axgn-2021123100008059282021FYfalseP3YP17YP30DP17YP7Yhttp://www.axogeninc.com/20191231/20211231#LeaseLiabilityCurrenthttp://www.axogeninc.com/20191231/20211231#LeaseLiabilityCurrenthttp://www.axogeninc.com/20191231/20211231#LeaseLiabilitiesNoncurrenthttp://www.axogeninc.com/20191231/20211231#LeaseLiabilitiesNoncurrenthttp://www.axogeninc.com/20191231/20211231#LeaseLiabilityCurrenthttp://www.axogeninc.com/20191231/20211231#LeaseLiabilityCurrenthttp://www.axogeninc.com/20191231/20211231#LeaseLiabilitiesNoncurrenthttp://www.axogeninc.com/20191231/20211231#LeaseLiabilitiesNoncurrent1 month, 15 days00008059282021-01-012021-12-3100008059282021-06-30iso4217:USD00008059282022-02-22xbrli:shares00008059282021-12-3100008059282020-12-31iso4217:USDxbrli:shares00008059282020-01-012020-12-3100008059282019-01-012019-12-310000805928us-gaap:CommonStockMember2018-12-310000805928us-gaap:AdditionalPaidInCapitalMember2018-12-310000805928us-gaap:RetainedEarningsMember2018-12-3100008059282018-12-310000805928us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310000805928us-gaap:CommonStockMember2019-01-012019-12-310000805928us-gaap:RetainedEarningsMember2019-01-012019-12-310000805928us-gaap:CommonStockMember2019-12-310000805928us-gaap:AdditionalPaidInCapitalMember2019-12-310000805928us-gaap:RetainedEarningsMember2019-12-3100008059282019-12-310000805928us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310000805928us-gaap:CommonStockMember2020-01-012020-12-310000805928us-gaap:RetainedEarningsMember2020-01-012020-12-310000805928us-gaap:CommonStockMember2020-12-310000805928us-gaap:AdditionalPaidInCapitalMember2020-12-310000805928us-gaap:RetainedEarningsMember2020-12-310000805928us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310000805928us-gaap:CommonStockMember2021-01-012021-12-310000805928us-gaap:RetainedEarningsMember2021-01-012021-12-310000805928us-gaap:CommonStockMember2021-12-310000805928us-gaap:AdditionalPaidInCapitalMember2021-12-310000805928us-gaap:RetainedEarningsMember2021-12-310000805928axgn:RestrictedCashMember2020-12-310000805928axgn:RestrictedCashMember2021-12-310000805928us-gaap:StandbyLettersOfCreditMemberaxgn:HeightsUnionMember2021-12-310000805928axgn:AviveSoftTissueMembraneMember2021-01-012021-12-310000805928axgn:OberlandFacilityMemberaxgn:DebtDerivativeLiabilityMember2021-12-31axgn:settlementScenario0000805928axgn:PeriodOneMemberaxgn:OberlandFacilityMemberaxgn:DebtDerivativeLiabilityMember2021-12-31xbrli:pure0000805928axgn:PeriodTwoMemberaxgn:OberlandFacilityMemberaxgn:DebtDerivativeLiabilityMember2021-12-310000805928axgn:PeriodThreeMemberus-gaap:StockOptionMemberaxgn:OberlandFacilityMemberaxgn:DebtDerivativeLiabilityMember2021-12-310000805928axgn:PeriodFourMemberaxgn:OberlandFacilityMemberaxgn:DebtDerivativeLiabilityMember2021-12-310000805928srt:MinimumMember2021-01-012021-12-310000805928srt:MaximumMember2021-01-012021-12-310000805928axgn:OberlandFacilityTrancheOneMember2020-06-300000805928axgn:OberlandFacilityTrancheTwoMember2021-06-300000805928axgn:OberlandFacilityTrancheOneMemberaxgn:DebtDerivativeLiabilityMemberus-gaap:MeasurementInputExpectedTermMember2021-12-310000805928axgn:OberlandFacilityTrancheOneMemberaxgn:DebtDerivativeLiabilityMemberus-gaap:MeasurementInputExpectedTermMember2020-12-310000805928axgn:OberlandFacilityTrancheOneMemberaxgn:MeasurementInputCouponRateMemberaxgn:DebtDerivativeLiabilityMember2021-12-310000805928axgn:OberlandFacilityTrancheOneMemberaxgn:MeasurementInputCouponRateMemberaxgn:DebtDerivativeLiabilityMember2020-12-310000805928axgn:OberlandFacilityTrancheOneMemberus-gaap:MeasurementInputDiscountRateMemberaxgn:DebtDerivativeLiabilityMember2021-12-310000805928axgn:OberlandFacilityTrancheOneMemberus-gaap:MeasurementInputDiscountRateMemberaxgn:DebtDerivativeLiabilityMember2020-12-310000805928axgn:OberlandFacilityTrancheOneMemberaxgn:MandatoryPrepaymentEventBefore2024Memberaxgn:MeasurementInputMandatoryPrepaymentRateMemberaxgn:DebtDerivativeLiabilityMember2021-12-310000805928axgn:OberlandFacilityTrancheOneMemberaxgn:MandatoryPrepaymentEventBefore2024Memberaxgn:MeasurementInputMandatoryPrepaymentRateMemberaxgn:DebtDerivativeLiabilityMember2020-12-310000805928axgn:OberlandFacilityTrancheOneMemberaxgn:MandatoryPrepaymentEventIn2024OrAfterMemberaxgn:MeasurementInputMandatoryPrepaymentRateMemberaxgn:DebtDerivativeLiabilityMember2021-12-310000805928axgn:OberlandFacilityTrancheOneMemberaxgn:MandatoryPrepaymentEventIn2024OrAfterMemberaxgn:MeasurementInputMandatoryPrepaymentRateMemberaxgn:DebtDerivativeLiabilityMember2020-12-310000805928axgn:OberlandFacilityTrancheOneMemberaxgn:MeasurementInputMandatoryPrepaymentRateMemberaxgn:OptionalPrepaymentEventMemberaxgn:DebtDerivativeLiabilityMember2021-12-310000805928axgn:OberlandFacilityTrancheOneMemberaxgn:MeasurementInputMandatoryPrepaymentRateMemberaxgn:OptionalPrepaymentEventMemberaxgn:DebtDerivativeLiabilityMember2020-12-310000805928axgn:OberlandFacilityTrancheTwoMemberaxgn:DebtDerivativeLiabilityMemberus-gaap:MeasurementInputExpectedTermMember2021-12-310000805928axgn:MeasurementInputCouponRateMemberaxgn:OberlandFacilityTrancheTwoMemberaxgn:DebtDerivativeLiabilityMember2021-12-310000805928us-gaap:MeasurementInputDiscountRateMemberaxgn:OberlandFacilityTrancheTwoMemberaxgn:DebtDerivativeLiabilityMember2021-12-310000805928axgn:MandatoryPrepaymentEventBefore2024Memberaxgn:MeasurementInputMandatoryPrepaymentRateMemberaxgn:OberlandFacilityTrancheTwoMemberaxgn:DebtDerivativeLiabilityMember2021-12-310000805928axgn:MandatoryPrepaymentEventIn2024OrAfterMemberaxgn:MeasurementInputMandatoryPrepaymentRateMemberaxgn:OberlandFacilityTrancheTwoMemberaxgn:DebtDerivativeLiabilityMember2021-12-310000805928axgn:MeasurementInputMandatoryPrepaymentRateMemberaxgn:OberlandFacilityTrancheTwoMemberaxgn:OptionalPrepaymentEventMemberaxgn:DebtDerivativeLiabilityMember2021-12-310000805928us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2021-12-310000805928us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310000805928us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310000805928us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310000805928us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2021-12-310000805928us-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310000805928us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310000805928us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310000805928us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel1Member2021-12-310000805928us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2021-12-310000805928us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2021-12-310000805928us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2021-12-310000805928us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2021-12-310000805928us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310000805928us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310000805928us-gaap:FairValueMeasurementsRecurringMember2021-12-310000805928us-gaap:FairValueMeasurementsRecurringMemberaxgn:DebtDerivativeLiabilityMemberus-gaap:FairValueInputsLevel1Member2021-12-310000805928us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberaxgn:DebtDerivativeLiabilityMember2021-12-310000805928us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberaxgn:DebtDerivativeLiabilityMember2021-12-310000805928us-gaap:FairValueMeasurementsRecurringMemberaxgn:DebtDerivativeLiabilityMember2021-12-310000805928us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2020-12-310000805928us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310000805928us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310000805928us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310000805928us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2020-12-310000805928us-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310000805928us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310000805928us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310000805928us-gaap:BondsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2020-12-310000805928us-gaap:FairValueInputsLevel2Memberus-gaap:BondsMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310000805928us-gaap:FairValueInputsLevel3Memberus-gaap:BondsMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310000805928us-gaap:BondsMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310000805928us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel1Member2020-12-310000805928us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2020-12-310000805928us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2020-12-310000805928us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2020-12-310000805928us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2020-12-310000805928us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310000805928us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310000805928us-gaap:FairValueMeasurementsRecurringMember2020-12-310000805928us-gaap:FairValueMeasurementsRecurringMemberaxgn:DebtDerivativeLiabilityMemberus-gaap:FairValueInputsLevel1Member2020-12-310000805928us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberaxgn:DebtDerivativeLiabilityMember2020-12-310000805928us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberaxgn:DebtDerivativeLiabilityMember2020-12-310000805928us-gaap:FairValueMeasurementsRecurringMemberaxgn:DebtDerivativeLiabilityMember2020-12-310000805928us-gaap:FairValueInputsLevel3Memberaxgn:CommonStockDerivativeOptionLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310000805928us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberaxgn:DebtDerivativeLiabilityMember2019-12-310000805928us-gaap:FairValueInputsLevel3Memberaxgn:CommonStockDerivativeOptionLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2020-01-012020-12-310000805928us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberaxgn:DebtDerivativeLiabilityMember2020-01-012020-12-310000805928us-gaap:FairValueInputsLevel3Memberaxgn:CommonStockDerivativeOptionLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310000805928us-gaap:FairValueInputsLevel3Memberaxgn:CommonStockDerivativeOptionLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2021-01-012021-12-310000805928us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberaxgn:DebtDerivativeLiabilityMember2021-01-012021-12-310000805928us-gaap:FairValueInputsLevel3Memberaxgn:CommonStockDerivativeOptionLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310000805928axgn:OberlandFacilityMember2021-12-310000805928axgn:OberlandFacilityMember2020-12-310000805928axgn:FurnitureAndOfficeEquipmentMember2021-12-310000805928axgn:FurnitureAndOfficeEquipmentMember2020-12-310000805928us-gaap:LeaseholdImprovementsMember2021-12-310000805928us-gaap:LeaseholdImprovementsMember2020-12-310000805928us-gaap:EquipmentMember2021-12-310000805928us-gaap:EquipmentMember2020-12-310000805928us-gaap:LandMember2021-12-310000805928us-gaap:LandMember2020-12-310000805928us-gaap:ConstructionInProgressMember2021-12-310000805928us-gaap:ConstructionInProgressMember2020-12-310000805928us-gaap:PatentsMember2021-12-310000805928us-gaap:PatentsMember2020-12-310000805928us-gaap:LicensingAgreementsMember2021-12-310000805928us-gaap:LicensingAgreementsMember2020-12-310000805928us-gaap:TrademarksMember2021-12-310000805928us-gaap:TrademarksMember2020-12-310000805928us-gaap:LicensingAgreementsMembersrt:MinimumMember2021-01-012021-12-310000805928us-gaap:LicensingAgreementsMembersrt:MaximumMember2021-01-012021-12-310000805928srt:MaximumMemberus-gaap:PatentsMember2021-01-012021-12-3100008059282019-01-012019-01-310000805928axgn:PatentsAndLicenseAgreementsMember2021-12-310000805928us-gaap:LicensingAgreementsMember2021-01-012021-12-310000805928us-gaap:SellingAndMarketingExpenseMember2021-01-012021-12-310000805928us-gaap:SellingAndMarketingExpenseMember2020-01-012020-12-310000805928us-gaap:SellingAndMarketingExpenseMember2019-01-012019-12-310000805928axgn:OberlandFacilityTrancheOneMember2021-12-310000805928axgn:OberlandFacilityTrancheOneMember2020-12-310000805928axgn:OberlandFacilityTrancheTwoMember2021-12-310000805928axgn:OberlandFacilityTrancheTwoMember2020-12-310000805928axgn:OberlandFacilityMember2020-06-302020-06-300000805928axgn:OberlandFacilityMember2021-06-300000805928axgn:OberlandFacilityMember2021-01-012021-12-310000805928axgn:OberlandFacilityMember2020-06-300000805928us-gaap:LondonInterbankOfferedRateLIBORMemberaxgn:OberlandFacilityMember2020-06-302020-06-300000805928axgn:OberlandFacilityMember2020-01-012020-12-310000805928us-gaap:StockOptionMemberaxgn:OberlandFacilityMember2020-06-300000805928us-gaap:StockOptionMemberaxgn:OberlandFacilityMember2021-01-012021-12-310000805928us-gaap:StockOptionMember2020-12-100000805928us-gaap:StockOptionMemberaxgn:OberlandFacilityMember2020-12-102020-12-100000805928axgn:TPCInvestmentsIILPAWhollyOwnedSubsidiaryOfOberlandCapitalMemberus-gaap:StockOptionMember2020-12-100000805928axgn:EachOfThirdAndFourthQuarterOf2020Memberaxgn:OberlandFacilityMember2020-06-302020-06-300000805928axgn:EachOfTheFirstAndSecondQuarterOf2021Memberaxgn:OberlandFacilityMember2020-06-302020-06-300000805928axgn:EachQuarterAfterTheSecondQuarterOf2021Memberaxgn:OberlandFacilityMember2020-06-302020-06-300000805928axgn:DebtDerivativeLiabilityMember2020-06-300000805928axgn:OberlandFacilityTrancheTwoMemberaxgn:DebtDerivativeLiabilityMember2021-06-300000805928axgn:OberlandFacilityTrancheOneMemberaxgn:DebtDerivativeLiabilityMember2021-06-300000805928us-gaap:StockOptionMember2020-06-300000805928axgn:PaycheckProtectionProgramLoanMember2020-04-230000805928us-gaap:StandbyLettersOfCreditMember2021-03-31axgn:plan0000805928axgn:Axogen2019LongTermIncentivePlanNewAxogenPlanMember2021-05-102021-05-100000805928axgn:Axogen2019LongTermIncentivePlanNewAxogenPlanMember2021-05-100000805928axgn:Axogen2019LongTermIncentivePlanNewAxogenPlanMember2019-08-142021-05-100000805928axgn:Axogen2019LongTermIncentivePlanNewAxogenPlanMember2019-08-140000805928axgn:Axogen2019LongTermIncentivePlanNewAxogenPlanMember2021-12-310000805928us-gaap:EmployeeStockOptionMember2021-01-012021-12-310000805928us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310000805928us-gaap:ShareBasedCompensationAwardTrancheThreeMemberaxgn:AxoGen2010StockIncentivePlanMemberus-gaap:EmployeeStockOptionMember2021-01-012021-12-310000805928axgn:AxoGen2010StockIncentivePlanMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:EmployeeStockOptionMember2021-01-012021-12-310000805928axgn:AxoGen2010StockIncentivePlanMemberus-gaap:EmployeeStockOptionMember2021-01-012021-12-310000805928us-gaap:ShareBasedCompensationAwardTrancheOneMemberaxgn:Axogen2017EmployeeStockPurchasePlanMemberus-gaap:EmployeeStockOptionMember2021-01-012021-12-310000805928axgn:Axogen2017EmployeeStockPurchasePlanMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:EmployeeStockOptionMember2021-01-012021-12-310000805928axgn:Axogen2017EmployeeStockPurchasePlanMemberus-gaap:EmployeeStockOptionMember2021-01-012021-12-310000805928axgn:Axogen2017EmployeeStockPurchasePlanMemberaxgn:DirectorsAndOfficersStockOptionsMember2021-01-012021-12-310000805928axgn:ShareBasedCompensationAwardTrancheFourMemberaxgn:DirectorsAndOfficersStockOptionsMember2021-01-012021-12-310000805928srt:MinimumMemberaxgn:AxoGen2010StockIncentivePlanMember2021-01-012021-12-310000805928srt:MaximumMemberaxgn:AxoGen2010StockIncentivePlanMember2021-01-012021-12-310000805928us-gaap:EmployeeStockOptionMember2020-01-012020-12-310000805928us-gaap:EmployeeStockOptionMember2019-01-012019-12-310000805928axgn:DirectorsAndCertainExecutiveOfficersMemberus-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310000805928axgn:DirectorsAndCertainExecutiveOfficersMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310000805928axgn:RestrictedAndPerformanceStockUnitsMember2019-12-310000805928axgn:RestrictedAndPerformanceStockUnitsMember2019-01-012019-12-310000805928axgn:RestrictedAndPerformanceStockUnitsMember2020-01-012020-12-310000805928axgn:RestrictedAndPerformanceStockUnitsMember2020-12-310000805928axgn:RestrictedAndPerformanceStockUnitsMember2021-01-012021-12-310000805928axgn:RestrictedAndPerformanceStockUnitsMember2021-12-310000805928us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310000805928us-gaap:RestrictedStockUnitsRSUMember2019-01-012019-12-310000805928us-gaap:PerformanceSharesMember2021-01-012021-12-310000805928axgn:PerformanceSharesBiologicLicenseApplicationMember2019-12-170000805928axgn:PerformanceSharesBiologicLicenseApplicationMember2021-12-310000805928us-gaap:ShareBasedCompensationAwardTrancheOneMemberaxgn:PerformanceSharesBiologicLicenseApplicationMember2019-12-172019-12-170000805928us-gaap:ShareBasedCompensationAwardTrancheOneMemberaxgn:PerformanceSharesBiologicLicenseApplicationMember2018-12-272018-12-270000805928axgn:PerformanceSharesBiologicLicenseApplicationMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2018-12-272018-12-270000805928axgn:PerformanceSharesBiologicLicenseApplicationMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2019-12-172019-12-170000805928axgn:TwoThousandSeventeenPerformanceShareUnitMemberTwoThousandSeventeenPerformanceShareUnitMember2017-12-180000805928axgn:TwoThousandSeventeenPerformanceShareUnitMemberTwoThousandSeventeenPerformanceShareUnitMember2017-12-182017-12-180000805928axgn:TwoThousandSeventeenPerformanceShareUnitMemberTwoThousandSeventeenPerformanceShareUnitMember2020-01-012020-03-310000805928axgn:TwoThousandEighteenPerformanceShareUnitMember2018-12-270000805928axgn:TwoThousandEighteenPerformanceShareUnitMember2020-01-012020-12-310000805928axgn:TwoThousandTwentyPerformanceShareUnitMember2020-03-160000805928axgn:TwoThousandTwentyPerformanceShareUnitMember2020-06-012020-06-300000805928axgn:TwoThousandTwentyPerformanceShareUnitMember2020-10-012020-12-310000805928axgn:TwoThousandTwentyPerformanceShareUnitMember2021-07-012021-09-300000805928axgn:TwoThousandTwentyPerformanceShareUnitMember2020-07-170000805928axgn:TwoThousandTwentyPerformanceShareUnitMember2020-07-012020-07-310000805928axgn:TwoThousandTwentyOnePerformanceShareUnitMember2021-03-160000805928axgn:TwoThousandTwentyOnePerformanceShareUnitMembersrt:MinimumMember2021-03-162021-03-160000805928srt:MaximumMemberaxgn:TwoThousandTwentyOnePerformanceShareUnitMember2021-03-162021-03-160000805928axgn:TwoThousandTwentyOnePerformanceShareUnitMember2021-10-012021-12-310000805928us-gaap:PerformanceSharesMember2021-12-310000805928axgn:Axogen2017EmployeeStockPurchasePlanMember2021-01-012021-12-310000805928axgn:Axogen2017EmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMember2021-01-012021-12-310000805928axgn:Axogen2017EmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMember2020-01-012020-12-310000805928axgn:Axogen2017EmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMember2019-01-012019-12-310000805928axgn:Axogen2017EmployeeStockPurchasePlanMember2021-12-310000805928axgn:Axogen401kPlanMember2021-01-012021-12-310000805928axgn:Axogen401kPlanMemberaxgn:Axogen401kPlanEmployerMatchingContributionTranche1Member2021-01-012021-12-310000805928axgn:Axogen401kPlanMemberaxgn:Axogen401kPlanEmployerMatchingContributionTranche2Member2021-01-012021-12-310000805928axgn:Axogen401kPlanMember2020-01-012020-12-310000805928axgn:Axogen401kPlanMember2019-01-012019-12-310000805928axgn:CorporateHeadquartersFacilityMember2007-02-06utr:sqft0000805928axgn:CorporateHeadquartersFacilityMember2021-07-130000805928axgn:HeightsUnionMember2021-12-310000805928axgn:HeightsUnionMember2020-08-280000805928axgn:HeightsUnionMember2020-08-282020-08-280000805928axgn:BurlesonFacilityMember2020-10-010000805928us-gaap:SubsequentEventMemberaxgn:BurlesonFacilityMember2022-01-270000805928axgn:CommunityTissuesServicesAgreementMember2015-08-062015-08-060000805928axgn:CommunityTissuesServicesAgreementMember2021-01-012021-12-310000805928axgn:CommunityTissuesServicesAgreementMember2020-01-012020-12-310000805928axgn:CommunityTissuesServicesAgreementMember2019-01-012019-12-310000805928axgn:MasterServicesAgreementForClinicalResearchAndRelatedServicesMember2011-12-012011-12-310000805928axgn:MasterServicesAgreementForClinicalResearchAndRelatedServicesMember2021-01-012021-12-310000805928axgn:MasterServicesAgreementForClinicalResearchAndRelatedServicesMember2020-01-012020-12-310000805928axgn:MasterServicesAgreementForClinicalResearchAndRelatedServicesMember2019-01-012019-12-310000805928axgn:APCFacilityMember2018-07-31utr:acre0000805928axgn:APCFacilityMember2018-07-012018-07-310000805928axgn:DesignBuildAgreementMember2019-07-090000805928axgn:DesignBuildAgreementMember2019-07-092019-07-090000805928axgn:DesignBuildAgreementMemberus-gaap:ConstructionInProgressMember2021-01-012021-12-310000805928axgn:DesignBuildAgreementMemberus-gaap:ConstructionInProgressMember2019-07-092021-12-310000805928axgn:DesignBuildAgreementMemberus-gaap:ConstructionInProgressMember2021-12-310000805928axgn:APCFacilityMemberaxgn:DesignBuildAgreementMember2021-12-310000805928axgn:APCFacilityMemberaxgn:DesignBuildAgreementMember2021-01-012021-12-310000805928axgn:APCFacilityMemberaxgn:DesignBuildAgreementMember2020-01-012020-12-310000805928axgn:DebtDerivativeLiabilityMember2021-12-310000805928axgn:OberlandFacilityMemberaxgn:DebtDerivativeLiabilityMember2020-06-300000805928axgn:OberlandFacilityTrancheTwoMember2020-06-3000008059282019-02-042019-02-040000805928axgn:HeightsUnionMember2021-07-122021-07-120000805928us-gaap:AllowanceForCreditLossMember2018-12-310000805928us-gaap:AllowanceForCreditLossMember2019-01-012019-12-310000805928us-gaap:AllowanceForCreditLossMember2019-12-310000805928us-gaap:AllowanceForCreditLossMember2020-01-012020-12-310000805928us-gaap:AllowanceForCreditLossMember2020-12-310000805928us-gaap:AllowanceForCreditLossMember2021-01-012021-12-310000805928us-gaap:AllowanceForCreditLossMember2021-12-310000805928us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2018-12-310000805928us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-01-012019-12-310000805928us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-12-310000805928us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-01-012020-12-310000805928us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-12-310000805928us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-01-012021-12-310000805928us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________________________

Form 10-K

____________________________________________________________________________

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2021

Or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to______________

Commission File Number: 001-36046

AXOGEN, INC.

(Exact name of registrant as specified in its charter)

Minnesota

(State or other jurisdiction of

incorporation or organization)

13631 Progress Blvd., Suite 400 Alachua, FL

(Address of principal executive offices)

41-1301878

(I.R.S. Employer

Identification No.)

32615

(Zip Code)

Registrant’s telephone number, including area code: (386) 462-6800

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of exchange on which registered |

| Common Stock, $0.01 par value | | AXGN | | The Nasdaq Stock Market |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐

Non-accelerated filer ☐

Accelerated filer x

Smaller reporting company ☐

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of June 30, 2021, the aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant was approximately $641,907,222 based upon the last reported sale price of our common stock on the Nasdaq Capital Market.

The number of shares outstanding of the Registrant’s common stock as of February 22, 2022 was 41,795,240 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement to be filed pursuant to Regulation 14A within 120 days after the end of the Registrant’s fiscal year are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

From time to time, in reports filed with the U.S. Securities and Exchange Commission (the “SEC”) (including this Annual Report on Form 10-K), in press releases, and in other communications to shareholders or the investment community, Axogen, Inc. (including Axogen, Inc.’s wholly owned subsidiaries, Axogen Corporation, Axogen Processing Corporation and Axogen Europe GmbH, the “Company,” “Axogen,” “we,” “our,” or “us”) may provide forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995, concerning possible or anticipated future results of operations or business developments. These statements are based on management's current expectations or predictions of future conditions, events, or results based on various assumptions and management's estimates of trends and economic factors in the markets in which the Company is active, as well as its business plans. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “projects,” “forecasts,” “continue,” “may,” “should,” “will,” “goals,” and variations of such words and similar expressions are intended to identify such forward-looking statements. The forward-looking statements may include, without limitation, statements regarding our assessment of our internal controls over financial reporting; statements related to the impact of the 2019 novel coronavirus and any and all variants thereof ("COVID-19") on our business; hospital staffing challenges and its impact on our business; statements regarding our growth, our financial guidance and performance; product development; product potential; Axogen Processing Center renovation timing and expense; sales growth; product adoption; market awareness of our products; anticipated capital requirements, including the potential of future financings; data validation; expected clinical study enrollment, timing and outcomes; our visibility at and sponsorship of conferences and our educational events; regulatory process and approvals; and other factors, including legislative, regulatory, political and economic developments not within our control. The forward-looking statements are and will be subject to risks and uncertainties, which may cause actual results to differ materially from those expressed or implied in such forward-looking statements. Forward-looking statements contained in this Form 10-K should be evaluated together with the many uncertainties that affect the Company’s business and its market, particularly those discussed in the risk factors and cautionary statements set forth in the Company’s filings with the SEC, including as described in “Risk Factors” included in Item 1A of this Form 10-K and “Risk Factor Summary” included in this Form 10-K. Forward-looking statements are not guarantees of future performance, and actual results may differ materially from those projected. The forward-looking statements are representative only as of the date they are made and, except as required by applicable law, the Company assumes no responsibility to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or otherwise.

RISK FACTOR SUMMARY

Below is a summary of our risk factors. Additional discussion of the risks summarized in this risk factor summary, and other risks that we face, can be found below under the heading “Risk Factors” and should be carefully considered, together with other information in this Form 10-K and our other filings with the SEC before making an investment decision regarding our common stock.

Risks Related to the Company

•Our revenue growth depends on our ability to increase distribution and sales to existing customers and develop new customers, domestically and abroad, and there can be no assurance that these efforts will result in significant increases in sales.

•Our revenue depends primarily on four products.

•The COVID-19 pandemic could continue to have a material adverse effect on our ability to operate, results of operations, financial condition, liquidity, and capital investments.

•Our success will be dependent on continued acceptance of our products by the medical community.

•We have not consistently experienced positive cash flow from our operations, and the ability to achieve consistent, positive cash flow from operations will depend on increasing revenue from distribution of our products, which may not be achievable.

•We are highly dependent on the continued availability of our facilities and could be harmed if the facilities are unavailable for any prolonged period of time.

•Delays, interruptions, or the cessation of production by our third-party suppliers of important materials may prevent or delay our ability to manufacture or process the final products.

•Technological change and competition for newly developed products could reduce demand for our products.

•We must maintain high quality processing of our products.

•Our revenue depends upon prompt and adequate reimbursement from public and private insurers and national health systems.

•Negative publicity concerning methods of donating human tissue and screening of donated tissue may reduce demand for our products and negatively impact the supply of available donor tissue.

•The failure of third parties to perform many necessary services for the commercialization of our products, including services related to recovery/acquisition, distribution and transportation, would impair our ability to meet commercial demand.

•We are dependent on our relationships with independent agencies to generate a material portion of our revenue.

•If we do not manage product inventory in an effective and efficient manner, it could adversely affect profitability resulting in significant fluctuations in our operating results.

•Our operating results could be adversely impacted if we are unable to effectively manage and sustain our future growth or scale our operations.

•There may be significant fluctuations in our operating results.

•We may be unsuccessful in commercializing our products outside the U.S.

•We incur costs as a result of operating as a public company, and our management is required to devote substantial time to compliance initiatives.

•Changes in the tax code could have a material adverse effect on our results of operations, financial condition, liquidity, and capital investments.

Risks Related to the Regulatory Environment in which the Company Operates

•Our business is subject to continuing regulatory compliance by the FDA and other authorities, which is costly and could result in negative effects on our business.

•We have suspended market availability of our Avive Soft Tissue Membrane and there is no guarantee it will be placed back on the market.

•The use, misuse or off-label use of our products may harm our reputation, the image of our products, result in injuries leading to product liability suits, which could be costly to our business, or result in FDA sanctions.

•Our Avance Nerve Graft product is currently allowed to be distributed pursuant to a transition plan with the FDA and a change in position by the FDA regarding its use of enforcement discretion to permit the sale of Avance Nerve Graft would have a material adverse effect on us.

•Our business is subject to continuing compliance to standards by various accreditation and registration bodies which is costly, and loss of accreditation or registration could result in negative effects on our business.

•Our Axoguard products are subject to FDA and international regulatory requirements.

•Defective products could lead to recall or other negative business conditions.

•Our operations must comply with FDA and other governmental requirements.

•Clinical trials can be long, expensive and results are ultimately uncertain which could jeopardize our ability to obtain regulatory approval and continue to market our Avance Nerve Graft product.

•We rely on third parties to conduct our clinical trials and they may not perform as contractually required or expected.

•U.S. governmental regulation could restrict the use of our Avance Nerve Graft and Avive Soft Tissue Membrane product, restrict our procurement of tissue or increase costs.

•Our Axotouch product is subject to FDA and other regulatory requirements.

•Healthcare law and policy changes may have a material adverse effect on us.

•We could be subject to civil or criminal penalties if we are found to have violated laws protecting the confidentiality of health information, which could increase our liabilities and harm our reputation or our business.

Risks Related to Our Intellectual Property

•Failure to protect our intellectual property rights could result in costly and time-consuming litigation and our loss of any potential competitive advantage.

•Future protection for our proprietary rights is uncertain and may impact our ability to successfully compete in our industry.

•The patent protection for our products may expire before we are able to maximize their commercial value which may subject us to increased competition and reduce or eliminate our opportunity to generate product revenue.

•Others may claim an ownership interest in our intellectual property which could expose us to litigation and have a significant adverse effect on our prospects.

•We depend on the maintenance of exclusive licenses.

•Our trademarks are valuable, and our business may be adversely affected if trademarks are not adequately protected.

Risks Related to Our Common Stock

•An active trading market in our common stock may not be maintained.

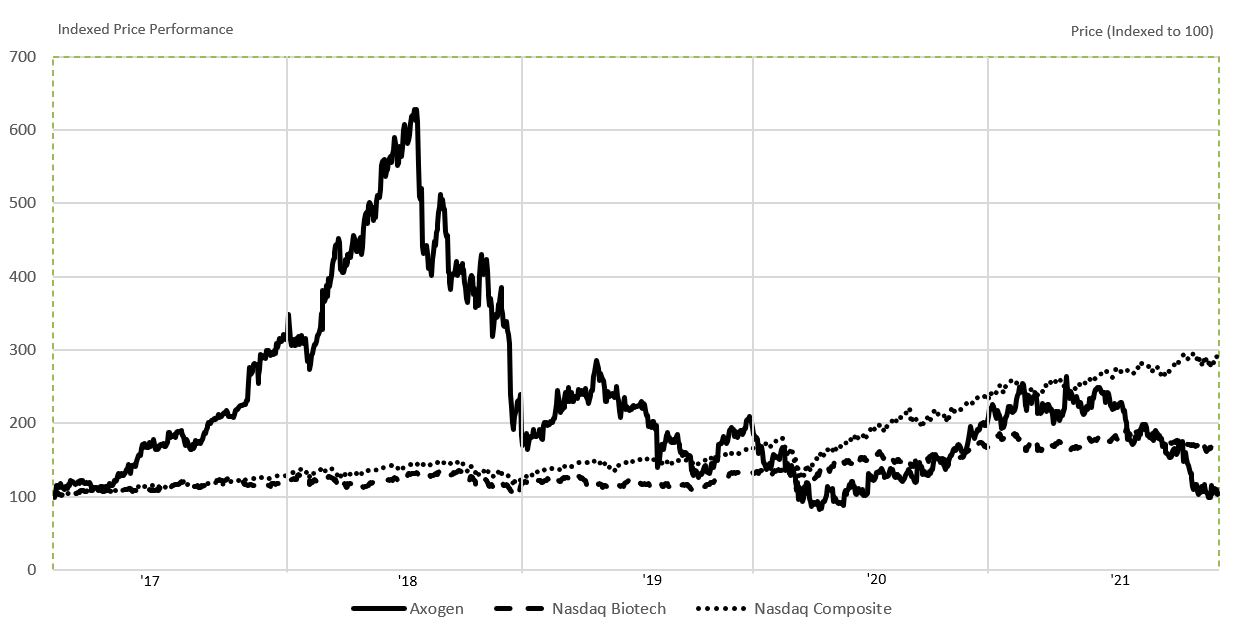

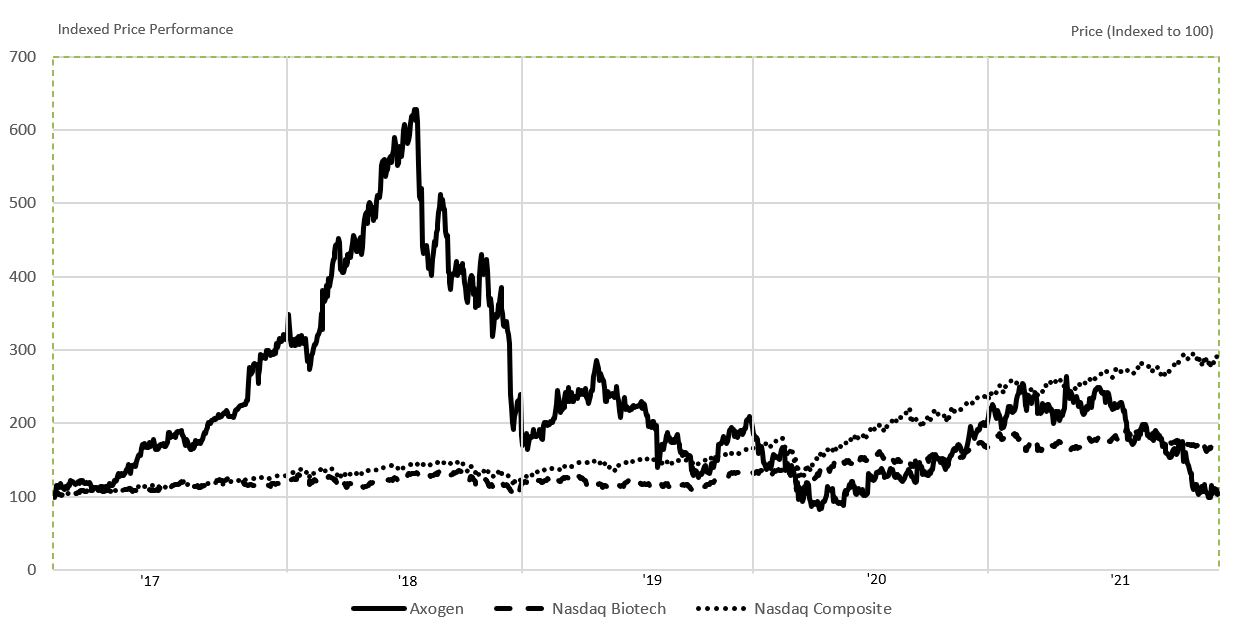

•The price of our common stock could be highly volatile due to a number of factors, which could lead to losses by investors and costly securities litigation.

•We do not anticipate paying any cash dividends in the foreseeable future.

•Anti-takeover provisions in Minnesota law may deter acquisition bids for us that you might consider favorable.

Risks Related to Financing Our Business

•Our credit facility and payment obligations under the Revenue Participation Agreement with TPC Investments II LP and Argo SA LLC, each affiliates of Oberland Capital (collectively, “Oberland Capital”), contains operating and financial covenants that restrict our business and financing activities, require cash payments over an extended period of time and are subject to acceleration in specified circumstances, which may result in Oberland Capital taking possession and disposing of any collateral.

•We may need to raise additional funds to finance our future capital or operating needs, which could have adverse impacts on our business, results of operations, and the interests of our shareholders.

General Risk Factors

•Legal proceedings that we become involved in from time to time could adversely affect our business operations or financial condition.

•We may be subject to future product liability litigation which could be expensive, and our insurance coverage may not be adequate.

•Loss of key members of management, who we need to succeed, could adversely affect our business.

•Our business and financial performance could be adversely affected, directly or indirectly, by natural or man-made disasters or other similar events.

•Changes in U.S. trade policy, threats of international tariffs, and changes to the U.S. political landscape may adversely affect our business, results of operations, financial condition, and prospects.

•Our results of operations could be negatively affected by potential fluctuations in foreign currency exchange rates.

•Our failure to protect our technology systems and comply with data protection laws and regulations could lead to government enforcement actions and significant penalties against us, and adversely impact our business, results of operations, financial condition, and prospects.

•We are dependent on internal information and telecommunications systems, and any failure of these systems, including system security breaches, data protection breaches or other cybersecurity attacks, may negatively impact our business and results of operations.

•Our management has broad discretion in the use of our cash and cash equivalents and, despite management’s efforts, cash and cash equivalents may be used in a manner that does not increase the value of shareholders’ investments.

•Our business and stock price may be adversely affected if our internal controls are not effective.

•Our business, results of operations, financial condition, and prospects could be adversely affected, directly or indirectly, by the effects of an increased focus on environmental, social and governance issues.

PART I

ITEM 1. BUSINESS

General

Axogen is the leading company focused specifically on the science, development, and commercialization of technologies for peripheral nerve regeneration and repair. We are passionate about providing the opportunity to restore nerve function and quality of life for patients with peripheral nerve injuries. We provide innovative, clinically proven, and economically effective repair solutions for surgeons and healthcare providers. Peripheral nerves provide the pathways for both motor and sensory signals throughout the body. Every day, people suffer traumatic injuries or undergo surgical procedures that impact the function of their peripheral nerves. Physical damage to a peripheral nerve or the inability to properly reconnect peripheral nerves can result in the loss of muscle or organ function, the loss of sensory feeling, or the initiation of pain.

Axogen’s platform for peripheral nerve repair features a comprehensive portfolio of products, including:

•Avance® Nerve Graft, a biologically active off-the-shelf processed human nerve allograft for bridging severed peripheral nerves without the comorbidities associated with a second surgical site;

•Axoguard Nerve Connector®, a porcine (pig) submucosa extracellular matrix (“ECM”) coaptation aid for tensionless repair of severed peripheral nerves;

•Axoguard Nerve Protector®, a porcine submucosa ECM product used to wrap and protect damaged peripheral nerves and reinforce the nerve reconstruction while preventing soft tissue attachments;

•Axoguard Nerve Cap®, a porcine submucosa ECM product used to protect a peripheral nerve end and separate the nerve from the surrounding environment to reduce the development of symptomatic or painful neuroma;

•Avive® Soft Tissue Membrane, a processed human umbilical cord intended for surgical use as a resorbable soft tissue conduit; and

•Axotouch® Two-Point Discriminator, used to measure the innervation density of any surface area of the skin.

We suspended the market availability of Avive Soft Tissue Membrane ("Avive") effective June 1, 2021 and we continue discussions with the U.S. Food and Drug Administration (the “FDA”) to determine the appropriate regulatory classification and requirements for Avive. The suspension was not based on any safety or product issues or concerns with Avive. We seek to return Avive to the market, although we are unable to estimate the timeframe or provide any assurances that a return to the market will be achievable.

The Axogen portfolio of products is available in the U.S., Canada, Germany, United Kingdom ("UK"), Spain, South Korea, and several other countries.

Nerves can be damaged in several ways. When a nerve is cut due to a traumatic injury or inadvertently during a surgical procedure, functionality of the nerve may be compromised, causing the nerve to no longer carry the signals to and from the brain to the muscles and skin thereby reducing or eliminating functionality. The loss of function can impact a person’s ability to work and perform daily tasks, to properly be aware and respond to their environment (e.g., heat, cold or other dangers), and could negatively impact their ability to experience and enjoy life.

Nerve damage or transection of the type described above generally requires a surgical repair. Traditionally, the standard has been to either suture the nerve ends together directly without tension or to bridge the gap between the nerve ends with a less important nerve surgically removed from elsewhere in the patient’s own body, referred to as nerve autograft. More recently, synthetic or collagen conduits have been used for the repair of short gaps. Nerves that are not repaired or heal abnormally may result in a permanent loss of function and/or sensation. Additionally, abnormal healing can form a neuroma that may send altered signals to the brain resulting in the sensation of pain. This abnormal section of the nerve can, under certain circumstances, be surgically cut out and the resulting gap repaired.

In addition, compression on a nerve, blunt force trauma or other physical irritations to a nerve can cause nerve damage that may alter the signal conduction of the nerve, result in pain, and may, in some instances, require surgical intervention to address the resulting nerve compression. Finally, when a patient undergoes a mastectomy due to breast cancer or prophylactically due to a genetic predisposition for breast cancer, the nerves are cut to allow the removal of the breast tissue. This can result in a loss of sensation, the potential risk of a symptomatic neuroma, and could negatively impact the patient’s quality of life. When a patient chooses an autologous breast reconstruction after a mastectomy, sensation and quality of life can, in certain cases, be returned through surgical nerve repair.

To improve the options available for the surgical repair and regeneration of peripheral nerves, Axogen has developed and licensed regenerative medicine technologies. Axogen’s innovative approach to regenerative medicine has resulted in first-in-class products that it believes are redefining the peripheral nerve repair market. Axogen’s products are used by surgeons during surgical interventions to repair a wide variety of physical nerve damage or transection throughout the body, which can range from a simple laceration of a finger to a complex brachial plexus injury (an injury to the network of nerves that control the movement and sensation of the shoulder, arm, and hand) as well as nerve injuries caused by dental, orthopedic, and other surgical procedures.

Peripheral Nerve Regeneration Market Overview

Peripheral nerve injury (“PNI”) through damage or transection is a major source of physical disability impairing the ability to move muscles or to feel normal sensations. Patients suffer traumatic bodily injuries every day that may result in damage or transection to peripheral nerves severe enough to require surgical treatment. We break our total addressable market into four categories: (1) Trauma, (2) oral maxillofacial (“OMF”), (3) breast reconstruction neurotization ("Breast") and (4) Upper Extremity Compression (together, the "Total Addressable Market").

We estimate that the U.S. PNI has a potential total addressable market for our current product portfolio of $2.7 billion. Estimating the Total Addressable Market for nerve repair is challenging as there is not a simple data source for the incidence of peripheral nerve issues. This is further complicated by the fact that nerves can be injured through a variety of traumatic and surgical injuries and can be impacted from a patient's head to toe. In addition, we believe nerves are often one of many structures injured in a trauma (i.e., amputation) or in surgery and the incidence of these nerve injuries are often not coded or tracked. Quantifying the procedures involving nerve repair may also be challenging. While selected trauma and surgical procedures are dedicated to the repair of nerves, most of the incidence of nerve repair is a step in a larger trauma or surgical procedure. Current Procedural Terminology ("CPT") codes exist for surgeons to code for nerve repair; however, we believe the data substantially underestimates the total number of nerves repaired. Physicians are encouraged to document all steps of procedures, but open trauma often involves many surgical steps, and CPT codes may be inclusive of each other or may not be documented or reported in billing records. As a result, we believe CPT coding underrepresents the total number of nerve repairs performed in trauma. Because we believe CPT claims are not fully representative of the true volumes of nerve repair surgery, we follow an “empirical” methodology to estimate the Total Addressable Market – using published clinical literature and procedure databases to make what we believe are the most objective assumptions.

Trauma

The "Trauma" portion of the Total Addressable Market encompasses traumatic PNI throughout the body, with approximately 95% of injuries affecting upper and lower extremity nerves. We estimate that the Trauma portion of the Total Addressable Market is approximately $1.9 billion based upon epidemiological studies regarding the general number of trauma patients, clinical literature review reporting PNI incidence, and physician interviews. We have estimated the portion of these nerve repair procedures due to trauma that would require Gap Repair, Primary Repair and/or Nerve Protection and applied, as we believed was appropriate in each procedure segment, the number of units and average sales price of Avance Nerve Graft and the average market price for nerve connectors, and nerve protectors to determine the probable Total Addressable Market.

OMF

We estimate that the OMF portion of the Total Addressable Market is approximately $300 million annually, based upon research indicating that approximately 56,000 PNI occur in the U.S. each year related to third molar surgeries, anesthetic injections, dental implants, orthognathic surgery, and mandibular resection procedures. We have applied the average sales price of the Avance Nerve Graft, Axoguard Nerve Connector, and Axoguard Nerve Protector that address such PNI to derive the OMF portion of the estimated Total Addressable Market.

Breast

We estimate that the Breast portion of the Total Addressable Market is approximately $250 million. Currently, when a patient undergoes autologous breast reconstruction after a mastectomy, the patient receives the shape of a natural breast, but often times experiences little to no return of sensory feeling. In certain cases, sensation can be returned to the breast area with the use of our products through an innovative surgical technique called Resensation®. We believe that the ideal breast reconstruction should restore breast size, shape, symmetry, and softness, as well as sensation, without the potential risks and co-morbidity associated with autograft. We believe the Resensation technique incorporates a patient's desire for the opportunity to return sensation to their breasts with a reproducible and efficient surgical approach for reconstructive plastic surgeons.

Upper Extremity Compression

PNI caused by recurrent carpal tunnel syndrome and cubital tunnel syndrome constitutes the "Upper Extremity Compression" portion of the Total Addressable Market. We estimate that the Upper Extremity Compression portion of the Total Addressable Market is approximately $270 million, or 130,000 procedures. We estimate there are approximately 488,000 primary carpal tunnel and 95,000 primary cubital tunnel relief surgeries performed annually in the U.S. We estimate that approximately 97,500 carpal tunnel revision surgeries and 32,400 total cubital tunnel procedures are addressable each year in the U.S. to mitigate the recurrence of symptoms. These revision and primary surgeries are required due to compression of the peripheral nerve associated with soft tissue attachments from the surrounding tissue or tissue infiltration entrapping the nerve. To prevent additional recurrences, surgeons will opt for a Nerve Protection which includes a product such as the Axoguard Nerve Protector. To derive the carpal and cubital tunnel revision portion of the Total Addressable Market, we multiplied the average market sales price of Axoguard Nerve Protectors by the number of estimated procedures.

Although distribution and sales of products in the Trauma, OMF, Breast and Upper Extremity Compression portions of the Total Addressable Market constitute our primary revenue sources today, market expansion opportunities in lower extremity surgery, head and neck surgery, urology and the surgical treatment of pain offer us expanded revenue opportunities. The Company has begun an expansion into the surgical treatment of pain with an initial focus on traumatic injuries, including amputation, and orthopedic surgeries such as total hip arthroplasty, total knee arthroplasty, knee arthroscopy, Morton’s neuroma, foot and ankle procedures, and wrist arthroscopy. The size of the pain market opportunity is challenging to identify as the cause of the chronic pain is often not diagnosed and there has not historically been a surgical treatment to resolve the cause of the pain. The Company believes the market opportunity is sufficient to apply selected resources to the opportunity and there is a significant patient and societal need to reduce the use of pharmacologic solutions, including opioids.

Axogen’s Product Portfolio

Avance Nerve Graft

Avance Nerve Graft is a biologically active nerve implant with more than ten years of comprehensive clinical evidence and more than 50,000 implants since launch. Avance Nerve Graft is intended for the surgical repair of peripheral nerve transections to support regeneration across the defect (a gap created when the nerve is severed). It is intended to act as a structural bridge in order to guide and support axonal regeneration across a peripheral nerve gap caused by traumatic injury or surgical intervention. Avance Nerve Graft is decellularized and sterile processed human peripheral nerve tissue. Axogen developed Avance Nerve Graft by following the guiding principle that the human body created the optimal peripheral nerve structure. Axogen, through its licensing efforts and research, developed the Avance MethodTM, a proprietary method for processing recovered human peripheral nerve tissue in a manner that preserves the essential structure of the ECM while cleansing away cellular and noncellular debris. Avance Nerve Graft provides the natural peripheral nerve structure of a nerve, including the native laminin to guide the regenerating nerve fibers. The nerve ECM is additionally processed to remove a natural inhibitor to regeneration called chondroitin sulphate proteoglycan.

Axogen believes that Avance Nerve Graft is the first off-the-shelf human nerve allograft for bridging nerve transections. Avance Nerve Graft is comprised of bundles of small diameter endoneurial tubes that are held together by an outer sheath called the epineurium. Avance Nerve Graft has been processed to remove cellular and noncellular factors such as cells, fat, blood, and axonal debris, while preserving the three-dimensional laminin lined tubular bioscaffold (i.e., microarchitecture), epineurium and microvasculature of the peripheral nerve. After processing, Avance Nerve Graft is flexible and pliable, and its epineurium can be sutured in place allowing for tension-free approximation of the proximal and distal peripheral nerve stumps. During the healing process, the body revascularizes and gradually remodels the graft into the patient’s own tissue while allowing the processed peripheral nerve allograft to physically support axonal regeneration across the peripheral nerve transection. Avance Nerve Graft does not require immunosuppression for use.

With lengths up to 70 mm and diameters up to 5 mm, Avance Nerve Graft allows surgeons to choose and trim the implant to the correct length for repairing the relevant peripheral nerve gap, as well as to match the diameter to the proximal and distal end of the severed peripheral nerve. Avance Nerve Graft is stored frozen and utilizes packaging that maintains the graft in a sterile condition. The packaging is typical for medical products so the surgical staff is familiar with opening the package for transfer of Avance Nerve Graft into the sterile surgical field. Such packaging also provides protection during shipment and storage and a reservoir for the addition of sterile fluid to aid in thawing the product. Avance Nerve Graft thaws in less than 10 minutes, and once thawed, it is ready for implantation.

Avance Nerve Graft provides the following key advantages:

•A three-dimensional bioscaffold for bridging a peripheral nerve gap;

•A biologically active nerve therapy with more than 10 years of comprehensive clinical evidence;

•No patient donor-nerve surgery, therefore no comorbidities associated with a secondary surgical site;

•Available in a variety of diameters up to 5mm to meet a range of anatomical needs;

•Available in a variety of lengths up to 70mm, to meet a range of gap lengths;

•Decellularized and cleansed ECM;

•Implanted without the need for immunosuppression, remodels into patient’s own tissue;

•Structurally supports the body’s own regeneration process;

•Handles similar to an autograft, and is flexible and pliable;

•Alleviates tension at the repair site;

•Three-year shelf life; and

•Supplied sterile.

Axoguard Nerve Connector

Axoguard Nerve Connector is a coaptation aid used to align and connect severed peripheral nerve ends in a tensionless repair. The product is in a tubular shape with an open lumen on each end where the severed peripheral nerve ends are placed. It is typically used when the gap between the peripheral nerve ends is 5mm or less in length. Axoguard Nerve Connector is made from a processed porcine ECM that allows the body’s natural healing process to repair the peripheral nerve while its tube shape isolates and protects the transected nerves during the healing process. During healing, the patient’s own cells incorporate into the ECM product to remodel and form a tissue similar to the outermost layer of the peripheral nerve (nerve epineurium). Axoguard Nerve Connector is provided sterile, for single use only, and in a variety of sizes to meet the surgeon’s needs.

Axoguard Nerve Connector can be used:

•As an alternative to direct suture repair;

•As a peripheral nerve coaptation; Connector-Assisted Repair®;

•To aid coaptation in direct repair, grafting, or cable grafting repairs; and

•To reinforce the coaptation site.

Axoguard Nerve Connector has the following advantages:

•Processed intact porcine ECM with an open, porous structure that allows for cell infiltration and remodeling;

•Designed as a coaptation aid for tensionless repair of transected or severed peripheral nerves;

•Alleviates tension at the repair site;

•Remodels into the patient’s own tissue;

•Reduces the number of required sutures (versus direct repair with suture);

•Allows surgeon to move sutures away from the repair site which may minimize inflammation and aid nerve regeneration;

•Reduces potential for fascicular mismatch;

•Allows visualization of underlying peripheral nerve ends;

•Available in seven different diameters and two different lengths to address a variety of nerve repair situations;

•Strong and flexible, easy to suture; and

•Stored at room temperature with a minimum of 18-month shelf life.

Axoguard Nerve Protector

Axoguard Nerve Protector is a product used to protect and wrap damaged peripheral nerves and reinforce reconstructed nerve gaps while preventing soft tissue attachments. It is designed to protect and isolate the peripheral nerve during the healing process after surgery by creating a barrier between the nerve tissue and the surrounding tissue bed. The product is delivered in a slit tube format allowing it to be wrapped around peripheral nerve structures. Axoguard Nerve Protector is made from a processed porcine ECM. During healing, the ECM remodels allowing the protector to separate the peripheral nerve from the surrounding tissue. Axoguard Nerve Protector competes against off-the-shelf biomaterials such as reconstituted bovine collagen

as well as the use of the patient’s own tissue such as vein and hypothenar fat pad wrapping. Axoguard Nerve Protector is provided sterile, for single use only, and in a variety of sizes to meet the surgeon’s needs.

Axoguard Nerve Protector can be used to:

•Separate and protect the nerve from the surrounding tissue during the healing process;

•Minimize risk of soft tissue attachments and entrapment in compressed peripheral nerves;

•Protect peripheral nerves in a traumatized wound bed; and

•Reinforce a coaptation site.

Axoguard Nerve Protector has the following advantages:

•Processed porcine submucosa ECM used to reinforce a coaptation site, wrap a partially severed peripheral nerve or protect peripheral nerve tissue;

•Creates a protective layer that isolates and protects the peripheral nerve in a traumatized wound bed;

•Remodels into the patient’s own tissue;

•Easily conforms and provides 360-degree wrapping of damaged peripheral nerve tissue;

•Allows the body's natural healing process to repair the nerve;

•Minimizes the potential for soft tissue attachments and peripheral nerve entrapment by physically isolating the nerve during the healing process;

•Allows peripheral nerve gliding;

•Strong and flexible, plus easy to suture;

•Is available in five different widths and two different lengths to address a variety of peripheral nerve repair situations; and

•Stored at room temperature with a minimum of 24-month shelf life.

Avive Soft Tissue Membrane

Avive Soft Tissue Membrane ("Avive") is processed human umbilical cord membrane that may be used as a resorbable soft tissue covering to separate tissues in the surgical bed. Avive is provided sterile and in a variety of sizes to meet the surgeon’s surgical needs. Avive can be used to separate tissues in the surgical bed as a permeable membrane. As previously announced, we suspended the market availability of Avive Soft Tissue Membrane ("Avive") effective June 1, 2021, and we continue discussions with the FDA to determine the appropriate regulatory classification and requirements for Avive. The suspension was not based on any safety or product issues or concerns with Avive. We seek to return Avive to the market, although we are unable to estimate the timeframe or provide any assurances that a return to the market will be achievable. Avive has historically represented approximately 5% of our revenues through the second quarter of 2021, and no Avive revenue was recorded in the third and fourth quarters of 2021.

Avive has the following advantages:

•Umbilical cord amniotic membrane that is naturally resorbable;

•Is non-immunogenic;

•Processed to preserve the natural properties of umbilical cord amniotic membrane;

•Comprised of umbilical cord amniotic membrane which is up to eight times thicker than placental amniotic membrane alone;

•Long lasting (in animal studies, stays in place for at least 16 weeks);

•Easy to handle, suture or secure during a surgical procedure;

•Conforms and stays in place at the application site;

•Chorion free (reducing the likelihood of immune response); and

•Room temperature storage with a two-year shelf life.

Axoguard Nerve Cap

Axoguard Nerve Cap is a proprietary porcine submucosa ECM product used to protect a peripheral nerve end and separate the nerve from the surrounding environment to reduce the development of symptomatic or painful neuroma.

Nerves are often cut in a variety of surgeries and every nerve that is cut and not reconstructed forms an entangled mass of disorganized nerve and fibrous tissue that could cause debilitating pain called a symptomatic neuroma. Neuromas are a cause of pain for those patients who complain of chronic post-surgical pain, including in amputees which may lead to an inability to use their prosthesis. Despite more than 30 different treatment methods, it is our belief that neuromas continue to be an unresolved problem in microsurgery. We believe the Axoguard Nerve Cap can address these painful neuroma and better address nerve pain than other methods, including pharmacotherapy and chemical injections, among others. Axoguard Nerve Cap can be used to reduce the development of symptomatic or painful neuroma formation.

Axoguard Nerve Cap has the following advantages:

•Separates the nerve end from surrounding tissue, neurotrophic factors and mechanical stimulation;

•Reduces painful neuroma formation;

•Allows for anchoring of a nerve end or stump to nearby tissue structure;

•Material gradually remodels into the patient’s own tissue to protect the nerve end; and

•Semi-translucence allows for visualization of nerve ends or stumps and easy visualization for suture placement.

Axotouch Two-Point Discriminator

The Axotouch Two-Point Discriminator tool can be used to measure the innervation density of any surface area of the skin. The discs are useful for determining sensation after damage to a peripheral nerve, following the progression of a repaired peripheral nerve, and during the evaluation of a person with possible peripheral nerve damage, such as compression. The Axotouch Two-Point Discriminator is a Class 1 510(k) exempt medical device.

The Axotouch Two-Point Discriminator tool is a set of two aluminum discs each containing a series of prongs spaced between two to 15 millimeters apart. Additionally, 20 and 25 millimeter spacing is provided. A circular depression on either side of the disc allows ease of rotation. The discs can be rotated between a single prong for testing one-point and any of the other spaced prongs for testing two-point intervals.

Axotouch Two-Point Discriminator has the following advantages:

•Capable of measuring the innervation density of any skin surface;

•Portable and easy to use;

•Strong aluminum design is resistant to bending;

•Bright colors allow for clear discrimination between discs;

•Clear numbering allows users to interpret results; and

•Reusable carry case protects discs.

Acroval Neurosensory and Motor Testing System

To pursue our mission most effectively, we have made a strategic decision to place our full focus on innovations within our surgical solutions portfolio. Effective November 2019, Axogen discontinued all sales of the Acroval Neurosensory and Motor Testing System. We continue to provide service and support for the existing systems in the marketplace.

Tissue Recovery and Processing for Avance Nerve Graft and Avive Soft Tissue Membrane

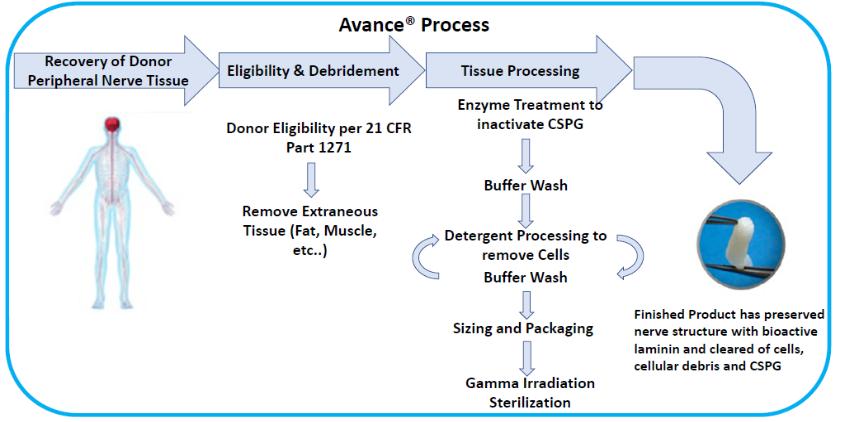

Avance Nerve Graft Processing Overview

Axogen has developed the Avance Method, an advanced and proprietary technique to process Avance Nerve Graft from donated human peripheral nerve tissue. The Avance Method requires special training over several months for each manufacturing associate who processes Avance Nerve Grafts. The processing and manufacturing system for Avance Nerve

Graft has required significant capital investment, and we seek to continually improve our manufacturing and quality assurance processes and systems. Axogen’s Avance Method is depicted as follows:

Avance Nerve Graft and Avive Soft Tissue Membrane Processing

Axogen’s Avance Method and processing of Avive Soft Tissue Membrane consists of several steps, including peripheral nerve tissue, in the case of Avance, and umbilical cord, in the case of Avive, recovery/acquisition and testing, donor medical review and release, processing, packaging, and sterilization to meet or exceed all applicable FDA, state, and international regulations and American Association of Tissue Banks (“AATB”) standards. We have a number of contracts with recovery and acquisition agencies to supply peripheral nerve tissue and umbilical cord and believe these contracts, and the ability to enter into additional contracts, will provide us with the tissues we require for our Avance and Avive implants. As an FDA registered tissue establishment, Axogen utilizes both its own personnel and a variety of subcontractors for recovery/acquisition, storage, testing, processing and sterilization of the donated peripheral nerve and umbilical cord tissue. Additionally, independent Good Manufacturing Practice ("GMP") and Good Laboratory Practice ("GLP") compliant laboratories have been contracted by Axogen and its subcontractors to perform testing from donor eligibility through release. The safety of Avance Nerve Graft and Avive Soft Tissue Membrane is supported by donor screening, process validation, process controls, and validated terminal sterilization methods. The Axogen Quality System has built in redundancies that are meant to control the release of each product for implantation only after such product meets our stringent quality control and product requirements.

Avance Nerve Graft and Avive Soft Tissue Membrane Tissue Recovery/Acquisition and Processing Facility

Axogen partners with other FDA registered tissue establishments and AATB accredited recovery/acquisition agencies or recovery/acquisition agencies in compliance with FDA, state and international regulations and AATB standards for human tissue recovery. After consent for donation is obtained, donations are screened and tested in detail for safety in compliance with FDA, state and international regulations and AATB standards on communicable disease transmission. Axogen processes and packages Avance Nerve Graft and Avive Soft Tissue Membrane using its employees and equipment pursuant to a License and Services Agreement, as amended (the “CTS Agreement”) with Community Blood Center (doing business as Community Tissue Services) (“CTS”), in Dayton, Ohio. CTS is an FDA registered tissue establishment and an AATB accredited organization. Axogen voluntarily suspended the market availability of Avive Soft Tissue Membrane on June 1, 2021.

The current CTS Agreement terminates December 31, 2023, subject to earlier termination by either party at any time for cause (subject to the non-terminating party’s right to cure, in certain circumstances), or without cause upon 6 months prior notice. Under the CTS Agreement, Axogen pays CTS a facility fee for clean room/manufacturing, storage, and office space. CTS also provides services in support of Axogen’s manufacturing such as routine sterilization of daily supplies, providing disposable supplies and microbial services, and office support. The service fee is based on a per donor batch rate. The CTS facility provides a cost effective, quality controlled and licensed facility. Axogen’s processing methods and process controls have been developed and validated to ensure product uniformity and quality. Pursuant to the CTS Agreement, Axogen pays license fees on a monthly basis to CTS. See "Item 8. Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements - Note 14 - Commitments and Contingencies - Service Agreements."

Axogen is renovating a property located near the CTS facility, the Axogen Processing Center facility (the "APC Facility") comprised of a 107,000 square foot building on approximately 8.6 acres of land. It is expected that renovation and validation will be completed before the termination date of the CTS Agreement to provide a new processing facility that can be included in our Biologics License Application (“BLA”) for Avance Nerve Graft. The capacity of the property once operational, along with the ability for expansion, is expected to provide processing capabilities that will meet our intended sales growth. Axogen has obtained certain economic development grants from state and local authorities totaling $2,685 including $1,250 of cash grants to offset costs to acquire and develop the APC Facility. The economic development grants are subject to certain job creation milestones by 2023 and related contingencies. Axogen has received approximately $1,188 from these grants through December 31, 2021. These grants have claw back clauses if Axogen does not meet these job creation milestones by 2023. See "Item 8. Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements - Note 14 - Commitments and Contingencies - Service Agreements."

Avance Nerve Graft and Avive Soft Tissue Membrane Packaging

After processing, the packaging operation is performed in a controlled environment at the CTS facility. Each Avance Nerve Graft and Avive Soft Tissue Membrane is visually inspected and organized by size into finished product codes. The tissue implant is then packaged in primary packaging. The outer pouch acts as the primary sterility and moisture barrier.

Avance Nerve Graft and Avive Soft Tissue Membrane Sterilization and Labeling

After being processed and packaged, Avance Nerve Graft and Avive Soft Tissue Membrane are then terminally sterilized and shipped to Axogen’s Burleson, Texas distribution facility (the “Distribution Facility”). There the products receive their final labels and are released following a final stringent technical and quality review. Orders for Avance Nerve Graft and Avive Soft Tissue Membrane are placed with Axogen’s customer care team and the products are packaged and shipped from the Distribution Facility.

Avance Nerve Graft and Avive Soft Tissue Membrane Product Release

Axogen has established quality procedures for review of tissue recovery, relevant donor medical record review and release to processing that meet or exceed FDA requirements as defined in the Code of Federal Regulations ("CFR") 21 CFR Part 1271, state regulations, international regulations and AATB standards. The Axogen Quality System meets the requirements set forth under 21 CFR Part 1271 for Human Cells, Tissues and Cellular and Tissue-Based Products, including Good Tissue Practices (“GTP”) and is compliant with the 21 CFR Part 820 Quality System Regulations (“QSR”). Furthermore, Axogen utilizes validated processes for the handling of raw material components, environmental control, processing, packaging, and terminal sterilization. In addition to ongoing monitoring activities for product conformity to specifications and sterility, shipping methods have been validated in accordance with applicable industry standards.

Manufacturing of Axogen Products Other Than Avance Nerve Graft and Avive Soft Tissue Membrane

Manufacturing for the Axoguard Product Line

The Axoguard product line is manufactured by Cook Biotech Incorporated, in West Lafayette, Indiana (“Cook Biotech”), which was established in 1995 to develop and manufacture implants utilizing porcine ECM. Axogen decided to expand its portfolio of products and felt that the unique ECM material offered by Cook Biotech provided the combination of properties needed in nerve reconstruction. Cook Biotech’s ECM material is pliable, capable of being sutured, translucent and allows the patient’s own cells to incorporate into the ECM to remodel and form a tissue similar to the nerve’s epineurium. Cook Biotech has its own source of the raw material for the ECM material and manufactures Axoguard products from such sources.

In August 2008, Axogen entered into an agreement with Cook Biotech, amended in February 2012 and February 26, 2018 (the “Distribution Agreement”), to distribute its ECM technology in the form of the Surgisis® Nerve Cuff, the form of a nerve wrap or patch, or the form of any other mutually agreed to configuration. The Surgisis products were rebranded under Axogen’s Axoguard name and consist of the Axoguard Nerve Connector and Axoguard Nerve Protector. Axogen’s distribution rights are worldwide in the field of the peripheral and central nervous system but excluding use of the products in the oral cavity for endodontic and periodontal applications and OMF surgery solely as they relate to dental, soft or hard tissue repair, or reconstruction. We believe the exclusion does not limit our identified OMF market, but expansion into certain additional OMF market areas could be limited to other Axogen products not subject to the Distribution Agreement.

Axogen developed, patented, and obtained regulatory approval on the Axoguard Nerve Cap, which in its current configuration is made with Cook Biotech’s ECM material. Pursuant to the Nerve End Cap Supply Agreement dated June 27, 2017 (the “Supply Agreement”), Cook Biotech is the exclusive contract manufacturer of the Axoguard Nerve Cap and both

parties have provided the other party the necessary licenses to their technologies for operation of the Supply Agreement. With respect to the license from Cook Biotech, Axogen is able to sell the Axoguard Nerve Cap worldwide in the field of the peripheral and central nervous system, but subject to the same exclusions as Axoguard Nerve Connector and Axoguard Nerve Protector.

The Distribution Agreement terminates on June 30, 2027. Although the agreement requires certain minimum purchases, through mutual agreement, the parties have not established such minimums and to date have not enforced such provision, and also establishes a formula for the transfer cost of the Axoguard Nerve Connector and Axoguard Nerve Protector. The Supply Agreement has a term through August 27, 2027.

Manufacturing for the Axotouch Two-Point Discriminator

The Axotouch Two-Point Discriminator was contract manufactured by Viron Technologies, doing business as Cybernetics Research Laboratories (“CRL”), in Tucson, Arizona. CRL supplied the Axotouch unpackaged, and they are packaged at Axogen’s distribution facility in Burleson, Texas. We believe we have enough inventory on hand to support sales through 2024.

Sales and Marketing

Overview

Axogen is focused on developing the peripheral nerve repair and regeneration market, committed to improving awareness of new surgical peripheral nerve repair options and is building additional scientific and clinical data to assist surgeons and patients in making informed choices with respect to the repair of peripheral nerve injuries. Axogen believes that there is an opportunity to improve current approaches to peripheral nerve repair and that its approach will solidify its position as a leader in the field of peripheral nerve repair products. The following provides the key elements of Axogen’s sales and marketing strategy.

Increase Awareness of Axogen’s Products