EXHIBIT 10.1

AGREEMENT OF LEASE

between

ASHLEY AVENUE ASSOCIATES I, LLC

and

AXOGEN CORPORATION

TABLE OF CONTENTS

|

BASIC PROVISIONS |

|

|

DEFINITIONS |

|

|

ARTICLE 1 |

DEMISE OF PREMISES AND COMMENCEMENT DATE |

|

ARTICLE 2 |

COMMON AREAS |

|

ARTICLE 3 |

RENT |

|

ARTICLE 4 |

SECURITY |

|

ARTICLE 5 |

ASSIGNMENT AND SUBLETTING |

|

ARTICLE 6 |

REPAIRS, MAINTENANCE AND UTILITIES |

|

ARTICLE 7 |

COMPLIANCE WITH LAW |

|

ARTICLE 8 |

ALTERATIONS |

|

ARTICLE 9 |

INSURANCE |

|

ARTICLE 10 |

DAMAGE AND DESTRUCTION; EMINENT DOMAIN |

|

ARTICLE 11 |

RENT ABATEMENT |

|

ARTICLE 12 |

QUIET POSSESSION |

|

ARTICLE 13 |

DEFAULT; REMEDIES AND DAMAGES |

|

ARTICLE 14 |

UNAVOIDABLE DELAYS, FORCE MAJEURE |

|

ARTICLE 15 |

NOTICES |

|

ARTICLE 16 |

ACCESS |

|

ARTICLE 17 |

SIGNS |

|

ARTICLE 18 |

END OF TERM |

|

ARTICLE 19 |

HOLDING OVER |

|

ARTICLE 20 |

INDEMNITY |

|

ARTICLE 21 |

SUBORDINATION |

|

ARTICLE 22 |

CERTIFICATES |

|

ARTICLE 23 |

PARKING SPACES; USE OF EXTERIOR AREAS |

|

ARTICLE 24 |

WAIVER PROVISIONS |

|

ARTICLE 25 |

MISCELLANEOUS |

2

THIS AGREEMENT OF LEASE (this “Lease”) is made and entered into as of this 26 day of October, 2018, by and between ASHLEY AVENUE ASSOCIATES I, LLC, a Delaware limited liability company, having its principal office at c/o Denholtz Management Corp., 14 Cliffwood Avenue, Suite 200, Matawan, New Jersey 07747 (“Landlord”) and AXOGEN CORPORATION, a Delaware corporation, having an address at 13631 Progress Boulevard, Suite 400, Alachua, FL 32615 (“Tenant”).

NOW, THEREFORE, in consideration of the terms, covenants and conditions herein set forth, Landlord and Tenant hereby covenant and agree as follows:

The following Basic Provisions and Definitions are incorporated into and made a part of this Lease:

|

BASIC PROVISIONS |

||||

|

|

|

|

||

|

(1) |

Complex: |

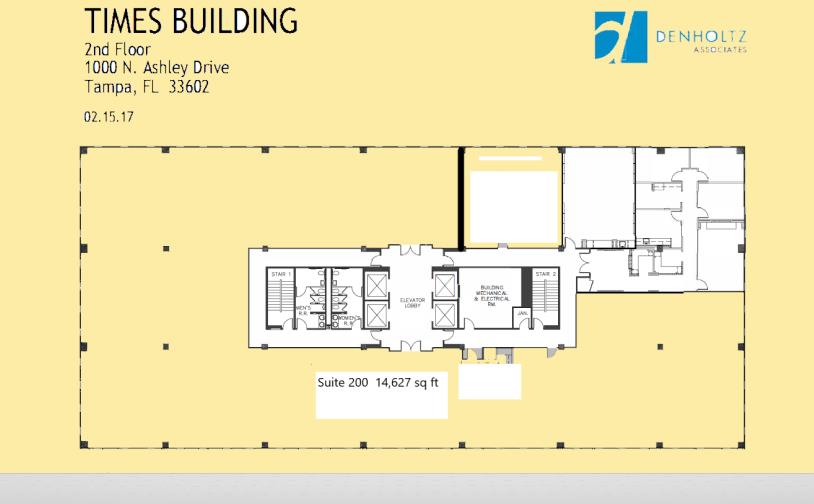

1000 N. Ashley Drive, Tampa, Florida |

||

|

|

|

|

||

|

(2) |

Building: |

1000 N. Ashley Drive, Tampa, FL 33602 |

||

|

|

|

|

||

|

(3) |

Premises: |

Suite 200, consisting of approximately 14,647 Square Feet |

||

|

|

|

|

||

|

(4) |

Permitted Use: |

Office |

||

|

|

|

|

||

|

(5) |

Estimated Commencement Date: |

December 1, 2018 |

||

|

|

|

|

||

|

(6) |

Expiration Date: |

The last day of the twenty-fourth (24th) Lease Month |

||

|

|

|

|

||

|

(7) |

Term: |

The twenty-four (24) month period beginning on the Commencement Date and ending on the Expiration Date, unless sooner terminated or extended as provided elsewhere in this Lease |

||

|

|

|

|

||

|

(8) |

Security: |

$67,786.32, adjustable based on Landlord review of Tenant financials |

||

|

|

|

|

||

|

(9) |

Base Rent: |

Period |

Annual Base Rent |

Monthly Base Rent |

|

|

|

Lease Months 1 through 12 |

$380,822.00 |

$31,735.17 |

|

|

|

Lease Months 13 through 24 |

$392,246.66 |

$32,687.22 |

|

|

|

|

||

|

(10) |

Base Year: |

Calendar year 2019 |

||

|

|

|

|

||

|

(11) |

Tenant's Percentage: |

Initially 8.12%, subject to adjustment per terms of the Lease |

||

|

|

|

|

||

|

(12) |

Sales Tax: |

Tenant shall remain liable for the payment of sales tax applicable to the laws of the State of Florida |

||

|

|

|

|

||

|

(13) |

Tenant's Address: |

AxoGen Corporation |

||

|

|

|

1000 N. Ashley Drive |

||

|

|

|

Suite No. 200 |

||

|

|

|

Tampa, FL 33602 |

||

|

|

|

|

||

|

(14) |

Landlord's Address: |

For notices and correspondence: |

||

|

|

|

c/o Denholtz Management Corp. |

||

|

|

|

14 Cliffwood Avenue |

||

|

|

|

Suite 200 |

||

|

|

|

Matawan, NJ 07747 |

||

3

|

|

|

For payment of Rent: CHECKS PAYABLE TO Ashley Avenue Associates I, LLC |

||

|

|

|

REFERENCE NO.: 2000018344691 |

||

|

|

|

|

||

|

|

|

VIA U.S. MAIL: |

||

|

|

|

Ashley Avenue Associates I, LLC |

||

|

|

|

P.O. Box 863975 |

||

|

|

|

Orlando, FL 32886-3975 |

||

|

|

|

|

||

|

|

|

VIA SPECIAL OR OVERNIGHT COURIER: |

||

|

|

|

Ashley Avenue Associates I, LLC – 863975 |

||

|

|

|

Wholesale Lockbox |

||

|

|

|

11050 Lake Underhill Road |

||

|

|

|

Orlando, FL 32825 |

||

|

|

|

|

||

|

|

|

WIRING INSTRUCTIONS: |

||

|

|

|

Name: Ashley Avenue Associates I, LLC |

||

|

|

|

Acct #: 2000018344691 |

||

|

|

|

ABA Routing #: 031201467 |

||

|

|

|

Bank Name: Wells Fargo Bank |

||

|

|

|

Charlotte, NC |

||

|

|

|

Reference Tenant name and account number |

||

|

|

|

|

||

|

(15) |

Broker: |

Cushman & Wakefield and Newmark Knight Frank |

||

|

|

|

|

||

|

(16) |

Exhibits: |

The following exhibits annexed hereto are hereby incorporated herein and made a part hereof: |

||

|

|

|

|

||

|

|

|

Exhibit A |

- |

Site Plan |

|

|

|

Exhibit B |

- |

Floor Plan |

|

|

|

Exhibit C |

- |

Rules & Regulations |

|

|

|

Exhibit D |

- |

Landlord's Work |

|

|

|

Exhibit E |

- |

Termination Option |

|

|

|

Exhibit F |

- |

Tenant Contact Form |

4

DEFINITIONS

(1) “Additional Rent” means any and all sums due or becoming due pursuant to the terms of this Lease for any reason with the exception of Base Rent, including, without limitation, attorneys fees and court costs.

(2) “Alteration(s)” means any and all installations, changes, additions or improvements to the Premises made by or at the request of Tenant, other than the Landlord's Work.

(3) “Base Operating Expenses” means the Operating Expenses incurred by Landlord in the Base Year.

(4) “Base Taxes” means the Taxes incurred by Landlord in the Base Year.

(5) “Building” means the building designated in the Basic Provisions section of this Lease.

(6) “Commencement Date” means the earlier to occur of (i) the day on which possession of the Premises is delivered to Tenant ready for occupancy, or (ii) the day Tenant or anyone claiming under or through Tenant first occupies the Premises.

(7) “Common Areas” means those portions of the Complex and services which are generally available to any and all of the owners, tenants or users of the Complex and the business invitees of such owners, tenants or users.

(8) “Complex” means the Building, the Common Areas and any other improvements on that certain developed parcel of real property designated as “Complex” in the Basic Provisions section of this Lease and as shown on Exhibit A.

(9) “Fee Mortgagee” means any person or entity which has a mortgage against the Complex or Building.

(10) “Governmental Authorities” means all federal, state, county and municipal governments and appropriate departments, commissions, boards, subdivisions, and officers thereof.

(11) “Hazardous Materials” means any substances, materials, wastes, pollutants and the like which are defined as hazardous or toxic in, and/or regulated by (or become defined in and/or regulated by), any Legal Requirements.

(12) “HVAC System” means the heating, air conditioning and ventilation systems, and all component parts of such systems, installed by Landlord for the purpose of supplying ventilation, heat and/or cooling to the Premises, excluding any supplemental units servicing the Premises in whole or part.

(13) “Interest Rate” means the Prime Rate (hereinafter defined) plus five percent (5%).

(14) “Landlord’s Work” – See Exhibit D

(15) “Lease” means this lease as same may be amended, modified, extended or renewed.

(16) “Lease Month” means each calendar month commencing (i) on the Commencement Date if the Commencement Date falls on the first day of a calendar month, or (ii) if the Commencement Date is not the first day of a calendar month, on the first day of the month following the Commencement Date with the first Lease Month to include the initial partial calendar month in which the Commencement Date falls.

(17) “Legal Requirements” means any and all applicable laws and ordinances and the orders, rules, regulations and requirements of all Governmental Authorities which may be applicable to the Lease or Hazardous Materials.

(18) “Operating Expense(s)” means any and all amounts incurred by Landlord in any calendar year in connection with Landlord's responsibilities under this Lease and/or to operate, manage, maintain and repair the Complex, including, without limitation, (i) wages, salaries and worker's compensation (including employee benefits and unemployment and social security taxes and insurance) of staff performing services in connection with the Complex, and (ii) management fees (not to exceed five percent (5%) of all Rent collected by Landlord from all tenants in the Complex).

(19) “Personalty” means any and all personal property of any type (including, without limitation, inventory, fixtures, equipment, machinery and vehicles) belonging to Tenant and located in or about the Building, the Premises and/or the Complex.

5

(20) “Premises” means the portion of the Building designated in the Basic Provisions section of this Lease, as shown on Exhibit B.

(21) “Prime Rate” means the prime interest rate for short term (90 day) unsecured loans as published from time to time by the Wall Street Journal.

(22) “Repair(s)” means any and all maintenance, repairs, replacements, alterations and additions required to maintain the Premises and/or the Complex to the standard to which similar properties are maintained in the community in which the Complex is located.

(23) “Rent” means any and all Base Rent and/or Additional Rent.

(24) “Rules and Regulations” - means the Rules and Regulations set out in Exhibit C, subject to the provisions of Section 25.1.

(25) “Security” means the amount specified in the Basic Provisions, subject to the provisions of Article 4.

(26) “Square Feet” refers to the total number of square feet of floor area of all floors in the Building, including any mezzanine or basement space, as measured from the exterior faces of the exterior walls and/or the center line of any common walls. The Square Feet of the Premises shall conclusively be the number of Square Feet indicated in the Basic Provisions, which number includes a factor which takes into account the Common Areas.

(27) “Taking” means a legal transfer of ownership and/or possession, whether temporary or permanent, for any public or quasi‑public use by any lawful power or authority by exercise of the right of condemnation or eminent domain or by agreement between Landlord and those having the authority to exercise such right.

(28) “Taxes” means any and all real estate taxes and general, special and betterment assessments, incurred by Landlord as owner of the Complex in any calendar year, including, without limitation, all water and sewer charges, and any taxes, fees and charges imposed in lieu of or in addition to the foregoing due to a future change in the method of taxation. Nothing contained in this Lease shall require Tenant to pay any estate, inheritance, succession, corporate franchise or income tax of Landlord, nor shall any of same be deemed Taxes, except to the extent same are substituted in lieu of other forms of Taxes. Any Taxes for a calendar tax year only a part of which is included within the Term, shall be adjusted between Landlord and Tenant on the basis of a 365‑day year as of the Commencement Date or the Expiration Date or sooner termination of the Term, as the case may be, for the purpose of computing Tenant's Tax Payment.

(29) “Tenant's Percentage” means the number of Square Feet within the Premises divided by the number of Square Feet within the Building. Landlord shall proportionally increase or decrease Tenant's Percentage if the number of Square Feet in the Building increases or decreases due to additional development, subdivision, demolition, condemnation, or similar reasons.

(30) “Vesting Date” means the date of vesting of title or transfer of possession, whichever is earlier, if the Complex, Building, Premises or any portion thereof is the subject of a Taking.

(31) “Year End Reconciliation” means an itemized statement of the difference, if any, between (i) the Tax Payment due and the actual amount of Estimated Tax Payments made by Tenant for the preceding calendar year and (ii) the Operating Expense Payment due and the actual amount of Estimated Operating Expense Payment made by Tenant for the preceding calendar year.

6

ARTICLE 1 DEMISE OF PREMISES AND COMMENCEMENT DATE

Section 1.1 Demise. Landlord is the owner of the Complex and hereby leases the Premises to Tenant for the Term. Tenant hereby takes the Premises from Landlord, subject to all liens, encumbrances, easements, restrictions, covenants, zoning laws and regulations affecting and governing the Premises. Tenant shall use the Premises for the Permitted Use and for no other use or purpose. Tenant shall have access to the Premises 24 hours per day, 365 days per year.

Section 1.2 Delivery and Acceptance. Upon substantial completion of the Landlord's Work, as set forth in Exhibit D, Landlord shall deliver, and Tenant shall accept delivery and possession of the Premises. The Premises shall be delivered in “broom clean”, but otherwise in “AS IS, WHERE IS” condition. If the Premises are not ready for Tenant's occupancy at the time of the Estimated Commencement Date, Landlord shall have no liability to Tenant for any delay and this Lease shall not be affected thereby, except that the Commencement Date shall be the actual date of delivery of possession of the Premises to Tenant. Upon entering into possession of the Premises, Tenant shall conclusively be deemed to have accepted the Premises in its then “AS IS, WHERE IS” condition, including, without limitation, as regards the title thereto, the nature, condition and usability thereof, and the use or uses to which the Premises may be put, and shall be deemed to have assumed all risk, if any, resulting from any patent defects and from the failure of the Premises to comply with all Legal Requirements applicable thereto. Except as specifically provided in Exhibit D, Landlord shall not be required to perform any work to prepare the Premises for Tenant's intended use. Landlord agrees to provide verbal notice to Tenant approximately twenty (20) calendar days prior to the anticipated substantial completion of the Landlord’s Work. Upon receipt of such notice, Tenant and its agents, shall be permitted access to the Premises, on advance notice to Landlord, for the sole and limited purpose of the installation of Tenant’s communications and/or computer cabling and wiring (but not computers, telephones, furniture or to conduct any business) (the “Tenant Installation”). The Tenant Installation shall be completed at no cost or expense to Landlord and at Tenant’s sole risk. Landlord shall have no obligation to Tenant for any loss or damage to the Tenant Installation unless such loss or damage shall be the result of the gross negligence or willful misconduct of Landlord, its agents, servants or employees. Tenant agrees to indemnify and hold Landlord harmless from any loss or damages (including reasonable attorneys’ fees) caused by Tenant, its agents, servants and employees and resulting from the entry into the Premises pursuant to the provisions of this Section.

Section 1.3 Commencement Date Letter. After determination of the Commencement Date, Landlord may send Tenant a commencement letter confirming the Commencement Date, the Expiration Date and any other variable terms of the Lease. The commencement letter, which may be delivered by regular mail, shall become a part of this Lease and shall be binding on Tenant and Landlord if Tenant does not give Landlord notice of its disagreement with any of the provisions of such commencement letter within ten (10) days after the date of such letter.

ARTICLE 2 COMMON AREAS

Section 2.1 Use of Common Areas. Beginning on the Commencement Date, Tenant shall have the nonexclusive right to the use of the Common Areas in common with others.

Section 2.2 Complex and Building. Provided Landlord makes commercially reasonable efforts to avoid interfering with Tenant's use and occupancy of the Premises, Landlord shall have the right (i) to add to, or subtract from, the Common Areas, the Complex and/or the Building as Landlord may elect and Tenant shall not be entitled to any compensation as a result thereof, nor shall same be deemed an actual or constructive eviction, (ii) to erect, use and maintain pipes, ducts, shafts and conduits in and through the Premises, and (iii) to temporarily close any part of the Common Areas for such time as may be required to prevent a dedication thereof or an accrual of any rights in any person or in the public generally therein, or when necessary for the maintenance or repair thereof, or for such other reason as Landlord in its judgment may deem necessary or advisable.

ARTICLE 3 RENT

Section 3.1 Rent.

(a) All payments of Rent shall be paid to or on behalf of Landlord in lawful money of the United States, without prior demand or notice. All payments of Rent shall be delivered to Landlord at the address set forth in this Lease or to any other place designated by Landlord. Tenant's obligation to pay Rent accruing or on account of any time period during the Term shall survive the Expiration Date. Notwithstanding the foregoing, if Tenant fails to timely pay Rent, then any late payment of Rent shall be paid by Tenant to Landlord in good and immediately payable funds, meaning certified funds, including but not limited to a bank check, a cashier’s check, or cash in the form of lawful currency of the United States

7

(b) The first full monthly installment of Base Rent shall be paid to Landlord simultaneous with execution of this Lease by Tenant. Thereafter, Base Rent shall be paid in equal monthly installments in advance on or before the first day of each month during the Term.

(c) Except as otherwise expressly and specifically provided to the contrary in this Lease, no abatement, diminution or reduction of Rent shall be claimed by or allowed to Tenant, or any persons or entities claiming under Tenant, under any circumstances for any cause or reason.

Section 3.2 Tenant’s Tax Payment and Operating Expense Payment

(a) Tenant shall pay to Landlord, as Additional Rent: (i) a portion of all Taxes in excess of the Base Taxes (“Tax Payment”), and (ii) a portion of all Operating Expenses in excess of the Base Operating Expenses (“Operating Expense Payment”). Tenant’s Tax Payment shall be equal to the product of (the Taxes allocated to the Building less the Base Taxes) multiplied by Tenant’s Percentage. Tenant’s Operating Expense Payment shall be equal to the product of (the Operating Expenses allocated to the Building less the Base Operating Expenses) multiplied by Tenant’s Percentage.

(b) In each calendar year after the Base Year, Landlord, at its option, shall have the right to require Tenant to pay, on a monthly basis as Additional Rent, an “Estimated Tax Payment” and an “Estimated Operating Expense Payment”. The Estimated Tax Payment shall be equal to the product of Landlord’s reasonable estimate of the actual Taxes for the current year minus the Base Taxes multiplied by Tenant’s Percentage and divided by the number of months remaining in the year. The Estimated Operating Expense Payment shall be equal to the product of Landlord’s reasonable estimate of the actual Operating Expenses for the current year minus the Base Operating Expenses multiplied by Tenant’s Percentage and divided by twelve (12).

(c) After the end of each calendar year after the Base Year, Landlord shall furnish to Tenant a Year End Reconciliation Statement. Within thirty (30) days after Tenant’s receipt of a Year End Reconciliation, Tenant shall pay to Landlord the net deficiency, if any, set out in the Year End Reconciliation. If the Year End Reconciliation shows an overpayment of Estimated Tax and/or Estimated Operating Expense Payments, such overpayment shall be credited to Tenant against the next monthly installment or installments of Rent due from Tenant, or shall be refunded to Tenant if such excess relates to the calendar year in which the Term expires.

(d) Every Year End Reconciliation shall be conclusive and binding upon Tenant; however, if Tenant disputes or disagrees with any Year End Reconciliation, Tenant shall have the right to undertake a review (“Tenant’s Review”) of Landlord’s books used to determine Tenant’s Tax Payment and Operating Expense Payment upon the following terms and conditions:

(i) Tenant shall deliver notice (“Review Notice”) to Landlord, in writing, of such dispute or disagreement no later than thirty (30) days after receipt of the Year End Reconciliation to be verified.

(ii) Tenant’s Review shall be conducted only by (i) the Tenant, or (ii) an agent of the Tenant that is not being compensated by Tenant on a contingent fee basis. Tenant’s Review shall be conducted during regular business hours at the office where Landlord maintains its books.

(iii) The Review shall commence no later than thirty (30) days after the date of delivery of the Review Notice and shall be completed within five (5) business days after commencement.

(iv) A copy of the results of the Tenant’s Review shall be delivered to Landlord within thirty (30) days after completion of the Tenant’s Review. If the results of the Tenant’s Review are not timely delivered to Landlord, then the Year End Reconciliation shall be deemed to have been approved and accepted by Tenant as correct.

(v) Tenant’s Review shall be limited strictly to those items in the Year End Reconciliation that Tenant has specifically identified in the Review Notice. Tenant shall not be entitled to inspect books or records that apply to any calendar year other than the year covered by the subject Year End Reconciliation.

(vi) Tenant acknowledges and agrees that any records reviewed constitute confidential information of Landlord which shall not be disclosed to anyone other than the auditor performing Tenant’s Review and the principals of Tenant. Tenant further acknowledges and agrees that the disclosure of information to any other person, whether by Tenant or anyone acting on behalf of Tenant, shall cause irreparable harm to Landlord and may be the basis of legal action by Landlord against Tenant and/or the auditor performing Tenant’s Review. Tenant shall be responsible for any breach of this provision by the entity conducting Tenant’s Review.

8

(e) Landlord shall have thirty (30) days to review the results of Tenant’s Review. Thereafter, if Landlord and Tenant have not reached agreement regarding the Year End Reconciliation, Tenant shall submit the dispute to arbitration pursuant to this Lease. The decision of the arbitrator shall be binding upon both parties (“Binding Year End Reconciliation”).

(f) Pending the determination of such dispute by agreement or arbitration, Tenant shall pay Rent or accept credit in accordance with the Year End Reconciliation and such payment or acceptance shall be without prejudice to Tenant’s position. If the Binding Year End Reconciliation shows a deficiency above the payment made by Tenant pending determination of the arbitration, within fifteen (15) days after Tenant’s receipt of the Binding Year End Reconciliation, Tenant shall pay to Landlord the net deficiency. If the Binding Year End Reconciliation shows an overpayment of Estimated Tax and/or Estimated Operating Expense Payments above the credit already issued to Tenant, the net credit to Tenant shall be made against the next monthly installment or installments of Rent due from Tenant, or shall be refunded to Tenant if such excess relates to the calendar year in which the Term expires.

(g) Landlord may elect to contest the amount or validity of assessed valuation or Taxes for any real estate fiscal year, in which event Taxes shall be deemed to include any fees and/or expenses incurred by Landlord in contesting or appealing Taxes and Tenant shall pay Tenant’s Percentage of said fees as indicated in the Year End Reconciliation. Any refund of tax as a result of said appeal shall be included in the Year End Reconciliation. Tenant shall cooperate with Landlord, execute any and all documents required in connection with said appeal.

(h) In addition to Tenant’s Tax Payment, Tenant shall pay, before delinquent, any and all taxes and assessments (i) levied against fixtures, equipment, signs and personal property located or installed in, about or upon the Premises; (ii) on account of any rent, income or other payments received by Tenant or anyone claiming by, through or under Tenant; (iii) arising out of the use or occupancy of the Premises and this transaction, or any document to which Tenant is a party creating or transferring an interest or estate in the Premises and (iv) imposed by any Governmental Authority as sales or use tax.

Section 3.3 Late Charge. If any Rent is not paid to Landlord within five (5) days after its due date, a late charge equal to ten percent (10%) of the then late payment shall be automatically due from Tenant to Landlord (“Late Charge”). The Late Charge is in compensation of Landlord's additional costs of processing late payments.

ARTICLE 4 SECURITY

(a) Tenant has, simultaneously with the execution hereof, deposited with Landlord the Security for the faithful performance and observance by Tenant of the terms of this Lease. Landlord may retain, use, or apply the whole or part of the Security to the extent required for payment of any: (i) Rent; (ii) loss or damage that Landlord may suffer by reason of an Event of Default by Tenant including, without limitation, any damages incurred by Landlord or deficiency resulting from the re-letting of the Premises, whether such damages or deficiency accrues before or after summary proceedings or other reentry by Landlord; (iii) costs incurred by Landlord in connection with the cleaning or repair of the Premises upon expiration or earlier termination of this Lease. Landlord shall not be obligated to apply the Security and the Landlord's right to bring an action or special proceeding to recover damages or otherwise to obtain possession of the Premises before or after Landlord's declaration of the termination of this Lease for nonpayment of Rent or for any other reason shall not be affected by reason of the fact that Landlord holds the Security. The Security will not be a limitation on the Landlord's damages or other rights and remedies available under this Lease, or at law or equity; nor shall the Security be a payment of liquidated damages or advance of the Rent or any component thereof.

(b) If Landlord uses, applies, or retains all or any portion of the Security, Tenant will restore the Security to its original amount immediately upon written demand from Landlord. Tenant's failure to strictly comply with this requirement shall be an Event of Default.

(c) Subject to applicable Legal Requirements and requirements of Landlord's lender(s), Landlord may commingle the Security with its own funds. Landlord shall not be required to keep the Security in an interest-bearing account. Upon expiration or earlier termination of the Lease, Landlord will return the Security to the then current Tenant and Landlord shall be deemed released by Tenant from all liability for the return of the Security. If any part of Landlord's property of which the Premises forms a part is sold, leased or otherwise legally transferred (including to a mortgagee upon foreclosure of its mortgage), Landlord shall transfer the Security to the successor entity, and, upon such transfer, Landlord shall be deemed released by Tenant from all liability for the return of the Security; and Tenant shall look solely to the Landlord's successor for the return of the Security.

(d) The Security shall not be mortgaged, assigned, or encumbered by Tenant, and neither Landlord nor its successors or assigns shall be bound by any such mortgage, assignment or encumbrance.

9

(e) If Tenant fully and faithfully complies with all of the terms, covenants, conditions and provisions of this Lease, Landlord shall, within sixty (60) days after the later of the Expiration Date and the date of surrender of possession of the Premises to Landlord in accordance with this Lease, return to Tenant the Security, or such portion thereof as shall then remain, less an estimated amount due for any unpaid Operating Expense Payment and/or Tax Payment.

ARTICLE 5 ASSIGNMENT AND SUBLETTING

Section 5.1 Assignment and Subletting.

(a) Except as otherwise set out in this Article, Tenant shall not mortgage, encumber or assign its interest in this Lease or sublet all or any part of the Premises without the prior written consent of Landlord, which consent shall not be unreasonably withheld, conditioned or delayed.

(b) Landlord's consent to any one assignment or sublease will not act as a waiver of the requirement of obtaining the Landlord's consent to any subsequent assignment or sublease.

(c) Should Tenant wish to assign this Lease or sublet any portion of the Premises, Tenant shall submit to Landlord a written request (“Tenant's Request”) for Landlord's consent to such assignment or subletting. Tenant's Request shall include, at a minimum, the name and address of the proposed assignee or subtenant, the proposed use of the Premises, financial statements of the proposed assignee or sublessee in form satisfactory to Landlord, a copy of the proposed assignment or sub-lease and any other documentation reasonably required by Landlord.

(d) Notwithstanding anything contained in this Lease to the contrary, Landlord shall not be obligated to consider any request by Tenant to consent to any proposed assignment of this Lease or sublet of all or any part of the Premises unless (i) Tenant is current in payment of Rent, and (ii) each request by Tenant is accompanied by a nonrefundable fee payable to Landlord in the amount of Five Hundred and 00/100 Dollars ($500.00) to cover Landlord's expenses incurred in processing each Tenant's Request. Neither Tenant's payment nor Landlord's acceptance of the said fee shall be construed to impose any obligation whatsoever upon Landlord to consent to Tenant's Request. Landlord shall have the right to charge Tenant an additional or higher fee in the event the processing of the proposed assignment or subletting shall require more than two (2) hours to negotiate and/or draft the necessary documents.

(e) Landlord and Tenant agree that any one of the following factors will be reasonable grounds for declining the Tenant's request:

(i) financial strength of the proposed subtenant/assignee is not of the strength Landlord would require of any prospective tenant for similar properties in the Complex as of the date of the request;

(ii) business reputation of the proposed subtenant/assignee is not in accordance with generally acceptable commercial standards and the businesses of other tenants in the Complex;

(iii) the proposed subtenant/assignee is an existing tenant or occupant of the Complex, or a person or entity with whom Landlord is then dealing with regard to leasing space in the Complex, or with whom Landlord has had any dealings within the past six months with regard to leasing space in the Complex;

(iv) use of the Premises will violate the exclusive right(s) of any other tenant of the Complex, any other agreements affecting the Premises, the Landlord or other tenants.

(f) If Tenant sublets all or part of the Premises, for a net consideration (i.e. all rent and other forms of income or payment to Tenant from the subtenant less all actual, reasonable and necessary brokerage commissions and other costs incurred by Tenant in obtaining a subtenant) which is in excess of the Rent accruing under the Lease during the term of the sublease, then Tenant shall pay to Landlord, as Additional Rent, fifty percent (50%) of such excess consideration.

Section 5.2 Change of Control. Excluding the sale of corporate shares held by the general public and traded through a nationally recognized stock exchange, the sale, assignment, transfer or other disposition of any of the issued and outstanding capital stock of Tenant (or of any successor or assignee of Tenant which is a corporation), or of the interest of any general partner in a partnership constituting Tenant hereunder, or of the interest of any member of a limited liability company, joint venture, syndicate or other group which may collectively constitute Tenant hereunder, shall result in changing the control of Tenant or such other corporation or such partnership, limited liability company, joint venture, syndicate or other group, such sale, assignment, transfer or other disposition shall be deemed an assignment of this Lease. For the purposes of this Section, “control”

10

of any corporation shall be deemed to have changed, if, in one or more transactions, any person or group of persons purchases or otherwise succeeds to more than fifty percent (50%) in the aggregate of the voting power for the election of the Board of Directors of such corporation and “control” of a partnership, a limited liability company, joint venture, syndicate or other group shall be deemed to have changed if, in one or more transactions, any person or group of persons purchases or otherwise succeeds to more than fifty percent (50%) in the aggregate of the general partners' or other active interest in such limited liability company, joint venture, syndicate or other group.

Section 5.3 Continuation of Liability. Regardless of any assignment, subletting or other transfer by Tenant of any of Tenant's rights or obligations under this Lease, Tenant shall continue to be and remain liable hereunder. Any violation of any provision of this Lease, whether by act or omission, by any assignee, subtenant or similar occupant, shall be deemed a violation of such provision by Tenant, it being the intention and meaning of the parties hereto that Tenant shall assume and be liable to the Landlord for any and all acts and omissions of any and all assignees, subtenants and similar occupants.

Section 5.4 Default after Transfer. If the Premises or any part thereof is sublet or occupied by anybody other than Tenant, Landlord may, after an Event of Default by Tenant, and without notice to Tenant collect rent from the assignee, subtenant or occupant, and apply the net amount collected to the Rent due from Tenant, but no such collection shall be deemed an acceptance of the subtenant or occupant as tenant, or a release of Tenant from the further performance by Tenant of the terms of this Lease.

Section 5.5 Recapture. Landlord shall have the right, within forty five (45) days after Landlord's receipt of Tenant's Request, to terminate this Lease on notice (a “Recapture Notice”) to Tenant. If Landlord gives a Recapture Notice, Tenant shall have five (5) calendar days from receipt of such Recapture Notice to rescind, in writing, the Tenant's Request and, upon such rescission, both the Recapture Notice and Tenant's Request shall be deemed withdrawn, null and void. If Tenant's Request is not so rescinded within the permitted time period, then this Lease shall terminate (in whole if Tenant's Request is for an assignment of the Lease or subleasing of all or substantially all of the Premises, or with respect to that part of the Premises which is the subject of a subletting if Tenant's Request is for a subletting of less than substantially all of the Premises) (that portion, whether the whole or a part, of the Premises which is the subject of Tenant's Request is hereinafter referred to as the “Subject Portion”) on the date which is thirty (30) days after the date of the Recapture Notice (the “Surrender Date”). Tenant shall vacate the Subject Portion on or before the Surrender Date and deliver possession of the Subject Portion to Landlord in the condition required by this Lease. Effective as of the Surrender Date, neither Landlord nor Tenant shall have any further obligations under this Lease with respect to the Subject Portion, except for those rights and obligations which survive expiration or termination of the Lease. Effective as of the Surrender Date, all Rent shall be adjusted on a pro rata basis to reflect the reduced size of the Premises, if applicable.

ARTICLE 6 REPAIRS, MAINTENANCE AND UTILITIES

Section 6.1 Tenant’s Obligations.

(a) Except as otherwise provided in this Lease, Tenant shall, at no cost or expense to Landlord: Repair all light fixtures, including any ballasts, and light bulbs;

(b) If the Premises has a point of entry and exit on the exterior of the Building, Tenant shall keep the sidewalk adjoining the Premises free from rubbish, dirt, garbage and other refuse.

(c) All damage to the Premises or Building, or to their fixtures, appurtenances and equipment caused by Tenant, its servants, employees, agents, visitors or licensees, shall be Repaired promptly by Tenant at no cost or expense to Landlord and to Landlord’s reasonable satisfaction. Tenant shall cause all Repairs to be made in a good and workmanlike manner and in accordance with the provisions of this Lease. If after twenty (20) days’ notice Tenant has failed to proceed with due diligence to make the required Repairs the same may be made by Landlord at Tenant’s expense, and any expense incurred by Landlord, for said Repairs shall be paid to Landlord as Additional Rent within ten (10) calendar days after delivery of a bill or statement to Tenant.

(d) Any supplemental HVAC units, whether installed by Landlord or Tenant or left by a previous tenant, and any Tenant installed lighting shall be Tenant’s sole responsibility to maintain and repair. Landlord shall have no obligation to repair, maintain or replace such HVAC units or lighting.

(e) Tenant is required to separate waste in accordance with Legal Requirements.

11

Section 6.2 Landlord’s Obligations and Services.

(a) Landlord agrees to make all Repairs to the structural portions and exterior surfaces of the Building, the roof, the roof gutters, and operate and Repair the Common Areas.

(b) Landlord shall additionally provide the following services to Tenant:

(i) Repair of the interior of the Premises within a reasonable period of time after submission of a request by Tenant, the cost of same being included in Operating Expense.

(ii) Janitorial services and removal and disposal of all trash and other refuse, the cost of same being deemed an Operating Expense. Landlord reserves the right to impose a surcharge on Tenant directly if excessive amounts or unusual types of trash are generated in the Premises.

(iii) Operation and Repair of HVAC System in a manner consistent with the standard to which similar properties are maintained in the area, the cost of same being included in Operating Expenses. Tenant agrees to abide by all regulations and requirements which Landlord may reasonably prescribe for the proper functioning and protection of the HVAC System. Landlord shall have free access to any and all components of the HVAC System; and Tenant agrees that there shall be no construction of partitions or other obstructions which might interfere with Landlord’s full access thereto. Tenant agrees that Tenant, its agents, employees or contractors shall not at any time enter the said enclosures or tamper with, adjust, touch or otherwise in any manner affect the HVAC System.

(c) Tenant acknowledges that Landlord shall not be providing the security which Tenant may require with respect to its Permitted Use(s).

(d) Landlord reserves the right to undertake such Complex-wide Repairs and provide such Complex-wide services as it deems necessary to preserve and promote the good physical condition of the Building and such costs shall be deemed Operating Expenses.

Section 6.3 Utilities.

(a) The following utilities will be made available at the Premises:

(i) (A) Electricity and natural gas, for consumption at normal office levels between the hours of 8:00 A.M. and 6:00 P.M, Monday through Friday, and 8:00 A.M. through 1:00 P.M. on Saturdays. (the “Allowed Utility Usage”) (i.e. customary office lighting, operation of personal computer equipment, fax machines and copiers (“Customary Office Usage”), and for ordinary office heating and cooling), the costs of which have been included as a component of Operating Expenses. Tenant agrees that items above Customary Office Usage, such as a server/computer room, shall be directly metered, at Tenant’s sole cost and expense and that the provisions of Section 6.3(b) of this Lease shall apply to such direct meter.

(B) Landlord may, at any time and from time to time, at no cost or expense to Tenant, survey the estimated use of electricity and/or natural gas in the Premises. If the surveyed usage of electricity and/or natural gas exceeds the Allowed Utility Usage, Tenant shall pay to Landlord, on a monthly basis, an “Excess Utility Charge” equal to one-twelfth (1/12th) of the surveyed usage in excess of the Allowed Utility Usage multiplied by Landlord’s then current actual rate for the utility.

(C) Landlord shall provide a copy of any utility survey to Tenant and the results of such survey shall be deemed binding upon Tenant unless Tenant objects to same within thirty (30) days of the date the survey is delivered to Tenant. If Landlord and Tenant are unable to agree upon the results of a survey, the disagreement shall be submitted to arbitration in accordance with the terms of this Lease. Pending the outcome of such arbitration, the charges to Tenant imposed pursuant to this Section shall be paid by Tenant without prejudice to Tenant’s rights.

(ii) water service, the cost of which shall be included in Operating Expenses.

(iii) sewer service, the cost of which shall be included in Operating Expenses.

(b) Tenant agrees to pay or cause to be paid all charges for utilities of any kind which are billed directly to Tenant, and agrees to indemnify, defend and save Landlord harmless against any liability or damages for such charges.

12

(c) Tenant covenants and agrees that its use of utility services will not exceed either the capacity or maximum load of the utility lines serving the Premises or which may from time to time be prescribed by applicable Governmental Authorities.

(d) Unless the direct and proximate result of the gross negligence or willful misconduct of Landlord, its agents, servants or employees, Landlord shall in no event be liable or responsible to Tenant for any loss, damage or expense which Tenant may sustain or incur if either the quantity or character of utility services is changed or is no longer available or suitable for Tenant’s purposes.

Section 6.4 Overtime Utilities. If Tenant requires air cooling or heating beyond the hours stated in Section 6.3(a)(i)(A) (“Overtime Utilities”), then Overtime Utilities shall be provided by Landlord to Tenant and Tenant shall be obligated to pay Landlord, as Additional Rent, an Overtime Utility Charge, currently billed at $35.00 per hour. Overtime Utility Charges shall be subject to adjustment on 30 days notice to Tenant. The parties agree and acknowledge that the Overtime Utility Charges are billed in two hour increments and not subject to prorating.

ARTICLE 7 COMPLIANCE WITH LAW

Section 7.1 Legal Requirements. Tenant shall, at its expense throughout the Term, promptly comply, or cause compliance, with all Legal Requirements of all Governmental Authorities which may be applicable to the Premises or the use or manner of use thereof.

Section 7.2 Hazardous Materials. Tenant agrees to refrain, and to prevent its employees, invitees, agents, contractors and subtenants, from utilizing or storing any Hazardous Materials in the Complex, except for cleaning fluids and common office supplies in de minimis quantities for normal cleaning use within the Premises which shall be stored in proper containers and in compliance with Legal Requirements. Tenant hereby covenants and agrees to indemnify, defend and hold Landlord harmless from and against any and all claims, actions, administrative proceedings, judgments, damages, penalties, costs, expenses, losses and liabilities of any kind or nature that arise (indirectly or directly) from or in connection with the presence (or suspected presence), release (or suspected release), spill (or suspected spill) or discharge (or suspected discharge) of any Hazardous Materials in, on or about the Complex at any time resulting from the acts or omissions of Tenant, its subtenants or their respective employees, agents or contractors. Without limiting the generality of the foregoing, the indemnity set forth above shall specifically cover any investigation, monitoring and remediation costs.

ARTICLE 8 ALTERATIONS

Section 8.1 Permitted Alterations. Tenant shall be permitted to make any Alteration(s) which (i) are not structural in nature and/or do not affect the structural portions of the Building, (ii) do not exceed Ten Thousand Dollars ($10,000.00) in the aggregate during the Term and (iii) do not require any permit or other form of legal authority (collectively, “Permitted Alterations”). Any and all other Alterations shall require the prior written consent of Landlord, which consent shall not be unreasonably withheld.

Section 8.2 Requirements.

(a) All Alterations, including Permitted Alterations, shall be made at no cost or expense to Landlord.

(b) Tenant shall submit to Landlord a copy of any plans and specifications prepared in connection with any Alteration except Permitted Alterations (including layout, architectural, mechanical and structural drawings).

(c) Before commencing any Alteration, Tenant shall provide, or shall cause its contractor to provide, any necessary and appropriate riders for fire and extended coverage, and commercial general liability and property damage insurance, covering the risks during the course of such Alteration and obtain and pay for all necessary permits and authorizations. Landlord agrees to join in the application for such permits or authorizations upon request of Tenant if necessary provided Landlord is promptly reimbursed for any filing or other costs, fees or expenses incurred and Tenant otherwise indemnifies Landlord for all losses, costs, claims and expenses incurred by Landlord in connection therewith.

(d) All Alterations shall be made with reasonable diligence, in a good and workmanlike manner, by contractor(s) approved by Landlord in Landlord's sole discretion and in compliance with all applicable Legal Requirements. Upon completion, Tenant shall obtain and deliver to Landlord any necessary amendment to the certificate of occupancy.

13

Section 8.3. Ownership. All Alterations shall remain the property of Tenant and shall be removed by Tenant upon expiration or earlier termination of the Lease. Notwithstanding the foregoing, Tenant may request Landlord's consent to abandon any Alteration(s) provided such request is submitted to Landlord, in the form of a Notice, prior to commencing the Alteration. Landlord may grant or withhold its consent to such request in Landlord's sole discretion and failure of the Landlord to respond to such request shall be deemed a denial. Any Alteration abandoned by Tenant with Landlord's consent shall immediately become the sole property of Landlord.

ARTICLE 9 INSURANCE

Section 9.1 Tenant's Coverages.

(a) Commencing with the Commencement Date and throughout the Term, Tenant shall, at Tenant's cost and expense, provide and cause to be maintained:

(i) commercial general liability insurance (including contractual liability coverage) issued on an occurrence basis, insuring against claims for bodily injury, death or property damage that may arise from or be occasioned by (x) the condition, use or occupancy of the Premises, the sidewalks adjacent thereto, and the loading docks and other appurtenances, or (y) any act, omission or negligence of Tenant, its subtenants, or their respective contractors, licensees, agents, servants, employees, invitees or visitors; such insurance to afford minimum protection of not less than $3,000,000.00 combined single limit per occurrence. The liability insurance requirements hereunder may be reviewed by Landlord every two (2) years for the purpose of increasing (in consultation with their respective insurance advisors) the minimum limits of such insurance from time to time to limits which shall be reasonable and customary for similar facilities of like size and operation in accordance with generally accepted insurance industry standards;

(ii) commercial property insurance (including coverages against loss or damage by fire, lightning, windstorm, hail, explosion, vandalism and malicious mischief, riot and civil commotion, smoke and all other perils now or hereafter included in extended coverage endorsements) covering Tenant's merchandise, inventory, trade fixtures, furnishings, equipment and leasehold improvements for the full replacement value on an agreed amount basis, including all items of personal property of Tenant located on, in or about the Premises, in an amount equal to one-hundred percent (100%) of the actual replacement cost thereof (with provisions for a deductible as shall be reasonable in comparison with similar properties);

(iii) business interruption insurance in such amounts as will reimburse Tenant for direct and indirect loss of earnings attributable to those events commonly insured against by reasonably prudent tenants and/or attributable to Tenant's inability to access or occupy all or part of the Premises; and

(iv) during performance of any Alteration, Tenant shall maintain Worker's Compensation, public liability and builder's risk form of casualty insurance in amounts appropriate to the status of the construction being performed by Tenant. In addition, all contractors working on behalf of Tenant shall provide evidence of coverage, equal to the requirements of Tenant, and in the case of the public liability and builder's risk form of casualty insurance policies, naming Landlord as an additional insured.

(b) If Tenant fails to maintain the required insurance the same may be purchased by Landlord at Tenant's expense, and any expense therefor incurred by Landlord, with interest thereon at the Interest Rate, shall be paid to Landlord as Additional Rent after receipt of a bill or statement.

(c) All insurance policies required to be maintained by Tenant pursuant to this Article shall be effected under policies issued by insurers which are permitted to do business in the State where the Complex is situated and rated “A/VIII” by A.M. Best Company, or any successor thereto. Tenant shall provide to Landlord, and to any Fee Mortgagee, certificates of the policies required to be maintained pursuant to this Lease. Each such policy shall contain a provision that no act or omission of the insured shall affect or limit the obligation of the insurance company to pay the amount of any loss sustained and an agreement by the insurer that such policy shall not be modified or canceled without at least 30 days' prior notice to Landlord and to any Fee Mortgagee.

(d) All policies of insurance provided for under this Article, shall name Tenant as the insured, and except for Workers' Compensation, shall name Landlord and Landlord's managing agent as additional insureds, along with any Fee Mortgagee pursuant to a standard first mortgagee clause, subject in all respects to the terms of this Lease.

(e) Any insurance provided for in this Article may be effected by a blanket policy or policies of insurance, provided that the amount of the total insurance available shall be at least the protection equivalent to separate policies in the amounts

14

herein required, and provided further that in other respects, any such policy or policies shall comply with the provisions of this Article. An increased coverage or “umbrella policy” may be provided and utilized to increase the coverage provided by individual or blanket policies in lower amounts, and the aggregate liabilities provided by all such policies shall be satisfactory provided they otherwise comply with the provisions of this Article.

(f) Each policy carried by Tenant shall be written as a primary policy not contributing with, and not in excess of, coverage carried by Landlord and/or Landlord's managing agent.

Section 9.2 Landlord's Coverages. Commencing with the Commencement Date and throughout the Lease Term, Landlord shall maintain, or cause to be maintained:

(a) commercial property insurance covering the Complex, in an amount equal to one-hundred percent (100%) of the actual replacement cost thereof (exclusive of the cost of excavations, pavement, foundations and footings) with or without provisions for a deductible as shall be reasonable in comparison with similar properties;

(b) commercial general liability insurance (including contractual liability) covering the Common Areas, in an amount not less than $5,000,000 for personal and bodily injury to all persons in any one occurrence and for property damage;

(c) rent insurance, for the benefit of Landlord, covering the risks referred to in Paragraph (a) above, in an amount equal to all Rent payable for a period of twelve (12) months commencing on the date of loss;

(d) if at any time a steam boiler or similar equipment is located in, on or about the Building, a policy insuring against loss or damage due to explosion, rupture or other failure of any boiler, pipes, turbines, engines or other similar types of equipment; and

(e) other coverage as Landlord may reasonably deem necessary and appropriate.

If by reason of failure of Tenant to comply with the provisions of this Lease, including but not limited to the manner in which Tenant uses or occupies the Premises, Landlord's insurance rates shall on the Commencement Date or at any time thereafter be higher than such rates otherwise would be, then Tenant shall reimburse Landlord, as Additional Rent hereunder, for that part of all insurance premiums thereafter paid or incurred by Landlord, which shall have been charged because of such failure or use by Tenant, and Tenant shall make such reimbursement upon the first day of the month following the billing to Tenant of such additional cost by Landlord.

Section 9.3 Waiver of Subrogation. Every insurance policy carried by either party shall include provisions denying to the insurer subrogation rights against the other party and any Fee Mortgagee to the extent such rights have been waived by the insured prior to the occurrence of damage or loss. Each party hereby waives any rights of recovery against the other party for any direct damage or consequential loss covered by said policies against which such party is protected, or required hereunder to be protected, by insurance or (by the inclusion of deductible provisions therein or otherwise) has elected to be self‑insured, to the extent of the proceeds paid under such policies and the amount of any such self‑insurance, whether or not such damage or loss shall have been caused by any acts or omissions of the other party.

ARTICLE 10 DAMAGE AND DESTRUCTION; EMINENT DOMAIN

Section 10.1 Termination Due to Damage or Destruction. If the Premises, or any portion thereof, shall be damaged by fire or other casualty, Tenant shall immediately give Notice thereof to Landlord. If the Building shall be damaged or destroyed to the extent that the estimated cost of repair or restoration of the damage or destruction shall be in excess of twenty five percent (25%) of the replacement cost of the Building, then Landlord shall have the right to terminate this Lease by giving notice of such election to Tenant within sixty (60) days after such damage or destruction shall have occurred. If such notice shall be given, this Lease shall terminate as of the date of Tenant's receipt of such Notice. Landlord shall not be required to restore or rebuild the damaged or destroyed Premises, or any portion thereof, and all insurance proceeds payable on account of such damage or destruction may be retained by Landlord. In case the Building shall be damaged by such fire or other casualty and Landlord estimates that its restoration obligation under this Section will require in excess of one hundred eighty (180) days after the casualty date to complete, Landlord shall give Tenant notice of its estimate of the completion date of such restoration (“Landlord’s Estimate”), and Tenant shall have thirty (30) days after receipt of Landlord’s Estimate to terminate this Lease by notice to Landlord. Landlord’s Estimate shall be delivered to Tenant not more than thirty (30) business days after Landlord’s receipt of notice from Tenant that the damage has occurred, which notice shall include a request for delivery of Landlord’s Estimate pursuant to this paragraph. If Tenant terminates the Lease pursuant to this sub-paragraph, then this Lease and the term and estate hereby granted shall expire as of the last day of the month in which Tenant’s notice is given. If Landlord does not deliver Landlord’s Estimate and Landlord’s restoration

15

obligation under this Section hereof is not completed within one hundred eighty (180) days after the casualty date, Tenant may thereafter terminate this Lease by giving Landlord a termination notice at any time prior to two hundredth (200th) day after the casualty date and prior to the date Landlord completes its restoration obligation under this Section. If such termination notice is given, then this Lease and the term and estate hereby granted shall expire as of the last day of the month in which Tenant’s notice is given.

Section 10.2 Taking.

(a) If a Taking of all or substantially all of the Premises occurs, then this Lease shall terminate as of the Vesting Date. If there is a Taking of less than substantially all of the Premises, then this Lease shall terminate on the Vesting Date with respect to the portion so taken.

(b) If there is a Taking of part of the Complex but none of or less than substantially all of the Premises, Landlord may elect to terminate this Lease if (i) there is any Taking occurring during the last two (2) years of the Term; or (ii) in Landlord's reasonable judgment, it shall not be economically feasible to restore and replace the Building, the Premises, the Common Areas, the Complex or part thereof, to tenantable condition capable of being operated as a mixed use complex in an economical manner. If Landlord elects to terminate this Lease pursuant to this Section, Landlord shall, within one hundred twenty (120) days of the Taking, give notice to Tenant, and the Term shall expire as of the last day of the calendar month in which such Notice is given.

(c) If there is a Taking of more than thirty-three (33%) of the Square Feet of the Premises, Tenant, subject to Landlord's lenders' requirements, may elect to terminate this Lease if, by reason of the Taking there is a prohibition of the use of the Premises for Tenant's actual permitted use thereof. If Tenant elects to terminate this Lease pursuant to this Section, Tenant shall, within one hundred twenty (120) days of the Taking, give Notice to Landlord, and the Term shall expire and come to an end as of the last day of the calendar month in which such Notice is given.

(d) If there is a Taking, then commencing on the Vesting Date, Base Rent shall be the product of (i) Base Rent immediately preceding the Taking, and (ii) a fraction, the numerator of which shall be the number of Square Feet within the Premises remaining after the Taking, and the denominator of which shall be the number of Square Feet within the Premises immediately preceding the Taking.

(e) Tenant shall not be entitled to and hereby waives any and all claims against Landlord for any compensation or damage for loss of use of the Premises, the Common Areas or any portion thereof, for any interruption of services required to be provided by Landlord hereunder, and/or for any inconvenience or annoyance resulting from any damage, destruction, repair or restoration.

(f) All compensation awarded or paid in respect of a Taking shall belong to and be the property of Landlord without any participation by Tenant. Nothing herein shall be construed to preclude Tenant from prosecuting any claim directly against the condemning authority in such condemnation proceeding for moving expenses; any fixtures or equipment owned by Tenant; and the unamortized cost of Tenant's improvements, provided that no such claim shall (x) diminish or otherwise adversely affect Landlord's award or the award of any Fee Mortgagee, or (y) include any value for the leasehold estate created hereby or the unexpired term of this Lease.

Section 10.3 Restoration by Landlord. If the whole or any part of the Premises or Building shall, during the Term, be damaged or destroyed by fire or other casualty, or any portion of the Premises be Taken, and this Lease is not terminated pursuant to the terms hereof, Landlord shall, to the extent of insurance proceeds or award received by Landlord, repair, restore and/or rebuild the Premises and or Building substantially to the condition and character existing as of the Commencement Date. In no event shall Landlord be required to repair or replace any Personalty.

ARTICLE 11 RENT ABATEMENT

(a) For purposes of this Article only, the Premises, or any portion thereof, shall be considered “Untenantable” if Tenant is, in fact, unable to engage in its regular business practices in the Premises due to (i) damage or destruction, (ii) loss of utilities, HVAC or elevator service, which loss is within the ability of Landlord to control, or (iii) a Taking, and (iv) the Premises is not rendered Untenantable by reason of any negligent or willful act of Tenant, its agents, servants or employees.

(b) If all or part of the Premises are rendered Untenantable, Tenant shall, within five (5) business days after the occurrence, notify Landlord that the Premises, or a part thereof, has been rendered Untenantable (a “Rent Abatement Notice”).

16

The Rent Abatement Notice shall be in writing, shall specify (i) the nature of the cause of the Untenantability, (ii) the area(s) of the Premises Tenant claims to be Untenantable and (iii) the date the space became Untenantable. The Rent Abatement Notice shall be delivered to Landlord in the manner required under this Lease for delivery of Notices. If a Rent Abatement Notice is not delivered to Landlord within the time and in the manner set out herein, then Tenant shall be deemed to have waived any right to abatement of Rent.

(c) If the Premises are rendered Untenantable, in whole or in part, for a period of ten (10) or more business days, and the Lease is not terminated pursuant to the provisions hereof then Rent shall abate proportionately to the portion of the Premises rendered Untenantable from the date of the event causing the Untenantability and continuing until the Untenantability is remediated (the “Abatement Period”). However, the necessity for the completion of any repair, restoration or other work to be performed by Tenant shall not provide the basis for abatement of Rent.

(d) Determination of the percentage of Rent to be abated shall be reasonably made by Landlord. If Landlord and Tenant disagree on the extent of the Untenantability of the Premises, an appropriate third-party professional, designated by Landlord and reasonably acceptable to Tenant, shall certify to Landlord and Tenant as to the condition of the Premises (the “Abatement Certification”), which Abatement Certification shall be binding upon both parties. The cost of obtaining the Abatement Certification shall be borne by Tenant and reimbursable to Landlord as Additional Rent.

(e) Upon substantial completion of the remediation of the condition resulting in the Untenantability of the Premises, as reasonably determined by Landlord, the Abatement Period shall terminate. If Landlord and Tenant disagree on the date of substantial completion or the tenantability of any part of the Premises, an appropriate third-party professional, designated by Landlord and reasonably acceptable to Tenant, shall certify to Landlord and Tenant as to the condition of the Premises (the “Restoration Certification”), which Restoration Certification shall be binding upon the parties. The cost of obtaining the Restoration Certification shall be borne by Tenant and reimbursable to Landlord as Additional Rent.

(f) Anything to the contrary notwithstanding, there shall be no abatement of Rent for any portion of the Premises in which Tenant continues to operate its business.

ARTICLE 12 QUIET POSSESSION

Provided no Event of Default remains uncured, Tenant shall have and enjoy, possession and use of the Premises and all appurtenances thereto during the Term, which is quiet and undisturbed by Landlord, subject to the terms of this Lease. This covenant shall be construed as running with Landlord's estate as owner of the Premises and is not, nor shall it operate or be construed as, a personal covenant of Landlord, except to the extent of Landlord's interest in the Premises and shall be binding upon successor owners. Tenant shall not, through its acts or omissions, or the acts or omissions of Tenant's employees, agents, servants or contractors, disturb the quiet possession of any other tenant or occupant of the Building.

ARTICLE 13 DEFAULT; REMEDIES AND DAMAGES

Section 13.1 Events of Default. Each of the following shall be deemed an “Event of Default”:

(a) any failure by Tenant to pay Base Rent on the date it was payable under this Lease, or any failure by Tenant to pay Additional Rent or other sum of money payable under this Lease within five (5) days after notice from Landlord that such payment of Additional Rent or other sum is due;

(b) any interest of Tenant passes to another except as permitted under Article 5;

(c) if proceedings in bankruptcy shall be instituted by or against any Tenant or guarantor of this Lease, or if any Tenant or guarantor of this Lease shall file, or any creditor or other person shall file, any petition in bankruptcy under any law, rule or regulation of the United States of America or of any State, or if a receiver of the business or assets of Tenant or of any guarantor of this Lease shall be appointed, or if a general assignment is made by Tenant for the benefit of creditors, or any sheriff, marshal, constable or other duly constituted public official takes possession of the Premises, or any part thereof, by authority of any attachment or execution proceedings, and offers same for sale publicly, and, with respect to any of the foregoing actions which shall be involuntary on Tenant's part, such action is not vacated or withdrawn within thirty (30) days thereafter;

(d) failure to pay Rent in a timely fashion three (3) or more times in any twelve (12) calendar month period or four (4) or more times during the Term;

17

(e) any other failure by Tenant to perform any of the other terms, of this Lease (for which Notice and/or cure periods are not otherwise set forth in this Lease) for more than twenty (20) days after notice of such default shall have been given to Tenant, or if such default is of such nature that it cannot with due diligence be completely remedied with said period of twenty (20) days such longer period of time as may be reasonably necessary to remedy such default provided Tenant shall commence within said period of twenty (20) days and shall thereafter diligently prosecute to completion, all steps necessary to remedy such default, but in no event more than ninety (90) days after notice of such default shall have been given to Tenant; and

(f) an Event of Default provided for under any other section of this Lease.

Section 13.2 Remedies.

(a) If an Event of Default shall occur, Landlord shall, in addition to any other right or remedy available at law, in equity or otherwise, have the right:

(i) to bring suit for the collection of Rent and/or other amounts for which Tenant may be in default, or for the performance of any other covenant or agreement devolving upon Tenant, all with or without entering into possession or terminating this Lease;

(ii) terminate this Lease and dispossess Tenant and any other occupants thereof, remove their effects not previously removed by them and hold the Premises free of this Lease; or

(iii) without terminating this Lease, re-enter the Premises by summary proceedings and dispossess Tenant and any other occupants thereof, remove their effects not previously removed by them and hold the Premises free of this Lease. No such re‑entry or taking possession of the Premises by Landlord shall be construed as election on its part to terminate this Lease unless a written notice of such intention be given to Tenant or unless such termination is decreed by a court of competent jurisdiction. Landlord may remove all persons and Personalty remaining in the Premises after possession of the Premises has lawfully been returned to Landlord shall be deemed abandoned by Tenant to Landlord. Landlord shall have the right to dispose of the Personalty in any manner Landlord deems appropriate. Tenant agrees to indemnify and hold Landlord harmless from any and all (i) costs and expenses incurred by Landlord for the removal or disposal of the abandoned Personalty, and (ii) claims by third parties for ownership, obligation, payment, debt, loss or damage to any item or items of Personalty so abandoned. The provisions of this Section shall survive the Expiration Date or earlier termination of this Lease;

(b) After such a dispossession or removal, (i) Landlord may re-let the Premises or any part or parts thereof, for a term or terms which may, at the option of Landlord, be less than or exceed the period which would otherwise have constituted the balance of the Term, and (ii) Tenant shall pay to Landlord any deficiency between the Rent due hereunder plus the reasonable costs and expenses incurred or paid by Landlord in terminating this Lease or in re-entering the Premises and in securing possession thereof, as well as the expenses of re-letting the Premises, including, without limitation, repairing, altering and preparing the Premises for new tenants, brokers' commissions, legal fees, and other expenses and concessions (“Default Costs”), and the amount of rents and other charges collected on account of the new lease or leases of the Premises which would otherwise have constituted the balance of the Term (not including any renewal periods, the commencement of which shall not have occurred prior to such dispossession or removal). Landlord reserves the right to bring actions or proceedings for the recovery of any deficits remaining unpaid without being obliged to await the end of the Term for a final determination of Tenant's account, and the commencement or maintenance of any one or more actions or proceedings shall not bar Landlord from bringing other or subsequent actions or proceedings for further accruals pursuant to the provisions of this Section. Any rent received by Landlord from such re-letting shall be applied first to the payment of any indebtedness (other than Rent due hereunder) of Tenant to Landlord; second, to the payment of any Default Costs; third, to the payment of Rent due and unpaid hereunder, and the balance, if any, shall be held by Landlord and applied in payment of future Rent as it may come due and payable hereunder.

(c) If Landlord elects to terminate this Lease, Landlord shall be entitled to recover from Tenant, at Landlord's option, an amount calculated as of the date of such termination equal to the difference, if any, between: (i) the entire amount of the Rent which would become due and payable during the remainder of the Term, discounted to present value using a discount rate equal to the Interest Rate and (ii) the fair rental value of the Premises during the remainder of the Term (taking into account, among other factors, an assessment of future market conditions for the Premises, the probability of reletting the Premises for all or part of the remainder of the Term, the anticipated duration of the period the Premises will be unoccupied prior to reletting and the anticipated cost of reletting the Premises), also discounted to present value using a discount rate equal to the Interest Rate, to be due and payable immediately; it being understood and agreed that such payment shall be and constitute Landlord's liquidated damages, Landlord and Tenant acknowledging and agreeing that it is difficult or impossible to determine the actual damages Landlord would suffer from Tenant's breach hereof and that the agreed upon liquidated damages are not punitive or penalties and are just, fair and reasonable.

18

(d) Landlord agrees to use commercially reasonable efforts to mitigate any damages occasioned by Tenant's default. Tenant agrees that Landlord's duty to mitigate (i) shall arise only after Landlord regains possession of the Premises, (ii) shall be deemed satisfied if Landlord has used commercially reasonable efforts to relet the Premises, whether or not such efforts are successful, and (iii) shall not require Landlord to market the Premises ahead of other space which is vacant or about to become vacant in properties owned by Landlord or its affiliates within five (5) miles of the Premises.

(e) In the event Tenant fails to pay Rent for three (3) or more consecutive months during the Term, Landlord and their respective representatives, may enter the Premises at all times for the purpose of exhibiting same to prospective tenants.

(f) Payments of Rent not received by Landlord when due shall accrue interest at the Interest Rate from the date on which such payment as due until the date full payment (including accrued interest) is received by Landlord.

(g) In addition to the foregoing, if an Event of Default shall occur other than as to the payment of Rent, Landlord, in addition to any other right or remedy available at law or in equity, shall have the right, but not the obligation, to cure such failure. Notwithstanding the above, if, in Landlord's reasonable judgment, an emergency shall exist, Landlord may cure such Event of Default upon such Notice to Tenant as may be reasonable under the circumstances (and may be without any prior notice if the circumstances shall so require). If Landlord cures such failure, Tenant shall pay to Landlord on demand, as Additional Rent, the reasonable and necessary cost or amount thereof, together with interest thereon at the Interest Rate from the date of outlay of expense until payment.

(h) If there is a breach by Tenant, or any persons claiming through or under Tenant, of any term, covenant or condition of this Lease, Landlord shall have the right to enjoin such breach and the right to invoke any other remedy allowed by law or in equity as if re-entry, summary proceedings and other special remedies were not provided in this Lease for such breach.

(i) The right to invoke the remedies set forth herein is cumulative and shall not preclude Landlord from invoking any other remedy allowed at law, in equity or otherwise.

ARTICLE 14 UNAVOIDABLE DELAYS, FORCE MAJEURE

With the exception of Tenant's obligation to pay Rent, if Landlord or Tenant shall be prevented or delayed from punctually performing any obligation or satisfying any condition under this Lease by any strike, lockout, labor dispute or other labor trouble, inability to obtain labor, materials or reasonable substitutes therefor, act of God, weather, soil conditions, site conditions, present or future governmental restrictions, regulation or control, governmental pre-emption or priorities or other conflicts in connection with a national or other public emergency or shortages of fuel, supply of labor resulting therefrom, insurrection, sabotage, fire or other casualty, or any other condition beyond the control of the party required to perform, other than unavailability of funds or financing (individually and collectively “Unavoidable Delays”), then the time to perform such obligation or satisfy such condition shall be extended by the delay caused by such event. If either party shall, as a result of an Unavoidable Delay, be unable to exercise any right or options within any time limit provided therefor in this Lease, such time limit shall be deemed extended for a period equal to the duration of such Unavoidable Delay. This Lease and the obligations of Tenant to pay Rent hereunder and perform all of the other covenants, agreements, terms, provisions and conditions hereunder on the part of Tenant to be performed shall in no way be affected, impaired or excused because Landlord is unable to fulfill any of its obligations under this Lease as a result of any Unavoidable Delay.

ARTICLE 15 NOTICES