UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) |

For the Fiscal Year Ended

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) |

Commission File Number:

PSYCHEMEDICS CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

| | |

| (State or Other Jurisdiction of | (I.R.S. Employer |

|

| |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number Including Area Code: (

Securities registered pursuant to Section 12(b) of the Act:

| Title of Class | Trading Symbol(s) | Name of each exchange on which registered |

| | | The |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by a check mark if the registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Exchange Act of 1934). Yes ☐

Indicate by a check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934). Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or emerging growth company. See definitions of “accelerated filer”, “large accelerated filer”, “non-accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act of 1934.

| Large Accelerated Filer ☐ | Accelerated Filer ☐ | |

| Smaller Reporting Company | Emerging Growth Company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by a check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities and Exchange Act of 1934). Yes

As of June 30, 2022, there were 5,626,196 shares of Common Stock of the Registrant outstanding. The aggregate market value of the Common Stock of the Registrant held by non-affiliates (assuming for these purposes, but not conceding, that all executive officers, directors and 5% shareholders are “affiliates” of the Registrant) as of June 30, 2022, was $

As of March 15, 2023, there were

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements under “Business,” “Risk Factors,” “Legal Proceedings,” “Market for Registrant’s Common Stock and Related Stockholder Matters” and “Management Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this Annual Report on Form 10-K (this “Form 10-K”) constitute forward-looking statements under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements made with respect to future earnings, earnings per share, revenues, operating income, cash flows, competitive and strategic initiatives, potential stock repurchases, liquidity needs, cash dividends, future business, growth opportunities, profitability, pricing, new accounts, customer base, market share, test volume, sales volume, sales and marketing strategies, U.S. and foreign drug testing laws and regulations and the enforcement of such laws and regulations, required investments in plant, equipment and people, new test development, and contingencies, including litigation results. These statements involve known and unknown risks, uncertainties and other factors that may cause results, levels of activity, growth, performance, earnings per share or achievements to be materially different from any future results, levels of activity, growth, performance, earnings per share or achievements expressed or implied by such forward-looking statements.

The forward-looking statements included in this Form 10-K and referred to elsewhere are related to future events or our strategies or future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “believe,” “anticipate,” “future,” “potential,” “estimate,” “encourage,” “opportunity,” “growth,” “leader,” “could”, “expect,” “intend,” “plan,” “expand,” “focus,” “through,” “strategy,” “provide,” “offer,” “allow,” “commitment,” “implement,” “result,” “increase,” “establish,” “perform,” “make,” “continue,” “can,” “ongoing,” “include” or the negative of such terms or comparable terminology. All forward-looking statements included in this Form 10-K are based on information available to us as of the filing date of this report, and the Company assumes no obligation to update any such forward-looking statements. Our actual results could differ materially from the forward-looking statements.

Factors that may cause such differences include but are not limited to: (1) intense competition in the drug testing industry, particularly among companies that test utilizing hair samples; (2) risks associated with the development of markets for new products and services offered; (3) pricing policies; (4) risks associated with capacity expansion; (5) risks associated with U.S. government regulations, including, but not limited to, Food and Drug Administration (the “FDA”) regulations, (6) risks associated with denial, suspension, or revocation of certifications or other licenses for any of our clinical laboratories; (7) Psychemedics' ability to maintain its reputation and brand image; (8) the ability of Psychemedics to achieve its business plans, productivity improvements, cost controls, leveraging of its global operating platform, and acceleration of the rate of innovation; (9) the direct and indirect impact of the COVID-19 pandemic on our business and operations; (10) information technology system failures and data security breaches; (11) the uncertain global economy; (12) our ability to attract, develop and retain executives and other qualified employees and independent contractors, including distributors; (13) Psychemedics' ability to obtain and protect intellectual property rights; (14) litigation risks; and (15) changes in economic conditions which affect demand for our products and services.

Additional important factors that could cause actual results to differ materially from expectations reflected in our forward-looking statements include those described in Item 1A, “Risk Factors.”

PSYCHEMEDICS CORPORATION

FORM 10-K

ANNUAL REPORT

For the Year Ended December 31, 2022

TABLE OF CONTENTS

Available Information

Psychemedics Corporation (together with its wholly-owned subsidiaries, the “Company” or “Psychemedics”) maintains its principal executive office at 289 Great Road, Acton, MA 01720. Our telephone number is (978) 206-8220 and internet address is www.psychemedics.com. Our stock is traded on the NASDAQ Stock Market under the symbol “PMD”. The Company makes available, free of charge, on the Investor Information section of its website, its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K from time to time, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with the Securities and Exchange Commission (the “SEC”). Copies are also available, without charge, from Psychemedics Corporation, Attn: Investor Relations, 289 Great Road, Acton, MA 01720. Alternatively, reports filed with the SEC may be viewed or obtained at the SEC Public Reference Room in Washington, D.C., or from the SEC on its website at www.sec.gov. We do not intend for information contained in our website to be part of this Annual Report on Form 10-K.

General

Psychemedics Corporation is a Delaware corporation organized on September 24, 1986. The consolidated financial statements of the Company include the accounts and results of operations of Psychemedics Corporation and its wholly-owned subsidiary, Psychemedics International, LLC and their jointly-owned subsidiary, Psychemedics Laboratórios Ltd. All significant inter-company balances and transactions have been eliminated in consolidation. All the Company’s physical assets are located within the United States. The Company provides testing services for the detection of drugs of abuse through the analysis of hair samples. The Company’s testing methods utilize a patented technology that digests the hair and releases drugs trapped in the hair without destroying the drugs. This is fundamental to the entire process because the patented method gets virtually 100% of the drug out of the hair, and if you cannot get the drug out of the hair, you cannot measure it. The Company then performs a proprietary custom-designed patented (US 10,539,580) enzyme immunoassay (“EIA”) on the liquid supernatant, with confirmation testing by mass spectrometry.

The Company’s primary application of its patented technology is as a testing service that analyzes hair samples for the presence of certain drugs of abuse. The Company’s customized proprietary EIA procedures to drug test hair samples differ from the more commonly used immunoassay procedures employed by other hair testing companies. The Company’s testing results provide quantitative information that can indicate the approximate amount of drug ingested as well as historical data, which can show a pattern of individual drug use over a longer period of time, thereby providing superior detection compared to other types of drug testing. This information is useful to employers for both applicant and employee testing, as well as treatment professionals, law enforcement agencies, school administrators, and parents concerned about their children’s drug use. The Company provides screening and confirmation by mass spectrometry using industry-accepted practices for cocaine, marijuana, PCP, amphetamines (including ecstasy, eve and Adderall®), opiates (including heroin, hydrocodone, hydromorphone, oxycodone, oxymorphone and codeine), synthetic cannabinoids (including K2, Spice, Blaze), benzodiazepines (Xanax®, Valium®, and Ativan®), nicotine, Fentanyl, and alcohol.

Hair drug testing services are currently performed at the Company’s Culver City, California campus located at 5832 Uplander Way and 5750 Hannum Avenue.

Background on Drug Testing with Hair

When certain chemical substances enter the bloodstream, the blood carries these substances to the hair where they become “entrapped” in the protein matrix in amounts approximately proportional to the amount ingested. The Company utilizes a patented drug extraction method followed by a unique patented EIA procedure to identify drugs in the hair. The patented drug extraction method effectively releases drugs from the hair without destroying the drugs, getting virtually 100% of the drug out of the hair. The patented method can be used with a broad range of immunoassay screen techniques and mass spectrometry methods.

The immunoassays used by the Company have been patented under the name “Solid Phase Multi-Analyte Assay.” The immunoassays produced by the Psychemedics R&D team were uniquely designed specifically to meet and even exceed the standards of radioimmunoassay (“RIAH”), the original testing method created and utilized by the Company prior to 2013. Because Psychemedics is the only hair testing laboratory that manufactures its own screening assays, it has full control over all aspects of its technology, and that powerful advantage facilitated the Company's creation of its EIA assays with equivalence to its own previously FDA-cleared radioimmunoassays.

The EIA screened positive results are then confirmed by mass spectrometry. Depending upon the length of hair, the Company is able to provide historical information on drug use by the person from whom the sample was obtained. Because head hair grows approximately 1.3 centimeters per month, a 3.9-centimeter head hair sample can reflect drug ingestion over the approximate three months prior to the collection of the sample. Another option is sectional analysis of the head hair sample, in which the hair is sectioned into lengths which approximately correspond to certain time periods, thereby providing information on patterns of drug use.

Validation of the Company’s Proprietary Testing Methods

The process of analyzing human hair for the presence of drugs has been the subject of numerous peer-reviewed, scientific field studies. Many of the studies have been funded by the National Institute of Justice or the National Institute on Drug Abuse (“NIDA”). Several hundred research articles written by independent researchers have been published supporting the general validity and usefulness of hair analysis.

Some of the Company’s customers have also completed their own testing to validate the Company’s hair test results compared to other companies’ urine test results. These studies consistently confirmed the Company’s superior detection rate compared to urinalysis testing. When results from the Company’s hair testing methods were compared to urine results in side-by-side evaluations, 5 to 10 times as many drug abusers were accurately identified by the Company’s proprietary methods.

In 1998, the National Institute of Justice, utilizing Psychemedics’ previously utilized RIAH hair testing assay, completed a Pennsylvania Prison study where hair analysis revealed an average prison drug use level of approximately 7.9% in 1996. Comparatively, urinalysis revealed virtually no positives. After measures to curtail drug use were instituted (drug-sniffing dogs, searches and scanners), the usage level fell to approximately 2% according to the results of hair analysis in 1998. Again, the urine tests showed virtually no positives. The study illustrates the usefulness of hair analysis to monitor populations and the weakness of urinalysis.

The Company has received 510k clearance from the FDA on nine EIA assays used to test head and body hair for drugs of abuse.

The Company’s decontamination wash protocol and the effects in eliminating surface contamination were analyzed in a study conducted by scientists at the Laboratory of the Federal Bureau of Investigation (the “FBI”) and published in August 2014 in the Journal of Analytical Toxicology. The FBI concluded that the use of an extended wash protocol of the type used by the Company will exclude false positive results from environmental contact with cocaine. In the study, the FBI cited Psychemedics’ studies published in 1993, 2002, 2004, and 2005, and named our Vice President of Laboratory Operations, and our laboratory, in its acknowledgments. The FBI study also supported the use of metabolites known as hydroxycocaines as evidence of ingestion. These metabolites were first identified in hair by Psychemedics.

Advantages of Using the Company’s Patented Method

The Company asserts that hair testing using its patented method confers substantive advantages over detection through urinalysis. Although urinalysis testing can provide accurate drug use information, the scope of the information is short-term and is generally limited to the type of drug ingested within a few days of the test. Studies published in many scientific publications have indicated that most drugs disappear from urine within a few days.

In contrast to urinalysis testing, hair testing using the Company’s patented method can provide long-term historical drug use information resulting in a significantly wider window of detection. This window may be several months or longer depending on the length of the hair sample. The Company’s standard test offering, however, uses a 3.9-centimeter length head hair sample cut close to the scalp, which measures use for approximately three months prior to collection of the sample.

This wider window enhances the detection efficiency of hair analysis, making it particularly useful in pre-employment and random testing. Hair testing not only identifies more drug users, but it may also uncover patterns and severity of drug use (information most helpful in determining the scope of an individual’s involvement with drugs), while serving as a deterrent against drug use. Hair testing employing the Company’s patented method greatly reduces the incidence of “false negatives” associated with evasive measures typically encountered with urinalysis testing. For example, urinalysis test results are adversely impacted by excessive fluid intake prior to testing and by adulteration or substitution of the urine sample. Moreover, a drug user who abstains from use for a few days prior to urinalysis testing can usually escape detection. Hair testing is effectively free of these problems, as it cannot be thwarted by evasive measures typically encountered with urinalysis testing. Hair testing is also attractive to customers since sample collection is typically performed under close supervision yet is less intrusive and less embarrassing for test subjects.

Hair testing using the Company’s patented method, along with mass spectrometry confirmation, further reduces the prospects of error in conducting drug detection tests. Urinalysis testing is more susceptible to problems such as “evidentiary false positives” resulting from passive drug exposure or poppy seeds. To combat this problem, in federally mandated testing, the opiate cutoff levels for urine testing were raised 667% (from 300 to 2,000 ng/ml) on December 1, 1998, and testing for the presence of a heroin metabolite, 6-MAM, was required. These requirements, however, effectively reduced the detection time frame for confirmed heroin use, such that 6-MAM in urine can typically only be detected for several hours post drug use. In contrast, the metabolite 6-MAM is stable in hair and can be detected for months.

In the event a positive urinalysis test result is challenged, a test on a newly collected urine sample is not a viable remedy. Unless the forewarned individual continues to use drugs prior to the date of the newly collected sample, a re-test may yield a negative result when using urinalysis testing because of temporary abstinence. In contrast, when the Company’s hair testing method is offered on a repeat hair sample, the individual suspected of drug use cannot as easily affect the results because historical drug use data remains locked in the hair fiber.

When compared to other hair testing methods, not only are the Company’s assays cleared by the FDA for head and body hair, the assays also employ a unique patented method of digesting hair that the Company believes allows for the most efficient release of drugs from the hair without destroying the drugs. The Company’s method of releasing drugs from hair is a key advantage and results in superior detection rates.

Disadvantages of Hair Testing

There are some disadvantages of hair testing as compared to drug detection through urinalysis. Because hair starts growing below the skin surface, drug ingestion evidence does not appear in hair above the scalp until approximately five to seven days after use. Thus, hair testing is not suitable for determining drug presence in “for cause” testing as is done in connection with an accident investigation. It does, however, provide a drug history which can complement urinalysis information in “for cause” testing.

The Company’s prices for its tests are generally slightly higher than prices for tests using urinalysis, but the Company believes that its superior detection rates provide more value to the customer. This higher pricing policy could, however, adversely impact the growth of the Company’s current base business and failure to obtain new business customers.

Hair Alcohol Testing

In 2013, the Company launched a test for alcohol using hair. This test measures average alcohol consumption over a period of approximately three months, indicates the approximate level of alcohol use during that time period, and can provide a behavioral indication of excessive use. The test measures the amount of ethyl glucuronide (EtG) in the hair – a trace metabolite of ethanol and a direct alcohol biomarker.

Intellectual Property

Certain aspects of the hair analysis method currently used by the Company are covered by US and foreign patents owned by the Company. The Company has been granted a total of twelve US patents, including a patent issued to the Company in 2011 that focuses on digesting hair and releasing drugs trapped in the hair without destroying the drugs. This patent can be used with a broad range of immunoassay screen techniques, mass spectrometry methods, and chromatographic procedures. In 2012, the Company received an additional US patent that extended the range of the patent received in 2011. Two US patents related to integrity testing of hair samples issued in 2015 and 2016, and a US patent application directed to detection of multiple analytes was allowed. Additional patent applications are currently pending in the U.S. and internationally. In 2019, US Patent 10,539,580 was issued covering our Solid Phase Multi-Analyte Assay used in all our cleared EIA FDA submissions.

The Company also relies on trade secrets to protect certain aspects of its proprietary technology. The Company’s ability to protect the confidentiality of its trade secrets is dependent upon the Company’s internal safeguards and upon the laws protecting trade secrets and unfair competition.

In the event that patent protection or protection under the laws of trade secrets is not sufficient and the Company’s competitors succeed in duplicating the Company’s products, the Company’s business could be materially adversely affected.

Target Markets

Workplace

The Company focuses its primary marketing efforts on the domestic private sector, with particular emphasis on job applicants and employee testing.

Most businesses use drug testing to screen job applicants and employees. The Hazeldon Foundation survey from 2007 indicated that 85% of Human Resource (“HR”) professionals believe that drug testing is an effective way to identify substance abuse. The prevalence of drug screening programs reflects a concern that drug use contributes to employee health problems and costs. As the same study found that 62% of HR professionals believe that absenteeism is the most significant problem caused by substance abuse and addiction, followed at 49% by reduced productivity, a lack of trustworthiness at 39%, a negative impact on the company’s external image at 32%t, missed deadlines at 31%, and in certain industries, safety hazards. It has been estimated that substance abuse costs to American businesses is more than $100 billion annually.

The principal criticism of employee drug testing programs centers on the effectiveness of the testing program. Most private sector testing programs use urinalysis. Such programs are susceptible to evasive maneuvers and the inability to obtain confirmation through repeat samples in the event of a challenged result. An industry has developed over the Internet, and through direct mail, marketing a wide variety of adulterants, dilutants, clean urine and devices to assist drug users in falsifying urine test results.

Moreover, scheduled tests such as pre-employment testing and some random testing programs provide an opportunity for many drug users to simply abstain for a few days in order to escape detection by urinalysis.

The Company presents its patented hair analysis method to potential clients as a better technology well suited to employer needs. Field studies and actual client results support the accuracy and superior effectiveness of the Company’s patented technology and its ability to detect varying levels of drug use.

The Company performs a confirmation test of all screened positive results through mass spectrometry. The use of mass spectrometry is an industry accepted practice used to confirm a positive test result from the screening process. The Company offers its clients an expanded drug screen with mass spectrometry confirmation of cocaine, PCP, marijuana, amphetamines, alcohol, opiates, synthetic cannabinoids and benzodiazepines.

Schools

The Company currently serves hundreds of schools throughout the United States and in several foreign countries. The Company offers its school clients the same five-drug screen with mass spectrometry confirmation that is used with the Company’s workplace testing service.

Parents

The Company also offers a personal drug testing service, known as “PDT-90”®, for parents concerned about drug use by their children. It allows parents to collect a small sample of hair from their child in the privacy of the home, send it directly to the Company’s laboratory and have it tested for drugs of abuse by the Company. The PDT-90 testing service uses the same patented method that is used with the Company’s workplace testing services.

Research

The Company is involved in the following ongoing studies involving use of drugs of abuse in various populations: In 2017, the Company partnered with an NIH-funded study titled “Adolescent Brain Cognitive Development” (“ABCD”) which expects to enroll 12,000 youths age 9-10 over a 2-2.5 year recruitment period. The objective of the ABCD consortium is to establish a national, multisite, longitudinal cohort and database by studying youth prospectively in order to examine brain and cognitive development in children and adolescents through a period (10 years) when significant development of intellectual and emotional functions occurs. Psychemedics’ role in this study is to test hair to detect use of drugs over the time period. The Company is also partnering with Olin Neuropsychiatry Research Center Institute of Living Hartford Hospital in a research study entitled, “Neurochemical and Functional Correlates of Memory in Emerging Adult Marijuana Users.” The study is aiming to better characterize the impact of heavy marijuana use on memory and is funded by a grant from NIDA.

Geographic Scope

Revenues outside the United States were 3%, 5%, and 9% of consolidated revenues for years ended, 2022, 2021 and 2020, respectively.

Distribution

The Company markets its corporate drug testing services through its own sales force, distributors and webinars. The Company markets its home drug testing service, PDT-90®, through the Internet.

Significant Customers and Concentration of Credit Risk

The Company had no customers that represented 10% or more of total revenue for the years ended December 31, 2022, 2021 and 2020, respectively. The Company had one customer that represented 11% and 12% of the total accounts receivable balance as of December 31, 2022 and 2021, respectively.

The Company maintains its cash in a bank account at one of the largest financial institutions in the U.S. The individual balance, at times, may exceed federally insured limits. These deposits may be redeemed upon demand, and the Company believes that the financial institution that holds the Company’s cash is financially sound and, accordingly, minimal credit risk exists with respect to cash.

Competition

The Company competes directly with numerous commercial laboratories that test for drugs primarily through urinalysis testing. Most of these laboratories, such as Quest Diagnostics, have substantially greater financial resources, market identity, drug testing market share, marketing organizations, facilities, and more personnel than the Company. Psychemedics has developed a strong base of corporate customers and believes that future success with new business customers is dependent on the Company’s ability to communicate the advantages of implementing a drug program utilizing the Company’s patented hair analysis method.

The Company’s ability to compete is also a function of pricing. The Company’s prices for its tests are generally slightly higher than prices for tests using urinalysis. However, the Company believes that its superior detection rates, coupled with the customer’s ability to test less frequently due to hair testing’s wider window of detection (three months versus approximately three days with urinalysis), provide more value to the customer. This pricing policy could, however, lead to slower volume growth for the Company.

The Company also competes with other hair testing laboratories. The Company distinguishes itself from hair testing competitors by emphasizing the superior results the Company obtains through use of its unique patented extraction method in combination with the Company’s FDA cleared immunoassay screen.

Government Regulation

The Company is licensed as a clinical laboratory by the State of California as well as certain other states. All tests are performed according to the laboratory standards established by the Department of Health and Human Services, through the Clinical Laboratories Improvement Amendments, and various state licensing statutes.

A substantial number of states regulate drug testing. The scope and nature of such regulations varies greatly from state to state and is subject to change from time to time. The Company addresses state law issues on an ongoing basis.

The Federal Food, Drug and Cosmetic Act, as amended, requires companies engaged in the business of testing for drugs of abuse using a test (screening assay) not previously recognized by the FDA to submit their assay to the FDA for recognition prior to marketing. In addition, the laboratory performing the tests is required to be certified by a recognized agency. In 2002, the Company received 510k clearance to market all five of its assays utilizing RIAH technology.

In 2008, the Company received the first College of American Pathologists certification specifically including hair testing.

In 2011, the Company received ISO/IEC 17025 International Accreditation for a broad spectrum of laboratory testing including drugs of abuse and forensics in hair and urine specimens. ISO/IEC 17025 accreditation provides formal recognition to laboratories that demonstrate technical competency and maintains this recognition through periodic evaluations to ensure continued compliance.

In 2012, the Company received 510k clearance from the FDA to market five of its assays utilizing the Company’s custom developed EIA technology.

In 2013, the Company received 510k clearance from the FDA to market two additional assays utilizing the Company’s custom developed EIA technology.

In 2016, the Company received accreditation from the Standards Council of Canada as an accredited testing laboratory.

In 2017, the Company received 510k clearance from the FDA to market one additional assay utilizing the Company’s custom developed EIA technology.

In 2019, the Company received 510k clearance from the FDA to market one additional assay utilizing the Company’s custom developed EIA technology.

Research and Development

The Company is continuously engaged in research and development activities. During the years ended December 31, 2022, 2021 and 2020, $1.3 million, $1.1 million and $1.3 million, respectively, were expended for research and development. The Company continues to perform research activities to develop new products and services and to improve existing products and services utilizing the Company’s proprietary technology. The Company also continues to evaluate methodologies to enhance its drug screening capabilities. Additional research using the Company’s proprietary technology is being conducted by outside research organizations through government-funded studies.

Employees

As of December 31, 2022, the Company employed 133 employees, 3 of whom were in R&D. None of the Company’s employees are subject to a collective bargaining agreement and the Company believes that overall relations with employees are good.

In addition to other information contained in this Form 10-K, the following risk factors should be carefully considered in evaluating Psychemedics Corporation and its business because such factors could have a significant impact on our business, operating results, and financial condition. Additional risks not presently known to the Company, or that it presently deems immaterial, may also negatively impact the Company. These risk factors could cause actual results to materially differ from those projected in any forward-looking statements.

Risks Related to Our Business and Operations

The ongoing COVID-19 pandemic may continue to adversely affect our business, results of operation and financial condition.

The Company is closely monitoring the impact of the COVID-19 pandemic on all aspects of its business. Fluctuations in the number of COVID-19 cases may have a negative effect on the Company's business and financial performance. Given the continued unpredictability pertaining to the COVID-19 pandemic, the impact on the Company's business continues to be uncertain and depends on a number of evolving factors that the Company may not be able to predict or effectively respond to. These factors include: the timing, extent, trajectory, and duration of any pandemic; increases in COVID-19 infection rates and the geographic location of such increases; the development, availability, distribution and effectiveness of vaccines and treatments; the imposition of protective public safety measures; and the impact of any pandemic on supply chain and the global economy. To the extent the COVID-19 pandemic or any future pandemic adversely affects our business, results of operations and financial condition, it may also have the effect of heightening other risks.

The Company incurred additional costs to implement operational changes in response to this pandemic. The COVID-19 pandemic disrupted, and along with other economic factors, a resurgence in COVID-19 could continue to disrupt, the Company’s supply chain, including its ability to secure test collection and testing supplies and equipment and personal protective equipment for its employees.

Companies may develop products that compete with our products and some of these companies may be larger and better capitalized than we are.

Many of our competitors and potential competitors are larger and have greater financial resources than we do and offer a range of products broader than our products. Some of the companies with which we now compete or may compete in the future may develop more extensive research and marketing capabilities and greater technical and personnel resources than we do and may become better positioned to compete in an evolving industry. Inability to compete successfully could harm our business and prospects.

Increased competition, including price competition, could have a material impact on the Company’s net revenues and profitability.

Our business is intensely competitive, both in terms of price and service. Pricing of drug testing services is a significant factor often considered by customers in selecting a drug testing laboratory. Larger clinical laboratory providers can increase cost efficiencies afforded by large-scale automated testing. This results in greater price competition. The Company may be unable to increase cost efficiencies sufficiently, if at all, and as a result, its net earnings and operating cash flows could be negatively impacted by such price competition. The Company may also face increased competition from companies that do not comply with existing laws or regulations or otherwise disregard compliance standards in the industry. Additional competition, including price competition, could have a material adverse impact on the Company’s net revenues and profitability.

Inflationary pressures on the costs of direct materials, supplies, and personnel expenses could have a material impact on the Company’s gross profit and profitability.

Inflationary pressures have resulted in increases in the costs of shipping charges, supplies, and other services that we purchase from vendors, suppliers, and others. Inflationary pressures, along with the competition for labor, have also resulted in an increase of our labor costs, which include the costs of compensation, benefits, and other employee-related expenses. Continuation of the current inflationary environment may adversely impact the Company.

Our results of operations are subject in part to variation in our customers’ hiring practices and other factors beyond our control.

Our results of operations have been and may continue to be subject to variation in our customers’ hiring practices and job creation, which in turn is dependent, to a large extent, on the general condition of the economy, especially within our major market segments. Results for a particular quarter may vary due to several factors, including but not limited to:

| • |

economic conditions in our markets in general; |

| • |

economic conditions affecting our customers and their particular industries; |

| • |

the introduction of new products and product enhancements by us or our competitors; and |

| • |

pricing and other competitive conditions. |

A failure to obtain and retain new customers, or a loss of existing customers, or a reduction in tests ordered, could impact the Company’s ability to successfully grow its business.

The Company needs to obtain and retain new customers. In addition, a reduction in tests ordered, without offsetting growth in its customer base, could impact the Company’s ability to successfully grow its business and could have a material adverse impact on the Company’s net revenues and profitability. We compete primarily based on the quality of testing, timeliness of results, reputation in the industry, the pricing of services and ability to employ qualified personnel. The Company’s failure to successfully compete on any of these factors could result in the loss of customers and a reduction in the Company’s ability to expand its customer base.

Our business could be harmed if we are unable to protect our technology.

We rely primarily on a combination of trade secrets, patents and trademark laws and confidentiality procedures to protect our technology. Despite these precautions, unauthorized third parties may infringe or copy portions of our technology. In addition, because patent applications in the United States are not publicly disclosed until either: (1) 18 months after the application filing date or (2) the publication date of an issued patent wherein applicant(s) seek only US patent protection, applications not yet disclosed may have been filed which relate to our technology. Moreover, there is a risk that foreign intellectual property laws will not protect our intellectual property rights to the same extent as United States intellectual property laws. In the absence of the foregoing protections, we may be vulnerable to competitors who attempt to copy our products, processes or technology.

Our business could be affected by IT system failures or Cybersecurity breaches.

A computer or IT system failure could affect our ability to perform tests, report test results or properly bill customers for services performed. Failures could occur as a result of the standardization of our IT systems and other system conversions, telecommunications failures, malicious human acts (such as electronic break-ins or computer viruses) or natural disasters. Sustained system failures or interruption of the Company’s systems in one or more of its operations could disrupt the Company’s ability to process and provide test results in a timely manner and/or bill the appropriate party. Failure of the Company’s information systems could adversely affect the Company’s business, profitability and financial condition.

Our technologies, systems and networks may be subject to cybersecurity breaches. Although we have experienced occasional, actual or attempted breaches of our cybersecurity, none of these breaches has had a material effect on our business, operations or reputation. If our systems for protecting against cybersecurity risks prove to be insufficient, we could be adversely affected by having our business systems compromised, our proprietary information altered, lost or stolen, or our business operations disrupted. As cyber-attacks continue to evolve, we may be required to expend significant additional resources to continue to modify or enhance our protective measures or to investigate and remediate any information systems and related infrastructure security vulnerabilities.

In addition, certain third parties to whom we outsource our services and functions, or with whom we interface, store our confidential patient data or other confidential information as also subject to the same IT risks. A breach or attack affecting these outsourced third parties could negatively impact our business.

Failure to maintain confidential information could result in a significant financial impact.

The Company maintains confidential information regarding the results of drug tests and other information including credit card and payment information from our customers. The failure to protect this information could result in lawsuits, fines or penalties. Any loss of data or breach of confidentiality, such as through a computer security breach, could expose the Company to a financial liability.

Adverse results in material litigation could have an adverse financial impact and an adverse impact on our client base and reputation.

We are or may in the future become subject to a variety of litigation and legal proceedings relating to, among other things: corporate matters; commercial matters; financial and securities regulations; and employment matters. These proceedings may result in substantial monetary damages. Results of legal and regulatory proceedings cannot be predicted with certainty and for some matters, such as class actions, no insurance is cost-effectively available. Regardless of merit, legal and regulatory proceedings may be both time-consuming and disruptive to our operations and could divert the attention of our management and key personnel from our business operations. We estimate loss contingencies and establish accruals as required by generally accepted accounting principles, based on our assessment of contingencies where liability is deemed probable and reasonably estimable, in light of the facts and circumstances known to us at a particular point in time.

We are subject to, and could be further subject to, governmental investigations or actions by other third parties.

We are subject to various federal and state laws, including employment laws and regulations, violations of which can involve civil or criminal sanctions. Responding to governmental investigations or other actions may be both time-consuming and disruptive to our operations and could divert the attention of our management and key personnel from our business operations.

Our future success will depend on the continued service of our key employees.

Our people are a critical resource. The loss of any of our key personnel, including our Chief Executive Officer, executive team and other highly skilled employees, could harm our business and prospects. We may not be able to attract and retain personnel necessary for the development of our business. We do not have key personnel under contract other than 3 officers who have agreements providing for severance and non-compete covenants in the event of termination of employment following a change of control. Further, we do not have any key man life insurance for any of our officers or other key personnel.

There is a risk that our insurance will not be sufficient to protect us from errors and omissions liability or other claims, or that in the future errors and omissions insurance will not be available to us at a reasonable cost, if at all.

Our business involves the risk of claims of errors and omissions and other claims inherent to our business. We maintain errors and omissions and general liability insurance subject to deductibles and exclusions. There is a risk that our insurance will not be sufficient to protect us from all such possible claims. An under-insured or uninsured claim could harm our operating results or financial condition.

Our research and development capabilities may not produce viable new services or products.

In order to remain competitive, we need to continually improve our products, develop new technologies to replace older technologies that have either become obsolete or for which patent protection is has expired. It is uncertain whether we will continually be able to develop services that are more efficient, effective or that are suitable for our customers. Our ability to create viable products or services depends on many factors, including the implementation of appropriate technologies, the development of effective new research tools, the complexity of the chemistry and biology, the lack of predictability in the scientific process and the performance and decision-making capabilities of our scientists. There is no guarantee that our research and development teams will be successful in developing improvements to our technology.

Improved testing technologies, or the Company’s customers using new technologies to perform their own tests, could adversely affect the Company’s business.

Advances in technology may lead to the development of more cost-effective technologies that can be operated by third parties or customers themselves in their own offices, without requiring the services of a freestanding laboratory. Development of such technology and its use by the Company’s customers could reduce the demand for its testing services and negatively impact our revenues.

We may not be able to recruit and retain the experienced scientists and management we need to compete in our industry.

Our future success depends upon our ability to attract, retain and motivate highly skilled scientists and management. Our ability to achieve our business strategies depends on our ability to hire and retain high caliber scientists and other qualified experts. We compete with other testing companies, research companies and academic and research institutions to recruit personnel and face significant competition for qualified personnel. We may incur greater costs than anticipated, or may not be successful, in attracting new scientists or management or in retaining or motivating our existing personnel.

Our future success also depends on the personal efforts and abilities of the principal members of our senior management and scientific staff to provide strategic direction, to manage our operations and maintain a cohesive and stable environment.

Our facilities and practices may fail to comply with government regulations.

Our testing facilities and processes must be operated in conformity with current government regulations. These requirements include, among other things, quality control, quality assurance and the maintenance of records and documentation. If we fail to comply with these requirements, we may not be able to continue our services to certain customers, or we could be subject to fines and penalties, suspension of production, or withdrawal of our certifications. We operate a facility that we believe conforms to all applicable requirements. This facility and our testing practices are subject to periodic regulatory inspections to ensure compliance.

Our business could be harmed from the loss or suspension of any licenses.

The forensic laboratory testing industry is subject to significant regulation and many of these statutes and regulations are subject to change. The Company cannot assure that applicable statutes and regulations will not be interpreted or applied by a regulatory authority in a manner that would adversely affect its business. Potential sanctions for violation of these regulations could include the suspension or loss of various licenses, certificates and authorizations, which could have a material adverse effect on the Company’s business. In addition, potential delays in renewals of licenses could also harm the Company.

If our use of chemical and hazardous materials violates applicable laws or regulations or causes personal injury, we may be liable for damages.

Our drug testing activities, including the analysis and synthesis of chemicals, involve the controlled use of chemicals, including flammable, combustible, and toxic materials that are potentially hazardous. Our use, storage, handling and disposal of these materials is subject to federal, state and local laws and regulations, including the Resource Conservation and Recovery Act, the Occupational Safety and Health Act and local fire codes, and regulations promulgated by the Department of Transportation, the Drug Enforcement Agency, the Department of Energy, and the California Department of Public Health and Environment. We may incur significant costs to comply with these laws and regulations in the future. In addition, we cannot completely eliminate the risk of accidental contamination or injury from these materials, which could result in material unanticipated expenses, such as substantial fines or penalties, remediation costs or damages, or the loss of a permit or other authorization to operate or engage in our business. Those expenses could exceed our net worth and limit our ability to raise additional capital.

Our operations could be interrupted by damage to our laboratory facilities.

Our operations are dependent upon the continued use of our laboratories and equipment in Culver City, California. Catastrophic events, including earthquakes, fires or explosions, could damage our laboratories, equipment, scientific data, work in progress or inventories of chemicals and may materially interrupt our business. We employ safety precautions in our laboratory activities in order to reduce the likelihood of the occurrence of certain catastrophic events; however, we cannot eliminate the chance that such events will occur. Rebuilding our facilities could be time consuming and result in substantial delays in fulfilling our agreements with our customers. We maintain business interruption insurance to cover continuing expenses and lost revenue caused by such occurrences. However, this insurance does not compensate us for the loss of opportunity and potential harm to customer relations that our inability to meet our customers’ needs in a timely manner could create.

Agreements we have with our employees, consultants and customers may not afford adequate protection for our trade secrets, confidential information and other proprietary information.

In addition to patent protection, we also rely on copyright and trademark protection, trade secrets, know-how, continuing technological innovation and licensing opportunities. In an effort to maintain the confidentiality and ownership of our trade secrets and proprietary information, we require our employees, consultants and advisors to execute confidentiality and proprietary information agreements. However, these agreements may not provide us with adequate protection against improper use or disclosure of confidential information and there may not be adequate remedies in the event of unauthorized use or disclosure. Furthermore, we may from time to time hire scientific personnel formerly employed by other companies involved in one or more areas similar to the activities we conduct. In some situations, our confidentiality and proprietary information agreements may conflict with, or be subject to, the rights of third parties with whom our employees, consultants or advisors have prior employment or consulting relationships. Although we require our employees and consultants to maintain the confidentiality of all proprietary information of their previous employers, these individuals, or we, may be subject to allegations of trade secret misappropriation or other similar claims as a result of their prior affiliations. Finally, others may independently develop substantially equivalent proprietary information and techniques or otherwise gain access to our trade secrets. Our failure or inability to protect our proprietary information and techniques may inhibit or limit our ability to compete effectively or exclude certain competitors from the market.

International trade policies may impact demand for our products and our competitive position.

Government policies on international trade and investment such as import quotas, capital controls or tariffs, whether adopted by individual governments or addressed by regional trade blocs, can affect the demand for our services, impact the competitive position of our products or prevent us from being able to sell products in certain countries. The implementation of more restrictive trade policies, such as more detailed inspections, higher tariffs or new barriers to entry, could negatively impact our business, results of operations and financial condition. For example, a government’s adoption of “buy national” policies or retaliation by another government against such policies could have a negative impact on our results of operations.

Global operations are subject to extensive trade and anti-corruption laws and regulations.

The U.S. Foreign Corrupt Practices Act and similar foreign anti-corruption laws generally prohibit companies and their intermediaries from making improper payments or providing anything of value to improperly influence foreign government officials for the purpose of obtaining or retaining business or obtaining an unfair advantage. Recent years have seen a substantial increase in the global enforcement of anti-corruption laws. Our operations outside the United States could increase the risk of such violations. Violations of anti-corruption laws or regulations by our employees or by intermediaries acting on our behalf may result in severe criminal or civil sanctions, could disrupt our business, and result in an adverse effect on our business and results of operations or financial condition.

Our approach to environmental, social, and governance (ESG) matters may not satisfy all our stakeholders.

We assess opportunities and risks related to environmental, social and governance (ESG) matters. As part of this process, we may make decisions related to ESG matters and may set goals and targets related to ESG matters. We have a broad range of stakeholders, including our stockholders, employees, schools, and communities we serve, some of whom increasingly focus on ESG matters. Certain stakeholders may not be satisfied with our decisions related to ESG matters, the goals we set regarding ESG matters, our progress towards these goals or the resulting outcomes. This could lead to negative perceptions of, or loss of support for our business, difficulty recruiting or attracting new employees and our stock price being negatively impacted.

Risks Related to Our Stock

Our quarterly operating results could fluctuate significantly, which could cause our stock price to decline.

Our quarterly operating results have fluctuated in the past and are likely to fluctuate in the future. Our results are impacted by the extent to which we are able to gain new customers, competitive pricing, and on the hiring practices of our existing customers, including seasonality. Demand for drug testing can be impacted by changes in government requirements regarding testing for drugs of abuse, delays in implementation of such requirements, as well as general economic conditions. Entering into new customer contracts can involve a long lead time. Accordingly, negotiation can be lengthy and is subject to a number of significant risks, including customers’ budgetary constraints and internal reviews. Due to these and other market factors, our operating results could fluctuate significantly from quarter to quarter. In addition, we may experience significant fluctuations in quarterly operating results due to factors such as general and industry-specific economic conditions that may affect the budgets and the hiring practices of our customers.

Due to the possibility of fluctuations in our revenue and expenses, we believe that quarter-to-quarter comparisons of our operating results are not necessarily a good indication of our future performance. Our operating results in some quarters may not meet the expectations of stock market analysts and investors. If we do not meet analysts’ or investors’ expectations, our stock price could decline.

Payment of a cash dividend could decline or cease.

With some interruptions during the COVID pandemic, the Company has historically paid cash dividends. Any cessation of our program or reduction in our cash dividend could affect our stock price. If we cease this practice or reduce the amount of the regular cash dividend, due to operating or economic conditions, our stock price could suffer. Further, if the Company ceases its future cash dividends, a return on investment in our common stock would depend entirely upon future appreciation. There is no guarantee that our common stock will appreciate in value or even maintain the price at which stockholders have purchased their shares.

Our stock price could experience substantial volatility.

The market price of our common stock has historically experienced and may continue to experience extensive volatility. Our quarterly operating results, the success or failure of future development efforts, changes in general conditions in the economy or the financial markets and other developments affecting our customers, our distributors, our competitors or us could cause the market price of our common stock to fluctuate substantially. This volatility may adversely affect the price of our common stock. In the past, securities class action litigation has often been instituted following periods of volatility in the market price of a company’s securities. A securities class action suit against us could result in potential liabilities, substantial costs and the diversion of management’s attention and resources, regardless of whether we win or lose.

Item 1B. Unresolved Staff Comments

Not applicable.

The Company maintains its corporate office at 289 Great Road, Acton, Massachusetts, 01720; the office consists of six thousand square feet and is leased through February 2024.

The Company leases two facilities for laboratory testing purposes in Culver City, California. The first is fourteen thousand square feet of space with an additional ten thousand square feet of storage space. This facility is leased through December 2024. The second facility of sixteen thousand square feet is leased through March 2025.

Information pertaining to legal proceedings can be found in Item 8. Financial Statements and Supplementary Data Note 9 - “Commitments and Contingencies” to the Consolidated Financial Statements included in this Annual Report.

Item 4. Mine Safety Disclosures

Not applicable.

Item 5. Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities

The Company’s common stock is traded on the NASDAQ Stock Market under the symbol “PMD”. As of March 15, 2023, there were 157 record holders of the Company’s common stock. The number of record owners was determined from the Company’s stockholder records maintained by the Company’s transfer agent and does not include beneficial owners of the Company’s common stock whose shares are held in the names of various security holders, dealers and clearing agencies. The Company believes that the number of beneficial owners of the Company’s common stock held by others as or in nominee names exceeds 3,100.

The following table sets forth for the periods indicated the range of prices for the Company’s common stock as reported by the NASDAQ Stock Market and cash dividends declared by the Company.

| High |

Low |

Dividends |

||||||||||

| Fiscal 2022: |

||||||||||||

| First Quarter |

$ | 7.77 | $ | 6.25 | $ | - | ||||||

| Second Quarter |

7.21 | 6.01 | 0.07 | |||||||||

| Third Quarter |

6.94 | 6.05 | 0.07 | |||||||||

| Fourth Quarter |

6.70 | 4.85 | 0.07 | |||||||||

| Fiscal 2021: |

||||||||||||

| First Quarter |

$ | 7.90 | $ | 4.95 | $ | - | ||||||

| Second Quarter |

8.36 | 6.20 | - | |||||||||

| Third Quarter |

8.60 | 8.05 | - | |||||||||

| Fourth Quarter |

8.90 | 6.76 | 0.05 | |||||||||

The Company most recently declared a cash dividend of $0.07 per share on March 21, 2023, which will be paid on April 10, 2023.

Issuer Purchases of Equity Securities

During 2022, the Company did not repurchase any common shares for treasury.

Unregistered Sales of Equity Securities and Use of Proceeds

There were no unregistered sales of common stock of the Company during 2022.

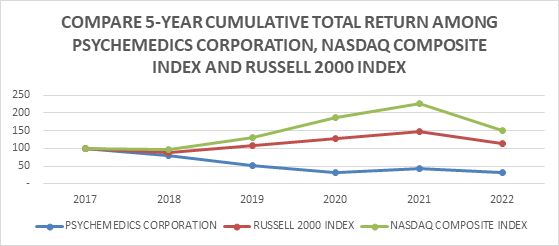

Performance Graph

Calculated by the Company using www.yahoo.com/finance historical prices.

| 2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

||||||||||||||||||||

| PMD |

PSYCHEMEDICS CORPORATION |

100.00 | 80.54 | 51.36 | 32.49 | 42.12 | 32.83 | ||||||||||||||||||

| Russell 2000 |

RUSSELL 2000 INDEX |

100.00 | 87.82 | 108.66 | 128.61 | 146.23 | 114.70 | ||||||||||||||||||

| NASDAQ |

NASDAQ COMPOSITE INDEX |

100.00 | 96.12 | 129.97 | 186.69 | 226.63 | 151.61 | ||||||||||||||||||

| (1) |

The above graph assumes a $100 investment on December 31, 2017, through the end of the 5-year period ended December 31, 2022, in the Company’s Common Stock, the Russell 2000 Index and the NASDAQ Composite Index. The prices all assume the reinvestment of cash dividends. |

| (2) |

The Russell 2000 Index is composed of the smallest 2,000 companies in the Russell 3,000 Index. The Company has been unable to identify a peer group of companies that engage in testing of drugs of abuse, except for large pharmaceutical companies where such business is insignificant to such companies’ other lines of businesses. The Company therefore uses in its proxy statements a peer index based on market capitalization. |

| (3) |

The NASDAQ Composite Index includes companies whose shares are traded on the NASDAQ Stock Market. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The Management’s Discussion and Analysis of Financial Condition and Results of Operations should be read together with the more detailed business information and financial statements and related notes that appear elsewhere in this annual report on Form 10-K. This annual report may contain certain “forward-looking” information within the meaning of the Private Securities Litigation Reform Act of 1995. This information involves risks and uncertainties. Actual results may differ materially from the results discussed in the forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed in Item 1A — Risk Factors.

Overview

Psychemedics Corporation is the world’s largest provider of hair testing for drugs of abuse, utilizing a patented hair analysis method involving digestion of hair, enzyme immunoassay technology and confirmation by mass spectrometry to analyze human hair to detect abused substances. The Company’s customers include Fortune 500 companies, as well as small to mid-size corporations, schools, and governmental entities, located in the United States and internationally. During the year ended December 31, 2022, the Company’s revenues were $25.2 million, an increase of 1% from $24.9 million in 2021. The increase was due to higher organic growth in the Company’s largest market segment offset by a decline in Brazil revenues, including the Brazil driver license business.

Under the provisions of the CARES Act signed into law on March 27, 2020, and the subsequent extension of the CARES Act, the Company was eligible for a refundable employee retention credit subject to certain criteria through the fiscal year ended December 31, 2021. The Company recognized $2.6 million of employee retention credits during fiscal year 2021 of which $1.8 million was included in cost of revenues and $0.8 million in operating expenses in the statement of operations.

As the Company has disclosed previously, most recently in its Quarterly Report on Form 10-Q in the third quarter of 2022, the Company’s Board of Directors authorized the Company to explore shareholder enhancement opportunities, including strategic alternatives, such as the potential sale or merger of the Company, capitalization optimization and cash dividend strategies. Management and the Board of Directors are committed to continuing to evaluate all avenues for enhancing shareholder value. There can be no assurances that the shareholder enhancement review process will result in a transaction or other strategic change or outcome. The Company has not set a timetable for the conclusion of its review of strategic alternatives, and it does not intend to comment further unless and until the Board has approved a specific course of action or the Company has otherwise determined that further disclosure is appropriate or required by law. The Company’s Board of Directors has designated a subcommittee of the Board to review shareholder enhancement opportunities. The Company has retained investment banking firms and corporate transaction legal advisors in connection with its exploration of shareholder enhancement opportunities.

The following table sets forth, for the periods indicated, the selected statements of operations data as a percentage of total revenue:

| Year Ended December 31, |

||||||||||||

| 2022 |

2021 |

2020 |

||||||||||

| Revenues |

100.0 | % | 100.0 | % | 100.0 | % | ||||||

| Cost of revenues |

63.2 | % | 58.8 | % | 77.1 | % | ||||||

| Gross profit |

36.8 | % | 41.2 | % | 22.9 | % | ||||||

| Operating Expenses: |

||||||||||||

| General & administrative |

23.2 | % | 24.6 | % | 28.5 | % | ||||||

| Marketing & selling |

12.6 | % | 11.3 | % | 16.7 | % | ||||||

| Research & development |

5.3 | % | 4.5 | % | 6.0 | % | ||||||

| Total Operating Expenses |

41.1 | % | 40.4 | % | 51.2 | % | ||||||

| Operating (loss) income |

-4.3 | % | 0.8 | % | -28.3 | % | ||||||

| Other Income (Expense): |

||||||||||||

| Gain on forgiveness of PPP Loan |

0.0 | % | 8.8 | % | 0.0 | % | ||||||

| Settlements |

0.0 | % | -12.6 | % | 0.0 | % | ||||||

| Other income (expense) |

0.2 | % | -0.2 | % | -0.7 | % | ||||||

| Total Other Income (Expense) |

0.2 | % | -4.0 | % | -0.7 | % | ||||||

| Net loss before provision for (benefit from) income taxes |

-4.1 | % | -3.2 | % | -29.0 | % | ||||||

| Provision for (benefit from) income taxes |

0.2 | % | -0.6 | % | -11.0 | % | ||||||

| Net loss |

-4.3 | % | -2.6 | % | -18.0 | % | ||||||

Revenue by Geographic Region

| Year Ended December 31, |

||||||||||||

| 2022 |

2021 |

2020 |

||||||||||

| Consolidated Revenue: |

||||||||||||

| United States |

$ | 24,509 | $ | 23,584 | $ | 19,486 | ||||||

| International |

731 | 1,325 | 1,874 | |||||||||

| Total Revenue |

$ | 25,240 | $ | 24,909 | $ | 21,360 | ||||||

Results for the Year Ended December 31, 2022, Compared to Results for the Year Ended December 31, 2021 (in thousands)

| 2022 |

2021 |

Change |

% |

|||||||||||||

| Revenues |

$ | 25,240 | $ | 24,909 | $ | 331 | 1 | % | ||||||||

| Cost of revenues |

15,949 | 14,645 | 1,304 | 9 | % | |||||||||||

| Gross profit |

9,291 | 10,264 | ( 973 | ) | -9 | % | ||||||||||

| Operating Expenses: |

||||||||||||||||

| General & administrative |

5,857 | 6,126 | ( 269 | ) | -4 | % | ||||||||||

| Marketing & selling |

3,191 | 2,799 | 392 | 14 | % | |||||||||||

| Research & development |

1,326 | 1,130 | 196 | 17 | % | |||||||||||

| Total Operating Expenses |

10,374 | 10,055 | 319 | 3 | % | |||||||||||

| Operating (loss) income |

( 1,083 | ) | 209 | ( 1,292 | ) | -618 | % | |||||||||

| Other Income (Expense): |

||||||||||||||||

| Gain on forgiveness of PPP Loan |

- | 2,181 | ( 2,181 | ) | -100 | % | ||||||||||

| Settlements |

- | ( 3,150 | ) | 3,150 | -100 | % | ||||||||||

| Other income (expense) |

43 | ( 61 | ) | 104 | -170 | % | ||||||||||

| Total Other Income (Expense) |

43 | ( 1,030 | ) | 1,073 | -104 | % | ||||||||||

| Net loss before provision for (benefit from) income taxes |

( 1,040 | ) | ( 821 | ) | ( 219 | ) | 27 | % | ||||||||

| Provision for (benefit from) income taxes |

44 | ( 156 | ) | 200 | -128 | % | ||||||||||

| Net loss |

$ | ( 1,084 | ) | $ | ( 665 | ) | $ | ( 419 | ) | 63 | % | |||||

Revenue: The revenue increase of 1% was primarily due to a 6% increase in average revenue per sample, offset by a 5% decrease in volume. Domestic revenues increased by 4% compared to the prior year period, due to an increase in average revenue per sample with similar volumes. International revenues decreased by 45% compared to the prior year period, due to decline in volume from unfavorable market forces in Brazil. See geographic breakdown of revenue above. The Company does not expect any material change in its Brazil driver license business as this market continues to be considerably uncertain.

Gross profit: The 9% decrease in gross profit was due to an increase in personnel and related costs, which was primarily due to the recognition of the refundable Employee Retention Tax Credits in 2021.

General and administrative (“G&A”) expenses: G&A expenses decreased 4% from 2021 to 2022, primarily driven by reductions in legal expenses related to lawsuit settlements and the exploration of possible strategic alternatives in the prior year. The decrease was also attributed to lower professional fees related to the employee retention tax credit recognized in 2021. As a percentage of revenue, G&A expenses represented 23.2% in 2022 compared to 24.6% in 2021.

Marketing and selling expenses: Marketing and selling expenses increased 14% from 2021 to 2022, primarily driven by higher personnel costs due to the employee retention tax credit recognized in 2021. As a percentage of revenue, marketing and selling expenses represented 12.6% in 2022 compared to 11.3% in 2021.

Income Taxes: During the year ended December 31, 2022, the Company recorded a tax expense of $0.04 million representing a tax rate of (4%) compared to a tax rate of 19% in 2021. For information regarding additional matters related to our taxes, please see Note 5 — "Income Taxes" to the Consolidated Financial Statements included in this Annual Report.

Results for the Year Ended December 31, 2021, Compared to Results for the Year Ended December 31, 2020 (in thousands)

| 2021 |

2020 |

Change |

% |

|||||||||||||

| Revenues |

$ | 24,909 | $ | 21,360 | $ | 3,549 | 17 | % | ||||||||

| Cost of revenues |

14,645 | 16,474 | ( 1,829 | ) | -11 | % | ||||||||||

| Gross profit |

10,264 | 4,886 | 5,378 | 110 | % | |||||||||||

| Operating Expenses: |

||||||||||||||||

| General & administrative |

6,126 | 6,095 | 31 | 1 | % | |||||||||||

| Marketing & selling |

2,799 | 3,577 | ( 778 | ) | -22 | % | ||||||||||

| Research & development |

1,130 | 1,280 | ( 150 | ) | -12 | % | ||||||||||

| Total Operating Expenses |

10,055 | 10,952 | ( 897 | ) | -8 | % | ||||||||||

| Operating income (loss) |

209 | ( 6,066 | ) | 6,275 | 103 | % | ||||||||||

| Other (Expense) Income: |

||||||||||||||||

| Gain on forgiveness of PPP Loan |

2,181 | - | 2,181 | 100 | % | |||||||||||

| Settlements |

( 3,150 | ) | - | ( 3,150 | ) | 100 | % | |||||||||

| Other expense |

( 61 | ) | ( 140 | ) | 79 | -56 | % | |||||||||

| Total Other (Expense) Income |

( 1,030 | ) | ( 140 | ) | ( 890 | ) | 636 | % | ||||||||

| Net loss before benefit from income taxes |

( 821 | ) | ( 6,206 | ) | 5,385 | -87 | % | |||||||||

| Benefit from income taxes |

( 156 | ) | ( 2,347 | ) | 2,191 | -93 | % | |||||||||

| Net loss |

$ | ( 665 | ) | $ | ( 3,859 | ) | $ | 3,194 | -83 | % | ||||||

Revenue: The revenue increase of 17% was primarily due to a 9% increase in volume, compounded by an 8% increase in average revenue per sample, primarily as a result of business mix and increased domestic volumes. Domestic revenues increased by 21% compared to the prior year period, due to an increase in volume and growth in the base business. International revenues decreased by 29% from 2020 to 2021, due to decline in volume from unfavorable market forces in Brazil and the COVID-19 pandemic. See geographic breakdown of revenue above. The Company does not expect any material change in its Brazil driver license business as this market continues to be considerably uncertain.

Gross profit: The 110% increase in gross profit was due to higher sales volume and lower personnel costs. Higher volume and lower personnel costs was the primary factor in the gross profit percentage increase from 23% in 2020 to 41% in 2021. The decrease in lower labor and related costs was primarily due to the recognition of the refundable employee retention tax credits in 2021 and the retention of certain laboratory employees during 2020, to qualify for PPP Loan forgiveness with no offsetting proportional revenue.

General and administrative (“G&A”) expenses: G&A expenses increased 1% from 2020 to 2021, primarily driven by higher legal expenses related to the exploration of possible strategic alternatives in an effort to enhance shareholder value. As a percentage of revenue, G&A expenses represented 24.6% in 2021 compared to 28.5% in 2020.

Marketing and selling expenses: Marketing and selling expenses decreased 22% from 2020 to 2021, primarily driven by cost reduction initiatives; specifically, lower personnel related costs (including less travel and meals) and in addition refundable employee retention tax credits. As a percentage of revenue, marketing and selling expenses represented 11.3% in 2021 compared to 16.7% in 2020.

Income Taxes: During the year ended December 31, 2021, the Company recorded a tax benefit of $0.2 million representing a tax rate of 19% compared to a tax rate of 38% in 2020. For information regarding additional matters related to our taxes, please see Note 5 — "Income Taxes" to the Consolidated Financial Statements included in this Annual Report.

Liquidity and Capital Resources

The Company had $4.8 million and $2.0 million of cash as of December 31, 2022, and 2021, respectively. The Company’s operating activities generated net cash of $4.9 and $0.4 million in 2022 and 2021, respectively. Investing activities used net cash of $0.2 million in both 2022 and 2021. Financing activities used net cash of $1.9 million and $1.0 million in 2022 and 2021, respectively.

Operating cash generated in operations of $4.9 million in 2022 primarily reflected the net loss of $1.1 million adjusted for depreciation and amortization of $2.4 million and stock compensation expense of $0.9 million. Cash generated in operations was also affected by the following changes in assets and liabilities: collection of a tax receivable of $2.3 million, accounts receivable of $0.4 million, prepaid expenses of $0.4 million, and an increase in accrued expenses of $0.7 million. The $4.5 million change in operating cash from a positive $0.4 million in 2021 to a positive $4.9 million in 2022 was primarily driven by the income tax receivable in 2022 and the forgiveness of the PPP loan in 2021.

Operating cash generated in operations of $0.4 million in 2021 primarily reflected the net loss of $0.7 million adjusted for PPP Loan forgiveness of $2.2 million, depreciation and amortization of $2.8 million and stock compensation expense of $0.7 million. Cash generated in operations was also affected by the following changes in assets and liabilities: an increase in accounts receivable of $0.8 million and an increase in accrued expenses of $1.4 million. The $4.5 million change in operating cash from a negative $4.1 million in 2020 to a positive $0.4 million in 2021 was primarily driven by improved operating results in 2021.

Cash used in investing activities primarily reflected the purchase of capital expenditures. Capital expenditures were $0.2 million and $0.2 million in 2022 and 2021, respectively. In both 2022 and 2021, the expenditures related principally to laboratory equipment, machinery, and computer software.

During 2022 and 2021, the Company did not repurchase any shares of common stock for treasury. The Company has authorized 750,000 shares for repurchase since June of 1998, of which 250,000 shares of common stock were authorized in March of 2008 for repurchase. Since 1998, a total of 550,684 shares have been repurchased. The Company distributed cash dividends to its shareholders of $1.2 million in 2022 and $0.3 million in 2021. Cash flows used in financing activities also reflected repayments under the Equipment Loan Arrangement of $0.7 million in both 2022 and 2021.

During the last three consecutive quarters of 2022, the Company’s Board of Directors declared a quarterly cash dividend of $0.07 per common share. In March 2023, the Company announced that the Board of Directors authorized a quarterly cash dividend of $0.07 per share, payable in April 2023. There can be no assurance that the Company will pay dividends in the future. The Company will continue to evaluate the dividend as it moves forward.