| Label |

Element |

Value |

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Registrant Name |

dei_EntityRegistrantName |

WASATCH FUNDS TRUST

|

|

| Prospectus Date |

rr_ProspectusDate |

Jan. 31, 2016

|

|

| Wasatch Strategic Income Fund |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Risk/Return [Heading] |

rr_RiskReturnHeading |

WASATCH STRATEGIC INCOME FUND® — SUMMARY

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

INVESTMENT OBJECTIVE

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

The Fund’s primary investment objective is to capture current income.

|

|

| Objective, Secondary [Text Block] |

rr_ObjectiveSecondaryTextBlock |

A secondary objective is long-term growth of capital.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

FEES AND EXPENSES OF THE FUND

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

The tables below describe the fees and expenses that you may pay if you buy, sell or hold Investor Class shares of the Fund.

|

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

SHAREHOLDER FEES (FEES PAID DIRECTLY FROM YOUR INVESTMENT)

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

ANNUAL FUND OPERATING EXPENSES (EXPENSES THAT YOU PAY EACH YEAR AS A PERCENTAGE OF THE VALUE OF YOUR INVESTMENT)

|

|

| Fee Waiver or Reimbursement over Assets, Date of Termination |

rr_FeeWaiverOrReimbursementOverAssetsDateOfTermination |

January 31, 2017

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

PORTFOLIO TURNOVER

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). Higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 78% of the average value of its portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

78.00%

|

|

| Expenses Not Correlated to Ratio Due to Acquired Fund Fees [Text] |

rr_ExpensesNotCorrelatedToRatioDueToAcquiredFundFees |

The Total Annual Fund Operating Expenses may not equal the expense ratio stated in the Fund's most recent Annual Report and Financial Highlights, which reflects the operating expenses of the Fund and does not include Acquired Fund Fees and Expenses.

|

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

EXAMPLE

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

This example is intended to help you compare the cost of investing in the Investor Class of the Fund with the cost of investing in other mutual funds. The example assumes that you invested $10,000 in the Investor Class of the Fund for the time periods indicated and then redeemed all of your shares at the end of those periods. The example also assumes that your investment had a 5% return each year and that operating expenses (as a percentage of net assets) of the Fund’s Investor Class remained the same. This example reflects contractual fee waivers and reimbursements through January 31, 2017. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

| Strategy [Heading] |

rr_StrategyHeading |

PRINCIPAL STRATEGIES

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

The Fund invests primarily in income-producing securities.

Under normal market conditions, we will invest the Fund’s assets in income-producing domestic and foreign securities, including equity securities and fixed income securities of companies of all market capitalizations. Equity securities include common stock, preferred stock and securities convertible into common stock, warrants and rights, and other securities with equity characteristics (for example, participatory notes or derivatives linked to a basket of underlying equity securities, certain options on common stock, and exchange-traded funds). The Fund is not managed as a balanced portfolio. At times, one type of security may make up a substantial portion of the Fund, while other types may have minimal or no representation.

The Fund may invest its assets in securities issued by foreign companies in developed countries without limit. To a lesser extent, the Fund may invest in foreign companies in emerging markets. Securities issued by companies incorporated outside the United States whose securities are principally traded in the United States are not defined as foreign companies.

In our search for investments, we maintain the flexibility to invest in companies from a variety of industries. The Fund, however, does have a concentration in the financials sector — meaning that at least 25% of the Fund’s total assets will be invested in securities of issuers in the group of industries in the financials sector. For both domestic and foreign securities, we define the group of industries comprising the financials sector to include, among others, Banks (Commercial Banks, Thrifts and Mortgage Finance), Diversified Financial Companies (Diversified Financial Services, Consumer Finance, Capital Markets), Finance Companies, Financial Data Processing Services and Systems, Finance Companies (Small Loan), Financial Information Services, Insurance Companies (Life, Multi-Line, Property-Casualty), Investment Management Companies, Real Estate Companies (Real Estate Investment Trusts [REITs], Real Estate Management and Development Companies), Rental and Leasing Services (Commercial), Savings and Loans, and Securities Brokerage and Services.

The Fund may invest a large percentage of its assets in a few sectors, including consumer discretionary, consumer staples, energy, financials, industrials and information technology.

The Fund may invest in exchange-traded funds (ETFs).

The Fund may make short sales of securities, and may also use derivatives such as put and call options and futures contracts for hedging and non-hedging purposes. The Fund may write put and call options subject to applicable law and SEC guidelines.

In the selection of equity securities, we use “bottom-up” fundamental analysis to identify individual companies with attractive, sustainable dividend yields or the potential for dividend growth. In certain situations, the Fund may acquire non-income producing securities if we believe the company has the potential to pay dividends in the future. Our analysis may include studying a company’s financial statements, building proprietary financial models, visiting company facilities, and meeting with executive management, suppliers and customers.

Characteristics we consider when investing in equity securities generally include:- Attractive, sustainable dividend yields or the potential for dividend growth.

- Experienced top management.

- Sustainable competitive advantage.

- Stable demand for products and services.

- Ability to capitalize on favorable long-term trends.

The Fund’s investments in fixed income securities may include domestic and foreign corporate bonds with a variety of maturities (e.g., long-term, intermediate or short-term) and credit qualities (e.g., investment grade or non-investment grade). At certain times the Fund may emphasize one particular maturity or credit quality. The Fund may invest in non-investment grade securities without limitation. The Fund may also invest in U.S. Treasury securities and the debt obligations of foreign governments.

Characteristics we consider when investing in fixed income securities generally include:- Rates of current income.

- Credit quality of the issuer.

- Maturity, duration and other characteristics of the obligation.

|

|

| Strategy Portfolio Concentration [Text] |

rr_StrategyPortfolioConcentration |

The Fund, however, does have a concentration in the financials sector — meaning that at least 25% of the Fund’s total assets will be invested in securities of issuers in the group of industries in the financials sector. For both domestic and foreign securities, we define the group of industries comprising the financials sector to include, among others, Banks (Commercial Banks, Thrifts and Mortgage Finance), Diversified Financial Companies (Diversified Financial Services, Consumer Finance, Capital Markets), Finance Companies, Financial Data Processing Services and Systems, Finance Companies (Small Loan), Financial Information Services, Insurance Companies (Life, Multi-Line, Property-Casualty), Investment Management Companies, Real Estate Companies (Real Estate Investment Trusts [REITs], Real Estate Management and Development Companies), Rental and Leasing Services (Commercial), Savings and Loans, and Securities Brokerage and Services.

The Fund may invest a large percentage of its assets in a few sectors, including consumer discretionary, consumer staples, energy, financials, industrials and information technology.

|

|

| Risk [Heading] |

rr_RiskHeading |

PRINCIPAL RISKS

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

All investments carry some degree of risk that will affect the value of the Fund, its investment performance and the price of its shares. As a result, you may lose money if you invest in the Fund. An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

The Fund is subject to the following principal investment risks:

Stock Market Risk. The Fund’s investments may decline in value due to movements in the overall stock market.

Stock Selection Risk. The Fund’s investments may decline in value even when the overall stock market is not in a general decline.

Foreign Securities Risk. Foreign securities are generally more volatile and less liquid than U.S. securities. Further, foreign securities may be subject to additional risks not associated with investments in U.S. securities. Differences in the economic and political environment, the amount of available public information, the degree of market regulation, and financial reporting, accounting and auditing standards, and, in the case of foreign currency-denominated securities, fluctuations in currency exchange rates, can have a significant effect on the value of a foreign security.

Emerging Markets Risk. In addition to the risks of investing in foreign securities in general, the risks of investing in the securities of companies domiciled in emerging market countries include increased political or social instability, economies based on only a few industries, unstable currencies, runaway inflation, highly volatile securities markets, unpredictable shifts in policies relating to foreign investments, lack of protection for investors against parties that fail to complete transactions, and the potential for government seizure of assets or nationalization of companies.

Smaller Company Stock Risk. Small- and mid-cap stocks may be very sensitive to changing economic conditions and market downturns. In particular, the issuers of small company stocks have more narrow markets for their products and services, fewer product lines, and more limited managerial and financial resources than larger issuers. The stocks of small companies may therefore be more volatile and the ability to sell these stocks at a desirable time or price may be more limited.

Sector Weightings Risk. To the extent the Fund emphasizes, from time to time, investments in a particular sector, the Fund will be subject to a greater degree to the risks particular to that sector, including the sectors described below. Market conditions, interest rates, and economic, regulatory, or financial developments could significantly affect all the securities in a single sector. If the Fund invests in a few sectors, it may have increased exposure to the price movements of those sectors.

Consumer Discretionary Sector Risk. Industries in the consumer discretionary sector, such as consumer durables, hotels, restaurants, media, retailing, and automobiles, may be significantly impacted by the performance of the overall economy, interest rates, competition, consumer confidence and spending, and changes in demographics and consumer tastes.

Consumer Staples Sector Risk. The consumer staples sector may be affected by marketing campaigns, changes in consumer demands, government regulations and changes in commodity prices.

Energy Sector Risk. The value of energy companies is particularly vulnerable to developments in the energy sector, fluctuations in the price and supply of energy fuels, energy conservation, the supply of and demand for specific energy-related products or services, and tax policy and other government regulation.

Financials Sector Risk. The financials sector is subject to extensive government regulation, can be subject to relatively rapid change due to increasingly blurred distinctions between service segments, and can be significantly affected by the availability and cost of capital funds, changes in interest rates, the rate of corporate and consumer debt defaults, and price competition.

Industrials Sector Risk. Industries in the industrials sector include companies engaged in the production, distribution or service of products or equipment for manufacturing, agriculture, forestry, mining, and construction, and can be significantly affected by general economic trends, including such factors as employment and economic growth, interest rate changes, changes in consumer spending, legislative and government regulation and spending, import controls, commodity prices, and worldwide competition.

Information Technology Sector Risk. Stocks of information technology companies may be volatile because issuers are sensitive to rapid obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. Information technology stocks, especially those of smaller, less-seasoned companies, tend to be more volatile than the overall market.

Derivatives Risk. The Fund may suffer a loss from its use of put and call options and futures contracts, which are forms of derivatives. Derivatives can amplify a gain or loss, potentially earning or losing substantially more money than the actual cost of the derivative instrument, with the potential for unlimited losses on certain instruments. Derivatives may be difficult to value, may become illiquid, and may affect the timing and character of taxes payable by shareholders.

Short Sales Risk. The Fund can make short sales of securities, which means it may experience a loss if the market price of the security increases between the date of the short sale and the date the security is replaced. Short sales may reduce a fund’s returns or increase volatility.

Investment Companies Risk. The Fund may invest in the shares of other investment companies, including foreign and domestic registered and unregistered open-end funds, closed-end funds, unit investment trusts and exchange-traded funds. Investing in another investment company subjects the Fund to the same risks associated with investing in the securities held by the applicable investment company and the investment strategies employed by such funds (such as the use of leverage). In addition, the benefit of investing in another investment company is largely dependent on the skill of the investment advisor of the underlying company and whether the associated fees and costs involved with investing in such company are offset by the potential gains. As a shareholder in an investment company, the Fund will bear its ratable share of that investment company’s expenses including advisory and administrative fees. Fund shareholders would therefore be subject to duplicative expenses to the extent that the Fund invests in other investment companies.

Exchange-Traded Funds (ETFs) Risk. ETFs are investment companies that are bought and sold on a securities exchange. Shares of ETFs are redeemable only in larger aggregations of a specified number of shares and generally on an in-kind basis. When the Fund invests in an ETF, it will bear additional expenses based on its pro rata share of the ETF’s operating expenses. In addition, the Fund will incur brokerage costs when purchasing and selling shares of ETFs. The risk of owning an ETF generally reflects the risks of the underlying securities held by the ETF and investment strategies employed by such ETF (such as the use of leverage). The market price may also fluctuate due to the supply of and demand for the ETF’s shares on the exchange upon which its shares are traded. Lack of liquidity in an ETF could result in the ETF being more volatile than the underlying portfolio of securities. In addition, because of ETF expenses, compared to owning the underlying securities directly, it may be more costly to own an ETF.

REIT Risk. Investments in real estate investment trusts (REITs) subject the Fund to risks associated with the direct ownership of real estate. The value of REIT securities can be affected by changes in real estate values and rental income, property taxes, interest rates, tax and regulatory requirements and the management skill and creditworthiness of the issuer. In addition, the value of a REIT can depend on the structure and cash flow generated by the REIT and REITs may not have diversified holdings. Because REITs are pooled investment vehicles that have expenses of their own, the Fund will indirectly bear its proportionate share of those expenses.

Credit Risk. Credit risk is the risk that the issuer of a debt security will fail to repay principal and interest on the security when due. Credit risk is affected by the issuer’s credit status, and is generally higher for non-investment grade securities.

Interest Rate Risk. Interest rate risk is the risk that a debt security’s value will decline due to changes in market interest rates. Even though some interest-bearing securities offer a stable stream of income, their prices will still fluctuate with changes in interest rates. The Fund may be subject to greater risk of rising interest rates than would normally be the case due to the current period of historically low rates and the effect of potential government fiscal policy initiatives and resulting market reaction to those initiatives. When interest rates change, the values of longer duration debt securities usually change more than the values of shorter-duration debt securities.

Non-Investment Grade Securities Risk. Non-investment grade securities (also known as “high yield” or “junk bonds”), those rated below investment grade by the primary rating agencies (e.g., below BB/Ba by S&P/Moody’s) tend to have more volatile prices and increased price sensitivity to changing interest rates and adverse economic and business developments than investment grade securities. In addition, compared to investments in investment grade securities, investments in non-investment grade securities are subject to greater risk of loss due to default by the issuer or decline in the issuer’s credit quality. There is a greater likelihood that adverse economic or company-specific events will make the issuer unable to make interest and/or principal payments, and more susceptible to negative market sentiment, leading to depressed prices and decreased liquidity for the non-investment grade securities.

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

All investments carry some degree of risk that will affect the value of the Fund, its investment performance and the price of its shares. As a result, you may lose money if you invest in the Fund.

|

|

| Risk Not Insured Depository Institution [Text] |

rr_RiskNotInsuredDepositoryInstitution |

An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

|

|

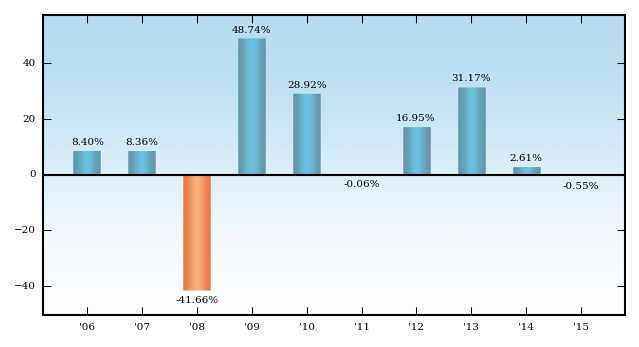

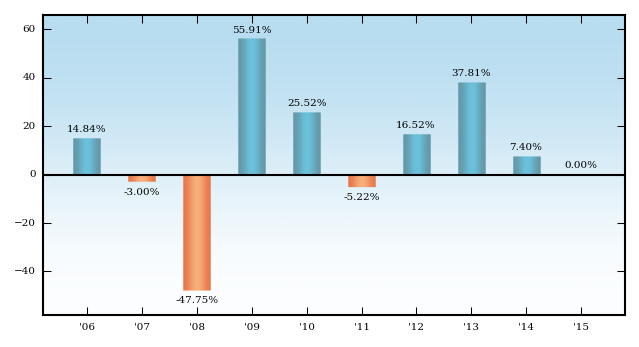

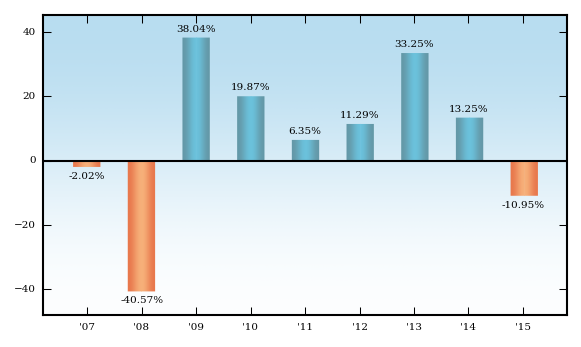

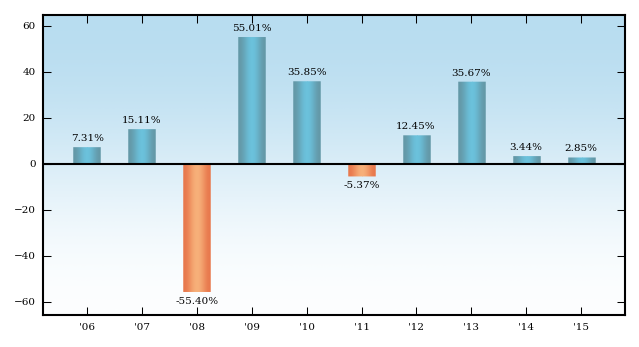

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

HISTORICAL PERFORMANCE

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

The following tables provide information on how the Investor Class of the Fund has performed over time. The past performance, before and after taxes, of the Fund’s Investor Class is not necessarily an indication of how these shares will perform in the future. The bar chart below is intended to provide you with an indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year, as represented by the Investor Class of the Fund. The table below is designed to help you evaluate your risk tolerance by showing the best and worst quarterly performance of the Fund’s Investor Class for the years shown in the bar chart. The average annual total return table below allows you to compare the Fund’s performance over the time periods indicated to that of a broad-based stock market index composed of securities similar to those held by the Fund and an additional broad-based bond market index. Performance information is updated regularly and is available on the Fund’s website www.WasatchFunds.com.

|

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The bar chart below is intended to provide you with an indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year, as represented by the Investor Class of the Fund. The average annual total return table below allows you to compare the Fund’s performance over the time periods indicated to that of a broad-based stock market index composed of securities similar to those held by the Fund and an additional broad-based bond market index.

|

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

www.WasatchFunds.com

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

The past performance, before and after taxes, of the Fund’s Investor Class is not necessarily an indication of how these shares will perform in the future.

|

|

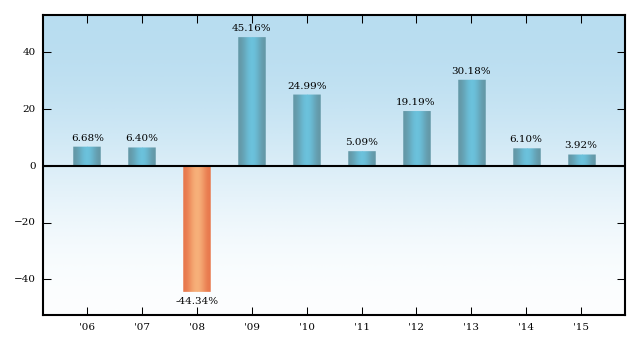

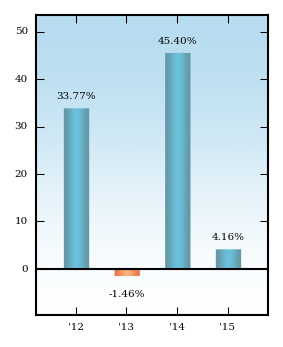

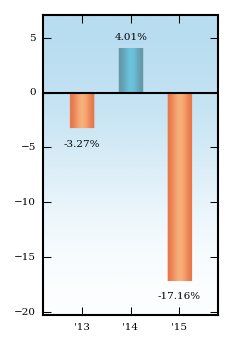

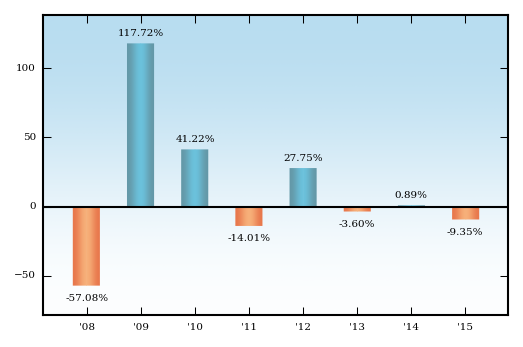

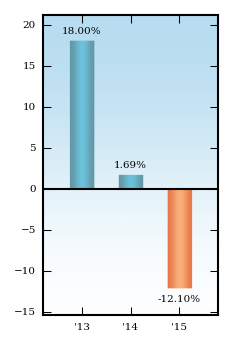

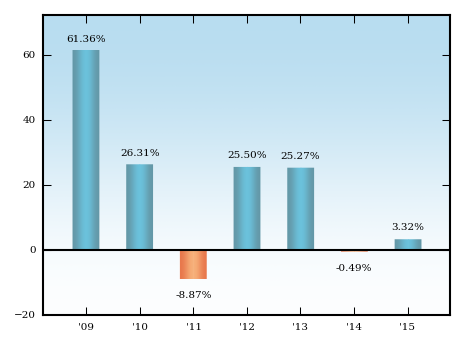

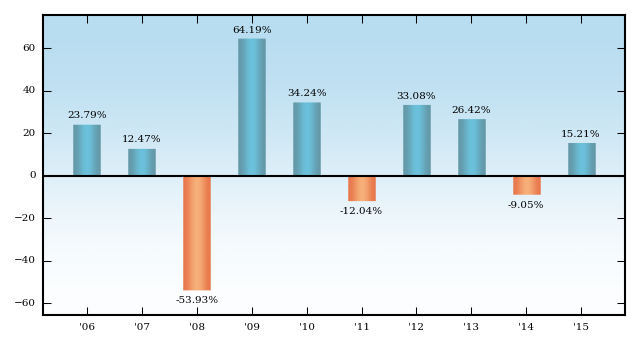

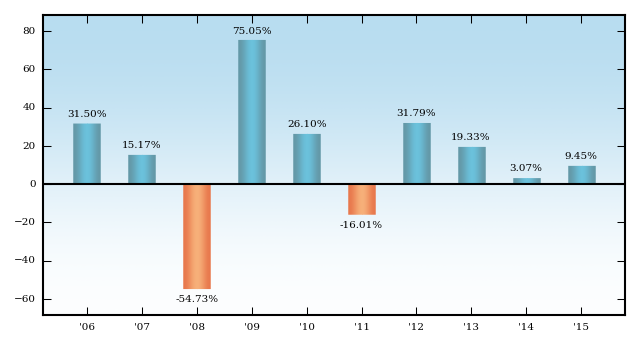

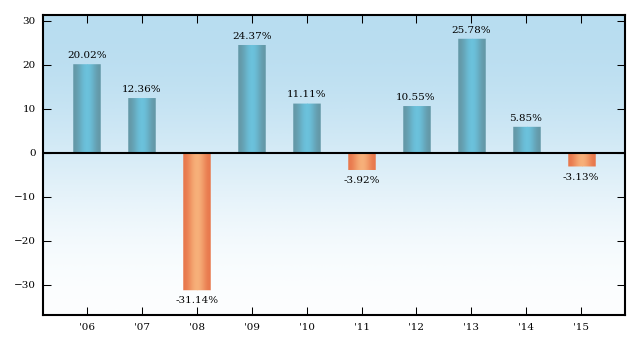

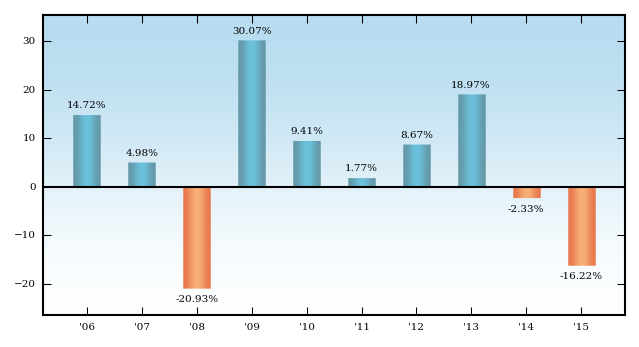

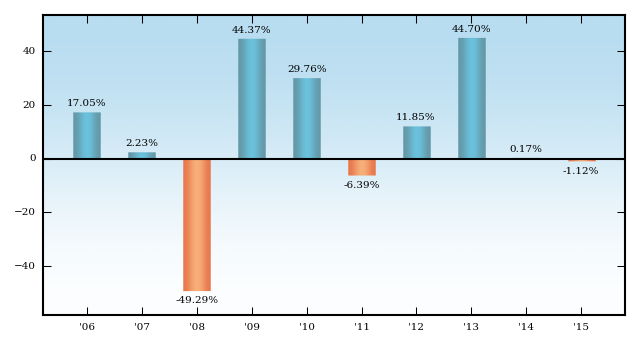

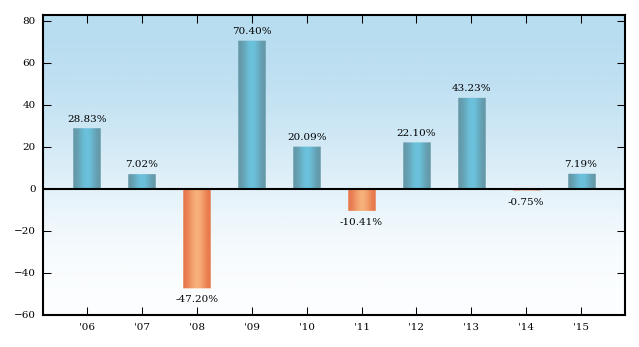

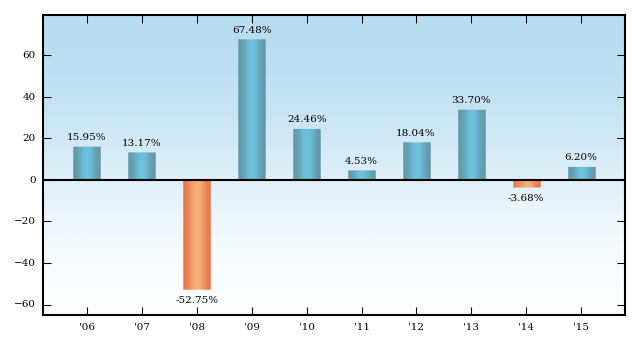

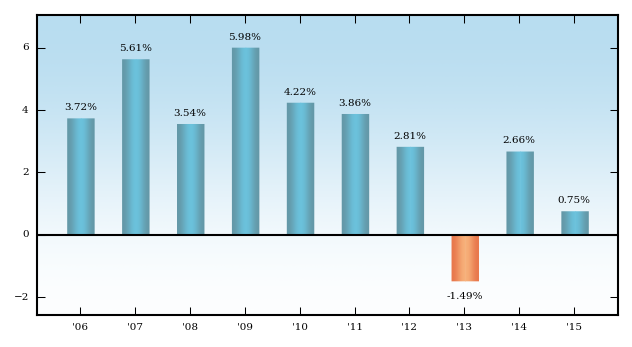

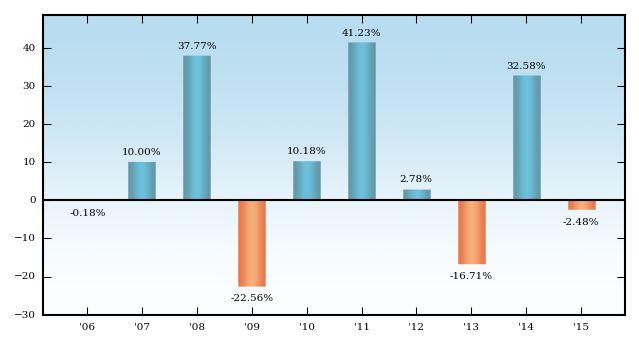

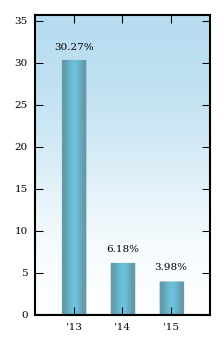

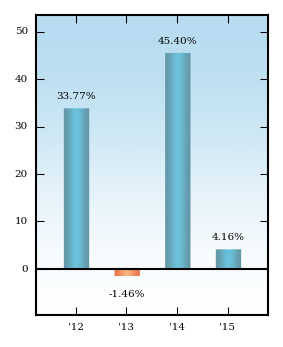

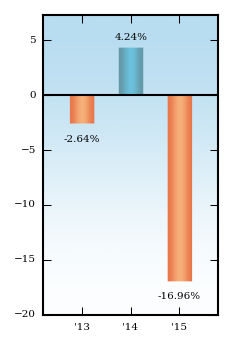

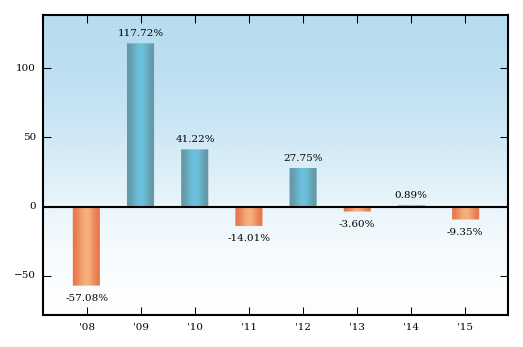

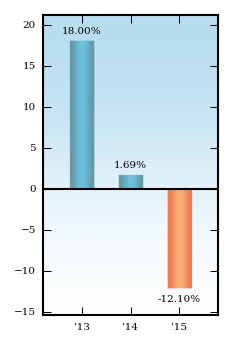

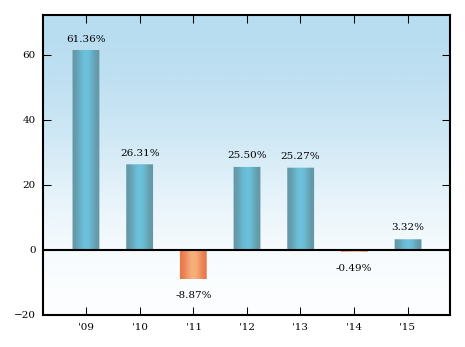

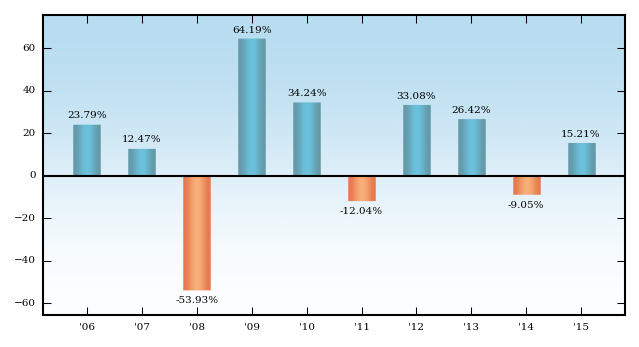

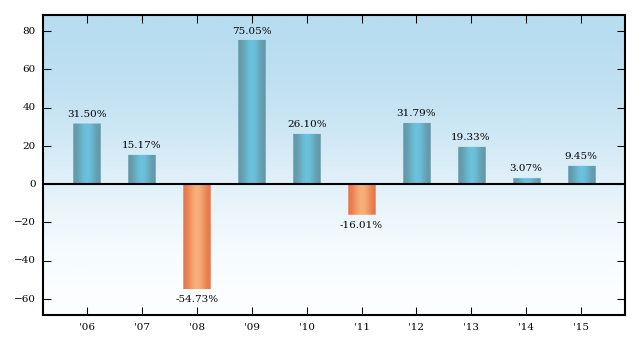

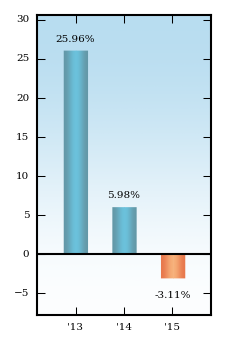

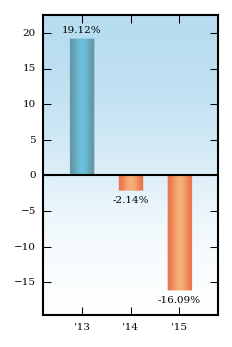

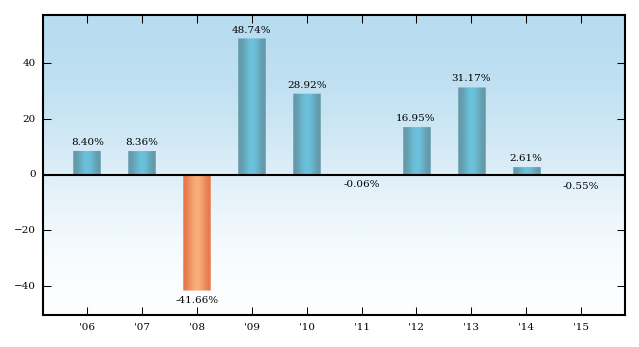

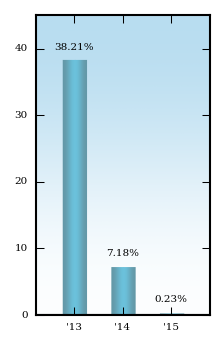

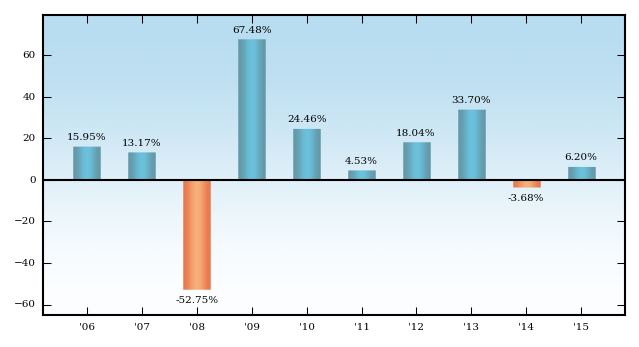

| Bar Chart [Heading] |

rr_BarChartHeading |

WASATCH STRATEGIC INCOME FUND — INVESTOR CLASS

Year by Year Total Returns

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

Best and Worst Quarterly Returns

| Best — 6/30/2009 | | | 21.21% | | | Worst — 12/31/2008 | | | -28.22% | |

|

|

| Performance Table Heading |

rr_PerformanceTableHeading |

Average Annual Total Returns — (as of 12/31/15)

|

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates, and do not reflect the impact of state and local taxes.

|

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

The after-tax returns are not relevant to investors who hold Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

|

|

| Performance Table Explanation after Tax Higher |

rr_PerformanceTableExplanationAfterTaxHigher |

The Fund’s returns after taxes on distributions and sale of Fund shares may be higher than returns before taxes and after taxes on distributions because they include the effect of a tax benefit an investor may receive from the capital losses that would have been incurred.

|

|

| Performance Table Narrative |

rr_PerformanceTableNarrativeTextBlock |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown. The after-tax returns are not relevant to investors who hold Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

The Fund’s returns after taxes on distributions and sale of Fund shares may be higher than returns before taxes and after taxes on distributions because they include the effect of a tax benefit an investor may receive from the capital losses that would have been incurred.

|

|

| Wasatch Strategic Income Fund | Investor Class Shares |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Redemption Fee (as a % of amount redeemed on shares held 60 days or less) |

rr_RedemptionFeeOverRedemption |

2.00%

|

|

| Exchange Fee |

rr_ExchangeFeeOverRedemption |

none

|

|

| Maximum Account Fee |

rr_MaximumAccountFeeOverAssets |

none

|

|

| Management Fee |

rr_ManagementFeesOverAssets |

0.70%

|

|

| Distribution/Service (12b-1) Fee |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.25%

|

|

| Acquired Fund Fees and Expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.56%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

1.51%

|

[1] |

| Expense Reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

[2] |

| Total Annual Fund Operating Expenses After Expense Reimbursement |

rr_NetExpensesOverAssets |

1.51%

|

|

| 1 Year |

rr_ExpenseExampleYear01 |

$ 154

|

|

| 3 Years |

rr_ExpenseExampleYear03 |

478

|

|

| 5 Years |

rr_ExpenseExampleYear05 |

824

|

|

| 10 Years |

rr_ExpenseExampleYear10 |

$ 1,801

|

|

| 2007 |

rr_AnnualReturn2007 |

(2.02%)

|

|

| 2008 |

rr_AnnualReturn2008 |

(40.57%)

|

|

| 2009 |

rr_AnnualReturn2009 |

38.04%

|

|

| 2010 |

rr_AnnualReturn2010 |

19.87%

|

|

| 2011 |

rr_AnnualReturn2011 |

6.35%

|

|

| 2012 |

rr_AnnualReturn2012 |

11.29%

|

|

| 2013 |

rr_AnnualReturn2013 |

33.25%

|

|

| 2014 |

rr_AnnualReturn2014 |

13.25%

|

|

| 2015 |

rr_AnnualReturn2015 |

(10.95%)

|

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

Best

|

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Jun. 30, 2009

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

21.21%

|

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

Worst

|

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Dec. 31, 2008

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(28.22%)

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(10.95%)

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

9.73%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

6.26%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Feb. 01, 2006

|

|

| Wasatch Strategic Income Fund | Return After Taxes on Distributions | Investor Class Shares |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(12.85%)

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

8.26%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

4.39%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Feb. 01, 2006

|

|

| Wasatch Strategic Income Fund | Return After Taxes on Distributions and Sale of Fund Shares | Investor Class Shares |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(5.12%)

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

7.48%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

4.34%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Feb. 01, 2006

|

|

| Wasatch Strategic Income Fund | S&P 500® Index (reflects no deductions for fees, expenses or taxes) |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

1.38%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

12.57%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

7.09%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Feb. 01, 2006

|

|

| Wasatch Strategic Income Fund | Barclays Capital U.S. Aggregate Bond Index (reflects no deductions for fees, expenses or taxes) |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

0.55%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

3.25%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

4.55%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Feb. 01, 2006

|

|

|

|