Table of Contents

Table of Contents

| TABLE OF CONTENTS | ||

|

| ||

|

| ||

| 2 | ||||

| 7 | ||||

| 12 | ||||

| 17 | ||||

| 22 | ||||

| 27 | ||||

| 32 | ||||

| 37 | ||||

| 42 | ||||

| 47 | ||||

| 52 | ||||

| 57 | ||||

| 62 | ||||

| 67 | ||||

| 72 | ||||

| 77 | ||||

| 83 | ||||

| 88 | ||||

| 93 | ||||

| 98 | ||||

| 102 | ||||

| 106 | ||||

| 111 | ||||

| 113 | ||||

| 121 | ||||

| 124 | ||||

| 133 | ||||

1

Table of Contents

| WASATCH CORE GROWTH FUND — Summary | ||

|

| ||

|

| ||

INVESTMENT OBJECTIVE

The Fund’s primary investment objective is long-term growth of capital. Income is a secondary objective, but only when consistent with long-term growth of capital. Currently, we do not expect the Fund’s investments to generate substantial income.

FEES AND EXPENSES OF THE FUND

The tables below describe the fees and expenses that you may pay if you buy, sell or hold Investor Class shares of the Fund.

| SHAREHOLDER FEES (fees paid directly from your investment) | Investor Class Shares | |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) |

None | |

| Redemption Fee (as a % of amount redeemed on shares held 60 days or less) |

2.00% | |

| Exchange Fee |

None | |

| Maximum Account Fee |

None |

| ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) | Investor Class Shares | |

| Management Fee |

1.00% | |

| Distribution/Service (12b-1) Fee |

None | |

| Other Expenses |

0.21% | |

|

| ||

| Total Annual Fund Operating Expenses1 |

1.21% |

| 1 | The Advisor has contractually agreed to reimburse the Investor Class shares of the Fund for Total Annual Fund Operating Expenses in excess of 1.50% of average daily net assets until at least January 31, 2015 (excluding interest, dividend expense on short sales/interest expense, taxes, brokerage commissions, other investment related costs and extraordinary expenses). The Board of Trustees is the only party that can terminate the contractual limitation prior to the contract’s expiration. The Advisor can rescind the contractual limitation on expenses at any time after its expiration date. |

EXAMPLE

This example is intended to help you compare the cost of investing in the Investor Class of the Fund with the cost of investing in other mutual funds. The example assumes that you invested $10,000 in the Investor Class of the Fund for the time periods indicated and then redeemed all of your shares at the end of those periods. The example also assumes that your investment had a 5% return each year and that the operating expenses (as a percentage of net assets) of the Fund’s Investor Class remained the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Core Growth Fund — Investor Class |

$ | 123 | $ | 384 | $ | 665 | $ | 1,465 | ||||||||

2

Table of Contents

| JANUARY 31, 2014 | ||

|

| ||

|

| ||

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). Higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 16% of the average value of its portfolio.

PRINCIPAL STRATEGIES

The Fund invests primarily in smaller growing companies at reasonable prices.

Under normal market conditions, we will invest at least 65% of the Fund’s net assets in the equity securities of growing companies. Equity securities include common stock, preferred stock and securities convertible into common stock, warrants and rights, and other securities with equity characteristics (which include any instrument tied to a specific security or basket of securities, such as equity-linked derivatives and notes, certain options on common stock, and exchange traded funds). These companies are usually small to mid-size with market capitalizations of less than $5 billion at the time of purchase.

The Fund may invest up to 20% of its total assets at the time of purchase in securities issued by foreign companies in developed or emerging markets. Securities issued by companies incorporated outside the United States whose securities are publicly traded in the United States are not defined as foreign companies and are not subject to this limitation.

We focus on companies that we consider to be high quality. We use a process of “bottom-up” fundamental analysis to look for individual companies that we believe are stable and have the potential to grow steadily for long periods of time. Our analysis may include studying a company’s financial statements, building proprietary financial models, visiting company facilities, and meeting with executive management, suppliers and customers.

The Fund seeks to purchase stocks at prices we believe are reasonable relative to our projection of a company’s long term earnings growth rate. The secondary objective of income is achieved when fast growing portfolio companies pay dividends, generated by cash flow, typically after achieving growth targets.

The Fund may invest a large percentage of its assets in a few sectors, including industrials, financials, consumer discretionary, information technology and health care.

PRINCIPAL RISKS

All investments carry some degree of risk that will affect the value of the Fund, its investment performance and the price of its shares. As a result, you may lose money if you invest in the Fund. An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

The Fund is subject to the following principal investment risks:

Stock Market Risk. The Fund’s investments may decline in value due to movements in the overall stock market.

Stock Selection Risk. The Fund’s investments may decline in value even when the overall stock market is not in a general decline.

Foreign Securities Risk. Foreign securities are generally more volatile and less liquid than U.S. securities. Further, foreign securities may be subject to additional risks not associated with investments in U.S. securities due to differences in the economic and political environment, the amount of available public information, the degree of market regulation, and financial reporting, accounting and auditing standards, and, in the case of foreign currency-denominated securities, fluctuations in currency exchange rates.

Emerging Markets Risk. In addition to the risks of investing in foreign securities in general, the risks of investing in the securities of companies domiciled in emerging market countries include increased political or social instability, economies based on only a few industries, unstable currencies, runaway inflation, highly volatile securities markets, unpredictable shifts in policies relating to foreign investments, lack of protection for investors against parties that fail to complete transactions, and the potential for government seizure of assets or nationalization of companies.

Smaller Company Stock Risk. Small and mid cap stocks may be very sensitive to changing economic conditions and market downturns. In particular, the issuers of small company stocks have more narrow markets for their products and services, fewer product lines, and more limited managerial and financial resources than larger issuers. The stocks of small companies may therefore be more volatile and the ability to sell these stocks at a desirable time or price may be more limited.

Growth Stock Risk. Growth stock prices may be more sensitive to changes in current or expected earnings than the prices of other stocks, and they may fall or not appreciate in step with the broader securities markets.

Sector Weightings Risk. To the extent the Fund emphasizes, from time to time, investments in a particular sector, the Fund will be subject to a greater degree to the risks particular to that sector, including the sectors described below. Market conditions, interest rates, and economic, regulatory, or financial developments could significantly affect all the securities in a single sector. If the Fund invests in a few sectors, it may have increased exposure to the price movements of those sectors.

Financials Sector Risk. The financials sector is subject to extensive government regulation, can be subject to relatively rapid change due to increasingly blurred distinctions between service segments, and can be significantly affected by the availability and cost of capital funds, changes in interest rates, the rate of corporate and consumer debt defaults, and price competition.

3

Table of Contents

| WASATCH CORE GROWTH FUND — Summary | ||

|

| ||

|

| ||

Consumer Discretionary Sector Risk. Industries in the consumer discretionary sector, such as consumer durables, hotels, restaurants, media, retailing and automobiles, may be significantly impacted by the performance of the overall economy, interest rates, competition, consumer confidence and spending, and changes in demographics and consumer tastes.

Health Care Sector Risk. Health care companies are strongly affected by worldwide scientific or technological developments. Their products may rapidly become obsolete. Many health care companies are also subject to significant government regulation and may be affected by changes in government policies.

Industrials Sector Risk. Industries in the industrials sector, such as companies engaged in the production, distribution or service of products or equipment for manufacturing, agriculture, forestry, mining and construction, can be significantly affected by general economic trends, including such factors as employment and economic growth, interest rate changes, changes in consumer spending, legislative and government regulation and spending, import controls, commodity prices, and worldwide competition.

Information Technology Sector Risk. Stocks of information technology companies may be volatile because issuers are sensitive to rapid obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. Information technology stocks, especially those of smaller, less-seasoned companies, tend to be more volatile than the overall market.

4

Table of Contents

| JANUARY 31, 2014 | ||

|

| ||

|

| ||

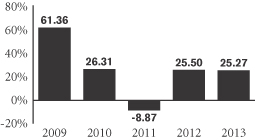

HISTORICAL PERFORMANCE

The following tables provide information on how the Investor Class of the Fund has performed over time. The past performance, before and after taxes, of the Fund’s Investor Class is not necessarily an indication of how these shares will perform in the future. The bar chart below is intended to provide you with an indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year, as represented by the Investor Class of the Fund. The table below is designed to help you evaluate your risk tolerance by showing the best and worst quarterly performance of the Fund’s Investor Class for the years shown in the bar chart. The average annual total return table below allows you to compare the Fund’s performance over the time periods indicated to that of a broad-based market index and an additional index composed of securities similar to those held by the Fund. Performance information is updated regularly and is available on the Fund’s website www.WasatchFunds.com.

WASATCH CORE GROWTH FUND — INVESTOR CLASS

Year by Year Total Returns

Best and Worst Quarterly Returns

| Best — 6/30/09 |

29.50% | |||

| Worst — 12/31/08 |

-27.03% |

| Average Annual Total Returns — (as of 12/31/13) | 1 Year |

5 Years | 10 Years | |||||||||

| Wasatch Core Growth Fund — Investor Class |

||||||||||||

| Return before taxes |

30.18% | 24.23% | 8.91% | |||||||||

| Return after taxes on distributions |

29.76% | 24.14% | 8.10% | |||||||||

| Return after taxes on distributions and sale of Fund shares |

17.43% | 20.04% | 7.22% | |||||||||

| Russell 2000® Index (reflects no deductions for fees, expenses or taxes) |

38.82% | 20.08% | 9.07% | |||||||||

| Russell 2000® Growth Index (reflects no deductions for fees, expenses or taxes) |

43.30% | 22.58% | 9.41% | |||||||||

After-tax returns are calculated using the historical highest individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown. The after-tax returns are not relevant to investors who hold Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

5

Table of Contents

| WASATCH CORE GROWTH FUND — Summary | JANUARY 31, 2014 | |

|

| ||

|

| ||

PORTFOLIO MANAGEMENT

Investment Advisor

Wasatch Advisors, Inc.

Portfolio Managers

| JB Taylor Lead Portfolio Manager Since 2000 |

Paul Lambert Portfolio Manager Since 2005 |

PURCHASE AND SALE OF FUND SHARES

| INVESTMENT MINIMUMS | INVESTOR CLASS | |||

| New Accounts |

$ | 2,000 | ||

| New Accounts with an Automatic Investment Plan |

$ | 1,000 | ||

| Individual Retirement Accounts (IRAs) |

$ | 2,000 | ||

| Coverdell Education Savings Accounts |

$ | 1,000 | ||

| SUBSEQUENT PURCHASES | INVESTOR CLASS | |||

| Regular Accounts and IRAs |

$100 | |||

| Automatic Investment Plan |

|

$50 per month and/or $100 per quarter |

| |

| • | You may purchase, redeem or exchange Fund shares on any day the New York Stock Exchange is open for business. |

| • | You may sell shares online at www.WasatchFunds.com, via email at shareholderservice@wasatchfunds.com or by calling 800.551.1700 if you did not decline the telephone redemption privilege when establishing your account. |

| • | You may write to: Wasatch Funds, P.O. Box 2172, Milwaukee, WI 53201-2172 or via overnight delivery to: Wasatch Funds, 803 West Michigan Street, Suite A, Milwaukee, WI 53233-2301. The letter should include your name, Fund Name, Class of shares (i.e., Investor Class), account number, dollar amount of shares to be bought or sold, your daytime telephone number, signature(s) of account owners (sign exactly as the account is registered) and Medallion signature guarantee (if required). For IRA accounts, please obtain an IRA Distribution Form from www.WasatchFunds.com or by calling a shareholder services representative. |

| • | You may buy or sell shares of the Fund through banks or investment professionals, including brokers, and they may charge you a transaction fee for this service. |

TAX INFORMATION

The Fund intends to make distributions. You will generally have to pay federal income taxes, and any applicable state or local taxes, on the distributions you receive from the Fund as ordinary income or capital gains unless you are investing through a tax exempt account such as a qualified retirement plan. Distributions on investments made through tax-deferred vehicles, such as 401(k) plans or IRAs, may be taxed later upon withdrawal of assets from those plans or accounts.

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Advisor or its affiliates may pay the intermediary for the sale of shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary or your individual financial advisor to recommend the Fund over another investment. Ask your individual financial advisor or visit your financial intermediary’s website for more information.

6

Table of Contents

| WASATCH EMERGING INDIA FUND — Summary | JANUARY 31, 2014 | |

|

| ||

|

| ||

INVESTMENT OBJECTIVE

The Fund’s investment objective is long-term appreciation of capital.

FEES AND EXPENSES OF THE FUND

The tables below describe the fees and expenses that you may pay if you buy, sell or hold Investor Class shares of the Fund.

| SHAREHOLDER FEES (fees paid directly from your investment) | Investor Class Shares | |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) |

None | |

| Redemption Fee (as a % of amount redeemed on shares held 60 days or less) |

2.00% | |

| Exchange Fee |

None | |

| Maximum Account Fee |

None | |

| ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) | Investor Class Shares | |

| Management Fee |

1.50% | |

| Distribution/Service (12b-1) Fee |

None | |

| Other Expenses |

1.49% | |

|

| ||

| Total Annual Fund Operating Expenses1 |

2.99% | |

| Expense Reimbursement |

(1.04)% | |

|

| ||

| Total Annual Fund Operating Expenses After Expense Reimbursement |

1.95% | |

| 1 | The Advisor has contractually agreed to reimburse the Investor Class shares of the Fund for Total Annual Fund Operating Expenses in excess of 1.95% of average daily net assets until at least January 31, 2015 (excluding interest, dividend expense on short sales/interest expense, taxes, brokerage commissions, other investment related costs and extraordinary expenses). The Board of Trustees is the only party that can terminate the contractual limitation prior to the contract’s expiration. The Advisor can rescind the contractual limitation on expenses at any time after its expiration date. |

EXAMPLE

This example is intended to help you compare the cost of investing in the Investor Class of the Fund with the cost of investing in other mutual funds. The example assumes that you invested $10,000 in the Investor Class of the Fund for the time periods indicated and then redeemed all of your shares at the end of those periods. The example also assumes that your investment had a 5% return each year and that the operating expenses (as a percentage of net assets) of the Fund’s Investor Class remained the same. The example reflects contractual fee waivers and reimbursements through January 31, 2015. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Emerging India Fund — Investor Class |

$ | 198 | $ | 826 | $ | 1,480 | $ | 3,235 | ||||||||

7

Table of Contents

| WASATCH EMERGING INDIA FUND — Summary | ||

|

| ||

|

| ||

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 40% of the average value of its portfolio.

PRINCIPAL STRATEGIES

The Fund invests primarily in companies tied economically to India.

Under normal market conditions, we will invest at least 80% of the Fund’s assets in the equity securities of companies tied economically to India. Equity securities include common stock, preferred stock and securities convertible into common stock, warrants and rights, and other securities with equity characteristics (which include any instrument tied to a specific security or basket of securities, such as equity-linked derivatives and notes, certain options on common stock, and exchange traded funds).

We will generally consider qualifying investments to be in companies that are listed on an Indian exchange, that have at least 50% of their assets in India, or that derive at least 50% of their revenues or profits from goods produced or sold, investments made, or services performed in India.

The Fund is expected to invest across market capitalization levels, ranging from small capitalization stocks to larger capitalization stocks. However, we expect the Fund to invest a significant portion of its assets in small to mid-size companies with market capitalizations of less than $5 billion at the time of purchase.

We use a process of quantitative screening followed by “bottom up” fundamental analysis to identify individual companies that we believe have above average revenue and earnings growth potential.

The Fund may invest a large percentage of its assets in a few sectors, including financials, consumer discretionary, industrials, consumer staples, materials, health care and information technology.

We may also invest in initial public offerings (IPOs).

The Fund is non-diversified, meaning that it can concentrate investments in a more limited number of issuers than a diversified fund.

PRINCIPAL RISKS

All investments carry some degree of risk that will affect the value of the Fund, its investment performance and the price of its shares. As a result, you may lose money if you invest in the Fund. An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

The Fund is subject to the following principal investment risks:

Stock Market Risk. The Fund’s investments may decline in value due to movements in the overall stock market.

Stock Selection Risk. The Fund’s investments may decline in value even when the overall stock market is not in a general decline.

Foreign Securities Risk. Foreign securities are generally more volatile and less liquid than U.S. securities. Further, foreign securities may be subject to additional risks not associated with investments in U.S. securities due to differences in the economic and political environment, the amount of available public information, the degree of market regulation, and financial reporting, accounting and auditing standards, and, in the case of foreign currency-denominated securities, fluctuations in currency exchange rates.

Indian Market Risk. Government actions, bureaucratic obstacles and inconsistent economic and tax reform within the Indian government have had a significant effect on the economy and could adversely affect market conditions, deter economic growth and reduce the profitability of private enterprises. Global factors and foreign actions may inhibit the flow of foreign capital on which India is dependent to sustain its growth. Large portions of many Indian companies remain in the hands of their founders (including members of their families). Family-controlled companies may have weaker and less transparent corporate governance, which increases the potential for loss and unequal treatment of investors. India experiences many of the market risks associated with developing economies, including relatively low levels of liquidity, which may result in extreme volatility in the prices of Indian securities. Religious, cultural and military disputes persist in India, and between India and Pakistan (as well as sectarian groups within each country). The threat of aggression in the region could hinder development of the Indian economy, and escalating tensions could impact the broader region, including China.

Because the Fund concentrates its investments in a single region of the world, the value of the Fund’s shares may be affected by events that adversely affect India and may fluctuate more than the value of a less concentrated fund’s shares.

Emerging Markets Risk. In addition to the risks of investing in foreign securities in general, the risks of investing in the securities of companies domiciled in emerging market countries (such as India) include increased political or social instability, economies based on only a few industries, unstable currencies, runaway inflation, highly volatile securities markets, unpredictable shifts in policies relating to foreign investments, lack of protection for investors against parties that fail to complete transactions, and the potential for government seizure of assets or nationalization of companies.

8

Table of Contents

| JANUARY 31, 2014 | ||

|

| ||

|

| ||

Small Company Stock Risk. Small cap stocks may be very sensitive to changing economic conditions and market downturns. In particular, the issuers of small company stocks often have more narrow markets for their products and services, fewer product lines, and more limited managerial and financial resources than larger issuers. The stocks of small companies may therefore be more volatile and the ability to sell these stocks at a desirable time or price may be more limited.

Growth Stock Risk. Growth stock prices may be more sensitive to changes in current or expected earnings than the prices of other stocks, and they may fall or not appreciate in step with the broader securities markets.

Initial Public Offerings (IPOs) Risk. IPOs involve a higher degree of risk because companies involved in IPOs generally have limited operating histories and their prospects for future profitability are uncertain. Prices of IPOs may also be unstable due to the absence of a prior public market, the small number of shares available for trading and limited investor information.

Sector Weightings Risk. To the extent the Fund emphasizes, from time to time, investments in a particular sector, the Fund will be subject to a greater degree to the risks particular to that sector, including the sectors described below. Market conditions, interest rates, and economic, regulatory, or financial developments could significantly affect all the securities in a single sector. If the Fund invests in a few sectors, it may have increased exposure to the price movements of those sectors.

Consumer Staples Sector Risk. The consumer staples sector may be affected by marketing campaigns, changes in consumer demands, government regulations and changes in commodity prices.

Consumer Discretionary Sector Risk. Industries in the consumer discretionary sector, such as consumer durables, hotels, restaurants, media, retailing and automobiles, may be significantly impacted by the performance of the overall economy, interest rates, competition, consumer confidence and spending, and changes in demographics and consumer tastes.

Financials Sector Risk. The financials sector is subject to extensive government regulation, can be subject to relatively rapid change due to increasingly blurred distinctions between service segments, and can be significantly affected by the availability and cost of capital funds, changes in interest rates, the rate of corporate and consumer debt defaults, and price competition.

Health Care Sector Risk. Health care companies are strongly affected by worldwide scientific or technological developments. Their products may rapidly become obsolete. Many health care companies are also subject to significant government regulation and may be affected by changes in government policies.

Industrials Sector Risk. Industries in the industrials sector, such as companies engaged in the production, distribution or service of products or equipment for manufacturing, agriculture, forestry, mining and construction, can be significantly affected by general economic trends, including such factors as employment and economic growth, interest rate changes, changes in consumer spending, legislative and government regulation and spending, import controls, commodity prices, and worldwide competition.

Information Technology Sector Risk. Stocks of information technology companies may be volatile because issuers are sensitive to rapid obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. Information technology stocks, especially those of smaller, less-seasoned companies, tend to be more volatile than the overall market.

Materials Sector Risk. Changes in world events, political, environmental and economic conditions, energy conservation, environmental policies, commodity price volatility, changes in exchange rates, imposition of import controls, increased competition, depletion of resources and labor relations may adversely affect the companies engaged in the production and distribution of materials.

Non-Diversification Risk. The Fund can invest a larger portion of its assets in the stocks of a limited number of companies than a diversified fund, which means it may have more exposure to the price movements of a single security or small group of securities than funds that diversify their investments among many companies.

9

Table of Contents

| WASATCH EMERGING INDIA FUND — Summary | ||

|

| ||

|

| ||

HISTORICAL PERFORMANCE

The following tables provide information on how the Investor Class of the Fund has performed over the last calendar year and since inception. Past performance, before and after taxes, of the Fund’s Investor Class is not necessarily an indication of how these shares will perform in the future. The bar chart below is intended to provide you with an indication of the risks of investing in the Fund by showing the Fund’s performance from year to year, as represented by the Investor Class of the Fund. The table below is designed to help you evaluate your risk tolerance by showing the best and worst quarterly performance of the Fund’s Investor Class for the calendar years shown in the bar chart. The average annual total return table below allows you to compare the Fund’s performance over the time periods indicated to that of a broad-based market index composed of securities similar to those held by the Fund. Performance information is updated regularly and is available on the Fund’s website www.WasatchFunds.com.

WASATCH EMERGING INDIA FUND — INVESTOR CLASS

Year by Year Total Returns

Best and Worst Quarterly Returns

| Best — 3/31/12 |

21.43% | |||

| Worst — 6/30/12 |

-6.95% |

| Average Annual Total Returns — (as of 12/31/13) | 1 Year | Since Inception (4/26/11) |

||||||||

| Wasatch Emerging India Fund — Investor Class |

||||||||||

| Return before taxes |

-1.46% | 0.91% | ||||||||

| Return after taxes on distributions |

-1.46% | 0.85% | ||||||||

| Return after taxes on distributions and sale of Fund shares |

-0.82% | 0.70% | ||||||||

| MSCI India Investable Market Index* (reflects no deductions for fees, expenses or taxes) |

-5.32% | -9.02% | ||||||||

After-tax returns are calculated using the historical highest individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown. The after-tax returns are not relevant to investors who hold Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

*Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. This report is not approved or produced by MSCI.

10

Table of Contents

| JANUARY 31, 2014 | ||

|

| ||

|

| ||

PORTFOLIO MANAGEMENT

Investment Advisor

Wasatch Advisors, Inc.

Portfolio Manager

| Ajay Krishnan, CFA Lead Portfolio Manager Since Inception |

PURCHASE AND SALE OF FUND SHARES

| INVESTMENT MINIMUMS | INVESTOR CLASS | |||

| New Accounts |

$ | 2,000 | ||

| New Accounts with an Automatic Investment Plan |

$ | 1,000 | ||

| Individual Retirement Accounts (IRAs) |

$ | 2,000 | ||

| Coverdell Education Savings Accounts |

$ | 1,000 | ||

| SUBSEQUENT PURCHASES | INVESTOR CLASS | |||

| Regular Accounts and IRAs |

$ | 100 | ||

| Automatic Investment Plan |

|

$50 per month and/or $100 per quarter |

| |

| • | You may purchase, redeem or exchange Fund shares on any day the New York Stock Exchange is open for business. |

| • | You may sell shares online at www.WasatchFunds.com, via email at shareholderservice@wasatchfunds.com or by calling 800.551.1700 if you did not decline the telephone redemption privilege when establishing your account. |

| • | You may write to: Wasatch Funds, P.O. Box 2172, Milwaukee, WI 53201-2172 or via overnight delivery to: Wasatch Funds, 803 West Michigan Street, Suite A, Milwaukee, WI 53233-2301. The letter should include your name, Fund Name, Class of shares (i.e., Investor Class), account number, dollar amount of shares to be bought or sold, your daytime telephone number, signature(s) of account owners (sign exactly as the account is registered) and Medallion signature guarantee (if required). For IRA accounts, please obtain an IRA Distribution Form from www.WasatchFunds.com or by calling a shareholder services representative. |

| • | You may buy or sell shares of the Fund through banks or investment professionals, including brokers, and they may charge you a transaction fee for this service. |

TAX INFORMATION

The Fund intends to make distributions. You will generally have to pay federal income taxes, and any applicable state or local taxes, on the distributions you receive from the Fund as ordinary income or capital gains unless you are investing through a tax exempt account such as a qualified retirement plan. Distributions on investments made through tax-deferred vehicles, such as 401(k) plans or IRAs, may be taxed later upon withdrawal of assets from those plans or accounts.

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Advisor or its affiliates may pay the intermediary for the sale of shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary or your individual financial advisor to recommend the Fund over another investment. Ask your individual financial advisor or visit your financial intermediary’s website for more information.

11

Table of Contents

| WASATCH EMERGING MARKETS SELECT FUND — Summary | ||

|

| ||

|

| ||

INVESTMENT OBJECTIVE

The Fund’s investment objective is long-term growth of capital.

FEES AND EXPENSES OF THE FUND

The tables below describe the fees and expenses that you may pay if you buy, sell or hold Investor Class shares of the Fund.

| SHAREHOLDER FEES (fees paid directly from your investment) | Investor Class Shares | |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) |

None | |

| Redemption Fee (as a % of amount redeemed on shares held 60 days or less) |

2.00% | |

| Exchange Fee |

None | |

| Maximum Account Fee |

None | |

| ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) | Investor Class Shares | |

| Management Fee |

1.25% | |

| Distribution/Service (12b-1) Fee |

None | |

| Other Expenses |

1.15% | |

|

| ||

| Total Annual Fund Operating Expenses1 |

2.40% | |

| Expense Reimbursement |

(0.71)% | |

|

| ||

| Total Annual Fund Operating Expenses After Expense Reimbursement |

1.69% | |

| 1 | The Advisor has contractually agreed to reimburse the Investor Class shares of the Fund for Total Annual Fund Operating Expenses in excess of 1.69% of average daily net assets (excluding interest, dividend expense on short sales/interest expense, taxes, brokerage commissions, other investment related costs and extraordinary expenses in excess of such limitations) until at least January 31, 2015. The Board of Trustees is the only party that can terminate the contractual limitation prior to the contract’s expiration. The Advisor can rescind the contractual limitation on expenses at any time after its expiration date. |

EXAMPLE

This example is intended to help you compare the cost of investing in the Investor Class of the Fund with the cost of investing in other mutual funds. The example assumes that you invested $10,000 in the Investor Class of the Fund for the time periods indicated and then redeemed all of your shares at the end of those periods. The example also assumes that your investment had a 5% return each year and that the Fund’s operating expenses (as a percentage of net assets) of the Fund’s Investor Class remained the same. The example reflects contractual fee waivers and reimbursements through January 31, 2015. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Emerging Markets Select Fund — Investor Class Shares |

$ | 172 | $ | 681 | $ | 1,216 | $ | 2,682 | ||||||||

12

Table of Contents

| JANUARY 31, 2014 | ||

|

| ||

|

| ||

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal period, the Fund’s portfolio turnover rate was 43% of the average value of its portfolio, on an annualized basis.

PRINCIPAL STRATEGIES

The Fund invests primarily in companies of all market capitalizations that are tied economically to emerging market countries.

Under normal market conditions, we will invest at least 80% of the Fund’s assets in the equity securities of companies that are tied economically to emerging market countries. Equity securities include common stock, preferred stock and securities convertible into common stock, warrants and rights, and other securities with equity characteristics (which include any instrument tied to a specific security or basket of securities, such as equity-linked derivatives and notes, certain options on common stock, and exchange traded funds).

Emerging market countries are those currently included in the Morgan Stanley Capital International (MSCI) Emerging Markets Index. We will generally consider qualifying investments to be in companies that are listed on an exchange in an emerging market country, that have at least 50% of their assets in an emerging market country, or that derive at least 50% of their revenues or profits from goods produced or sold, investments made, or services performed in an emerging market country.

We travel extensively outside the U.S. to visit companies and expect to meet with senior management. We use a process of quantitative screening followed by “bottom up” fundamental analysis with the goal of owning the highest quality growth companies tied economically to emerging market countries. Our analysis may include studying a company’s financial statements, visiting company facilities, and meeting with executive management, suppliers and customers.

We do not use allocation models to restrict the Fund’s investments to certain regions, countries or industries.

The Fund may invest a large percentage of its assets in a few sectors, including consumer staples, consumer discretionary, financials, health care, industrials and materials and in convertible securities.

The Fund may invest in initial public offerings (IPOs) and early stage companies.

The Fund is non-diversified, meaning that it can concentrate investments in a more limited number of issuers than a diversified fund. Under normal market conditions, the Fund will generally invest in 30 to 50 companies. However, we may invest in fewer or more companies when we believe that doing so will help our efforts to achieve the Fund’s investment objective.

PRINCIPAL RISKS

All investments carry some degree of risk that will affect the value of the Fund, its investment performance and the price of its shares. As a result, you may lose money if you invest in the Fund. An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

The Fund is subject to the following principal investment risks:

Stock Market Risk. The Fund’s investments may decline in value due to movements in the overall stock market.

Stock Selection Risk. The Fund’s investments may decline in value even when the overall stock market is not in a general decline.

Foreign Securities Risk. Foreign securities are generally more volatile and less liquid than U.S. securities. Further, foreign securities may be subject to additional risks not associated with investments in U.S. securities due to differences in the economic and political environment, the amount of available public information, the degree of market regulation, and financial reporting, accounting and auditing standards, and, in the case of foreign currency-denominated securities, fluctuations in currency exchange rates.

Emerging Markets Risk. In addition to the risks of investing in foreign securities in general, the risks of investing in the securities of companies domiciled in emerging market countries include increased political or social instability, economies based on only a few industries, unstable currencies, runaway inflation, highly volatile securities markets, unpredictable shifts in policies relating to foreign investments, lack of protection for investors against parties that fail to complete transactions, and the potential for government seizure of assets or nationalization of companies.

Small Company Stock Risk. Small cap stocks may be very sensitive to changing economic conditions and market downturns because the issuers often have narrow markets for their products or services, fewer product lines, and more limited managerial and financial resources than larger issuers. The stocks of small cap companies may therefore be more volatile and the ability to sell these stocks at a desirable time or price may be more limited.

Growth Stock Risk. Growth stock prices may be more sensitive to changes in current or expected earnings than the prices of other stocks, and they may fall or not appreciate in step with the broader securities markets.

Convertible Securities Risk. Generally, convertible securities offer lower interest or dividend yields than non-convertible securities of similar quality and have less potential for gains or capital appreciation in a rising stock market than other equity securities. They tend to be more volatile than other fixed income securities, and the markets for convertible securities may be less liquid than the markets for common stocks or bonds. The value of convertible securities is susceptible to the risk of market losses attributable to changes in interest rates. An issuer may have the right to buy back certain convertible securities at a time and price that would be unfavorable to the Fund.

13

Table of Contents

| WASATCH EMERGING MARKETS SELECT FUND — Summary | ||

|

| ||

|

| ||

Sector Weightings Risk. To the extent the Fund emphasizes, from time to time, investments in a particular sector, the Fund will be subject to a greater degree to the risks particular to that sector, including the sectors described below. Market conditions, interest rates, and economic, regulatory, or financial developments could significantly affect all the securities in a single sector. If the Fund invests in a few sectors, it may have increased exposure to the price movements of those sectors.

Consumer Staples Sector Risk. The consumer staples sector may be affected by marketing campaigns, changes in consumer demands, government regulations and changes in commodity prices.

Consumer Discretionary Sector Risk. Industries in the consumer discretionary sector, such as consumer durables, hotels, restaurants, media, retailing and automobiles, may be significantly impacted by the performance of the overall economy, interest rates, competition, consumer confidence and spending, and changes in demographics and consumer tastes.

Financials Sector Risk. The financials sector is subject to extensive government regulation, can be subject to relatively rapid change due to increasingly blurred distinctions between service segments, and can be significantly affected by the availability and cost of capital funds, changes in interest rates, the rate of corporate and consumer debt defaults, and price competition.

Health Care Sector Risk. Health care companies are strongly affected by worldwide scientific or technological developments. Their products may rapidly become obsolete. Many health care companies are also subject to significant government regulation and may be affected by changes in government policies.

Industrials Sector Risk. Industries in the industrials sector, such as companies engaged in the production, distribution or service of products or equipment for manufacturing, agriculture, forestry, mining and construction, can be significantly affected by general economic trends, including such factors as employment and economic growth, interest rate changes, changes in consumer spending, legislative and government regulation and spending, import controls, commodity prices, and worldwide competition.

Materials Sector Risk. Changes in world events, political, environmental and economic conditions, energy conservation, environmental policies, commodity price volatility, changes in exchange rates, imposition of import controls, increased competition, depletion of resources and labor relations may adversely affect the companies engaged in the production and distribution of materials.

Initial Public Offerings (IPOs) Risk. IPOs involve a higher degree of risk because companies involved in IPOs generally have limited operating histories and their prospects for future profitability are uncertain. Prices of IPOs may also be unstable due to the absence of a prior public market, the small number of shares available for trading and limited investor information.

Early Stage Companies Risk. Early stage companies may never obtain necessary financing, may rely on untested business plans, may not be successful in developing markets for their products or services, and may remain an insignificant part of their industry, and as such may never be profitable. Stocks of early stage companies may be illiquid, privately traded, and more volatile and speculative than the securities of larger companies.

Non-Diversification Risk. Because the Fund is non-diversified and generally invests in 30 to 50 companies, the Fund will have more exposure to the price movements of a single security or a small group of securities than funds that diversify their investments among many companies. The Fund’s total return and net asset value could fluctuate more than if a greater number of securities were held.

14

Table of Contents

| JANUARY 31, 2014 | ||

|

| ||

|

| ||

HISTORICAL PERFORMANCE

The following tables provide information on how the Investor Class of the Fund has performed over the last calendar year and since inception. Past performance, before and after taxes, of the Fund’s Investor Class is not necessarily an indication of how these shares will perform in the future. The bar chart below is intended to provide you with an indication of the risks of investing in the Fund by showing the Fund’s performance, as represented by the Investor Class of the Fund. The table below is designed to help you evaluate your risk tolerance by showing the best and worst quarterly performance of the Fund’s Investor Class for the calendar year shown in the bar chart. The average annual total return table below allows you to compare the Fund’s performance over the time periods indicated to that of a broad-based market index composed of securities similar to those held by the Fund. Performance information is updated regularly and is available on the Fund’s website www.WasatchFunds.com.

WASATCH EMERGING MARKETS SELECT FUND — INVESTOR CLASS

Calendar Year Total Return

Best and Worst Quarterly Returns

| Best — 12/31/13 |

3.00% | |||

| Worst — 6/30/13 |

-6.54% |

| Average Annual Total Returns — (as of 12/31/13) | 1 Year |

Since Inception (12/13/12) |

||||||||

| Wasatch Emerging Markets Select Fund — Investor Class |

||||||||||

| Return before taxes |

-3.27% | -1.46% | ||||||||

| Return after taxes on distributions |

-3.19% | -1.38% | ||||||||

| Return after taxes on distributions and sale of Fund shares |

-1.74% | -1.02% | ||||||||

| MSCI Emerging Markets Index* (reflects no deductions for fees, expenses or taxes) |

-2.60% | -1.17% | ||||||||

After-tax returns are calculated using the historical highest individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown. The after-tax returns are not relevant to investors who hold Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

*Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. This report is not approved or produced by MSCI.

15

Table of Contents

| WASATCH EMERGING MARKETS SELECT FUND — Summary | JANUARY 31, 2014 | |

|

| ||

|

| ||

PORTFOLIO MANAGEMENT

Investment Advisor

Wasatch Advisors, Inc.

Portfolio Managers

| Ajay Krishnan, CFA Lead Portfolio Manager Since Inception |

Roger Edgley, CFA Portfolio Manager Since Inception |

PURCHASE AND SALE OF FUND SHARES

| INVESTMENT MINIMUMS | INVESTOR CLASS | |||

| New Accounts |

$ | 2,000 | ||

| New Accounts with an Automatic Investment Plan |

$ | 1,000 | ||

| Individual Retirement Accounts (IRAs) |

$ | 2,000 | ||

| Coverdell Education Savings Accounts |

$ | 1,000 | ||

| SUBSEQUENT PURCHASES | INVESTOR CLASS | |||

| Regular Accounts and IRAs |

$ | 100 | ||

| Automatic Investment Plan |

|

$50 per month and/or $100 per quarter |

| |

| • | You may purchase, redeem or exchange Fund shares on any day the New York Stock Exchange is open for business. |

| • | You may sell shares online at www.WasatchFunds.com, via email at shareholderservice@wasatchfunds.com or by calling 800.551.1700 if you did not decline the telephone redemption privilege when establishing your account. |

| • | You may write to: Wasatch Funds, P.O. Box 2172, Milwaukee, WI 53201-2172 or via overnight delivery to: Wasatch Funds, 803 West Michigan Street, Suite A, Milwaukee, WI 53233-2301. The letter should include your name, Fund Name, Class of shares (i.e., Investor Class), account number, dollar amount of shares to be bought or sold, your daytime telephone number, signature(s) of account owners (sign exactly as the account is registered) and Medallion signature guarantee (if required). For IRA accounts, please obtain an IRA Distribution Form from www.WasatchFunds.com or by calling a shareholder services representative. |

| • | You may buy or sell shares of the Fund through banks or investment professionals, including brokers, and they may charge you a transaction fee for this service. |

TAX INFORMATION

The Fund intends to make distributions. You will generally have to pay federal income taxes, and any applicable state or local taxes, on the distributions you receive from the Fund as ordinary income or capital gains unless you are investing through a tax exempt account such as a qualified retirement plan. Distributions on investments made through tax-deferred vehicles, such as 401(k) plans or IRAs, may be taxed later upon withdrawal of assets from those plans or accounts.

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Advisor or its affiliates may pay the intermediary for the sale of shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary or your individual financial advisor to recommend the Fund over another investment. Ask your individual financial advisor or visit your financial intermediary’s website for more information.

16

Table of Contents

| WASATCH EMERGING MARKETS SMALL CAP FUND — Summary | JANUARY 31, 2014 | |

|

| ||

|

| ||

INVESTMENT OBJECTIVE

The Fund’s investment objective is long-term growth of capital.

FEES AND EXPENSES OF THE FUND

The tables below describe the fees and expenses that you may pay if you buy, sell or hold Investor Class shares of the Fund.

| SHAREHOLDER FEES (fees paid directly from your investment) | Investor Class Shares | |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) |

None | |

| Redemption Fee (as a % of amount redeemed on shares held 60 days or less) |

2.00% | |

| Exchange Fee |

None | |

| Maximum Account Fee |

None | |

| ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) | Investor Class Shares | |

| Management Fee |

1.75% | |

| Distribution/Service (12b-1) Fee |

None | |

| Other Expenses |

0.31% | |

|

| ||

| Total Annual Fund Operating Expenses1 |

2.06% | |

| Expense Reimbursement |

(0.11)% | |

|

| ||

| Total Annual Fund Operating Expenses After Expense Reimbursement |

1.95% | |

| 1 | The Advisor has contractually agreed to reimburse the Investor Class shares of the Fund for Total Annual Fund Operating Expenses in excess of 1.95% of average daily net assets until at least January 31, 2015 (excluding interest, dividend expense on short sales/interest expense, taxes, brokerage commissions, other investment related costs and extraordinary expenses). The Board of Trustees is the only party that can terminate the contractual limitation prior to the contract’s expiration. The Advisor can rescind the contractual limitation on expenses at any time after its expiration date. |

EXAMPLE

This example is intended to help you compare the cost of investing in the Investor Class of the Fund with the cost of investing in other mutual funds. The example assumes that you invested $10,000 in the Investor Class of the Fund for the time periods indicated and then redeemed all of your shares at the end of those periods. The example also assumes that your investment had a 5% return each year and that the operating expenses (as a percentage of net assets) of the Fund’s Investor Class remained the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Emerging Markets Small Cap Fund — Investor Class |

$ | 198 | $ | 635 | $ | 1,098 | $ | 2,381 | ||||||||

17

Table of Contents

| WASATCH EMERGING MARKETS SMALL CAP FUND — Summary | ||

|

| ||

|

| ||

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). Higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 41% of the average value of its portfolio.

PRINCIPAL STRATEGIES

The Fund invests primarily in small companies tied economically to emerging markets.

Under normal market conditions, we will invest at least 80% of the Fund’s assets in the equity securities of companies with market capitalizations of less than $3 billion that are tied economically to emerging market countries. Equity securities include common stock, preferred stock and securities convertible into common stock, warrants and rights, and other securities with equity characteristics (which include any instrument tied to a specific security or basket of securities, such as equity-linked derivatives and notes, certain options on common stock, and exchange traded funds). The Fund considers a company to be a small-capitalization company if its market capitalization, at the time of purchase, is less than the larger of $3 billion or the market capitalization of the largest company in the Morgan Stanley Capital International (MSCI) Emerging Markets Small Cap Index during the most recent 12 month period.

Emerging market countries are those currently included in the Morgan Stanley Capital International (MSCI) Emerging Markets Index. We will generally consider qualifying investments to be in companies that are listed on an exchange in an emerging market country, that have at least 50% of their assets in an emerging market country, or that derive at least 50% of their revenues or profits from goods produced or sold, investments made, or services performed in an emerging market country.

We travel extensively outside of the U.S. to visit companies and expect to meet with senior management. We use a process of quantitative screening followed by “bottom up” fundamental analysis to identify individual companies that we believe have above average revenue and earnings growth potential.

We do not use allocation models to restrict the Fund’s investments to certain regions, countries or industries.

The Fund may invest a large percentage of its assets in a few sectors, including consumer discretionary, financials, industrials, consumer staples, materials and health care.

PRINCIPAL RISKS

All investments carry some degree of risk that will affect the value of the Fund, its investment performance and the price of its shares. As a result, you may lose money if you invest in the Fund. An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

The Fund is subject to the following principal investment risks:

Stock Market Risk. The Fund’s investments may decline in value due to movements in the overall stock market.

Stock Selection Risk. The Fund’s investments may decline in value even when the overall stock market is not in a general decline.

Foreign Securities Risk. Foreign securities are generally more volatile and less liquid than U.S. securities. Further, foreign securities may be subject to additional risks not associated with investments in U.S. securities due to differences in the economic and political environment, the amount of available public information, the degree of market regulation, and financial reporting, accounting and auditing standards, and, in the case of foreign currency-denominated securities, fluctuations in currency exchange rates.

Emerging Markets Risk. In addition to the risks of investing in foreign securities in general, the risks of investing in the securities of companies domiciled in emerging market countries include increased political or social instability, economies based on only a few industries, unstable currencies, runaway inflation, highly volatile securities markets, unpredictable shifts in policies relating to foreign investments, lack of protection for investors against parties that fail to complete transactions, and the potential for government seizure of assets or nationalization of companies.

Small Company Stock Risk. Small cap stocks may be very sensitive to changing economic conditions and market downturns because the issuers often have more narrow markets for their products or services, fewer product lines, and more limited managerial and financial resources than larger issuers. The stocks of small cap companies may therefore be more volatile and the ability to sell stocks at a desirable time or price may be more limited.

Growth Stock Risk. Growth stock prices may be more sensitive to changes in current or expected earnings than the prices of other stocks, and they may fall or not appreciate in step with the broader securities markets.

Sector Weightings Risk. To the extent the Fund emphasizes, from time to time, investments in a particular sector, the Fund will be subject to a greater degree to the risks particular to that sector, including the sectors described below. Market conditions, interest rates, and economic, regulatory, or financial developments could significantly affect all the securities in a single sector. If the Fund invests in a few sectors, it may have increased exposure to the price movements of those sectors.

Consumer Staples Sector Risk. The consumer staples sector may be affected by marketing campaigns, changes in consumer demands, government regulations and changes in commodity prices.

18

Table of Contents

| JANUARY 31, 2014 | ||

|

| ||

|

| ||

Consumer Discretionary Sector Risk. Industries in the consumer discretionary sector, such as consumer durables, hotels, restaurants, media, retailing and automobiles, may be significantly impacted by the performance of the overall economy, interest rates, competition, consumer confidence and spending, and changes in demographics and consumer tastes.

Financials Sector Risk. The financials sector is subject to extensive government regulation, can be subject to relatively rapid change due to increasingly blurred distinctions between service segments, and can be significantly affected by the availability and cost of capital funds, changes in interest rates, the rate of corporate and consumer debt defaults, and price competition.

Health Care Sector Risk. Health care companies are strongly affected by worldwide scientific or technological developments. Their products may rapidly become obsolete. Many health care companies are also subject to significant government regulation and may be affected by changes in government policies.

Industrials Sector Risk. Industries in the industrials sector, such as companies engaged in the production, distribution or service of products or equipment for manufacturing, agriculture, forestry, mining and construction, can be significantly affected by general economic trends, including such factors as employment and economic growth, interest rate changes, changes in consumer spending, legislative and government regulation and spending, import controls, commodity prices, and worldwide competition.

Materials Sector Risk. Changes in world events, political, environmental and economic conditions, energy conservation, environmental policies, commodity price volatility, changes in exchange rates, imposition of import controls, increased competition, depletion of resources and labor relations may adversely affect the companies engaged in the production and distribution of materials.

19

Table of Contents

| WASATCH EMERGING MARKETS SMALL CAP FUND — Summary | ||

|

| ||

|

| ||

HISTORICAL PERFORMANCE

The following tables provide information on how the Investor Class of the Fund has performed over time. The past performance, before and after taxes, of the Fund’s Investor Class is not necessarily an indication of how these shares will perform in the future. The bar chart below is intended to provide you with an indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year, as represented by the Investor Class of the Fund. The table below is designed to help you evaluate your risk tolerance by showing the best and worst quarterly performance of the Fund’s Investor Class for the years shown in the bar chart. The average annual total return table below allows you to compare the Fund’s performance over the time periods indicated to that of a broad-based market index and an additional index composed of securities similar to those held by the Fund. Performance information is updated regularly and is available on the Fund’s website www.WasatchFunds.com.

WASATCH EMERGING MARKETS SMALL CAP FUND — INVESTOR CLASS

Year by Year Total Returns

Best and Worst Quarterly Returns

| Best — 6/30/09 |

56.10% | |||

| Worst — 12/31/08 |

-32.16% |

| Average Annual Total Returns — (as of 12/31/13) | 1 Year | 5 Years |

Since Inception (10/1/07) |

|||||||||

| Wasatch Emerging Markets Small Cap Fund — Investor Class |

||||||||||||

| Return before taxes |

-3.60% | 26.63% | 5.19% | |||||||||

| Return after taxes on distributions |

-4.10% | 26.44% | 5.04% | |||||||||

| Return after taxes on distributions and sale of Fund shares |

-1.63% | 22.14% | 4.06% | |||||||||

| MSCI Emerging Markets Small Cap Index* (reflects no deductions for fees, expenses or taxes) |

1.04% | 19.58% | 0.12% | |||||||||

| MSCI Emerging Markets Index* (reflects no deductions for fees, expenses or taxes) |

-2.60% | 14.79% | -0.58% | |||||||||

After-tax returns are calculated using the historical highest individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown. The after-tax returns are not relevant to investors who hold Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

*Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. This report is not approved or produced by MSCI.

20

Table of Contents

| JANUARY 31, 2014 | ||

|

| ||

|

| ||

PORTFOLIO MANAGEMENT

Investment Advisor

Wasatch Advisors, Inc.

Portfolio Managers

| Roger Edgley, CFA Lead Portfolio Manager Since 2007 |

Laura Geritz, CFA Portfolio Manager Since 2009 |

Andrey Kutuzov, CFA Associate Portfolio Manager Since January 31, 2014 |

PURCHASE AND SALE OF FUND SHARES

| INVESTMENT MINIMUMS | INVESTOR CLASS | |||

| New Accounts |

$ | 2,000 | ||

| New Accounts with an Automatic Investment Plan |

$ | 1,000 | ||

| Individual Retirement Accounts (IRAs) |

$ | 2,000 | ||

| Coverdell Education Savings Accounts |

$ | 1,000 | ||

| SUBSEQUENT PURCHASES | INVESTOR CLASS | |||

| Regular Accounts and IRAs |

$100 | |||

| Automatic Investment Plan |

|

$50 per month and/or $100 per quarter |

| |

| • | You may purchase, redeem or exchange Fund shares on any day the New York Stock Exchange is open for business. |

| • | You may sell shares online at www.WasatchFunds.com, via email at shareholderservice@wasatchfunds.com or by calling 800.551.1700 if you did not decline the telephone redemption privilege when establishing your account. |

| • | You may write to: Wasatch Funds, P.O. Box 2172, Milwaukee, WI, 53201-2172 or via overnight delivery to: Wasatch Funds, 803 West Michigan Street, Suite A, Milwaukee, WI 53233-2301. The letter should include your name, Fund Name, Class of shares (i.e., Investor Class), account number, dollar amount of shares to be bought or sold, your daytime telephone number, signature(s) of account owners (sign exactly as the account is registered) and Medallion signature guarantee (if required). For IRA accounts, please obtain an IRA Distribution Form from www.WasatchFunds.com or by calling a shareholder services representative. |

| • | You may buy or sell shares of the Fund through banks or investment professionals, including brokers, and they may charge you a transaction fee for this service. |

TAX INFORMATION

The Fund intends to make distributions. You will generally have to pay federal income taxes, and any applicable state or local taxes, on the distributions you receive from the Fund as ordinary income or capital gains unless you are investing through a tax exempt account such as a qualified retirement plan. Distributions on investments made through tax-deferred vehicles, such as 401(k) plans or IRAs, may be taxed later upon withdrawal of assets from those plans or accounts.

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Advisor or its affiliates may pay the intermediary for the sale of shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary or your individual financial advisor to recommend the Fund over another investment. Ask your individual financial advisor or visit your financial intermediary’s website for more information.

21

Table of Contents

| WASATCH FRONTIER EMERGING SMALL COUNTRIES FUND — Summary | ||

|

| ||

|

| ||

INVESTMENT OBJECTIVE

The Fund’s investment objective is long-term growth of capital.

FEES AND EXPENSES OF THE FUND

The tables below describe the fees and expenses that you may pay if you buy, sell or hold Investor Class shares of the Fund.

| SHAREHOLDER FEES (fees paid directly from your investment) | Investor Class Shares | |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) |

None | |

| Redemption Fee (as a % of amount redeemed on shares held 60 days or less) |

2.00% | |

| Exchange Fee |

None | |

| Maximum Account Fee |

None | |

| ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) | Investor Class Shares | |

| Management Fee |

1.75% | |

| Distribution/Service (12b-1) Fee |

None | |

| Other Expenses |

0.68% | |

|

| ||

| Total Annual Fund Operating Expenses1 |

2.43% | |

| Expense Reimbursement |

(0.18)% | |

|

| ||

| Total Annual Fund Operating Expenses After Expense Reimbursement |

2.25% | |

| 1 | The Advisor has contractually agreed to reimburse the Investor Class shares of the Fund for Total Annual Fund Operating Expenses in excess of 2.25% of average daily net assets (excluding interest, dividend expense on short sales/interest expense, taxes, brokerage commissions, other investment related costs and extraordinary expenses) until at least January 31, 2015. The Board of Trustees is the only party that can terminate the contractual limitation prior to the contract’s expiration. The Advisor can rescind the contractual limitation on expenses at any time after its expiration date. |

EXAMPLE

This example is intended to help you compare the cost of investing in the Investor Class of the Fund with the cost of investing in other mutual funds. The example assumes that you invested $10,000 in the Investor Class of the Fund for the time periods indicated and then redeemed all of your shares at the end of those periods. The example also assumes that your investment had a 5% return each year and that the operating expenses (as a percentage of net assets) of the Fund’s Investor Class remained the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Frontier Emerging Small Countries Fund — Investor Class |

$ | 228 | $ | 740 | $ | 1,279 | $ | 2,752 | ||||||||

22

Table of Contents

| JANUARY 31, 2014 | ||

|

| ||

|

| ||

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 13% of the average value of its portfolio.

PRINCIPAL STRATEGIES

The Fund invests primarily in the equity securities of companies of all market capitalizations that are tied economically to frontier markets and small emerging market countries.

Under normal market conditions, we will invest at least 80% of the Fund’s assets in the equity securities of companies that are tied economically to frontier markets and small emerging market countries. Equity securities include common stock, preferred stock and securities convertible into common stock, warrants and rights, and other securities with equity characteristics (which include any instrument tied to a specific security or basket of securities, such as equity-linked derivatives and notes, certain options on common stock, and exchange traded funds).

“Frontier markets” include any country that is outside the Morgan Stanley Capital International (MSCI) All Country World Index, and also any country that is currently included in the Russell Frontier Index, the S&P Frontier Broad Market Index (BMI), the MSCI Frontier Markets Index, or similar market indices, or that, in our opinion, has similar characteristics regardless of its inclusion in an index.

“Emerging markets” include those countries currently considered to be developing as per their inclusion in the MSCI Emerging Markets Index. We consider a “small emerging market country” to be any country that individually constitutes not more than 7% of the MSCI Emerging Markets Index or the S&P Emerging BMI.

We will generally consider qualifying investments to be in companies that are listed on an exchange in a frontier market or small emerging market country, that are legally domiciled in a frontier market or small emerging market country, that have at least 50% of their assets in a frontier market or small emerging market country, or that derive at least 50% of their revenues or profits from goods produced or sold, investments made, or services provided in a frontier market or small emerging market country. The Fund will not be required to sell a security because the market to which it is economically tied is no longer what we consider to be a frontier market or a small emerging market country.

In general, frontier markets and small emerging market countries, with the exception of the oil-producing Persian Gulf States, tend to have relatively low gross national product per capita compared to the larger traditionally-recognized emerging markets and the world’s major developed economies. Frontier and small emerging market countries include the least developed markets even by emerging market standards. We believe frontier markets and small emerging market countries offer investment opportunities that arise from long-term trends in demographics, deregulation, offshore outsourcing and improving corporate governance.

The Fund may invest in the equity securities of companies of any size, although we expect a significant portion of the Fund’s assets to be invested in the companies with market capitalizations of under US$3 billion at the time of purchase.

We travel extensively outside the U.S. to visit companies and expect to meet with senior management. We use a process of quantitative screening followed by “bottom up” fundamental analysis with the goal of owning the highest quality growth companies tied economically to frontier markets and small emerging market countries.

We do not use allocation models to restrict the Fund’s investments to certain regions, countries or industries.

The Fund may invest a large percentage of its assets in a few sectors, including consumer staples, consumer discretionary, financials and industrials.

We may also invest in initial public offerings (IPOs).

The Fund is non-diversified, meaning that it can concentrate investments in a more limited number of issuers than a diversified fund.

PRINCIPAL RISKS

All investments carry some degree of risk that will affect the value of the Fund, its investment performance and the price of its shares. As a result, you may lose money if you invest in the Fund. An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

The Fund is subject to the following principal investment risks:

Stock Market Risk. The Fund’s investments may decline in value due to movements in the overall stock market.

Stock Selection Risk. The Fund’s investments may decline in value even when the overall stock market is not in a general decline.