on Distributions | 18.25% | 3.67% | 3.43% |

| Return After Taxes on Distributions and Sale of Fund Shares | 10.34% | 3.52% | 3.15% |

| S&P 500® Index (reflects no deductions for fees, expenses or taxes) | 11.96% | 14.66% | 6.95% |

| Citigroup U.S. Domestic 3-Month Treasury Bills Index (reflects no deductions for fees, expenses or taxes) | 0.27% | 0.09% | 0.73% |

| Terry

Lally, CFA Lead Portfolio Manager Since January 2017 |

| Investment Minimums | Investor Class |

| New Accounts | $2,000 |

| New Accounts with an Automatic Investment Plan | $1,000 |

| Individual Retirement Accounts (IRAs) | $2,000 |

| Coverdell Education Savings Accounts | $1,000 |

| Subsequent Purchases | Investor Class |

| Regular Accounts and IRAs | $100 |

| Automatic Investment Plan | $50

per month and/or $100 per quarter |

| • | You may purchase, sell (redeem) or exchange Fund shares on any day the New York Stock Exchange is open for business. |

| • | To open a new account directly with Wasatch Funds or to purchase shares for an existing account, go online at www.WasatchFunds.com. For a new account, complete and electronically submit the online application. Accounts for third parties, trusts, corporations, partnerships and other entities may not be opened online and are not eligible for online transactions. By telephone, complete the appropriate application and call a shareholder services representative at 800.551.1700 for instructions on how to open or add to an account via wire. To open a new account by mail, complete and mail the application and any other materials (such as a corporate resolution for corporate accounts) and a check. To add to an existing account, complete the additional investment form from your statement or write a note that includes the Fund name and Class of shares (i.e., Investor Class), name(s) of investor(s) on the account and the account number. Send materials to: Wasatch Funds, P.O. Box 2172, Milwaukee, WI 53201-2172 or via overnight delivery to: Wasatch Funds, 235 W. Galena St., Milwaukee, WI 53212. |

| • | To sell shares purchased directly from Wasatch Funds, go online at www.WasatchFunds.com, or call a shareholder services representative at 800.551.1700 if you did not decline the telephone redemption privilege when establishing your account. Redemption requests may be sent by mail or overnight delivery to the appropriate address shown above. Include your name, Fund name, Class of shares (i.e., Investor Class), account number, dollar amount of shares to be sold, your daytime telephone number, signature(s) of account owners (sign exactly as the account is registered) and Medallion signature guarantee (if required). For IRA accounts, please obtain an IRA Distribution Form from www.WasatchFunds.com or by calling a shareholder services representative. |

| • | Fund shares may be bought or sold through banks or investment professionals, including brokers. They may charge you a transaction fee for this service. |

| Shareholder Fees (fees paid directly from your investment) | Investor

Class Shares |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) | None |

| Redemption Fee (as a % of amount redeemed on shares held 60 days or less) | 2.00% |

| Exchange Fee | None |

| Maximum Account Fee | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | Investor

Class Shares |

| Management Fee1 | 1.50% |

| Distribution/Service (12b-1) Fee | None |

| Other Expenses | 0.17% |

| Total Annual Fund Operating Expenses2 | 1.67% |

| 1 | Effective January 31, 2017, the management fee was reduced from 1.75% to 1.50%. The management fee and total annual fund operating expenses have been restated to reflect the current management fee. |

| 2 | Wasatch Advisors, Inc. (Advisor), the Fund’s investment advisor, has contractually agreed to reimburse the Investor Class shares of the Fund for Total Annual Fund Operating Expenses in excess of 1.95% of average daily net assets until at least January 31, 2019 (excluding interest, dividend expense on short sales/interest expense, taxes, brokerage commissions, other investment related costs, acquired fund fees and expenses, and extraordinary expenses, such as litigation and other expenses not incurred in the ordinary course of business). The Board of Trustees is the only party that can terminate the contractual limitation prior to the contract’s expiration. The Advisor can rescind the contractual limitation on expenses at any time after its expiration date. |

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Micro Cap Fund — Investor Class | $170 | $526 | $907 | $1,977 |

| 6/30/2017 | 16.85% |

| Best — 6/30/2009 | 27.00% |

| Worst — 12/31/2008 | -31.16% |

| Average Annual Total Returns — (as of 12/31/16) | 1 Year | 5 Years | 10 Years |

| Wasatch Micro Cap Fund — Investor Class | |||

| Return Before Taxes | 7.79% | 11.56% | 4.62% |

| Return After Taxes on Distributions | 5.61% | 10.12% | 3.64% |

| Return After Taxes on Distributions and Sale of Fund Shares | 6.21% | 9.18% | 3.66% |

| Russell Microcap® Index* (reflects no deductions for fees, expenses or taxes) | 20.37% | 15.59% | 5.47% |

| Ken

Korngiebel, CFA Lead Portfolio Manager Since July 2017 |

Dan

Chace, CFA Portfolio Manager Since 2004 |

| Investment Minimums | Investor Class |

| New Accounts | $2,000 |

| New Accounts with an Automatic Investment Plan | $1,000 |

| Individual Retirement Accounts (IRAs) | $2,000 |

| Coverdell Education Savings Accounts | $1,000 |

| Subsequent Purchases | Investor Class |

| Regular Accounts and IRAs | $100 |

| Automatic Investment Plan | $50

per month and/or $100 per quarter |

| • | You may purchase, sell (redeem) or exchange Fund shares on any day the New York Stock Exchange is open for business. |

| • | To open a new account directly with Wasatch Funds or to purchase shares for an existing account, go online at www.WasatchFunds.com. For a new account, complete and electronically submit the online application. Accounts for third parties, trusts, corporations, partnerships and other entities may not be opened online and are not eligible for online transactions. By telephone, complete the appropriate application and call a shareholder services representative at 800.551.1700 for instructions on how to open or add to an account via wire. To open a new account by mail, complete and mail the application and any other materials (such as a corporate resolution for corporate accounts) and a check. To add to an existing account, complete the additional investment form from your statement or write a note that includes the Fund name and Class of shares (i.e., Investor Class), name(s) of investor(s) on the account and the account number. Send materials to: Wasatch Funds, P.O. Box 2172, Milwaukee, WI 53201-2172 or via overnight delivery to: Wasatch Funds, 235 W. Galena St., Milwaukee, WI 53212. |

| • | To sell shares purchased directly from Wasatch Funds, go online at www.WasatchFunds.com, or call a shareholder services representative at 800.551.1700 if you did not decline the telephone redemption privilege when establishing your account. Redemption requests may be sent by mail or overnight delivery to the appropriate address shown above. Include your name, Fund name, Class of shares (i.e., Investor Class), account number, dollar amount of shares to be sold, your daytime telephone number, signature(s) of account owners (sign exactly as the account is registered) and Medallion signature guarantee (if required). For IRA accounts, please obtain an IRA Distribution Form from www.WasatchFunds.com or by calling a shareholder services representative. |

| • | Fund shares may be bought or sold through banks or investment professionals, including brokers. They may charge you a transaction fee for this service. |

| Shareholder Fees (fees paid directly from your investment) | Investor

Class Shares |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) | None |

| Redemption Fee (as a % of amount redeemed on shares held 60 days or less) | 2.00% |

| Exchange Fee | None |

| Maximum Account Fee | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | Investor

Class Shares |

| Management Fee1 | 1.50% |

| Distribution/Service (12b-1) Fee | None |

| Other Expenses | 0.29% |

| Acquired Fund Fees and Expenses2 | 0.05% |

| Total Annual Fund Operating Expenses3 | 1.84% |

| 1 | Effective January 31, 2017, the management fee was reduced from 1.75% to 1.50%. The management fee and total annual fund operating expenses have been restated to reflect the current management fee. |

| 2 | The Total Annual Fund Operating Expenses may not equal the expense ratio stated in the Fund’s most recent Annual Report and Financial Highlights, which reflects the operating expenses of the Fund and does not include Acquired Fund Fees and Expenses. |

| 3 | Wasatch Advisors, Inc. (Advisor), the Fund’s investment advisor, has contractually agreed to reimburse the Investor Class shares of the Fund for Total Annual Fund Operating Expenses in excess of 1.95% of average daily net assets until at least January 31, 2019 (excluding interest, dividend expense on short sales/interest expense, taxes, brokerage commissions, other investment related costs, acquired fund fees and expenses, and extraordinary expenses, such as litigation and other expenses not incurred in the ordinary course of business). The Board of Trustees is the only party that can terminate the contractual limitation prior to the contract’s expiration. The Advisor can rescind the contractual limitation on expenses at any time after its expiration date. |

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Micro Cap Value Fund- Investor Class | $187 | $579 | $996 | $2,158 |

| • | Undiscovered Gems — Companies with good growth potential that have yet to be broadly discovered by Wall Street analysts, thus leaving them attractively undervalued relative to their expected growth rate. |

| • | Fallen Angels — High quality growth companies that have experienced a temporary setback and therefore have appealing valuations relative to their long term growth potential. |

| • | Value Momentum — Valuation that is inexpensive relative to a company’s history, but catalyst for future growth has been identified. |

| 6/30/2017 | 10.24% |

| Best — 6/30/2009 | 40.00% |

| Worst — 12/31/2008 | -26.67% |

| Average Annual Total Returns — (as of 12/31/16) | 1 Year | 5 Years | 10 Years |

| Wasatch Micro Cap Value Fund — Investor Class | |||

| Return Before Taxes | 12.42% | 15.90% | 8.04% |

| Return After Taxes on Distributions | 11.98% | 13.20% | 6.46% |

| Return After Taxes on Distributions and Sale of Fund Shares | 7.39% | 12.52% | 6.29% |

| Russell Microcap® Index* (reflects no deductions for fees, expenses or taxes) | 20.37% | 15.59% | 5.47% |

| Brian

Bythrow, CFA Lead Portfolio Manager Since 2003 |

| Investment Minimums | Investor Class |

| New Accounts | $2,000 |

| New Accounts with an Automatic Investment Plan | $1,000 |

| Individual Retirement Accounts (IRAs) | $2,000 |

| Coverdell Education Savings Accounts | $1,000 |

| Subsequent Purchases | Investor Class |

| Regular Accounts and IRAs | $100 |

| Automatic Investment Plan | $50

per month and/or $100 per quarter |

| • | You may purchase, sell (redeem) or exchange Fund shares on any day the New York Stock Exchange is open for business. |

| • | To open a new account directly with Wasatch Funds or to purchase shares for an existing account, go online at www.WasatchFunds.com. For a new account, complete and electronically submit the online application. Accounts for third parties, trusts, corporations, partnerships and other entities may not be opened online and are not eligible for online transactions. By telephone, complete the appropriate application and call a shareholder services representative at 800.551.1700 for instructions on how to open or add to an account via wire. To open a new account by mail, complete and mail the application and any other materials (such as a corporate resolution for corporate accounts) and a check. To add to an existing account, complete the additional investment form from your statement or write a note that includes the Fund name and Class of shares (i.e., Investor Class), name(s) of investor(s) on the account and the account number. Send materials to: Wasatch Funds, P.O. Box 2172, Milwaukee, WI 53201-2172 or via overnight delivery to: Wasatch Funds, 235 W. Galena St., Milwaukee, WI 53212. |

| • | To sell shares purchased directly from Wasatch Funds, go online at www.WasatchFunds.com, or call a shareholder services representative at 800.551.1700 if you did not decline the telephone redemption privilege when establishing your account. Redemption requests may be sent by mail or overnight delivery to the appropriate address shown above. Include your name, Fund name, Class of shares (i.e., Investor Class), account number, dollar amount of shares to be sold, your daytime telephone number, signature(s) of account owners (sign exactly as the account is registered) and Medallion signature guarantee (if required). For IRA accounts, please obtain an IRA Distribution Form from www.WasatchFunds.com or by calling a shareholder services representative. |

| • | Fund shares may be bought or sold through banks or investment professionals, including brokers. They may charge you a transaction fee for this service. |

| Shareholder Fees (fees paid directly from your investment) | Investor

Class Shares |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) | None |

| Redemption Fee (as a % of amount redeemed on shares held 60 days or less) | 2.00% |

| Exchange Fee | None |

| Maximum Account Fee | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | Investor

Class Shares |

| Management Fee | 1.00% |

| Distribution/Service (12b-1) Fee | None |

| Other Expenses | 0.29% |

| Acquired Fund Fees and Expenses1 | 0.01% |

| Total Annual Fund Operating Expenses2 | 1.30% |

| 1 | The Total Annual Fund Operating Expenses may not equal the expense ratio stated in the Fund’s most recent Annual Report and Financial Highlights, which reflects the operating expenses of the Fund and does not include Acquired Fund Fees and Expenses. |

| 2 | Wasatch Advisors, Inc. (Advisor), the Fund’s investment advisor, has contractually agreed to reimburse the Investor Class shares of the Fund for Total Annual Fund Operating Expenses in excess of 1.50% of average daily net assets until at least January 31, 2019 (excluding interest, dividend expense on short sales/interest expense, taxes, brokerage commissions, other investment related costs, acquired fund fees and expenses, and extraordinary expenses, such as litigation and other expenses not incurred in the ordinary course of business). The Board of Trustees is the only party that can terminate the contractual limitation prior to the contract’s expiration. The Advisor can rescind the contractual limitation on expenses at any time after its expiration date. |

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Small Cap Growth Fund — Investor Class | $132 | $411 | $712 | $1,568 |

| 6/30/2017 | 9.83% |

| Best — 6/30/2009 | 25.04% |

| Worst — 12/31/2008 | -22.04% |

| Average Annual Total Returns — (as of 12/31/16) | 1 Year | 5 Years | 10 Years |

| Wasatch Small Cap Growth Fund — Investor Class | |||

| Return Before Taxes | 4.82% | 10.41% | 7.11% |

| Return After Taxes on Distributions | 2.80% | 8.32% | 5.84% |

| Return After Taxes on Distributions and Sale of Fund Shares | 4.40% | 8.28% | 5.77% |

| Russell 2000® Growth Index* (reflects no deductions for fees, expenses or taxes) | 11.32% | 13.74% | 7.76% |

| Russell 2000® Index* (reflects no deductions for fees, expenses or taxes) | 21.31% | 14.46% | 7.07% |

| JB

Taylor Lead Portfolio Manager Since 2016 |

Jeff

Cardon, CFA Portfolio Manager Since 1986 |

Ken

Korngeibel, CFA Portfolio Manager Since August 2017 |

Ryan

Snow Portfolio Manager Since August 2017 |

| Investment Minimums | Investor Class |

| New Accounts | $2,000 |

| New Accounts with an Automatic Investment Plan | $1,000 |

| Individual Retirement Accounts (IRAs) | $2,000 |

| Coverdell Education Savings Accounts | $1,000 |

| Subsequent Purchases | Investor Class |

| Regular Accounts and IRAs | $100 |

| Automatic Investment Plan | $50

per month and/or $100 per quarter |

| • | You may purchase, sell (redeem) or exchange Fund shares on any day the New York Stock Exchange is open for business. |

| • | To open a new account directly with Wasatch Funds or to purchase shares for an existing account, go online at www.WasatchFunds.com. For a new account, complete and electronically submit the online application. Accounts for third parties, trusts, corporations, partnerships and other entities may not be opened online and are not eligible for online transactions. By telephone, complete the appropriate application and call a shareholder services representative at 800.551.1700 for instructions on how to open or add to an account via wire. To open a new account by mail, complete and mail the application and any other materials (such as a corporate resolution for corporate accounts) and a check. To add to an existing account, complete the additional investment form from your statement or write a note that includes the Fund name and Class of shares (i.e., Investor Class), name(s) of investor(s) on the account and the account number. Send materials to: Wasatch Funds, P.O. Box 2172, Milwaukee, WI 53201-2172 or via overnight delivery to: Wasatch Funds, 235 W. Galena St., Milwaukee, WI 53212. |

| • | To sell shares purchased directly from Wasatch Funds, go online at www.WasatchFunds.com, or call a shareholder services representative at 800.551.1700 if you did not decline the telephone redemption privilege when establishing your account. Redemption requests may be sent by mail or overnight delivery to the appropriate address shown above. Include your name, Fund name, Class of shares (i.e., Investor Class), account number, dollar amount of shares to be sold, your daytime telephone number, signature(s) of account owners (sign exactly as the account is registered) and Medallion signature guarantee (if required). For IRA accounts, please obtain an IRA Distribution Form from www.WasatchFunds.com or by calling a shareholder services representative. |

| • | Fund shares may be bought or sold through banks or investment professionals, including brokers. They may charge you a transaction fee for this service. |

| Shareholder Fees (fees paid directly from your investment) | Investor

Class Shares |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) | None |

| Redemption Fee (as a % of amount redeemed on shares held 60 days or less) | 2.00% |

| Exchange Fee | None |

| Maximum Account Fee | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | Investor

Class Shares |

| Management Fee | 1.00% |

| Distribution/Service (12b-1) Fee | None |

| Other Expenses | 0.24% |

| Acquired Fund Fees and Expenses1 | 0.21% |

| Total Annual Fund Operating Expenses2 | 1.45% |

| 1 | The Total Annual Fund Operating Expenses may not equal the expense ratio stated in the Fund’s most recent Annual Report and Financial Highlights, which reflects the operating expenses of the Fund and does not include Acquired Fund Fees and Expenses. |

| 2 | Wasatch Advisors, Inc. (Advisor), the Fund’s investment advisor, has contractually agreed to reimburse the Investor Class shares of the Fund for Total Annual Fund Operating Expenses in excess of 1.50% of average daily net assets until at least January 31, 2019 (excluding interest, dividend expense on short sales/interest expense, taxes, brokerage commissions, other investment related costs, acquired fund fees and expenses, and extraordinary expenses, such as litigation and other expenses not incurred in the ordinary course of business). The Board of Trustees is the only party that can terminate the contractual limitation prior to the contract’s expiration. The Advisor can rescind the contractual limitation on expenses at any time after its expiration date. |

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Small Cap Value Fund — Investor Class | $148 | $459 | $793 | $1,736 |

| • | Undiscovered Gems — Companies with good growth potential that have yet to be broadly discovered by Wall Street analysts, thus leaving them attractively undervalued relative to their expected growth rate. |

| • | Fallen Angels — High quality growth companies that have experienced a temporary setback and therefore have appealing valuations relative to their long-term growth potential. |

| • | Quality Value — Quality companies with earnings potential that is not fully reflected in their stock prices. |

| 6/30/2017 | 5.64% |

| Best — 6/30/2009 | 33.91% |

| Worst — 12/31/2008 | -34.04% |

| Average Annual Total Returns — (as of 12/31/16) | 1 Year | 5 Years | 10 Years |

| Wasatch Small Cap Value Fund — Investor Class | |||

| Return Before Taxes | 19.85% | 15.63% | 6.87% |

| Return After Taxes on Distributions | 19.83% | 15.60% | 6.27% |

| Return After Taxes on Distributions and Sale of Fund Shares | 11.25% | 12.63% | 5.38% |

| Russell 2000® Value Index* (reflects no deductions for fees, expenses or taxes) | 31.74% | 15.07% | 6.26% |

| Russell 2000® Index* (reflects no deductions for fees, expenses or taxes) | 21.31% | 14.46% | 7.07% |

| Jim

Larkins Lead Portfolio Manager Since 1999 |

| Investment Minimums | Investor Class |

| New Accounts | $2,000 |

| New Accounts with an Automatic Investment Plan | $1,000 |

| Individual Retirement Accounts (IRAs) | $2,000 |

| Coverdell Education Savings Accounts | $1,000 |

| Subsequent Purchases | Investor Class |

| Regular Accounts and IRAs | $100 |

| Automatic Investment Plan | $50

per month and/or $100 per quarter |

| • | You may purchase, sell (redeem) or exchange Fund shares on any day the New York Stock Exchange is open for business. |

| • | To open a new account directly with Wasatch Funds or to purchase shares for an existing account, go online at www.WasatchFunds.com. For a new account, complete and electronically submit the online application. Accounts for third parties, trusts, corporations, partnerships and other entities may not be opened online and are not eligible for online transactions. By telephone, complete the appropriate application and call a shareholder services representative at 800.551.1700 for instructions on how to open or add to an account via wire. To open a new account by mail, complete and mail the application and any other materials (such as a corporate resolution for corporate accounts) and a check. To add to an existing account, complete the additional investment form from your statement or write a note that includes the Fund name and Class of shares (i.e., Investor Class), name(s) of investor(s) on the account and the account number. Send materials to: Wasatch Funds, P.O. Box 2172, Milwaukee, WI 53201-2172 or via overnight delivery to: Wasatch Funds, 235 W. Galena St., Milwaukee, WI 53212. |

| • | To sell shares purchased directly from Wasatch Funds, go online at www.WasatchFunds.com, or call a shareholder services representative at 800.551.1700 if you did not decline the telephone redemption privilege when establishing your account. Redemption requests may be sent by mail or overnight delivery to the appropriate address shown above. Include your name, Fund name, Class of shares (i.e., Investor Class), account number, dollar amount of shares to be sold, your daytime telephone number, signature(s) of account owners (sign exactly as the account is registered) and Medallion signature guarantee (if required). For IRA accounts, please obtain an IRA Distribution Form from www.WasatchFunds.com or by calling a shareholder services representative. |

| • | Fund shares may be bought or sold through banks or investment professionals, including brokers. They may charge you a transaction fee for this service. |

| Shareholder Fees (fees paid directly from your investment) | Investor

Class Shares |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) | None |