Wasatch Core Growth Fund®

(Investor Class Shares)

(Investor Class Shares)

| Summary Prospectus —January 31, 2016 | Ticker: WGROX |

Before you

invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus and other information about the Fund online at

www.WasatchFunds.com.You can also get this information at no cost by calling 800.551.1700 or by sending an email to shareholderservice@wasatchfunds.com. The Fund’s

prospectus and statement of additional information, each dated January 31, 2016, are incorporated by reference into this summary prospectus.

Investment Objective

The Fund’s primary investment objective

is long-term growth of capital. Income is a secondary objective, but only when consistent with long-term growth of capital. Currently, we do not expect the Fund’s investments to generate substantial

income.

Fees and Expenses of the Fund

The tables below describe the fees and

expenses that you may pay if you buy, sell or hold Investor Class shares of the Fund.

| Shareholder Fees (fees paid directly from your investment) | Investor

Class Shares |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) | None |

| Redemption Fee (as a % of amount redeemed on shares held 60 days or less) | 2.00% |

| Exchange Fee | None |

| Maximum Account Fee | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | Investor

Class Shares |

| Management Fee | 1.00% |

| Distribution/Service (12b-1) Fee | None |

| Other Expenses | 0.17% |

| Total Annual Fund Operating Expenses1 | 1.17% |

| 1 | Wasatch Advisors, Inc. (Advisor), the Fund’s investment advisor, has contractually agreed to reimburse the Investor Class shares of the Fund for Total Annual Fund Operating Expenses in excess of 1.50% of average daily net assets until at least January 31, 2017 (excluding interest, dividend expense on short sales/interest expense, taxes, brokerage commissions, other investment related costs, acquired fund fees and expenses, and extraordinary expenses, such as litigation and other expenses not incurred in the ordinary course of business). The Board of Trustees is the only party that can terminate the contractual limitation prior to the contract’s expiration. The Advisor can rescind the contractual limitation on expenses at any time after its expiration date. |

Example

This example is intended to help you compare

the cost of investing in the Investor Class of the Fund with the cost of investing in other mutual funds. The example assumes that you invested $10,000 in the Investor Class of the Fund for the time periods indicated and then redeemed all of your

shares at the end of those periods. The example also assumes that your investment had a

1

5%

return each year and that operating expenses (as a percentage of net assets) of the Fund’s Investor Class remained the same. This example reflects contractual fee waivers and reimbursements through January 31, 2017. Although your actual costs

may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Core Growth Fund — Investor Class | $119 | $372 | $644 | $1,420 |

Portfolio Turnover

The Fund pays transaction costs, such as

commissions, when it buys and sells securities (or “turns over” its portfolio). Higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs,

which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 39% of the average value of its portfolio.

Principal Strategies

The Fund invests primarily in smaller growing

companies at reasonable prices.

Under normal market

conditions, we will invest at least 65% of the Fund’s net assets in the equity securities of growing companies. Equity securities include common stock, preferred stock and securities convertible into common stock, warrants and rights, and

other securities with equity characteristics (for example, participatory notes or derivatives linked to a basket of underlying equity securities, certain options on common stock, and exchange-traded funds). The companies in which we invest are

usually small to mid-size with market capitalizations of less than $5 billion at the time of purchase.

The Fund may invest up to 20% of its total assets at the

time of purchase in securities issued by foreign companies in developed or emerging markets. Securities issued by companies incorporated outside the United States whose securities are principally traded in the United States are not defined as

foreign companies and are not subject to this limitation.

We focus on companies that we consider to be high quality.

We use a process of “bottom-up” fundamental analysis to look for individual companies that we believe are stable and have the potential to grow steadily for long periods of time. Our analysis may include studying a company’s

financial statements, building proprietary financial models, visiting company facilities, and meeting with executive management, suppliers and customers.

The Fund seeks to purchase stocks at prices we believe are

reasonable relative to our projection of a company’s long term earnings growth rate. The Fund’s secondary objective of income is achieved when fast growing portfolio companies pay dividends, generated by cash flow, typically after

achieving growth targets.

The Fund may invest a large

percentage of its assets in a few sectors, including consumer discretionary, financials, health care, industrials and information technology.

Principal Risks

All investments carry some degree of risk

that will affect the value of the Fund, its investment performance and the price of its shares. As a result, you may lose money if you invest in the Fund. An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the

Federal Deposit Insurance Corporation (FDIC) or any other government agency.

The Fund is subject to the following principal investment

risks:

Stock Market Risk. The Fund’s investments may decline in value due to movements in the overall stock market.

Stock Selection Risk. The

Fund’s investments may decline in value even when the overall stock market is not in a general decline.

Foreign Securities Risk.

Foreign securities are generally more volatile and less liquid than U.S. securities. Further, foreign securities may be subject to additional risks not associated with investments in U.S. securities. Differences in the economic and political

environment, the amount of available public information, the degree of market regulation, and financial reporting, accounting and auditing standards, and, in the case of foreign currency-denominated securities, fluctuations in currency exchange

rates, can have a significant effect on the value of a foreign security.

Emerging Markets Risk. In

addition to the risks of investing in foreign securities in general, the risks of investing in the securities of companies domiciled in emerging market countries include increased political or social instability, economies based on only a few

industries, unstable currencies, runaway inflation, highly volatile securities markets, unpredictable shifts in policies relating to foreign investments, lack of protection for investors against parties that fail to complete transactions, and the

potential for government seizure of assets or nationalization of companies.

Smaller Company Stock Risk.

Small- and mid-cap stocks may be very sensitive to changing economic conditions and market downturns. In particular, the issuers of small company stocks have more narrow markets for their products and services, fewer product lines, and more limited

managerial and financial resources than larger issuers. The stocks of small companies may therefore be more volatile and the ability to sell these stocks at a desirable time or price may be more limited.

Growth Stock Risk. Growth

stock prices may be more sensitive to changes in companies’ current or expected earnings than the prices of other stocks, and growth stock prices may fall or may not appreciate in step with the broader securities markets.

Sector Weightings Risk. To

the extent the Fund emphasizes, from time to time, investments in a particular sector, the Fund will be subject to a greater degree to the risks particular to that sector, including the sectors described below. Market conditions, interest rates, and

economic, regulatory, or financial developments could significantly affect all the securities in a single sector. If the Fund invests in a few sectors, it may have increased exposure to the price movements of those sectors.

2

Consumer Discretionary Sector Risk. Industries in the consumer discretionary sector, such as consumer durables, hotels, restaurants, media, retailing, and automobiles, may be significantly impacted by the performance of the overall economy, interest

rates, competition, consumer confidence and spending, and changes in demographics and consumer tastes.

Financials Sector Risk. The

financials sector is subject to extensive government regulation, can be subject to relatively rapid change due to increasingly blurred distinctions between service segments, and can be significantly affected by the availability and cost of capital

funds, changes in interest rates, the rate of corporate and consumer debt defaults, and price competition.

Health Care Sector Risk.

Health care companies are strongly affected by worldwide scientific or technological developments. Their products may rapidly become obsolete. Many health care companies are also subject to significant government regulation and may be affected by

changes in government policies.

Industrials

Sector Risk. Industries in the industrials sector include companies engaged in the production, distribution or service of products or equipment for manufacturing, agriculture, forestry, mining, and construction, and

can be significantly affected by general economic trends, including such factors as employment and economic growth, interest rate changes, changes in consumer spending, legislative and government regulation and spending, import controls, commodity

prices, and worldwide competition.

Information

Technology Sector Risk. Stocks of information technology companies may be volatile because issuers are sensitive to rapid obsolescence of existing technology, short product cycles, falling prices and profits,

competition from new market entrants, and general economic conditions. Information technology stocks, especially those of smaller, less-seasoned companies, tend to be more volatile than the overall market.

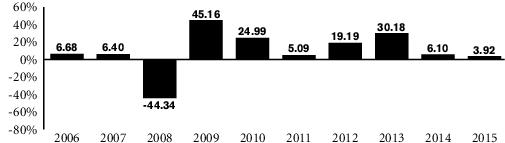

Historical Performance

The following tables provide information on

how the Investor Class of the Fund has performed over time. The past performance, before and after taxes, of the Fund’s Investor Class is not necessarily an indication of how these shares will perform in the future. The bar chart below is

intended to provide you with an indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year, as represented by the Investor Class of the Fund. The table below is designed to help you evaluate

your risk tolerance by showing the best and worst quarterly performance of the Fund’s Investor Class for the years shown in the bar chart. The average annual total return table below allows you to compare the Fund’s performance over the

time periods indicated to that of a broad-based market index and an additional index composed of securities similar to those held by the Fund. Performance information is updated regularly and is available on the Fund’s website www.WasatchFunds.com.

Wasatch Core Growth Fund — Investor Class

Year by Year Total Returns

Best and Worst Quarterly

Returns

| Best — 6/30/2009 | 29.50% |

| Worst — 12/31/2008 | -27.03% |

| Average Annual Total Returns — (as of 12/31/15) | 1 Year | 5 Years | 10 Years |

| Wasatch Core Growth Fund — Investor Class | |||

| Return Before Taxes | 3.92% | 12.45% | 7.50% |

| Return After Taxes on Distributions | 1.17% | 11.64% | 6.60% |

| Return After Taxes on Distributions and Sale of Fund Shares | 4.54% | 9.96% | 6.02% |

| Russell 2000® Index (reflects no deductions for fees, expenses or taxes) | -4.41% | 9.19% | 6.80% |

| Russell 2000® Growth Index (reflects no deductions for fees, expenses or taxes) | -1.38% | 10.67% | 7.95% |

After-tax returns are calculated

using the historical highest individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown. The after-tax

returns are not relevant to investors who hold Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

The Fund’s returns after taxes on distributions and

sale of Fund shares may be higher than returns before taxes and after taxes on distributions because they include the effect of a tax benefit an investor may receive from the capital losses that would have been incurred.

3

Portfolio Management

Investment Advisor

Wasatch Advisors, Inc.

Portfolio Managers

| JB

Taylor Lead Portfolio Manager Since 2000 |

Paul

Lambert Portfolio Manager Since 2005 |

Purchase and Sale of Fund Shares

| Investment Minimums | Investor Class |

| New Accounts | $2,000 |

| New Accounts with an Automatic Investment Plan | $1,000 |

| Individual Retirement Accounts (IRAs) | $2,000 |

| Coverdell Education Savings Accounts | $1,000 |

| Subsequent Purchases | Investor Class |

| Regular Accounts and IRAs | $100 |

| Automatic Investment Plan | $50

per month and/or $100 per quarter |

| • | You may purchase, sell (redeem) or exchange Fund shares on any day the New York Stock Exchange is open for business. |

| • | To open a new account directly with Wasatch Funds or to purchase shares for an existing account, go online at www.WasatchFunds.com. For a new account, complete and electronically submit the online application. Accounts for third parties, trusts, corporations, partnerships and other entities may not be opened online and are not eligible for online transactions. By telephone, complete the appropriate application and call a shareholder services representative at 800.551.1700 for instructions on how to open or add to an account via wire. To open a new account by mail, complete and mail the application and any other materials (such as a corporate resolution for corporate accounts) and a check. To add to an existing account, complete the additional investment form from your statement or write a note that includes the name and Class of shares (i.e., Investor Class), name(s) of investor(s) on the account and the account number. Send materials to: Wasatch Funds, P.O. Box 2172, Milwaukee, WI 53201-2172 or via overnight delivery to: Wasatch Funds, 235 W. Galena St., Milwaukee, WI 53212. |

| • | To sell shares purchased directly from Wasatch Funds, go online at www.WasatchFunds.com, or call a shareholder services representative at 800.551.1700 if you did not decline the telephone redemption privilege when establishing your account. Redemption requests may be sent by mail or overnight delivery to the appropriate address shown above. Include your name, Fund Name, Class of shares (i.e., Investor Class), account number, dollar amount of shares to be sold, your daytime telephone number, signature(s) of account owners (sign exactly as the account is registered) and Medallion signature guarantee (if required). For IRA accounts, please obtain an IRA Distribution Form from www.WasatchFunds.com or by calling a shareholder services representative. |

| • | Fund shares may be bought or sold through banks or investment professionals, including brokers. They may charge you a transaction fee for this service. |

| • | Shareholders with combined account balances of $100,000 or more held directly with Wasatch Funds may be eligible for certain service benefits, including access to an exclusive toll free telephone number. For more information, visit www.WasatchFunds.com and read about “Premier Services” in the Account Policies section of the statutory prospectus, or contact a shareholder services representative at 800.551.1700 or via email at shareholderservice@wasatchfunds.com. |

Tax Information

The Fund intends to make distributions. You

will generally have to pay federal income taxes, and any applicable state or local taxes, on the distributions you receive from the Fund as ordinary income or capital gains unless you are investing through a tax exempt account such as a qualified

retirement plan. Distributions on investments made through tax-deferred vehicles, such as 401(k) plans or IRAs, may be taxed later upon withdrawal of assets from those plans or accounts.

Payments to Broker-Dealers and Other Financial

Intermediaries

If you purchase shares

of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Advisor or its affiliates may pay the intermediary for the sale of shares and related services. These payments may create a conflict of interest by influencing

the broker-dealer or other intermediary or your individual financial advisor to recommend the Fund over another investment. Ask your individual financial advisor or visit your financial intermediary’s website for more information.

WGROX

4