BNY

Mellon Massachusetts Fund

Summary Prospectus | August 31, 2021

Class Ticker

A PSMAX

C PCMAX

Z PMAZX

Before you invest, you may want to review the fund's prospectus, which contains more information about the fund and its risks. You can find the fund's prospectus and other information about the fund, including the statement of additional information and most recent reports to shareholders, online at http://im.bnymellon.com/literaturecenter. You can also get this information at no cost by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bnymellon.com. The fund's prospectus and statement of additional information, dated August 31, 2021 (each as revised or supplemented), are incorporated by reference into this summary prospectus.

The fund seeks to maximize current income exempt from federal income tax and from Massachusetts state income tax, without undue risk.

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and examples below. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the fund or shares of other funds in the BNY Mellon Family of Funds that are subject to a sales charge. More information about sales charges, including these and other discounts and waivers, is available from your financial professional and in the Shareholder Guide section beginning on page 22 of the prospectus, in the Appendix on page A-1 of the prospectus and in the How to Buy Shares section and the Additional Information About How to Buy Shares section beginning on page II-1 and page III-1, respectively, of the fund's Statement of Additional Information.

Shareholder Fees (fees paid directly from your investment) | |||||||||

Class A | Class C | Class Z | |||||||

Maximum

sales charge (load) imposed on purchases | 4.50 | none | none | ||||||

Maximum

deferred sales charge (load) | none* | 1.00 | none | ||||||

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||

Class A | Class C | Class Z | |||||||

Management fees | .55 | .55 | .55 | ||||||

Distribution (12b-1) fees | none | .75 | none | ||||||

Other expenses: | |||||||||

Shareholder services fees | .25 | .25 | .00** | ||||||

Miscellaneous other expenses | .23 | 1.06 | .21 | ||||||

Total other expenses | .48 | 1.31 | .21 | ||||||

Total annual fund operating expenses | 1.03 | 2.61 | .76 | ||||||

*Class A shares bought without an initial sales charge as part of an investment of $1 million or more may be charged a deferred sales charge of 1.00% if redeemed within one year. | |||||||||

**Amount represents less than .01%.

Example

The Example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the fund for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that the fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

1 Year | 3 Years | 5 Years | 10 Years | |

Class A (with or without redemption at end of period) | $550 | $763 | $993 | $1,653 |

Class C (with redemption at end of period) | $364 | $811 | $1,385 | $2,944 |

Class C (without redemption at end of period) | $264 | $811 | $1,385 | $2,944 |

Class Z (with or without redemption at end of period) | $78 | $243 | $422 | $942 |

Portfolio Turnover

The fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the fund's performance. During the most recent fiscal year, the fund's portfolio turnover rate was 13.31% of the average value of its portfolio.

To pursue its goal, the fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in municipal bonds that provide income exempt from federal and Massachusetts state income taxes. Municipal bonds are debt securities or other obligations issued by states, territories and possessions of the United States and the District of Columbia and their political subdivisions, agencies and instrumentalities, or multistate agencies and authorities, and certain other specified securities.

The fund invests at least 70% of its assets in municipal bonds rated, at the time of purchase, investment grade (i.e., Baa/BBB or higher) or the unrated equivalent as determined by BNY Mellon Investment Adviser, Inc. For additional yield, the fund may invest up to 30% of its assets in municipal bonds rated below investment grade ("high yield" or "junk" bonds) or the unrated equivalent as determined by BNY Mellon Investment Adviser, Inc. The dollar-weighted average maturity of the fund's portfolio normally exceeds ten years, but the fund may invest without regard to maturity. A bond's maturity is the length of time until the principal must be fully repaid with interest. Dollar-weighted average maturity is an average of the stated maturities of the bonds held by the fund, based on their dollar-weighted proportions in the fund.

The fund's portfolio managers focus on identifying undervalued sectors and securities. To select municipal bonds for the fund, the portfolio managers use fundamental credit analysis to estimate the relative value and attractiveness of various sectors and securities and actively trade among various sectors based on their apparent relative values.

Although the fund seeks to provide income exempt from federal and Massachusetts state income taxes, income from some of the fund's holdings may be subject to the federal alternative minimum tax.

An investment in the fund is not a bank deposit. It is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. It is not a complete investment program. The fund's share price fluctuates, sometimes dramatically, which means you could lose money.

· Municipal securities risk. The amount of public information available about municipal securities is generally less than that for corporate equities or bonds. Special factors, such as legislative changes, and state and local economic and business developments, may adversely affect the yield and/or value of the fund's investments in municipal securities. Other factors include the general conditions of the municipal securities market, the size of the particular offering, the maturity of the obligation and the rating of the issue. Changes in economic, business or political conditions relating to a particular municipal project, municipality, or state, territory or possession of the United States in which the fund invests may have an impact on the fund's share price. In addition, the cost associated with combating the outbreak of COVID-19 and its negative impact on tax revenues has adversely affected the financial condition of many state and local governments. The effects of this outbreak could affect the ability of state and local governments to make payments on debt obligations when due and could adversely impact the value of their bonds, which could negatively impact the performance of the fund.

· Interest rate risk. Prices of bonds and other fixed rate fixed-income securities tend to move inversely with changes in interest rates. Typically, a rise in rates will adversely affect fixed-income securities and, accordingly, will cause the value of the fund's investments in these securities to decline. During periods of very low interest rates, which occur from time to time due to market forces or actions of governments and/or their central banks, including the Board of Governors of the Federal Reserve System in the U.S., the fund may be subject to a greater risk of principal decline from rising interest rates. When interest rates fall, the fund's investments in new securities may be at lower yields and may reduce the fund's income. Very low or negative

BNY Mellon Massachusetts Fund Summary | 2 |

interest rates may magnify interest rate risk. Interest rates in the United States currently are at or near historic lows due to market forces and actions of the Board of Governors of the Federal Reserve System in the U.S., primarily in response to the COVID-19 pandemic and resultant market disruptions. Changing interest rates, including rates that fall below zero, may have unpredictable effects on markets, may result in heightened market volatility and may detract from fund performance. The magnitude of these fluctuations in the market price of fixed-income securities is generally greater for securities with longer effective maturities and durations because such instruments do not mature, reset interest rates or become callable for longer periods of time. Unlike investment grade bonds, however, the prices of high yield ("junk") bonds may fluctuate unpredictably and not necessarily inversely with changes in interest rates.

· Credit risk. Failure of an issuer of a security to make timely interest or principal payments when due, or a decline or perception of a decline in the credit quality of the security, can cause the security's price to fall. The lower a security's credit rating, the greater the chance that the issuer of the security will default or fail to meet its payment obligations.

· High yield securities risk. High yield ("junk") securities involve greater credit risk, including the risk of default, than investment grade securities, and are considered predominantly speculative with respect to the issuer's ability to make principal and interest payments. These securities are especially sensitive to adverse changes in general economic conditions, to changes in the financial condition of their issuers and to price fluctuation in response to changes in interest rates.

· Liquidity risk. When there is little or no active trading market for specific types of securities, it can become more difficult to sell the securities in a timely manner at or near their perceived value. In such a market, the value of such securities and the fund's share price may fall dramatically. The secondary market for certain municipal bonds tends to be less well developed or liquid than many other securities markets, which may adversely affect the fund's ability to sell such municipal bonds at attractive prices. Investments that are illiquid or that trade in lower volumes may be more difficult to value. The market for below investment grade securities may be less liquid and therefore these securities may be harder to value or sell at an acceptable price, especially during times of market volatility or decline.

· State-specific risk. The fund is subject to the risk that Massachusetts' economy, and the revenues underlying its municipal obligations, may decline. Investing primarily in the municipal obligations of a single state makes the fund more sensitive to risks specific to that state and may entail more risk than investing in the municipal obligations of multiple states as a result of potentially less diversification.

· Non-diversification risk. The fund is non-diversified, which means that the fund may invest a relatively high percentage of its assets in a limited number of issuers. Therefore, the fund's performance may be more vulnerable to changes in the market value of a single issuer or group of issuers and more susceptible to risks associated with a single economic, political or regulatory occurrence than a diversified fund.

· Management risk. The investment process used by the fund's portfolio managers could fail to achieve the fund's investment goal and cause your fund investment to lose value.

· Market risk. The value of the securities in which the fund invests may be affected by political, regulatory, economic and social developments, and developments that impact specific economic sectors, industries or segments of the market. In addition, turbulence in financial markets and reduced liquidity in equity, credit and/or fixed-income markets may negatively affect many issuers, which could adversely affect the fund. Global economies and financial markets are becoming increasingly interconnected, and conditions and events in one country, region or financial market may adversely impact issuers in a different country, region or financial market. These risks may be magnified if certain events or developments adversely interrupt the global supply chain; in these and other circumstances, such risks might affect companies world-wide. Recent examples include pandemic risks related to COVID-19 and aggressive measures taken world-wide in response by governments, including closing borders, restricting international and domestic travel, and the imposition of prolonged quarantines of large populations, and by businesses, including changes to operations and reducing staff.

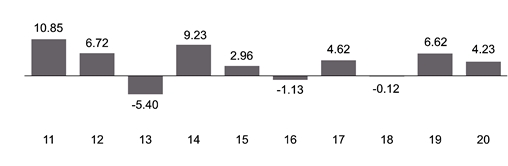

The following bar chart and table provide some indication of the risks of investing in the fund. The bar chart shows changes in the performance of the fund's Class A shares from year to year. Sales charges, if any, are not reflected in the bar chart, and, if those charges were included, returns would have been less than those shown. The table compares the average annual total returns of the fund's shares to those of a broad measure of market performance. The fund's past performance (before and after taxes) is not necessarily an indication of how the fund will perform in the future. More recent performance information may be available at www.im.bnymellon.com.

BNY Mellon Massachusetts Fund Summary | 3 |

Year-by-Year

Total Returns as of 12/31 each year (%) | |

| Best

Quarter Worst Quarter |

The year-to-date total return of the fund's Class A shares as of June 30, 2021 was 1.15%. | |

After-tax performance is shown only for Class A shares. After-tax performance of the fund's other share classes will vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor's tax situation and may differ from those shown, and the after-tax returns shown are not relevant to investors who hold their shares through U.S. tax-deferred arrangements such as 401(k) plans or individual retirement accounts. Returns after taxes on distributions and sale of fund shares may be higher than returns before taxes or returns after taxes on distributions due to an assumed tax benefit from losses on a sale of the fund's shares at the end of the period.

Average Annual Total Returns (as of 12/31/20) | ||||

Class | 1 Year | 5 Years | 10 Years | |

Class A returns before taxes | -0.42% | 1.85% | 3.27% | |

Class A returns after taxes on distributions | -0.49% | 1.84% | 3.25% | |

Class A returns after taxes on distributions and sale of fund shares | 0.59% | 1.95% | 3.16% | |

Class C returns before taxes | 0.80% | 1.61% | 2.76% | |

Class Z returns before taxes | 4.51% | 3.04% | 3.99% | |

Bloomberg U.S. Municipal Bond Index | 5.21% | 3.91% | 4.63% | |

The fund's investment adviser is BNY Mellon Investment Adviser, Inc. (BNYM Investment Adviser).

Thomas Casey and Daniel Rabasco, CFA are the fund's primary portfolio managers, positions they have held since May 2011 and October 2014, respectively. Mr. Casey is a director and senior portfolio manager for tax-sensitive strategies at Mellon Investments Corporation (Mellon), an affiliate of BNYM Investment Adviser. Mr. Rabasco is a managing director and Head of Municipal Bonds at Mellon. Messrs. Casey and Rabasco also are employees of BNYM Investment Adviser.

In general, for each share class, the fund's minimum initial investment is $1,000 and the minimum subsequent investment is $100. Class Z shares generally are not available for new accounts. You may sell (redeem) your shares on any business day by calling 1-800-373-9387 (inside the U.S. only) or by visiting www.im.bnymellon.com. If you invested in the fund through a third party, such as a bank, broker-dealer or financial adviser, you may mail your request to sell shares to BNY Mellon Institutional Department, P.O. Box 9882, Providence, Rhode Island 02940-8082. If you invested directly through the fund, you may mail your request to sell shares to BNY Mellon Shareholder Services, P.O. Box 9879, Providence, Rhode Island 02940-8079. If you are an Institutional Direct accountholder, please contact your BNY Mellon relationship manager for instructions.

The fund anticipates that dividends paid by the fund generally will be exempt from federal and Massachusetts state income taxes. However, the fund may realize and distribute taxable income and capital gains from time to time as a result of the fund's normal investment activities.

BNY Mellon Massachusetts Fund Summary | 4 |

If you purchase shares through a broker-dealer or other financial intermediary (such as a bank), the fund's distributor and its related companies may pay the intermediary for the sale of fund shares and related services. To the extent that the intermediary may receive lesser or no payments in connection with the sale of other investments, the payments from the fund's distributor and its related companies may create a potential conflict of interest by influencing the broker-dealer or other intermediary and your financial representative to recommend the fund over the other investments. This potential conflict of interest may be addressed by policies, procedures or practices adopted by the financial intermediary. As there may be many different policies, procedures or practices adopted by different intermediaries to address the manner in which compensation is earned through the sale of investments or the provision of related services, the compensation rates and other payment arrangements that may apply to a financial intermediary and its representatives may vary by intermediary. Ask your financial representative or visit your financial intermediary's website for more information.

This prospectus does not constitute an offer or solicitation in any state or jurisdiction in which, or to any person to whom, such offering or solicitation may not lawfully be made.

BNY Mellon Massachusetts Fund Summary | 5 |

This page has been left intentionally blank.

BNY Mellon Massachusetts Fund Summary | 6 |